1. Introduction

In today's environment, in addition to achieving the main goals of generating profits and increasing the cost of capital, companies must ensure the implementation of the 2030 Agenda for Sustainable Development, formed by the United Nations [

1]. The 17 Sustainable Development Goals (SDGs) defined by this Agenda form a conceptually new field of conditions and tasks for enterprises, for the implementation or achievement of which it is necessary to adapt or transform production and management business processes, to ensure the implementation of green and socially responsible business models. Based on the provisions of legitimacy and stakeholder theories, only through such changes can companies ensure trusting relationships with society and other groups of stakeholders, minimizing the risk of conflicts and boycotts, which will contribute to their mutual prosperity, the achievement of public welfare, and the expansion of the choice and freedom of people.

Solving sustainability challenges has become an integral feature of leading companies playing a decisive and pivotal role in reaching the SDGs, solving social and environmental protection problems [

2,

3,

4,

5,

6], and ESG practices have become vital for the public and company investors [

7,

8]. Therefore, the results of achieving SDGs by companies should be reported to their management, corporate governance bodies, capital providers and other stakeholders related to their activities, which allows assessing the corporate sustainability profile [

9]. While in 1997, of the 250 largest Fortune 500 companies in the world, only 35% disclosed information about sustainability, in 2020 this figure has increased to 96% [

10]. Ongoing decision-making, policy making and strategy development by internal and external stakeholders in such an environment is based not only on the consideration of traditional financial performance indicators, but also on the efforts and ability of companies to achieve the SDGs.

To meet such information needs of stakeholders, companies publish various types of reports (sustainability, integrated, SDG, non-financial, etc.), which at the same time act as an institutional tool for improving their behavior in the context of solving sustainable development problems [

11]. Thus, the introduction of corporate reporting procedures based on the results of the impact on sustainable development contributes not only to increasing the transparency of activities, but also affects the financial performance of companies. However, the specifics and direction of such an impact have been little studied, which is especially true for countries that have only recently introduced mandatory disclosure requirements for public companies or where such a voluntary practice has not been significantly developed, such as in Turkey.

Based on the Sustainability Principles Compliance Outline [

12], Turkish public companies, in addition to traditional financial reports, must publish information characterizing their impact on the environmental, social, and corporate governance aspects of companies. This practice of publishing additional information in sustainable reports is based on the “comply or explain” principle, which makes the role of companies in Turkey's sustainable development more transparent and will help attract more investment in the long term. Based on the requirements of this document, the first sustainable reports were to be published by Turkish securities issuers for the 2022 reporting year.

According to Sachs et al. [

13], Turkey ranks only 72nd out of 166 countries of the world, further highlighting the need to develop public company sustainability reporting practices towards achieving sustainable development goals. As Dursun and Burcu [

14] point out in this regard, if Turkey plans to move its economy into the top 10 EU economies in a healthy and stable manner, sustainability must become the main strategy of the Turkish business world. At the same time, the financial implications of implementing sustainable development practices for companies are critical to their decision-making [

15], which can be a serious reason for the ineffectiveness of their implementation or masking and imitation of their implementation in Turkish enterprises, as enterprises from other countries do to improve their reputation, obtain a license to operate, fulfill a social contract, etc. [

2,

6,

16]. Therefore, when looking for ways to improve the sustainability reporting system for Turkish securities issuers, the role of sustainability practices in their financial performance should be considered.

This study aims to analyze the impact of sustainability reporting on the financial performance of companies from the Turkish FBT and TCL sectors. The main contribution of the paper is to study the impact of sustainability reporting practices on financial performance measures of Turkish FBT and TCL companies. This allows enriching the existing literature on integrated and non-financial reporting in Turkey and formulating recommendations for creating a more favorable environment for the effective performance of its core functions, in particular, the achievement of sustainable development goals by companies.

