1. Introduction

A. Background and context of India’s clean energy goals:

India has recently surpassed China as the most populous country in the world. Its rapid economic growth since the 1990s has led to a significant increase in its energy consumption, with Total Primary Energy Consumption (TPEC) increasing from 8.3 EJ in 1990 to approximately 32.2 EJ in 2020. The International Energy Agency predicts that over the next few decades, energy demand growth in India will be higher than in any other country [

1]. Even though India employs a variety of energy sources, and there is a clear shift towards non-fossil fuels, coal remains the most significant energy source in the country even in 2020 (close to 55% of energy coming from it), followed by oil (about 29%), which are the two dirtiest sources of fossil fuel energy [

2]. It is thus not surprising that India is the world’s third-largest contributor to greenhouse gas (GHG) emissions, which has also been increasing steadily since 2010 [

1]. Persistently plagued by serious environmental concerns such as severe air pollution and contaminated water supplies resulting from their heavy dependence on coal and oil, the Indian government is presently formulating policies to promote greater utilization of lower-carbon energy sources.

B. Significance of natural gas and LNG in the energy transition:

In recent years, India has significantly increased its investments in renewable energy production, such as solar and hydrogen. Renewables account for about 10 percent of India’s total energy consumption [

3], and it plans to increase this share to 50 percent by 2040 [

4]. While the commendable emphasis on renewable energy is pivotal for addressing environmental concerns, it is imperative to recognize that this alone may not suffice to meet India’s rapidly growing energy demands. Therefore, in the short term, India must rely on domestic and imported fossil energy sources. However, a concerted effort should be made to minimize dependence on ’dirty’ fuels. As the most environmentally friendly choice among fossil energy alternatives, natural gas can play a crucial role as an interim energy source in the ongoing transition process. The Indian government has established a target of raising the proportion of natural gas in the overall energy mix from 6.5% to 15% by 2030 [

5]. To reach this ambitious objective, the government has implemented various initiatives to enhance nationwide access to natural gas, such as extending domestic pipeline networks and increasing the number of liquefied natural gas (LNG) terminals. Despite numerous government initiatives, the proportion of natural gas in the energy mix has declined due to various social, political, and economic challenges. It is thus imperative to examine the future growth trajectory of Natural Gas production, consumption, and import needs in India in the medium run.

C. Research objectives and scope:

In this paper, we have first tried to discern the evolving trends in energy demand within India. We have examined the dynamic shifts in the proportional contributions of diverse energy sources—spanning both renewable and non-renewable categories—to India’s overall energy consumption landscape, starting from 1990. Subsequently, we have tried to forecast energy consumption, natural gas production, and natural gas consumption in India up to the year 2050. We have used both univariate forecasting techniques, like double exponential smoothing, and multivariate forecasting techniques, namely the Cochrane-Orcutt method. For multivariate forecasting, we have considered two alternative scenarios for GDP growth: a business-as-usual scenario (BAUS) assuming a 6% growth rate and a high growth rate scenario (assuming an 8% growth rate). Our univariate forecasts are very similar to our multivariate forecasts under the BAUS case, highlighting the robustness of our results. We have used univariate forecasts for natural gas production and compared them with the projected values from India’s National Energy Policy 2017 [

6]. Our analysis reveals that the latter figures are overly optimistic. Our production and consumption projections highlight a significant deficit in the anticipated natural gas production compared to the projected demand, a trend consistently observed across all forecasting methods and scenarios examined in our study. According to our model, imports, predominantly in the form of LNG, are poised to account for approximately 30-50 percent of India’s natural gas consumption. Considering these findings, this paper advocates for government policies in India to prioritize augmenting domestic natural gas production, facilitating LNG imports, and expanding investments in renewable energy resources.

2. Literature Survey

As the natural gas market in India is still in its early stages of development, it is important to evaluate the external factors influencing its growth to understand its contribution to the overall energy mix. We also need to consider India’s overall energy market. The significance of natural gas in India’s energy composition has prompted extensive research on various facets of it. Some of them, which are closely related to our study, are outlined below.

Kumar et al. [

7] examined the economic and environmental impacts of natural gas on various sectors of the Indian economy. Given their environmental consequences, they have also highlighted the growing prospects of demand for natural gas, which is met by increasing imports. Samaddar and Arora [

8] portray the importance of Natural Gas in the Indian context and also examine the trend in the energy mix and the demand for Natural Gas, which was initially constrained due to non-availability and poor infrastructure development. The sustainability goals of the Government of India to reduce carbon emission levels have increased the focus on Natural Gas. Sinha et al. [

9] have also studied the present infrastructural development taken up to improve the demand for natural gas and suggested proactive government measures to boost infrastructure to increase the availability of natural gas in the future.

Mitra [

10] examined the energy policy planning and modeling practices prevalent in India, especially in the Petroleum and Natural Gas sectors, and commented that focusing too much on supply-side management has to be shunned and India needs to have an integrated approach towards demand and supply management through appropriate incentives and disincentives. Early in this century, Prasad [

11] argued that India needs a clear policy towards natural gas to reap full benefits from its potential, and the policies should encompass production, trans-country transport through pipelines, local distribution, and market regulation. Kelkar [

12] argued that India has a tremendous domestic Natural Gas production potential and requires a long-run business-friendly and liberalized policy for sustainable development of the sector. Similarly, Jain and Sen [

13] examined the policy regime in India’s natural gas sector. They concluded that the transition of the economy from a centrally administered one to a market-determined one is also reflected in the Natural Gas sector, and the government’s decision to oversee the production, import, and distribution of Natural Gas has led to economic distortions. Vaid [

14] assessed India’s existing and proposed Natural Gas infrastructure and argued that poor transport and distribution infrastructure is causing an energy crisis in the country. The author suggested that better gas diplomacy for transnational gas pipelines and policy push for completing domestic projects would enable India to obtain sufficient natural gas to meet its growing demand.

Seznec and Pallakonda [

15] argued that natural gas consumption in India has tremendous growth potential but is constrained by low availability. Janardhanan [

16] argued that the trans-land gas pipeline from Turkmenistan or Iran to India is fraught with geopolitical insecurity and is not a viable option. Mahalingam and Sharma [

17] commented that the Natural Gas sector regulation in the country was not left to an independent regulator, which has stifled the sector’s growth. Tiewsoh et al [

18] provide an overview of the reserves and exploitation of conventional energy resources in India and observe that the share of Natural Gas in energy consumption had stagnated throughout the first decade of this century. The growing gap between energy consumption and domestic production also necessitates long-run policy framing for the sector.

Bhowmick and Dutta [

19] argue that several technological, political, economic, environmental, legal, and social factors affect the success of Natural Gas emerging as a significant energy source in industry and households in the country. Rawat and Garg [

20] tried to identify the barriers to developing and expanding the natural gas sector in India. They inferred that operational and supply-related bottlenecks impede this sector’s progress.

