1. Introduction

In the era of digital economy, digital innovation serves as a crucial driver for enterprises to attain competitive advantage. Knowledge resources, which embody the accomplishments of digital innovation, constitute the pivotal assets enabling enterprises to achieve sustainable competitive advantage. These resources epitomize cutting-edge core technologies and are rigorously safeguarded by enterprises. Consequently, enterprises opt for formal intellectual property protection such as patents and trademarks to shield their digital innovation achievements from imitation, thereby securing excessive profits through exclusive rights. Alternatively, they adopt confidentiality measures to restrict access to sensitive information in order to prevent knowledge loss and maintain continuous competitiveness (Ren et al., 2020). However, with technological advancements, many core knowledge domains are no longer confidential. Even substantial investments in knowledge protection technology cannot entirely eliminate partial leakage of knowledge. Henceforth, after careful consideration, enterprises choose to disclose certain portions of their knowledge (Wang et al., 2017). Simultaneously, an indiscriminate prevention of imitation may prompt competitors to develop alternative technologies; thus in practice, numerous enterprises voluntarily and openly disseminate segments of their core knowledge through public channels (Polidoro et al., 2011; Pacheco-de-Almeida et al., 2012). For instance, innovative achievements related to AI intelligence, 5G networks and blockchain technology have not only been patented but also published (Ren et al., 2016). The act of strategically disclosing a portion of knowledge by enterprises is referred to as strategic knowledge disclosure. Simultaneously, the primary objective behind strategic information disclosure is to enhance the market value and generate corporate wealth, thereby constituting a crucial aspect of corporate strategy. However, conventional perspectives argue that knowledge spillover hampers the maintenance of competitive advantages and acquisition of exclusive interests for enterprises, which also contributes to the “open innovation paradox” (Laursen et al., 2014). Today, the development of digital intelligence economy highlights the arrival of the era of openness and integration, bringing new opportunities and challenges to enterprises. Therefore, the investigation into the impact of strategic knowledge disclosure on the sustainability of enterprise digital innovation holds significant theoretical value and provides crucial guidance for fostering the sustainable development of enterprise digital innovation. As there is very little research on strategic knowledge disclosure in China, the following review mainly focuses on the differences between strategic knowledge disclosure and traditional knowledge spillover and the impact of strategic knowledge disclosure on corporate innovation.

Strategic knowledge disclosure and traditional knowledge spillover are two concepts related to knowledge dissemination and sharing. They have certain differences in purpose, subject, scope and impact. In terms of purpose, strategic knowledge disclosure refers to that an enterprise or organization consciously discloses certain knowledge of strategic significance to improve the competitiveness of the enterprise or achieve other strategic goals (Davenport et al., 1998; Jia, 2019); And knowledge spillover refers to the unconscious dissemination and sharing of knowledge within or between organizations, which may lead to the weakening or loss of knowledge advantages (Nonaka et al., 1996). In terms of subjects, the subjects of strategic knowledge disclosure are enterprises or organizations, which decide which knowledge needs to be disclosed according to their own strategic needs (Farnsworth et al., 2016); While the subject of knowledge spillover includes the interaction between members within the organization and the organization, which may involve knowledge dissemination and sharing. In terms of scope, strategic knowledge disclosure usually involves core knowledge and technology with strategic value, and enterprises will choose the knowledge content to be disclosed according to their own strategic positioning and needs (Dong et al.,2021); However, knowledge spillover may involve all kinds of knowledge within the organization, including core knowledge and non-core knowledge, which is not controllable to some extent. In terms of influence, the impact of strategic knowledge disclosure on enterprises is active and controllable, and enterprises can adjust the strategy of knowledge disclosure according to their own strategic goals (Liu, 2023); However, the impact of knowledge spillover on enterprises may be passive and uncontrollable, and enterprises need to take certain measures to prevent the weakening or loss of knowledge advantages. To sum up, strategic knowledge disclosure and knowledge spillover are two different concepts. Enterprises need to take these two aspects into consideration in the process of knowledge management to achieve a balance between knowledge sharing and protection.

The international scholars research on strategic knowledge disclosure is abundant, which mainly shows in the phenomenon, motivation, influencing factors and effects of disclosure. Among them, the research on strategic knowledge disclosure and enterprise innovation is representative as follows: Harhoff et al. (2003) believed that upstream enterprises can obtain user feedback information through knowledge disclosure, so as to optimize technology and achieve efficient technological innovation, and proposed strategic knowledge disclosure as a means of knowledge sharing, which can help them obtain sustainable competitive advantage. Thiel et al. (2011) and Simeth et al. (2013) found that for technologies in the development stage, strategic knowledge disclosure can improve the speed of technological innovation, and the degree of strategic knowledge disclosure helps enterprises to closely connect with scholars and academia, so that it is easier to obtain the latest technological innovation knowledge. Johnson (2014) found that enterprises will use strategic knowledge disclosure as defensive protection when the innovation results are not difficult and easy to be imitated, when competitors hope to profit through patent litigation, and when enterprises have other sources of complementary competitive advantage. In addition, Alnuaimi et al. (2016) believed that when conducting exploratory innovation in the field of emerging technologies, the disclosure of strategic knowledge helps to promote the innovation technology to become the industry standard, and also helps enterprises to establish compatibility with other complementary products. At the same time, strategic knowledge disclosure can improve the innovation reputation of enterprises, which is conducive to attracting external financial support and attracting external talents to join. Although there is little research on strategic knowledge disclosure in China, some scholars have paid attention to the relationship between strategic knowledge disclosure and corporate innovation. Ren et al. (2021) took 110 listed pharmaceutical and communication equipment companies as research objects and found through empirical analysis that both exploratory and exploitative innovation promoted strategic knowledge disclosure of enterprises, but exploratory innovation played a more significant role; Exploratory innovation has significant industry difference in promoting strategic knowledge disclosure, while exploitative innovation has no significant industry difference in strategic knowledge disclosure. Technological diversification positively moderates the impact of exploratory innovation on enterprises’ strategic knowledge disclosure. Ying et al. (2022) found that the development of strategic knowledge disclosure can significantly improve the original value exclusivity and the regenerative value exclusivity, and the promotion effect on the regenerative value exclusivity is more significant, that is, it has a positive impact on the continuous possession of innovation achievements by enterprises.

After conducting a comprehensive analysis of current research, it becomes evident that: (1) the predominant focus in mainstream research lies on the negative aspects of knowledge spillover, neglecting the potential positive effects associated with strategic knowledge disclosure. (2) While some scholars have acknowledged the positive impact of strategic knowledge disclosure on corporate innovation and monopolization of innovative achievements, they have not delved deeply into exploring the mediating factors. The primary reasons for this are as follows: (1) The direction of knowledge spillover often remains uncontrollable and fails to align completely with enterprises’ expectations. Due to concerns regarding knowledge protection, most enterprises believe that the drawbacks outweigh the benefits of knowledge spillover. (2) Existing research on the influence of strategic knowledge disclosure on corporate innovation is relatively fragmented, lacking clarity regarding specific influencing mechanisms and pathways between these two variables. In light of these circumstances, this paper initially defines relevant concepts based on an analysis of existing theories and proposes research hypotheses grounded in an examination of influencing mechanisms. Subsequently, utilizing data from three high-tech industries spanning from 2012 to 2021, this paper analyzes both direct impacts exerted by strategic knowledge disclosure on sustainability in digital innovation input and output while also testing for mediating effects of market trust. Finally, research conclusions are drawn and management suggestions are put forward.

