Submitted:

28 August 2023

Posted:

30 August 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Materials and Methods

- Material and information delays;

- Non-linear relationships;

- Causation not correlation;

- Feedbacks in the system.

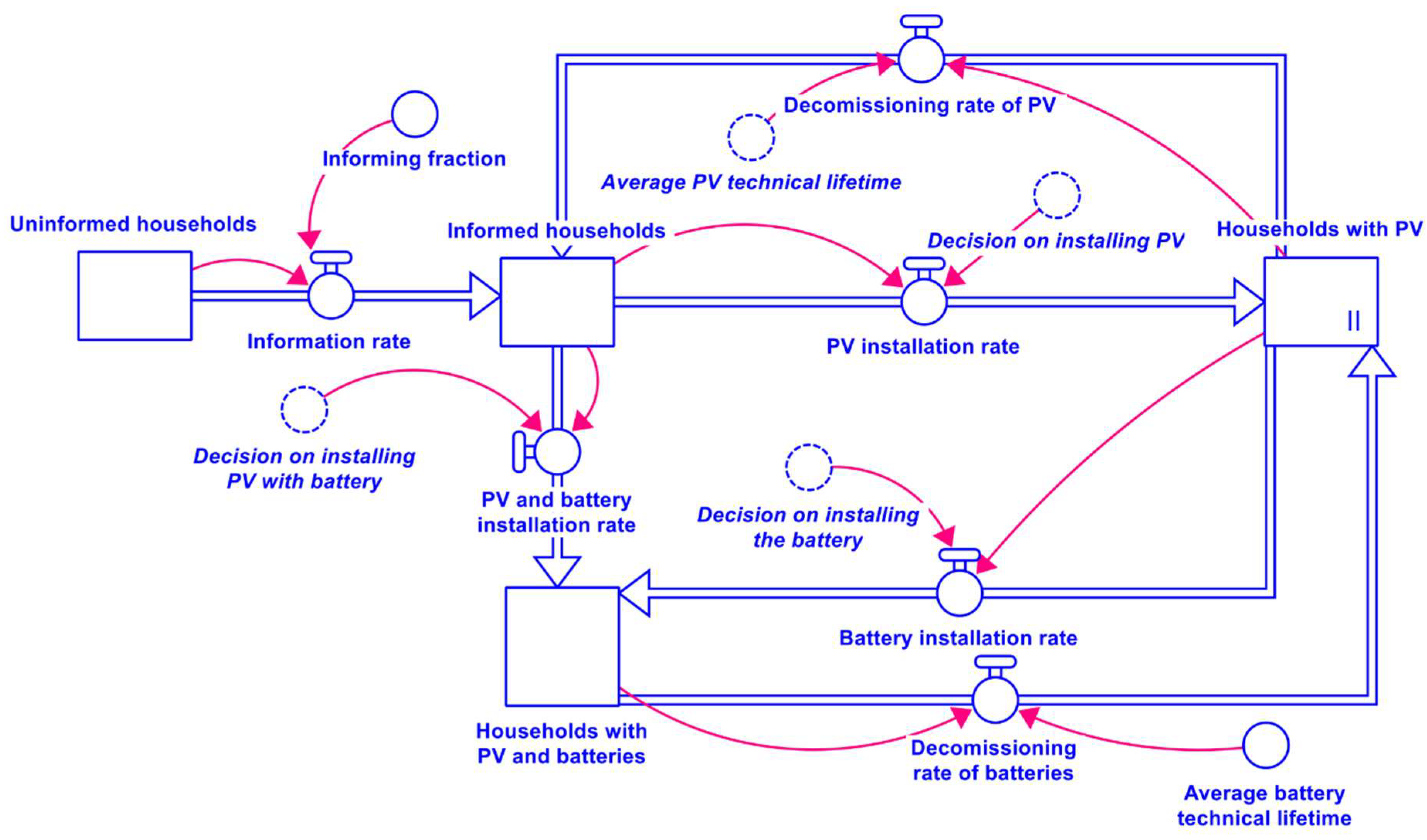

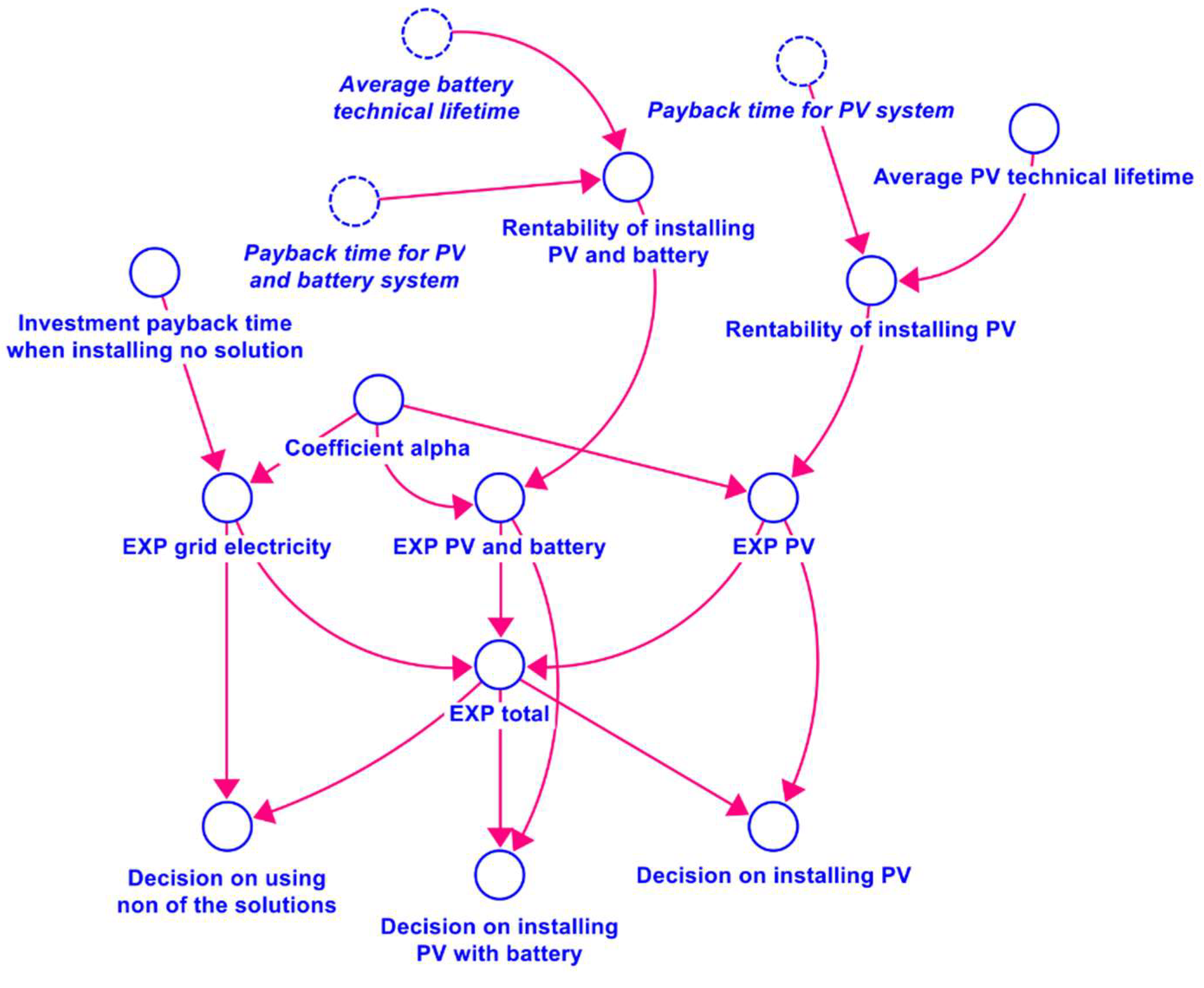

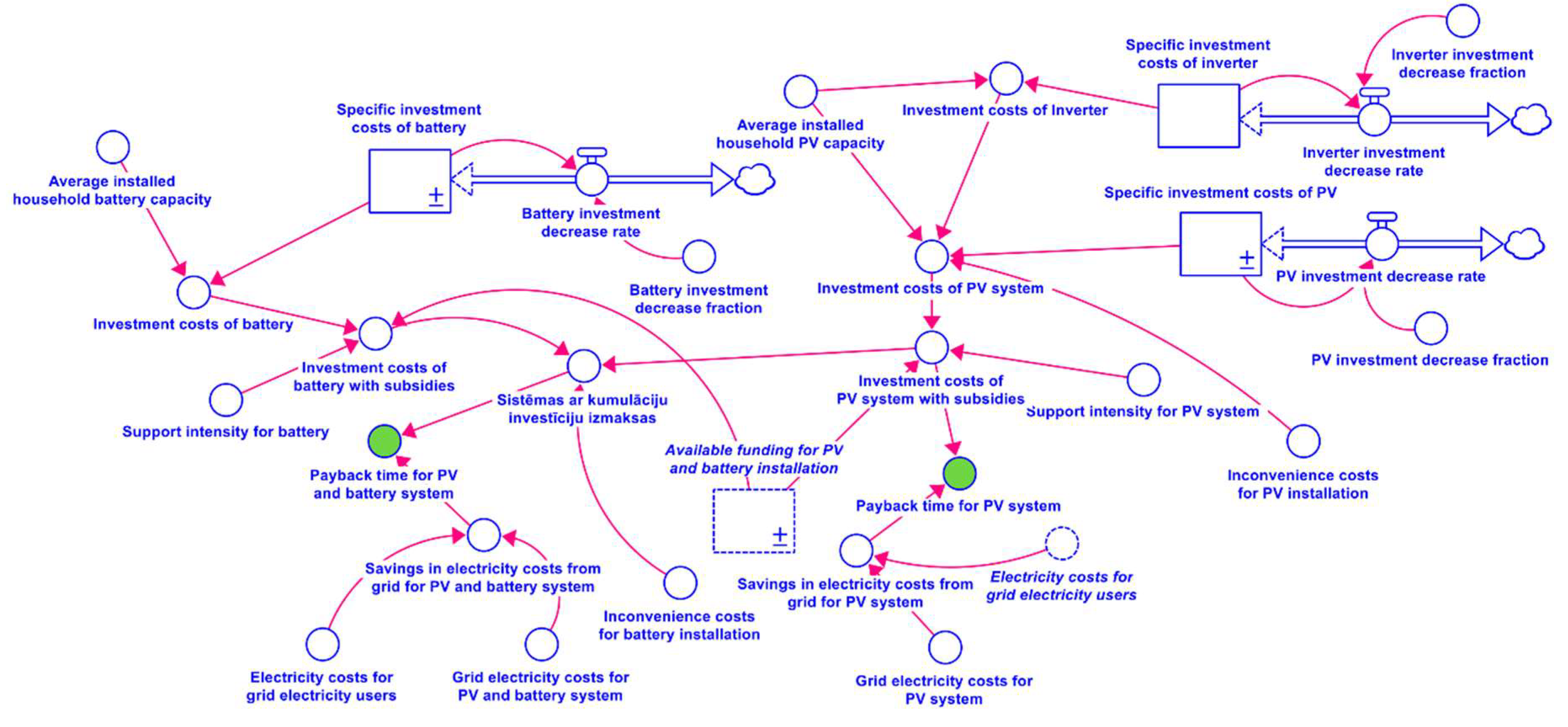

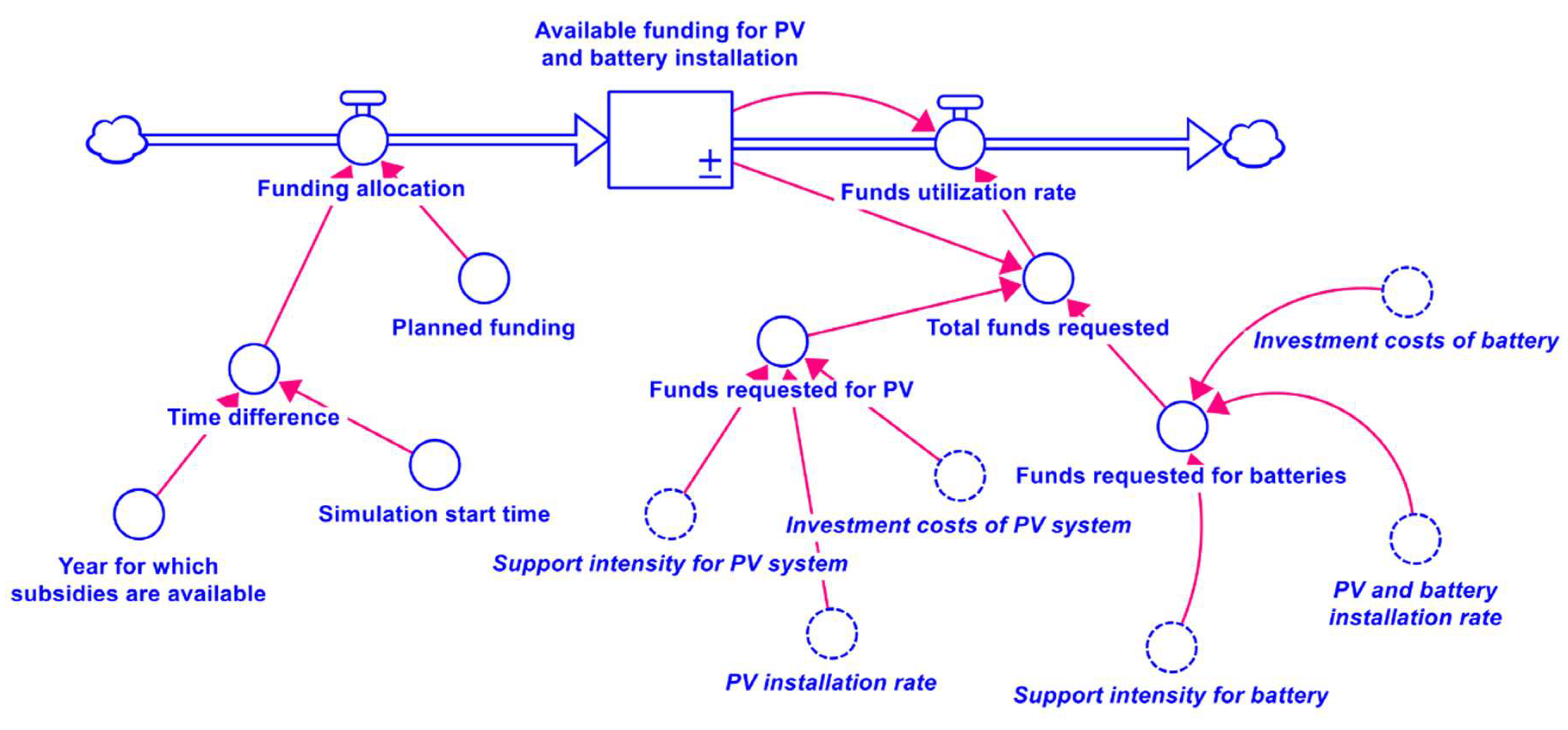

2.1. Model structure

2.2. Input data and assumptions

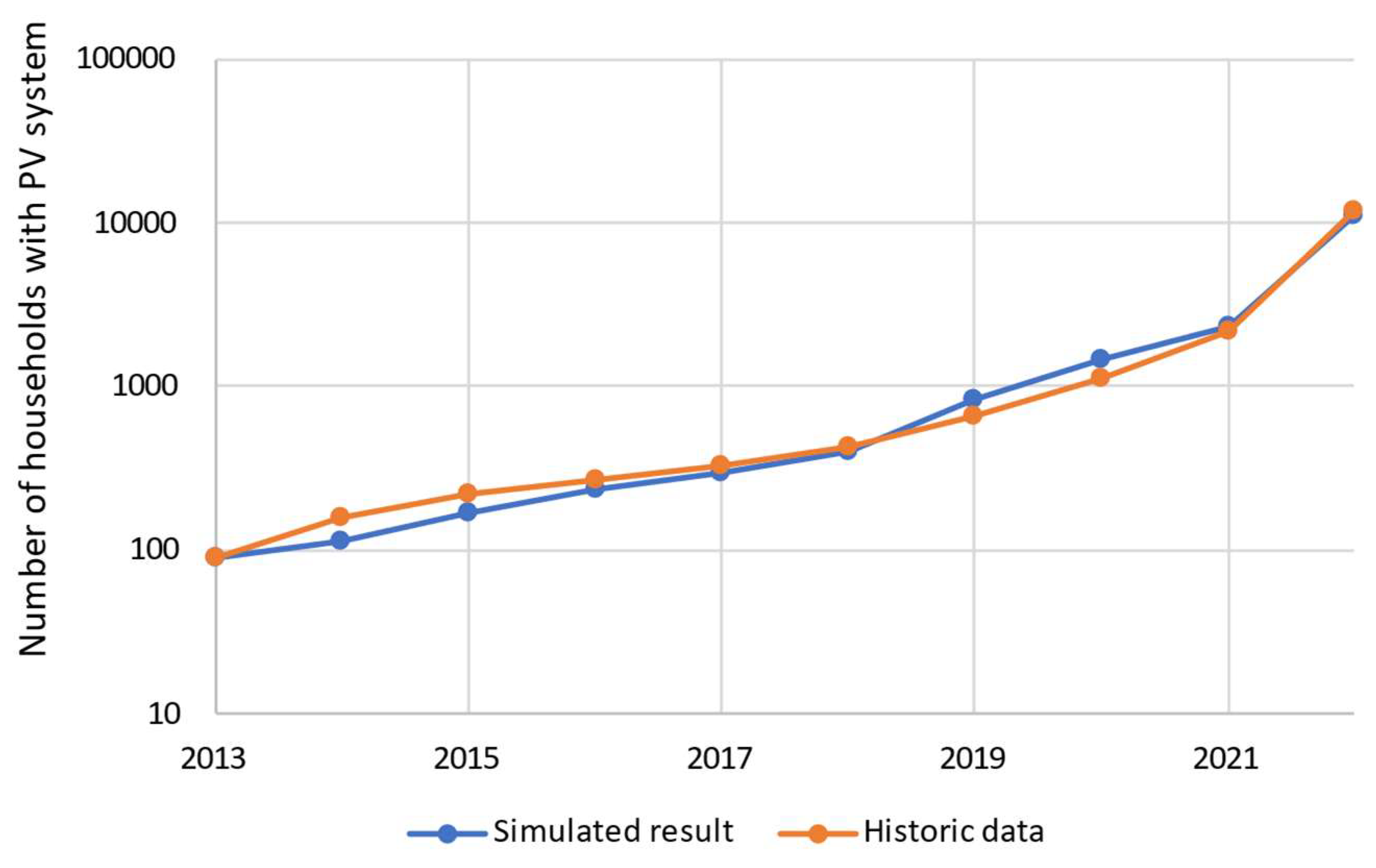

2.3. Model validation

2.3. Defining scenarios

3. Results

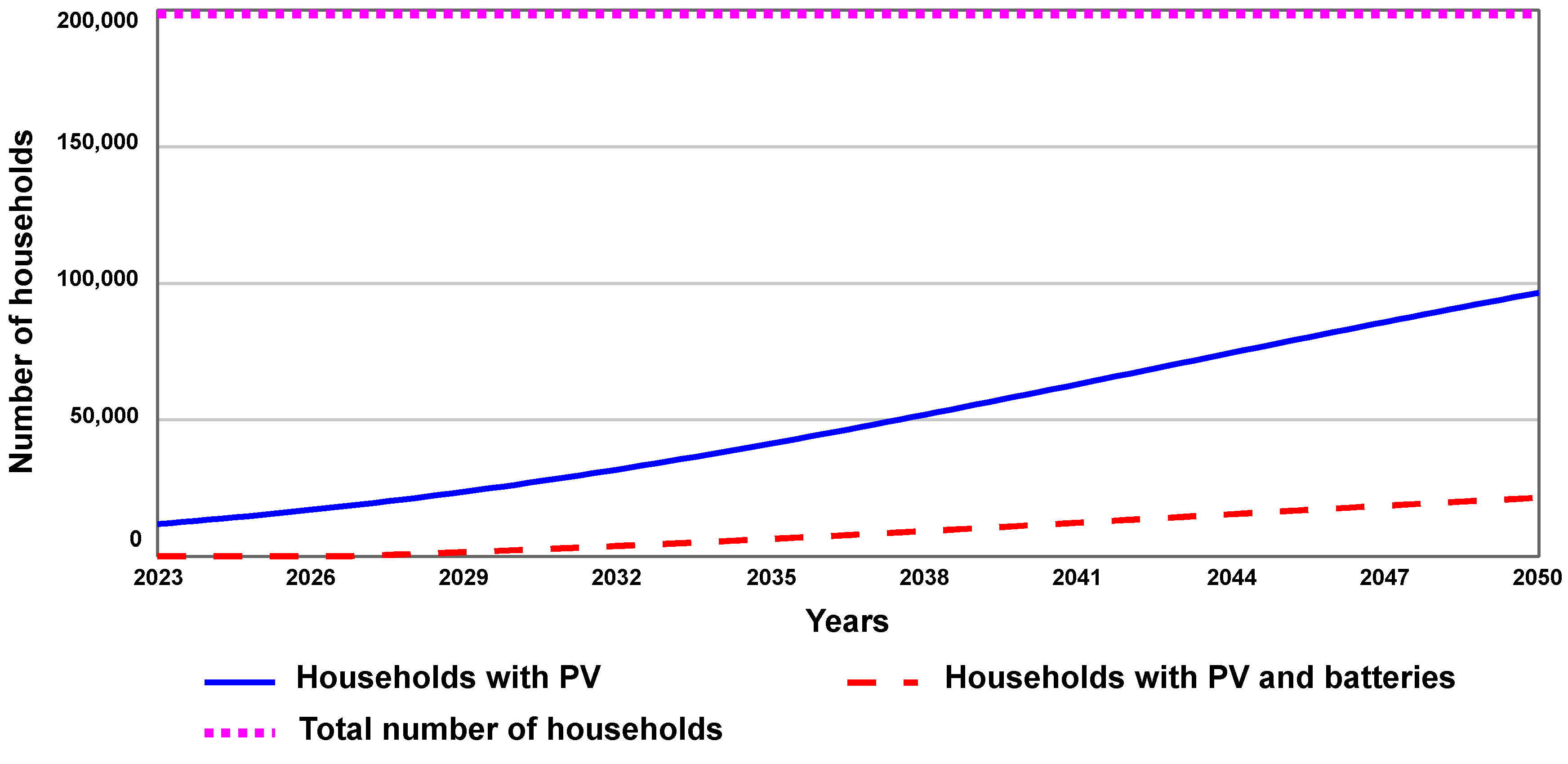

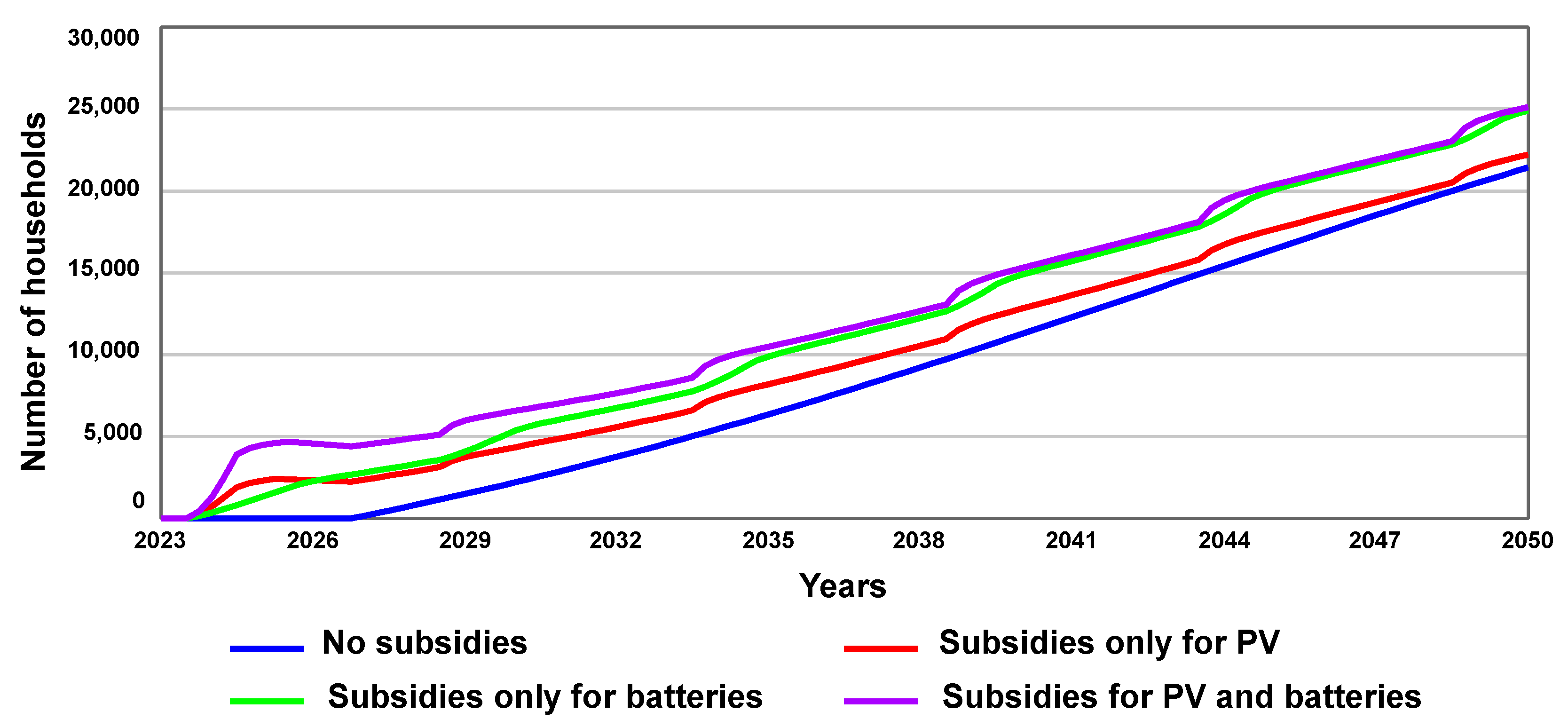

3.1. Model results