More recently, Alam et al. [

21] used the time series method to forecast Natural gas prices in India in pre- and post-COVID scenarios and inferred that the prices will show a rising trend till 2025. They recommended that India channel its investment towards Renewables and domestic production of Natural Gas and other fossil fuels. Adebayo et al. [

22] examined the role of natural gas (and nuclear energy) in fostering sustainable development in India. They commented that gas consumption is detrimental to the country’s environmental sustainability in the long run.

However, hardly any studies attempt to forecast Natural Gas demand and production in India over the medium to long run and its associated policy implications. The only study available in the public domain is that by the Petroleum & Natural Gas Regulatory Board of the Government of India [

23]. Even this report forecasts up to 2030, and the energy sector in general and the Natural gas industry in particular have undergone substantial transformations since 2015.

This paper aims to plug this gap in existing research. This is especially important because India seeks to be a Zero-carbon economy by 2070. In this process, natural gas has emerged as an essential energy source for India during the transition period. It is cheaper and more readily available than renewables but cleaner than other fossil fuels like coal and oil. Thus, this sector holds the key to a successful evolution of the Indian economy to an environmentally sustainable one, and we must try to understand the medium to long-run prospects, problems, challenges, and opportunities of this sector.

3. Methodology and Data Sources

Univariate Modelling:

In this paper, we have used both univariate and multivariate techniques to forecast total energy demand and LNG production and consumption in India over the 2030-2050 period. For the univariate method, we have considered exponential smoothing, where forecasts are weighted averages of previous observations with exponentially decreasing weights on older terms. Specifically, we applied Holt’s Linear exponential smoothing method for forecasting (Gelper et al. [

24]). This method accommodates both the Level or Average Value and Trend components of the Time Series.

Multivariate Modelling:

In addition, we have used the Cochrane-Orcutt Autoregressive model for forecasting based on a multivariate model. Based on current literature (e.g., Suganthi and Jagadeesan [

25]; Sengupta [

26]; Parikh et al [

27] for India, and Intarapravich et al [

28]; Hunt & Ninomiya [

29]; for studies outside India, among others), we hypothesize that Gross Energy Consumption depends primarily on four factors – Gross Output or GDP from the production side, Technology (or Energy Efficiency), Total Population, and Energy prices. It is also argued that the manufacturing sector typically has higher energy intensity than the rest of the economy, and hence, the share of manufacturing in GDP also affects TPEC. Thus, our list of explanatory variables includes GDP (both level and per capita at constant 2011-12 prices), Population (million), Gross Capital Formation (both level and per capita at constant 2011-12 prices, as a proxy for Technology), Share of Manufacturing in GDP, and Energy Prices.

We have used a log-linear Cobb–Douglas (C-D) type functional form where the elasticities of demand with respect to the factors are assumed to be constant and captured as parameters of the equation:

With a log-transformation, we get the following log-linear model amenable to OLS estimation:

θi are lag parameters corresponding to lagged primary energy demand variables, and i is the lag length. This model has been estimated using the Cochrane-Orcutt method.

We have used a similar methodology to forecast LNG Consumption in the country except for the change that instead of taking both Population and GDP as explanatory variables, we have taken GDP Per Capita as an explanatory variable.

Data Sources:

The sources for secondary data include BP Statistical Review [

30] and International Energy Agency [

31] reports for Energy Consumption data, World Bank [

32] reports for population and GDP data, National Accounts Statistics [

33] of the Government of India for data on GDP, Capital Formation, and sectoral shares in GDP, Handbook of Statistics on Indian Economy [

34] for data on price indices, and India Energy Outlook [

1] for details on domestic energy production and consumption. We have used annual data till 2022, going back to 1990 (even earlier in some cases). However, we have used a three-year moving average for the year 2021 to accommodate the impact of the COVID-19 pandemic and lockdown on production and energy consumption. Thus, our study consists of data for 32 periods from 1990 to 2022. We then forecasted Energy Demand in India till 2050, which is a period of roughly 30 years. In addition, we also forecasted natural gas consumption and production for the same period.

4. Results and Analysis

4.1. Gross Energy Demand

4.1.1. Status, Trends

It is an established fact that a positive relationship exists between economic growth and energy demand. Therefore, we try to outline the energy demand pattern and economic growth levels during 1990-2022.

