1. Introduction

At a time of growing concern about climate change and ongoing sustainability policies, choosing between renewable and non-renewable energy sources has become a key decision for all countries worldwide. With the announcement of the Fit for 55 initiative in 2021, the Visegrad Group (V4) countries (Czech Republic, Hungary, Poland and Slovakia) are at a pivotal moment that will shape their energy landscapes and economic trajectories for the coming decades. At the same time, these countries are a pertinent example of regions grappling with important energy and environmental policy dilemmas, while at the same time, they have been back on the path of building market-based economies for more than 30 years.

Against the backdrop of a shared history, after decades of communist rule, these countries have undergone a dynamic transformation, not only in terms of the economic landscape but also in terms of energy paradigms. The energy infrastructure that these countries inherited from their communist history, despite significant investment, still lags behind Western European standards. It is because their energy system was for many years based on centralised energy production and heavy reliance on non-renewable resources, as well as policies whose priorities often deviated from environmental sustainability. At the same time, energy demand was determined by the heavy industry that formed the backbone of their economies.

As the European Union (EU) increases its commitment to combating climate change and achieves ambitious greenhouse gas reduction targets, these countries are becoming both participants and observers in a monumental transformation. The Visegrad region, with its diverse landscapes and energy needs, is grappling with the overall need to reduce CO2 emissions while promoting economic growth and extensive investment in renewable energy. The energy transition will also require the V4 countries to increase the production of green electricity, which is expected to be the main source of energy in the economy.

Considering this rationale, this study focuses on the impact of electricity consumption from renewable and non-renewable sources and CO

2 emissions on economic growth in the Visegrad countries. Its genesis is based on considerations of, on the one hand, maintaining economic growth, which generates electricity demand, and, on the other hand, reducing its production from fossil fuels, which have a negative impact on the environment [

1]. In this case, the recommended course of action is to increase the share of renewable energy in total energy production, which involves significant investment and expenditure. Secondly, due to the transition to a zero-carbon economy, electricity demand is increasing. For the V4 countries, this poses a significant challenge to increase electricity production while maintaining economic growth.

This study aims to assess the impact of CO

2 emissions and renewable and non-renewable energy consumption on economic growth in the V4 countries between 1991 and 2021. The study is designed to show both commonalities and individual differences between the group’s member countries. This approach is based on the theses proposed by Menegaki and Tsani [

2], who pointed out that estimates for individual countries mostly differ from the results of pooled (panel) regression models and that policy recommendations should be made at the national rather than regional or group level. Based on the stated objective and the literature review, the following research hypotheses were formulated.

H1. There is a positive and significant relationship between renewable energy consumption and economic growth in the individual Visegrad countries.

H2. There is a positive and significant relationship between non-renewable energy consumption and economic growth in the Visegrad countries.

H3. The increase in CO2 is negatively and significantly related to economic growth in the Visegrad countries.

H4. The relationship between renewable and non-renewable energy consumption and economic growth varies between the Visegrad countries.

To achieve this, the study used panel methods such as Fully modified ordinary least squares (FMOLS) regression and dynamic ordinary least square (DOLS), as well as Auto Regressive Distributed Lag (ARDL).

This article attempts to make a scientific contribution in three areas: 1) the study of the dynamic relationship between the economic development of the V4 countries, renewable electricity production and CO2 emissions between 1991 and 2021, 2) a longitudinal analysis that allows conclusions to be drawn regarding the countries of the V4 group of post-socialist countries, which underwent an economic transition in different ways after 1991 and joined the European Union in 2004, 3) the use of modern econometric tools: dynamic panel data models, including the DOLS Panel, FMOLS Panel and, combined with individual analysis based on the ARDL model, 4) the results obtained are important in the context of both academic considerations and decisions in the field for energy policy. The relationships between economic growth and renewable electricity consumption and production can serve as practical guidance for countries that are in the early stages of their energy transition.

The following sections can be found in the study.

Section 2 presents the results of other studies on energy linkages to economic growth and CO

2 in EU and V4 countries.

Section 3 describes the methodology,

Section 4 presents the data with descriptive statistics, and Section 5 presents the empirical results with a discussion.

The article concludes with conclusions, including policy implications arising from the research.

2. Literature Review

Studying the relationship between economic growth, energy consumption, and CO2 is the subject of many studies and research, whether for individual countries, panel studies or others.

At the current stage of development of economies, including dependence on non-renewable energy sources, in the face of conflicts, the exertion of influence by countries exporting non-renewable raw materials, but also climate change and sustainability policies, it is important to study the impact on economic growth with a breakdown between non-renewable and renewable energy with the inclusion of CO2.

From the literature review, it can be concluded that the nature of the relationship between energy consumption and economic growth falls into four theoretical paradigms: 1) growth hypothesis (unidirectional causality: energy consumption affects economic growth), 2)

conservation hypothesis (economic growth is the cause of energy consumption), 3)

feedback hypothesis (bidirectional causality between economic growth and energy consumption), and 4) neutrality hypothesis (no relationship) [

3]. It should also be acknowledged that, initially, studies of relationships using econometric modelling focused on analysing the level of economic growth versus total energy consumption without disaggregating between renewable and non-renewable energy or the level of CO

2 [

4].

Marques et al., in their search for the relationship between energy consumption and the level of economic growth for the period 1968-2013, divided the different regions of the world into four areas: America, Africa, Europe and Central Asia, Asia and the Pacific and Africa and the Middle East. They confirmed for the extended period the growth hypothesis for the countries of America, Africa and the Middle East and the

conservation hypothesis for Europe, Central Asia, Africa and the Middle East. In the short term, bidirectional relationships were confirmed, except for Africa and the Middle East [

5].

For example, Huang, Hwang, and Yang, using World Bank panel data for 82 countries of the world for the period 1972-2002, looked for a relationship between economic growth and the level of energy consumption. The authors indicated that for the lower and upper-middle-income group countries, economic growth positively influenced the level of energy consumption; for the high-income group countries, economic growth negatively influenced the level of energy consumption, while for the low-income group countries, no relationship was confirmed. In no case was it confirmed that the level of energy consumed influenced economic growth, which could have contributed to the reduction of non-renewable energy consumption and, therefore, the reduction of CO

2, especially by the high GDP countries. [

6].

Alper and Oguz investigated the relationships between economic growth, renewable energy consumption, capital, and labour for the new EU member states between 1990 and 2009, using ARDL modelling, among others. A statistically significant causal relationship between renewable energy consumption and economic growth was confirmed for Bulgaria, Estonia, Poland and Slovenia; only for the Czech Republic was economic growth the cause of renewable energy consumption [

7].

Esso studied the long-run causal relationship between energy consumption and economic growth in 7 sub-Saharan African countries and, using a co-integration model, his results confirm a unidirectional relationship between GDP and energy consumption levels in all the countries analysed [

8].

Fang, in turn, confirmed, analysing data from 1978 to 2008, that for China, a 1% increase in renewable energy consumption increases real GDP by 0.12% [

9]. Inglesi-Lotz, analysing panel data for all of the OECD countries for the period from 1990 to 2010, confirmed the positive impact of renewable energy consumption on economic welfare [

10].

Sebri and Ben-Salha used the ARDL model to investigate the relationship between economic growth, levels of renewable energy consumption, CO

2 emissions and trade openness for the BRICS (Brazil, Russia, India, China, South Africa) countries. The empirical results indicate a positive impact of renewable energy on the level of global production [

11].

Bhattacharya et al. analysed 38 top renewable energy-consuming countries, looking for the relationship between renewable and non-renewable energy consumption, capital and labour, and the output level between 1991 and 2012. The study confirmed that the level of renewable energy consumption had a positive impact on output for 57% of the countries in the sample [

12].

So far, however, no comprehensive studies analysing the relationship in question for the V4 countries have appeared, and the results of many studies are inconsistent.

Table 1 presents a synthetic overview of recent studies in which the authors have analysed Visegrad countries and provides an overview of the methods used to study the relationship between energy consumption, economic growth and CO

2.

3. Materials and Methods

3.1. Date

The article examines the relationship between renewable (REW) and non-renewable (NREW) energy consumption, carbon dioxide (CO2) emissions, and economic growth (GDP). The analysis was conducted for the V4 member countries from 1991 to 2021 (n=31).

Electricity consumption was taken as gross electricity production expressed in tonnes of oil equivalent per capita, CO emissions

2 were taken in metric tons per capita, and GDP as GDP per capita in constant 2015 US dollars. Data for GDP are from the World Bank’s WDI resource, while data for the NREW, REW and CO

2 variables are from the European Environment Agency database. Data were transformed into natural logarithms. Descriptive statistics for the time series studied are presented in

Table 2.

3.2. Methodology and econometric framework

In order to represent the relationship between economic growth, renewable and non-renewable energy production and CO

2, and to isolate joint and individual effects, two models were developed. A panel model was used to examine common features, while separate models were estimated for individual data. The overall research problem can be represented by the following mathematical equation:

The model was transformed to a log-linear form to eliminate serial correlation and heteroskedasticity, which is shown below:

Where𝛼 are the regression parameters to be estimated is the error term.

