1. Introduction

China attaches great importance to the strategic significance of digitalization and digital transformation, and constantly promotes the top-level design of the digital development to help digitalization further industrial integration development and explore new drivers of economic development.

In general, China’s global enterprises are carrying out two things: one is to break through production efficiency through intelligent machines; the other is to build digital platforms to improve operation efficiency and service quality structurally. By combining digital economy development strategies with those of other countries around the world, not only the pace of digital infrastructure investment and construction at home was accelerated, but also the opening and sharing of digital resources through digital technology was promoted, and the barriers to data flow between countries was gradually eliminated, and the cost of digital economy for mutual investment was greatly reduced. In addition, digital technology could be deeply integrated with traditional real economy, relied on the third party data, the second party operator network data and the first party product data, used advanced big data, artificial intelligence and other technologies to achieve multidimensional correlation analysis, so as to understand its customers and networks better than the operators’ customers, and combine customer scenario challenges, solution value and product competitiveness.

The digital transformation is particularly important for the manufacturing industry, which is increasingly dominated by developing countries. There would be many new business models, new products, great power in the digital transformation of manufacturing and export enterprises, and more value would be realized (Lin et al., 2021) [

1]. As a major manufacturing country, China had a complete industrial foundation, based on which the digital economy can be vigorously developed. The implementation of digital transformation of enterprises could greatly reduce production costs, improve the intensity of enterprise R&D, enhance innovation capacity, and promote high-quality development of the manufacturing industry. Therefore, under the digital era, it was urgent to explore the impact mechanism of digital transformation on the export performance and business performance of China’s manufacturing export enterprises, as well as how to promote the deep integration of digital transformation and manufacturing industry, and enhance the competitiveness of manufacturing export enterprises.

This paper constructed digital transformation indicators with the data of listed companies from 2012 to 2019 to study the impact of digital transformation on enterprise performance. In order to understand the theme, this paper focused on the current situation and existing problems of digital transformation of manufacturing export enterprises in China, and analyzed the relationship between digital transformation of manufacturing export enterprises, and their business performance and export performance.

The marginal contributions may be as follows: Firstly, this paper comprehensively analyzed the development status of digital transformation and the operation and export performance of China’s manufacturing export enterprises, and explored the problems existing in the digital transformation of manufacturing export enterprises and the integration of manufacturing industry; Secondly, this paper established theoretical model base on the relevant theoretical analysis, and the enterprise-level data of the manufacturing industry, while the relevant empirical model was established to explore the impact path of the degree of digital transformation on enterprises, and then explored the relationship between the degree of digital transformation and enterprise operation and export performance, and finally put forward suggestions on how to improve the performance of China’s manufacturing export enterprises under the background of digital transformation.

In order to study this, the rest of this paper were as the follows: the 2nd part was literature review, the 3rd part was the analysis of the status of the digitization of manufacturing export enterprises, the 4th part was theories, hypothesis and theoretical models, the 5th part was empirical models and analysis, and the 6part was discussion.

2. Literature Review

2.1 Definition of Concepts Related to Informatization, Internetization, Digitization and Digital Transformation

Generally, the definition of informatization is a narrow definition of information system construction in the field of IT. Wikipedia defines informatization as: informatization refers to the development and transformation of region, economy and society based on information technology and information resources. As defined in the government informatization report, informatization was a historical process that relied on information technology and information resources to improve the quality of economic growth and promote social transformation. Some scholars defined informatization as business carried out in the physical world, supported by information systems, and informatization capability as a reflection of a company’s ability to effectively manage and use information (Zhang et al., 2011) [

2]. The rapid development of enterprise informatization construction prompted China’s enterprises to realize modern management, more online business management operations, and standardized and scientific management and operation modes, which helped enterprises to significantly reduce management and operation costs, and improve management and operation efficiency. In order to make accurate use of IT resources, the former information governance model considered that the orientation of information technology was the effective management of the company (Matéa et al., 2017) [

3].

There was no precise and strict definition of Internetization, so in many cases, people often confused Internet thinking and Internetization (Shen et al., 2023) [

4]. The State Council defined “Internet Plus” as deeply integrating economic society and Internet innovation, improving the production and innovation capacity of the real economy, and forming an Internet-based economic development pattern. The core of the Internetization lied in rebuilding the real economy and traditional fields based on Internet technology and basic business forms (Bogoviz et al., 2018) [

5]. When enterprises tried to innovate in the aspect of Internet, they should not only provide relevant soil and space for trial and error, but also have relevant high-quality technical personnel to ensure business planning and implementation.

Through the IoT, blockchain, big data, mobile Internet, data mining and other digital technologies, enterprises and individuals construct the physical world into the digital world, and this process not only promotes the realization of technology, but also changes the mode of thinking. The characteristics of digitalization are as follows: (1) Using digitalization and other technologies to completely construct the physical world into the digital world; (2) Human beings conduct most activities and interactions in the digital world, while a small amount of command and decision-making information returns to the physical world to command and operate equipment and machines; (3) Digital data is the medium and carrier linking the physical world and the digital world, and is the foundation of the digital world. In the digital transformation, the organizational form of the enterprise itself needed to change, so as to promote the technology-driven change and generate the driving force of spontaneous innovation (Vial, 2019) [

6].

Digital transformation is based on digitalization, which is developing in every aspects. The research on digital transformation has increasingly become the focus of scholars and enterprises. Google sees digital transformation as the ability to redesign and define relationships with customers, partners, and employees with the help of new-age technology. The digital transformation of enterprises covers the application of modernization, the creation of new business models and the provision of new products and services for customers. China Academy of Information and Communications Technology believes that digital transformation refers to the process of integrating industry and digital technology in an all-round way to achieve the purpose of improving efficiency. Specifically, digital technology is applied to realize the digitalization of various elements and links of the industry, optimize the allocation of resources and business processes, and change the mode of production, so as to improve the industrial efficiency.