This paper is innovative in that: (1) From the perspective of enterprise strategy, it explores the positive side of knowledge spillover for enterprises to maintain continuous innovation advantage, and provides strong evidence for breaking the “open innovation paradox”. (2) This paper enriches the research connotation of enterprise digital innovation. By exploring the influence mechanism of strategic knowledge disclosure on enterprise digital innovation sustainability, this paper finds new driving factors to promote the sustainable development of enterprise digital innovation input and output. (3) It expands the research content and method of trust theory, and provides a new perspective for the category division and quantitative research of market trust.

2. Research design

2.1. Definition of Concept

Strategic knowledge disclosure: At present, the concept of strategic knowledge disclosure is still scattered in academia, and no unified definition has been reached. According to the literature review, the motivation of strategic knowledge disclosure mainly includes direct motivation and indirect motivation. Direct motivation refers to active learning to improve the ability or to build a dominant position through the establishment of standards, while indirect motivation refers to the strategic choice made in response to the environment. In terms of the content of strategic disclosure, first of all, current scholars generally believe that the knowledge strategically disclosed should be the core knowledge of enterprises, and this knowledge has the characteristics of exclusivity or heterogeneity, which is the knowledge not available to other enterprises (Ritala et al., 2018). Secondly, the core knowledge disclosed by enterprises is generally peripheral knowledge or core knowledge with strong uncertainty. Based on this, this paper draws on the review of Yu and Yang (2022), and defines strategic knowledge disclosure as the behavior that enterprises voluntarily, strategically and irrevocably disclose private core knowledge resources that could have been retained to the outside world from the strategic level to achieve a certain purpose. Since this paper mainly focuses on the impact on the sustainability of enterprise digital innovation, the core knowledge analyzed in this paper refers to the core knowledge of enterprise digital innovation.

Sustainability of digital innovation: According to the innovation theory of digital economy, enterprise digital innovation refers to the process of creating novel innovative results (products, services, processes or business models) by combining digital technologies (information, computing, communication and connection, etc.) (Hund et al., 2021; Wu et al., 2022). That is, in the process of digital innovation, enterprises constantly introduce new technologies, such as artificial intelligence, big data, cloud computing, etc., and apply these technologies to actual business to realize the optimization and upgrading of business processes. At the same time, enterprises need to establish and improve the transformation mechanism of innovation achievements, quickly transform innovation achievements into actual productivity, and constantly introduce innovative products and services to maintain the competitiveness of enterprises in the field of digital innovation. Although the academic community has not yet reached a consensus on the concept of digital enterprise sustainability, the generally accepted view refers to the ability of enterprises to maintain sustainable development, optimize and enhance their competitiveness in the process of digital technology application and innovation. Combined with the process of digital innovation, this paper refers to the research of Triguero et al. (2013). Based on the perspective of “input-output”, the sustainability of digital innovation is divided into the sustainability of digital innovation input and the sustainability of digital innovation output. In the process of digital innovation, the ability to maintain digital innovation input and continue digital innovation results.

Market trust: According to the theory of trust, different research fields have different focuses in defining trust, but no matter in which field, trust is a directional concept (Lyon et al., 2012), involving two types of subjects, namely, the truster and the trusted. Accordingly, It also includes two aspects of trust and credibility (Ben-Ner et al., 2001; Hardin, 2002). Specifically, trust is an attribute of the person who trusts and credibility is an attribute of the person who is trusted. However, in the field of economics, economists tend to regard trust as the result of people’s rational choices, and people’s pursuit of long-term interests in repeated games gradually leads to the emergence of trust (Fudenberg et al., 1992; Zhang et al., 2002). From the perspective of market sociology and with reference to the research of Zhao et al. (2019), this paper defines market trust as the confidence or attitude given by market subjects to the positive expectation of “efficiency-fairness”, “demand-satisfaction” and other market economic logics based on rational considerations. Strictly speaking, market subjects refer to individuals and organizations that engage in economic activities, enjoy rights and assume obligations in the market. Therefore, according to the categories of market subjects, this paper excludes the disclosing subjects (enterprises), and considers the market competition environment, divides market trust into investor trust, consumer trust, worker trust and rival trust.

2.2. Research hypothesis

2.2.1. Strategic knowledge disclosure and digital innovation sustainability

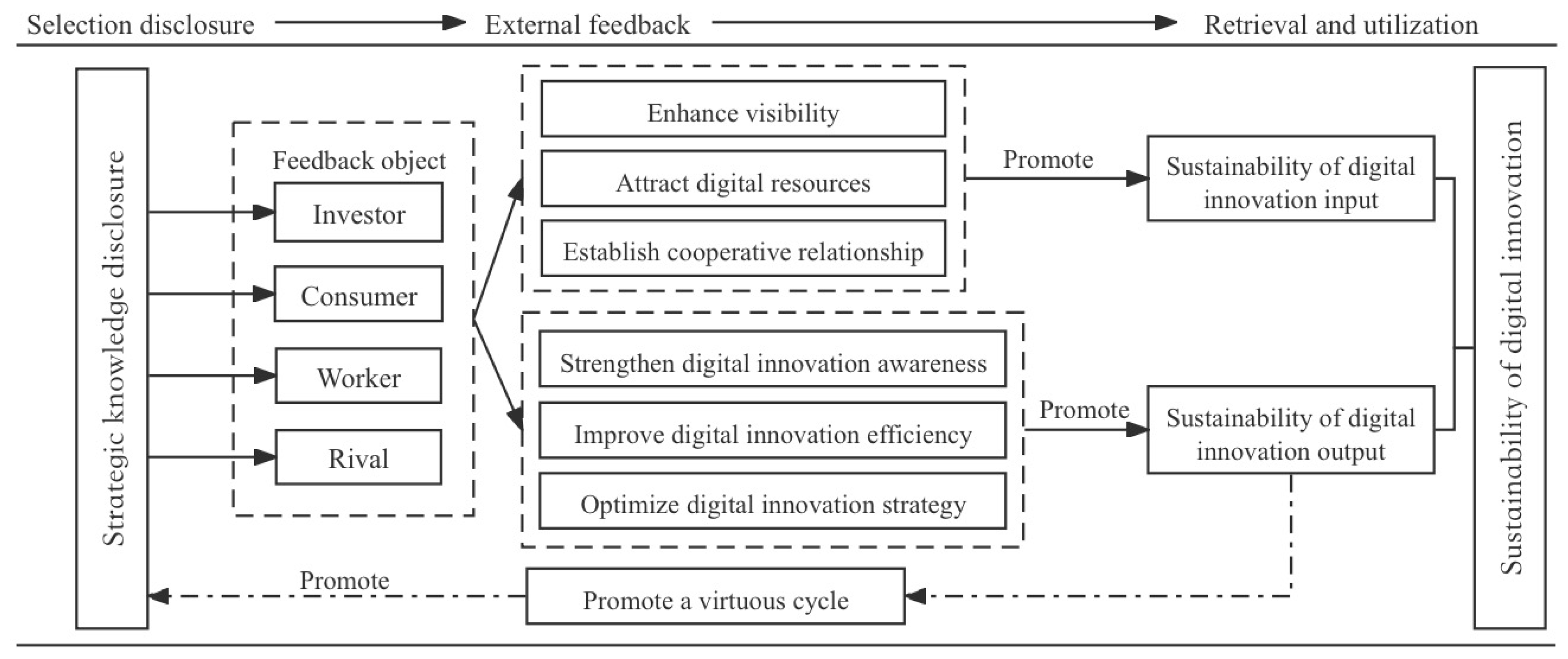

As an important means of information communication between enterprises and external stakeholders, strategic knowledge disclosure of moderate scale may affect the sustainability of enterprises’ digital innovation input by enhancing visibility, attracting digital resources and establishing cooperative relationships.