In the first stage of the study, tests of stationarity of variables were carried out through both tests provided for individual and panel data. For panel data, three different types of tests were used: the Pesaran test and the Shin IPS [

31] Levin, Lu and Chin (LLC) test [

32] and the second generation CIPS test (Cross Sectionally Dependent Panel Unit Root Test) [

33]. For individual testing, the Dickey-Fuller (ADF) tests were used [

34] and the Phillips-Perron (PP) unit root test[

35]. The use of the two types of tests at both the individual and panel levels ensured the robustness of the results obtained.

Based on the results of the unit root tests, co-integration for panel and individual data was estimated in the study’s next step. Due to the relatively small cross-section of the panel, tests for panel data were applied by Kao [

36] and Pedroni [

37]. For individual data, the ARDL boundary test was used due to the length of the time series.

A form of the ARDL model that examines the long-term relationship between selected variables is shown below [

38]:

Where:

- Δ - first difference value of the variable

- represents the long-term rate

- εt represents the residual component.

In order to test the absence of a long-term relationship, the hypothesis H0:

and the alternative hypothesis H1:

. If the calculated F-statistic is higher than the upper limit of the critical value I(1) for the number of explanatory variables ( k), the null hypothesis will be rejected. If the F statistic is less than the lower limit of the critical value I(0), the null hypothesis cannot be rejected. An F statistic that is between I(0) and I(1) indicates undecided co-integration [

38].

After examining co-integration when a long-run relationship was shown, panel and individual models were estimated in the next step. A Fully Modified OLS (also known as FMOLS) was estimated for the panel data [

39] and Dynamic Ordinary Least Squares (DOLS) [

40] [

41]. FMOLS is a technique for performing the most efficient method of cointegrating regression analysis while negating endogeneity error and serial correlation. To confirm the consistency of the results, DOLS was estimated, which is specifically designed for cointegrated time series data and is well suited for estimating long-run relationships, especially in small panels. The panel analysis was designed to show the typical characteristics of the countries studied. The general form of the estimator used in the study is presented below [

39]:

When co-integration was demonstrated for individual data, a different technique was used to estimate the relationship. In order to capture both the long-run relationship and the adjustment process in disequilibrium, a constrained error correction model (ECM) expressed in the following form was used [

42]:

Where the ECM correction factor is determined from the residuals of the long-term model [

43]:

In the final stage of the study, causality tests for individual data were conducted based on the Toda-Yamamoto (TY) test [

44]. The TY method is carried out in two stages using the S-VAR model. First, the optimal lag length (k) and the maximum order of integration (dmax) are determined, and then the VAR model is estimated at the series level. In addition, it is tested whether the VAR (k + dmax) has been determined correctly. The second step uses a modified Wald procedure to test the VAR (k) model for causality by determining whether the optimal lag length is equal to p = [ k + d ( max )], and the model is expressed as follows:

Based on the results, causality between pairs of variables was determined, indicating whether it was unidirectional, bidirectional or whether there was a cause-and-effect relationship.

