1. Introduction

The issue of corporate fraud in its different manifestations has held a long substantial place in accounting literature, owing to the numerous negative consequences that it has on many types of stakeholders and other parties that use financial reporting. As a result, all parties involved in this issue, including management, those responsible with governance, and external auditors, had to face the moral and ethical duty first, followed by the professional and legal responsibilities dictated by the relevant standards and regulations.

International Auditing Standards (IAS) provide important guidance to assist the auditor in all stages of the audit, as they focus on many topics that the external auditor must pay attention to during the performance of the audit mission, including the issue of fraud in companies, as IAS No. 240 that defined fraud as “An intentional act committed by one or more persons among management, those charged with governance, employees, or third parties, involving the use of deception to gain an unfair or unlawful advantage”. The standard also defines the characteristics and forms of fraud, the causes that contribute to it, the auditor's responsibilities for fraud, and the appropriate actions to substantial misstatement risks related to fraud. Furthermore, the International Auditing and Assurance Standards Board issued additional guidance specialized in specific issues, as International Auditing Practices Statement No. 1009 (Computer Assisted Audit Techniques) provided important guidance to external auditors on how to use modern technologies in the auditing process, such as artificial intelligence techniques, which is currently considered one of the most prominent solutions that can be adopted to increase the audit quality.

Currently, the capabilities of AI technologies have developed significantly and have begun to contribute to facilitating and accelerating many human tasks in many fields, including accounting work. According to (Dayyabu et al., 2023), fraud examiners, auditors, accountants, bankers, and businesses should adopt and use artificial intelligence approaches to more quickly detect anomalies and recognize fraudulent financial transactions. Previous research suggests a variety of potential advantages from the application of AI to the audit process, including the improvement of the process of detecting material misstatements and the advancement of communication methods with those in charge of governance (Elliot et al., 2020). On the other hand, there are some common barriers to the use of AI in auditing, such as a lack of soft skills to use and manage AI, uncertainty about compliance with the International Standards on Auditing (ISAs), and a general lack of confidence in AI's abilities in a constantly-changing environment (Raphael, 2017). Based on the above, this study investigated the impact of the use of artificial intelligence techniques by Jordanian external auditors in fraud risk assessment, the moderating effect of auditor size.

2. Study Problem

Fraud typically involves the use of complex and sophisticated deceptive methods by perpetrators of various types of fraud in businesses, and modern technological techniques have been used to conceal its impact and increase the difficulty of detecting it, resulting in a significant increase in fraud cases in the last years of this decade. Nowadays, fraud is typically tackled using state-of-the-art analytical techniques, which come with numerous challenges (Bart, 2023). The Association of Certified Fraud Examiners published annual report No. 12 in 2022, which showed that the total loss resulting from fraud cases reviewed globally amounted to $3.6 billion, which is a significant sum when compared to prior years. In the Middle East area, 138 fraud cases were investigated, of which Jordan had four, with an average loss of $186,000, a large proportion of these cases are in the banking and financial services sector, which has increased the responsibility placed on external auditors for identifying and responding to fraud risks using modern auditing techniques that rely on available technology such as artificial intelligence techniques. With these advanced technologies, auditors can now examine more financial data or even audit the entire data of clients in order to complete the audit task in a more comprehensive and detailed manner, as well as to reduce the assessed risks of fundamental errors due to fraud.

The following questions can be used to develop the study problem:

What is the impact of using artificial intelligence technologies in all their dimensions (expert systems, artificial neural networks, machine learning, and large language model) in fraud risk assessment?

3. Study Importance

Corporates fraud is one of the worrying topics at the internal and external levels, as it has negative effects and consequences on the company’s resources and reputation and on the stakeholders that benefit from the financial reports that may contain material deception that affects their decisions. Therefore, this study will seek to reach a more in-depth understanding of the risks of fraud and formulate appropriate responses to it through several methods, including the use of artificial intelligence techniques. Based on the researcher knowledge, this study is one of the first in Jordan that has explored the subject., and it is expected to provide a qualitative addition to the relevant literature and previous studies, as well as recommendations that may assist Jordanian external auditors in reducing the risks of fraud.