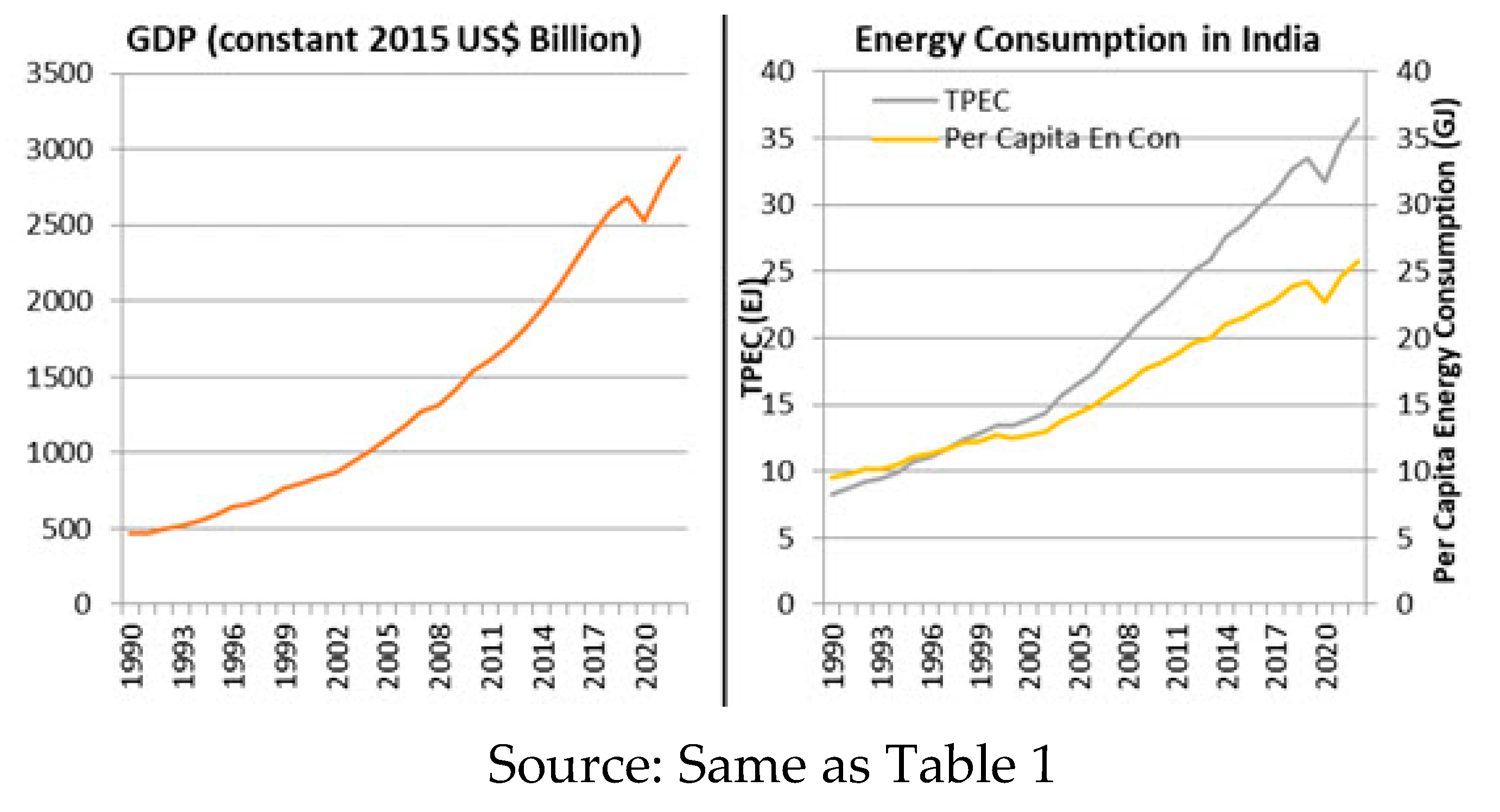

From

Table 1, we find that during the year 1990, India’s GDP was 465.2 billion US

$ (at constant 2015 prices); Primary Energy Consumption was 8.3 EJ, and Per Capita Energy Consumption was 9.5 Gigajoule per person. With progress in economic growth and development, GDP increased over the decades to 2954.9 billion US

$ in 2022, Energy Consumption increased to 36.4 EJ, and Per Capita Energy Consumption increased to 0.26 EJ per 10 million persons. This consistent upward trend (except for the COVID-19 pandemic period of 2020-21) is exhibited in

Figure 1 as well.

4.1.2. Share of Coal/Oil/Nuclear/Renewables

It is necessary to examine the pattern of energy mix, which comes from different energy sources – both renewable and non-renewable or fossil energy. In India, renewables like Solar and Wind energy were not used until the 1980s, and coal was the dominant source of TPEC, accounting for more than half of total energy consumption. During the 1990-2010 period, the share of fossil fuel increased while renewables declined. After 2010, the share of renewables, including hydroelectricity, increased, but the share of fossil fuels remained above 80 percent till 2020, as evident from

Table 2. Consumption of fossil fuels other than Coal and Oil has also increased in the last decade, and Natural Gas has played a significant role in that. This follows a continuous effort to improve environmental sustainability and decrease the consumption of high-carbon energy sources.

4.1.3. Forecast

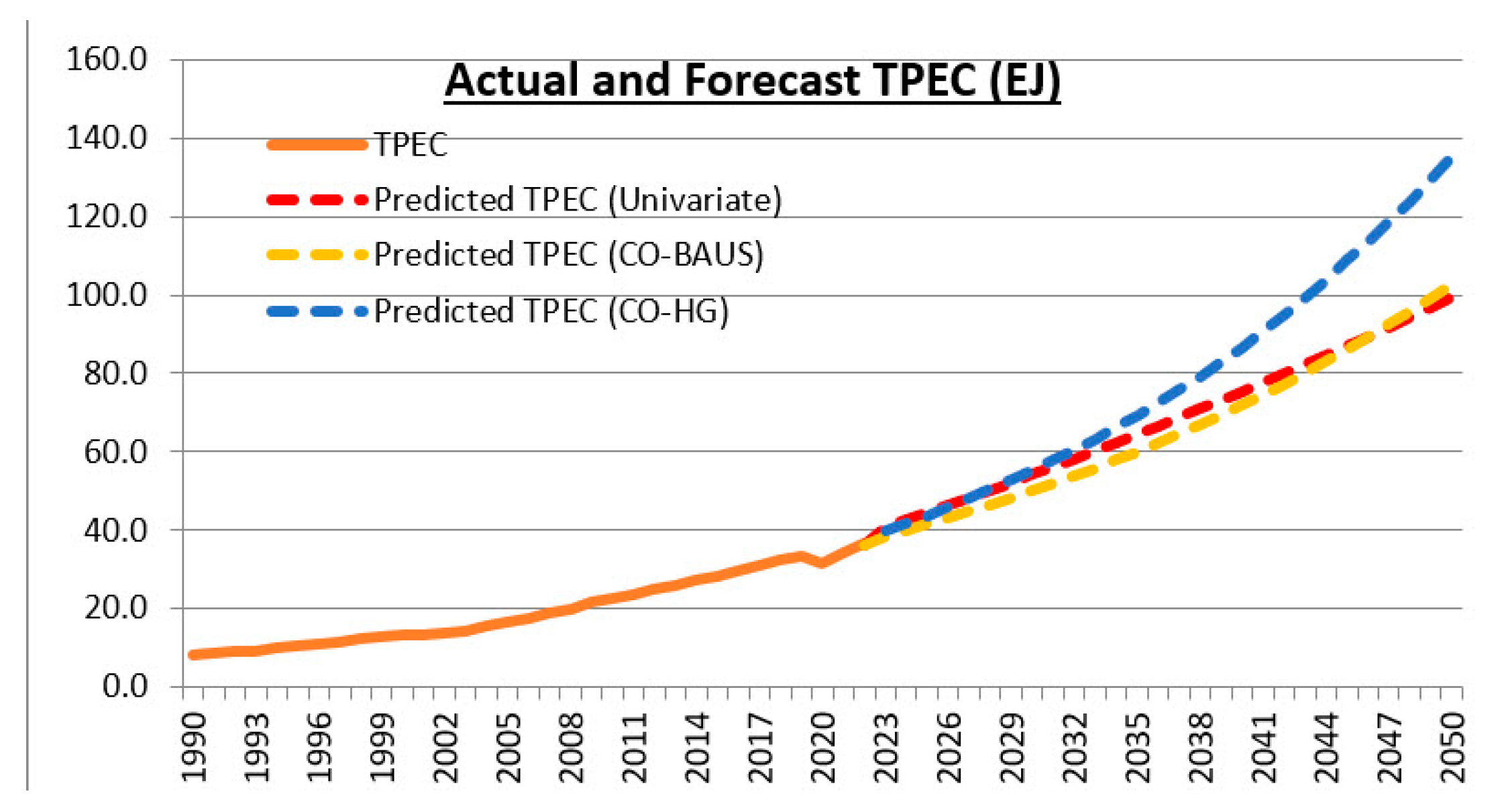

We have tried to forecast Total Primary Energy Consumption in India over the next two decades using both Univariate and Multivariate methods. For the univariate method, we have considered exponential smoothing, where forecasts are weighted averages of previous observations with exponentially decreasing weights on older terms. Specifically, we applied Holt’s Linear exponential smoothing method for forecasting. Using this univariate method, we find that TPEC is expected to reach around 54 EJ in 2030, 75 EJ in 2040, and 99 EJ in 2050 (

Table 3). These figures are close to the predictions by IEA [

1] and BP [

30].