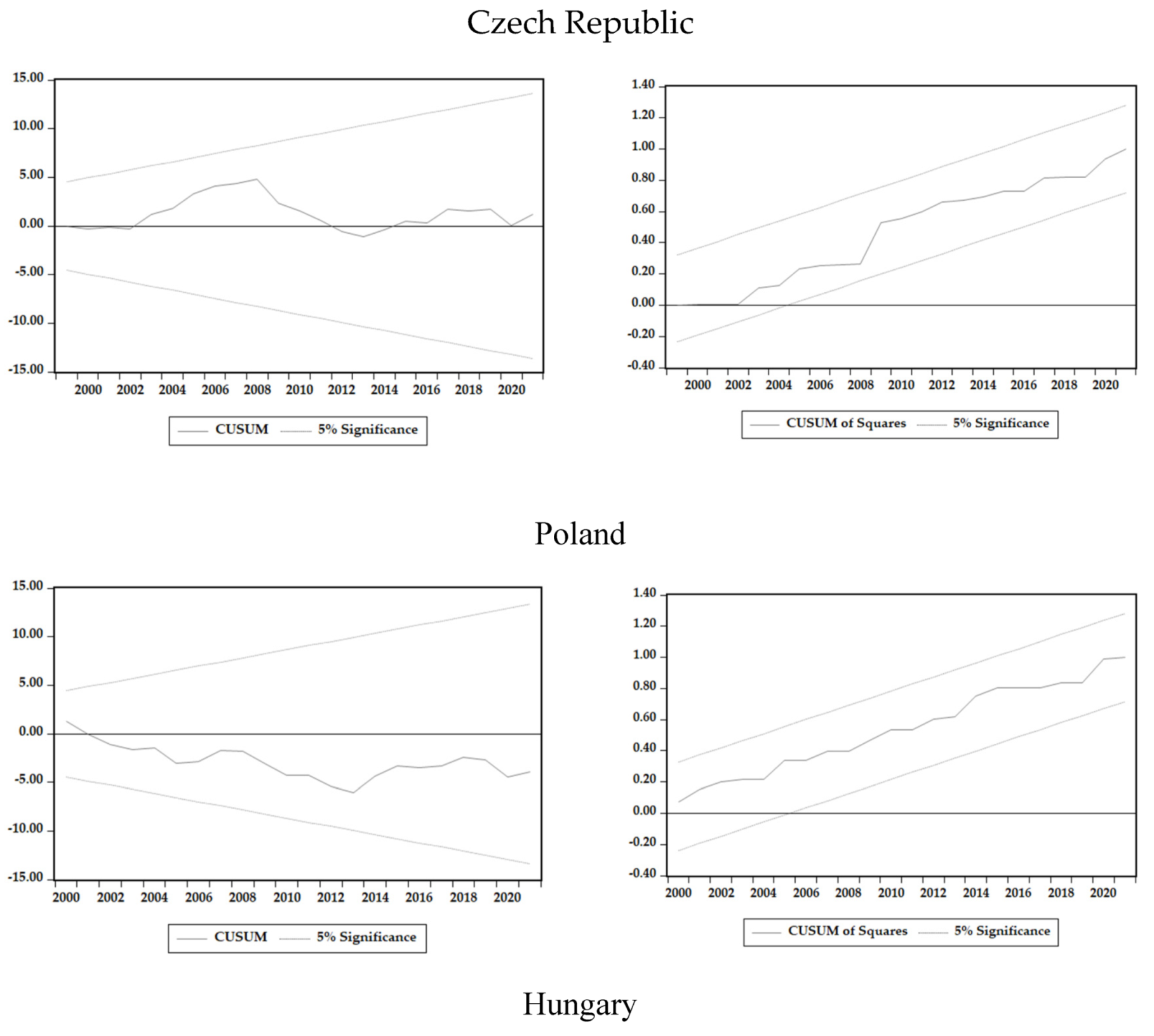

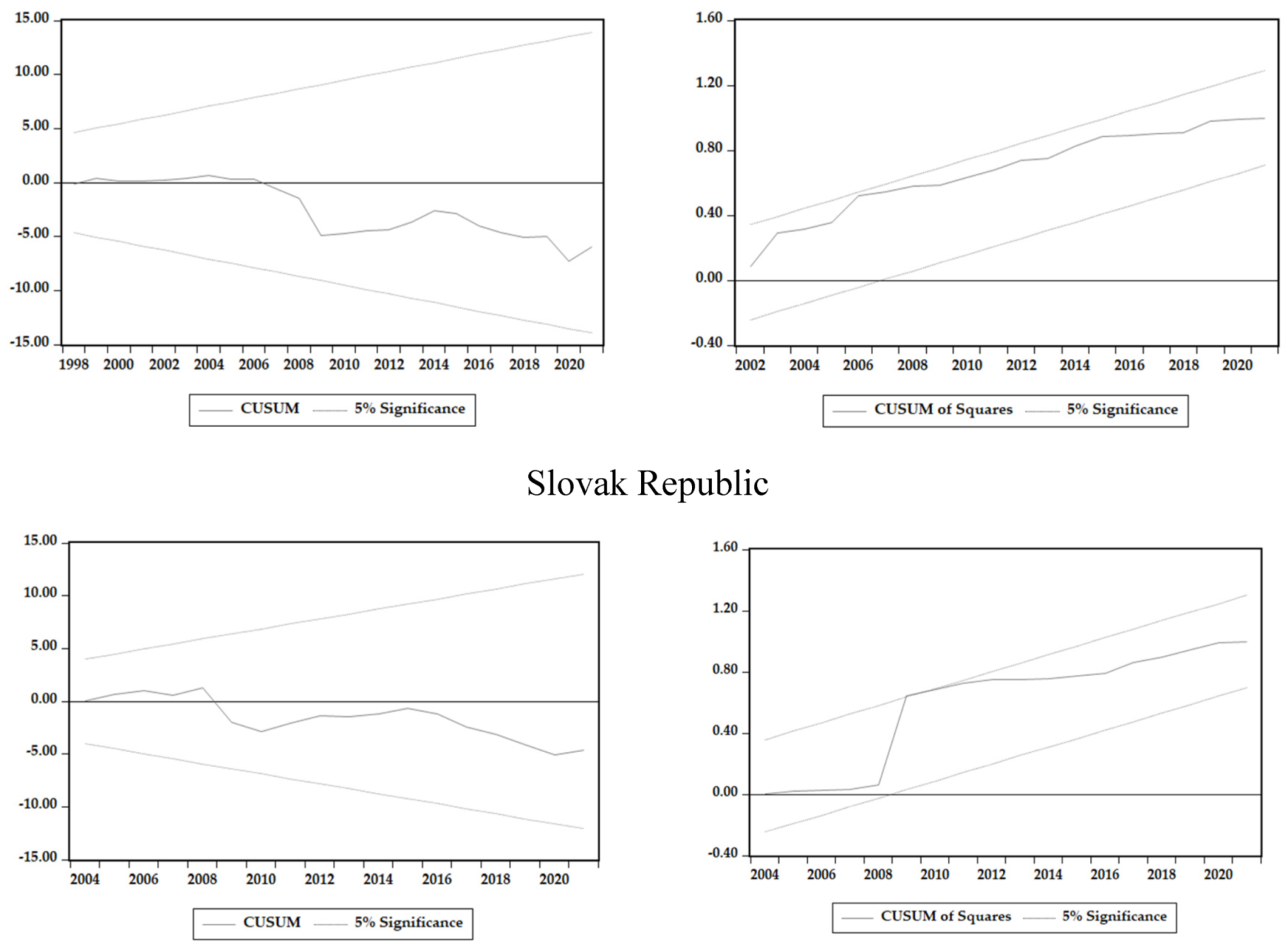

All obtained models were subjected to diagnostic tests of correctness and fit, such as serial correlation tests (LM test) [

45] and heteroskedasticity (ARCH test [

46] and Breusch-Pagan-Godfrey [

47]). In addition, stability was examined graphically using the cumulative sum of squares (CUSUM) and cumulative sum of squares (CUSUMQ) measures [

48].

4. Empirical results and discussion

In this section, the results of the tests are presented. First, the results of the unit root tests are presented. Next, panel co-integration, FMOLS (fully modified ordinary least squares), DOLS (dynamic ordinary least squares), ARDL (autoregressive distributed lag) and causality tests are examined. These tests allow us to assess long-term relationships, adjust for potential endogeneity and explore causal relationships between variables of interest. Finally, diagnostics were conducted to ensure the robustness and reliability of our findings.

4.1. Results for Unit Root Test

The first stage of the study, following the methodological guidelines, required variables to be tested for stationarity. For panel data, the second-generation CIPS panel unit root test, the first-generation Pesaran and Shin IPS tests, and the Levin, Lu and Chin (LLC) test were applied. The Akaike information criterion (AIC) was used to determine the optimal number of lags. The results shown in

Table 3 for the CIPS and IPS tests indicate that the variables are stationary at the first difference, while the results of the LLC test indicate that all variables except lnREW are stationary at the I(0) level and all variables are stationary at the first difference. It means the conditions for applying the ARDL model to panel data are met.

In contrast,

Table 4 shows the unit root tests for each country. The study used the standardised tests provided for the ARDL method in the form of the Dickey-Fuller (ADF) test and the Phillips-Perron (PP) unit root test.

The convergent result of both tests at a significance level of 5% confirms the stationarity of the tested time series. According to the data presented in

Table 3, all the studied series are stationary in I(1), confirming the applicability of the co-integration test method based on the ARDL model.

4.2. Co-integration results

Table 5 shows the results of the co-integration test for the panel data. Two types of tests were used in the study: the Pedroni and Kao tests. The results provide strong evidence of a long-term relationship between the analysed variables. The p-values for most of the Pedroni test statistics indicate the rejection of the null hypothesis of no long-term relationship between the analysed variables. Also, the Kao test indicates statistical significance at the 5% level. The combined test result means a significant and persistent relationship between the variables over a long time.

For individual countries, a co-integration test based on ARDL Bound Testing was performed (

Table 6). If the value of the test statistic is less than the lower bound I(0), we have no basis for inferring long-term co-integration. On the other hand, if the value of the F statistic is higher than the upper bound of I(1), then we can assume that co-integration is present. According to the assumed significance level of 5%, co-integration has been confirmed for all countries studied. Given the above, limited correction models (ECMs) were estimated in accordance with the methodology in order to examine the relationships involved.

4.2. Results of evaluations of short- and long-term models

Table 7 presents the long-run estimates for the panel data. Due to the few countries in the panel, the FMOLS and DOLS estimator were used to compare the results. The results obtained confirmed that all variables are statistically significant for the panel data in the long run.

The values of the coefficients for the DOLS panel data indicate that a 1% increase in CO2 emissions leads to a 1.27% decrease in GDP in the long term. A 1% increase in renewable energy consumption leads to a 0.09% increase in GDP. In contrast, an increase in non-renewable energy production generates an increase in GDP of 0.87%. The data for the FMOLS estimator converge and differ to a small extent. Comparing the two models, the DOLS model has a better fit in terms of the R2 parameter.

Table 8 shows the estimation results of the ARDL-ECM model for individual V4 countries. In the case of Poland, a 1% increase in CO

2 emissions generates a negative effect in the form of a 1.85% decrease in GDP in the long run. An analogous observation was found in Hungary, where a 1% increase in CO

2 emissions affects the GDP decrease by 2.95% and Slovakia by 1.16%. For the Czech Republic, no significant long-term relationship was found between CO

2 and GDP.

Renewable energy consumption impacted GDP in the long run in Hungary, where a 1% increase in renewable energy consumption affected GDP growth by 0.21%, and in Slovakia, the increase is 0.29%. In Poland and the Czech Republic, the long-run coefficient was insignificant for the LnREW variable.

In Poland, the Czech Republic and Slovakia, on the other hand, GDP in the long term was influenced by non-renewable energy consumption. In Poland, a 1% increase in non-renewable consumption affected GDP growth by 1.68%, in the Czech Republic by 3.07%, and in Slovakia, it had a negative effect in the form of a 2.03% decrease in GDP.

The analysis of the short-run data presented in

Table 9 shows that in all the models tested, the error correction term was negative, statistically significant and between 0 and -1. This indicates that the coefficients of the models were correctly estimated. At the same time, the speed of adjustment to long-run equilibrium varied across countries. The ECT coefficient for Poland of -0.98 suggests that, on average, for a 1% deviation from the long-run equilibrium, GDP adjusts by about -0.98% towards the equilibrium level in one period. It means that any short-term deviation from the long-term relationship between GDP, renewable energy, non-renewable energy and CO

2 in Poland is corrected relatively quickly. For Hungary: an ECT coefficient of -0.555 indicates that in Hungary, a deviation of 1% from the long-run equilibrium results in a correction of GDP by about -0.55% towards the equilibrium level. Like Poland, Hungary also shows a relatively rapid adjustment process towards the long-run relationship. For the Czech Republic and Slovakia, lower values of the ECT parameter of 0.34 and 0.33, respectively, were obtained. It means that for these two countries, a 1% deviation from the long-run equilibrium leads to an adjustment of GDP by around -0.34% towards the equilibrium level within one period.

The results suggest a relatively fast stabilising effect, in which any deviations from equilibrium are corrected in individual countries within 2-3 periods, indicating a long-term relationship between GDP, renewable energy, non-renewable energy and CO2 in individual countries.

4.3. Causality Results

Table 10 shows the individual results of the Toda-Yamamoto causality test for the countries studied. Analysing the results obtained for the Czech Republic, a unidirectional relationship was found between CO

2 and GDP and between renewable energy consumption (REW) and GDP. It was also found that non-renewable energy (NREW) has a significant impact on GDP.

The results of the causality test for Poland indicate significant unidirectional causal relationships between GDP and CO2, as well as between non-renewable energy and CO2. A bidirectional relationship was also found between CO2 emissions and renewable energy production.

The causality test results for Hungary suggest no significant causal links between CO2, GDP and renewable energy. However, there is evidence of unidirectional causality between GDP and non-renewable energy and between non-renewable energy and CO2.

The causality analysis for Slovakia indicates no significant causal relationships between CO2 and GDP. However, there is a significant bidirectional causality between renewable energy and GDP and a unidirectional causality between non-renewable energy and GDP and renewable energy. In addition, a bidirectional relationship between CO2 emissions and non-renewable energy production has also been demonstrated.

