1. Introduction

Bank mergers have been a matter of interest for economists and financial professionals for many decades, beginning in the early 20th century. However, the frequency and importance of bank mergers have changed over time. In the United States, the first bank merger was documented in 1904. Merging with the Bank of the Manhattan Corporation was the National City Bank of New York (Abbot, 1929). The necessity to boost productivity and lessen rivalry in the banking sector led to this merger (Carletti et al., 2007). Nevertheless, because so many banks failed during the Great Depression of the 1930s, there was a fall in bank mergers. Regulations were eventually put in place by the government to stabilize the sector.

The banking business expanded and underwent consolidation following World War Two. This was caused by the expanding economy and the financial industry’s rising complexity (Reinhart & Rogoff, 2013). A further benefit of technology and regulatory advancement was that it was more straightforward for banks to combine and grow their businesses. Due to this trend, there were many bank mergers throughout the 1960s and 1970s (Bawani et al., 2016).

The banking industry started to deregulate more quickly in the 1970s. This included repealing the Glass-Steagall Act, which divided commercial and investment banking, eased branching limitations and removed interest rate restrictions (Sherman, 2009). Banks could thereby increase their operations and access new markets. A wave of bank mergers resulted from the increasing rivalry since smaller banks could not compete with larger, more diversified banks.

The effects of bank mergers on the banking sector and the economy have long been discussed (Rezitis, 2008; Al-Sharkas et al., 2008; Piloff & Santomero, 1998). On the one hand, bank mergers can boost productivity and reduce costs for the combined company, which benefits customers. They may also result in the establishment of more diversified institutions with a more remarkable ability to withstand economic downturns. On the other side, bank mergers may result in a concentration of power in the hands of a few major banks and a reduction in competition, which would raise consumer prices and stagnate innovation. Such a financial system’s stability is an issue in numerous ways (Demirguc-Kunt & Levine, 2000). The causes of bank mergers, their historical development, and their effects on the banking sector and the economy have all changed through time and are still a topic of discussion and inquiry.

A significant financial benefit of bank mergers is economies of scale (Avkiran, 1999). It alludes to the financial savings realized by expanding business operations. The new organization can reduce costs by combining two banks by eliminating redundant operations like technology, marketing, and human resources. This may result in lower costs, raising the combined entity’s profitability. Research has shown that costs as a proportion of assets decreased by 0.5 and 1.5% when smaller banks combined with larger banks (Srinivasan, 1992).

The increased revenue from cross-selling is another financial advantage of bank mergers. Cross-selling offers existing consumers new goods or services (Lin, 2009). By combining two banks, the new firm can access a more extensive customer base, expanding the potential for cross-selling. For instance, the merged business might offer a car loan to a Bank A customer interested in buying a new automobile, boosting the entity’s income.

Finally, through increasing diversification, bank mergers can lower risk. To lower a portfolio’s risk, diversification refers to investing in various assets (Shim, 2019). The combined firm can diversify its portfolio by merging two banks, which lowers the portfolio’s risk (Shim, 2019). Consider a scenario in which Bank A has a sizable investment in commercial real estate loans, and Bank B has a sizable investment in consumer loans. The merging business can then diversify its investments to lower risk.

The banking business’s financial, operational, and strategic sides can benefit from bank mergers in various ways. The improved operational effectiveness, risk management, and capacity to enter new markets, broaden product and service offerings, and boost competitiveness all benefited from the increased financial strength and profitability. This may allow the combined company to provide superb customer service while increasing shareholder value.

It is crucial to remember that bank mergers come with dangers and difficulties, such as the need to comply with regulations, integrate people and systems, and maybe eliminate jobs. Moreover, chances are related to bank M&A, particularly in light of the 2008 financial crisis; there has been a heightened emphasis on the possible hazards of bank mergers in recent years (Cowan, 2022). This section of the essay will examine the numerous hazards connected to bank mergers, such as higher systemic risk, diminished competition, and greater market power concentration.

The possibility for greater market power concentration is one of bank mergers’ most frequently mentioned dangers. When two or more banks combine, they frequently grow into a more prominent organization that can control a specific market or area. As a result, there may be less competition, higher consumer prices, and fewer options for consumers (Hankir et al., 2011).

According to Kumar (2019), the Bank of America and Fleet-Boston Financial merger created the second-largest bank in the US. Concerns about diminished competition and heightened market power were also raised by the merger’s creation of a strong market position in the Northeastern United States. Similar worries about rising market power concentration and diminished competition were expressed by the JPMorgan and Bear Stearns case in 2008 (Grove & Patelli, 2013).

The possibility that bank mergers may lessen competition in the financial sector is a significant worry. A monopoly develops in a nation or an area due to the merger of two already sizable banks. Fewer banks mean less competition, which raises prices and limits consumer options (Carletti et al., 2007).

For instance, the 2008 merger of Wells Fargo and Wachovia produced the United State’s fourth-largest bank (Hirsch Jr. & Dowdy, 2009). The Western States developed a dominating market position due to the union, raising concerns about diminished competition and heightened market power. Similar worries were raised about diminished competition and increased market dominance following the 1998 merger of Citigroup and Travelers Group, which established the largest financial services corporation in the world (Carow, 2001).

Regulations must ensure that mergers will not create monopolies or market dominance that could harm consumers. Additionally, authorities need to ensure the combined bank has sufficient capital and liquidity to survive potential future shocks and implement the necessary measures to reduce systemic risks. Governmental agencies and other industry stakeholders must also play a constructive part in the merger process by carefully examining each phase. It would also be constructive to provide feedback on potential effects on the communities and economies they serve.

By centralizing this information, regulators and decision-makers can balance the advantages and dangers of bank mergers. This might safeguard the interests of consumers and the larger economy while encouraging stability and growth in the financial sector.

The Sustainable Development Goals (SDGs) were adopted by the United Nations in 2015 as a universal call to action to end poverty, protect the planet, and ensure that all people enjoy peace and prosperity by 2030. These 17 goals are interconnected and require collective action from governments, the private sector, civil society, and individuals.

The financial sector has a crucial role to play in achieving the SDGs. Banks, in particular, have a responsibility to align their strategies, products, and services with the SDGs. A growing number of banks have started to integrate the SDGs into their business models and operations, recognizing the potential for sustainable finance to create long-term value for both their stakeholders and society at large.

Mergers and acquisitions (M&A) have been a common strategy for banks seeking to grow and strengthen their market position. However, M&A can also have significant implications for the SDGs, both positive and negative (Bawani et al., 2016). On the one hand, a merger can create synergies and efficiencies that result in greater financial stability, improved customer service, and increased access to finance, all of which can contribute to the SDGs. On the other hand, a merger can also lead to job losses, reduced competition, and weakened social and environmental performance, which can undermine the SDGs.

Against this backdrop, this paper aims to analyze the merger between Barwa Bank and International Bank of Qatar from an SDG perspective. We will use the Balanced Scorecard (BSC) framework to assess the impact of the merger on the SDGs, focusing on four perspectives: financial, customer, internal processes, and learning and growth. The BSC is a widely used tool for strategic management that provides a comprehensive view of an organization’s performance and helps align strategy with goals and objectives.

The balanced scorecard method assesses how well a company, organization, or event is performing. It considers various factors, including financial, customer, internal procedures, and learning and growth. The balanced scorecard can be used in various industries, including banking, and is particularly helpful in determining an organization’s overall health and success. One key aspect of the balanced scorecard technique is that it allows for direct maintenance of the scores by industry experts for extremely accurate outcomes. Since the information is collected straight from the source, it lowers the chance of false information (Luo et al., 2012). The balanced scorecard methodology is selected for this analysis because experts from Barwa Bank and IBQ’s top management are available.

With the developed scorecard, it is intended to be studied why Barwa Bank and IBQ merged. We will use a case study approach and integrate several data sources to thoroughly understand this transaction and its circumstances. The results of this study will add to the body of knowledge already available on bank mergers and offer guidance to other banks thinking about doing the same. The study will also serve as a helpful resource for policymakers and regulators as they think through the effects of such mergers on the stability and development of the Islamic financial sector (Shim, 2019).

The main findings of this analysis suggest that a bank merger should focus on short-term plans to optimize financial performance, expand market share, and enhance service quality. These short-term strategies include cost management, revenue stream identification, risk management, targeted customer acquisition and retention efforts, market research, competitive analysis, improved customer service, efficient complaint resolution processes, and leveraging technology. These strategies align the merged bank’s operations with the criteria of profitability, market share, and service quality while promoting respon’Ible banking practices that contribute towards the SDGs. In the long-term, the merged bank should prioritize diversification of revenue streams, expansion of customer base, and optimization of cost structure, along with establishing a strong brand presence, customer loyalty programs, and continuous improvement in service quality. Monitoring progress, making necessary adjustments, and aligning with SDGs are crucial for sustained profitability and long-term success in the marketplace.

The main contributions of this analysis are the identification of short-term and long-term strategies for a bank merger to align with the criteria of profitability, market share, and service quality while promoting responsible banking practices in line with the Sustainable Development Goals (SDGs). The findings highlight the importance of cost management, revenue stream identification, risk management, customer acquisition and retention efforts, market research, competitive analysis, customer service improvement, and leveraging technology in the short-term, while emphasizing the need for diversification of revenue streams, expansion of customer base, and optimization of cost structure in the long-term. Policy recommendations include regular monitoring of financial performance, market trends, and customer feedback, along with proactive adjustments to strategies, and prioritizing responsible lending and investment practices that align with the SDGs. These recommendations can guide bank mergers in making informed decisions and achieving sustained profitability and long-term success, while contributing towards social and environmental sustainability.

The paper is structured as follows. Chapter two presents the current literature. Chapter three explains the data and methodology used in the research. Chapter four includes the results of the analysis. Chapter five discussed the research results, including policy recommendations and short/long term suggestions for the merged entity. And lastly chapte six concludes the article.