The analysis of the impact of sustainability disclosure on the activities of Turkish companies was studied by scientists long before its mandatory regulatory approval for Turkish public companies in 2020. This is primarily due to the application of the GRI methodology by some companies since 2006 to form non-financial reporting and develop institutional support for the publication of sustainability disclosures on the Istanbul Stock Exchange (ISE), in particular, due to the introduction of the BIST Sustainability Index on it since 2014. This proves that some Turkish companies have long been using additional sustainability disclosure tools, creating the necessary information space to change the behavior of capital providers towards sustainability orientation. However, such experience did not always have a positive effect, but was characterized by approaches similar to SDG-washing.

Thus, Agca and Önder [

17] examined the impact of various factors influencing voluntary disclosure levels for Turkish ISE-listed non-financial firms. They found that all the companies surveyed were reluctant to disclose non-financial information, which included information about employees, corporate governance, and socially significant information. Senal and Aslantaş Ateş [

12] substantiated the feasibility of creating a single standardized report to disclose the social and environmental performance of business, which should generally increase the level of transparency of companies and ensure sustainable corporate development.

Aktaş, Kayalıdere and Kargın [

19] examined the compliance of sustainability reports of 9 Turkish companies with GRI requirements and found their minimum compliance and information limitations, in particular, in terms of performance measures. The authors also noted the need for research that will analyze the impact of the level of sustainability disclosures on firms' performance. Kartal [

20] also confirmed a similar situation with compliance with the minimum requirements of the GRI standards for Turkish banks. Kocamiş and Yildirim [

21] examined the compliance of reports published by Turkish companies with the GRI requirements and highlighted the positive role of the BIST Sustainability Index in ensuring the sustainability of Turkish companies, since the publication of sustainability reports will increase stakeholder confidence in companies and increase business transparency for government, public and capital providers. Dursun and Burcu [

14] and Aracı and Yuksel [

22] also noted the need to unify sustainability reports that are disclosed by companies with the BIST Sustainability Index based on the GRI methodology.

Thus, in the absence of normative regulation of sustainability reporting in Turkey, researchers basically justified the need to introduce a single format of such a report, its formation on the basis of a certain methodology (GRI, IR, etc.), emphasized the feasibility of introducing regulatory rules that would allow creating a better institutional environment for sustainability disclosure, and also noted the need to analyze the effect of sustainability practices on financial performance of Turkish companies.

However, with the gradual harmonization of sustainability reports published on the ISE, based on the GRI methodology, the vector of scientific research in this area is gradually changing, and considerable attention is beginning to be paid to the study of cause-and-effect relationships between sustainability reporting and financial performance, profitability, market cost, etc. The introduction of the sustainability reporting regulation in Turkey in 2020 for ISE-listed companies has given an even greater push to the development of this line of research, with the result that the number of academic studies on the impact of corporate sustainability practices on financial performance has increased significantly in recent years [

23].

Thus, Önder [

24] examined the impact of institutional sustainability on profitability (ROA) of 33 Turkish organizations that published their sustainability reports according to GRI in 2015 on the ISE. To do this, he used the Overall Sustainability Rating (OSR) indicator and its four structural elements (performances) according to the GRI methodology (community, employees, environmental, governance). As a result of applying the regression analysis, a significant positive impact of OSR and Environmental performance on ROA was revealed.

Doğan and Kevser [

25], having studied the activities of 10 banks from the Turkish banking sector for 2013–2018, found that ESG indicators from their published sustainability reports do not affect their financial performance (ROA, ROE). Emir and Kıymık [

26], after examining the role of GRI sustainability reports of BIST Metal Goods companies listed the on ISE for 2014–2018 in supporting their financial performance measures (ROA, ROE, ROC, Profit before tax, Growth rate in total assets), found a significant positive impact on the first four indicators and a significant negative impact on the Growth rate in total assets.

Kılıç et al. [

27] investigated the impact of sustainability score (moderator variable (SP × SIZE)) on the financial performance (ROE, ROA, ROS, MV/BV) of Turkish companies included in the BIST 100 ISE index. The use of such an independent variable made it possible to analyze the effect of firm size on financial performance measures, in particular, it was found that the moderator variable has a significant impact only on ROA.