2.2. Literature on the Impact of Digital Transformation on Enterprise Performance

2.2.1. Literature on the Digital Transformation of Manufacturing Industry

As for the purpose of digital transformation, organizational change theory believes that it is the change measures taken by enterprises to cope with the changes of external factors. Zaoui et al. (2020) believed that digital transformation changed the customer relationship, internal process and value creation of enterprises, and every enterprise should successfully lead the digital transformation [

7]. He et al. (2023) explored the impact of digital transformation on the underlying mechanisms and boundary conditions of green innovation. They found that digital transformation positively affects substantive innovation, and they explored the boundary conditions of digital transformation’s effects on green innovation by analyzing the moderating effect of environmental orientation and separating the motivations into voluntary-driven and mandatory-driven [

8]. Kumar et al. (2023) identified supply chain digitization barriers in light of sustainable development goals (SDGs), and they found that the most important factor in the adoption of SCD was ‘administrative barriers.’ They tried to assist supply chain managers in the decision-making process as it provided structural thinking and framework by establishing the relationship between the barriers of SCD and their effect on the SDGs [

9].

2.2.2. Literature on Digital Transformation Measurement Index

Up to now, the index measurement standard of digital transformation was not unique, and there were few researches, while scholars’ researches on digital transformation mostly focus on information technology ability, informatization degree and other aspects. Cooper et al. (1985) considered the economic benefit was mainly measured from export profit, export income, export value and so on [

10]. Bharadwaj (2000) divided IT resources into IT infrastructure and IT human resources to measure the company’s IT capability [

11]. Peppard et al. (2001) summarized information technology capability into information infrastructure, management capability and business matching capability [

12]. Aral et al. (2007) found that IT investment had no significant influence on ROA and net profit rate [

13]. Nylen et al. (2015) believed that the enterprise’s good products were efficient, easy to learn, and the value needed consumers, so that such digital innovative products can cater to the retail consumer market trend [

14].

2.2.3. Literature on Enterprise Performance Measurement Indicators

Most of the study of enterprise performance started from three perspectives: enterprise operating performance, enterprise innovation performance, and enterprise export performance. Some scholars (Guo et al., 2022) took corporate social responsibility as business performance indicators [

15]. Wang et al. (2021) uses the ratio of return on total assets and operating profit rate to measure corporate transformation performance [

16]. Some authors choose to construct an index evaluation system to measure the business performance of enterprises. Kauffman et al. (2018) focuses on the relationship between digital economy and enterprise innovation performance. They believed that the application of digital technology can not only reduce the information friction between enterprises and the market, but also improve the scientific decision-making [

17]. Correa (2012) believed that the more intense the market integration, the more it would promote the improvement of enterprises’ innovation performance [

18]. Kanuri et al. (2022) empirically investigated an online sales push’s impact on salesperson effort allocation and sales performance, and their results indicated that following an online sales push, salespeople expended their effort based on a customer’s online proclivity and potential prior to the push [

19].

2.2.4. Literature on the Path of Digital Transformation

Berman et al. (2012) believed that enterprise digital transformation was to reconstruct business model to improve enterprise market competitiveness [

20]. Lerch (2015) believed that digital transformation could improve the quality of products and services on the basis of improving operational efficiency, and ultimately increase the company’s market share and influence [

21]. Zhang et al. (2019) conducted an empirical analysis on 254 enterprises in Guangdong Province and found that both dimensions of big data capability had a significant positive impact on enterprise performance. Among them, integration and utilization of big data resources can improve business performance by positively affecting organizational learning [

22]. Lai et al. (2020) shew that digital transformation can not only reduce enterprise costs, but also improve enterprise service efficiency [

23]. Qi et al. (2020) analyzed the influence of digitalization level on enterprise performance by establishing digital indicators based on the data of Chinese manufacturing enterprises from 2011 to 2018, and concluded that sales activities and management activities had two influence paths, and the results were not significant because they offset each other [

24]. Lee et al. (2021) addressed six dominant topics, such as identified, namely smart factory, sustainability and product-service systems, construction digital transformation, public infrastructure-centric digital transformation, techno-centric digital transformation, and business model centric digital transformation. Their study contributed to adopting and demonstrating the ML-based topic modeling for intelligent and systematic bibliometric analysis [

25]. Battisti et al. (2023) investigated the effects of technological and organizational change (T&O) on jobs and workers, and shew that firms that adopted T&O offered routine workers retraining opportunities to upgrade to more abstract jobs [

26]. Jauhar et al. (2023) examined digital transformation technologies application in the related industry, and analyzed product returns in the e-commerce industry [

27].

2.2.5. Literature on the Effect of Digital Transformation on Enterprise Performance of Manufacturing Export Enterprises

By adopting appropriate organizational change strategies, enterprises could make changes from the aspects of organizational personnel, organizational tasks, and organizational technology. The specific methods and strategies were improved and planned (Nelson et al., 1992; Barney et al., 2001; Ahuja et al., 2004; Anold et al., 2012)[28-31]. Walter et al. (2015) believed that enterprises also knew that only through organizational learning, dynamic change ability and information technology could they successfully adjust their organizational structure [

32]. Chen et al. (2020) constructed an evaluation system from three aspects of technological change, organizational change and management change to measure the ability of manufacturing enterprises to make digital transformation [

33]. Alexandre et al. (2022) investigated the relevance of some performance indicators of airline’s management and operational efficiency. Through the analysis of these performance indicators, it was possible to determine strategies that support decision making to increase the operational efficiency of airlines [

34]. Parsheera (2022) highlighted some of the state-level differences in digital access, skills, and infrastructure across India—as a basis for dispelling assumptions about the homogeneity and universality of India’s digital transformation. They drew attention to the varying levels of digital readiness within India, and to the need to account for these variations in the design and implementation of the country’s digital initiatives [

35].

3. Analysis of the Status of the Digitization of Manufacturing Export Enterprises

3.1. Current Situation of Digital Transformation of Domestic and Foreign Enterprises

Most domestic enterprises have begun to carry out digital transformation, under different industries, the digital level gap was large.

In terms of the overall domestic digital transformation, nearly 70% of enterprises have started digital transformation, and the rest are in the planning state. In December 2018, Zhiding.com conducted a survey report on 500 enterprises or institutions from the government, manufacturing, finance, education, retail and other industries, showing that about 14% of enterprises had basically completed the digital transformation and were in the optimization and innovation stage, and about 14% of enterprises were in the process of digital transformation. About 41% of enterprises were conducting single point trials or partial roll-out of digital transformation, and another 31% were in wait-and-see or planning mode.

