1. Introduction

This article aims to explore the influence of digitalization on the evaluation of budgeting functions, encompassing planning, motivation, performance appraisal/control, and their qualitative attributes. Grounded in the principles of contingency theory, the study also considers the effect of various factors that condition the impact of digitalization on the assessment of budgeting functions. These factors include firm size, environmental uncertainty, technological advancement, organizational culture, competition, as well as corporate goals and strategy. Moreover, the research delves into the interplay between the evaluation of budgeting functions and digitalization, examining their joint effect on the accomplishment of budgetary tasks and overall organizational performance, spanning financial outcomes and sustainable development endeavors.

Within the scholarly discourse, extensive research has been conducted on the influence of specific contingent variables on budgeting functions. These variables include firm size [

1], [

2], organizational structure [

3] environmental uncertainty [

4], [

5], [

6], [

7], technological sophistication [

8], [

9], [

10], organizational culture [

11], [

12], competition [

13], as well as corporate goals and strategies [

14], [

15] However, these studies notably lack any references to the impact of digitalization on budgeting and its functions.

Within the existing literature, extensive investigations have been conducted to explore the impact of digitalization on the practice of management accounting solutions in enterprises. Noteworthy studies conducted by Rikhardsson and Yigitbasioglu (2018) [

16], Garanina et al. (2022) [

17], Kostić and Sedej (2022) [

18], Granlund and Malmi (2002) [

19], Martin et al. (2016) [

20], Yigitbasioglu (2019) [

21], and Möller et al. (2020) [

22] have provided valuable insights in this area. This article highlights the preliminary nature of most investigations in the domain, primarily focusing on the realm of management accounting, rather than specifically delving into budgeting, its functions, and qualitative attributes. While studies conducted by Bhimani (2020) [

23] and Bhimani and Willcocks (2014) [

24] have contributed substantially, empirical research remains scarce in this area. Moreover, the research at hand addresses a critical void as it pertains to the comprehensive evaluation of the influence of digitalization on budgeting functions, their qualitative characteristics, and the resultant impact on organizational achievements, including financial performance and sustainable development goals. Selected studies, namely Baumöl and Perscheid (2019) [

25], Bergmann et al. (2020) [

10], Dillerup et al. (2019) [

26], Duh et al. (2006) [

27], Kappes and Klehr (2021) [

28], and Nasca et al. (2018) [

29], touch upon certain qualitative aspects of budgeting. However, they fall short of providing a holistic assessment of digitalization’s implications on budgeting functions, their qualitative features, and the outcomes in terms of organizational performance. Bergmann et al. (2020) [

10] found a positive correlation between data infrastructure refinement and the use of business analytics in budgeting. They also discovered that organizations emphasizing budgeting functions were more likely to adopt business analytics in budgeting, leading to higher satisfaction with the budgeting process. However, the study only focused on the impact of one digitalization tool, business analytics.

Studies consistently indicate that the implementation of digitalization has a positive impact on enterprise performance, including financial achievements [

30], [

31], [

32], [

33], [

34], [

35], [

36] and a company’s sustainable development goals [

37], [

38], [

39]. However, these studies predominantly focus on the effects of digitalization in the operational aspects of the enterprise, with limited attention given to supporting (managerial) processes, particularly budgeting and budgetary control. Furthermore, the role of budgeting in supporting the achievement of a company’s sustainable development goals has primarily been analyzed through the lens of project budgeting rather than comprehensive budgeting (master budget).

From the analysis of previous studies, it becomes evident that there exist research gaps, particularly in the following areas: the impact of digitalization on the execution of budgeting functions, consideration of the effect of contingent variables in this relationship (such as firm size, environmental uncertainty, competition, technology, etc.), establishing correlations between the execution of budgeting functions and the assessment of budgetary task achievements, the financial outcomes of budgeting, and achievements in sustainable development in the context of implementing digitalization in budgeting.

The study used a survey, conducted online and anonymously, targeting company budgeting staff around the world. It was distributed through social media and survey platforms, as well as directly to companies from the EMIS database. Structural Equation Modelling (SEM) was utilized for measurement validation and to evaluate the structural model. The PLS-SEM technique was used to assess the complex relationships among multiple variables, and the mixed model was employed (both reflective and formative).

The article consists of six sections, including the introduction.

Section 2 presents prior research on the determinants of budgeting function execution, the impact of digitalization on firm performance, the consequences of digitalization in managerial accounting systems and budgeting, and the formulation of the research hypotheses.

Section 3 describes the data sources and research methodology.

Section 4 contains the research results. In

Section 5, a discussion is conducted in light of the research findings resulting in final conclusions (

Section 6).

3. Data and methodology

The research was conducted based on a survey study. The survey instruments were developed in combination with a literature review. The data for the questionnaire was collected through the use of a non-interventional, anonymized, self-administered, web-based survey to be completed by individuals involved in budgeting within their company (management, chief accountants, and accounting specialists) between August and November 2023. The survey was distributed using social media and groups devoted to survey exchanges, as well as via the online research platforms Survey Swap and Survey Circle. Moreover, the links to surveys were sent by email to 37600 companies, whose email addresses were identified from the EMIS database. Ultimately, 319 responses were received, which represents a 0.85% response rate. The dominant part of the operational activities of the companies studied were conducted in a range of countries, namely: Argentina, Armenia, Australia, Austria, the Bahamas, Bahrain, Bangladesh, Belgium, Bhutan, Bulgaria, Canada, China, Costa Rica, Croatia, Cyprus, Denmark, Egypt, Finland, France, Georgia, Germany, Greece, Hungary, India, Ireland, Israel, Italy, Jordan, Malaysia, Malta, Mauritius, Mexico, Morocco, the Netherlands, Pakistan, Poland, Portugal, Romania, Saudi Arabia, the Seychelles, Singapore, Slovenia, South Africa, Spain, Switzerland, Thailand, the United Arab Emirates, the United Kingdom, the United States of America, and Vietnam.

