1. Introduction

1.1. Background

The only way to speed up agricultural modernization, achieving sustainable economic development, and reaching China's "carbon peak and carbon neutrality" goal requires an immediate emphasis on ecological civilization construction and the rural revitalization strategy. The No. 1 Central Document's primary goal for rural areas is to optimize the structure of the product industry, which will be essential for future agricultural deployment (Zhao,2022). With the aim to mitigate climate change, and maximize resource conservation and efficient use, green finance involves investing in and financing projects that support environmental protection, energy efficiency, clean energy, green buildings, and other environmentally friendly practices (Ma,2015). Because of this, many academics have started to emphasize how the industrial structure of agriculture and green financing are interconnected, yet there is a serious lack of pertinent research. Additionally, there is a dearth of pertinent empirical study, and the data support needs to be improved. A more thorough investigation is currently required to determine how green finance might help with the effort to upgrading of the agricultural industrial system.

The purpose of this study is to investigate how green finance affects the industrial structure of the agriculture sector by applying a fixed effect model to the pertinent data. We chose data from 31 Chinese provinces and municipalities from 2012 to 2021 (apart from Hong Kong, Macau, and Taiwan) in order to ensure data comparability and temporal consistency. The conclusion is that optimizing the agricultural industrial structure in accordance with regional conditions is a crucial step in the development of ecological agriculture. When agricultural industrial structures reach an advanced degree of development, sustainable development, energy conservation, and emission reduction should be actively sought goals. Green finance instruments should be used to maximize this growth.

1.2. Literature Review

Researchers from other countries first concentrated on the connection between financial development and industrial structure when examining the links between green funding and restructuring the agricultural industrial structure. Murdock et al. (1997) claim that using financial policies might make it easier to distribute social resources equally across different sectors, which will aid in ensuring adequate funding for industrial development. Green finance, according to Salazar, is a subset of financial innovation that links the financial sector to environmental causes in order to safeguard the environment (Salazar,1998). The distinguishing characteristic of green finance, in Cowan's opinion, is the intersection of the fields of green economics and finance, which largely addresses the funding issues of the green economy (Cowan,1999). According to Yoshino et al., (2019) green finance can assist boost the probability of return on investment for environmentally friendly energy projects. Other academics are of the opinion that the research object of green finance is mainly financial activities or financial instruments, focusing on the assessment of its impact on industrial ecological environment. For example, through the invention of numerous green financial instruments, it helps push forward environmental protection projects while slowing down pollution ones, and thus accomplishes ecological adjustment of industrial structure (Nderson,2016). According to Wang et al., green finance can limit investment on energy-intensive sectors while bolstering investing on tech-heavy sectors, allowing for a necessary shift in industrial structure (Wang et al.,2019).

In the domestic literature, which mostly focuses on green finance and industrial structure adjustment, there aren't a lot of particular studies on green finance and the adjustment of the agricultural industrial structure. This is because the domestic literature primarily focuses on green finance and industrial structure adjustment. Deng Honghai, a well-known agricultural economist in China, is of the opinion that what is meant by the adjustment of the agricultural industrial structure is the right adjustment between the transformation of matter and energy during the procedure of agricultural production. The use of resources and environmental protection are also tied to it, in addition to the expansion of the overall amount of agricultural goods. On the basis of constructing the four-sector DSGE model, Ma Biao and colleagues enhanced the role of credit support, promoting economic growth as well as industrial structure efficiency and adjustment (Ma et al.,2017). On the premise of optimizing ecological industry, through industrial structure optimization and adjustment and green low-carbon transformation, constantly increasing the proportion of green industries in the national economy promotes industrial frame upgrading and the economic society's coordinated development (Fang and Lin,2019). The transformation and enhancement of industrial structures can be facilitated by the reconstruction of the green industrial system (comprising of green business, green manufacturing, and green consumerism) with green finance (Qian et al.,2018).

Academics often build a model based on the relationship between the development the system of agricultural industrial and the growth in the economy, and then use the model to conduct in-depth research. Furthermore, the overwhelming majority of academics researching green finance employ qualitative methods, which explains the veracity and significance of green finance's growth. The majority of academics have not examined connection between green financing and the industrial structure of agriculture. Regarding the role of enhancing farm industrial structure to the growth of green finance, there are no extensive studies or systematic research findings. A static panel model cannot adequately describe the dynamic process by which green finance works to influence the high-level development of the agricultural industrial structure. This study uses a dynamic panel model to empirically explore the mechanism of green finance on the upgrading of China's agricultural industrial structure after assessing the development process of green finance and the level of upgrading of the country's agricultural industrial structure. The modernization of China's agriculture industrial structure and promotion of the economy's long-term prosperity will be supported by these discoveries.

1.3. Contributions of the study

The main contributions of the study are given below:

Empirical evidence is presented in the study to show how green finance has improved China's agricultural industrial structure and encouraged sustainable agriculture. The results imply that green financing contributes to the expansion of China's agriculture sector.

Disparities in geographical distribution of green financing throughout China's eastern, central, and western regions are highlighted in this study, along with their effects on sustainable agriculture. This knowledge can be used to create policies and plans that will encourage a more equitable distribution of green funding around the nation, which will result in sustainable agriculture.

The study suggests a number of development strategies that can help China's agricultural industrial structure grow and transform further, such as sustainable agriculture, cutting-edge green financial products, better regulations and policies, and the incorporation of digital technologies.

A tailored approach is stressed in the study, which promotes sustainable agriculture by highlighting the need to take into account regional variations and modify development methods accordingly. By taking this approach, sustainable agriculture practices can be improved by ensuring that the methods put into action are suitable for the unique demands and characteristics of each location.

The study used a fixed-effect model, a reliable statistical technique that takes into account unobserved time-invariant variability between provinces. This approach strengthens the validity and trustworthiness of the study's findings and offers trustworthy information to support sustainable agricultural practices.