4. Study Model

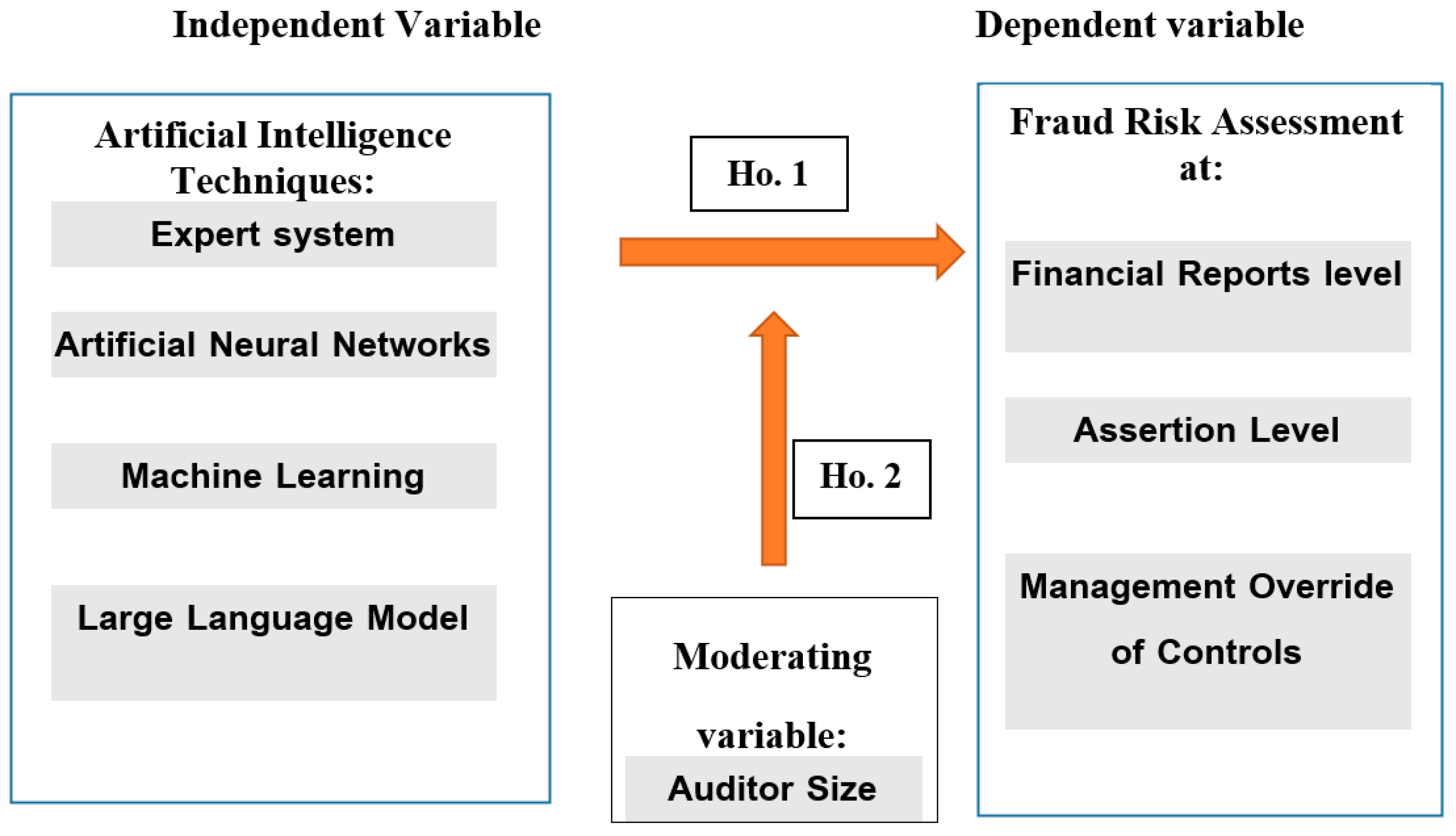

Figure 1 represents the study model, which consists of the independent variable represented by artificial intelligence techniques, and the dependent variable represented by reducing fraud risks.

This study assesses external auditor size as a moderating variable by employing a dummy variable that equals one (1) if the firm is audited by a Big 4 firm and zero (0) otherwise (Abu-Siam & Binti Laili, 2022; Khaksar et al., 2022).

5. Literature review and hypothesis development

5.1. Fraud Risk Assessment

According to the International Auditing and Assurance Standards Board (IAASB), the body that specifies auditors' responsibilities under International Standard on Auditing (ISA) 240 which effective for audits for periods beginning on or after December 15, 2009., "An auditor performing an audit in line with ISA is responsible for obtaining reasonable assurance that the financial reports are free from material misstatement, whether due to fraud or error".

At the financial statement level, the assertion level for transaction classes, account balances, and disclosures, as well as the risk of management override controls, the auditor bears the responsibility of determining and assessing the risks of material misstatement caused by fraud. Auditor risk assessments should be measured throughout the audit engagement as auditors gather new information and evidence at every stage of the audit and update their assessment of the likelihood of fraud occurrence at initial stages, fieldwork stages when performing analytical procedures, a test of control, substantive test, and report stage (ISA, 240).

In general, AI is a valuable tool that can improve the efficiency and effectiveness of audits. It has also been demonstrated to be a reliable strategy for limiting the possibility of human error. According to (Nurim et al., 2023) an auditor with specific knowledge of fraud risk will be more conservative in fraud risk assessment, and an auditor's personal characteristics have a crucial role in fraud risk assessment, particularly in a country with limited law enforcement. Nora et al. (2022) stated that AI can swiftly examine large amounts of data and increase the robustness of risk assessment. Also (Mat Ridzuan et al., 2022) found a significant positive relationship between auditors' proficiency with digital technology and their ability to evaluate fraud risk.

5.2. Artificial Intelligence in Accounting Profession

Many previous studies have addressed the topic of artificial intelligence and its impact on the accounting profession and auditing. The study of (Samhadan and Salmo, 2021) examined the implications of artificial intelligence on the field of auditing, and the factors influencing the adoption of artificial intelligence technology by the auditing profession, the results of the study indicated the role of this technology in enhancing audit quality and reducing audit risks. Also (Abu Al-Enein, 2019) investigated the impact of using artificial intelligence systems and modern information technology to increase the efficiency of the external auditor with the aim of improving the quality of the external audit process for Egyptian companies, the findings revealed that the external auditor's use of various artificial intelligence means and modern information technology resulted in improved external audit procedures and methods, as well as implementing the tasks assigned to him quickly and accurately, increasing the external auditor's ability to verify the correctness of the operations with less effort and cost. Albawwat & Frijat (2021) show that autonomous AI systems are perceived by Jordanian auditors as being difficult to use, assisted and enhanced AI systems are perceived as being simple to use. Additionally, auditors misjudge the capabilities of autonomous AI systems and think they are useless for auditing. In the same context. (Al-Sayyed et al., 2021) examine how artificial intelligence technologies are affecting audit evidence from the perspective of certified auditors in Jordanian information technology (IT) enterprises, and demonstrated that the audit evidence was impacted by the expert system and there was no discernible impact of neural network technology on the audit evidence. Also (Owonifari et al., 2023) found a significant positive relationship between audit practice in Nigeria and data mining, machine learning, and image recognition, this will allow auditors to forecast future trends and make more educated decisions that are focused on improving auditing practices.

