1. Introduction

Integrating decentralized renewable energy production systems into the power grid presents complex challenges due to the intermittent nature of the resources. Battery Energy Storage Systems (BESS) and Renewable Energy Communities (REC) are pivotal in addressing these challenges.

European directives are driving the transition towards renewable energy production by incentivizing positive consumer behavior. REC, an emerging concept, encourages consumers and prosumers to aggregate for energy production, consumption, storage, and sharing, often utilizing photovoltaic systems. Collective-Self-Consumption (CSC), incentivized monetarily, motivates consumers to align their electricity usage with production periods, enhancing both incentives and grid independence.

REC not only pursues CSC incentives but also aims to participate in electricity markets. This study explores conditions under which a REC should invest in a community battery to enhance CSC and to participate in the day-ahead and intra-day electricity market engaging in Energy Arbitrage (EA), buying low and selling high to generate profit.

1.1. Structure

This manuscript is structured as follows:

1.2. Novelty

In this context introduced, the paper contributes in three main ways:

It introduces a new ageing aware rolling-horizon model for the hourly scheduling of a community battery. While existing battery scheduling models cover multiple services, integrating CSC and EA into these models is a novel addition. This novelty stems from the recent emergence of both CSC and EA concepts. The former is obviously related to the new appearance of RECs. The latter, it has only recently become feasible with the development of the intraday market, allowing bidding up to an hour before delivery, based on reliable forecasts and knowledge of the day-ahead market prices.

It conducts an extensive sensitivity analysis on various scenarios to explore the economic feasibility of investing in a community battery. Five key parameters are considered: community size, electricity market prices, battery cost, size, and the decision to engage in energy arbitrage. Such a comprehensive techno-economic analysis of this asset has not yet been proposed in the literature on RECs.

Additionally, the scheduling model takes into account battery ageing, as does the investment assessment. The combined effects of the provision of EA and CSC services on ageing have not been previously studied.

1.3. Limitations

Primary limitations are acknowledged:

Forecast errors are not considered. Indeed, scheduling assumes deterministic knowledge of future load and production. However, considering that scheduling is rolling horizon and takes place one hour before delivery, i.e., at the close of the intraday market, forecast errors should be limited.

A real time control is not implemented and at the same time the costs of imbalances are not included in the economic calculation. This point is complicit with the previous assumption, because if the forecasts are perfect, there are no imbalances and no need for a control to reduce them, performing dispatching.

Simplified participation in the day-ahead and intraday markets is assumed, where all bids can be submitted at the closure of the latter market without differences in prices between the two markets. However, in reality, an initial scheduling should occur at the closure of the day-ahead market, followed by continuous rescheduling during the intraday market as delivery time approaches. The cost of rescheduling due to price differences between the two markets, albeit low in the Italian context, is not included in the economic evaluation.

The provision of ancillary services in the balancing market is not evaluated, but it could certainly serve as an additional revenue stream for a community battery.

Electricity grid is not modeled, which is definitely an aspect to consider to fully complete evaluations like those proposed. Scheduling without considering grid constraints could lead to bidding solutions that are technically undeliverable.

These limitations foreshadow future articles and the direction for further developments in broader research, positioning this study as an initial building block.

1.4. Legislative Framework

The regulations and directives defining EU energy policies aim to reduce greenhouse gas emissions and improve energy efficiency by increasing electricity production from renewable energy sources (RES) [

1]. The integration of RES into the electricity grid involves two main strategies that aim to increase self-consumption. The first focuses on improving demand flexibility through BESS, the second on the formation of renewable energy communities, encouraging the active participation of citizens in the energy transition [

2].

Directive 2019/944 introduces new guidelines to simplify citizen interaction with the electricity system, promoting active participation and aggregation in RECs [

3]. This includes various market activities such as generation, consumption, sharing, trading of electricity, and providing flexibility services via demand response and energy storage. These activities can be pursued individually or through RECs, which role is emphasized in Article 22 of the revision of the Renewable Energy Directive (RED II) 2018/2001 [

4]. Following these directives, EU Member States are defining mechanisms to enable consumer participation in energy communities and providing incentives to enable their fast and effective deployment.

