1. Introduction

A cutting-edge use of blockchain technology that is profoundly altering the energy area is peer-to-peer energy trading. Bypassing conventional middlemen like utility corporations, this innovative approach enables prosumers—individuals who produce and consume electricity—to sell their surplus energy to nearby customers directly. The way we generate and use power might be revolutionized by this move towards decentralized, transparent, and secure energy markets. Prosumers who use renewable energy sources (RES) to produce their electricity, such as solar panels, have the chance to sell any surplus to other customers through (P2P) energy trading. In making these transactions possible Blockchain becomes essential because it offers a safe and transparent platform for tracking each trade of energy. These transactions are smooth and automatic because too smart contracts, self-executing agreements with established rules. The advantages of this approach are manifold. Firstly, it empowers prosumers, allowing them to monetize their surplus energy at a fair market price. This incentive encourages further investments in renewable energy sources, contributing to a more sustainable energy ecosystem.

Furthermore, the blockchain’s role in streamlining transactions leads to reduced costs, making P2P trading economically viable. It also ensures the security and transparency of transactions, reducing the risk of fraud and enhancing trust among participants. The decentralization inherent in P2P energy trading reduces the dependence on central utilities, thus promoting a more distributed and resilient energy grid. As P2P energy trading gains momentum, several startups, including LO3 Energy

1, have pioneered platforms for these transactions. Established utilities are also exploring blockchain-based solutions. P2P energy trading has the ability to transform the energy landscape, making it more sustainable, effective, and available to all. Renewable energy sources are being adopted at an increasing rate. Blockchain stands at the forefront of this energy revolution, offering a secure and transparent foundation for transactions that benefit both producers and consumers alike.

Businesses are starting to acknowledge the extensive application of blockchain technology in (P2P) energy trade, which is prompting them to change their business strategy. The blockchain revolution is fostering innovation and steering the energy sector towards more intelligent grids. Nevertheless, the realization of blockchain’s full potential in P2P energy trading is an ongoing journey, marked by proof-of-concept and adoption phases. Existing limitations related to blockchain performance, scalability, and interoperability continue to be subjects of discussion. Implementing blockchain at a large scale remains a challenge, with the lack of communication and interoperability between different blockchain networks hindering scalability.

This research paper is guided by three key objectives which include: to look into p2p energy trade and evaluate how blockchain plays a part, suggest a flexible, reliable, and safe framework that facilitates efficient and frequent energy exchange; finally, assess the feasibility of the suggested model by conducting a practical test of peer-to-peer energy trading as a real-life example. The parts that follow will provide a thorough analysis of the literature, examine multiple energy trading models that utilize blockchain technology for peer-to-peer transactions, present a case study and address potential future research areas.

2. Literature Review

2.1. Blockchain Energy Trading in P2P

P2P energy trading gains attention in academia and industry. Researchers like [

1] categorize P2P systems into building, storage, and renewable domains, exploring network features and market dynamics. They classify P2P energy trading systematically, addressing virtual and physical layer challenges. Similarly, [

2] highlight blockchain’s integration benefits in smart energy systems, emphasizing the required technologies.

2.2. Applications of blockchain technology

We explore blockchain’s use cases in energy trading, analyzing its relevance and potential advantages in this sector. [

3] offers criteria to decide when blockchain surpasses traditional databases. When it comes to peer-to-peer (P2P) power trading, blockchain eliminates intermediaries in favor of decentralized miners that verify transactions and maintain the trade ledger. Blockchain technology helps P2P energy trading tremendously by enabling a successful renewable electricity market on a digital P2P platform. This approach enhances energy security, promotes sustainability, and supports low-carbon solutions.

However, as described in [

4], energy trade (p2p) and the application of blockchain in it presents a number of technological difficulties. Strong protocols and algorithms are required for network administration to oversee blockchain activities. On-chain and off-chain data handling are both a part of data management. The resolution of consensus management’s throughput and latency problems is essential for transaction validation. Power loss management addresses fluctuations in distribution and consumption. Dynamic pricing models offer avenues for further exploration tailored to P2P energy trading dynamics.

2.3. Adoption of blockchain technology within the energy industry

Peer-to-peer (P2P), business-to-business (B2B), energy markets, commodities trading, and non-profit endeavors are just a few of the applications being investigated by established organizations and pilot projects throughout the world for blockchain integration in the energy sector [

5,

6]. A notable blockchain use case that promotes the expansion of renewable energy and the shared economy is peer-to-peer energy trading. Though relatively new, companies in this field signify blockchain’s early development. The lack of concrete proof of its performance in P2P energy trade has sparked ongoing arguments about its prospects and problems, particularly in the context of the blockchain trilemma. Some notable companies that have adopted Blockchain for peer to peer energy trading are reported in

Table 2.

2.4. Blockchain trilemma

The original Bitcoin blockchain introduced a 1-megabyte block size limit to defend against potential malicious attacks, particularly denial-of-service attempts. This constraint prevented an attacker from flooding the network with oversized fake data for mining, as blocks exceeding this limit would be rejected. However, in (P2P) energy trade and the broader energy sector, handling vast data volumes is a challenge. Real-time tracking generates data like kilowatt-hours (kWh) produced, consumed, and transaction records. Processing this data at high rates can lead to congestion and higher fees. Blockchain’s limitations, including scalability, security, and decentralization, as per Vitalik Buterin, present a dilemma. To address these challenges, it’s crucial to consider the implications of blockchain-based energy trading.

Decentralization allows multiple network nodes, enhancing security, while scalability concerns transaction validation time and throughput. Scalability, a key issue in blockchain technology, involves trade-offs, such as security or decentralization. This balance is critical in energy trading. Blockchain-based P2P energy trading decentralizes transactions, reducing reliance on intermediaries. Varying consumption patterns lead to differing transaction volumes between prosumers and lower-energy households. Achieving this balance is essential for blockchain-based energy trading. The energy trading blockchain trilemma relates to trade-offs between scalability, security, and decentralization. Scalability challenges affect transaction processing speed and security. P2P energy trading relies on direct matching of energy supply and demand, emphasizing the need for a delicate balance within the trilemma.

2.5. Limitations of the literature

Numerous scholarly articles have examined blockchain technology from a range of angles. As an illustration, [

8] carried out a thorough systematic evaluation of the most recent studies on blockchain technology. [

9] did quick research by interviewing people and doing an internal session to look into blockchain and distributed ledger technologies, concentrating on the benefits and limitations. In addition to exploring blockchain architecture and consensus techniques, [

10] also identified potential patterns. [

11] provided insights on blockchain technology in the context of (P2P) trade, nonprofit help, and energy trade in the context of B2B. [

12] conducted literature research and examined business models on blockchain solutions in the sector of energy, focusing on technical challenges. Another review research looked at issues with peer-to-peer microgrids constructed using blockchain technology. [

13] gave a description of how to incorporate game-theoretic techniques into energy trading through p2p approach.

However, existing literature does not specify the precise blockchain model for P2P trading and how it effectively addresses the blockchain trilemma. Second-layer solutions show promise in addressing the blockchain trilemma, but their optimal implementation in P2P energy trading for trilemma resolution remains uncertain. Several questions related to the blockchain trilemma persist:

- ■

How to effectively manage the scaling of transactions that occur off the main blockchain and on the main blockchain, taking place within secondary sidechain and primary blockchain record-keeping systems is the major challenge in terms of scalability.

- ■

With regards to security, the emphasis is on figuring out which protocols may be rolled out sideways reacting to dishonest or improper behaviors, as well as coming up with plans for handling a network that is overloaded.

- ■

In terms of decentralization, the central issue is how to uphold decentralization when incorporating off-chain transactions.

