Submitted:

18 January 2024

Posted:

19 January 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Review of Literature

2.1. The study's objectives and purpose

2.1.1. Hospital Management Accounting: Concepts and Functions

2.1.2. Challenges in Hospital Management Accounting

2.1.3. Opportunities in Hospital Management Accounting

2.1.4. Strategies for the Sustainability of Hospital Management Accounting

3. Methodology

3.1. Identifying the issue/problem

3.2. Sample identification

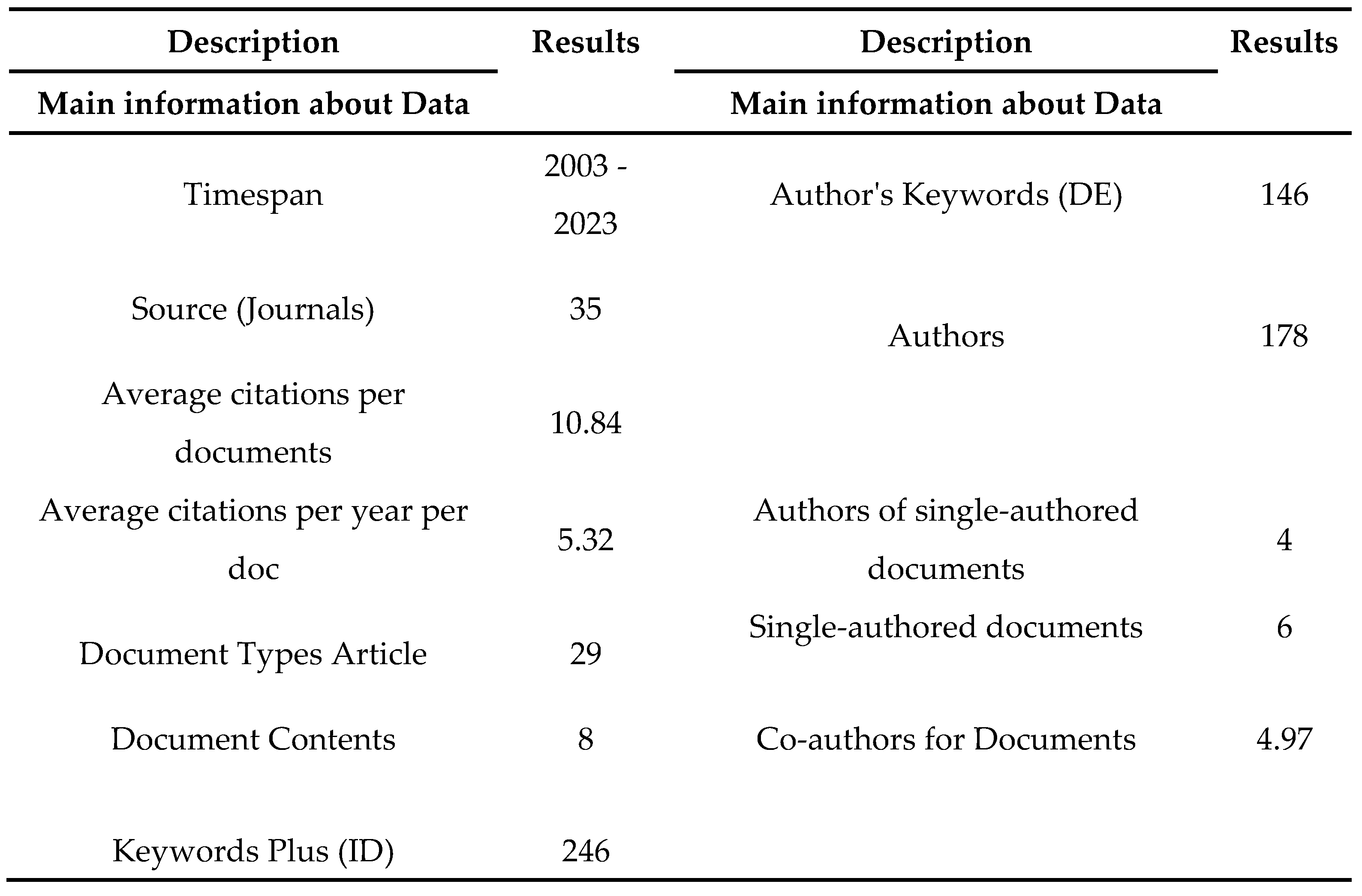

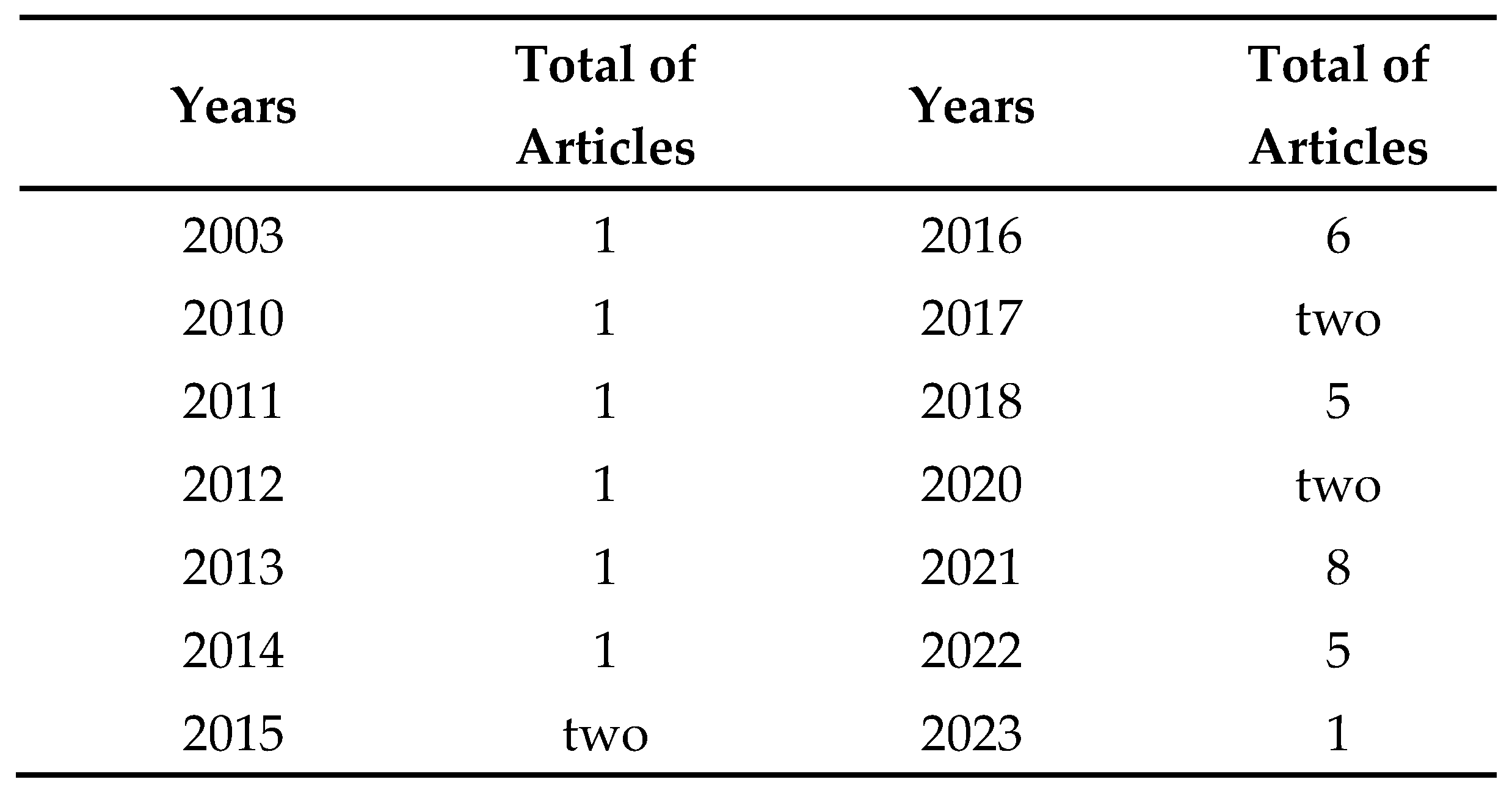

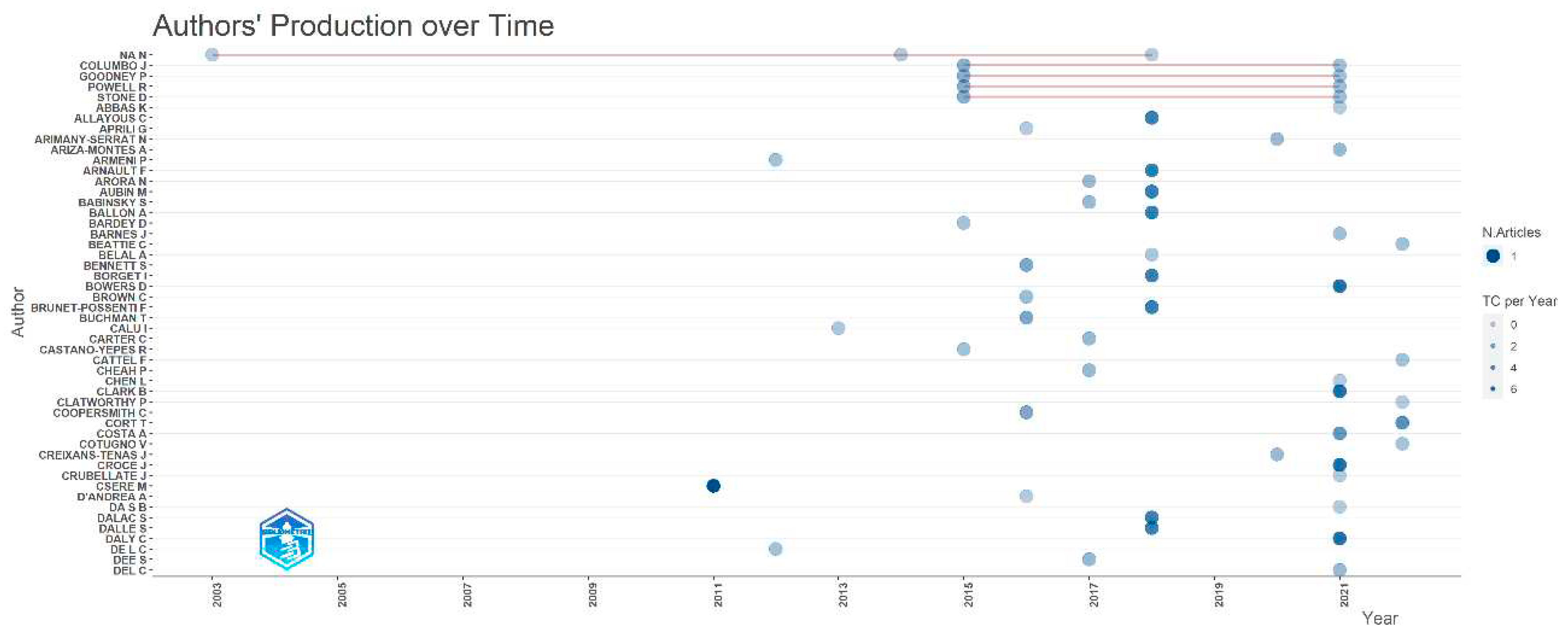

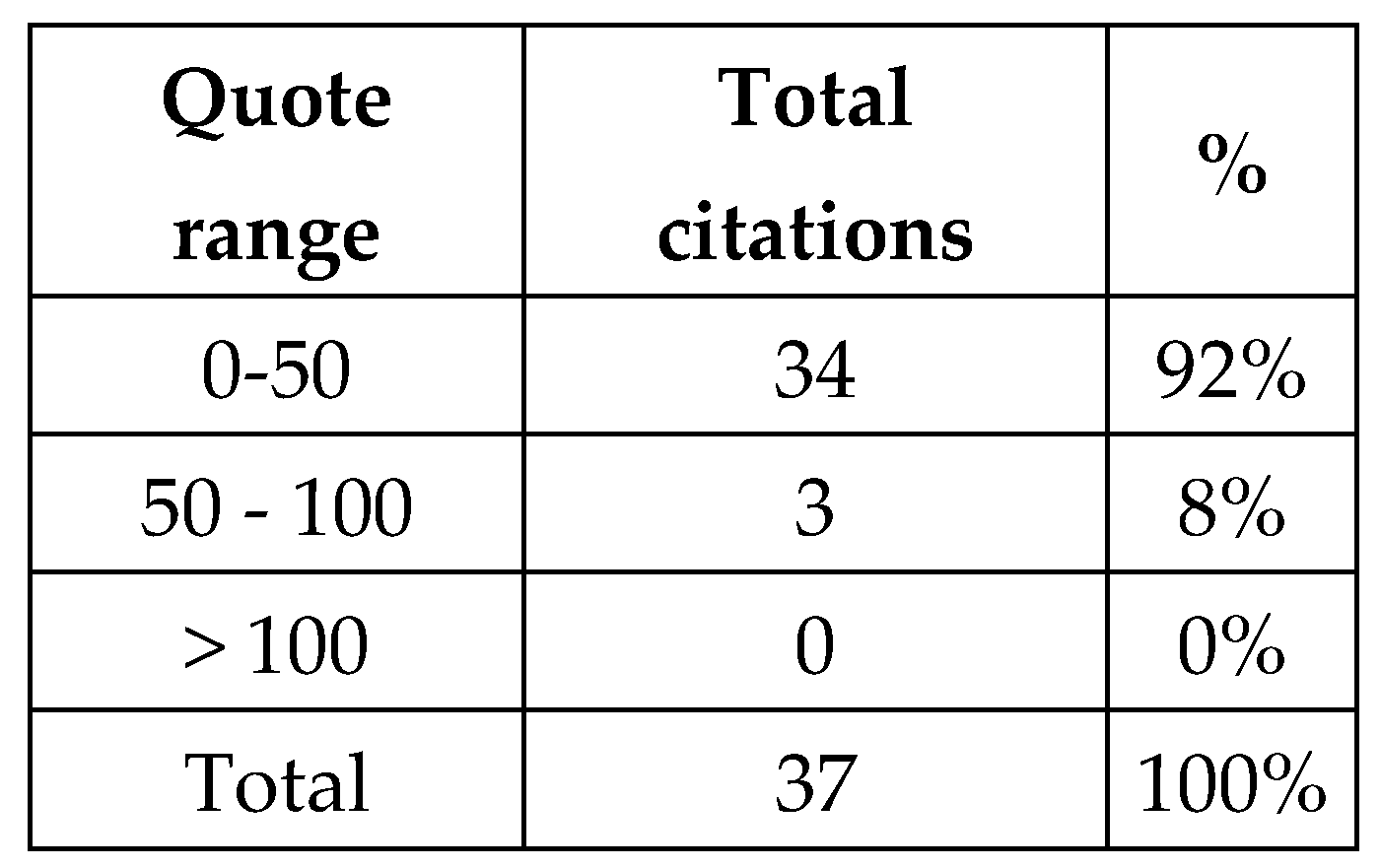

3.3. Research profile (Study quality assessment (3) and Evidence analysis/summary (4))

3.4. Interpretation and presentation of results

4. Conclusion

5. Perspectives for future studies

