1. Introduction

It is difficult to realise a creative dream without any financial support or access to finance. To overcome this problem an alternative form of financing, namely crowdfunding, has emerged. The COVID-19 pandemic has triggered several reactionary measures to the financing of entrepreneurship endeavours, worldwide (Leong, Tan, Tan, and Faisal, 2020). An increase in the restrictions to access finance due to the unavailability of finance is a growing concern for new SMEs and entrepreneurs after the global financial crisis. The current health crisis, namely COVID-19 has exacerbated access to finance for entrepreneurs. The work of social entrepreneurs is vital during the COVID-19 pandemic, as they can reach those who are unaccountable to the market and governments (World Economic Forum, 2020). Crowdfunding refers to financial contributions made by a group of people, known as backers, to a crowdfunding platform using the Internet, without a standardised financial intermediary (Presenza, Abbate, Cesaroni, and Appio, 2019). The digital evolution and innovation in crowdfunding have emerged as an alternative access to finance for entrepreneurs which has dramatically grown in recent times (Shneor and Vik, 2019).

The World Bank estimate the growth of crowdfunding volume to become $300 by the year 2025 (Short, Ketchen, McKenny, Allison and Ireland, 2017). In sub-Saharan Africa, the crowdfunding market volume is estimated to be at $2.5 billion by the year 2025 (World Bank, 2013). Therefore, the crowdfunding platform on the African continent has increased from 100 to 1660 in the year 2020 (Adhikary, Katsuna and Hoda, 2018). Crowdfunding has increased in growth and popularity and has contributed to the disintermediation of finance. This has contributed to access to finance. Crowdfunding is an alternative source of finance that could provide a supportable solution to addressing the lack of access to finance that has been experienced in recent times (Lurchenko, Pretty and Block, 2022). Therefore, investors or backers make decisions based on the information provided on the crowdfunding platform and the language of expectation (Eldridge, Nisar and Torchia, 2021).

The ongoing COVID-19 pandemic has influenced the emergence of an alternative solution to gaining access to finance, namely crowdfunding. This involves an internet-based platform and many people, who are willing to contribute, to raise capital for a project, openly and transparently. The role of entrepreneurs and SMEs in fostering economic growth in economies through job creation is well documented in several studies (Nyberg and Aberg, 2017). An additional number of studies has advanced ‘access to finance from traditional sources of finance as the major impediment to the development of this sector. With the rapid advancement in technology, investors have also allocated more risk capital to digital equity crowdfunding sites (Brown, Mawson, Rowe and Mason, 2018). Because of the integration and development of the Internet and financial technology, Internet finance has gradually become an important focus for promoting the development of inclusive finance and venture capital financing (Leong, Tan, Tan, and Faisal, 2022).

The sustainability of entrepreneurs is considered to be a major engine of economic growth and development mainly because it creates jobs and innovation (Mamaro and Sibindi, 2022). This has directed African governments to encourage the establishment of small- and medium-sized enterprises across the continent. Nowadays, small- and medium-sized enterprises are the main job creation drivers on the continent (Adjakou, 2021). Governments around the world pay special attention to removing barriers to entrepreneurial initiatives, to support development, through various policies, especially corporate finance (Ngo and Nguyen, 2022). One consideration to address this is through crowdfunding, which has the potential to advance poverty alleviation in Africa and on many other continents, in a variety of ways, from efficiently rallying and channelling savings to growing businesses in key industrial sectors and, thereby reducing the vulnerability of some of the poorest people, by bringing people together, namely, those with funding needs and those with savings to invest or donate (Hiller, 2017).

Despite the growth of crowdfunding in Africa, the research on this trend that has been conducted on the African continent is still in the infancy stage. Several studies conducted on the signal factors that affect the success of crowdfunding projects on the African continent have not been investigated further (for review Wachira, 2021; Hiller, 2017; Berndt, 2016; Gajda and Walton, 2013). In developed countries, studies mainly focus on identifying factors of success, using a single crowdfunding platform, such as Kickstarter and Indiegogo and variables such as project description, backers' geographical location, social network, information disclosure, e-WOM, (Kuppuswamy and Bayus 2018; Bi, Liu and Usman, 2017; Presenza et al., 2019). Despite, the potential of crowdfunding in the African continent to finance entrepreneurs and SMEs on the African continent, these studies were limited to descriptive and conceptual (Berndt 2016; Olafusi, Ishola, Abimbola and Idowu, 2022). However, the drivers of successful performance during the COVID-19 pandemic remain unanswered and, more importantly, existing studies generally use crowdfunding projects from a single platform or model these dynamic influences of different signals on crowdfunding success.

Against this backdrop the present inquiry was predicated on the following aim:

To determine the factors influencing the crowdfunding performance in Africa during the COVID-19 pandemic.

The study identifies drivers of crowdfunding success during the COVID-19 pandemic and addresses the directional causal relationship between these variables to explore related managerial and practical implications. In addition, it aims to contribute to the advancement of signalling theory, by identifying factors which signal crowdfunding success on the African continent.

This rest of the paper is organised as follows; section 2 focuses on the literature review and hypothesis development, followed by the research method in

Section 3. The research Discussion and implication of the study are presented in section 4, followed by the conclusion and the direction of the future research, in section 5.

2. Literature Review and Hypotheses Development

The signalling theory was first investigated in the context of job and product markets. This theory has been advanced by Spence (1973), which provides a signal balance which distinguishes which signal information concerning the quality of the capital market. The theory is supported by (Mavlanova, Benbunan-Fich, and Koufaris, 2012; and Akintoye and Niyonzima, 2018). According to Ahlers, Cumming and Gunther (2015) that transparent communication between crowdfunding stakeholders assists in overcoming the problem of information asymmetry. Hence, this theory is adaptable to crowdfunding by identifying the variables which signal the success and quality of the crowdfunding project.

Based on social theory, backers and the public, in general, accept recommendations made by experienced fundraisers (Tajvarpour and Pujari, 2022). Furthermore, the usage of private and public network signal digital reputation and the collaboration between backers and entrepreneurs resulting in the crowdfunding success performance (Miglo and Miglo, 2019). Social network usage reflects the project's trustworthiness, professionalism, persuasiveness and enhances trust and increases public participation (Massa, Saluzzo and Alegre, 2021). Consequently, crowdfunding is characterized by many backers who fail to take decisions on whether the project is worth their contribution, resulting in high information costs (Junge, Laursen and Nielsen, 2022). The crowdfunding platform and the use of the Internet have significantly reduced transaction costs, the cost of fraud and the impact of information asymmetry (Thies, Huber, Bock, Benlian, and Kraus, 2019).

According to Weiner (1985), people search for the causes of successful and unsuccessful events or circumstances based on the characteristics of locus (internal vs. external), stability (stable vs. unstable), and controllability (controllable vs. uncontrolled). In the context of entrepreneurship, blame external attribution that are beyond of individual such as inflation, financial crisis whereas internal attribution controllable factors such as management style and leadership (Lee and Chiravuri, 2018). Therefore, in the context of crowdfunding the success attribution are relatively internal and external. The entrepreneur internally creates crowdfunding project with factors that lead to success while externally need to investigate what is behind the motivation of backers to support crowdfunding campaign. Attribution theory posit that internal factors lead to success and external factors lead to failed (Kelley and Michela, 1980).