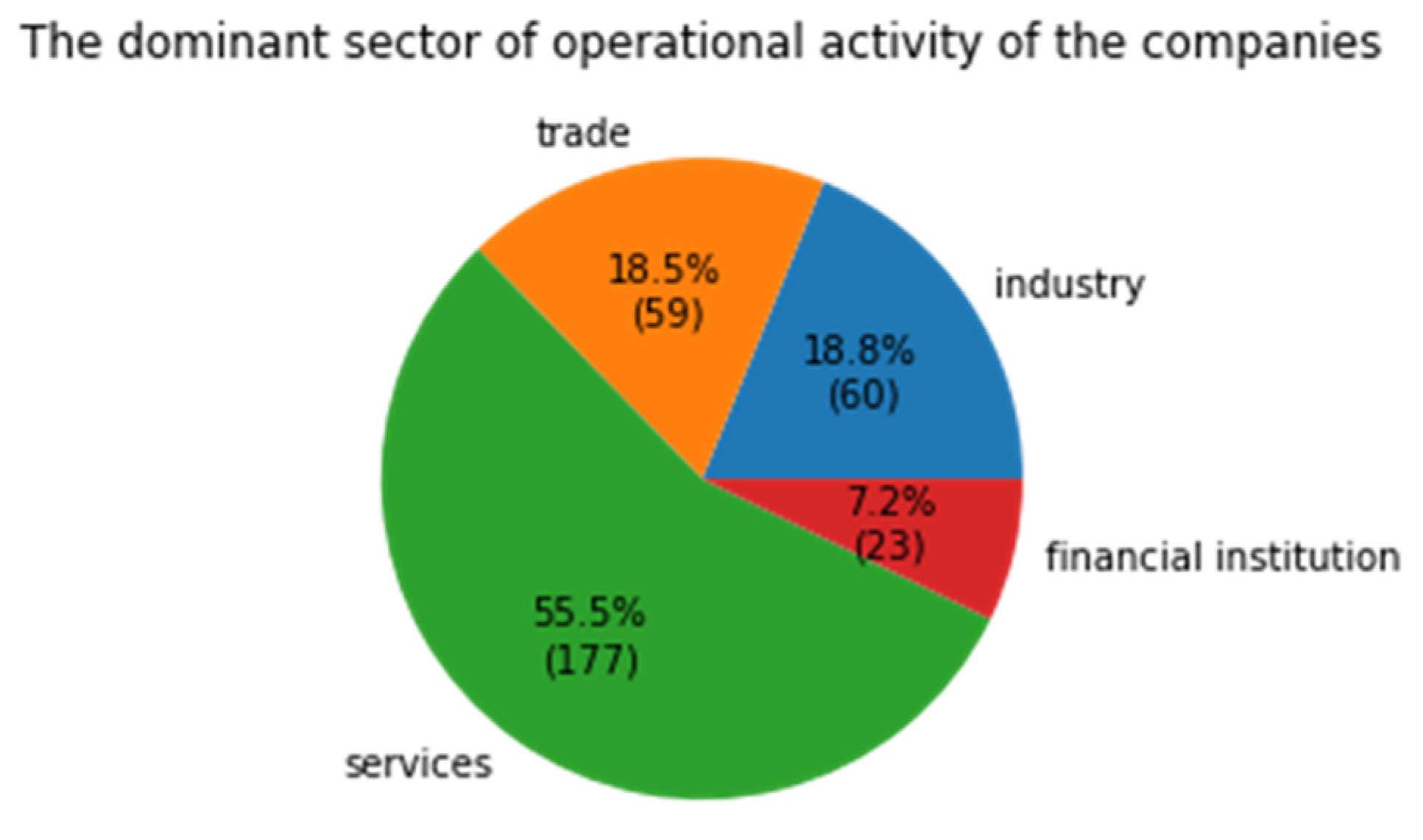

The dominant sector of operational activity of the companies studied is presented in

Figure 1.

