Submitted:

19 July 2023

Posted:

20 July 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature review

2.1. Quality of experience

2.2. User retention intension

2.3. Brand trust

2.4. Brand attachment

3. Methodology

3.1. Research approach

3.2. Case selection

3.3. Data collection

3.4. Data analysis

3.5. Theoretical saturation test

4. fsQCA analysis

4.1. Introduction and applicabiliity analysis of fsQCA

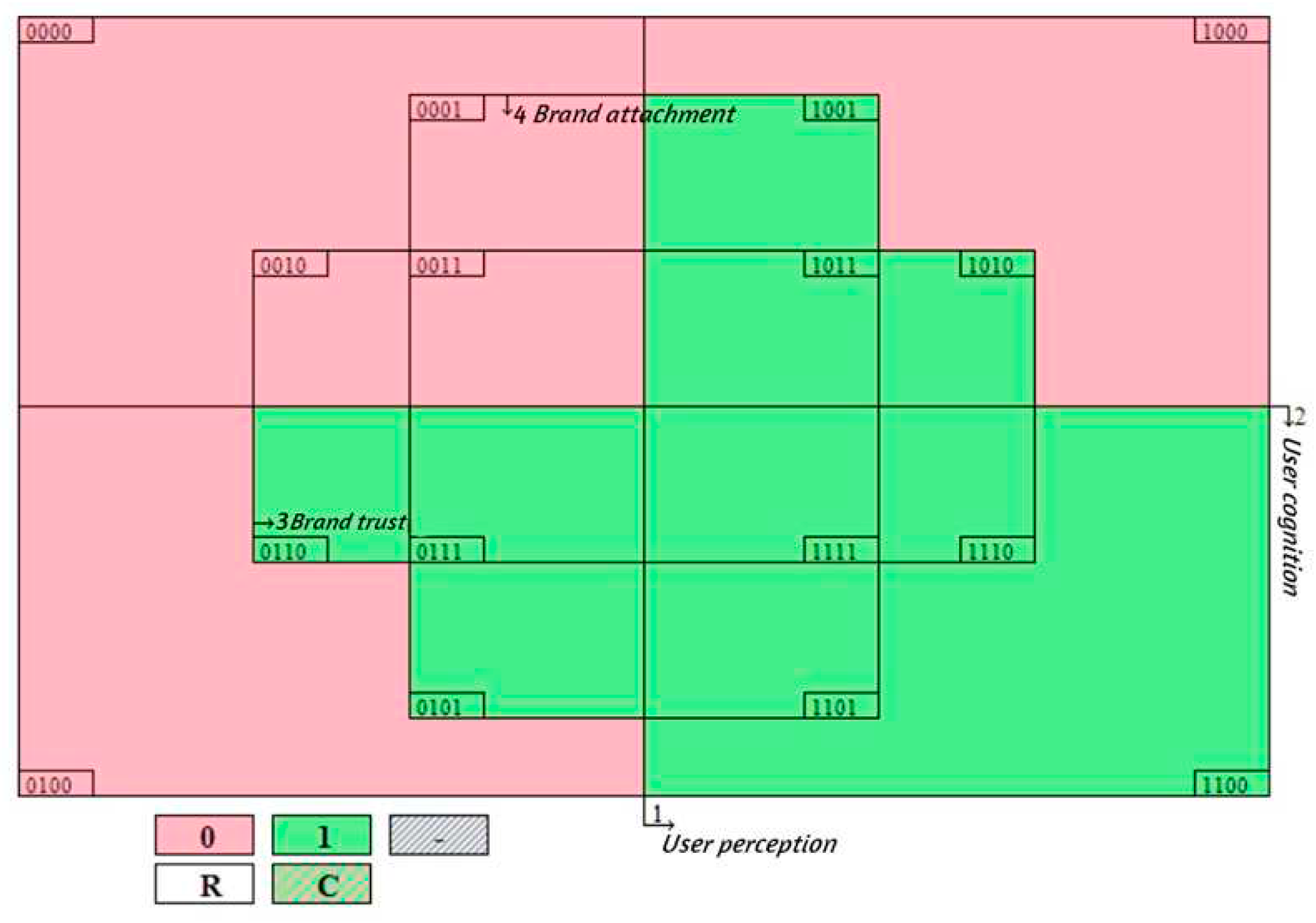

4.2. Definition and calibration of causal conditions

4.3. Necessity analysis

4.4. Sufficiency analysis

4.4.1. Longitudinal analysis of configuration paths generating high user retention intention

4.4.2. Longitudinal analysis of configuration paths generating low user retention intention

4.4.3. Horizontal analysis of potential substitution relationships between conditions

4.4.4. Further analysis

- (1)

-

Longitudinal analysis of configuration paths generating high brand trust. Table 8 presents the two configuration paths (S5 and S6) used to explain high brand trust, with overall consistency and coverage of model solutions of 0.94 and 0.93, respectively, indicating that the two configurations have sufficient explanatory power for the formation of high brand trust. The following longitudinal analysis details each configuration path that generates a high brand trust.

- (a)

- User cognition driven. Configuration S5 indicates that a configuration path with deficient user cognition and brand attachment as core conditions can generate a high brand trust. Its consistency is 0.98, and its coverage is 0.31. This configuration path indicates sufficiency for developing a high brand trust, which partially explains its generation. Users with sufficient rational cognition of the product or service will still generate a high brand trust even if they lack a high emotional or cognitive attachment to the brand. In this case, it is not necessary for the product or service to gives the user a satisfactory perceptual experience. Typical users in this condition configuration have value propositions and personal preferences for the target products and services but may lack emotional attachment to the products or services of a particular brand.

