1. Introduction

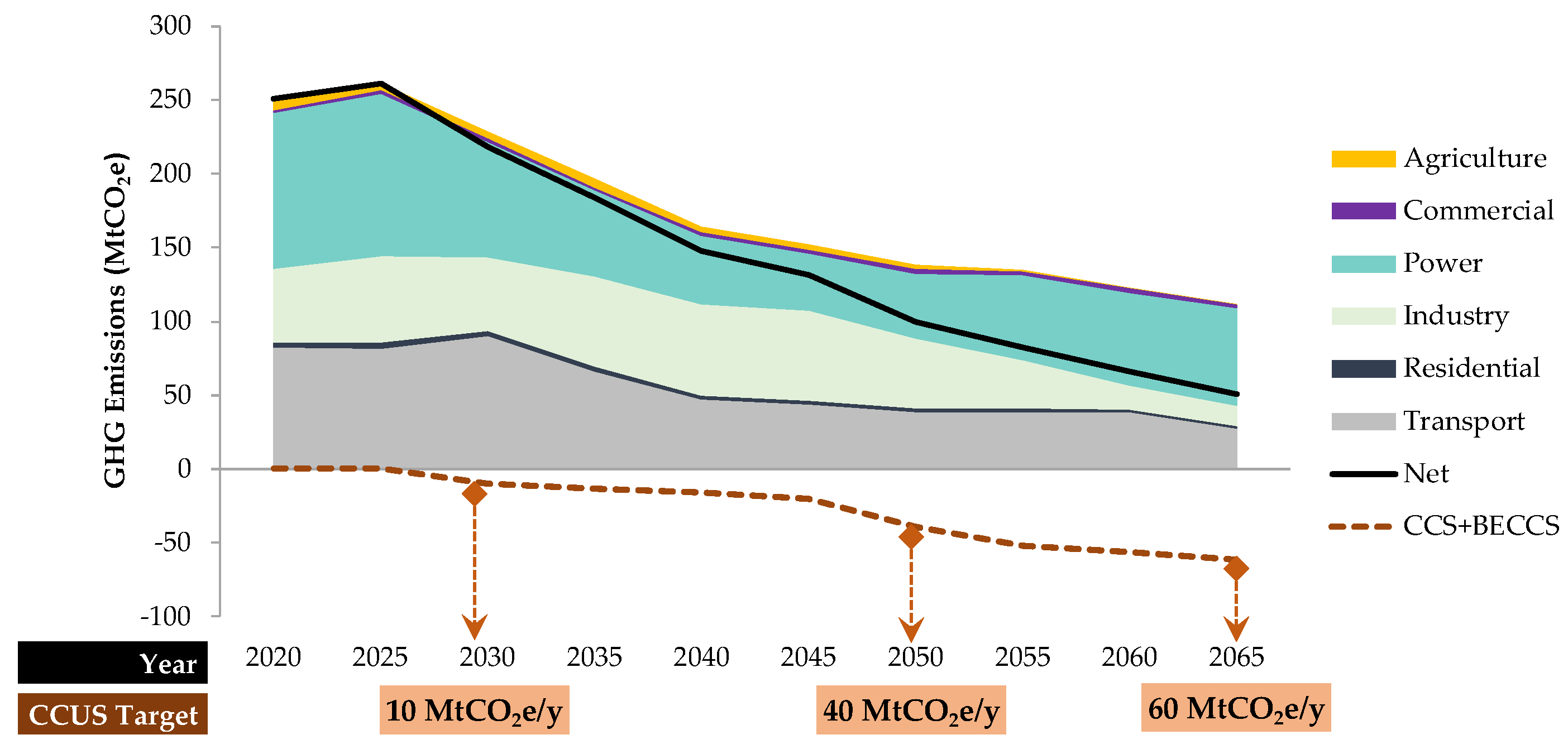

The energy landscape in Thailand is poised for significant transformation. From 2015 to 2036, the energy demand in the country is projected to surge to approximately 172.29 million tons of oil equivalent (Mtoe), marking a substantial increase of 103.24% over this period [

1]. This heightened demand for energy is intrinsically linked to an increase in greenhouse gases (GHGs) emissions. According to the Intergovernmental Panel on Climate Change (IPCC), the recommended goal is to reduce global carbon dioxide (CO

2) emission by 50 – 80% relative to 1990 levels by the year 2050 [

2]. As a result of the 26th UN climate change conference (COP 26) in Glasgow [

3], Thailand is actively seeking effective strategies to accomplish specific objectives within three separate timeframes: short-term, medium-term, and long-term. Thailand has established a Nationally Determined Contribution (NDC) with the objective of reducing GHGs emissions by 40% by the year 2030 [

4]. This objective is aimed at increasing capacity to 10 million tons CO

2 equivalent per year (MtCO

2e/y). Furthermore, Thailand has revised its Long-Term Low Greenhouse Gas Emission Development Strategy (LT-LEDS) with the goal of achieving 40 MtCO

2e/y to promote Carbon Neutrality by 2050 and reaching 60 MtCO

2e/y additionally to achieve Net Zero emissions by 2065 [

5] as shown in

Figure 1.

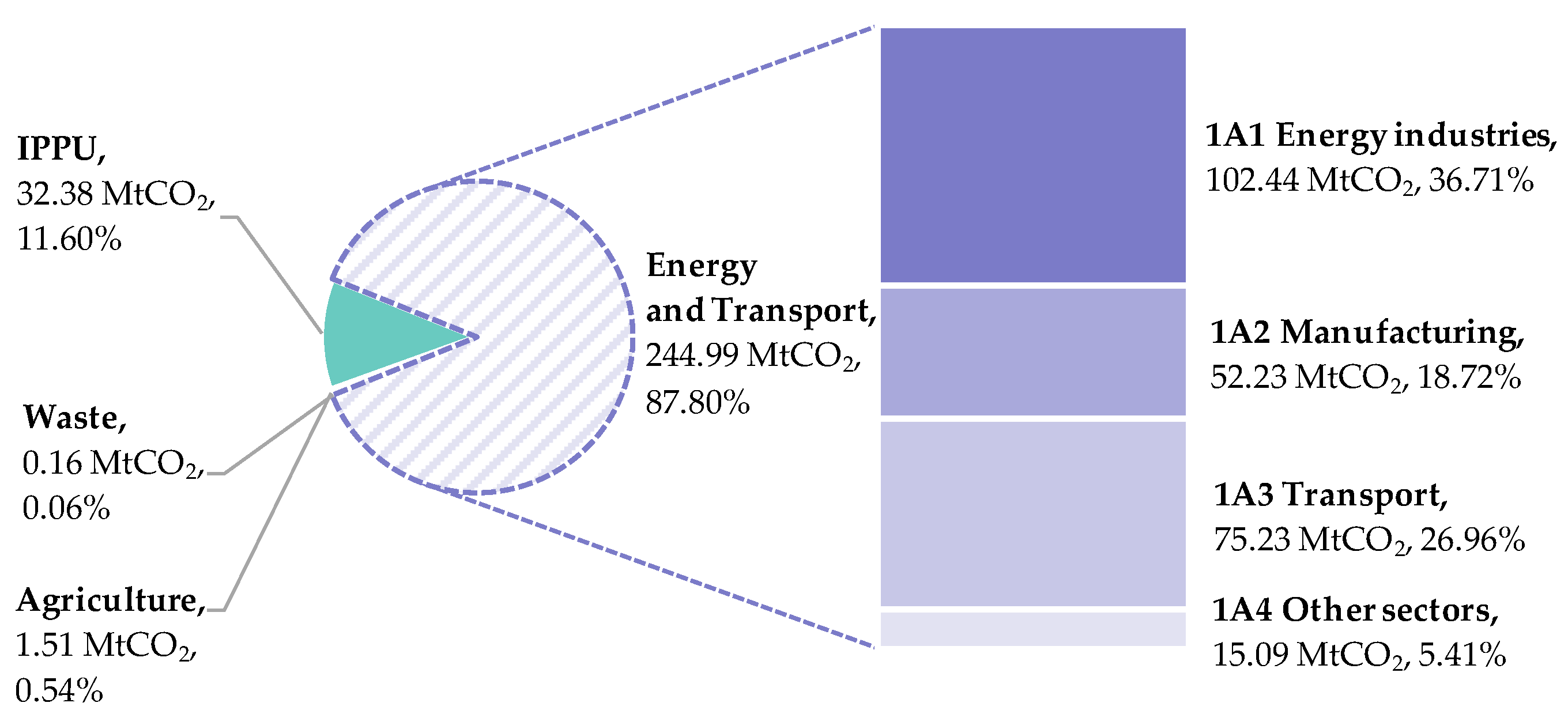

The latest CO

2 emissions data of Thailand, as reported in the Fourth Biennial Update Report (BUR4) [