(1) Enhance visibility. After the disclosure of strategic knowledge, the enterprise’s brand, products, technology and services will be promoted to a wider range of markets and customer groups, and then the enterprise’s visibility and influence will be improved (Alnuaimi et al., 2016). On the one hand, it will help enterprises to establish a leading position in the digital technology industry, occupy the reputation of “leading” in the industry, and improve their market competitiveness. With the gradual expansion of market share, input in digital innovation will continue to increase. On the other hand, it will help to improve the digital innovation atmosphere of the industry in which the enterprise is located, encourage more enterprises in the same industry to join the ranks of digital innovation, and make the enterprise have to increase the input in digital innovation to maintain its competitive advantage and position.

(2) Attract digital resources. In the process of digital innovation, the core competitiveness of an enterprise comes from its unique knowledge, technology and resources (Teece et al., 2018). Strategic knowledge disclosure can help enterprises show their digital innovation capabilities and achievements, thus attracting more excellent talents, investors and partners. These resources can provide support in terms of capital, technology and market channels for enterprises’ digital innovation activities, thus promoting the sustainability of enterprises’ digital innovation input. At the same time, through strategic disclosure of digital technology and other knowledge related to digital innovation, it can guide the receiving enterprise to produce a content that is compatible with the knowledge disclosed by the source enterprise in structure and content, which is likely to be the upstream knowledge needed by the source enterprise in the process of digital innovation, and the source enterprise can invest in the subsequent digital innovation through absorption and introduction.

(3) Establish cooperative relationship. Strategic knowledge disclosure can be used as a cooperation invitation to help enterprises find potential partners that match their core competitiveness and establish a good cooperative relationship (Alexy et al., 2013). Research and development teams, such as university research institutions and research institutes, may find disclosing parties to seek cooperation due to their attention to the disclosed knowledge. This cooperation relationship helps enterprises to obtain more digital innovation resources and market opportunities, thus promoting enterprises to achieve continuous input in digital innovation.

However, it is worth noting that in some cases, knowledge disclosure may damage the core competitiveness of enterprises and put them at a disadvantage in the competition (Saiz et al., 2018). Especially for those enterprises with digital technology as their core competitiveness, excessive disclosure of digital technology knowledge may cause enterprises to face greater competitive pressure, loss of digital technology advantages, and then lead to the loss of a large number of market shares, and the investment in digital innovation will also be reduced. However, different from uncontrollable knowledge spillover, strategic knowledge disclosure is a selective knowledge disclosure, and enterprises can adjust their knowledge disclosure strategies according to their own strategic goals (Durana et al., 2020). Considering that disclosing enterprises have strong subjective initiative in market competition, the possibility of over-disclosure is low, and the positive impact of strategic knowledge disclosure on digital innovation is much greater than the negative impact.

Based on this, the following research hypotheses are put forward:

H1: Strategic knowledge disclosure has a significantly positive impact on the sustainability of digital innovation input.

In terms of digital innovation output, strategic knowledge disclosure may affect the sustainable output of digital innovation results by strengthening digital innovation awareness, improving digital innovation efficiency, optimizing digital innovation strategy and promoting a virtuous cycle.

(1) Strengthen digital innovation awareness. Strategic knowledge disclosure can promote the sharing and dissemination of knowledge within the enterprise, and promote the formation of a good innovation atmosphere within the enterprise (Lichtenthaler et al., 2009). This kind of knowledge sharing and dissemination helps to provide a clear goal and direction for enterprises’ digital innovation, so as to absorb and integrate digital innovation resources in a targeted manner. It helps employees to get more inspiration and inspiration in the process of innovation, and improves the digital innovation ability of enterprises. At the same time, strategic knowledge disclosure can show enterprises’ innovation achievements and technologies to employees, stimulate employees’ pride and innovation spirit, and thus improve employees’ innovation enthusiasm and creativity.

(2) Improve digital innovation efficiency. On the one hand, when the knowledge is disclosed, the receiving enterprises will recombine their complementary knowledge and spillover knowledge to form a public knowledge pool; The more enterprises use the knowledge in the knowledge pool, the larger the knowledge pool will be (Yang et al., 2010). The existence of knowledge pool not only provides source enterprises with more available and relevant knowledge sources for digital innovation, but also helps source enterprises to utilize and re-absorb knowledge, thus enhancing their digital innovation capabilities. Due to the existence of internal correlation, compared with external knowledge, source enterprises do not need to make great effort and high cost to search for external knowledge, which improves the efficiency of digital innovation of source enterprises. On the other hand, through the strategic disclosure of knowledge, the source enterprises can clearly observe the whole process of combining and recombining the spillover knowledge with the unfamiliar complementary knowledge, which not only increases the opportunities for the source enterprises to learn indirectly, but also greatly reduces the “detors” in the digital innovation. The active disclosure of some knowledge not only uses the external brain for its own use, but also enhances the enterprise’s understanding of its own knowledge system, which has a positive impact on the source enterprise’s digital innovation efficiency.

(3) Optimize digital innovation strategy. On the one hand, as an important part of corporate strategy, strategic knowledge disclosure is like a “stone” thrown into the pool. After disclosure, enterprises can help them understand the changes of market, rivals and customers’ needs through market feedback, peer response strategies and customer response, so as to provide a basis for enterprises to adjust their digital innovation strategies. The digital innovation strategy that adapts to the market demand is conducive to further improving the sustainability of enterprise digital innovation output. On the other hand, the current digital development is still in the initial stage of development, there are diversified development paths in the market, and the threat of substitutes is great. Strategic knowledge disclosure can guide rivals to change from independent innovation strategy to imitation strategy, and indirectly reduce the generation of alternative threats (Polidoro et al., 2012). This is because once rivals adopt imitation strategy, due to path dependence and large switching cost, they will be firmly locked and can only adopt following strategy (Lieberman et al., 2006). This further ensures that the products produced by the digital innovation of the source enterprise will take the leading position in the market, and with the attention and trust of consumers, it will promote the continuous output of digital innovation.

(4) Promote a virtuous cycle. With the improvement of the sustainability of enterprises’ digital innovation output, it can also promote the development of strategic knowledge disclosure. As enterprises continuously carry out digital innovation activities, they can produce more digital innovation achievements and technologies, which can also be made public to the outside world through strategic knowledge disclosure. Thus, through the above mechanisms, the input and output of digital innovation of enterprises can be improved, and the digital innovation ability and level of enterprises can be promoted in a circular manner, and the further development of digital innovation activities can be promoted.

Based on this, the following hypotheses are put forward:

H2: Strategic knowledge disclosure has a significantly positive impact on the sustainability of digital innovation output.