2. Theoretical framework and research hypotheses

2.1. Measure the development level of green finance in China

Green finance supports the adoption of the concept of green sustainable growth by financial institutions in the new era, the demand to strengthen supply-side structural transformation, and the assurance to offer outstanding support for "agriculture, rural areas, and farmers". The improvement and modernization of the agricultural industrial system is also supported by green funding. The academic community has not yet produced a standard measurement of the expanding level of green finance, however, as a result of the new emergence of green finance in China. The building of an index system is currently the main method used to evaluate the current state of green finance development. This study examines green finance from seven angles: green credit, green insurance, green bonds, green support, and green funds, as well as green rights and interests. It also takes into account the complexity and timing of the development of the green finance system. The advancement of the green finance system's evaluation indicators is shown in the results below (

Table 1).

The Index of the development level of green finance is then calculated by applying the Entropy value technique to it of China's provinces from 2012 to 2021 (apart from Hong Kong, Macao, and Taiwan).

Table 2 displays the particular outcomes.

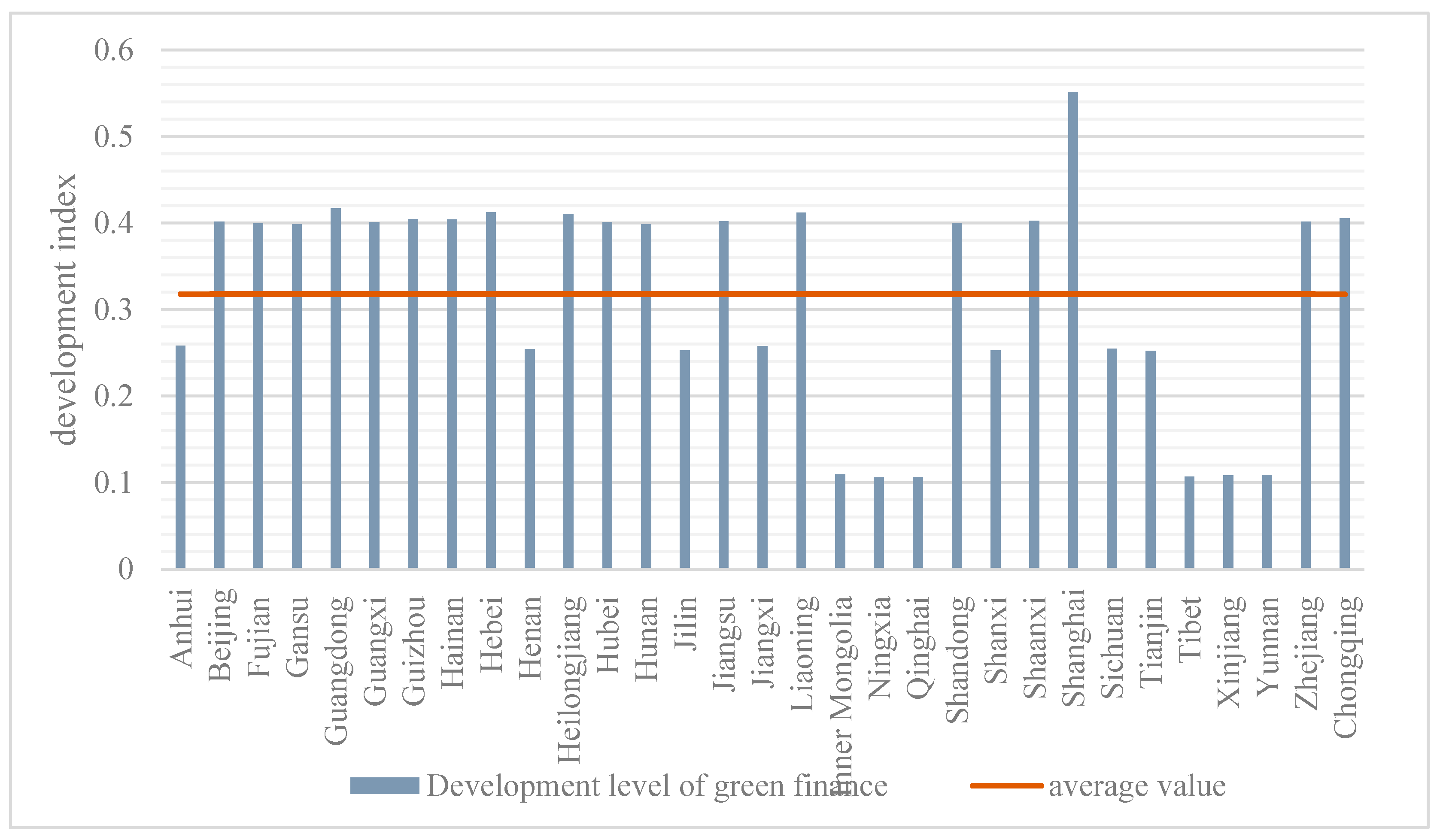

The Index of the development level of green finance of provinces and municipalities directly under the Central Government of China between 2012 and 2021 demonstrates that, despite minor fluctuations, that of China's economically developed provinces and municipalities remains comparatively elevated. In less developed countries, the development of green financing is gradual. Shanghai, for example, will have the highest green finance development level index in 2021, with a value of 0.609. With a score of 0.117, Xinjiang Uygur Autonomous Region comes in last. There was a significant value disparity. To put it another way, China's rate of growth in green finance is not balanced.