- (b)

- Quality of experience driven. Configuration S6 indicates that a configuration path with high user perception and cognition as the core conditions can generate high brand trust. The consistency is 0.94, and the coverage is 0.92, indicating that this configuration path has sufficient explanatory power for developing high brand trust. This means that when users have sufficient rational cognition about the product or service, if it brings users a satisfactory perceptual experience, users will have a high brand trust. In this case, it is not necessary for users to have an emotional or cognitive attachment to the brand. Typical users in this condition configuration focus on their ultimate perceptual experience of the product or service. They have value propositions and personal preferences for the target products and services.

- (2)

- Longitudinal analysis of configuration paths generating low brand trust. Configuration W4 shows that user perception, cognition, and brand attachment deficits are the configuration paths that generate low brand trust. Furthermore, the consistency and coverage of their model solutions are 0.85 and 0.35, respectively, indicating that this configuration is a sufficient condition for low brand trust and partially explains the causes of low brand trust.

| Frequency cutoff: 3 | (High) Brand attachment | (Low) Brand attachment |

|---|---|---|

| Consistency cutoff: 0.91 | Consistency cutoff: 0.97 | |

| S7 | W5 | |

| User perception | ● | ⊗ |

| User cognition | ● | ⊗ |

| Brand trust | ⊗ | ⊗ |

| Raw coverage | 0.07 | 0.11 |

| Unique coverage | 0.07 | 0.11 |

| Consistency | 0.91 | 0.97 |

| Overall solution consistency | 0.91 | 0.97 |

| Overall solution coverage | 0.07 | 0.11 |

4.5. Robustness test

5. Dicussion and conclusion

5.1. Research findings

5.2. Theoretical and management implication

5.2.1. Theoretical implication

5.2.2. Managerial implication

5.3. Limitations and directions for future research

5.3.1. Limitations

5.3.2. Directions for future research

References

- Fornell, C. , and Wernerfelt, B. Defensive marketing strategy by customer complaint management: a theoretical analysis. Journal of Marketing Research. 1984, (24),337-346.

- Rasool,A.,Shah,F.A.,and Tanveer,M.Relational dynamics between customer engagement,brand experience,and customer loyalty:An empirical investigation.Journal of internet commerce.2021,20(3):273-292.

- Griffin, J. Customer loyalty: how to earn it, how to keep it, Simmonand Schuster Inc. 1995.

- Reichheld, F.F.; Sasser, W.E. Zero defections: Quality comes to services. Harv. Bus. Rev. 1990, 68, 105–111. [Google Scholar]

- Sujan, H.; Steenkamp, J.-B.E.M. Product Quality: An Investigation into the Concept and How It Is Perceived by Consumers. Assen/Maastricht:Van Gorcum. 1989, 55, 82. [Google Scholar] [CrossRef]

- Rob, Markey. Do you underestimate the customer? Harvard Business Review. 2020, 1, 1–1.

- Lin, Y.-H.; Chen, S.-Y.; Lin, P.-H.; Tai, A.-S.; Pan, Y.-C.; Hsieh, C.-E.; Lin, S.-H. Assessing User Retention of a Mobile App: Survival Analysis. JMIR mHealth uHealth 2020, 8, e16309. [Google Scholar] [CrossRef]

- Huang, G.; Ren, Y. Linking technological functions of fitness mobile apps with continuance usage among Chinese users: Moderating role of exercise self-efficacy. Comput. Hum. Behav. 2020, 103, 151–160. [Google Scholar] [CrossRef]

- Sathish, S.K. , and Patankar, A. Intent based association modeling for e-commerce.Natural Language Processing and Information Systems(Nldb 2019).2019,11608,144-156.

- Qu, C. , and Chen, N. Platform competition under technology shock —user sorting and platform transformation.Research on Economics and Management. 2019,40(11),112-128.

- Mittal, V.; Kamakura, W.A. Satisfaction, Repurchase Intent, and Repurchase Behavior: Investigating the Moderating Effect of Customer Characteristics. J. Mark. Res. 2001, 38, 131–142. [Google Scholar] [CrossRef]

- González, M.E.A.; Comesaña, L.R.; Brea, J.A.F. Assessing tourist behavioral intentions through perceived service quality and customer satisfaction. J. Bus. Res. 2007, 60, 153–160. [Google Scholar] [CrossRef]

- Huarng, K.-H.; Yu, T.H.-K. The impact of surge pricing on customer retention. J. Bus. Res. 2020, 120, 175–180. [Google Scholar] [CrossRef]

- Henning-Thurau, T. , and Klee, A. The impact of customer satisfaction and relationship quality on customer retention: a critical reassessment and model development. Psychology and Marketing. 1997,14(8), 737–764.

- Ranaweera, C.; Prabhu, J. The influence of satisfaction, trust and switching barriers on customer retention in a continuous purchasing setting. Int. J. Serv. Ind. Manag. 2003, 14, 374–395. [Google Scholar] [CrossRef]

- Pan, H. L. , and Huang, M. X. The cultivation and the difference effect of consumer emotional relationships: an interactive-compensatory effect of satisfaction, attachment, and identification on the customer’s behaviors. Nankai Business Review. 2017,20(4), 16-26.

- Trestian, R., Comsa, I.S., and Tuysuz, M.F.Seamless multimedia delivery within a heterogeneous wireless networks environment: are we there yet? IEEE Communications Surveys and Tutorials. 2018, 20(2), 945–977. [CrossRef]

- Sangaralingam, K.; Verma, N.; Ravi, A.; Bae, S.W.; Datta, A. High value customer acquisition & retention modelling - a scalable data mashup approach. 2019 IEEE International Conference on Big Data 2019, 1907–1916. [Google Scholar] [CrossRef]

- Wang, X. X. , and Li, C. Objective criteria or subjective evaluation: a review of consumer experience quality measurement research. Foreign Economics & Management. 2019,41(1),127-140.