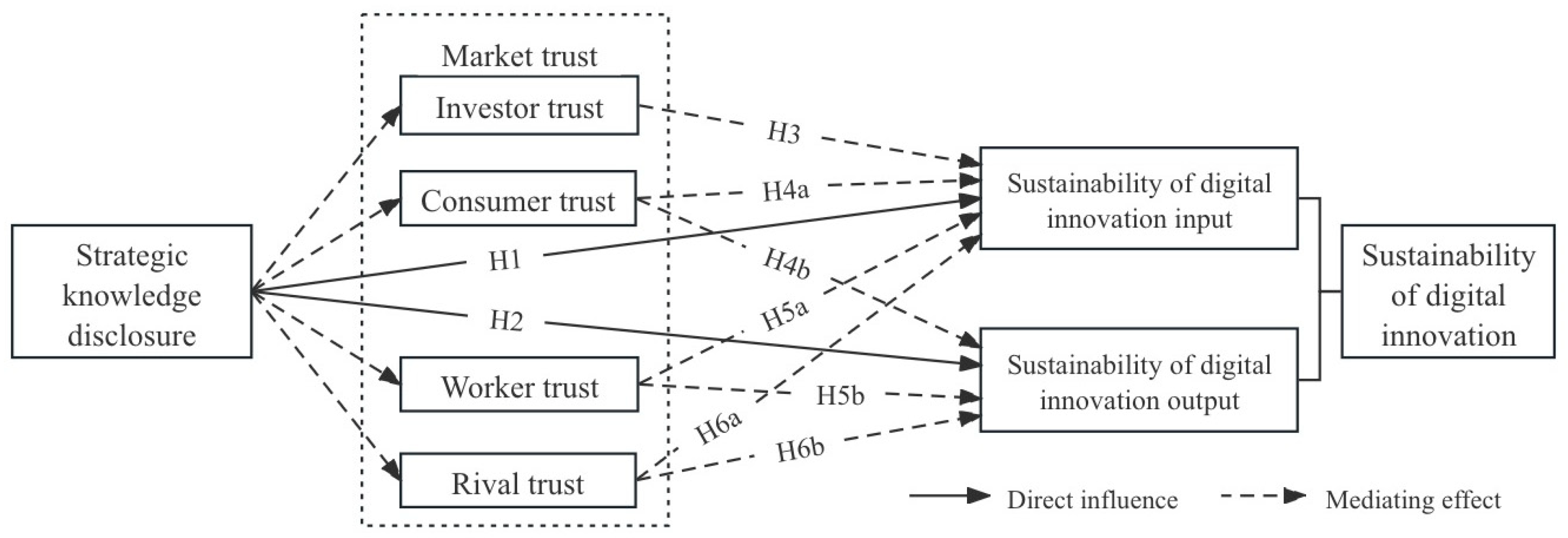

2.2.2. Mediating effect of market trust

Strategic knowledge disclosure adopts the method of public disclosure to the outside world, and the outside individuals and organizations can learn the disclosed knowledge content through free search. However, through the analysis of the influence mechanism of strategic knowledge disclosure and the sustainability of digital innovation, the influence process actually goes through three stages of “selection disclosure - external feedback - retrieval and utilization”. The groups involved in external feedback include consumers, investors, workers, partners and rivals, and these groups are the main players of the market. Therefore, this paper considers that the main knowledge receiving scope of strategic knowledge disclosure is market subjects, and market subjects generate external spillover effects through feedback (purchase, investment, cooperation or imitation, etc.) on the knowledge disclosed by enterprises, thus affecting the digital innovation of source enterprises. This kind of feedback represents the confidence and attitude of the market subjects towards the disclosed knowledge. Therefore, it is necessary to introduce “market trust” as the feedback of market subjects to explore its mediating effect. The main mediating mechanisms are as follows:

Investor trust mainly affects the input stage of digital innovation. Internal and external investors’ recognition of the disclosed knowledge will generate the willingness to invest or continue to invest in corporate digital innovation. The higher the trust of investors is, the stronger the investment intention will be. Therefore, strategic knowledge disclosure may promote the sustainability of corporate digital innovation input by influencing the improvement of investor trust. Based on this, the following hypotheses are put forward:

H3: Investor trust has a positive mediating effect between strategic knowledge disclosure and sustainability of digital innovation input.

When consumers affirm the content of enterprises’ strategic knowledge disclosure, they will be willing to buy enterprises’ digital innovation products. The continuous expansion of market demand not only drives the continuous output of digital innovation, but also promotes enterprises to increase the input of production factors to develop digital innovation products according to the cost theory. Therefore, strategic knowledge disclosure may promote the continuous output and input of digital innovation by improving consumer trust. Based on this, the following hypotheses are proposed:

H4a: Consumer trust has a positive mediating effect between strategic knowledge disclosure and sustainability of digital innovation input.

H4b: Consumer trust has a positive mediating effect between strategic knowledge disclosure and sustainability of digital innovation output.

Workers as an important carrier of knowledge and productivity. The content of strategic knowledge disclosure of enterprises is recognized. On the one hand, external workers are more willing to join disclosed enterprises and participate in the research and development of digital innovation (Kim et al., 2017). On the other hand, internal workers will have more confidence in the development of enterprises, and the labor efficiency of enterprises will be improved. Therefore, strategic knowledge disclosure may promote the sustainability of enterprises’ digital innovation input and output by improving workers’ trust. Based on this, the following hypothesis is proposed:

H5a: Worker trust has a positive mediating effect between strategic knowledge disclosure and sustainability of digital innovation input.

H5b: Worker trust has a positive mediating effect between strategic knowledge disclosure and sustainability of digital innovation output.

Rivals have a positive attitude towards the content of enterprises’ strategic knowledge disclosure, which means that imitators will increase and imitators will share the market share of the source enterprises, which is not conducive to the sales of digital innovation products of the source enterprises, and further affects the input and output of digital innovation. Therefore, strategic knowledge disclosure may hinder the sustainability of digital innovation input and output by improving the trust of rivals. Based on this, the following hypotheses are proposed:

H6a: Rival trust has a negative mediating effect between strategic knowledge disclosure and sustainability of digital innovation input.

H6b: Rival trust has a negative mediating effect between strategic knowledge disclosure and sustainability of digital innovation output.

To sum up, this paper proposes the influence mechanism as shown in

Figure 1 and the research model as shown in

Figure 2.

2.3. Research methods

2.3.1. Variable setting and measurement

(1) Independent variable: strategic knowledge disclosure (SKDI). The existing research rarely deals with the ways of knowledge disclosure. Yu and Yang (2022) proposed that there are two main ways of strategic knowledge disclosure at present, namely patent application and public publication. Compared with knowledge confidentiality, these two ways can be regarded as the process of actively disclosing knowledge. However, compared with the free use of public publication, because patents are protected by intellectual property laws, the scope of disclosure is limited, and unless they are made public free of charge, they cannot be widely disseminated. This paper argues that patent application is more conducive to the knowledge protection measures of enterprises, which shows that enterprises have ownership of innovation achievements, rather than voluntary free public disclosure. Public publication means that enterprises voluntarily submit their research results to the Review Committee of scientific journals in the form of paper publication, and discuss the details of the research results with the review committee, which can ensure that the public publication is the core knowledge of the frontier of enterprises, in line with the definition of strategic knowledge disclosure in the previous section. In the same way, conference papers are usually a free and open sharing behavior of enterprise researchers participating in industry symposia. Therefore, the number of scientific papers and conference papers published by enterprises are used to measure strategic knowledge disclosure. Since this paper mainly focuses on the knowledge disclosure of enterprises in digital innovation, social science papers are excluded.