6], indicates that in 2019, the country’s total CO

2 emissions reached 279.04 MtCO

2. Notably, the energy and transportation sector accounted for the highest proportion of CO

2 emissions at 87.80%, which is equivalent to 244.99 MtCO

2. In terms of proportions within the energy and transportation sectors, the fuel combustion industry on the producer side (1A1) stands out. This includes the combustion of main activities such as electricity and heat production (1A1a), as well as fuel refining combustion (Petroleum refining: 1A1b). This industry holds the largest share of CO

2 emissions within the energy sector, accounting for 36.71%, which is equivalent to 102.44 MtCO

2, shown in .

In general, natural processes have inherent mechanisms that enable them to partially mitigate the accumulation of atmospheric CO

2. These processes have existed for extensive periods of time, contributing to the maintenance of a balanced carbon cycle. However, due to the significant release of CO

2 emissions caused by human activities, it has become necessary for engineering solutions to intervene for the purpose of restoring the natural balance of the carbon cycle [

7]. Technology with high investment value is necessary to achieve the reduction targets that have already been set, especially through the utilization of Carbon Capture Utilization and Storage (CCUS) [

8]. CCUS technologies serve a dual purpose in achieving the goal of carbon neutral and net zero objectives, both the mitigation of emissions and the capture of CO

2 from the atmosphere [

9]. The cornerstone of CCUS technology implementation is the process of CO

2 capture [

10], The captured CO

2 can then be used for a diverse range of purposes. There are two possibilities, including utilizing the benefits of mineralization in cement synthesis and storing it over time in the ground’s layer. Therefore, it is highly suitable for businesses characterized by significant CO

2 emissions and substantial point sources [

11]. Moreover, it is worth noting the concept of Bioenergy with Carbon Capture and Storage (BECCS) [

12].

The IEA has compiled policies to support CCUS in foreign industries across three main sectors: Fuel transformation, Power generation, and Industry. The group encompasses numerous sub-industries with high CO

2 emissions, thus offering potential for CCUS implementation. The IEA has identified sources of CO

2 emissions from power and heat generation, chemicals, iron and steel, cement, and fuel refining industries [

13]. The selection of industrial groups with the potential to adopt CCS technology is intended to identify industries capable of reducing CO

2 emissions. This process allows for prioritizing the suitability of industrial groups for appropriate CCS technology implementation. The pilot industry group is chosen based on two main criteria: impact and readiness. The impact criteria consists of two impact sub-criteria. The first one pertains to the intensity of CO

2 emissions while the second one concerns the source of CO

2 emissions, which is a stationary source. The readiness criteria consists of four sub-criteria. The first sub-criterion focuses on industries with a sufficient technological readiness level for the business or commercial application of CO

2 capture technology. The second sub-criterion considers industries with geological storage potential or those that show promise as CO

2 utilization targets. The third sub-criterion considers industries that have analyzed their CO

2 emission data and have published their findings using reliable resources. The fourth sub-criterion focuses on industries that have access to comprehensive data concerning domestic and global GHG mitigation costs [

14].

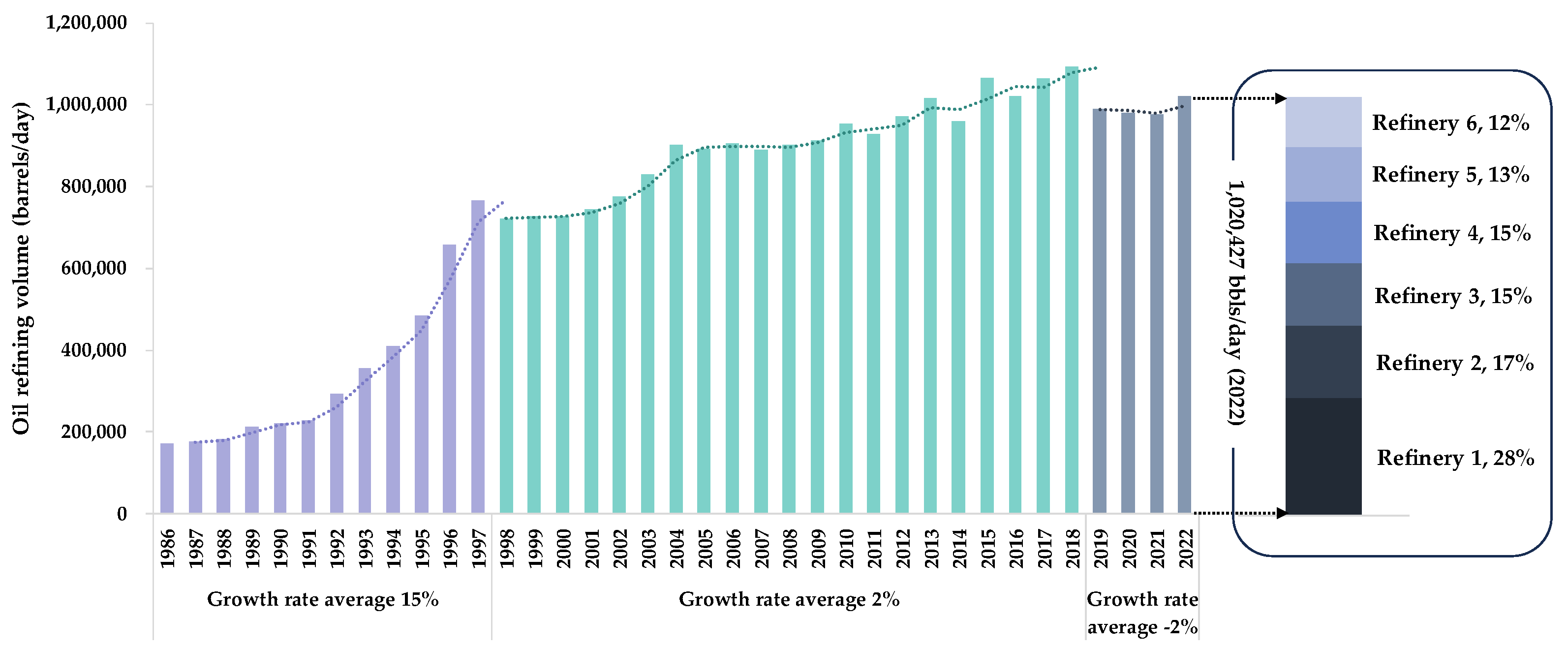

The refining industry holds the position of being the third-largest stationary emitter of GHG emissions globally [

15,

16], accounting for approximately 6% of total industrial GHG emissions [

17,

18]. Refineries are often not considered as candidates for deploying CCS due to the diverse nature of refining facilities, which would necessitate the development of customized CCS systems [

19]. According to a study, the contribution of global oil refining to GHG emissions increased from 1.38 GtCO

2e in 2000 to 1.59 Gt CO

2 in 2021 [

20], which represents an increase of around 15% over the span of two decades. Thailand is the one of GHG emissions from the top 20 countries have become a growing proportion of the total such emissions from the global oil refining sector, accounting for 83.9% of the total in 2021 [

20]. Thailand currently has a total of six oil refineries, and the country’s refining statistics tend to show an average growth rate of 5% [

21]. This growth rate can be categorized into three periods: (1) 1986 – 1997, with the highest average growth rate of 15%; (2) 1998 – 2018, with an average growth rate of 2%; and (3) 2019 (COVID period) – 2022, with an average growth rate of -2%, as shown in

Figure 3.

