Submitted:

21 June 2023

Posted:

21 June 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

- To determine the drivers of adopting EMAS and;

- To determine the effect of EMAS adoption on green environmental performance.

2. Literature review

3. Theoretical Understanding and Foundation

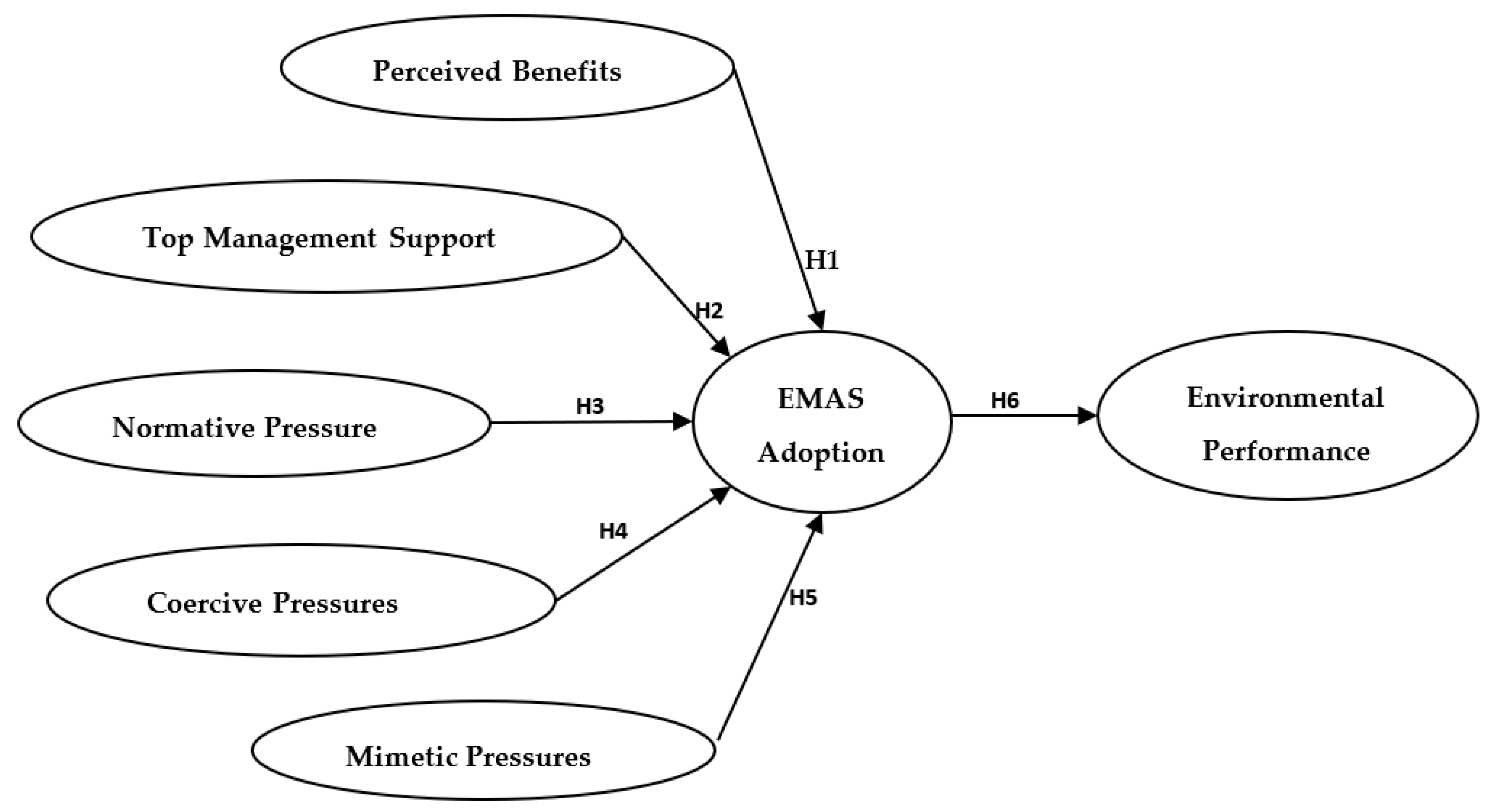

4. Research Model and Hypotheses

4.1. Perceived Benefits

4.2. Top Management Support

4.3. Normative Pressure

4.4. Coercive Pressure

4.5. Mimetic Pressure

4.6. EMAS and Environmental Performance

5. Methodology

5.1. Instruments

5.2. Sample and Data Collection Method

5.3. Constructs Measures

6. Data Analysis

7. Results

7.1. Assessment of the Measurement Model

5.2. Assessment of the Structural Model

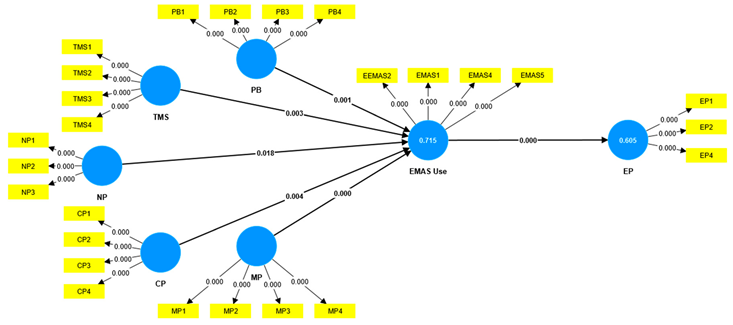

| Hypothesis No. | Relationship | Path coefficient | STDEV | T –Value | P - Value | Supported |

|---|---|---|---|---|---|---|

| H1 | PB → EMAS U | 0.153 | 0.046 | 3.350 | 0.001*** | Yes |

| H2 | TMS → EMAS U | 0.184 | 0.061 | 2.992 | 0.003** | Yes |

| H3 | NP → EMAS U | 0.105 | 0.045 | 2.359 | 0.018* | Yes |

| H4 | CP → EMAS U | 0.161 | 0.055 | 2.917 | 0.004** | Yes |

| H5 | MP → EMAS U | 0.509 | 0.054 | 9.343 | 0.000*** | Yes |

| H6 | EMAS U → EP | 0.778 | 0.037 | 21.218 | 0.000*** | Yes |

8. Discussion and conclusion

9. Implications

9.1. Theoretical Implications:

9.2. Practical Implications:

10. Limitations and Recommendations for Future Studies

Funding

