Submitted:

25 May 2023

Posted:

26 May 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Materials and Methods

2.1. Non-Cooperative Game Models in Ports for Air Pollution Control Considering Low-Sulfur Marine Fuel Subsidies

2.2. A simultaneous Game Model for Two Ports

2.3. A Sequential Competitive Game Model for Two Ports

3. Results

3.1. Analysis of the Factors Influencing the Optimal Prices of Ports

3.2. Comparative Analysis of the Simultaneous Game Model and Sequential Game Model

4. Discussion and Case Analysis

4.1. Data Source

4.1.1. AIS Data of Container Ships in Shanghai Port and Ningbo Zhoushan Port

4.1.2. Price of Marine Fuel

4.1.3. Parameter Values

4.2. A Case Study of Non-Cooperative Game Considering Low Sulfur Fuel Subsidies in Ports

4.2.1. Discussion of the Case Analysis

- Simultaneous competition between two ports.

- 2.

- Sequential competition between two ports

- 3.

- Comparative analysis of the two non-cooperative game models

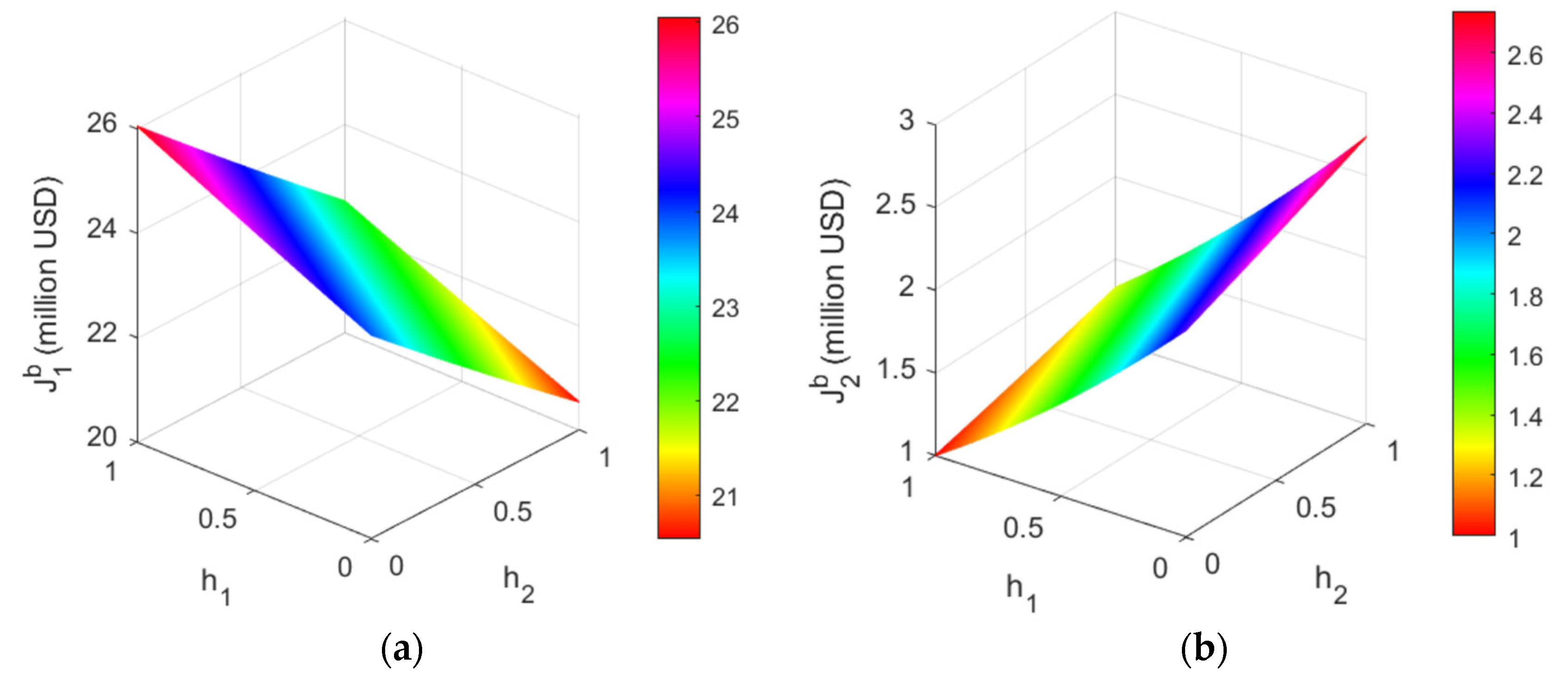

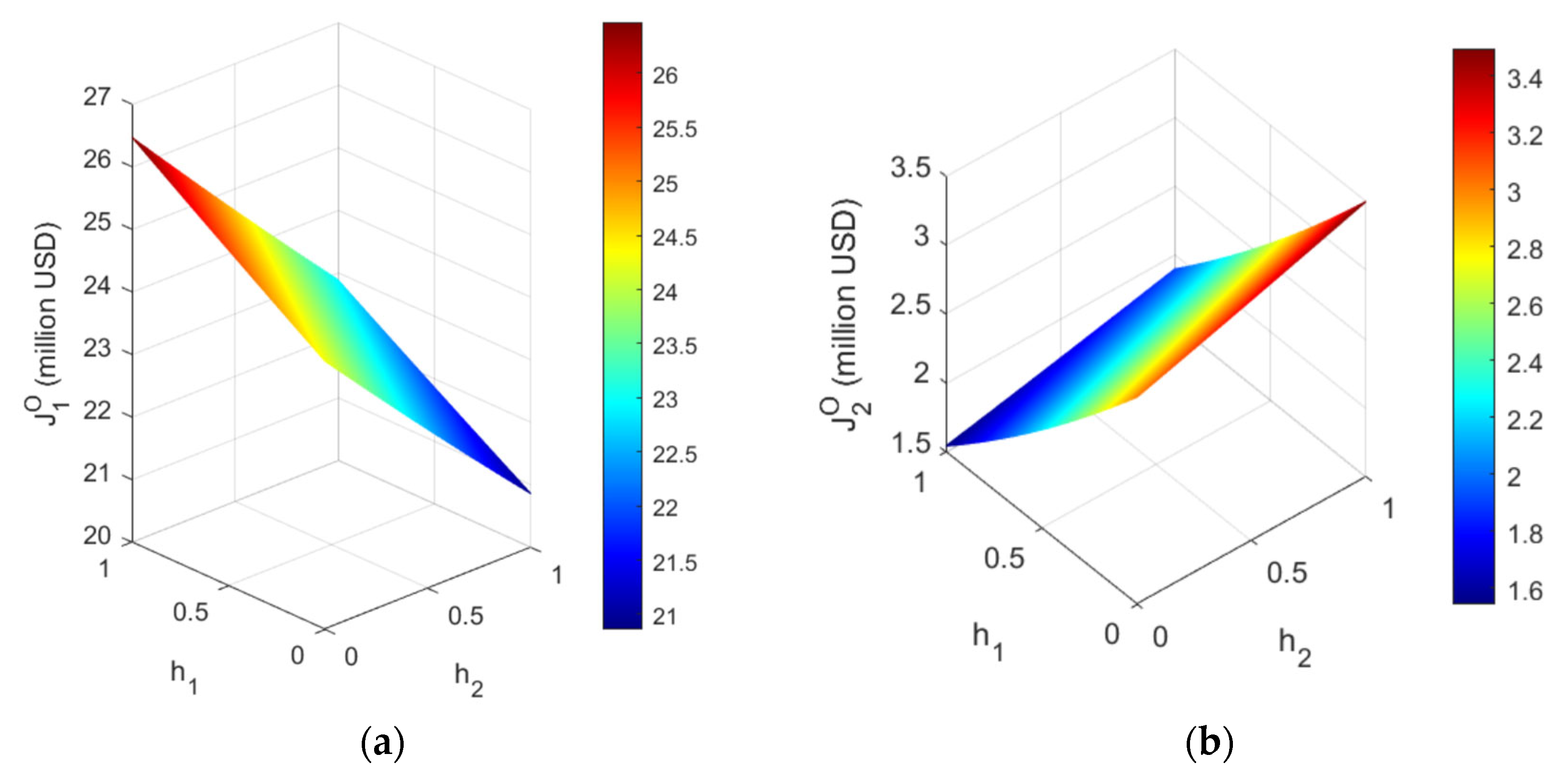

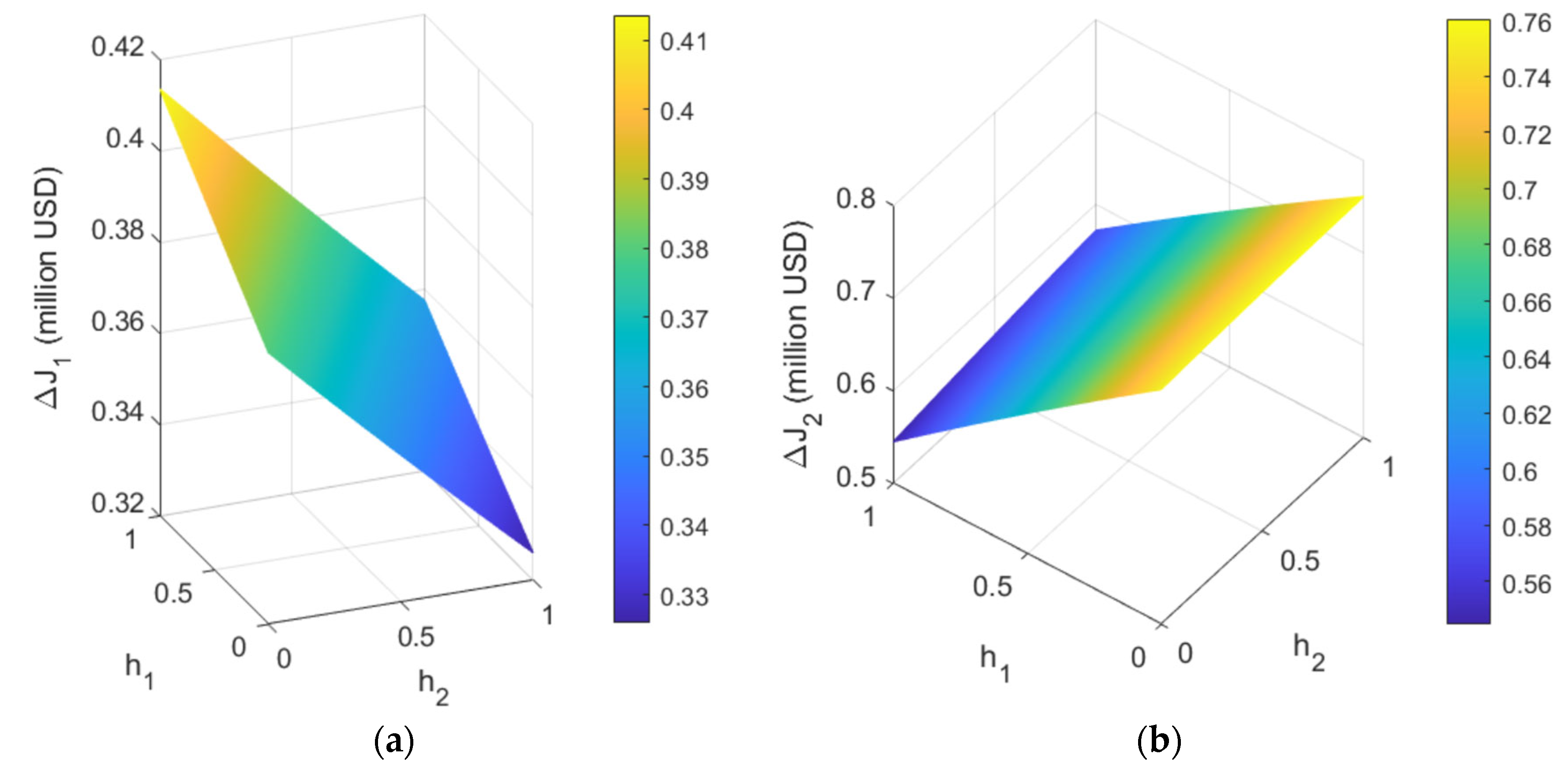

4.2.2. The Impact of the Subsidy Ratios on the Profit of the Two Ports

4.2.3. Uncertainty Analysis

4.3. Conclusions

Funding

Acknowledgments

References

- Mirabelli, M. C.; Boehmer, T. K. , Damon; S. A.; Sircar, K. D.; Wall, H. K., Yip, F. Y.;... & Garbe, P. L. Air quality awareness among US adults with respiratory and heart disease. Am. J. Prev. Med 2018, 54, 679–687. [Google Scholar] [CrossRef] [PubMed]

- Cai, Y.; Hodgson, S.; Blangiardo, M.; Gulliver, J.; Morley, D.; Fecht, D. & Elliott, P. Road traffic noise, air pollution and incident cardiovascular disease: a joint analysis of the hunt, epic-oxford and UK biobank cohorts. Environ Int 2018, 114, 191–201. [Google Scholar] [CrossRef] [PubMed]