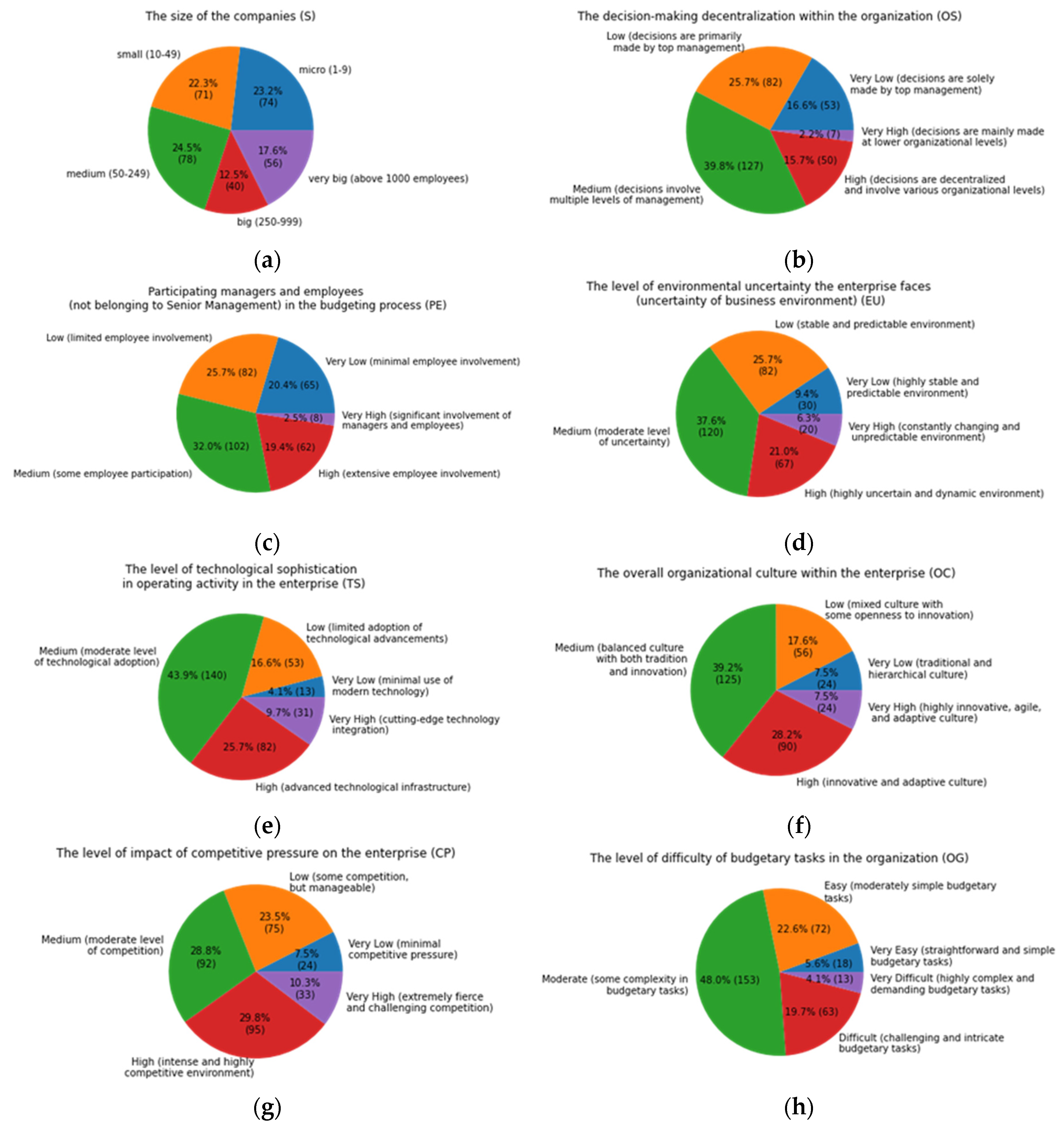

The first part of the questionnaire was related to budgeting contingencies. The following contingencies were analyzed:

size of enterprise (S),

decision-making decentralization (OS),

participation of managers and employees (not belonging to Senior Management) in budgeting (PE),

environmental uncertainty (EU),

technologically sophisticated operating activity (TS),

organizational culture (OC),

competitive pressure (CP),

difficulty of budgetary tasks (OG),

support of competitive strategy and functional strategies (sales, marketing, production, procurement, etc.) (BS),

quality of the organizational structure (SQ).

All the variables in the questionnaire were rated on a five-point Likert scale. The responses are coded as follows: 1 – the lowest level of a particular contingency, 2 - low level, 3 – medium level, 4 – high level, 5 – the highest level. The responses are presented in

Figure 2, whilst the statistics are displayed in

Table 1.

Following this, questions were asked regarding the application of the following digitalization solutions in budgeting. The following technologies were analyzed: Integrated MIS - in particular ERP systems (MIS/ERP), cloud computing (CC), Big Data Analytics (BDA), business intelligence tools (BI), Customer Relationship Management systems (CRM), Robotic Process Automation (RPA), Artificial Intelligence/Machine Learning (AI/ML), the Internet of Things (IoT), digital collaboration and communication tools (DCC), dedicated information systems for budgeting and control (IBS), Accounting Information Systems with budgeting solutions (AIS), Blockchain technology (BC), and Excel/Access (E/A). The intensity of the use of specific digitalization solutions in budgeting was evaluated by respondents using the following possible responses: no implementation (1), planned implementation within the next 3 years (2), partial implementation (3), moderate implementation (4), and high level of implementation (5). The responses and statistics are presented in

Table 2.

The results indicated that the implementation of modern technologies in the budgeting processes is in its infancy. The technologies usually employed in budgeting solutions are based on Excel/Access (mode = 5, median = 4). Emerging sophisticated technologies such as Machine Learning/Artificial Intelligence, Robotic Process Automation, and the Internet of Things were used to a small extent (mode = 1, median = 2), especially Blockchain (median and mode = 1).

The respondents were subsequently asked about budgeting functions and the qualitative characteristics of budgeting in their companies. The following functions were investigated:

planning – contribution to creating a financial plan outlining future goals, expenses, and revenues for the organization (EP),

motivating – budgets serve as targets for teams and individuals, motivating them to achieve budgetary tasks, in particular through incentivizing (EM),

controlling – establishing performance benchmarks and working with teams of individuals (EV),

coordinating – fostering coordination, communication, and collaboration among different departments within the organization (EC),

learning from past experiences and adapting to changing circumstances through budgeting (EL),

simplicity of budgeting (EG),

flexibility of budgeting (EF),

efficiency of budgeting (EE),

level of integration of budgeting with other information systems (ERP, PMS, CRM, HMR, P2P, and others) (EI),

level of detail and completeness of information required in budgeting (ED),

level of adaptation to new circumstances resulting from budgeting (EA).

Responses were coded using a scale from 1 (very low rating), 2 (low rating), 3 (moderate rating), 4 (high rating) to 5 (very high rating). The results are presented in

Table 3.

In the next step, questions were asked regarding the benefits of budgeting. In this stage of the research, we verified whether perceived budget task execution (TE), perceived financial benefits from budgeting (FP1), perceived financial performance of the enterprise (FP2), and evaluation of supporting the company’s sustainable development (SD) were positively correlated with the evaluation of budgeting functions and the qualitative characteristics of budgeting. Variable TA was measured by indicating the level of execution of budget tasks (from 1 – very low, to 5 – very high). Variable FP1 encompassed the assessment of perceived financial benefits from budgeting and was measured on a scale from 1 (very poor financial benefits) to 5 (very significant financial benefits). Variable FP2 reflected the assessment of the company’s financial performance on a scale from 1 (very poor financial results) to 5 (very good financial results). The respondents rated to what extent budgeting in the company supported the company’s sustainable development (variable SD) on a scale from 1 (budgeting does not support the company’s sustainable development) to 5 (budgeting fully and actively promotes the company’s sustainable development). The results and statistics are presented in

Table 4.

