Submitted:

20 October 2023

Posted:

20 October 2023

You are already at the latest version

Abstract

Keywords:

Introduction

Methodology

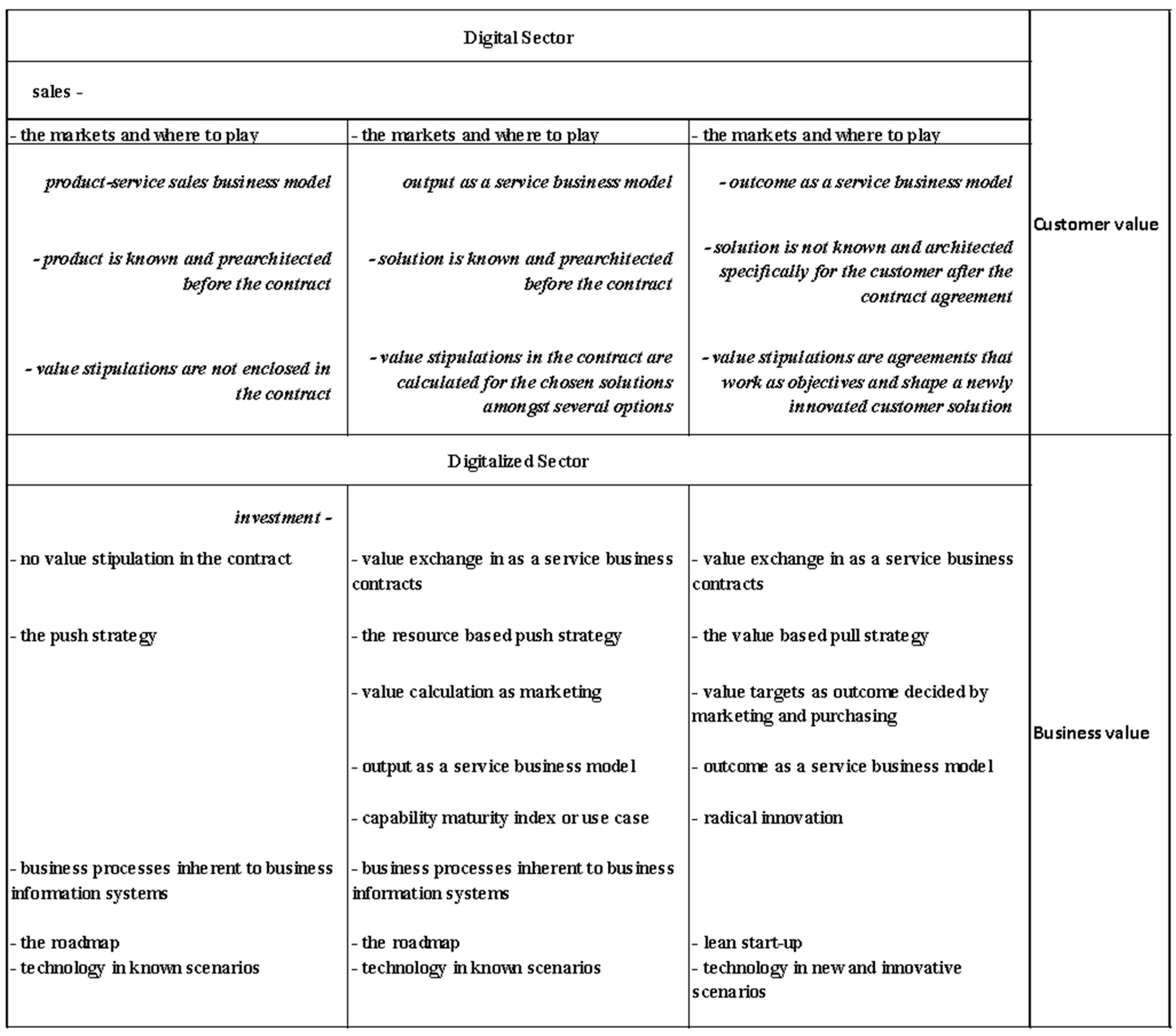

As a Service Business Models and the Role of Value Therein

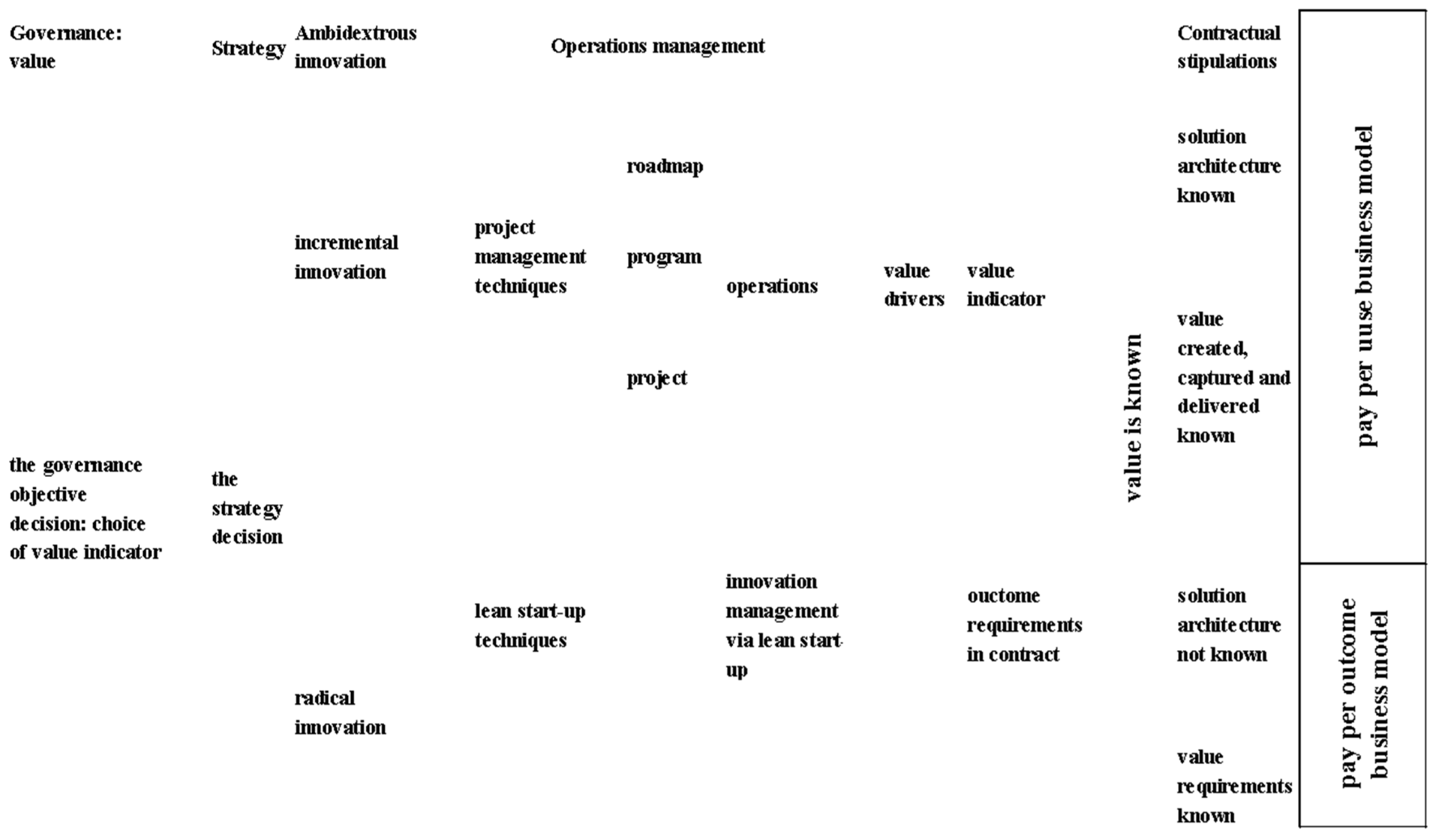

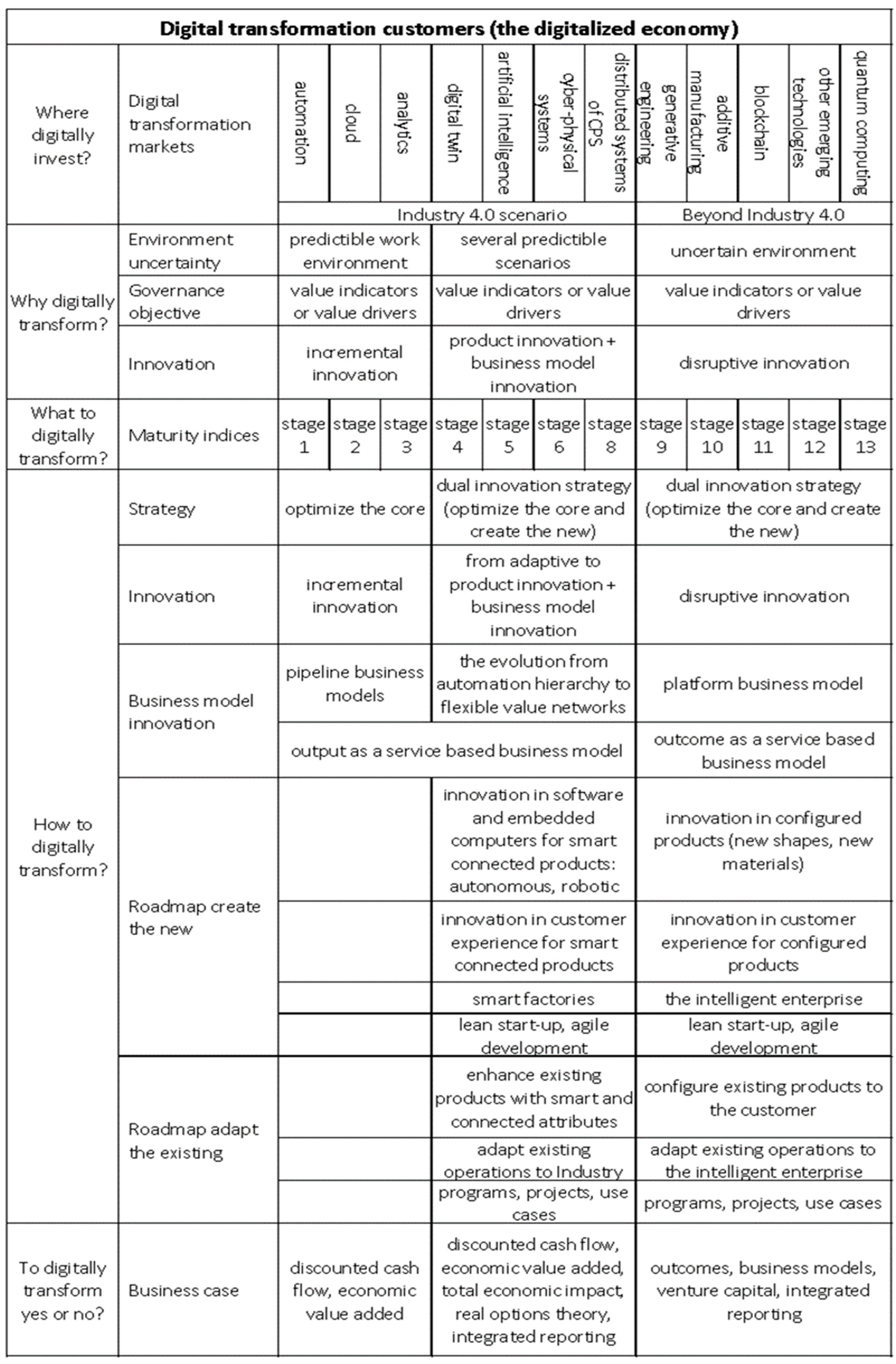

Empirical Data Analysis the First Management Instrument in Digital Transformation: Digital Strategy

