1. Introduction

Without a doubt, the world is experiencing a whirlwind of digital development in all sectors of the economy, and in every aspect of humanity’s activities, changing habits, the way of working and relating. Klaus Schwab in his book “The Fourth Industrial Revolution” [

1] indicates that this phenomenon is unlike anything humanity has experienced before, both in terms of scale, scope, and complexity.

“Digital Transformation” can be applied to changes in the industry and in the organization, which encompasses both the digitization of processes with a focus on their efficiency and how digital innovation improves existing physical products with digital capabilities.

Digital transformation encompasses both digitization of processes with a focus on efficiency, and digital innovation with a focus on upgrading existing physical products with digital capabilities [

2]. The growing proliferation of digital technologies has been an important catalyst for organizational transformation in recent decades, allowing the exploration of new use cases [

3], integrating digital technologies and business processes, and thus enhancing and improving key business competencies.

The term transformation refers to a fundamental change within the organization, which has a great impact on organizational strategy and internal structures [

3].

Therefore, it requires companies to realign and initiate a change process concerning their structures as well as their business models, which is certainly a challenging organization of the learning process. [

4]

Banks have understood this phenomenon of digital transformation and have begun to adapt in different ways and speeds since the concept of becoming a digital bank can be diverse. It could be indicated that a digital bank would consider an offer, distribution, and sale of financial products and financial services through digital channels, along with the use of the latest technologies to better understand customers and anticipate their needs quickly and conveniently. [

5]

In this research, a longitudinal causal conclusion methodology has been used [

6], focusing on the scientometric analysis of the scientific production of researchers [

7], the impact of their publications, and collaboration networks between articles published in the Web of Science (WoS) [

8], for its influence on scientific knowledge [

9].

A scientometric analysis has not been carried out in the field of banking digital transformation, so this research is an opportunity to generate new knowledge. One of the benefits of this type of analysis is the creation of “maps” that allow us to better visualize the most prominent authors, countries of origin, institutions in which they work, collaboration between authors, and their fields of development, among other variables. This analysis method is rigorous, less biased, and allows a broad view of the digital transformation banking research field, through research metadata [

10,

11,

12].

The development of the banking sector undoubtedly has an impact on the development of economies, so the study of digital transformation banking contributes to the development of banks and the economies in which they are inserted. For this reason, this research contributes to two sustainable development objectives, on the one hand contributing to the eighth objective, since the development of digital banking improves decent work opportunities and promotes economic growth, and secondly contributes to the ninth objective of the SDGs, since digital banking is a driver of innovation and entrepreneurship in the banking sector [

13].

It is interesting to analyze the effect that digital transformation has had on the banking sector, to assess the impact that this transformation has had on the competitiveness of the sector and its incumbents. To carry out the analysis, the WoS database corpus (312 records) was obtained, which was refined to obtain sources directly related to banking digital transformation. The first step will be a descriptive bibliometric analysis [

14] showing results in the number of publications per year, references by type, total articles by country of the author, affiliations, and sources of information. In addition to a scientometric analysis that includes co-authorship, co-occurrence of keywords, cocitations [

15].

This scientific report will allow researchers interested in banking digitalization processes to identify the main authors, and their affiliation to university institutions, main journals, national and international collaboration networks, and will serve as a basis for future work.

2. Methodology

To carry out this work, the methodology of bibliometric analysis was used, along with the application of mathematical and statistical techniques to identify patterns that emerged from the publications and use of documents [

16]. Additionally, the article uses the scientometric method by applying bibliometric techniques to scientific production [

17].

The analysis performed in this report is exploratory in nature [

18]. The phases proposed by Velt, Torkkeli and Laine [

11] were carried out: formulation, identification, selection, and thematic synthesis.

In the first stage called “formulation” the following research questions are posed:

How has the distribution of publications per year, on digital transformation in Banking, worldwide?

What is the number of citations or references per year, together with the most cited articles and authors?

Which are the institutions with the greatest participation in the “digital transformation in banking” publication?

Which countries publish the most in digitization in banking?

What are the main sources of publication on digital transformation in the banking sector?

What other topics or descriptors are related to digital transformation in banking? Co-occurrence analysis.

The second phase proposed by Velt, Torkkeli, and Laine [

11] corresponds to the “identification” stage. This stage consists of establishing the search attributes [

19], based on the identification keywords, and the time horizon of said search was also determined. Following the recommendations of Velt, Torkkeli, and Laine [

18], the most relevant WoS categories in the field of research on digital transformation in banking were selected. The consultation of these databases was carried out on May 7, 2023, configuring a search vector with the keywords “banking” “digital” and “transformation” in Web of Science, following the methodology of Vega and Galindo [

20].

The data query in WoS was made on May 7, 2023, it is as follows:

TITLE-ABS-KEY (digital AND transformation AND banking)

Book chapters, conferences, etc. were included.

In the “selection” stage, the WoS bibliographic tools published by Clarivate were selected, since they are databases that serve as references for the measurement of scientific production [

21], due to the number of articles published in renowned academic journals, for being one of the largest bibliometric databases, for being up-to-date, and for its impact on the scientific community.

The fourth stage involved verifying the dataset for accuracy and completeness. Any errors or gaps in the data were addressed during this phase. This process was carried out by one of the authors, filtering documents that are not relevant to the categories or disciplines of study under analysis, among which we can name: geology, and audio engineering, among others.

The fifth stage involves analyzing data using appropriate tools to achieve research objectives and answer questions. The scientometric indicators analyzed included articles, conferences, book chapters, journals, engineering institutes, and countries.

Maps of co-authorship by author, by organization, by country were included. Keyword co-occurrence maps, citation map by author, by organization.

3. Results

This section summarizes the main results of a scientometric study on digital transformation in banking from 2002 to 2023 using VosViewer.

First, the most influential articles on digitization in Banking were identified, who authorized them, and in which journals they were published. The publication of the search vector in the period between 2002 and 2023, in the WoS corpus, yielded a total of 312 refined publications, considered a total of 17,861 citations.