Dincer, Keskin, and Dincer [

28] analyzed the impact of sustainability reporting on the ROA of 46 Turkish companies listed on the ISE over the period 2016–2020 and found, using pooled ordinary least squares, that sustainability reporting has a significant positive impact on ROA, and a significant negative relationship between Risk, Size and ROA. Aydoğan and Kara [

23] also confirm that there is a trend towards the positive impact of sustainability practices on financial performance and provide evidence of this from an analysis of 58 non-banking companies listed on the ISE in 2015–2021. They determined that there is a positive relationship between corporate sustainability practices and ROA, and LEV has a negative significant effect on ROA.

An analysis of works that study the impact of sustainability reporting on financial performance of various types of Turkish companies indicates that there is no clear understanding of the role and significance of such practices for a company’s financial well-being, since such impact, if any, is characterized by different directions (positive, negative, mixed) and the degree of its significance (significant or insignificant). Similar results have also been obtained by scientists from similar studies in other countries [

4,

7,

8,

29]. The reason for this situation is a number of institutional factors that affect a company's activities in a particular industry, the results of their publication of sustainability reports, as well as the methodology used by scientists to conduct research (sample size, time interval, analysis method, etc.). As a result, the impact of sustainability practices of companies' financial performance remains not fully understood due to their versatility and overlapping, and due to the presence of contradictory and ambiguous empirical results, and therefore this issue is one of the most relevant for further scientific research.

2. Materials and Methods

To determine the impact of sustainability reporting on financial performance of companies in the FBT and TCL sector, a regression analysis of data based on the use of the ordinary least square method was used. The study sample included companies listed on the ISE and belonging to the Food, Beverage and Tobacco and Textile, Wearing Apparel and Leather sectors. According to the EU Statistical Classification of Economic Activities (NACE), the surveyed enterprises are abbreviated “FBT” and “TCL” and include enterprises from sectors from 15 to 19 (production of food products and beverages, tobacco products, textiles, wearing apparel, leather, leather products and footwear).

Of the 67 FBT and TCL companies represented on the ISE, only a part published sustainability reports in the form prescribed by law, which indicates a violation of listing requirements by some companies and negatively characterizes the development of the institutional environment for the sustainable development reporting system in Turkey. As a result, the paper analyzed the economic activity and sustainability practices of 48 Turkish FBT and TCL companies for 2022, which published sustainability reports and for which the necessary data for study were available. The information base for the study was formed using the resources of the KAP Public Disclosure Platform, which contains the financial statements of companies, sustainability reports, as well as using other additional information about the activities of companies (corporate management system, main financial indicators, company foundation date) posted on their official sites.

To characterize the financial performance of FBT and TCL companies, a number of dependent variables were used that relate to three main aspects of such performance – earnings (Earnings before interest, taxes, depreciation and amortization (EBITDA)), profitability (Return on Assets (ROA), Return on Equity (ROE)), and productivity (Assets turnover ratio (ATO)). Based on the findings of Xu and Wang [

30], this study also uses the logged value of EBITDA. The financial performance measures used in the paper are quite often used by scholars in similar studies [24, 25, 26, 4, 27, 28, 23 and others] and are defined as accounting-based measures derived from accounting calculations.

To analyze the impact of sustainability practices on selected dependent variables, it is proposed to use one general and three partial indices, namely, SRDQI, EDQI, SDQI and CGDQI, which were formed based on the results of studies by Aggarwal [

29], Hongming et al. [

31], and Soriya and Rastogi [

32]. SRDQI – Sustainability Reporting Disclosure Quality Index, which is calculated for each of the studied FBT and TCL companies based on content analysis of publicly disclosed sustainability reports. To quantify the quality of information disclosure in such reports on companies’ sustainability practices, it was proposed to conduct a score evaluation of each of the 52 elements of a sustainability report. Each of the elements of the report was evaluated on a four-point scale (0-3), which is the most convenient to use, based on the structure of sustainability reports that are disclosed by ISE-listed public companies. The score "0" was assigned in case of non-disclosure of the report element; "1" – if this element is not relevant for the company, but if there is an explanation of the reasons for such absence, which indicates the presence of sustainable practices or intentions regarding their application, if there is a change in the level of relevance; "2" – with partial disclosure of this element; "3" – with full disclosure of this element with additional explanations and confirmations in the form of links to external web resources. The maximum number of points that can be obtained as a result of evaluating all elements of the report is 156.