- Jang, K.K.; Bae, J.; Kim, K.H. Servitization experience measurement and the effect of servitization experience on brand resonance and customer retention. J. Bus. Res. 2021, 130, 384–397. [Google Scholar] [CrossRef]

- Xu, Z.L., and Gu, A.W. Research on the brand equity driving model based on relationship perspective.China Industrial Economics. 2011, (10),109-118. 2011; (10), 109–118.

- Jin, N.; Lee, S.; Lee, H. The Effect of Experience Quality on Perceived Value, Satisfaction, Image and Behavioral Intention of Water Park Patrons: New versus Repeat Visitors. Int. J. Tour. Res. 2015, 17, 82–95. [Google Scholar] [CrossRef]

- Sun, X.L. , Lin, B.S.,and Gao,J.A review on the quality assessment of tourism experience:advances,elements and prospects.Human Geography. 2018,33(1),143-151.

- Ma, T. Tourist experience quality and satisfaction: connotation, relationship and measurement. Tourism Tribute. 2019, 34(11), 29–40. [Google Scholar]

- Xiao, N., Huang, Y.,and Liu,J.S.Evaluation and spatial differentiation of tourism experience quality of theme park in china.Scientia Geographica Sinica.2019, 39(6),978-986. 6.

- Domínguez-Quintero, A.M.; González-Rodríguez, M.; Paddison, B. The mediating role of experience quality on authenticity and satisfaction in the context of cultural-heritage tourism. Curr. Issues Tour. 2020, 23, 248–260. [Google Scholar] [CrossRef]

- Tang, P. , and He, J.M. The impact of cultural heritage rejuvenation experience quality on visitors’ destination loyalty: a serial multiple mediation model.Nankai Business Review. 2020,23(5),76-87.

- Shin, D.-H. Conceptualizing and measuring quality of experience of the internet of things: Exploring how quality is perceived by users. Inf. Manag. 2017, 54, 998–1011. [Google Scholar] [CrossRef]

- He,X.M.,Wang,K.,Huang,H.W.,et al.Green resource allocation based on deep reinforcement learning in content-centric IoT.IEEE Transactions on Emerging Topics in Computing. 2020,8(3),781-796.

- Wang,Y.H.,Liu,S.,Tang,S.N.,et al.A measurement and empirical research on quality of experience (QoE) of customer’ online shopping from B2C social e-commerce platform in china.Journal of Beijin Institute of Technology(Social Sciences Edition). 2021,23(3),71-85.

- Jin, X.P., and Bi, X. Research on user satisfaction model of mobile library based on structural equation model.Information Science. 2017,35(11),94-98. 11.

- Ma, T. On measurement methods of tourist experience: A critical review and prospect. Tourism Science. 2019, 33(3), 37–49. [Google Scholar]

- Fiedler,M.,De Moore,K.,Ravuri,H.,Tanneedi,P., et al.Users on the move: on relationships between QoE ratings, data volumes and intentions to churn.2017 IEEE 42nd Conference on Local Computer Networks Workshops(Lcn Workshops 2017). 2017,97-102.

- Munuera-Aleman, J.L.; Delgado-Ballester, E.; Yague-Guillen, M.J. Development and Validation of a Brand Trust Scale. Int. J. Mark. Res. 2003, 45, 1–18. [Google Scholar] [CrossRef]

- Chaudhuri,A., and Holbrook,M.B. The chain of effects from brand trust and brand affect to brand performance: The role of brand loyalty. J. Mark. 2001, 65, 81–93. [CrossRef]

- Mazodier, M.; Merunka, D. Achieving brand loyalty through sponsorship: the role of fit and self-congruity. J. Acad. Mark. Sci. 2011, 40, 807–820. [Google Scholar] [CrossRef]

- See-To,E.W.K., and Ho,K.K.W.Value co-creation and purchase intention in social network sites: the role of electronic word-of-mouth and trust - a theoretical analysis. Computers in Human Behavior. 2015, (31),627-627.

- Hegner,S.M., and Jevons,C.Brand trust: a cross-national validation in germany, india, and south africa.Journal of Product and Brand Management. 2016,25(1),58-68.

- Ross, N. Customer retention in freemium applications. J. Mark. Anal. 2018, 6, 127–137. [Google Scholar] [CrossRef]

- Wang, L. , He, Y.F., Yang, Y., and Zhao, Y. A case study of promoting and inhibiting factors of the brand attachment in cross-border e-commerce platform based on fsQCA method.Management Review. 2020,32(12), 320-332.

- Hu,S.H.,Chen,P., and Chen,X.H.Do personalized economic incentives work in promoting shared mobility? examining customer churn using a time-varying cox model.Transportation Research Part C-emerging Technologies. 2021,128,1-16.

- Kao, Y.-F.; Huang, L.-S.; Wu, C.-H. Effects of Theatrical Elements on Experiential Quality and Loyalty Intentions for Theme Parks. Asia Pac. J. Tour. Res. 2008, 13, 163–174. [Google Scholar] [CrossRef]

- ISO 9241-210-2010. Ergonomics of human-system interaction--part 210: human-centred design for interactive systems[S].2010.

- Chang, T.-Y.; Horng, S.-C. Conceptualizing and measuring experience quality: the customer’s perspective. Serv. Ind. J. 2010, 30, 2401–2419. [Google Scholar] [CrossRef]

- Bhattacheriee, A. Understanding information systems continuance: an expectation-confirmation model. MIS Quarterly. 2001, 25(3), 351–370. [Google Scholar] [CrossRef]

- Ryu, K.; Han, H.; Kim, T.-H. The relationships among overall quick-casual restaurant image, perceived value, customer satisfaction, and behavioral intentions. Int. J. Hosp. Manag. 2008, 27, 459–469. [Google Scholar] [CrossRef]

- Brakus, J. J., Schmitt, B. H., and Zarantonello, L. Brand experience: what is it? how is it measured? does it affect loyalty? Journal of Marketing. 2009,73(3), 52-68.