2. Mergers and acquisitions from SDGs Perspective

Mergers and acquisitions (M&A) are common business tactics to expand internationally. Oh, Peter, and Johnson (2014) claim that M&A is a strategy business use to grow their operations and obtain a competitive edge. According to Sheidu and Yusuf (2015), a merger is the comingling of two or more businesses. In a broad sense, M&A refers to business mergers, acquisitions, fusions, and synergies in which one business loses its identity while the other keeps it. Anyanwu and Agwor (2015) see mergers as a "strategic partnership" where two businesses collaborate to seek shared goals. According to Ahmed & Ahmed (2014), a merger is an amalgamation in which two formerly independent entities are combined to form a single entity. By "Absorption or Consolidation," this is possible. One of the entities has absorbed when it keeps its name (Anyanwu & Agwor, 2015).

Based on four hypotheses—diversity, synergy, market share, and manager benefit maximization—bank mergers can be categorized. According to the synergy hypothesis, combined banks would benefit from economies of scale, leading to higher stock prices and profitability. According to the Diversity Hypothesis, mergers give banks access to varied product and service portfolios while lowering the risks associated with broader geographic exposure. The stock prices of the target and acquirer banks would rise due to this risk-reducing diversification. The Market Share Hypothesis contends that a merger of two rivals would lead to less price competition because of higher pricing and lower supervisory costs. According to the manager benefit maximization hypothesis, bank managers would favor the merger to maximize their benefits, retain job security, and boost profitability for shareholders. However, it is possible that this will not result in improved public welfare (Palombo, 1997).

Correa (2006) used banks from the USA, Germany, France, Brazil, Argentina, and Panama to study international bank acquisitions between 1994 and 2003. According to the report, only two years after the transaction date, the banks’ performance had improved. In his 2009 study, Lin (2009) emphasized the scale dimension as a crucial element in cross-border bank mergers and acquisitions. Utilizing data from the World Bank, it was found that choosing a bank with low costs is also crucial and that large banks with high profits tend to be acquired more significantly than smaller ones.

Mehra (2011) used a logit model to analyze a dataset based on quarters from 1986 to 2008 to assess mergers and acquisitions within the American banking industry. According to the study, banks that had previously undertaken mergers and acquisitions were more likely to consolidate, and laws also impacted this trend. Large-scale banks intentionally position mergers to grow their market share, and it was acknowledged that liquidity concerns significantly impact earnings during the merger process.

Few studies in the available literature have used balanced scorecards for bank M&As. Lindblom & Von Koch (2002) used a balanced scorecard methodology to examine international bank mergers and acquisitions in the European Union market. According to their analysis, the M&A strategy makes sense because the banks’ complementary strengths in several model components make it a firm fit.

The association between bank mergers and acquisitions and their financial performance both before and after the merger was examined by Oghuvwu & Omoye (2016). The financial indicators of both banks are examined using the balanced scorecard before and after the merger. In their datasets, authors indicate a strong positive link between M&A and bank performance.

A thorough, balanced scorecard analysis of the merger of banks makes numerous additions to the body of knowledge. First and foremost, this study intends to shed light on the advantages and disadvantages of merging two different banks and serve as a model for subsequent mergers. The study’s goal is backed by recommendations for a short- and long-term strategic plan in the final parts. A better, more educated roadmap will facilitate mergers between Islam and the West.

Second, while developing the scorecards, financial performance analysis is also considered, and problems with risk management, banking products, and client retention are also covered. As a result, the study aims to serve as a foundation for subsequent research on the financial performance of merging banks with similar or dissimilar internal systems (Aysan & Unal, 2021).

Furthermore, the dearth of research necessitates the development of the best decision-making procedures for these kinds of mergers, which could affect the merger’s success and continuity. The success of these mergers can be increased with a greater understanding of the decision-making process and the use of advanced decision-making tools.

The four key categories of the balanced scorecard created for this study are Financial Statement Based Perspective, Consumer Based Perspective, Operations Based Perspective, Competition Based Perspective. There are three KPIs for each category, for a total of twelve. References for every KPI are provided in

Table 1.

3. Data & Methodology

The Barwa Bank & IBQ merger is examined in this study using the balanced scorecard method. A balanced scorecard typically has four categories: financial, customer satisfaction, internal business, and learning and growth. The scorecard created for this analysis can be found in the results chapter.

Each KPI from the scorecard is connected to one SDG. Thus, the analysis of the merger from a sustainability perspective will be completed throughout the paper. With the developed scorecard, it is intended to be studied why Barwa Bank and IBQ merged. A case study approach and integration of several data sources are used to thoroughly understand this transaction and its circumstances.

To start with the first KPI, increasing profitability, we connected it with the SDG 8, which is Decent Work and Economic Growth is one of the most critical goals for sustainable development. The goal aims to promote sustained and inclusive economic growth, full and productive employment, and decent work for all. It recognizes the central role that work plays in people’s lives and the critical role that it plays in reducing poverty and inequality (Lewis, 2008).

The profitability of a bank can have a significant impact on SDG 8. Banks are critical players in the economy, and their profitability is an important indicator of economic growth and development. Profitable banks are better positioned to provide financial services, invest in infrastructure, and support economic growth. In addition, profitable banks can provide more resources to support social and environmental initiatives that contribute to sustainable development.

In addition, the merged bank can support SDG 8 by promoting decent work. The bank can provide financing for businesses that prioritize decent work practices, such as fair wages, safe working conditions, and equal opportunities. The bank can also adopt responsible lending practices that promote environmental and social sustainability, which can contribute to decent work and economic growth.

Secondly, the market share of a bank refers to the proportion of total deposits and loans held by the bank in a particular market. The market share of a bank can have significant implications for SDG 8, which aims to promote sustained and inclusive economic growth, full and productive employment, and decent work for all.

A high market share can provide banks with greater financial resources to invest in infrastructure, create jobs, and provide access to financial services for underserved populations. This can promote economic growth and job creation, which are key drivers of SDG 8. Additionally, a high market share can provide banks with the capacity to adopt responsible lending practices that promote social and environmental sustainability, which can also contribute to SDG 8.

Financial resilience is a critical factor in the banking sector’s ability to contribute to SDG 9 (industry, innovation, and infrastructure). Financial resilience refers to the ability of a bank to withstand external shocks and economic downturns while maintaining its financial stability and supporting economic growth.

From an SDG perspective, financial resilience is important because it enables banks to provide stable and reliable financial services to individuals and businesses, which, in turn, can contribute to economic development and poverty reduction. Banks that are financially resilient can also play a vital role in promoting investment in sustainable infrastructure projects, which can help achieve SDG 9’s targets of promoting inclusive and sustainable industrialization and fostering innovation.

A bank that provides high-quality services can facilitate access to financial resources needed to invest in infrastructure, adopt sustainable industrial practices, and promote innovation, which are all critical components of SDG 9. High-quality banking services can help to promote financial inclusion by making it easier for individuals and businesses to access credit, savings accounts, and other financial services.

Moreover, banks that provide high-quality services can also help to promote responsible lending and investment practices that contribute to sustainable development. For instance, they can promote the adoption of environmentally sustainable practices by offering green loans and financing sustainable infrastructure projects.

Satisfying customers with Islamic needs can play an important role in promoting progress towards SDG 10, which aims to reduce inequalities within and among countries. The Islamic finance industry is based on a set of ethical principles that are aligned with the objectives of SDG 10. These principles promote social justice, fairness, and equitable distribution of resources, which are critical in achieving SDG 10.

Moreover, the principle of Shari’ah compliance, which underpins the Islamic finance industry, can also contribute to progress towards SDG 10. Shari’ah compliance requires financial transactions to be conducted in accordance with Islamic ethical principles, which prioritize fairness, transparency, and social responsibility. This can help to ensure that financial resources are allocated in a way that promotes social justice and reduces economic inequalities.

Customer loyalty can play a significant role in promoting progress towards SDG 8, which aims to promote sustained, inclusive, and sustainable economic growth, full and productive employment, and decent work for all. Customer loyalty is an important factor in the success and sustainability of any business, including banks. Sustained customer loyalty can result in a stable customer base, increased revenue, and long-term profitability, which can contribute to economic growth and the creation of decent work opportunities (Purnamasari et al., 2022).

Moreover, customer loyalty can also promote sustainable and responsible business practices. Customers who are loyal to a bank are more likely to demand sustainable and socially responsible banking products and services, which can encourage banks to incorporate these principles into their operations. This can lead to more sustainable and responsible business practices, which can contribute to progress towards SDG 8.

The managerial & organizational quality of the merged bank can potentially contribute to progress towards SDG 8, which aims to promote sustained, inclusive, and sustainable economic growth, full and productive employment, and decent work for all. Firstly, managerial & organizational quality can help to promote stability and continuity within the merged bank, which is important for achieving sustained economic growth (Kamukama et al., 2017). By establishing formal policies and procedures, the bank can ensure that its operations are consistent and transparent, which can help to build trust with its customers, investors, and other stakeholders. This, in turn, can help to attract more investment, expand its customer base, and promote the creation of new job opportunities.

Technological & organizational infrastructure of the merged bank can potentially contribute to progress towards SDG 9, which aims to build resilient infrastructure, promote inclusive and sustainable industrialization, and foster innovation. Firstly, the adoption of advanced technology can help to improve the efficiency and effectiveness of the merged bank’s operations, which can contribute to the development of resilient infrastructure. For example, by using advanced digital platforms and data analytics tools, the bank can streamline its processes, reduce transaction times, and minimize the risk of errors. This can help to enhance the reliability and resilience of the bank’s operations, which is important for promoting economic growth and development.

Increase in Agility & Human Capital of the merged bank can potentially contribute to progress towards SDG 4, which aims to ensure inclusive and equitable quality education and promote lifelong learning opportunities for all.