3.1. How has been the distribution of publications per year, on digital transformation in banking, worldwide?

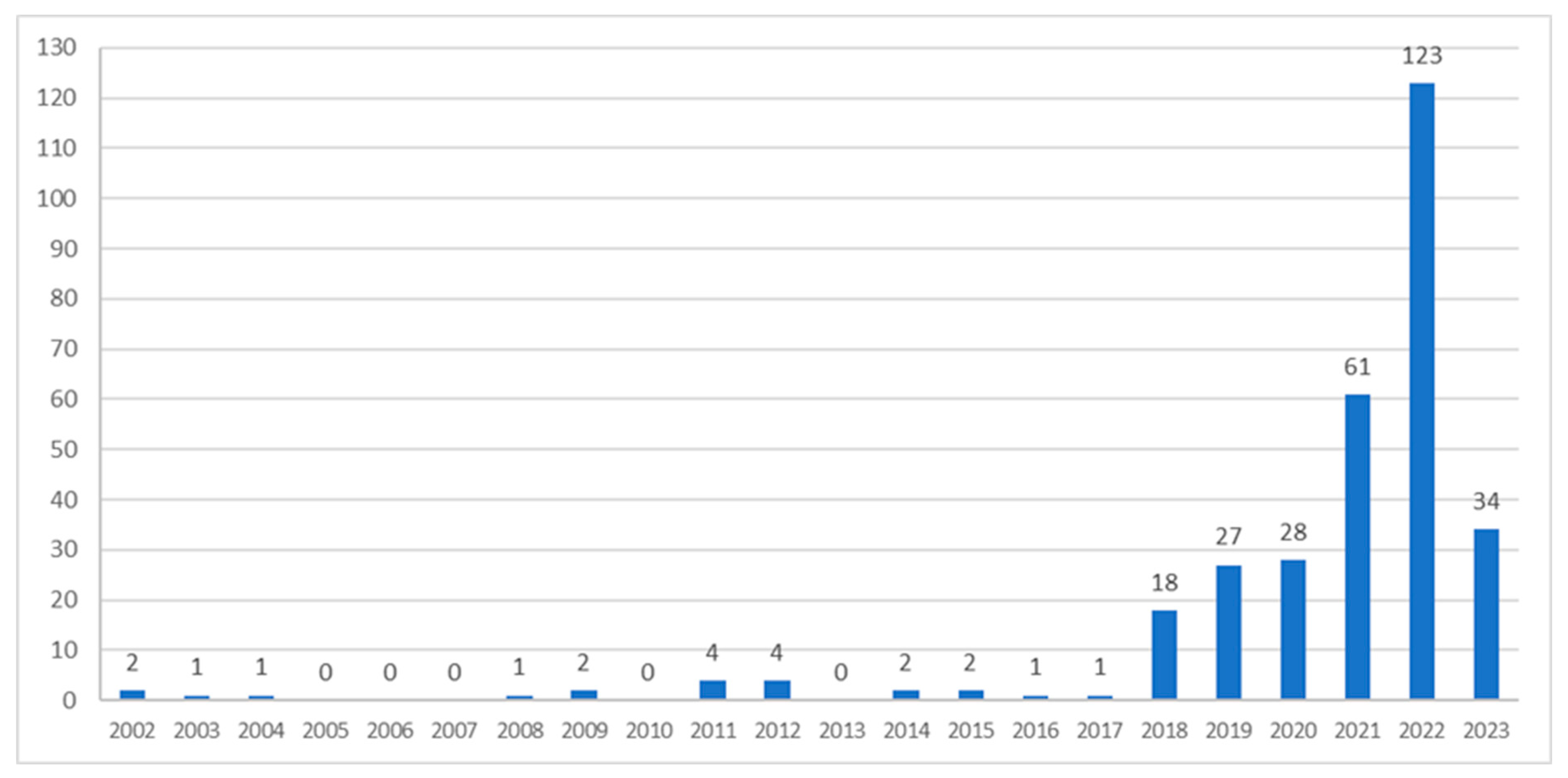

It can be seen in

Figure 1 that the publications per year present a trend of strong increase, especially from 2018 onwards with an average of 51 publications per year. In 2019 these publications increased by 50% compared to 2018. It can be seen that during the year of the COVID-19 pandemic (2020), there were 28 publications. In this way, the year 2021 was reached with an increase of 117.9%. As of May 2023, 34 publications have already been presented, so it is expected that by the end of 2023 scientific production in this area will continue with the same or higher growth rate.