Acknowledgments

Conflicts of Interest

References

- Asiaei, K.; Bontis, N.; Alizadeh, R.; Yaghoubi, M. Green Intellectual Capital and Environmental Management Accounting: Natural Resource Orchestration in Favor of Environmental Performance. Bus. Strategy Environ. 2022, 31, 76–93. [Google Scholar] [CrossRef]

- Latif, B.; Mahmood, Z.; Tze San, O.; Mohd Said, R.; Bakhsh, A. Coercive, Normative and Mimetic Pressures as Drivers of Environmental Management Accounting Adoption. Sustainability 2020, 12, 4506. [Google Scholar] [CrossRef]

- Nguyen, T.H. Factors Affecting the Implementation of Environmental Management Accounting: A Case Study of Pulp and Paper Manufacturing Enterprises in Vietnam. Cogent Bus. Manag. 2022, 9, 2141089. [Google Scholar] [CrossRef]

- Iqbal, Q.; Ahmad, N.H.; Li, Z. Frugal-Based Innovation Model for Sustainable Development: Technological and Market Turbulence. Leadersh. Organ. Dev. J. 2021. [Google Scholar] [CrossRef]

- Idris, K.M.; Mohamad, R. The Influence of Technological, Organizational and Environmental Factors on Accounting Information System Usage among Jordanian Small and Medium-Sized Enterprises. Int. J. Econ. Financ. Issues 2016, 6, 240–248. [Google Scholar]

- Normal, I.N.; Setini, M. Absorption Capacity and Development of Photocatalyst Green Ceramic Products with Moderation of Green Environment for Sustainability Performance of Developing Industries. Sustainability 2022, 14, 10457. [Google Scholar] [CrossRef]