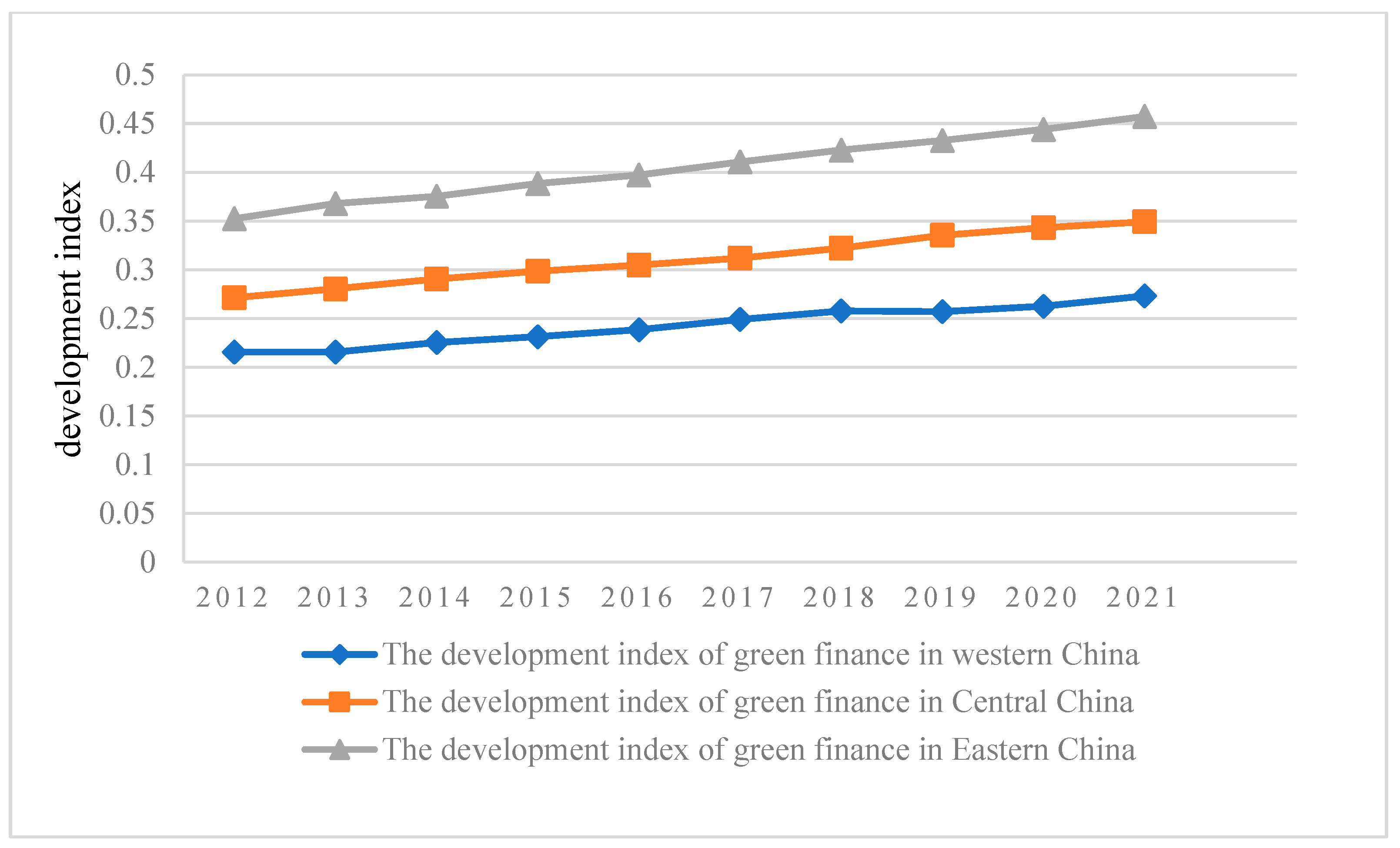

This study estimates the degree of development that will be brought about by green finance in the three regions in China of China between the years of 2012 and 2021 using the entropy approach based on the information previously provided. Details can be seen in

Figure 1.

Figure 1 shows that while the development of green financing is relatively low in central and western China, it is extremely high in eastern China. The growth of green financing is accelerating in eastern and central China. Eastern, central, and western areas had a growth in the development of green finance from 0.35254, 0.27147, and 0.21564 in 2012 to 0.45732, 0.34925, and 0.27328, respectively, in 2021. This is compatible with China's economic development's achievements in green finance.

However, compared to the average GDP growth rate for the same time period, green finance development is growing more slowly. Industries with considerable amounts of pollution, inappropriate energy use, and excessive capacity continue to be the key forces behind economic growth. The agricultural sector has a limited impact and demand on green finance. In order to steer market funds, green finance, in the opinion of Ding Pan and others, was essential. Targeted and controlled policies can help green industries get more money and make industries that need a great deal of inputs, use a large amount of energy, and don't make much money pay higher investment costs, which speeds up the growth of the structure of ecological industries(Ding et al,2021).This thoroughly demonstrates the need for additional research into the relationship between green finance and agriculture in order to increase its demand and driving effect. It is therefore imperative to have urgent discussions about how to hasten the healthy and sustainable growth of green financing in order to support the high-level progress of the agricultural industrial system.