Goal-setting theory argues that the effectiveness of the targeted amount and deadlines are related to crowdfunding success (Lunenburg, 2011). The theory posit that it is very important for entrepreneur or project creator to provide a reasonable targeted amount that attracts backers to contribute. Targeted amount or fundraising goal need to be realistic, and achievable amount. The crowdfunding project which set a lower targeted amount seems to be successful rather than projects which larger and unrealistic targeted amount (Mollick, 2014). The usage of goal setting theory may assist entrepreneurs to maintain focus and dedication for their project which ultimately lead to a successful crowdfunding campaign. Therefore, presentation of video and images are behind the motivation to backers to support the crowdfunding campaign.

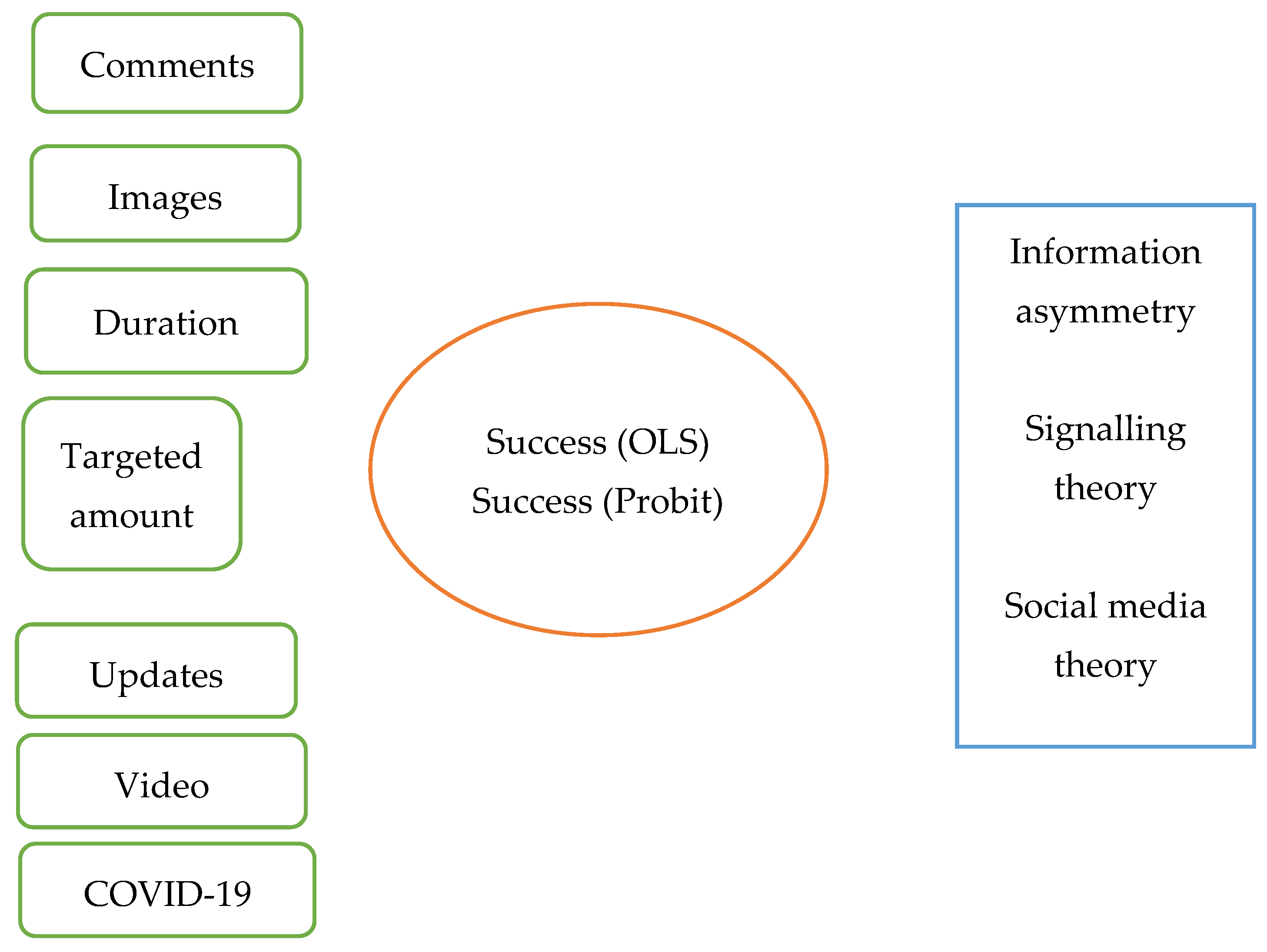

Figure 1 below presents the relationship between independent variables and the theories applicable to the study.

Figure 1.

The theoretical framework. Source: Authors’ own compilation.

Figure 1.

The theoretical framework. Source: Authors’ own compilation.

There are two types of crowdfunding, firstly, one that includes an investment model, namely lending and equity-based crowdfunding, and secondly, a non-investment model, which includes the reward and donation-based model. Please see the

Table 1 below.

2.1. Development of the research hypotheses

The hypothesis was developed based on the signal theory and its relationship to the successful performance of crowdfunding.

Targeted amount on the other hand, if the funding target is not reached, it would mean that the crowdfunding has failed, and the funds will then be returned to the investors. Hence, the targeted amount negatively affects crowdfunding success (Mallick, 2014). To achieve the targeted amount, the project creator needs to seek a reasonable and reliable amount to ensure the success of the project campaign (Liu, Ben and Zhang, 2022). Several studies confirmed that crowdfunding projects that higher goal amounts are likely to be unsuccessful (Ahlers, Cumming, Günther and Schweizer, 2015; Cha, 2017). Therefore, the lower the amount requested the higher probability of crowdfunding success which is in line with goal setting theory.

The presentation of comments on the crowdfunding campaign page, made by potential backers or crowd, and where questions can be asked or clarify on or information concerning the crowdfunding campaign can be sought from a project creator, are encouraged, as this provides the opportunity for more information to overcome the misunderstanding (Wang, Li, Liang HG, Ye, and Ge, 2018). The comments made on the crowdfunding campaign platform can contribute to eliminating risk concerning information asymmetry between backers and the SME. Hence, constant communication using comments and updates on the projects may directly influence the backer's contribution to the crowdfunding project and lead to successful performance (Kunz, Bretschneider, Erler and Leimeister, 2016). This signals trustworthiness and builds confidence among the crowd or backers concerning the crowdfunding campaign which leads to success. The project creators need to post regular updates on the crowdfunding platform and respond when the crowd seek clarity or more information (Kunz et al, 2016).

Gefen and Straub (2004) showed that the exchange of communication among the crowdfunding stakeholders through constant updates reduces perceived risk which increases excitement among backers to support the crowdfunding project campaign. Consequently, constant updates can contribute to overcoming information asymmetry among the backers (Tian, Guan, and Shi, 2018).