- Wasiq, M.; Kamal, M.; Ali, N. Factors Influencing Green Innovation Adoption and Its Impact on the Sustainability Performance of Small- and Medium-Sized Enterprises in Saudi Arabia. Sustainability 2023, 15, 2447. [Google Scholar] [CrossRef]

- Idris, K.M.; Mohamad, R. AIS Usage Factors and Impact among Jordanian SMEs: The Moderating Effect of Environmental Uncertainty. J. Adv. Res. Bus. Manag. Stud. 2017, 6, 24–38. [Google Scholar]

- Chen, X.; Weerathunga, P.R.; Nurunnabi, M.; Kulathunga, K.M.M.C.B.; Samarathunga, W.H.M.S. Influences of Behavioral Intention to Engage in Environmental Accounting Practices for Corporate Sustainability: Managerial Perspectives from a Developing Country. Sustainability 2020, 12, 5266. [Google Scholar] [CrossRef]

- Deb, B.C.; Rahman, Md.M.; Rahman, M.S. The Impact of Environmental Management Accounting on Environmental and Financial Performance: Empirical Evidence from Bangladesh. J. Account. Organ. Change 2022. [CrossRef]

- Dissanayake, K.; Rajapakse, B. Environmental Management Accounting for Corporate Sustainability: A Case from a Sri Lankan Automobile Company. Int. J. Audit. Account. Stud. 2020, 2, 41–65. [Google Scholar]

- Shahzad, M.; Qu, Y.; Rehman, S.U.; Zafar, A.U. Adoption of Green Innovation Technology to Accelerate Sustainable Development among Manufacturing Industry. J. Innov. Knowl. 2022, 7, 100231. [Google Scholar] [CrossRef]

- Mukwarami, S.; Nkwaira, C.; van der Poll, H.M. Environmental Management Accounting Implementation Challenges and Supply Chain Management in Emerging Economies’ Manufacturing Sector. Sustainability 2023, 15, 1061. [Google Scholar] [CrossRef]

- Al-Tamimi, S.A. Towards Integrated Management Accounting System for Measuring Environmental Performance. 2022.

- Javed, F.; Yusheng, K.; Iqbal, N.; Fareed, Z.; Shahzad, F. A Systematic Review of Barriers in Adoption of Environmental Management Accounting in Chinese SMEs for Sustainable Performance. Front. Public Health 2022, 10, 832711. [Google Scholar] [CrossRef]

- Mohd Fuzi, N.; Habidin, N.F.; Janudin, S.E.; Ong, S.Y.Y.; Ku Bahador, K.M. Environmental Management Accounting Practices and Organizational Performance: The Mediating Effect of Information System. Meas. Bus. Excell. 2019, 23, 411–425. [Google Scholar] [CrossRef]

- Ha, V.T. Factors Affecting The Implementation Of Environmental Management Accounting In Manufacturing Enterprises: Evidence From Vietnam. J. Posit. Sch. Psychol. 2022, 6, 1–17. [Google Scholar]

- Iqbal, Q. The Era of Environmental Sustainability: Ensuring That Sustainability Stands on Human Resource Management. Glob. Bus. Rev. 2020, 21, 377–391. [Google Scholar] [CrossRef]

- Iqbal, Q.; Ahmad, N.H.; Li, Z.; Li, Y. To Walk in Beauty: Sustainable Leadership, Frugal Innovation and Environmental Performance. Manag. Decis. Econ. 2022, 43, 738–750. [Google Scholar] [CrossRef]

- Erauskin-Tolosa, A.; Zubeltzu-Jaka, E.; Heras-Saizarbitoria, I.; Boiral, O. ISO 14001, EMAS and Environmental Performance: A Meta-Analysis. Bus. Strategy Environ. 2020, 29, 1145–1159. [Google Scholar] [CrossRef]

- Kong, Y.; Javed, F.; Sultan, J.; Hanif, M.S.; Khan, N. EMA Implementation and Corporate Environmental Firm Performance: A Comparison of Institutional Pressures and Environmental Uncertainty. Sustainability 2022, 14, 5662. [Google Scholar] [CrossRef]

- Ema, 2022.Pdf.