- Zhang,H.J., Hu, L.Y., and Gu,Y.Z. User experience, entrepreneurship traits, and corporate opportunity identification——an exploratory case study based on JD.Management Review. 2021,33(7),337-352.

- Liu, J.H. , Zhou, C.C., and Wang, D.C. Customer retention based on trust and switching barriers: a case study.Management world.2010, (4), 131-144.

- Jolley, B.; Mizerski, R.; Olaru, D. How habit and satisfaction affects player retention for online gambling. J. Bus. Res. 2006, 59, 770–777. [Google Scholar] [CrossRef]

- Rust, R., and Zahorik, A. J. Customer satisfaction, customer retention, and market share.Journal of Retailing. 1993, 69, 193–215.

- East, R., Harris, P., Lomax, W., Willson, G., Hammond, K. Customer defection from supermarkets. Advances in Consumer Research. 1998, 25, 507–512.

- Berné, C.; Múgica, J.M.; Yagüe, M.J. The effect of variety-seeking on customer retention in services. J. Retail. Consum. Serv. 2001, 8, 335–345. [Google Scholar] [CrossRef]

- Shen, C.H., Lu, M.M., and Liu, Z.L. On the relationship between contractual arrangement and market expansion based on a case of china Unicom.J.Cent.South Univ.(Social Science).2014,20(6), 86-93.

- Jones, M.A.; Mothersbaugh, D.L.; Beatty, S.E. Switching barriers and repurchase intentions in services. J. Retail. 2000, 76, 259–274. [Google Scholar] [CrossRef]

- Gerpott, T.J.; Rams, W.; Schindler, A. Customer retention, loyalty, and satisfaction in the German mobile cellular telecommunications market. Telecommun. Policy 2001, 25, 249–269. [Google Scholar] [CrossRef]

- Guo, L.; Xiao, J.J.; Tang, C. Understanding the psychological process underlying customer satisfaction and retention in a relational service. J. Bus. Res. 2009, 62, 1152–1159. [Google Scholar] [CrossRef]

- Husain,R.,Paul,J., and Koles,B.The role of brand experience, brand resonance, and brand trust in luxury consumption.Journal of retailing and consumer services. 2022, (66),1-16.

- Toufaily, E.; Ricard, L.; Perrien, J. Customer loyalty to a commercial website: Descriptive meta-analysis of the empirical literature and proposal of an integrative model. J. Bus. Res. 2013, 66, 1436–1447. [Google Scholar] [CrossRef]

- Li, F.; Kashyap, R.; Zhou, N.; Yang, Z. Brand Trust as a Second-order Factor: An Alternative Measurement Model. Int. J. Mark. Res. 2008, 50, 817–839. [Google Scholar] [CrossRef]

- Garbarino, E. , and Johnson, M.S. The different roles of satisfaction, trust, and commitment in customer relationships.Journal of Marketing. 1999,63(2),70-87.

- Barners, S.J. , and Bohringer, M. Modeling use continuance behavior in microblogging services: The case of twitter. Journal of Computer Information Systems. 2011,51(4),1-10.

- Pookulangara, S. , and Koesler, K.Cultural influence on consumers’usage of social networks and its’impact on online purchase intentions.Journal of Retailing and Consumer Services.2011,18(4),348-354.

- Laroche, M.; Habibi, M.R.; Richard, M.-O.; Sankaranarayanan, R. The effects of social media based brand communities on brand community markers, value creation practices, brand trust and brand loyalty. Comput. Hum. Behav. 2012, 28, 1755–1767. [Google Scholar] [CrossRef]

- Liu, L.L. ,Lee,M.K.O.,Liu,R.J.,et al.Trust transfer in social media brand communities: The role of consumer engagement.International Journal of Information Management. 2018, (41),1-13.

- Xue,J.P,Zhou,Z.M.,Zhang,L.B.,et al.Do brand competence, and warmth always influence purchase intention? the moderating role of gender.Frontiers in Psychology. 2020; (11), 1–11.

- Alwi, S.F.S. , Nguyen, B., Melewar, T.C.et al.Explicating industrial brand equity Integrating brand trust, brand performance, and industrial brand image. Industrial Management & Data Systems.2016,116(5),858-882.

- Bowlby, J. On Knowing What You are not supposed to know and feeling what you are not supposed to feel. 1979; 24, 403–408. [Google Scholar] [CrossRef]

- Schultz, S.E. , Kleine, R.E., and Kernan, J.B.These are a few of my favorite things: toward an explication of attachment as a consumer behavior construct. Advances in Consumer Research. 1989,16(1), 359-366.

- Park, C.W.; Macinnis, D.J.; Priester, J.; Eisingerich, A.B.; Iacobucci, D. Brand Attachment and Brand Attitude Strength: Conceptual and Empirical Differentiation of Two Critical Brand Equity Drivers. J. Mark. 2010, 74, 1–17. [Google Scholar] [CrossRef]

- Lacoeuilhe, J., Louis, D., and Lombart, C. Impacts of product, store, and retailer perceptions on consumers’ relationship to the terroir store brand. Journal of Retailing and Consumer Services. 2017; 39, 43–53.

