1. Introduction

Ecological agriculture is a modern agricultural model guided by the principles of ecology and economics, which effectively addresses the scarcity of agricultural resources and environmental pressures and achieves sustainable agricultural development [

1,

2,

3]. As a typical example of ecological agriculture, the rice–crayfish co-cultivation technique (CRT) was successfully invented in the early 2010s [

4] and has become an emerging conservation tillage technology in China [

5], receiving strong support from local governments. The CRT combines rice cultivation and crayfish breeding by digging circular aquaculture trenches around paddy fields [

4]. By minimizing chemical inputs and using scarce land and water resources [

6], the CRT improves rice field output and enhances the ecological environment of the fields [

5,

7]. The CRT offers higher economic benefits and environmental sustainability than single-crop rice cultivation systems such as double-cropped rice and ratoon rice. However, the initial investment and long return period of CRT often pose financial challenges for farmers, who may lack the necessary working capital. Farmers must make several preparations before adopting the CRT. These include adjusting the farmland structure, procuring crayfish juveniles, and obtaining any necessary additional equipment. Crayfish breeding also requires significant inputs of feed and chemicals (disinfectants, fish medicine, etc.) [

8]. In order to increase economic returns, some farmers expand the scale of rice–crayfish co-cultivation and increase stocking densities of crayfish, requiring a more significant financial investment [

7,

9]. These investments create higher initial funding requirements and pressure to expand the scale, thereby affecting the successful promotion of the CRT. However, financial constraints among rural residents, including those in China, restrict the smooth adoption of various ecological agricultural technologies, including rice–crayfish co-cultivation [

10,

11]. Rural households are dispersed and lack adequate collateral and guarantees. Meanwhile, there is asymmetric information in rural financial markets [

12]. Therefore, it is difficult for formal financial institutions to provide sufficient credit support to rural residents. Additionally, the inconvenience of rural transportation infrastructure increases the difficulty for farmers to receive remittances from family and friends, exacerbating the problem of financial constraints, which has been challenging to alleviate.

Digital finance refers to the use of digital technologies by traditional financial institutions and internet companies to provide payment, financing, investment, and other new financial services [

13]. Digital finance utilizes digital technologies such as big data, artificial intelligence, and cloud computing to significantly reduce transaction costs and information asymmetry, thereby improving the accessibility of funds. First, digital finance overcomes the constraints of time and geography, allowing even remote small farmers to apply for loans using mobile devices. Second, financial institutions assess the credit risk of farmers based on their transaction footprints, allowing farmers without collateral or guarantees to obtain small loans [

14]. Last, digital finance facilitates money transfers and remittances for farmers, easing their financial constraints. During the process of using digital finance for payment, lending, or investment, farmers can also access financial and economic information [

15]. For example, “Yunongtong,” a digital financial product launched by the Construction Bank, is specifically designed for farmers' green production and development. When using e-commerce, farmers can access market prices and technical information related to agricultural products, which enhances their awareness of technology applications and effectiveness [

16], thus promoting the adoption of the CRT. Additionally, digital finance is often embedded in social platforms such as WeChat and Alipay, allowing farmers to engage in online and offline communication and interaction through social platform features. Farmers can accumulate social capital through communication and interaction [

17] to further promote the adoption of the CRT by more farmers.

The development of the digital economy has led to an increasing impact of digital finance on farmers. Previous studies have indicated that digital finance can have several positive effects. These include increasing household income, facilitating agricultural input, and boosting agricultural output [

18]. Additionally, digital finance has the potential to narrow the urban–rural income gap [

19] and promote green agricultural growth [

20]. Digital finance also influences farmers' consumption behavior [

21], entrepreneurship [

22], and adoption of green agricultural technologies [

16]. [

18] found that the use of mobile wallets facilitates convenient remittances from family and friends, alleviates financial constraints, increases household income, and promotes agricultural input and output. [

20] used provincial panel data from 2012 to 2019 to examine how financial institutions can guide funds towards green agriculture through digital finance, thus promoting sustainable agricultural development. [

16] found that digital finance provides credit channels for family farms, strengthens social trust, and promotes the adoption of green pest control technologies.

The above literature studies provide valuable references for this study, but there are still areas that require further exploration. First, although scholars have verified the role of digital finance in green agricultural production, most studies are based on macro panel data and lack micro-level data. We can capture individual heterogeneity and other characteristics, and conduct in-depth research on farmers of different ages, education levels, and incomes, enriching the conclusions and making policy recommendations more targeted based on micro-level data. Second, in the few studies that examine the impact of digital finance on farmers' green production behavior from a micro perspective, the sample selection bias caused by observable and unobservable variables in farmers' digital finance usage decisions is often overlooked. Last, there is a lack of discussion on the mechanisms by which digital finance influences farmers' green production behavior. Therefore, this study integrates digital finance and the adoption of the CRT at the individual farmer level into the same analytical framework to investigate whether and how digital finance promotes farmers' adoption of the CRT. This study uses a multinomial Probit model to analyze the factors influencing the decision to use digital finance. An Endogenous Switching Probit (ESP) model is employed to analyze digital finance's impact and heterogeneity on farmers' CRT adoption. Finally, an intermediary effects model is used to examine the mechanism by which digital finance affects farmers' adoption of the CRT.

The marginal contributions of this study are as follows: This study examines the determinants of farmers' decision to use digital finance and the impact of digital finance usage on the adoption of ecological agricultural technologies based on survey data. To avoid estimation bias caused by self-selection in the use of digital finance, an ESP model is used to estimate the impact of digital finance usage on the adoption of ecological agricultural technologies. Considering farmers' heterogeneity, this study explores the differential impact of digital finance on the adoption of ecological agricultural technologies among farmers with different endowments. Furthermore, this study tests the mechanism by which digital finance affects farmers' adoption of ecological agricultural technologies. Through this research study, we hope to provide scientific references for those who consider digital finance as a means to alleviate farmers' resource constraints and promote the development of ecological agriculture.

2. Theoretical framework and research hypothesis

2.1. Theoretical framework

Factors influencing farmers' decision to use digital finance include their human capital, financial capital, social capital, and physical capital. These factors include age, health status, education level, risk perception [

23,

24,

25], planting area, household size, household income, farmer organization, and other endowments [

24,

26,

27]. Based on this, this study incorporates individual characteristics of the household head, household characteristics, and village characteristics into the farmers' digital finance usage behavior equation. Among them, individual characteristics of the household head include age, health status, education level, risk appetite, and attitude. Household characteristics include cultivated area, soil quality, agricultural labor force, proportion of agricultural income, and New agricultural business entity. Village characteristics include irrigation conditions, the presence of e-commerce service platforms, and distance to the nearest township. In theory, digital finance is inclusive, and vulnerable groups rely more on cash. Therefore, older people, those with higher agricultural dependency, and lower education levels are expected to benefit more from digital finance.

The adoption of ecological agricultural technologies by farmers is influenced by various factors, including individual characteristics, household characteristics, and village characteristics. Individual characteristics include age, health status, education level, risk attitude [

28,

29]; household characteristics include cultivated area, soil fertility, agricultural labor, proportion of agricultural income, New agricultural business entity [

29]; and village characteristics include irrigation facilities, presence of e-commerce service platforms, distance from the village to the nearest market [

30].