- Kong, Y.; Javed, F.; Sultan, J.; Hanif, M.S.; Khan, N. EMA Implementation and Corporate Environmental Firm Performance: A Comparison of Institutional Pressures and Environmental Uncertainty. Sustainability 2022, 14, 5662. [Google Scholar] [CrossRef]

- Daddi, T.; Todaro, N.M.; Marrucci, L.; Iraldo, F. Determinants and Relevance of Internalisation of Environmental Management Systems. J. Clean. Prod. 2022, 374, 134064. [Google Scholar] [CrossRef]

- Saleh, M.M.A.; Jawabreh, O.A.A. ROLE OF ENVIRONMENTAL AWARENESS IN THE APPLICATION OF ENVIRONMENTAL ACCOUNTING DISCLOSURE IN TOURISM AND HOTEL COMPANIES AND ITS IMPACT ON INVESTOR’S DECISIONS IN AMMAN STOCK EXCHANGE. Int. J. Energy Econ. Policy 2020, 10, 417–426. [Google Scholar] [CrossRef]

- Khan, M.A. ESG Disclosure and Firm Performance: A Bibliometric and Meta Analysis. Res. Int. Bus. Finance 2022, 61, 101668. [Google Scholar] [CrossRef]

- Puertas, R.; Guaita-Martinez, J.M.; Carracedo, P.; Ribeiro-Soriano, D. Analysis of European Environmental Policies: Improving Decision Making through Eco-Efficiency. Technol. Soc. 2022, 70, 102053. [Google Scholar] [CrossRef]

- Carnini Pulino, S.; Ciaburri, M.; Magnanelli, B.S.; Nasta, L. Does ESG Disclosure Influence Firm Performance? Sustainability 2022, 14, 7595. [Google Scholar] [CrossRef]

- Chouaibi, S.; Rossi, M.; Siggia, D.; Chouaibi, J. Exploring the Moderating Role of Social and Ethical Practices in the Relationship between Environmental Disclosure and Financial Performance: Evidence from ESG Companies. Sustainability 2021, 14, 209. [Google Scholar] [CrossRef]

- Wu, S.; Li, Y. A Study on the Impact of Digital Transformation on Corporate ESG Performance: The Mediating Role of Green Innovation. Sustainability 2023, 15, 6568. [Google Scholar] [CrossRef]

- Naranjo Tuesta, Y.; Crespo Soler, C.; Ripoll Feliu, V. Carbon Management Accounting and Financial Performance: Evidence from the European Union Emission Trading System. Bus. Strategy Environ. 2021, 30, 1270–1282. [Google Scholar] [CrossRef]

- Lutfi, A.; Al-Khasawneh, A.L.; Almaiah, M.A.; Alsyouf, A.; Alrawad, M. Business Sustainability of Small and Medium Enterprises during the COVID-19 Pandemic: The Role of AIS Implementation. Sustainability 2022, 14, 5362. [Google Scholar] [CrossRef]

- Saeidi, S.P.; Othman, M.S.H.; Saeidi, P.; Saeidi, S.P. The Moderating Role of Environmental Management Accounting between Environmental Innovation and Firm Financial Performance. Int. J. Bus. Perform. Manag. 2018, 326–348. [Google Scholar] [CrossRef]

- Ismail, M.S.; Ramli, A.; Darus, F. Environmental Management Accounting Practices and Islamic Corporate Social Responsibility Compliance: Evidence from ISO14001 Companies. Procedia - Soc. Behav. Sci. 2014, 145, 343–351. [Google Scholar] [CrossRef]

- Xu, N.; Fan, X.; Hu, R. Adoption of Green Industrial Internet of Things to Improve Organizational Performance: The Role of Institutional Isomorphism and Green Innovation Practices. Front. Psychol. 2022, 13, 917533. [Google Scholar] [CrossRef]

- Tornatzky, L.; Fleischer, M. The Process of Technology Innovation, Lexington, MA 1990.