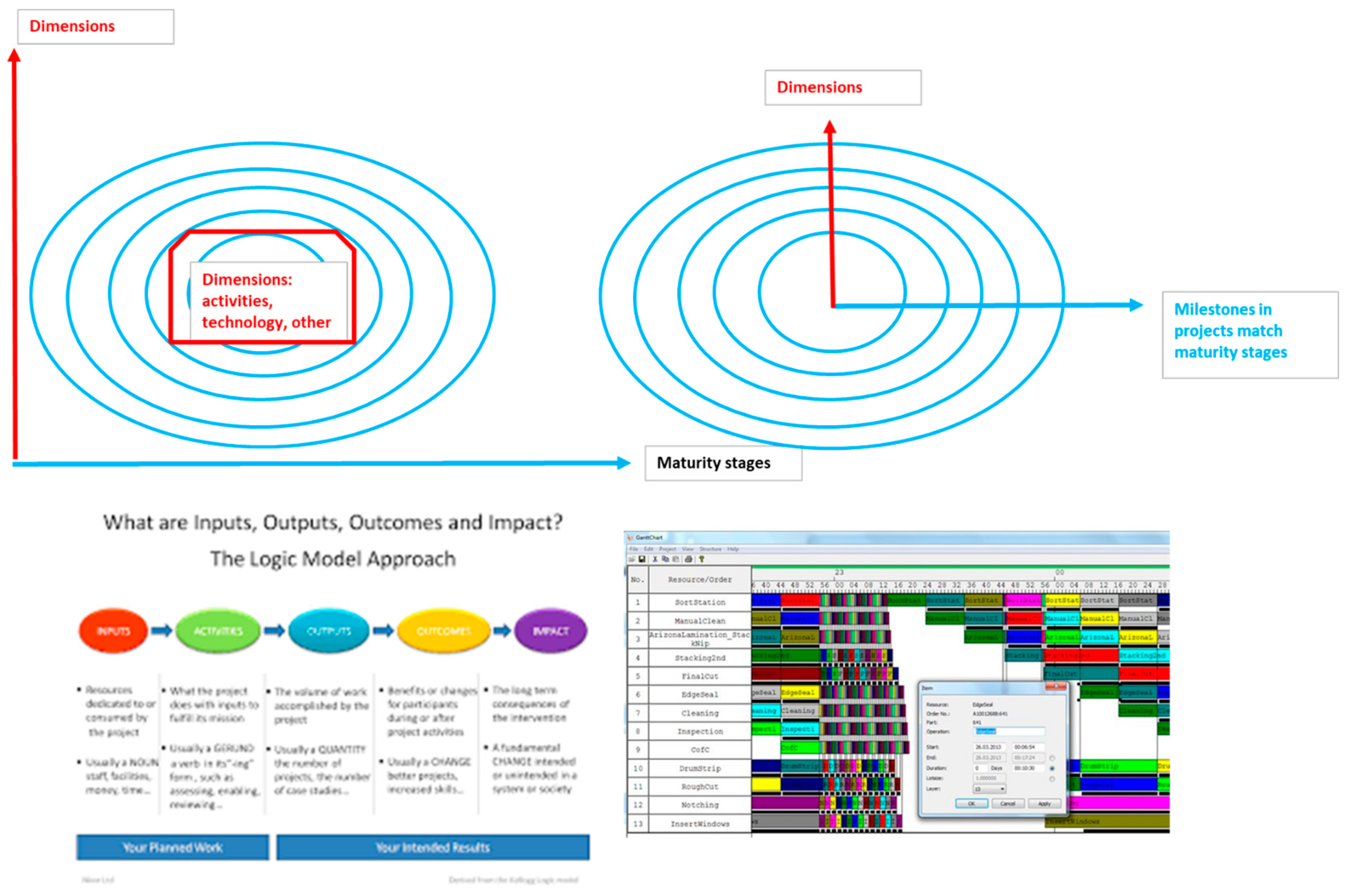

Management Instrument Used in the Predictable Business Environment: Maturity Analysis

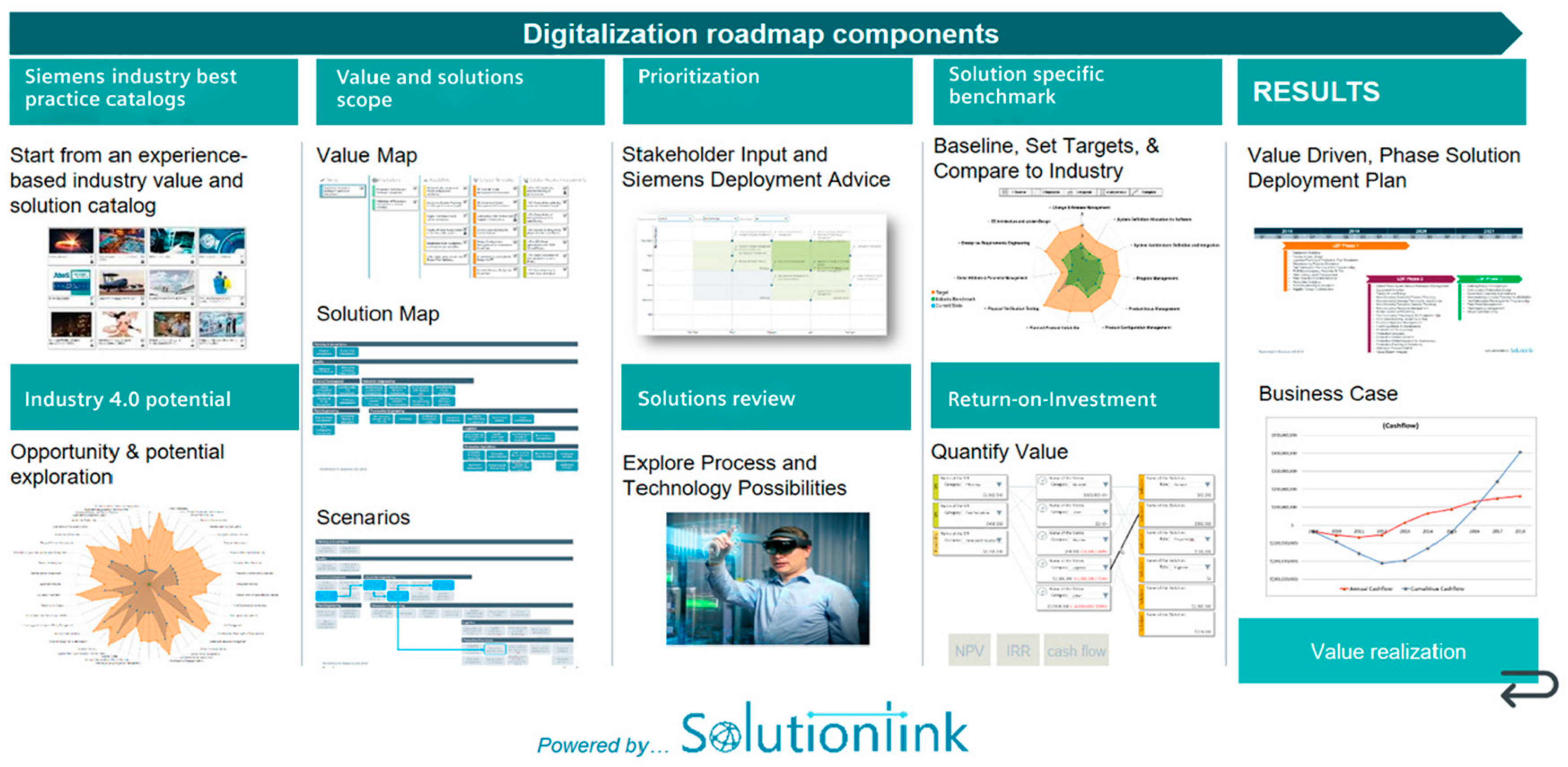

Management Instrument Used in the Predictable Business Environment: Roadmaps, Programs, Projects, and Operations to Shape Digital Transformation Related Activities

Management Instrument Used in the Predictable Business Environment: The Business Case, a Management Instrument to Compute Business Value out of Roadmaps

The Pay-per-Use Business Model, the Last Management Instrument Used in the Digital Transformation Management Consulting

An Alternative Stage of the Digital Transformation Journey if Pre-Architected Solutions Are Not Found: Customer Co-Creation

An Alternative Stage of the Digital Transformation Journey for Customer Co-Creation: The Outcome as a Service Business Model

Discussion and Analysis

| Digital transformation management instruments | Multiple case study | |

| 1. | Management instrument: digital strategy | Siemens [184,185,186,188,189,190,191,192,193,194,195,196,197,200,201,202,203,204,205,206,207,208,209,210,211,212,213,214,215,216,217,218,219,220] PWC [221,222] for Oracle Consulting [222,223,224,225,226,227,228] SAP [229,230,231,232,233,234] PTC [235,236,237,238,239,240,241] |

| - lean start-up innovation techniques | Siemens [186,211,212,213,280,297,298,299,300,301,302] PWC [221,222] SAP [291,292,293,294,295,296,303,304,305,306,307] Scientific literature review [314,315,316,317,318,319,320]. |

|

| 2. | Maturity index | Siemens [242,243] PWC [221,222] PTC [235,236,237,240,241] SAP [244,245] |

| 3. | Roadmaps | Siemens [246,247,248,249,250,251] PWC [221,222] PTC [238,239,252] SAP [253,254,255,256,257,258] |

| - ties between maturity index and roadmaps | Scientific literature review [313] | |

| 4. | Business case and capital allocation instruments | Siemens [202,203,204,205,206,207,208,259,260,261,262,264,265,266,267,268,269,270,271] PWC [221,222] PTC [235,236,237,272,273,274,275,276] SAP [252,253,254,255,256,257,258] |

| 5. | As a service business model | |

| - pay per use business model | Siemens [277,278,279,280,281]. PWC for Oracle [221,222] and Oracle [282,283] PTC [284,285,286,287,288,289,290] SAP [291,292,293,294,295,296,297,298] |

|

| - pay per outcome business model | Siemens [178,184,202,203,204,205,207,208,214,215,219,248,261,264,268,278,279,280,281,297] PWC-Oracle [221,222] SAP [291,292,293,294,295,296,303,304,305,306,307] PTC [308,309] |

Conclusions

References

- The Incumbent’s Advantage in the Internet of Things. Available online: https://www.bcg.com/en-hu/publications/2019/incumbent-advantage-internet-of-things-iot (accessed on 1 October 2023).