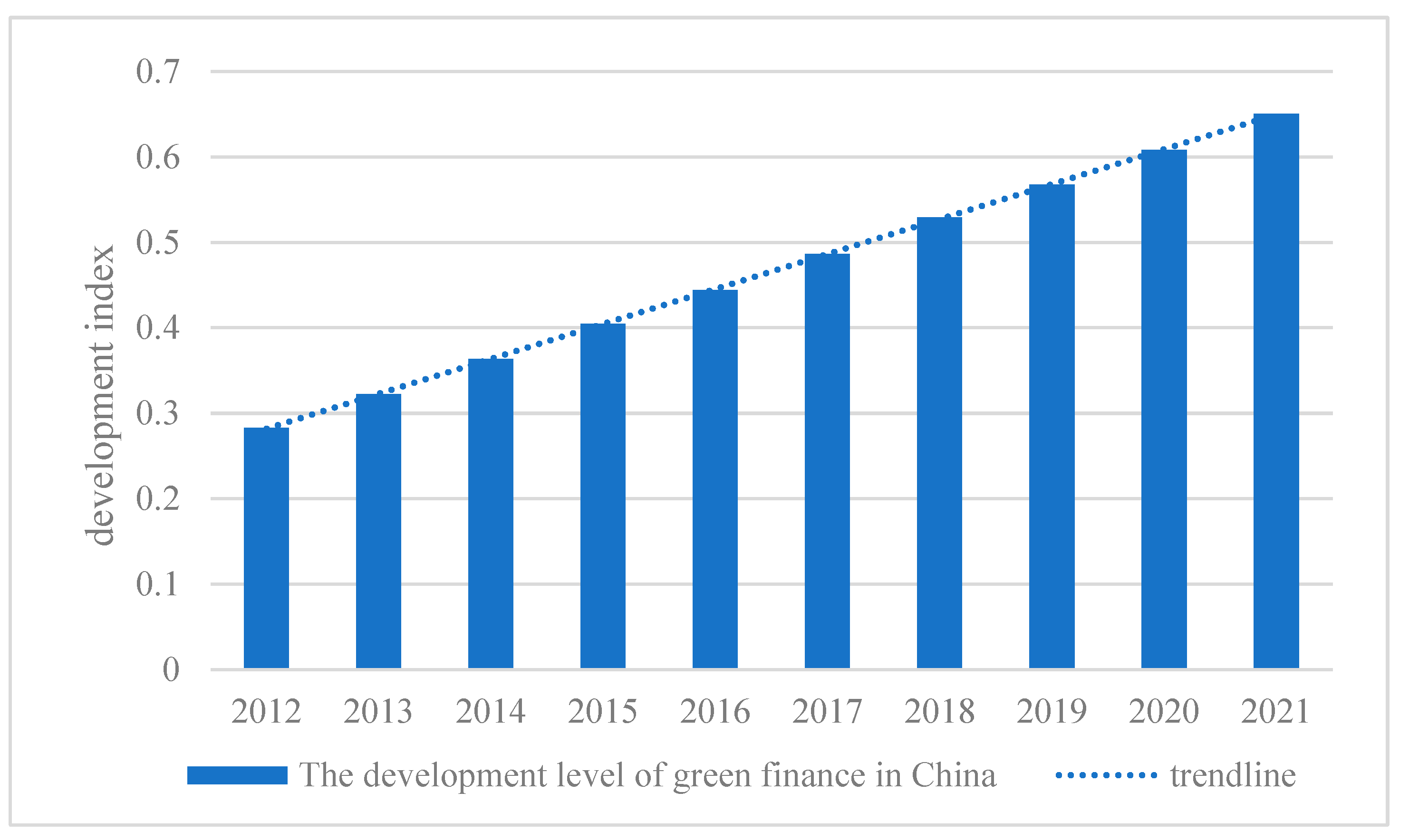

The advancement of the development level index for green financing from 2012 to 2021 is depicted in

Figure 2, which covers a ten-year time span. In general, the growth of environmentally friendly finance in China has received a lot of attention in the past decade and has been gradually rising since the beginning of this century.

Figure 3 shows the average value of the development level index of green finance from 2012 to 2021 for 31 provinces and cities. Based on the province level, this report separates the green finance development level into three levels. Between 0.4 and 0.5 is the first level. In the range of 0.3 and 0.4 is the second level. 0.3 and lower constitute the third level.The first region contains 14 provinces and municipalities, as shown in the picture. The second region consists of four provinces, districts, and cities. Thirteen provinces are present at the third level. Overall, China's municipalities and provinces have a lot of room to accelerate the growth of green financing. The overall index for China assessing the growth of green finance has an average value of 0.3178, with 18 provinces and cities scoring higher than the country as a whole. In contrast, the majority of our nation's provinces and cities have more sophisticated green finance systems. If it can be linked with agricultural industrial structure optimization and upgrading, it will surely assist high-level development of the system of agricultural industrial, which will support long-term growth and the aspiration of the populace for a higher quality of living.

2.2. Identify the degree of a high-level development of China's agricultural sector.

The replacement of low-level with high-level capital- and technology-intensive businesses is what defines an improved agricultural industrial structure, and this calls for the continued development of an industrial structure based on rationalization as well as the process of innovation and the application of more new technologies(Liu and Chen,2022). Using the industrial structure height index developed by Liu Wei et al.(Liu et al.,2008), we can calculate the test index for the improvement of the agricultural industrial structure. The following is the calculation formula:

where

refers to the proportion of industrial output value to domestic output value in the t cycle;

refers to the generalized labor productivity of industry i in cycle t; i the ratio of industrial growth to total employment. Because statistics on agriculture are limited, provincial statistical data of rural employees in the whole industry is not available. Therefore, with reference to the existing research results of Kuang Yuanpei et al.(Kuang and Zhou,2016), this paper realizes the replacement of labor productivity of each major industry in the analysis of agricultural industry based on the ratio of added value and intermediate consumption of different industries. The level of the agricultural industrial structure is greater and the impact of upgrading it is better the larger the value of

.