Digital finance usage is an important driving factor influencing the adoption of ecological agricultural technologies. Studies by [

16] and [

29] have found that digital finance significantly promotes farmers' adoption of green pest control technologies and sustainable agricultural practices. Among them, mobile payment services can help farmers with money transfers, strengthen social network relationships, reduce risks, and unleash the potential for agricultural development [

31]. Credit and financing services can provide liquidity support, enabling farmers to overcome the initial funding threshold in agriculture or expand their existing production and operation scale. In summary, digital finance provides farmers with broad coverage and lower-cost financial services, serving as a beneficial complement to traditional financial services and supporting farmers' adoption of ecological agricultural technologies. Therefore, we hypothesize H1:

H1:

Digital finance promotes farmers' adoption of ecological agricultural technologies.

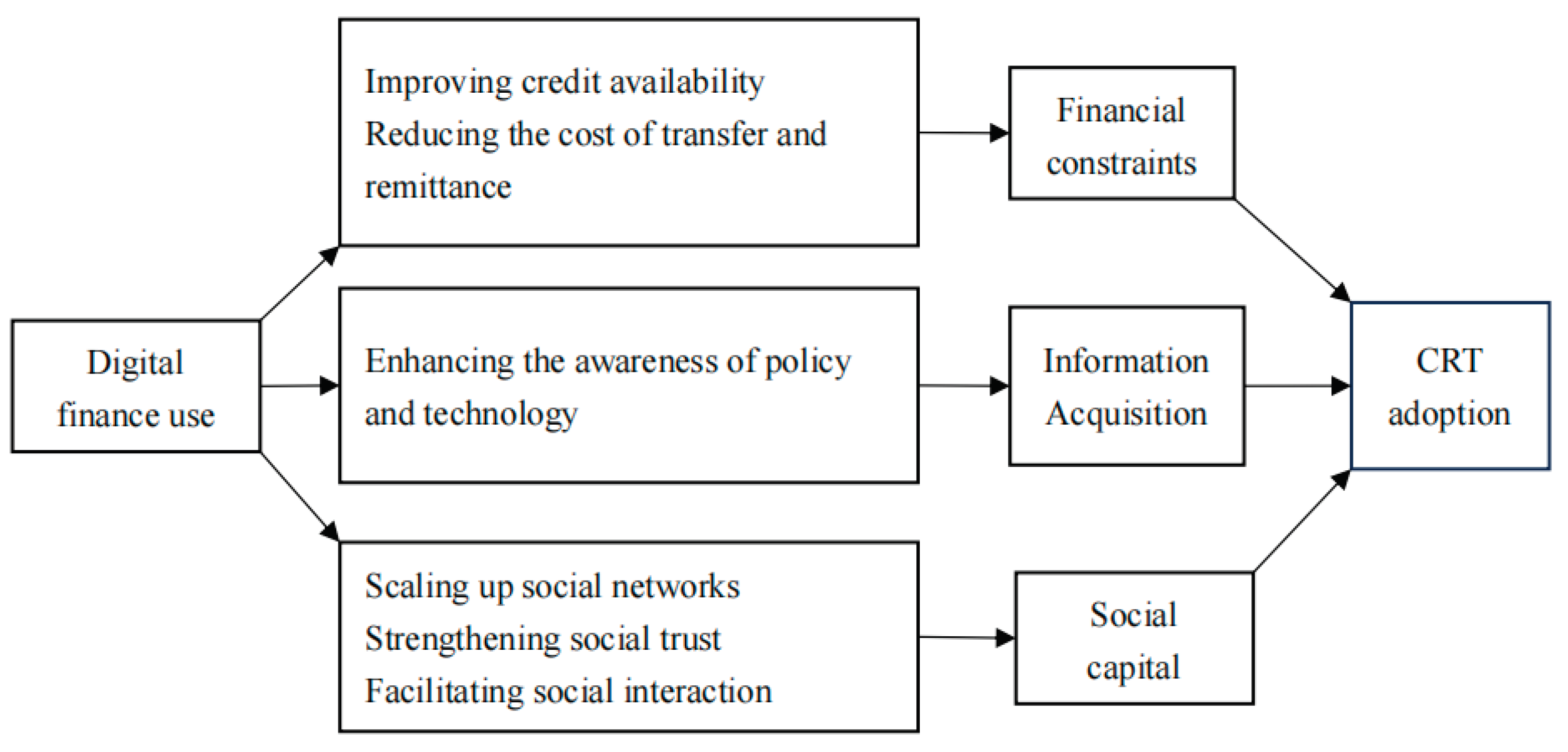

2.2. Mechanisms of digital finance on farmers' adoption of ecological agricultural technologies

Digital finance indirectly influences farmers' adoption of ecological agricultural technologies through three channels: alleviating financial constraints, expanding information channels, and increasing social capital accumulation [

16,

29]. The mechanisms are illustrated in

Figure 1.

2.2.1. Alleviating financial constraints

Digital finance utilizes digital technologies such as the internet, big data, cloud computing, and artificial intelligence. These technologies help reduce transaction costs and information asymmetry. As a result, credit accessibility is improved, and financial constraints for farmers are alleviated [

32]. On the one hand, digital finance breaks the bar-riers of time and space, expanding the scope of financial services. Even in remote rural areas, dispersed smallholder farmers no longer need to visit physical branches to conduct transactions [

13]. They can directly open accounts and apply for loans through mobile devices, reducing the transaction costs associated with loan applications and increasing farmers' willingness to apply for loans. In addition, digital finance addresses information asymmetry in financial markets at a lower cost, reducing the degree of information asymmetry [

33]. When farmers use digital payments, transaction information footprints are generated, which financial institutions can utilize to assess farmers' creditworthiness [

14], including borrowing scale, repayment capacity, and household economic conditions. This reduces the information asymmetry between financial institutions and borrowers, thereby providing credit support and improving credit accessibility for borrowers without collateral or guarantees. Additionally, digital finance facilitates transfers and remittances among family and friends. Farmers can promptly receive remittances from relatives and friends in the case of risk shocks [

21], alleviating household financial constraints.

Financial investment is a key factor influencing farmers' adoption of ecological agri-cultural technologies [

34]. Ecological agricultural technologies often require significant upfront investment, have long return cycles, and are subject to high natural risks and market price fluctuations. These characteristics lead to agricultural production instability, making it difficult for farmers to obtain credit support from formal financial institutions [

12,

35,

36], which limits the adoption of ecological agricultural technologies. However, digital finance can improve farmers' credit accessibility, facilitate transfers and remit-tances, alleviate financial constraints, and promote their adoption of ecological agricul-tural technologies. Therefore, we propose hypothesis H2:

H2:

Digital finance promotes the adoption of ecological agricultural technologies by alleviating farmers' financial constraints.

2.2.2. Alleviating financial constraints

Digital finance is a digitized approach that facilitates information sharing. The pay-ment, lending, and investment functions of digital finance all serve as means of infor-mation transmission. On the one hand, when financial institutions provide financial ser-vices to farmers using digital technologies, they focus on farmers' production and empha-size the degree of greening in their outputs [

20,

37]. Financial institutions can direct capital flow towards sustainable green agriculture, such as “Yunongtong.” In order to obtain credit support, farmers pay attention to the greening of their own production and opera-tion. It can be seen that digital finance investments can transmit green guidance infor-mation to farmers, influencing their awareness of ecological agricultural policies and promoting the adoption of ecological agricultural technologies. On the other hand, farmers can use digital technologies to access ecological agricultural technology-related infor-mation [

16]. Farmers can obtain operational information on ecological agricultural tech-nologies and agricultural product market prices through internet platforms (e-commerce) quickly and at a low cost. This increases farmers' awareness of ecological agricultural technologies.