5.3. Artificial Intelligence and Fraud

With regard to previous literature directly related to the subject of the study, Raj and Shikha (2022) analyzed the ability of artificial intelligence techniques to prevent financial fraud, the study concluded that artificial intelligence techniques greatly help in detecting financial fraud, with some determinants related to the constantly changing pattern and techniques of fraud, which requires the use of the latest technologies while working to develop them continuously. According to the viewpoint of those who work in the financial sector, Abdulrahman (2019) also investigated the impact of artificial intelligence techniques on detecting fraud in the United Arab Emirates, and conclude that these various types of techniques have an impact on detecting and reducing fraud cases in the banking sector and will play a significant role in the future in detecting fraud and reducing it to the lowest levels.

There are various implementations of AI, one of which is machine learning, which described as a computer science in which computer algorithms are used in conjunction with statistics to detect patterns in big data (Handoko, 2021). According to Varmedja et al. (2019), a variety of Machine Learning Algorithms can be utilized to identify and categorize transactions as real or fraudulent. Through algorithm and data preparation, machine learning systems are more adaptive to ongoing modifications and upgrades, offering them a more effective and efficient fraud detection strategy (Das et al., 2021).

Artificial Neural Networks (ANN) are defined as a collection of algorithms that use approaches similar to those found in the human brain (Murorunkwere et al., 2022). ANN algorithms are used by (Işık et al., 2023) to test the accuracy of detecting fraudulent transactions and achieved 99.7981% accuracy in detecting fraud. As stated in (López, et al., 2019), ANN make it easy to handle larger datasets and despite their complex algorithms, they produce easily interpretable results, which makes it popular in risk assessment and fraud detection. Also (Murorunkwere et al., 2022) demonstrate that ANN function well in detecting tax fraud with high accuracy. Artificial neural networks is regarded as one of the most successful techniques for detecting credit card fraud transactions with high precision and low cost (Kasasbeh et al., 2022).

Another implementations of AI is expert system, which defined as a computer programs that have been designed with the knowledge and expertise of one or more account control experts (Mohammed& Abdullah, 2022), the study's findings indicate that both supervisory body auditors and auditors in Iraqi auditing offices and businesses are aware of the advantages of utilizing expert systems in external auditor work, particularly with regard to the quality of audit output. According to the findings of (Öztürk & Usul, 2020), organizations can better detect existing frauds and prevent further anomalies in the future by using rule-based expert system applications.

Large Language Model (LLM) is regarded as one of the most well-known artificial intelligence approaches that have arisen as a result of the rapid advancement of technology. LLM are a new developments that combine an extensive understanding of language and context to create a knowledge of text that is comparable to that of a person (Burke et al., 2023). In order to determine whether it would be feasible to use a "frozen" LLM for financial document auditing, (Hillebrand et al., 2023) examine the potential and limitations of LLMs in the field of financial auditing. They also evaluated a number of designs that were specifically created to align the wording of annual reports that complied with IFRS regulations with applicable laws and found it’s beneficial for auditing.

Based on the above review, we hypothesized that:

H0.1: There is no statistically significant effect at a significant level (a ≤ 0.05) for artificial intelligence techniques in fraud risk assessment.

5.4. Auditor Size and Fraud

In terms of the relationship between the size of an external auditor and corporate fraud, Farber (2005) concludes that organizations that commit fraud usually avoid engaging the big four external auditors because their audit quality is higher than other external auditors, which leads to reducing the likelihood of a company committing fraud. Big four auditing firms are thought to be more capable of detecting fraudulent financial reports and increasing the quality of reports (DeAngelo 1981; DeFond and Zhang, 2014). There are many previous studies that have found a positive relationship between hiring a big external auditor and corporate fraud reduction (Frikha Chaari et al., 2022; Khaksar et al., 2022). A substantial amount of financial support is required to be able to use a new technology such as AI, companies must spend for the purchase of hardware and software to support technology facilities, also computer skills is essential, audit firms should budget for training and learning for their auditors to understand how to use this technology (Widuri et al., 2016). A large auditing firm is synonymous with a high budget, and with a large budget, they are thought to be more able to purchase the latest technology than regular or non-big audit firms and reduce the impact of technical context on the adoption of machine learning by auditors (Handoko, 2021).

Based on the above review, we hypothesized that:

H0.2: There is no statistically significant effect at a significant level (a ≤ 0.05) for artificial intelligence techniques in fraud risk assessment, with the modified role of auditor size.

6. Research Method

In order to gather study data, a descriptive analytical method was used. The primary research tool was a questionnaire, which was created to gather sufficient data concurrently with the study's objectives. Each research variable had four questions created, for a total of 28 questions, utilizing a five-point Likert scale, where 1 denotes strongly disagree and 5 denotes strongly agree.

7. Population and Sample

The study population consists of all certified public accountants performing external auditing in Jordan and registered with the Jordanian Association of Certified Public Accountants, with a total of (519) auditors according to the association statistics in 2023. Participants were chosen based on their desire and availability to participate in the study. The random sampling approach was used to choose them from the target population. However, 280 questionnaires were sent electronically to auditors employed in auditing firms in Jordan. A total of 196 valid questionnaires answered and analyzed, representing 70% of the total distributed questionnaires. Auditors employed by Big four auditing firms answered 105 of the questionnaires; the remaining 91 were answered by auditors from Non-Big four auditing firms.

8. The Study Questionnaire Reliability

Cronbach's Alpha is used to quantify reliability. This indicator accepts values between 0 and 1, with the lowest value that is statistically acceptable being 0.70. A value greater than 0.70 provides a solid indication for assessing the stability of the scale (Creswell & Creswell, 2018).

Table 1 demonstrates that the value of the Cronbach alpha is greater than (70%) for all variables and items answers in the measurement tool, and equal (0.890) for the final sample, so it can be described as stable and internally consistent.

The total survey element score = (0.890).