- Malär, L.; Krohmer, H.; Hoyer, W.D.; Nyffenegger, B. Emotional Brand Attachment and Brand Personality: The Relative Importance of the Actual and the Ideal Self. J. Mark. 2011, 75, 35–52. [Google Scholar] [CrossRef]

- Thach, E.C.; Olsen, J. The Role of Service Quality in Influencing Brand Attachments at Winery Visitor Centers. J. Qual. Assur. Hosp. Tour. 2006, 7, 59–77. [Google Scholar] [CrossRef]

- Li, Q.G. , Xue, K., and Yang, F.P. Effects of brand-Self connection on brand experience and repurchase intention.Research on Economics and Management.2011, (9), 96-104.

- Zhang, M. L. , Tang, S. L., and Wang, W. The influence of brand relationship interaction on brand loyalty based on service-dominant logic. Chinese Journal of Management. 2014,11(8), 1230-1238.

- Hwang, J.; Han, H.; Choo, S.-W. A strategy for the development of the private country club: focusing on brand prestige. Int. J. Contemp. Hosp. Manag. 2015, 27, 1927–1948. [Google Scholar] [CrossRef]

- Zhou, J. M. , Guo, G. Q., and Zhang, X. S. Negative network rumor and brand attachment: roles of brand involvement and trust. Economic Management. 2015,37(9), 83-91.

- Hwang, J.; Kim, H. ; Hwang; Jinsoo; Kim; Hyunjoon An investigation of advertising effectiveness in the context of first-class flights : The moderating role of frequent flyer program. Int. J. Tour. Hosp. Res. 2018, 32, 61–70. [Google Scholar] [CrossRef]

- Den, S. J., Guo, G. Q., and Zhou, J. M. A study of the influences of brand association and brand cognition on brand attachment. Journal of Management. 2018; 31, 1, 44–53.

- Liu, Y. , Kou, Y., Guan, Z. Z., and Pu, B. Research on mechanism of perceived value on hotel brand attachment: A moderated mediating model. Tourism Tribune. 2019,34(4), 29-39.

- Eunmin, H., Seyhmus, B., and Sarah, T. Building loyalty through reward programs: the influence of perceptions of fairness and brand attachment. International Journal of Hospitality Management. 2019; 76, 19–28.

- Eisenhardt, K.M.; Graebner, M.E. Theory Building From Cases: Opportunities And Challenges. Acad. Manag. J. 2007, 50, 25–32. [Google Scholar] [CrossRef]

- Du, Y. Z. , and Jia, L. D. The configuration perspective and qualitative comparative analysis (QCA): A new approach to management research. management World. 2017, (6),155-167.

- Fiss, P.C. Building Better Causal Theories: A Fuzzy Set Approach to Typologies in Organization Research. Acad. Manag. J. 2011, 54, 393–420. [Google Scholar] [CrossRef]

- Yin,R. K. Case study research: design and methods (5th ed.), CA: Sage Publications Inc. 2014.

- Li, H.L. , and Wang, X.Y. The effect of online user reviews on customer value creation: From the perspective of price decision. Price:Theory & Practice.2018, (1), 150-153.

- Jiménez, F.R.; Mendoza, N.A. Too Popular to Ignore: The Influence of Online Reviews on Purchase Intentions of Search and Experience Products. J. Interact. Mark. 2013, 27, 226–235. [Google Scholar] [CrossRef]

- Zhu, L.Y. , Yuan, D.H., and Zhang, J.Y. The impact of online user reviews quality and commentators rank on consumer purchasing intention-the moderating role of product involvement. Management Review. 2017,29(2), 87-96.

- Wang, C.Z., He, S., and Wang, K. Research on how additional review affects perceived usefulness of review. 2015; 28, 102–114.

- Tao, H. Y., Li, Y. P., and Luo, Z. X. Formation mechanism of shanzhai model and its implications to organizational innovation. China Soft Science. 2010; (11), 123–135.

- Lee, J.; Park, D.-H.; Han, I. The effect of negative online consumer reviews on product attitude: An information processing view. Electron. Commer. Res. Appl. 2008, 7, 341–352. [Google Scholar] [CrossRef]

- Corbin, M. , and Strauss, A. Basics of qualitative research: techniques and procedures for developing grounded theory. London: Sage Publications.2007.

- Jiao, Y.Y., Gao, X., and Fu, S.H. Research on the user group innovative behavior in innovation communities based on the perspective of peer influence.Nankai Business Review. 2022, 25(1), 165–176.

- Zhang,H.J., Hu, L.Y., and Gu,Y.Z. Research on the impact of user experience on entrepreneurial opportunity iteration——an exploratory case study based on Xiaomi[J/OL]. Studies in Science of Science. 2022-01-16. 1- 17.

- An, H.X., and Li, Z. Research on customer experience management of old chinese brands. Journal of Management World. 2013, (2), 182–183.

- Parasuraman, A., Zeithaml, V.A., and Malhotra,A.E-S-QUAL - a multiple-item scale for assessing electronic service quality.Journal of Service Research. 2005, 7(3), 213–233.

- Hsu, C.-L.; Lin, J.C.-C. What drives purchase intention for paid mobile apps? – An expectation confirmation model with perceived value. Electron. Commer. Res. Appl. 2015, 14, 46–57. [Google Scholar] [CrossRef]

- Fan, X.P. , Lu, Y.F., and Han, H.Y.The effect of online shopping information context on consumers’ decision-making: a perspective of bounded rationality.Journal of Industrial Engineering/Engineering Management. 2016,30(2),38-47.

- Yuan, D.H. , Wang, Q., and Zhu, L.Y. A literature review of brand evangelism.Foreign Economics & Management. 2016,38(3),61-72.

- Zhou, Y.J. , Lin, J., and Wang, Y.Y.Partner versus servant: the impact of consumer-brand relationship on consumers’ attitude to brand failures and apologies.Management Review. 2021,33(2),195-206.