3. Systems for P2P Energy Trade Based on Blockchain Technology

A novel blockchain-based architecture that overcomes the hurdles of expansiveness, safety, and dispersion within the energy trading domain are instigating a revolution in (P2P) energy commerce. This model’s core aim is to create a scalable, secure, and efficient environment for rapid and frequent energy trading. This is achieved through a second-layer solution built on a robust blockchain foundation.

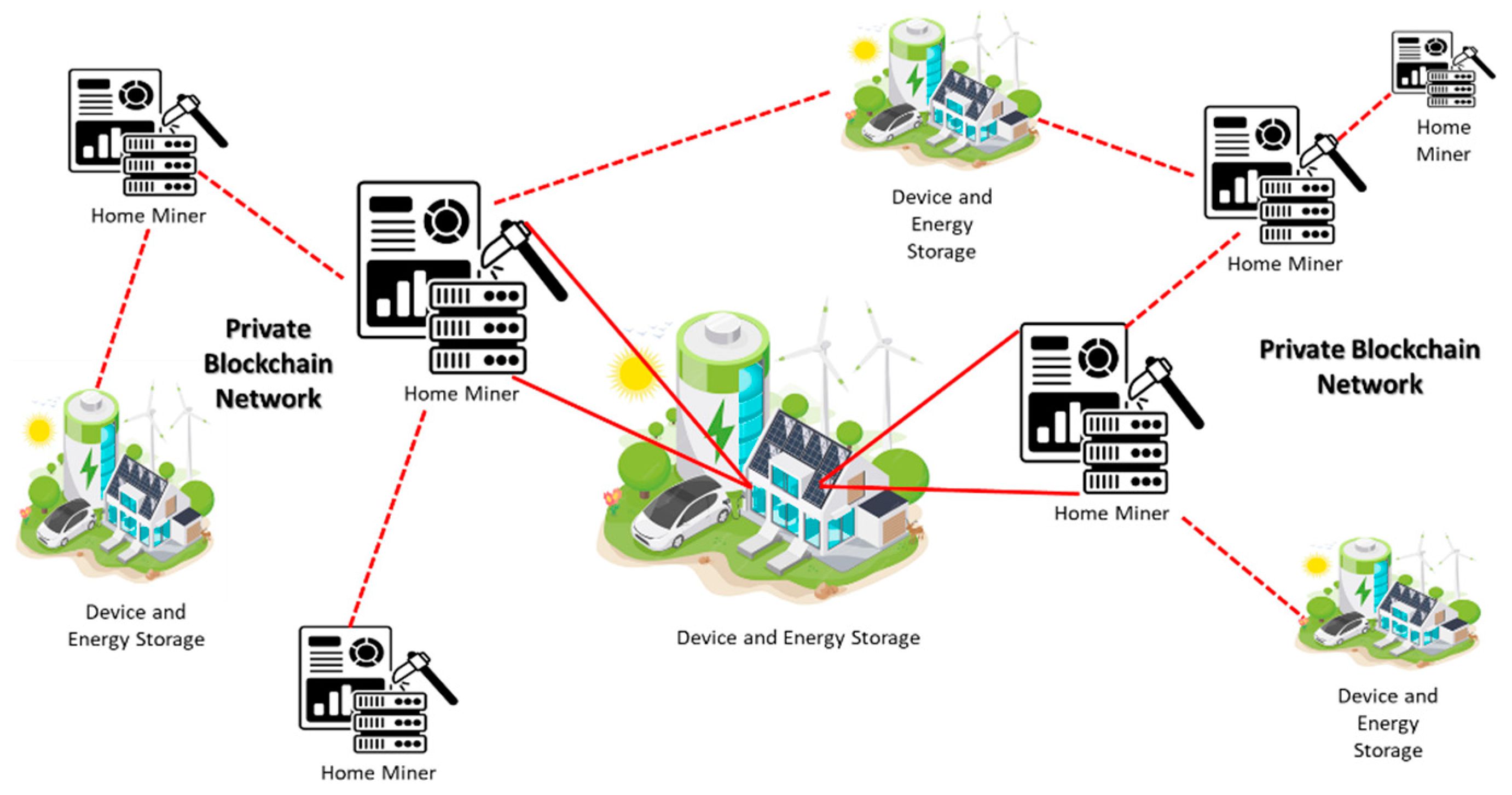

In the world of blockchain P2P energy trade, there are two main participant types: “Energy network participants” encompass “prosumers” (those who both consume and produce energy) and “traditional consumers”. These participants use the blockchain network to handle shared renewable energy transactions. Some also serve as blockchain miners, contributing computational power to maintain transaction accuracy. Block producers, responsible for processing transactions and creating blocks, fall under the miner category as stewards to the blockchain network [

15,

16].

Participants in P2P energy trade can draw energy depending on their production and consumption balance or send excess energy to the grid. Renewable energy contributions from prosumers are rewarded with remuneration, sometimes in the form of cryptocurrencies or crypto-utility tokens. Consumers benefit from competitive rates when purchasing energy using the same cryptocurrency. Pricing is determined by market conditions or a fixed token supply with variable renewable energy availability and is dependent on the dynamics of demand and supply for renewable energy that is currently available.

In our use case study (see

Figure 1), we assume that Kahramaa

2 employs specific pricing tariffs (see

Table 3). Energy wholesalers provide energy at higher costs (e.g., 7.3 cents during peak hours and 3.64 cents during off-peak periods) when energy demand exceeds network capacity. This incentivizes surplus renewable energy production, reducing energy prices and rewarding prosumers. Prosumers set their buying and selling prices, with trades occurring when prices align. Payment transactions in P2P energy trading are facilitated by blockchain. Transactions record payer, payee, and payment amount. These are securely stored on a decentralized ledger using smart contracts. Smart contracts enforce rules for payment calculations based on energy tariff spot prices and consumption or production data from energy smart meters. They are programmable code segments acting as autonomous agents, eliminating the need for intermediaries or central authorities.