Firstly, the human capital of the merged bank can contribute to the development of inclusive and equitable quality education. By providing training and development opportunities to its employees, the bank can enhance their skills and knowledge, which can help to improve the quality of the services it provides to its customers. This, in turn, can help to build trust with its customers, increase customer loyalty, and contribute to the development of an educated and informed customer base.

Information enhancement of the customers and doing business is an essential driver of economic growth and development, and it can play a vital role in contributing to the achievement of Sustainable Development Goals (SDGs). The information enhancement of the merged bank can potentially contribute to progress towards SDG 9, which aims to build resilient infrastructure, promote inclusive and sustainable industrialization, and foster innovation.

The information enhancement of the merged bank can contribute to the development of resilient infrastructure. By adopting innovative technologies and processes, the bank can improve its operational efficiency and effectiveness, which can lead to more reliable and resilient infrastructure. This, in turn, can help to reduce the vulnerability of infrastructure to natural disasters and other disruptive events, contributing to the achievement of SDG 9.

Future readiness & adaptability of the merged bank can potentially contribute to progress towards SDG 9, which aims to build resilient infrastructure, promote inclusive and sustainable industrialization, and foster innovation.

The future readiness of the merged bank can contribute to the development of resilient infrastructure. By being able to respond quickly to changes in the external environment, the bank can adapt its infrastructure to meet new challenges and demands. For example, the bank can quickly respond to changes in the regulatory environment or changes in customer preferences, which can help to ensure that the bank’s infrastructure remains resilient and effective.

The sustainable finance practices of the merged bank can potentially contribute to progress towards SDG 17, which aims to strengthen the means of implementation and revitalize the global partnership for sustainable development. The sustainable finance practices of the merged bank can contribute to the mobilization of financial resources for sustainable development. By integrating ESG factors into its decision-making processes, the bank can allocate capital towards sustainable projects and initiatives that support the achievement of the SDGs. This can help to mobilize additional financial resources towards sustainable development, which is critical for achieving the SDGs.

The sustainable finance practices of the merged bank can also contribute to the promotion of partnerships for sustainable development. By adopting sustainable finance practices, the bank can collaborate with other stakeholders, such as governments, non-governmental organizations, and other financial institutions, to promote sustainable development. This can help to create partnerships that can leverage expertise, resources, and knowledge towards the achievement of the SDGs.

These carefully selected criteria are analyzed under a quantum spherical fuzzy set technique with balanced scorecard analysis. The approaches used in the proposed model are explained in the following subtitles.

3.1. Quantum Spherical Fuzzy Sets with Golden Cut

Quantum mechanics aim to understand the probabilities of various conditions. In this context, angles (

) and amplitude results (

) are taken into consideration (Kayacık et al., 2022). This situation helps to solve complex problems in a more effective manner (Yüksel and Dinçer, 2023). This theory is explained in Equations (1)-(3). In this context,

states collective events and

u refers to the event (Ai et al., 2023).

For decision-making models to be formed correctly, it is necessary to minimize the uncertainty in the process. To achieve this goal, these techniques can be used with different fuzzy numbers. Within this scope, Spherical fuzzy sets (

) are also introduced to increase the precise results (Kahraman and Gündogdu, 2021). For this purpose, generalized forms of Neutrosophic and Pythagorean fuzzy numbers are taken into consideration (Gimenez-Grau et al., 2020). These sets consider both membership, non-membership, and hesitancy parameters (μ, ν and π) together that is accepted as the main benefit of them. Equations (4) and (5) indicate the details of these sets (Munir et al., 2020).

In this model, Quantum mechanisms and Spherical fuzzy sets are integrated as in Equations (6)-(8) where

,

, and

refer to the parameters.

Another key point to increase the appropriateness of the decision-making process is to compute the degrees effectively. For this purpose, golden ratio (G) is used in this proposed model. Equations (9) and (10) give information about this process in which

a and

b demonstrate the large and small quantities (Xu et al., 2023; Sun et al., 2022).

Equations (11) and (12) explain the amplitude of non-membership and hesitancy degrees and Equations (13)-(15) refer to the phase angles of membership, non-membership, and hesitancy degrees in Quantum Spherical fuzzy sets.

The details of the mathematical operations are shown in Equations (16)-(19).

3.2. The extension of M-SWARA

SWARA (Stepwise Weight Assessment Ratio Analysis) method is a multi-purpose decision making method. SWARA is used to select the most suitable one among a set of options or alternatives. SWARA performs a weight evaluation ratio analysis that determines the weight of each alternative for each criterion (Bouraima et al., 2023). The SWARA method can also be considered in determining the importance of each criterion. On the other hand, one of the most criticized aspects of the SWARA technique is that it does not take into account the causal relationship between the factors (Ayyildiz, 2022). In this framework, in this study, some improvements were made on the classical SWARA method, and a new technique called M-SWARA is created. Thanks to this technique, it will be possible to calculate the importance weights of the criteria and to determine the causality relationship between the criteria (Dinçer et al., 2022). Firstly, evaluations are obtained from the expert team. Secondly, relation matrix is created with Equation (20) (Martínez et al., 2023).

Equation (21) is used to generate aggregated value.

After that, defuzzification processes are applied. It is a process used to convert fuzzy output values to a specific value in a fuzzy logic system. In this process, Equation (22) is taken into consideration.

In the fourth stage,

(comparative significance),

(coefficient),

(recalculated weight), and

(weight) values are computed by Equations (23)-(25).

;

To generate M-SWARA, the following improvements are made to the classical SWARA. Relation matrix is created by using values. In this process, the matrix is limited and transposed by the power of “2t+1”. Finally, a threshold value is computed by taking the average value of the matrix. With the help of this situation, the causal directions can be identified. In this process, when the values are higher than the threshold, it means that the factor on the row has an influence the item on the column.

3.3. Neuro Decision-Making with Facial Action Coding System

Collecting expert opinions is very important in decision making analysis. In this process, facial expressions can increase the accuracy and reliability of expert opinions. In other words, these statements can be an extra source of information in the evaluation of expert opinions. Neuro decision-making methodology considers the nonverbal expression of emotion, such as happiness and surprise. Facial Action Coding System focuses on the facial expressions by considering 46 different action units (AUs) (Skiendziel et al. 2019). Within this framework, these units are used for coding facial expressions. Owing to this condition, it is aimed to reach more appropriate findings (Shao et al., 2021).

4. Analysis Results

In this study, it is aimed to find significant indicators of M&A process. In the analysis process, firstly, similar studies in literature are evaluated. As a result, 12 different SDGs-based criteria are selected. The details of these items are indicated in

Table 2.

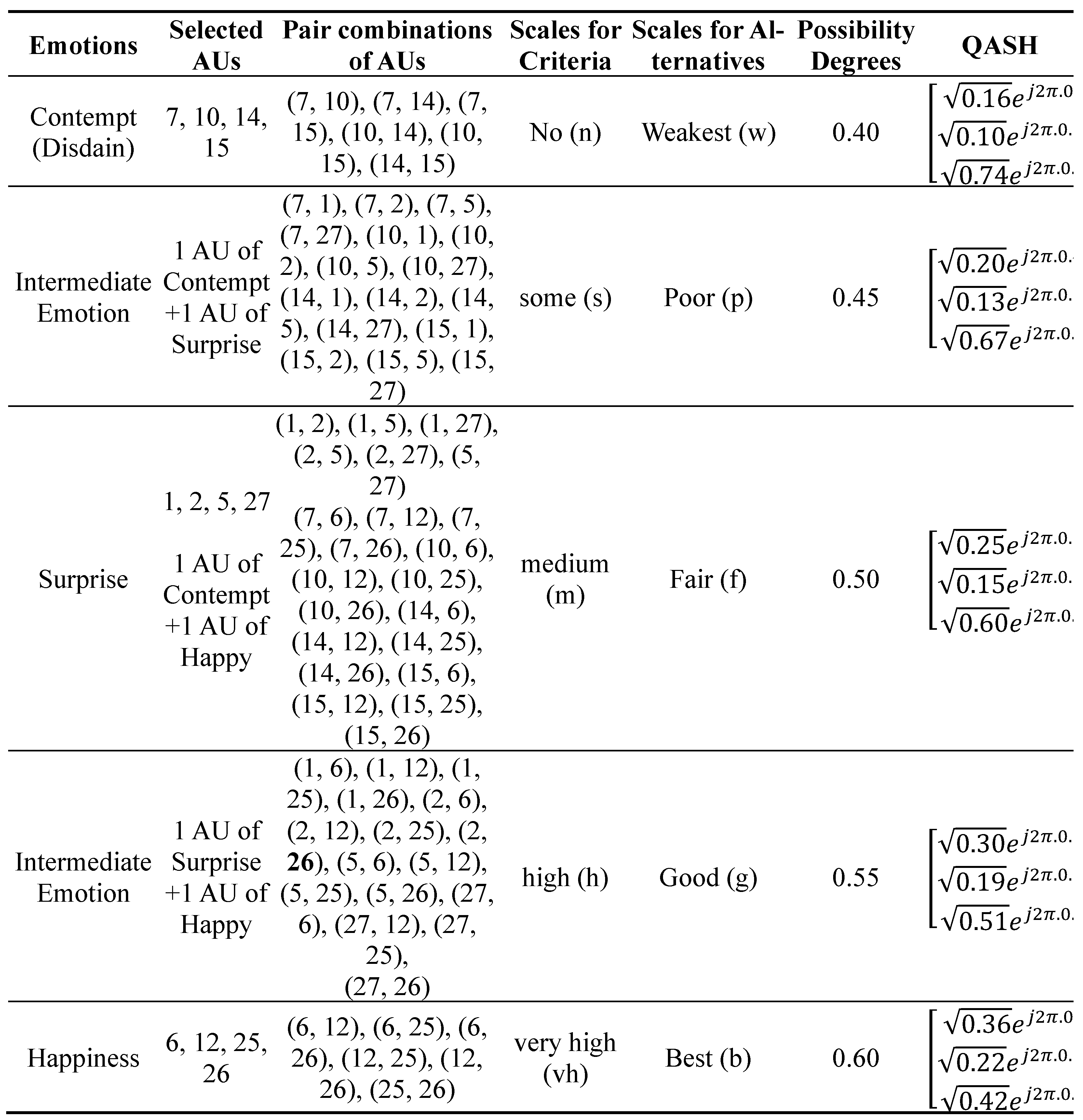

Secondly, the evaluations are collected from the expert team that consists of 5 different decision-makers. The details of these scales, AUs and fuzzy numbers are explained in

Table 3.