- Alshirah, M.; Lutfi, A.; Alshirah, A.; Saad, M.; Ibrahim, N.; Mohammed, F. Influences of the Environmental Factors on the Intention to Adopt Cloud Based Accounting Information System among SMEs in Jordan. Accounting 2021, 7, 645–654. [Google Scholar] [CrossRef]

- Lutfi, A.; Alsyouf, A.; Almaiah, M.A.; Alrawad, M.; Abdo, A.A.K.; Al-Khasawneh, A.L.; Ibrahim, N.; Saad, M. Factors Influencing the Adoption of Big Data Analytics in the Digital Transformation Era: Case Study of Jordanian SMEs. Sustainability 2022, 14, 1802. [Google Scholar] [CrossRef]

- Zhu, K.; Kraemer, K.L.; Xu, S. The Process of Innovation Assimilation by Firms in Different Countries: A Technology Diffusion Perspective on e-Business. Manag. Sci. 2006, 52, 1557–1576. [Google Scholar] [CrossRef]

- Brammer, S.; Hoejmose, S.; Marchant, K. Environmental Management in SMEs in the UK: Practices, Pressures and Perceived Benefits: Environmental Management in SMEs. Bus. Strategy Environ. 2012, 21, 423–434. [Google Scholar] [CrossRef]

- Piwowar-Sulej, K.; Iqbal, Q. Leadership Styles and Sustainable Performance: A Systematic Literature Review. J. Clean. Prod. 2023, 382, 134600. [Google Scholar] [CrossRef]

- Lutfi, A.; Al-Okaily, M.; Alsyouf, A.; Alsaad, A.; Taamneh, A. The Impact of AIS Usage on AIS Effectiveness among Jordanian SMEs: A Multi-Group Analysis of the Role of Firm Size. Glob. Bus. Rev. 2020, 0972150920965079. [Google Scholar] [CrossRef]

- Lutfi, A.; Al-Khasawneh, A.L.; Almaiah, M.A.; Alshira’h, A.F.; Alshirah, M.H.; Alsyouf, A.; Alrawad, M.; Al-Khasawneh, A.; Saad, M.; Ali, R.A. Antecedents of Big Data Analytic Adoption and Impacts on Performance: Contingent Effect. Sustainability 2022, 14, 15516. [Google Scholar] [CrossRef]

- Organizational Citizenship Behavior for the Environment Decoded: Sustainable Leaders, Green Organizational Climate and Person-Organization Fit | Emerald Insight. Available online: https://www.emerald.com/insight/content/doi/10.1108/BJM-09-2021-0347/full/html (accessed on 6 June 2023).

- Jamil, C.Z.M.; Mohamed, R.; Muhammad, F.; Ali, A. Environmental Management Accounting Practices in Small Medium Manufacturing Firms. Procedia - Soc. Behav. Sci. 2015, 172, 619–626. [Google Scholar] [CrossRef]

- Latan, H.; Chiappetta Jabbour, C.J.; Lopes de Sousa Jabbour, A.B.; Wamba, S.F.; Shahbaz, M. Effects of Environmental Strategy, Environmental Uncertainty and Top Management’s Commitment on Corporate Environmental Performance: The Role of Environmental Management Accounting. J. Clean. Prod. 2018, 180, 297–306. [Google Scholar] [CrossRef]

- Lutfi, A. Understanding the Intention to Adopt Cloud-Based Accounting Information System in Jordanian SMEs. Int. J. Digit. Account. Res. 2022, 22, 47–70. [Google Scholar] [CrossRef] [PubMed]

- Xu, M.; Zou, X.; Su, Z.; Zhang, S.; Ge, W. How Do Complementary Technological Linkages Affect Carbon Emissions Efficiency? J. Innov. Knowl. 2023, 8, 100309. [Google Scholar] [CrossRef]

- Adjei, J.K.; Adams, S.; Mamattah, L. Cloud Computing Adoption in Ghana; Accounting for Institutional Factors. Technol. Soc. 2021, 65, 101583. [Google Scholar] [CrossRef]

- Lutfi, A. Investigating the Moderating Role of Environmental Uncertainty between Institutional Pressures and ERP Adoption in Jordanian SMEs. J. Open Innov. Technol. Mark. Complex. 2020, 6, 91. [Google Scholar] [CrossRef]

- DiMaggio, P.J.; Powell, W.W. The Iron Cage Revisited: Institutional Isomorphism and Collective Rationality in Organizational Fields. Am. Sociol. Rev. 1983, 147–160. [Google Scholar] [CrossRef]

- Latif, B.; Mahmood, Z.; Tze San, O.; Mohd Said, R.; Bakhsh, A. Coercive, Normative and Mimetic Pressures as Drivers of Environmental Management Accounting Adoption. Sustainability 2020, 12, 4506. [Google Scholar] [CrossRef]

- Ong, T.S.; Lee, A.S.; Latif, B.; Sroufe, R.; Sharif, A.; Heng Teh, B. Enabling Green Shared Vision: Linking Environmental Strategic Focus and Environmental Performance through ISO 14001 and Technological Capabilities. Environ. Sci. Pollut. Res. 2023, 30, 31711–31726. [Google Scholar] [CrossRef]

- Solovida, G.T.; Latan, H. Linking Environmental Strategy to Environmental Performance: Mediation Role of Environmental Management Accounting. Sustain. Account. Manag. Policy J. 2017, 8, 595–619. [Google Scholar] [CrossRef]

- Do Dynamic Capabilities Matter? A Study on Environmental Performance and the Circular Economy in European Certified Organisations - Marrucci - 2022 - Business Strategy and the Environment - Wiley Online Library. Available online: https://onlinelibrary.wiley.com/doi/abs/10.1002/bse.2997 (accessed on 6 June 2023).

- Burritt, R.L.; Herzig, C.; Schaltegger, S.; Viere, T. Diffusion of Environmental Management Accounting for Cleaner Production: Evidence from Some Case Studies. J. Clean. Prod. 2019, 224, 479–491. [Google Scholar] [CrossRef]

- The Contribution of the Eco-Management and Audit Scheme to the Environmental Performance of Manufacturing Organisations - Marrucci - 2022 - Business Strategy and the Environment - Wiley Online Library. Available online: https://onlinelibrary.wiley.com/doi/abs/10.1002/bse.2958 (accessed on 6 June 2023).

- Alshira’h, A.F.; Alsqour, M.; Lutfi, A.; Alsyouf, A.; Alshirah, M. A Socio-Economic Model of Sales Tax Compliance. Economies 2020, 8, 88. [Google Scholar] [CrossRef]

- Lutfi, A. Factors Influencing the Continuance Intention to Use Accounting Information System in Jordanian SMEs from the Perspectives of UTAUT: Top Management Support and Self-Efficacy as Predictor Factors. Economies 2022, 10, 75. [Google Scholar] [CrossRef]

- Lutfi, A. Understanding Cloud Based Enterprise Resource Planning Adoption among SMEs in Jordan. J. Theor. Appl. Inf. Technol. 2021, 99, 5944–5953. [Google Scholar] [CrossRef]

- Hoang, N.-L.; Landolfi, A.; Kravchuk, A.; Girard, E.; Peate, J.; Hernandez, J.M.; Gaborieau, M.; Kravchuk, O.; Gilbert, R.G.; Guillaneuf, Y.; et al. Toward a Full Characterization of Native Starch: Separation and Detection by Size-Exclusion Chromatography. J. Chromatogr. A 2008, 1205, 60–70. [Google Scholar] [CrossRef]

- Gerbing, D.W.; Anderson, J.C. An Updated Paradigm for Scale Development Incorporating Unidimensionality and Its Assessment. J. Mark. Res. 1988.

- Tabachnick, B.G.; Fidell, L.S. Computer-Assisted Research Design and Analysis; Allyn and Bacon: Boston, 2001; ISBN 978-0-205-32178-0. [Google Scholar]

- Lisi, I.E. Translating Environmental Motivations into Performance: The Role of Environmental Performance Measurement Systems. Manag. Account. Res. 2015, 29, 27–44. [Google Scholar] [CrossRef]

- Hair, J.F.; Sarstedt, M.; Ringle, C.M. Rethinking Some of the Rethinking of Partial Least Squares. Eur. J. Mark. 2019, 53, 566–584. [Google Scholar] [CrossRef]

- Phan, T.N.; Baird, K.; Su, S. Environmental Activity Management: Its Use and Impact on Environmental Performance. Account. Audit. Account. J. 2018, 31, 651–673. [Google Scholar] [CrossRef]

- Wang, S.; Wang, H.; Wang, J. Exploring the Effects of Institutional Pressures on the Implementation of Environmental Management Accounting: Do Top Management Support and Perceived Benefit Work? Bus. Strategy Environ. 2019, 28, 233–243. [Google Scholar] [CrossRef]

- Malik, S.; Chadhar, M.; Vatanasakdakul, S.; Chetty, M. Factors Affecting the Organizational Adoption of Blockchain Technology: Extending the Technology–Organization–Environment (TOE) Framework in the Australian Context. Sustainability 2021, 13, 9404. [Google Scholar] [CrossRef]

- Phan, T.N.; Baird, K. The Comprehensiveness of Environmental Management Systems: The Influence of Institutional Pressures and the Impact on Environmental Performance. J. Environ. Manage. 2015, 160, 45–56. [Google Scholar] [CrossRef]

- Tashakor, S.; Appuhami, R.; Munir, R. Environmental Management Accounting Practices in Australian Cotton Farming: The Use of the Theory of Planned Behaviour. Account. Audit. Account. J. 2019, 32, 1175–1202. [Google Scholar] [CrossRef]

- Marrucci, L.; Daddi, T.; Iraldo, F. The Circular Economy, Environmental Performance and Environmental Management Systems: The Role of Absorptive Capacity. J. Knowl. Manag. 2022, 26, 2107–2132. [Google Scholar] [CrossRef]

- Lutfi, A.; Alshira’h, A.F.; Alshirah, M.H.; Al-Okaily, M.; Alqudah, H.; Saad, M.; Ibrahim, N.; Abdelmaksoud, O. Antecedents and Impacts of Enterprise Resource Planning System Adoption among Jordanian SMEs. Sustainability 2022, 14, 3508. [Google Scholar] [CrossRef]

- Lutfi, A.; Al-Okaily, M.; Alsyouf, A.; Alsaad, A.; Taamneh, A. The Impact of AIS Usage on AIS Effectiveness among Jordanian SMEs: A Group Analysis of the Role of Firm Size. Glob. Bus. Rev. 2020, 21, 1–19. [Google Scholar] [CrossRef]

| Construct | Items | Adopted From |

|---|---|---|

| Perceived benefits | 4 | [23] |

| TMS | 4 | [23] |

| Mimetic pressure | 4 | [2] |

| Coercive pressure | 4 | [2] |

| Normative pressure | 4 | [2] |

| EMAS adoption | 6 | [2] |

| Environmental performance | 4 | [64] |

| Latent Construct | Cronbach’s alpha | Composite Reliability (rho_c) | AVE |

|---|---|---|---|

| > 0.7 | > 0.7 | > 0.5 | |

| Environmental Performance (EP) | 0.720 | 0.775 | 0.543 |

| EMAS Use (EMAS U) | 0.755 | 0.844 | 0.576 |

| Perceive Benefits (PB) | 0.775 | 0.856 | 0.598 |

| Top Management Support (TMS) | 0.704 | 0.815 | 0.527 |

| Coercive Pressure (CP) | 0.860 | 0.908 | 0.715 |

| Normative Pressure (NP) | 0.897 | 0.935 | 0.827 |

| Memetic Pressure (MP) | 0.713 | 0.812 | 0.522 |

| CP | EMAS Use | EP | MP | NP | PB | TMS | |

|---|---|---|---|---|---|---|---|

| CP | 0.845 | ||||||

| EMAS Use | 0.525 | 0.759 | |||||

| EP | 0.449 | 0.728 | 0.737 | ||||

| MP | 0.426 | 0.717 | 0.701 | 0.722 | |||

| NP | 0.588 | 0.449 | 0.372 | 0.335 | 0.909 | ||

| PB | 0.034 | 0.425 | 0.327 | 0.414 | 0.071 | 0.773 | |

| TMS | 0.439 | 0.640 | 0.543 | 0.602 | 0.371 | 0.263 | 0.726 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).