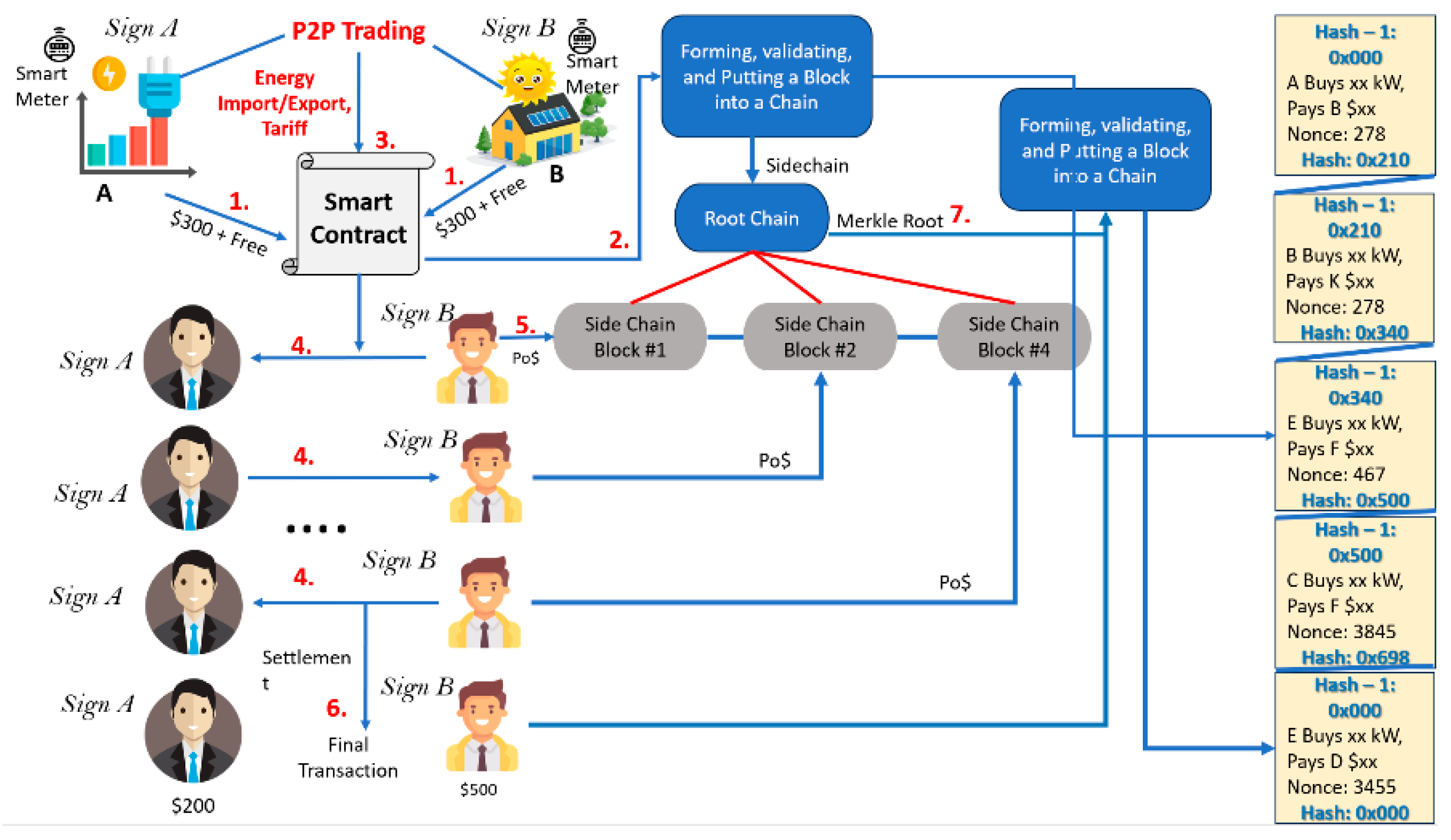

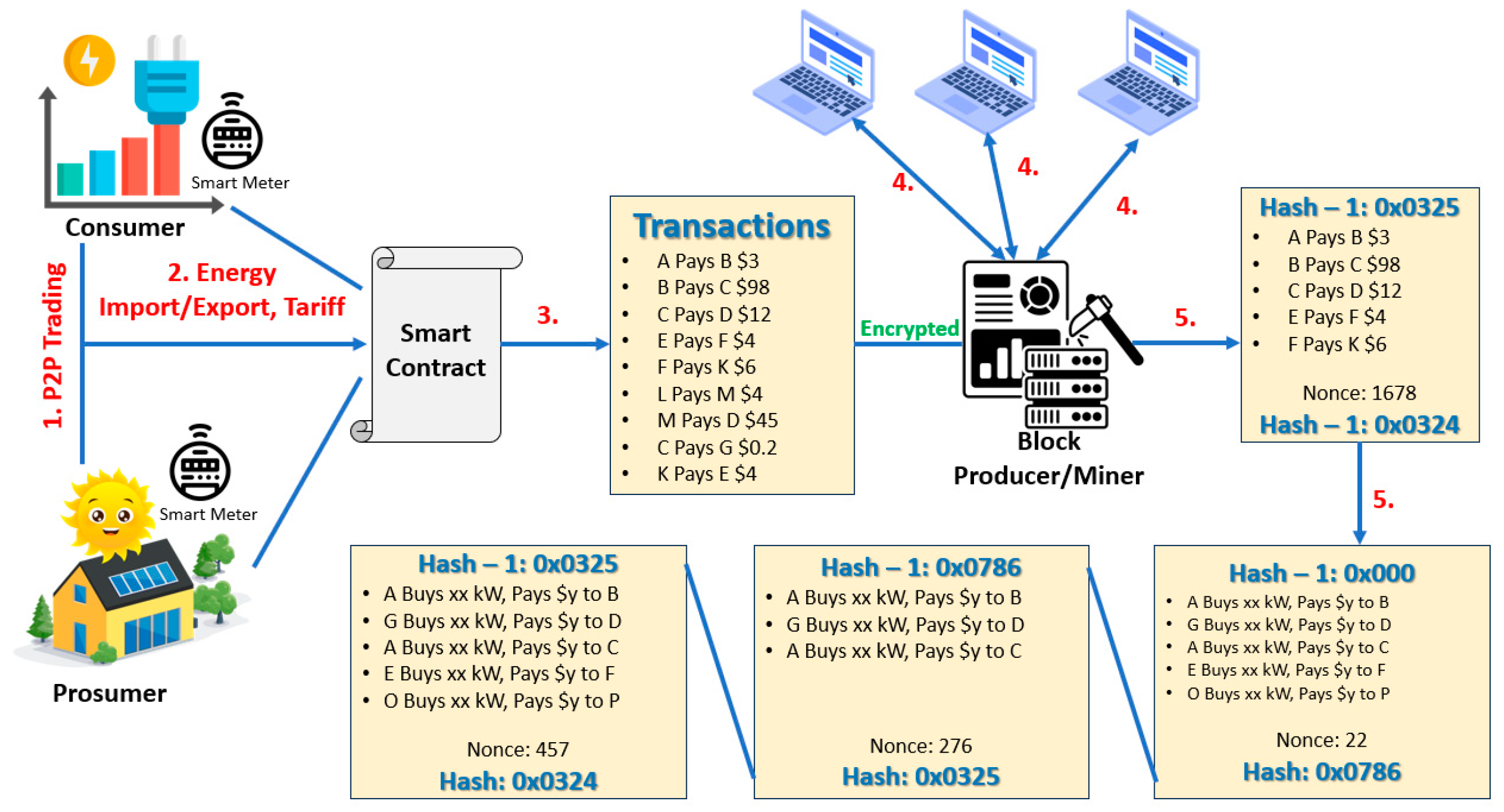

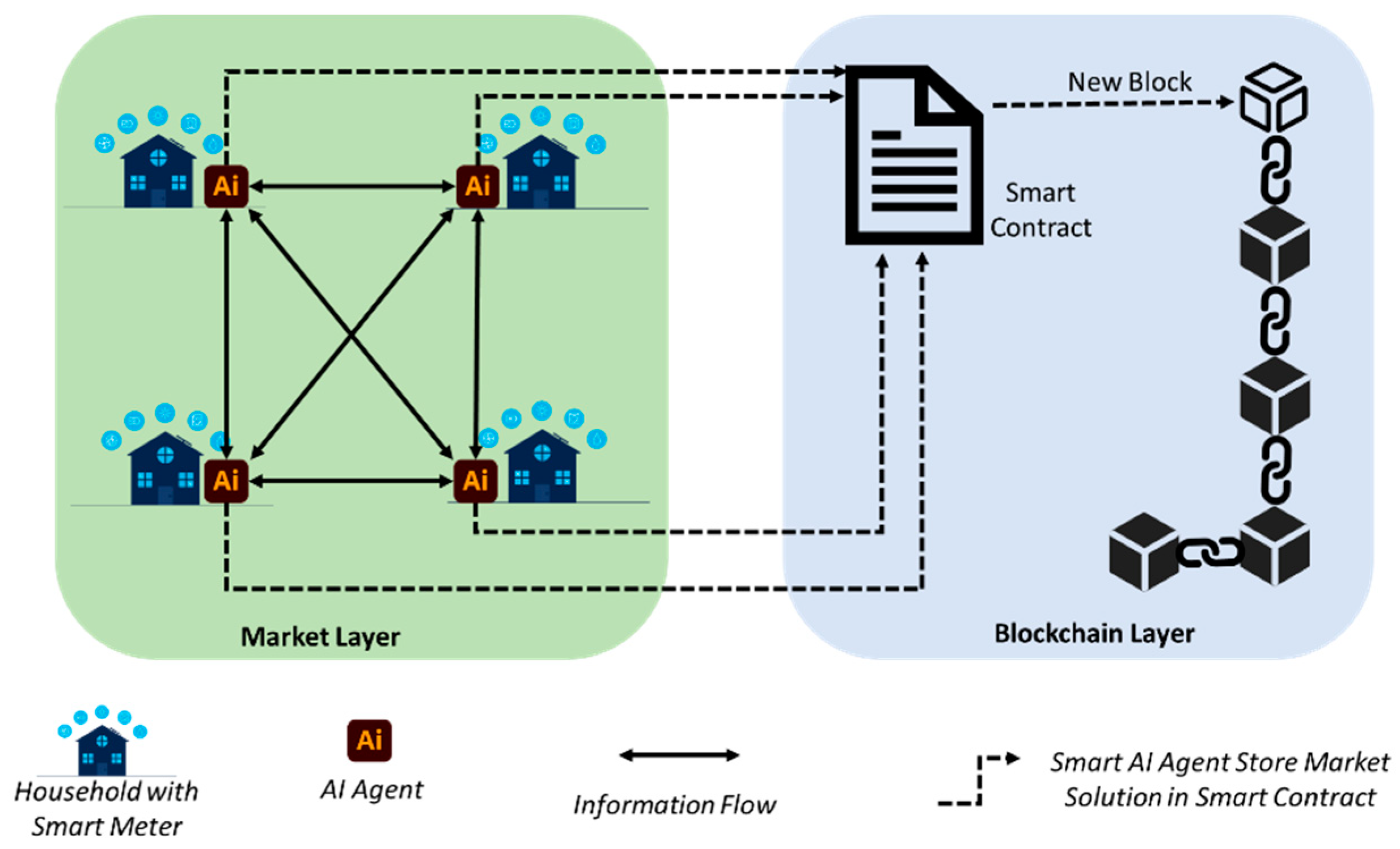

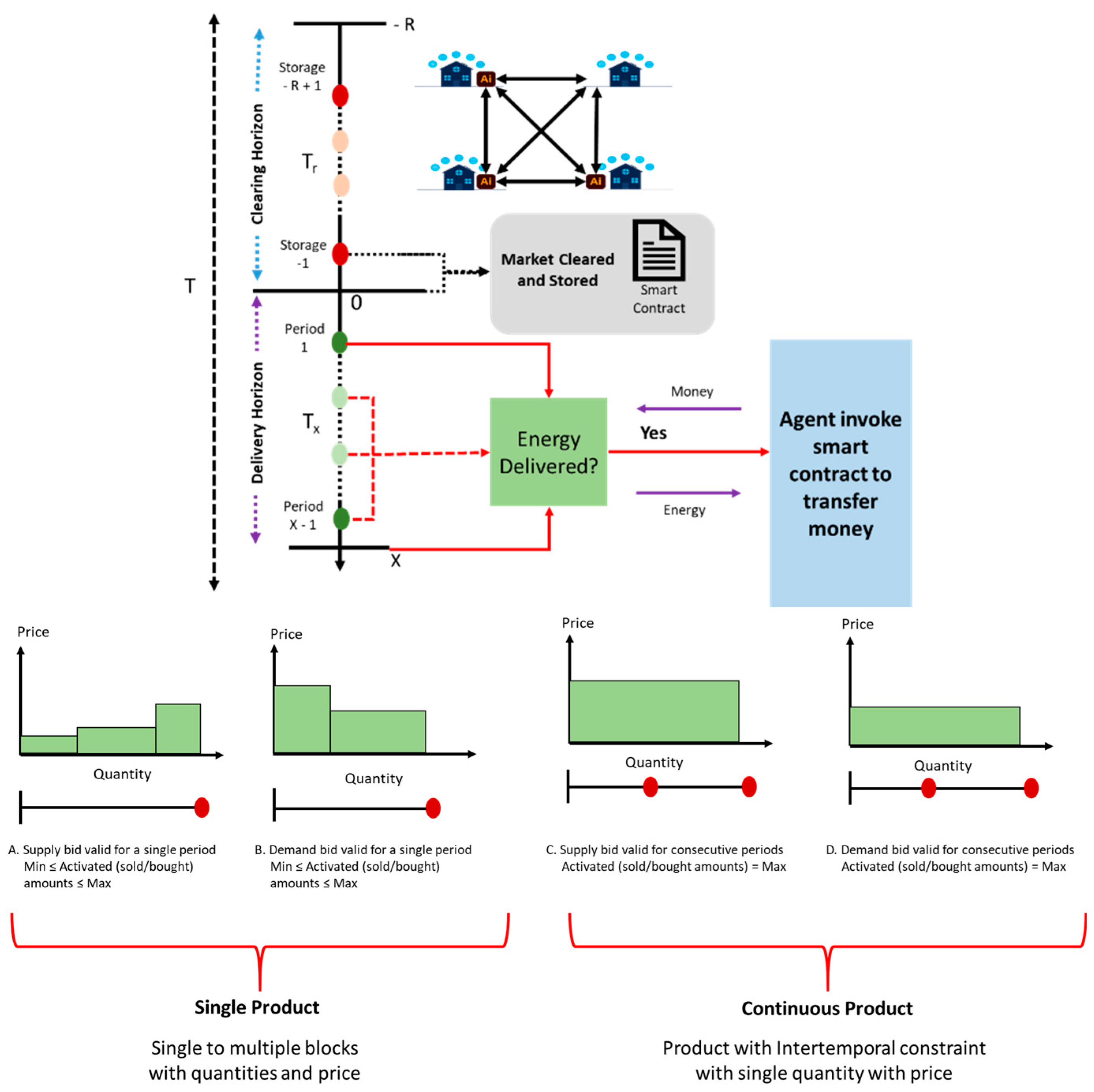

Transaction processing in P2P energy trading involves several crucial steps, as shown in

Figure 2. It starts with P2P energy sharing between prosumers and consumers. Smart contracts then initiate payment transactions, utilizing tariff and energy data to calculate the payment amount. To ensure security, they are encrypted with methods like homomorphic encryption and grouped into a block.

Blockchain miners validate these transaction blocks and broadcast a candidate block to network nodes. Nodes collectively validate transactions through a consensus mechanism, ensuring that funds are available before authentication. The blockchain forms a linked list of blocks through hashing and common signatures, maintaining a comprehensive transaction history. Given blockchain’s current limitations, second-layer solutions are explored to enhance transaction speed and capacity without compromising security. These solutions hold promise in addressing the blockchain trilemma. The study proposes a use-case for second-layer solutions, side-chain processing of off-chain transactions, and network transaction fees as incentives for autonomous operation in blockchain-based P2P energy trade (see

Figure 3).

Participants deposit a payment to commit an operation fee into a wallet with multiple signatory that acts as the contract’s repository to start a smart contract. Let’s say that A and B each contribute

$300. Both parties sign the transaction digitally before it is uploaded to the blockchain for validation. These digital signatures authorize the transaction, verified through the participants’ public keys. As long as they retain control over their private keys, no one else can sign on their behalf. The transaction block is stored in a side chain, becoming its root.

Figure 2 illustrates a payment limit of

$1000, which the smart contract utilizes to calculate energy prices and ensure that the total transaction does not exceed this amount.

Participants in this system agree to transactions beforehand, guaranteeing that all parties can complete many transactions as long as they have enough money in the payment channel. The commitment bond, a proof-of-stake consensus technique, is used to store off-chain transactions on a sidechain. Transaction fees serve as the compensation for side-chain consensus. Within the sidechain, these transactions are arranged into a tree structure, with the depth of the tree growing as more users conduct trade. By enforcing state changes inside chain hierarchies, this architecture creates a system that is resistant to fraud. The parties concerned must work together to close the channel or settle the dispute. According to the final amount following the previous transaction, reimbursements are distributed upon settlement. A participant A receives a

$200 refund, and a participant B receives a

$500 refund in

Figure 2, which serves as an illustration of the final settlement. These settlements often take place at the conclusion of a predefined billing cycle, enabling participants to start new contracts for ongoing involvement.

