1. Introduction

Global electricity consumption is expected to rise by 60% by 2030, partly due to the increased usage of equipment, appliances, lighting, and other energy-consuming devices [

1]. The introduction of new products and technologies has expanded access to modern conveniences and improved the quality of life worldwide. However, the corresponding surge in energy demand presents challenges for governments striving to satisfy demand while addressing environmental pollution and fighting climate change.

Media coverage frequently portrays energy import dependency negatively. Concurrently, one of the key objectives of the European Green Deal is to reduce energy dependency by 2050. A 2021 study highlights the geopolitical implications of the Green Deal, suggesting that moving away from fossil fuel dependency may economically and politically destabilize regional partners [

2].

The current political context, marked by embargoes on fossil fuel imports and the RePowerEU plan to eliminate dependence on Russian imports by 2030 [

3] raises questions about the economy's impact. Recent studies indicate that the potential economic effects of energy import embargoes range from low to significant [

4,

5].

This study aims to explore the influence of the economy (GDP) and individual sectors (GVA) on different types of energy imports in the EU-27. While GDP represents the economy's strength, GVA measures each sector's contribution [

6]. Numerous studies have identified correlations and causality between GDP, GVA, R&D, and energy consumption, but few have focused on energy imports' role in the economy. We found no relevant studies that incorporate R&D investments when examining the effects of imports on the economy.

Our research addresses these gaps and provides solutions to questions arising from the current economic and political context. We also broaden the literature by examining the effects of a wider range of fuel imports in the EU-27. The conclusions may not be entirely positive in light of the Green Deal targets, as they demonstrate a strong connection between certain economic variables and imports. Given the results' implications for the EU-27's geopolitical energy markets, potential solutions could involve replacing some imported resources with locally produced alternatives or imports that produce fewer CO2 emissions and are more cost-effective.

Data shows that Europe produced only 39% of the available energy in 2019, and the rest, was imported [

7]. As a result, the GDP, can also be influenced by the prices of imported fuels in EU-27. The example of the Russian – Ukrainian conflict, is speaking by itself when studying the effects of energy imports, over European economies. The dependency decreases of non-renewable energy that comes with high carbon emissions, is one of the main points of the Green Deal [

8].

If most of the imports of oil and coal from Russia can be replaced due to the world market capacity [

9], the biggest challenge is linked with the imports of natural gas. An IEA report shows 10 points plan to reduce European Union’s reliance on Russian natural gas which includes measures from the replacement of this resource with alternatives, to acceleration of the deployment of new wind and solar projects [

10]. The available data, shows that natural gas is mostly used in buildings sector (185 bcm), electricity (151 bcm), industry (116 bcm) and transport (4 bcm) [

11]. Building sector is responsible for 38% of total gas consumption [

11], but measures for decreasing the usage of this energy source are already considered. One solution for partially replacing the natural gas from imports can come from the Black Sea. In 2018, in Romania the concessors estimated 100-200 bcm natural gas resources, and the specialists from NAMR (National Agency for Mineral Resources) estimated over 300 [

12]. The long-term solution for electricity generated from natural gas, and its usage in industry sector can be hydrogen and biomethane [

11].

One study that comprises data from 23 developed and developing countries, shows that 1% increase in energy imports will increase the GDP by 1.171% on long term [

13]. Using panel cointegration, Granger causality analysis and panel error correction tests, the authors studied the relations between the imports and GDP for a period of 26 years.

Another study investigates the links between petroleum imports, economic growth and CO

2 emissions in two African countries for 24 years [

14]. Using simultaneous equation models and threshold regression analysis the authors results indicate that in Nigeria, aggregate and sectoral outputs increase when the imports of petroleum products are above a certain threshold.

Fedoseeva & Zeidan show that economic growth and fossil fuel consumption are correlated in EU, which could be a drawback in reducing the consumption of energy from this fuel [

15]. Furthermore, they found that primary energy imports are affected by the natural gas imports.

In China, Zhao and Wu (2007), found that industry and transport influence the oil imports, and not the price [

16]. They used in their study cointegration and VECM techniques, for a period between 1995 to 2006, divided in quarters.