Italy has implemented the REC legislative framework through specific legal provisions and regulations [

5,

6,

7,

8,

9]. In Italy, a REC is a virtual community of consumers, producers and prosumers who produce, consume, storage and share energy from renewable sources. Energy sharing is called Collective Self-Consumption (CSC), and is determined as the virtual self-consumption of the whole REC. Specifically defined as the minimum on an hourly basis between the feeding and withdrawal by all members of the CER. The CSC is incentivized by the Italian government at about 110 €/MWh. This amount can be used for various communities’ activities or redistributed between members

In order to optimize the CSC, a grid-connected BESS can also be used, as defined in [

8,

9]. In particular the energy withdrawn from the BESS for the purpose of subsequent feed-in is added to the energy withdrawn to calculating the collective self-consumption. In order to be able to exchange energy with the grid, the BESS must participate in electricity markets, the details of whose operation are defined by the Italian regulator in accordance with European directives [

10,

11].

1.5. Literature Review

There is a lack in the literature addressing the issue of BESS in RECs. That is, there is a young but widespread interdisciplinary literature on RECs which, however, hardly goes into the specifics of the role BESS can play in RECs. On the other hand, there is extensive literature on the use of utility scale grid-connected BESS to provide multiple services, which, however, is not applied to the RECs context.

1.5.1. Renewable Energy Communities (RECs)

RECs around Europe vary in characteristics due to factors like energy technology, sources, carriers, regional differences and regulations. An overview of the types that are becoming more widespread can be found in [

12] and [

13]. A further important distinction is the configuration: physical or virtual, the two are compared in [

14] and [

15]. The physical requires that the electricity grid be owned by the REC while the virtual requires that the national grid be used. Both configurations are permitted under EU regulations, but only virtual is allowed in Italy. This study deals with a virtual configuration in which energy is produced by photovoltaic panels or is withdrawn from the national power grid.

In the literature on RECs, the most studied aspects are those of an economic nature, indeed an extensive literature comparing different business models for RECs can be found [

16,

17,

18,

19,

20,

21]. The main aspects considered concern the redistribution of incentives [

18] and the allocation of costs among the various stakeholders participating in the energy community [

22]. In some contexts, the possibility of peer to peer treading within the community is also studied [

23,

24]. The effects of demand-side management and how the composition [

25] and configuration [

26] of a REC affects its economic sustainability are evaluated. In general, the main research question is which are the conditions needed by RECs to operate in an economic beneficial way [

19,

20] and how different stakeholders contribute to the overall sustainability goal of the community [

27]. For a focus on how the implementation of different business models is implemented at the level of objective functions to be optimized, see [

28].

The economic evaluations in these articles are based on energy simulations that do not, however, delve into the role of the battery. Some articles do, but they are limited to assessments on sizing [

16,

29,

30], which means how the battery size can influence the self-consumption and gains of the REC and its members. Only some go deep investigating as well the impact on the distribution grid [

31,

32], the scheduling process needed for the battery owned by a prosumer that is also part of a REC [

33], or the possibility of aggregating multiple batteries into a virtual one to maximize collective self-consumption [

34]. This latter aspect is also studied in a previous article by the author, which proposes centrally managing numerous small batteries to maximize not only individual prosumers’ self-consumption but also the collective self-consumption of the community [

35]. The same approach is also tested using thermal storage from heat pumps instead of batteries [

36]. However, the limitation of these approaches lies in the difficulty of installing hardware structures capable of facilitating communication among all the batteries. Furthermore, regulatory rules governing their potential participation in electricity markets are not yet fully defined. These issues are overcome, however, when considering a single grid-connected BESS who is shared between community members. The use of this type of battery within RECs, however, has not yet been sufficiently studied.