9. Normal Distribution Test Results

The results of the normal distribution test for the study sample's participant answers are displayed in

Table 2. This is done to ensure that the participants' answers are normal. The skewness coefficient was calculated and a value outside of the range (±1) denotes a highly skewed distribution. After the Kurtosis coefficient's value was extracted, the distribution was determined to be normal if its value did not exceed (±1.96) at the 0.05 level (Hair et al., 2018).

According to the results of

Table 2, the distribution of the data was normal, as the value of the (skewness coefficient) for all variables that did not fall outside the range of (±1) and the value of the (kurtosis coefficient) did not exceed (±1.96).

10. Multicollinearity Test

Multicollinearity was tested using the variance inflation factor and tolerance; if the test result is less than 5, it indicates that the independent variables have little correlation and that multiple linear regression analysis can be performed (Hair et al., 2018).

Table 3 shows that each variable's tolerance was less than 5, and the variance inflation factor coefficient for independent variables was greater than 0.2 but less than 1.

11. Descriptive Statistics and Hypothesis Testing

For each paragraph in the questionnaire, descriptive statistics include mean, standard deviation, importance level, and rank.

11.1. Descriptive Statistics for Independent Variables

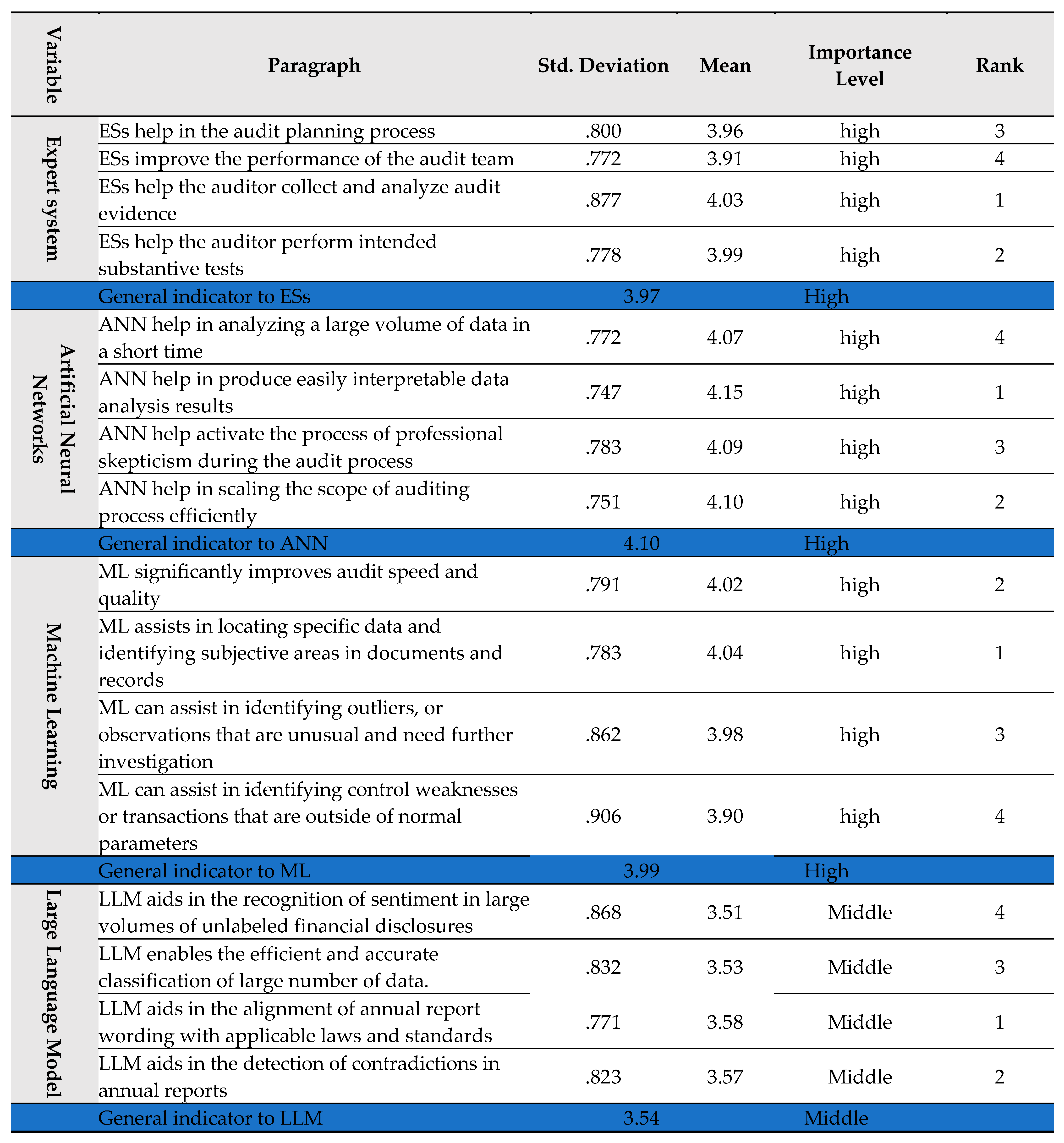

Table 4 displays indicators and descriptive statistics for the dimensions of artificial intelligence techniques, as measured by (16) questions directed to chartered accountants practicing the auditing profession in Jordan.

According to the results of the previous table, the general arithmetic mean of the artificial intelligence techniques came at a high level of importance, with the exception of the LLM technique, that arithmetic mean appeared at a middle level of 3.54 due to its recent adoption in auditing firms operating in Jordan.