When searching for the relations between GVA and energy imports, Mushet et al. (2020) found that energy imports influence the industrial and services sectors. The method used in the study was regression analysis, for 48 observations [

17].

In Israel, China and South Korea, energy imports increase the economic growth. Bildirici and Kayikci (2022) used in the study Markov-Switching Bayesian Granger Causality test and traditional Granger causality test [

18].

A study made in Brazil, China, Indonesia, India, Mexico, Russia, and Turkey shows that for those countries, renewable energy can be used to reduce the energy imports. At the same time, imports cannot be completely replaced by renewables, so other solutions must be found [

19].

2. Materials and Methods

After reviewing the literature, data about the variables of interest was gathered from official database. EU-27 is considered a single entity due to the common agreement to become climate neutral, to increase the energy independency, and to help all the countries do achieve these objectives until 2050 [

20]. For the data about energy imports, GDP, GVA and R&D it was considered a period from 2000-2021.

Table 1 which shows the source of data, the name of the variables, the unit of measurement, and the symbol, was used for finding the answers for the research questions. For the present study raw and combined data was considered.

First step was to build a graphic representation of the imports in EU, to analyze the possible links with economy status. For answering the research questions, all the data was uploaded and tested using SPSS-28. Collected data covers 21 years (a size less than 50) so, Shapiro - Wilk test for normality of the data, was applied [

25,

26]. All the data is normal distributed (sig. > 0.05), and we used Pearson, when finding correlations between the variables. As described in Fox & Levin (2007), a coefficient value between -1 to -0.91 means a perfect negative correlation, −0.9 to −0.6 strong negative correlation, −0.59 to −0.3 moderate negative correlation, −0.29 to −0.1 weak negative correlation, −0.09 to 0.1 no correlation, 0.11 to 0.3 weak positive correlation, 0.31 to 0.6 moderate positive correlation, 0.61 to 0.9 strong positive correlation and 0.91 to 1, perfect positive correlation [

27]. The value of significance (Sig. 2-tailed) was also followed. If Sig. is less or equal to 0.05, the correlations are significant. All the data was transformed into natural logarithms because of the high values, to decrease the skewness, and to increase the linearity of the regressions.

Linear regression and multiple regression were used to find how changes in the independent variable changes the dependent variable. When using linear or multiple regression analysis, the data was tested for linear relationship, normal distribution (Shapiro-Wilk test) and autocorrelation (Durbin-Watson). The linear regression formula:

where Y = dependent variable, X = independent variable, a = intercept (constant), and B = regression coefficient [

28].

When both values are log-transformed, the regression equation becomes:

The coefficients can be interpretated as the elasticity of Y variable compared to X variable [

29]. One percent change in the independent variable, changes with B percent the dependent variable. For multiple regression the equation used was:

Where B

1 to B

n are the regression coefficients.

For finding the effect of economic variable over the imports of nonrenewable energy resources, we used backward method. Considering the links found in the literature, correlations between variables, we found which economic variable predicts best a certain type of energy imports. Knowing that this method has advantages but also is contested by some researchers [

30], it was used because is important to find the best fit, by removing the least important variables. We considered as dependent variable the imports, and the independent variables the ones with whom we found a correlation from GDP, R&D and GVA sectors.