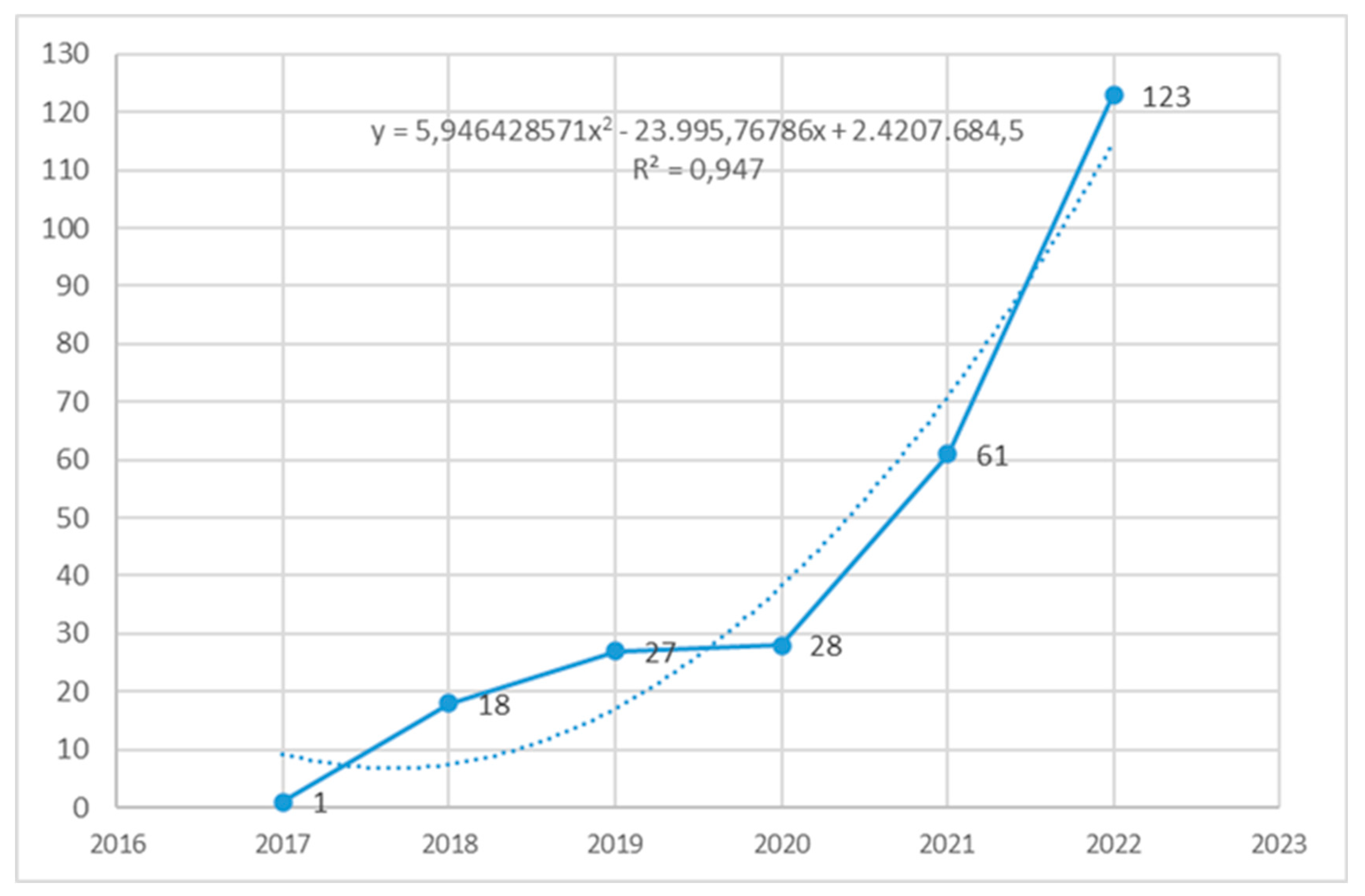

Publications in the area in the last 6 years gave a quadratic growth curve with the following formula: PUB(YEAR) = 5.946428571*(YEAR)

2 - 23,995.76786*YEAR + 2,4207,684.5 with an R

2 of 0.947.

Figure 2 illustrates a significant increase in publications over the last 5 years, indicating the growth of a substantial number of researchers in this area of research.

Figure 2 shows sustained linear growth since 2017; previous years were not considered, since there was no scientific production representative of the area under study. By the year 2022, the maximum scientific production has been reached with a total of 123 publications. In the last six years, 93.3% of the published papers were released. It is worth mentioning that none of the meaning has been removed or added in the rewriting process.

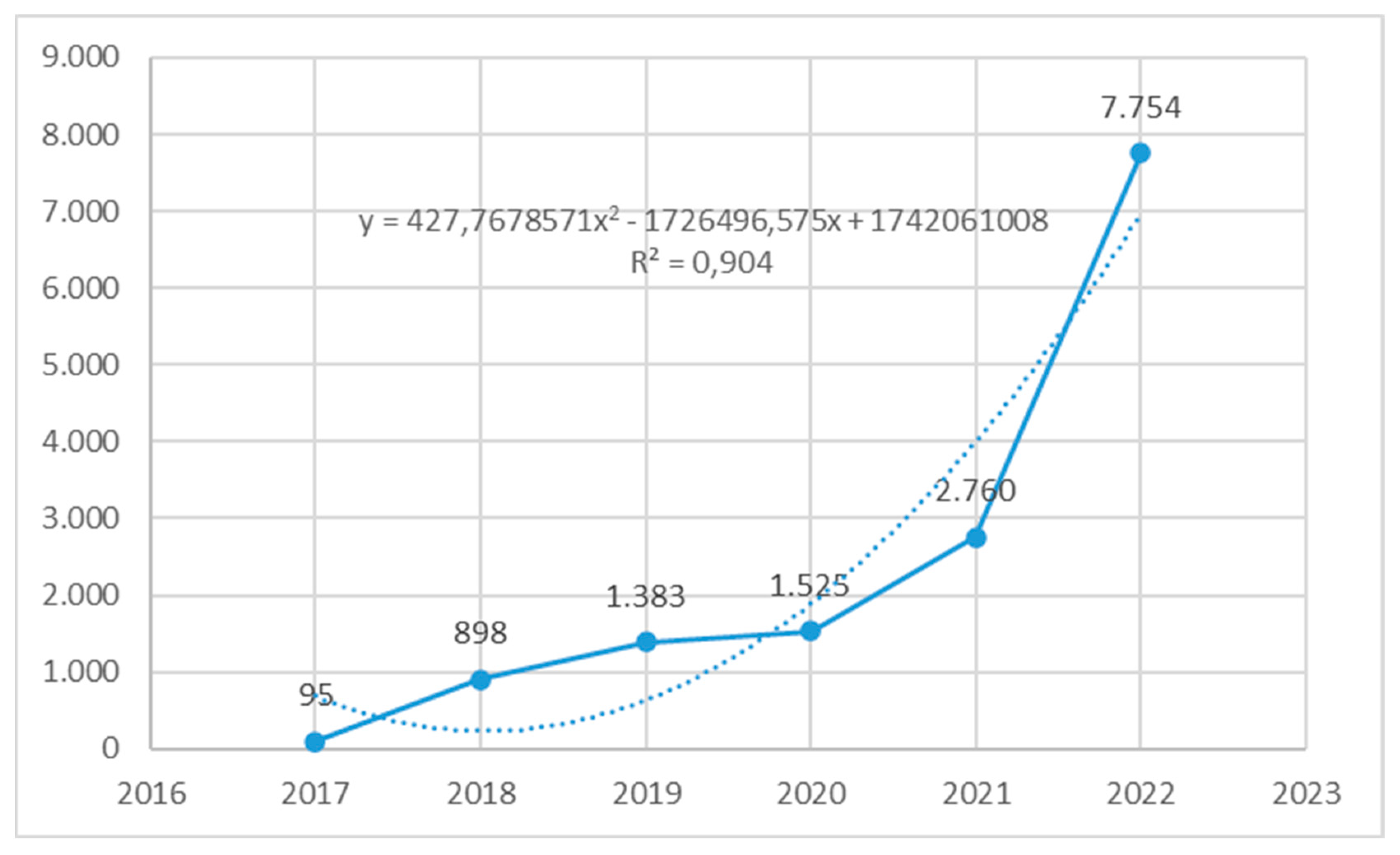

Figure 3 shows the number of citations per year in the literature on Digital Transformation in Banking. There is a correlation between the number of publications and the annual citations of said publications, so it can be understood that the discipline has an impact on the generation of knowledge. A quadratic equation was obtained, with an R

2 of 0.904. The citation peak occurs in the year 2022 with 7,754 citations.

3.2. What is the number of citations or references per year, together with the most cited articles and authors?

Table 1 presents a characterization of the type of publication of the WoS corpus, which indicates the number of publications according to the type of reference that was registered. It is important to highlight that 84.6% of the publications correspond to academic articles, that is, they are documents that have academic rigor in their construction. To this value will be added the articles that are not yet numbered within a journal, but possibly will be, with 29 publications. These publications are followed by the type “reviews” (2.9%). Then, to a lesser extent (1.6%) are “editorial material”.

Table 2 shows the citation rate of publications with a total of 2.44 citations. The initial observation is that 1.3% of all publications, specifically 4 articles, have never been cited. Then, 10 articles have between 1 and 10 citations (which corresponds to 3.2% of the published studies). 32 publications have more than 11 but less than 20 citations (10.3%), 79 publications have more than 21 but less than 40 citations (25.3%), 73 articles have between 41 and 60 citations (23.4%), and finally 114 publications have more than 61 citations each, which represents 36.5% of the published studies.