The decision-making process for farmers adopting ecological agricultural technologies involves the collection of relevant information. The more comprehensive the technical in-formation that farmers gather, the higher levels of technical awareness. This results in perceived usefulness, ease of use, and higher probabilities of adoption [

38]. Therefore, by expanding farmers' information channels, digital finance enhances farmers' awareness and promotes the adoption of ecological agricultural technologies. Therefore, we propose hypothesis H3:

H3:

Digital finance promotes the adoption of ecological agricultural technologies by expanding farmers' information channels.

2.2.3. Increasing social capital accumulation

Social capital refers to the social resources that households need to achieve liveli-hood goals, including social networks, social trust, and social participation [

39]. Social capital has a significant influence on farmers' technology adoption [

40].

Digital finance promotes the adoption of ecological agricultural technologies by in-creasing social capital accumulation. On the one hand, the convenience of mobile pay-ments drives the popularity of digital finance products carried by mobile applications, strengthening social network relationships [

31]. The use of financial functions such as payment transfers on platforms such as Alipay and WeChat increases online and offline communication and interaction. Social communication and interaction have been found to expand the scale of social networks [

41] and enhance the hierarchical structure of social relationships. This facilitates the sharing and diffusion of ecological agricultural technol-ogy information and knowledge, leveraging the “diffusion effect” of technology [

42]. On the other hand, digital finance establishes transparent, secure, and efficient trust mecha-nisms in payment security and personal privacy protection, strengthening trust among farmers [

16]. When farmers see other farmers adopting ecological agricultural technolo-gies, they are more likely to adopt them due to their trust in their peers, leading to a “peer effect.” Last, village collectives utilize digital finance platforms to establish technology promotion accounts (e.g., WeChat official accounts). Through these accounts, they can disseminate information on ecological agricultural technology operation methods and other technical support services, facilitating farmers' social participation in collective af-fairs [

40]. Village collectives' targeted and efficient technology promotion activities enable farmers to comprehensively grasp relevant technical information, thereby increasing their willingness to adopt ecological agricultural technologies. Therefore, we propose hypothe-sis H4:

H4:

Digital finance promotes the adoption of ecological agricultural technologies by increasing farmers' social capital accumulation.

3. Empirical strategy

3.1. Data

Data used in this study come from a farm household survey conducted in the Jianghan Plain in China from July to August 2021. The Jianghan Plain is located in the central-southern part of Hubei Province (29°26′-31°37 N, 111°14′-114°36′E) and has a typical subtropical monsoon climate with abundant sunlight and rainfall. The plain was formed by alluvial deposits of the Yangtze and Han Rivers, resulting in fertile soil and abundant groundwater resources. The Jianghan Plain has a long history of rice cultivation and crayfish breeding and has become an important region for promoting the CRT. The CRT is widely applied in the Jianghan Plain. The co-cultivation area and production volume of crayfish in Hubei Province ranks first among the 31 provinces in China. Therefore, the Jianghan Plain is a representative and suitable area for studying the CRT.

In recent years, due to the intensive use of agricultural land, there has been a decline in soil fertility and the quality of the agricultural ecological environment in the Jianghan Plain. It is urgent to transform the agricultural development model and promote ecological agriculture [

7,

38]. The Agricultural and Rural Bureau of Hubei Province has advanced a series of measures, such as straw returning and recycling pesticide bottles and bags. The promotion of ecological agricultural technology for rice–crayfish co-cultivation is a crucial measure. In addition, the digital economy in Hubei Province has been developing rapidly. The “White Paper on the Development of the Digital Economy in Hubei Province (2021) (Hubei Provincial Development and Reform Commission)” reveals that the core industries of the province's digital economy reached a scale of 654.2 billion yuan in 2020. The average annual growth rate was 7.75%, which exceeded the average GDP growth rate for the same period. Financial institutions have also been innovating their service models, and digital finance has attained rapid promotion, especially the mobile payment service. For example, Postal Savings Bank of China established “Xiang Nong E Tie” in 2021 to provide online financial services for rural revitalization and promote agricultural production. The broadband coverage rate in the survey area reached 97%, with a well-developed network infrastructure.

We selected nine counties of Jianghan Plain as the sample locations for the survey. (Shashi, Jiangling, Gong'an, Shishou, Jianli, and Honghu in Jingzhou City, and Xiantao, Qianjiang, and Tianmen directly under the administration of Hubei Province). First, according to the economic development level, we selected four townships from each sample county. Second, we randomly selected two villages from each township. Last, we randomly selected 15 households from each village. A total of 1,080 questionnaires were distributed, and after excluding samples with missing key variables, we obtained 1,063 valid questionnaires, resulting in an effective response rate of 98.43%. The data were collected during the field survey through face-to-face interviews conducted by the researchers. The survey mainly involves farmer characteristics, household characteristics, village characteristics, and the use of digital finance. Before the formal survey, we conducted a preliminary survey in Jingzhou City to improve the survey questionnaire.

3.2. Variable settings

3.2.1. Dependent variable

Existing research mainly uses a binary variable to measure the adoption behavior of CRT [

38]. This study adopts the same approach based on relevant research. Specifically, it is measured based on the questionnaire item “Did your household adopt CRT in 2020?” The respondents' answer options are “yes” or “no.” If the respondent adopted the CRT, the value is 1; otherwise, it is 0. The sample follows a normal distribution with fat tails on both sides, so a Probit model is used for analysis.

3.2.2. Independent variables

This study examines households' use of digital finance based on their usage of digital payment products, digital credit products, and digital wealth management products. Specifically, the digital payment behavior is measured based on the questionnaire item “Did your household use Alipay, WeChat Pay, or online banking in 2020?”. The digital credit behavior is measured based on the item “Did your household use internet loans or crowdfunding in 2020?”. The digital wealth management behavior is measured based on the item “Did your household invest in internet wealth management products in 2020?”. If a household engages in any of the three behaviors, it is considered to use digital finance, the value is 1; otherwise, it is 0.

3.2.3. Control variables

This study selects four categories of 14 variables as control variables, including individual characteristics of the household head, household characteristics, village characteristics, and regional dummy variables [

28,

29,

30,

43]. Individual characteristics include male, age, health status, education, political identity, and risk appetite degree. Household characteristics variables include planting area, soil fertility, agricultural labor, the proportion of agricultural income, and whether the household is a New agricultural business entity. Village characteristics encompass factors such as irrigation conditions, the availability of e-commerce service stations, and the village's proximity to the nearest township. The surveyed area includes nine counties (cities) in the Jianghan Plain, including six counties under the jurisdiction of Jingzhou City and three directly governed counties in Hubei Province. Considering the differences in economic development levels, a regional dummy variable is assigned a value of 1 if the household is located in Jingzhou City; otherwise, it is 0.

3.2.4. Mediating variables

The mediating variables in this study include funding constraints, information acquisition, and social capital. Specifically, the smaller the funding constraints faced by households, the lower the financial threshold for adopting CRT. This is measured based on the questionnaire item “Do you think the financial threshold for CRT is high?” Households that pay more attention to agricultural production and financial information are more likely to proactively adopt CRT when conditions permit. This is measured based on the item “How much attention does your household pay to agricultural production and financial information?” Social capital refers to the trust, reciprocity, and social network resources brought by the social status of the household. This is measured based on the item “Did your household incur expenses on social interactions and postal and telecommunications fees in 2020?”.