- Public-sector sustainability reporting framework development: Investigate and create public-sector sustainability reporting frameworks, taking into account the characteristics and peculiarities of this sector, to provide comprehensive information on social, environmental and economic dimensions

- Assessment of the quality and relevance of public sustainability reports sector: Investigate the quality of sustainability reports produced by public sector entities, considering the reliability, transparency, integrity and relevance of the information presented.

- Evaluation of the influence of sustainability reports in government: Analyze the impact of sustainability reports on decision-making, accountability to society and management practices of public sector entities, identifying changes and improvements resulting from these reports.

- Comparative analysis of public sector sustainability reporting methods: Carry out comparative studies between different public sector entities, at local, regional and national levels, to identify good practices and sustainability reporting standards, seeking to understand the differences and similarities between approaches adopted.

- Development of specific sustainability indicators for the public sector: Develop sustainable performance indicators that are relevant and appropriate for the public sector, considering the particularities of the activities and responsibilities of this sector, allowing a more accurate and comprehensive assessment of sustainable performance.

- Integration of environmental cost accounting in the public sector: Investigate ways to integrate environmental cost accounting into public sector accounting practices, allowing the measurement and monitoring of costs associated with the environmental impacts of government activities.

- Analysis of barriers and challenges in implementing accounting, reporting and sustainability reporting in the public sector: Identify the main barriers and challenges faced by public sector entities in implementing accounting practices and sustainability reporting, such as lack of resources, organizational resistance and knowledge gaps.

- Assessing stakeholders' Role in Accounting, accountability and sustainability reporting in the public sector: Analyze the involvement and influence of stakeholders, such as citizens, local communities, civil society organizations and regulatory bodies, in accounting, accountability and sustainability reporting in the public sector.

- Impact of legislation and regulation on environmental accounting and reporting in the public sector: Investigate the impact of laws and regulations related to sustainability accounting and reporting in the public sector, considering how these policies influence accountability and transparency practices.