- Chen, D.; Zhao, N. , Lang; J., Zhou, Y.; Wang, X.; Li, Y.; Zhao, Y.; Guo, X. Contribution of ship emissions to the concentration of PM2.5: a comprehensive study using AIS data and WRF/Chem model in Bohai Rim Region, China. Sci. Total Environ 2018, 610-611, 1476–1486. [Google Scholar] [CrossRef]

- Peng, Y.; Dong, M.; Li, X. Cooperative optimization of shore power allocation and berth allocation: A balance be-tween cost and environmental benefit. J. Clean Prod 2020, 279, 123816. [Google Scholar] [CrossRef]

- Durmaz, M. , Kalender, S.S., Ergin, S. Experimental study on the effects of ultra-Low sulfur diesel fuel to the exhaust emissions of a ferry. Fresen. Environ. Bull (PDF) Experimental Study on the Effects of Ultra-Low Sulfur Diesel Fuel to the Exhaust Emissions of a Ferry (researchgate.net). 2017, 26, 5833–5840. [Google Scholar]

- Nicholas, R. Gysel et al. Detailed analysis of criteria and particle emissions from a very largecrude carrier using a novel ECA fuel. Environ. Sci. Technol 2017, 51, 1868–1875. [Google Scholar] [CrossRef]

- The Ministry of Transport of China, Implementation Scheme of the Domestic Emission Control Areas for Atmospheric Pollution from Vessels 2018. Implementation Scheme of the Domestic Emission Control Areas for Atmospheric Pollution from Vessels--China Maritime Safety Administration (msa.gov.cn).

- Shi, K.; Weng, J. Impacts of the COVID-19 epidemic on merchant ship activity and pollution emissions in Shanghai port waters. Sci. Total Environ 2021, 790, 148198. [Google Scholar] [CrossRef]

- Weng, J.; Shi, K.; Gan, X.; Li, G.; Huang, Z. Ship emission estimation with high spatial-temporal resolution in the Yangtze River estuary using AIS data. J. Clean. Prod 2020, 248, 119297. [Google Scholar] [CrossRef]

- Wan, Z.; Zhang, Q.; Xu, Z.; Chen, J.; Wang, Q. Impact of emission control areas on atmospheric pollutant emissions from major ocean-going ships entering the Shanghai Port, China. Mar. Pollut. Bull 2019, 142, 525–532. [Google Scholar] [CrossRef]