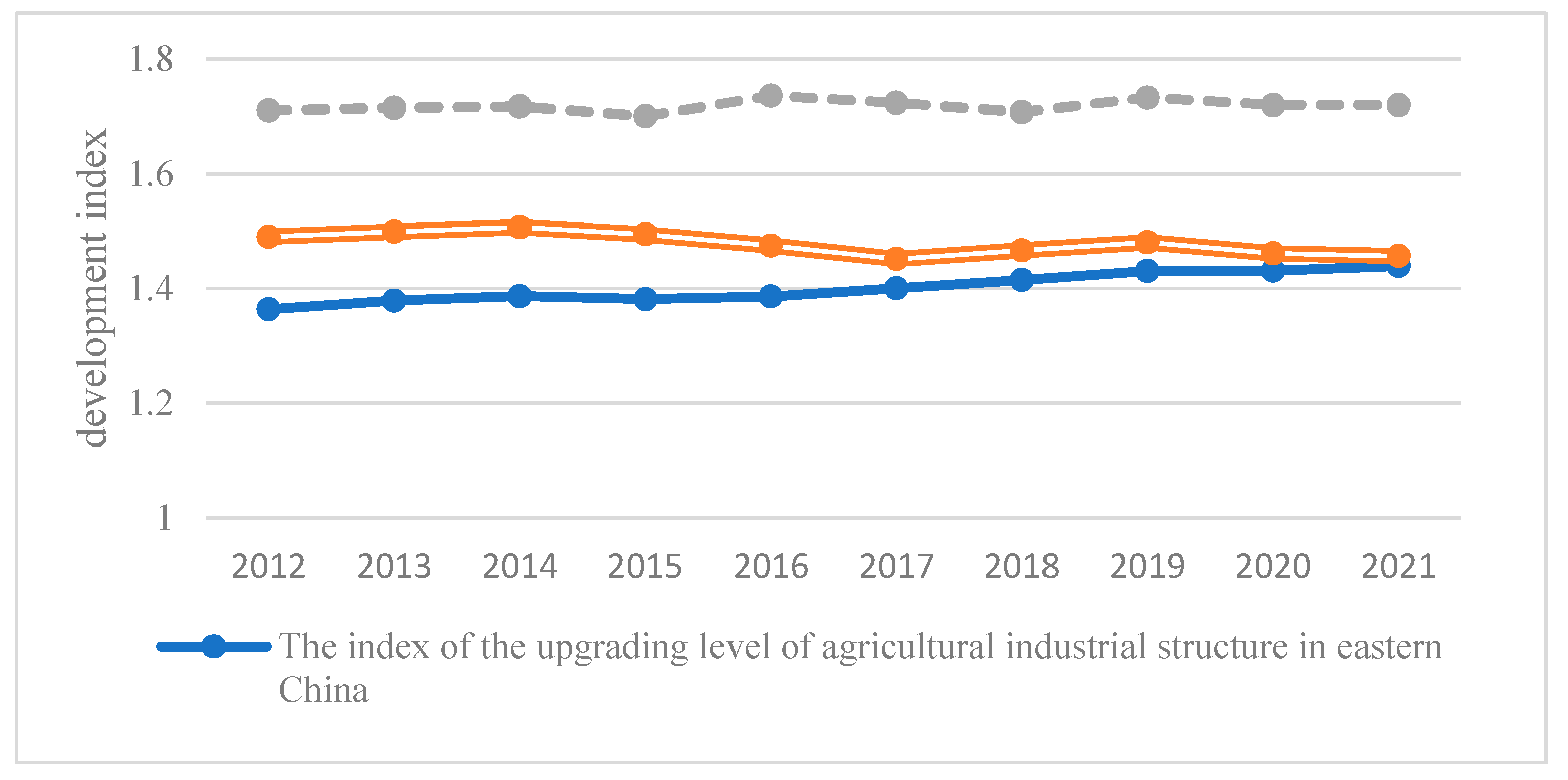

The formula for this measurement was used to determine the advanced level of the industrial structure of agricultural in different part of China using the original data of regional statistics yearbooks from 2012 to 2021 (excluding Hong Kong, Macau, and Taiwan).

Figure 4 illustrates how the eastern region's agricultural industrial structure is progressing to an advanced level. The inclination in the center section was initially downward and later upward. There are notable geographical differences in the level of updating agricultural industrial structure, with the western region having a relatively steady level of advanced growth. The rather well-established agricultural industrial system in the eastern region is growing slowly. The agricultural machinery's insufficient power, and the ineffectiveness of mechanized production and operation, which impede the growth of a high-level agricultural industrial structure, may all be contributing factors to the relatively low labor productivity in these regions. The significance of this study is illustrated by the overall analysis of the structure of China's agriculture business, which indicates that there is a sizable amount of potential for optimization.

2.3. Research hypotheses

Future financial development's trend and direction are represented by green finance.The transformation of the agriculture industry, the expansion of the local economy sustainably, and the acceleration of social advancement all depend on green finance. For the improvement and modernization of agricultural organizations, China has a wide range of green financial instruments, including green bonds, green insurance, and so on. Adjusting the industrial structure is the main component of economic transformation and upgrading, whereas optimizing and upgrading the agricultural industry is the core component of industrial structure adjustment. Green industries can grow as a result of the actively expanding green financing, which can also help China's traditional agricultural sectors become more environmentally friendly (Meng et al.,2023). Specifically, by spreading out risks during agriculture production and operation, green finance continuously expands the supply of agricultural credit, brings the security of sufficient funds for improving the structure of agricultural industry, enhances farmers' enthusiasm for large-scale and specialized management of products, promotes the agricultural business to strengthen its internal framework and professional management level. Thus, the economy of scale can be generated. Meanwhile, abundant capital makes the growth and expansion of agricultural industry inseparable from capital, which makes the development of agricultural industrial structure gradually become capital intensive, and ultimately accomplish the objective of a modern agricultural industrial structure. Therefore, theoretical hypothesis 1 is put forward:

Hypothesis 1: Green finance can significantly promote the optimization and upgrading of China's agricultural industrial structure, so that green finance can effectively promote the high-level development of agricultural industrial structure.

Currently, the application of the policies of green finance in China differs by industry and region, and the existing agricultural green finance standards are not unified, imperfect and the scope is not clear. As a result, in some regions and agricultural sectors, it is not possible to determine whether loans are part of green financial services. Additionally, there are regional variations in how regulators interpret and put into practice green finance rules, which makes it difficult to provide financial support for sustainable agriculture, and there is a need to address the market failure of green financing. At the same time, due to variations in environmental laws and regulations, ecological conditions, and economic development objectives, the amount of growth of green finance in various locations is highly variable. That is, green finance has yet to establish a consistent circulation mechanism among diverse regions, and the capital market is in its early stages. As a consequence of this, the necessary green financing for the advancement of the agricultural industrial structure have been improperly allocated across sectors. As a consequence of this, the following proposition on a theoretical hypothesis is put forth in this paper:

Hypothesis 2: The varying degrees of growth of green financing in eastern, central, and western China result in regional variability in boosting agricultural industrial structure upgrading.

3. Materials and methods

3.1. Variable selection and setting

3.1.1. Explained variables

The upgrading of agricultural industrial structure (uais) is used in this article as an explanatory variable to investigate the impact of green funding on the enhancement of agricultural industrial structure. (The third chapter and second section of this paper go into great detail regarding how the agricultural industrial structure's index system was developed and how its indicators were calculated.)

3.1.2. Core explanatory variables

The key explanatory variable used in the present research to investigate the effect of green financing on the upgrading of the structure of agricultural is the previously computed green finance development level index. The research results, however, will be different in the high-grade development of the Chinese agricultural industrial system if green finance is the only explanatory variable. As a result, we include additional variables as control variables in the model that have an effect on the development of the agricultural business. To be able to determine the relationship between green finance and the optimization of the agricultural industrial structure, the influence of control factors on this optimization of the agricultural structure is removed.