(2) Dependent variable: sustainability of digital innovation — sustainability of digital innovation input (

SDII), sustainability of digital innovation output (

SDIO). For digital innovation input, it mainly includes enterprises’ input in digital technology research and development, digital product design, digital service and other aspects in the process of digital innovation. Since it is difficult to objectively measure the intellectual capital and innovative thinking of researchers, and the capital investment plays a leading role in digital innovation investment activities, this paper uses enterprise R&D input as the measurement index of enterprise digital innovation input. For digital innovation output, most current scholars use the number of digital invention patent authorization and patent citation as the measurement index of digital innovation output. Combined with previous research, this paper chooses the number of digital technology patents granted by enterprises as the measurement index of digital innovation output. Technology patents are characterized by “novelty, creativity and practicality,” and need to go through strict qualification examination, which can better represent the digital innovation output of enterprises. Specifically, according to the International Patent Category (IPC) division of digital technology (cloud computing, 5G, artificial intelligence, etc.) related industries in the

Strategic Emerging Industries Classification and International Patent Classification Reference Table (2021) issued by the State Intellectual Property Office, the invention patents that contain the corresponding IPC in the application information are identified and authorized as digital technology patents. The proxy variable of enterprise digital innovation output is obtained. For the sustainability of digital innovation input and output, referring to the research of Triguero et al. (2013), this paper adopts the sequential growth rate of digital innovation input and output multiplied by the current digital innovation input and output, and takes the natural logarithm to measure it. The specific calculation formula is as follows:

and respectively represent the sustainability of digital innovation input and output. and represent the sum of R&D input and the sum of the number of digital technology patents granted in year t and year t-1, respectively. and correspond to the sum of R&D input and the sum of the number of digital technology patents granted in year t-1 and year t-2, respectively.

(3) Mediating variable: market trust (MTRU) —— investor trust (ITRU), consumer trust (CTRU), worker trust (WTRU), rival trust (RTRU). At present, most scholars use questionnaire survey to directly ask market subjects about market trust. Although this method can intuitively express the direct confidence or attitude of market subjects, it is difficult to accurately find the corresponding market subjects of sample enterprises in the huge market. Therefore, it is necessary to transform the measurement of market trust. Based on the logic of data availability and market sociology, this paper uses the incremental intangible assets of enterprises to measure investor trust, because intangible assets, as the result of enterprise innovation activities, contain more information about innovation input. The greater the increment of enterprise intangible assets is, the more investment investors have in the enterprise and the more confidence they have in the enterprise innovation. The incremental sales volume of new products is used to measure consumer trust. The higher the sales volume of new products is, the more recognition consumers have for enterprise products. The incremental number of R&D personnel is used to measure the trust of workers. The more R&D personnel join the enterprise, the more recognition of R&D talents to the enterprise. The increase in the number of citations of scientific papers and conference papers (excluding universities or research institutes as the first unit) is used to measure the trust of rivals. The higher the number of citations is, the more recognized the knowledge disclosed by rivals in the same industry is.

(4) Control variables: enterprise size (SIZE), enterprise age (AGET), listed years (LIYE), return on assets (ROAS), asset-liability ratio (ALRA) and fixed assets ratio (FARA), etc. Referring to the research of Huang et al. (2022), we control the factors that may affect the sustainability of digital innovation. The enterprise scale is measured by the total assets of the enterprise at the end of the observation period and processed by logarithm. The larger the enterprise scale is, the more capable the enterprise is to invest in digital innovation and research and development, thus affecting the sustainability of digital innovation input and output. The enterprise age is represented by the observation year minus the establishment year and the logarithm. The listed years were taken as the observation year minus the listed year and logarithmized. Return on assets is expressed by the ratio of corporate net profit to total assets at the end of the year. Asset-liability ratio is expressed by the ratio of total liabilities to total assets at the end of the year. The ratio of fixed assets is expressed by the ratio of fixed assets to total assets at the end of the year.

2.3.2. Construction of measurement model

Combined with the above variable Settings and measurement methods, in order to test the relationship between strategic knowledge disclosure and the sustainability of digital innovation and the mediating effect of market trust, the following measurement model is established by referring to the research of Wen et al. (2004) :

where,

is the coefficient of the regression model,

is the enterprise,

is the year,

is the enterprise (individual) fixed effect,

is the year (time) fixed effect,

is the random error term. Models (1) and (2) test the direct impact of strategic knowledge disclosure on the sustainability of digital innovation input and output, respectively. Model (3) and Model (4) test the mediating effect of the four dimensions of market trust (

MTRU — ITRU, CTRU, WTRU, RTRU) between strategic knowledge disclosure and sustainability of enterprise digital innovation input. Model (3) and Model (5) test the mediating effect of the three dimensions of market trust (

MTRU — CTRU,

WTRU and

RTRU) between strategic knowledge disclosure and the sustainability of enterprise digital innovation output.

3. Empirical analysis

3.1. Data processing

3.1.1. Data source and sample selection

(1) Data source. According to the Statistical Classification Catalogue of High-tech Industries issued by the National Bureau of Statistics in 2013, this study selects all listed companies in three high-tech industries, namely pharmaceutical manufacturing, electronic and communication equipment manufacturing, and computer and office equipment manufacturing, as research objects, and collects their panel data from 2012 to 2021 as research samples. The sample selection is mainly based on the following considerations: on the one hand, these three industries have large R&D input, high R&D density, large number of patents and high degree of openness of R&D cooperation environment, and the behavior of public strategic knowledge disclosure is more common, which can more effectively verify the research model. On the other hand, the knowledge base, technology R&D methods and core product scope required by the three types of industries and the selected enterprises are very different, which can highlight the differences between industries in the research and effectively verify the hypothesis. In terms of data sources, the basic information and financial data of the enterprises were mainly collected from the annual report, CSMAR database and Wind database. The patent-related data mainly come from the incoPat patent database and the Patent Retrieval and Analysis System of the State Intellectual Property Office. The data of publicly published papers of listed enterprises are collected from CNKI, including academic journal papers and conference papers.

(2) Sample selection. According to the research needs, this paper has done the following screening and processing on the basis of the original data: 1) Eliminating the *ST and ST enterprises in the sample. 2) the enterprises with serious missing sample data were eliminated. 3) Enterprises that did not apply for digital technology patents during the observation period were deleted. 4) In order to reduce the influence of outliers, all continuous variables are winsorized by 1%. Finally, after data cleaning and elimination, the balanced panel data of 168 enterprises with a total of 1680 observations were obtained.

3.1.2. Descriptive statistics and correlation analysis

Table 2 shows the descriptive statistics of the main variables and the correlation coefficient matrix.

According to

Table 2, the maximum value of the sum of the number of published scientific papers and conference papers (excluding social science papers) measuring strategic knowledge disclosure is 119, the minimum value is 0, the mean value is 6.189, and the median is 5.576, indicating that the level of strategic knowledge disclosure varies greatly, and most enterprises have a low level of strategic knowledge disclosure. Strategic knowledge disclosure (

SKDI) has a significant positive correlation with the sustainability of digital input (

SDII) and the sustainability of digital innovation output (

SDIO). Similarly, the results of the correlation between the dimensions of market trust, strategic knowledge disclosure and the input and output sustainability of digital innovation also preliminarily support the hypothesis of this paper. In addition, in order to avoid multicollinearity of variables, this paper conducts correlation coefficient test and variance inflation factor test on all kinds of variables. The test results show that the correlation value is less than 0.459, the tolerance is greater than 0.296, and the VIF value does not exceed 2.633, which indicates that there is no multicollinearity among the selected variables.