However, the univariate forecasts depend on past trends of TPEC only and do not consider the movement of other explanatory variables on TPEC. Hence, a better estimate of the projected values would be that from the multivariate forecasting methods. For the multivariate forecasts based on the Cochrane-Orcutt method, we have assumed the following scenario for the explanatory variables –

(i) GDP: two alternate scenarios - 6 percent pa growth between 2020-2050 (Business as Usual scenario (BAUS), observed long-run growth rate over the 2010-2020 period) and 8 percent pa growth rate (high growth scenario).

(ii) GCF: remains unchanged at 30 percent of GDP

(iii) Share of the manufacturing sector in GDP: unchanged at 16 percent of GDP

(iv) Price levels: follows the IEA projections, rising by 2.5 percent pa during 2020-30 and at 3 percent pa after that

(v) Population: MOHFW [

35] projections.

The Multivariate Cochrane-Orcutt regression results are provided in Appendix Table A-1. Using those results and under the assumptions outlined above, TPEC is expected to reach around 50 EJ by 2030, 72 EJ by 2040, and 102 EJ by 2050 (for the BAUS scenario). If India shows an impressive 8 percent pa growth sustained over the next two decades, TPEC will touch 55 EJ in 2030, 86 EJ in 2040, and 135 EJ under the High growth scenario.

We find that the Univariate and Multivariate forecasts under BAUS are close, and the discrepancy between them is less than 5% in the long run (

Figure 2). We can thus infer that our forecasts are robust. The high-growth forecast is close to the other forecasts for 2030 but significantly higher for 2040 and 2050.

Several institutions like British Petroleum (BP) [

36] have predicted that the share of Coal and Oil is expected to show a declining trend over the next three decades, while Natural Gas and Renewables will show a marked rising trend (

Table 4). This trend will be accelerated if the country follows the Net Zero Carbon policy over the 2030-50 period. This brings us to the importance of natural gas in India’s energy transition process.

4.2. Natural gas

4.2.1. Production and Consumption: Status, Trends

It is found that India has been gradually inclined towards using renewable energy sources to decarbonize the environment within the next twenty years. However, it cannot depend only on renewables without compromising economic growth. Therefore, demand for natural gas, which has a low carbon content compared to other non-renewable energy sources, has recently gained importance.

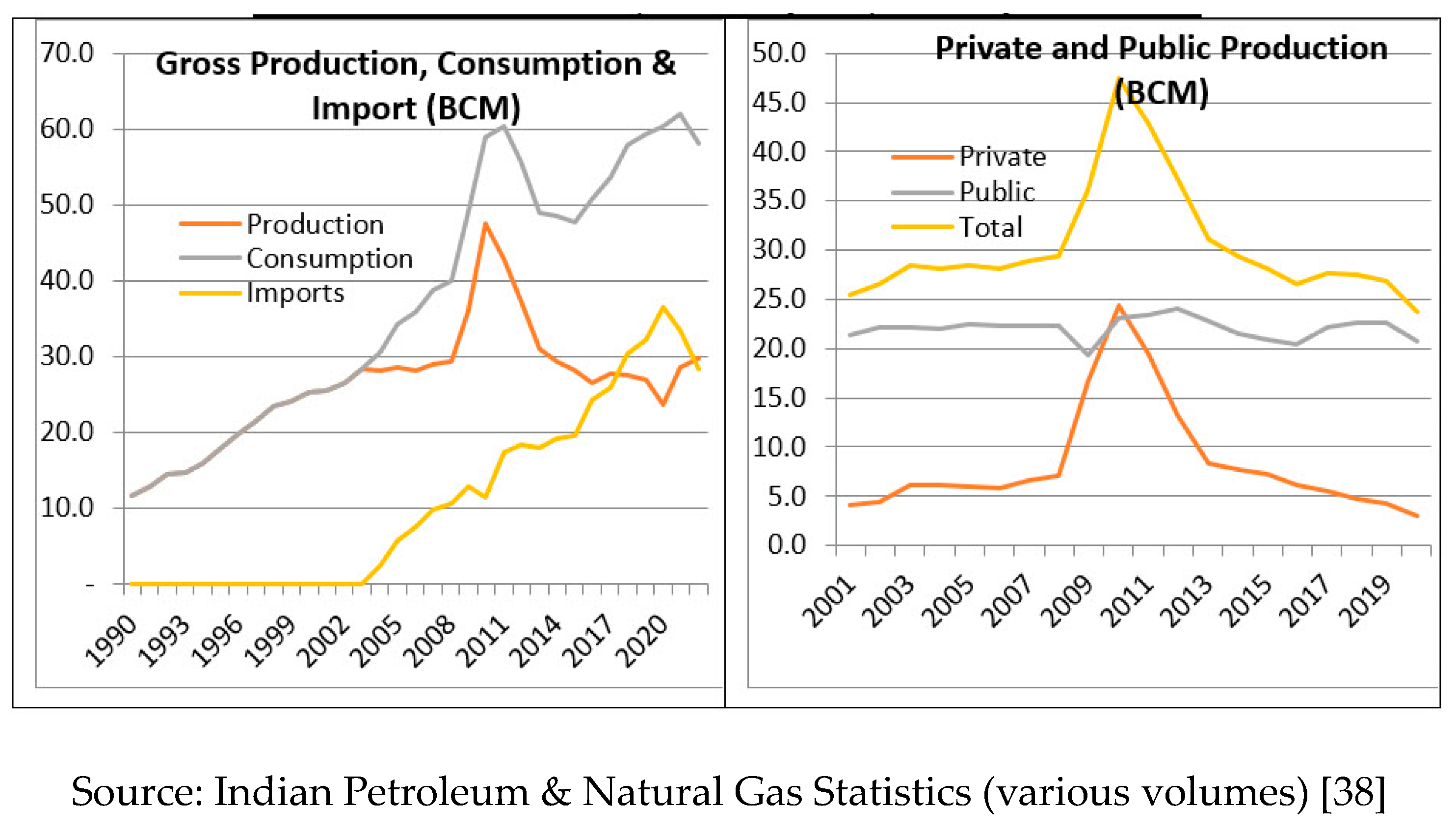

We find that Natural Gas consumption during the year 1990 was 11.59 bcm, all of which was produced domestically (

Table 5). Both consumption and production of Natural Gas have increased since then. However, after 2010, domestic production decreased while consumption kept growing. Higher amounts of Natural Gas had to be imported to meet the shortfall. Natural gas imports have consistently increased since 2000, indicating that natural gas imports have played an essential role in India’s energy mix in the current century (

Figure 3). Also, domestic production of Natural Gas had almost halved in the country between 2010-2020 because of various reasons like the aging of the gas wells, conflict with the lessee in the leased-out KG-D6 offshore basin, and under-exploitation of Coal Bed Methane (Corbeau et al.) [

37].