3.1.3. Control variables

Numerous variables can influence the construction of the agricultural industry. On the basis of this consideration and extant domestic and international research findings, a control strategy for our high-grade agricultural industrial structure is proposed, which reduces estimation errors caused by the lack of variables. The research contents of this project include: first, the urbanization level (urb). Urbanization can improve the specialization and scale within the agricultural industry, but it will also appropriation of agricultural resources (Xiang and Mao,2016). The urbanization rate, or ratio of urban to total population in each province, is utilized in this study to assess the level of urbanization and the degree of urbanization development. The second element has to do with education in countryside regions. It is set by dividing the number of students enrolled in higher education institutions (including general college students) by the total number of rural residents in each province. Human capital is the term used to describe employees who possess a particular set of traits and abilities and who can use resources efficiently to meet social requirements, hence advancing the development of the agricultural industrial structure. Education is important in this process since it may raise worker quality and skills, which is necessary for the agricultural industrial structure to grow in development. The third is the mechanization of agriculture at the scientific and technological level (tec). We can increase agricultural production efficiency, lower labor costs, and better satisfy societal demand for agricultural products by utilizing cutting-edge agricultural apparatus and technology (Ma et al.,2023). As a result, the amount of mechanization in this study is based on the degree of agricultural mechanization. The level of agricultural mechanization is determined by the relationship between the total agricultural mechanization power and the total area of grains sown in each province. The fourth element is the degree of marketization (Mopen), which assesses the degree of agricultural marketization by contrasting the proportion of funds allocated to agriculture in the local government budget to the total amount of funds allocated to the budget as a whole. The level of local government investment in agriculture and its impact on the marketization of agriculture can be shown by this index. This is a result of the green economy's promotion of international trade in green products and services, the growth of China's green sector on the global market, and the development of the market system for the green economy, which is driven by green financing (An and Zi,2020). When there is more marketization, there is also more economic development in the area, which has a positive impact on agriculture.

3.2. Model setting

To determine whether green financing has an impact on agricultural industrial structure, we will design the following basic model of benchmark econometric analysis based on empirical research to verify hypothesis 1 proposed above.

The agricultural upgrading level index of provinces and municipalities directly under the central government is represented by the explained variable in the formula (4-1). The core explanatory variable represents the level of development of green finance in each region, and the control variable is the previously mentioned variable. The letters stand for regional fixed effect, for random perturbation term, for time fixed effect, and i and t, respectively, denote the province and time in the data.

To better understand the overall distribution of the sample, descriptive statistics of the variables utilized in this paper are required prior to baseline regression, and it is also possible to timely observe whether there are extreme outliers interfering with the regression results. Specifically, the sample size, mean, variance, minimum, and maximum need to be listed separately. Through the measurement of these data, relevant conclusions of the research results can be drawn. For information, see

Table 4:

The large range of variable values in

Table 4 illustrates how many elements, such as the degree of agricultural mechanization and rural human capital, would influence the effects of developing and optimizing the agricultural industrial structure. The agricultural industry upgrading index ranges from a minimum of 0.457 to a maximum of 0.894. The maximum and minimum values of green financing are 0.609 and 0.090. The significance of the subsequent research described in this paper is highlighted by the fact that other variables are also significantly different, showing that there is an imbalance in the growth of the improving of agricultural industrial structure in nation's diverse areas.

3.3. Data explanation

This article uses panel data from 31 Chinese municipalities and provinces between the years of 2012 and 2021 (excluding Hong Kong, Macao, and Taiwan) in accordance with the research standards. The initial information on urbanization level and rural human capital was taken from the China Population and Employment Statistical Yearbook. The initial information on the degree of agricultural mechanization was provided by China's Rural Statistical Yearbook. Original data for the marketization level was provided by the National Bureau of Statistics and the province Bureau of Statistics; additional original data sources include the Wind database, the China Regional Economic Statistical Yearbook, and the China Financial Yearbook.

4. Results and discussion

4.1. VIF test

If a variable can be expressed linearly by other variables, it indicates that the model has some multicollinearity problems. Since advanced green financing development and agricultural industrial structure is calculated by building an index system, more variables are adopted and more control variables are selected, so this paper needs to use variance inflation factor to test the multicollinearity of the data. The outcomes are displayed in

Table 5:

The mean variance inflation factor of the variables is 1.22, and the variance inflation factor of the remaining variables is also significantly less than 10, with the maximum variance inflation factor of the five variables being 1.41, which is much less than 10. This demonstrates that there is no multicollinearity in the variables that were selected for this paper and that the model can be used for regression analysis

4.2. Analysis of regression results

Table 7 displays the findings of this section's investigation into the influence of green finance on the modernization of the agricultural industrial structure. Column (1) displays the OLS regression, column (2) the fixed effects(FE), and column (3) the random effects(RE).

Table 7 demonstrates that the growth of green finance significantly promotes the revival of rural industries, regardless of whether OLS or fixed regional effect is used. The model may, however, have endogeneity issues due to the causal relationships between the variables, which means that using the OLS estimation approach could result in biased estimation results. The Hausmann test is used to choose between the fixed effects and random effects models, even though the influence of the random effects model is not substantial in terms of the dependability of the results.

The specific regression model form is chosen using statistics and adjoint probability P values from the Hausman test. Fixed effects are preferable to random effects because they appear to differ significantly in coefficient estimation. The Hausman test statistics and adjoint probability p-values are utilized to choose particular regression model types. H0: The ideal solution is the random effects model. FE holds independent of the truth of the starting hypothesis. Nevertheless, RE is more reliable than FE if the null hypothesis is correct; on the other hand, FE is superior to RE if the null hypothesis is incorrect. The Hausmann test's findings in this paper are as follows:. Under 99% confidence interval, the null hypothesis is severely rejected when P value is less than 0.01. In other words, the basic regression model is chosen to be the fixed effect model.

This result is significant at the 1% level, as determined by the test, which verifies hypothesis 1 in this investigation. According to the fixed effect model, an increase of 1% in the improving level of environmentally friendly finance can result in an increase of 0.599 in the upgrading level of agricultural industrial structure.

Regarding the control variables, the level of rural human capital has a positive impact on the optimization and upgrading of agricultural industrial structure at a significant level of 1%, reflecting the enhancement of rural human capital level, and it also has a spillover effect on technology and management, which is helpful to encouraging the development of agricultural industry. The agricultural industrial structure needs to be upgraded as well, which requires the talents. It takes a lot of experienced and skilled personnel to promote new farmers. In other instances, as the rate of urbanization rises, the rural population will move to the city and many Farmers no longer farm, which will negatively impact the high-quality agricultural industrial structure and may limit its expansion. Second, the degree of marketization is essential for encouraging the development of regional industries. The demand for a variety of industries will increase as the marketization level is raised, and changing the industrial structure will become simpler. However, due to regression, the marketization level is unable to effectively assist the agricultural industrial structure's transformation and modernization during the adjustment phase. It's possible that such a result happens because agricultural sales and output are not significantly impacted by the law of value. The general level of agricultural science and technology in China is still quite low, and there is a huge gap between this level in China and the advanced level in industrialized nations, which may account for the lackluster outcomes. The modernization of the agricultural industrial system is greatly aided by the level of technological innovation. For the purpose of improve its level, the modernization of the agricultural industrial system requires both a rise in agricultural scientific and technology innovation and an improvement in agricultural production techniques.