Diagnostics results

Table 11 shows the diagnostic tests for the ARDL-ECM model tested. Four techniques were used in this study to identify possible instability, namely variable autocorrelation (i.e., Breusch-Godfrey LM test), time series heteroskedasticity (i.e., Breusch-Pagan-Godfrey heteroskedasticity test and ARCH), functional form problem (i.e., Ramsey RESET test). As shown in

Table 9, the empirical results indicate that all ARDL-ECM models pass the tests, indicating the absence of bias.

To confirm the robustness of the estimated results, the cumulative sum of recursive residuals (CUSUM) and cumulative sum of recursive residuals squared (CUSUMSQ) tests are used to assess the dynamic stability of the parameters. The graphs are presented in

Appendix A. As both the green data series in Figure 1 and the orange data series in Figure 2 fall within the set limits, the model is considered stable, and the coefficients are considered significant at the 5% significance level.

4.4. Discussion

At the outset, it should be pointed out that it is not straightforward to compare the results obtained with those presented in previous studies, so that this section will point out the general common conclusions for this study and other studies. This is firstly due to the different time and spatial sets of previous studies and the data sets and methods used. Secondly, the V4 countries are very often included in broader research categories. Thirdly, for the V4 countries in the context of the variables studied, Toda-Yamamoto causality tests were not conducted early on.

The results obtained by the authors for the Visegrad countries indicate that, on an individual (ARDL-ECM model) and panel (FMOLS and DOLS) basis, there is a long-term negative cointegrating relationship between CO

2 emissions and economic growth. The result shows that a 1% increase in CO

2 emissions leads to a decrease in GDP of around 1.26% for the V4 economies. Therefore, these results differ from similar studies that used FMOLS and DOLS methods. Uçak et al. [

49], for highly developed OECD countries, indicate that a 1% increase in GDP leads to a 0.86% increase in CO

2. Similarly, using the same methods, Mitić et al. [

50] find that a 1% change in GDP leads to about 0.35% change in CO

2 in transition economies. Khan et al. [

51] also show a significant long-term impact of GDP on CO

2 emissions in ASEAN countries.

In contrast, the result is consistent with the study by Salazar-Núñez et al. [

52], which indicated, based on data for the last 50 years, that the relationship between CO2 emissions and GDP growth is negative. It fits in with studies that suggest that as GDP per capita increases, CO

2 emissions initially increase but then decrease, according to an inverted U-shaped curve [

53]. Also, studies for the economies of China, Colombia, Ecuador and Peru indicate that as CO

2 emissions increase, GDP per capita tends to decrease [

54] [

53] [

55] [

56].

In relating these observations to the results obtained in the study, it is essential to point out the specific characteristics of the V4 countries. Being in the bloc of communist countries until the end of the 1980s, these countries had energy-intensive economies oriented towards intensive industrial production, often leading to environmental degradation [

56]. After the economic transition, the industry’s role began to decline, and services began to dominate the production structure. The growth of freedoms and civic initiatives in Eastern and Central Europe also led to greater public involvement and potentially increased enforcement of environmental regulations [

57]. In addition, due to the increased importance of services and the change in the socio-economic structure in the economies of these countries, there was dynamic economic growth with a decrease in greenhouse gas emissions.

The results thus support Hannesson’s hypothesis that CO

2 intensity decreases as countries become more prosperous, implying that structural changes in GDP, such as a shift towards services, may not significantly help decarbonisation efforts and reduce CO

2 [

58]. It means that reducing CO

2 emissions while achieving economic growth is possible. Given the above, hypothesis H3 can be confirmed based on the result obtained.

The study also showed that a 1% increase in non-renewable energy production in the Visegrad countries leads to an increase in GDP of about 0.86%, while an increase in renewable energy production leads to an increase in GDP of about 0.09%. Thus, hypotheses H1 and H2 have been positively verified. However, a difference is apparent in the individual models: in the Czech Republic and Hungary, producing both types of energy positively affects GDP growth, with non-renewable energy to a greater extent. In Poland, on the other hand, renewable energy production has a negative impact on GDP in the long term, and the opposite is true in Slovakia.

Previous research shows that non-renewable energy consumption has a positive impact on GDP growth in the long term [

59] [

60]. It has also been shown that an increase in non-renewable energy consumption leads to an increase in real GDP in the short term [

61] [

62]. In contrast, studies in some countries suggest that non-renewable energy consumption has a negative impact on economic growth, while renewable energy consumption has a positive impact on economic growth [

4].

In contrast, Sahlian et al., using a sample of 28 European Union countries, indicate that renewable energy can contribute to GDP growth [

63]. Also, results for OECD countries confirm the indicated observation for renewable energy production and water [

64]. Similar results were also obtained by Alfonso et al. [

65], indicating that electricity consumption from renewable sources positively influences growth in Estonia and Sweden.

It is also worth pointing out that some studies indicate that the impact of renewable energy on GDP may vary depending on the economic development status of a country. In developed economies, higher renewable electricity consumption is associated with higher GDP growth rates [

66], while in emerging and developing economies, the relationship appears to be non-linear [

67]. It is also indicated by the results of the causality test, which shows the complex relationship between energy production economics and the environment.

In the Czech Republic, CO

2 emissions and non-renewable energy affect GDP. In Poland, the links between GDP, CO

2 emissions and non-renewable energy require a balance between economic growth and environmental protection. In Hungary, non-renewable energy affects GDP growth, while the lack of direct causal links between CO

2, GDP and renewable energy suggests the need for non-renewable resource management. In Slovakia, renewable energy impacts GDP, while non-renewable energy impacts GDP and CO

2. In each country, the challenge is to adapt the energy strategy to the unique conditions to achieve sustainable development in the context of global environmental goals. This is consistent with the findings of the study by Papież et al. [

20], which used a VAR model, showing that in countries with relatively well-developed renewable energy sectors, renewable electricity consumption boosts the economy and vice versa. Given the above rationale and the results obtained, it should be assumed that hypothesis H4 has been positively verified.

The results obtained thus confirm previous observations while adding new aspects to the existing state of knowledge. As a general reference, it should be pointed out that despite some commonalities, energy production in the individual V4 countries is based on different sources. Thus, the results suggest that the main factor determining the impact of energy production on GDP is the energy mix. Slovakia, which has a relatively high share of RES and a low share of coal in production compared to other V4 countries, shows a positive impact of increasing production from renewable sources on GDP. The Czech Republic and Hungary, which have a moderate share of coal in energy production, show a positive impact of both renewable and non-renewable energy production on GDP. Poland, where energy production is mainly based on coal, is in the worst position. It means that an increase in energy production from renewable sources must involve significant investment and costs, which can harm long-term economic growth.

6. Conclusion

This study aimed to investigate the impact of renewable and non-renewable energy consumption and CO2 emissions on economic growth at the regional level of the V4 group and the relationships between selected variables in the individual countries of the group. In order to clarify the indicated relationships based on the latest available data, the FMOLS/DOLS and ARDL approaches were applied, and causality was tested based on the Toda-Yamamoto test. The results obtained confirmed the four assumed research hypotheses.

The main findings of this study are as follows. Firstly, the FMOLS and DOLS results show that renewable energy has a positive, albeit small, impact on economic growth in the panel of countries studied over the long term. By far, the more significant impact is generated by non-renewable energy. Also importantly, a negative impact on economic growth was shown for CO2. It shows that the V4 countries are still dependent on non-renewable energy and that CO2 emissions burden their economic growth in the long term.

Secondly, from individual studies within the ARDL model, a difference in the direction and significance of the impact of individual variables is apparent. In the case of Poland, Slovakia and Hungary, a strongly negative effect of CO2 on economic growth can be seen. Also in Poland, the Czech Republic and Slovakia, non-renewable energy had a significant impact on economic growth in the long term, while in Hungary, renewable energy had a significant impact.

The results obtained and the causality test indicate causality between GDP and CO2 for the Czech Republic and Poland. It indicates that in these two countries, CO2 emissions play a significant impact on economic growth. In terms of energy production, in the Czech Republic and Slovakia, economic growth was influenced by renewable energy. At the same time, there was a significant causality between non-renewable energy and economic growth in all countries. In addition, in the case of Poland, it was possible to confirm the relationship between renewable energy and CO2. The overall results showed that the relationship between economic growth, renewable and non-renewable energy production and CO2 emissions is influenced by structural economic characteristics and the energy structure.

Based on the results, the following policy implications are recommended. Firstly, intensive investments in the area of renewable energy would need to be implemented at the regional level. The results show the positive impact of renewable energy production on economic growth in the countries studied. Thus, the development of renewable sources can contribute to long-term GDP growth. Since CO2 emissions have a negative impact on economic development and growth, reductions in this area should bring real long-term benefits for the countries studied. Secondly, when making the energy transition, non-renewable sources should be phased out. This is particularly the case in Poland, where non-renewable energy production still plays a significant role in economic growth.