- Successful Innovators Walk the Talk. The Most Innovative Companies 2020. Available online: https://www.bcg.com/en-hu/publications/2020/most-innovative-companies/successful-innovation (accessed on 1 October 2023).

- Digital Transformation. Available online: https://www.bcg.com/digital-bcg/digital-transformation/overview.aspx (accessed on 1 October 2023).

- EY named a leader in global digital business transformation report by independent research firm. Available online: https://www.ey.com/en_gl/news/2019/03/ey-named-a-leader-in-global-digital-business-transformation-report-by-independent-research-firm (accessed on 1 October 2023).

- Industrial Internet and the Emergence of the Outcome Economy. Available online: https://blog.iiconsortium.org/2015/03/industrial-internet-and-the-emergence-of-the-outcome-economy.html (accessed on 1 October 2023).

- Ecosystem Play to Generate $100T by 2028, Accenture Says. Available online: https://www.datanami.com/2018/07/12/ecosystem-play-to-generate-100t-by-2028-accenture-says/ (accessed on 1 October 2023).

- Building high impact partner ecosystems. Available online: https://www.accenture.com/nz-en/insights/high-tech/future-partner-relationship (accessed on 1 October 2023).

- Smart connected product design & development. Available online: https://www.accenture.com/us-en/services/industry-x/smart-connected-product-design-development (accessed on 1 October 2023).

- Convergence on the outcome economy. Available online: https://reports.weforum.org/industrial-internet-of-things/3-convergence-on-the-outcome-economy/#:~:text=This%20new%20world%20is%20called,a%20specific%20place%20and%20time (accessed on 1 October 2023).

- Digital Transformation Initiative (DTI). Available online: https://reports.weforum.org/digital-transformation/ (accessed on 1 October 2023).

- Outcome. Available online: https://www.weforum.org/organizations/outcome (accessed on 1 October 2023).

- Ojasalo, J.; Ojasalo, K. Service Logic Business Model Canvas. J. Res. Entrep. Mark. 2018, 20, 70–98. [Google Scholar] [CrossRef]

- Vargo, S.L.; Lusch, R.F. Evolving to a new dominant logic. Logic of Marketing, Journal of Marketing 2004, 68, 1–17. [Google Scholar]

- Vargo, S.L.; Lusch, R.F. Service-dominant logic: continuing the evolution. Journal of the Academy of Marketing Science 2008, 36, 1–10. [Google Scholar] [CrossRef]

- Vargo, S.L.; Maglio, P.P.; Akaka, M.A. On value and value co-creation: a service systems and service logic perspective. European Management Journal 2008, 26, 145–152. [Google Scholar] [CrossRef]

- Gilsing, R. et al.. A Method to Guide the Concretization of Costs and Benefits in Service-Dominant Business Models. In: Camarinha-Matos, L.M., Afsarmanesh, H., Ortiz, A. (Eds) Boosting Collaborative Networks 4.0. PRO-VE 2020. IFIP Advances in Information and Communication Technology, 598, Springer, Cham, 2020. [CrossRef]

- Industrie 4.0 Maturity Index. Managing the Digital Transformation of Companies. Available online: https://en.acatech.de/publication/industrie-4-0-maturity-index-update-2020/. 2020.

- Yin, R.K. Case Study Research: Design and Methods. Sage, London. 1994. [Google Scholar]

- Gummesson, E. Qualitative Methods in Management Research.SAGE, California. 2000. [Google Scholar]

- Gummesson, E. Are current research approaches in marketing leading us astray? . Marketing Theory 2001, 1, 27–48. [Google Scholar] [CrossRef]

- Gummesson, E. Exit services marketing – enter service marketing. Journal of Customer. Behaviour 2007, 6, 113–141. [Google Scholar]

- Gummesson, E. Extending the service-dominant logic: from customer centricity to balanced. Centricity. Journal of the Academy of Marketing Science 2008, 36, 15–17. [Google Scholar] [CrossRef]

- Bloor, M.; Frankland, J.; Thomas, M.; Stewart, K. Focus Groups in Social Research. Introducing Qualitative Series. Sage, London. 2000. [Google Scholar]

- Hines, T. An evaluation of two qualitative methods (focus group interviews and cognitive maps) for conducting research into entrepreneurial decision making. Qualitative Market Research: An International Journal 2000, 3, 7–16. [Google Scholar] [CrossRef]

- Silverman, D. Interpreting Qualitative Data. Sage, Thousand Oaks, California. 2011. [Google Scholar]

- Wilkinson, S. Focus group research. In Qualitative Research, 3rd Ed.; Silverman, D., Ed.; Sage: London, 2011; pp. 169–184. [Google Scholar]

- Kasanen, E.; Lukka, K.; Siitonen, A. The constructive approach in management accounting Research. Journal of Management Accounting Research 1993, 5, 243–264. [Google Scholar]

- Oyegoke, A. The constructive research approach in project management research. International Journal of Managing Projects in Business 2001, 4, 573–595. [Google Scholar] [CrossRef]

- Kuhn, T. The Structure of Scientific Revolutions, 2nd ed.; University of Chicago Press, 1970; Section V. [Google Scholar]

- Instrumental Case Study. Available online: https://methods.sagepub.com/reference/encyc-of-case-study-research/n175.xml (accessed on 1 October 2023).

- PTC Named a Leader in IoT Software Platforms by Top Independent Research Firm. Available online: https://www.businesswire.com/news/home/20161115006565/en/PTC-Named-a-Leader-in-IoT-Software-Platforms-by-Top-Independent-Research-Firm (accessed on 1 October 2023).

- Why do Forrester, IDC, Forrester and Gartner think that PTC Thingworx is the best IoT Platform?, Available online:. Available online: https://bilgehanbaykal.com/2018/06/30/why-do-forrester-idc-forrester-and-gartner-think-that-ptc-thingworx-is-the-best-iot-platform/ (accessed on 1 October 2023).

- Analytics, digital twins separate pack in industrial IoT, says Forrester. Available online: https://www.zdnet.com/article/analytics-digital-twins-separate-pack-in-industrial-iot-says-forrester/ (accessed on 1 October 2023).

- Siemens MindSphere named a Leader in The Forrester Wave™: Industrial IoT Software Platforms, Q4 2019. Available online: https://www.plm.automation.siemens.com/media/global/en/Siemens%20MindSphere%20named%20a%20Leader%20in%20The%20Forrester%20Wave%20_%20Industrial%20IoT%20Software%20Platforms%2C%20Q4%202019_tcm27-67461.pdf (accessed on 1 October 2023).

- Siemens’ MindSphere Continues Industrial IoT Momentum. Available online: https://iotbusinessnews.com/2020/02/10/22818-siemens-mindsphere-continues-industrial-iot-momentum/ (accessed on 1 October 2023).

- The Forrester Wave™: Industrial Internet-Of-Things Software Platforms, Q3 2021. https://reprints2.forrester.com/#/assets/2/57/RES176190/report (accessed on 1 October 2023). (accessed on 1 October 2023).

- The Forrester Wave™: Integration Platforms As A Service, Q3 2023. Available online: https://www.softwareag.com/en_corporate/platform/integration-apis/enterprise-ipaas-forrester.html (accessed on 1 October 2023).

- ERP Software Global Market Report 2023. Available online: https://www.researchandmarkets.com/reports/5735142/erp-software-global-market-report?gclid=Cj0KCQjwjt-oBhDKARIsABVRB0xhq6L4uX85jXjPMWpbsrvyTuFtqWKOWymGRD_0KBCydvqquMynjNYaAiIDEALw_wcB (accessed on 1 October 2023).

- Mordor Intelligence (2023), Product Lifecycle Management (PLM) Software Market Size and share Analysis – Growth Trends and Forecasts (2023 - 2028). Available online: https://www.mordorintelligence.com/industry-reports/product-lifecycle-management-software-market (accessed on 1 October 2023).

- CIMdata Publishes PLM Market and Solution Provider Report. Available online: https://www.cimdata.com/en/news/item/6459-cimdata-publishes-plm-market-and-solution-provider-report (accessed on 1 October 2023).

- Betz, F. Strategic business models. Engineering Management Journal 2002, 14, 21–27. [Google Scholar] [CrossRef]

- Chesbrough, H. Business model innovation: it’s not just about technology anymore. Strategy and Leadership 2007, 35, 12–17. [Google Scholar] [CrossRef]

- Magretta, J. Why business models matter. Harvard Business Review 2002, 80, 86–92. [Google Scholar]

- Hedman, J.; Kalling, T. The business model concept: theoretical underpinnings and empirical illustrations. European Journal of Information Systems 2003, 12, 49–59. [Google Scholar] [CrossRef]

- Osterwalder, A. The business model ontology: a proposition in a design science approach. Doctoral dissertation. Doctoral dissertation. University of Lausanne, Lausanne, 2004. 2004. [Google Scholar]

- Osterwalder, A.; Pigneur, Y. Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers; Wiley: Hoboken, NJ, USA, 2010. [Google Scholar]

- Osterwalder, A.; Pigneur, Y.; Tucci, C.L. Clarifying business models: origins, present and future of the concept. Association for Information Systems 2005, 15, 1–43. [Google Scholar] [CrossRef]

- Zott, C.; Amit, R. Business model designs and the performance of entrepreneurial firms. Organization Science 2007, 18, 181–199. [Google Scholar] [CrossRef]

- Zott, C.; Amit, R. The fit between product market strategy and business model: implications for firm performance. Strategic Management Journal 2008, 29, 1–26. [Google Scholar] [CrossRef]

- Zott, C.; Amit, R. Business model design: an activity system perspective. Long Range Planning 2010, 43, 216–226. [Google Scholar] [CrossRef]

- Johnson, M.W.; Christensen, C.M.; Kagermann, H. Reinventing your business model. Harvard Business Review 2008, 86, 50–59. [Google Scholar]

- Al-Debei, M.M.; Avison, D. Developing a unified framework of the business model concept. European Journal of Information Systems 2010, 19, 359–376. [Google Scholar] [CrossRef]

- Kindström, D.; Kowalkowski, C. Service innovation in product-centric firms: a multidimensions business model perspective. Journal of Business & Industrial Marketing 2014, 29, 96–111. [Google Scholar]

- Digital transformation. Creating new business models where digital meets physical. Available online: https://www.ibm.com/downloads/cas/B6Y8LY4Z (accessed on 1 October 2023).