Regarding the Hirsch impact index or H index [

22] the search carried out presents an H index of 27, which is a good level.

Table 3 shows the 15 most cited articles. Among them, it is worth mentioning the article “On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services” of the year 2018, carrying out an analysis of how innovation and the development of Fintech promote changes in the business model. technology-based businesses for traditional banking [

23]. We could indicate that this article is one of the driving forces behind the development of the study area, given its year of publication and the impact it has had. The document is a discussion by the authors, about different aspects of financial services and the changes that are occurring, leveraged by technological innovations. Operations management factors are addressed, the processes associated with electronic payments, cryptocurrencies, the possibility of P2P loans, and the use of social networks, and how this affects financial markets, commerce, risk management, among others.

3.2.1. Main authors

Among the 312 records selected from the Wos corpus, 708 authors researched digitization in the banking sector, either as main autohors or as co-authors. The number of articles published measures each author’s knowledge contribution. It is not always possible to recognize the influence of the authors, however, they are very important from the point of view that they have contributed to the development of this theme.

Table 4 presents 15 authors who have at least 2 publications within the search vector. It can be observed that the total citations of these authors are low, representing 4.8% of the total citations of the search vector. Ricardo Palomo, professor of Financial Economics and dean of the CEU San Pablo University, as well as Delegate of the Rector for Digital Transformation, stands out, with 3 articles within the search vector. Subsequently, 14 authors present 2 articles within the vector.

Table 5 shows the 15 authors who have the highest number of citations, in the study area, within the search vector. Robert J Kauffman, is the main author on the subject of digital transformation in banking, publishing 2 articles in the study area, which have been cited 388 times, representing 2.2% of the total citations. The 2 articles by the professor belonging to the Singapore University of Business Management belong to the 15 most cited articles. Subsequently, there is the author Markos Zachariadis, from the University of Manchester, with 2 articles, representing 0.7% of the total citations. The table in section 5 lists the most cited authors in the search. It can be noted that most of the authors belong to developed countries such as the United States, France, the United Kingdom, Germany, among others. others.

There is not a great relationship between the most cited authors and the most productive authors, except Robert Kauffman. The area of study is new, so there are new authors who are gradually increasing their productivity, but the impact of their publications is still not high, on the other hand, there are authors with high levels of productivity and citations, but who have only dabbled with some research in the discipline.