- Explore the use of modern technologies in public sector sustainability accounting and reporting: Investigate the potential and benefits of leveraging technologies such as artificial intelligence, big data, and blockchain in public sector sustainability accounting and reporting, with the goal of improving information accuracy, efficiency, and reliability.

6. Study limitations

- Complexity of Hospital Costs: Hospitals deal with a variety of costs, such as medical supplies, salaries, advanced medical technology, and medications. These costs vary between departments and services, and management accounting faces the challenge of capturing, tracking and allocating these costs accurately and reliably.

- Integration of Information Systems: Hospitals often have fragmented and unintegrated information systems. This creates difficulties in obtaining consistent and updated data, in addition to creating gaps in communication and difficulties in effectively analyzing and monitoring financial and operational data.

- Measuring Value in Health: Assessing value in health is complex and involves measuring the results achieved by health services and their relationship with costs. Developing appropriate metrics and indicators to capture the value generated by hospital services is a significant challenge.

- Planning and Budgeting: Hospitals face the challenge of balancing revenues with operating costs under financial constraints. Management accounting is critical in projecting revenue, estimating costs, and setting realistic financial goals, but it is challenging to accurately forecast revenue considering changes in reimbursement policies, fluctuations in demand for healthcare services, and other unpredictable external factors.

Author Contributions

Declaration of interests

References

- Andrades, J. and Larrán-Jorge, M. (2019), “Examination of the amount of mandatory non-financial contributions information disclosed by Spanish state-owned companies and their potential variables.

- influential”, Meditari Pesquisa Contábil.

- Argento, D. Grossi, G. Persson, K. and Vingren, T. (2019), “Explaining sustainability disclosures of hybrid organizations: the case of Swedish state-owned companies”, Meditari Pesquisa Contábil. 502.

- Ball, A. (2002), “Sustainability accounting in UK local government, an agenda for research”, CCA Research Report, No. 78, Association of Chartered Certified Accountants, London.

- Ball, A. (2004), “A sustainability accounting project for the UK local government sector? testing the.

- process of mapping social theory and locating a frame of reference”. Critical Perspectives on Accounting, Vol. 15 No. 8, pp. 1009-1035.

- Che-Ku-Kassim, CKH, Ahmad, S., Mohd-Nasir, NE, Wan-Mohd-Nori, WMN and Mod Arifin, NN (2019), “Environmental Reporting by Malaysian Local Governments”, Meditari Accounting Research.

- Decree-Law no. 284, of 26th July 1999, published in Official Gazette no. 172, series 1-A.

- Drury, C. (2013). Management and cost accounting. Cengage Learning.

- Farneti, F. and Guthrie, J. (2009), “Sustainability reporting by Australian public sector organizations: why they blow the whistle”, Accounting Forum, Vol. 33 No. 2, pp. 89-98.

- Farneti, F. Casonato, F. Montecalvo, M. and de Villiers, C. (2019a), “The influence of integrating reporting and information needs of stakeholders on the disclosure of social information in a state-owned company”, Meditari Pesquisa Contábil.

- Farneti, F. Guthrie, J. and Canetto, M. (2019b), “Social reporting of an Italian provincial government: a longitudinal analysis”, Meditari Pesquisa Contábil.

- Gibson, R. and Guthrie, J. (1995), “Recent environmental disclosures in annual reports of Australian public and private sector organisations”, Accounting Forum, Vol. 19 Nos. 2/3, p. 111127.

- Goswami, K. and Lodhia, S. (2014), “Sustainability disclosure standards of South Australian local councils: a case study”, Public Money and Management, Vol. 34 No. 4, pp. 273-280.

- GRI (2004), Public Agency Sustainability Reporting: A GRI Resource Document in Support of the Public Agency Sector Supplement, Global Reporting Initiative, Amsterdam.

- GRI (2005), Sector Supplement for Public Bodies, Global Reporting Initiative, Amsterdam.

- GRI FPA (2012), Integrating Sustainability into Reporting - An Australian Public Sector Perspective, GRI Focal Point Australia (FPA), Sydney.

- Guthrie, J. and Farneti, F. (2008), “GRI sustainability report of Australian public sector organizations”, Public Money and Management, Vol. 28 No. 6, pp. 361-366.

- Hansen, D. R. , & Mowen, M. M. (2018). Cost management: Accounting and control. Cengage Learning.