3.2. Hypothesis testing

3.2.1. Impact of strategic knowledge disclosure on the sustainability of digital innovation

In this paper, the Hausman test results of the above measurement models are all P<0.01, so the fixed effect model is used for benchmark regression analysis. In order to test the direct impact of strategic knowledge disclosure on the sustainability of digital innovation input and output (Hypothesis H1 and H2), we firstly remove the independent variables and conduct regression analysis on the control variables and dependent variables (benchmark model (0)a and (0)b), and then introduce the independent variables into the model for regression.

Table 3 shows the regression results of the direct impact of strategic knowledge disclosure on the input and output sustainability of digital innovation.

According to

Table 3, the test results of Model (1) show that on the basis of control variables, the direct influence coefficient of strategic knowledge disclosure (

SKDI) on the sustainability of digital innovation input (

SDII) is 0.373 (p<0.001), indicating that strategic knowledge disclosure has a significant role in promoting the sustainability of digital innovation input. The greater the number of scientific papers and conference papers published by the enterprise, that is, the higher the level of strategic knowledge disclosure is, the more the external feedback on the core knowledge content disclosed by the enterprise is, the more conducive it is to attract digital resources and continuously realize the input in digital innovation. Hypothesis H1 is proved. The test results of Model (2) show that on the basis of control variables, the direct influence coefficient of strategic knowledge disclosure (

SKDI) on the sustainability of

digital innovation output (

SDIO) is 0.213 (p<0.001), indicating that strategic knowledge disclosure has a significant role in promoting the sustainability of digital innovation output of enterprises. The higher the level of strategic knowledge disclosure is, the better the enterprise can use the new knowledge after external reorganization to improve the efficiency of digital innovation and optimize the digital innovation strategy, so that the enterprise can continuously achieve the output of digital innovation, Hypothesis H2 is proved. The regression analysis results of Model (1) and Model (2) show that the next step of mediating effect analysis can be carried out. In addition, from Model (0)a, Model (1), Model (0)b and Model (2), it can be seen that the control variables enterprise size (

SIZE)

, enterprise age (

AGET), return on assets (

ROAS) and fixed asset ratio (

FARA) all have positive effects on the sustainability of enterprise digital innovation input and output. However, the years of listing (

LIYE) and asset-liability ratio

(ALRA) have a negative impact on the sustainability of digital innovation input and output. The possible reason is that the longer the listing time is, the more mature and stable the ownership structure and business model of the enterprise are, and the less willing to make radical changes and implement digital innovation. The greater the total debt of enterprises is, on the one hand, it is not conducive to the trust of internal and external subjects in enterprises. The decrease of external trust affects the decrease of enterprises’ digital innovation input, and the decrease of internal trust affects the decrease of enterprises’ digital innovation output. On the other hand, for digital innovation that requires a large amount of capital, the increase in total liabilities is not conducive to the circulation of enterprise capital chain and affects the output of digital innovation results.

3.2.2. Mediating effect

Table 4 lists the test results of the mediating effect of market trust between strategic knowledge disclosure and sustainability of digital innovation.

It can be seen from

Table 4 that Model (3)a and Model (4)a test the mediating effect of investor trust (

ITRU) between strategic knowledge disclosure and the sustainability of digital innovation input. Since the regression coefficient of market trust in Model (4)a is 0.099 (p<0.001) reaches the positive significant level. And the regression coefficient of strategic knowledge disclosure is 0.294 (p<0.01) is still positive and significant. This shows that investor trust has a significantly positive mediating effect, and corporate strategic knowledge disclosure promotes the sustainability of corporate digital innovation input by improving investor trust. Hypothesis H3 is proved. Model (3)b, (4)b and (5)a test the mediating effect of consumer trust (

CTRU). The regression coefficients of consumer trust in models (4)b and (5)a are 0.087 (p<0.01), 0.131 (p<0.01), and the regression coefficients of strategic knowledge disclosure were 0.302 (p<0.01), 0.219 (p<0.01) all reached the positive and significant level. This means that consumer trust has a significantly positive mediating effect between strategic knowledge disclosure and digital innovation input and output sustainability. Hypotheses H4a and H4b are proved. Models (3)c, (4)c and (5)b test the mediating effect of workers’ trust (

WTRU). The regression coefficients of workers’ trust in Models (4)c and (5)b are 0.056 (p<0.001) and 0.089 (p<0.001). The regression coefficients of strategic knowledge disclosure are 0.205 (p<0.01) and 0.109 (p<0.01). All reached the positive and significant level. Therefore, workers’ trust has a significantly positive mediating effect, and Hypotheses H5a and H5b are proved. Models (3)d, (4)d and (5)c test the mediating effect of rival trust (

RTRU). The regression coefficients of rival trust in models (4)d and (5)c are -0.054 (p<0.01) and -0.030 (p<0.01). The regression coefficients of strategic knowledge disclosure are 0.113 (p<0.01) and 0.328 (p<0.001). All reached the significant level. However, the negative regression coefficient of rivals’ trust means that there is a significant negative mediating effect, indicating that enterprises’ strategic knowledge disclosure hinders the sustainability of enterprises’ digital innovation input and output by improving the trust level of rivals. Hypotheses H6a and H6b are proved.

There are two types of mediating effect: partial mediating effect and complete mediating effect. According to the research results of Wen and Ye(2014), when the direct influence coefficient of independent variable is significant, the influence coefficient of independent variable on mediating variable is significant, and both coefficients of independent variable and mediating variable act at the same time is significant, it is a partial mediating effect. If the independent variable coefficient is not significant when the independent variable and the mediating variable act at the same time, and all other regression coefficients are significant, it is a complete mediating effect. In summary, the four dimensions of market trust (investor trust, consumer trust, worker trust and rival trust) have partial mediating effects on the relationship between strategic knowledge disclosure and the sustainability of digital innovation input and output.

3.3. Robustness test

This paper mainly carries out the robustness test from the following aspects: (1) Grouping test. According to the industry category (pharmaceutical manufacturing, electronic and communication equipment manufacturing and computer and office equipment manufacturing), it is divided into three groups for grouped regression. The academic atmosphere level, competition intensity and technical barrier level of different industries are different, and the degree and implementation effect of strategic knowledge disclosure and market trust strength are quite different. (2) Adding control variables. By adding control variables to the model, including the region where the enterprise is located (mid-eastern China, mid-western China) and the characteristics of the top management team (academic background and digital background of the executives, etc.), the economic development level of different regions is quite different, and the support for enterprise digital innovation is different. On the one hand, the characteristics of the top management team will affect the decision and effect of strategic knowledge disclosure. The top management team with academic background is more inclined to publish papers and attend academic conferences and other strategic knowledge disclosure behaviors of researchers. On the other hand, as the leader of the enterprise, the top management team determines the development direction of the enterprise, and the top management with digital background will be more familiar with the digital field. Executives with digital background are more sensitive to digital innovation opportunities, and invest a lot of digital resources when the opportunities are mature. (3) Change the regression model. The random effect model was used to replace the fixed effect model for verification, and the least square method (OLS) was used to replace the negative binomial regression for test. The test results are consistent with the previous conclusions, indicating that the research conclusions are robust.