- Kavadias, S.; Ladas, K.; Loch, C. The Transformative Business Model. Harvard Business Review. 2016. [Google Scholar]

- Casadesus-Masanell, R.; Ricart, J. How to Design a Winning Business Model. Harvard Business Review. 2011. [Google Scholar]

- Grossman, R. The Industries That Are Being Disrupted the Most by Digital. Harvard Business Review. 2016. [Google Scholar]

- Ovans, A. Business models. Harvard Business Review. 2015. [Google Scholar]

- Blank, S. Why the Lean Start-Up Changes Everything. Havard Business Review, May, 2013.

- Grossman, R. The Industries That Are Being Disrupted the Most by Digital. Harvard Business Review, 2016.

- Defining, Conceptualising and Measuring the Digital Economy. Available online: https://diodeweb.files.wordpress.com/2017/08/diwkppr68-diode.pdf (accessed on 1 October 2023).

- Hamel, G.; Prahalad, C.K. Competing for the future. Harvard Business Review July-August 1994. 19 August.

- Hamel, G. Leading the revolution. Harvard Business School. 2000. [Google Scholar]

- Hamel, G. Moon shots for management. Harvard Business Review, February. 2009. [Google Scholar]

- Osterwalder, A.; Pigneur, S. Business Model Innovation. Uluru. 2008. [Google Scholar]

- Osterwalder, A.; Pigneur, Y.; Smith, A. Business model Generation. 2010. [Google Scholar]

- Ostewarlder, A. A Better way to Think about Your Business Model. Harvard Business Review May. 2013. [Google Scholar]

- Osterwalder, A.; Pigneur, Y. Business Model Generation: a Handbook for Visionaries, Game Changers, and Challengers. Wiley: New York, NY, USA, 2013. [Google Scholar]

- Osterwalder, A.; Pigneur, Y.; Bernarda, G.; Smith, A. Value Proposition Design: How to Create Products and Services Customers Want. 2014. [Google Scholar]

- Barnes, C.; Blake, H.; Pinder, D. Creating and Delivering Your Value Proposition: Managing Customer Experience for Profit. Kogan Page Publishers. 2009. [Google Scholar]

- Kotler, P.; Keller, K.L. Marketing Management. Pearson Educaton Limited. 2012. [Google Scholar]

- Kaplan, R.S.; Norton, D.P. The strategy map: guide to aligning intangible assets. Strategy & Leadership. 2004. [Google Scholar]

- Kontes, P. The CEO, Strategy, and Shareholder Value. Wiley. 2010. [Google Scholar]

- Industry, X. 0 - Realizing Digital Value in Industrial Sectors. Available online: https://www.slideshare.net/accenture/industry-x0-realizing-digital-value-in-industrial-sectors (accessed on 1 October 2023).

- Digital Transformation of Industries. Demystifying Digital and Securing $100 Trillion for Society and Industry by 2025. Available online: https://issuu.com/laszlopacso/docs/wef-digital-transformation-of-indus (accessed on 1 October 2023).

- Business Model Innovation. Available online: https://www.bcg.com/capabilities/innovation-strategy-delivery/business-model-innovation (accessed on 1 October 2023).

- Boosting Resilience with Production as a Service. The Incumbent’s Advantage in the Internet of Things. Available online: https://www.bcg.com/publications/2022/production-as-a-service-benefits-opportunities (accessed on 1 October 2023).

- What Is a Business Model Innovation Capability? Available online: https://bethestrategicpm.com/what-is-a-business-model-innovation-framework/ (accessed on 1 October 2023).

- Boston Consulting Group (BCG): Channel Profile & Services. Available online: https://www.channelinsider.com/partners/boston-consulting-group/ (accessed on 1 October 2023).

- Implementing the smart factory. New perspectives for driving value. Available online: https://www2.deloitte.com/us/en/insights/topics/digital-transformation/smart-factory-2-0-technology-initiatives.html (accessed on 1 October 2023).

- Uncovering the connection between digital maturity and financial performance. How digital transformation can lead to sustainable high performance. Available online: https://www2.deloitte.com/us/en/insights/topics/digital-transformation/digital-transformation-survey.html (accessed on 1 October 2023).

- Smart RPA Enterprise Playbook. Available online: https://static1.squarespace.com/static/5ad4b6cca2772c224f9077c2/t/5bf04f91032be406b194fd76/1542475668417/Everest+Group-UiPath+-+Enterprise+Smart+RPA+Playbook.pdf (accessed on 1 October 2023).

- Digital Strategy and Transformation. Available online: https://www.ey.com/en_gl/digital/transformation (accessed on 1 October 2023).

- The missing piece. How EY’s Health Outcomes Platform can create triple wins through outcomes-based contracting. Available online: https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/life-sciences/life-sciences-pdfs/ey-health-outcomes-platform-the-missing-piece.pdf (accessed on 1 October 2023).

- Outcomes-based payment models. Available online: https://www.ey.com/en_ro/life-sciences/outcomes-based-payment-models (accessed on 1 October 2023).

- Delivering outcomes for clients. Available online: https://home.kpmg/xx/en/blogs/home/posts/2019/10/delivering-outcomes-for-clients.html (accessed on 1 October 2023).

- Contracting for performance: Unlocking additional value. Available online: https://www.mckinsey.com/capabilities/operations/our-insights/contracting-for-performance-unlocking-additional-value (accessed on 1 October 2023).

- Outcome-based contracts - Adding value to the contract life-cycle. Available online: https://www.worldcc.com/Resources/Content-Hub/details/Outcome-based-contracts-Adding-value-to-the-contract-life-cycle (accessed on 1 October 2023).

- Six drug pricing models have emerged to improve product access and affordability. Available online: https://www.pwc.com/us/en/industries/health-industries/library/6-drug-pricing-models.html#:~:text=As%20biopharmaceutical%20companies%20have%20experimented,pricing%20and%20volume%2Dbased%20purchasing. (accessed on 1 October 2023).

- Pay-for-performance arrangements. Available online: https://www.pwc.com/gx/en/pharma-life-sciences/pdf/pay-for-performance.pdf (accessed on 1 October 2023).

- Visnjic, I. , Jovanovic, M., Neely, A., Engwall, M. (2017). What brings the value to outcome-based contract providers? Value drivers in outcome business models. International Journal of Production Economics 2017, 192, 169–181. [Google Scholar] [CrossRef]

- Visnjic, I.; Neely, A.; Jovanovic, M. The path to outcome delivery: interplay between service market strategy and open business models. Technovation 2018, 72-73, 46–59. [Google Scholar]

- Manufacturing: Robotics as a RaaS Service Extends to Entire Factories. Available online: https://www.todaytechnoinfo.com/manufacturing-how-robotics-as-a-raas-service-extends-to-entire-factories/ (accessed on 1 October 2023).

- Li, D.; Mishra, N. Engaging suppliers for reliability improvement under outcome based compensations. 2020, Omega.

- Raddats, C.; Kowalkowski, C.; Benedettini, O.; Burton, J.; Gebauer, H. Servitization: a Contemporary Thematic Review of Major Research Streams. Industrial Marketing Management 2019, 207–223. [Google Scholar] [CrossRef]

- Zolnowski, A.; Weiß, C.; Böhmann, T. Representing Service Business Models with the Service Business Model Canvas -- The Case of a Mobile Payment Service in the Retail Industry. 2014 47th Hawaii International Conference on System Sciences, Waikoloa, HI, USA, 2014, 718-727. [CrossRef]

- Grönroos, C. Adopting a service logic for marketing. Marketing Theory 2006, 6, 317–333. [Google Scholar] [CrossRef]

- Grönroos, C. Service logic revisited: who creates value? And who co-creates?. European Business Review 2008, 20, 298–314. [Google Scholar]

- Grönroos, C. Value co-creation in service logic: a critical analysis. Marketing Theory 2011, 11, 279–301. [Google Scholar]

- Heinonen, K.; Strandvik, T.; Mickelsson, K.J.; Edvardsson, B.; Sundström, E.; Andersson, P. A customer dominant logic of service. Journal of Service Management 2010, 21, 531–548. [Google Scholar] [CrossRef]

- Voima, P.; Heinonen, K.; Strandvik, T. Exploring customer value formation: a customer dominant Logic Perspective, Working Papers. 2010, 552, Hanken School of Economics, Helsinki.

- Shcherbakova, T. (2020), Service Business Model - a New Approach to Improving Efficiency in the Digital Economy. In: Nazarov, A.D., PRoceedings of the 2nd International Scientific and Practical Conference – Modern Management Trends and the Digital Economy: From Regional Development to Global Economic Growth (MTDE 2020), 138, 1012-1017.

- Machines as a service: Industry 4.0 powers OEM aftermarket revenue growth. Available online: https://www.forbes.com/sites/willemsundbladeurope/2018/08/13/machines-as-a-service-industry-4-0-powersoem- aftermarket-revenue-growth/ (accessed on 1 October 2023).