3. Results

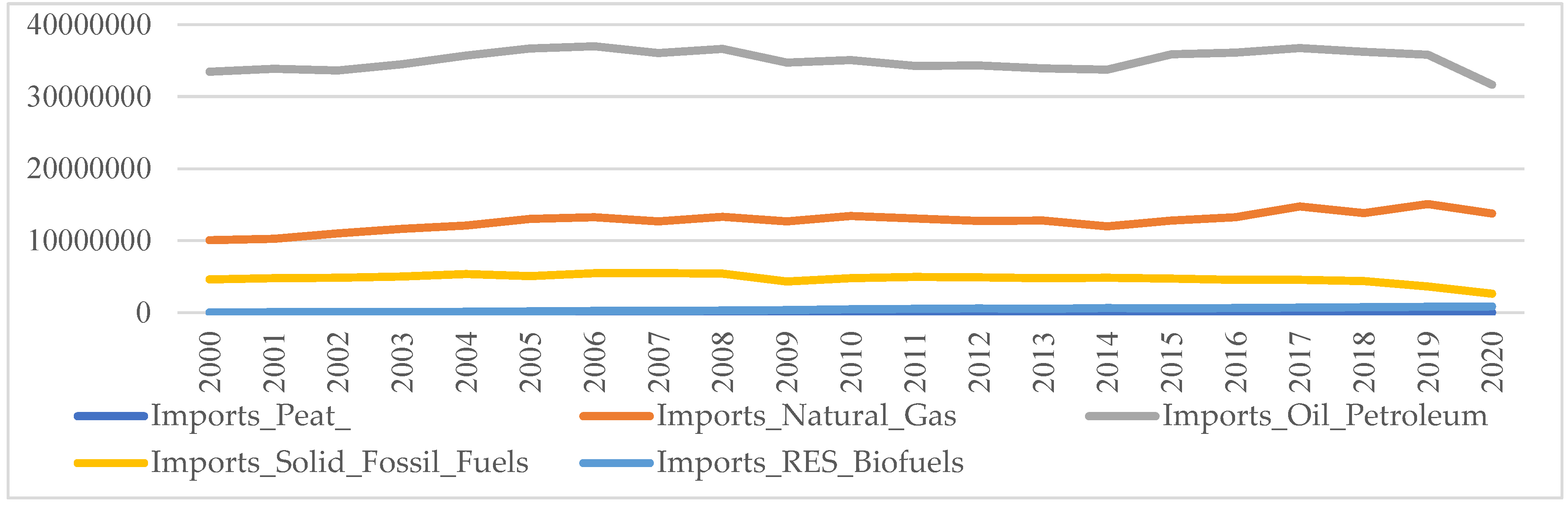

The chosen data are for all imports, not linked with the country of origin, or the price paid for transport. Official data found on Eurostat database (

Figure 1), shows that EU imports the most oil and petroleum (Figure), followed by natural gas and solid fossil fuel. Those are obviously linked with the economic context. It can be observed the effect of the financial crisis (2007-2009) and the Covid-19 Pandemic over the imports of NRES.

In order to have a complete view over the data, it is important to know the links and the direction of correlation between energy imports, GDP, R&D and the components of the GVA. After testing the distribution of data (Shapiro-Wilk test), we conclude that all the data is normal distributed (Sig.> 0.05).

Pearson Correlation test shows that total imports of energy are in moderate positive correlation with the GDP (r= 0.486, sig. = 0.026), and with some of economic sectors: GVA Manufacturing (r= 0. 561, sig. = 0.009), GVA Constructions (r= 0. 554, sig. = 0.003) and GVA Wholesale (r= 0. 616, sig. = 0.005). Increase of GDP and economic sectors over the years, made the consumption of energy to grow. This resulted in increased demand for energy, regardless of source (renewable or nonrenewable). Due to the low prices paid for imported energy, even if investments were made to increase the RES, a high rate of energy came from imports.

The most imported energy resource, oil and petroleum products, it is not correlated with any of studied variable linked with economy. This may happen due to the high spread of usage in all economy sectors. One author finds that reasons that stay behind this lack of correlation are the derived demand, increase in efficiency, and fuel substitution for oil and petroleum products [

31].

The dependency of imports of natural gas, is one of the biggest problems that EU faces in present. The collected data shows a strong positive correlation between the quantity of imported natural gas and the GDP (r= 0.859, sig. <.001), GVA from industry (r = 0.840, sig. <.001), GVA from manufacturing (r= 0.810, sig. <.001), GVA from construction (r= 0.896, sig. <.001), GVA wholesale retail transport and services (r= 0.868, sig. <.001), GVA information and communication (r= 0.835, sig. <.001), GVA real estate (r= 0. 840 sig. <.001) and a moderate positive relation with GVA from agriculture, forest, and fishing (r= 0. 600, sig. = 0.004).