Besides studying the trends in the production of Natural Gas over time, we need to explore the requirement or demand for natural gas within the country across energy using and non-energy-using sectors of the economy and the resultant imports. Natural gas is widely used as an energy source by several sectors, such as power generation, industrial, agricultural, tea plantations, and residential. Moreover, it is also used for non-energy use in sectors like fertilizer and petrochemicals. Initially, the country’s energy and non-energy use of Natural Gas were almost similar. During the 1990-2010 period, Natural Gas use as energy skyrocketed to more than double that of non-energy use. However, during the next decade, the non-energy use of Natural Gas increased while that as an energy source declined to one-third its amount in 2010.

The main reason behind this was the falling domestic gas production; the government started a rationing system where allotment to Fertiliser and Petrochemical sectors were prioritized. Fertilizer production and Power generation account for more than four-fifths of Natural Gas consumption in India. Thus, falling domestic natural gas production has impacted India’s ambitious program of cleaning the electricity sector by shifting from a coal-based power grid to a Gas-based power generation. Domestic production has, however, picked up after 2018 when the HELP (Hydrocarbon Exploration and Licensing Policy) was enacted, but imports still play an important role in India’s gas sector.

4.2.2. Univariate Forecast of Natural Gas Consumption

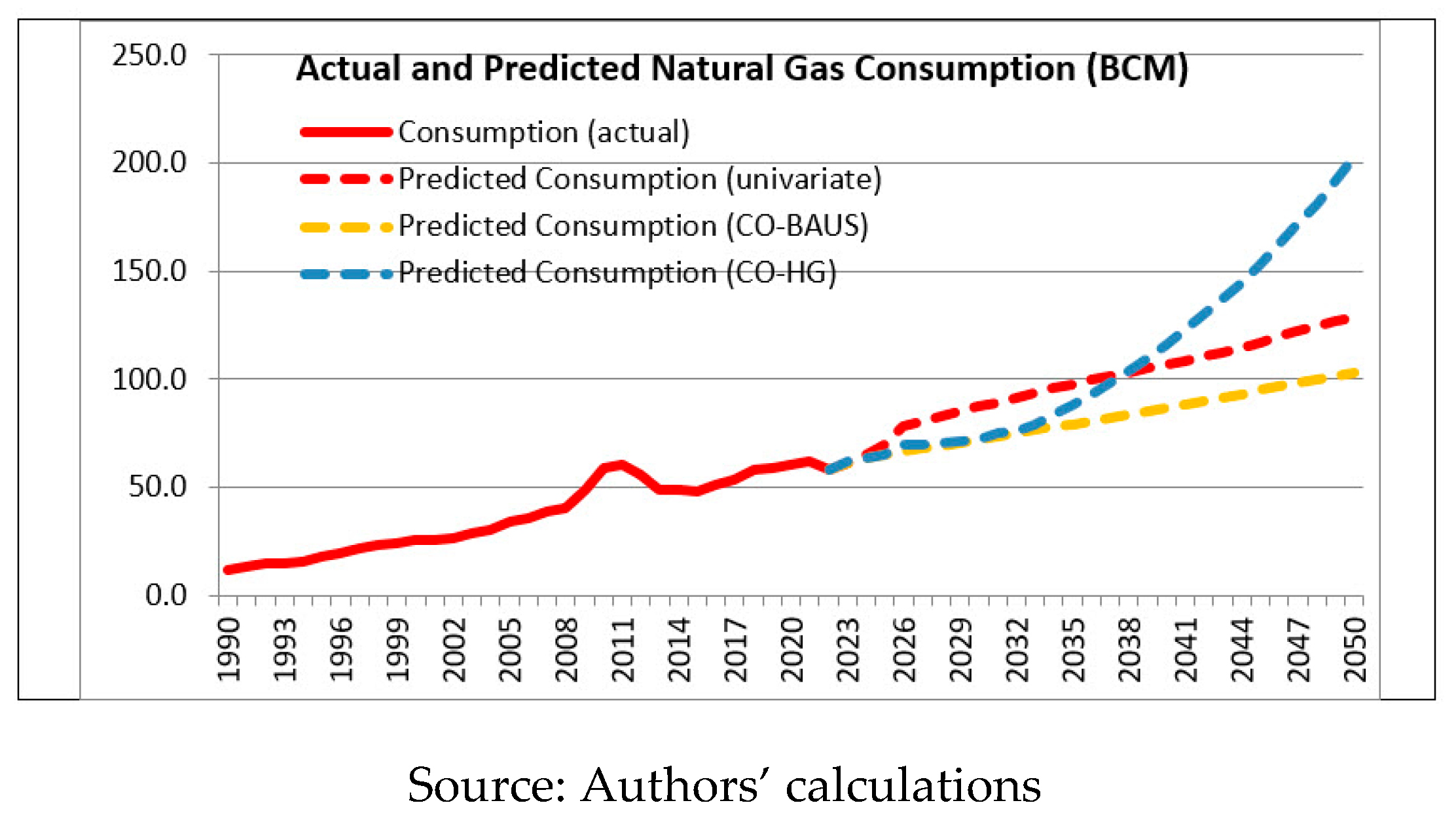

As mentioned in the methodology section, we have used Exponential Smoothing using Holt-Winter’s Linear method for univariate forecasting since it is the most appropriate method for forecasting yearly data without seasonal components. Using a double exponential smoothing forecasting process, our results indicate that consumption of Natural Gas will continue to rise in the coming decades till 2050 (

Table 7).

4.2.3. Multivariate Forecast of Natural Gas Consumption

As mentioned in the methodology section, While Holt-Winter’s smoothing algorithm provides a reasonable approximation for predicting future natural gas production and consumption, it relies solely on the historical values of the specific variable to be forecasted. Given that numerous factors influence natural gas consumption, the suitability of forecasting energy demand using a double exponential smoothing algorithm may be subject to scrutiny. Exploring alternative methods that consider various related variables may be necessary. In this study, we opted for the Cochrane-Orcutt model. Results of multivariate time-series regression using the Cochrane-Orcutt model are available in Appendix Table A-2.

Regression results show that only GDP Per Capita has a positive and statistically significant impact on Natural Gas consumption. Other variables like Gross Capital Formation, Share of Manufacturing in GDP (PCMANU), and Price Index of Natural Gas also have a positive impact on Gas consumption. However, the coefficients are not statistically significant. This translates to a forecasted Natural Gas consumption of 88 BCM in 2040 and 133 BCM in 2050 under the BAUS. Under the High Growth scenario, Gas consumption may cross 200 BCM in 2050 (

Table 7 above).