The wholesaler or municipal authorities may need a comprehensive, auditable transaction record for legal and auditing reasons. In these circumstances, authenticated and recorded side-chain transactions might be encoded using cutting-edge techniques like zero-knowledge proofs [21]. The electrical grid authority may securely maintain the most recent version of the whole side-chain ledger. P2P electrical transactions may be logged and invoiced on the blockchain at specified intervals, maybe in a span of five seconds or every 15 minutes. Second-layer recorded transactions provide efficient and quick procedures. This strategy permits rapid micropayments that can also pay transaction costs, unlike conventional bimonthly payments.

Off-chain transactions remain off the blockchain, relying on bonded fraud proofs for enforcement, ensuring reliable autonomous network operation with minimal downtime. Penalties are imposed on fraudulent behavior. For final settlement transaction timing, a number of tactics can be used, such as predetermined time frames or based on the volume of trading transactions. The energy trading network could be able to perform the same functions as the blockchain network, but it does not offer the same level of security advantages. Although simultaneous contract exits might overburden the network, the second-layer method lowers transaction fees and simplifies smart contract execution. In such cases, participants receive refunds, presenting a challenge for energy trading. Policies may need to impose fees or higher tariffs by the wholesale producer if smart contracts are not funded adequately.

4. Case study of (P2P) energy trade

Using information from the Education City Community Housing (ECCH) compound reported in

Figure 4, this research seeks to estimate the volume of transactions and related costs in participant energy trading, considering both blockchain models and the cost reductions made possible by the second-layer solution. Using Hyperledger Fabric’s smart contract, we’ve created a smart grid in which prosumers and consumers trade energy. The private blockchain network is established from GUI provided by Hyperledger Fabric and Solidity for writing smart contracts. Our model covers eight nodes in this study with transactions taking place between a consumer and prosumer.

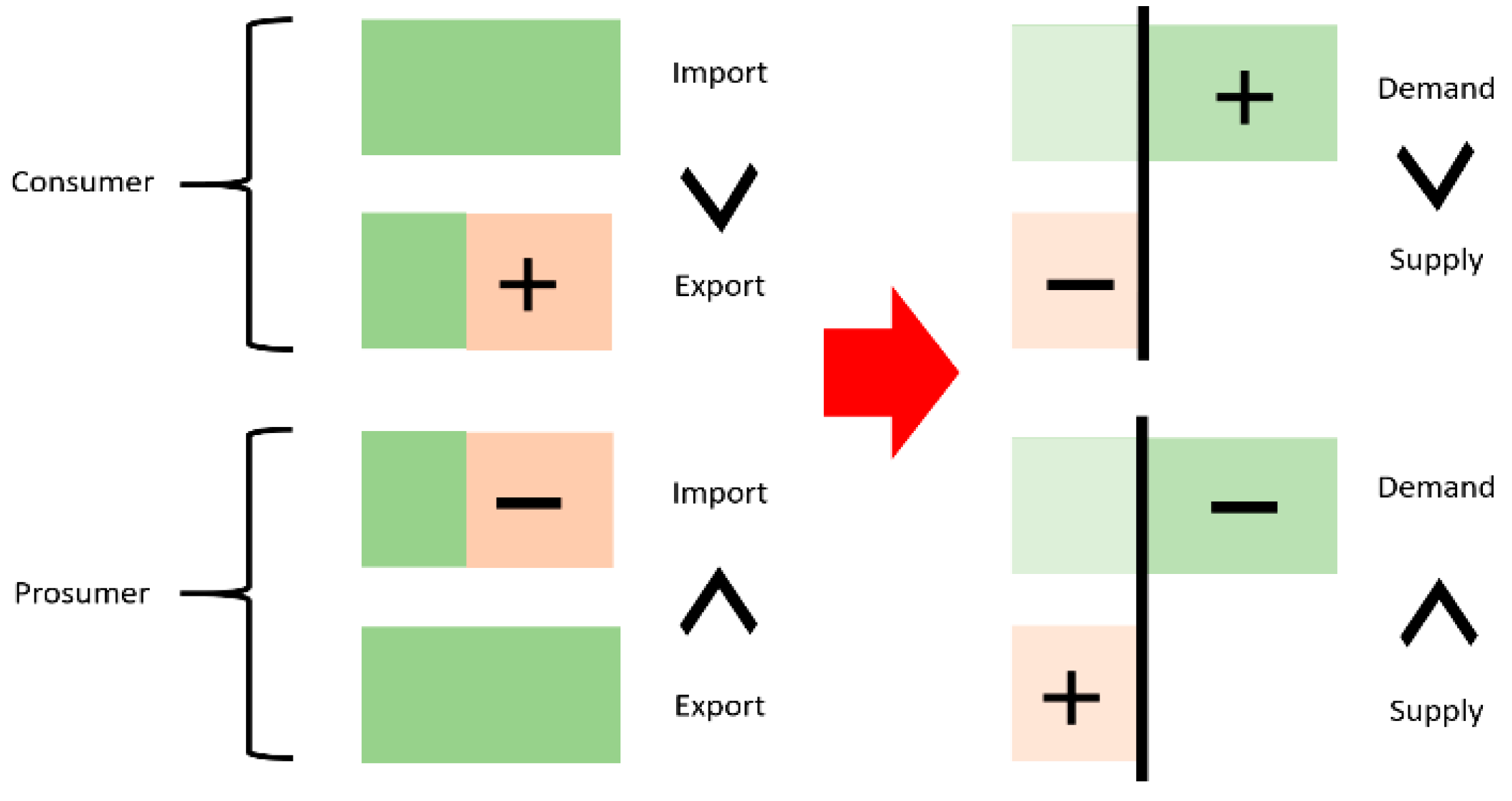

The balance of energy between prosumers (energy producers and consumers), that is formed by dynamics of demand and supply of energy, determines the number of transactions. Energy demand occurs when energy import surpasses export, while an energy surplus results from the reverse scenario.

Figure 5 illustrates the process of matching demand with supply to determine the number of transactions. Energy demand is rated and coupled with supply when there is a greater demand for energy than there is supply. While decreasing demand ranking produces the fewest transactions, ascending demand ranking produces the greatest number of deals. In contrast, supply is rated and matched with demand when supply is greater than demand. Transactions are maximized by a falling supply ranking whereas they are minimized by an ascending ranking (see

Figure 6).

The number of transactions (TX) over a two-month period is determined by computing Eq. 1 for the lowest number of transactions and Eq. 2 for the greatest amount.

where,

Table 4.

Units/symbols for the Financial model.

Table 4.

Units/symbols for the Financial model.