In terms of industries, the digitalization level of ICT, communication media, finance and insurance industries was relatively high, while the digitalization level of real estate, construction industry and agriculture industries was relatively low. According to the report on China’s digital Economy released by McKinsey Global Institute in December 2017, the digitalization level of 21 industries in China was evaluated from five levels. The higher the level, the higher the digitalization level, and the TMT industry was in the forefront.

In terms of management level, the high level of digitalization lied in technology application and model innovation, while the low level of digitalization lied in user experience and product service. In October 2018, IDC conducted research on enterprises in six key industries, including retail, education and manufacturing, and evaluated digitalization level from seven management levels. The results shew that the digitalization level of technology application and mode innovation was high, while the digitalization level of user experience and product service was low.

3.2. Current Situation of Digital Transformation of Domestic Manufacturing Export Enterprises

According to the study of China Internet Development Report 2022, the industrial scale of China’s digital economy reached 50.2 trillion yuan in 2022, accounting for 41.5% of GDP, which was an important driving force to stabilize the sustainable growth of China’s economy.

In recent years, in response to the requirements of The State Council and the State-owned Assets Supervision and Administration Commission on the digital transformation of Chinese manufacturing enterprises in the 14th Five-Year Plan, manufacturing export enterprises continued to enhance their own digital transformation ability. The digital transformation degree of export enterprises in each subsector of manufacturing industry was calculated according to the classification of subsectors of manufacturing enterprises in Wind. The data was shown in

Table 1, with six sub-sectors: Textile, clothing and apparel industry; printing and recording media reproduction industry; computer, communication and other electronic equipment manufacturing industry; cultural and educational, industrial and art, sports and entertainment equipment manufacturing industry; petroleum processing, coking and nuclear fuel processing industry; railway, ship, aerospace and other transportation equipment manufacturing industry with an overall digital transformation degree higher than 0.1.

4. Theories, Hypothesis and Theoretical Models

4.1. Basis of Theories

In 1984, Wernerfelt formally proposed the Resource Based View theory, marking the birth of the theory of enterprise core competitiveness. In order to analyze the distribution and use of resources in an enterprise and draw feasible strategic choices based on the analysis, Wernerfelt analyzed the relationship between profits and resources on the premise of putting forward the economic analysis tool based on resources, and then analyzed how specific resources and enterprise resource state management strategies were viewed and analyzed over time [

36]. Wernerfelt mainly analyzed four kinds of attractive resources, including machine capacity, customer loyalty, production experience and technical leadership, and used the resource-based view to divide resources into two categories: supplementing existing resources and obtaining complementary resources with existing resources. Tang (2021) believes that digital transformation was driven by technological change within organizations and can become the source of competitive advantage of enterprises through emerging technologies [

37].

The traditional trade theory originated from the theory of absolute advantage and the theory of comparative advantage. Adam Smith put forward the theory of absolute advantage in 1776, while David Ricardo proposed the theory of comparative advantage, which believed that the differences in production technology between countries determined the differences in comparative costs, so two countries need not have absolute advantages when trading two kinds of products. According to the current research of other scholars, there were mainly two views on the impact of digital transformation on enterprise costs. Most scholars believe that digital transformation can significantly reduce the production cost and operating cost of enterprises to enhance their competitiveness.

4.2. Research Hypothesis

Based on resource-based view theory, trade theory and previous studies of other scholars, this paper discusses the purpose and necessity of digital transformation of manufacturing enterprises, possible measures taken by enterprises to cope with future business risks, how these measures can improve enterprise performance and what benefits digital transformation will bring. According to the resource-based theory, human resources and R&D intensity should be evaluated. Therefore, this paper proposed hypothesis H1a and H1b.

Hypothesis H1a: There was a positive relationship between enterprise digital transformation degree and enterprise business performance;

Hypothesis H1b: There was a positive relationship between enterprise digital transformation degree and enterprise export performance.

Specifically, the core explanatory variable enterprise digital transformation degree had a significant positive impact on enterprise performance, which was, improving digital transformation degree would have a positive impact on enterprise operation and export performance. Enterprise digital transformation may have a positive impact on enterprise performance, and digital transformation may have an impact on enterprise performance through other paths. Therefore, this paper proposed hypotheses H2a to H4c to be tested.

Hypothesis H2a: there was a negative relationship between enterprise digital transformation degree and enterprise operating cost;

Hypothesis H2b: There was a positive relationship between enterprise digital transformation degree and enterprise R&D intensity;

Hypothesis H2c: There was a positive relationship between enterprise digital transformation and enterprise human resources;

Hypothesis H3a: The lower the enterprise operating cost, the greater the enterprise operating performance and export performance;

Hypothesis H3b: The stronger the R&D intensity, the greater the business performance and export performance;

Hypothesis H3c: The more human resources an enterprise had, the greater their operating performance and export performance;

Hypothesis H4a: Operating cost plays an intermediary role between enterprise digital transformation and the performance of enterprise management and export;

Hypothesis H4b: R&D intensity plays a mediating role between enterprise digital transformation and the performance of enterprise operation and export; Hypothesis H4c: Human resources play an intermediary role between enterprise digital transformation and the performance of enterprise operation and export.

When an enterprise carries out digital transformation, its organizational tasks, organizational technologies, organizational personnel and other aspects will be changed, which will ultimately affect the overall profitability of the enterprise.

Hypothesis H5: There was a time-lag effect between enterprise digital transformation and enterprise business performance and export performance

As the early stage of enterprise digital transformation was relatively large, the impact of technological progress had not been fully revealed, which makes the effect of digital transformation on performance seem small. Moreover, due to the relatively high short-term cost pressure, enterprise profitability will be reduced and other operating project expenses may be crowded out. Therefore, digital transformation may have a time-lag effect on business performance and export performance.