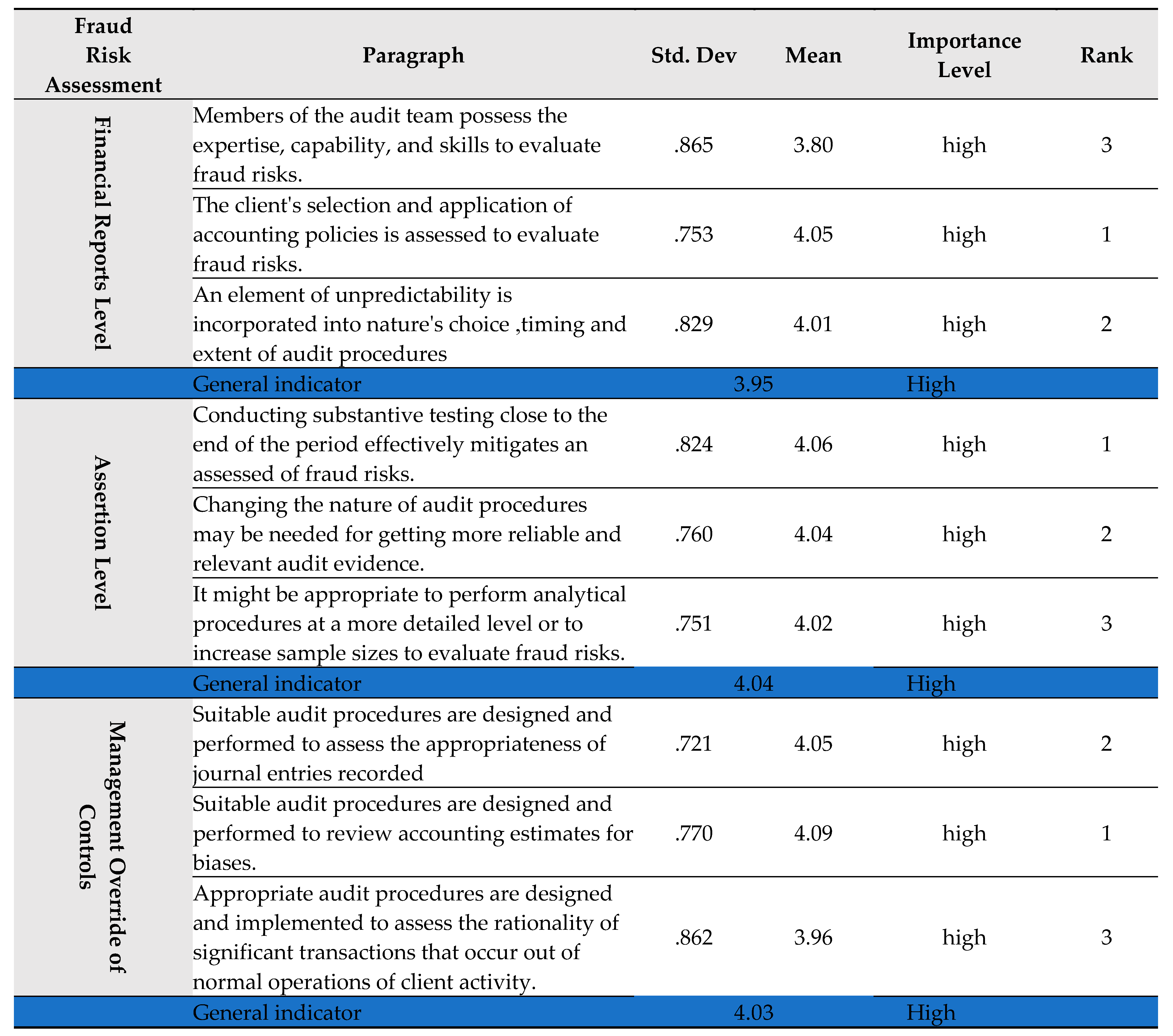

11.2. Descriptive Statistics for Dependent Variable

Table 5 displays indicators and descriptive statistics for the dimensions of fraud risk assessment, as measured by (9) questions directed to chartered accountants practicing the auditing profession in Jordan.

The preceding table's results indicate that the general arithmetic mean of the fraud risk assessment was highly significant. This indicates that Jordanian auditors consider the requirements of ISA 315 and 240, which stated that the auditor's responsibility is to acquire reasonable assurance that the financial reports are free of material misstatement, whether due to fraud or error.

12. Hypothesis Testing

The first hypothesis was tested using the multiple regression, which represents the answer to the first main question in the study problem, and the results are displayed in

Table 6.

The F-statistic value of 32.13 with a P-value of 0.00 was higher than the tabulated value of 2.37. This shows the model's fitness and statistical significance at (191/4) degrees of freedom. The R-square was 0.400, indicating that the model's explanatory factors explain 40% of the variability in the dependent variable.

In terms of the hypothesis test, we discovered that Large Language Model technique had the highest positive effect among the variables in the dependent variable (Fraud Risk Assessment), with a beta coefficient of = 0.254. At a significant level (Sig = 0.00), the calculated value (T) of 4.322 was greater than the tabulated value. (1.96) LLM may learn to anticipate abnormalities and potential areas of risk in financial accounts by training these models on previous audit data. It can investigate all transactions, not just a sample, due to its capacity to analyse huge amounts of data fast and precisely. This AI-powered approach improves auditing efficiency and effectiveness, allowing auditors to focus on more complicated duties related to fraud risk assessment at the financial statement level, the assertion level for classes of transactions, account balances, and disclosures, and the risk of management override controls.