The purpose of this study is to evaluate various business models for CO

2 capture in the oil refining sector. This article is divided into five parts.

Section 2 elaborates on the potential of oil refining, discussing the application of amine technology in six Thai refineries. In

Section 3, the business model potential is examined in depth. The results are summarized and discussed in

Section 4. Finally,

Section 5 concludes the study with a brief overview.

2. Oil Refining Industry CCS Potential

Despite significant research and development efforts aimed at improving the effectiveness and cost-efficiency of CCS technologies, the implementation of such projects has been marked by uneven progress and has encountered various challenges in terms of investment and deployment on a global scale [

22]. There are several technical approaches for CO

2 capture, including industrial separation, post-combustion, pre-combustion, and oxyfuel combustion. Post-combustion capture systems are widely used across a broad range of technology readiness levels (TRL)from 1 to 9 [

23]. Especially in oil refining sector, there are advantages including the technology in question has reached a higher level of maturity compared to other available options. Furthermore, it offers the advantage of easy adaptation to existing industrial facilities. However, post-combustion methods have disadvantages. They include low CO

2 partial pressure and concentration, which reduces the efficiency of capture, necessitates more energy, and leads to increased capital and operational expenses [

24,

25]. The amine method is frequently used for capture, and its application has been shown to achieve a 98% capture rate efficiency [

26].

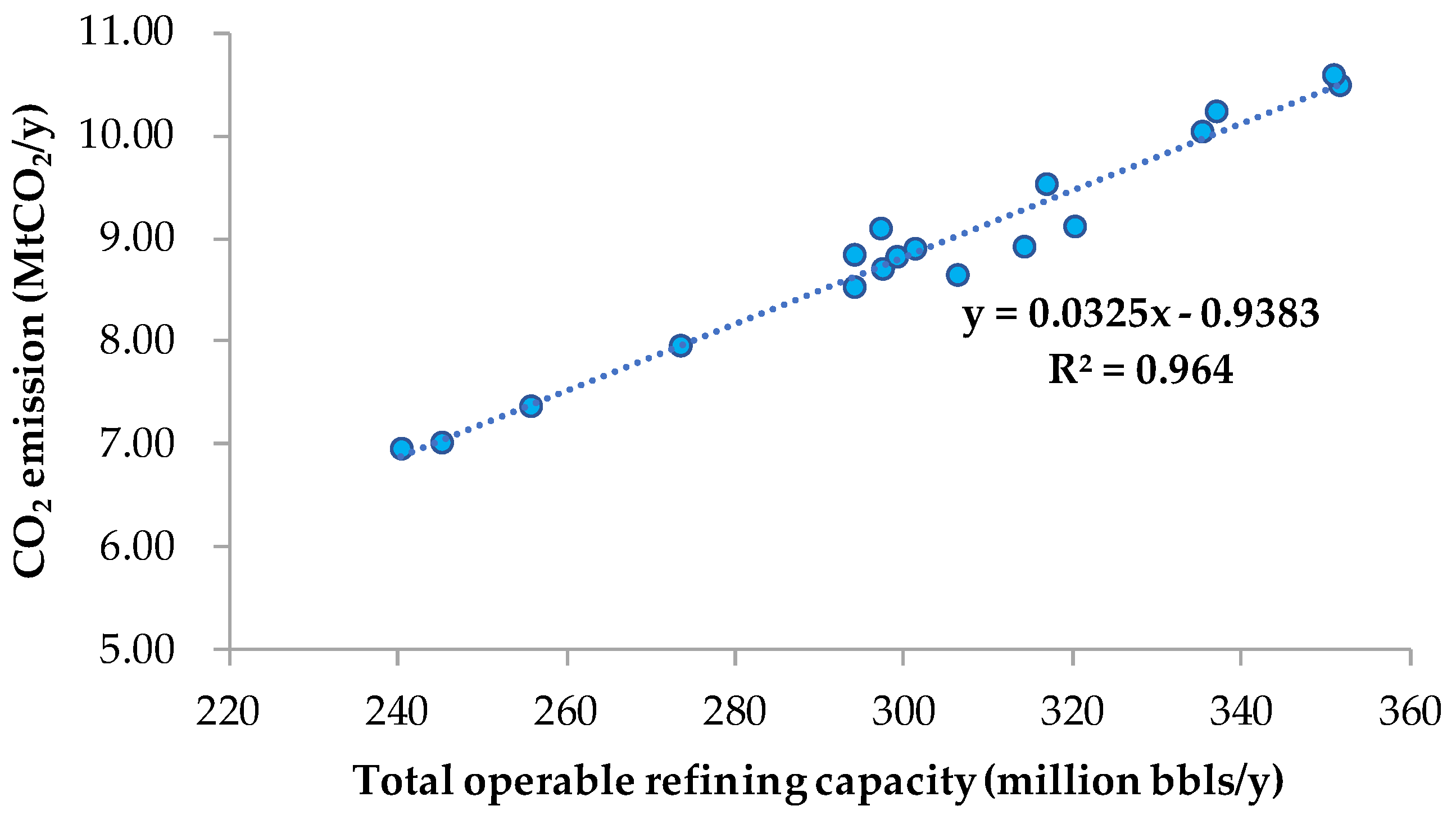

2.1. Evaluation of Capture Potential of Oil Refining Sector

The study of the capture potential of the oil refining sector will utilize data on petroleum refining obtained from the EPPO [

21] for the period spanning from 2000 to 2017. Additionally, the reported CO

2 emissions will be sourced from the Energy Sector Greenhouse Gas Accounting Report for the same years. The oil refining production from six refinery plants data over an 18-year period has been utilized for plotting purposes. Therefore, a linear regression model was developed to establish a relationship between the transformed total operable refining capacity (X) and transformed CO

2 emissions (Y). The resulting equation was Y = 0.0325X – 0.9383, correlation between oil refining volume and CO

2 emissions [

27] as shown in

Figure 4(a), where a strong linear relationship is evident (R

2 = 0.9640). This leads to a potential capture volume estimated at around 9.79 MtCO

2/y, as demonstrated in the evaluation of the capture potential of all six refineries in

Table 1.