- Jiang, L.X. ,Fen,R.,Teng,H.B.,et al.Adoption of new products in branding contexts: the influence of consumer innovativeness and brand attachment.Nankai Business Review.2015,18(6),71-80.

- Zhang, M. , and Du, Y.Z. Qualitative comparative analysis (QCA) in management and organization research:position,tactics,and directions.Chinese Journal of Management. 2019,16(9):1312-1323.

- Ragin, C.C. , and Strand, S.I. Using qualitative comparative analysis to study causal order-comment on caren and Panofsky.Sociological Methods & Research. 2008,36(4), 431-441.

- Douglas, E.J.; Shepherd, D.A.; Prentice, C. Using fuzzy-set qualitative comparative analysis for a finer-grained understanding of entrepreneurship. J. Bus. Ventur. 2019, 35, 1–17. [Google Scholar] [CrossRef]

- Ma, H.J. , Lin, Y., and Xiao, B. Impact of multi-agent interaction in digital entrepreneurial ecosystem on digital entrepreneurial performance—a study based on fsQCA method. R & D Management. 2022,34(3),41-53.

- Mas-Tur, A.; Pinazo, P.; Tur-Porcar, A.M.; Sánchez-Masferrer, M. What to avoid to succeed as an entrepreneur. J. Bus. Res. 2015, 68, 2279–2284. [Google Scholar] [CrossRef]

- Schneider, C. Q. , and Wagemann, C. Set-theoretic methods for the social sciences: a guide to qualitative comparative analysis, Cambridge University Press.2012.

- Furnari, S.; Crilly, D.; Misangyi, V.F.; Greckhamer, T.; Fiss, P.C.; Aguilera, R.V. Capturing Causal Complexity: Heuristics for Configurational Theorizing. Acad. Manag. Rev. 2021, 46, 778–799. [Google Scholar] [CrossRef]

- Wang, Q. ,Rong,Z.,and Xie,K.A horizontal trust transfer mechanism of the improvement of new customers’cross platform purchase behavior on customer retention.Management review.2021,33(3):146-158.

- Du,Y.Z.,Li,J.X.,Liu,Q.C.,et al.Configurational theory and QCA method from a complex dynamic perspective:Research progress and future directions.Management world.2021,37(3):180-197.

- Brito, L. A. L., Brito, E. P. Z., and Hashiba, L. H.What type of cooperation with suppliers and customers leads to superior performance? Journal of Business Research 2014, 67(5), 952–959. [CrossRef]

| Category of products | Product number | Total user reviews mining |

Number of data cleaning |

Number of first-time buyers | Number of brand switching users |

Number of old users | Average number of Likes |

Average number of comments |

Additional reviews time |

|---|---|---|---|---|---|---|---|---|---|

| Xiaomi mobile phone | 1 | 6930 | 143 | 9 | 28 | 106 | 21 | 11 | 11 |

| Redmi mobile phone | 2 | 7920 | 89 | 7 | 11 | 71 | 5 | 3 | 17 |

| Small household appliances | 3 | 4940 | 60 | 2 | 3 | 55 | 9 | 2 | 11 |

| Routers and speakers | 4 | 4850 | 83 | 5 | 3 | 75 | 6 | 2 | 24 |

| Mi notebook | 5 | 3960 | 41 | 4 | 6 | 31 | 11 | 7 | 9 |

| Xiaomi refrigerators and washing machines | 6 | 4226 | 31 | 2 | 5 | 24 | 2 | 1 | 19 |

| Xiaomi TV | 7 | 3960 | 91 | 6 | 5 | 80 | 2 | 13 | 5 |

| Smart wearable devices | 8 | 4950 | 66 | 4 | 4 | 58 | 6 | 2 | 11 |

| Smart home devices | 9 | 4950 | 67 | 1 | 4 | 62 | 6 | 2 | 8 |

| Category-ization | Conceptualization | Labeling | Original information (evidence cited) | Literature dialogue |

|---|---|---|---|---|

| User Perception |

Demanding | Products to meet the diversified needs of users |

[1-239] Superfine products, exquisite workmanship, touch-sensitive, fast running speed, powerful photo, and cost-effective, satisfying. | An and Li [95] |

| Responsiveness | Companies respond quickly and efficiently to user requests |

[4-2736] Xiaomi’s service attitude is excellent! I am a person who does not know anything about the network the first time to connect my own router. Customer service taught me step by step to do, only blame their IQ is too low, pounding for a long time did not understand the whole, people are very patient customer service repeatedly guide me, questions and answers. | Parasuraman et al [96] |

|

| Participation | User involvement in product development research |

[9-17] Nine years of meeting time, four years of companionship, from ordinary Mi fans to the inner test fans group, from the inner test fans group to the special group, met a lot of people along the way, which will be a lifetime hard to forget, not only to devote 100% of the feelings, or persistent persistence and love. | Shin [28] | |

| User Cognition | User expectations | Product or service meets user expectations | [1-86] Xiaomi did not let me down. As good as ever. [4-1282] I bought many Xiaomi products, never disappointed, and will continue to support Xiaomi. | Hsu and Lin[97] |

| Bounded rationality |

Cost and benefit trade-offs the choice after balancing | [1-10] Rational consumption made me choose Xiaomi. The product itself is excellent. All aspects weighed to the extreme. The Xiaomi series are all good products worth choosing. | Fan and Lu [98] | |

| Quality Trust | Reliable Quality | High quality wins user trust | [9-2189] I have always trusted Xiaomi’s products, the quality of workmanship is absolutely nothing to say, the future selection of small appliances preferred Xiaomi. [9-4402] I have always believed in the quality of Xiaomi. Every time I do not know how to choose will be more priority to choose Xiaomi. | Yuan et al [99] |

| Competence Trust | Entrepreneurial competency trust | Users have confidence in the ability of entrepreneurs | [1-3381] Lei is my favorite entrepreneur. [2-6196] Support Lei as always. [1-2308] Lei Jun’s Xiaomi is still relatively generous. [2-2337] Lei Jun is a product of conscience. |