4.2.3. Forecast of Natural Gas Production

As mentioned in the methodology section, Forecasts of domestic production of Natural Gas have been done in two ways. First, we used the Holt-Winters univariate exponential smoothing method to estimate production till 2050. Using this method, production is expected to rise to 49 BCM in 2040 and 56 BCM in 2050 (

Table 8). In the same table, we have also reported the projected domestic production values from India’s National Energy Policy 2017 report prepared by the government think tank Niti Aayog [

39] and the BP Energy Outlook 2023 [

36]. The NEP/Niti Aayog projections can be considered overly optimistic as even half of the projected figure for 2022 has not been met. We also see that projected production lags behind expected consumption during the period.

4. Discussion and Implications for Natural Gas Sector

While we have presented model-based forecasts about Natural Gas consumption and production in India, there are also other considerations. India expects to meet nearly 15 percent of its total energy needs from Natural Gas in the short to medium term (PNGRB, 2013) [

23]. Following our projections of TPEC in

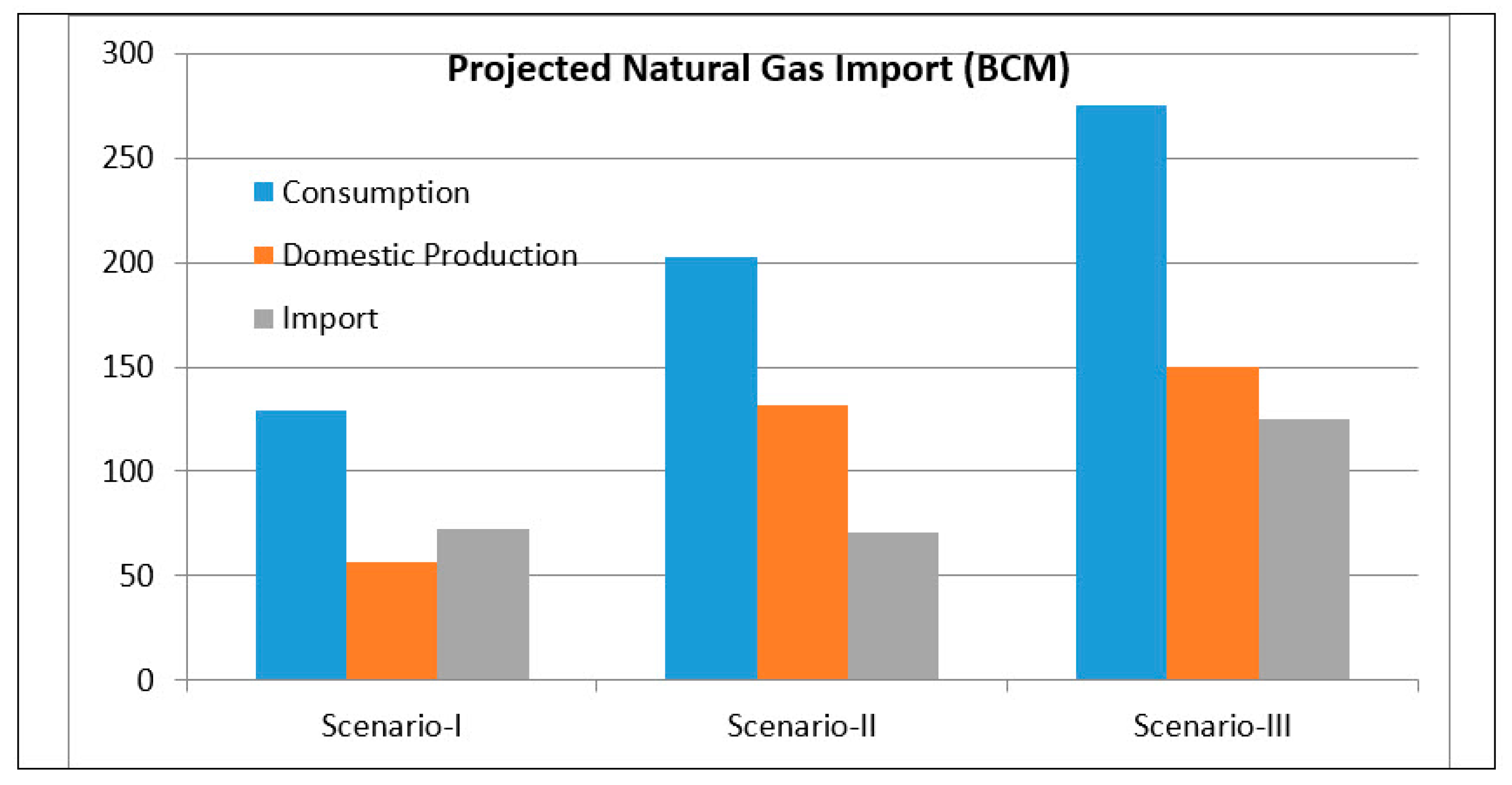

Table 3, this translates to about 8 EJ of energy coming from gas by 2030, rising to approximately 15 EJ by the year 2050. That amounts to nearly quadrupling Natural Gas consumption from its current figures by 2030 and increasing it by eight times by 2050 – a very tall order indeed! Even a conservative projection of 10% of TPEC being met by gas would indicate gas consumption to be close to 150 BCM in 2030 and 275 BCM in 2050.

A corollary of such a scenario is that domestic production of Natural Gas would not be able to meet even one-third of these projected consumption levels. Naturally, India’s dependence on imported Natural Gas will increase further, and by 2050, 30-50 percent of India’s gas consumption (roughly 70-125 BCM) will be met by imports (

Figure 5).

This has several implications for the Gas sector in particular and the energy sector in general. First, with an increasing share of gas in the energy basket, India’s gas infrastructure has to be ramped up on a war footing basis. India’s operational gas pipeline length is 21,129 km, while another 12,000 km of pipeline is under construction (GoI) [

40]. The combined capacity of LNG terminals for handling gas imports is 42.7 MMTPA, of which about half are being utilized. To address the increased gas consumption, pipelines must be trebled by 2030 and quadrupled by 2050. Similarly, to handle the increased imports, LNG terminal capacity has to be doubled by 2030 and trebled by 2050. However, only half of the additional infrastructure necessary by 2030 is currently under construction (MoPNG) [

41]. This requires massive investment in gas infrastructure. Since Natural gas is seen as an interim choice in India’s energy basket, being relatively cleaner among all fossil fuels, before transitioning to a non-fossil fuel regime in the long run, the efficacy of such a considerable investment is questioned by the corporate sector and fiscal policymakers.