3.2.5. Instrumental variable

The instrumental variable in this study is the average proportion of other households in the same village using digital finance, excluding the interviewed households [

44]. Under the influence of conformity bias, individual households' behavior is affected by the behavior of other households in the village. The higher the average proportion of other households in the village using digital finance, the greater the probability of households using digital finance. However, the overall level of digital finance usage in a village does not have a direct relationship with the adoption of CRT by individual households. Therefore, this instrumental variable satisfies the conditions of relevance and exogeneity. However, the effectiveness of the instrumental variable needs to be further tested. The empirical results and analysis will provide detailed information on the instrumental variable testing results. The definition and descriptive statistics of each variable are presented in

Table 1.

3.3. Variable descriptive statistics

The results in third and fourth columns of

Table 1 report the mean values of variables between the households using digital finance and those who not using digital finance. The t-test results in

Table 1 show significant differences among households using digital finance in terms of age, health status, education level, household cultivated area, soil fertility, agricultural labor force, and farmer organizations, indicating higher endowment levels. As shown in

Table 2, 59.55% of households use digital finance, while 40.89% of households do not use digital finance. This indicates that digital financial services have penetrated into rural areas. Among the households adopting CRT, there are 740 households, accounting for 69.61%. The households not adopting CRT are 323, accounting for 30.39%, indicating that there is still room for further promotion of CRT. Among the households adopting CRT, the proportion of those using digital finance is 66.08%. Among the households not adopting CRT, the proportion of those not using digital finance is 55.41%.

Table 1 and

Table 2 reflect the average differences in some variables under the use of digital finance. However, this cannot fully explain whether these differences are caused by digital finance, as the self-selection issue of the sample needs to be thoroughly considered. Therefore, a more scientifically rigorous ESP will be used next.

3.4. Empirical model

3.4.1. Endogenous switching probit model

Identifying the causal relationship between key variables is a crucial factor in determining the measurement model. It is not possible to simultaneously observe the adoption of CRT by the same household under the conditions of using digital finance and not using digital finance. Therefore, it is not possible to directly estimate the impact of digital finance on the adoption behavior of CRT by households. Furthermore, there are unobservable factors that influence both the decision to use digital finance and the adoption behavior of CRT, such as the individual capabilities of households. Ignoring this issue would result in sample selection bias and endogeneity problems.

Considering the issue of selection bias caused by observable and unobservable factors, we adopt ESP model [

45]. The ESP model simultaneously estimates the selection equation and the outcome equation using the full information maximum likelihood (FIML) method, thereby obtaining consistent and unbiased estimators. Additionally, after obtaining the relevant coefficients, we can calculate the average treatment effect (ATT, ATU, ATE) of digital finance usage on the adoption of CRT by households.

The ESP model consists of two steps. First, we utilize the Probit model to construct the selection equation for households' usage of digital finance:

In the equation, represents the latent variable of the probability of household using digital finance, which depends on the observable variables . When , it indicates that the household uses digital finance, while indicates that the household does not use digital finance. represents the influencing factors of households using digital finance, is the coefficient to be estimated, and is the random disturbance term.

Next, we construct the outcome equation for the adoption behavior of CRT by households:

In the equation, and represent the probabilities of households adopting CRT when using digital finance and when not using digital finance, respectively. and are the observable variables representing the adoption behavior of CRT by households when using and not using digital finance, respectively. and are factors such as individual characteristics, household characteristics, and village characteristics that affect the adoption behavior of CRT by households. and are estimated coefficients, and and are random disturbance terms following a normal distribution.

Based on the estimation results of the ESP model, we can further calculate three average treatment effects of digital finance usage on the adoption of CRT by households: the average treatment effect on the treated (ATT), the average treatment effect on the untreated (ATU), and the average treatment effect on the entire sample (ATE). However, both ATU and ATE include the effects of the samples that do not use digital finance, which are less meaningful for policy evaluation [

46]. Therefore, this study only estimates the ATT to measure the impact of digital finance on the adoption of CRT by households. Based on equations (1)-(2) and utilizing the full information counterfactual estimation, we obtain the average treatment effect on the treated (ATT) of digital finance usage on the adoption of CRT by households:

In the equation, ATT refers to the average difference in the probability of adopting CRT for households that actually use digital finance compared to when they do not use digital finance. n represents the sample size of the experimental group.

3.4.2. Mediation effect model

Drawing on existing literature [

47], this study employs the stepwise regression method to test for mediation effects. The specific steps of the mediation effect test are as follows:

First, according to equation (5), test the overall effect of digital finance on the adoption of CRT by households. Second, using equation (6), with the mediator variable as the dependent variable and digital finance usage as the independent variable, test the effect of digital finance usage on the mediator variable. Finally, according to equation (7), test the effects of digital finance usage and the mediator variable on the adoption of CRT by households. In the equations, represents the adoption behavior of CRT by households, represents digital finance usage, represents the mediating variable, , , and are the parameters to be estimated, and , , and are random disturbance terms. If is significant, and both and are significant, it indicates that digital finance affects the adoption of CRT by households through the mediator variable. If and are not both significant, it indicates that the mediating pathway is not established.

4. Results and analysis

4.1. Simultaneous estimation results

Table 3 presents the simultaneous estimation results of the decision models for household digital finance usage and the adoption of CRT. The test for independence between the two-stage equations is significant at a 5% level, rejecting the null hypothesis of mutual independence between the selection and outcome equations. The correlation coefficients (

and

) of the random error terms in the selection and outcome equations are significantly negative at a 1% level. This indicates the presence of sample selection bias in the decision-making process of household digital finance usage, which needs to be corrected. The goodness-of-fit test for the model is also significant at a 1% level, suggesting that choosing the ESP model is reasonable.

4.1.1. Factors influencing household digital finance usage decision

The results in column (2) of

Table 3 show that age significantly positively impacts household digital finance usage decisions. Younger households are more likely to try new things and can choose digital finance products to suit their needs, increasing their likelihood of using digital finance. The digital divide contributes to a higher likelihood of mistakes among older households when using the internet or smartphones to access digital financial services. As a result, these households have a lower probability of accessing financial services through digital channels.

The level of health significantly positively impacts household digital finance usage decisions. This indicates that households in better health are more likely to use digital finance. As the health level improves, households have more confidence in future investments and a stronger ability to allocate resources using financial factors [

28,

48]. Education level also has a significant positive effect on household digital finance usage decisions. Compared with traditional finance, digital finance is still relatively new to households. Higher education levels enable households to have a better understanding and acceptance of new things, as well as accumulate more financial knowledge. Digital finance, with its features such as online transfers, online consumption, and new payment methods, is more readily accepted by households with higher education levels [

49]. Party membership also has a significant positive impact on household digital finance usage decisions. Generally, party members have advantages in terms of education and acceptance of new things, which increases the likelihood of using digital finance. The level of risk preference significantly positively impacts household digital finance usage decisions. As a new type of financial service, digital finance still has some flaws and risks. Households with a higher level of risk preference are more willing to try new things, resulting in a higher likelihood of using digital finance.