Based on the proposals of Soriya and Rastogi [

32], it is advisable to calculate the SRDQI using the following formula:

where

– score obtained by assigning (0-3) coding to 52 elements of the sustainability report, and m is the maximum score that can be obtained for all elements of the sustainability report.

Using the same methodology, it is proposed to calculate EDQI – Environmental Disclosure Quality Index, SDQI – Social Disclosure Quality Index, and CGDQI – Corporate Governance Disclosure Quality Index. These three indices are partial indicators that are calculated for three main subcategories of sustainability report – “B. Environmental Principles”, “C. Social Principles”, and “D. Corporate Governance Principles”. The main difference when calculating each of these indices will be m – maximum score obtained for every subcategory, since each of them has a different number of elements. For EDQI, m will be 75, for SDQI 45, and for CGDQI – 6.

The paper also used four control variables such as Company size, Leverage (Debts to Assets), Company age, and Dummy variable for a subbranch. The first two control variables are quite often used by scientists in conducting such studies [24, 8, 28 and others]. Size allows you to check whether sustainability disclosure is only a valuable "toy" for large companies, and Lev – to establish the role of equity/raised capital in ensuring financial performance. The use of the third control variable is based on the assumption of Soriya and Rastogi [

32] and Aydoğan and Kara [

23] that the age of the company that discloses sustainability information can also affect its financial indicators. A dummy variable for a subbranch is added to determine if there is an impact of a subbranch on the value of sustainability practices for provision of financial performance.

Table 1 reflects the names and procedure for calculating the variables used to build analytical models, distinguishes between their types and gives their abbreviations.

To determine the impact of the sustainability reporting practices of Turkish FBT and TCL companies on their financial performance, two types of analytical models were formed such as OVER models (1.1-1.4) and SEP models (2.1-2.4). Models of the first type allow us to analyze the impact of the overall quality of sustainability reports on financial performance measures. Second type models allow us to analyze the influence of three main subcategories of a sustainability report (environmental performance, social performance, corporate governance performance) on financial performance measures. Since the study analyzes the financial performance of FBT and TCL companies using four measures (EBITDA, ROA, ROE and ATR), four direct models were built for each type of model, which will be analyzed using the Gretl software package:

where l_EBITDA, ROA, ROE, and ATR – dependent variables, i – entity, and t – time; α – identifier; βn – regression coefficients; SRDQI, EDQI, SDQI, and CGDQI – independent variables, l_S, LEV, l_A, DVS – control variables, where i – entity and t – time; εit – error term.