Zhou et al [100]; Yuan et al[99] |

| Emotional Attachment | Emotional attachment | Users love the Xiaomi brand |

[3-221] I have always had a soft spot for Xiaomi. [3-367] I have had a soft spot for the Xiaomi brand for years. |

Park et al [70] |

| Cognitive Attachment | Brand cognition | Positive brand experience makes users habitually consume | [9-337] My family has always been a Mi fan, from mobile phones to household appliances are Xiaomi. Anyway, Xiaomi is the best choice for shopping. [4-1484] Big brand, quality-assured, very satisfied, the future on Xiaomi. |

Brakus and Schmitt[47] |

| User Retention Intentions |

Retention commitment | Commitment to ongoing brand focus |

[1-573] I will always support Jingdong and Xiaomi. [4-2573] I always like Xiaomi’s stuff and will continue to support Xiaomi in the future. |

This study refines |

| Retention tendency | User propensity to repurchase after brand experience |

[2-2397] I also use Xiaomi products. MIUI system is excellent, and I continue to buy Xiaomi and support the national product. [7-2260] Xiaomi is indeed a trustworthy product and cost-effective, and I will continue to pay attention to the brand Xiaomi and buy more Xiaomi products. |

Rob [6] |

| Main category |

Sub-category | Relationship connotation | Literature dialogue |

|---|---|---|---|

| Quality of experience | User exception | User cognition and user perception reflect users’ cognitive impressions and experience results before and after using products or services, respectively, and the result of their joint action is the quality of user experience. | ISO 9241-210 [43] |

| User cognition | |||

| Brand trust | Quality Trust | Quality trust and ability trust reflect the user’s trust in the quality of the brand’s products and the ability of the brand builder after experiencing the products and services, respectively. | Yuan and Wang [99] |

| Competence Trust | |||

| Brand attachment | Emotional attachment | Emotional attachment and cognitive attachment reflect users’ positive emotional experience and cognitive impression of a specific brand, which manifests as loyalty and habitual consumption of the brand, constituting brand attachment. | Jiang et al [101] |

| Cognitive attachment | |||

| User retention intention | Retention commitment | Retention commitment and tendency to stay reflect users’ commitment to stay tuned to the brand and the tendency to repurchase after a product or service experience, respectively, reflecting users’ retention intention. | Rust and Zahorik [51] |

| Retention tendency |

| Representative original statements | Main category relationship structure |

|---|---|

| [4-1484] Big brand, quality-assured, easy to install, just three steps to get it done, the transfer speed is also quite fast. The price is a special discount to buy, excellent value. The mobile terminal can see to adjust many settings, and at a glance, very satisfied (user perception), later shop preferred Xiaomi brand (retention commitment). | User perception User retention intention |

| [8-1121] I bought Xiaomi’s wearable products for the first time, and the experience was beyond my imagination (user expectations). I have also used Huawei and other brands of products before. In contrast, Xiaomi’s products are more cost-effective, more powerful, and practical (user perception), and the price is affordable. I also hope that Xiaomi’s brand is getting better and better and will continue to support the Xiaomi brand (retention commitment). | User cognition User retention intention |

| [3-3323] Xiaomi’s products have consistently been recognized by my family and me as a very trustworthy brand, both in terms of quality of goods and after-sales service (brand identity). I will continue to buy Xiaomi’s products next time (tendency to stay). | Brand trust User retention intention |

| [1-1843] Xiaomi mobile phone has always been my preferred brand (brand attachment). I have also been concerned about Xiaomi, used several Xiaomi mobile phones, and feel that the system has done very well. I will continue to support Xiaomi (retention commitment). | Brand attachment User retention intention |

| [7-2260] TV received, the function is much, excellent, bought for the elderly and children to use, the language function is also very convenient and suitable, quickly get started, the picture quality is clear (user perception), a lot better than imagined (user expectations), Xiaomi is indeed a trustworthy product (brand identity), cost-effective (user perception), the future I will continue to pay attention to the brand Xiaomi (retention commitment), and buy more Xiaomi products in the future (retention tendency). | Quality of experience Brand trust User retention intention |

| [1-1463] The phone feels excellent in your hand. The shell is particularly delicate and silky smooth. The screen is particularly clear and worthy of Samsung’s screen. The software is high-speed (user perception). The camera is the best I have ever seen on a mobile phone (user perception). To sum up, this phone’s software and hardware are pretty good and very satisfactory. I am already a long-time Mi fan (brand attachment), and I will continue to patronize it in the future (retention commitment). | Quality of experience Brand attachment User retention intention |

| Variable name | Definition | Judgment notes | Assignment |

|---|---|---|---|

| User perception |

The overall feeling of the user after experiencing the product or service. | The product or service gives the user a satisfactory perceptual experience. | 1 |

| Poor perceived experience of the product or service to the user. | 0 | ||

| User cognition |

Summary of users’ perceptions and experiences of tacit and explicit knowledge from review information [41]. | Users express sufficient rational cognition about the product or service. | 1 |

| Users express less cognition about the product or service. | 0 | ||

| Brand trust | develops from past brand experiences and prior consumer-brand interactions [99]. | Users express a strong sense of trust with the product or personal brand. | 1 |

| Users do not express a strong trust with the product or personal brand. | 0 | ||

| Brand attachment | The strength of the cognitive and emotional ties that link consumers themselves to the brand [70]. | Users express strong emotional or cognitive attachments to the brand. | 1 |

| Users do not express strong emotional or cognitive attachments to the brand. | 0 | ||