Following this, Structural Equation Modeling (SEM) was employed to validate the measurements and to assess the structural model. First-generation multivariate data analysis techniques, for example multiple and logistic regression and analysis of variance (ANOVA), have crucial limitations, namely: a simple model structure involving one layer of dependent and independent variables, that all variables should be considered observable, and the assumption that variables are measured without error [

106]. These limitations can be overcome by using second-generation techniques, namely SEM, which are increasingly popular in academia. The modeling uses the interrelationships between latent constructs involved in the analysis and allows for the assessment of complex relationships among multiple variables. Generally, there are two types of SEM techniques: CB-SEM and PLS-SEM. CB-SEM is used for existing theory testing and confirmation, while for prediction and theory development, the appropriate method is PLS-SEM [

106]. Moreover, PLS-SEM is the preferred approach for formative measurement models [

106]. In this study, due to the theory development, PLS-SEM was employed to validate the measurements and asses the structural model.

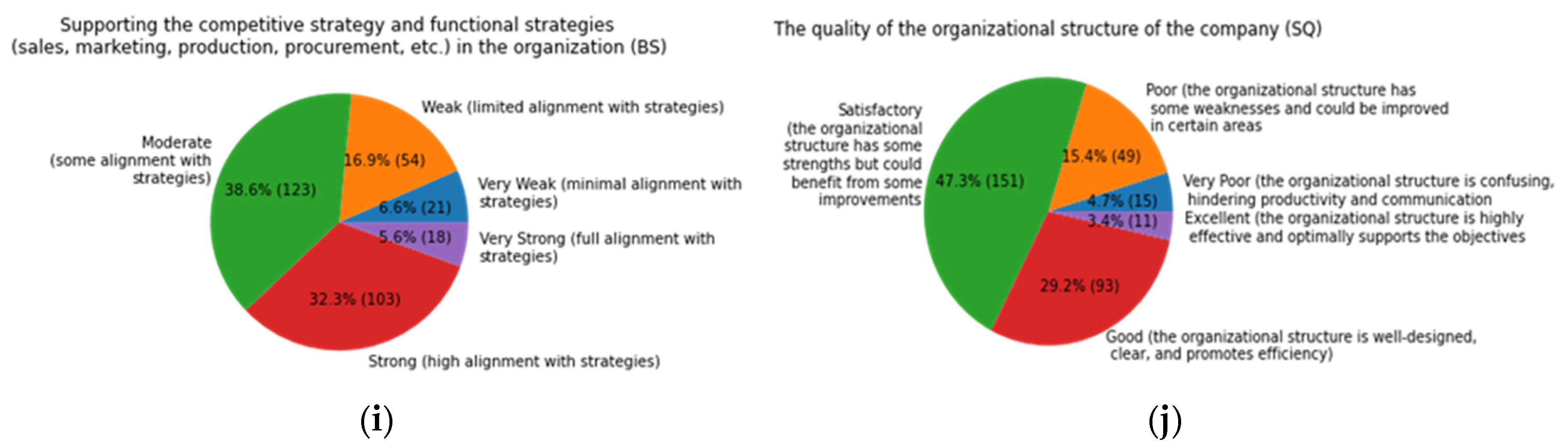

There are two conceptual approaches to measurement: reflective and formative. In the reflective measurement model, the indicators are considered to be manifestations of the construct, which means that the relationships go from the construct to the indicators, while in the formative measurement model, the indicators define and form the construct [

107], so a change in the indicators results in a change in the construct. In this study, taking into account theoretical considerations such as the nature of the latent constructs, the direction of causality between the indicators and latent constructs, and the characteristics of the items used to measure the constructs [

108], a mixed model was employed (both reflective and formative). The formative model was used for c constructs

Contingencies and

Digitalization because each indicator contributes a specific meaning to the latent variable. Meanwhile, the indicators manifested by the constructs

Functions and

Benefits share a common theme, are interchangeable, and are highly correlated. The correlation was confirmed using heat maps (

Figure 3). The heat maps display the correlation between multiple indicators for the variables

Functions and

Benefits as a color-coded matrix and the Pearson correlation coefficient. Accordingly, the latent variables

Functions and

Benefits are reflective in nature.

Each model consists of two sub-models: inner or structural, which links together the latent variables (constructs), and the outer or measurement sub-model which explains the relationships between the latent variable and its indicator variables [

106].

The development of the model and the calculations, as well as testing the hypotheses, were conducted with the use of SmartPLS 4.0 software [

109].