In

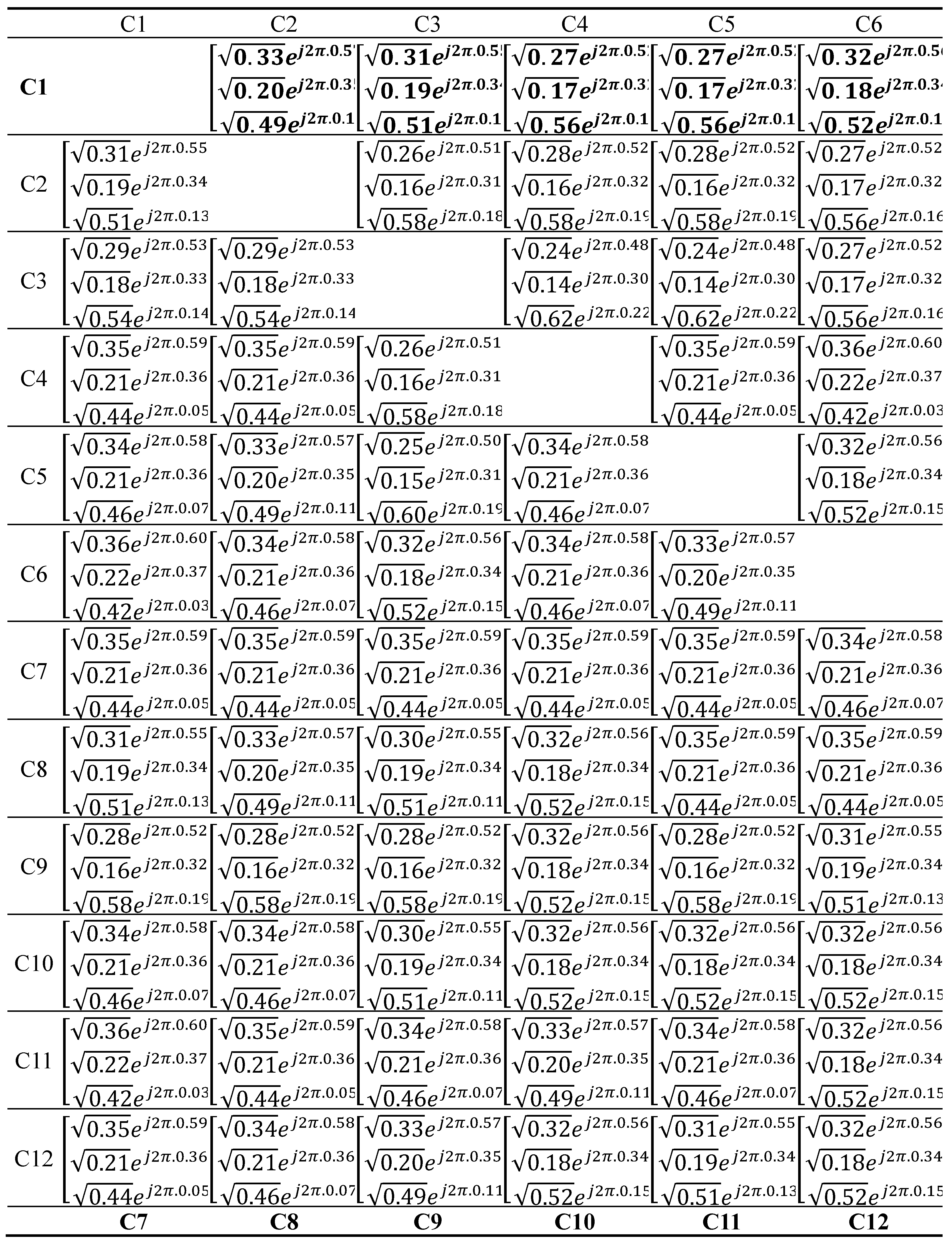

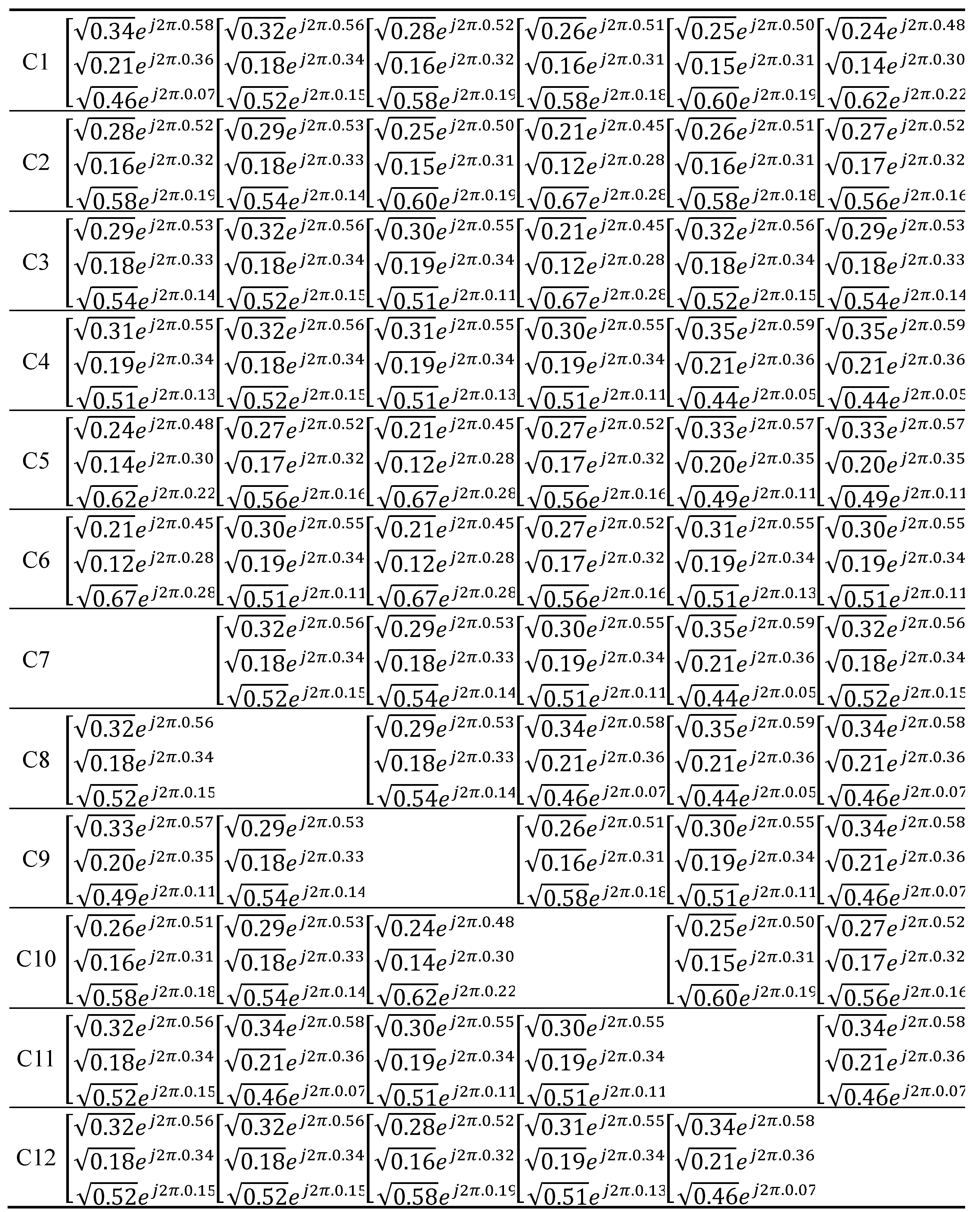

Table 4, facial evaluations of the decision-makers are demonstrated.

Thirdly, the average values of the fuzzy numbers are computed. These values are shown in

Table 5.

In the fourth step, score functions of the criteria are computed as in

Table 6.

The fifth step includes the normalization of the values. With the help of this process, it can be more possible to make more effective evaluation with the data. Normalized matrix is constructed in

Table 7.

After that, the sj, kj, qj, and wj values are calculated in the following step. For this purpose, Equations (23)-(25) are taken into consideration.

Table 8 gives information about these values.

The seventh step is related to the construction of the relation matrix. With the help of this matrix, impact directions among the items can be identified.

Table 9 explains the details of this matrix.

Table 8 demonstrates that increasing Profitability (C1) and market share (C2) are the most influenced criteria. On the other side, increase in agility & human capital (C9) is effective on fewer criteria than others. Finally, the stable matrix is created. In this matrix, the weights of the criteria can be understood. The details of this matrix are shown in

Table 10.

In

Table 10, the values in the rows give information about the weights. Hence, it is seen that increasing profitability (C1) has the greatest weight (0.095). Similarly, market share (C2) is the second most critical factor (0.092) for M&A decisions in the banking industry. Finally table 11 below shows the weight ranking of the KPIs as the analysis results.

Table 11.

Weight Ranking.

Table 11.