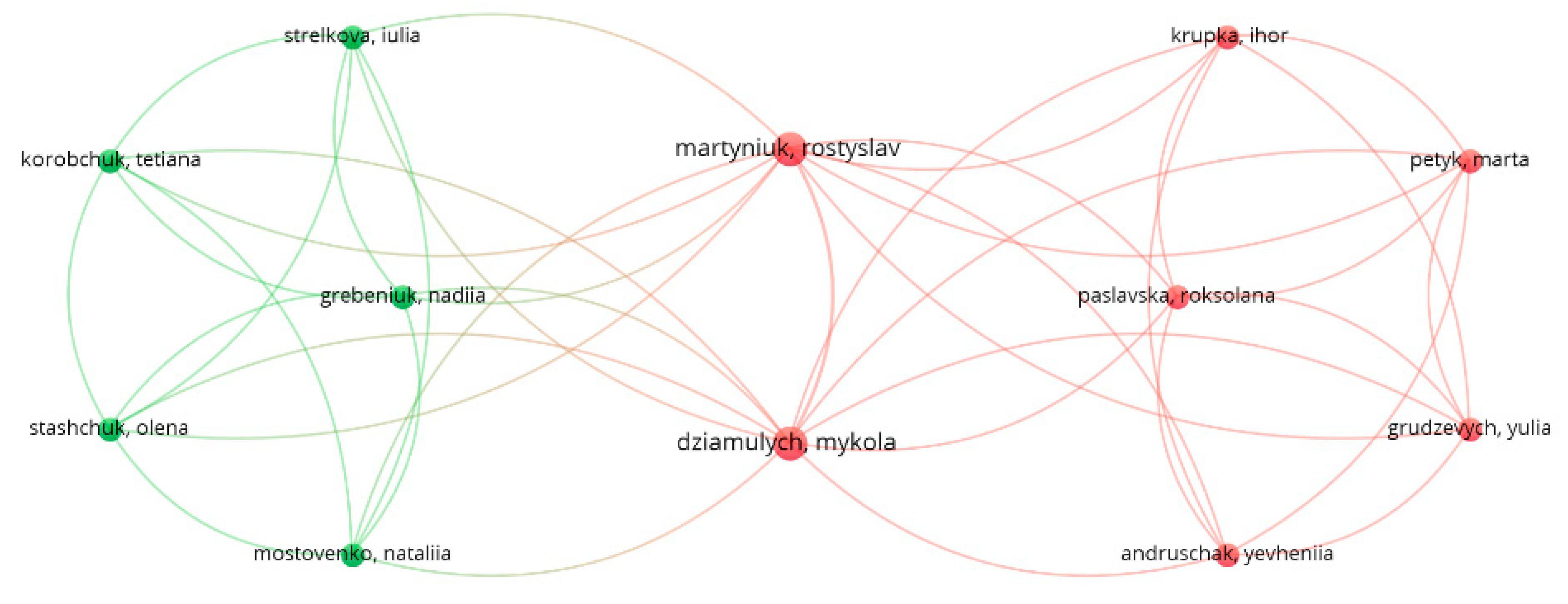

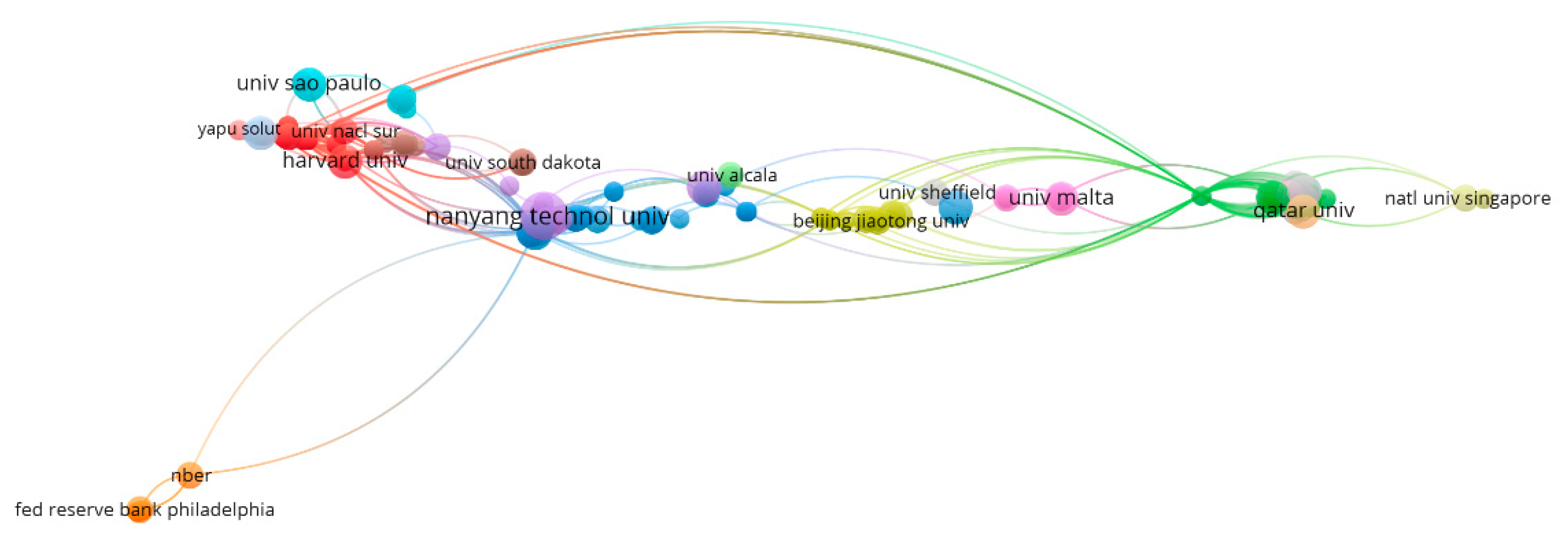

We proceeded with a joint analysis that was co-authored. To reduce the number of authors to 12, the analysis only included those who had published at least two articles. The graphical representation of co-authorship is illustrated in

Figure 4.

We can observe that the collaboration is not developed, because the study area is recent, presenting a low number of publications per author in the area, which is reflected in the collaborative publications.

3.3. Which are the institutions with the greatest participation in the “digital transformation in banking” publication?

Scientific productivity in the area of digital transformation in banking is distributed among 303 organizations, covering 708 authors. There is a medium concentration of organizations since 27 organizations represent 33% of the total productivity of the search vector.

The institutions related to the topic are listed in

Table 6, in descending order of their influence based on the number of articles, their H-index, the average number of citations, and the total number of citations obtained from the search vectors.

The most productive organizations are the Massachusetts Institute of Technologies and (MIT), the Russian Academy of Sciences, and the Financial University of the Government of the Russian Federation with 6 articles. The University of London, Florida State University, Tavria Dmytro Motornyi State Agrotech, Indo Institute of Business Management (IIM System), and Symbiosis International University submit 5 papers.

In terms of productivity, it can be mentioned that the universities with the highest productivity in the field of digital transformation in banking belong to developed countries.

The graph in

Figure 5 shows the collaborations between universities.

A predominant cluster of red color is observed, which corresponds to 40 universities, in which the following can be highlighted: Harvard University, Singapore University of Business Management, Emirates Technological, and CEU University of Sao Paulo. Another relevant group is the color purple, highlighting universities such as Nanyang Technological, Guangxi University, and soas Unversity London.

3.4. Which countries are the ones that publish the most in digitization in banking?

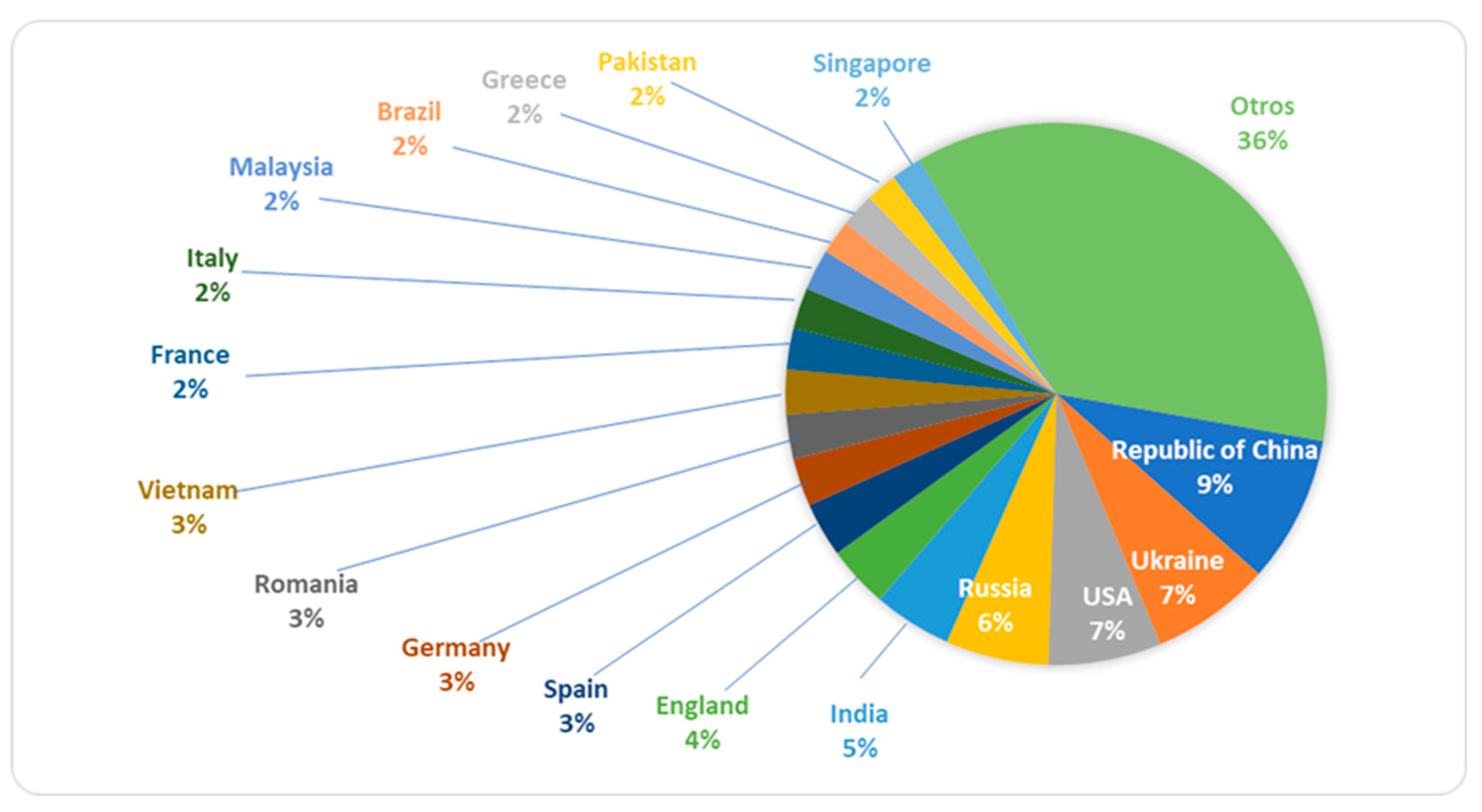

When answering this question, it can be seen in

Figure 6 that the countries that make the greatest contribution to the mentioned publications are: the Republic of China, with 8.8% of the publications, then the Ukraine with 7.2%, United States with 6.7% and Russia with 6.1%.