The variable pertaining to Artificial Neural Networks had the second-highest influence, with a beta coefficient of β = 0.248 and a computed value (T) of 4.021, both of which were higher than their tabular value and statistically significant (Sig = 0.00). These findings demonstrate the significance of ANN technique, which have a positive and strong correlation with fraud risk assessment, which means that ANNs are widely used in risk assessment and fraud detection because they are simple to handle larger sets of data and despite their complex algorithms, yield results that are easily interpretable. This finding aligns with numerous earlier research studies, such as (Işık et al., 2023; Murorunkwere et al., 2022; López et al., 2019). Furthermore, the results show a significant positive relationship between machine learning and fraud risk assessment, with (T) value reaching 3.583, which is greater than the tabular value and significant at the (Sig = 0.010) levels. Machine learning systems are more responsive to continuous modifications and upgrades via algorithm and data preparation, providing them with a more successful and efficient fraud detection and assessment. This outcome agrees with a number of earlier investigations, like. (Handoko, 2021; Varmedja et al., 2019). Ultimately, the research has determined that expert system and fraud risk assessment are positively correlated, as evidenced by (T) value of 3.492, which is higher than the tabular value and at a significant level (Sig = 0.001). This result agrees with (Öztürk & Usul, 2020) study, which indicated that organizations can better detect existing frauds and prevent further anomalies in the future by using rule-based expert system applications.

As a result, the first hypothesis is rejected due to a statistical significant relationship between artificial intelligence techniques and fraud risk assessment. This indicates AI techniques are extremely beneficial in fraud risk assessment at all levels.

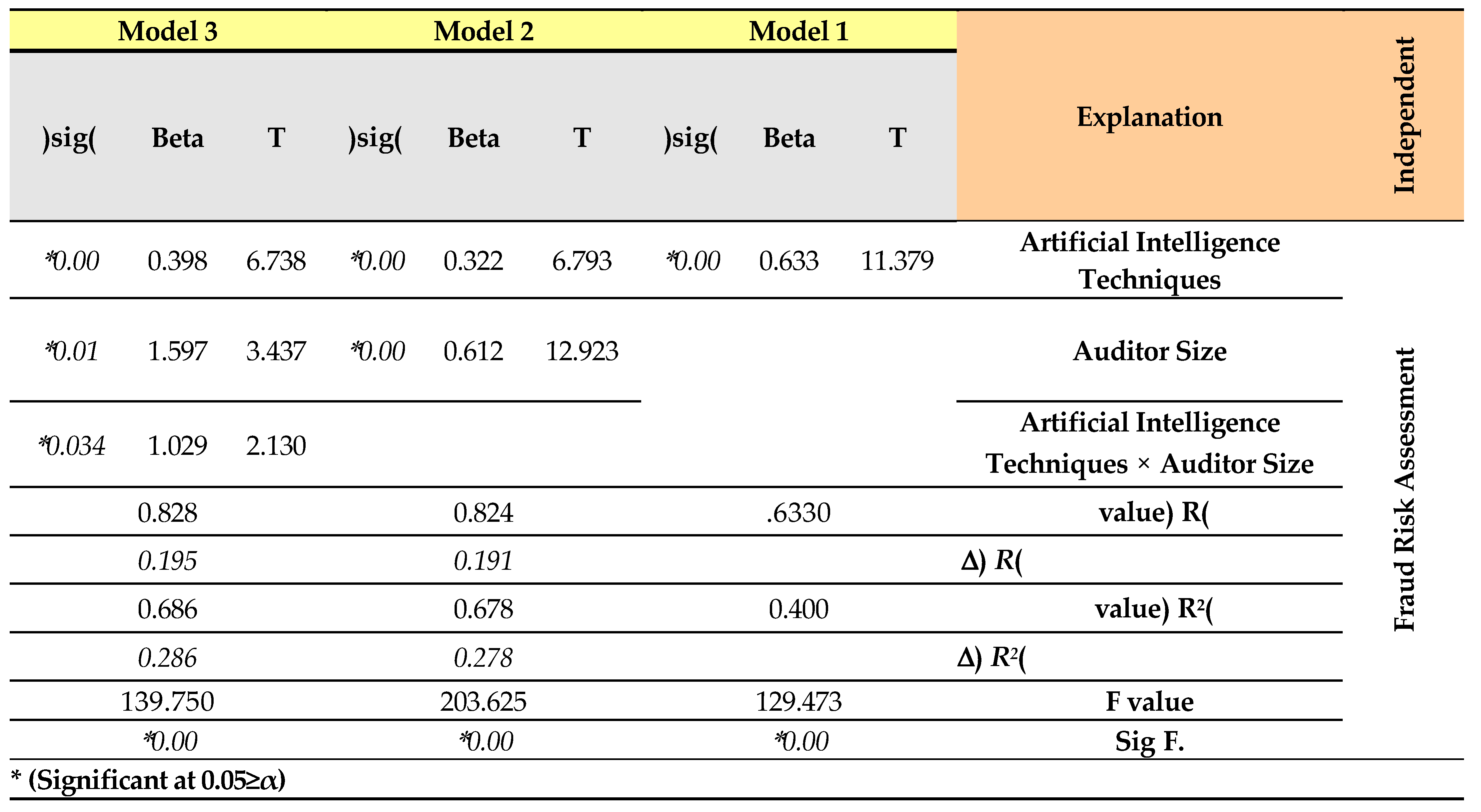

The second hypothesis was tested using the Hierarchical Regression test, which represents the answer to the second main question in the study problem, and its results were as shown in the

Table 7.

The effect of using artificial intelligence techniques in fraud risk assessment was studied in the first model, as shown in

Table 5. It was demonstrated that there is a significant direct effect of using artificial intelligence techniques in fraud risk assessment, as evidenced by the F value of (129.473) and T value of (13.202), which is significant at the level (0.05), and it appears from the results of the first model that the use of artificial intelligence techniques based on the value of (R2), it explained (40%) of the variance in fraud risk assessment. The variable of auditor size was introduced and added to the second model to investigate its effect on fraud risk assessment. It was discovered that auditor size has a significant direct effect on fraud risk assessment, as evidenced by the F value of (203.625) and T value of (12.923), which is significant at the level (0.05). According to the results of the second model, including the auditor's size variable resulted in a 27.8% increase in the value of (R2) when comparing the first and second models. It implies that big four auditing firms in Jordan are associated with having large budgets, and that these firms are better equipped than smaller audit firms to acquire the most recent technology. This outcome agrees with a number of earlier researches, such as (Handoko, 2021; Widuri et al., 2016). The binary interaction formula between the auditor's size and artificial intelligence techniques was added and introduced in the third model. It was discovered that this interaction has a significant direct effect, as evidenced by the F value of (139.750) and T value of (2.130), which is significant at the level (0.05). When comparing the first and third models, the interpretation factor (R2) also showed a 28.6% increase.