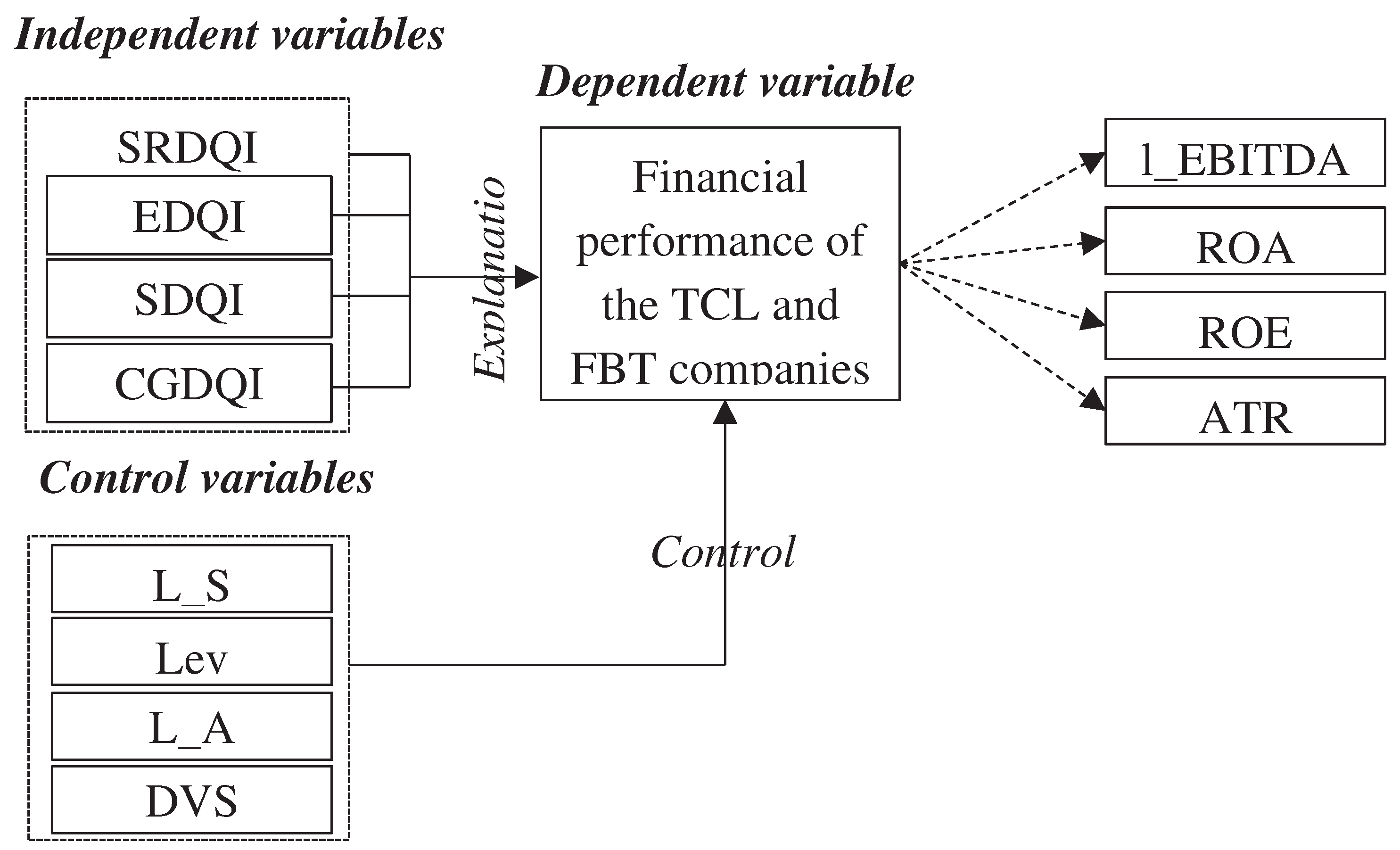

The research framework used in this study is shown in

Figure 1.

3. Results

Descriptive statistics for the dependent and independent variables used in this study are presented in

Table 2.

Table 2 shows that all the mean values of the dependent variables (l_EBITDA, ROA, ROE, and ATR) are positive, which indicates the satisfactory financial performance of most of the studied companies. The closeness of mean and median values for all dependent and independent variables indicates a high level of symmetry in the distribution of range values. Since the mean values of used overall and separate indices are quite low (SRDQI – 58.4%, EDQI – 49.4, SDQI – 66.2, CGDQI – 70.1), this shows that Turkish FBT and TCL companies have to make a significant effort to improve their sustainability practices, especially those that provide ecological performance, since the average EDQI is less than 50%.

Since the maximum values of all separate indices are 100%, and the SRDQI value is 98.1, this indicates that individual companies fully or almost fully implement all practices that are elements of sustainability reports defined by the Sustainability Principles Compliance Outline. On the other hand, the presence of minimum index values equal to 0 or close to 0 indicates that individual companies ignore compliance with this system of principles both in general and in relation to individual subcategories of the sustainability report.

After testing the problem of multicollinearity between dependent variables, it was found for ROA and ROA (0.9), which is explained by the fact that both variables represent similar aspects of financial performance (profitability). Since all obtained correlation values between all independent explanatory variables for SEP models are less than 0.8, this indicates that there is no serious multicollinearity problem.

