1. Introduction

The increasingly frequent occurrence of extreme natural disasters and global temperature anomalies have elevated climate shocks to a significant impediment to both human survival and development[

1]. In January 2023, the Global Risks Report 2023 by the World Economic Forum (WEF) provided rankings of global risks in terms of severity, encompassing both the short-term (next two years) and long-term (next ten years) outlook. Furthermore, in March 2023, the Intergovernmental Panel on Climate Change (IPCC) of the United Nations released its sixth assessment report (AR6), highlighting the role of anthropogenic greenhouse gas emissions in driving global warming. The report underscores the extensive ramifications on food and water security, and human health, as well as the far-reaching economic, social, and environmental development as the three pillars of sustainability. In April 2023, the Emergency Disaster Database (EM-DAT) reported that the cumulative economic losses attributed to climate change reached a staggering

$223.8 billion. The year 2022 witnessed the occurrence of 387 natural disasters worldwide, leading to a tragic loss of 30,704 lives and affecting approximately 185 million individuals. Notably, hot weather conditions alone accounted for 16,305 fatalities, constituting over half of the total deaths recorded in 2022.

Climate change is a pressing global issue that poses significant challenges to the development of nations worldwide. Temperature change has consistently garnered substantial attention from countries across the globe. An example of this attention is the 26th Conference of the Parties (COP26) of the United Nations Framework Convention on Climate Change (UNFCCC) in November 2021. At this conference, 200 countries and major economies signed the Glasgow Climate Convention. They committed to limiting global warming to 1.5 degrees Celsius (currently approaching 1.2 degrees Celsius) to mitigate the escalation of extreme catastrophic climate events on a global scale. Global warming serves as a critical manifestation of climate change, with temperature change serving as a crucial indicator thereof. Against this backdrop, scholars and experts have delved into the multifaceted impact of temperature change on crucial aspects such as human life security, economic development, financial stability, agricultural production, energy consumption, and ecosystems. Inflation, a key macroeconomic factor, holds a pivotal role in the monetary policy objectives of central banks and serves as a measure of a country's economic health and smooth progress. Not only is it a matter of utmost concern for government departments worldwide, but it also assumes great importance for citizens, directly influencing their living standards and well-being. The awareness has increased steadily among scholars regarding the impact of temperature changes, within the framework of climate shocks, on the level of inflation[

2,

3,

4,

5,

6,

7]. Prior research has demonstrated the significant impact of temperature changes on the level of inflation within a country, with the magnitude of this effect varying across nations with different levels of economic development. Notably, Faccia et al.[

5]discovered that abnormal summer temperatures exert distinct influences on inflation levels in developed and developing countries. Specifically, high summer temperatures were found to decrease inflation in the medium to long-term in developed countries. Conversely, Mukherjee et al.[

7] revealed that temperature shocks induce inflationary pressures in both developed and developing countries, with the effects persisting for a longer duration in developing nations.

Hence, this paper adopts the relationship between climate change and inflation as a focal point, conducting empirical analyses to investigate the impact of temperature changes resulting from climate shocks on inflation. This investigation utilizes balanced panel data encompassing 26 selected countries from 1995 to 2021 to formulate policy recommendations aimed at addressing the identified issues.

According to the World Meteorological Organization (WMO), climate change refers to the alteration in average weather patterns over an extended duration. The IPCC of the United Nations defines climate change as the application of statistical analyses to detect alterations in the mean or rate of change in pertinent data, thereby identifying shifts in the climate state that persist for decades or longer. Additionally, the UNFCCC defines climate change as modifications in the global climate system over an extended timeframe, attributed directly or indirectly to human activities.

In empirical analyses aimed at measuring climate change, certain scholars utilize temperature change as a key metric [

8,

9,

10,

11,

12,

13]

. Some scholars utilize greenhouse gas emissions as a metric to assess changes in the climate over a specific time frame[

14]. In contrast, other scholars employ the frequency of extreme natural disasters recorded in the Emergency Disaster Database (EM-DAT) as an indicator to measure climate change[

15,

16,

17]. In recent years, climate change has attracted significant attention from researchers. The frequency of extreme natural disasters and the associated economic losses resulting from abnormal temperatures have been on the rise worldwide. Consequently, an increasing number of scholars have dedicated their efforts to investigating the interconnection between climate change and various aspects such as economic development, financial stability, human life security, agricultural production, and energy consumption.