Consequently, it can be concluded that the variable of auditor size has positively altered the relationship between the use of AI techniques and the fraud risk assessment; that is, the higher the degree of external audit fraud risk assessment in the presence of auditor size, the greater use of AI techniques. We reject the null hypothesis (HO) and accept the alternative hypothesis (Ha), which states that there is a statistically significant effect of using artificial intelligence techniques in fraud risk assessment, with the modified role of auditor size.

13. Summary and Conclusion

The moderating effect of auditor size was examined in this study along with the effects of artificial intelligence techniques used by Jordanian chartered accountants in fraud risk assessment. The research has produced a number of notable findings, rendered a significant contribution to the field, and revealed a number of implications and limitations that provide opportunities for further study.

A sample of 196 was used, including certified public accountants performing external auditing in Jordan, The result reveals that AI techniques are extremely beneficial in fraud risk assessment at all levels, and the relationship between the use of AI techniques and the assessment of fraud risk has improved as auditor size has increased. Many studies in various countries have shown that artificial intelligence techniques can significantly aid in the detection of financial fraud. Studies, like (Fukas et al., 2022) demonstrate how AI Shapley additive explanations can be used to identify the critical elements for financial statement fraud detection and their directional differences in a set of data of publicly traded companies convicted of financial statement fraud by the United States Securities and Exchange Commission. In Nigeria, Owonifari et al., (2023) showed that there was a significant positive correlation between audit practice and data mining, machine learning, and image recognition. This relationship helps auditors make better decisions by allowing them to anticipate future trends and improve audit practice. Ikhsan et al., (2022) finds that increasing audit quality can be achieved with a high accuracy value using a fraud detection model based on data analytics and artificial intelligence in the Asian context.

In light of these worldwide patterns and results, our research in the Jordanian context is consistent with the broader body of literature, revealing that when assessing fraud risk, AI techniques are helpful and have gotten better as auditor sizes have increased. The significance of employing AI techniques by Jordanian chartered accountants when evaluating fraud risk is one of the primary implications highlighted by the current study. Using such techniques will increase audit quality and improve audit practices.

This study adds to the academic literature by presenting empirical proof of the effects of using AI techniques in fraud assessment by auditing firms in Jordan, a region with little previous research in this area. The findings add to our knowledge of how AI techniques can influence fraud detection.

However, this study, like every other study, faces multiple limitations. The first is one is the number of study participants. Only 196 external auditors responded, which may not be sufficient to produce a more reliable outcome. A larger sample size may improve the reliability of the results. Second, the respondents' knowledge about AI concepts may be imprecise sometimes, which may limit their awareness of AI techniques. Furthermore, the study strongly suggests that Jordanian auditing firms are persuaded of the value of utilizing AI technologies in the auditing process overall and in assessing fraud risks specifically.

Acknowledgments

The author would like to thank the anonymous reviewers of the study questionnaire for their comments and suggestions. I also thank the auditing firms operating in Jordan for assisting the author in responding to the questionnaires.

Conflicts of Interest

No potential conflict of interest was reported by the author.

References

- Abdulrahman, M. H. 2019. “The Impact of Artificial Intelligence (AI) in Detecting Fraud in the UAE.” Electronic Interdisciplinary Miscellaneous Journal 17 (10): 1-19. www.eimj.org.

- Abu Al-Enein, A. 2020. “Using Artificial Intelligence Systems and Modern Information Technology to Increase the Efficiency of the External Auditor with the Aim of Improving the Quality of the External Audit Process for Egyptian Companies.” Scientific Journal of Accounting Studies 2 (4): 130-196 . [CrossRef]

- Abu-Siam, Y., and Binti Laili, N. 2022. “The Impact of External Auditors size on Earnings Management: Evidence from Jordan.” Central European Management Journal 30 (4): 2140–2147. [CrossRef]

- Albawwat, I., and Frijat, Y. 2021. “An analysis of auditors’ perceptions towards artificial intelligence and its contribution to audit quality,” Accounting 7(4): 755–762. [CrossRef]

- Al-Sayyed, S., Al-Aroud, S., and Zayed, L. 2021. “The effect of artificial intelligence technologies on audit evidence.” Accounting 7(2): 281–288. [CrossRef]

- Bart, Baesens. 2023. “Fraud analytics: a research.” Journal of Chinese Economic and Business Studies 21(1): 137–141. [CrossRef]

- Burke, J., Hoitash, R., Hoitash, U., and Xiao, S. 2023. “Using a Large Language Model for Accounting Topic Classification.” SSRN Electronic Journal. [CrossRef]

- 8. Creswell, J and Creswell, D. 2018. Research Design: Qualitative, Quantitative and Mixed Methods Approaches. (5th ed) India: SAGE Publications, Inc.

- Dayyabu, Y. Y., Arumugam, D., & Balasingam, S. 2023. “The application of artificial intelligence techniques in credit card fraud detection: A quantitative study.” In E3S Web of Conferences (Vol. 389). EDP Sciences. [CrossRef]

- Das, P. K., Tripathy, H. K., and Yusof, M. S. A. 2021. Privacy and Security Issues in Big Data: An Analytical View on Business Intelligence (1st ed.) USA: Springer.