In addition, it should be pointed out that the Visegrad countries in the energy transition face similar problems while having different individual characteristics. The differences are mainly due to the energy mix, primarily based on the energy policy pursued under communism. All countries except Poland have nuclear power plants, which account for a significant share of conventional energy production. It puts Poland in the least favourable position, and increasing non-renewable energy production will impact long-term economic growth. In contrast, Slovakia, which has the largest share of RES among the countries surveyed, shows the most considerable beneficial effect of renewable energy production.

Author Contributions

Conceptualization, data curation, writing—original draft preparation, supervision, J.M. and B.S.; methodology, B.S.; software, validation, formal analysis, J.M and B.S.; investigation, resources, writing—review and editing, J.M. and B.S.; visualization, B.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the West Pomeranian University Research Programme.

Data Availability Statement

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. CUSUM and CUSUMSQ result for the estimated models

References

- Bhuiyan, M.A.; Zhang, Q.; Khare, V.; Mikhaylov, A.; Pinter, G.; Huang, X. Renewable Energy Consumption and Economic Growth Nexus—A Systematic Literature Review. Frontiers in Environmental Science 2022, 10. [Google Scholar] [CrossRef]

- Menegaki, A.N.; Tsani, S. Chapter 5 - Critical Issues to Be Answered in the Energy-Growth Nexus (EGN) Research Field. In The Economics and Econometrics of the Energy-Growth Nexus; Menegaki, A.N., Ed.; Academic Press, 2018; pp. 141–184 ISBN 978-0-12-812746-9.

- Bhat, J.A. Renewable and Non-Renewable Energy Consumption—Impact on Economic Growth and CO2 Emissions in Five Emerging Market Economies. Environ Sci Pollut Res 2018, 25, 35515–35530. [Google Scholar] [CrossRef]

- Ito, K. CO2 Emissions, Renewable and Non-Renewable Energy Consumption, and Economic Growth: Evidence from Panel Data for Developing Countries. International Economics 2017, 151, 1–6. [Google Scholar] [CrossRef]

- Marques, L.; Fuinhas, J.; Marques, A. On the Dynamics of Energy-Growth Nexus: Evidence from a World Divided into Four Regions. International Journal of Energy Economics and Policy 2017, 7, 208–215. [Google Scholar]

- Huang, B.-N.; Hwang, M.J.; Yang, C.W. Causal Relationship between Energy Consumption and GDP Growth Revisited: A Dynamic Panel Data Approach. Ecological Economics 2008, 67, 41–54. [Google Scholar] [CrossRef]

- Alper, A.; Oguz, O. The Role of Renewable Energy Consumption in Economic Growth: Evidence from Asymmetric Causality. Renewable and Sustainable Energy Reviews 2016, 60, 953–959. [Google Scholar] [CrossRef]

- Esso, J.L. The Energy Consumption-Growth Nexus in Seven Sub-Saharan African Countries. Economics Bulletin 2010, 30, 1191–1209. [Google Scholar]

- Fang, Y. Economic Welfare Impacts from Renewable Energy Consumption: The China Experience. Renewable and Sustainable Energy Reviews 2011, 15, 5120–5128. [Google Scholar] [CrossRef]

- Inglesi-Lotz, R. The Impact of Renewable Energy Consumption to Economic Growth: A Panel Data Application. Energy Economics 2016, 53, 58–63. [Google Scholar] [CrossRef]

- Sebri, M. Use Renewables to Be Cleaner: Meta-Analysis of the Renewable Energy Consumption–Economic Growth Nexus. Renewable and Sustainable Energy Reviews 2015, 42, 657–665. [Google Scholar] [CrossRef]

- Bhattacharya, M.; Paramati, S.R.; Ozturk, I.; Bhattacharya, S. The Effect of Renewable Energy Consumption on Economic Growth: Evidence from Top 38 Countries. Applied Energy 2016, 162, 733–741. [Google Scholar] [CrossRef]

- Rajaguru, G.; Khan, S.U. Causality between Energy Consumption and Economic Growth in the Presence of Growth Volatility: Multi-Country Evidence. Journal of Risk and Financial Management 2021, 14, 471. [Google Scholar] [CrossRef]

- Myszczyszyn, J.; Suproń, B. Relationship among Economic Growth (GDP), Energy Consumption and Carbon Dioxide Emission: Evidence from V4 Countries. Energies 2021, 14, 7734. [Google Scholar] [CrossRef]

- Topcu, E.; Altinoz, B.; Aslan, A. Global Evidence from the Link between Economic Growth, Natural Resources, Energy Consumption, and Gross Capital Formation. Resources Policy 2020, 66, 101622. [Google Scholar] [CrossRef]

- Streimikiene, D.; Kasperowicz, R. Review of Economic Growth and Energy Consumption: A Panel Co-integration Analysis for EU Countries. Renewable and Sustainable Energy Reviews 2016, 59, 1545–1549. [Google Scholar] [CrossRef]

- Menegaki, A.N.; Marques, A.C.; Fuinhas, J.A. Redefining the Energy-Growth Nexus with an Index for Sustainable Economic Welfare in Europe. Energy 2017, 141, 1254–1268. [Google Scholar] [CrossRef]

- Armeanu, D.S.; Vintilǎ, G.; Gherghina, S.C. Does Renewable Energy Drive Sustainable Economic Growth? Multivariate Panel Data Evidence for EU-28 Countries. Energies 2017, 10. [Google Scholar] [CrossRef]

- Marinaș, M.-C.; Dinu, M.; Socol, A.-G.; Socol, C. Renewable Energy Consumption and Economic Growth. Causality Relationship in Central and Eastern European Countries. PLOS ONE 2018, 13, e0202951. [Google Scholar] [CrossRef] [PubMed]

- Papież, M.; Śmiech, S.; Frodyma, K. Effects of Renewable Energy Sector Development on Electricity Consumption – Growth Nexus in the European Union. Renewable and Sustainable Energy Reviews 2019, 113, 109276. [Google Scholar] [CrossRef]

- Ozcan, B.; Ozturk, I. Renewable Energy Consumption-Economic Growth Nexus in Emerging Countries: A Bootstrap Panel Causality Test. Renewable and Sustainable Energy Reviews 2019, 104, 30–37. [Google Scholar] [CrossRef]

- Costa-Campi, M.T.; García-Quevedo, J.; Trujillo-Baute, E. Electricity Regulation and Economic Growth. Energy Policy 2018, 113, 232–238. [Google Scholar] [CrossRef]

- Gozgor, G.; Lau, C.K.M.; Lu, Z. Energy Consumption and Economic Growth: New Evidence from the OECD Countries. Energy 2018, 153, 27–34. [Google Scholar] [CrossRef]

- Lazăr, D.; Minea, A.; Purcel, A.-A. Pollution and Economic Growth: Evidence from Central and Eastern European Countries. Energy Economics 2019, 81, 1121–1131. [Google Scholar] [CrossRef]

- Muço, K.; Valentini, E.; Lucarelli, S. The Relationships between GDP Growth, Energy Consumption, Renewable Energy Production and CO2 Emissions in European Transition Economies. International Journal of Energy Economics and Policy 2021, 11, 362–373. [Google Scholar] [CrossRef]

- Myszczyszyn, J.; Suproń, B. Relationship among Economic Growth, Energy Consumption, CO2 Emission, and Urbanization: An Econometric Perspective Analysis. Energies 2022, 15, 9647. [Google Scholar] [CrossRef]

- Litavcová, E.; Chovancová, J. Economic Development, CO2 Emissions and Energy Use Nexus-Evidence from the Danube Region Countries. Energies 2021, 14, 3165. [Google Scholar] [CrossRef]

- Cialani, C. CO2 Emissions, GDP and Trade: A Panel Co-integration Approach. International Journal of Sustainable Development & World Ecology 2017, 24, 193–204. [Google Scholar] [CrossRef]

- Li, R.; Jiang, H.; Sotnyk, I.; Kubatko, O.; Almashaqbeh Y. A., I. The CO2 Emissions Drivers of Post-Communist Economies in Eastern Europe and Central Asia. Atmosphere 2020, 11, 1019. [Google Scholar] [CrossRef]

- Gardiner, R.; Hajek, P. Interactions among Energy Consumption, CO2, and Economic Development in European Union Countries. Sustainable Development 2020, 28, 723–740. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for Unit Roots in Heterogeneous Panels. Journal of Econometrics 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Unit Root Tests in Panel Data: Asymptotic and Finite-Sample Properties - ScienceDirect. Available online: https://www.sciencedirect.com/science/article/pii/S0304407601000987 (accessed on 20 August 2023).