- Wan, Z.; Ji, S.; Liu, Y.; Zhang, Q.; Chen, J. Wang, Q. Shipping emission inventories in China’s Bohai Bay, Yangtze River Delta, and Pearl River Delta in 2018. Mar. Pollut. Bull 2020, 151, 110882. [Google Scholar] [CrossRef]

- Schwarzkopf, D.A; Petrik, R.; Matthias, V.; Quante, M.; Majamäki, E. , Jalkanen J.P. A ship emission modeling system with scenario capabilities. Atmos. Environ-X 2021, 12, 100132. [Google Scholar] [CrossRef]

- Toscano, D.; Murena, F.; Quaranta, F.; Mocerino, L. Assessment of the impact of ship emissions on air quality based on a complete annual emission inventory using AIS data for the port of Naples. Ocean. Eng 2021, 232, 109166. [Google Scholar] [CrossRef]

- Yang, L.; Zhang, Q.; Zhang, Y.; Lv, Z.Y.; Wang,Y. N.; Wu,L.; Feng, X.; Mao,H.J. An AIS-based emission inventory and the impact on air quality in Tianjin port based on localized emission factors. Sci. Total Environ 2021, 783, 146869. [Google Scholar] [CrossRef]

- Murenaa, F.; Mocerinob, L.; Quarantab, F.; Toscanoa, D. Impact on air quality of cruise ship emissions in Naples, Italy. Atmos. Environ 2018, 187, 70–83. [Google Scholar] [CrossRef]

- López-Aparicio, S.; Tønnesen, D.; Thanh, T.N.; Neilson, H. Shipping emissions in a Nordic port: assessment of mitigation strategies. TRANSPORT RES D 2017, 53, 205–216. [Google Scholar] [CrossRef]

- Zhang,Y. ; Fung, J.C.H.; Chan, J.W.M.; Lau. A.K.H. The significance of incorporating unidentified vessels into AIS-based ship emission inventory. Atmos. Environ 2019, 203, 102–113. [Google Scholar] [CrossRef]

- Monteiro, A.; Russo, M.; Gama, C.; Borrego, C. How important are maritime emissions for the air quality: At European and national scale. Environ. Pollut 2018, 242, 565–575. [Google Scholar] [CrossRef]

- Chen, D.; Wang, X.; Nelson, P.; Li, Y.; Guo, X. Ship emission inventory and its impact on the PM2.5 air pollution in Qingdao PortNorth China. Atmos. Environ 2017, 166, 351–361. [Google Scholar] [CrossRef]

- Tichavska, M.; Tovara, B.; Gritsenkob, D. Air emissions from ships in port: does regulation make a difference? Transp. Policy 2017, 75, 128–140. [Google Scholar] [CrossRef]

- Kwona, Y.; Limb, H.; Limc,Y. ; Lee, H. Implication of activity-based vessel emission to improve regional air inventory in a port area. Atmos. Environ 2019, 203, 262–270. [Google Scholar] [CrossRef]

- Ekmekçioğlu,A. ; Levent Kuzu, S.; Ünlügençoğlu, K.; Çelebi, U.B. Assessment of shipping emission factors through monitoring and modelling studies. Sci. Total Environ 2020, 743, 140742. [Google Scholar] [CrossRef] [PubMed]

- Dragovic, B.; Tzannatos, E.; Tselentis, V.; Meštrovic, R.; Škuric, M. Ship emissions and their externalities in cruise ports. Transport Res. D 2015, 61, 289–300. [Google Scholar] [CrossRef]

- Progiou, A.G.; Bakeas, E.; Evangelidou, E. Air pollutant emissions from Piraeus port: external costs and air quality levels. Transport Res. D 2021, 91, 102586. [Google Scholar] [CrossRef]