4. Conclusions and suggestions

This paper aims at the question of whether strategic knowledge disclosure is conducive to the continuous realization of digital innovation by Chinese enterprises. Based on the relevant data of 168 listed companies in three types of high-tech industries in China from 2012 to 2021, this paper studies the impact of strategic knowledge disclosure on the sustainability of digital innovation input and output with the four dimensions of market trust — investor trust, consumer trust, worker trust and rival trust as the mediating variables. The results show that:

(1) Strategic knowledge disclosure has a significant role in promoting the input and output sustainability of digital innovation. As an important means of information communication between enterprises and external stakeholders, strategic knowledge disclosure may affect the sustainability of digital innovation input by increasing visibility, attracting digital resources and establishing cooperative relationships. For digital innovation output, strategic knowledge disclosure may affect the sustainable output of digital innovation results by strengthening digital innovation awareness, improving digital innovation efficiency, optimizing digital innovation strategy and promoting a virtuous cycle.

(2) Investor trust has a significant positive mediating effect between strategic knowledge disclosure and the sustainability of digital innovation input, and it is a partial mediating effect. When internal and external investors accept the core knowledge disclosed by enterprises, they will be willing to invest or continue to invest in enterprises’ digital innovation. The higher the degree of trust of investors is, the stronger the willingness to invest is.

(3) Consumer trust has a significant positive mediating effect between strategic knowledge disclosure and digital innovation input and output sustainability, which is a partial mediating effect. When consumers recognize the content of enterprises’ strategic knowledge disclosure, the market demand for digital innovation products will continue to expand. Therefore, the higher the consumer trust is, the more stimulating the continuous input and output of digital innovation will be.

(4) Worker trust has a significant positive mediating effect between strategic knowledge disclosure and the sustainability of digital innovation input and output, which is a partial mediating effect. As an important carrier of knowledge and productivity, in strategic knowledge disclosure, internal and external workers have a positive attitude towards the disclosed knowledge, and are more willing to invest in the enterprise’s digital innovation, which provides a guarantee for the enterprise to achieve sustainable digital innovation.

(5) Rival trust has a significant negative mediating effect between strategic knowledge disclosure and the sustainability of digital innovation input and output, and it is a partial mediating effect. Although strategic knowledge disclosure can alleviate the “substitute threat”, it will drive the “imitator threat”. Rivals will recognize the knowledge disclosed by enterprises, and will imitate the corresponding technology to develop imitators. Imitators will lead to the loss of market share of enterprises, thus adversely affecting the input and output of digital innovation.

Based on the above conclusions, the following management suggestions are put forward:

(1) In view of Conclusion (1), Chinese enterprises should abandon the view that knowledge spillover is not conducive to maintaining continuous innovation advantage and competitive advantage, and should not over-protect core knowledge. They should make full use of new opportunities in open innovation, actively explore ways and means of knowledge disclosure that are beneficial to enterprises, and disclose part of core knowledge strategically, selectively, free and appropriately. For example, when a certain digital technology research and development encounter a bottleneck, enterprises can choose to open up the upstream technology knowledge, guide enterprises or individuals in the same industry to develop downstream technology, and introduce complete digital technology for the research and development of digital innovation products. In this process, enterprises can also tap like-minded partners or high-quality human resources. For relevant national departments and units, on the one hand, scientific research institutions, universities, enterprises and individuals should be encouraged to actively participate in the production, sharing and dissemination of core knowledge of digital innovation, improve the quality of disclosed knowledge, and strengthen the review and evaluation of disclosed knowledge to ensure its accuracy, authority and practicability. On the other hand, we should encourage the construction of diversified open knowledge platforms, assist enterprises to expand the ways of knowledge disclosure, support enterprises and scientific research institutions to develop various open knowledge platforms, and promote the integration and sharing of core knowledge resources of digital innovation. At the same time, China should strengthen cooperation and exchange with internationally renowned knowledge platforms, introduce international high-quality knowledge resources, improve the national level of digital innovation, and promote the sustainable development of digital innovation.

(2) According to research conclusions (2), (3) and (4), Chinese enterprises should first focus on seizing the opportunity of knowledge disclosure, in order to occupy the dominant advantage in the field of digital innovation knowledge, and first obtain the positive attitude of most investors, consumers and workers to enterprises, so as to ensure the acquisition of high-quality digital resources and the majority of market share at the early stage of technology development. Secondly, enterprises should improve the quality of knowledge disclosure, ensure that the disclosed knowledge is the frontier and core knowledge mastered by enterprises, never resort to fraud, and pay attention to establish the reputation of honest management, so as to gain the continuous trust of market players. Finally, different disclosure methods should be adopted for different market players. For example, the understanding threshold of the disclosed knowledge should be lowered for consumers, and the obscure technical solutions should be described in easy-to-understand language, and released through the media commonly used by consumers. For internal and external workers, enterprises should also pay attention to the construction of corporate culture, strengthen the dissemination of corporate values, create harmonious labor relations, improve workers’ sense of identity for the enterprise, and continue to attract and retain talents.

(3) In view of Conclusion (5), although the private core knowledge of the enterprise is disclosed, in order to avoid the threat of imitators, the enterprise should selectively disclose part of the peripheral knowledge of the core content. For the core problems and solutions to be disclosed, sufficient de-textualization must be carried out. On the one hand, it is convenient for external personnel to access these problems and solutions and ensure that the subsequent related knowledge generated has value to the source enterprise; On the other hand, it can ensure that the enterprise will not disclose too much core knowledge, so as not to lose the advantages of continuous competition and innovation. In terms of knowledge selection, enterprises should choose the core knowledge with module nature in their product knowledge system to disclose to the outside, and control the imitation speed of rivals with the help of the correlation between knowledge modules.

The limitations of this paper are as follows: (1) Regarding the measurement of strategic knowledge disclosure, this study solely relies on the summation of scientific papers and conference papers published by enterprises, excluding social science papers. This approach only focuses on a single aspect of strategic knowledge disclosure levels. However, it is crucial to explore and investigate other methods for disclosing strategic knowledge, particularly the tacit knowledge disclosure methods employed by enterprises. (2) This paper exclusively examines the mediating effect of market players in the external feedback stage subsequent to strategic knowledge disclosure. To successfully achieve continuous digital innovation through effective knowledge retrieval, enterprises must not only select appropriate retrieval methods but also possess strong capabilities to absorb and integrate new knowledge from external sources. Therefore, further exploration should be conducted in subsequent stages concerning enterprise knowledge retrieval.

References

- Alexy, O.; George, G.; Salter, A. J. Cui Bono? The Selective Revealing of Knowledge and Its Implications for Innovative Activity. Academy of Management Review 2013, 38, 270–291. [Google Scholar] [CrossRef]

- Alnuaimi, T.; George, E.G. Appropriability and the retrieval of knowledge after spillovers. Strategic Management Journal 2016, 37, 1263–1279. [Google Scholar] [CrossRef]

- Ben-Ner, A.; Putterman, L. Trusting and Trustworthiness. Boston University Law Review 2001, 81, 523–551. [Google Scholar]

- Davenport, T.H.; Prusak, L. Working Knowledge: How Organizations Manage What They Know; Harvard Business Press, 1998. [Google Scholar]

- Dong, Q.; Barcena-Ruiz, J.C. Corporate social responsibility and disclosure of R&D knowledge. Economics of Innovation and New Technology 2021, 30, 585–602. [Google Scholar]

- Durana, P.; Valaskova, K.; Vagner, L.; Zadnanova, S.; Podhorska, I.; Siekelova, A. Disclosure of strategic managers’ factotum: Behavioral incentives of innovative business. International Journal of Financial Studies 2020, 8, 17. [Google Scholar] [CrossRef]