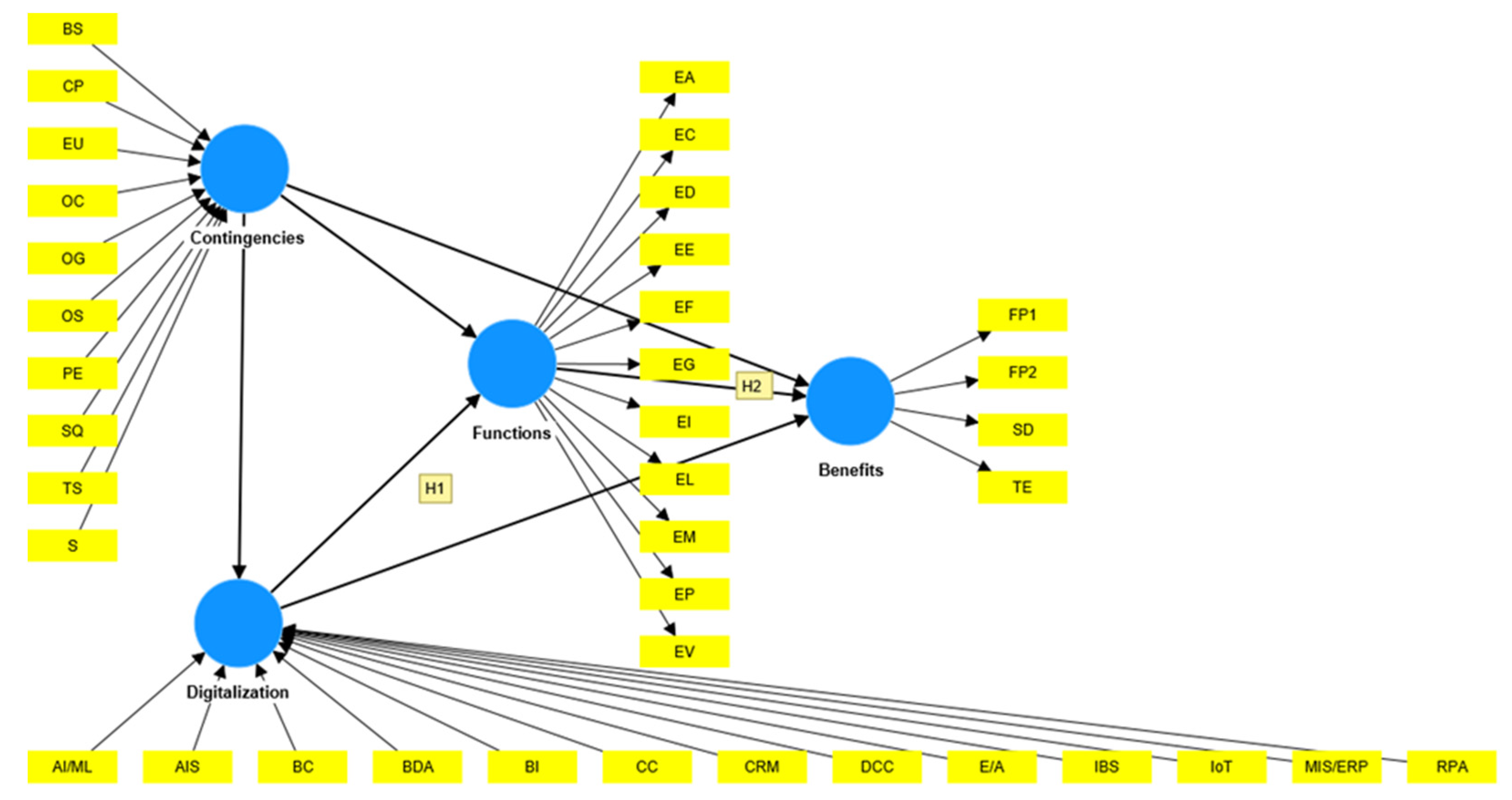

The model contains four latent constructs depicted in the ovals:

Contingencies, Digitalization, Functions, and

Benefits. The indicators are presented in rectangles. The construct

Contingencies is formed from the indicators presented in

Table 2, while

Table 3 shows the indicators of

Digitalization, and respectively

Table 4 and Table 5

Functions and

Benefits. The single-headed arrows point in the direction that represents the directional relationship [

106].

The study model consists of two mediator variables

Digitalization and

Functions. The mediators are intermediate variables that increase or decrease the effect of the independent variables on the dependent variable [

110], which means that a third mediator variable intervenes between the two other related constructs. In the study model,

Functions mediates the relationships between

Contingencies and

Benefits as well as

Digitalization and

Benefits, whereas

Digitalization intervenes between

Contingencies, Functions, and

Benefits.

The model was calculated using 3000 iterations and a 10-7 stop criterion to determine the path coefficients, outer weights and loadings. In the further stage, the bootstrapping procedure was employed to determine the significance of the estimated path analysis. In this non-parametric procedure, a large number of samples are drawn from the original sample with replacement [

106]. In this research, 5000 bootstrap samples were used and the procedure was conducted with a 95% confidence level. The study model is presented in

Figure 5. The analysis of the formative models focuses on the outer weights, while the reflective models take into account the outer loadings.