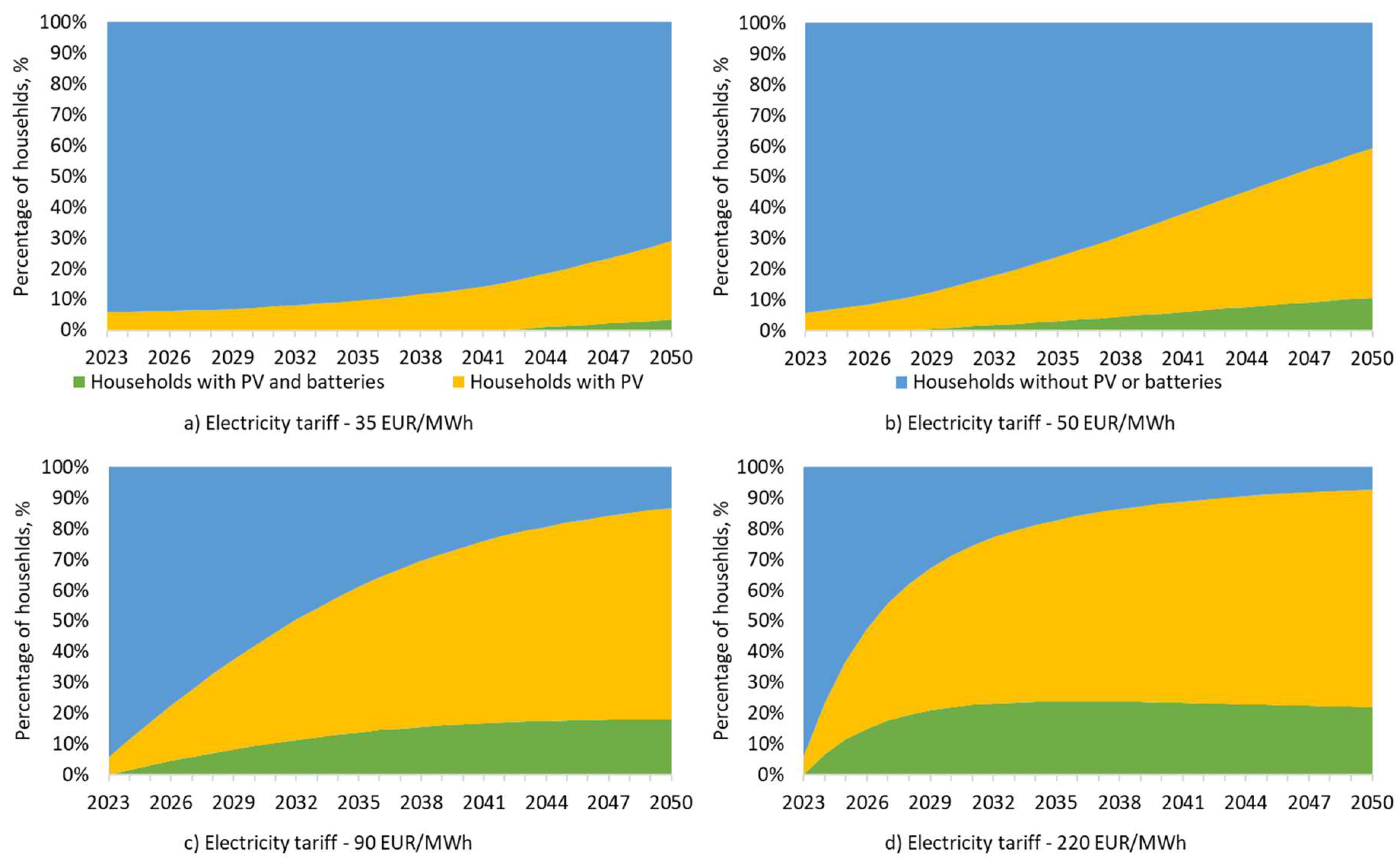

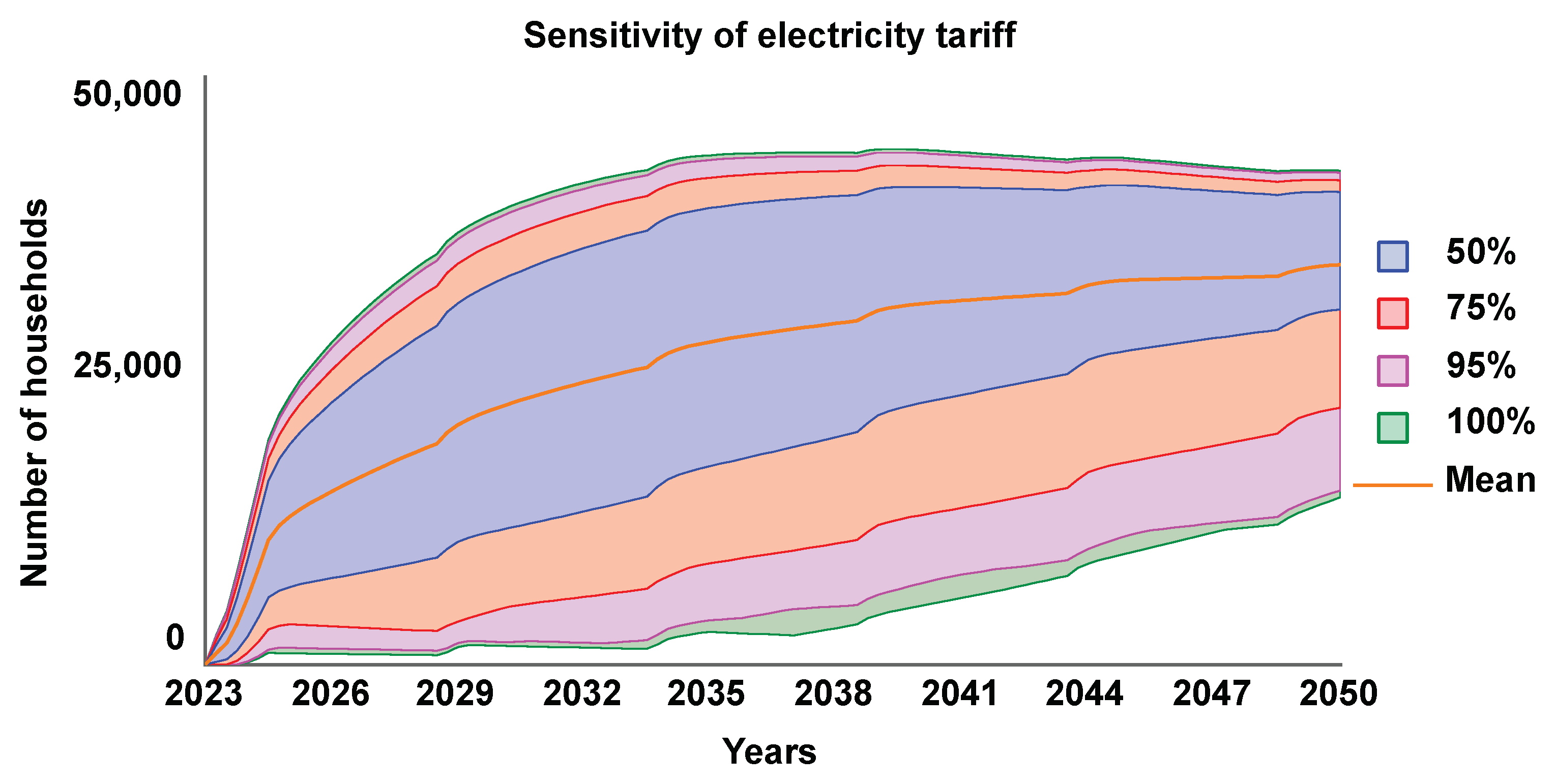

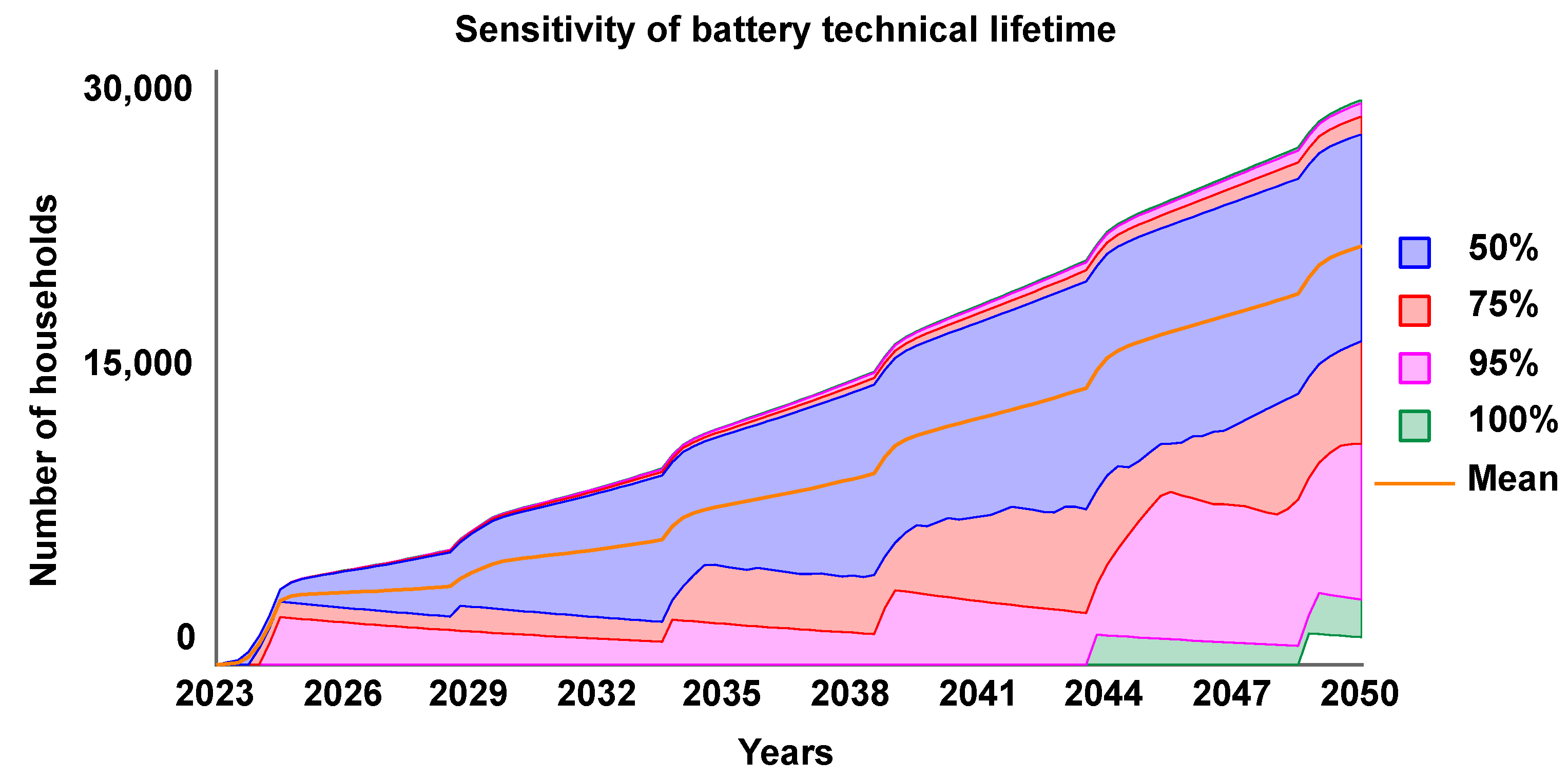

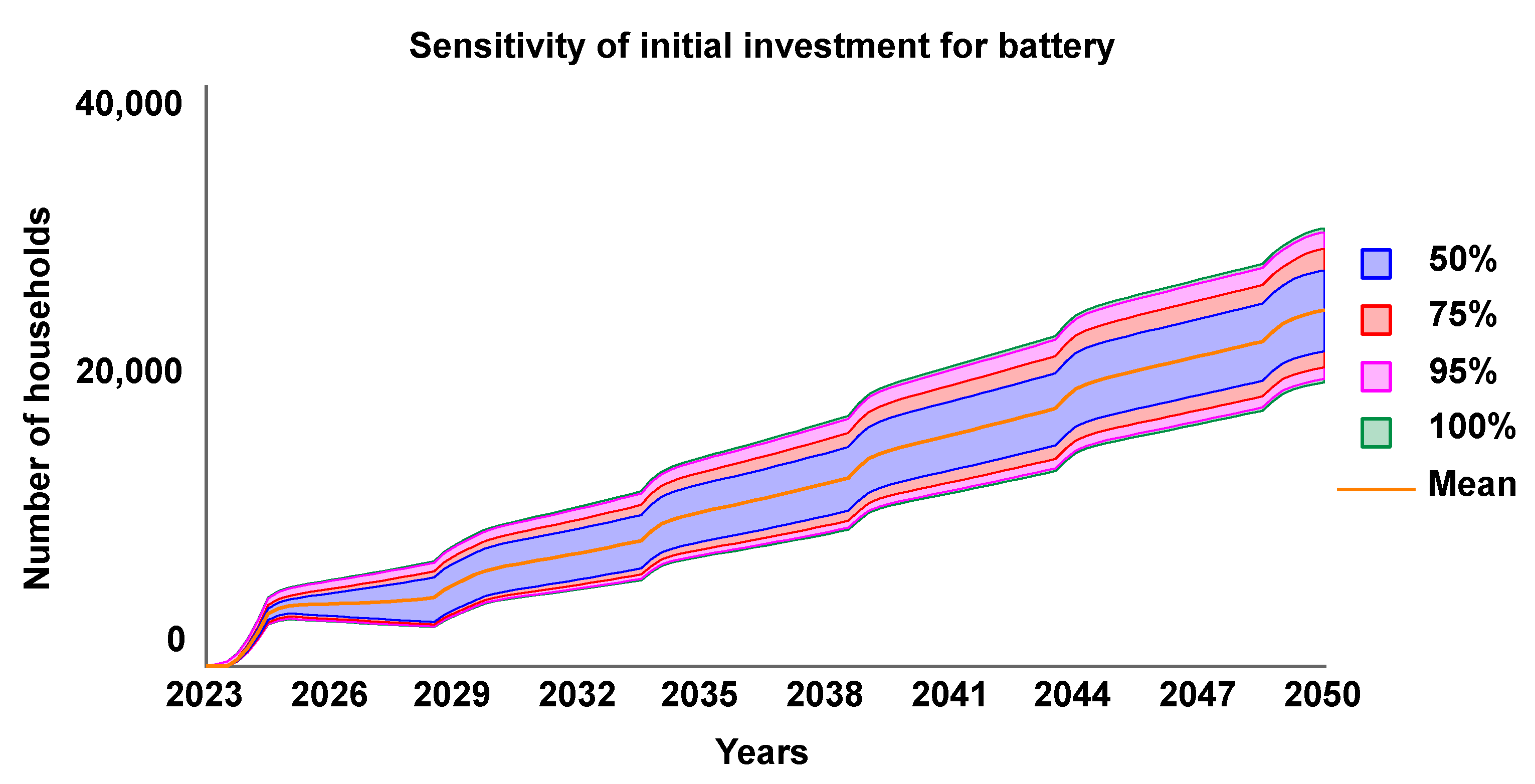

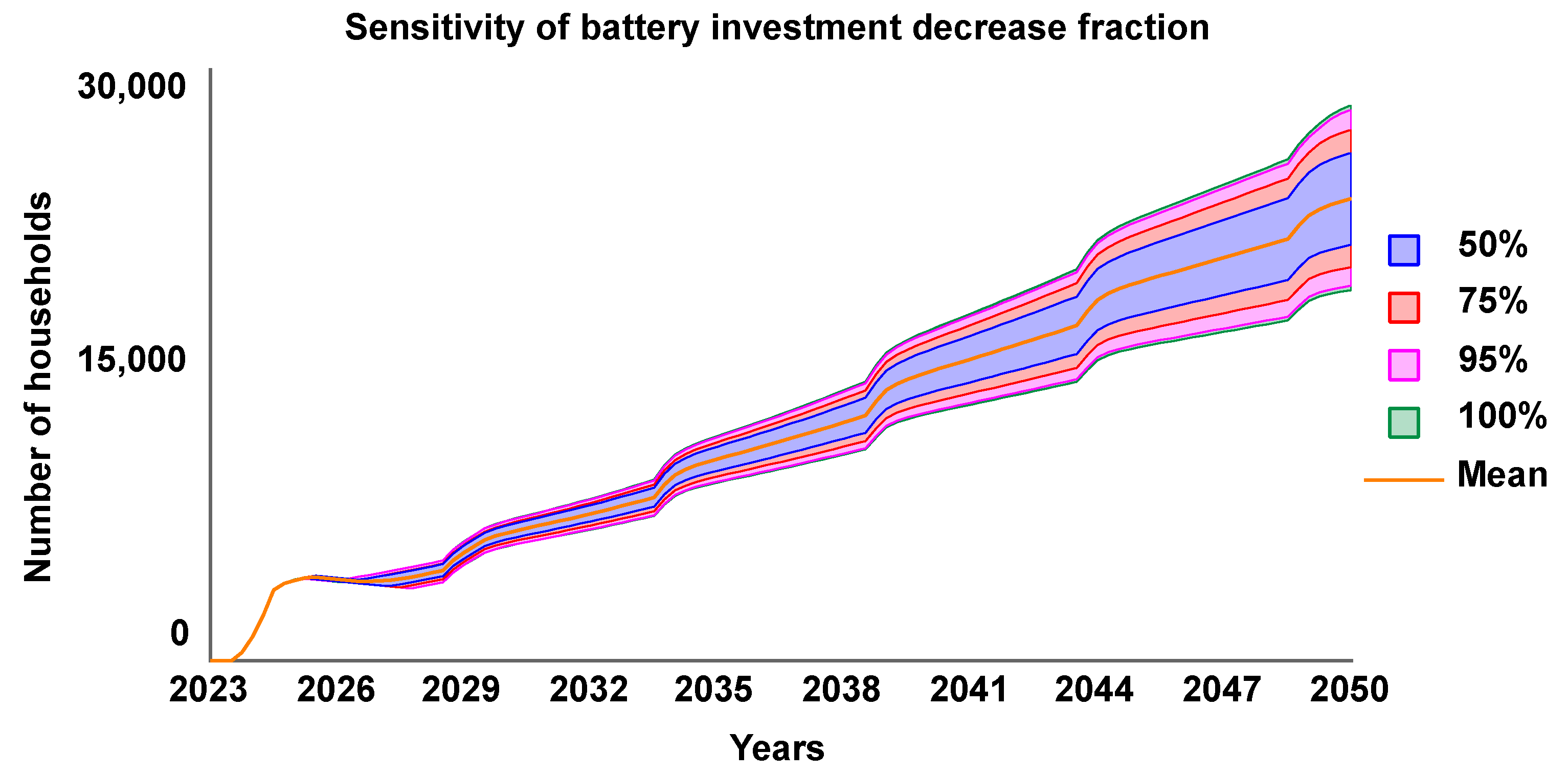

3.2. Results of sensitivity analysis

4. Discussion and conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- European Parliament, “Directive (EU) 2018/2001 of the European Parliament and of the Council of 11 December 2018 on the promotion of the use of energy from renewable sources (recast),” Official Journal of the European Union, vol. 2018, no. L 328, pp. 82–209, 2018.