The availability of images and videos on the crowdfunding campaign site signals the quality of the crowdfunding project, which may lead to successful performance (Jiang, Wang, and Benbasat, 2005). The project creator or entrepreneur presents a video and image which provides information about the crowdfunding campaign. Additionally, the project creator provides detailed information, intending to attract the interest of backers in the crowdfunding campaign (Liang, Wu, and Huang, 2019). Therefore, the objective of posting videos and images is to provide reassurance concerning the authenticity and trustworthiness of the crowdfunding campaign, hence, increasing the probability of success.

The project duration refers to the time between launching the crowdfunding campaign and its end (Liu et al., 2022). It normally ranges from 1-40 days; crowdfunding campaigns, which last longer than 40 days, are not successful (Mollick 2014). Hence, a shorter duration sends a positive signal to backers and investors and increases backers' certainty concerning the project campaign and concerning trustworthiness which ultimately increases the success (Lukkarinen, Teich, Wallenius and Wallenius, 2016; Mollick, 2014).

The presence of the COVID-19 pandemic signals the growth of the crowdfunding market. As the world grapples with this pandemic, crowdfunding provides a dynamic opportunity to assess local relief needs and global public responses (Zribi, 2022). The crowdfunding market in Europe has collected 1.02 billion Euros which represents a 62% growth compared to the year 2019. Conversely, in the African continent, the COVID-19 pandemic has negatively affected financial markets and loss of confidence and liquidity constraints (Zeidy, 2020). Therefore, the COVID-19 pandemic increases the usage of crowdfunding especially for non-profit organisations such as a donation-based model (Santos and Laureano, 2022). However, the COVID-19 pandemic signifies a negative impact on crowdfunding success. From the above foregoing the following hypotheses are formulated:

Hypothesis 1: The targeted amount contributes to the success of a crowdfunding project.

Hypothesis 2: The number of backers of crowdfunding projects increases the probability of success

Hypothesis 3: The presence of comments on the crowdfunding campaign site increases the success

Hypothesis 4: The availability of images on the crowdfunding campaign site increases the probability of success

Hypothesis 5: The presence of videos on the crowdfunding site, increases the probability of success

Hypothesis 6: The longer the duration of the crowdfunding campaign the lower the probability of success

Hypothesis 7: The COVID-19 pandemic negatively influences the probability of success

3. Research methodology

The non-probability sampling method was applied in the study, specifically convenience sampling consisting of 216 crowdfunding projects in the year 2020 during the hard lockdown on the African continent. Specifically, secondary data consist of crowdfunding projects from 36 African countries. The reward-based crowdfunding projects in Africa collected from The Crowd Data Center were the main source.

The study applied two estimation methods namely, ordinary least square (OLS) and probit model both used success as dependent variable measured by a binary of 1 if the project was successful, and 0 if the project failed. In this study, the study applied two methods of estimation to calculate our equations namely, OLS and probit model. The

Table 2 below describes the variables adopted and its measurement.

For the first equation used an ordinary least square (OLS) estimation where our dependent variable is success. ε is the error term which follow identical independent distribution and follow normal distribution.

This is the first equation where ordinary least square (OLS) is used in model 1

For our second equation utilized probit model estimation. The reason of using probit model is as our dependent variable is binary in nature of 1,0 outcome. It is estimated using maximum likelihood estimation method (Wooldridge, 2019) where the model takes the form as follows:

This is the second equation where probit regression model 2 is applied:

This quantitative and cross-country study in the African continent from a period from January 2020 to December 2020. The secondary data gathered from the following countries are specified in the table below.

4. Empirical Results and Discussion of Findings

The previous section discussed the research methodology applicable to this study. Hence, this section presents descriptive, correlation analysis and the regression analysis respectively. Detailed empirical results are being discussed the research objective.

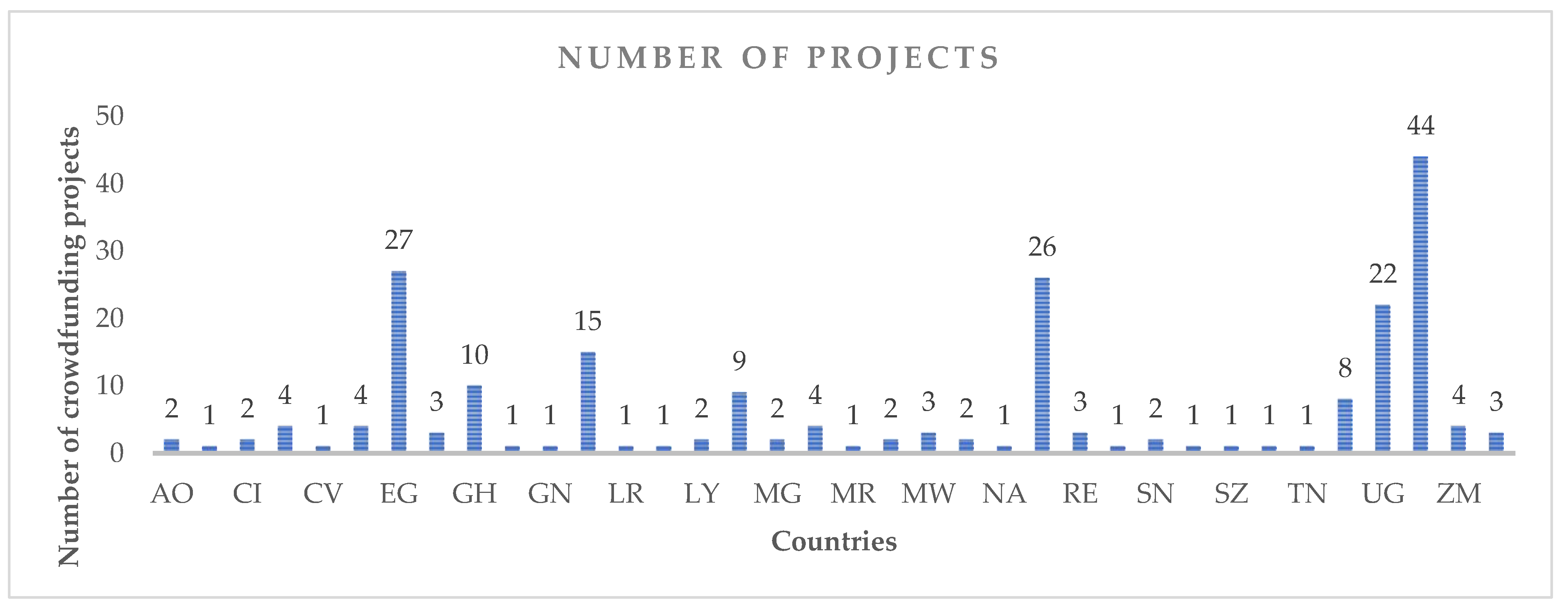

The crowdfunding projects dominance in each country. South Africa is leading with 44 projects, followed by Egypt 27, Nigeria 22, Uganda 22, Kenya 15 and Ghana 10 respectively. Other countries account less than 10 crowdfunding projects. Theses countries are as follows; namely, Angola [AO], Central African Republic [CF], Cote d'Ivoire [CI], Cameroon [CM], Cape Verde [CV], Algeria [DZ], Egypt [EG], Ethiopia [ET], Ghana [GH], Heard and Mc Donald Islands [GM], Guinea [GN], Kenya [KE], Liberia [LR], Lesotho [LS], Libyan Arab Jamahiriya [LY], Morocco [MA], Madagascar [MG], Mali [ML], Mauritania [MR], Mauritius [MU], Malawi [MW], Mozambique [MZ], Namibia [NA], Nigeria [NG], Reunion [RE], Rwanda [RW], Senegal [SN], Somalia [SO], Swaziland [SZ], Togo [TG], Tunisia [TN], Tanzania, United Republic of [TZ], Uganda [UG], South Africa [ZA], Zambia [ZM], Zimbabwe [ZW].