However, to reduce import dependency and enhance domestic production of natural gas, the Government of India has taken several initiatives such as Natural Gas marketing reforms, the discovery of the market price of natural gas through e-bidding, implementation of production enhancement contracts cross-country natural gas pipelines; building land re-gasification infrastructure along with floating storage regasification units in the country; city gas distribution network have been developing to ensure increase in supply of natural gas to domestic, industrial and commercial space (Annual Report of Ministry of Petroleum and Natural Gas, GOI) [

42]. Whether these policies are capable of transforming the Gas sector at the ground level remains to be seen.

5. Conclusion and Future Recommendations

India faces inherent challenges in its energy landscape, relying significantly on fossil fuel imports due to its limited ability to obtain energy from domestic resources. This paper has used both univariate and multivariate forecasting of energy demand. The BAUS scenario predicts total primary energy consumption (TPEC) will attain approximately 50 EJ by 2030 and 100 EJ by 2050. We also found that our Univariate and Multivariate forecasts are close in the long run, leading us to conclude that our predictions are robust. Natural Gas consumption is likely to reach around 90 BCM in 2040 and 133 BCM in 2050 under the BAUS and is expected to cross 200 BCM if India shows high economic growth over the next 30 years. Against this, domestic production in 2050 is forecasted to be around 60 BCM in the worst-case scenario and around 125 BCM in the best-case scenario. LNG imports will likely meet the gap (ranging between 30-50% of demand).

Despite significant focus on renewable energy in the last decade, India has struggled to make substantial progress. Various sources such as solar, waste, tidal wave, biomass, geothermal, and wind can contribute to the energy mix, as highlighted by NITI [4, 39] and recent media reports (ET [

43]). However, the current infrastructure, policy framework, and public perception impede the effective harnessing of these resources. Indeed, the government of India has undertaken several policy initiatives to tackle these resources. Still, implementing these remains slow, and whether the ambitious plans are fulfilled remains to be seen.

Even with expanded reserves and enhanced renewable energy development, this paper concludes that domestic production alone is unlikely to meet the escalating energy demand. India will continue to depend significantly on imported fossil energy. A crucial consideration is the choice of fossil energy imports, traditionally oil and, more recently, natural gas in liquefied natural gas (LNG) form. Today, India is the world’s fourth largest importer of LNG, with Qatar, UAE, and USA being its top three sources of LNG import (IGU) [

44]. Our analysis concludes that there will remain a significant gap between India’s consumption and production of natural gas in the medium term (till 2050), which requires to be filled in by LNG imports. While imports and distribution infrastructure like terminals and pipelines are the focus of policy in the short run, the government is actively pursuing several options for storing natural gas in depleted natural gas or oil fields for the medium run. These actions need to be carefully monitored as creating gas storage facilities is very expensive. Also, since Gas is seen as an interim solution towards bringing down carbon emissions while the long-run goal remains a movement away from fossil fuel, private players only have a mild interest in investing in gas infrastructure. Creating an ecosystem and incentive structure to encourage such investment is a task that needs to be given adequate thought.

Advancements in LNG technology, encompassing liquefaction, transport, and regasification, have positioned LNG as the preferred fuel for many countries, including India. Notably, LNG stands out as the cleanest among fossil energy sources. The strategic import of LNG and development of renewable energy from domestic sources will enable India to incorporate some clean coal electricity generation while meeting global climate change commitments. Achieving this balance requires coordinated efforts across the public and private sectors, embracing both renewable and non-renewable sources and efficiently managing domestic and imported energy resources in which Natural Gas will play a stellar role. To conclude, as India navigates the complex terrain of energy transitions, natural gas emerges as a beacon of hope—a bridge fuel that can facilitate the journey from non-renewable to renewable energy and thus toward a cleaner, greener, and more prosperous future.

Author Contributions

Conceptualization, S.G. and R.M.; methodology, S.G.; software, R.M. and B.C.; validation, R.M.; formal analysis, S.G. and R.M.; investigation, B.C.; resources, S.G., R.M. and B.C.; data curation, B.C.; writing—original draft preparation, B.C., S.G. and R.M.; writing—review and editing, R.M. and S.G.; visualization, R.M.; supervision, R.M. and S.G.;. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

All the data are available publicly.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Multivariate Time Series Forecasting: Cochran Orcutt Model [Dependent variable: Total Primary Energy Consumption].

Table A1.

Multivariate Time Series Forecasting: Cochran Orcutt Model [Dependent variable: Total Primary Energy Consumption].

| Explanatory Variables |

Coefficients |

P-value |

| LN Population |

1.164*

(0.830) |

0.082 |

| LN GDP |

0.445***

(0.172) |

<0.01 |

| LN PCMANU |

0.045

(0.099) |

0.652 |

| LN Gross Capital Formation |

0.030

(0.034) |

0.383 |

| LN Price Index |

0.109

(0.068) |

0.124 |

| Durbin Watson Statistic |

1.826 |

0.194 |

| Adjusted R2

|

0.994 |

Table A2.

Multivariate Time Series Forecasting: Cochran Orcutt Model [Dependent variable: Consumption of Natural Gas].

Table A2.

Multivariate Time Series Forecasting: Cochran Orcutt Model [Dependent variable: Consumption of Natural Gas].

| Explanatory Variables |

Coefficients |

P-value |

| LN GDP Per capita |

0.624**

(0.239) |

0.015 |

| LN PCMANU |

0.163

(0.305) |

0.597 |

| LN Gross Capital Formation |

0.129

(0.118) |

0.284 |

| LN Price Index of NG |

0.016

(0.042) |

0.699 |

| Durbin Watson Statistic |

1.6349 |

0.25 |

| Adjusted R2

|

0.450 |

References

- IEA (2021), India Energy Outlook 2021 Special Report http://www.iea.org.

- Energy Statistics of India (2023), Ministry of Statistics and Programme Implementation, Government of India (MoSPI) http://www.mospi.gov.in.

- GoI (2013) “Vision 2030”: Natural Gas Infrastructure in India, Petroleum & Natural Gas Regulatory Board, Ministry of Petroleum and Natural Gas, Government of India.

- NITI Aayog, GoI (2017) – “India Vision 2040” Chapter 15, Draft National Energy Policy NITI Aayog, Government of India http://www.niti.gov.in.

- MoPNG (2022), Annual Report, Ministry of Petroleum and Natural Gas, Government of India, http://mopng.gov.in.

- NEP (2017), https://www.niti.gov.in.

- Kumar, V.V.; Shastri, Y. and Hoadley, A. (2020), A consequence analysis study of natural gas consumption in a developing country: Case of India. Energy Policy 2020, Volume 145,. [CrossRef]

- Samaddar A and Arora S (2012), Natural Gas Scenario in India: An Overview. SSRN 2144061, 2012 http://papers.ssrn.com.

- Sinha(2002).