The studied wholesale power market (see

Figure 6 and

Figure 7) now has a 30-minute settlement time. A 5-minute settlement period will be implemented. To determine the minimal and maximal transactions, the energy statistics for both minute settlements (30 and 15 minutes) are employed. The daily average of transactions is shown in

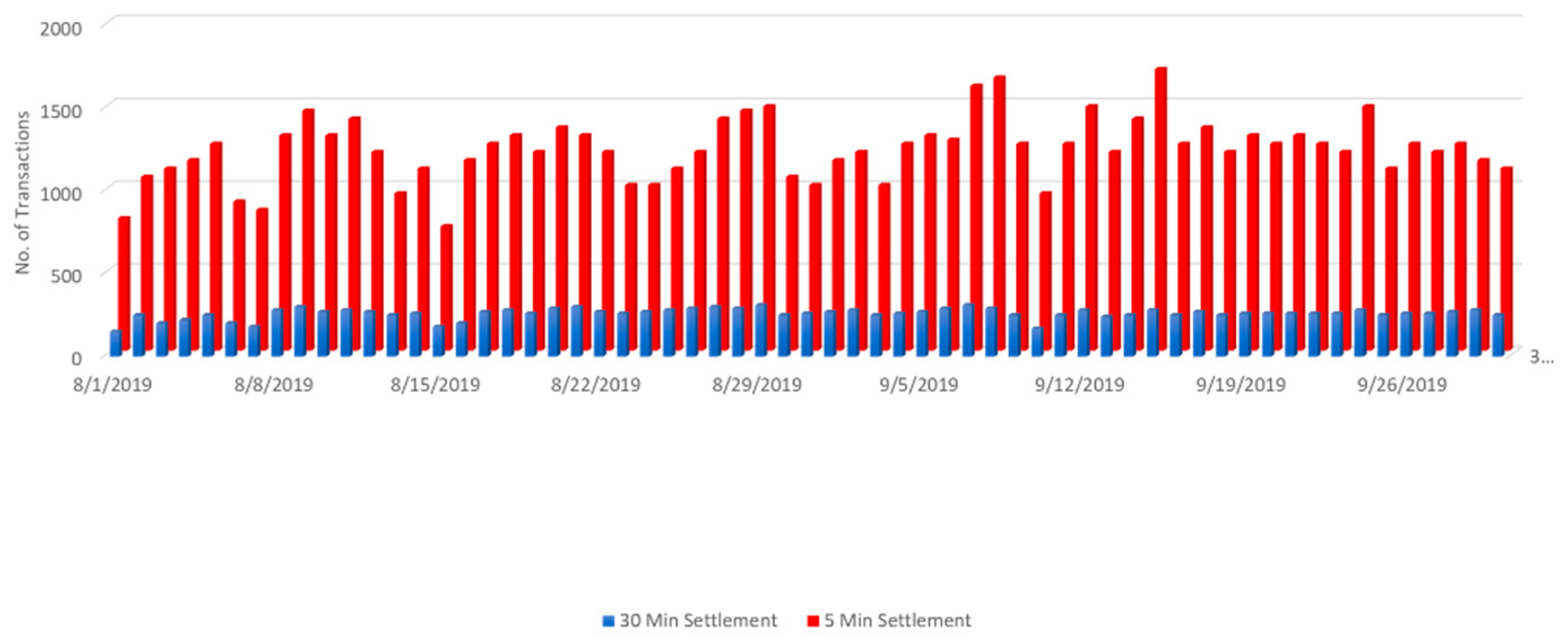

Figure 8 for both the 5-minute and 30-minute time frames. Five-minute settlements varied from 260 to 1780 transactions in the ECCH experiment, and thirty-minute settlements ranged from 40 to 460 transactions. The red and blue curves stand in for these transactions.

When evaluating the costs of blockchain fees on the Hyperledger Fabric (HF) blockchain, it is important to consider the additional fees associated with the blockchain technology. These fees can vary depending on the type of blockchain network being used, and the type of transactions being made. For example, the fees associated with transactions on the public Ethereum blockchain are typically higher than those associated with the private HF blockchain. For example, transactions that involve smart contracts may incur additional fees due to the complexity of the execution logic. Additionally, the fees associated with deploying and running a smart contract may be higher than the fees associated with a regular transaction. Furthermore, the fees associated with deploying and running a dApp on the HF blockchain may be higher than the fees associated with a normal transaction. Additionally, the fees associated with running a permissioned network may be higher than those associated with a public blockchain. Finally, the fees associated with running a private network may be higher than those associated with a public blockchain [

17].

The cost of using Hyperledger Fabric (HF) to process transactions in USD depends on a variety of factors, such as the particular blockchain network size and the number of nodes, the number of transactions per second, the complexity of the transaction, and the amount of data stored in the chain. In general, the cost per transaction in Hyperledger Fabric is lower compared to other distributed ledger technologies, since its permissioned and private architecture allows for more efficient data processing and storage. Moreover, the use of smart contracts and other features such as consensus algorithms enable the network to run more efficiently, reducing the cost per transaction. Since Hyperledger Fabric is an open-source platform, the cost of running the network is determined by the cost of setting up and running the nodes and is dependent on the resources required to run the network. Additionally, there are certain fees associated with the use of the network, such as transaction fees and gas fees, which can be paid in USD or other currencies. Overall, the cost of using Hyperledger Fabric to process transactions in USD is relatively low compared to other blockchain networks.

Equation (3) outlines the calculation for HF blockchain transaction costs, which are based on the size of the transaction in bytes, and the transaction fee rate set by the network. The equation is as follows:

For example, if the size of a transaction is 150 bytes and the fee rate is 0.001 ETH, the cost of the transaction would be 0.15 EneToken