Figure 1.

The theoretical framework.

Figure 1.

The theoretical framework.

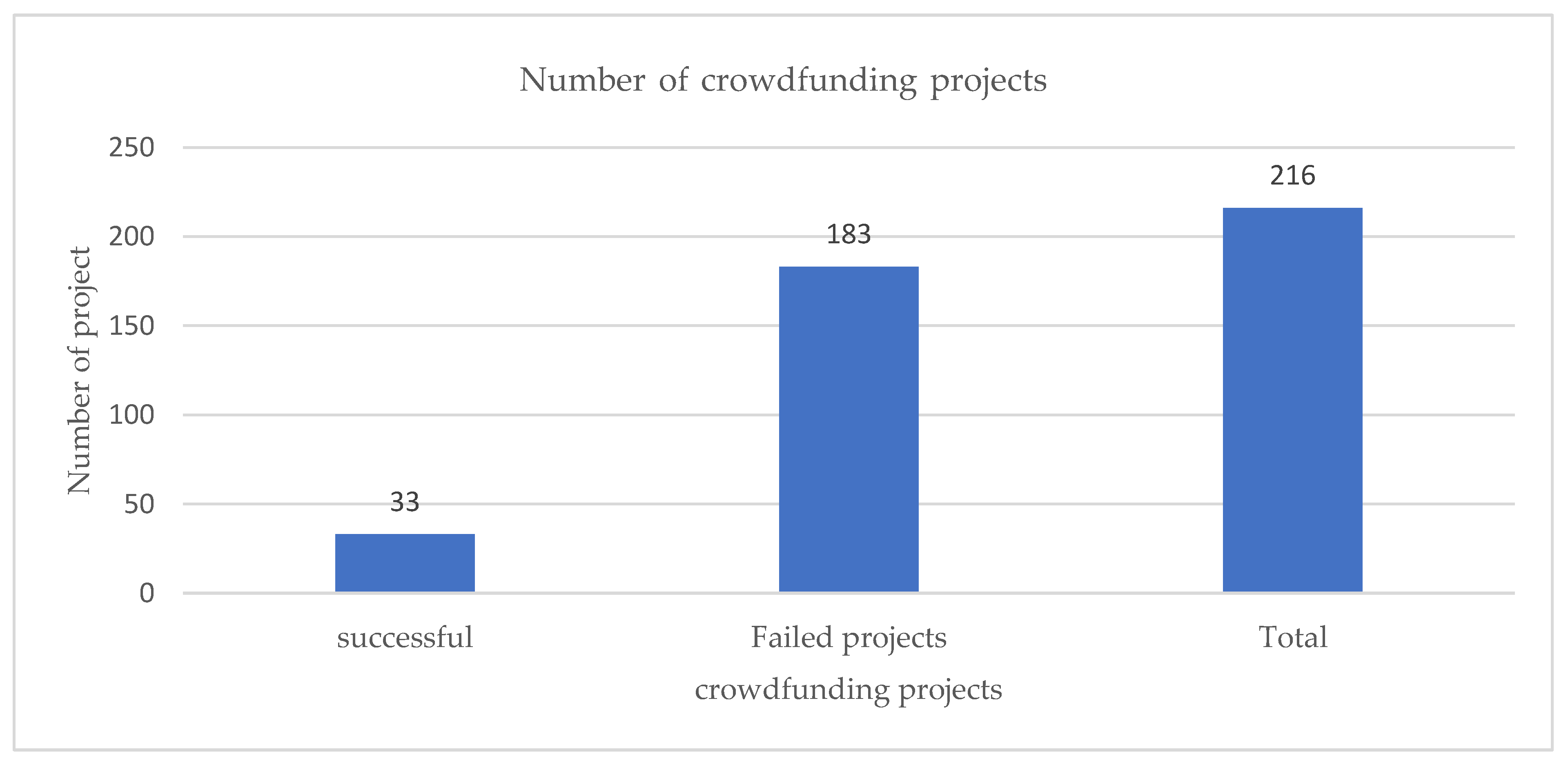

Figure 2 above indicate the successful and unsuccessful crowdfunding project in the African continent. The results implied that crowdfunding projects in Africa are being characterised by a lower success rate.

The descriptive statistics, in

Table 3, shows a mean value of around 1,384 backers, 3,622 duration, 6,652 comments, 0,758 images, 9,293 targeted amount, 1,586 updates and 0,55 video generally supports crowdfunding campaigns.

In

Table 4, a descriptive and correlation analysis of the results is presented that includes the mean, standard deviation, and correlations between the variables. The correlation coefficients are between -0,02 and 0,60 which are within the threshold of 0,80 suggested by Wooldridge (2019). It can be concluded that the correlation among the variables is not far. Therefore, there are no multicollinearity problems between the variables. Both descriptive and correlation of all variables are reported in Table. Based on the correlation matrix, a strong correlation is shown among both independent variables with a threshold of less than 0,80 (Kline and Tamer, 2020).

The present section discusses the empirical results which aimed to respond to research objective of the study namely, investigate the factors driving crowdfunding success in Africa. The study conducted OLS and regression analysis to determine the factors driving crowdfunding success. Below

Table 5 presents the OLS regression analysis in model 1 and the probit regression analysis in model 2.

The

Table 5 above present both OLS and probit results. The fitness of the models was validated by the R-squared and Durbin Watson test of 38% and the pseudo-R-squared of 70% respectively; 1,9 respectively.

Table 5 offers proof of the fitness of the model and, as a result, it supports the dependence of data of the model probit and OLS.