Previous studies have demonstrated the adverse effects of temperature changes and extreme natural disasters on macroeconomic factors. For instance, Bansal and Ochoa [

8] conducted an analysis using global capital market data and revealed that the covariance between country stock returns and temperature carries valuable information regarding cross-country risk premiums. They further highlighted the influence of temperature on the overall economy, with the temperature risk premium being more pronounced in countries situated closer to the equator. Similarly, Hsiang and Jina [

18] investigated the impact of natural disasters on national economic growth, shedding light on the repercussions of such events on economic development. Following natural disasters, there is a notable decline in national income, and the recovery process can extend over 20 years. Nordhaus [

19] employs an updated DICE model to project the uncertainty surrounding future climate change, highlighting the highly uncertain nature of the impact of climate change on future economic variables. Additionally, Luo Liangwen[

20] extensively reviews the literature on the impacts of climate change on economic growth, agriculture, and labor markets. The findings indicate substantial economic losses resulting from these impacts, particularly in developing countries. Debelle [

21] pointed out that natural disasters caused by climate change can increase infrastructural damages, agricultural losses, and product prices. Yang Lu[

22]examined the impact of temperature changes on China's industrial output using firm-level microdata to predict the medium- and long-term effects of future warming. The findings revealed that temperature changes are likely to result in a decline in China's industrial output. Yang X X [

23] developed a long-term dynamic change output model to analyze the adverse impacts of climate shocks, specifically warming, on economic and financial development. Feitelson et al. [

24] demonstrated the role of climate change as an intermediary factor contributing to violent conflicts in the Middle East. Pugatch T[

25] discovered a positive correlation between extreme weather events, specifically storms, and mortality rates in Mexico. The mortality rate is found to be influenced by the balance between intensity and frequency of storms. The agricultural sector is currently facing its most significant threat from climate change, as it gives rise to natural disasters that pose substantial risks to agricultural production. Research indicates that both temperature anomalies and precipitation can adversely affect agricultural yields. Lei X[

26] employed a dynamic stochastic general equilibrium model to assess the quantitative repercussions of climate change on China's macroeconomy. The findings indicate that climate change will have a detrimental effect on the output value of the agricultural sector and impose higher welfare costs on households. Mukherjee and Ouatarra [

7] highlighted the influence of temperature fluctuations on agricultural production and energy demand. They further emphasized that when the demand surpasses the supply, the price levels increase globally. Liu M H[

10] examined the impact of temperature change on household energy consumption, specifically from the perspective of demand heterogeneity, using panel data.

To date, researchers have conducted comprehensive investigations into the influence of climate change on macroeconomic factors from multiple perspectives. However, there has been relatively less emphasis on exploring the specific effects of temperature changes and extreme natural disasters on inflation. Moreover, scholarly consensus has not been reached regarding the relationship between climate change and inflation, with diverging viewpoints among scholars. Some argue that climate change has an insignificant impact on inflation levels. For example, Cavallo et al.[

27] show that this relationship is insignificant in Chile in 2010. Abe [

28] observed that Japan experienced a minimal increase in inflation following the disaster. However, certain scholars argue that climate does indeed affect inflation. From a supply perspective, climate change can stimulate inflation growth. Temperature anomalies and frequent natural disasters can adversely impact agricultural production and infrastructure, leading to detrimental supply shocks [

29]. Heinen et al [

3] revealed that floods and hurricanes are considerably effective in inflation in 15 Caribbean countries. Also, Batten et al. [

4]found that temperature changes contribute to increased volatility in agricultural and energy prices, subsequently leading to heightened volatility in inflation levels. Similarly, Klomp and Sseruyange [

6] discovered that natural disasters have a substantial impact on raising the price level of a country, regardless of the independence of the central bank. From a demand perspective, the reconstruction of damaged infrastructure may contribute to inflationary pressures. Mukherjee and Ouatarra [