- Soto Setzke, D.; Riasanow, T. , Böhm, M. et al. Pathways to Digital Service Innovation: The Role of Digital Transformation Strategies in Established Organizations. Inf Syst Front. 2023, 25, 1017–1037. [Google Scholar] [CrossRef]

- Liinamaa, J. ; Viljanen. , M.; Hurmerinta, A.; Ivanova-Gonge, M.; Luotola, H.; Gustafsson, M. Performance-Based and Functional Contracting in Value Based Solution Selling. Industrial Marketing Management, 2016, 59, 37–49. [Google Scholar] [CrossRef]

- Ng, I.C.L.; Maull, R.; Yip, N. Outcome-based contracts as a driver for systems thinking and service dominant logic in service science: evidence from the defense industry. European Management Journal 2009. [CrossRef]

- Ng, I.C.; Xin Ding, D.; Yip, N. Outcome-based contracts as new business model: The role of partnership and value-driven relational assets. Industrial Marketing Management 2013, 42, 730–774. [Google Scholar] [CrossRef]

- Jorgensen, M.; Mohagheghi, P.; Grimstad, S. Direct and indirect type of connection between type of contract and software project outcome. International Journal of Project Management 2017, 35, 1573–1586. [Google Scholar] [CrossRef]

- Prohl, K.; Kleinaltenkamp, M. Managing value in use in business markets. Industrial Marketing Management. 2020. [Google Scholar]

- Kannarkat, J.T.; Good, C.B.; Parekh, N. Value based Pharmaceutical contracts: Value for Whom? Elsevier Commentary. 2020. [Google Scholar]

- Essig, M.; Glas, A.H.; Selviaridis, K.; Roehrich, J.K. Performance-based contracting in business markets. Industrial Marketing Management 2016, 59, 5–11. [Google Scholar] [CrossRef]

- Storbacka, K. A solution business model: Capabilities and management practices for integrated solutions. Industrial Marketing Management 2011, 40, 699–711. [Google Scholar] [CrossRef]

- Macdonald, E.K. , Kleinaltenkamp, M.; Wilson, H.N. How business customers judge solutions: Solution quality and value-in-use. Journal of Marketing 2016, 80, 96–120. [Google Scholar] [CrossRef]

- Keith, B.; Vitasek, K.; Manrodt, K.; Kling, J. Strategic Sourcing in the New Economy: Harnessing the Potential of Sourcing Business Models for Modern Procurement. 2016. [Google Scholar]

- How Accenture is reinventing digital transformation through Industry X.0. Available online: https://manufacturingdigital.com/company-reports/how-accenture-reinventing-digital-transformation-through-industry (accessed on 1 October 2023).

- Industry X.0. Available online: https://www.accenture.com/us-en/services/industryx0-index (accessed on 1 October 2023).

- Leadership, not tech, makes digital champions. Available online: https://www.accenture.com/us-en/blogs/industry-digitization/leadership-not-tech-makes-digital-champions (accessed on 1 October 2023).

- Digital engineering and manufacturing. Available online: https://www.accenture.com/us-en/insights/industry-x-index (accessed on 1 October 2023).

- CapGemeni. Digital transformation: A Roadmap for Billion-dollar Organizations. Digital Transformation Review No. 1. 2013.

- Using the Industrie 4.0 Maturity Index in Industry. Current challenges, case studies and trends. Available online: https://en.acatech.de/publication/using-the-industrie-4-0-maturity-index-in-industry-case-studies/ (accessed on 1 October 2023).

- Digitalization. Available online: https://www.gartner.com/en/information-technology/glossary/digitalization (accessed on 1 October 2023).

- Digital transformation. Understand digital transformation and how our insights can help drive business value. Available online: https://www.accenture.com/ro-en/insights/digital-transformation-index (accessed on 1 October 2023).

- Digital Transformation: A Sustainable Evolution Journey. Available online: https://www.accenture.com/content/dam/accenture/final/industry/high-tech/document/FY23-DTI-2022-Full-Report-EN-V11.pdf (accessed on 1 October 2023).

- High Tech Industry Digital Transformation Narrative. Available online: https://www.slideshare.net/accenture/high-tech-digital-transformation (accessed on 1 October 2023).

- Three big goals for a winning cloud strategy. Available online: https://insuranceblog.accenture.com/three-big-goals-for-a-winning-cloud-strategy (accessed on 1 October 2023).

- IDC Spending Guide Sees Worldwide Digital Transformation Investments Reaching $3.4 Trillion in 2026. Available online: https://www.idc.com/getdoc.jsp?containerId=prUS49797222 (accessed on 1 October 2023).

- Driving the Digital Agenda Requires Strategic Architecture. Available online: https://idc-cema.com/dwn/SF_177701/driving_the_digital_agenda_requires_strategic_architecture_rosen_idc.pdf (accessed on 1 October 2023).

- IDC FutureScape: Worldwide Digital Transformation 2020 Predictions. Available online: https://www.idc.com/getdoc.jsp?containerId=US45569118 (accessed on 1 October 2023).

- Digital Transformation Drives Business Strategy and Skills Drive Digital Transformation. Available online: https://www.idc.com/getdoc.jsp?containerId=US45021019, (accessed on 1 October 2023).

- Digital Transformation Market by Offering (Solution and Services), Technology (Cloud Computing, Big Data and Analytics, Blockchain, Cybersecurity, AI), Business Function (Accounting & Finance, IT, HR), Vertical, and Region – Global Forecast to 2030. Available online: https://www.marketsandmarkets.com/Market-Reports/digital-transformation-market-43010479.html?gclid=Cj0KCQjwjt-oBhDKARIsABVRB0zHy4zioPmz5PH01q9E_5mV9CzoYFLAzDrVjMOuGTj-p1AUArNcpTcaAj0lEALw_wcB (accessed on 1 October 2023).

- Digital Transformation Market Size, Share & Trends Analysis Report By Solution (Analytics, Mobility), By Deployment, By Service, By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2023 – 2030. Available online: https://www.grandviewresearch.com/industry-analysis/digital-transformation-market#:~:text=The%20global%20digital%20transformation%20market,26.7%25%20from%202023%20to%202030 (accessed on 1 October 2023).

- Digital Transformation Market - Market Size & Forecast to 2032. Available online: https://www.researchandmarkets.com/reports/5752406/digital-transformation-market-market-size-and?gclid=Cj0KCQjwjt-oBhDKARIsABVRB0xRKg3Q3UmjWmjShSRUmOgVa_bD4QyhR6QtrRlOOodrvw0K1TEUQfoaAi2VEALw_wcB (accessed on 1 October 2023).

- With 20.9% CAGR, Digital Transformation Market Size to Hit USD 6.78 Trillion by 2029. Available online: https://www.globenewswire.com/en/news-release/2023/02/21/2611812/0/en/With-20-9-CAGR-Digital-Transformation-Market-Size-to-Hit-USD-6-78-Trillion-by-2029.html (accessed on 1 October 2023).

- Digital Transformation Initiative. Available online: https://www.weforum.org/whitepapers/digital-transformation-initiative/ (accessed on 1 October 2023).

- Agenda articles. Available online: https://www.weforum.org/agenda/the-digital-transformation-of-business/ (accessed on 1 October 2023).

- Digital Transition Framework: An action plan for public-private collaboration. Available online: https://www3.weforum.org/docs/WEF_Digital_Transition_Framework_2023.pdf (accessed on 1 October 2023).

- Morakanyane, R.; Grace, A.A.; O’Reilly, P. Conceptualizing Digital Transformation in Business Organizations: A Systematic Review of Literature. 2017. 427–443. [CrossRef]

- Association of International Certified Professional Accountants. Advanced Financial Management. Kaplan Publishing Limited. 2012.

- ACCA September 2023 Exams. Available online: https://www.accaglobal.com › pdf › sa_aug10_p3 (accessed on 1 October 2023).

- Business cases that convince. Available online: https://www.cimaglobal.com/Events/Events/Mastercourses/Business-skills-CPD-courses/Project-management/Business-cases-that-convince/ (accessed on 1 October 2023).

- Creating bulletproof business cases. Available online: https://www.pmi.org/learning/library/business-cases-project-scope-analysis-6119 (accessed on 1 October 2023).

- What is a business case? Available online: https://www.apm.org.uk/resources/what-is-project-management/what-is-a-business-case/ (accessed on 1 October 2023).

- Rappaport, A. Creating Shareholder Value: The New Standard for Business Performance. Simer and Schuster Publishing Group, New York. 1986. [Google Scholar]

- Mc Kinsey. Valuation: Measuring and Managing the Value of Companies. John Wiley and Sons. 1990.

- Mc Kinsey. Valuation: Measuring and Managing the Value of Companies. John Wiley and Sons. 1986.

- Mc Kinsey. Valuation: Measuring and Managing the Value of Companies. John Wiley and Sons. 2000.

- Mc Kinsey. Valuation: Measuring and Managing the Value of Companies. John Wiley and Sons. 2005.

- Mc Kinsey. Valuation: Measuring and Managing the Value of Companies. John Wiley and Sons. 2010.

- Mc Kinsey. Valuation: Measuring and Managing the Value of Companies. John Wiley and Sons. 2015.

- Mc Kinsey. Valuation: Measuring and Managing the Value of Companies. John Wiley and Sons. 2020.

- Stern, J.M.; Stewart, G.B.; Chew, D.H. The EVA Financial Management System. Journal of Applied Corporate Finance, 1995, pp. 32–46. [CrossRef]

- Stern, J.M.; Shiely, J.S.; Ross, I. The EVA Challenge: Implementing Value-Added Change in an Organization. Wiley. 2002. [Google Scholar]

- Damodaran, A. Strategic Risk Taking: a Framework for Strategic Management. Pearson Prentice Hall. 2007. [Google Scholar]

- Damodaran, A. Applied Corporate Finance. Wiley. 2010. [Google Scholar]

- Damodaran, A. Damodaran on Valuation: Security analysis for Investment and Corporate Finance. Wiley. 2011. [Google Scholar]

- Damodaran, A. Investment Valuation: Tools and Techniques for Determining the Value of Any Asset. Wiley. 2012. [Google Scholar]

- Damodaran, A. Investment Valuation: Security Analysis for Investment and Corporate Finance. Wiley. 2012. [Google Scholar]

- Economic Value Added (EVA): Available online:. Available online: http://people.stern.nyu.edu/adamodar/New_Home_Page/lectures/eva.html (accessed on 1 October 2023).

- Value Enhancement: EVA and CFROI. Available online: http://people.stern.nyu.edu/adamodar/pdfiles/eqnotes/eva.pdf (accessed on 9 September 2023).

- Madden, B. The Lifecycle Valuation Model as a Total System in Wealth Creation: a Systems Mindset for Building and Investing in Businesses for the Long Term. John Wiley and Sons. 2010. [Google Scholar]

- Stegmann, P. Strategic Value Management: Stock Value Creation and the Management of the Firm. Wiley. 2009. [Google Scholar]

- Stegmann, P. Strategic Value Management. Wiley. 2009. [Google Scholar]

- Kaplan, R.S.; Norton, D.P. Strategy Maps: Converting Intangible Assets into Tangible Outcomes. Harvard Business School Press. 2004. [Google Scholar]

- What are Real Options? Available online:. Available online: https://corporatefinanceinstitute.com/resources/knowledge/valuation/real-options/ (accessed on 1 October 2023).