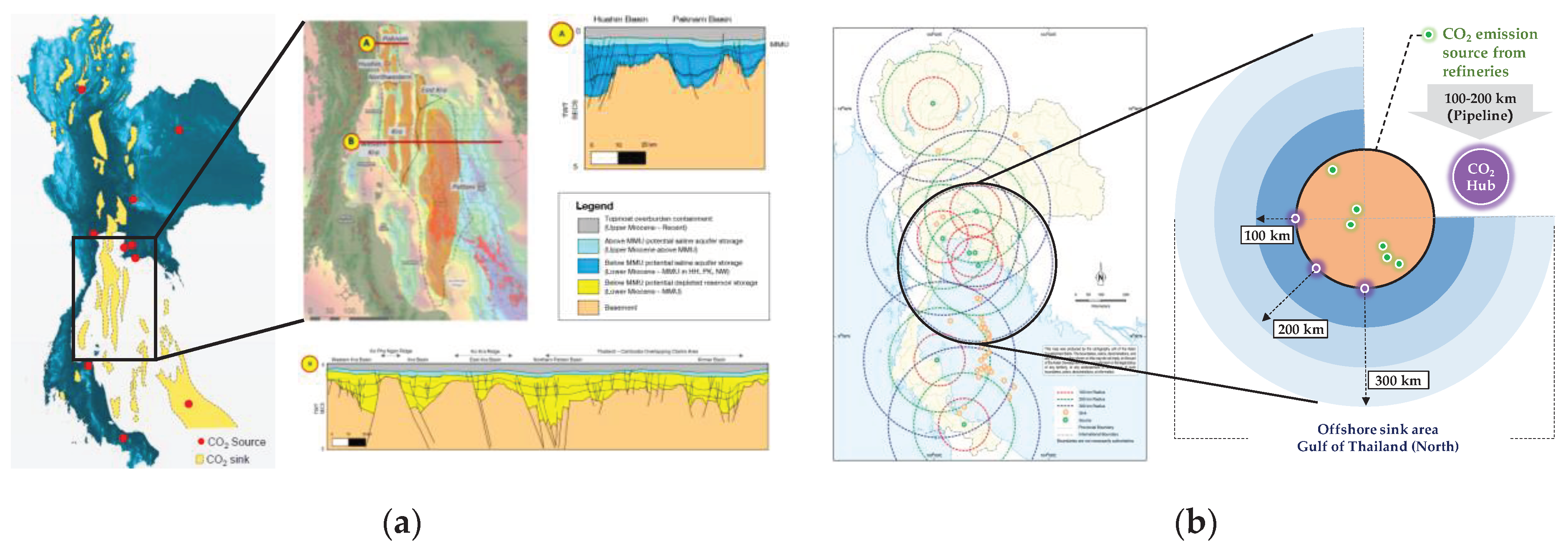

2.2. Evaluation Source to Sink Matching for Refining Sector

According to a reservoir potential assessment study conducted by CCS experts at OGCI [

28] and data from the Global CCS Institute [

29], the Asia-Pacific region is recognized as one of the world’s geological areas suitable for carbon sequestration. Furthermore, the Global CCS Institute [

29] presented a recent analysis of areas suitable for CO

2 storage. This analysis revealed that many regions of Thailand possess storage potential, particularly numerous areas in the Gulf region that are classified as ’suitable’ or ’very suitable’ for CO

2 capture. Thailand demonstrates a significant correlation between its primary sources and sinks, offering promising opportunities for the implementation of CCS technology. Within the Thai context, certain locations, particularly those situated in the North Gulf of Thailand, have gained recognition due to their considerable CO

2 storage capacity [

30]. The Gulf of Thailand contains several offshore sinks that can be reached by emission sources along the coast [

31]. Notably, six refineries emitting GHGs are situated closely along the upper coast of the Gulf of Thailand as shown in

Figure 5. This area is being considered a prime candidate for the implementation of CCS due to its substantial CO

2 storage potential. The proximity of these six refineries to the upper Gulf of Thailand coastline, which can serve as a reservoir for CO

2, positions it favorably for CCS initiatives. Hence, evaluating the CO

2 capture potential of the oil refining sector aligns with the objectives of this study in the context of the source-sink relationship. As such, the process of matching sources and sinks holds significant importance in this study’s framework. Formative assessment of source-sink is essential and will be key for investment business model.

3. Potential of CCS Business Model

3.1. Cost Estimation for CCS Technology Investment in Various Scales

The most expensive component of CCS is the process of capturing CO

2, which accounts for 50% or more of the overall expenses and can increase to 90% when compression is included. [

33]. The investment costs for adopting CCS technology are derived from international research data encompassing the costs of CO

2 capture, onshore and offshore transportation costs at various distances, and Measurement, Monitoring, and Verification (MMV) for different capture sizes: 1, 2.5, and 10 MtCO

2/y to illustrate the cost variations resulting from improved economies of scale, the capture cost is determined by considering the low, high, and average capture ranges within a specific refinery, as shown in

Table 2.

For transportation, the pipeline distance is categorized into three segments, specifically 100 - 300 km from the CO

2 source. However, the transportation cost calculates for onshore pipelines at 200 km and for an offshore pipeline extending another 200 km. This results in a total pipeline transportation distance of 400 km, detailed in

Table 3.

Regarding storage and MMV costs, as presented in

Table 4, the values are indicated up to 15 MtCO

2/y. However, in this study, the costs are extrapolated to three capture sizes, which resulted from the overall cost assessment.

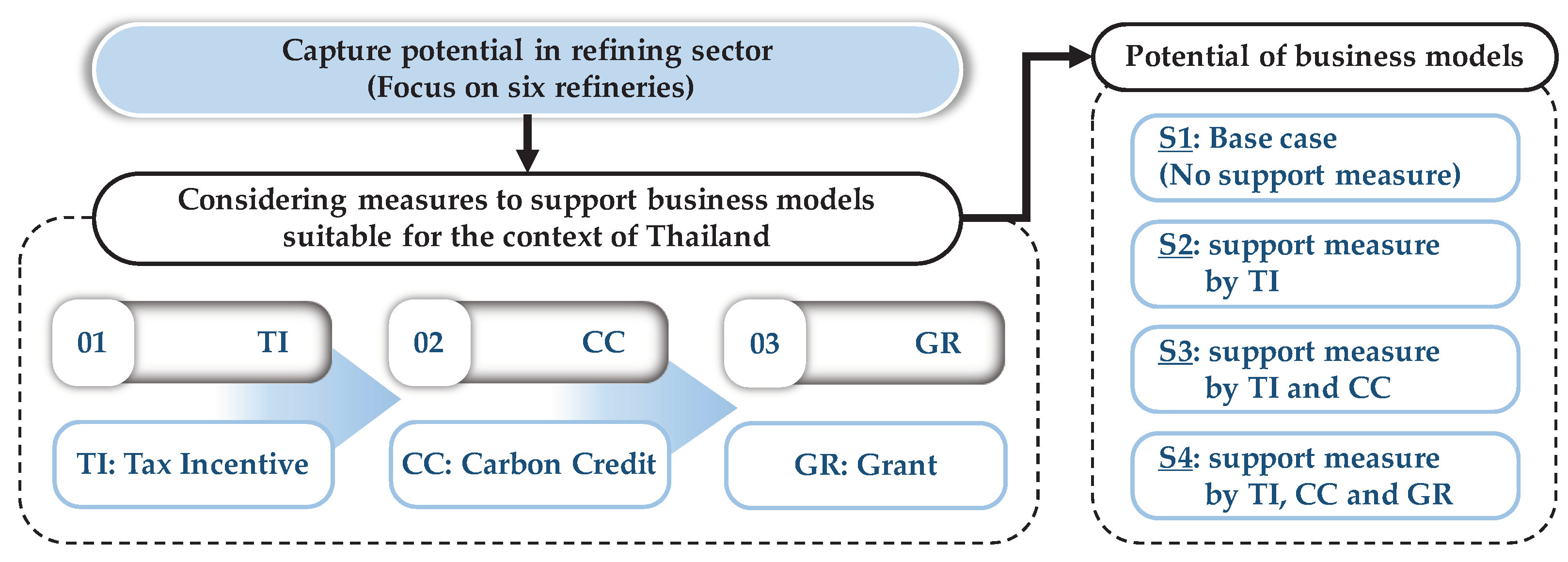

3.2. Business Model Options for Support CCS in Refining Sector in Thailand

The comprehensive cost estimation results indicate that for capture sizes of 1, 2.5, and 10 MtCO

2/y, the corresponding total costs were approximately 7,200, 5,000, and 2,700 THB/tCO

2, with larger capture volumes yielding greater cost savings. The cost breakdown for each size is illustrated in

Figure 6. Notably, the high cost associated with obtaining CCS is primarily attributed to its substantial contribution, accounting for 69% of the overall cost. Refinery statistics from the year 2022 indicate that six refineries have the potential to capture around 9.79 MtCO