4.3. Robustness test

All variables used in this paper were winsor at the first and last 1%, in order to get rid of outliers' interference. The basic regression test was conducted on data after using winsor, and the results are as follows.

This study uses the fixed effect model (FE), which satisfies the significance test of 1% with a 99% level of confidence. This study adopts the FE because the improvement degree of the agricultural industrial structure will expand by 0.599 for every 1% increase. This demonstrates the robustness of this model and shows that, throughout the sample period, green finance can support the modernization of the industrial structure of agricultural. This conclusion is also compatible with that reached using standard regression.

4.4. Heterogeneity analysis

The vastness of China's territory results in significant regional distinctions in economic status, industrial structure, resource endowment, and other factors. As a consequence, the growth of green financing may have distinct effects on the advancement of China's eastern and western agricultural industrial structure.

Table 9.

Subsample regression.

Table 9.

Subsample regression.

| Variables |

Nationwide |

Eastern region |

Central region |

Western region |

| |

uais |

uais |

uais |

uais |

| gfd |

0.599***

|

0.457***

|

0.721**

|

0.809 |

| |

(0.172) |

(0.143) |

(0.325) |

(0.496) |

| urb |

-0.193**

|

0.036 |

-0.440***

|

-0.233 |

| |

(0.075) |

(0.084) |

(0.123) |

(0.165) |

| edu |

1.045***

|

0.996***

|

1.230***

|

0.974***

|

| |

(0.123) |

(0.163) |

(0.258) |

(0.212) |

| tec |

0.027 |

0.040 |

0.065 |

-0.048 |

| |

(0.059) |

(0.311) |

(0.069) |

(0.113) |

| mopen |

-0.184***

|

-0.198***

|

-0.327**

|

-0.063 |

| |

(0.065) |

(0.049) |

(0.157) |

(0.206) |

| _cons |

1.050***

|

0.858***

|

1.185***

|

1.142***

|

| N |

310 |

110 |

80 |

120 |

| r2 |

0.272 |

0.501 |

0.374 |

0.225 |

| r2_a |

0.179 |

0.421 |

0.262 |

0.104 |

The upgrading of the agricultural industrial structure in the eastern region is significantly correlated with green funding, according to the heterogeneity study. Green financing encourages it at the significance level of 1%. From a historical viewpoint, this might be the case because, in the past, resource-based sectors were crucial to the growth of the eastern region and served as the major engine for regional economic expansion. Meanwhile, the affect of "green finance" on the industrial construction of agricultural adjustment has grown more significant in the context of the optimization of ecological and green industries. However, due to the slow rate advancement in the central and western regions and the low level of green finance, the driving effect of green financing on the agricultural sector is minimal, and the driving contribution to the optimization of the agricultural industrial structure is weak. According to the quantitative link, the eastern region may have a higher degree of development and a more consistent impact of green finance on industrial upgrading, which may better support the high-level improvement of the industrial structure of agricultural .

In conclusion, Hypothesis 2 is confirmed since the effects of green financing development on the optimization of the agricultural industrial structure differ significantly between China's eastern, central, and western areas.

5. Conclusion and policy implications

5.1. Conclusion

Empirical evidence supports hypothesis 1 with 99% confidence level, which suggests that green finance may greatly enhanced the upgrading of the industrial structure of agricultural at the national level. It for agriculture is strongly supported, which enables the agricultural industrial structure to be adjusted in order to obtain enough funding, encourages the expansion of scale and specialization within agriculture, and realizes the upgrading of production and operation mode, realizing better scale economies.

The results of the study demonstrate that there are considerable regional differences in the effect of the expansion of green financing on the modernization of the agricultural industrial structure. The development of green financing may significantly benefit the agricultural industrial structure in eastern China, but its efficacy at the provincial level in central and western China is less definite. This can be due to the eastern region having experienced more development than the middle and western regions.

5.2. Policy implications

For the purpose to promote the growth of the green financing system and support the process of upgrading the industrial structure of agriculture, the following policy recommendations are made in this article. They are predicated on the findings of the research and discussion from earlier.

(1) Develop a green financial market that operates on several levels, as well as green financial products and services that are cutting edge. The market for green financing will continue to experience an increase in demand for the various types and quantities of green industries as a result of environmental protection and emission reduction, which will necessitate a wide variety of green finance products and service models that can be customized to meet individual needs (Wang and Ren,2022). We will implement pilot financial innovations such as financing with environmental rights as collateral and environmental pollution liability insurance, as well as increase support for reform and creativity in green finance in those areas, presuming that risks are under control and businesses are sustainable. These innovations include financing with environmental rights as collateral and environmental pollution liability insurance.

(2) Improve laws, regulations and systems related to green finance. We should reinforce the binding force of laws and institutional arrangements through clear laws and policies and give the optimization of the agricultural industrial systems the weight it deserves. The distinction between agricultural green finance and conventional finance should be institutionally clarified further, and green credit should receive more favorable policies. We ought to support the restructuring of the agricultural economy, build a strong system of agricultural insurance, and extend social insurance to rural areas.

(3) The digital economy and green finance need to be linked. Because the green finance markets and the digital economy are interconnected, the establishment of a more comprehensive required environmental information disclosure system would help in guiding the growth of green finance (Chen,2020). Along with other financial products and services, the big data Internet platform is able to efficiently provide the necessary technical support for the study of environmentally friendly finance and development, as well as foster collaboration and innovation in the sciences and technology.