In addition, soil fertility significantly negatively impacts household digital finance usage decisions. The higher the soil quality, the less input is required for agricultural production materials such as fertilizers. Therefore, the probability of household digital finance usage is lower. The number of agricultural laborers significantly positively impacts household digital finance usage decisions. The more laborers engaged in agricultural production, the more economic transactions and information flow, such as purchasing agricultural production materials, are involved. This increases the likelihood of households using digital finance. Membership in farmer organizations also has a significant positive impact on household digital finance usage decisions. Farmer organizations play a vital role in China's agricultural modernization. They consist of large-scale and family farms. These organizations achieve economic benefits through scale effects, technological innovation, and scientific management. Financial instruments play an essential role for new agricultural entities. The distance between village committees and township agricultural markets significantly negatively impacts household digital finance usage decisions. The closer the distance to township agricultural markets, the higher the degree of marketization that households are exposed to. This leads to more opportunities for digital payments, greater knowledge of digital finance, and, thus, a higher probability of using digital finance.

The estimation results indicate that the average proportion of other households in the same village using digital finance has a significant positive impact on the household's decision to use digital finance. In other words, the higher the average rate of digital finance usage among other households in the same village, the higher the probability of digital finance usage for the surveyed households. Furthermore, we also tested the validity of the instrumental variables. The instrumental variable model (IV-2SLS) for the effect of digital finance usage on the adoption of CRT shows that the first-stage F-value is 54.12. It is greater than 10, ruling out the possibility of weak instrumental variables. Therefore, the instrumental variables can be considered effective.

4.1.2. Factors influencing the adoption of CRT by households

Results in columns (2)– (3) of

Table 2 show that Education level and party membership significantly negatively impact the adoption of CRT by households using and not using digital finance. This indicates that households with higher education levels and party membership are less likely to adopt CRT. Higher education levels and party membership are associated with higher cultural and knowledge levels among households, enabling them to make more informed agricultural production decisions. Higher education levels and party membership also provide households with more non-agricultural employment opportunities. On the one hand, compared with non-agricultural employment, CRT cannot guarantee a stable income or economic returns in every period. On the other hand, adopting CRT entails higher labor and input costs. Therefore, considering the cost–benefit ratio, the likelihood of households adopting CRT is lower.

Furthermore, soil fertility significantly negatively impacts the adoption of CRTs by households using and not using digital finance. Better soil fertility is associated with higher natural resource endowment for households, resulting in relatively lower material inputs such as fertilizers and pesticides per unit area than infertile land. This favors the adoption of rice–crayfish co-cultivation technology by households. The distance between village committees and the nearest township significantly positively impacts the adoption of CRT by households using and not using digital finance. This indicates that the closer households are to township agricultural markets, the less likely they are to adopt CRT. Proximity to township agricultural markets implies higher levels of marketization for households. On the one hand, it provides households with more non-agricultural employment information and opportunities. On the other hand, higher marketization levels increase households' risk perception. CRT involves technical and market risks, requiring households to learn and master various operational skills in production and management, such as feeding, disease control, and water quality regulation. Based on the assumption of “bounded rationality of small farmers,” households exhibit profit-seeking behavior and risk aversion, aiming to maximize utility [

50]. Compared with unstable and relatively lower agricultural incomes, households are more inclined to choose stable non-agricultural incomes with higher relative returns. Therefore, the likelihood of households adopting CRT is lower.

Risk preference significantly impacts the adoption of rice–crayfish co-cultivation technology by households using digital finance. More risk-averse households are more willing to try new agricultural planting technologies and are thus more inclined to use various financial services to facilitate the adoption of CRT. The cultivated area has a significant positive effect on the adoption of CRT by households using digital finance. Larger cultivated areas require higher inputs of production materials and have higher funding needs. Digital finance can effectively alleviate financial constraints, enabling households to adopt CRT.

Table 3.

Endogenous Switching Probit (ESP) estimates of the determinants of digital finance use and rice-crayfish co-cultivation technology (CRT) adoption.

Table 3.

Endogenous Switching Probit (ESP) estimates of the determinants of digital finance use and rice-crayfish co-cultivation technology (CRT) adoption.

| Variable |

Selection equation |

Digital finance users’ adoption |

Non-users’ adoption |

| Coefficient |

Coefficient |

Coefficient |

| Male |

-0.167* (0.345) |

0.239 (0.411) |

0.034 (0.403) |

| Age (years) |

-0.067*** (0.006) |

0.010 (0.008) |

-0.004 (0.015) |

| Health status (1=very poor,5=very good) |

0.199*** (0.059) |

-0.044 (0.079) |

-0.108* (0.075) |

| Education (years) |

0.074*** (0.018) |

-0.045*** (0.017) |

-0.048* (0.024) |

| Party membership (1=yes) |

0.513** (0.134) |

-0.330*** (0.134) |

-0.387*** (0.200) |

| Risk appetite (0=risk aversion,5=risk appetite) |

0.058** (0.026) |

0.079** (0.033) |

-0.021 (0.038) |

| Planting area (ha) |

0.002 (0.002) |

0.009*** (0.003) |

0.005 (0.004) |

| Soil fertility (1=very bad, 5=very good) |

0.073 (0.061) |

0.143* (0.075) |

0.243*** (0.09) |

| Agricultural labor (Number) |

0.232*** (0.084) |

0.052 (0.089) |

0.118 (0.139) |

| Share of agricultural income (%) |

0.024 (0.045) |

-0.032 (0.041) |

-0.082 (0.086) |

| New agricultural business entity (Number) |

0.298* (0.158) |

-0.199 (0.152) |

-0.396 (0.252) |

| Irrigation condition (%) |

-0.014* (0.007) |

0.004 (0.007) |

0.013 (0.011) |

| E-commerce service platform (1=yes) |

0.093 (0.010) |

0.129 (0.120) |

-0.128 (0.129) |

| Distance to nearest township (km) |

-0.02* (0.011) |

0.045*** (0.014) |

0.075*** (0.017) |

| Jingzhou (1=yes) |

-0.152 (0.111) |

0.049** (0.126) |

0.290* (0.157) |

| Instrumental variable |

1.443*** (0.240) |

|

|

| Constant |

2.592*** (0.966) |

-0.730 (0.963) |

-2.116 (1.562) |

|

|

-0.755*** (0.174) |

|

|

|

|

-0.668*** (0.209) |

| LR-test of independent equations: Chi-squared |

13.79***

|

|

|

| Log likelihood |

-1069.356 |

|

|

| Ward chi (2) |

289.67***

|

|

|

| Observations |

1063 |

633 |

430 |

4.2. Average treatment effect (ATT) estimation

Building on the previous analysis, the average treatment effect (ATT) for the treatment group of households using digital finance is calculated based on Equation (4).

Table 4 reports the average treatment effect (ATT) for households using digital finance as 0.515. This indicates that for households using digital finance, the probability of adopting CRT would decrease by 51.5% if digital finance is not utilized. Therefore, the use of digital finance increases the probability of households adopting CRT by 51.5%.

4.3. Robustness check

To check the robustness of the estimation, our study further employs the Propensity Score Matching (PSM) method to estimate the impact of digital finance on the adoption of CRT by households. PSM is widely used as a quasi-experimental method to address sample selection bias, and previous literature has commonly utilized this method for robustness checks. In this study, three methods, namely nearest neighbor matching, radius matching, and kernel matching, are used to match the samples. After conducting standardized bias and common support region tests for each round of sample matching, the Average Treatment Effect (ATT) for the treatment group using digital finance is calculated. As shown in

Table 4, the ATT values based on nearest neighbor matching, radius matching, and kernel matching are 0.101, 0.169, and 0.103 respectively, and these results are statistically significant at the 5% level. This indicates that the conclusion that the use of digital finance significantly promotes the adoption of CRT by households is robust. It is worth noting that the ATT values obtained from the PSM model are smaller than those obtained from the ESP model, as the PSM model does not account for the influence of unobservable factors, leading to biased estimates. This further demonstrates that the results obtained from the ESP model, which considers the endogeneity issue, are more effective than methods such as the PSM (Lokshin and Sajaia, 2004).