2/y. To evaluate the viability of potential business models, a cost estimate of

$55/tCO

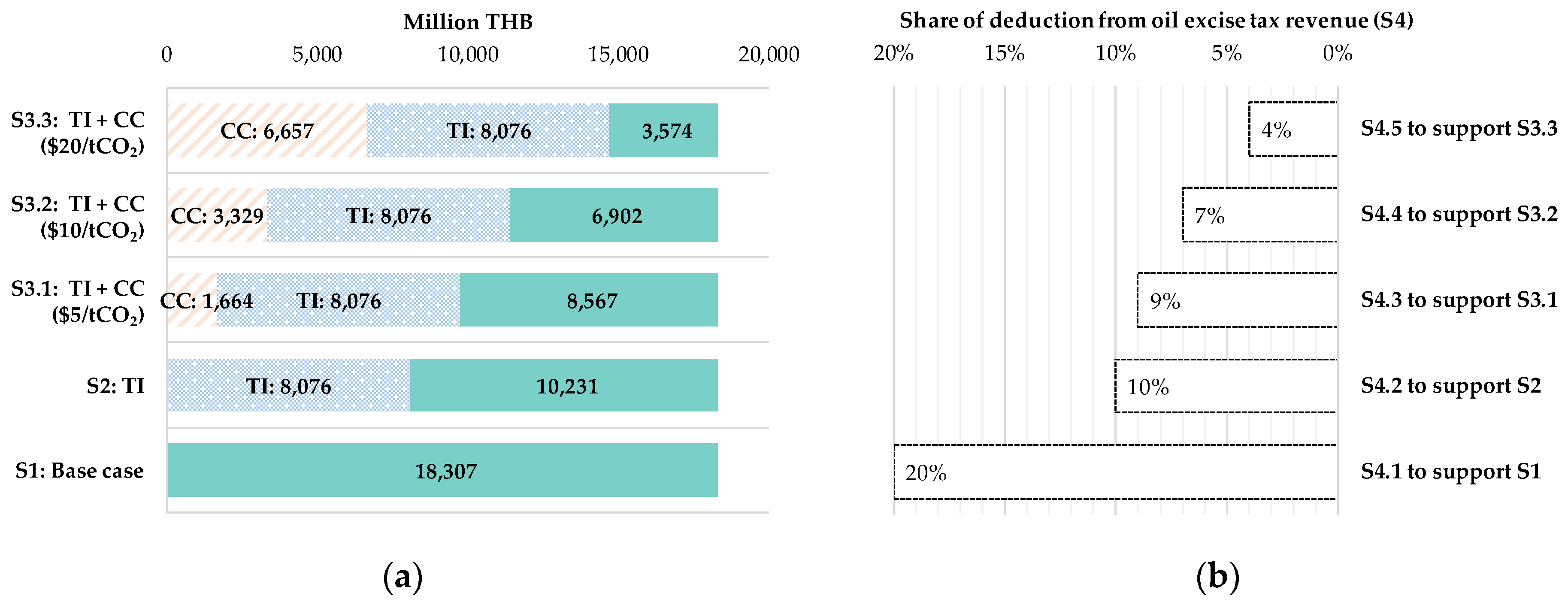

2 has been implemented. This assessment results in an initial investment cost of approximately 18,307 million THB. Business model analysis entails isolating capture costs from other expenditures, simplifying the implementation of support measures. The government’s focus is solely on the refinery sector, while activities such as transportation, storage, and MMV have been segregated into distinct operations overseen by state-owned enterprises.

In the evaluation of business models, the government assumes a pivotal role by offering assistance through the establishment of pertinent policies in the early stages to attract investments and provide incentives. Within the scope of this study, three primary measures have been identified to support financial business models. Commencing with the measure receiving the least government support, which includes tax incentives and carbon credits, the study reveals that Grant support, as illustrated in

Figure 7, ultimately emerges as the government measure with the most significant impact.

3.2.1. Potential of Private Investment Model: Capturing Technology

This study proposes three capture technology financial support ’scenarios: (1) Tax Incentive (TI), (2) Carbon Credit (CC), and (3) Grant (GR). Tax incentive scenario is baes on the government support measures which has assumption as follows: The initial investment required for the implementation of CCS, specifically for the capture technology alone, amounts to $55/tCO2, which, at the exchange rate of 1 USD to 34 THB, equals 18,307 million THB. This assessment of the initial investment cost gains particular significance when contemplating the potential capture of 9.79 MtCO2/y. In the context of taxation, corporate income tax is levied based on the applicable tax rate for each refinery. Moreover, there is a tax incentive that allows a 200% deduction on the capital investment made in the same fiscal year.

The aforementioned refineries are projected to require an initial capital investment of approximately 18,307 million THB. Therefore, it is essential for the governmental to participate and play a role in the early phases of technological adoption, by providing support and assistance measures that are suitable and compatible with the specific circumstances of the refinery sector in Thailand as shown details of tax incentive scenario in

Table 5.

From

Table 5, it was found that six refineries received 8,076 million THB of a total tax margin, calculated from tax in normal circumstance minus tax after CCS implementation, which resulted in a total net virtual cost of 10,231 million THB. The difference between tax and net virtual investment of each refinery will have different proportions depending on two major factors: proportion of CO

2 capture potential and proportion of normal tax of each refinery.

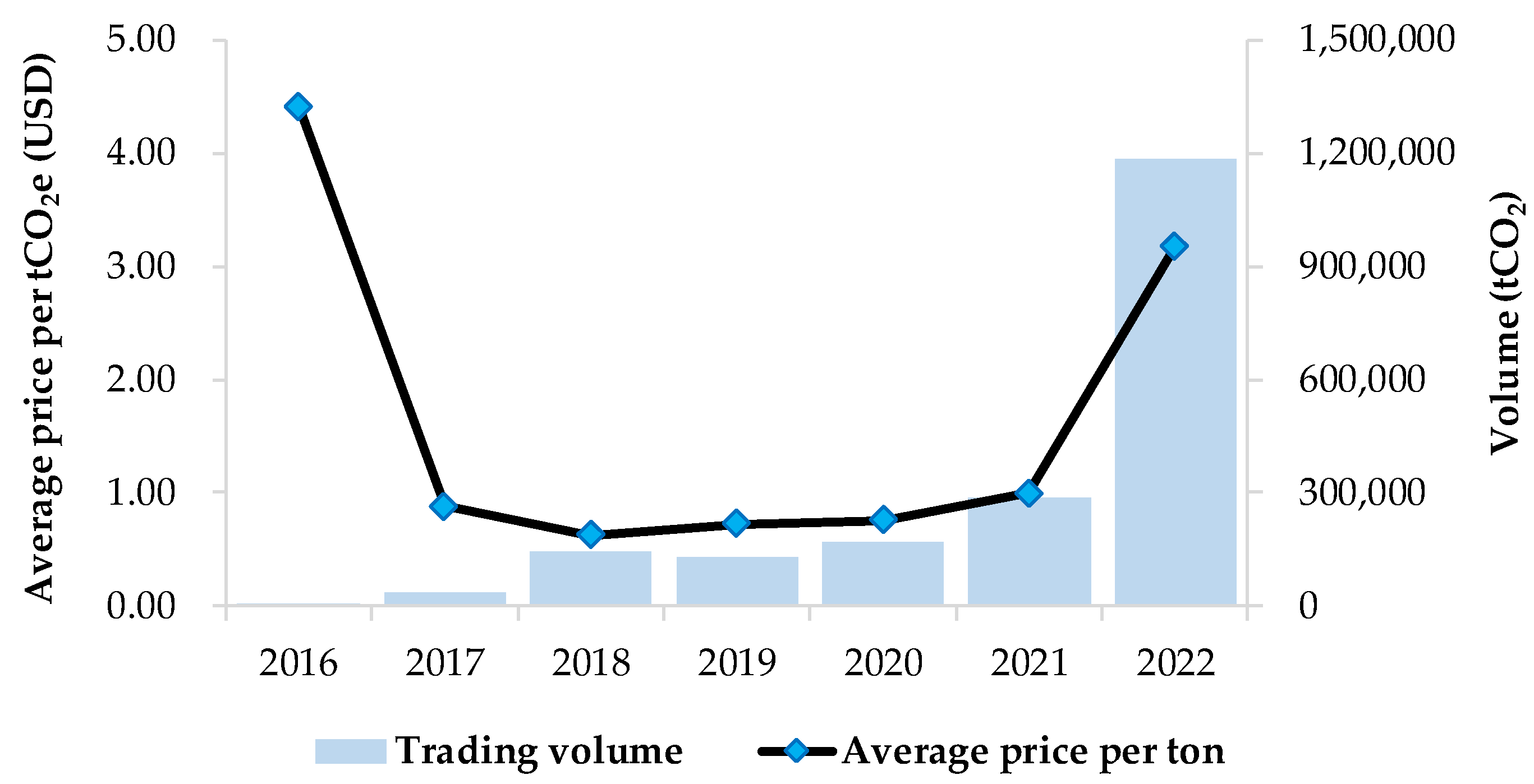

3.2.2. Carbon Credit Scenario (CC: S3)

The average price of carbon credits in Thailand from 2016 to 2022 [

38] exhibited an upward trend. Nevertheless, the average price in 2022 remains fairly affordable as shown in