Multiple regression (

Table 2) shows that imports of natural gas can be predicted in 87.3% of cases by the GDP, investments in R&D, GVA manufacturing and GVA real estate. 1% increase in European GDP will increase the imports of natural gases by 4.16%. The results are in line with the literature. Other authors found the same positive relation between the two variables, concluding that there is a bidirectional relationship [

32]. Investments in research and development can be a solution for decreasing the natural gas dependency. The results show that 1% increase in investments in R&D will decrease the natural gas imports by 0.80 %. This is not surprising when considering that most of the organizations invest in increasing efficiency and decrease the energy consumption. If the value added from real estate sector increases with 1%, the imports of natural gas will decrease by 1.5%. More than 40% of total gas demand in EU is from residential sector, in 2020 [

33]. There are also solutions for replacing the gas consumption with other more efficient energy resources, but this means more investments, which may be a barrier, for many. The benefit is that with the increased price of natural gas many will consider a change. If governments will increase the funds for renewables through incentives, this might help in passing from traditional usage to other renewable, more efficient and with less emissions source of energy. Also, if GVA from manufacturing sector increases by 1%, the natural gas imports will decrease by 0.89%. Literature show that manufacturing is the most gas-intensive sector, and investments to arrive to zero emissions targets decreases this dependency [

34].

The results indicate a drawback in EU independency of natural gas. At this moment, EU cannot flourish without imported natural gas. Due to the imposed restrictions, the increase price and decrease of natural gas from Russia, EU must find solutions. On short term, EU solution for gas crisis was to replace imports of NG from east with imports of liquified natural gas (LNG). But this rases other problems. Many households, or machines used in industry sectors, does not work properly when the type of gas is changed, or the amount of CO2 released into the atmosphere, increases [

8]. A medium-term solution can be the extraction of natural gases from the Black Sea. Romanians will already start the extraction this year, but due to the low capacities and the lack of investments, is still going to be in small quantities. Another solution can be the replacement of imported natural gas with hydrogen converted from RES (solar and wind), as a study suggests [

35]. This may be cheaper, and easier to transport. Also a hybrid solution of hydrogen, heat and electric storage may be an answer to the problem, if technological, societal and legal barrier can be pass [

36].

Further, Pearson test, shows negative correlation between fossil fuels imports and mentioned economic variables. With the increase of GDP (r = -0.532, sig. = 0.013), R&D (r = -0.643, sig. = 0.002), GVA from agriculture, forests, and fishing (r = -0.601, sig. = 0.004), GVA from industry (r = -0.502, sig. = 0.020), GVA from wholesale, retail, transport services (r = -0.482, sig. = 0.027), GVA from information and communication (r = -0.678, sig<.001), GVA from real estate (r = -0.533, sig. = 0.013) the imports of fossil fuels imports will decrease. The collected data about solid fossil fuels shows the decreasing dependency of EU from this source of energy. The major benefit is that the lowering transformation of this resource to energy will decrease the CO2 emissions (transformation of fossil fuels in energy, is linked with the highest CO2 emissions) [

37].

The multiple regression analysis (

Table 3) shows that for 91.7% of cases, 1% increase in investments in R&D, will decrease the imports of fossil fuels by 2.21%. This result is not surprising knowing that investments in R&D increase the efficiency and the usage of renewables, as an energy resource. Also, with the increase of information and communication sector, by 1%, the imports of fossil fuels will decrease by 2.77%. This is most likely because in service sector the usage of energy is lower than in other economic sectors. Literature shows that with the increase of services share in an economy, the share of energy decreases, and the usage of renewables sources increases [

38]. On the other side, when the agriculture sector increases, by 1%, the imports of fossil fuels increase by 0.82%. The links between the two variables are mainly because in the production of chemicals for fertilizers, drying grain, heat for glasshouses the farmers use energy from fossil fuels [

39]. When other GVA sectors increases by 1%, the imports of fossil fuels increase by 5.1%.