- Luehrman, T. Investment Opportunities as Real Options: Getting started in the Numbers. Harvard Business Review. 1998. [Google Scholar]

- Luehrman, T. Strategy as a Portfolio of Real Options. Harvard Business Review. 1998. [Google Scholar]

- Abrams, C.; Von Kanel, J.; Muller, S.; Pfitzmann, B.; Rushcka-Taylor, S. Optimized enterprise risk management. IBM Syst. Manag. J. 2007, 219–234. [Google Scholar] [CrossRef]

- Enterprise Risk Management. Available online: https://www.cgma.org/resources/tools/essential-tools/enterpise-risk-management.html (accessed on 1 October 2023).

- Enterprise Risk Management. Available online: https://www.coso.org/guidance-erm (accessed on 1 October 2023).

- A Structured Approach to Enterprise Risk Management and the Requirements of ISO 31000. Available online: https://competency.aicpa.org/media_resources/206407-a-structured-approach-to-enterprise-risk-management (accessed on 1 October 2023).

- Enterprise Risk Management Special Interest Section. Available online: https://www.casact.org/membership/special-interest-sections/enterprise-risk-management-special-interest-section (accessed on 1 October 2023).

- Cumming. The Oxford Handbook of Venture Capital. Oxford Handbooks Online. 2012.

- McGrath, R.G.; Mac Millan, I.M. Discovery-Driven Planning. Harvard Business Review. 1995. [Google Scholar]

- Integrated Reporting. The Future of Corporate Reporting. Available online: https://www.pwc.nl/nl/assets/documents/pwc-handboek-integrated-reporting.pdf (accessed on 1 October 2023).

- Integrated Reporting. The Future of Corporate Reporting. Available online: https://www.pwc.nl/nl/assets/documents/pwc-handboek-integrated-reporting.pdf (accessed on 1 October 2023).

- Creating Value. Value to the Board. Available online: https://integratedreporting.org/wp-content/uploads/2015/04/Value-to-the-Board.pdf (accessed on 1 October 2023).

- Find out how integrated reporting is being used across the globe. Available online: https://integratedreporting.org/ (accessed on 1 October 2023).

- Business model background paper for <IR>. Available online: https://www.ifac.org/system/files/publications/files/Business-Model-IIRC.pdf (accessed on 1 October 2023).

- The International IR Framework. Available online: https://integratedreporting.org/wp-content/uploads/2015/03/13-12-08-THE-INTERNATIONAL-IR-FRAMEWORK-2-1.pdf (accessed on 1 October 2023).

- Integrated Reporting. Statement on Management Accounting. Available online: https://www.imanet.org/-/media/0830fcd907cd41a7bd760b8900fe7b94.ashx (accessed on 1 October 2023).

- From Share Value to Shared Value: Exploring the Role of Accountants in Developing Integrated Reporting in Practice. Available online: https://www.imanet.org/research-publications/c-suite-reports/from-share-value-to-shared-value-exploring-the-role-of-accountants-in-developing-integrated (accessed on 1 October 2023).

- Integrated Reporting. Statement on Management Accounting. Available online: https://www.imanet.org/-/media/0830fcd907cd41a7bd760b8900fe7b94.ashx (accessed on 1 October 2023).

- International IR Framework. Available online: https://integratedreporting.org/wp-content/uploads/2021/01/InternationalIntegratedReportingFramework.pdf (accessed on 1 October 2023).

- Sustainability Information 2020. Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:13f66763-0d96-421c-a6a4-9c10bb9b9d28/sustainability2020-en.pdf (accessed on 1 October 2023).

- Siemens Advanta Consulting. Available online: https://www.siemens-advanta.com/services/consulting (accessed on 1 October 2023).

- Turning Innovation into Strategic Advantages. Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:833f3a8b-cb9d-4b0b-96d8-738ad8e40966/presentations-for-live-stream-260611-dr-roland-busch.pdf (accessed on 1 October 2023).

- Digitalization in Process Industries. Available online: https://www.siemens.rs/industrija-4.0/event2016/presentations/Digitalization%20in%20Process%20Industries_Belgrade_20160518_Werner%20Schoefberger.pdf (accessed on 1 October 2023).

- Shaping the Digital Transformation Plattform Industrie 4.0. Available online: https://ec.europa.eu/information_society/newsroom/image/document/2017-7/170208_industrie_40_42893.pdf (accessed on 1 October 2023).

- Competitive Thanks to the Digital Transformation. Available online: https://new.siemens.com/global/en/company/topic-areas/digital-enterprise/process-industry/digitalization-consulting.html (accessed on 1 October 2023).

- Digitalization Roadmap. Define a Multi-Year Industry Best-Practice-Based Digitalization Strategy. Available online: https://www.plm.automation.siemens.com/media/global/pt/Siemens%20SW%20Digitalization%20roadmap%20Fact%20Sheet_tcm70-71287.pdf (accessed on 1 October 2023).

- Digital Transformations in Industrial Companies. Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:a784fcd8-fa0a-4577-92dc-38e8cb975f51/HBR-Siemens-Report-20-1-22.pdf (accessed on 1 October 2023).

- Digital Transformation Strategy. Available online: https://www.sw.siemens.com/en-US/services/digital-transformation-strategy/ (accessed on 1 October 2023).

- Customer Value Co-Creation to drive and scale Digital. Available online: https://ingenuity.siemens.com/2018/07/customer-value-co-creation-to-drive-and-scale-digital/ (accessed on 1 October 2023).

- 4 Prevailing Industrial IoT Use Cases. Available online: https://static.sw.cdn.siemens.com/siemens-disw-assets/public/3lnJPWvv04RBr3kBnkCsM4/en-US/Ebook_4-Prevailing-industrial-IoT-use-cases_tcm27-100807.pdf (accessed on 1 October 2023).

- Embracing the Digital Transformation. Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:f06590be-f311-4966-94df-f490abcc7d40/siemens-pharma-digi-consulting-en.pdf (accessed on 1 October 2023).

- Digitalization Consulting. Prepare Your Production for the Digital Age. Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:f8285765-e8e6-41fc-b6d6-bb9d232f0e8f/referenz-digitalization-consulting-eng.pdf (accessed on 1 October 2023).

- Empowering people. Insights into strategy implementation in the digital era. Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:8d36aa1c-abf2-4baa-bfef-0404443b9f67/220121-Research-Report-Strategy-implementation.pdf (accessed on 1 October 2023).

- Value Co-Creation. Working with customers to develop digital fields of business. Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:9ec757af-93d9-4049-8eed-cf8e07a04f58/inno2017-cocreation-e.pdf (accessed on 1 October 2023).

- On the way to a digital future. Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:4a393d17100ca584fd07f44a46ca849e44343f24/siemens-china-ar-brochure.pdf (accessed on 1 October 2023).

- Value Creation and Customer Centricity, Available online: https://www.siemens-advanta.com/de/node/294.

- Customers. Strong relationships. Available online: https://www.siemensgamesa.com/en-int/sustainability/customers (accessed on 1 October 2023).

- Turning the Internet of Things into Reality. A Practical Approach to Your Unique IoT Journey, Available online:. Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:b0ec23e4-f23f-49ca-ba6e-718437a87887/turningtheinternetofthingsintorealitywhitepaperbysiemensadvanta.pdf (accessed on 1 October 2023).

- Outcomes and Opportunities. How Finance-Enabled Business Models are Developing to Drive Effective Organizational and Digital Transformation. Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:539929f57ab38a1ed72a15cb2a377246fb7eed88/sfs-whitepaper-2017-outcomes-and-opportunities.pdf (accessed on 1 October 2023).

- Sinalytics enables Digitalization: Industrial Data Analytics. Available online: https://indico.cern.ch/event/524996/contributions/2193648/attachments/1287431/1915652/SiemensSinalytics-Roshchin.pdf (accessed on 1 October 2023).

- Siemens Digitalization Strategy & Sinalytics Platform, Unlock the potential with digitalization. Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:5d4519bc-37d3-49f5-a79b-48112fd91c39/version2unlockthepotentialwithdigitalization.pdf (accessed on 1 October 2023).

- Countdown to the Tipping Point for Industry 4.0. Practical Steps for Manufacturers to Gain Competitive Advantage from Industry 4.0 Investment. Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:fb9d1e59-4d83-41ab-af28-3ef298710d43/version:1670368649/countdown-to-the-tipping-point-for-industry-4-sfs-whitepaper-en.pdf (accessed on 1 October 2023).

- The Digitalization Productivity Bonus. What Value does Digitalization Offer Manufacturers? Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:672acd222386308d6771df1c2bf64cfa58b34763/sfs-whitepaper-2017-the-digitalization-productivity-bonus.pdf (accessed on 1 October 2023).

- IOT: Internet of Trains. Available online: http://web.stanford.edu/class/archive/ee/ee392b/ee392b.1186/lecture/jun5/Siemens.pdf (accessed on 1 October 2023).

- The Digital Transformation: Turning Challenges into Opportunities. Available online: https://www.dimecc.com/wp-content/uploads/2018/04/Mrosik_presentation.pdf (accessed on 1 October 2023).

- Eviden and Siemens together shaping the Digital Future. Available online: https://atos.net/en/about-us/partners-and-alliances/siemens (accessed on 1 October 2023).

- Siemens’ President & CEO Roland Busch Exclusive On Impact Of Generative AI On Jobs | CNBC-TV18. Available online: https://www.youtube.com/watch?v=kw5IEZZiKKc (accessed on 1 October 2023).

- How Innovation and Digitalization are Shaping the World of Transport. Available online: https://www.linkedin.com/pulse/how-innovation-digitalization-shaping-world-transport-roland-busch-1f/ (accessed on 1 October 2023).

- Co-Create to Innovate: a Smarter Way to Sustainable Cities. Available online: https://www.linkedin.com/pulse/co-create-innovate-smarter-way-sustainable-cities-roland-busch/ (accessed on 1 October 2023).

- PwC’s Predictable Value. Available online: https://www.pwchk.com/en/services/consulting/technology/oracle-business-applications/predictable-value.html#:~:text=Predictable%20Value%20is%20PwC’s%20unique,and%20how%20to%20get%20there (accessed on 1 October 2023).

- Proven Outcomes for Data Centers. Service programs tailored to meet your performance goals. Available online: https://sid.siemens.com/v/u/A6V10711523 (accessed on 1 October 2023).