- European Commission, “European Climate Law,” Proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL establishing the framework for achieving climate neutrality and amending Regulation (EU) 2018/1999 (European Climate Law), pp. 1–46, 2020. [CrossRef]

- European Commission, “Amended proposal for European Climate Law,” Amended proposal for a REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL on establishing the framework for achieving climate neutrality and amending Regulation (EU) 2018/1999 (European Climate Law) EN, vol. 2020/0036/, pp. 1–6, 2020.

- N. Scarlat, M. Prussi, and M. Padella, “Quantification of the carbon intensity of electricity produced and used in Europe,” Appl Energy, vol. 305, p. 117901, 2022, doi:10.1016/j.apenergy.2021.117901. [CrossRef]

- G. Oreski et al., “Motivation, benefits, and challenges for new photovoltaic material & module developments,” Progress in Energy, vol. 4, no. 3, 2022, doi:10.1088/2516-1083/ac6f3f. [CrossRef]

- D. Gielen, F. Boshell, D. Saygin, M. D. Bazilian, N. Wagner, and R. Gorini, “The role of renewable energy in the global energy transformation,” Energy Strategy Reviews, vol. 24, no. June 2018, pp. 38–50, 2019, doi:10.1016/j.esr.2019.01.006. [CrossRef]

- W. Wang, K. Kang, G. Sun, and L. Xiao, “Configuration optimization of energy storage and economic improvement for household photovoltaic system considering multiple scenarios,” J Energy Storage, vol. 67, no. October 2022, p. 107631, 2023, doi:10.1016/j.est.2023.107631. [CrossRef]