Weight Ranking.

| KPIs |

# |

Weight |

Ranking |

| Increasing Profitability |

C1 |

0.095 |

1 |

| Market Share |

C2 |

0.092 |

2 |

| Improvement in Service Quality |

C4 |

0.086 |

3 |

| Customer Loyalty |

C6 |

0.085 |

4 |

| Sustainable Finance Products |

C12 |

0.085 |

5 |

| Satisfying the customer needs with Islamic banking services |

C5 |

0.084 |

6 |

| Technological & Organizational Infrastructure |

C8 |

0.084 |

7 |

| Future Readiness & Adaptability |

C11 |

0.084 |

8 |

| Managerial & Organizational Quality |

C7 |

0.081 |

9 |

| Financial Resilience |

C3 |

0.08 |

10 |

| Information Enhancement of the Customers and Doing Business |

C10 |

0.075 |

11 |

| Increase in Agility & Human Capital |

C9 |

0.069 |

12 |

5. Discussion

This part of the paper will discuss the scorecard KPIs with the highest value of weight based on the analysis results. Highest weight belongs to the profitability, meaning that it is the most important criteria of the case bank merger from an SDGs perspective. Profitability is often considered a critical criterion in evaluating bank mergers from an SDG (Sustainable Development Goals) perspective, as it directly influences a bank’s ability to contribute to sustainable development. There are several reasons why profitability is deemed significant in this context.

Firstly, financial sustainability is a crucial aspect to consider. Profitability serves as a key indicator of a bank’s ability to maintain financial stability and generate the necessary resources to support its operations and investments, including those aligned with SDGs (Grove & Patelli, 2013). A profitable bank is better positioned to have stable earnings and capital base, which are essential for long-term sustainability and continued contribution to the SDGs.

Also, profitability plays a role in resource mobilization. A profitable bank can attract more investors, raise capital, and access funding from capital markets, which can be used to finance projects that align with SDGs, such as renewable energy, affordable housing, or clean water initiatives. Adequate profitability allows a bank to mobilize resources for financing sustainable development initiatives and contribute to addressing global challenges.

Moreover, profitability can facilitate innovation and technological advancement. With sufficient resources, a bank can invest in research and development, technological infrastructure, and innovative products and services that promote sustainable development. For example, digital banking solutions can improve financial inclusion, promote responsible lending, and facilitate efficient payments and remittances, which can contribute to SDGs related to financial inclusion, responsible consumption, and sustainable economic growth.

Profitability can also create social impact. A profitable bank can allocate a portion of its profits to support initiatives aligned with SDGs, such as education, health, and poverty alleviation (Nguyen, 2019). By investing in socially responsible projects and supporting community development initiatives, banks can contribute to social welfare and inclusive development, thereby fulfilling their role as responsible corporate citizens.

Lastly, profitability is significant from a shareholder’s perspective. Shareholders, including institutional investors, may have expectations for a return on their investment. A profitable bank is better positioned to deliver sustainable returns over the long term, which can attract more investment in the bank and provide additional resources to support SDG-related initiatives (Grove & Patelli, 2013).

The second weight belongs to the market share. Market share is a critical criterion in evaluating bank mergers from an SDG (Sustainable Development Goals) perspective due to its potential impact on the ability of the merged entity to contribute to sustainable development. From an academic standpoint, there are several reasons why market share is considered significant in this context.

Market share reflects the scale and reach of the merged entity in the financial market. A bank with a larger market share has a broader customer base, higher transaction volume, and wider geographic coverage, which can translate into increased access to financial services for a larger population. This can contribute to SDGs related to financial inclusion, poverty alleviation, and economic empowerment by enabling more people, especially those in underserved or remote areas, to access banking services and participate in formal financial systems (Nguyen, 2019).

Market share can also influence the pricing and availability of financial products and services. Banks with a larger market share often have more pricing power and bargaining leverage, which can result in more competitive rates and fees for customers. This can benefit consumers and businesses alike, particularly those in vulnerable or marginalized communities, by making financial services more affordable and accessible. Lower transaction costs and fees can encourage savings, investments, and responsible borrowing, which are aligned with SDGs related to responsible consumption, economic growth, and reduced inequality (Hankir et al., 2011).

Thirdly, market share can affect the ability of the merged entity to attract and retain customers, particularly in a competitive market. A larger market share can signal greater stability, credibility, and trust, which are important factors for customers in choosing a financial institution. Customer loyalty and retention can lead to longer-term customer relationships and higher customer lifetime value, which can support the sustainability and profitability of the merged entity. A stable and growing customer base can also provide a platform for cross-selling and promoting sustainable financial products and services, such as green loans, social impact investments, and ethical banking practices (Vander Vennet, 1996). This is aligned with SDGs related to sustainable finance and responsible investment.

Moreover, market share can influence the merged entity’s ability to compete with other financial institutions and drive positive changes in the financial sector. A bank with a larger market share can have a stronger market position, which can enable it to have a greater influence on industry practices, standards, and regulations. This can lead to more sustainable business practices, responsible lending and investment decisions, and enhanced corporate governance, which can contribute to the overall sustainability of the financial sector and align with SDGs related to responsible consumption and production, industry innovation, and sustainable infrastructure (Anyanwu and Agwor, 2015).

As with the third weight, service quality is a key criterion for assessing the impact of bank mergers from a Sustainable Development Goals (SDG) perspective. It encompasses various dimensions, including accessibility, responsiveness, reliability, empathy, and tangibles, which collectively determine the level of customer satisfaction and experience. High service quality in a bank merger can lead to improved financial inclusion, increased customer well-being, enhanced financial literacy, and responsible financial behavior among customers. Moreover, it can foster a positive corporate culture within the merged entity, promoting responsible business practices and ethical conduct (Kjan et al., 2020).

From an SDG perspective, service quality in a bank merger is vital as it directly aligns with several goals, such as SDG 1 (No Poverty), SDG 3 (Good Health and Well-being), SDG 5 (Gender Equality), SDG 8 (Decent Work and Economic Growth), and SDG 9 (Industry, Innovation, and Infrastructure). For instance, by providing accessible and responsive financial services, a merged bank can contribute to poverty alleviation, health and well-being improvement, gender equality promotion, and decent work creation (Hankir et al., 2011). Additionally, by ensuring reliable and empathetic customer service, the merged entity can enhance financial literacy, promote responsible financial behavior, and foster a positive corporate culture, thus contributing to industry innovation and infrastructure development.

Service quality is a crucial criterion for evaluating bank mergers from an SDG perspective. It encompasses various dimensions that directly impact customer satisfaction, financial inclusion, customer well-being, and corporate culture (Nguyen, 2019). By aligning with multiple SDGs, service quality in a bank merger can contribute to achieving sustainable development outcomes and fostering responsible business practices. However, it should be assessed in conjunction with other relevant factors, and appropriate methodologies, such as the Balanced Scorecard, can provide a comprehensive analysis of the merger’s alignment with the SDGs.

Based on the first three most important criteria of profitability, market share, and service quality in the analysis of the bank merger from an SDG perspective, the following short-term plans could be considered for the merged bank:

The merged bank should focus on optimizing its financial performance by implementing cost management strategies to streamline operations, identifying new revenue streams through product innovation or expanding existing offerings, and strengthening risk management practices to mitigate potential risks that could impact profitability (Oh & Kim, 2017). Regular financial analysis, performance monitoring, and proactive adjustments to the business strategies can help ensure sustained profitability and financial stability.

The merged bank could develop strategies to expand its market share by targeting specific customer segments, regions, or product lines. This may involve conducting market research to identify untapped opportunities, developing targeted marketing campaigns to attract and retain customers, and enhancing customer acquisition and retention efforts through tailored product offerings, personalized customer service, and competitive pricing. Regular market monitoring and competitive analysis can guide the bank in making informed decisions to capture a larger market share.

Moreover, it should prioritize service quality by enhancing customer experience through improved customer service, faster response times to customer inquiries or complaints, and efficient complaint resolution processes. This may involve investing in customer service training for bank staff, implementing customer feedback mechanisms, and leveraging technology to enhance digital banking experiences. Regular customer feedback analysis, benchmarking against industry standards, and continuous improvement initiatives can help ensure that service quality remains a top priority for the merged bank.

These short-term plans can guide the merged bank in aligning its operations with the identified criteria of profitability, market share, and service quality, while also promoting responsible banking practices that contribute towards the SDGs. Monitoring and evaluating the progress of these plans and making necessary adjustments can help ensure their effectiveness in achieving the desired outcomes (Ahmed et al., 2015).

In longer terms, the merged bank could focus on long-term sustainability and profitability by diversifying its revenue streams, expanding its customer base, and optimizing its cost structure. This may involve exploring new business lines or markets, expanding the bank’s digital capabilities to improve operational efficiency, and strengthening risk management practices to mitigate potential risks. Additionally, the merged bank could prioritize responsible lending and investment practices that align with the SDGs, such as financing projects that promote environmental sustainability, social inclusion, and economic development. Regular financial performance monitoring, strategic planning, and risk assessments can help guide the merged bank in achieving sustained profitability in the long run.

They could develop long-term strategies to capture a larger market share by establishing a strong brand presence, building customer loyalty, and expanding its market reach. This may involve investing in marketing and advertising campaigns to create awareness and attract new customers, leveraging customer data and analytics to better understand customer needs and preferences, and developing innovative products and services that cater to changing customer demands. The merged bank could also prioritize customer retention and loyalty programs to foster long-term relationships with existing customers. Regular market analysis, customer feedback, and competitive intelligence can inform the long-term market share expansion strategies of the merged bank.

Lastly, the merged bank could prioritize continuous improvement in service quality by investing in customer service training, enhancing customer communication channels, and incorporating customer feedback into its service delivery processes. This may involve implementing technology solutions to improve customer experience, enhancing self-service options, and developing robust complaint resolution mechanisms. The merged bank could also establish a culture of customer-centricity, where employees are empowered to proactively address customer needs and concerns. Regular customer satisfaction surveys, feedback analysis, and performance tracking can help the merged bank in maintaining a high standard of service quality in the long term (Indupurnahayu et al., 2022).