Table 5, above, shows that, regarding model 1, comments and duration are negatively associated with crowdfunding success but not significant (β=-0.0004 and -0.0007 respectively in model 1). Therefore, results imply that comments made on the crowdfunding campaign page as well as longer durations do not increase the probability of success. The results suggest comments and duration have a negative effect on crowdfunding success. The findings are in line with studies by Aleksina, Akulenka and Lublóy (2019); Dikaputra, Sulung and Kot

(2019

); Prasobpiboon

, Ratanabanchuen and Chandrachai (2021

) as well as Gangi and Daniele (2017). Hence, the comments and duration on the crowdfunding platform may signal an unsuccessful campaign project. In contrast, Alazazi, Wang and Allan (2020), Ho, Chiu, Mansumitrchai, Yuan, Zhao and Zou (2021); Dikaputra et al (2019) found a positive relationship between comments and duration on crowdfunding success. Therefore, according to the findings of this study, the use usage of long duration and comments on the crowdfunding website is discouraged, as it negatively impacts crowdfunding performance.

Whereas the targeted amount and COVID-19 pandemic are negative and significantly associated with crowdfunding success (β=-0.0343; p>0,01 and -0.1008; p>0,05 respectively in model 1). Findings suggest that the targeted amount and the COVID-19 pandemic strongly decrease the potential of crowdfunding success. Targeted amounts and the COVID-19 pandemic signal a negative influence on crowdfunding performance, according to Ayturk, Ekici, Sirma and Icke, (2022), Schraven (2022), Petitjean (2018), and Song, Berger, Yosipof, and Barnes (2019), and Wang, Li, Liang, Ye and Ge (2018). Therefore, it is important to set a realistic targeted amount, which is in line with signalling theory. In contrast, Alazazi et al (2020) found a positive relationship between the targeted amount and crowdfunding success performance. The higher the targeted amount pledged or requested on the crowdfunding campaign platform, the higher the likelihood of the failure of the crowdfunding campaign (Wachira, 2021, Aleksina et al., 2019, Shneor, Mrzygłód, Adamska-Mieruszewska and Fornalska-Skurczyńska, 2021). The findings of the study remain inconclusive; hence this study adds to the existing literature.

Conversely, the presence of the image, video, backers and updates positively and significantly affect the crowdfunding success (β=0,1066 p<0,05; 0.0699 p<0,10; 0. 00058 <0,01; and 0.0261 p<0,01 respectively in model 1). The presentation of images, videos and updates signals the probability of success while eliminating the problem of information asymmetry between backers and fund seekers known as entrepreneurs. Therefore, trustworthiness between crowdfunding stakeholders overcomes uncertainties about the quality of the campaign thus increasing the probability of success (Zhao, Ma, Chen, Shang, and Song, 2022). Consequently, potential backers who contribute to investing are attracted by the presentation of updates, images as well as videos.

Conversely updates, backers positively and significantly influence crowdfunding success (β=0,010; 0,137 respectively; p<0,05, and p<0,01). The findings of the study are supported by Tian, Guan, Zhang Shi and Shen (2022); Zribi (2022), de Larrea Altin, and Singh (2019), Tan and Reddy (2021), and Fontana and Ordonez (2020). Constant updates made on the crowdfunding campaign site are used as an effective communication tool between backers and entrepreneurs and reduce information asymmetry. Furthermore, for updates, backers signal the crowdfunding success. In contrast, Liu, Chen, and Fan (2021); Wang, Li, Liang, Ye and Ge (2017), and Tan and Reddy (2021) reported a negative relationship between updates and crowdfunding success. Therefore, there is no universal agreement on the factors that affect crowdfunding success.

The duration of the crowdfunding appeal on the site was positive but insignificantly influenced the crowdfunding success (β=0,022). The results are in line with that of Hsieh and Vu (2021), Kedas and Sarkar (2022), and Calic and Shevchenko (2020). Therefore, the duration is a signal of crowdfunding success on the African continent. These findings are in contrast to the results by the Sajedi and Soosaipillai (2021), Alazazi et al (2020), Hsieh and Vu (2021), and Tan and Reddy (2021) who found that duration had a negative effect on a crowdfunding project to ensure the success of the campaign. It is advisable for project creators to set up a reasonable time frame for crowdfunding projects, to ensure the success of the campaign. Most of the variables that impact the crowdfunding performance have been affected by the COVID-19 pandemic such as comments. However, it is evident that, during the COVID-19 pandemic, many of the views on the variables that influence crowdfunding success have changed. The presence of comments, videos and images has assisted in overcoming information.

Model 2 represents the probit regression results that respond to the research question, outlined above. The findings revealed that images, comments, videos, and duration were positive drivers but did not significantly influence the crowdfunding success (β=0.8897; 0.0889; 0.0204 and 0.0039 respectively in model 2). Findings implied that both images, comments videos and duration are the important drivers of crowdfunding success that attract large of backers to contribute to the campaign platform. The availability of images, videos and updates on the crowdfunding campaign increases the probability of success whereas the higher number of backers signal the crowdfunding success due to a high number of backers supporting the campaign. The availability of images, videos, comments, and updates on the crowdfunding platform overcomes the problems of information asymmetry and signals the success of performance (DeCrescenzo, Botella-Carrubi, and García, 2021).

The findings are consistent with that of Fourkan (2021), Tafesse (2021), Song et al (2019), Yeh, Chen and Lee (2019), and Liu, Ben and Zhang (2022). The availability of videos, images, and comments on the crowdfunding campaign platform, effectively alleviates the existence of information asymmetry between the fund seeker and funds providers. Furthermore, they signal the quality of the crowdfunding project, hence, it is likely to attract a large number of backers. Thus, it increases the probability of crowdfunding success.

Additionally, backers were found to be positive and significantly affect the crowdfunding success (β=0. 0403 p<0,01). Hence, a large number of backers signal the probability of crowdfunding success performance. In contrast, updates decrease the probability of crowdfunding success but are not significant (β=-0.0255). surprisingly, the update seems not to affect the crowdfunding success. Additionally, the targeted amount and the COVID-19 pandemic were negative and significantly associated with crowdfunding success performance (β=-0.6362 p<0,01; -0.6891 p<0,10). This implies that the targeted amount and the COVID-19 pandemic do not attract potential backers to invest in a campaign hence decreasing the probability of success. The results imply that the targeted amount enhances the backer's contribution, which ultimately increases success. This is in line with the studies by Alazazi et al (2020). The targeted amount signals crowdfunding success. These findings are challenged by researchers like Latinovic and Arsic (2019), Troise, Tani and Jones (2020), Liu et al (2022), and Predkiewicz and Kalinowska-Beszczynska (2020) who found a negative relationship between the targeted amount and backers’ performance. Therefore, the findings remain inconclusive. Crowdfunding platforms encourage the project creator to initiate the presence of videos and images, infographics, and animation (Crosetto, and Regner, 2018).

Among the few studies that have examined the factors influencing crowdfunding campaigns, the primary attention has been given to equity-based and reward-based crowdfunding campaigns however, these studies originate from developed countries (Petitjean, 2018; Sajjan and Venkatesha, 2020; Liu, Ben and Zhang, 2022; Smirnova, Platt and Lei, 2019). Hence, the current study contributes to the gap in knowledge in this regard, in Africa.