4.4. Heterogeneity analysis

Based on the previous analysis, the promotion effect of digital finance on households' adoption of CRT varies because of differences in age, education level, and income. In this study, age, education level, the proportion of agricultural income, and cultivated area are divided into high and low groups based on their means. The kernel matching method in the PSM is used to estimate the average treatment effect (ATT) of digital finance on adopting CRT for different groups of households. The results are presented in

Table 5.

Results from

Table 5 reveal that using digital finance significantly promotes the adoption of CRT by older households, with an ATT value of 0.102. The influence of digital finance on younger age groups' adoption behavior is insignificant. It is generally believed that older households have relatively weaker abilities to absorb and digest new technologies and concepts, while younger households have stronger abilities to embrace new things. They are more likely to obtain financial support for adopting CRT through digital finance. However, empirical findings indicate that the effect of digital finance is more significant for vulnerable elderly households, which differs from this general perception. The reason may be that the younger generation has a broader access range to financial resources and attaches less importance to digital finance than older farming households.

Digital finance significantly promotes the adoption of CRT by households with lower education levels, as indicated by an ATT value of 0.116. In contrast, the influence of digital finance on households with higher education levels is insignificant. Traditional financial services often pose educational barriers, making it challenging for less educated households to access them. However, digital finance provides convenient access to financial services, empowering households, particularly those with lower education levels, to obtain such services. This, in turn, alleviates the financial constraints faced by less educated households and promotes the adoption of conservation tillage technology. Consequently, the impact of digital finance on the adoption behavior of CRT by less educated households is significant.

Digital finance significantly promotes adopting CRT by households with both high and low proportions of agricultural income. The ATT value for the low agricultural income proportion group is 0.086, while for the high agricultural income proportion group, it is 0.213. Comparatively, digital finance has a more significant promoting effect on the adoption of rice–crayfish co-cultivation technology by households with a higher proportion of agricultural income. The proportion of agricultural income reflects the dependence of households on agricultural income. This dependence is evident in two aspects. First, when the proportion of agricultural income is higher, households tend to prioritize agricultural production. They are more inclined to invest additional funds in adopting new agricultural technologies to increase their future agricultural income. Second, a higher proportion of agricultural income means households have fewer alternative sources of funds. Consequently, they rely on digital finance to access funds and provide financial support for adopting new agricultural technologies. Therefore, digital finance has a greater impact on the adoption of CRT by households with a higher proportion of agricultural income.

Overall, digital finance significantly promotes vulnerable groups such as older people, those with lower education levels, and with a higher proportion of agricultural income. This reflects the inclusiveness of digital finance as a new financial service model, which enables more vulnerable groups to share the benefits of digital technology.

5. Mechanism analysis

The previous section has verified the direct impact of digital finance on farmers' adoption of CRT. The following section further examines how digital finance influences farmers' adoption of CRT. Based on the theoretical analysis in the previous section, digital finance impacts farmers' adoption of CRT through three channels. First, it alleviates financial constraints faced by farmers. Second, it expands the information channels available to farmers. Last, it contributes to the accumulation of social capital among farmers. In this study, an intermediary effect model is used to test these three channels, and the results are shown in

Table 6.

5.1. Alleviating financial constraints

Digital finance improves credit availability, facilitates household transfers and remittances, and mitigates farming households' financial constraints. According to column (1) in

Table 6, the use of digital finance significantly negatively impacts farmers' financial constraints. When digital finance use and financial constraints are simultaneously regressed in column (2), both significantly affect the adoption of CRT. This indicates that digital finance significantly alleviates financial constraints for farmers and indirectly promotes the adoption of CRT. Field research has found that farmers predominantly use digital finance for transfers and remittances, and they use it less for obtaining productive credit. This may be because small-scale farmers distrust online credit and are reluctant to apply. Nonetheless, it is undeniable that digital finance alleviates financial constraints for farmers and promotes the adoption of CRT. Currently, digital finance products are continuously expanding, and designing financial products suitable for small-scale farmers, especially credit products, is crucial to alleviate their credit constraints and further promote the adoption of CRT.

5.2. Expanding information channels

Digital finance guides farmers to pay attention to policy information, promotes participation in online platforms, and expands farmers' information channels. According to the results in column (3) of

Table 6, digital finance significantly impacts farmers' attention to economic information. When digital finance use and attention to economic information are simultaneously regressed in column (4), both significantly positively affect the adoption of CRT. This indicates that digital finance benefits farmers accessing economic information and indirectly promotes adopting CRT. Therefore, using digital finance, policy information, market information, and technical information related to CRT is beneficial in increasing farmers' awareness of the technology. Compared with traditional agriculture, CRT requires higher knowledge and skills from agricultural operators. Farmers need to learn and master the operational skills of each link to exploit the production advantages of CRT fully.

5.3. Increasing social capital accumulation

Social capital is an important factor influencing farmers' adoption of CRT. According to column (5) in

Table 6, digital finance significantly impacts farmers' social capital. When digital finance use and social capital are simultaneously regressed in column (6), both significantly affect the adoption of CRT. This indicates that using digital finance promotes the accumulation of social capital for farmers and facilitates the adoption of CRT. Therefore, during the use of digital finance, the accumulation of social capital is beneficial in promoting the diffusion of CRT and harnessing the “diffusion effect” and “homophily effect” of the technology. Farmers can access more reliable agricultural technology promotion information through financial platforms, thereby promoting the adoption of CRT.

6. Conclusions and discussion

This study examines the factors influencing farmers' decisions to use digital finance in the Jianghan Plain and reveals the impact of digital finance on the adoption of conservation tillage technology by farmers. By using survey data from 1,063 farming households in the Jianghan Plain in China. This study employs an ESP model to address the issue of sample selection bias. This study uses the PSM method to test the robustness of the ESP model results and conducts a heterogeneity analysis to examine the impact of digital finance on different groups of farmers. Subsequently, an intermediary effect model is used to test the mechanisms through which digital finance influences farmers' adoption of conservation tillage technology.

Specifically, the empirical results based on the ESP model reveal the factors influencing farmers' use of digital finance. The age of the household head, health status, education level, party membership, and membership in agricultural organizations affect farmers' use of digital finance. The use of digital finance significantly promotes farmers' adoption of conservation tillage technology. Notably, the heterogeneity analysis finds that digital finance has a more significant promoting effect on adopting conservation tillage technology among older, and less educated with a higher proportion of agricultural income, indicating a higher dependence of these vulnerable groups on digital finance. Furthermore, the mechanism analysis finds that digital finance promotes adopting conservation tillage technology by alleviating farmers' financial constraints, expanding information channels, and increasing social capital accumulation.