- Mitra, Neelanjana (1992). Energy Policy Planning in India: Case of Petroleum and Natural Gas. Economic and Political Weekly, 27(35), M109–M115.

- Prasad, N. K. (2008). Regulation of Natural Gas in India. Economic and Political Weekly, 43(39), pp21–24.

- Kelkar, V. (2009). Towards a New Natural Gas Policy. Economic and Political Weekly, 44(36), pp8–10.

- Jain, Anil and Sen, Anupama (2011) Natural Gas in India: An Analysis of Policy, The Oxford Institute for Energy Studies, Oxford, UK.

- Manish Vaid (2014) India’s Natural Gas Infrastructure: Reassessing Challenges and Opportunities, Strategic Analysis, Vol. 38, No. 4, pp508-527. [CrossRef]

- Seznec, J., and Pallakonda, R. (2017) NATURAL GAS, in India’s Energy Needs and the Arab/Persian Gulf (pp. 6–8). Atlantic Council. http://www.jstor.org/stable/resrep03692.7.

- Janardhanan, N. K., and Institute of Peace and Conflict Studies. (2017). India’s Energy Policy: Energy Needs and Climate Change. In Indian and Chinese Energy Policies: Addressing Energy Needs and Climate Change (pp. 3–8). Institute of Peace and Conflict Studies. http://www.jstor.org/stable/resrep09398.4.

- Mahalingam, S., and Sharma, D. (2017). Political Economy of Independent Regulation in India’s Natural Gas Industry. Economic and Political Weekly, 52(20), pp44–50.

- Lari Shanlang Tiewsoh, Martin Sivek and Jakub Jirásek (2017) Traditional energy resources in India (coal, crude oil, natural gas): A review, Energy Sources, Part B: Economics, Planning, and Policy, Vol. 12, No. 2, pp110-118. [CrossRef]

- 2017; 01, Bhowmick, Mallika and Titas Dutta (2017) Dependency of Indian Economy on Natural Gas and Its Barriers, Working Paper Series, GCP/ JU/ 17/ 01, Global Change Programme, Jadavpur University.

- Rawat, Atul and Garg, Chandra Prakash, (2021), Assessment of the barriers of natural gas market development and implementation: A case of developing country, Energy Policy, Vol 152, 2021. [CrossRef]

- Alam, Md; Murshed, Muntasir; Palanisamy, Dr; Duraisamy, Pachiyappan and Abduvaxitovna, Shamansurova. (2023). Forecasting oil, coal, and natural gas prices in the pre-and post-COVID scenarios: Contextual evidence from India using time series forecasting tools. Resources Policy. Vol. 81, No. 103342. [CrossRef]

- Adebayo, Tomiwa; Ozturk, Ilhan; Aga, Mehmet; Uhunamure, Solomon; Kirikkaleli, Dervis and Shale, Karabo (2023) Role of natural gas and nuclear energy consumption in fostering environmental sustainability in India. Scientific Reports, Vol. 13, No. 11030. [CrossRef]

- PNGRB (2013) Vision 2030: Natural Gas Infrastructure in India, Report by Industry Group for PNGRB, www.pngrb.gov.in/Hindi-Website/pdf/vision-NGPV-2030-06092013.pdf.

- Gelper, S.; Fried, R. and Croux, C. (2007), Robust Forecasting with Exponential and Holt-Winters Smoothing. SSRN, http://dx.doi.org/10.2139/ssrn.1089403.

- Suganthi, L. and T. R. Jadadeesan, (1992), A modified model for prediction of India’s future energy requirement, Energy & Environment, 3(4), pp.371-86.

- Sengupta, J.K., (1993), Information Theory in Econometrics. Econometrics of Information and Efficiency, 1993, 71-105.

- Parikh, J., Purohit, P. and Maitra, P. (2007), Demand Projections of petroleum products and natural gas in India. Energy, Vol. 32 No. 10. [CrossRef]

- Intarapravich, D.; Johnson C.J.; Li, B.; Long, S. and Pezeshki, S. (1996), Asia- Pacific energy supply and demand to 2010. Energy, Volume 21 No. 11, 1996, 1017-1039. [CrossRef]

- Hunt, L. C. and Ninomiya, Y. (2005), Primary energy demand in Japan: an empirical analysis of long-term trends and future CO2 emissions. Energy Policy, Volume 33 No. 11, 2005, 1409-1424. [CrossRef]

- BP Statistical Review (2023), BP Statistical Review of World Energy, 2023. http://bp.com/statisticalreview.

- IEA (2023) International Energy Agency, 2023. http://www.iea.org.

- World Bank, World Development Indicators, http://data.worldbank.org.

- National Accounts Statistics, MoSPI, https://mospi.gov.in.

- Handbook of Statistics on the Indian Economy (2022) – Wholesale Price Index, Annual Average; Reserve Bank of India [available from https://dbie.rbi.org.in.

- MOHFW (2011), Annual Report, Ministry of Health and Family Welfare http://main.mohfw.gov.in.

- BP Energy Outlook (2023) – BP Energy Outlook Summary Tables – 2020 - 2050 http://bp.com/energyoutlook.

- Corbeau, Anne-Sophie, Shahid Hasan and Swati Dsouza (2018) The Challenges Facing India on its Road to a Gas-Based Economy, King Abdullah Petroleum Studies and Research Centre, https://www.kapsarc.org/uploads/2018/10.pdf, accessed on 14-08-2023.

- Indian Petroleum and Natural Gas Statistics (various volumes) – Economics and Statistics Division, Ministry of Petroleum and Natural Gas, Government of India, http:/mopng.gov.in.

- NITI Aayog. (2017b), “Draft National Energy Policy.” June 27. Government of India. http://niti.gov.in/writereaddata/files/new_initiatives/NEP-ID_27.06.2017.pdf.

- GoI, (2023), Snapshot of India’s Oil & Gas data: Monthly Ready Reckoner April 2023, Petroleum Planning & Analysis Cell, Ministry of Petroleum & Natural Gas, Government of India.

- MoPNG (2018a), Indian Petroleum and Natural Gas Statistics 2017-18, http://petroleum.nic.in/sites/default/files/ipngstat_0.pdf.

- MoPNG (2023), Annual Report of Ministry of Petroleum and Natural Gas, GOI; 2023, http://mopng.gov.in.

- ET (2021) - India to achieve 50% clean energy share, 500 GW RE capacity targets before 2030 deadline: RK Singh, The Economic Times, Nov 09, 2021, [https://economictimes.indiatimes.com/industry/renewables/india-to-achieve-50-clean-energy- share-500-gw-re-capacity-targets-before-2030-deadline-singh/articleshow/87604552.cms, accessed on 12-08-2023].

- International Gas Union, 2022 World LNG Report, https://www.igu.org/wp-content/uploads/2022/07/IGU-World-LNG-Report-2022_final.pdf, accessed on 16-08-2023.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).