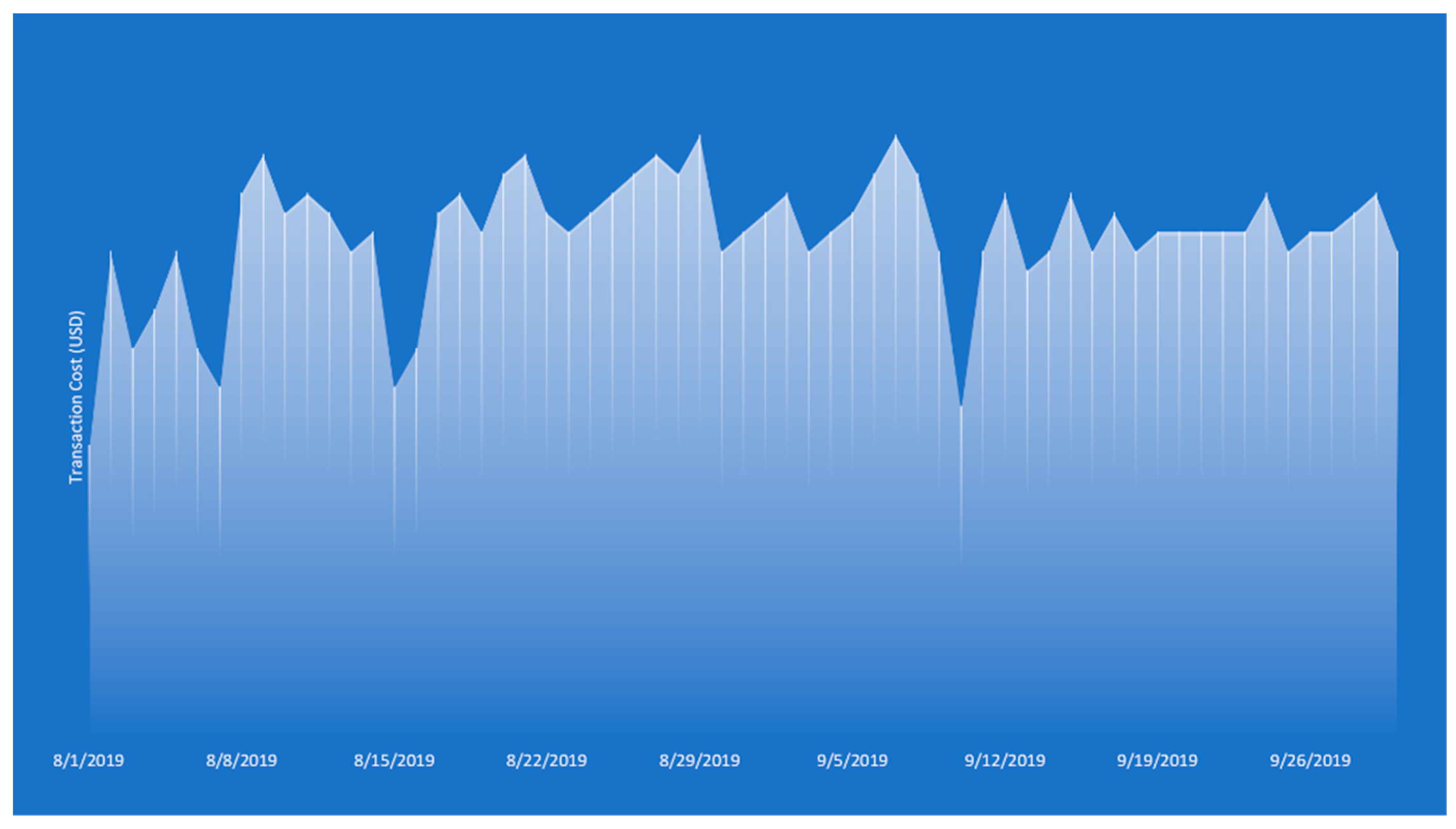

3. The fee rate is determined by the network, and it can vary depending on the current network load and the specific blockchain protocol. As a general rule, larger transactions tend to have higher fees, and if the fee rate is too low, the transaction may not be accepted by the network. It is important to research the fee rate of the network before submitting a transaction, in order to ensure that the cost of the transaction is not too high, and that it will be accepted by the network. Additionally, some networks allow users to set their own fee rate, which can be a useful tool for controlling the cost of transactions. Figure. 9 displays the daily average cost per transaction over the course of two months. Equation (4) provides the computation of the overall blockchain costs.