- M. F. Elmorshedy, M. R. Elkadeem, K. M. Kotb, I. B. M. Taha, and D. Mazzeo, “Optimal design and energy management of an isolated fully renewable energy system integrating batteries and supercapacitors,” Energy Convers Manag, vol. 245, no. August, p. 114584, 2021, doi:10.1016/j.enconman.2021.114584. [CrossRef]

- S. Landl and H. Kirchsteiger, “Mitigating Overvoltage in Power Grids with Photovoltaic Systems by Energy Storage,” Environmental and Climate Technologies, vol. 26, no. 1, pp. 470–483, 2022, doi:10.2478/rtuect-2022-0036. [CrossRef]

- S. Sridhar and S. R. Salkuti, “Development and Future Scope of Renewable Energy and Energy Storage Systems,” Smart Cities, vol. 5, no. 2, pp. 668–699, 2022, doi:10.3390/smartcities5020035. [CrossRef]

- J. Hyvönen, A. Santasalo-Aarnio, S. Syri, and M. Lehtonen, “Feasibility study of energy storage options for photovoltaic electricity generation in detached houses in Nordic climates,” J Energy Storage, vol. 54, no. February, 2022, doi:10.1016/j.est.2022.105330. [CrossRef]

- L. Montoya-Duque, S. Arango-Aramburo, and J. Arias-Gaviria, “Simulating the effect of the Pay-as-you-go scheme for solar energy diffusion in Colombian off-grid regions,” Energy, vol. 244, p. 123197, 2022, doi:10.1016/j.energy.2022.123197. [CrossRef]

- N. Matera, D. Mazzeo, C. Baglivo, and P. M. Congedo, “Energy Independence of a Small Office Community Powered by Photovoltaic-Wind Hybrid Systems in Widely Different Climates,” Energies (Basel), vol. 16, no. 10, 2023, doi:10.3390/en16103974. [CrossRef]

- Ortega and F. Milano, “Generalized model of vsc-based energy storage systems for transient stability analysis,” IEEE Transactions on Power Systems, vol. 31, no. 5, pp. 3369–3380, 2016, doi:10.1109/TPWRS.2015.2496217. [CrossRef]

- D. Mazzeo et al., “Artificial intelligence application for the performance prediction of a clean energy community,” Energy, vol. 232, p. 120999, 2021, doi:10.1016/j.energy.2021.120999. [CrossRef]