4. Results

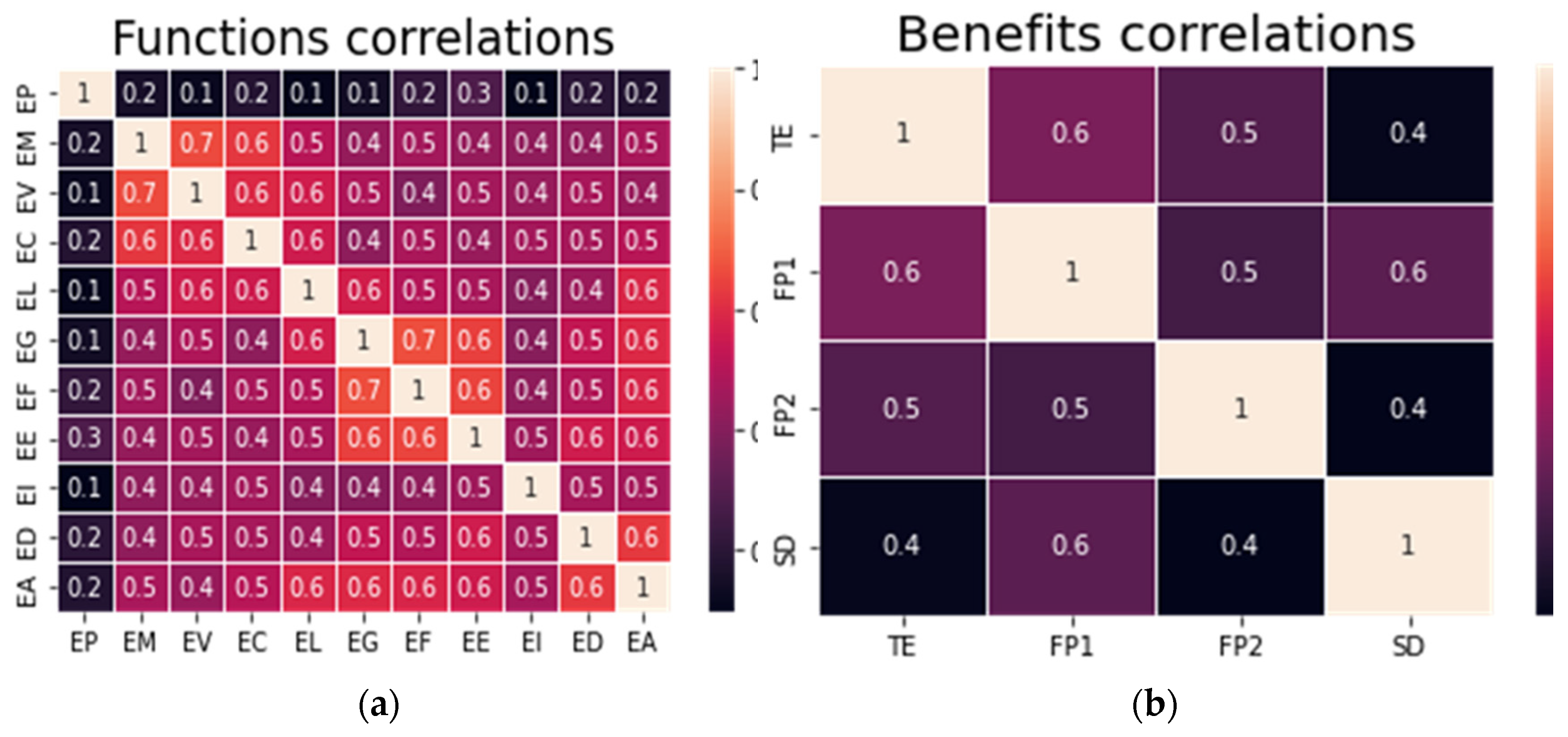

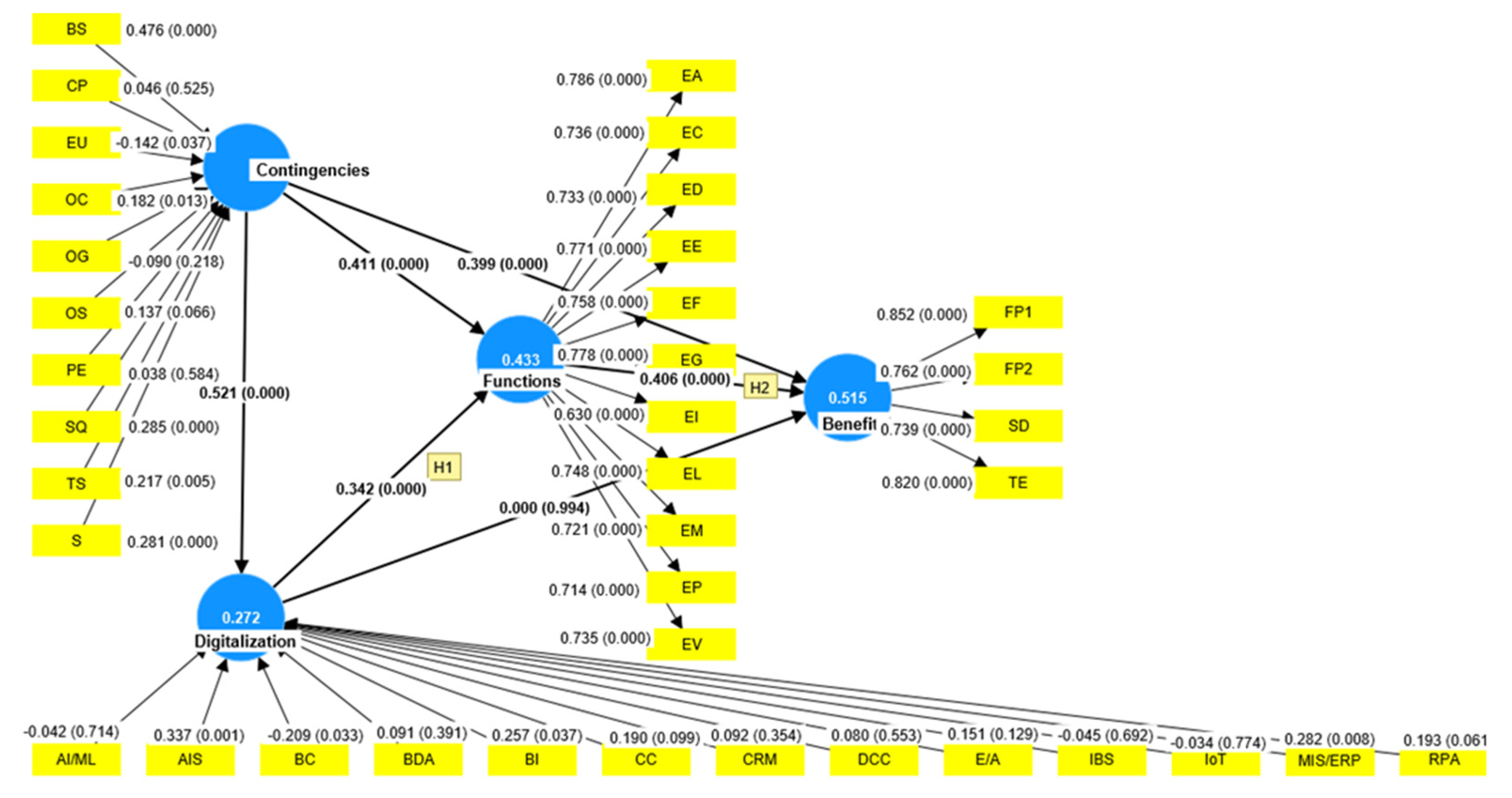

In

Figure 5, the results of PLS-SEM modeling are presented in accordance with the structure described in

Figure 4. In the inner model, the path coefficients and

p-value are displayed, while in the outer model – the outer weights or loadings and the

p-value. Additionally, the R-square (R2) was calculated for the constructs and is presented in the ovals.

The determination of R2 for the constructs demonstrates a moderate fit of the model for the variables

Functions and

Benefits, and a weak fit for

Digitalization [

110]. The R2 for

Digitalization is 0.272, which means that the proposed model explains 27.7% variance of the variable, while respectively for the variables

Functions it is 43.3% and

Benefits 51.5%.

Analysis of mediators indicated that the path coefficients are positive and significant (p<0.05) for Digitalization -> Functions -> Benefits, Contingencies -> Functions -> Benefits, Contingencies -> Digitalization -> Functions with medium partial positive effect, for the path: Contingencies -> Digitalization -> Functions -> Benefits – with a small partial positive effect, and no effect for Contingencies -> Digitalization -> Benefits. (

Table 6).

The effect size can be interpreted based on the path coefficient, with the values indicating mediating effect sizes of 0.01 for a small effect, 0.09 for a medium effect, and 0.25 for a large effect [

111]. In the further analyses, the total effect was investigated (equivalent to the direct and indirect effects of the constructs through mediation).