Table 3 shows the results of regression analysis of data on the example of eight models (p-value and significance level). They show which of the regressors of each model has the most significant impact on the dependent variables, its strength and direction.

In general, the analysis of the results of applying the OVER models allows us to establish the complete absence of a significant impact of sustainability practices on all types of financial performance measures used. At the same time, a significant influence of control variables on financial performance of Turkish FBT and TCL companies was revealed. Thus, l_S is statistically significant and has a positive effect on l_EBITDA (at the 1% level), which indicates the need to increase the amount of capital of enterprises to ensure the growth of this indicator. Lev has a negative and significant impact on ROA (at the 5% level) and a positive and significant impact on ATR (at 1%), which reflects the multifaceted role of increasing the share of attracted resources in the total capital of enterprises for financial performance. A negative significant influence of l_A on ROA and ROE (at the level of 5% and 10%) indicates that older companies pay less attention to the implementation of sustainability practices than younger ones. Based on the identified significant negative impact of DVS on ROA and ROE (at the level of 5%), one can state that belonging to TCL companies negatively affects financial performance measures.

The analysis of SEP models also confirms that various types of sustainability indicators do not significantly affect the financial performance of Turkish FBT and TCL companies. Of all the four models analyzed, only CGDQI was found to have a positive and significant effect on ATR at the 1% level. This means that the corporate governance performance of FBT and TCL companies ensures the achievement of positive ATR values, which is an empirical confirmation of the feasibility of improving this type of sustainability practices of companies. The analysis of SEP models also revealed a similar influence of all control variables on financial performance measures as in the analysis of OVER models.

4. Discussion

The results obtained fully confirm the authors’ conclusions about the complete or overwhelming lack of impact of sustainability reporting on financial performance [

25,

27,

29]. That is, regardless of the level of sustainable performance of companies, it has no or almost no effect on their financial performance measures. This situation can be justified by the imperfection of the sustainability reporting system in Turkey or by the multidirectional impact of individual subcategories of company sustainability performance, as a result of which their overall impact, analyzed using the SRDQI, could be nullified.

On the other hand, the results obtained contradict the conclusions of scientists who studied the activities of Turkish companies and found a significant positive or negative influence of indicators characterizing sustainability practices on financial performance measures (ROA, ROE) [

23,

24,

26,

27,

28]. As a result, the conclusions obtained contradict the provisions of stakeholder theory, which characterizes the specifics of the influence of additional forms of information disclosure on the performance of enterprises. In particular, the representatives of this theory note that by improving their reputation and interaction with stakeholders and society, while strengthening their investment attractiveness, the financial performance of firms should improve. We can give the following explanations for the lack of confirmation of stakeholder theory provisions in this study:

The quality level of the Turkish FBT and TCL sustainability reports is not high enough as the mean value of SRDQI was only about 58%. As a result, the information disclosed in them is insufficient to provide the necessary influence on stakeholders, which should result in a change in financial performance;

Disclosed sustainability reports reflecting an enterprise’s sustainability practices can have a major impact on stakeholders mainly after they are published, so their direct effect on financial performance measures and enterprise value can be more clearly seen in the long term. On the other hand, the introduction of sustainability practices requires the implementation of long-term investments that negatively affect financial performance in the reporting period. However, no significant negative relationship was found between the variables studied in the paper in the reporting period. Thus, this fact additionally confirms the above first explanation of the non-fulfillment of stakeholder theory provisions.

Further research on the impact of individual indices characterizing sustainability performance components also almost did not allow obtaining clear results that would indicate the existence of a statistically significant relationship between the variables under study. Only CGDQI has a positive significant impact on ATR, which confirms the importance of effective implementation of corporate governance practices to increase ATR values. The findings, which do not reflect the existence of the problem of multidirectional influence of company sustainability performance subcategories, indicate the need to improve the current reporting system in Turkey in the field of sustainable development.