A contribution in this field has been made by [

37], who proposes a community BESS for energy arbitrage (EA) and peak shaving, evaluating multiple scenarios and different types of batteries. However, the perspective adopted is actually that of the Distribution System Operator (DSO) rather than that of a REC, which is why it does not integrate collective self-consumption (CSC) on the scheduling algorithms. The same lack is present in all the other articles mentioned in the next paragraph. Another profound contribution is made by [

38], who describes how to perform the scheduling of a community BESS demonstrating its advantages without, however, making any assessment on the investment costs neither considering the ageing of the battery.

A literature review carried out by [

39] shows that in order to achieve a greater implementation of the community BESS, it is necessary that they are used to cater for multiple services in order to optimize their utility and economic gains. The literature regarding the use of BESS to provide multiple services is however not the same as the REC literature but is that regarding grid connected utility scale BESS.

1.5.2. Battery Energy Storage Systems (BESS) to Provide Multiple Services

As stated before, there is extensive literature on the use of utility scale grid-connected BESS to provide multiple services, which, however, is not applied to the RECs context. These services can be classified in 4 mainstream categories:

Provision of ancillary services (AS) to the grid operator to enhance the system reliability (e.g., Frequency Containment, Frequency Restoration and Replacement Reserve).

Dispatching, i.e., real-time coverage of dispatching errors.

Achievement of local objective as self-consumption and collective-self-consumption (CSC).

Energy Arbitrage (EA) i.e., buying and selling electricity to generate a revenue.

Models in the literature focus mainly on AS and dispatching. [

40] proposes a general framework for the scheduling and control of a BESS to provides multiple services and uses it in the problem of providing dispatchability. This problem is explored in more detail in [

41], adding grid constraints and proposing a two-level control layer to avoid battery saturation. In [

42] the provision of AS is also added to the problem formulation.

For a review on the possibility of providing AS using BESS focused on Italy market and regulation see [

43]: a market price sensitivity analysis compared to the economic feasibility of the investment is performed. Instead, BESS modelling methodology for stacking more than one ancillary service is described in [

44].

A more comprehensive overview of how a BESS can provide multiple services and the programming methodologies used in various cases is beyond the scope of this article, see [

45].

What needs to point out is that the scheduling algorithms developed for the provision of multiple services have already been developed but not yet been applied to CSC and EA, i.e., they were not developed from the point of view of REC. At the same time, in REC literature, the use of a community battery to provide multiple services is not considered. This novelty stems from the recent emergence of both CSC and EA concepts. The former is obviously related to the new appearance of RECs. The latter, it has only recently become feasible with the development of the intraday market, allowing bidding up to an hour before delivery, based on reliable forecasts and knowledge of the day-ahead market prices.

The aim of this article is to propose a scheduling model for a community BESS and to use it to run simulations that clarify the role and potential this BESS can have on an REC. By conducting an extensive sensitivity analysis on various scenarios, the economic feasibility of investing in a community battery is explored. Such a comprehensive techno-economic analysis of this asset has not yet been proposed in the literature on Renewable energy Communities.

2. Materials and Methods

The chapter begins by introducing the selected case study for simulations, detailing the concept of a Renewable Energy Community (REC) within Italian regulatory frameworks. It explains how a Battery Energy Storage System (BESS) can actively engage in Collective Self-Consumption (CSC) and Energy Arbitrage (EA).

After the case study introduction, the BESS model is elaborated upon. A Mixed-Integer Linear Programming (MILP) approach is utilized to compute BESS scheduling, considering relevant parameters and techniques to address battery aging effects.

Next, the economic evaluation formulations are presented to assess the financial feasibility of the proposed system. Finally, simulated scenarios are introduced, followed by a comparative analysis of these scenarios in the results chapter.

