1. Introduction

Projects are recognized as the engine and catalyst for development, whereas adequate financing and funding are simply the fuel that keeps the engine (projects) running. Such projects are typically initiated by public organizations (government), private organizations (investors), or a partnership of both, collectively referred to as clients. Many projects may be running concurrently in some cases, each with its own budget and duration; some may be similar while others are completely different; all are meant to serve the objectives of a business or a specific organization. A program, and to a lesser extent a portfolio, is a collection of projects.

A portfolio is also a grouping of projects, programs, and other types of work (whether or not they are linked), which enables efficient administration of the grouped work to achieve the strategic business objectives. The portfolio selection problem describes a scenario in which a decision-maker in project management chooses a subset of projects from a small pool of alternatives while keeping in mind time, resources, cost, and other constraints, and then creates a group that can meet the desired and most advantageous organizational goals (Korotkov, & Wu, 2019). Portfolio selection is an integral part of business strategic decision-making as well as an essential step in arranging project management. Organizations can benefit from effective portfolio management by fulfilling their strategic objectives, improving their competitiveness in the market, and promoting the long-term expansion of their companies. Poor portfolio selection will diminish the competitive edge, which will cause major losses for enterprises in addition to complicating project portfolio implementation and wasting a large amount of resources. The enterprise multi-objectives are therefore the cornerstone for comprehending how to optimize the project portfolio, since they appear to be essential for the survival and expansion of the organization. (Su-Lan, Xiao-Lan, Sheng-Yuan, & Tong, 2021). In light of limited resources and current organizational strategies, project portfolio selection can be defined as a dynamic decision-making process for evaluating, selecting, and prioritizing a project or collection of projects for implementation (Khalili-Damghani, Sadi-Nezhad, Lotfi, & Tavana, 2013). While making multiple-choice decisions, mathematical optimization techniques are used to assist the decision-maker in identifying appropriate and workable solutions to real-world issues that entail multiple-choice objective functions that must be optimized simultaneously. When faced with multiple options, decision-makers frequently rely on hazy information and/or questionable facts since they typically lack a thorough understanding of the objectives and limits.

In addition, the growing use of mathematical models by organizations to analyze projects and programs in order to implement business strategy has increased the demand for knowledge of project portfolio management (Koh, 2011). Organizations are interested in increasing efficiency through project portfolio management as they battle with heightened performance pressures (Müller, 2008). The reality that, managing multi-choice projects more strategically boosts efficiency and effectiveness while enhancing organizational outcomes is attested to by many current successful firms (Itegi, 2015). A project portfolio is a tool that some businesses use to successfully manage ongoing programs and projects with many objectives (PMI, 2017).

In 1952, Markowitz presented a bi-criterion portfolio selection model where the manager seeks to maximize the expected portfolio return and to minimize financial risk. In other words, we look for the portfolio that enables investors to make more money while reducing the chance of suffering financial losses. It is clear that these two requirements clash and cannot both be optimized at the same time. Hence, in order to find the most gratifying portfolio, the manager must make some concessions. In this study, we are interested in investigating the effect of Multi-choice Goal programming in project Portfolio Analysis. Goal programming, at its core, is a goal-oriented optimization technique for multi-objective decision-making in a clear-cut decision environment. When dealing with multi-objective optimization, when the distinct objectives are frequently at odds with one another, it is a variation of linear programming (Hadeel, Ali, Maha, & Aisha, 2019). As a result, goal programming may manage a sizable number of variables, restrictions, and objectives. The model's defined goals can be achieved when the deviations are reduced to zero. Moreover, deviations might be positive or negative, denoting overachievement or underachievement of the goals subject to certain limitations. Goal programming's capacity to generate non-Pareto efficient solutions is a contentious flaw. This goes against the core tenet of choice theory, which holds that no reasonable person will consciously pick a course of action that is Pareto inefficient. However, there are methods for recognizing when this happens and appropriately projecting the solution onto the Pareto efficient solution (Romero, 1991; Hannan, 1980; Tamiz, Mirrazavi, & Jones 1999).

Statement of the Problem

The premise that managing a multi-choice project portfolio promotes efficiency and effectiveness while also boosting organizational performance is supported by several current successful firms. To the prejudice of restricted resources, the majority of companies in Nigeria, it seems, are contending with rising demand and consistently shifting consumer tastes. To improve the portfolio structure, an effective and efficient project selection criterion is required. The majority of hiring managers base their decisions on past performance. As a result, many organizations wind up funding projects that yield lower returns. In this study, goal programming technique was used to pick the project portfolio for the Lagos State Project Portfolio from 2017 to 2021 as a study case.