4. Conclusions

Energy imports have an important role in EU-27 economy, by increasing the GDP. In the present, decreasing the energy imports would have a big negative impact over the economy. And EU-27 does not have the necessary resources to replace them. In order to arrive to the targets imposed by the Paris Agreement, practical solutions must be implemented, without increasing the energy produced in EU from polluting resources. Even if in theory solutions exist, funds must be allocated to this mater. But the economic and politic context will make extremely difficult the replacement of polluting energy resources. After a pandemic which affected all economic sectors, a war near EU borders that made EU policy makers to take drastic measures, finding financial resources to decrease the dependency of energy imports, and at the same time to decrease the greenhouse gas emissions will be a challenge. Even if is demonstrated by literature that imported energy can be partially replaced by energy that comes from renewables, a weak economy can lead to decrease in investments for building new capacities [

40].

The lack of correlation between imports of oil and petroleum products, GDP, GVA sectors and R&D, show that by investments in increasing efficiency, finding solution to replace a resource with another, have a positive outcome.

One of the most important findings is that imports of natural gas are heavily linked with the GDP. Increases in GDP also increases the imports more than four times. To decouple the two indicators, a mix of solutions for increase the efficiency or to replace this fuel must be implemented. Increasing the extraction from different EU sites, may be the easiest way to arrive to the Green Deal targets. But EU has limited natural resources of natural gas and only few countries can benefit from this source. Literature shows that it can be replace by hydrogen produced from solar and wind energy. At the same time, investments in R&D, increase in manufacturing and real estate sector decreases the imports of natural gas. Investments made for more energy efficient buildings, the changes in heating and cooling of houses from traditional fuels to renewables, the increasing of services share in economy sectors, have a negative effect over the gas imports.

The importance of investing in R&D cannot be omitted when analyzing the links with the imports of fossil fuels. The results are not surprising when knowing that investments in R&D increase the efficiency and at the same time, the usage of renewables, as an energy resource.

To decrease the energy imports, the main objectives for EU – 27 policy makers should be the investments in R&D, increase of energy generation from renewable resources, increasing the energy efficiency and to accelerate the shift from industrial and transport to services sector. The last solution may be beneficial for EU but could raise problems in terms of CO2 emissions, worldwide.

Author Contributions

Conceptualization, I.I.A. and P.H.; methodology, I.IA.; software, I.IA.; validation, D.D.M., and S.D.C.; formal analysis, I.I.A..; investigation, I.I.A.; resources, I.I.A. and S.D.C. data curation, D.D.M; writing—original draft preparation, I.I.A.; writing—review and editing, I.I.A., P.H., S.D.C.; visualization, D.D.M.; supervision, I.I.A.; project administration, I.I.A.; funding acquisition, I.I.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by European Union’s Horizon 2020 research and innovation program under the Marie Sklodowska-Curie, grant number 801505.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

References

- ACER. (2021). https://acer.europa.eu/en/Gas/Documents/ACER_FACT-SHEETS_2021-07_02.pdf .

- Adewuyi, A., & Awodumi, O. (2021). Environmental pollution, energy import, and economic growth: evidence of sustainable growth in South Africa and Nigeria. . Environ Sci Pollut Res, 28( https://doi.org/10.1007/s11356-020-11446-z), 14434–14468 . [CrossRef]

- Alison, O. (2018, February 23). A Guide to Gross Value Added (GVA) in Scotland. Retrieved December 2, 2022, from https://sp-bpr-en-prod-cdnep.azureedge.net/published/2018/2/23/A-Guide-to-Gross-Value-Added--GVA--in-Scotland/SB%2018-15.pdf.

- Bachmann, R., Kuhn , M., Peichl, A., Baqaee, D., Löschel, A., Pittel, K., . . . Schularick, M. (2022, March 7). What if? The Economic Effects for Germany of a Stop of Energy Imports from Russia. EconTribute, p. https://www.econtribute.de/RePEc/ajk/ajkpbs/ECONtribute_PB_028_2022.pdf.

- Calanter, P. (2018). Opportunities Of Capitalizing Romania’S New Offshore Gas Reserves By Increasing Domestic Consumption And Creating A Regional Gas Hub. Institute for World Economy of the Romanian Academy, 6(2), 171-180.