The findings from the bootstrapping, including the mean from the original sample (O), the mean in bootstrapping, i.e., the average coefficient over all bootstrapping runs (M), the standard deviation (STDEV), the t-values, and

p-values, as well as the confidence intervals, are presented in

Table 7.

The path coefficient can be interpreted in the following way: if Digitalization changes by one standard deviation, Functions changes by 0.342 standard deviations. As we hypothesized, digitalization positively affects budgeting functions (path coefficient = 0.342, p < 0.001), supporting H1. Furthermore, if the variable Functions changes by one standard deviation, the variable Benefits increases by 0.406 standard deviations. Budgeting functions are significantly related to the benefits of budgeting (path coefficient 0.406, p < 0.001), which provides empirical support for H2.

The next stage is evaluating the quality of the measurement model. Assessment of the reflective measurement model involves indicator reliability, internal consistency reliability, convergent validity, and discriminant validity [

106].

Indicator reliability is first assessed by observing the factor loadings and examining how much of each indicator’s variance is explained by its construct, which is indicative of indicator reliability (

Table 8). The outer loading, which constitutes the absolute correlations between a construct and each of its manifest variables, should be higher than 0.7 [

112], while above 0.708 is recommended as such a value indicates that the construct explains more than 50% of the indicator’s variance [

106].

The results show that for the latent variable Functions, all factor loadings are above 0.708 except for EI (i.e., the level of integration of budgeting with other information systems), for which the loading is 0.630. Furthermore, all indicator loadings of the construct Benefits are high, above the recommended value. Moreover, the results are significant.

Internal consistency reliability involves an examination of the extent to which indicators measuring the same construct are associated with each other using the following metrics: Cronbach’s alpha, composite reliability (rho_a), and composite reliability (rho_c), whose recommended values are between 0.70 and 0.90, whereas a result above 0.95 indicates redundancy [

106]. The results, as shown in

Table 9, are acceptable.

The next step involves the assessment of convergent validity based on the average variance extracted (AVE), which measures the extent to which the construct converges to explain the variance of its indicators. The results are also satisfactory since the average variance extracted (AVE) value for each construct in

Table 9 is no less than the recommended threshold value of 0.50.

The fourth step is measurement discriminant validity. Hair et al. suggest using the heterotrait-monotrait ratio (HTMT), which for conceptually different constructs should be less than 0.85 [

106]. The result is acceptable since HTMT for the variables Functions <-> Benefits is equal to 0.739.

As our PLS-SEM model includes both formative and reflective constructs, it is essential to evaluate the formatively specified constructs. The three key steps for evaluating formative models include the assessment of convergent validity, the indicator of collinearity (VIF, variance inflation factor), statistical significance, and the relevance of the indicator weights [

106].

Convergent validity in the formative measurement model involves each latent variable using global single-item measurements in the research questionnaire with generic assessments of the concepts that capture the essence of the constructs. Then, to do a convergent validity test, the global single-item measurements can be employed in the redundancy analyses and the correlation between the formative construct and the single-item measurement should be greater than 0.708 [

113]. In the case of a lack of such global single-item measurement, the best solution is to use a reflective measurement model of the same model, as was applied in this study.

To assess the level of collinearity, the variance inflation of factor (VIF) values was evaluated (

Table 10). The results indicate that VIF < 3 for all variables, hence collinearity is not a problematic issue [

106].

The last step in the evaluation of the formative measurement models comprises the examination of the statistical significance and relevance of the indicator weights [

106].

Table 11 presents the outer weights.

An outer weight close to 0 means a weak relationship, a weight close to 1 indicates a strong positive relationship, and a weight close to -1 shows a strong negative relationship [

114].

Based on the results presented in

Table 11, it is evident that several key indicators play a significant role for the construct Contingencies. These include internal contingencies such as BS (strategy), SQ (structure), and S (size), as well as external contingencies such as EU (environmental uncertainty), OC (culture), and TS (technology). Interpretation of the indicator weight is based on its absolute and relative size. This means that support of competitive strategy and functional strategies (sales, marketing, production, procurement), the size of the company, organizational culture and technological sophistication imply a positive contribution, while respectively environmental uncertainty has a relatively negative contribution to the construct.

Meanwhile, for construct Digitalization the following indicators are significant: AIS, BC, BI, MIS/ERP. Therefore, such technologies as Integrated MIS in particular Enterprise Resource Planning systems (MIS/ERP), business intelligence tools (BI), and Accounting Information Systems with budgeting solutions (AIS) indicate a higher relative contribution to the construct, while Blockchain (BC) has a negative contribution. Although the remaining indicators are not statistically significant, it is uncommon for them be removed from the model, as formative measurement theory requires all indicators in order to fully capture the domain of the latent variable [

114].

5. Discussion

The research aimed to investigate the impact on budgeting functions of digitalization used in budgeting, on the grounds of contingency theory. As technology continues to change the world in many ways, it also influences budgeting processing in enterprises and the role of controllers. A literature review was carried out in order to propose a model related to the implementation of technologies in budgeting processes, and its impact on the functions, qualitative characteristics and benefits arising from budgeting, taking into account company contingencies. In its theoretical perspective, the model and its constructs, as well as the indicators were based on prior literature. Our PLS-SEM model includes both formative and reflective constructs. The construct validity and reliability of the model were conducted according to criteria for both measurement theories: formative and reflective. The assessment of the model is satisfactory since it meets all the requirements.

The findings indicate that the current state of digitalization in budgeting is rather low, and that the adoption of technologies is still limited, except for Excel and Access. The findings are convergent with the conclusions of the report prepared by IGC (International Group of Controlling) [

115].