Aim and Objectives of the Study

In the research, it is aimed to investigate the effect of Multi-choice Goal programming in project Portfolio Analysis, using Lagos State Project Portfolio from between 2017-2021 as a study case. Specifically, the objectives of the study are to:

Examine the effectiveness of Multi-choice Goal programming in analyzing the project Portfolio of Lagos State Government

Investigate the possible lapses in the use of Multi-choice Goal programming in analyzing the project Portfolio of Lagos State Government

Review of Literature

Goal programming, according to Chowdary and Slomp (2002), is a very powerful and adaptable technique for decision making analysis of a contemporary decision maker who is tasked with fulfilling numerous competing objectives under complicated environmental constraints. Multi Goal Programming, according to, is a method frequently employed to discover a compromise solution in order to achieve several competing goals (Chandra, 2020). A well-known method for resolving particular kinds of multi-objective optimization issues is goal programming (Roa, 2020). The most potent multi-objective decision-making technique that has been applied to solve a range of decision-making issues is goal programming (Wiguna, & Sudiartha, 2021). It is a method for handling scenarios with several objectives in decision-making. The method allows the decision maker to describe the amount of multi-choice desire for each target that may be avoided, preventing anyone from underestimating the decision (Wiguna, & Sudiartha, 2021). Goal-programming is more advantageous for issues with conflicting objective functions. Goal-programming seeks to reduce deviations from the predetermined aims to a minimum (Hussain, & Kim, 2020).

The earliest goal programming formulations categorized the undesirable deviations into priority levels, with the minimization of a deviation at a higher priority level being infinitely more essential than any deviations at a lower priority level. Lexicographical or pre-emptive goal programming is what this is. Ignizio (1976) provides a method demonstrating how to solve a lexicographic target program as a collection of linear programs. When the objectives to be accomplished have a distinct priority ordering, lexicographic goal programming is utilized. Weighted or non-pre-emptive goal programming should be employed if the decision maker is more interested in direct comparisons of the goals. In this instance, the accomplishment function is created by adding all of the undesirable deviations together and multiplying them by weights that represent their relative importance. Due to the phenomena of incommensurability, deviations measured in various units cannot be easily totaled. In general, there are two types of goal programming models:

The Lexicographic Goal Programming Model;

The arrangement of the undesirable deviations was caused by the initial goal programming formulations. Minimizing deviations at higher priority levels is much more crucial than at lower priority levels. Hence, lexicographic (preemptive) or non-Archimedean goal programming are examples of preemptive paradigms.

Weighted Goal Programming Model

When a decision-maker wishes to evaluate objectives side by side, they should use a weighted goal programming approach. The following non-preemptive model demonstrates how considering deviational factors at the same priority level might help establish each deviation's relative relevance:

Subject to the equation 2 to 4 conditions

Modern Portfolio Theory

The modern portfolio theory (MPT) emphasizes that increased risk comes with higher reward and describes how risk-averse investors might build portfolios to optimize or maximize expected return based on a given degree of market risk. Harry Markowitz's theories from 1952 laid the groundwork for the notion. According to the theory, it is possible to create an effective frontier of optimal portfolios that deliver the highest predicted return for a specific amount of risk. The theory's key idea is that an investment's risk and return characteristics should not be considered in isolation, but rather should be assessed in light of how the investment influences the risk and return of the entire portfolio.

According to modern portfolio theory, an investor can put together a portfolio of several assets to optimize returns for a particular amount of risk. Similar to this, an investor can create a portfolio with the lowest risk feasible given a certain level of projected return. The return on a particular investment is less significant than how the investment performs when seen in the context of the overall portfolio, according to statistical measurements like variance and correlation.

The Markowitz Portfolio Theory also makes the assumption that, given a specific set of conditions, all investors will have the same expectations and make the same decisions. According to the hypothesis of homogenous expectations, every investor will have similar expectations for the inputs required to create effective portfolios, such as asset returns, variances, and covariances. Investors will, for instance, select the investment strategy with the best return if presented with many investment strategies offering various returns at a specific risk. Similar to this, if investors are presented with plans that have various risks but the same profits, they will pick the one with the lowest risk. According to McClure (2017), a portfolio's risk can be decreased by investing in multiple stocks, which is one of the benefits of diversification. The advantages of diversity, commonly referred to as not placing all of one's eggs in one basket, are quantified.

2. Methodology

2.1. Goal Programming: Optimizations and Minimization Formulation

The existing multi goal programming model can be expressed as:

From the above functions, M-goals and p-system as well as n-decision exist

Where:

Based on the critics of the above model, the improved Multi-choice Goal Programming was designed.

Equation (1) above was redefined to have:

2.2. Case Study

Goal programming was used in this study to track the performance of the Lagos State Government from 2017 to 2021. Her financial records for the specified years were used to compile information on a number of project portfolios that were carried out in the state in order to monitor or improve performance. This study applies a goal-programming methodology to ten projects carried out over a five-year period by the Lagos State Government (2017-2021).

Table 1.

Project Portfolio of Lagos State, Nigeria.

Table 1.