It is important to highlight the efforts that Ukraine and Russia have made in this regard, since they are nations classified as developing countries according to the International Monetary Fund, the United Nations, and the World Bank, indicating that the adoption of new business models and new technologies in the banking sector is an important subject of study for nations.

On the contrary, developed economies such as the Republic of China and the United States present a high concentration of publications on the subject, because the greatest developments and leadership in innovation in the banking sector are seen in developed nations.

In

Table 7, it can be seen that the country with the highest number of citations is the Republic of China, representing 8.8% of the total articles, followed by Ukraine with 35 articles representing 7.2%, then the USA with 33 articles. representing 6.7% and then Russia with 30 articles.

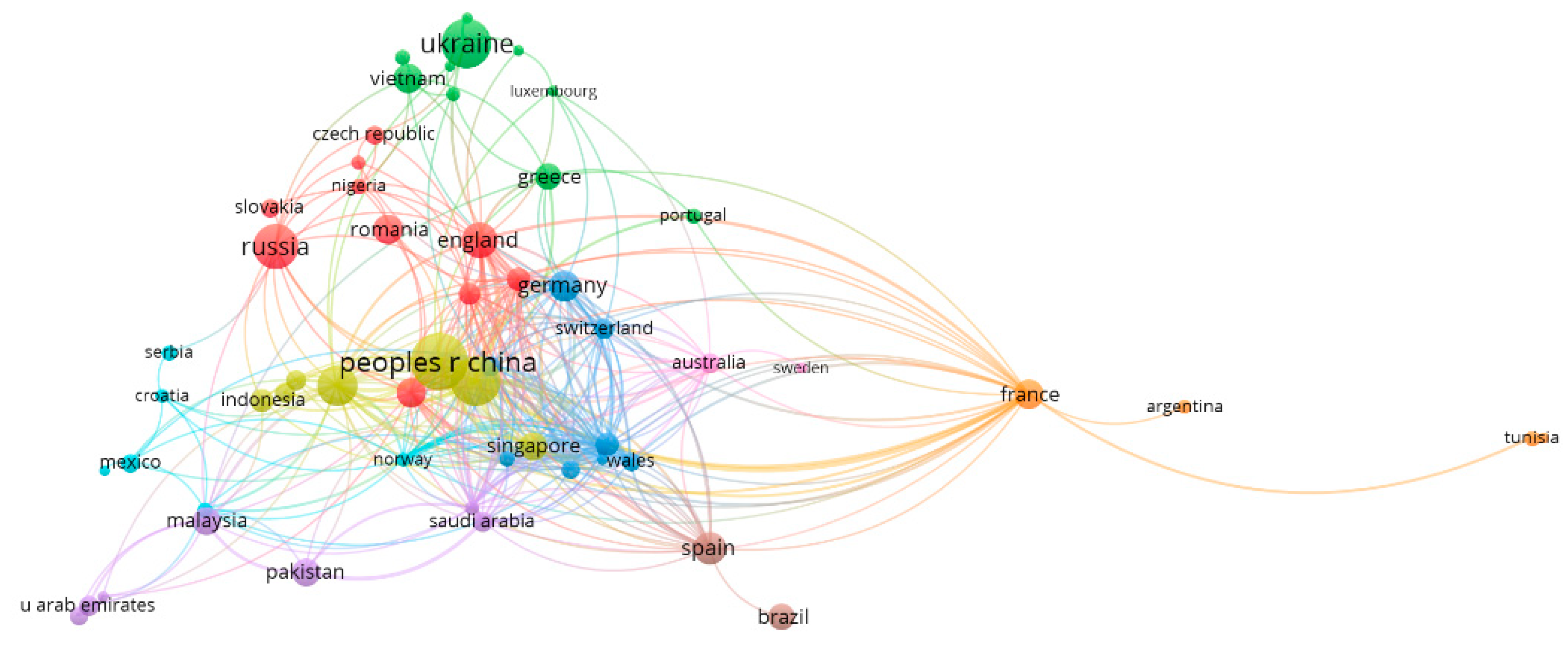

The graph in

Figure 7 displays co-authorships between 58 countries with at least two co-authored articles, grouped into 9 categories (

Table 8 and

Figure 7).

3.5. What are the main sources of publication on digital transformation in the banking sector?

Out of the 312 articles analyzed, 29.2% of them, which equals to 91 articles, were published in 21 journals. This indicates that the degree of concentration is low. On average, each of these articles received 57.2 citations, resulting in a total of 4,818 citations.

Table 9 shows a breakdown of the 21 media that have published more than 3 articles.

The main sources of academic information are Sustainability (20 articles), Financial and Credit Activity-Problems of Theory and Practice (8 articles), Technological Forecasting and Social Change (5 articles), then there is a group of journals with 4 published articles: Journal Of Financial Services Marketing, Journal of Risk and Financial Management, Applied Economics Studies, Mirovaya Ekonomika i Mezhdunarodnye Otnosheniya.

The main academic journals that present articles on the digital transformation of banking present a classification of their Quartile, where they can go from Q1 to Q4.