The research results confirm both hypotheses. Digitalization positively affects budgeting functions and the qualitative characteristics of budgeting (path coefficient =0.342, p<0.001), supporting hypothesis H1. In this regard, the results of our research expand the research approaches and results obtained by other authors: (Moll and Yigitbasioglu [

21], Möller et al. [

22], Bergmann et al. [

10], as well as Raisch and Krakowski [

100], however our research results pertain to a broader spectrum of digitalization tools used in budgeting. Additionally, analysis of the mediation models reveals a medium partial positive effect, (0.179, p<0.001) for the path Contingencies - Digitalization (of budgeting) - Functions of budgeting (and qualitative characteristics of budgeting). This means that the adoption of digitalization strengthens the effect of contingencies on budgeting functions. We confirm that budgeting functions and their qualitative characteristics (incorporating: planning, motivating, controlling, coordinating, learning from past experiences and adapting to changing circumstances through budgeting, simplicity of budgeting, flexibility of budgeting, and efficiency of budgeting) are significantly related to the benefits of budgeting. The path coefficient for Functions (of budgeting and the quantitative characteristics of budgeting) - Benefits (arising from budgeting) is equal to 0.406, p<0.001, with the outer weights of the indicators positive and statistically significant, which provides empirical support for H2.

We have provided evidence that selected internal company contingencies, i.e., support of competitive strategy and functional strategies, size of the company, quality of the organizational structure and support of competitive strategy, as well as external contingencies, i.e., technological sophistication and organizational culture, have a positive contribution. Meanwhile, the next external contingency, i.e., environmental uncertainty, has a relatively negative contribution to the construct. The findings of our research indicate that, even with the incorporation of digitalization in budgeting, the impact of contingency variables on the implementation of budgeting functions remains significant, especially as regards internal contingencies. These variables, whose importance has previously been demonstrated by other authors, were identified without considering the aspect of digitalization in budgeting: [

1], [

2], [

3], [

8], [

9], [

10], [

11], and [

15]. At the level of significance of individual contingencies, our research did not confirm the importance of competition, which is inconsistent with some research findings [

48], [

13]. It is noteworthy that according to our research findings, the level of environmental uncertainty is negatively correlated with the assessment of budgeting function execution. This may be the result of budgeting methods not being adequately adapted by companies to conditions of higher environmental uncertainty [

3], [

6], [

7], however it certainly requires more detailed investigation.

The digitalization technologies used in budgeting: integrated MIS in particular Enterprise Resource Planning systems (MIS/ERP), business intelligence tools (BI), and accounting information systems with budgeting solutions (AIS) indicate a higher relative contribution to the construct, while Blockchain (BC) has a negative relative contribution, which addresses the research gap identified by Rikhardsson and Yigitbasioglu [

16]. The findings of our research indicate that the use of ERP systems in budgeting is a significant factor in enhancing the execution of budgeting functions, which contradicts the results described by Granlund and Malmi [

19]. In the context of BI systems, our research findings confirm the positive role of their application in budgeting, in agreement with Bergmann et al. [

10]. Although the remaining indicators for digitalization are not statistically significant as individual variables, they are required in order to fully capture the domain of the latent variable (Digitalization), indirectly indicating their role as digitalization tools enhancing budgeting functions and the qualitative characteristics of budgeting. Our research findings confirm the impact of digitalization in budgeting on selected qualitative characteristics of budgeting, including simplicity of budgeting (confirming the findings of Ghobakhloo [

29]), flexibility of budgeting (in accordance with Koch et al. [

103]), efficiency of budgeting (relating to Duh et al. [

27]), the level of detail and completeness of information required in budgeting (corresponding with Amann [

104]), and the level of adaptation to new circumstances resulting from budgeting (with reference to Kappes and Klehr [

28]).

The findings demonstrate that for the latent variable Functions (functions of budgeting and the qualitative characteristics of budgeting), all the factor loadings are high above 0.708, except for EI (level of integration of budgeting with other information systems), for which the loading is 0.630. Furthermore, all the indicator loadings of the construct Benefits (of budgeting) are also high, above the recommended value. Consequently, the constructs explain more than 50% of the indicator’s variance. The significant benefits arising from budgeting include: perceived budget task execution, perceived financial benefits from budgeting, perceived financial performance of the enterprise, and evaluation of support for the company’s sustainable development. Our research further confirms a small positive indirect impact in the relationship: Contingencies - Digitalization - Functions – Benefits (O = 0.073, p = 0.000). This aligns with the more simplified research findings that indicate a positive correlation between digitalization of budgeting and corporate achievements: financial performance [

69], [

30], [

31], [

35] (but our findings relate to supporting and managerial processes), and support for company’s sustainable development [

37], [

38], [

39] (however, our findings relate to the overall budgeting system, not project budgeting). These research findings contribute to theory and practice in several ways. Firstly, we contribute to the literature on digitalization in budgeting by developing an understanding of the impact of emerging technologies and tools on budgeting functions and the qualitative characteristics of budgeting, as well as the benefits arising from budgeting, especially on the grounds of contingency theory. Although the benefits of the adoption of modern technologies have been indicated and confirmed in prior studies, there is still little conceptual understanding and empirical evidence to validate these assertions, especially using second-generation analyzing data techniques such as PLS-SEM. This study fills the research gap in this area.

Secondly, the findings may be useful for financial professionals and trainees, as well as managers, in understanding the benefits of budgeting digitalization and the conditions that influence the implementation of modern techniques and instruments. According to Ulrich and Rieg (2022), the main obstacles to digitalization are a lack of knowledge and insufficient abilities [

115]. By conceptualizing the impact of digitalization on budgeting functions and benefits, our study directs attention toward the necessity to adopt emerging technologies in enterprises, and hence ensure that employees involved in budgeting processes acquire and improve digital competencies.

The findings of the study must be interpreted in light of certain limitations. Firstly, the literature research method concerns only papers that correspond to particular search criteria, so there is a risk of omitting some research. Secondly, we used a small sample size – only 319 respondents. Finally, the questionnaire was based on a data collection method from which some variables could have been omitted due to the closed questions and their lower validity rate. Also, the questionnaire only examines limited budgeting contingencies, functions and benefits, as well as technologies; therefore, the results cannot be generalized and may not reflect findings in other areas and circumstances.

Despite these limitations, we believe our study offers opportunities for future research. Firstly, the understanding of digitalization and its impact on budgeting functions and benefits could be further advanced by conducting more context-specific investigations, for example in a particular industry or SME sector. Secondly, the study provides an important basis for further studies aimed at investigating the digital competencies required by employees involved in budgeting processes in a changing environment.