The analysis of the influence of control variables shows that the financial performance of Turkish FBT and TCL companies depends on their size (l_EBITDA), capital structure (ROA, ATR), company age (ROA, ROE), and industry affiliation (ROA, ROE). This influence is multidirectional and correlates with the conclusions of other researchers, in particular, that Lev has a negative significant impact on ROA [

23]. The results obtained in the study regarding the significant negative impact of l_A on ROA both confirm the findings of Soriya and Rastogi [

32] and refute the findings of Aydoğan and Kara [

23], which revealed a positive impact of company age for Turkish non-bank firms.

This study has a number of limitations that should be taken into account by scientists when using the results obtained in this paper. First, the SRDQI indicator was used to characterize the quality of sustainability reporting, which is only one of the possible general parameters characterizing the sustainable performance of firms. Scientists may use other indicators that may have a different impact on the financial performance of companies. Secondly, the subject of the study included only enterprises in the FBT and TCL sectors, whose sustainability reporting is posted on the ISE website and on the official websites of companies. To form a more accurate picture of the impact of sustainability reporting on financial performance of Turkish companies, the number of industries and enterprises studied can be expanded. This can be done in the future when the practice of compiling and publishing sustainability reporting becomes generally accepted for all Turkish companies. Thirdly, to obtain more accurate results of the impact of sustainability practices on the financial performance of Turkish FBT and TCL companies in the future, it is necessary to expand the observation period and conduct a panel analysis of data for several reporting periods.

Authors should discuss the results and how they can be interpreted from the perspective of previous studies and of the working hypotheses. The findings and their implications should be discussed in the broadest context possible. Future research directions may also be highlighted.

5. Conclusions

The purpose of the study is to examine the impact of sustainability reporting on financial performance, with a focus on companies from the Turkish FBT and TCL sectors. The paper reviewed 2022 48 sustainability reports of FBT and TCL companies listed on the Istanbul Stock Exchange and established the role of sustainability practices implemented by these companies in ensuring financial performance. To assess the quality of implementation of sustainability practices by companies, one general (SRDQI) and three partial indices (EDQI, SDQI, and CGDQI) were used, which were calculated based on content analysis of publicly disclosed sustainability reports and their three main subcategories, in particular, by scoring the elements of such reports. The paper used four types of financial performance measures (l_EBITDA, ROA, ROE, and ATR), which, based on the two types of indices used, made it possible to form two types of analytical models (OVER models and SEP models) to achieve the objectives of the study. Four control variables such as Company size, Leverage, Company age, and Dummy variable for a subbranch were used to control for the influence of other factors that may affect financial performance.

The results obtained revealed the complete absence of statistically significant impact of SRDQI on all financial performance measures used for Turkish FBT and TCL companies. Among partial indices, only CGDQI has a positive significant impact on ATR. The results of the analysis of the influence of control variables in OVER and SEP models simultaneously show the dependence of individual financial performance measures on the size of companies, their age, industry affiliation, and also on the structure of capital they use.

Based on the revealed low quality of sustainability reports of Turkish FBT and TCL companies, as well as considering the lack of influence of sustainability performance on financial performance, the need to improve the institutional environment of sustainability reporting in Turkey was determined. This conclusion largely correlates with the proposals of Kılıç et al. [

27] and Dincer, Keskin and Dincer [

28] regarding the need to improve the regulation of companies and disseminate best practices and principles of work based on sustainable development among all members of society in accordance with the experience of developed countries.

Based on the results of the study, it is proposed to strengthen the quality of information disclosure in sustainability reports, improve the system for monitoring the placement of reports among ISE-listed companies, as well as promote the dissemination of the concepts of sustainability management and investment in sustainable development in society, which would contribute to the formation of views on sustainable development among capital providers and other stakeholders associated with the company's activities. The result of such improvements should be an understanding of information about the sustainability practices of Turkish companies among various stakeholder groups, the lack of which is also stated by Kılıç et al. [

27]. Ultimately, such improvements should establish feedback and effective interaction between sustainability-oriented companies and stakeholders, increase their level of corporate responsibility, contributing to the improvement of the sustainability practices of Turkish companies and, in general, ensuring sustainable economic growth of the country.