Figure 8. Hence, the study employs a carbon pricing mechanism with three distinct price levels: (S3.1)

$5/tCO

2, (S3.2)

$10/tCO

2, and (S3.3)

$20/tCO

2. These prices serve the purpose of motivating refineries to invest in carbon capture and storage (CCS) technologies, enabling them to sell carbon credits at a premium rate. Even though there are scenario of tax incentive and

$5-20/tCO

2 of carbon credit trading, refineries has approximately 8,567 - 3,574 million THB of net virtual cost as shown details in results and discussion.

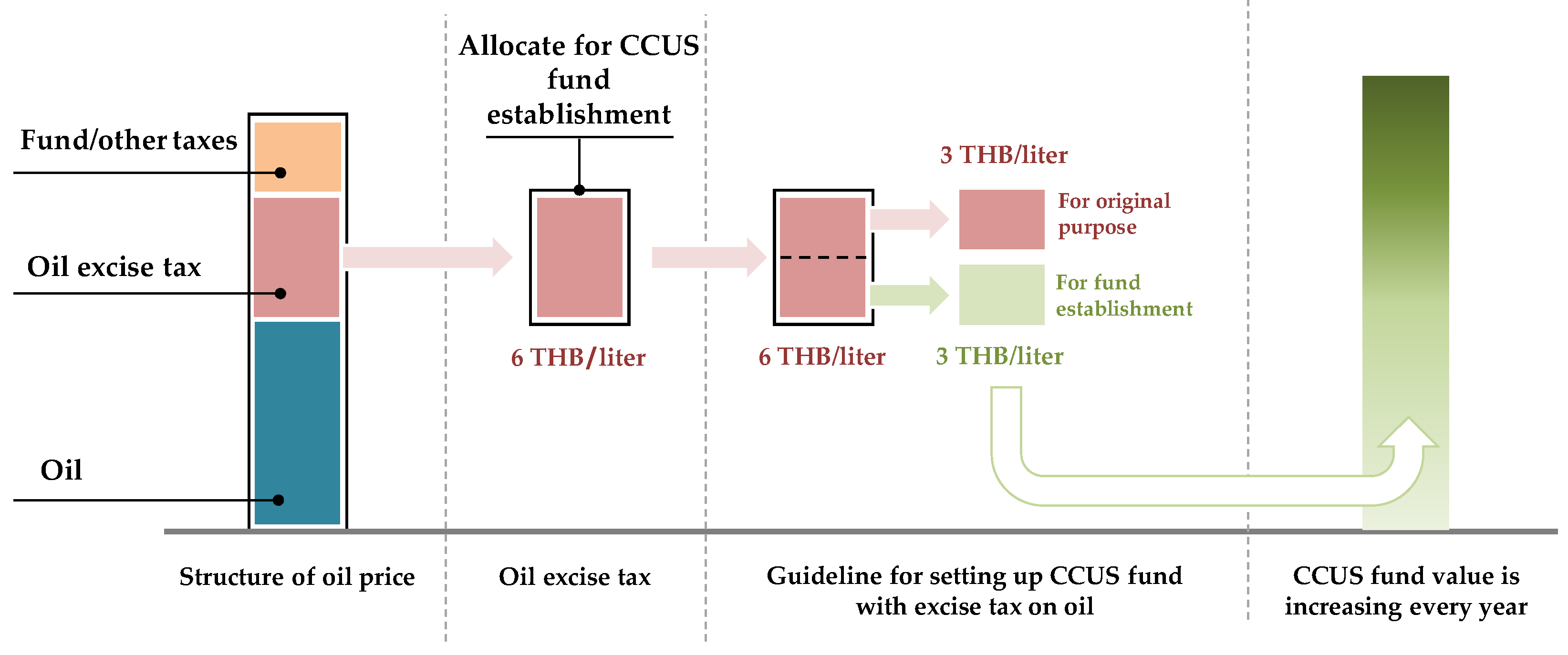

3.2.3. Grant Support (GR: S4)

The concept of investment grant (GR) is applying excise tax mechanism in fuel trading, especially the excise tax of oil that normally collected and recycle some revenue to support CCS based on polluter pay principle (PPP). The concept is that one liter of oil will be taxed approximately 6 THB, the cost deducted for 50%, or accounted as 3 THB, to be brought to the CCS fund (it may be in the form of fund or direct budgeting specifically), and the remaining three THB is for the Excise Department to use for the original purpose, keep in the Comptroller General’s Department. In this study, the tax deduction ratio is considered based on the amount of virtual investment that refinery actually pay as data of S1, S2, and S3.1 – S3.3, to be a model and guideline for primary support from public sector. The concept of excise tax on oil to support CCS is shown in

Figure 9.

Considering the provided data, and despite the implementation of tax incentive and carbon credit measures ranging from $5 to $20/tCO2, the refinery is anticipated to face net virtual costs ranging from approximately 8,567 to 3,574 million THB. Therefore, it is crucial for the government to adopt strategies focused on enhancing investment through the provision of grants, referred to as Grants or GR

3.3. Potential of Public Investment Model: Transportation, Storage and MMV

Assumption for public investment model: transport and storage (T&S) and monitoring and verification (MMV) has been set as follows: (1) A total cost of transportation, storage and MMV is $24.54/tCO2 (used exchange rate: 1 USD = 34 THB), or 8,168 million THB (2) Weighted Average Cost of Capital: WACC is assumed as 10%, as similar to other GHG projects. (3) Return on Investment (ROI) to investor is average at 3% (4) Tariff rate with average ROI of 3% for 10 and 15 years operation.

Derived from the data on infrastructure investment within the government sector concerning transport, storage, and MMV, as presented in

Table 6 and

Table 7, the pertinent details can be succinctly encapsulated as follows:

In scenarios where the government undertakes management and investment across the entirety of the transport, storage, and MMV sectors, while stipulating a 3% average ROI to be achieved within a 10 years timeframe, a charge amounting to 242 THB/tCO2 becomes imperative.

The government sector assumes responsibility for oversight and investment spanning all facets of transportation, storage, and MMV, with an objective of attaining an average ROI of 3% over a 15 years duration, a collection of 211 THB/tCO2 becomes a requisite.

The ambit of transportation and storage fees encapsulates the expenses associated with the complete spectrum of operational and subsequent entities that follow the capture phase.