Based on these research findings, the following policy recommendations are made: (1) this study confirms that digital finance promotes adopting conservation tillage technology. It alleviates farmers' financial constraints, expands information access, and increases social capital accumulation. This provides a scientific reference for governments considering promoting eco-agricultural development by popularizing digital finance. (2) To encourage the use of digital finance among farmers, it is recommended that the government initially focuses on promoting it among young, healthy, and highly educated farmers. Additionally, members of agricultural organizations should also be targeted for promotion. (3) Particular attention should be given to farmers who are older, less educated, and rely heavily on agricultural income. By improving their ability to use digital finance, they can better access its benefits and share in its advantages. (4) The government should expand the scope of digital finance services and improve their quality. For example, encouraging collaboration between traditional financial institutions and digital finance platforms to increase farmers' sources of funds; guiding promotional departments to establish conservation tillage technology promotion accounts on digital finance platforms, disseminating information on technology usage, effectiveness, and government policies, and strengthening interaction and communication with farmers; financial institutions should improve financial product design and provide financial products suitable for small-scale farmers, especially credit products; increasing farmers' technical training to enhance the convenience and security of digital finance technology operation, increase the usefulness and usability of technology, and promote further penetration of digital finance.

The popularization of digital finance plays a vital role in promoting the adoption of conservation tillage technology. Based on this fact, this study provides strong evidence for the impact of digital finance usage in promoting the adoption of conservation tillage technology through unique field survey data and econometric models. It offers a new perspective on the ecological benefits of farmers' use of digital finance. However, several aspects require further research in the future. (1) These data only focus on the rice–crayfish co-cultivation technology in the Jianghan Plain in China. Research results would be more effective and practical if they encompassed other eco-agricultural technologies, as digital finance may have different impacts on different eco-agricultural technologies. (2) Adoption of agricultural practices is a process, and we only used binary variables to measure the adoption behavior, which cannot reflect the dynamic adoption process of farmers. Considering the limitations of the cross-sectional data used in our study, future research could employ panel data to extend this work. (3) Farmers' usage of digital finance products is primarily concentrated in digital payments, with low utilization rates for digital credit and digital wealth management. Lack of awareness and low trust in new financial services may be constraining factors, particularly in the early stages of adoption. Additionally, the elderly population, in addition to a lack of financial knowledge, faces “digital barriers,” which refer to difficulties in using digital devices. The accessibility of digital devices and the usability of digital finance technology should be improved.

Author Contributions

Conceptualization, Zhe Liu; Methodology, Zhe Liu and John Stephen Clark; Formal analysis, Zhe Liu and Qingsong Tian; Investigation, Zhenhong Qi; Writing – original draft, Zhe Liu; Writing – review & editing, Zeyu Zhang; Funding acquisition, Zhenhong Qi.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

This article does not contain any studies with human participants or animals performed by any of the authors. Informed consent was obtained from all the individual participants included in the study.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

References

- Lockeretz, W. Problems in evaluating the economics of ecological agriculture. Agr. Ecosyst. Environ. 1989, 27, 67–75. [Google Scholar] [CrossRef]

- Shah, S. I. A.; Zhou, J. H.; Shah, A. A. Ecosystem-based Adaptation (EbA) practices in smallholder agriculture: emerging evidence from rural Pakistan. J. Clean. Prod. 2019, 218, 673–684. [Google Scholar] [CrossRef]

- Priyadarshini, P.; Abhilash, P. C. Policy recommendations for enabling transition towards sustainable agriculture in India. Land. Use. Pol. 2020, 96, 104718. [Google Scholar] [CrossRef]

- Cao, C.; Wang, Y.; Wang, J. P.; Yuan, p. l.; Chen, S. W. “Dual character” of rice-crayfish culture and strategy for its sustainable development. Chin. J. Eco-Agric. 2017, 25, 1245–1253. (In Chinese) [Google Scholar] [CrossRef]

- Wei, Y. B.; Lu, M.; Yu, Q. Y.; Xie, A. K.; Hu, Q.; Wu, W. B. Understanding the dynamics of integrated rice–crawfish farming in Qianjiang county, China using Landsat time series images. Agric. Syst. 2021, 191, 103167. [Google Scholar] [CrossRef]

- Xie, J.; Hu, L. L.; Tang, J. J.; Wu, X.; Li, N. N.; Yuan, Y. G.; Yang, H. S; Zhang, J. E.; Luo, S. M.; Chen, X. Ecological mechanisms underlying the sustainability of the agricultural heritage rice–fish coculture system. Proceedings of the National Academy of Sciences of the United States of America 2011, 108, 1381–1387. [Google Scholar] [CrossRef] [PubMed]

- Ge, L.; Sun, Y; Li, Y. J.; Wang, L. Y.; Guo, G. Q.; Song, L. L.; Wang, C.; Wu, G. G.; Zang, X. Y.; Cai, X. M.; Li, S. X.; Li, P. Ecosystem sustainability of rice and aquatic animal co-culture systems and a synthesis of its underlying mechanisms. Sci. Total. Environ. 2023, 880, 163314. [CrossRef] [PubMed]

- Zhou, Y.; Yan, X. Y.; Gong, S. L.; Li, C. W.; Zhu, R.; Zhu, B.; Liu, Z. Y.; Wang, X. L.; Cao, P. Changes in paddy cropping system enhanced economic profit and ecological sustainability in central China. J. Integr. Agric. 2022, 21, 566–577. [Google Scholar] [CrossRef]

- Bashir, M. A.; Liu, J.; Geng, Y. C.; Wang, H. Y.; Pan, J. T.; Zhang, D.; Rehim, A.; Aon, M. Liu, H. B. Co-culture of rice and aquatic animals: An integrated system to achieve production and environmental sustainability. J. Clean. Prod. 2020, 249, 119310. [Google Scholar] [CrossRef]

- Cafer, A. M.; Rikoon, J. S. Adoption of new technologies by smallholder farmers: the contributions of extension, research institutes, cooperatives, and access to cash for improving tef production in Ethiopia. Agriculture and Human Values 2018, 35, 685–699. [Google Scholar] [CrossRef]

- Sieber, S.; Graef, F.; Amjath-Babu, T. S.; Mutabazi, K. D.; Tumbo, S. D.; Fasse, A.; Paloma, S. G. Y.; Rybak, C.; Lana, M. A.; Ndah, H. T.; Uckert, G.; Schuler, J.; Grote, U. Trans-SEC’s food security research in Tanzania: from constraints to adoption for out- and upscaling of agricultural innovations. Food. Secur. 2018, 10, 775–783. [Google Scholar] [CrossRef]

- Boucher, S. R.; Carter, M. R.; Guirkinger, C. Risk rationing and wealth effects in credit markets: theory and implications for agricultural development. Am. J. Agric. Econ. 2008, 90, 409–423. [Google Scholar] [CrossRef]

- Bruhn, M.; Love, I. The real impact of improved access to finance: evidence from mexico. Journal of Finance 2014, 69, 1347–1376. [Google Scholar] [CrossRef]

- Mbiti, I.; Weil, D. N. The home economics of e-money: velocity, cash management, and discount rates of m-pesa users. Am Econ Rev. 2013, 103, 369–374. [Google Scholar] [CrossRef]

- Lee, C. C.; Wang, F. H.; Lou, R. C.; Wang, K. Y. How does green finance drive the decarbonization of the economy? empirical evidence from China. Renewable Energy 2023, 204, 671–684. [Google Scholar] [CrossRef]

- Yu, L. L.; Zhao, D. Y.; Xue, Z. H.; Gao, Y. Research on the use of digital finance and the adoption of green control techniques by family farms in China. Technol. Soc. 2020, 62, 101323. [Google Scholar] [CrossRef]

- Ellison, N. B.; Vitak, J.; Gray, R.; Lampe, C. Cultivating social resources on social network sites: facebook relationship maintenance behaviors and their role in social capital processes. Journal of Computer-Mediated Communication 2014, 19, 855–870. [Google Scholar] [CrossRef]