- Cătuţi, M., Egenhofer, C., & Elkerbout, M. (2019). he future of gas in Europe: Review of recent studies on the future of gas. CEPS, Research Report, 03, https://www.ceps.eu/wp-content/uploads/2019/08/RR2019-03_Future-of-gas-in-Europe.pdf.

- Christof, R., & Titus, E. (2021). Oil Intensity: The Curiously Steady Decline of Oil in GDP. Columbia Center on Global Energy Policy.

- David, B., Benjamin, M., Camille, L., & Philippe, M. (2022, April). The Economic Consequences of a Stop of Energy Imports from Russia. Conseil d'analyse economique, pp. https://www.energiesdelamer.eu/wp-content/uploads/2022/04/05-04-022-cae-focus84-Embargo-sur-les-importations-de-gaz-russe.pdf.

- Deme Group. (2021, January). Shipping sun and wind to Belgium is key in climate neutral economy. Retrieved August 25, 2022, from https://www.deme-group.com/sites/default/files/2021-01/Hydrogen%20Import%20Coalition%20Final%20Report.pdf.

- Elliott, A., & Woodward, W. (2007). Statistical analysis quick referenceguidebook with SPSS examples. 1st ed. London: Sage Publications.

- Energy&Climate Inteligence Unit. (2022, March). FARMING, FERTILISER, AND FOSSIL FUELS. How the gas crisis is squeezing Britain’s farmers. Retrieved December 1, 2022, from https://ca1-eci.edcdn.com/Food-farming-fertiliser-March-2022-ECIU.pdf?v=1648124498.

- European Comission. (n.d.). EC Europa. Retrieved Jun. 20, 2022, from https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal/finance-and-green-deal/just-transition-mechanism_en.

- European Comission. (n.d.). Green Deal. Retrieved March 9, 2022, from https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal/energy-and-green-deal_en.

- European Commission. (2022, May 18). RePowerEU. Retrieved November 11, 2022, from European Commission P. REPowerEU: A plan to rapidly reduce dependence on Russian fossil fuels and fast forward the green transition.

- European Commission. (n.d.). Where does our energy come from? (European Commission) Retrieved March 9, 2022, from https://ec.europa.eu/eurostat/cache/infographs/energy/bloc-2a.html.

- Eurostat. (n.d.). Retrieved April 20, 2022, from https://ec.europa.eu/eurostat/databrowser/view/NRG_BAL_S__custom_2870750/default/table?lang=en.

- Eurostat. (2022). GDP and main aggregates- international data cooperation annual data. Retrieved June 7, 2022, from https://ec.europa.eu/eurostat/databrowser/view/NAIDA_10_GDP__custom_2870267/default/table?lang=en.

- Eurostat. (2022). Eurostat Data Browser. Retrieved June 7, 2022, from https://ec.europa.eu/eurostat/databrowser/view/NAMA_10_A10__custom_2568689/default/table.

- Eurostat. (n.d.). Data browser, Eurostat. Retrieved May 1, 2022, from https://ec.europa.eu/eurostat/databrowser/view/RD_E_GERDTOT__custom_2837378/default/table?lang=en.

- Eurostat. (n.d.). Data browser, Eurostat. Retrieved May 1, 2022, from https://ec.europa.eu/eurostat/databrowser/view/NRG_BAL_S__custom_2562800/default/table.

- Ewout, W. S. (2008). Clinical Prediction Models: A Practical Approach to Development, Validation, and Updating. New York: Springer New York, NY.

- Federico, U., Patrick, H., & Nicola, P. (2021). Development of Tools Enabling the Deployment and Management of a Multi-Energy Renewable Energy Community with Hybrid Storage. Chemical Engineering Transaction(86). [CrossRef]

- Fotio, H. K., Poumie, B., Baida, L. A., Nguena, C. L., & Adams, S. (2022). A new look at the growth-renewable energy nexus: Evidence from a sectoral analysis in Sub-Saharan Africa. Structural Change and Economic Dynamics, 62, 61-71. [CrossRef]

- Ghasemi A, Z. S. ( 2012). Normality Tests for Statistical Analysis: A Guide for Non-Statisticians. Int J Endocrinol Metab., 10(2), 486-489. [CrossRef]

- Grekou, C., Hache, E., Lantz, F., Massol, O., Mignon, V., & Ragot, L. (2022). Guerre en Ukraine: bouleversements et défis énergétiques en Europe. Policy Brief CEPII, https://policycommons.net/artifacts/2459406/guerre-en-ukraine/3481203/ on 26 Dec 2022. CID: 20.500.12592/b3mjjc.