2.1. Case Study

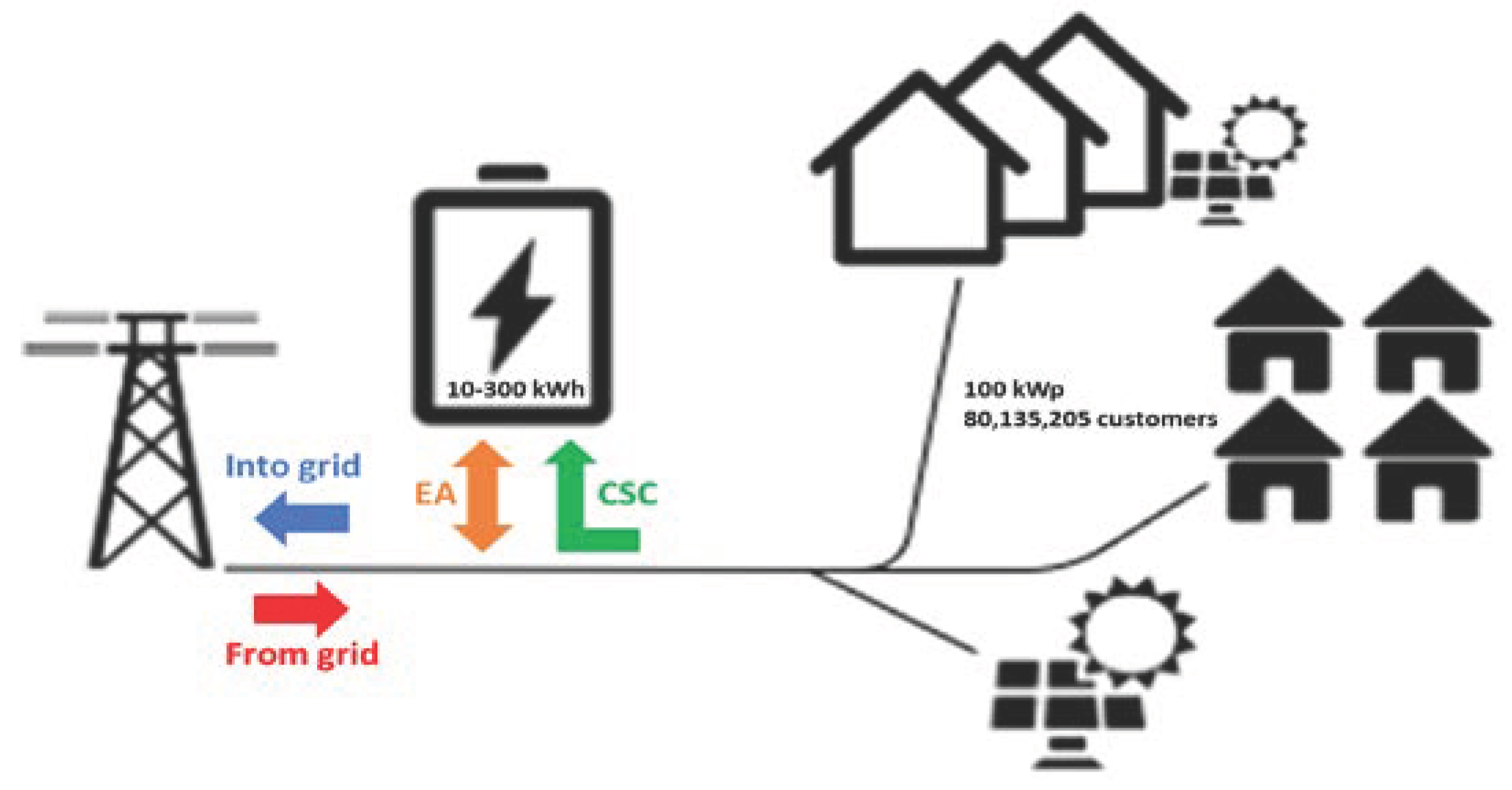

A Renewable Energy Community (REC) fueled by an overall of 100 kWp photovoltaic systems is examinate, exclusively comprising residential customers. Photovoltaic power is the REC reference size and is kept constant during simulations, however, the results are scalable to REC with higher production. On the other hand, battery size and number of consumers are the subject of sensitivity studies.