(4) Pay close attention to regional growth variances, and support the high-level development of agricultural industrial structure and green finance in accordance with regional needs. The fourteenth five-year plan is a crucial window of opportunity for China's economy to prosper. We must establish development strategies that take into account local features if we wish to simultaneously achieve high-level development of green finance and the agricultural industrial structure. Furthermore, we must encourage and support the modernization of traditional agriculture, and we should take use of the potential presented by the structural transformation of agriculture made possible by green financing.

Conflicts of Interests

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Author Contributions

Conceptualization, M. Z. and M.S.; methodology, Y. L. and M. Z; validation, E. E.; formal analysis, Y.L.; investigation, E.E and Z. K. resources, Z. K. and E. E.; writing—original draft preparation, E. E., Z. K. and M. Z.; writing—review and editing, E. E.; supervision, M. Z. and E. E; project administration, E.E. All authors have read and agreed to the published version of the manuscript.

Data Availability Statement

The data used to support the findings of this study are available from the corresponding author upon request.

Acknowledgments

The study is financial supported by the Taishan Young Scholar Program (tsqn202103070), the Taishan Scholar Foundation of Shandong Province, China (CN).

References

- Zhao Peihua. Empirical analysis on the relationship between agricultural industrial structure adjustment and agricultural economic growth in Henan Province [J]. Jiangsu Agricultural Sciences 2009, 50, 243–247. [Google Scholar]

- Hellmann T.,Murdock K.,Stiglitz J.Financial Restrain: Toward a New Paradigm[R].The Role of Government in East Asia Economic Development Comparative Institutional Analysis, 1997.

- Salazar,J.Environmental Finance:Linking Two World[Z].Presented at a Workshop on Financial Innovations for Biodiversity Bratislava, 1998, 1, 2–18.

- Cowan,E.Topical Issues In Environmental Finance [Z].Research Paper Was Commissioned by the Asia Branch of Canadian International Development Agency(CIDA). 1999, 1, 1-20.

- Nderson, J. Environmental Finance [C]//Ramiah V, Gregoriou G N.Handbook of Environmental and Sustainable Finance.Amsterdam:Elsevier Inc.2016.

- Wang E.,Liu X.,Wu J.,etal.Green Credit,Debt Maturity,and Corporate Investment-Evidence from China[J]. Sustainability 2019, 3, 583–602.

- Ma Biao,Lin Lin,Wu Junfeng. Research on the relationship between production capacity, financial support and economic fluctuation in supply-side structural reform [J]. Industrial Economics Research, 2017, 5, 12–24. [Google Scholar]

- Long Yunan,Chen Guoqing. Green finance development and industrial structure optimization in China under the background of "Beautiful China" [J]. Enterprise Economics, 2018, 4, 11–18. [Google Scholar]

- Ding Pan,Jin Weihua,Chen Nan. Green finance development, industrial structure upgrading and sustainable economic growth [J]. Southern Finance, 2021, 2, 13–24. [Google Scholar]

- Ma Jun. On building China's green finance System [J]. Financial Forum, 2015, 20, 18–27. [Google Scholar]

- Liu Xuexia,Chen Chuanlong. Study on the path of transformation and upgrading of agricultural industrial structure promoted by digital technology [J]. Administrative Reform 2022, 12, 57–65. [Google Scholar]

- Liu Wei,Zhang Hui,Huang Zehua. The height of industrial structure and industrialization process and regional differences in China [J]. Economic Trends, 2008, 11, 4–8. [Google Scholar]

- Kuang Yuanpei,Zhou Ling. Study on industrial structure effect of agricultural land circulation [J]. Economist, 2016, 11, 90–96. [Google Scholar]

- Xiang Guanghui,Mao Qilin. How rural urbanization affects agricultural industrial structure [J]. Journal of Guangdong University of Finance and Economics, 2016, 31, 77–87. [Google Scholar]

- Zhou Shaofu,Wang Wei,Dong Dengxin. Effects of human capital and industrial structure transformation on economic growth: Empirical evidence from China's provincial panel data [J]. The Journal of Quantitative and Technical Economics, 2013, 30, 65–77+123. [Google Scholar]

- Ma Yuting,Gao Qiang,Yang Xudan. rural labor aging and agricultural industrial structure upgrading: Theoretical mechanism and empirical test [J]. Journal of Huazhong Agricultural University (Social Sciences Edition). 2023, 2, 69–79. [Google Scholar]

- Gao Jinjie,Zhang Weiwei. The impact of green finance on the ecological development of industrial structure in China: An empirical test based on Systematic GMM model. Economic Review. 2021, 2, 105–115. [Google Scholar]

- Chen Xiangyang. Financial structure, technological innovation and carbon emission: Also on the development of green finance system [J]. Guangdong Social Sciences. 2020, 4, 41–50. [Google Scholar]

- TAGHIZADEH-HESARY F, YOSHINO N. The way to induce private participation in green finance and investment[J]. Finance Research Letters, 2019, 31, 98–103. [Google Scholar] [CrossRef]

- LABATT S,WHITE R R. Environmental finance: a guide to environmental risk assessment and financial products[M].New York: John Wiley & Sons Inc. 2002, 2.

- Fang Jianguo,Lin Fanli. The relationship between green finance and sustainable economic development: An empirical analysis based on 30 provincial panel data in China [J]. Journal of China University of Petroleum (Social Science Edition) 2019, 1, 14–20. [Google Scholar]

- Qian Shuishui,WANG Wenzhong,FANG Haiguang. An empirical analysis of the effect of green credit on industrial structure optimization in China [J]. Finance Theory & Practice, 2018, 1, 7–14. [Google Scholar]

- Wang Yao,Ren Yujie. Construction of China's green finance system under the "double carbon" goal [J]. Contemporary Economic Science 2022, 5, 1–13. [Google Scholar]

- An Guojun, Zi Wenshuo. Discussion on green finance promoting sustainable development of Free Trade Zone [J]. Fiscal Research 2020, 5, 117–129. [Google Scholar]

- Meng Weifu,Li Sha,Liu Jinghan,Chen Yang. Research on the influence mechanism of digital inclusive finance promoting rural revitalization [J]. Economic Issues. 2023, 3, 102–111. [Google Scholar]

- Lin Ximu,Xiao Yubo. The measurement and mechanism of green finance promoting high-quality economic development [J]. Contemporary Economic Science. 2023, 3, 1–18. [Google Scholar]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).