- Hasan, D., Serhat, Y., & Cabolat, Z. N. (2019). A Strategic Approach to Reduce Energy Imports of E7 Countries: Use of Renewable Energy. In Handbook of Research Anthology on Clean Energy Management and Solutions (pp. 18-38). R. Bhattacharya, & R. Das.

- Iancu, I., Darab, C., & Cirstea, S. (2021). The Effect of the COVID-19 Pandemic on the Electricity Consumption in Romania. Energies , 14(3146), https://doi.org/10.3390/en14113146. [CrossRef]

- IEA. (2022). A 10-Point Plan to Reduce the European Union’s Reliance on Russian Natural Gas. Paris: IEA.

- ISO/IEC 25010. (2011). ISO. Retrieved 2 01, 2023, from https://www.iso.org/standard/35733.html.

- Kafle, S. C. (2019). Correlation and Regression Analysis Using SPSS. OCEM Journal of Management, Technology & Social Sciences, 1(1), 126-132.

- Kan, C., Richard, C. W., & Michael, K. B. (1980). Carbon dioxide from fossil fuels. Adapting to uncertainty. ENERGY POLICY, https://deepblue.lib.umich.edu/bitstream/handle/2027.42/23100/0000019.pdf?sequence=1.

- Leonard, M., J.Pisani-Ferry, Shapiro, J., Tagliapietra, S., & Wolff, G. (2021). The geopolitics of the European Green Deal. Policy Contribution(4), https://www.bruegel.org/wp-content/uploads/2021/02/PC-04-GrenDeal-2021-1.pdf.

- Levin, J., & Fox, J. (2007). Elementary Statistics in Social Research, 2nd ed. London, UK: Pearson Education.

- Lim, H., & Yoo, S. (2012). Natural Gas Consumption and Economic Growth in Korea: A Causality Analysis. Energy Sources, Part B: Economics, Planning, and Policy, 7(2), 169-176. [CrossRef]

- Melike, B., & Fazıl, K. (242). The relation between growth, energy imports, militarization and current account balance in China, Israel and South Korea. Energy, 2022, https://doi.org/10.1016/j.energy.2021.12253. [CrossRef]

- Murshed, M., Mahmood, H., Alkhateeb, T., & Bassim, M. (2020). The Impacts of Energy Consumption, Energy Prices and Energy Import-Dependency on Gross and Sectoral Value-Added in Sri Lanka. . Energies , 13, https://doi.org/10.3390/en13246565. [CrossRef]

- OECD. (2022, July 22). How vulnerable is European manufacturing to gas supply conditions? Retrieved November 13, 2022, from https://www.oecd.org/ukraine-hub/policy-responses/how-vulnerable-is-european-manufacturing-to-gas-supply-conditions-01278ba3/.

- Pedace, R. (2013). Econometrics For Dummies. For Dummies; 1st edition (9 July 2013).

- Svetlana, F., & Rodrigo, Z. (2018). How (a)symmetric is the response of import demand to changes in its determinants? Evidence from European energy imports. Energy Economics, 69, 379-394. [CrossRef]

- Üzumcu, A., Ülker, Ç. K., & Adem, K. (2019). ENERGY IMPORT AND ECONOMIC GROWTH: AN ANALYSIS ON SOME ENERGY IMPORTER COUNTRIES. Cumhuriyet Üniversitesi İktisadi ve İdari Bilimler Dergis, 20(2), 317-334.

- Xingjun, Z., & Yanrui, W. (2007). Determinants of China's energy imports: An empirical analysis. Energy Policy, 35(8), 4235-4246. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).