As already described in subsection 1.4. Legislative framework, according to the Italian regulation the Collective-Self-Consumption (CSC), which is the virtual self-consumption of the whole community, is incentives at about 110 €/MWh. It is specifically defined as the minimum on an hourly basis between the feeding and withdrawal by all members of the REC.

The energy withdrawn from a grid-connected Battery Energy System (BESS) for the purpose of subsequent feed-in (green row in

Figure 1) is added to the energy withdrawn to calculating the CSC. This is why this article assess using a BESS to increase the CSC and thus the incentive.

In order to be able to exchange energy with the grid, the BESS must participate in electricity markets. In particular, this article considers participation in the day-ahead and intraday markets. This opens up the possibility of perform energy arbitrage (EA) by buying energy when prices are low and reselling it when they are high.

2.2. BESS Scheduling Model

According to the definition of CSC and to the electricity market, the simulations performed have an hourly time step. However, in the near future the market will become quarter-hourly.

Considering that the intraday market closes an hour before delivery [

46], the optimal battery scheduling for the next 24 hours is calculated every hour, and the first hour is used as simulation. The scheduling problem is defined as a Mixed-Integer Linear Programming (MILP) optimization model. This problem is rolling horizon, because it is solved each hour, and it is 24-hour looking ahead.

Such problem is solved for each hour of the yeas (8760 hours) for 20 years, so each simulation is a combination of 8760 per 20 MILP optimizations.

As explained in subsection 1.3. Limitations, a deterministic knowledge of production, load, and energy price for the next 24 hours is considered. These series serve as inputs for the MILP problems.

A thorough description of the scheduling optimization model follows: objective function (equation 1) and constraints (equations 2,3,4 and 5).

The objective function fobj is an economic one. It is the sum on 24 hours of the revenue obtained from Energy Arbitrage (EA) and Collective-Self-Consumption (CSC) minus an Activation Penalty (AP), which is linked with BESS aging and replacement cost. Aim of the optimization problem is to maximize the objective function.

The hourly energy BESS exchanges with the grid (Ebess) is the variable to be optimized: a vector of length 24 representing the scheduling of the battery. Ebess,h is negative, if the battery feeds energy into the grid, or positive, if the battery draws energy.

EPh represents the hourly Energy Price. The price is always negative, so if energy is withdrawn the product Ebess,h∙EPh is a cost, while when it is fed it is a gain.

The gain for CSC is the product between the value of the incentive (inc = 110 €/MWh) and the energy drawn from BESS that is counted as CSC. The latter is the minimum between the REC energy Surplus (Esur,h) and the energy drawn by BESS, i.e., the positive values of Ebess,h (max(0, Ebess,h)).

The penalty due to activation linked with aging is the product of the amount of energy fed or withdrawn (|Ebess,h|) and the Activation Cost (AC) parameter, whose function will be explained in the next subsession.

The constrains of the model are the following:

Defining the State of Charge (SoC) variable, which is dependent on parameter E

bess and considers an average charging and discharging efficiency (

) of 0.90 [

47].

SoC and E

bess box constrains considering BESS maximum capacity (C

max) and depth of discharge (DoD). DoD is fixed to 0.10 while C

max is equal to BESS size at the beginning of each simulation but then decrease due to ageing effects. Therefore, it is assumed in Equation 4 that the battery can be fully charged or discharged in one-hour, average q-rate = 1.

This constraint obliges the battery to only be able to charge with the energy surplus of REC (Esur) and to only discharge to meet the REC’s energy need (Eneed). This constraint is aimed at preventing EA through the purchase or sale of energy from outside the REC, which is not necessary for CSC. The constraint is active in scenarios with only CSC and inactive when EA is also desired.

There are also additional constraints and dummy variables in the model that serve for the linearization of functions absolute value, minimum and maximum.