Overall, the criteria established from the study’s findings are useful in creating the merged bank’s short- and long-term strategies. Each of them is placed on the short- or long-term lists based on the impact factor of the criteria. In the short term, more crucial factors are essential to make sure the company is competitive and compatible. The long-term objectives for the improvement and enhancement of the firm in the marketplace include additional criteria.

6. Conclusions

This study contributes to the literature on bank mergers and acquisitions by examining their implications for the Sustainable Development Goals (SDGs). It provides insights on how profitability, market share, and service quality can impact sustainability and responsible banking practices of a merged bank, aligning them with the SDGs. These findings enrich the literature on sustainable finance, responsible banking, and bank mergers, benefiting scholars and researchers.

The study also has policy implications for regulators, policymakers, and stakeholders in the banking industry. Policymakers and regulators can use the insights to develop regulations and guidelines that encourage responsible banking practices and align bank mergers with the SDGs, promoting sustainable lending, responsible customer service, and market competition in line with SDG objectives.

Bank managers and executives involved in or considering bank mergers can also benefit from the findings. The criteria of profitability, market share, and service quality identified in the study can guide decision-making in strategic planning and operational decisions, potentially enhancing sustainability and responsible banking practices in the merged entity, contributing to SDG achievement (Alkhazali et al., 2020).

The study underscores the importance of incorporating sustainable finance practices in bank mergers and acquisitions, aligning criteria with the SDGs, and promoting environmental sustainability, social inclusion, and economic development. This serves as a call to action for banks to integrate sustainable finance practices into their strategies and operations, contributing to SDG achievement.

Lastly, the study emphasizes the importance of stakeholder engagement in bank mergers and acquisitions. Considering the SDGs in the context of criteria such as profitability, market share, and service quality highlights the need for active stakeholder engagement, fostering trust, transparency, and accountability in decision-making processes related to mergers and acquisitions, contributing to responsible and sustainable operations of the merged bank (Shim, 2019).

Regulators, bank managers, and boards play a crucial role in promoting sustainable bank mergers that align with the United Nations Sustainable Development Goals (SDGs). Regulators can integrate sustainability metrics into their assessment criteria for bank mergers, incentivizing merged banks to prioritize sustainability and responsible banking practices in their operations (Abubakar et al., 2022). Regulators can also encourage merged banks to engage in sustainable lending and investment practices by providing incentives such as favorable regulatory treatment or lower capital requirements for financing projects aligned with the SDGs.

Additionally, regulators can set guidelines and standards for responsible customer service in bank mergers, ensuring that merged banks maintain high levels of customer protection, fair treatment, and financial education. Furthermore, regulators can promote competition among merged banks with social and environmental considerations, encouraging partnerships with socially responsible organizations and market entry for banks that demonstrate responsible banking practices. Regulators can also promote stakeholder engagement in bank mergers, requiring merged banks to actively engage with stakeholders and incorporate their perspectives in decision-making processes (Bawani et al., 2016). Lastly, regulators can monitor and evaluate the progress of merged banks towards SDG alignment, setting up reporting requirements and mechanisms to assess their sustainability performance and holding them accountable for their progress.

For bank managers and boards, the following policy recommendations are proposed based on the findings of this study. Firstly, bank managers and boards should prioritize the development and implementation of sustainability strategies that align with the SDGs. This includes setting clear sustainability goals and targets, integrating sustainability considerations into business strategies and decision-making processes, and monitoring and reporting on sustainability performance. Secondly, bank managers and boards should prioritize responsible customer service that promotes financial inclusion, consumer protection, and fair treatment of customers. This includes providing transparent and responsible financial products and services, empowering customers to make responsible financial decisions, and addressing customer complaints or grievances in a timely and fair manner. Lastly, bank managers and boards should demonstrate ethical and responsible leadership that promotes a culture of sustainability and social responsibility within the bank. This includes promoting a clear tone from the top, fostering a culture of transparency, inclusiveness, and stakeholder engagement, and ensuring that the bank’s organizational structure, policies, and practices are aligned with its sustainability goals and values.

By implementing these policy recommendations, bank managers and boards can contribute to the achievement of the SDGs, promote sustainable banking practices, and ensure that bank mergers are conducted in a manner that aligns with sustainability principles. This can result in long-term value creation for the bank, its stakeholders, and society at large, and contribute to a more sustainable and inclusive financial system that supports the realization of the SDGs.

References

- Abbot Jr, H. W. (1929). The Merger Movement Among New York Banks. Bankers’ Magazine (1896-1943), 119(2), 307.

- Abubakar, J., AlQashouti, B., Aysan, A., & Unal, I. M. (2022). Is Islamic Finance A Panacea for Global Economic Disruptions after COVID-19 Outbreak? Available at SSRN 4085941.

- Afthanorhan, A.; Awang, Z.; Rashid, N.; Foziah, H.; Ghazali, P.L. Assessing the effects of service quality on customer satisfaction. Manag. Sci. Lett. 2019, 13–24. [Google Scholar] [CrossRef]

- Adamu, D.A.; Saleh, M.B.; Muhammad, I. Assessment of the non- financial measures of performance of deposit money banks in Nigeria. J. Account. Tax. 2015, 7, 131–136. [Google Scholar] [CrossRef]

- Ahmed, M.; Ahmed, Z. Mergers and acquisitions: Effect on financial performance of manufacturing companies of Pakistan. Middle-East Journal of Scientific Research 2014, 21, 689–699. [Google Scholar]

- Ahmed, S.; Mohiuddin, M.; Rahman, M.; Tarique, K.M. ; Azim the impact of Islamic Shariah compliance on customer satisfaction in Islamic banking services: mediating role of service quality. J. Islam. Mark. 2021, 13, 1829–1842. [Google Scholar] [CrossRef]

- Ai, R.; Zheng, Y.; Yüksel, S.; Dinçer, H. Investigating the components of fintech ecosystem for distributed energy investments with an integrated quantum spherical decision support system. Financial Innov. 2023, 9, 27. [Google Scholar] [CrossRef]

- Ali, H.; Zainuddin, A.; Rashid, W.E.W.; Jusoff, K. Customers Satisfaction in Malaysian Islamic Banking. Int. J. Econ. Finance 2009, 1, 197–202. [Google Scholar]

- Alkhazali, Z.; Abu-Rumman, A.; Khdour, N.; Al-Daoud, K. Empowerment, HRM practices and organizational performance: a case study of Jordanian commercial banks. Entrep. Sustain. Issues 2020, 7, 2991–3000. [Google Scholar] [CrossRef]

- Al-Sharkas, A.A.; Hassan, M.K.; Lawrence, S. The Impact of Mergers and Acquisitions on the Efficiency of the US Banking Industry: Further Evidence. J. Bus. Finance Account. 2007, 35, 50–70. [Google Scholar] [CrossRef]

- Amin, M.; Isa, Z.; Fontaine, R. The role of customer satisfaction in enhancing customer loyalty in Malaysian Islamic banks. Serv. Ind. J. 2011, 31, 1519–1532. [Google Scholar] [CrossRef]

- Anyanwu, S.; Agwor, T. Impact of Mergers and Acquisitions on the Performance of Manufacturing Firms in Nigeria. Afr. Res. Rev. 2015, 9, 156. [Google Scholar] [CrossRef]

- Aysan, A.F.; Belatik, A.; Unal, I.M.; Ettaai, R. Fintech Strategies of Islamic Banks: A Global Empirical Analysis. Fintech 2022, 1, 206–215. [Google Scholar] [CrossRef]

- Aysan, A. F., & Unal, I. M. (2021). A Bibliometric Analysis of Fintech and Blockchain in Islamic Finance.

- Aysan, A.F.; Unal, I.M. Challenges in Islamic Fintech and Digitalization: An Extensive Literature Review. World Sci. Annu. Rev. Islam. Finance 2023, 1, 41–52. [Google Scholar] [CrossRef]

- Ayyildiz, E. Fermatean fuzzy step-wise Weight Assessment Ratio Analysis (SWARA) and its application to prioritizing indicators to achieve sustainable development goal-7. Renew. Energy 2022, 193, 136–148. [Google Scholar] [CrossRef]

- Bajaj, H. Organizational culture in bank mergers & acquisitions. Indian Journal of Industrial Relations 2009, 229–242. [Google Scholar]

- Bakir, C. (2013). Bank behavior and resilience: The effect of structures, institutions and agents. Springer.

- Bawani, M.A.; Ghias, K.; Ahmed, I. Post Merger Performance of the KsE Listed, selected Banks of Pakistan. Journal of Business Strategies 2016, 10, 85. [Google Scholar]

- Behn, B. K., & Riley Jr, R. A. (1999). Using nonfinancial information to predict financial performance: The case of the US airline industry. Journal of Accounting, Auditing & Finance, 14(1), 29-56.

- Belkhaoui, S.; Lakhal, L.; Lakhal, F.; Hellara, S. Market structure, strategic choices and bank performance: a path model. Manag. Finance 2014, 40, 538–564. [Google Scholar] [CrossRef]

- Berger, A.N.; Bouwman, C.H. How does capital affect bank performance during financial crises? J. Financial Econ. 2013, 109, 146–176. [Google Scholar] [CrossRef]

- Bikker, J., & Bos, J. W. (2008). Bank Performance: A theoretical and empirical framework for the analysis of profitability, competition and efficiency. Routledge.

- Bilal, A., Zia, U. R., leeb, Q., & Asad, S. (2010). Determinants of customer loyalty in the banking sector: The case of Pakistan. African Journal of Business Management, 4(6), 1040-104.

- Bouraima, M.B.; Qiu, Y.; Stević, Ž.; Simić, V. Assessment of alternative railway systems for sustainable transportation using an integrated IRN SWARA and IRN CoCoSo model. Socio-Economic Plan. Sci. 2023, 86, 101475. [Google Scholar] [CrossRef]

- Brueller, N.N.; Carmeli, A.; Markman, G.D. Linking Merger and Acquisition Strategies to Postmerger Integration: A Configurational Perspective of Human Resource Management. J. Manag. 2016, 44, 1793–1818. [Google Scholar] [CrossRef]

- Carletti, E., Hartmann, P., & Spagnolo, G. (2007). Bank mergers, competition, and liquidity. Journal of Money, Credit and Banking, 39(5), 1067-1105.