- Advisory and Performance Services. Driving Outcomes Through Value-Based Services. Available online: https://www.downloads.siemens.com/download-center/Download.aspx?pos=download&fct=getasset&id1=A6V11494188 (accessed on 1 October 2023).

- Siemens and Nigerian Government Signed Implementation Agreement for Electrification Roadmap. Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:451ebc5d-dafb-4248-a4bb-b7cbaf9dcae1/PR201907236277EN.pdf (accessed on 1 October 2023).

- Siemens’ Pre-Engineering Contract for the Expansion of Nigeria’s Electricity Capacity to 25,000 MW Approved. Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:79dbf1f6-a73a-426c-adb2-e4e7d5a83201/siemens-nigeria-ppi-pr-final-en.pdf (accessed on 1 October 2023).

- Sustainability information 2020. https://assets.new.siemens.com/siemens/assets/api/uuid:13f56263-0d96-421c-a6a4-9c10bb9b9d28/sustainability2020-en.pdf (accessed on 1 October 2023).

- Managing Megatrends. Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:4f5ebaff-9f9d-47b1-912f-d54a41efe4a9/Siemens-Megatrends-2023-Report.pdf (accessed on 1 October 2023).

- PwC’s Predictable Value Approach. Available online: https://www.pwc.com/us/en/services/alliances/oracle-implementation/predictable-value.html (accessed on 1 October 2023).

- PWC’s Predictable Value Approach. Available online: https://www.pwc.com/us/en/services/alliances/assets/pwc-predictable-value-powered-by-oracle-cloud.pdf (accessed on 1 October 2023).

- Transformational Technology Industry Use Cases. Available online: https://www.oracle.com/a/ocom/docs/transformational-technology-use-cases.pdf (accessed on 1 October 2023).

- Oracle - SCOR Mapping v1.1. Available online: https://www.scribd.com/presentation/389521646/Oracle-SCOR-Mapping-v1-1 (accessed on 1 October 2023).

- Applied advanced technologies—the competitive edge, Emerging Technologies: The Competitive Edge for Finance and Operations. Available online: https://www.oracle.com/a/ocom/docs/dc/esg-research-oracle-emergingtech-0220.pdf (accessed on 1 October 2023).

- Get Cloud Confident with Oracle Consulting. Available online: https://www.oracle.com/consulting/ (accessed on 1 October 2023).

- Emerging Technologies: Driving Financial and Operational Efficiency. Available online: https://go.oracle.com/LP=88830?elqCampaignId=238833&src1=:ow:o:s:feb:Emergingtechnologies&intcmp=NAMK200204P00035:ow:o:s:feb:Emergingtechnologies (accessed on 1 October 2023).

- Transformational Technologies: Today. Available online: https://www.oracle.com/a/ocom/docs/dc/ytt-c3-p2-stg2-insight-180921-final.pdf (accessed on 1 October 2023).

- SAP S/4HANA Value Starter Program. Initial Introduction. Available online: https://assets.dm.ux.sap.com/s4hana_adoption_starter/pdfs/sap_s4hana_value_starter_initial_introduction.pdf (accessed on 1 October 2023).

- Knowledge Portfolio for SAP User Groups. Available online: https://asug.mx/wp-content/uploads/2021/02/Portafolio-de-Conocimiento-ASUG-Mexico-2021-1-English-V.pdf (accessed on 1 October 2023).

- The Value of RISE with SAP. Available online: https://assets.dm.ux.sap.com/webinars/sap-user-groups-k4u/pdfs/220630_discover_value_of_rise_with_sap.pdf (accessed on 1 October 2023).

- SAP’s Vision to Value Methodology. Available online: https://www.sap.com/romania/products/rise/vision-value.html.

- Your way to SAP S/4HANA Project Success with SAP Value Assurance and the Integrated Delivery Framework. Available online: https://assets.dm.ux.sap.com/webinars/sap-user-groups-k4u/pdfs/200629_sap_value_assurance_services.pdf (accessed on 1 October 2023).

- Your Vision-to-Value Journey. Available online: https://assets.dm.ux.sap.com/webinars/sap-user-groups-k4u/pdfs/200807_how_sap_solution_manager_and_sap_cloud_alm.pdf (accessed on 1 October 2023).

- Join the SAP S/4HANA Movement. About the movement and how to push adoption of SAP S/4HANA. https://stemo.bg/uploads/assets/S4MoveBG.pdf (accessed on 1 October 2023).

- What Is a Digital Thread? Available online: https://www.ptc.com/en/blogs/corporate/what-is-a-digital-thread (accessed on 1 October 2023).

- We Use Digital Technology to Improve the Physical World. Available online: https://www.ptc.com/en/about (accessed on 1 October 2023).

- Overcoming the Biggest Challenges in Digital Transformation. Available online: https://www.ptc.com/en/blogs/corporate/digital-transformation-challenges (accessed on 1 October 2023).

- The PTC Value Roadmap. Available online: http://support.ptc.com/WCMS/files/28837/en/J1051_ValueRoadmap_TS.pdf (accessed on 1 October 2023).

- PTC Value Road Map. Available online: https://ro.scribd.com/document/232911637/PTC-Tech-Day-The-PTC-Value-Roadmap-Shoemaker (accessed on 1 October 2023).

- Digital Transforms Physical. Available online: https://www.ptc.com/en (accessed on 1 October 2023).

- Where Today Meets Tomorrow The 2019 Siemens Digital Industries Software Media & Analyst Conference (Commentary). Available online: https://www.cimdata.com/en/resources/complimentary-reports-research/commentaries/item/12744-where-today-meets-tomorrow-the-2019-siemens-digital-industries-software-media-analyst-conference-commentary (accessed on 1 October 2023).

- Digital Transformation Approach for Industry 4.0. Designing the Way for Your Digital Transformation. Available online: https://www.itu.int/en/ITU-D/Regional-Presence/ArabStates/Documents/events/2019/ETDubai/Digital-Enterprise_finale.pdf (accessed on 1 October 2023).

- A comprehensive approach to the digital transformation of manufacturing enterprises. Available online: https://www.pwc.ru/ru/publications/iot/transform-brochure-eng.pdf (accessed on 1 October 2023).

- IDC Benchmark: Digital Maturity Check for Self-Assessment. Available online: https://news.sap.com/2015/12/idc-benchmark-digital-maturity-check-for-self-assessment/ (accessed on 1 October 2023).

- Competitive Thanks to the Digital Transformation. Available online: https://new.siemens.com/global/en/company/topic-areas/digital-enterprise/process-industry/digitalization-consulting.html (accessed on 1 October 2023).

- A roadmap to the digital enterprise. https://blog.siemens.com/2018/11/a-roadmap-to-the-digital-enterprise/ (accessed on 1 October 2023). 2018.

- A Framework for Digital Transformation. Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:75bbf44d-7e79-42be-84a5-285d456d95f2/DI-PA-Framework-for-the-Digital-Transformation.pdf (accessed on 1 October 2023).

- Sustainability report 2022. Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:c1088e4f-4d7f-4fa5-8e8e-33398ecf5361/sustainability-report-fy2022.pdf (accessed on 1 October 2023).

- Sustainability report 2021. Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:4806da09-01c7-40b1-af91-99af4b726653/sustainability2021-en.pdf (accessed on 1 October 2023).

- Embracing the Digital Transformation. Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:f06670be-f311-4966-94df-f490abcc7d40/siemens-pharma-digi-consulting-en.pdf (accessed on 1 October 2023).

- PTC Live Global. Available online: https://docplayer.net/214067830-Ptc-ptc-value-roadmap-7-2-and-iot-value-roadmap-1-0-workshop.html.

- SAP Road Maps, Available online: https://www.sap.com/products/roadmaps.html.

- Transition to SAP S/4HANA On-Premise Roadmap Updates. Available online: https://blogs.sap.com/2017/09/14/transition-to-sap-s4hana-on-premise-roadmap-updates/ (accessed on 1 October 2023).

- How to use SAP Activate for your SAP S/4HANA Roadmap. Available online: https://eursap.eu/2018/08/28/blog-sap-activate-s4hana-roadmap/ (accessed on 1 October 2023).

- Realize Vision, to Value with SAP Advisory Services. Available online: https://www.sap.com/assetdetail/2020/09/fc23fabd-ae7d-0010-87a3-c30de2ffd8ff.html (accessed on 1 October 2023).

- SAP’s Vision to Value Methodology. Available online: https://www.sap.com/romania/products/rise/vision-value.html.

- SAP S/4HANA Value Starter -Overview. A Coordinated Approach to Build a Benefits Summary Case for SAP S/4HANA. Available online: https://assets.cdn.sap.com/sapcom/docs/2020/11/9a679b75-bb7d-0010-87a3-c30de2ffd8ff.pdf (accessed on 1 October 2023).

- Teamcenter: reach beyond. Available online: https://www.plm.automation.siemens.com/media/global/en/Siemens%20SW%20Teamcenter%20Reach%20Beyond%20E-Book_tcm27-61921.pdf (accessed on 1 October 2023).

- Teamcenter product costing. Available online: https://www.plm.automation.siemens.com/media/country/engage/Siemens-PLM-Teamcenter-product-costing-fs-32233-A8_tcm47-35476.pdf (accessed on 1 October 2023).

- Teamcenter. Available online: https://www.plm.automation.siemens.com/ru_ru/Images/4680_tcm802-3245.pdf (accessed on 1 October 2023).

- Digital Enterprise – Thinking Industry Further! Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:d066655f-ef25-4d56-9fb8-5d338f5c6088/presentation-press-conference-hm-19-e.pdf (accessed on 1 October 2023).

- Customer Value Co-Creation to drive and scale Digital. Available online: https://ingenuity.siemens.com/2018/07/customer-value-co-creation-to-drive-and-scale-digital/ (accessed on 1 October 2023).

- Internet of Things. How to Accurately Calculate the ROI of IoT Initiatives. Available online: https://assets.new.siemens.com/siemens/assets/api/uuid:ee9843cf-cea3-4b10-b292-93767d137a33/howtoaccuratelycalculateroiiniotwhitepaperbysiemensadvanta.pdf (accessed on 1 October 2023).

- Control product profitability by performing product cost management early in the product lifecycle. Available online: https://www.plm.automation.siemens.com/global/en/products/collaboration/product-cost-management.html (accessed on 1 October 2023).

- CFO 4.0. Essential Financial Competencies for Successful Transition to Industry 4.0. https://new.siemens.com/global/en/products/financing/whitepapers/whitepaper-cfo-4-0.html (accessed on 1 October 2023). (accessed on 1 October 2023).