- Carr, E. W.; Corbett, J. J. Ship compliance in emission control areas: technology costs and policy instruments. Environ. Sci. Technol 2015, 49, 9584–9591. [Google Scholar] [CrossRef] [PubMed]

- Shi, K.; Weng, J.; Li, G. Exploring the effectiveness of ECA policies in reducing pollutant emissions from merchant ships in Shanghai port waters. Mar. Pollut. Bull., 2020, 155, 111164. [Google Scholar] [CrossRef] [PubMed]

- Bing, Q.; He, W.; Tian, Y. Ship emission reduction effect evaluation of air pollution control countermeasures. Transportation Research Procedia 2017, 25, 3606–3618. [Google Scholar] [CrossRef]

- Chen, W.; Yang, R. Evolving Temporal–Spatial Trends, Spatial Association, and Influencing Factors of Carbon Emissions in Mainland China: Empirical Analysis Based on Provincial Panel Data from 2006 to 2015. Sustainability 2018, 10, 74–84. [Google Scholar] [CrossRef]

- Jiang,B. ; Wang,X,Q.; Xue,H.L.; Li, J.; Gong, Y. An evolutionary game model analysis on emission control areas in China. Mar. Policy 2020, 118, 104010. [Google Scholar] [CrossRef]

- Meng, L.; Liu, K.; He, J.L.; Han; C. F.; Liu,P.H. Carbon emission reduction behavior strategies in the shipping industry under government regulation: A tripartite evolutionary game analysis. J. Clean Prod 2022, 378, 134556. [Google Scholar] [CrossRef]

- Lin, D.; and Juan, C.G. and Ng., M.W. Evaluation of green strategies in maritime liner shipping using evolutionary game theory. J. Clean Prod 2021, 279, 123268. [Google Scholar] [CrossRef]

- Yu, L.; Zheng, S.; and Gao, Q. Independent or collaborative management? Regional management strategy for ocean carbon sink trading based on game theory. Ocean Coast. Manage 2023, 235, 106484. [Google Scholar] [CrossRef]

- Zhou, Q.; Yuen, K.F. Low-sulfur fuel consumption: Marine policy implications based on game theory. Mar. Policy 2021, 124, 104304. [Google Scholar] [CrossRef]

- Dong, G.; and Zhong, D. Tacit collusion of pricing strategy game between regional ports: the case of Yangtze River economic belt [J]. Sustainability 2019, 11, 365. [Google Scholar] [CrossRef]

- Negenborn, R. R. & Zheng, S. Centralization or decentralization: a comparative analysis of port regulation modes. Transport Res. E 2014, 69, 21–40. [Google Scholar] [CrossRef]

| Notations | Explanation |

|---|---|

| Monthly throughput of regional ports | |

| Price impact factor on throughput | |

| Competitor's price impact factor | |

| Service cost per TEU for port | |

| The average fuel consumption per hour per ship during berthing period | |

| Handling efficiency of a crane per hour in port | |

| Fuel subsidy ratio in port | |

| Price of ultra-low sulfur diesel with a sulfur content 0.5% | |

| Price of low sulfur fuel (0.5%) | |

| Variables and functions | Explanation |

| Service price per TEU at port | |

| Monthly throughput of port | |

| Total fuel consumption by vessels in port | |

| Subsidies from ports for switching to ultra-low marine fuel when the supply of compliant fuel at port is insufficient | |

| Profit function of port |

| Callsign | IMO | MMSI | Gross Tonnage |

Net Tonnage |

DWT | Berth | Building Year | Distance (n mile) |

||

|---|---|---|---|---|---|---|---|---|---|---|

| BLBX | 8901755 | 416260000 | 17123 | 7336 | 23692 | Waigaoqiao | 1990 | 121.30 | ||

| BIBP7 | 9159878 | 413378250 | 16705 | 9118 | 24336 | Wusong | 1997 | 164.18 | ||