Hypothesis H6: The influence of enterprise digital transformation degree on enterprise performance was heterogeneous in regional and economic development level

In the era of digital economy and big data, computing power was an important foundation for the rapid development of national economy and micro enterprises. With the acceleration of digital transformation and upgrading, the total amount of data in the whole society had not only ushered in explosive growth, but also the demand for data storage, transmission, calculation, analysis and application had also increased significantly. Only by accelerating the construction of computing power can we effectively stimulate the innovation vitality of data elements, and promote the process of digital industrialization, industrial digitization and high-quality economic development.

4.3. The Construction of Enterprise Performance Evaluation Index

When selecting indicators to measure the business performance of enterprises, scholars had various strategies, who directly choose accounting indicators to measure the business performance of enterprises with explained variables [38-41]. On the basis of objective analysis, collection, sorting and judgment of the operating conditions of various industries in China, and the use of mathematical statistics to calculate and formulate, this paper used principal component analysis to construct the business performance evaluation system of listed companies in China. The nine financial indicators were defined in

Table 2. All the data in this paper were from Wind database and Guotai ‘an database.

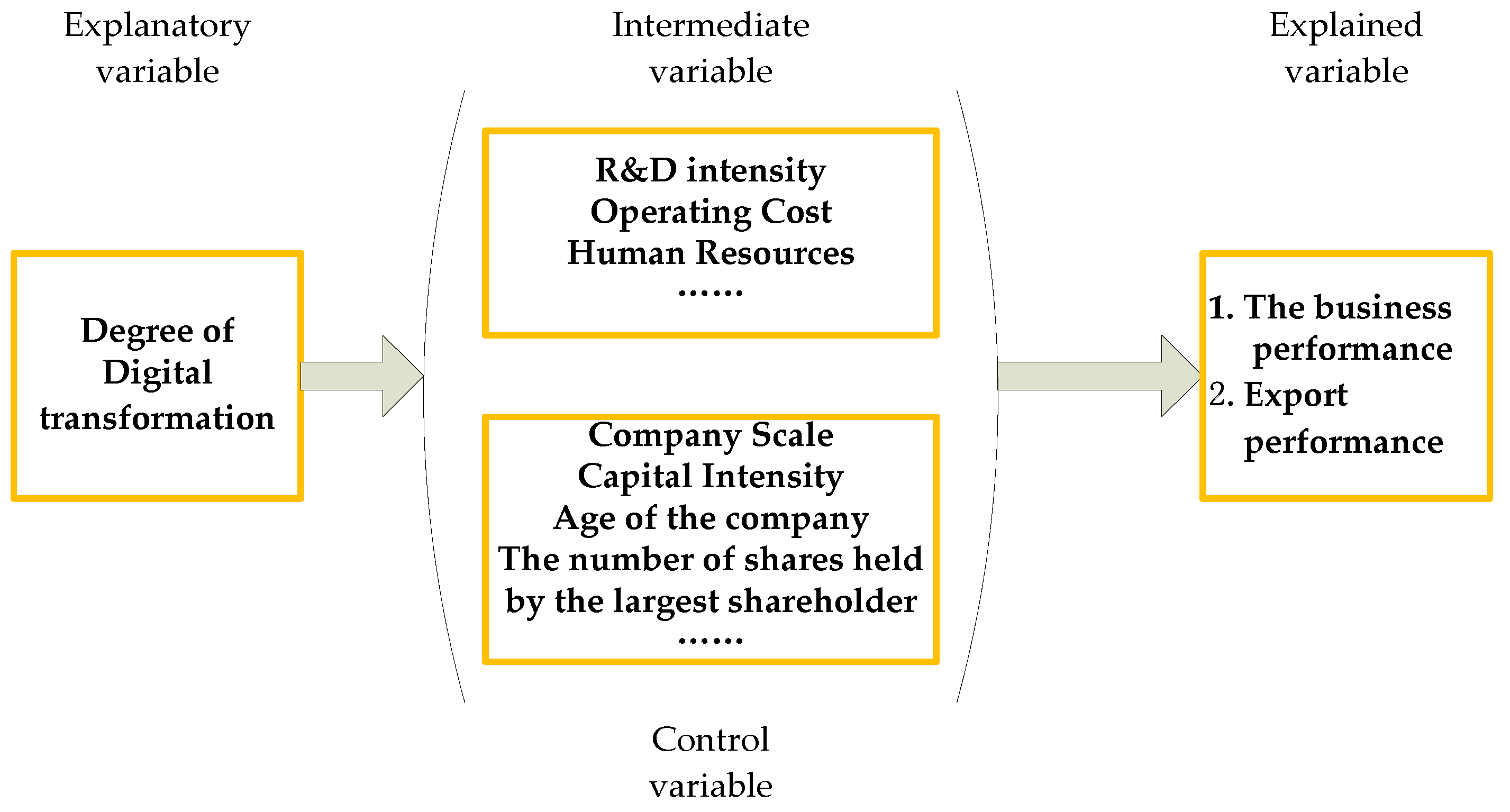

4.4. Construction of Theoretical Model

From the above analysis of both the hypothesis and the enterprise performance index, this paper put forward the following theoretical models to analyzed the relationship between the degree of digital transformation and enterprise’s performance. Meanwhile, in order to make enterprise’s performance clear, this paper divided the enterprise’s performance into two spheres: one is the enterprise’s business performance, the other is the enterprise’s export performance. Therefore, the theoretical models will also be divided into two spheres.

Therefore, the explained variables may be the business performance and export performance of enterprises, which would be measured by mathematical statistics method and the official standards. The core explanatory variables would mainly focus on the investment of digital technology etc. The intermediary variables would be the ratio of R&D expenses to operating income to measure the R&D intensity, and the ratio of operating costs to period expenses and re-expenses to measure the operating costs of the company. The control variables would be the factors that may affect the business performance of enterprises such as company size, capital intensity, Age and the proportion of the largest shareholder, etc. The illustration of the theoretical mode was shown in

Figure 1.

