1. Introduction

Every day, a newsvendor needs to buy journals based on an uncertain demand. Assuming that each journal has a fixed cost and selling price, if she/he asks for too many journals and the demand is not enough, there is a reduction in the profit. On the other hand, if the demand is higher than the number of journals ordered, potential sales do not occur, resulting in “lost profits” [

1]. This dilemma of buying more or less newspapers, which is know as the

newsvendor problem, can be used to model inventory management problems.

Several solutions can be found to solve several inventory management problems, [

1,

2,

3]. When multi–items are considered, one deals with the Multi-Item Newsvendor Problem (MINP). In this problem it is important to consider the number of constraints and their type (cost, service level, etc.), the decision-making policies (as e.g. optimize expected profit, service level, etc.). Often, solutions are found using risk–averse techniques. Further, usually MINP use probability density functions to model the uncertain demand [

4,

5,

6,

7].

However, the demanded probabilistic density functions are difficult to derive in real scenarios, especially for innovative and disruptive products, where there is no sufficient data to accurately predict the demand probability distribution. It is possible to mitigate these limitations by including additional information from human expertise using e.g. fuzzy systems [

8].

Fuzzy logic is a suitable tool to incorporate uncertain demands with a proven effectiveness in solving MINP [

8,

9,

10]. A fuzzy environment can use few data points to describe uncertainty through meaningful membership functions. Furthermore, fuzzy logic offers an ideal environment to describe the vagueness of human thinking through mathematical operations, defining linguistic terms such as “the demand of a product is around 2000” [

11].

The first fuzzy solution for an inventory management problem dates back to 1995 [

12]. A year later, Petrov proposed the first fuzzy solution for newsvendor problems [

8]. Analytical analyses in a fuzzy environment [

8,

13,

14,

15,

16] are useful to specific cases, where it is possible to study a limited number of items in a well isolated economic environment. Problems arise when the number of items and their relations increase, leading to highly nonlinear problems, making analytical approaches hard to implement. Most of the recent fuzzy [

17,

18,

19] and non-fuzzy [

20,

21,

22,

23,

24] solutions focus on solving highly complex single–item problems, lacking the generalization to multi–item problems.

Fuzzy MINP problems are usually solved recurring to metaheuristic algorithms [

9,

10]. Inspired by real-world phenomena, metaheuristics use computational power to find solutions when the classical methods cannot, due to time and complexity. However, metaheuristics do not always guarantee that the solutions found are optimal. However, they can provide, at least, good results for highly complex optimization problems [

25,

26].

Shao proposed a genetic algorithm [

27,

28], to solve the newsvendor problem with a fuzzy environment [

9]. This paper extended the fuzzy objective functions proposed in [

8], with the adoption of credibility theory concepts [

29,

30]. In [

9], Shao used the concepts of possibility, necessity and credibility of a fuzzy event, as well as the excepted value of a fuzzy variable [

31] to derive objective functions for different decision-making policies.

In 2011, Taleizadeh [

10] studied a variety of metaheuristic algorithms to solve a fuzzy single-period newsvendor problem and also proved the suitability of genetic algorithms for this problem.

This paper extends the formulation of the existing fuzzy newsvendor problem from single-item to multi-item problems, allowing its application to inventory problems. The proposed formulation is flexible, as it allows the use of any profit function. Further, this paper proposes the extension of the genetic algorithm in [

10] to solve the fuzzy multi-item newsvendor problem, enhancing the work of [

9] in both the generation and evaluation of solutions.

The paper is organized as follows.

Section 2 describes classical and fuzzy multi-item newsvendor problems. The optimization artchtiecture proposed in this paper is described in

Section 3. In this section, the optimization algorithm is described (which uses a genetic algorithm), and a novel method to estimate the credibility is proposed. Further, novel problem-specific genetic mechanisms are also proposed. The benchmark case studies are described in

Section 4. A general simulation procedure, which is necessary for addressing both classical and fuzzy multi-item newsvendor problems is proposed in

Section 5.

Section 6 presents the obtained results, and the conclusions and future work are presented in

Section 7.