- Pesaran, M.H. A Simple Panel Unit Root Test in the Presence of Cross-Section Dependence. Journal of Applied Econometrics 2007, 22, 265–312. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Distribution of the Estimators for Autoregressive Time Series with a Unit Root. Journal of the American Statistical Association 1979, 74, 427–431. [Google Scholar] [CrossRef]

- PHILLIPS, P.C.B.; PERRON, P. Testing for a Unit Root in Time Series Regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- McCoskey, S.; Kao, C. A Residual-Based Test of the Null of Co-integration in Panel Data. Econometric Reviews 1998, 17, 57–84. [Google Scholar] [CrossRef]

- Pedroni, P. Purchasing Power Parity Tests in Cointegrated Panels. The Review of Economics and Statistics 2001, 83, 727–731. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds Testing Approaches to the Analysis of Level Relationships. Journal of Applied Econometrics 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Pedroni, P. Fully Modified OLS for Heterogeneous Cointegrated Panels. In Nonstationary Panels, Panel Co-integration, and Dynamic Panels; H. Baltagi, B., B. Fomby, T., Carter Hill, R., Eds.; Advances in Econometrics; Emerald Group Publishing Limited, 2001; Vol. 15, pp. 93–130 ISBN 978-1-84950-065-4.

- Dreger, C.; Reimers, H.-E. Health Care Expenditures in OECD Countries: A Panel Unit Root and Co-integration Analysis. International Journal of Applied Econometrics and Quantitative Studies 2005, 2, 5–20. [Google Scholar] [CrossRef]

- Kao, C.; Chiang, M.-H. On the Estimation and Inference of a Cointegrated Regression in Panel Data. In Nonstationary Panels, Panel Co-integration, and Dynamic Panels; H. Baltagi, B., B. Fomby, T., Carter Hill, R., Eds.; Advances in Econometrics; Emerald Group Publishing Limited, 2001; Vol. 15, pp. 179–222 ISBN 978-1-84950-065-4.

- Pesaran, M.H.; Shin, Y. An Autoregressive Distributed-Lag Modelling Approach to Co-integration Analysis. In Econometrics and Economic Theory in the 20th Century: The Ragnar Frisch Centennial Symposium; Strøm, S., Ed.; Econometric Society Monographs; Cambridge University Press: Cambridge, 1999; ISBN 978-0-521-63323-9. [Google Scholar]

- Engle, R.F.; Granger, C.W.J. Co-Integration and Error Correction: Representation, Estimation, and Testing. Econometrica 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Toda, H.Y.; Yamamoto, T. Statistical Inference in Vector Autoregressions with Possibly Integrated Processes. Journal of Econometrics 1995, 66, 225–250. [Google Scholar] [CrossRef]

- Breusch, T.S. Testing for Autocorrelation in Dynamic Linear Models*. Australian Economic Papers 1978, 17, 334–355. [Google Scholar] [CrossRef]

- Engle, R.F. Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica 1982, 50, 987–1007. [Google Scholar] [CrossRef]

- Breusch, T.S.; Pagan, A.R. A Simple Test for Heteroscedasticity and Random Coefficient Variation. Econometrica 1979, 47, 1287–1294. [Google Scholar] [CrossRef]

- Brown, R.L.; Durbin, J.; Evans, J.M. Techniques for Testing the Constancy of Regression Relationships over Time. Journal of the Royal Statistical Society. Series B (Methodological) 1975, 37, 149–192. [Google Scholar] [CrossRef]

- Uçak, H.; Aslan, A.; Yucel, F.; Turgut, A. A Dynamic Analysis of CO2 Emissions and the GDP Relationship: Empirical Evidence from High-Income OECD Countries. Energy Sources, Part B: Economics, Planning, and Policy 2015, 10, 38–50. [Google Scholar] [CrossRef]

- Mitić, P.; Munitlak Ivanović, O.; Zdravković, A. A Co-integration Analysis of Real GDP and CO2 Emissions in Transitional Countries. Sustainability 2017, 9, 568. [Google Scholar] [CrossRef]

- Khan, M.W.A.; Panigrahi, S.K.; Almuniri, K.S.N.; Soomro, M.I.; Mirjat, N.H.; Alqaydi, E.S. Investigating the Dynamic Impact of CO2 Emissions and Economic Growth on Renewable Energy Production: Evidence from FMOLS and DOLS Tests. Processes 2019, 7, 496. [Google Scholar] [CrossRef]

- Salazar-NÃoñez, H.F.; Venegas-Martà nez, F.; Tinoco-Zermeño, M.Ã. Impact of Energy Consumption and Carbon Dioxide Emissions on Economic Growth: Cointegrated Panel Data in 79 Countries Grouped by Income Level. International Journal of Energy Economics and Policy 2020, 10, 218–226. [Google Scholar] [CrossRef]

- Daysi, G.; Karla, M.-M.; Paco, A.-S.; Santiago, O.-M. Co2 Emissions, High-Tech Exports and GDP per Capita. In Proceedings of the 2021 16th Iberian Conference on Information Systems and Technologies (CISTI); June 2021; pp. 1–5. [Google Scholar]

- Huang, Z. Analyze the Relationship Between CO₂ Emissions and GDP from the Global Perspective.; Atlantis Press, 2021; pp. 442–451. 18 September.

- Chavaillaz, Y.; Roy, P.; Partanen, A.-I.; Da Silva, L.; Bresson, É.; Mengis, N.; Chaumont, D.; Matthews, H.D. Exposure to Excessive Heat and Impacts on Labour Productivity Linked to Cumulative CO2 Emissions. Sci Rep 2019, 9, 13711. [Google Scholar] [CrossRef]

- Caporale, G.M.; Claudio-Quiroga, G.; Gil-Alana, L.A. Co2 Emissions and GDP: Evidence from China. SSRN Journal 2019. [Google Scholar] [CrossRef]

- Kochtcheeva, L.V. Environmental Disaster in the Post-Communist Countries: Is There a Solution? Environmental Practice 2002, 4, 10–13. [Google Scholar] [CrossRef]

- Hannesson, R. CO2 Intensity and GDP per Capita. International Journal of Energy Sector Management 2019, 14, 372–388. [Google Scholar] [CrossRef]

- Ali, Q.; Raza, A.; Narjis, S.; Saeed, S.; Khan, M.T.I. Potential of Renewable Energy, Agriculture, and Financial Sector for the Economic Growth: Evidence from Politically Free, Partly Free and Not Free Countries. Renewable Energy 2020, 162, 934–947. [Google Scholar] [CrossRef]

- Shabbir, S.; Zeshan, M.; Muhammad, S. Renewable and Non-renewable Energy Consumption, Real GDP and CO2 Emissions Nexus: A Structural VAR Approach in Pakistan; University Library of Munich, Germany, 2011; A.

- Belaïd, F.; Zrelli, M.H. Renewable and Non-Renewable Electricity Consumption, Carbon Emissions and GDP: Evidence From Mediterranean Countries. Working Papers 2016. [Google Scholar]

- Al-mulali, U.; Fereidouni, H.G.; Lee, J.Y.M. Electricity Consumption from Renewable and Non-Renewable Sources and Economic Growth: Evidence from Latin American Countries. Renewable and Sustainable Energy Reviews 2014, 30, 290–298. [Google Scholar] [CrossRef]

- Sahlian, D.N.; Popa, A.F.; Creţu, R.F. Does the Increase in Renewable Energy Influence GDP Growth? An EU-28 Analysis. Energies 2021, 14, 4762. [Google Scholar] [CrossRef]

- Ohler, A.; Fetters, I. The Causal Relationship between Renewable Electricity Generation and GDP Growth: A Study of Energy Sources. Energy Economics 2014, 43, 125–139. [Google Scholar] [CrossRef]

- Afonso, T.L.; Marques, A.C.; Fuinhas, J.A.; Saldanha, E.M. Interactions between Electricity Generation Sources and Economic Activity in Two Nord Pool Systems. Evidence from Estonia and Sweden. Applied Economics 2018, 50, 3115–3127. [Google Scholar] [CrossRef]

- Halkos, G.E.; Tzeremes, N.G. The Effect of Electricity Consumption from Renewable Sources on Countries׳ Economic Growth Levels: Evidence from Advanced, Emerging and Developing Economies. Renewable and Sustainable Energy Reviews 2014, 39, 166–173. [Google Scholar] [CrossRef]

- Liu, Y.; Wei, T.; Park, D. Macroeconomic Impacts of Energy Productivity: A General Equilibrium Perspective. Energy Efficiency 2019, 12, 1857–1872. [Google Scholar] [CrossRef]

Table 1.

Overview of the newest studies where V4 countries occurred.

Table 1.