5. Empirical Models and Results Analysis

5.1. Data Acquisition

The research object of this paper was 1007 listed companies in Shanghai and Shenzhen stock exchanges from 2012 to 2019. Panel data were selected as sample research objects to reflect the financial indicators such as profitability, solvency, operating capacity and growth capacity of each listed company. Data such as the number of shares held by major shareholders, the ratio of independent directors and the nature of ownership of each listed company were all derived from Wind database. Data reflecting the proportion of digital economy-related part in the intangible assets details of each listed company in the total intangible assets at the end of the year and annual change were collected through corporate annual reports, announcements, corporate websites and other channels.

The specific data samples were adjusted according to the following criteria: (1) Complete data of manufacturing enterprises had been available for analysis for 8 consecutive years; (2) The samples with special status and missing data were excluded. After a series of screening, the complete data related to 1007 listed companies were finally obtained.

5.2. Variable selection

In this paper, business performance and export performance of enterprises were selected as the explained variables, and used mathematical statistics method to measure the official standards of business performance.

With the help of Wind database and Guotai ‘an database, this paper can easily collect a large number of listed companies’ annual reports, and can also obtain corresponding data by browsing the official website. Therefore, according to the definition of digitalization and digital transformation, digital transformation pays more attention to the digital world rather than the physical world, and pays more attention to the investment in digital technology. The core explanatory variable of this paper is the degree of digital transformation. There are two main methods for measuring the degree of digital transformation in existing studies: the first is quantitative description method, which measures the degree of digital transformation by obtaining the cost of digital transformation (Zhang et al., 2021)[

42]; of course, the second is text analysis method, which measures the index by counting the frequency of keywords related to digital transformation in the text [

43].

This paper uses the first method for reference. First of all, with the help of Wind database and Guotai ‘an database, this paper can easily collect a large number of listed companies’ annual reports, and can also obtain corresponding data by browsing the official website; Secondly, word frequency cannot effectively reflect the actual digital investment level of the company, and can only judge whether the enterprise has carried out big data transformation or the importance of digital transformation from word frequency. Therefore, according to the definition of digitalization and digital transformation, digital transformation pays more attention to the digital world rather than the physical world, and pays more attention to the investment in digital technology. By referring to the research of scholars such as He et al. (2019), the ratio of the intangible assets related to digital transformation in the intangible assets at the end of the annual report of listed companies is used to measure the level of digital transformation of enterprises. That is, when the intangible assets item includes keywords related to digital transformation technologies such as “management software”, “information management system”, “management system”, “intelligent platform”, “software system”, etc., the detailed item is defined as “digital intangible assets”, and then the proportion of intangible assets in the current year is calculated by adding them up. Is the proxy variable of the degree of enterprise digital transformation [

44].

This paper used the ratio of R&D expenses to operating income to measure the R&D intensity of the company, and uses the ratio of operating costs to period expenses and re-expenses to measure the operating costs of the company, which was easy to calculate and authoritative.

As for the control variables, this paper mainly selected the factors that may affect the business performance of enterprises as the control variables from the company level. Company Size (Size), Capital intensity (Capital), Age (Age) and Tpshahor (proportion of the largest shareholder) were selected as the control variables. Generally speaking, the larger the size and age of the company was, the stronger the ability to cope with external risks and other capabilities. Therefore, the above variables were selected as control variables, and the Index selection was summarized in

Table 3.

5.3. Model Construction

In order to further clarify the causal relationship of various variables and verify the hypotheses, this paper established a regression model to test the hypotheses, and according to the research hypothesis of enterprise digital transformation degree and enterprise performance, regression model 1 and regression model 2 were established on the basis of four control variables:

In the control variable group, digital transformation (Transr) was added, and model 3 and model 4 were established to verify hypothesis H1a and H1b respectively.

In order to test hypothesis H3a, H3b and H3c, on the basis of model 1 and model 2, the substitution variables of Cost, R&D intensity and human resources (Cost, Innor and Peor) were added, and regression models 5 to 10 were established:

To test the path analysis in hypothesis 2, this paper established the relationship between digital transformation (Transr) and the Cost, R&D intensity, and human resource substitution variables (Cost, Innor, and Peor), and established the basic regression model 11 to 13 to control the variables:

Digital Transformation (Transr) was added to Model 11, and model 14 was established to verify hypothesis H2a:

Digital Transformation (Transr) was added to Model 12, and model 15 was established to verify hypothesis H2b:

Digital Transformation (Transr) was added to Model 13, and model 16 was established to verify hypothesis H2c:

Finally, on the basis of models 3 and 4, intermediate variables, namely Cost, R&D intensity and human resource substitution variables (Cost, Innor and Peor), were added to complete the final model construction of path analysis. Models 17 to 22 were established to verify hypothesis H4a, H4b and H4c:

In the above model, α represented the intercept, β represented the coefficient of each variable, and Ɛ represented the residual term.

5.4. Empirical Analysis

5.4.1. Measurement of business performance

In this paper, by referring to the relevant studies for the measurement of enterprise business performance, the collected indicator data was standardized, and then KMO and Barlett tests was conducted, and the KMO value after the tests was analyzed. If the value was higher than 0.8, the selected metric was well suited for analysis. If it was greater than 0.7 and less than 0.8, it was more suitable for analysis. If it was greater than 0.6 and less than 0.7, it can be analyzed. If this value was less than 0.6, it was not suitable for analysis. And if the p value corresponding to Bartlett test was lower than 0.05, it indicated that the principal component analysis was suitable.

According to the enterprise operation performance evaluation system constructed in this paper, nine financial index data f

ij of 1007 listed companies were collected and sorted into matrix data sets. KMO and Barlett tests were carried out in

Table 4.

The test results shew that the KMO value of enterprise business performance index after test was 0.616, higher than 0.6, p value =0.000< 0.005, indicating that the data meets the requirements of principal component analysis.

The calculation results were as follows: As shown in

Table 2, stata16.0 was used to conduct principal component analysis on enterprise business performance, and the principal components with eigenvalue greater than 1 were selected to obtain five principal components, namely, Cop1, Cop2, Cop3, Cop4 and Cop5, which extract a total of 83.230% of the index variables of 9 financial indicator variables. In addition, the variance percentage of each component reached more than 10%, and principal component 1 accounted for 23.602%, principal component 2 accounted for 16.647%, principal component 3 accounted for 16.368%, principal component 4 accounted for 15.390%, and principal component 5 accounted for 11.223%, which had a good reflection of the whole sample. The principal component coefficients of each financial index in the enterprise performance evaluation system were shown in

Table 5.