4. Results and Discussion

The petroleum refining industry, as a downstream sector, is a critical component of the oil industry. When considering the application of CCS technology, particularly CO

2 capture using amine, with an impressive capture potential of approximately 98%, it is evident that there exists a substantial CO

2 mitigation potential of 9.79 MtCO

2/y. Different regions exhibit unique characteristics in terms of source-sink matching. Among them, the eastern region stands out with the highest potential, emphasizing an onshore CO

2 source to offshore CO

2 sink arrangement. The concept of modeling is instrumental in validating the feasibility of achieving effective source-sink matching, which, in turn, contributes to cost-efficiency. To realize this objective, the establishment of a CCS hub, serving as a dedicated CO

2 collection station, plays a central role. This CCS hub is meticulously designed and equipped with a primary gas treatment unit, gas separation systems, compression infrastructure, storage tanks, as well as advanced control and management equipment. Its primary function is to efficiently process and condition CO

2 to meet the required specifications. Furthermore, it enables the temporary storage of CO

2 before it is transported via pipelines to designated offshore reservoirs for permanent storage. Even though there are scenario of tax incentive and carbon credit trading at

$5-20/tCO

2, refineries has approximately 8,567 - 3,574 million THB of net virtual cost. Thus, the government has to support an investment grant (Grant or GR) as shown details in

Table 8 and

Table 9 and

Figure 10.

Considering the initial investment cost of CCS in the refining industry in Thailand, it is evident that the investment requirement is notably high, approximately 18,307 million baht. In the absence of government assistance measures (S1: Base case/no support), it is anticipated that CCS implementation would be unfeasible if the entirety of this funding burden were to fall on the private sector alone. This scenario presents a significant challenge in achieving the carbon neutrality target by 2050. Hence, the government must carefully evaluate and implement suitable support measures. One such measure is the double tax reduction for refineries interested in pursuing CCS (S2: TI). This initiative would reduce the remaining cost for the refinery to approximately 10,231 million units, which, without such support, might render CCS unattainable due to the limitation of support through a single measure. The government must explore additional support measures, including the continuation of tax incentives. Another measure deserving further consideration and support is the elevation of carbon pricing (S3: CC).

Currently, Thailand’s carbon price stands at less than $5/tCO2. Hence, an alternative strategy to incentivize private sector investment in CCS is by raising the carbon price. Three distinct price points have been analyzed: $5/tCO2 (S3.1), $10/tCO2 (S3.2), and $20/tCO2. These price adjustments would result in respective reductions of the remaining cost to the refinery to approximately 8,567, 6,902, and 3,574 million THB in accordance with the ascending carbon price. As previously mentioned, despite the reduction in the remaining cost price, the refinery still requires government support. Among the suitable measures for providing support to the refinery is the deduction from oil excise tax revenue (S4: GR), which is the final measure under consideration. In light of the earlier scenarios discussed as follows.

S4.1: In the event that the government does not implement any assistance measures, it is imperative for the government to allocate a portion of the oil excise tax revenue, approximately 20%, as part of the revenue-sharing mechanism.

S4.2: If the government has implemented only one assistance measure, namely Tax Incentive (S2), the public sector should allocate a minimum of 10% of the oil excise tax revenue for the share deduction under the GR scenario.

S4.3: In the scenario where the government has implemented only two additional assistance measures, namely Tax Incentive (S2) and Carbon Credit at $5/tCO2 (S3.1), the government will decrease the share deduction from oil excise tax revenue to approximately 9% under the GR scenario.

"S4.4: In the scenario where the government has implemented only two additional measures, specifically Tax Incentive (S2) and Carbon Credit at $10/tCO2 (S3.2), the government sector will decrease the share deduction from oil excise tax revenue to approximately 7% under the GR scenario.

S4.5: In the event that the government has implemented only two additional assistance measures, specifically Tax Incentive (S2) and Carbon Credit at $20/tCO2 (S3.3), the government will decrease the share deduction from oil excise tax revenue to approximately 4% under the GR scenario.

5. Conclusions

In this study, an investigation was conducted to explore potential business models for CCS in the oil refining industry in Thailand. The research involved evaluating the capture potential, which subsequently informed the selection of an appropriate source-to-sink matching strategy, considering existing geological conditions, associated costs, and model considerations. The implementation of appropriate policies from the outset to attract investments and provide incentives plays a pivotal role in the government’s evaluation of business models, as it facilitates support allocation. Within this study, three key measures have been identified for bolstering financial business models. Beginning with government initiatives that receive relatively limited backing, such as tax incentives and carbon credits, the analysis reveals that grant assistance ultimately emerges as the government policy with the most significant impact. The present investigation resulted in some interesting findings:

The estimated potential capture volume is approximately 9.79 MtCO2/y, as determined through the evaluation of the capture potential across all six refineries.

The study identified a viable CO2 source within the refining sector and a compatible CO2 sink located in the northern Gulf of Thailand.

The government is required to establish a new legal entity tasked with managing and developing investment infrastructure. This entity will generate government revenue by collecting service fees associated with pipeline usage, CO2 storage, and long-term monitoring of CO2 emissions through MMV processes.

In case of government takes on the responsibility of managing and investing in transportation, storage and MMV processes, and aims for an average ROI of 3% over a 15 year period, the tariff rate would be set at 211 THB/tCO2.

Providing crucial support through the allocation of initial funding in the form of grants, thereby making the adoption of CCS technology within the refinery industry a viable prospect. In instances where specific incentive policies have not been established, the government should consider earmarking a minimum of 20% of the revenue generated from oil excise taxes to facilitate the initial implementation of CCS.

In the future, the development of effective CCS policies should encompass measures such as tax incentives and the sale of carbon credits at prices higher than current rates. This strategic approach would lead to a reduction of 4-10% in the government’s expenditure for funds derived from oil excise taxes, particularly when carbon credits are valued at more than $20/tCO2.

Nevertheless, it is imperative for the government sector to actively address this challenge by establishing a dedicated fund funded through oil excise taxes. This fund serves the critical purpose of creating incentives for entrepreneurs to invest in CCS initiatives, thereby generating revenue essential for fully supporting the development and implementation of the CCS system.

Author Contributions

Conceptualization, W.T., W.W., and J.S.; methodology, W.T., W.W., and J.S.; formal analysis, T.J., S.D, V.R., P.M., and C.R.; investigation, P.S. and G.W.; resources, W.W., J.S., and S.D.; data curation, W.T., W.W., J.S., V.R., and P.S.; writing—original draft preparation, W.T., J.S., P.M., and G.W.; writing—review and editing, W.T., W.W., J.S., T.J., and G.W.; visualization, S.D., V.R., P.M., C.R., P.S., and G.W.; supervision, W.T., W.W., J.S., and G.W.; project administration, W.T. and W.W.; funding acquisition, W.W.; All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by Thailand Greenhouse Gas Management Organization (TGO) and Program Management Unit for Human Resources & Institutional Development, Research and Innovation (PMU-B), Thailand.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Wongsapai, W.; Ritkrerkkrai, C.; Pongthanaisawan, J. Integrated model for energy and CO2 emissions analysis from Thailand’s long-term low carbon energy efficiency and renewable energy plan. Energy Procedia 2016, 100, 492–495. [Google Scholar] [CrossRef]

- Fischedick, M.; Roy, J. Climate Change 2014: Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Intergovernmental Panel on Climate Change 2014.

- Lennan, M.; Morgera, E. The Glasgow Climate Conference (COP26). The International Journal of Marine and Coastal Law 2022, 37, 137–151. [Google Scholar] [CrossRef]

- Climate Action Tracker, CAT. Thailand – main climate target (2030 conditional NDC target), 2022. Available online: https://climateactiontracker.org/countries/thailand/targets/ (accessed on 15 August 2023).

- Natural Resources and Environmental Policy and Planning, ONEP. Thailand’s Long-term Low Emission Development Strategy (revised), 2022. Available online: https://unfccc.int/sites/default/files/resource/Thailand LT-LEDS %28Revised Version%29_08Nov2022.pdf (accessed on 15 August 2023).

- The UNFCCC secretariat (UN Climate Change). Thailand. Biennial update report (BUR4) 2022. Available online: https://unfccc.int/documents/624750 (accessed on 15 August 2023).