3. Proposed optimization architecture

The formulation of the fuzzy newsvendor problem is extended in this paper from single-item to multi-item problems, allowing its application to inventory problems. This is accomplished with an optimization architecture that combines a modified genetic algorithm and the expected profit estimation introduced in

Section 2.2.4. Along with the common mechanisms of a genetic algorithm, crossover, mutation and selection [

27], two novel components are added: a credibility estimation procedure, which is introduced in

Section 3.1 and novel problem-specific genetic mechanisms, which are described in

Section 3.2.

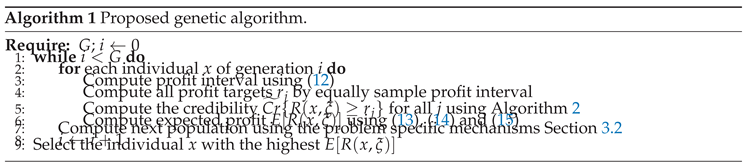

The proposed optimization architecture finds the solution with the highest expected profit, according to the fundamentals previously introduced in

Section 2. Algorithm 1 details the proposed genetic algorithm to maximize the expected profit. This algorithm needs to estimate the credibility

, which is explained in detail in

Section 3.1 and Algorithm 2.

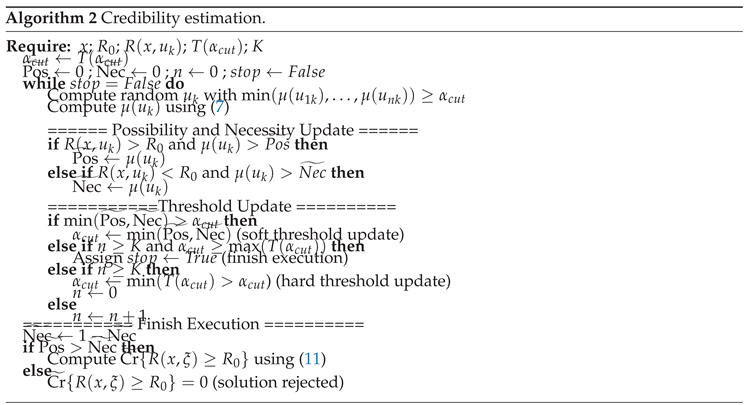

3.1. Proposed credibility estimation

This section describes the proposed credibility estimation, which is presented in Algorithm 2. The main objective of this approach is estimate the credibility of a solution

x generating a profit higher than a profit target

. It repeats the estimation

K times until it finds it. Estimations for different profit targets

are further used to estimate the expected profit of the solution

x, as it was previously described in

Section 2.2.4.

The demand vector is randomly generated, and considered quantities that have a membership grade higher than a

, which are defined by 10% quantiles, and as so can have the following values:

Further, the is always equal or greater than the minimum value between the highest membership grades found for both possibility and necessity. The progressively increases the minimal membership grade of the random demand vectors generated.

This is useful because the possibility estimation requires to find the demand vector with the highest membership grade that generates a profit higher than the profit target

, as defined in (

9). And, the necessity estimation requires to find the demand vector with the highest membership grade that generates a profit lower than the profit target

, as defined in (

10).

Note also that sometimes, due to the random generation, for low credibility solutions, the necessity estimation can be higher than the possibility estimation. Those results are impossible due to the nature of the problem, and therefore are automatically rejected by the algorithm.

3.2. Novel problem-specific genetic mechanisms

This section describes problem-specific mechanisms, which are implemented in the architecture proposed in Algorithm 1. These methods enhance the set of solutions by 1) discarding materials in the initial population, 2) scaling chromosomes according to the available budget, and 3) introduce a problem-specific context to the crossover operator. This section proposed thus the chromosomes initialization, the solution resizing and the chromosome normalization, which are described in the next three sections.

3.2.1. Initialization with zero quantities

The initialization with zero quantities initializes chromosomes with a single non-zero ordering quantity

. After selecting a random item

i for the non-zero ordering quantity, the chromosome is resized as explained in

Section 3.2.2 to scale

to reach the available budget. If

i is a profitable item, the chromosome is selected because the expected profit is higher than chromosomes containing less profitable items. This mechanism aims to select (and further combine) only the most profitable items.