- Çetin, M.; Karabay, M.E.; Efe, M.N. The Effects of Leadership Styles and the Communication Competency of Bank Managers on the Employee's Job Satisfaction: The Case of Turkish Banks. Procedia - Soc. Behav. Sci. 2012, 58, 227–235. [Google Scholar] [CrossRef]

- Chen, Q.; Vashishtha, R. The effects of bank mergers on corporate information disclosure. J. Account. Econ. 2017, 64, 56–77. [Google Scholar] [CrossRef]

- Cleverley, W. O. (1990). Improving financial performance: a study of 50 hospitals. Hospital & health services administration, 35(2), 173-188.

- Coelho, P.S.; Henseler, J. Creating customer loyalty through service customization. Eur. J. Mark. 2012, 46, 331–356. [Google Scholar] [CrossRef]

- Corbet, S.; Cumming, D.J.; Hou, Y.; Hu, Y.; Oxley, L. Have crisis-induced banking supports influenced European bank performance, resilience and price discovery? J. Int. Financial Mark. Institutions Money 2022, 78, 101566. [Google Scholar] [CrossRef]

- Correa, R., 2006. Essays on financial integration. Ph.D. Thesis, Columbia University, the USA.

- Davis, S. (2000). Bank mergers: lessons for the future. Springer.

- Delong, G.; Deyoung, R. Learning by Observing: Information Spillovers in the Execution and Valuation of Commercial Bank M&As. J. Finance 2007, 62, 181–216. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, A., & Huizinga, H. (2000). Financial structure and bank profitability. Available at SSRN 632501.

- Demirguc-Kunt, A., & Levine, R. (2000, October). Bank concentration: cross-country evidence. In World Bank Global Policy Forum Working Paper. Piloff, S. J., & Santomero, A. M. (1998). The value effects of bank mergers and acquisitions. In Bank Mergers & Acquisitions (pp. 59-78). Springer, Boston, MA.

- Dinçer, H.; Yüksel, S.; Aksoy, T.; Hacıoğlu, Ü. Application of M-SWARA and TOPSIS Methods in the Evaluation of Investment Alternatives of Microgeneration Energy Technologies. Sustainability 2022, 14, 6271. [Google Scholar] [CrossRef]

- Ehigie, B.O. Correlates of customer loyalty to their bank: a case study in Nigeria. Int. J. Bank Mark. 2006, 24, 494–508. [Google Scholar] [CrossRef]

- Farah, M.F. Consumers’ switching motivations and intention in the case of bank mergers: a cross-cultural study. Int. J. Bank Mark. 2017, 35, 254–274. [Google Scholar] [CrossRef]

- Fauzi, H.; Svensson, G.; Rahman, A.A. “Triple Bottom Line” as “Sustainable Corporate Performance”: A Proposition for the Future. Sustainability 2010, 2, 1345–1360. [Google Scholar] [CrossRef]

- Fry, J.N.; Shaw, D.C.; Dipchand, C.R. Customer Loyalty to Banks: A Longitudinal Study. J. Bus. 1973, 46, 517–525. [Google Scholar] [CrossRef]

- Gimenez-Grau, A.; Kristjansen, C.; Volk, M.; Wilhelm, M. A quantum framework for AdS/dCFT through fuzzy spherical harmonics on S4. J. High Energy Phys. 2020, 2020, 1–37. [Google Scholar] [CrossRef]

- Haleem, A. H., & Kevin, L. L. T. (2018). Impact of user competency on accounting information system success: Banking sectors in Sri Lanka. International Journal of Economics and Financial Issues, 8(6), 167.

- Hassan, Y., & Lukman, R. (2020). Comparative Effects of Pre and Post Bank Mergers and Acquisitions (M&A) on Employee Productivity in Selected Banks in Nigeria. Economic Insights-Trends & Challenges, (2).

- Hernon, P.; Nitecki, D.A.; Altman, E. Service quality and customer satisfaction: An assessment and future directions. J. Acad. Libr. 1999, 25, 9–17. [Google Scholar] [CrossRef]

- Hickson, D.J.; Pugh, D.S.; Pheysey, D.C. Operations Technology and Organization Structure: An Empirical Reappraisal. Adm. Sci. Q. 1969, 14, 378–397. [Google Scholar] [CrossRef]

- Hirsch Jr, F. A., & Dowdy, J. S. (2009). Whither Wachovia-Wells Fargo Wins the Battle for the Storied North Carolina Banking Institution. NC Banking Inst., 13, 167.

- Hou, M., Zhang, S., & Xia, J. (2022, July). Quantum fuzzy K-means algorithm based on fuzzy theory. In Artificial Intelligence and Security: 8th International Conference, ICAIS 2022, Qinghai, China, July 15–20, 2022, Proceedings, Part I (pp. 348-356). Cham: Springer International Publishing. 15 July.

- Houston, J.F.; Shan, H. Corporate ESG Profiles and Banking Relationships. Rev. Financial Stud. 2021, 35, 3373–3417. [Google Scholar] [CrossRef]

- Houston, J.F.; James, C.M.; Ryngaert, M.D. Where do merger gains come from? Bank mergers from the perspective of insiders and outsiders. J. Financial Econ. 2001, 60, 285–331. [Google Scholar] [CrossRef]

- Indupurnahayu, I., Nurhayati, I., Endri, E., Marlina, A., Yudhawati, D., & Muniroh, L. (2022). Islamic Bank Merger And Economic Crisis: Event Study Analysis. Quality-Access To Success, 23(187).

- Kahraman, C., & Gündogdu, F. K. (2021). Decision making with spherical fuzzy sets. Studies in Fuzziness and Soft Computing, 392, 3-25. 392, 3–25.

- Kamukama, N., Kyomuhangi, D. S., Akisimire, R., & Orobia, L. A. (2017). Competitive advantage: Mediator of managerial competence and financial performance of commercial banks in Uganda. African Journal of Economic and Management Studies.

- Kayacık, M.; Dinçer, H.; Yüksel, S. Using quantum spherical fuzzy decision support system as a novel sustainability index approach for analyzing industries listed in the stock exchange. Borsa Istanb. Rev. 2022, 22, 1145–1157. [Google Scholar] [CrossRef]

- Khan, Z.; Soundararajan, V.; Shoham, A. Global post-merger agility, transactive memory systems and human resource management practices. Hum. Resour. Manag. Rev. 2019, 30, 100697. [Google Scholar] [CrossRef]

- Khan, Z.; Soundararajan, V.; Wood, G.; Ahammad, M.F. Employee emotional resilience during post-merger integration across national boundaries: Rewards and the mediating role of fairness norms. J. World Bus. 2020, 55, 100888. [Google Scholar] [CrossRef]

- Khazanchi, D., & Arora, V. (2016). Evaluating Information Technology (IT) Integration Risk Prior to Mergers and Acquisitions (M&A). ISACA journal, 1.

- Kumar, B. R. (2019). Mergers and Acquisitions by Bank of America. In Wealth Creation in the World’s Largest Mergers and Acquisitions (pp. 259-270). Springer, Cham.

- Larsson, R.; Finkelstein, S. Integrating Strategic, Organizational, and Human Resource Perspectives on Mergers and Acquisitions: A Case Survey of Synergy Realization. Organ. Sci. 1999, 10, 1–26. [Google Scholar] [CrossRef]

- Lee, K. H., & Ullah, S. (2011). Customers’ attitude toward Islamic banking in Pakistan. International Journal of Islamic and Middle Eastern Finance and Management.

- Lenka, U.; Suar, D.; Mohapatra, P.K. Service Quality, Customer Satisfaction, and Customer Loyalty in Indian Commercial Banks. J. Entrep. 2009, 18, 47–64. [Google Scholar] [CrossRef]

- Lewis, M. K. (2008). In what ways does Islamic banking differ from conventional finance. Journal of Islamic Economics, Banking and Finance (JIEBF), 4(3), 9-24.

- Lin, D., 2009. Two essays in international banking and finance: Cross-border bank mergers and acquisitions, small and premium enterprise financing in transition economies. Ph.D. Thesis, Auburn University, the USA.

- Lindblom, T.; von Koch, C. Cross-Border Bank Mergers and Acquisitions in the EU. Serv. Ind. J. 2002, 22, 41–72. [Google Scholar] [CrossRef]

- Linder, J.C.; Crane, D.B. Bank mergers: integration and profitability. Journal of Financial Services Research 1993, 7, 35–55. [Google Scholar] [CrossRef]

- Luo, C.-M.A.; Chang, H.-F.; Su, C.-H. ‘Balanced Scorecard’ as an operation-level strategic planning tool for service innovation. Serv. Ind. J. 2012, 32, 1937–1956. [Google Scholar] [CrossRef]

- Maddaus, M. The Resilience Bank Account: Skills for Optimal Performance. Ann. Thorac. Surg. 2019, 109, 18–25. [Google Scholar] [CrossRef] [PubMed]

- Markman, G.M.; Venzin, M. Resilience: Lessons from banks that have braved the economic crisis—And from those that have not. Int. Bus. Rev. 2014, 23, 1096–1107. [Google Scholar] [CrossRef]

- Marshall, R.H.; Herter, C.A. Bank Mergers and the Nature of Competition in Banking. Am. J. Econ. Sociol. 1960, 20, 81–87. [Google Scholar] [CrossRef]

- Martínez, L.; Dinçer, H.; Yüksel, S. A hybrid decision making approach for new service development process of renewable energy investment. Appl. Soft Comput. 2023, 133, 109897. [Google Scholar] [CrossRef]

- Mehra, S., 2011. Essays on mergers and acquisitions amongst U.S. Commercial banks: Attributes of merging banks and implications of M&A on bank risk-taking. Ph.D. Thesis, University of Houston, the USA.