The principal component coefficients of business performance indicators were shown in

Table 6.

The five principal component expressions can be obtained from

Table 6 as follows:

Each index was multiplied by the variance contribution rate of the corresponding component, then divided by the cumulative total contribution rate of the five principal components, and finally summed to obtain the comprehensive score of enterprise business performance.

5.4.2. Descriptive statistics of study variables

The descriptive statistical results of indicators of digital transformation of manufacturing export enterprises, business performance, export performance and other related variables were as

Table 7.

5.4.2. Correlation analysis

In order to preliminarily judge the correlation between the performance of manufacturing export enterprises, digital transformation, operating costs, research and development intensity and other relevant variables and their degree, this paper conducted correlation analysis of the above variables.

It can be seen from the correlation test results in

Table 8, there was a strong positive correlation between enterprise digital transformation and enterprise business performance indicators and enterprise export performance indicators. H1a and H1b can be preliminarily verified.

Before the following regression analysis, this paper conducted collinearity diagnosis for each regression model by calculating the variance inflation factor (VIF). If the value was less than 5, there was no collinearity problem. The results were shown in

Table 9. VIF values of all models were less than 5, indicating that collinearity problem was impossible among variables:

5.5. Regression Analysis and Hypothesis Test

Through the correlation analysis in the above section, the relationship between digital transformation and various variables can be preliminarily judged. In order to further explore the causal relationship of various variables, this paper used SPSS statistical analysis software to conduct regression analysis on 1007 company samples, and tested the assumptions in the previous section according to the model. The empirical results of digital transformation on the performance of manufacturing export enterprises were shown in

Table 10.

5.6. Intermediating effect Test of Digital Transformation Degree on Enterprise Performance of Manufacturing Export Enterprises

To test hypothesis H4a, H4b, and H4c, models 17 to 22 were established to test the mediation effect. According to the above empirical results, it was clear: (1) digital transformation (Transr) had a significant positive effect on business performance (Prcomp), digital transformation (Transr) had a significant positive effect on Export performance, and digital transformation (Transr) had a negative impact on business Cost (Cost). Digital transformation (Transr) had a significant positive effect on research and development intensity (Innor), and digital transformation (Transr) had a positive effect on human resources (Peor). In this part, Model 20, model 21 and model 22 were used to analyze whether the coefficient corresponding to digital transformation in the intermediary effect was significant.

It was analyzed above that enterprise digital transformation had a significant positive impact on enterprise performance (Prcomp and Export), research and development intensity (Innor) and human resources (Peor), and a significant negative impact on the company’s operating Cost (Cost). On this basis, the mediating role of operating cost, R&D intensity and human resources was further examined. From

Table 11, the R

2 adjusted by model 17 was 0.015, which was 0.009 higher than that adjusted by model 3. The fit degree of the model was good and improved. The absolute value of the regression coefficient of digital transformation of the independent variable on the business performance of the dependent variable decreased but it was still significant (β=0.043, p<0.05), indicating that operating costs played a partial mediating role in the relationship between enterprises’ digital transformation degree and business performance.

Similarly, after adding the research and development intensity of intermediate variables (Innor), digital transformation was significant; the absolute value of the regression coefficient at the 0.05 level decreased from 0.053 to 0.050, indicating that R&D intensity played a partial mediating role in the relationship between digital transformation and business performance. After adding the intermediary variable human resource (Peor), digital transformation had a significant. At the level of 0.05, the absolute value of regression coefficient decreases to 0.047, indicating that human resources played a partial mediating role in the relationship between digital transformation degree and business performance. Then, based on model 4, models 20 to 22 also met the above analysis and demonstration. Operating cost, R&D intensity and human resources also played a partial mediating role in the relationship between digital transformation and the export performance of enterprises. To sum up, it could be seen that digital transformation affected the business performance and export performance of enterprises through operating costs, R&D intensity and human resources. Hypothesis H4a, H4b and H4c were verified, and the results were valid.

5.7. Delay Effect Analysis

In this paper, enterprise performance (Prcomp) and enterprise Export performance were treated with one-period and two-period lag. For enterprise performance, the coefficient of digital transformation degree of core explanatory variable was 0.039 when enterprise performance was delayed by one period, and passed the test at a significant level of 5%. Compared with the regression result of one-period lag, the coefficient of the second-phase delayed digital transformation degree increased in absolute value and was significant at 1%, indicating that it had a time-lag effect on enterprise business performance. After an enterprise increased its investment in digital transformation to improve digital transformation, it may have more positive effects on enterprise business performance in the later period. However, the digital transformation of enterprises lagging phase 1 and Phase 2 was not significant, so it was assumed that H5 was not supported.

5.8. Result Analysis

Based on the financial data of listed companies, this paper studies the impact of digital transformation on the performance of manufacturing export enterprises, and analyzes and demonstrates the relationship between the two from both theoretical and empirical aspects. And this paper analyzed and summarized the selection and measurement of proxy variables of digital transformation degree and enterprise performance, which provided a theoretical basis for further analysis, and put forward six hypotheses and establishes relevant models, which were verified by empirical method (

Table 12).

This paper explored the impact of digital transformation of manufacturing export enterprises on the performance of enterprises. Through empirical research, it was found that: (1) In the analysis based on large samples, digital transformation of manufacturing export enterprises had a significant positive impact on the performance of enterprises. (2) Through the multiple regression analysis of the intermediary effect test, it was found that digital transformation of enterprises can improve the enterprise performance by improving the enterprise human resources, increasing the enterprise research and development intensity, reducing the operating cost. (3) By enterprise nature analysis, it was found that digital transformation of non-state-owned enterprises had more positive impact on the business performance and export performance of enterprises, while non-state-owned enterprises was less. (4) By region and economic development level analysis, it was found that digital transformation of enterprises in coastal areas had a greater impact on enterprise performance than that in inland areas.