3.2.2. Solution resizing

The solution resizing mechanism scales the chromosome ordering quantities

to use all the available budget. It scales the quantities up or down without changing the relative proportions between them. On the one hand, this mechanism can transform over-budget solutions into feasible solutions by scaling them down. On the other hand, it can scale up under-budget solutions to use all the available budget. To apply this mechanism, the ordering quantities

are resized to quantities

by multiplying it by a resizing ratio, as follows:

3.2.3. Chromosome normalization

This normalization makes the crossover independent of the absolute values in

x, by normalizing them according to the items with most expected demand value

. In this paper, the most expected demand value comes from the item with the probabilistic density function

, but it could also be the fuzzy value with the highest grade. To apply the chromosome normalization, first the ordering quantities

must be normalized by applying the transformation:

where

is the ordering quantity of item

i,

is the expected demand value of the probabilistic distribution of item

i, and

is the normalized ordering quantity of item

i. After the crossover has been applied, all normalized ordering quantities

must be de-normalized by multiplying them by

.

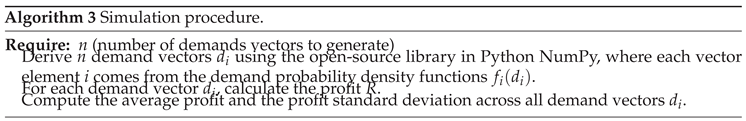

5. Simulation procedure

This section presents a general simulation procedure for addressing both classical and fuzzy multi-item newsvendor problems. Studies on the fuzzy multi-item newsvendor problem [

9,

10,

35] have been focusing on evaluating the performance of the solutions solely based on maximizing a fuzzy objective function. This approach raises questions, such as: “Is the objective function a good representation of reality?” or “Will the solution generate the expected results in a real scenario?”.

To address these issues, we propose the Algorithm 3, which uses demand vectors

u, based on each item’s demand

, to evaluate solutions, both fuzzy and non-fuzzy. The procedure simulates real scenarios by using a diverse range of demand vectors

u, with a greater emphasis on probable vectors while still accounting for less likely ones. By computing the profit for each demand vector

u with a given solution

x, the average profit and profit standard deviation across all vectors can be determined.

7. Conclusions

A novel formulation of the fuzzy newsvendor problem for inventory management applications was proposed. The designed framework implemented a fuzzy formulation to solve cases where there is insufficient data to predict the demand distributions and it is necessary to integrate human-expertise knowledge. One of the main contributions of this work is the redesign of the credibility estimation procedure, introducing a dynamic adjustment of a threshold to generate meaningful demand vectors, instead of using a purely random vector generation.

The proposed fuzzy optimization genetic algorithm is compared in two benchmark case studies. The proposed approach slightly outperform the classical approach. However, it clearly outperform the previous fuzzy approach. In the most complex case, case study 2, it improves the profit in 55%. The performance increase is the result of introducing a new initialization with null values that proved to be a valuable mechanism in low-budget scenarios, where there is the need for rejecting less profitable items.

The main advantage of this algorithm it is its flexibility. Despite using fixed costs to prove effectiveness against analytical approaches, this solution can work with nonlinear pricing models. To perform this, one only needs to integrate the pricing information when calculating profits in the credibility estimation. This is suggested for future work. Moreover, there is the possibility of changing performance measures. Profit was used to prove the effectiveness against analytical approaches, but the algorithm could prioritize the solutions that most satisfied possible costumer demand, by replacing the profit calculation with a service-level calculation.

Additionally, the proposed algorithm can also be implemented using parallel computing in a cloud environment, which drastically reduces execution time and makes the solution applicable in a real scenario.

Table 1.

Data for Case study 1: revenue loss per unit, cost for leftover, cost per unit, and mean of demand for the six items.

Table 1.

Data for Case study 1: revenue loss per unit, cost for leftover, cost per unit, and mean of demand for the six items.

| Item |

(CU) |

(CU) |

(CU) |

|

| 1 |

7 |

1 |

4 |

200 |

| 2 |

12 |

2 |

8 |

225 |

| 3 |

30 |

4 |

20 |

112.5 |

| 4 |

30 |

4 |

10 |

100 |

| 5 |

40 |

2 |

13 |

75 |

| 6 |

45 |

5 |

15 |

30 |

Table 2.

Case Study 1: benchmark solution with ordering quantities per item.

Table 2.