7] utilized a PVAR model to examine the effect of temperature shocks on inflation and found that such shocks create inflationary pressures in both developed and developing countries. Furthermore, the effects of temperature shocks tend to last longer in developing countries. Conversely, other scholars contend that climate change reduces inflation. Doyle and Noy [

2] conducted an empirical analysis on the economy of New Zealand in short-term using a VAR model, specifically examining the impact of natural disasters. Their findings indicated that the occurrence of natural disasters reduces the overall demand within the country, subsequently leading to a decrease in the level of inflation. Faccia et al.[

5] investigated the influence of abnormal summer temperatures on inflation in developed and developing countries. Their findings revealed that high summer temperatures lead to a decrease in inflation over the medium- to long-term. Additionally, the impact of significant natural disasters on inflation varies based on factors such as the country's level of development, the type and severity of the disaster, and the composition of inflation.

The literature review shows the considerable attention of researchers to the issue of climate change around the world, which has the following characteristics. Firstly, these studies mostly focus on the impact of climate change on economic development, financial stability, and human life security, while fewer studies target the analysis of the impact of climate change on inflation. Secondly, the existing studies have empirically examined the role of income level in the effect of climate change on inflation, which makes it difficult to identify the possible non-linear effects. To resolve these limitations, this paper focuses on the nexus of climate change and inflation and tries to expand the existing studies in the following aspects: 1- investigating the impact of climate change on inflation in a targeted manner; 2- using a panel threshold model to analyze the nonlinear role played by the high and low-income levels among countries in the effect of temperature change on inflation; and 3- using a panel mediation model to start from the demand side and explore the channels of the role of energy demand in the effect of temperature change on inflation.