6. Discussion

6.1. Academic Implications

In the empirical aspect, the empirical research was carried out by using the relevant enterprise data collected and organized in Wind database and Guotai ‘an database. Multiple regression models were constructed to verify the hypotheses step by step, and the intermediary effect test method was used to verify the role of human resources, operating costs and R&D intensity in the influence of digital transformation degree on enterprise performance of manufacturing export enterprises. Then, the robustness of the model was verified by replacing the explained variables, and the possible delayed impact of digital transformation was explored. Finally, heterogeneity analysis was carried out from the dimensions of enterprise nature, region and economic development level.

This paper measured enterprise digital transformation by using the proportion of the total assets of digital related parts in the intangible assets in the annual report to the total intangible assets, which had certain innovative significance for the study of enterprise digital transformation. Also, this paper evaluated the impact of digital transformation on enterprise performance from the enterprise dimension, and compared with the existing researches, and put forward useful countermeasures and suggestions for enterprises in the process of digital transformation. In addition, this paper used the data of more than one thousand listed manufacturing export enterprises in China, to study the impact of digital transformation on the business performance of enterprises, and selected a series of variable indicator data to analyze and studied the manufacturing enterprises, that occupied the first share of China’s GDP and were most affected by digital transformation, which had certain innovative significance.

6.2. Managerial Implications

Based on the above study of digital transformation on the performance of enterprises, the following policy suggestions were put forward. Firstly, enterprises should accelerate the pace of organizational change for digital transformation to actively seek to resume work and production, accurately control inventory, improve management efficiency and operational efficiency, and effectively reduce enterprise operating costs. Secondly, enterprises should lay out digital technology research and implementation plans as soon as possible, so as to open up the barriers between digital technologies and the production environment, supply chain, market sales etc. Thirdly, the government should promote the development of digital transformation and strengthen the construction of relevant digital infrastructure to eliminate barriers to regional data and digital industries, to push the free flow of data elements, and to introduce relevant data protection, collection, use and transmission norms and guidance recommendations. Fourthly, the government should attach importance to the education and introduction of digital talents, cultivate technical and managerial talents with innovative thinking and skilled use and management of data information, and encourage enterprises to conduct technical training for employees and introduce high-quality talents for management.

6.3. Limitations

This study has several limitations. First, Due to the limitations of data quantity, quality and channels, this paper only analyzed the data of 1007 manufacturing export enterprises. Second, the mechanism and path of the impact of digital transformation degree on enterprise performance is only studied from the perspective of resource-based theory and trade theory, and the mechanism and path are not explored from other perspectives. Third, endogeneity problem and variable measurement are not perfect.

6.4. Opportunities for Further Research

Therefore, the future research can increase the research on digital transformation on the performance of large and small, medium and micro manufacturing export enterprises respectively; and the later study will expand from other perspectives, and also deal with the endogeneity problem and variable measurement design.

Author Contributions

Conceptualization, Y.W., Q.W. and T.W.; methodology, Y.W., Q.W. and T.W.; validation, Y.W., Q.W., and T.W.; investigation, Y.W., Q.W.,T.W.; writing—original draft preparation, Y.W., Q.W.; writing—review and editing, Y.W., Q.W. and T.W.; supervision, Y.W., Q.W. All authors have read and agreed to the published version of the manuscript.

Funding

This study was funded by National Social Science Fund (No:21BSH097), China, the Key Project of the Center of Sino-Foreign Language Cooperation & Exchange (2021), Ministry of Education, China.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Not applicable.

Acknowledgments

This study was funded by National Social Science Fund (No. 21BSH097), China, the state Project of Ministry of Science & Technology (No. DL2021163001L), China, the Key Project of the Center of Sino-Foreign Language Cooperation & Exchange(2021), Ministry of Education, China, the Industry-Academic Cooperation Collaborative Education Project of the Ministry of Education (201902036018, 202102119014), China, Guangdong Natural Sciences Fund (2020A1414010301), and the Humanities and Social Sciences Fund of South China University of Technology.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Lin, Y.; Gu, Q. Exploring the Focus of Enterprise Informatization During Digital Transformation. 2021. [Google Scholar] [CrossRef]

- Zhang, J.; Wu, Z.; Feng, P.; Yu, D. Evaluation systems and methods of enterprise informatization and its application. 2011; 38. [Google Scholar]

- Matéa, A.; Trujilloa, J.; Mylopoulos, J. A: and derivation of key performance indicators for business analytics, 2017.

- Shen, G.; Shen, B.; Wu, R.; Yuan, Z. E: and the markups of export firms, 2023.

- Bogoviz, A.V.; Lobova, S.V.; Alekseev, A.N.; Koryagina, I.A.; Aleksashina, T.V. Digitization and Internetization of the Russian Economy: Achievements and Failures. In: Popkova, E. (eds) The Impact of Information on Modern Humans. HOSMC 2017. Advances in Intelligent Systems and Computing, 2018, 622. Springer, Cham. [CrossRef]

- Vial, G. Understanding digital transformation: A review and a research agenda. 1: Journal of Strategic Information Systems,2019,28(2), 2019. [Google Scholar]

- Zaoui, F.; Souissi N., A. Framework For A Strategic Digital Transformation. 6th IEEE International Congress on Information Science and Technology (IEEE CiSt), 2020 6TH IEEE CONGRESS ON INFORMATION SCIENCE AND TECHNOLOGY (IEEE CIST’20), 2020, pp.

- He, Q.; Ribeiro-Navarrete, S.; Botella-Carrubi, D. A matter of motivation: the impact of enterprise digital transformation on green innovation. Rev Manag Sci, 2023. [CrossRef]

- Kumar, Dadsena K.; Pant P. Analyzing the barriers in supply chain digitization: sustainable development goals perspective. Oper Manag Res. 2023. [CrossRef]

- Cooper, R. G.; Kleinschmidt E., J. The Impact of Export Strategy on Export Sales Performance. Journal of International Business Studies, 1985, 16(1).

- Bharadwaj, A. A Resource-Based Perspective on Information Technology Capability and Firm Performance: An Empirical Investigation. 1: MIS Quarterly,2000,24(1), 2000. [Google Scholar]

- Peppard, J. Managing IT as a Portfolio of Services. 2003. [Google Scholar]

- Aral, S.; Weill, P. IT Assets, Organizational Capabilities, and Firm Performance: How Resource Allocations and Organizational Differences Explain Performance Variation. Organization Science, 2007, 18(5): 763-80.