- Farnsworth, V.; Kleanthous, I.; Wenger-Trayner, E. Communities of practice as a social theory of learning: A conversation with Etienne Wenger. British journal of educational studies 2016, 64, 139–160. [Google Scholar] [CrossRef]

- Fudenberg, D.; Tirole, J. Game Theory; MIT Press: Cambridge, UK, 1992. [Google Scholar]

- Hardin, R. Trust and Trustworthiness; Russell Sage Foundation, 2002. [Google Scholar]

- Harhoff, D.; Henkel, J.; Hippel, E.V. Profiting from voluntary information spillovers: how users benefit by freely revealing their innovations. Research Policy 2003, 32, 1753–1769. [Google Scholar] [CrossRef]

- Huang, X.H.; Wang, H.D. Imports of digital products, knowledge stock and digital innovation of enterprises. Journal of Zhejiang University (Humanities and Social Sciences) 2022, 52, 28–43. [Google Scholar]

- Hund, A.; Wagner, H.; Beimborn, D.; Weitzel, T. Digital Innovation: Review and Novel Perspective. Journal of Strategic Information Systems 2021, 30, 1–39. [Google Scholar]

- Jia, N. Corporate innovation strategy and disclosure policy. Review of Quantitative Finance and Accounting 2019, 52, 253–288. [Google Scholar] [CrossRef]

- Johnson, J.P. Defensive publishing by a leading firm. Information Economics & Policy 2014, 28, 15–27. [Google Scholar]

- Kim, J.Y.; Steensma, H.K. Employee Mobility, Spin-outs, and Knowledge Spill-in: How Incumbent Firms Can Learn from New Ventures. Strategic Management Journal 2017, 38, 1626–1645. [Google Scholar] [CrossRef]

- Laursen, K.; Salter, A.J. The paradox of openness: Appropriability, external search and collaboration. Research policy 2014, 43, 867–878. [Google Scholar] [CrossRef]

- Lichtenthaler, U.; Lichtenthaler, E. A capability-based framework for open innovation: Complementing absorptive capacity. Journal of management studies 2009, 46, 1315–1338. [Google Scholar] [CrossRef]

- Lieberman, M.B.; Asaba, S. Why Do Firms Imitate Each Other. Academy of Management Review 2006, 31, 366–385. [Google Scholar] [CrossRef]

- Liu, Y.; Wang, X.; Yang, Y. The impact of strategic knowledge disclosure on enterprise innovation performance. Managerial and Decision Economics 2023, 44, 2582–2592. [Google Scholar] [CrossRef]

- Lyon, F.; Mollering, G.; Saunders, M.N.K. Introduction: The variety of methods for the multi-faceted phenomenon of trust. 2012. [Google Scholar]

- Nonaka; Takeuchi, H. ; Umemoto, K. A theory of organizational knowledge creation. International Journal of Technology Management 1996, 11, 833–845. [Google Scholar]

- Pacheco-de-Almeida, G.; Zemsky, P.B. Some like it free: Innovators strategic use of disclosure to slow down competition. Strategic Management Journal 2012, 33, 773–793. [Google Scholar] [CrossRef]

- Polidoro, F.; Toh, P.K. Letting rivals come close or warding them off? The effects of substitution threat on imitation deterrence. Academy of Management Journal 2011, 54, 369–392. [Google Scholar] [CrossRef]

- Polidoro, F., Jr.; Theeke, M. Getting Competition down to a Science: The Effects of Technological Competition on Firms’ Scientific Publications. Organization Science 2012, 23, 1135–1153. [Google Scholar] [CrossRef]

- Ren, S.C.; Cao, Y.G.; Zhang, H.Y. Research on the impact of technological innovation on the disclosure of corporate strategic knowledge. Science and Technology Management Research 2021, 41, 19–25. [Google Scholar]

- Ren, S.C.; Ma, J.J.; Xu, H. The antecedents and consequences of strategic knowledge disclosure: A case study of BGI. Science Research Management 2020, 41, 151–159. [Google Scholar]

- Ren, S.C.; Xu, H.; Xu, M.X. Strategic knowledge disclosure: motivations and drivers. Journal of the China Society for Scientific and Technical Information 2016, 35, 442–448. [Google Scholar]

- Ritala, P.; Husted, K.; Olander, H. External Knowledge Sharing and Radical Innovation: The Downsides of Uncontrolled Openness. Journal of Knowledge Management 2018, 22, 1104–1123. [Google Scholar] [CrossRef]

- Saiz, P.; Amengual, R. Do patents enable disclosure? Strategic innovation management of the four-stroke engine. Industrial and corporate change 2018, 27, 975–997. [Google Scholar] [CrossRef]

- Simeth, M.; Raffo, J.D. What makes companies pursue an open science strategy? Research Policy 2013, 42, 1531–1543. [Google Scholar] [CrossRef]

- Teece, D.J. Profiting from innovation in the digital economy: Enabling technologies, standards, and licensing models in the wireless world. Research policy 2018, 47, 1367–1387. [Google Scholar] [CrossRef]

- Thiel, J.; Peters, T.S. Intellectual property strategy in innovative SMEs—a case for strategic disclosure[C]// The Academy of Management. Annual Meeting of The Academy of Management. Boston: Academy of Management, 2011: 1-40.

- Triguero, A.; Corcoles, D. Understanding innovation: An analysis of persistence for Spanish manufacturing firms. Research Policy 2013, 42, 340–352. [Google Scholar] [CrossRef]

- Wang, S.; Zhao, X.Y. Research on strategic knowledge disclosure pattern of enterprises in different industrial environments. Science and Technology Management Research 2017, 37, 181–186. [Google Scholar]

- Wen, Z.L.; Ye, B.J. Analyses of mediating effects: the development of methods and models. Advances in Psychological Science 2014, 22, 731–745. [Google Scholar] [CrossRef]

- Wen, Z.L.; Zhang, L.; Hou, J.T.; Liu, H.Y. Testing and application of the mediating effects. Acta Psychologica Sinica 2004, 5, 614–620. [Google Scholar]

- Wu, Y.L.; Huang, S.L. The effects of digital finance and financial constraint on financial performance: Firm-level evidence from China’s new energy enterprises. Energy Economics 2022, 112, 106–118. [Google Scholar] [CrossRef]

- Yang, H.; Phelps, C.; Steensma, H.K. Learning from What Others Have Learned from You: The Effects of Knowledge Spillovers on Originating Firms. Academy of Management Journal 2010, 53, 371–389. [Google Scholar] [CrossRef]

- Ying, Y.; Yu, J.L.; Fan, Z.G.; Wei, J. Strategic knowledge disclosure and sustainable value appropriability. Studies in Science of Science 2023, 41, 1875–1886. [Google Scholar]

- Yu, Y.Y.; Yang, Z. The connotation, research topics and prospects of strategic knowledge disclosure. Nankai Business Review 2022, 25, 214–226. [Google Scholar]

- Zhang, W.Y.; Ke, R.Z. Trust in China: A Cross-Regional Analysis. Economic Research Journal 2002, 10, 59–70+96. [Google Scholar] [CrossRef]

- Zhao, W.L.; Zhang, N.; Dai, H.J. Logic and influence factors of market trust: an empirical analysis based on CGSS2010. Journal of China University of Mining & Technology (Social Sciences) 2019, 54–66. [Google Scholar]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).