- Abdul-Rahaman, A.; Abdulai, A. Mobile money adoption, input use, and farm output among smallholder rice farmers in Ghana. Agribusiness 2021, 38, 236–255. [Google Scholar] [CrossRef]

- Lagakos, D.; Marshall, S.; Mobarak, A. M.; Vernot, C.; Waugh, M. E. Migration costs and observational returns to migration in the developing world. J. Monetary Econ. 2020, 113, 138–154. [Google Scholar] [CrossRef]

- Liu, D.; Li, Y. S.; You, J.; Balezentis, T.; Shen, Z. Y. Digital inclusive finance and green total factor productivity growth in rural areas. J. Clean. Prod. 2023, 418, 138159. [Google Scholar] [CrossRef]

- Jack, W.; Suri, T. Risk sharing and transactions costs: evidence from Kenya's mobile money revolution. Am Econ Rev. 2014, 104, 183–223. [Google Scholar] [CrossRef]

- Kromidha, E. Identity mediation strategies for digital inclusion in entrepreneurial finance. Int. J. Inf. Manage. 2023, 72, 102658. [Google Scholar] [CrossRef]

- Aparo, N. O.; Odongo, W.; De Steur, H. Unraveling heterogeneity in farmer's adoption of mobile phone technologies: A systematic review. Technol. Forecasting Social Change. 2022, 185, 122048. [Google Scholar] [CrossRef]

- Song, K.; Wu, P. Z.; Zou, S. R. The adoption and use of mobile payment: Determinants and relationship with bank access☆. China Econ. Rev. 2023, 77, 101907. [Google Scholar] [CrossRef]

- Koulayev, S.; Rysman, M.; Schuh, S.; Stavins, J. Explaining adoption and use of payment instruments by US consumers. Rand Journal of Economics 2016, 47, 293–325. [Google Scholar] [CrossRef]

- Carter, M. R.; Olinto, P. Getting institutions “right” for whom? credit constraints and the impact of property rights on the quantity and composition of investment. Am. J. Agric. Econ. 2003, 85, 173–186. [Google Scholar] [CrossRef]

- Su, L. L.; Peng, Y. L.; Kong, R.; Chen, Q. Impact of e-commerce adoption on farmers’ participation in the digital financial market: evidence from rural China. J. Theor. Appl. El. Comm. 2021, 16, 1434–1457. [Google Scholar] [CrossRef]

- Bressan, S.; Pace, N.; Pelizzon, L. Health status and portfolio choice: is their relationship economically relevant? Int. Rev. Financ. Anal. 2014, 32, 109–122. [Google Scholar] [CrossRef]

- Zhao, P. P.; Zhang, W.; Cai, W. C.; Liu, T. J. The impact of digital finance use on sustainable agricultural practices adoption among smallholder farmers: an evidence from rural China. Environ. Sci. Pollut. Res. 2022, 29, 39281–39294. [Google Scholar] [CrossRef]

- Auci, S.; Pronti, A. Irrigation technology adaptation for a sustainable agriculture: a panel endogenous switching analysis on the Italian farmland productivity. Resour Energy econ. 2023, 74, 101391. [Google Scholar] [CrossRef]

- Jack, W.; Ray, A.; Suri, T. Transaction networks: evidence from mobile money in Kenya. Am Econ Rev. 2013, 103, 356–361. [Google Scholar] [CrossRef]

- Gomber, P.; Kauffman, R. J.; Parker, C.; Weber, B. W. On the fintech revolution: interpreting the forces of innovation, disruption, and transformation in financial services. J. Manage. Inform. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Beck, T.; Pamuk, H.; Ramrattan, R.; Uras, B. R. Payment instruments, finance and development. J. Dev. Econ. 2018, 2018. 133, 162–186. [Google Scholar] [CrossRef]

- Giné, X. Access to capital in rural Thailand: An estimated model of formal vs. informal credit. J. Dev. Econ. 2011, 96, 16–29. [Google Scholar] [CrossRef]

- Girma, Y. Credit access and agricultural technology adoption nexus in Ethiopia: A systematic review and meta-analysis. J. Agric. Food Res. 2022, 10, 100362. [Google Scholar] [CrossRef]

- Croppenstedt, A.; Demeke, M.; Meschi, M. M. Technology adoption in the presence of constraints: the case of fertilizer demand in Ethiopia. Rev. Dev. Econ. 2003, 7, 58–70. [Google Scholar] [CrossRef]

- Rasoulinezhad, E.; Taghizadeh-Hesary, F. Role of green finance in improving energy efficiency and renewable energy development. Energ. Effic. 2022, 15. [Google Scholar] [CrossRef]

- Yang, X; Zhou, X. H.; Deng, X. Z. Modeling farmers’ adoption of low-carbon agricultural technology in Jianghan Plain, China: an examination of the theory of planned behavior. Technol. Forecasting Social Change 2022, 180, 121726. [Google Scholar] [CrossRef]

- Narayan, D.; Cassidy, M. F. A dimensional approach to measuring social capital: development and validation of a social capital inventory. Current. Sociology 2016, 49, 59–102. [Google Scholar] [CrossRef]

- Hunecke, C.; Engler, A.; Jara-Rojas, R.; Poortvliet, P. M. Understanding the role of social capital in adoption decisions: an application to irrigation technology. Agric. Syst. 2017, 153, 221–231. [Google Scholar] [CrossRef]

- Ellison, N. B.; Steinfield, C.; Lampe, C. Connection strategies: social capital implications of Facebook-enabled communication practices. New. Media. Soc. 2011, 13, 873–892. [Google Scholar] [CrossRef]

- Bandie, R.; Rasul, I. Social networks and technology adoption in northern Mozambique. Econ. J. 2006, 116, 869–902. [Google Scholar] [CrossRef]

- Satar, M. S.; Alarifi, G.; Alrubaishi, D. Exploring the entrepreneurial competencies of E-commerce entrepreneurs. International journal of management education 2023, 21, 100799. [Google Scholar] [CrossRef]

- Deng, X.; Xu, D. D.; Zeng, M.; Qi, Y. B. Does internet use help reduce rural cropland abandonment? evidence from China. Land use Pol. 2019, 89, 104243. [Google Scholar] [CrossRef]

- Lokshin, M.; Sajaia, Z. Impact of interventions on discrete outcomes: maximum likelihood estimation of the binary choice models with binary endogenous regressors. Stata J. 2011, 11, 368–385. [Google Scholar] [CrossRef]

- Heckman, J.J.; Ichimura, H.; Todd, P. Matching as an econometric evaluation estimator: evidence from evaluating a job training programme. Rev. Econom. Stud. 1997, 64, 605–654. [Google Scholar] [CrossRef]

- Baron, R. M.; Kenny, D. A. The moderator-mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed]

- Atella, V.; Brunetti, M.; Maestas, N. Household portfolio choices, health status and health care systems: a cross- country analysis based on SHARE. J. Bank. Financ. 2012, 36, 1320–1335. [Google Scholar] [CrossRef] [PubMed]

- Lusardi, A.; Mitchell, O. S. The economic importance of financial literacy: theory and evidence. J. Econ. Lit. 2014, 52, 5–44. [Google Scholar] [CrossRef]

- Wu, H. X.; Song, Y.; Yu, L. S.; Ge, Y. Uncertainty aversion and farmers’ innovative seed adoption: evidence from a field experiment in rural China. J. Integr. Agric. 2023, 22, 1928–1944. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).