Overview of the newest studies where V4 countries occurred.

| Source |

Country |

Causality |

Model |

TIME |

| Huang et al. [6] |

26 OECD countries |

EC => GDP |

VECM and PVAR |

1971 to 2016 |

| Rajaguru and Khan [13] |

48 countries |

EC => GDP |

ARDL |

- |

| Myszczyszyn and Suproń [14] |

Viseguard countries |

EC <=> GDP |

ARDL |

1992-2015 |

| Topcu et al. [15] |

124 countries |

EC => GDP |

PVAR |

1980-2018 |

| Streimikiene and Kasperovich [16] |

EU Countries |

EC => GDP |

FMOLS, DOLS |

1995-2015 |

| Menegaki et al. [17] |

EU Countries |

EC<=>GDP |

PARDL |

2000-2012 |

| Armeanu et al. [18] |

EU Countries |

REW=>GDP |

PVAR |

2003-2014 |

| Marinaș et al. [19] |

CEE Countries |

REW<=>GDP |

ARDL |

1990-2014 |

| Papież et al. [20] |

EU Countries |

REW<=>GDP |

PVECM |

1990-2014 |

| Ozcan and Ozturk [21] |

Emerging countries |

REW≠GDP |

Causality panel |

1990-2016 |

| Costa-Campi et al. [22] |

EU Countries |

EC => GDP |

OLS panel |

2007-2013 |

| Gozgor et al. [23] |

OECD |

NREW => GDP

REW => GDP |

ARDL |

1990 - 2013 |

| Papież et al. [20] |

EU Countries |

REW≠GDP

NREW ≠GDP |

PVAR |

1995-2015 |

| Lazăr et al. [24] |

CEE Countries |

CO2 => GDP |

FMOLS |

1996-2015 |

| Muço et al. [25] |

European transition economies |

CO2 <=> GDP

REW => GDP |

PVAR |

1990-2018 |

| Myszczyszyn and Suproń [26] |

Viseguard countries |

CO2 <=> GDP

EC => GDP |

ARDL

|

1992-2016 |

| Litavcová and Chovancová [27] |

Danube Region Countries |

Mixed |

ARDL |

1990-2019 |

| Cialani [28] |

150 Countries |

CO2 <=> GDP |

ECM panel |

1960-2008 |

| Li et al. [29] |

Post-Communist Economies |

CO2 => GDP |

OLS panel |

1996-2018 |

| Gardiner and Hajek [30] |

EU Countries |

CO2 => GDP

EC => GDP |

PVECM |

1990-2015 |

Table 2.

Descriptive statistics.

Table 2.

Descriptive statistics.

| Variable |

Country |

Mean |

Median |

Max |

Min |

Std. Dev. |

n |

| lnGDP |

Czech Republic |

9.589 |

9.679 |

9.916 |

9.234 |

0.223 |

31 |

| Hungary |

9.259 |

9.330 |

9.648 |

8.899 |

0.233 |

31 |

| Poland |

9.095 |

9.114 |

9.669 |

8.465 |

0.366 |

31 |

| Slovak Republic |

9.361 |

9.425 |

9.812 |

8.779 |

0.344 |

31 |

| lnCO2 |

Czech Republic |

2.401 |

2.432 |

2.614 |

2.232 |

0.106 |

31 |

| Hungary |

1.615 |

1.678 |

1.868 |

1.364 |

0.138 |

31 |

| Poland |

2.063 |

2.043 |

2.248 |

1.955 |

0.085 |

31 |

| Slovak Republic |

1.795 |

1.828 |

2.094 |

1.455 |

0.124 |

31 |

| lnREW |

Czech Republic |

-3.276 |

-3.434 |

-2.346 |

-4.509 |

0.681 |

31 |

| Hungary |

-4.758 |

-4.140 |

-2.795 |

-6.383 |

1.319 |

31 |

| Poland |

-3.982 |

-4.405 |

-2.642 |

-4.845 |

0.796 |

31 |

| Slovak Republic |

-2.517 |

-2.498 |

-2.185 |

-3.485 |

0.290 |

31 |

| lnNREW |

Czech Republic |

-0.456 |

-0.382 |

-0.302 |

-0.717 |

0.142 |

31 |

| Hungary |

-1.225 |

-1.217 |

-1.071 |

-1.393 |

0.078 |

31 |

| Poland |

-1.068 |

-1.049 |

-0.897 |

-1.211 |

0.085 |

31 |

| Slovak Republic |

-0.806 |

-0.803 |

-0.658 |

-0.958 |

0.081 |

31 |

Table 3.

Panel Unit Root Test Results (IPS, CIPS, Levin, Lin & Chut).

Table 3.

Panel Unit Root Test Results (IPS, CIPS, Levin, Lin & Chut).

| Variable |

Level |

First Differences |

| CIPS |

Levin, Lin & Chu t |

IPS |

CIPS |

Levin, Lin & Chu t |

IPS |

CIPS |

| lnCO2 |

-2.16 |

-1.93** |

-2.16 |

-5.63* |

-4.97* |

-4.48* |

-2.16 |

| lnGDP |

-1.55 |

-1.93** |

0.97 |

-3.60* |

-4.97* |

-4.48* |

-1.55 |

| lnNREW |

-2.07 |

-1.58* |

-0.78 |

-4.94* |

-4.51* |

-5.25* |

-2.07 |

| lnREW |

-1.24 |

0.27 |

0.67 |

-3.34* |

-5.28* |

-5.38* |

-1.24 |

Table 4.

Unit Root Test Results for individual countries (the augmented Dickey-Fuller test (ADF) and Phillips-Perron test (PP).

Table 4.

Unit Root Test Results for individual countries (the augmented Dickey-Fuller test (ADF) and Phillips-Perron test (PP).

| Country |

Variable |

Level |

First Differences |

| ADF |

PP |

ADF |

PP |

| t-Stat |

p-value |

t-Stat |

p-value |

t-Stat |

p-value |

t-Stat |

p-value |

| Czech Republic |

lnGDP |

-0.81 |

0.801 |

-0.36 |

0.904 |

-4.11 |

0.004 |

-4.46 |

0.001 |

| lnNREW |

-1.56 |

0.491 |

-1.54 |

0.501 |

-4.90 |

0.001 |

-4.94 |

0.000 |

| lnREW |

-1.25 |

0.639 |

0.19 |

0.967 |

-5.98 |

0.000 |

-4.33 |

0.002 |

| lnCO2 |

-1.82 |

0.363 |

-2.04 |

0.271 |

-4.98 |

0.000 |

-4.92 |

0.000 |

| Hungary |

lnGDP |

0.26 |

0.972 |

-0.36 |

0.904 |

-4.60 |

0.001 |

-4.46 |

0.001 |

| lnNREW |

-1.49 |

0.526 |

0.72 |

0.991 |

-5.05 |

0.000 |

-4.01 |

0.004 |

| lnREW |

-1.48 |

0.531 |

3.30 |

1.000 |

-6.13 |

0.000 |

-2.97 |

0.050 |

| lnCO2 |

0.89 |

0.994 |

-1.79 |

0.379 |

-3.78 |

0.033 |

-5.6 |

0.000 |

| Poland |

lnGDP |

-2.64 |

0.099 |

5.08 |

1.000 |

-4.69 |

0.001 |

-5.16 |

0.000 |

| lnNREW |

-0.61 |

0.854 |

0.72 |

0.991 |

-4.92 |

0.001 |

-4.01 |

0.004 |

| lnREW |

0.93 |

0.995 |

2.43 |

1.000 |

-4.25 |

0.003 |

-4.31 |

0.002 |

| lnCO2 |

-2.02 |

0.278 |

-2.00 |

0.287 |

-5.24 |

0.000 |

-5.13 |

0.000 |

| Slovak Republic |

lnGDP |

-1.54 |

0.502 |

-0.23 |

0.923 |

-4.17 |

0.003 |

-4.95 |

0.000 |

| lnNREW |

-2.44 |

0.140 |

0.72 |

0.991 |

-6.14 |

0.000 |

-4.01 |

0.004 |

| lnREW |

-1.86 |

0.346 |

2.43 |

1.000 |

-5.17 |

0.000 |

-4.31 |

0.002 |

| lnCO2 |

-3.99 |

0.005 |

-2.85 |

0.064 |

-5.33 |

0.000 |

-7.04 |

0.000 |

Table 5.

Panel co-integration test results.

Table 5.

Panel co-integration test results.

| Test |

Statistic |

Weighted Statistic |

| Within-Dimension |

| v-Statistic panel |

1.25*** |

1.34*** |

| rho-Statistic panel |

-0.67 |

-0.30 |

| PP-Statistic panel |

-1.84** |

-1.46*** |

| ADF-Statistic Panel |

-2.22** |

-2.47* |

| Between-Dimension |

| Group rho-Statistic |

0.62 |

|

| Group PP-Statistic |

-2.20** |

|

| Group ADF-Statistic |

-2.99* |

|

| Kao-cointegration test |

| ADF |

-2.37* |

|

Table 6.

Co-integration test results for individual countries (ARDL Bound Test).

Table 6.

Co-integration test results for individual countries (ARDL Bound Test).

| Country |

F-statistics value |

F-Statistics |

I(0) |

I(1) |

| Czech Republic |

7.294* |

10% |

2.676 |

3.586 |

| |

|

5% |

3.272 |

4.306 |

| |

|

1% |

4.614 |

5.966 |

| Hungary |

5.497** |

10% |

3.097 |

4.118 |

| |

|

5% |

3.715 |

4.878 |

| |

|

1% |

5.205 |

6.640 |

| Poland |

11.492* |

10% |

3.770 |

4.535 |

| |

|

5% |

4.535 |

5.415 |

| |

|

1% |

6.428 |

7.505 |

| Slovak Republic |

8.227* |

10% |

3.097 |

4.118 |

| |

|

5% |

3.715 |

4.878 |

| |

|

1% |

5.205 |

6.640 |

Table 7.