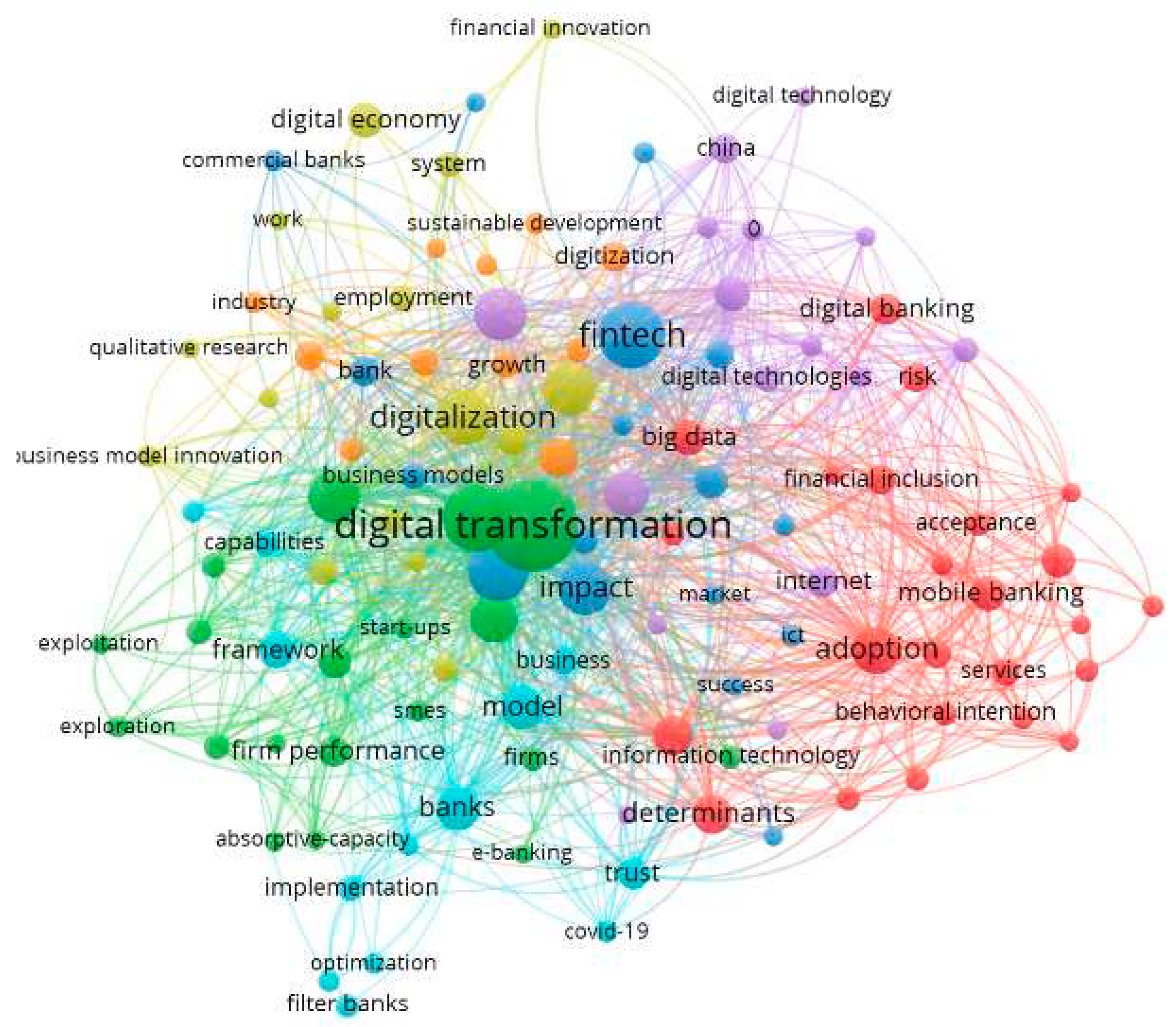

3.6. What other topics or descriptors are related to digital transformation in banking? Co-occurrence analysis.

What other keywords have with the main search term are analyzed to determine the relationships between them. That is, it corresponds to elements that are involved and closely related, coming from the set of scientific publications analyzed in the corpus.

The bibliometric analysis of keywords shows that, of the 116 keywords most included in the articles published in Web of Science, 18 appear more than five times and are used concurrently (see

Figure 8). This generates up to nine clusters, broken down as detailed in

Appendix A in

Table A1.

Based on the various analyses conducted, it can be inferred that the term “digital transformation” has been used the most, with a total of 91 instances belonging to the brown cluster. This is followed by “innovation” with 51 occurrences, “fintech” with 47 occurrences, and “performance” with 39 occurrences.

Table 10 displays the top 10 keywords by frequency, including the three interconnected terms.

4. Discussion

In this work, a bibliometric and scientometric analysis focused on the digital transformation in the banking sector was carried out. The purpose of this analysis is not to establish a causal relationship between scientific production and other variables. Instead, it serves as a foundation for examining the growth and progression of academic literature in a specific scientific field, specifically the digital transformation in the banking sector at an international level. To the best of our knowledge, this is the first scientometric study to focus on digital transformation in banking. As stated in the introduction, the aim of this study was to examine the most pertinent aspects of scientific literature on transformation. In order to accomplish our goal, we formulated a number of research questions and received satisfactory answers to all of them. The text below discusses the most noteworthy researchers in the field of digital transformation in banking, along with the countries and institutions where they conduct their research, the research networks they’re a part of the scientific journals that produce the most knowledge and publish their work, and the research topics relevant to digital transformation in banking. I have ensured that there are no spelling, grammar, or punctuation errors. With this type of analysis, it becomes feasible to identify potential areas of research based on the scientific impact and connections that can be established between various aspects associated with the advancement of digital transformation in the banking industry.

It can be inferred that there has been a significant increase in scientific publications over the past four years, which specifically explore the digital transformation within the banking sector. These publications comprise indexed articles, conference papers, and book sections - all indexed to WOS. This research area is relatively new and has seen a remarkable surge in the number of contributions in recent years. However, scientific production has been increasing, and the level of citations follows a positive correlation, reaching 17,861 citations for the 312 publications analyzed.

The main article are: “On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services” published in 2018 with 338 citations, by authors Peter Gomber, Robert Kauffman, Chris Parker and Bruce Weber, and the article “Fintechs: A literature review and research agenda” published in 2019, by the authors “Milian, EZ; Spinola, MD; de Carvalho, MM” with 127 citations, boost scientific productivity in the study area.

The growth of scientific production in the field of digital transformation in banking can be attributed, in part, to the emergence of new technologies and business models that rely on technological innovation. Overall, it can be said that these factors have contributed to the progress made in this field.

An important finding corresponds to the characteristics of the authors, it was possible to show that there are two types of authors: i) experienced researchers in administration disciplines related to new technologies, and ii) new researchers who have seen the study area as an opportunity. to focus their academic work. Thus, within the first group, we can name authors such as Robert Kauffman and David H Autor, and in the second group authors such as Markos Zachariadis.

The collaborative production between authors is low, it does not show large collaboration networks, but rather isolated groups between authors who do not have a large scientific production, together with a strong relationship by country and academic affiliation.

Out of all the journals on the subject of this research, it has been found that only 21 journals contribute to 29.2% of the publications. These journals have an average of 57.2 citations per publication, which is considered good since it is a relatively new field of study. Sustainability is the publication medium with the largest number of articles published, a recognized medium with an H index of 136, classified as Q1. Then, there are different specialized media in financial areas such as Financial and Credit Activity-Problems of Theory and Practice, Technological Forecasting and Social Change, Journal of Financial Services Marketing, and Journal of Risk And Financial Management.

It is worth noting that the majority of the authors analyzed have affiliations with institutions. Among these institutions, the Massachusetts Institute of Technology, the Russian Academy of Sciences, and the Financial University (all from the Russian Federation) stand out for their productivity. This evidence the promotion of the Russian government to investigate the digital economy.