Project Portfolio of Lagos State, Nigeria.

| Portfolio |

2017 |

2018 |

2019 |

2020 |

2021 |

| Agric Project |

2,950,699 |

2,114,882 |

1,341,008 |

7,814,527 |

10,175,949 |

| Construction and Rehabilitation |

19,787,898 |

22,976,320 |

8,993,492 |

5,672,168 |

15,384,376 |

| LAMATA BRT Project |

25,354,578 |

36,353,883 |

4,039,138 |

14,145,225 |

8,097,857 |

| Health Projects |

0 |

0 |

0 |

484,298 |

777,923 |

| Multilateral Funding Projects |

7,716,605 |

0 |

1,469,547 |

1,300,311 |

5,535,337 |

| Conservation Projects |

0 |

0 |

2,278 |

6,796 |

33,926 |

| Oil and Gas Project |

117,504 |

73,582 |

95,249 |

651,505 |

42,062 |

| Schools Furniture |

0 |

0 |

0 |

665,496 |

927,309 |

| Entrepreneurial Skill |

409,444 |

476,876 |

214,336 |

1,691,054 |

1,594,278 |

| Emergency Rescue Equipment |

4,163,105 |

1,582,244 |

2,968,086 |

1,859,292 |

2,245,517 |

The Model Targets

λ1: Is the total quantity of project portfolio in 2017 financial statements of Lagos State

λ2: Is the total quantity of project portfolio in 2018 financial statements of Lagos State

λ3: Is the total quantity of project portfolio in 2019 financial statements of Lagos State

λ4: Is the total quantity of project portfolio in 2020 financial statements of Lagos State

λ5: Is the total quantity of project portfolio in 2021 financial statements of Lagos State

As was previously stated, the objective of this study is to maximize the project portfolio of the Lagos State Government for the specified period while minimizing costs, so it is necessary to add positive and negative deviations to the constraints in order to assess whether the objectives are expanding or contracting.

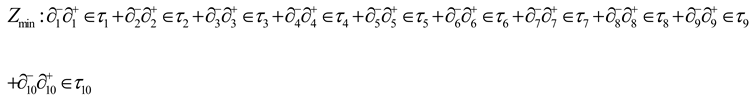

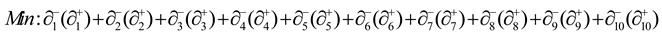

Objective Function

The objective function is defined in the following manner:

Based on the established goal constraints, the GP model (18) is created and formulated as follows

Table 2.

Target achievement.

Table 2.

Target achievement.

| |

Goal |

Outcomes |

Target |

| Min/Max Agric Project |

ɤ1

|

|

Achievement |

| Min/Max Construction and Rehabilitation |

ɤ2

|

|

Achievement |

| Min/Max LAMATA BRT Project |

ɤ3

|

|

Achievement |

| Min/Max Health Projects |

ɤ4

|

|

Achievement |

| Min/Max Multilateral Funding Projects |

ɤ5

|

|

Achievement |

| Min/Max Conservation Projects |

ɤ6

|

|

Achievement |

| Min/Max Oil and Gas Project |

ɤ7

|

|

Achievement |

| Min/Max Schools Furniture |

ɤ8

|

|

Achievement |

| Min/Max Entrepreneurial Skill |

ɤ9

|

|

Achievement |

| Min/Max Emergency Rescue Equipment |

ɤ10

|

|

Achievement |

Project Portfolio of Lagos State, Nigeria

In the table below, the cost of each project appears in Billion Naira. But for convenience, the values are further divided by 1,000,000 and rounded to 3-significant to have the current state.

Table 3.

Lagos State Project Cost (Billion of Naira).

Table 3.

Lagos State Project Cost (Billion of Naira).

| Targets |

2017 |

2018 |

2019 |

2020 |

2021 |

Total |

| Agric Project |

2.951 |

2.115 |

1.341 |

7.815 |

10.176 |

24.398 |

| Construction and Rehabilitation |

19.788 |

22.976 |

8.994 |

5.672 |

15.384 |

72.814 |

| LAMATA BRT Project |

25.355 |

36.354 |

4.039 |

14.145 |

8.098 |

87.991 |

| Health Projects |

0 |

0 |

0 |

0.484 |

0.778 |

1.262 |

| Multilateral Funding Projects |

7.717 |

0 |

1.470 |

1.300 |

5.535 |

16.022 |

| Conservation Projects |

0 |

0 |

0.002 |

0.007 |

0.034 |

0.043 |

| Oil and Gas Project |

0.118 |

0.074 |

0.095 |

0.652 |

0.042 |

0.981 |

| Schools Furniture |

0 |

0 |

0 |

0.666 |

0.927 |

1.593 |

| Entrepreneurial Skill |

0.410 |

0.477 |

0.214 |

1.691 |

1.594 |

4.386 |

| Emergency Rescue Equipment |

4.163 |

1.582 |

2.968 |

1.859 |

2.246 |

12.818 |

| Total |

60,499,833 |

63,577,787 |

19,123,134 |

34,290,672 |

44,814,534 |

|

Then, the project portfolio of Lagos State government for the period of 5 years can now be applied to the proposed model (19) above:

(Non-negative constraint)

The goal programming model defined above was solved using LINGO 17.0 x32 versions (20). Goal-setting is also covered in the sections that follow: