Submitted:

03 July 2023

Posted:

04 July 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature Review

3. Modelling the Processability of Cost Accounting for Material and Energy Flows

4. Modelling Material and Energy Flows and Costing

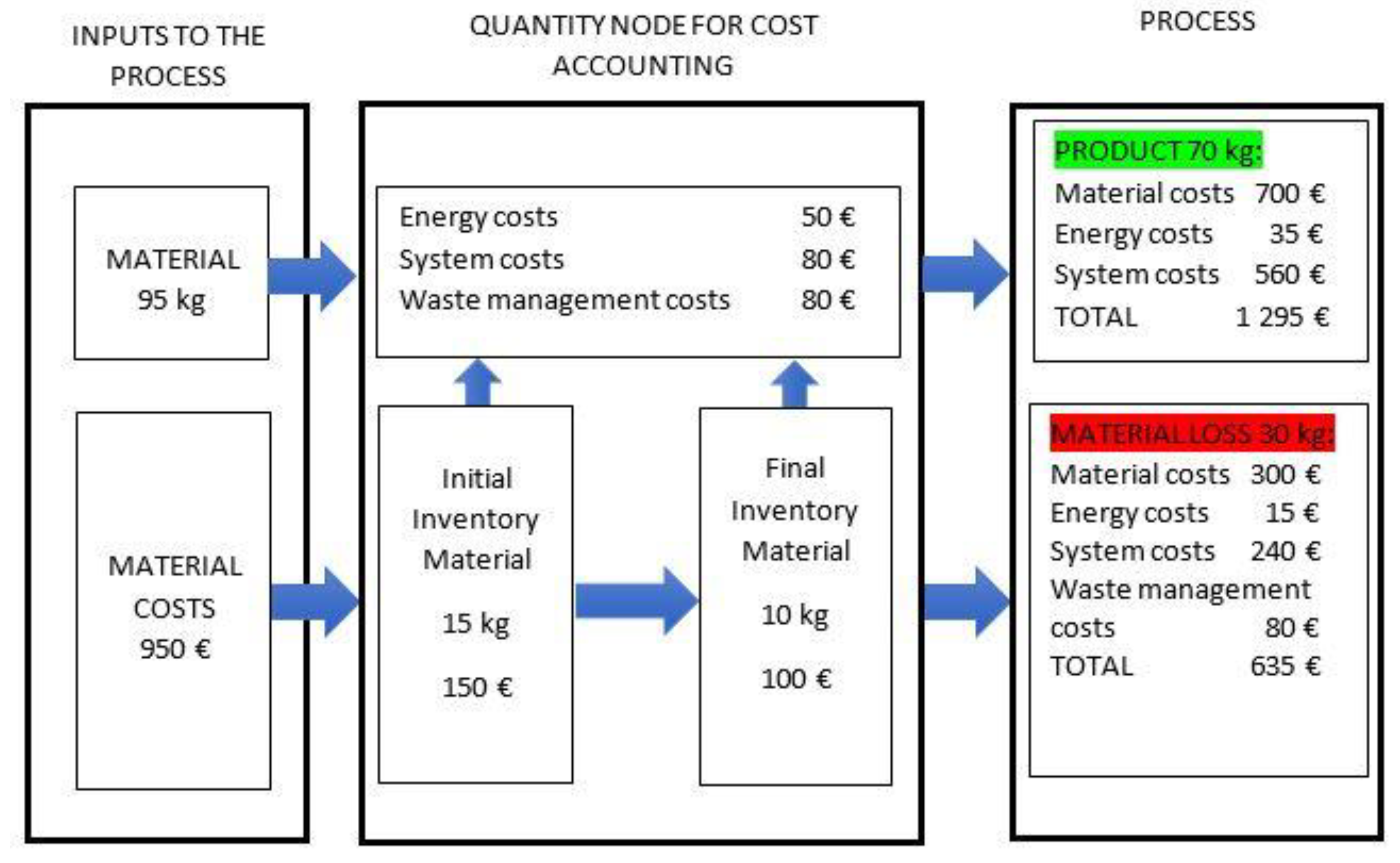

5. Inputs and Outputs of Business Processes

- Simple manufacturing process: This involves tracing the flow of each material and energy from start to finish, from input to output. In this case, it is possible to track and identify the contribution of each material and energy input in the final products.

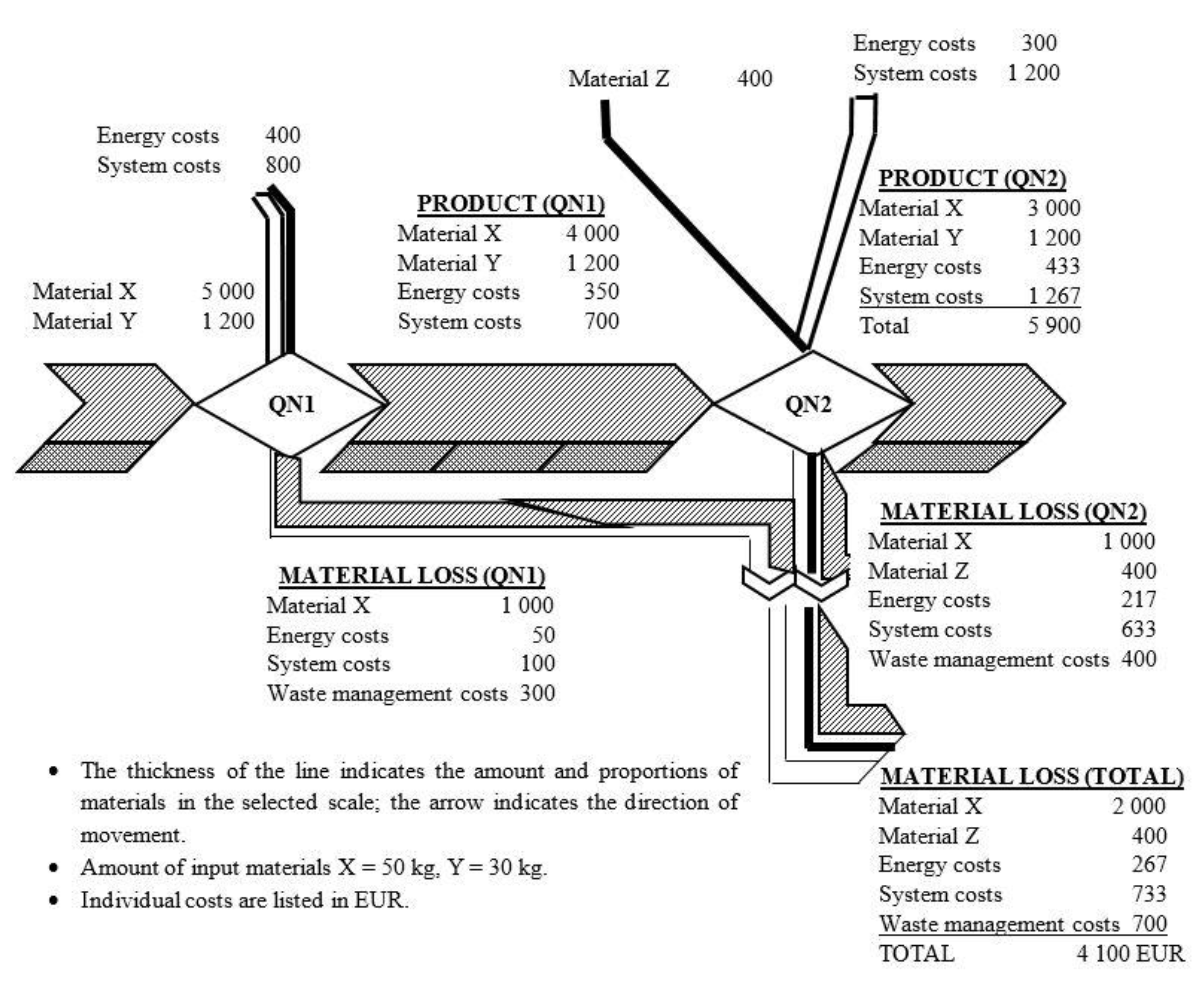

- Complex process: In more complex processes, the initial material and energy inputs are transformed into intermediate inputs, which cannot be individually recognized in the final products. In such cases, the intermediate products are considered as outputs. Please refer to Figure 3 for a visual representation.

- 1.

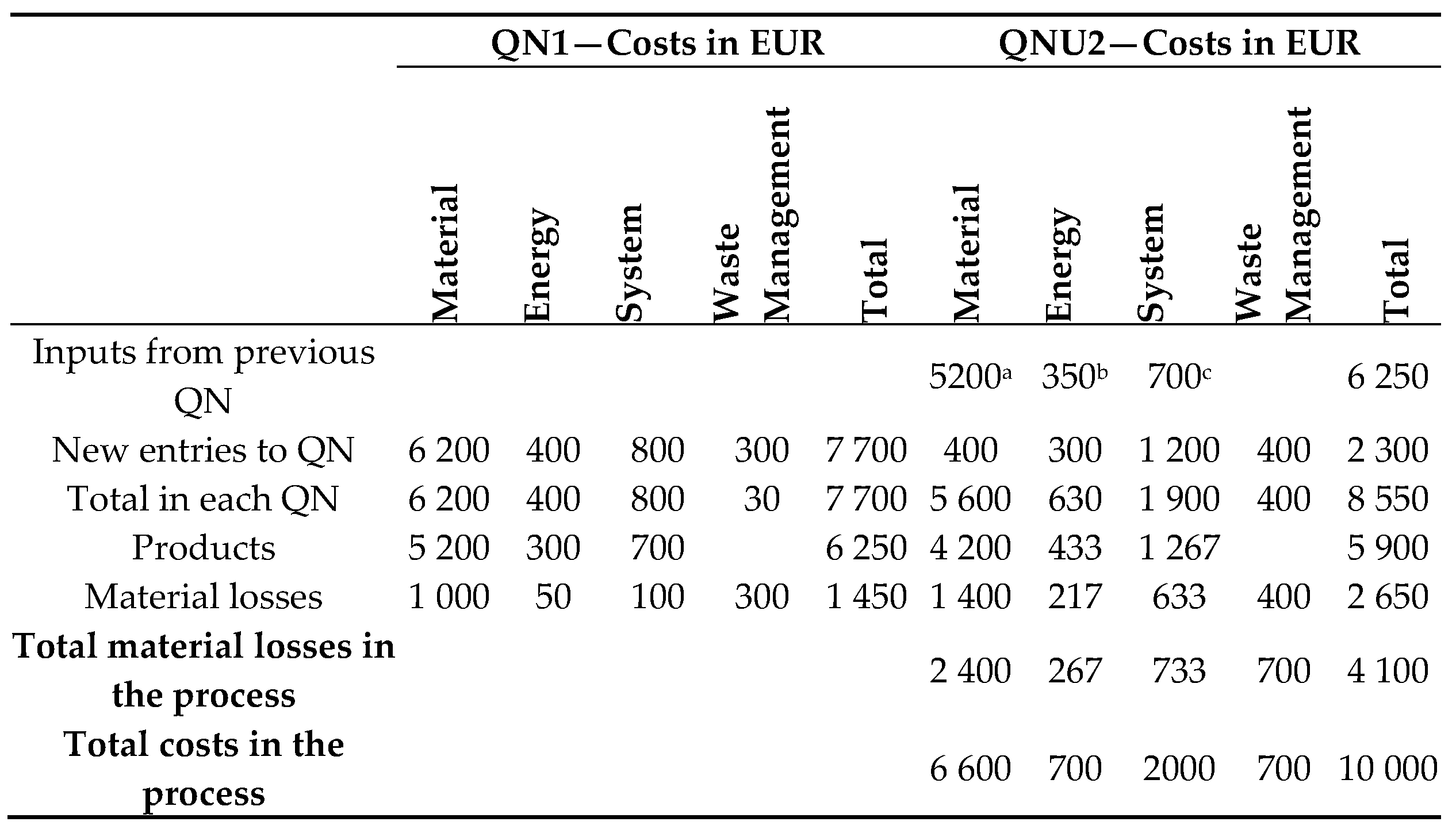

- Allocating energy, system, and waste management costs between quantity nodes:

- 2.

- More aggregated data for the entire process or technical installation can be utilized to quantify the costs of quantity nodes (QNs) in two sequential steps. First, these costs are calculated for the entire process within the cost accounting boundaries. Subsequently, they are allocated to individual quantity nodes based on an appropriate criterion, such as machine time, production volume, number of employees, hours worked, production area, etc. Table 3 provides an example of such a breakdown for a specified period.

- 3.

- Allocating energy, system, and waste management costs to products and material losses in each quantity node:

- 4.

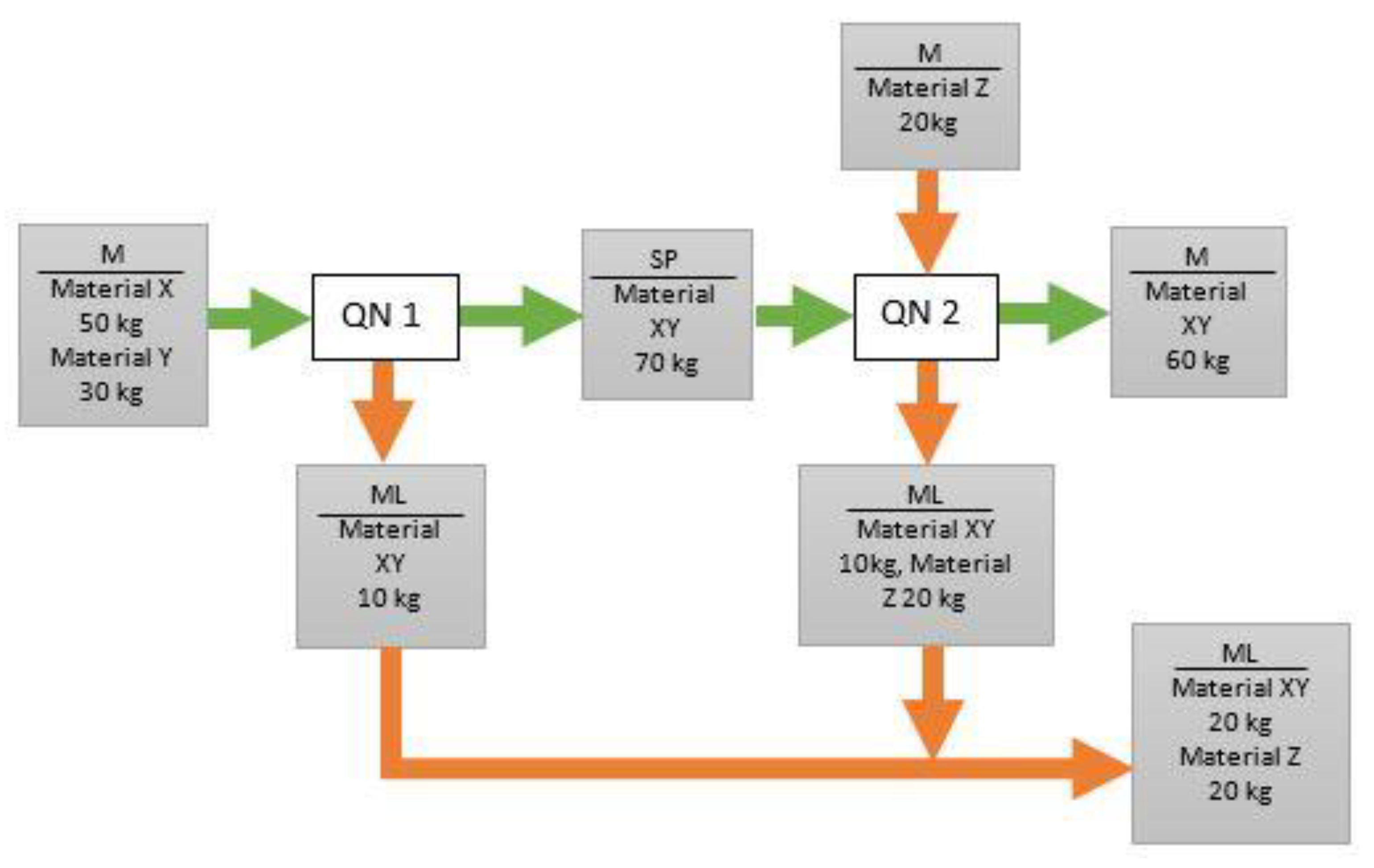

- In this approach, all waste management costs are attributed to material losses. Table 4 illustrates such an allocation for a specific period using the percentage distribution of material in QN1 and QN2 as the criterion. For example, in QN1, 87.5% of the material is allocated to products (70 kg/80 kg), while 12.5% is allocated to material losses (10 kg/80 kg). Similarly, in QN2, 66.67 % is allocated to products (60 kg/90 kg), and 33.33% is allocated to material losses (30 kg/90 kg) [23].

- 5.

- Alternative to percentage distribution of material:

- 6.

- Instead of using a percentage distribution of material based on weight, an alternative approach can be employed. This alternative approach utilizes the weight distribution of all materials in each quantity node as the allocation criterion. If this is not feasible, the percentage distribution of the main material directly related to the process is used as the criterion.

- 7.

- An alternative approach to the allocation criteria for energy consumption:

- 8.

-

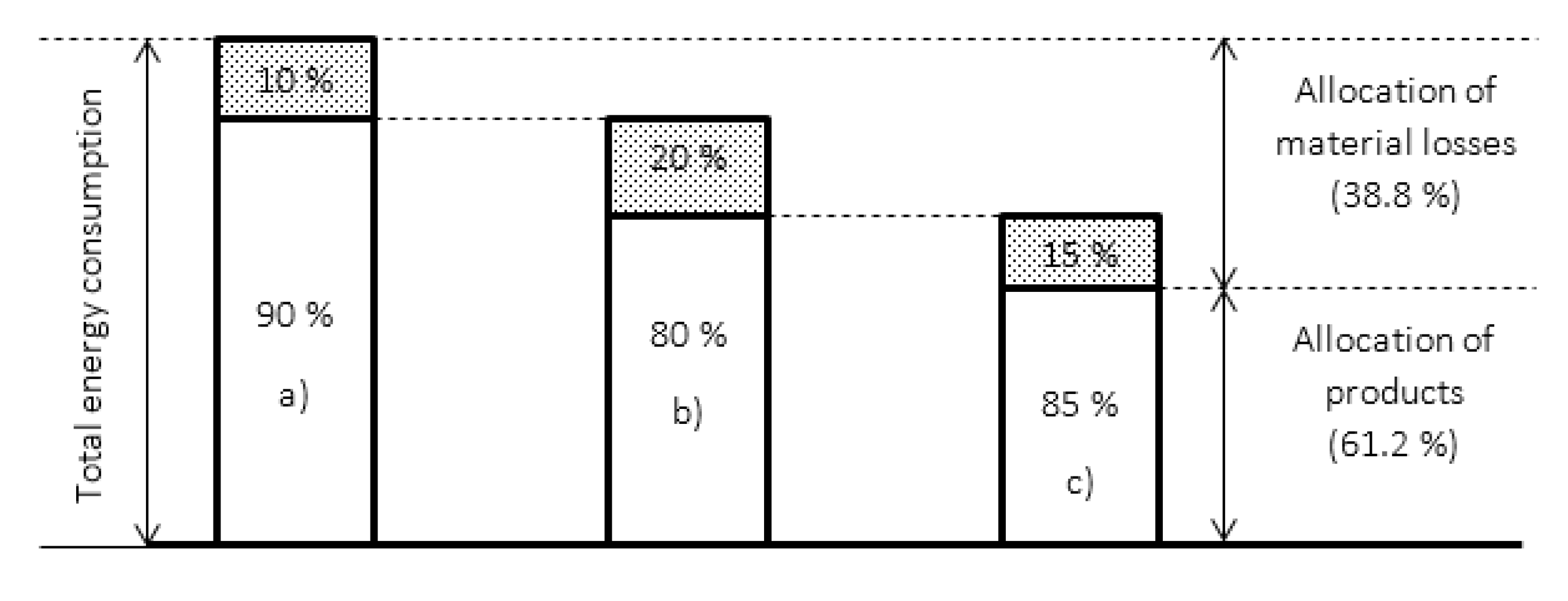

The common criterion for allocating energy consumption between products and material losses is the mass distribution of material inputs. However, if more detailed information on the energy efficiency of machines in the quantity nodes is available, a more accurate quantification of inefficiency and energy waste can be implemented (Figure 4). For example:

- (a)

- If 10% of a machine's operation represents idle running, this portion of energy is allocated to material losses rather than products.

- (b)

- A material inefficiency of 20% results in allocating 80% of the remaining energy consumption to products.

- (c)

- A 15% reduction inefficiency from the optimal state leads to allocating only 85% of the increased energy consumption to products.

- Energy allocated to products: 90%, 80%, 85%, 61.2%

- Energy allocated to material losses: 100% - 61.2% = 38.8%

| Cost Types | QN1 | QN2 | Total |

|---|---|---|---|

| Energy costs | 400 | 300 | 700 |

| System costs | 800 | 1200 | 2000 |

| Waste management costs | 300 | 400 | 700 |

| Cost Types | QN1 | QN2 |

|---|---|---|

| Energy costs | 400 | 300 |

| Products | 350 | 200 |

| Material losses | 50 | 100 |

| System costs | 800 | 1200 |

| Products | 700 | 800 |

| Material losses | 100 | 400 |

| Waste management costs | 300 | 400 |

| Products | 0 | 0 |

| Material losses | 300 | 400 |

6. Integrated Presentation and Analysis of Cost Data

7. Implications and Benefits of Adopting Material-Energy Flows Accounting

- Cost Reduction: The implementation of a functional environmental management system and the adoption of cost accounting practices for material-energy flows can yield significant cost reductions for companies. By meticulously tracking and analyzing material and energy costs, organizations can identify areas of inefficiency and waste, leading to the implementation of cost-saving measures, resource optimization, and reduction of material and energy losses. This proactive approach enables companies to achieve improved profitability by minimizing production costs.

- Environmental Performance: The establishment of an environmental management system and the integration of cost accounting practices focused on material-energy flows empower companies to assess and address their environmental impacts. Through quantification and analysis of these impacts, organizations can develop effective strategies to mitigate their carbon footprint, minimize waste generation, and enhance overall environmental performance. This comprehensive approach ensures that companies prioritize sustainability objectives and contribute to the preservation of the environment.

- Regulatory Compliance: Stringent environmental regulations and requirements are imposed by regulatory bodies on businesses across various industries. By implementing an environmental management system aligned with ISO standards and employing accurate cost accounting practices for material-energy flows, companies can ensure compliance with these regulations. The ability to precisely track and report environmental performance facilitates audits and regulatory inspections, enabling companies to demonstrate their adherence to regulatory guidelines effectively.

- Sustainable Supply Chain: Extending the material-energy flow cost accounting system to encompass the supply chain enables collaborative efforts between companies, suppliers, and customers to optimize resource utilization and improve environmental performance. This integrated approach fosters sustainable practices throughout the entire value chain, promoting the achievement of sustainability objectives and enhancing the reputation of all stakeholders involved.

- Decision-Making and Goal Setting: The availability of reliable and accurate data on material-energy flows empowers informed decision-making and goal setting within organizations. By leveraging this data, companies can identify areas for improvement, establish realistic targets for reducing material and energy consumption, and effectively track progress towards sustainability goals. This data-driven approach facilitates strategic decision-making that aligns economic and environmental objectives, enabling companies to make informed choices that balance financial viability with environmental responsibility.

8. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Atkinson, A. A.; Kaplan, R. S.; Matsumura, E. M.; Young, S. M. Management Accounting: Information for Decision-Making and Strategy Execution, 6th ed.; Pearson Education Limited, 2012; p. 550. [CrossRef]

- Schaltegger, S.; Burritt, R. Contemporary environmental accounting: issues, concepts and practice, 1st ed.; Routledge, 2017; pp. 441. [CrossRef]

- Chovancová, J.; Rovňák, M.; Shpintal, M.; Shevchenko, T.; Chovanec, F. Perception of Benefits and Barriers Associated with the Management Systems Integration - A Comparative Study of Slovak and Ukrainian Organizations. TEM J. 2022, 11, 772. [Google Scholar] [CrossRef]

- Varaniūtė, V.; Žičkutė, I.; Žandaravičiūtė, A. The Changing Role of Management Accounting in Product Development: Directions to Digitalization, Sustainability, and Circularity. Sustainability 2022, 14, 4740. [Google Scholar] [CrossRef]

- Chung, J.; Cho, C.H. Current Trends within Social and Environmental Accounting Research: A Literature Review. Account. Perspect. 2018, 17, 207–239. [Google Scholar] [CrossRef]

- Deegan, C. An overview of legitimacy theory as applied within the social and environmental accounting literature. In Sustainability accounting and accountability, 2nd ed.; Routledge, 2014; pp. 248-272.

- Schaltegger, S.; Freund, F.L.; Hansen, E.G. Business cases for sustainability: the role of business model innovation for corporate sustainability. Int. J. Innov. Sustain. Dev. 2012, 6, 95–119. [Google Scholar] [CrossRef]

- Burritt, R.L.; Schaltegger, S. Sustainability accounting and reporting: fad or trend? Accounting, Audit. Account. J. 2010, 23, 829–846. [Google Scholar] [CrossRef]

- Epstein, M. J.; Buhovac, A. R. Making sustainability work: Best practices in managing and measuring corporate social, environmental, and economic impacts, 2nd ed.; Berrett-koehler publishers, 2014; p. 304.

- ISO 14001:2015. Environmental management systems - Requirements with guidance for use. 2015.

- Bebbington, J.; Unerman, J.; O’Dwyer, B. Introduction to sustainability accounting and accountability. In Sustainability accounting and accountability, 2nd ed.; Routledge, 2014; pp. 3-14.

- Suadiye, G. Contemporary Developments on Sustainability Accounting and Reporting: An Overview Perspective. In Auditing Ecosystem and Strategic Accounting in the Digital Era: Global Approaches and New Opportunities, 1st ed.; Springer, Cham, 2021; pp. 59-86.

- Azapagic, A.; Stamford, L.; Youds, L.; Barteczko-Hibbert, C. Towards sustainable production and consumption: A novel DEcision-Support Framework IntegRating Economic, Environmental and Social Sustainability (DESIRES). Comput. Chem. Eng. 2016, 91, 93–103. [Google Scholar] [CrossRef]

- Chovancová, J.; Huttmanová, E. Possibilities of management systems implementation with focus on their mutual integration. Hradec Economic Days (13th International Scientific Conference on Hradec Economic Days). Hradec Králové, Czech republic, 2015.

- López-Gamero, M.D.; Molina-Azorín, J.F.; Claver-Cortés, E. The whole relationship between environmental variables and firm performance: Competitive advantage and firm resources as mediator variables. J. Environ. Manag. 2009, 90, 3110–3121. [Google Scholar] [CrossRef] [PubMed]

- Galdeano-Gómez, E. Does an Endogenous Relationship Exist between Environmental and Economic Performance? A Resource-Based View on the Horticultural Sector. Environ. Resour. Econ. 2008, 40, 73–89. [Google Scholar] [CrossRef]

- Henri, J.-F.; Journeault, M.; Rodrigue, M. The Domino Effect of Perceived Stakeholder Pressures on Eco-Controls. Account. Public Interes. 2021, 21, 105–136. [Google Scholar] [CrossRef]

- Burritt, R.L.; Saka, C. Environmental management accounting applications and eco-efficiency: case studies from Japan. J. Clean. Prod. 2006, 14, 1262–1275. [Google Scholar] [CrossRef]

- Dunk, A. Assessing the Effects of Product Quality and Environmental Management Accounting on the Competitive Advantage of Firms. Australas. Account. Bus. Finance J. 2007, 1, 28–38. [Google Scholar] [CrossRef]

- Jasch, C. The use of Environmental Management Accounting (EMA) for identifying environmental costs. J. Clean. Prod. 2003, 11, 667–676. [Google Scholar] [CrossRef]

- Hinz, K.; Wagner, B.; Enzler, S. Developments in material flow management: outlook and perspectives, 1st ed.; Physica-Verlag HD, 2006; pp. 201.

- Kokubu, K.; Kitada, H. Material flow cost accounting and existing management perspectives. J. Clean. Prod. 2015, 108, 1279–1288. [Google Scholar] [CrossRef]

- Majerník, M.; Andrejovský, P.; Daneshjo, N.; Sančiová, G. Environmental Business Economics, 1st ed.; Typopress s. r. o., 2017; pp. 250.

- ISO 14051: 2011. Material flow cost accounting - General framework. 2011.

- ISO 50001:2018. Energy management systems - Requirements with guidance for use. 2018.

- Kokubu, K.; Kitada, H.; Nishitani, K.; Shinohara, A. How material flow cost accounting contributes to the SDGs through improving management decision-making. J. Mater. Cycles Waste Manag. 2023, 1–11. [Google Scholar] [CrossRef]

finished product flow,

finished product flow,  material loss flow.

material loss flow.

finished product flow,

finished product flow,  material loss flow.

material loss flow.

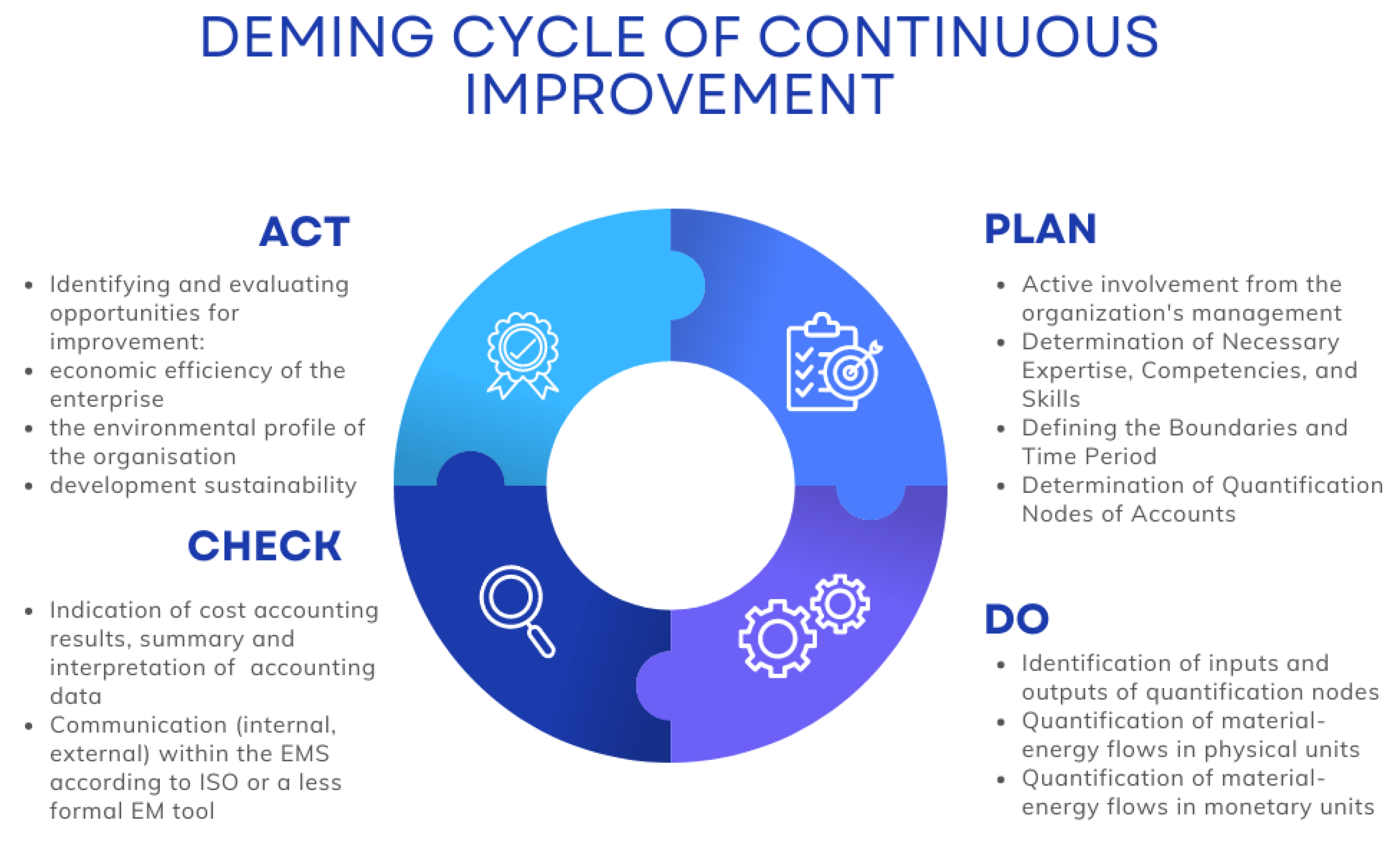

| Step | Description |

|---|---|

| 1 MANAGEMENT INVOLVEMENT |

The effective implementation of accounting practices requires strong support from top management within the organization. Management should actively participate in the process by providing leadership during implementation, assigning roles and responsibilities, allocating necessary resources, monitoring progress, reviewing results, and making decisions to improve the environmental-economic profile. |

| 2 DETERMINING THE REQUIRED EXPERTISE |

A comprehensive range of expertise is needed, particularly in areas such as operations design, production procurement, and technical knowledge related to material and energy flows within the organization. This includes understanding the implications of processes, quality management, corrective actions for environmental management, and knowledge of environmental aspects, impacts, and risks (EAI&R). Additionally, expertise in cost-benefit accounting for material and energy flows is essential. |

| 3 DEFINING BOUNDARIES AND TIME PERIOD FOR ACCOUNTING ANALYSES |

Organizations have the flexibility to determine the boundaries for accounting analyses, whether it involves a single process, multiple processes, an entire facility, or a supply chain. It is crucial to focus on processes with significant EAI&R potential. The time period for data collection should be sufficiently long to capture all relevant data and variations in processes, such as monthly, multiple months, six months, or a year. The time period can be aligned with the production of specific product items, for example. |

| 4 IDENTIFYING QUANTITY NODES (QNs) |

Various processes can be designated as quantity nodes (QNs) within the accounting framework. Examples of QNs include material receiving, semi-finished goods splitting, storage, intermediate storage, machining, welding, shipping, and others. The selection of quantity nodes is based on process information. Additional quantity nodes can be determined at locations with significant material losses, such as energy for transportation, oil leaks, pressurized air, or system costs. |

| 5 IDENTIFYING INPUTS AND OUTPUTS FOR EACH QN |

For each quantification node within the accounting boundaries, it is essential to identify inputs (materials and energy) and outputs (products, material losses, and energy losses). Energy and energy losses can either be included in the materials and material losses or estimated separately, depending on the organization's discretion. Identifying inputs and outputs for quantity nodes facilitates the linking of quantity nodes within the cost accounting boundaries, enabling interrelated evaluation of quantity nodes data throughout the system under study. |

| 6 QUANTIFYING MATERIAL FLOWS IN PHYSICAL UNITS |

For each quantity node, it is necessary to quantify inputs and outputs in physical units, such as weight, number of pieces, volume, length, etc. These measurements should be converted into a standardized unit (e.g., weight) to enable material balances for each quantity node. Material balance requires ensuring that the total quantity of outputs (products and material losses) equals the total quantity of inputs. All materials within the accounting boundaries should be quantified, while materials with minimal environmental or financial significance may be excluded. |

| 7 QUANTIFICATION OF MATERIAL FLOWS IN MONETARY UNITS |

MATERIAL COSTS For each quantity node, it is necessary to quantify the costs of inputs and outputs, including products and material losses. These costs can be determined based on various factors such as historical data, current costs, or costs for reproduction, depending on the organization's chosen cost accounting method. Additionally, material costs associated with changes in material inventory within each quantity node should also be quantified. ENERGY COSTS Energy costs need to be quantified for each quantity node in terms of energy consumption. If the energy costs of individual tasks are unknown or challenging to measure, the total energy costs of the selected processes should be allocated among the quantity nodes. Subsequently, the energy costs within each quantity node should be divided between products and material losses. SYSTEM COSTS System costs encompass all in-house material handling costs, excluding material, energy, and waste management costs. These costs include labour, depreciation, maintenance, transportation, and other relevant expenses. If the costs within each quantity node are unknown or difficult to measure, they should be allocated to the total system costs of the selected processes among the quantity nodes. Afterwards, the system costs of each quantity node should be apportioned between products and material losses. WASTE TREATMENT COSTS Waste treatment costs pertain to the expenses associated with managing material losses generated within each quantity node. It is essential to quantify these costs for each quantity node. |

| 8 SUMMARIZATION AND INTERPRETATION OF ACCOUNTING DATA |

The data acquired during the accounting analysis should be summarized in a format suitable for further interpretation, such as a material flow cost matrix or a material flow diagram. Summarized data allows organizations to identify quantity nodes with significant environmental and financial material losses. These quantity nodes can then undergo more detailed analysis and can be aggregated for the entire process under examination. |

| 9 COMMUNICATION OF ACCOUNTING RESULTS |

The outcomes of the accounting analysis should be effectively communicated to relevant stakeholders both within and outside the organization. This includes internal communication with management and external communication with stakeholders. The information derived from the accounting analysis can support decision-making processes aimed at improving both environmental and financial performance. Additionally, it can assist in developing effective communication tools to engage stakeholders. |

| 10 IDENTIFYING AND ASSESSING OPPORTUNITIES FOR IMPROVEMENT |

Identifying opportunities for improvement is a crucial aspect of cost accounting for material and energy flows in an organization. Actions aimed at achieving improvements may involve material substitution, modifications to production line processes or products, and the identification of research and innovation activities focused on enhancing material and energy efficiency. The cost accounting process not only facilitates improvements in accounting and information systems but also opens up avenues for overall organizational improvement. |

| Composition of Products and Material Losses | Production Result (Weight-kg) | Unit Cost (EUR/kg) | Composition of Products and Material Losses |

|---|---|---|---|

| Products | 60 | 4650 | |

| Material XY | 60 | 77.5 | 4650 |

| Material Z | 0 | 20 | 0 |

| Material losses | 40 | 1950 | |

| Material XY | 20 | 77.5 | 1550 |

| Material Z | 20 | 20 | 400 |

| Total | 100 | 6600 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).