For 50 properties over a period of two months,

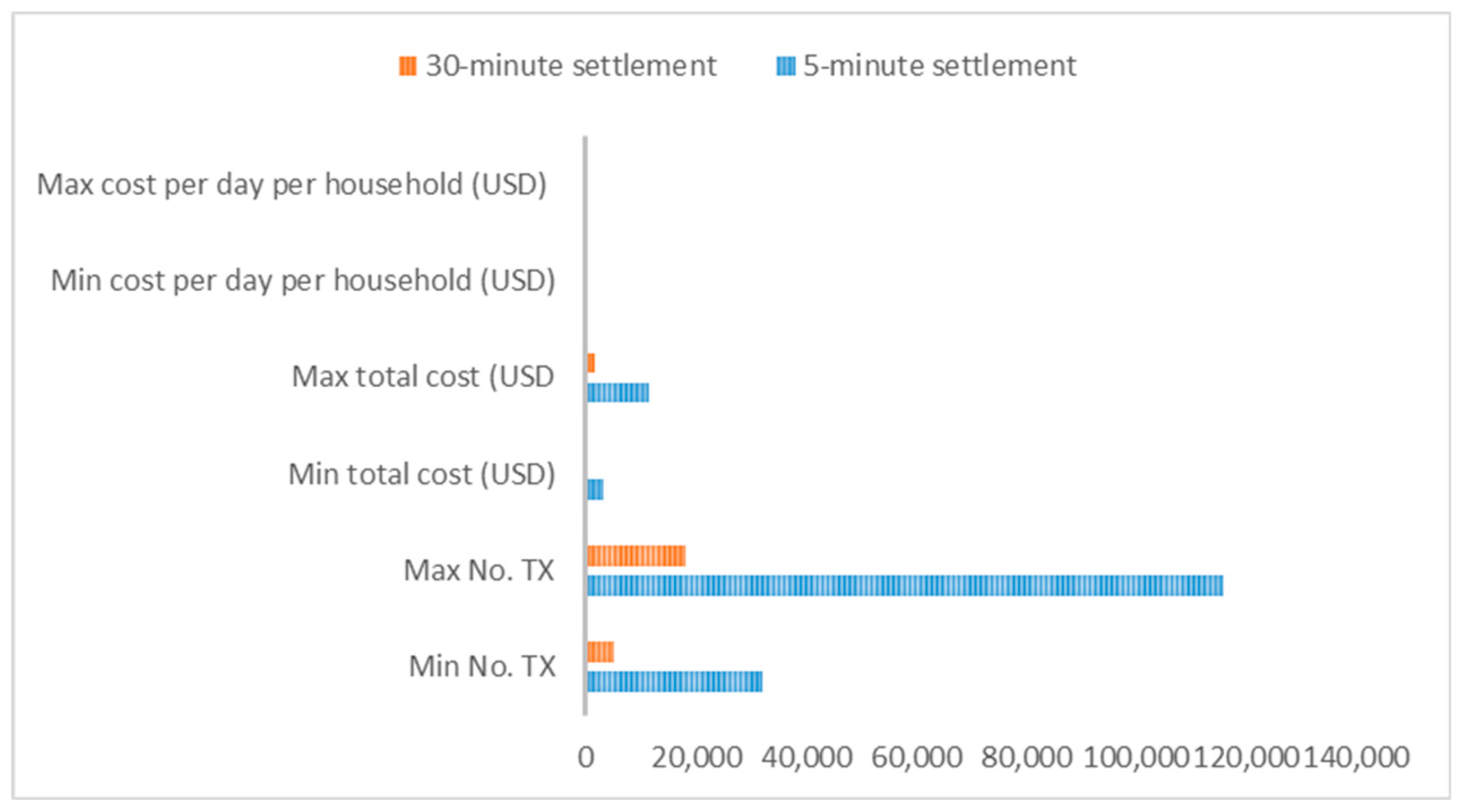

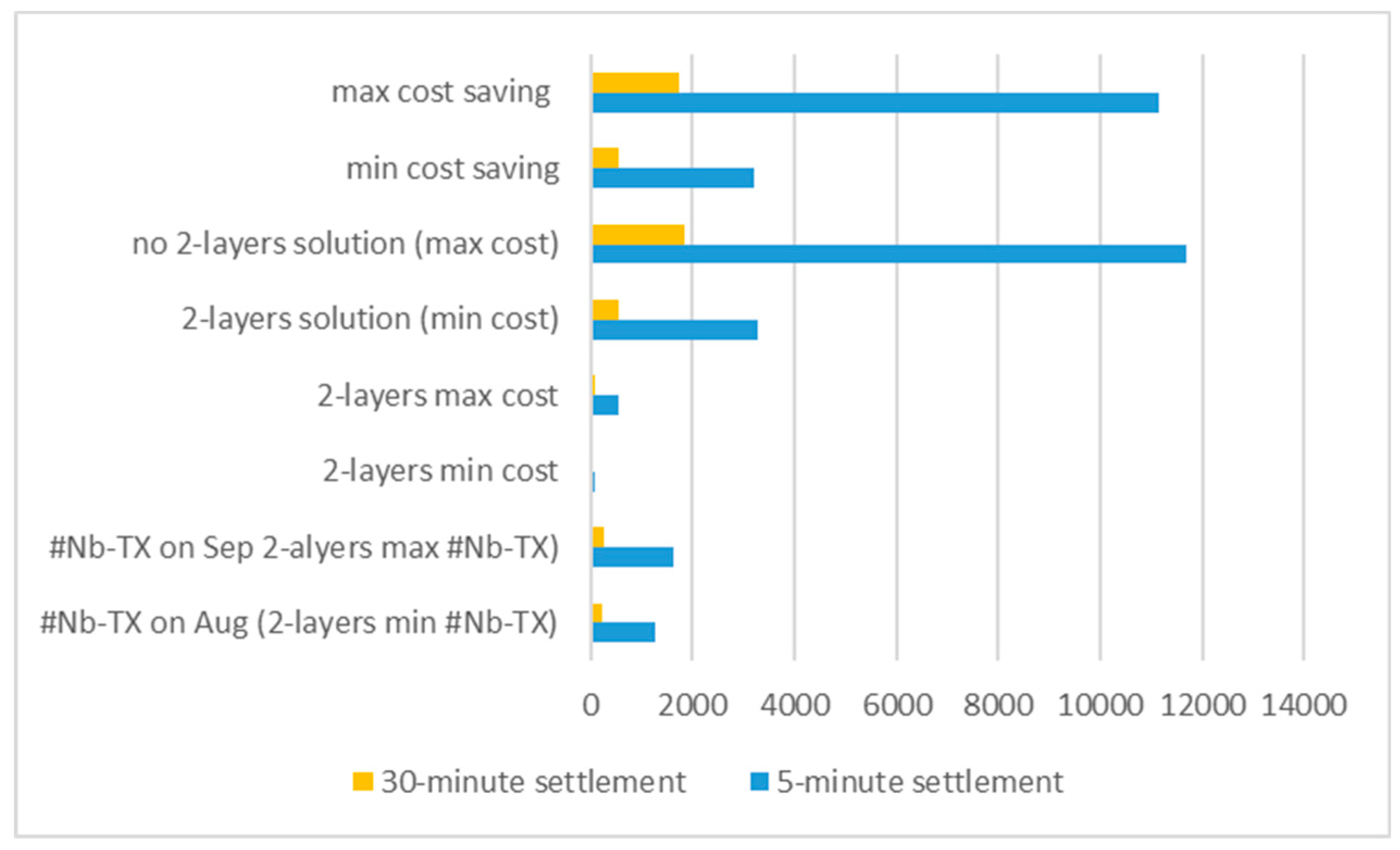

Figure 10 shows the lowest and maximum number of transactions and related expenditures. By utilizing a second-layer method, the block finality time—the length of time it takes for transactions to be recorded on the blockchain—can be configured to lower computational costs for each transaction. This has a significant impact on cost reductions. The maximum transaction cost was determined by the cost that occurred on August 8, 2019, while the minimum cost was calculated using the cost noted on September 8, 2019. Equations (5) and (6) illustrate the computation for the minimum and maximum costs of the second-layer solution:

Here, tmin corresponds to 8 September, and tmax corresponds to 8 August 2019.

Figure 11 compares the costs of blockchain solutions with and without implementations at the second layer, as well as the total and % of money saved. Savings vary from 95% to 98% when comparing the cost of employing the second-layer technique to the cost of registering each transaction on the blockchain.

5. Conclusions

Within the framework of the energy trading blockchain trilemma, the objective of this research is to provide a comprehensive evaluation of the status of scaling solutions. Even though peer-to-peer (P2P) energy trade is still in its infancy, blockchain technology has recently attracted more interest since it offers great promise for revolutionizing the way that energy is distributed. The industry has also witnessed the emergence of numerous startups. The success of energy trading depends on several important aspects, including technical improvements as well as regulatory, legal and economic, legal, and regulatory issues. For instance, transaction processing costs are far lower than the existing coordination costs, enabling more frequent energy trading that can fully realize the promise of renewable energy. While maintaining the security of P2P trading against participant misbehavior, criminal activity and fraud is essential, competitive pricing for energy providers and prosumers can further encourage the renewable energy market.

Funding

This study was supported by the Qatar Environment & Energy Research Institute, and the Qatar National Research Fund (QNRF) grant NPRP13S-0109-200032, A Blockchain Community Solar Ecosystem for Qatar.

Acknowledgments

This study was supported by the Qatar Environment & Energy Research Institute, and the Qatar National Research Fund (QNRF) grant NPRP13S-0109-200032, A Blockchain Community Solar Ecosystem for Qatar.

Conflicts of Interest

The authors declare no conflict of interest.

| 1 |

LO3 Energy - Start Up Energy Transition (startup-energy-transition.com) |

| 2 |

Qatar General Electricity & Water Corporation |

| 3 |

Native currency created with chaincode for HF. |

References

- Wayes Tushar, Chau Yuen, Tapan K. Saha, Thomas Morstyn, Archie C. Chapman, M. Jan E. Alam, Sarmad Hanif, H. Vincent Poor, Peer-to-peer energy systems for connected communities: A review of recent advances and emerging challenges, Applied Energy, Volume 282, Part A,2021,116131,ISSN0306-2619. [CrossRef]

- A. Boumaiza and A. Sanfilippo, “Peer to Peer Solar Energy Trading Demonstrator Blockchain-enabled,” 2023 11th International Conference on Smart Grid (icSmartGrid), Paris, France, 2023, pp. 1-7. [CrossRef]

- Žiga Turk, Robert Klinc,Potentials of Blockchain Technology for Construction Management,Procedia Engineering,Volume 196,2017,Pages 638-645,ISSN 1877-7058. [CrossRef]

- Hassan NU, Yuen C, Niyato D. Blockchain technologies for smart energysystems: fundamentals, challenges, and solutions. IEEE Ind Electron Mag 2019;13(4): 106–18.

- Yli-Huumo J, Ko D, Choi S, Park S, Smolander K. Where is current research on blockchain technology?—a systematic review. PLoS One 2016;11(10):e0163477.

- Zheng Z, Xie S, Dai H, Chen X, Wang H. An overview of blockchain technology: architecture, consensus, and future trends. In: Big Data (BigData Congress), 2017 IEEE International Congress on. IEEE; 2017.

- A. Boumaiza and A. Sanfilippo, “Blockchain-based Electricity Marketplace,” 2023 3rd International Conference on Electrical, Computer, Communications and Mechatronics Engineering (ICECCME), Tenerife, Canary Islands, Spain, 2023,pp.1-5. [CrossRef]

- Deshpande A, Stewart K, Lepetit L, Gunashekar S. Distributed ledger technologies/blockchain: challenges, opportunities and the prospects for standards. Overview report The British Standards Institution (BSI); 2017.

- Z. Zheng, S. Xie, H. Dai, X. Chen and H. Wang, “An Overview of Blockchain Technology: Architecture, Consensus, and Future Trends,” 2017 IEEE International Congress on Big Data (BigData Congress), Honolulu, HI, USA,2017,pp.557-564. [CrossRef]

- Muhammad Shoaib Farooq, Misbah Khan, Adnan Abid, A framework to make charity collection transparent and auditable using blockchain technology, Computers & Electrical Engineering, Volume 83,2020,106588,ISSN0045, 7906. [CrossRef]

- Vlada Brilliantova, Thomas Wolfgang Thurner, Blockchain and the future of energy,Technology in Society,Volume 57,2019,Pages 38-45,ISSN 0160-791X. [CrossRef]

- Tushar W, Saha TK, Yuen C, Smith D, Poor HV. Peer-to-peer trading in electricity networks: an overview. IEEE Trans Smart Grid 2020.

- A. Boumaiza and A. Sanfilippo, “Revolutionizing Energy Markets with Distributed Energy Generation and Blockchain Technology: A Case Study of Agent-Based Modeling and GIS in Education City Community Housing, Qatar,” IECON 20-49th Annual Conference of the IEEE Industrial Electronics Society, Singapore, Singapore, 2023, pp. 1-4. [CrossRef]

- Ipakchi A, Albuyeh F. Grid of the future. IEEE Power Energ Mag 2009;7(2):52–62.

- Felder FA, Athawale R. The life and death of the utility death spiral. Electr J 2014;27(6):9–16.

- Hassan NU, Yuen C, Niyato D. Blockchain technologies for smart energysystems: fundamentals, challenges, and solutions. IEEE Ind Electron Mag 2019;13(4): 106–18.

- Mylrea M, Gourisetti SNG. Blockchain for smart grid resilience: Exchanging distributed energy at speed, scale and security. Resilience week (RWS). IEEE; 2017. 2017.

- Andoni M, Robu V, Flynn D, Abram S, Geach D, Jenkins D, et al. Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renew Sustain Energy Rev 2019;100:143–74.

- Wang Y, Kogan A. Designing confidentiality-preserving Blockchain-based transaction processing systems. Int J Account Inform Syst 2018;30:1–18. [22] Poon, J. and V. Buterin, Plasma: Scalable autonomous smart contracts. White paper, 2017. [23] Technical report. 2017.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).