- Metawa, S.A.; Almossawi, M. Banking behavior of Islamic bank customers: perspectives and implications. Int. J. Bank Mark. 1998, 16, 299–313. [Google Scholar] [CrossRef]

- Mufti, O., Parvaiz, G. S., Wahab, M., & Durrani, M. (2016). Human Resource Competencies and Organizational Performance: A Study on Banking Sector Managers in Pakistan. Journal of Managerial Sciences, 10(1).

- Munir, M.; Kalsoom, H.; Ullah, K.; Mahmood, T.; Chu, Y.-M. T-Spherical Fuzzy Einstein Hybrid Aggregation Operators and Their Applications in Multi-Attribute Decision Making Problems. Symmetry 2020, 12, 365. [Google Scholar] [CrossRef]

- Naser, K.; Jamal, A.; Al-Khatib, K. Islamic banking: a study of customer satisfaction and preferences in Jordan. Int. J. Bank Mark. 1999, 17, 135–151. [Google Scholar] [CrossRef]

- Neffati, A., Fredj, I. B., & Schalck, C. (2011). Earnings management and banking performance: a Stochastic-Frontier analysis on US bank mergers. Interdisciplinary Journal of Research in Business, 1(6), 58-65.

- Oh, H., & Kim, K. (2017). Customer satisfaction, service quality, and customer value: years 2000-2015. International Journal of Contemporary Hospitality Management.

- Oh, J.-H.; Peters, L.D.; Johnston, W.J. Who's acquiring whom? — Experimental evidence of firm size effect on B2B mergers and marketing/sales tasks. Ind. Mark. Manag. 2014, 43, 1035–1044. [Google Scholar] [CrossRef]

- Olson, G.T.; Pagano, M.S. A New Application of Sustainable Growth: A Multi-Dimensional Framework for Evaluating the Long Run Performance of Bank Mergers. J. Bus. Finance Account. 2005, 32, 1995–2036. [Google Scholar] [CrossRef]

- Palombo, L., 1997. Bank associations and purchases. TBB. Bankacılar Dergisi, 3-4.

- Panetta, F.; Schivardi, F.; Shum, M. Do Mergers Improve Information? Evidence from the Loan Market. J. Money, Crédit. Bank. 2009, 41, 673–709. [Google Scholar] [CrossRef]

- Piloff, S. J., & Santomero, A. M. (1998). The value effects of bank mergers and acquisitions. In Bank Mergers & Acquisitions (pp. 59-78). Springer, Boston, MA.

- Purnamasari, F.; Nanda, H.I.; Purnamaputra, M.Z.; Susanti, M.; Palil, M.R. Merger In Islamic Banking Sector: A Snap Of Views From Their Customers And Prospective Customers. International Journal of Social Science Int. J. Soc. Sci. 2022, 2, 1839–1846. [Google Scholar] [CrossRef]

- Rau, P.R. Investment bank market share, contingent fee payments, and the performance of acquiring firms. J. Financial Econ. 2000, 56, 293–324. [Google Scholar] [CrossRef]

- Reinhart, C.M.; Rogoff, K.S. Banking crises: An equal opportunity menace. J. Bank. Finance 2013, 37, 4557–4573. [Google Scholar] [CrossRef]

- Rezitis, A.N. Efficiency and productivity effects of bank mergers: Evidence from the Greek banking industry. Econ. Model. 2008, 25, 236–254. [Google Scholar] [CrossRef]

- Ringim, K.J.; Razalli, M.R.; Hasnan, N. The Relationship between Information Technology Capability and Organizational Performance of Nigerian Banks. Int. J. Bus. Res. Dev. 2015, 4. [Google Scholar] [CrossRef]

- Salman, M.; Ganie, S.A.; Saleem, I. Employee Competencies as Predictors of Organizational Performance: A Study of Public and Private Sector Banks. Manag. Labour Stud. 2020, 45, 416–432. [Google Scholar] [CrossRef]

- Shao, Z.; Liu, Z.; Cai, J.; Ma, L. JÂA-Net: Joint Facial Action Unit Detection and Face Alignment Via Adaptive Attention. Int. J. Comput. Vis. 2020, 129, 321–340. [Google Scholar] [CrossRef]

- Sheidu, A. D., & Yusuf, H. (2015). Bank consolidation and improvement of shareholder value: An empirical evaluation of return on capital employed following bank mergers in Nigeria. American International Journal of Contemporary Research, 5(5) 240 - 246.

- Sherman, M. (2009). A short history of financial deregulation in the United States. Center for economic and policy research, 7.

- Skiendziel, T.; Rösch, A.G.; Schultheiss, O.C. Assessing the convergent validity between the automated emotion recognition software Noldus FaceReader 7 and Facial Action Coding System Scoring. PLoS ONE 2019, 14, e0223905. [Google Scholar] [CrossRef]

- Smith, A.D. Managerial decisions involving bank mergers and acquisitions within the current recession: case study. Int. J. Electron. Finance 2010, 4, 39–63. [Google Scholar] [CrossRef]

- Smith, R. C., & Walter, I. (1998). Global patterns of mergers and acquisition activity in the financial service industry. In Bank mergers & acquisitions (pp. 21-36). Springer, Boston, MA.

- Staikouras, C. K., & Wood, G. E. (2004). The determinants of European bank profitability. International Business & Economics Research Journal (IBER), 3(6).

- Succi, G.; Benedicenti, L.; Vernazza, T. Analysis of the effects of software reuse on customer satisfaction in an RPG environment. IEEE Transactions on Software Engineering 2001, 27, 473–479. [Google Scholar] [CrossRef]

- Sun, L.; Peng, J.; Dinçer, H.; Yüksel, S. Coalition-oriented strategic selection of renewable energy system alternatives using q-ROF DEMATEL with golden cut. Energy 2022, 256, 124606. [Google Scholar] [CrossRef]

- Sureshchandar, G.; Rajendran, C. ; Anantharaman The relationship between service quality and customer satisfaction – a factor specific approach. J. Serv. Mark. 2002, 16, 363–379. [Google Scholar] [CrossRef]

- Ullah, N. (2022). Impact Of Mergers & Acquisitions On The Operational Performance And Stability Of Islamic And Conventional Banks.

- Unal, I.M.; Aysan, A.F. Fintech, Digitalization, and Blockchain in Islamic Finance: Retrospective Investigation. Fintech 2022, 1, 388–398. [Google Scholar] [CrossRef]

- Vong, P. I., & Chan, H. S. (2009). Determinants of bank profitability in Macao. Macau Monetary Research Bulletin, 12(6), 93-113.

- Xu, X.; Yüksel, S.; Dinçer, H. An Integrated Decision-Making Approach with Golden Cut and Bipolar q-ROFSs to Renewable Energy Storage Investments. Int. J. Fuzzy Syst. 2022, 25, 168–181. [Google Scholar] [CrossRef]

- Yüksel, S.; Dinçer, H. Sustainability analysis of digital transformation and circular industrialization with quantum spherical fuzzy modeling and golden cuts. Appl. Soft Comput. 2023, 138, 110192. [Google Scholar] [CrossRef]

- Zollo, M.; Singh, H. Deliberate learning in corporate acquisitions: post-acquisition strategies and integration capability in U.S. bank mergers. Strat. Manag. J. 2004, 25, 1233–1256. [Google Scholar] [CrossRef]

Table 1.

KPIs and References.

Table 1.

KPIs and References.

| BSC Perspective |

KPIs |

References |

| Financial Statement Based Perspective |

Increasing Profitability |

Bikker & Bos, 2008; Demirgüç-Kunt & Huizinga, 2000; Linder & Crane, 1993; Staikouras & Wood, 2004; Vong & Chan, 2009; Aysan & Unal, 2023. |

| Market Share |

Behn & Riley Jr, 1999; Belkhaoui et al., 2014; Berger & Bouwman, 2013; Cleverley, 1990; Rau, 2000 |

| Financial Resilience |

Bakir, 2013; Corbet et al., 2022; Indupurnahayu et al., 2022; Khan et al., 2020a; Maddaus, 2020; Markman & Venzin, 2014 |

| Consumer Based Perspective |

Improvement in Service Quality |

Afthanorhan et al., 2019; Coelho & Henseler, 2012; Hernon et al., 1999; Lenka et al., 2009; Oh & Kim, 2017; Succi et al., 2001; Sureshchandar et al., 2002 |

| Satisfying the customer needs with Islamic banking services |

Ahmed et al., 2021; Ali et al., 2009; Farah, 2017; Lee & Ullah, 2011; Metawa & Almossawi, 1998; Naser et al., 1999 |

| Customer Loyalty |

Amin et al., 2011; Bilal et al., 2010; Coelho & Henseler, 2012; Ehigie, 2006; Fry et al., 1973; Lenka et al., 2009 |

| Operations Based Perspective |

Managerial & Organizational Quality |

Alkhazali et al., 2020; Chen & Vashishtha, 2017; Cetin et al, 2012; Kamukana et al, 2017; Mufti et al., 2016; Salman et al., 2020 |

| Technological & Organizational Infrastructure |

Haleem & Kevin, 2018; Hickson et al., 1969; Khazanchi & Arora, 2016; Linder & Crane, 1993; Ringim et al., 1993 |

| Increase in Agility & Human Capital |

Alkhazali et al., 2020; Brueller et al., 2018; Hassan & Lukman, 2020; Kjan et al., 2020; Larsson & Finkelstein, 1999 |

| Competition Based Perspective |

Information Enhancement of the Customers and Doing Business |

Chen & Vashishtha, 2017; DeLong & DeYoung, 2007; Houston et al., 2001; Panetta et al., 2009; Piloff & Santomero, 1998; Zollo & Singh, 2004; Unal & Aysan, 2022. |

| Future Readiness & Adaptability |