4. Conclusions

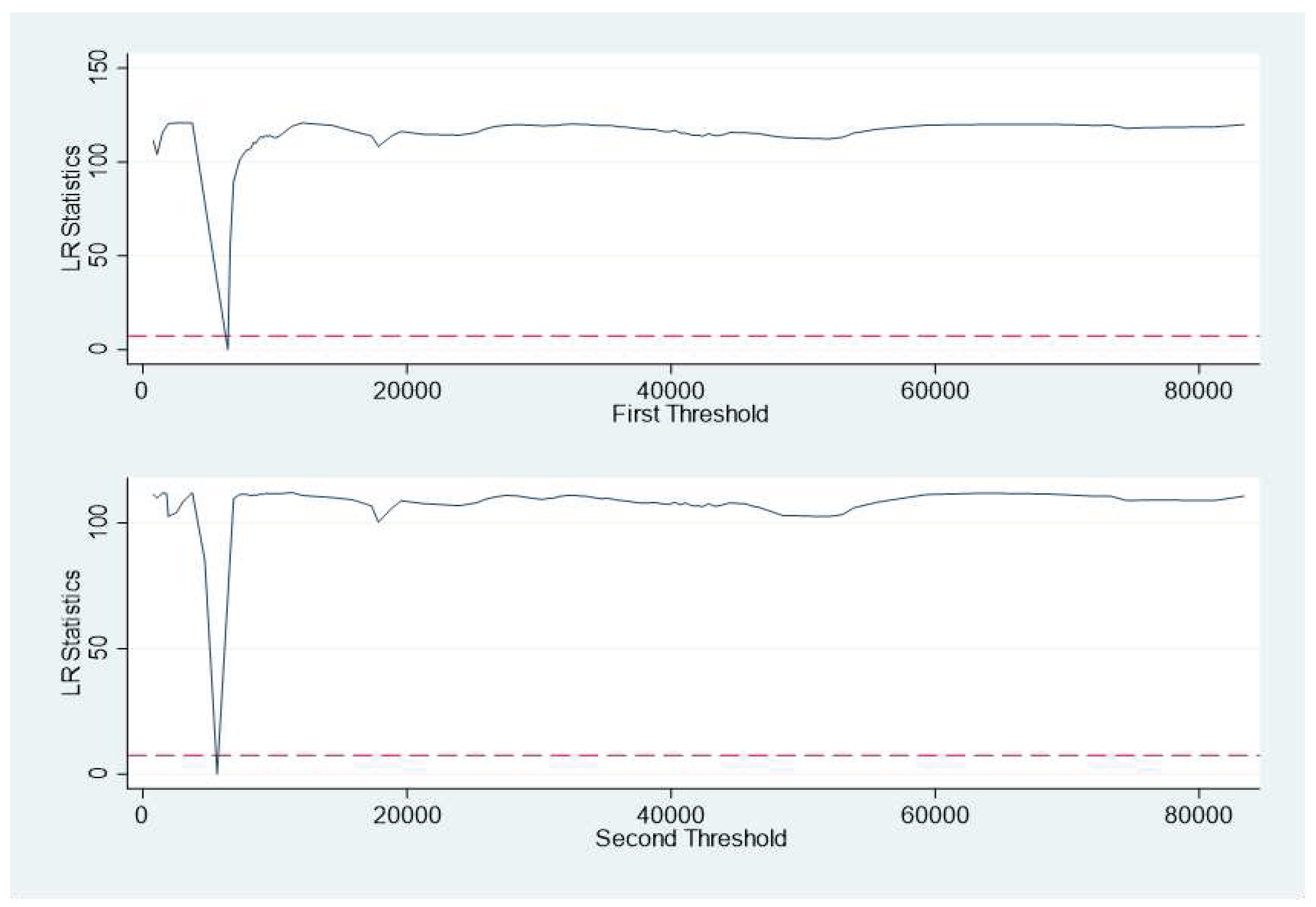

This study examines the relationship between climate change and inflation using balanced panel data from 26 countries between 1995 and 2021. The primary objective is to empirically check the influence of temperature change on inflation within a country. To achieve this aim, the study employs panel fixed effects models, mediated effects models, and panel threshold models. The main findings of this investigation are summarized as follows: Firstly, the analysis reveals a significant and positive relationship between temperature increase, resulting from climate change, and the inflation level in a country or region. Importantly, these empirical findings remain robust even after controlling for the replacement of core explanatory variables, adjustments in the research year interval, and the exclusion of hyperinflationary countries. Secondly, the study reveals a non-linear relationship between temperature change and inflation, depending on the income levels of countries. Specifically, the findings identify two threshold values, namely 5618.95 and 6524.5, for GDP per capita. Within these threshold ranges, temperature change demonstrates a positive effect on the inflation level, which is statistically significant. Thirdly, the study shows that temperature change, through its impact on energy demand, ultimately contributes to an increase in the inflation level. Fourthly, the research highlights the differential vulnerability to temperature change between low and middle-income countries and the low-temperature group. Specifically, the inflation level in low and middle-income countries is more sensitive to temperature change compared to the low-temperature group.

In light of the aforementioned findings, this paper puts forth the following recommendations: Firstly, it is crucial to integrate climate change considerations into the framework of monetary policy. The significant impact of temperature changes resulting from climate change on a country's inflation level underscores the necessity for central banks to incorporate climate-related factors into their monetary policy frameworks. This integration is essential as it forms the foundation for central banks to effectively pursue their monetary policy objectives. Climate change, as an exogenous shock, presents challenges for central banks in utilizing their current macroeconomic forecasting models to identify the origins of inflationary pressures and formulate effective responses to address them. Therefore, central banks should consider climate change in their monetary policies. In this way, they can enhance their risk identification and assessment processes regarding climate change-related risks, and make timely adjustments based on the scale and duration of climate change impacts. In addition, countries worldwide should strengthen national cooperation to effectively address the challenges posed by climate change. The impact of climate change on inflation exhibits a non-linear pattern, demonstrating variations across countries with diverse income levels. As a result, governments should actively engage in international exchange, cooperation, and the establishment of climate governance standards. By actively participating in these global initiatives and contributing to standard-setting processes, countries can accumulate invaluable international experience in climate governance. This experience serves to enhance their resilience in effectively managing and mitigating the consequences of climate shocks. Thirdly, researchers should study the intersection of climate change and economic development. The response to climate change should strive to achieve a harmonious synergy between reducing greenhouse gas emissions and fostering economic development. Achieving the climate governance objectives requires macroeconomic development-related indicators to ensure a balanced and sustainable approach to development that encompasses both environmental and economic dimensions.