- DeAngelo, L. 1981. Auditor size and audit quality. Journal of Accounting and Economics 3 (3): 183-199. [CrossRef]

- DeFond, M., and Zhang, J. 2014. “A review of archival auditing research.” Journal of Accounting and Economics 58 (2–3): 275-326. [CrossRef]

- Elliot, V. H., Paananen, M., & Staron, M. 2020. “Artificial intelligence for decision- makers.” Journal of Emerging Technologies in Accounting 17(1): 51-55. [CrossRef]

- Farber, D. B. 2005. “Restoring Trust after Fraud: Does Corporate Governance Matte” Accounting Review 80 (2): 539-561. [CrossRef]

- Frikha Chaari, H., Belanès, A., & Lajmi, A. 2022. “Fraud Risk and Audit Quality: the Case of US Public Firms.” Copernican Journal of Finance & Accounting, 11(1): 29–47. [CrossRef]

- Fukas, P., Rebstadt, J., Menzel, L., & Thomas, O. 2022. “Towards Explainable Artificial Intelligence in Financial Fraud Detection: Using Shapley Additive Explanations to Explore Feature Importance.” International Conference on Advanced Information Systems Engineering, Vol. 13295 LNCS: 109–126. [CrossRef]

- Hair, F, Black, C, Babin, J, Anderson, E, & Tatham, L. 2018. Multivariate Data Analysis (8th ed): Cengage Learning.

- Handoko, B. 2021. “How Audit Firm Size Moderate Effect of TOE Context toward Auditor Adoption of Machine Learning. Journal of Theoretical and Applied Information Technology 99 (24): 5972–5980. https://www.jatit.org/index.php.

- Hillebrand, L., Berger, A., Deußer, T., Dilmaghani, T., Khaled, M., Kliem, B., Sifa, R. 2023. “Improving Zero-Shot Text Matching for Financial Auditing with Large Language Models.” Association for Computing Machinery (ACM): 1-4 . [CrossRef]

- Ikhsan, W., Ednoer, E., Kridantika, W., & Firmansyah, A. 2022. “Fraud Detection Automation through Data Analytics and Artificial Intelligence.” Riset, 4(2): 103–119.

- Işık, Y., Kefe, İ., & Sağlar, J. 2023. “Detection of Fraudulent Transactions Using Artificial Neural Networks and Decision Tree Methods.” Business & Management Studies: An International Journal 11 (2): 451–467. [CrossRef]

- Kasasbeh, B., Aldabaybah, B., & Ahmad, H. 2022. “Multilayer perceptron artificial neural networks-based model for credit card fraud detection.” Indonesian Journal of Electrical Engineering and Computer Science, 26 (1): 362–373. [CrossRef]

- Khaksar, J., Salehi, M., & Lari DashtBayaz, M. 2022. “The relationship between auditor characteristics and fraud detection.” Journal of Facilities Management 20 (1): 79–101. [CrossRef]

- López, C., Rodríguez, M., & Santos, S. 2019. “Tax fraud detection through neural networks: An application using a sample of personal income taxpayers.” Future Internet 11(4): 1-13. [CrossRef]

- Mat Ridzuan, N., Said, J., Razali, F., Abdul Manan, D., & Sulaiman, N. 2022. “Examining the Role of Personality Traits, Digital Technology Skills and Competency on the Effectiveness of Fraud Risk Assessment among External Auditors.” Journal of Risk and Financial Management 15 (11): 536. [CrossRef]

- Mohammed, E., & Abdullah, S. 2022. “The Quality of Audit Work under Expert System.” Journal of Economics and Administrative Sciences, 28 (133): 187–199. [CrossRef]

- Murorunkwere, B., Tuyishimire, O., Haughton, D., & Nzabanita, J. 2022. “Fraud Detection Using Neural Networks: A Case Study of Income Tax.” Future Internet 14(6): 1-14. [CrossRef]

- Noordin, N., Hussainey, K., & Hayek, A. 2022. “The Use of Artificial Intelligence and Audit Quality: An Analysis from the Perspectives of External Auditors in the UAE.” Journal of Risk and Financial Management, 15 (8): 339. [CrossRef]

- Nurim, Y., Elrifi, M. Y., Mahardika, S. N., & Harjanto, N. 2023. “The Role of Knowledge Level and Personal Perspective of Risk on Fraud Risk Assessment Consistency: A Quasi-Experimental Method.” Review of Integrative Business and Economics Research 12 (1): 124–133.

- Owonifari, V. O., Igbekoyi, O. E., Awotomilusi, N. S., & Dagunduro, M. E. 2023. “Evaluation of Artificial Intelligence and Efficacy of Audit Practice in Nigeria.” Asian Journal of Economics, Business and Accounting 23 (16): 1–14. [CrossRef]

- Öztürk, M., & Usul, H. 2020. “Detection of Accounting Frauds Using the Rule-Based Expert Systems within the Scope of Forensic Accounting.” In Contemporary Studies in Economic and Financial Analysis 102: 155–171. [CrossRef]

- Raj, R and Choudhry, S. 2022. “Analysis of Artificial Intelligence Techniques for Prevention of Financial Fraud. International Journal of Engineering Research & Technology” (IJERT), 11 (2): 171-177. [CrossRef]

- Raphael, J. 2017. “Rethinking the Audit: Innovation Is Transforming How Audits Are Conducted-and Even What It Means to Be an Auditor.” Journal of Accountancy 223 (4), 28.

- Vardhani, P. R., Priyadarshini, Y. I., & Narasimhulu, Y. 2018. “CNN Data Mining Algorithm for Detecting Credit Card Fraud.” Springer Briefs in Applied Sciences and Technology: 85–93. [CrossRef]

- Widuri, R., O’Connell, B., & Yapa, P. W. S. 2016. “Adopting generalized audit software: an Indonesian perspective.” Managerial Auditing Journal 31 (8–9): 821–847. [CrossRef]

- Samhadan, M., & Salmo, T. 2021. “Implications of Artificial Intelligence on the Field of Auditing.” Arab Monetary Fund publications, Issue 15, United Arab Emirates.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).