- Facts & Figures. 2021Siemens Financial Services. https://assets.new.siemens.com/siemens/assets/api/uuid:54204a428230471d68ee1fbddfed1eca8b446d66/sfs-facts-figures-en.pdf (accessed on 1 October 2023).

- Driving digitalization with a boundary free platform. https://dvcon-europe.org/sites/dvcon-europe.org/files/DVCon_EU_Keynote_Final.pdf (accessed on 1 October 2023). (accessed on 1 October 2023).

- 10 Best Product Lifecycle Management Software in 2023. https://chisellabs.com/blog/best-product-lifecycle-management-software/ (accessed on 1 October 2023). (accessed on 1 October 2023).

- Realize your digital transformation now. The Digital Enterprise Suite for machine builders. https://assets.new.siemens.com/siemens/assets/api/uuid:763b9c75-0151-49bc-9595-082289e975fe/7795-13-des-oem-ipdf-en-181009-2-150dpi.pdf (accessed on 1 October 2023).

- 5 Step Digital Transformation Framework. Available online: https://www.ptc.com/en/blogs/corporate/5-step-digital-transformation-framework (accessed on 1 October 2023).

- Executive Leadership Makes or Breaks Digital Transformation Success. Available online: https://www.ptc.com/en/blogs/corporate/executive-leadership-role-digital-transformation-success (accessed on 1 October 2023).

- Identifying the Value of Digital Transformation. Available online: https://www.ptc.com/en/resources/manufacturing/white-paper/identifying-digital-transformation-value (accessed on 1 October 2023).

- PTC Live Global. https://docplayer.net/214067830-Ptc-ptc-value-roadmap-7-2-and-iot-value-roadmap-1-0-workshop.html (accessed on 1 October 2023).

- Your Return on Investment with Creo Simulation Live. Available online: https://www.ptc.com/en/blogs/cad/calculate-return-on-investment-creo-simulation-live (accessed on 1 October 2023).

- PTC Vuforia ROI Estimator. https://tools.totaleconomicimpact.com/go/ptc/vuforia/index.html (accessed on 1 October 2023).

- Servitisation. Available online: https://www.siemens.com/uk/en/company/topic-areas/digital-enterprise/servitisation.html (accessed on 1 October 2023).

- Siemens press conference. https://assets.new.siemens.com/siemens/assets/api/uuid:7140673e-cb74-48a8-ac5a-510308192f4b/presentation-hannover-messe-e.pdf.

- Financing and delivering building performance improvements. Available online: https://www.siemens.com/global/en/products/buildings/energy-sustainability/total-energy-management/financing-delivery-models.html (accessed on 1 October 2023).

- Value hacker. https://translate.google.com/translate?hl=en&sl=no&u=https://new.siemens.com/no/no/produkter/industri/value-hacker.html&prev=search&pto=aue (accessed on 1 October 2023).

- Our Strategy. Available online: https://www.plm.automation.siemens.com/global/en/industries/.

- Oracle NetSuite Cloud Services Contracts. Available online: https://www.oracle.com/corporate/contracts/cloud-services/netsuite/ (accessed on 1 October 2023).

- Anything as a Service (XaaS). Available online: https://www.oracle.com/a/ocom/docs/industries/high-tech/xaas-solution-brief.pdf (accessed on 1 October 2023).

- Enable New Business Models to Power Revenue Growth. Available online: https://www.ptc.com/en/solutions/maximizing-revenue-growth/new-business-models (accessed on 1 October 2023).

- PTC/ SaaS contract. Available online: https://www.ptc.com/en/documents/legal-agreements/cloud-terms (accessed on 1 October 2023).

- PTC Customer Success Services Terms & Conditions. Available online: https://www.ptc.com/-/media/Files/PDFs/legal-agreements/fy22/success-plans-terms-and-conditions/Success-Services-Terms-and-Condtions-Eng-Feb-2022.pdf (accessed on 1 October 2023).

- Success Services. Available online: https://www.ptc.com/en/customer-success/success-services (accessed on 1 October 2023).

- Realizing Maximum Value for Your Products. Available online: https://www.ptc.com/en/try-and-buy/subscription (accessed on 1 October 2023).

- The Subscription Value Chain. Available online: https://www.ptc.com/-/media/Files/PDFs/About/J14418-Subscription-Value-Chain-ebook_EN.pdf (accessed on 1 October 2023).

- Purchase PTC Products, Learn About Our Pricing and Packaging Options. Available online: https://www.ptc.com/en/try-and-buy/how-to-buy (accessed on 1 October 2023).

- Outcome-based economy – Are you ready for it?. https://blogs.sap.com/2017/05/05/outcome-based-economy-are-you-ready-for-it/ (accessed on 1 October 2023). 2017.

- Reimagine the Future of your Business with the SAP Internet of Things for an Outcome based economy. https://blogs.sap.com/2016/07/26/reimagine-the-future-of-your-business-with-the-sap-internet-of-things-platform-and-solutions-for-an-outcome-based-economy/ (accessed on 1 October 2023). 2016.

- Outcome based Economy. Available online: https://www.slideshare.net/sap/outcomebased-economy-infographic.

- Adapting for Success in the Outcome Economy. https://sapinsider.org/articles/adapting-for-success-in-the-outcome-economy/ (accessed on 1 October 2023).

- SAP’s Transformation to Outcome-Based Service Offerings - Anand Eswaran presentation for TSIA. Available online: https://www.youtube.com/watch?v=k7Ra6_MQWek (accessed on 1 October 2023).

- Intelligent Workflow for Lead-to-Order with Outcome Based Billing Using SAP Workflow Management. Available online: https://www.youtube.com/watch?v=Kp0WEZ85-lw (accessed on 1 October 2023).

- Industry 4.0: how digitalization revolutionizes the production chain. Available online: https://www.eitdigital.eu/fileadmin/files/2017/newsroom/publications/industry/Dieter_Wegener_How_digitalization_revolutionizes_the_production_chain.pdf (accessed on 1 October 2023).

- Investing in the Internet of Things (IoT), How to Turn Data into Value. https://assets.new.siemens.com/siemens/assets/api/uuid:b613391f-4e95-4c9c-adbf-e8ee0370fa03/version:1575978034/sfs-whitepaper-investing-in-the-iot.pdf (accessed on 1 October 2023).

- Value Co-Creation. Working with customers to develop digital fields of business. https://assets.new.siemens.com/siemens/assets/api/uuid:9ec757af-93d9-4049-8eed-cf8e07a04f58/inno2017-cocreation-e. (accessed on 1 October 2023).

- Siemens’ answer in an era of uncertainty – Customer Co-Creation. https://assets.new.siemens.com/siemens/assets/api/uuid:6d43dae9-51f8-4223-8fd2-2f74093aac43/us-digital-enterprise-del-customer-cocreation.pdf (accessed on 1 October 2023).

- Solution Co-creation. https://marketplace.siemens.com/global/en/all-offerings/services/s/solution-co-creation.html (accessed on 1 October 2023).

- The power of co-creation. Available online: https://www.siemens-energy.com/global/en/news/magazine/2022/the-power-of-co-creation.html (accessed on 1 October 2023).

- How SAP Co-Innovates with Customers: Be Bold and Challenge Us. Available online: https://news.sap.com/2020/11/sap-customer-co-innovation-projects-be-bold-challenge/ (accessed on 1 October 2023).

- Accelerating innovation together. Available online: https://www.sap.com/about/company/innovation/coil.html (accessed on 1 October 2023).

- Co-innovation prerequisites. Available online: https://insights.sap.com/is-co-innovation-worth-the-effort/ (accessed on 1 October 2023).

- Co-Innovation and Certification. Available online: https://www.sap.com/romania/partner/certify-my-solution/co-innovation-program.html (accessed on 1 October 2023).

- Co-innovation as a service: A reflection on SAP Co-innovation Lab. Available online: https://blogs.sap.com/2017/01/25/co-innovation-as-a-service-a-reflection-on-sap-co-innovation-lab/ (accessed on 1 October 2023).

- Align on Business Use Case. Available online: https://www.ptc.com/en/success-paths/thingworx-navigate/plan/align-on-business-use-case (accessed on 1 October 2023).

- Define Your Use Case. Available online: https://www.ptc.com/en/success-paths/get-started-vuforia-expert-capture/plan/define-use-case (accessed on 1 October 2023).

- Ahmed, A., Alshurideh, M., Al Kurdi, B., & Salloum, S. A. Digital Transformation and Organizational Operational Decision Making: A Systematic Review, In: Proceedings of the International Conference on Advanced Intelligent Systems and Informatics 2020. AISI 2020. Advances in Intelligent Systems and Computing, Hassanien, A.E., Slowik, A., Snášel, V., El -Deeb, H., and Tolba, F.M., 2021, 708-719, Springer. [CrossRef]

- Ciara, H.; Power, D.J. Challenges for digital transformation – towards a conceptual decision support guide for managers. Journal of Decision Systems 2018, 27, 38–45. [Google Scholar] [CrossRef]

- Matt, C. , Hess, T.; Benlian, A. Digital Transformation Strategies. Business Information Systems Engineering 2016, 57, 339–343. [Google Scholar] [CrossRef]

- Aheleroff, S. , Xu, X., Lu, Y., Aristizabal, M., Velásquez, J.P., Joa, B., and Valencia, Y. IoT-enabled smart appliances under industry 4.0: A case study. Advanced Engineering Informatics 2020, 83, 187–192. [Google Scholar] [CrossRef]

- Christensen, C.M. The innovators dilemma: when new technologies cause great firms to fail. Harvard Business School Press, Boston. 1997. [Google Scholar]

- Christensen, C.M. The ongoing process of building a theory of disruption. Journal of Production Innovation Management 2006, 23, 39–550. [Google Scholar]

- McAfee, A.; Brynjolfsson, E. Race Against the Machine. Lexington, Massachussets: Digital Frontier Press. 2011. [Google Scholar]

- Chesbrough, H. Making Sense of Corporate Venture Capital. Harvard Business Review. 2002. [Google Scholar]

- Customer development. Available online: https://www.slideshare.net/startuplessonslearned/introduction-to-customer-development-at-the-lean-startup-intensive-at-web-20-expo-by-steve-blank (accessed on 1 October 2023).

- The Lean Startup: How Today’s Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses. https://books.google.ro/books?id=tvfyz-4JILwC&redir_esc=y (accessed on 1 October 2023).

- The lean start-up principles. Available online: https://www.slideshare.net/startuplessonslearned/eric-ries-the-lean-startup-google-tech-talk/56 (accessed on 1 October 2023).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).