| D5IR9 | 9189500 | 636016980 | 66526 | 29460 | 67712 | Yangshan | 2000 | 139.74 | ||

| 3EB09 | 9320403 | 371860000 | 50963 | 30224 | 59587 | Changxing | 2006 | 125.34 | ||

| 9LU2532 | 9258210 | 667001729 | 1510 | 705 | 2212 | Baoshan | 2001 | 147.41 | ||

| GT | ||||||

|---|---|---|---|---|---|---|

| Container ships | ||||||

| Number of ships | 0 | 1 | 73 | 218 | 285 | |

| Percentage | 0 | 0.17% | 12.65% | 37.78% | 49.39% | |

| GT | ||||||

|---|---|---|---|---|---|---|

| Container ships | ||||||

| Number of ships | 0 | 0 | 7 | 46 | 168 | |

| Percentage | 0 | 0 | 3.17% | 20.81% | 76.02% | |

| Notations | Explanation | Value |

|---|---|---|

| Monthly throughput of regional ports | million TEUs | |

| Price impact factor on throughput | 0.15 million TEUs/$ | |

| Competitors' price impact factor | 0.1 million TEUs/$ | |

| Handling efficiency in Shanghai Port | millionTEUs/hour | |

| Handling efficiency in Ningbo Zhoushan Port | millionTEUs/hour | |

| Service cost per TEU in Shanghai Port | USD/TEU | |

| Service cost per TEU in Ningbo Zhoushan Port | USD/TEU | |

| Fuel subsidy ratio of Shanghai Port | ||

| Fuel subsidy ratio of Ningbo Zhoushan Port | 0.75 | |

| Price of MGO | 0.000 million USD/ton | |

| Price of VLSFO | 0.000 million USD/ton |

| GT | Unit | ||||||

|---|---|---|---|---|---|---|---|

| Parameters | |||||||

| USD | 87.13 | 87.13 | 87.16 | 88.00 | 88.23 | ||

| USD | 92.40 | 92.40 | 92.42 | 93.29 | 93.52 | ||

| million TEUs | 1.87 | 1.87 | 1.87 | 1.83 | 1.82 | ||

| million TEUs | 0.55 | 0.55 | 0.55 | 0.51 | 0.50 | ||

| million USD | 23.30 | 23.30 | 23.27 | 22.29 | 22.02 | ||

| million USD | 2.05 | 2.05 | 2.04 | 1.72 | 1.63 | ||

| GT | Unit | ||||||

|---|---|---|---|---|---|---|---|

| Parameters | |||||||

| USD | 88.92 | 88.92 | 88.94 | 89.74 | 89.96 | ||

| USD | 92.99 | 92.99 | 93.02 | 93.87 | 94.10 | ||

| million TEUs | 1.66 | 1.66 | 1.66 | 1.63 | 1.62 | ||

| million TEUs | 0.64 | 0.64 | 0.64 | 0.59 | 0.58 | ||

| million USD | 23.67 | 23.67 | 23.64 | 22.64 | 22.37 | ||

| million USD | 2.76 | 2.76 | 2.74 | 2.36 | 2.25 | ||

| GT | Unit | ||||||

|---|---|---|---|---|---|---|---|

| Parameters | |||||||

| USD | 1.78 | 1.78 | 1.78 | 1.74 | 1.73 | ||

| USD | 0.59 | 0.59 | 0.59 | 0.58 | 0.58 | ||

| million TEUs | 3 | 3 | 3 | 3 | 3 | ||

| million TEUs | -0.21 | -0.21 | -0.21 | -0.20 | -0.20 | ||

| million USD | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | ||

| million USD | -2.33 | -2.33 | -2.33 | -2.33 | -2.33 | ||

| USD | 0.37 | 0.37 | 0.37 | 0.35 | 0.35 | ||

| USD | 0.71 | 0.71 | 0.71 | 0.64 | 0.62 | ||

| / | 0.52 | 0.52 | 0.52 | 0.55 | 0.56 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).