Case Study 1: benchmark solution with ordering quantities per item.

| Item |

1 |

2 |

3 |

4 |

5 |

6 |

|

78.41 |

58.16 |

30.06 |

81.74 |

70.91 |

25.29 |

Table 3.

Data for Case study 2: revenue loss per unit, cost for leftover, cost per unit, mean and standard deviation of demand for the 17 items.

Table 3.

Data for Case study 2: revenue loss per unit, cost for leftover, cost per unit, mean and standard deviation of demand for the 17 items.

| Item |

(CU) |

(CU) |

(CU) |

|

|

| 1 |

7 |

1 |

4 |

102 |

51 |

| 2 |

12 |

2 |

8 |

73 |

18.3 |

| 3 |

30 |

4 |

19 |

123 |

30.8 |

| 4 |

30 |

4 |

17 |

95 |

23.8 |

| 5 |

40 |

2 |

23 |

62 |

15.5 |

| 6 |

45 |

5 |

15 |

129 |

43 |

| 7 |

16 |

1 |

10 |

69 |

34.5 |

| 8 |

21 |

2 |

10 |

83 |

41,5 |

| 9 |

42 |

3 |

40 |

120 |

30 |

| 10 |

34 |

5 |

20 |

89 |

22.3 |

| 11 |

20 |

3 |

10 |

115 |

38.3 |

| 12 |

15 |

5 |

7 |

91 |

30.3 |

| 13 |

10 |

3 |

4 |

52 |

17.3 |

| 14 |

20 |

3 |

12 |

76 |

38 |

| 15 |

47 |

2 |

33 |

66 |

16.5 |

| 16 |

35 |

4 |

21 |

147 |

36.8 |

| 17 |

22 |

1 |

11 |

104 |

34.7 |

Table 4.

Case Study 2: solution showing the ordering quantities per item.

Table 4.

Case Study 2: solution showing the ordering quantities per item.

| Item |

|

Item |

|

| 1 |

0 |

10 |

0 |

| 2 |

0 |

11 |

15.58 |

| 3 |

0 |

12 |

42.2 |

| 4 |

0 |

13 |

34.56 |

| 5 |

0 |

14 |

0 |

| 6 |

106.86 |

15 |

0 |

| 7 |

0 |

16 |

0 |

| 8 |

14.02 |

17 |

15.23 |

| 9 |

0 |

|

|

Table 5.

Results using the initialization with zero quantities

Table 5.

Results using the initialization with zero quantities

| Case study |

Init. with zero quantities |

Fitness |

Simulated profit |

| 1 |

Yes |

4167.9 |

2860.3 |

| 1 |

No |

4940.9 |

2853.0 |

| 2 |

Yes |

3741.9 |

3797.3 |

| 2 |

No |

2229.9 |

2446.6 |

Table 6.

Results using solution resizing.

Table 6.

Results using solution resizing.

| Case study |

Sol. resizing |

Fitness |

Unfeasible sol. |

Simulated profit |

| 1 |

Yes |

4167.9 |

0 |

2860.3 |

| 1 |

No |

3945.1 |

250.4 |

2293.2 |

| 2 |

Yes |

3741.9 |

0 |

3797.3 |

| 2 |

No |

2208.8 |

122.2 |

2305.6 |

Table 7.

Results using chromosome normalization.

Table 7.

Results using chromosome normalization.

| Case study |

Chromosome normalization |

Fitness |

Simulated profit |

| 1 |

Yes |

4889.5 |

2827.4 |

| 1 |

No |

4940.9 |

2853.0 |

| 2 |

Yes |

3713.7 |

3755.7 |

| 2 |

No |

3741.9 |

3797.3 |

Table 8.

Simulation results in terms of average profit and standard deviation of the profit.

Table 8.

Simulation results in terms of average profit and standard deviation of the profit.

| Case Study |

Method |

Average Profit |

Profit St. Dev. |

| 1 |

Classical approach |

2877.1 |

2.0 |

| 1 |

Fuzzy GA from [9] |

2889.8 |

1.2 |

| 1 |

Proposed approach |

2914.7 |

1.5 |

| 2 |

Classical approach |

3869.4 |

0.5 |

| 2 |

Fuzzy GA (as in [9]) |

2833.6 |

0.2 |

| 2 |

Proposed approach |

3878.7 |

0.8 |