| User retention intention | The tendency of customers to stay with the brand for a long time [51]. | Users express a strong tendency to stay tuned or repurchase. | 1 |

| Users do not express a strong tendency to stay tuned or repurchase. | 0 |

| (High) User retention intention | (Low) User retention intention | |||

|---|---|---|---|---|

| Cons | Cov | Cons | Cov | |

| User perception | 0.98 | 0.99 | 0.12 | 0.01 |

| ~User perception | 0.02 | 0.23 | 0.88 | 0.77 |

| User cognition | 0.93 | 0.99 | 0.02 | 0.00 |

| ~User cognition | 0.07 | 0.50 | 0.98 | 0.50 |

| Brand trust | 0.93 | 0.99 | 0.17 | 0.01 |

| ~Brand trust | 0.07 | 0.57 | 0.83 | 0.43 |

| Brand attachment | 0.67 | 0.99 | 0.07 | 0.01 |

| ~Brand attachment | 0.33 | 0.84 | 0.93 | 0.16 |

| Frequency cutoff: 1 | (High) User retention intention | (Low) User retention intention | ||||||

|---|---|---|---|---|---|---|---|---|

| Consistency cutoff: 1 | Consistency cutoff: 1 | |||||||

| S1a | S1b | S2 | S3 | S4 | W1 | W2 | W3 | |

| User perception | • | ● | • | ⊗ | ⊗ | |||

| User cognition | ● | ● | ● | ⊗ | ⊗ | |||

| Brand trust | • | ● | ⊗ | ⊗ | ||||

| Brand attachment | ● | ● | ⊗ | ⊗ | ||||

| Raw coverage | 0.92 | 0.88 | 0.91 | 0.66 | 0.64 | 0.86 | 0.79 | 0.69 |

| Unique coverage | 0.004 | 0.01 | 0.03 | 0.01 | 0.003 | 0.19 | 0.12 | 0.02 |

| Consistency | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Overall solution consistency | 1 | 1 | ||||||

| Overall solution coverage | 1 | 1 | ||||||

| Relationship Category | Configuration Comparison | Consistent conditions | Potential substitution relationships between conditions |

|---|---|---|---|

| 1 | S1a and S1b | User cognition | User perception ⇔ Brand trust |

| 2 | S1a、S2 and S3 | User perception | User cognition ⇔ Brand trust ⇔ Brand attachment |

| 3 | S1a、S1b and S4 | Brand trust | User perception ⇔ User cognition |

| 4 | S1b and S2 | User cognition | User perception ⇔ Brand trust ⇔ Brand attachment |

| 5 | S3 and S4 | Brand attachment | User perception ⇔ User cognition |

| 6 | W1 and W3 | Lack of user perception | Lack of user cognition ⇔ Lack of brand trust + Lack of brand attachment |

| 7 | W1 and W2 | Lack of user cognition | Lack of user perception ⇔ Lack of brand trust + Lack of brand attachment |

| 8 | W2 and W3 | Lack of brand trust + Lack of brand attachment | Lack of user perception ⇔ Lack of user cognition |

| Frequency cutoff: 3 | (High) Brand trust | (Low) Brand trust | |

|---|---|---|---|

| Consistency cutoff: 0.80 | Consistency cutoff: 0.85 | ||

| S5 | S6 | W4 | |

| User perception | ● | ⊗ | |

| User cognition | ● | ● | ⊗ |

| Brand attachment | ⊗ | ⊗ | |

| Raw coverage | 0.31 | 0.92 | 0.35 |

| Unique coverage | 0.01 | 0.61 | 0.35 |

| Consistency | 0.98 | 0.94 | 0.85 |

| Overall solution consistency | 0.94 | 0.85 | |

| Overall solution coverage | 0.93 | 0.35 | |

| Frequency cutoff: 2 | (High) User retention intention | (Low) User retention intention | |||||

|---|---|---|---|---|---|---|---|

| Consistency cutoff: 1 | Consistency cutoff: 1 | ||||||

| S9 | S10 | S11 | S12 | S13 | W6 | W7 | |

| User perception | • | ● | ● | ⊗ | |||

| User cognition | ● | • | • | ⊗ | ⊗ | ||

| Brand trust | ● | • | ⊗ | ⊗ | |||

| Brand attachment | ● | • | ⊗ | ||||

| Raw coverage | 0.92 | 0.91 | 0.88 | 0.66 | 0.64 | 0.17 | 0.79 |

| Unique coverage | 0.004 | 0.03 | 0.01 | 0.01 | 0.003 | 0.17 | 0.79 |

| Consistency | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Overall solution consistency | 1 | 1 | |||||

| Overall solution coverage | 1 | 0.95 | |||||

| Frequency cutoff: 1 | (High) User retention intention | (Low) User retention intention | ||||||

|---|---|---|---|---|---|---|---|---|

| Consistency cutoff: 1 | Consistency cutoff: 1 | |||||||

| S14 | S15 | S16 | S17 | S18 | W8 | W9 | W10 | |

| User perception | ● | ● | ● | ⊗ | ⊗ | |||

| User cognition | ● | ● | ● | ⊗ | ⊗ | |||

| Brand trust | ● | ● | ⊗ | ⊗ | ||||

| Brand attachment | ● | ● | ⊗ | ⊗ | ||||

| Raw coverage | 0.92 | 0.91 | 0.88 | 0.66 | 0.64 | 0.86 | 0.79 | 0.69 |

| Unique coverage | 0.004 | 0.03 | 0.01 | 0.01 | 0.003 | 0.19 | 0.12 | 0.02 |

| Consistency | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Overall solution consistency | 1 | 1 | ||||||

| Overall solution coverage | 1 | 1 | ||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).