The current study has several theoretical and practical implications. Firstly, the study contributes to the crowdfunding literature by understanding the drivers of crowdfunding success, which is based on the signalling, and social capital theories. Most former studies have investigated signalling dynamics, often limited to a single economy or country (Courtney et al. 2017; Usman et al. 2019; Wang et al. 2018). The study sampled crowdfunding projects across African counties for a period from January 2020 to December 2020. To the best of our knowledge, the current study is one of the first to investigate the importance of signalling in project success and its role in mitigating the problem of information asymmetry in the crowdfunding market from the perspective of African countries.

5. Conclusion

Crowdfunding platforms provide an alternative financial solution to entrepreneurs with a new innovative and creative ideas to have a direct interaction with potential investor or backers. Through crowdfunding platform, entrepreneurs are not obligated to acquire collateral or business plan to access funds. Consequently, the aim of the study was to determine the factors driving crowdfunding success particularly in the African continent. The study employed postpositivist research worldview characterised by a deductive strategy owing the developed theories requires testing. The secondary data collected from multiple reward based crowdfunding platform namely, Kickstarter, Indiegogo and Fun razed.

From both OLS and probit regression analysis, it is clear that factors driving crowdfunding success in Africa are not different from developed nations. The ordinary least square revealed that image, videos, updates, backers are the drivers of crowdfunding success. Therefore, entrepreneurs can enhance the crowdfunding success by providing more updates, images and videos because increases backers trust to support the project. The results also showed that comments, duration, targeted amount and COVID-10 pandemic were negative drivers of crowdfunding success. The presentation of comments, long duration and higher targeted amount discourages backers to support the crowdfunding campaign. Lastly, during the COVOD-19 pandemic most backers were not participating in the crowdfunding campaign hence decreases crowdfunding success.

Probit regression analysis revealed that images, comments, video and duration are the drivers of crowdfunding success. The longer duration provides reasonable time frame for to take their time to support the campaign project and the comments as a constant communication provides trust to backers. The findings also showed a negative relationship between updates, targeted amount and COVID-19 pandemic on crowdfunding success. The updates and COVID-19 pandemic decrease the backer’s participation therefore decreases the crowdfunding success.

The study contributes to lesser known in the literature concerning the factors driving crowdfunding success in Africa because the concept is still at the infancy stage in the African continent. Secondly, provides guidelines to project creators on how to create a successful crowdfunding campaign. Thirdly, it contributes methodologically owing to data collection from multiple crowdfunding platforms and countries. Lastly, advances the signal theory by identifying the factors that drives crowdfunding success in Africa.

There is no study without limitations; hence, the current study is limited to the following firstly, the study consists of crowdfunding projects campaigns on the African continent, secondly, the data collected was solely based on reward and donation-based crowdfunding models. Lastly, the study is limited to a quantitative research approach which is characterised by a deductive research strategy. The findings remain inconclusive in that signalling factors affect crowdfunding success in Africa. Hence, the findings of the study cannot be generalised to other developed countries, due to differences in ICT infrastructure, culture, and internet participation, which, ultimately, drives crowdfunding development and growth.

Therefore, future research may be conducted in developing and developed countries using the investment-based crowdfunding model. Additionally, future research studies should investigate if the results of this study are similar or not for different types and models of crowdfunding. Since the study exclusively explored rewards-based crowdfunding, the findings of the study may not apply to other different types of crowdfunding, such as equity-based crowdfunding or the lending-based crowdfunding model. Finally, therefore study suggests that researchers consider these findings as inspiration to conduct a qualitative study that could benefit the field by providing more in-depth explanations of the phenomenon and a better understanding of the variables that drive crowdfunding success.

Author Contributions

Conceptualisation, L.P.M. and A.B.S.; methodology, L.P.M.; software, L.P.M.; validation, L.P.M. and A.B.S.; formal analysis, L.P.M.; investigation, L.P.M.; resources, L.P.M.; data curation, L.P.M.; writing—original draft preparation, L.P.M.; writing—review and editing, A.B.S.; visualisation, L.P.M. and A.B.S.; supervision, A.B.S.; project administration, L.P.M.; funding acquisition, L.P.M. and A.B.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Research Framework in South Africa.

Data Availability Statement

The data may be available upon request

Acknowledgements

Presented at the World finance conference in Italy for their valuable input in this paper.

Conflicts of Interest

Declare conflicts of interest or state “The authors declare no conflict of interest.”

References

- Adhikary, Bishnu Kumar, Kenji Kutsuna, and Takaaki Hoda. 2018. Crowdfunding: lessons from Japan's approach. Singapore: Springer.

- Adjakou, Oloutchègoun Josias Lawrence. 2021."Crowdfunding: Genesis and comprehensive review of its state in Africa." Open Journal of Business and Management 9, 2: 557-585. [CrossRef]

- Ahlers, Gerrit KC, Douglas Cumming, Christina Günther, and Denis Schweizer. 2015."Signalling in equity crowdfunding." Entrepreneurship theory and practice 39, 4: 955-980. [CrossRef]

- Akintoye, I. R., and T. Niyonzima. 2018."Financial Reporting and Governmental Value Creation in Selected Commercial Banks in Rwanda." International Journal of Science and Research 7, 11:688-696. [CrossRef]

- Alazazi, Massara, Bin Wang, and Tareq Allan. 2020."Success factors of donation-based crowdfunding campaigns: A machine learning approach." Available at: https://hicss.hawaii.edu/.

- Aleksina, Anna, Stanislau Akulenka, and Ágnes Lublóy. 2019. "Success factors of crowdfunding campaigns in medical research: perceptions and reality." Drug discovery today 24, 7: 1413-1420. [CrossRef]

- Ayturk, Y., Ekici, O., & Sirma, I. The Determinants of reward-based crowdfunding Success in Turkey. Available at https://istfonbul.iu.edu.tr/Image/pdf/The-Determinants-of-Reward-based-Crowdfunding-Success-in-Turkey.pdf.

- Berndt, Adele. 2016."Crowdfunding in the African context: A new way to fund ventures." Entrepreneurship and SME Management across Africa: Context, Challenges, Cases: 31-49. [CrossRef]

- Bi, Sheng, Zhiying Liu, and Khalid Usman. 2017."The influence of online information on investing decisions of reward-based crowdfunding." Journal of business research 71: 10-18. [CrossRef]

- Brown, Ross, Suzanne Mawson, Alexander Rowe, and Colin Mason. 2018."Working the crowd: Improvisational entrepreneurship and equity crowdfunding in nascent entrepreneurial ventures." International Small Business Journal 36, 2: 169-193. [CrossRef]

- Calic, Goran, and Anton Shevchenko. 2020."How signal intensity of behavioral orientations affects crowdfunding performance: The role of entrepreneurial orientation in crowdfunding business ventures." Journal of Business Research 115: 204-220. [CrossRef]

- De Crescenzo, Veronica, Dolores Botella-Carrubi, and María Rodríguez García. 2021."Civic crowdfunding: A new opportunity for local governments." Journal of Business Research 123: 580-587. [CrossRef]

- de Larrea, Gabriela Lelo, Mehmet Altin, and Dipendra Singh. 2019."Determinants of success of restaurant crowdfunding." International Journal of Hospitality Management 78: 150-158. [CrossRef]