Out of the 655 keywords published in WoS, 101 appeared more than eight times. The most frequently repeated words, with the highest number of interconnections, were Digital Transformation, Innovation, Fintech, Performance, and Digitization. It’s important to note that this work has limitations which could be useful for guiding future research. The sensitivity of scientometric analysis to the type of databases used creates a significant limitation. This research has focused on the WoS database, considering all types of publications and not only journal articles, which is why they were considered works of limited impact, although they represent interesting contributions. The second limitation of scientometric analysis is that it must be used in conjunction with a comprehensive and thorough analysis of various works. Future lines of research could be works that combine scientometric analysis with literature review. The third limitation arises from the conceptualization of digital transformation in banking, given that it arises as a sub-area of study of digital transformation or digital economy, so the spectrum of studies is limited to date.

Author Contributions

Álvaro Cepeda-Ortiz has been involved in conceptualization, Data Curation, Formal Analysis, Investigating and conducting the study. Miguel Ángel Gonzalez Lorenzo has been supervising and validating data of the study.

Funding

This research received no external funding.

Institutional Review Board Statement

Informed consent was obtained from the respondents of the survey.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data will be made available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Co-occurrence clusters in the use of keywords plus.

Table A1.

Co-occurrence clusters in the use of keywords plus.

| Cluster |

Keywords |

| Clúster 1 – 11 items - Rojo |

Digital Transformation – Digital Banking – BigData – Challenges- Financial inclusion – Information – Internet Banking – Mobile Banking – Risk – Sustainability – Technology |

| Clúster 2 – 10 Items – Verde |

Banking – Blockchain – China – Digitalization – Financial Services – Fintech – Framework – Impact – systems – Transformation |

| Clúster 3 – 7 items – Azul |

Adoption – Determinants – Information Technology – Internet – Model – Performance – Trust |

| Clúster 4 – 4 items – Amarillo |

Bank – digital economy – Digitalization – Management |

| Clúster 5- 4 items - Morado |

Banks – Dynamic capabilities – Firm Performance – Innovation |

References

- Schwab, K. The Fourth Industrial Revolution; Crown Business, 2017. [Google Scholar]

- Yoo, Y.; Boland, R.J.; Lyytinen, K.; Majchrzak, A. Organizing for Innovation in the Digitized World. Organ. Sci. 2012, 23, 1398–1408. [Google Scholar] [CrossRef]

- Matt, C.; Hess, T.; Benlian, A. Digital Transformation Strategies. Bus. Inf. Syst. Eng. 2015, 57, 339–343. [Google Scholar] [CrossRef]

- Schuchmann, D.; Seufert, S. Corporate Learning in Times of Digital Transformation: A Conceptual Framework and Service Portfolio for the Learning Function in Banking Organisations. Int. J. Adv. Corp. Learn. (IJAC) 2015, 8. [Google Scholar] [CrossRef]

- Cuesta, C.; Ruesta, M.; Tuesta, D.; Urbiola, P. La transformación digital de la banca. BBVA Res. Obs. Digit. 2015. [Google Scholar]

-

Marketing Research: An Applied Orientation; Malhotra N.K. Pearson, 2021.

- Meneghini, R.; Packer, A.L. The extent of multidisciplinary authorship of articles on scientometrics and bibliometrics in Brazil. Interciencia 2010, 35, 510–514. [Google Scholar]

- Vega Muñoz, A.; Salinas Galindo, C.M. Análisis de la producción científica en asuntos públicos de Chile y Perú. Desafíos para una mejor gestión pública. LEX 2017, 15, 463. [Google Scholar] [CrossRef]

- Granda-Orive, J.I.; Alonso-Arroyo, A.; García-Río, F.; Solano-Reina, S.; Jiménez-Ruiz, C.A.; Aleixandre-Benavent, R. Ciertas ventajas de Scopus sobre Web of Science en un análisis bibliométrico sobre tabaquismo. Revista Española de Documentación Científica 2013, 36, e011. [Google Scholar] [CrossRef]

- OSAREH, F. Bibliometrics, Citation Analysis and Co-Citation Analysis: A Review of Literature I. Libri 1996, 46, 149–158. [Google Scholar] [CrossRef]

- Velt, H.; Torkkeli, L.; Laine, I. Entrepreneurial Ecosystem Research - Bibliometric Mapping of the Domain. 2020.

- Zupic, I.; Čater, T. Bibliometric Methods in Management and Organization. Organ. Res. Methods 2015, 18, 429–472. [Google Scholar] [CrossRef]

- ElMassah, S.; Mohieldin, M. Digital transformation and localizing the Sustainable Development Goals (SDGs). Ecol. Econ. 2020, 169. [Google Scholar] [CrossRef]

- Araya-Castillo, L.; Hernández-Perlines, F.; Moraga, H.; Ariza-Montes, A. Scientometric Analysis of Research on Socioemotional Wealth. Sustainability 2021, 13. [Google Scholar] [CrossRef]

- Vega-Muñoz, A.; Arjona-Fuentes, J.M.; Ariza-Montes, A.; Han, H.; Law, R. In search of ‘a research front’ in cruise tourism studies. International Journal of Hospitality Management 2020, 85, 102353. [Google Scholar] [CrossRef]

- Diodato, V.P.; Gellatly, P. Dictionary of Bibliometrics; UK Routledge, 2012. [Google Scholar]

- VANTI, N. Métodos cuantitativos de evaluación de la ciencia: bibliometría, cienciometría e informetría. Investig. Bibl. Arch. Bibl. Inf. 2000, 14. [Google Scholar] [CrossRef]

- Denyer, D.; Tranfield, D. Producing a systematic review. In The Sage Handbook of Organizational Research Methods; Buchanan, D., Bryman, A., Eds.; SAGE, 2009; pp. 671–689. [Google Scholar]

- Wang, C.L.; Chugh, H. Entrepreneurial learning: Past research and future challenges. Int. J. Manag. Rev. 2014, 16, 24–61. [Google Scholar] [CrossRef]

- Vega, A.; Galindo, C.M. Análisis de la producción científica en asuntos públicos de Chile y Perú. Desafíos para una mejor gestión pública. LEX 2017, 15, 463. [Google Scholar] [CrossRef]

- Cruz Ramírez, M.; Escalona Reyes, M.; Cabrera, S.; Martínez Cepena, M. Análisis cienciométrico de las publicaciones educacionales cubanas en la WoS y Scopus (2003-2012). Rev. Española Doc. Científica 2014, 37, e058. [Google Scholar] [CrossRef]

- Frenken, K.; Hardeman, S.; Hoekman, J. Spatial scientometrics: Towards a cumulative research program. J. Informetr. 2009, 3, 222–232. [Google Scholar] [CrossRef]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions, or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).