- Nylen, D. , Holmstrom J. Digital innovation strategy: A framework for diagnosing and improving digital product and service innovation. 5: IEEE Engineering Management Review,2015, 58 (1), 2015. [Google Scholar]

- Guo, C. The Impact of Management Succession on Corporate Social Responsibility of Chinese Family Firms: The Moderating Effects of Managerial Economic Motivations, Sustainability, 2022, 14, 16626. [CrossRef]

- Wang, Y. Research on the Impact of the Digital Economy on the Transformation of Manufacturing SMEs. 4: Comparative Economic & Social Systems,2021,(03), 2021. [Google Scholar]

- Kauffman, G.; Weber, P. On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. 2: Journal of Management Information Systems,2018, 35(1), 2018. [Google Scholar]

- Correa, J. A. Innovation and competition: An unsTable relationship. 1: Journal of Applied Econometrics,2012,27(1), 2012. [Google Scholar]

- Kanuri, V. K.; Habel, J.; Chaker Nawar, N.; Rangarajan, D.; Guenzi, P. B2B online sales pushes: Whether, when, and why they enhance sales performance,Prod Oper Manag. 2022; 1–21.

- Berman, S. J. Digital transformation: opportunities to create new business models. 1: Strategy & Leadership,2012,40(2), 2012. [Google Scholar]

- Lerch, C.; Gotsch, M. Digitalized Product-Service Systems in Manufacturing Firms: A Case Study Analysis. 4: Research-Technology Management,2015,58(5), 2015. [Google Scholar]

- Zhang, C.; Xie, W.; Wang, Y. 1: on the mechanism of Big Data capability on enterprise performance: Based on the process perspective of dual organizational learning, Enterprise Economy, 2019, (07), 2019.

- Lai, H. 1: on the Mechanism of Digital Technology Empowerment and New Retail Innovation—Taking Ali Rhinoceros and Pinduoduo as the Examples, China Business and Markets, 2020, (12), 2020.

- Qi, Y.; Cai, C. 1: on the multiple effects of digitalization on manufacturing enterprise performance and its mechanism, Study & Exploration, 2020,7, 2020.

- Lee, C.; Liu, C.; Trappey, A. J.C.; Mod, J. P.T.; Desouza, K. C. A: digital transformation in advanced manufacturing and engineering, 2021; ,50.

- Battisti, M.; Dustmann, Ch.; Schönberg, U. Technological and Organizational Change and the Careers of Workers, Journal of the European Economic Association, 2023. [CrossRef]

- Jauhar, S. K.; Chakma, B. R. Digital transformation technologies to analyze product returns in the e-commerce industry, Journal of Enterprise Information Management, 2023. [CrossRef]

- Nelson,. R. National Innovation Systems: A Retrospective on a Study. 3: Industrial and Corporate Change, 1992, 1(2), 1992.

- Barney, J.; Wright, M.; Ketchen, D.J. The Resource-Based View of the firm: ten years after 1991, Journal of Management, 2001, 27(6): 625-641.

- Ahuja, G.; Katila, R. Where do resources come from? The role of idiosyncratic situations, Strategic Management Journal, 2004, 25(8/9): 887-907.

- Arnold, V.; Benford T., S.; Hampton, C.; Sutton S., G. Enterprise Risk Management as a Strategic Governance Mechanism in B2B-Enabled Transnational Supply Chains. 5: Journal of Information Systems, 2012, 26 (1), 2012. [Google Scholar]

- Walter, K. The Role of Dynamic Capabilities in Responding to Digital Disruption: A Factor-Based Study of the Newspaper Industry. 3: Journal of Management Information Systems,2015,32(1), 2015. [Google Scholar]

- Chen, T.; Guo, D.; Chen, H.; Wei, T. Effects of R&D intensity on firm performance in Taiwan’s semiconductor industry. 2: Economic Research-Ekonomska Istraživanja, 2019,32(1), 2019. [Google Scholar]

- Alexandre, P.; Mauro, C.; Messias, R. R.; Antônio, S.M. Airline’s business performance indicators and their impact on operational efficiency, Brazilian Business Review, English ed.; Vitória,2022, 19( 6) : 642-665. [CrossRef]

- Parsheera, S. Understanding state-level variations in India’s digital transformation. The African Journal of Information and Communication (AJIC), 2022, 30: 1-9. [CrossRef]

- Wernerfelt, B. “A Resource-based view of the firm”, Strategic Management Journal, 1984, 5(2): 171-180.

- Tang, D. What is digital transformation? 8: EDPACS, 2021, 64(1), 2021. [Google Scholar]

- Ma, B.; Zhang, J. 1: to leverage relational gatekeepers to improve sales performance: Moderating effects of gatekeeper-salesperson Guanxi and gatekeeper-buyer Guanxi, Industrial Marketing Management, 2022, 107, 2022.

- Looy, A. V.; Shafagatova, A. Business process performance measurement: a structured literature review of indicators, measures and metrics. Springer Plus, 2016, 5:1797. [CrossRef]

- Rathore, R. S.; Agrawal, R. 1: indicators for technology business incubators in Indian higher educational institutes, Management Research Review, 2021,(44) 11, 2021.

- Amor, E.A.; Hadj, E.; Ghannouchi, S. A. Towards Managing Key Performance Indicators for Measuring Business Process Performance, EMCIS 2017, LNBIP, 2017.299, 579–591. [CrossRef]

- Zhang, Y.; Li, X.; Xing, M. 6: digital transformation and audit pricing, Audit Research, 2021, (03), 2021.

- Zhao, Z.; Wang, W.; Li, X. How Does Digital Transformation Affect the Total Factor Productivity of Enterprise? 1: FinanceaTrade Economics, 2021,42(07), 2021. [Google Scholar]

- He, F.; Liu, H. 1: of performance enhancement effect of digital transformation in physical enterprises from the perspective of digital economy, Reform, 2019, 302(04), 2019.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).