- D. Cirone, R. Bruno, P. Bevilacqua, S. Perrella, and N. Arcuri, “Techno-Economic Analysis of an Energy Community Based on PV and Electric Storage Systems in a Small Mountain Locality of South Italy: A Case Study,” Sustainability (Switzerland), vol. 14, no. 21, Nov. 2022, doi:10.3390/su142113877. [CrossRef]

- J. G. Monroe, P. Hansen, M. Sorell, and E. Z. Berglund, “Agent-based model of a blockchain enabled peer-to-peer energy market: Application for a neighborhood trial in Perth, Australia,” Smart Cities, vol. 3, no. 3, pp. 1072–1099, Sep. 2020, doi:10.3390/smartcities3030053. [CrossRef]

- D. Mazzeo, N. Matera, P. De Luca, C. Baglivo, P. M. Congedo, and G. Oliveti, “A literature review and statistical analysis of photovoltaic-wind hybrid renewable system research by considering the most relevant 550 articles: An upgradable matrix literature database,” J Clean Prod, vol. 295, p. 126070, 2021, doi:10.1016/j.jclepro.2021.126070. [CrossRef]

- P. Mascherbauer, L. Kranzl, S. Yu, and T. Haupt, “Investigating the impact of smart energy management system on the residential electricity consumption in Austria,” Energy, vol. 249, Jun. 2022, doi:10.1016/j.energy.2022.123665. [CrossRef]

- M. Miletić, M. Gržanić, I. Pavić, H. Pandžić, and T. Capuder, “The effects of household automation and dynamic electricity pricing on consumers and suppliers,” Sustainable Energy, Grids and Networks, vol. 32, Dec. 2022, doi:10.1016/j.segan.2022.100931. [CrossRef]

- V. Bakić, M. Pezo, Ž. Stevanović, M. Živković, and B. Grubor, “Dynamical simulation of PV/Wind hybrid energy conversion system,” Energy, vol. 45, no. 1, pp. 324–328, 2012, doi:10.1016/j.energy.2011.11.063. [CrossRef]

- Barisa, V. Kirsanovs, and A. Safronova, “Future transport policy designs for biomethane promotion: A system Dynamics model,” J Environ Manage, vol. 269, no. May, p. 110842, 2020, doi:10.1016/j.jenvman.2020.110842. [CrossRef]

- M. Kubli and S. Ulli-Beer, “Decentralisation dynamics in energy systems: A generic simulation of network effects,” Energy Res Soc Sci, vol. 13, pp. 71–83, 2016, doi:10.1016/j.erss.2015.12.015. [CrossRef]

- G. Valdmanis, M. Rieksta, I. Luksta, and G. Bazbauers, “Solar Energy Based Charging for Electric Vehicles at Fuel Stations,” Environmental and Climate Technologies, vol. 26, no. 1, pp. 1169–1181, 2022, doi:10.2478/rtuect-2022-0088. [CrossRef]

- J. Zapata Riveros, M. Kubli, and S. Ulli-Beer, “Prosumer communities as strategic allies for electric utilities: Exploring future decentralization trends in Switzerland,” Energy Res Soc Sci, vol. 57, Nov. 2019, doi:10.1016/j.erss.2019.101219. [CrossRef]

- Aslani, P. Helo, and M. Naaranoja, “Role of renewable energy policies in energy dependency in Finland: System dynamics approach,” Appl Energy, vol. 113, pp. 758–765, 2014, doi:10.1016/j.apenergy.2013.08.015. [CrossRef]

- D. J. Currie, C. Smith, and P. Jagals, “The application of system dynamics modelling to environmental health decision-making and policy - A scoping review,” BMC Public Health, vol. 18, no. 1. BioMed Central Ltd., Mar. 27, 2018. doi:10.1186/s12889-018-5318-8. [CrossRef]

- H. Qudrat-Ullah, “Modelling and Simulation in Service of Energy Policy,” in Energy Procedia, Elsevier Ltd, 2015, pp. 2819–2825. doi:10.1016/j.egypro.2015.07.558. [CrossRef]

- S. Bolwig et al., “Review of modelling energy transitions pathways with application to energy system flexibility,” Renewable and Sustainable Energy Reviews, vol. 101, pp. 440–452, Mar. 2019, doi:10.1016/J.RSER.2018.11.019. [CrossRef]

- “Comparison of support programs for citizens (In Latvian).” https://ekii.lv/index.php?page=programmu-salidzinajums (accessed Aug. 23, 2023).

- The Danish Energy Agency, “Catalogues of technology data by Danish Energy Agency,” https://ens.dk/en/our-services/projections-and-models/technology-data.

- V. Ramasamy, D. Feldman, J. Desai, and R. Margolis, “U.S. Solar Photovoltaic System and Energy Storage Cost Benchmarks: Q1 2021,” 2021. [Online]. Available: www.nrel.gov/publications.

- Distribution system operator, ““Electrical supply review",” 2023. Accessed: Aug. 23, 2023. [Online]. Available: https://sadalestikls.lv/lv/elektroapgades-apskats.

- U. G. K. Mulleriyawage and W. X. Shen, “Optimally sizing of battery energy storage capacity by operational optimization of residential PV-Battery systems: An Australian household case study,” Renew Energy, vol. 160, pp. 852–864, Nov. 2020, doi:10.1016/J.RENENE.2020.07.022. [CrossRef]

- Official statistics of Latvia, “MAS070.Traditional dwellings and the persons living in them by building type and time of construction in regions, republican cities, counties and neighborhoods 2011 – 2021(In Latvian).”.

- “NordPool market data.” Accessed: Aug. 23, 2023. [Online]. Available: https://www.nordpoolgroup.com/.

- “J.W. Forrester” and “P.M. Senge,” “Tests for building confidence in system dynamics models,” TIMS Studies in the Management Sciences, vol. 14, pp. 209–228, 1980.

- “Y. Barlas” “A. Erdem,” “Output Behavior Validation In System Dynamics Simulation,” Proceedings Of The European Simulation Symposium, vol. 1, pp. 1–4, 1994.

| Parameter | Value | Unit | Reference |

| PV investment cost (with installation) | 1100 | EUR/kW | [31] |

| Inverter investment cost | 100 | EUR/kW | [31] |

| Battery investment cost | 800 | EUR/kWh | [32] |

| Average installed household PV capacity | 8 | kW | [33] |

| Average installed household battery capacity | 5 | kWh | [34] |

| Average PV technical lifetime | 35 | years | [31] |

| Average battery technical lifetime | 20 | years | [31] |

| Number of one-family households | 198 541 | number | [35] |

| Number of households with PV | 11 764 | number | [33] |

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Average electricity price | 48.40 | 50.12 | 41.85 | 36.10 | 34.68 | 49.90 | 46.28 | 34.07 | 88.77 | 226.92 |

| Scenario | PV | Batteries | Financing, MEUR | Support intensity, % |

| Baseline | 0 | 0 | ||

| Subsidies 1 | X | 20 | 50 | |

| Subsidies 2 | X | 20 | 50 | |

| Subsidies 3 | X | X | 2 x 20 | 50 |

| Parameter | Unit of measurement | Lowest value | Highest value |

| Electricity tariff | EUR/MWh | 30 | 150 |

| Technical lifetime of battery | Years | 10 | 30 |

| Initial investment of battery | EUR/kWh | 600 | 1000 |

| Battery investment decrease fraction | %/year | 0.5 | 3 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).