- Dikaputra, Rinaldo, Liyu Adhi Kasari Sulung, and Sebastian Kot. 2019."Analysis of success factors of reward-based crowdfunding campaigns using multi-theory approach in ASEAN-5 countries." Social Sciences 8, 10: 1-15. [CrossRef]

- Eldridge, Derek, Tahir M. Nisar, and Mariateresa Torchia. 2021."What impact does equity crowdfunding have on SME innovation and growth? An empirical study." Small Business Economics 56: 105-120. [CrossRef]

- Fontana, Walter M. Sánchez, and Econ Luis B. Tonon Ordóñez. 2020."Signaling and success in campaigns of Latin-American crowdfunding." Retos 10(19), 95-110. [CrossRef]

- Fourkan, Md. 2021"Crowdfunding: Antecedents of number of backers and success of a project." Fourkan, M. (2021). Crowdfunding: antecedents of number of backers and success of a project. International Journal of Small Business and Entrepreneurship Research 9, (2): 1-13. Available at https://www.eajournals.org/wp-content/uploads/Crowdfunding.

- Gajda, Oliver, and James Walton. 2013. "Review of crowdfunding for development initiatives." IMC Worldwide for Evidence on Demand. UK Department for International Development, London. Available at https://eurocrowd.org/wpcontent/blogs.dir/sites/85/2013/10/EoD_HD061_Jul2013_Review_CrowdFunding.pdf.

- Gangi, Francesco, and Lucia Michela Daniele.2017. "Remarkable funders: how early-late backers and mentors affect reward-based crowdfunding campaigns." International Business Research 10, (11): 58-69. [CrossRef]

- Guan, Xiangjiu, Li Tian, Yazhou Zhang, Jinwen Shi, and Shaohua Shen. 2022 "Photocatalytic water splitting on BiVO4: Balanced charge-carrier consumption and selective redox reaction." Nano Research: 1-6. [CrossRef]

- Hiller, Alexander. 2017."An empirical analysis of crowdfunding in Sub-Saharan Africa." Availability at https://nbn-resolving.org/urn:nbn:de:bsz:14-qucosa2-163562.

- Ho, Han-Chiang, Candy Lim Chiu, Somkiat Mansumitrchai, Zhengqing Yuan, Nan Zhao, and Jiajie Zou. 2021."The influence of signals on donation crowdfunding campaign success during COVID-19 crisis." International journal of environmental research and public health 18, (14): 7715. [CrossRef]

- Hsieh, Hui-Ching, and Thi Huyen Chi Vu.2021. "The impact of economic policy uncertainty on crowdfunding success." Journal of International Financial Markets, Institutions and Money 75: 101418. [CrossRef]

- Iurchenko, Denis, Jeffrey S. Petty, and Joern Block. 2022."The effect of online discussion boards on equity crowdfunding dynamics." Journal of Small Business Management: 1-31. [CrossRef]

- Jiang, Zhenhui, Weiquan Wang, and Izak Benbasat. 2005."Multimedia-based interactive advising technology for online consumer decision support." Communications of the ACM 48, (9): 92-98. [CrossRef]

- Junge, Louise Bech, Iben Cleveland Laursen, and Kristian Roed Nielsen.2022. "Choosing crowdfunding: Why do entrepreneurs choose to engage in crowdfunding?" Technovation 111: 102385. [CrossRef]

- Kedas, Satishwar, and Soumodip Sarkar. 2023."Putting your money where your mouth is–the role of rewards in a value-based understanding of restaurant crowdfunding." International Journal of Contemporary Hospitality Management 35, (1): 92-114. [CrossRef]

- Kelley, Harold H., and John L. Michela. 1980."Attribution theory and research." Annual review of psychology 31, (1): 457-501. [CrossRef]

- Kline, Brendan, and Elie Tamer. 2020. "Econometric analysis of models with social interactions." In The Econometric Analysis of Network Data: 149-181. [CrossRef]

- Kunz, Michael Marcin, Ulrich Bretschneider, Max Erler, and Jan Marco Leimeister. 2017."An empirical investigation of signaling in reward-based crowdfunding." Electronic Commerce Research 17: 425-461. [CrossRef]

- Kuppuswamy, Venkat, and Barry L. Bayus. 2018."Crowdfunding creative ideas: The dynamics of project backers." The economics of crowdfunding: Startups, portals and investor behavior: 151-182. [CrossRef]

- Latinović, Milica, and Vesna Bogojević Arsić. 2019."Determinants of equity crowdfunding success." In 5th IPMA SENET Project Management Conference (SENET 2019): 151-155. Atlantis Press. [CrossRef]

- Leong, Carmen, Felix Ter Chian Tan, Barney Tan, and Fithra Faisal. 2022."The emancipatory potential of digital entrepreneurship: A study of financial technology-driven inclusive growth." Information & Management 59, (3): 103384. [CrossRef]

- Lee, Chang Heon, and Ananth Chiravuri. 2019."Dealing with initial success versus failure in crowdfunding market: Serial crowdfunding, changing strategies, and funding performance." Internet Research 29, (5): 1190-1212. [CrossRef]

- Liang, Ting-Peng, Shelly Ping-Ju Wu, and Chih-chi Huang. 2019."Why funders invest in crowdfunding projects: Role of trust from the dual-process perspective." Information & Management 56, (1): 70-84. [CrossRef]

- Liu, Yang, Yuan Chen, and Zhi-Ping Fan. 2021."Do social network crowds help fundraising campaigns? Effects of social influence on crowdfunding performance." Journal of Business Research 122 : 97-108. [CrossRef]

- Liu, Zhunzhun, Shenglin Ben, and Ruidong Zhang. 2023."Factors affecting crowdfunding success." Journal of Computer Information Systems 63, (2): 241-256. [CrossRef]

- Lunenburg, Fred C. 2011."Goal-setting theory of motivation." International journal of management, business, and administration 15., 1): 1-6.

- Mamaro, Lenny Phulong, and Athenia Bongani Sibindi. "Entrepreneurial Financing in Africa during the COVID-19 Pandemic." Journal of Risk and Financial Management 15, no. 11 (2022): 511. [CrossRef]

- Mavlanova, Tamilla, Raquel Benbunan-Fich, and Marios Koufaris. 2012. "Signaling theory and information asymmetry in online commerce." Information & management 49, (5): 240-247. [CrossRef]

- Miglo, Anton, and Victor Miglo. 2019."Market imperfections and crowdfunding." Small Business Economics 53: 51-79. [CrossRef]

- Mollick, Ethan R., and Venkat Kuppuswamy. 2014. "After the campaign: Outcomes of crowdfunding." UNC Kenan-Flagler Research Paper 2376997. [CrossRef]

- Ngo, Hang Thi, and Le Thi Hoai Nguyen. 2022."Consumer adoption intention toward FinTech services in a bank-based financial system in Vietnam." Journal of Financial Regulation and Compliance. 1-15. [CrossRef]

- Nyberg, Anna, and Malin Åberg. 2017."Crowdfunding Social Entrepreneurship; The Influential Factors in Crowdfunding Success for Social Entrepreneurs." Master’s thesis. University of Gothenburg, Göteborg. Available at http://hdl.handle.net/2077/53751.