- Quang, D.V.; Milani, D.; Zahra, M. A. A review of potential routes to zero and negative emission technologies via the integration of renewable energies with CO2 capture processes. International Journal of Greenhouse Gas Control 2023, 124, 103862. [Google Scholar] [CrossRef]

- Gerbelová, H.; Versteeg, P.; Ioakimidis, C.S.; Ferrão, P. The effect of retrofitting Portuguese fossil fuel power plants with CCS. Applied Energy 2013, 101, 280–287. [Google Scholar] [CrossRef]

- Tramme, E. Carbon removal with CCS technologies. Global CCS Institute 2021.

- Global CCS Institute. Fact sheet: Capturing CO2. Available online: https://www.globalccsinstitute.com/wp-content/uploads/2018/12/Global-CCS-Institute-Fact-Sheet_Capturing-CO2.pdf (accessed on 15 August 2023).

- The London School of Economics and Political Science, LSE. What is carbon capture, usage and storage (CCUS) and what role can it play in tackling climate change? 2023. Available online: https://www.lse.ac.uk/granthaminstitute/explainers/what-is-carbon-capture-and-storage-and-what-role-can-it-play-in-tackling-climate-change/ (accessed on 15 August 2023).

- Ahlstrom, J.M.; Walter, V.; Goransson, L.; Papadokonstantakis, S. The role of biomass gasification in the future flexible power system – BECCS or CCU? . Renewable Energy 2022, 190, 596–605. [Google Scholar] [CrossRef]

- International Energy Agency, IEA. Energy Technology Perspectives 2020: Special Report on Carbon Capture Utilisation and Storage CCUS in clean energy transitions.

- Thepsaskul, W.; Wongsapai, W.; Jaitieng, T.; Daroon, S.; Raksakulkarn, V.; Muangjai, P.; Ritkrerkkrai, C. Gap Analysis and Key Enabling Factors for Carbon Capture Utilization and Storage development in Thailand Oil and Gas Industry to Achieve Carbon Neutrality Target. Chemical Engineering Transactions (inproof). 2023, 106. [Google Scholar]

- Tianyang, L.; Guan, D.; Shan, Y.; Zheng, B.; Liang, X.; Meng, J.; Qiang, Z.; Tao, S. Adaptive CO2 emissions mitigation strategies of global oil refineries in all age groups. One earth 2021, 4, 1114–1126. [Google Scholar]

- Abella, J.P.; Bergerson, J.A. Model to investigate energy and greenhouse gas emissions implications of refining petroleum: impacts of crude quality and refinery configuration. Environmental Science & Technology 2012, 46, 13037–13047. [Google Scholar]

- Jing, L.; El-Houjeiri, H.M.; Monfort, J.C.; Brandt, A.R.; Masnadi, M.S.; Gordon, D.; Bergerson, J.A. Carbon intensity of global crude oil refining and mitigation potential. Nature Climate Change 2020, 10, 526–532. [Google Scholar] [CrossRef]

- International Energy Agency, IEA. World Energy Outlook 2018.

- Leeson, D.; Mac Dowell, N.; Shah, N.; Petit, C.; Fennell, P.S. A Techno-economic analysis and systematic review of carbon capture and storage (CCS) applied to the iron and steel, cement, oil refining and pulp and paper industries, as well as other high purity sources. International Journal of Greenhouse Gas Control 2017, 61, 71–84. [Google Scholar] [CrossRef]

- Shijun, M.; Lei, T.; Meng, J.; Liang, X.; Guan, D. Global oil refining’s contribution to greenhouse gas emissions from 2000 to 2021. The Innovation 2023, 4, 100361. [Google Scholar]

- Energy Policy and Planning Office, EPPO. Historical Statistics of Crude oil, Natural gas, and Oil refining 1986 – 2022. Available online: https://www.eppo.go.th/index.php/th/energy-information/static-energy/static-petroleum (accessed on 15 August 2023).

- Martin-Roberts, E.; Scott, V.; Flude, S.; Johnson, G.; Haszeldine, R.S.; Gilfillan, S. Carbon capture and storage at the end of a lost decade. One Earth 2021, 4, 1–16. [Google Scholar] [CrossRef]

- Hong, W.Y. A techno-economic review on carbon capture, utilisation and storage systems for achieving a net-zero CO2 emissions future. Carbon Capture Science & Technology 2022, 3, 100044. [Google Scholar]

- Wang, X.; Song, C. Carbon capture from flue gas and the atmosphere: A perspective. Frontiers in Energy Research 2020, 8, 560849. [Google Scholar] [CrossRef]

- Leung, D.Y.C.; Caramanna, G.; Maroto-Valer, M.M. A overview of current status of carbon dioxide capture and storage technologies. Renewable and Sustainable Energy Reviews 2014, 39, 426–443. [Google Scholar] [CrossRef]

- Lee, Y.; Kim, J.; Kim, H.; Park, T.; Jin, H.; Kim, H.; Park, S.; Lee, K.S. Operation of a Pilot-Scale CO2 Capture Process with a New Energy-Efficient Polyamine Solvent. Applied sciences 2020, 10, 7669. [Google Scholar] [CrossRef]

- Madugula, A.C.S.; Sachde, D.; Hovorka, S.D.; Meckel, T.A. Estimation of CO₂ emissions from petroleum refineries based on the total operable capacity for carbon capture applications. Chemical Engineering Journal Advances 2021, 8, 100162. [Google Scholar] [CrossRef]

- Oil and Gas Climate Initiative, OGCI. 2022. CO2 Storage Resource Catalogue Cycle 3 Report. Available online: https://www.ogci.com/wp-content/uploads/2023/04/CSRC_Cycle_3_Main_Report_Final.pdf (accessed on 30 August 2023).

- Global CCS Institute, GCCSI. Global Status of CCS 2022. Available online: https://www.globalccsinstitute.com/resources/global-status-report/download/ (accessed on 30 August 2023).

- Asian Development Bank, ADB. 2013. Available online: https://www.adb.org/sites/default/files/publication/31122/carbon-capture-storage-southeast-asia.pdf (accessed on 30 August 2023).

- Choomkong, A.; Sirikunpitak, S.; Darnsawasdi, R.; Yordkayhun, S. A study of CO2 emissions sources and sinks in Thailand. Energy Procedia 2017, 138, 452–457. [Google Scholar] [CrossRef]

- PTT Exploration and Production Public Company Limited, Available online:. Available online: https://www.thailand-energy-academy.org/assets/upload/coursedocument/file/E205%20EP%20The%20National%20Energy%20Security%20and%20the%20Ways%20Forward.pdf (accessed on 30 August 2023).

- Kheirinik, M.; Ahmed, S.; Rahmanian, N. Comparative techno-economic analysis of carbon capture processes: Pre-combustion, post-combustion, and oxy-fuel combustion operations. Sustainability 2021, 13, 13567. [Google Scholar] [CrossRef]

- Energy Transitions Commission, ETC. Carbon Capture, Utilisation & Storage in the Energy Transition: Vital but Limited. Available online: https://www.energy-transitions.org/wp-content/uploads/2022/08/ETC-CCUS-Report-V1.9.pdf (accessed on 30 August 2023).

- Budinis, S.; Krevor, S.; Dowell, N.M.; Brandon, N.; Hawkes, A. An assessment of CCS costs, barriers, and potential. Energy strategy reviews 2018, 22, 61–81. [Google Scholar] [CrossRef]

- Zero Emissions Platform, ZEP. 2011. Available online: https://zeroemissionsplatform.eu/document/the-costs-of-co2-capture-transport-and-storage/ (accessed on 30 August 2023).

- Smith, E.; Morris, J.; Kheshgi, H.; Teletzke, G.; Herzog, H. The cost of CO2 transport and storage in global integrated assessment modeling. International Journal of Greenhouse Gas Control 2021, 109, 103367. [Google Scholar] [CrossRef]

- Thailand Greenhouse Gas Management Organization, TGO. 2023. Available online: http://carbonmarket.tgo.or.th/#vmenu_1 (accessed on 30 August 2023).

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).