- Hopwood, B. , Mellor, M. and O'Brien, G. (2005), “Sustainable development: mapping different approaches”, Sustainable Development, Vol. 13 No. 1, pp. 38-52.

- Hoque, Z. and Adams, C. (2008), Measuring Public Sector Performance: A Study of Government Departments in Australia, CPA Australia, Melbourne.

- Ibrahimi, M. and Naym, S. (2019), “The contingency of performance measurement systems in Moroccan institutions and public companies”, Management Accounting Research.

- Kaplan, R. S. , & Norton, D. P. (1992). The balanced scorecard: Measures that drive performance. Harvard Business Review, 70(1), 71-79.

- Kaur, A. and Lodhia, S. (2014), “The state of disclosures about stakeholder engagement in sustainability reporting in Australian local councils”, Pacific Accounting Review, Vol. 26 Nos. 1/2, pp. 54-74.

- Kaur, A. and Lodhia, S. (2016), “Influences on stakeholder engagement in sustainability accounting and reporting: a study of Australian local councils”, Corporate Responsibility and Stakeholders, Emerald Group Publishing, Bingley, pp. 105-129.

- Kaur, A. and Lodhia, S. (2017), “The extent of stakeholder involvement in sustainability accounting and reporting: Does stakeholder empowerment really exist?”, Organizational Governance. Moderna, Emerald Publishing, Bingley, pp. 129-145.

- Kaur, A. and Lodhia, S. (2018), “Stakeholder engagement in sustainability accounting and reporting: a study of Australian local councils”, Journal of Accounting, Auditing and Accountability, Vol. 31 No. 1, pp. 338-368.

- Kaur, A. and Lodhia, S. (2019), “Key issues and challenges in stakeholder engagement in sustainability reporting: a study of Australian local councils”, Pacific Accounting Review, Vol. 31 No. 1, pp. 2-18.

- Khalid, S. Beattie, C. Sands, J. and Hampson, B. (2019), “Incorporating the environmental dimension into the Balanced Scorecard: a case study in the healthcare area”, Meditari Pesquisa Contábil.

- Leeson, R. , Ivers, J. and Dickinson, D. (2005), “Public sector sustainability reporting: driving changes in practice, acceptance and reporting by public bodies”, Accountability Forum, Vol. 8 No. 12 /21.

- Lodhia, S. , Jacobs, K. and Park, Y.J. (2012), “Conducting public sector environmental reporting: the disclosure practices of Australian community departments”, Public Management Review, Vol. 14 No. 5, pp. 631-647.

- Lodhia, S. and Jacobs, K. (2013), “The practice turn in environmental reporting: a study of practices in two Australian Commonwealth departments”, Journal of Accounting, Auditing and Accountability, Vol. 26 No. 4, pp. 595-615.

- Lodhia, S. (2018), “Is the medium the message? Advancing the research agenda on the role of the media in sustainability reporting”, Meditari Pesquisa Contábil, Vol. 26 No. 1, pp. 2-12.

- Marcuccio, M. and Steccolini, I. (2005), “Social and environmental reporting in local authorities: a new Italian fashion?”, Public Management Review, Vol. 7 No. 2, pp. 155-176.

- Mussari, R. and Monfardini, P. (2010), “Social accounting practices in the public sector and non-profit organizations: an Italian perspective”, Public Management Review, Vol. 12 nº 4, p. 487492.

- Qian, W. , Burritt, R. and Monroe, G. (2011), “Environmental management accounting in local government: a waste management case”, Journal of Accounting, Auditing and Accountability, Vol. 24 No. 1, pp. 93-128.

- United Nations (UN) (2015), Transforming Our World: The 2030 Agenda for Sustainable Development, United Nations, New York, NY.

- Porter, M. E. (2010). What is value in health care? New England Journal of Medicine, 363(26), 2477-2481.

- Williams, B. , Wilmshurst, T. and Clift, R. (2011), “Sustainability reporting by local government in Australia: current and future perspectives”, Accounting Forum, Vol. 35 No. 3, pp. 176-186.

- Williams, BR (2015), “Reporting on sustainability by Australian boards – a communication perspective”, Asian Accounting Review, Vol. 23 No. 2, pp. 186-203.

- Trotta, P. (2016). Implementing strategic management accounting in hospitals: A case study. International Journal of Business and Management, 11(10), 43-51.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).