- Olafusi, Tomomewo Amos, Akintoye Rufus Ishola, Busari Tajudeen Abimbola, and Omopintemi Jerome Idowu. 2022."Development of SMEs in Africa: the role of crowdfunding." International Journal of Entrepreneurship 26, (5):1-16.

- Petitjean, Mikael. 2018."What explains the success of reward-based crowdfunding campaigns as they unfold? Evidence from the French crowdfunding platform KissKissBankBank." Finance Research Letters 26: 9-14. [CrossRef]

- Predkiewicz, Katarzyna, and Olga Kalinowska-Beszczynska. 2021."Financing eco-projects: analysis of factors influencing the success of crowdfunding campaigns." IJEBR 339, (1): 547-566. [CrossRef]

- Presenza, Angelo, Tindara Abbate, Fabrizio Cesaroni, and Francesco Paolo Appio. 2019."Enacting social crowdfunding business ecosystems: The case of the platform Meridonare." Technological Forecasting and Social Change 143: 190-201. [CrossRef]

- Sajedi, Asma, and Sarumathy Soosaipillai. 2021. "Determinants of equity crowdfunding success in Norway: an empirical study of how different factors affect the success of equity crowdfunding in the Norwegian market." Master's thesis, Norwegian School of Economics, Bergen.

- Saluzzo, Federica Massa, and Inés Alegre. 2021."Supporting entrepreneurs: The role of third-party endorsement in crowdfunding platforms." Technological Forecasting and Social Change 162: 120402. [CrossRef]

- Santos, Márcia RC, and Raul MS Laureano. 2022."COVID-19-related studies of nonprofit management: A critical review and research agenda." VOLUNTAS: International Journal of Voluntary and Nonprofit Organizations 33, (5): 936-951. [CrossRef]

- Schraven, Etienne Pierre. 2022."Crowdfunding: Perceptions of campaign success."PhD thesis, Vrije Universiteit Amsterdam, Amsterdam.

- Shneor, Rotem, and Amy Ann Vik. 2020. "Crowdfunding success: a systematic literature review 2010–2017." Baltic Journal of Management 15, (2): 149-182. [CrossRef]

- Shneor, Rotem, Urszula Mrzygłód, Joanna Adamska-Mieruszewska, and Anna Fornalska-Skurczyńska. 2021."The role of social trust in reward crowdfunding campaigns’ design and success." Electronic Markets: 1-16. [CrossRef]

- Short, Jeremy C., David J. Ketchen Jr, Aaron F. McKenny, Thomas H. Allison, and R. Duane Ireland. 2017."Research on crowdfunding: Reviewing the (very recent) past and celebrating the present." Entrepreneurship Theory and Practice 41, (2): 149-160. [CrossRef]

- Smirnova, Elena, Katarzyna Platt, Yu Lei, and Frank Sanacory. "Pleasing the crowd: the determinants of securities crowdfunding success." Review of Behavioral Finance 13, (2): 165-183. [CrossRef]

- Song, Yang, Ron Berger, Abraham Yosipof, and Bradley R. Barnes. 2019."Mining and investigating the factors influencing crowdfunding success." Technological Forecasting and Social Change 148: 119723. [CrossRef]

- Spence, Michael. 1978."Job market signaling." In Uncertainty in economics, pp. 281-306. Academic Press, 283-306. [CrossRef]

- Tafesse, Wondwesen. 2021."Communicating crowdfunding campaigns: How message strategy, vivid media use and product type influence campaign success." Journal of Business Research 127: 252-263. [CrossRef]

- Tajvarpour, Mohammad Hossein, and Devashish Pujari. 2022."The influence of narrative description on the success of crowdfunding campaigns: The moderating role of quality signals." Journal of Business Research 149: 123-138. [CrossRef]

- Tan, Yee Heng, and Srinivas K. Reddy. 2021."Crowdfunding digital platforms: Backer networks and their impact on project outcomes." Social Networks 64: 158-172. [CrossRef]

- Thies, Ferdinand, Alexander Huber, Carolin Bock, Alexander Benlian, and Sascha Kraus. 2019."Following the crowd—does crowdfunding affect venture capitalists’ selection of entrepreneurial ventures?" Journal of Small Business Management 57, (4): 1378-1398. [CrossRef]

- Tian, Zhiyuan, Lei Guan, and Meilin Shi. 2018."The key factors of successful internet crowdfunding projects-an empirical study based on different platforms." In 2018 15th International Conference on Service Systems and Service Management (ICSSSM), pp. 1-6. IEEE. [CrossRef]

- Troise, Ciro, Mario Tani, and Paul Jones. 2020."Investigating the impact of multidimensional social capital on equity crowdfunding performance." International Journal of Information Management 55: 102230. [CrossRef]

- Wachira, Virginia Kirigo. 2021."Crowdfunding in Kenya: Factors for Successful Campaign." Public finance Quarterly,3: 413-428. [CrossRef]

- Wang, Nianxin, Qingxiang Li, Huigang Liang, Taofeng Ye, and Shilun Ge. 2018."Understanding the importance of interaction between creators and backers in crowdfunding success." Electronic Commerce Research and Applications 27: 106-117. [CrossRef]

- Weiner, Bernard.1985. "An attributional theory of achievement motivation and emotion." Psychological review 92, (4): 548. [CrossRef]

- Wooldridge, Jeffrey M. 2019."Correlated random effects models with unbalanced panels." Journal of Econometrics 211, (1): 137-150. [CrossRef]

- World Bank, 2013. Crowdfunding’s Potential for the Developing World. Available at http://www.infodev.org/crowdfunding.

- World Economic Forum, V. 2020."The future of jobs report 2020." Retrieved from Geneva. Available at http://hdl.voced.edu.au/10707/555914.

- Yeh, Tsai-Lien, Tser-Yieth Chen, and Cheng-Chun Lee. 2019."Investigating the funding success factors affecting reward-based crowdfunding projects." Innovation 21, (3): 466-486. [CrossRef]

- Zeidy, Ibrahim A. 2020."Economic impact of covid-19 on micro, small and medium enterprises (msmes) in africa and policy options for mitigation." Common Mark. East. South. Africa. Nairobi. Available at https://smebizhub.viffaconsult.co.ke/wp-content/uploads/2020/11/Economic-Impact-of-Covid-19-on-MSMEs-in-Africa-and-Policy-Options-for-Mitigation-COMESA-Special-Report-August-2020.

- Zhao, Xin, Xiaowei Ma, Boyang Chen, Yuping Shang, and Malin Song. 2022. "Challenges toward carbon neutrality in China: Strategies and countermeasures." Resources, Conservation and Recycling 176: 105959. [CrossRef]

- Zribi, Sirine. 2022."Effects of social influence on crowdfunding performance: Implications of the covid-19 pandemic." Humanities and Social Sciences Communications 9, (1): 1-8. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).