Panel FMOLS and DOLS models estimation results.

Table 7.

Panel FMOLS and DOLS models estimation results.

| Variables |

Co-efficient |

Std. Error |

t-statistics |

Prob. |

| DOLS |

| lnCO2 |

-1.275 |

0.431 |

-2.959 |

0.004 |

| lnNREW |

0.857 |

0.350 |

2.447 |

0.017 |

| lnREW |

0.088 |

0.053 |

1.670 |

0.099 |

| R-squared |

0.870014 |

|

|

|

| FMOLS |

| lnCO2 |

-1.102 |

0.340 |

-3.244 |

0.002 |

| lnNREW |

0.920 |

0.304 |

3.026 |

0.003 |

| lnREW |

0.112 |

0.047 |

2.388 |

0.019 |

| R-squared |

0.769619 |

|

|

|

Table 8.

Long-run results of ARDL - ECM for individual countries.

Table 8.

Long-run results of ARDL - ECM for individual countries.

| Country |

Variables |

Co-efficient |

Std. Error |

t-statistics |

Prob. |

| Czech Republic |

|

|

|

|

|

| CO2 |

-1.088 |

0.806 |

-1.350 |

0.188 |

| NREW |

3.067 |

0.876 |

3.500 |

0.002 |

| REW |

0.408 |

0.551 |

0.740 |

0.466 |

| Poland |

Const. |

2.098 |

0.767 |

2.734 |

0.011 |

| CO2 |

-1.857 |

0.412 |

-4.511 |

0.000 |

| NREW |

1.683 |

0.649 |

2.593 |

0.015 |

| REW |

-0.129 |

0.094 |

-1.374 |

0.181 |

| |

Const. |

3.109 |

1.076 |

2.888 |

0.008 |

| Hungary |

CO2 |

-2.951 |

0.542 |

-5.447 |

0.000 |

| |

NREW |

0.523 |

0.515 |

1.015 |

0.319 |

| |

REW |

0.205 |

0.058 |

3.563 |

0.001 |

| |

Const. |

-3.147 |

0.818 |

-3.849 |

0.001 |

| Slovak Republic |

CO2 |

-1.166 |

0.523 |

-2.229 |

0.035 |

| |

NREW |

-1.950 |

0.491 |

-3.971 |

0.001 |

| |

REW |

0.297 |

0.149 |

1.995 |

0.057 |

Table 9.

Short-run results of ARDL - ECM for individual countries.

Table 9.

Short-run results of ARDL - ECM for individual countries.

| Country |

Variables |

Co-efficient |

Std. Error |

t-statistics |

Prob. |

| Czech Republic |

ΔlnGDPt-1

|

0.469 |

0.189 |

2.487 |

0.021 |

| ΔlnCO2 |

0.287 |

1.916 |

0.150 |

0.882 |

| ΔlnCO2 t-1

|

-1.685 |

2.122 |

-0.794 |

0.436 |

| Poland |

ΔlnNREW |

-0.054 |

2.145 |

-0.025 |

0.980 |

| ΔlnNREW t-1

|

1.078 |

1.885 |

0.572 |

0.574 |

| ΔlnREW |

0.564 |

0.412 |

1.371 |

0.185 |

| ΔlnREW t-1

|

-0.263 |

0.355 |

-0.742 |

0.466 |

| ECT t-1

|

-0.341 |

0.155 |

-2.202 |

0.039 |

| ΔlnGDP t-1

|

0.408 |

0.169 |

2.415 |

0.025 |

| ΔlnCO2 |

-0.824 |

0.378 |

-2.179 |

0.042 |

| ΔlnCO2 t-1

|

0.436 |

0.444 |

0.981 |

0.338 |

| ΔlnNREW |

-0.080 |

0.821 |

-0.097 |

0.923 |

| ΔlnNREW t-1

|

0.222 |

1.020 |

0.218 |

0.830 |

| ΔlnREW |

0.018 |

0.229 |

0.080 |

0.937 |

| ΔlnREW t-1

|

0.172 |

0.218 |

0.789 |

0.439 |

| ECT t-1

|

-0.982 |

0.214 |

-4.829 |

0.000 |

| Hungary |

ΔlnGDP t-1

|

-0.230 |

0.167 |

-1.372 |

0.185 |

| |

ΔlnCO2 |

-0.455 |

0.500 |

-0.910 |

0.374 |

| |

ΔlnCO2 t-1

|

0.584 |

0.591 |

0.987 |

0.335 |

| |

ΔlnNREW |

-0.024 |

0.421 |

-0.058 |

0.954 |

| |

ΔlnNREW t-1

|

-0.329 |

0.420 |

-0.784 |

0.442 |

| |

ΔlnREW |

-0.005 |

0.102 |

-0.045 |

0.965 |

| |

ΔlnREW t-1

|

0.115 |

0.093 |

1.230 |

0.233 |

| |

ECT t-1

|

-0.555 |

0.144 |

-3.841 |

0.001 |

| Slovak Republic |

ΔlnGDP t-1

|

0.524 |

0.178 |

2.942 |

0.008 |

| |

ΔlnCO2 |

-0.605 |

0.524 |

-1.155 |

0.261 |

| |

ΔlnCO2 t-1

|

0.401 |

0.617 |

0.650 |

0.523 |

| |

ΔlnNREW |

-0.735 |

0.541 |

-1.359 |

0.189 |

| |

ΔlnNREW t-1

|

0.070 |

0.492 |

0.143 |

0.887 |

| |

ΔlnREW |

0.259 |

0.157 |

1.649 |

0.114 |

| |

ΔlnREW t-1

|

-0.092 |

0.153 |

-0.603 |

0.553 |

| |

ECT t-1

|

-0.335 |

0.161 |

-2.081 |

0.048 |

Table 10.

Toda-Yamamoto causality test for individual countries.

Table 10.

Toda-Yamamoto causality test for individual countries.

| Cause → Effect |

Czech Republic |

Poland |

Hungary |

Slovakia |

| χ2 |

Prob. |

χ2 |

Prob. |

χ2 |

Prob. |

χ2 |

Prob. |

| CO2 -> GDP |

18.82 |

0.000 |

1.34 |

0.854 |

0.14 |

0.934 |

5.29 |

0.259 |

| GDP -> CO2 |

2.68 |

0.443 |

19.36 |

0.001 |

3.57 |

0.168 |

3.20 |

0.525 |

| GDP -> REW |

0.73 |

0.867 |

1.81 |

0.771 |

1.21 |

0.547 |

9.06 |

0.060 |

| REW -> GDP |

14.83 |

0.002 |

6.01 |

0.199 |

1.73 |

0.420 |

11.98 |

0.018 |

| GDP -> NREW |

2.29 |

0.514 |

5.82 |

0.213 |

6.02 |

0.049 |

2.42 |

0.659 |

| NREW -> GDP |

17.65 |

0.001 |

7.79 |

0.095 |

1.30 |

0.522 |

20.80 |

0.001 |

| CO2 -> REW |

0.42 |

0.935 |

10.15 |

0.038 |

1.07 |

0.585 |

7.59 |

0.108 |

| REW -> CO2 |

7.35 |

0.062 |

21.18 |

0.000 |

4.35 |

0.114 |

4.56 |

0.335 |

| CO2 -> NREW |

3.67 |

0.299 |

1.25 |

0.869 |

11.38 |

0.003 |

1.08 |

0.898 |

| NREW -> CO2 |

5.66 |

0.129 |

8.16 |

0.086 |

1.75 |

0.418 |

3.79 |

0.436 |

| REW -> NREW |

12.61 |

0.006 |

4.30 |

0.367 |

8.18 |

0.017 |

3.62 |

0.459 |

| NREW -> REW |

1.07 |

0.785 |

4.66 |

0.324 |

4.55 |

0.103 |

12.19 |

0.016 |

Table 11.

Diagnostics test for models.

Table 11.

Diagnostics test for models.

| Country |

Ser. Corr χ2

(Breusch-Godfrey LM Test) |

Homoskedasticity χ2

(Breusch-Pagan-Godfrey Test) |

Heteroskedasticity χ2 test

(ARCH) |

Stable

(Ramsey RESET Test) |

|

|

Czech Republic

Poland

Hungary

Slovak Republic |

0.910 |

0.356 |

0.151 |

Stable |

|

|

| 0.552 |

0.444 |

0.582 |

Stable |

|

|

| 0.591 |

0.397 |

0.341 |

Stable |

|

|

| 0.413 |

0.544 |

0.660 |

Stable |

|

|

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).