2.3. BESS Ageing Awareness

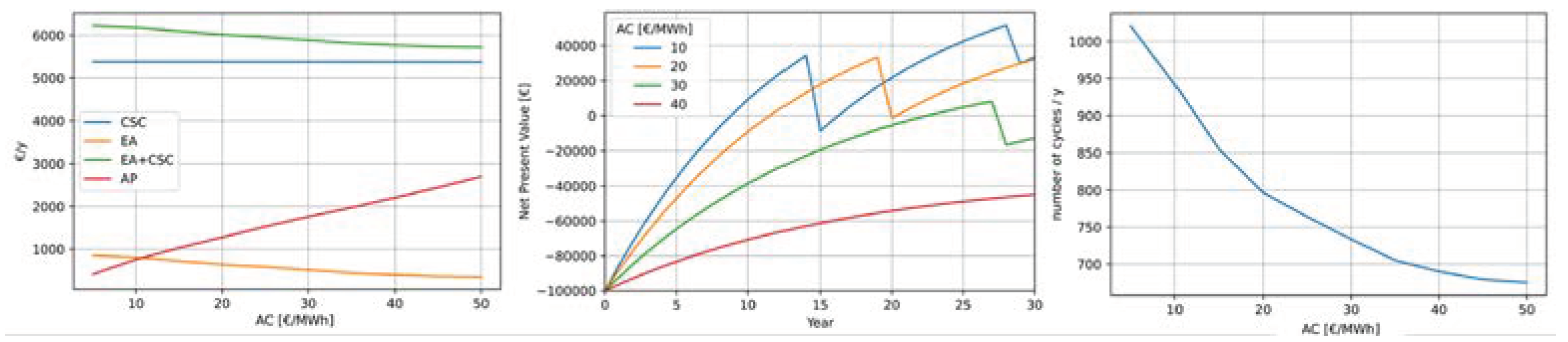

Figure 2 explains the effect of Activation Cost (AC) added to the MILP model (see equation 1.3) and its connection to BESS ageing.

Essentially, the AC value represents the minimum price difference required for executing a charge and discharge cycle to be advantageous. The division by 2 in equation 1.3 precisely aligns the AC value with the buy-and-sell price difference.

A high AC value corresponds to a low number of cycles, and vice versa (

Figure 2c). However, a low number of cycles results in lower earnings in EA (

Figure 2a). These effects can be evaluated over several years, during which the available battery capacity decreases until it reaches end-of-life and needs replacement. With high AC values, the battery ages more rapidly but annual earnings are higher; with low AC values, the battery lasts longer, but the earnings are lower. These effects are illustrated in

Figure 2b, which displays the Net Present Value (NPV) over the years.

To calculate battery aging, a rain flow counting method [

48] has been used to calculate the equivalent number of cycles undergone by the BESS. Assuming that the BESS reaches its end-of-life after 8000 cycles with 80% remaining capacity [

49], the available capacity is recalculated weekly in proportion to the number of equivalent cycles reached. Upon reaching 8000 cycles, the BESS is replaced (stairs in

Figure 2b).

This empirical and macroscopic approach to calculating aging is considered sufficient for the purposes of this paper. While using equivalent circuit models or physical (i.e., electrochemical) models could provide more precise estimates of aging, they are difficult to generalize to different storage technologies and require higher computational costs. The proposed approach, however, is simple to implement; one only needs to write the rain flow counting algorithm and enter the end-of-life information on the battery, easily obtainable from any manufacturer. Although the aging estimate may be coarse, it is sufficient for the purposes of this paper.

2.4. Economic Analysis

The economic assessment of BESS investment is based on the Net Present Value (NPV), calculate for 20 years (y) using equations 6.

NPV0 represents the initial investment for BESS, CFy denotes the annual cash flow, encompassing the sum gains from EA and CSC. The annual interest rate, denoted as i, is set at 5%. When BESS replacement occurs (R=1 otherwise R=0), Replacement cost (Costrepl) is incorporated into CFy. Costrepl is assumed to be equal to the initial installation cost (NPV0), which is equal to Sizebess per Costbess.

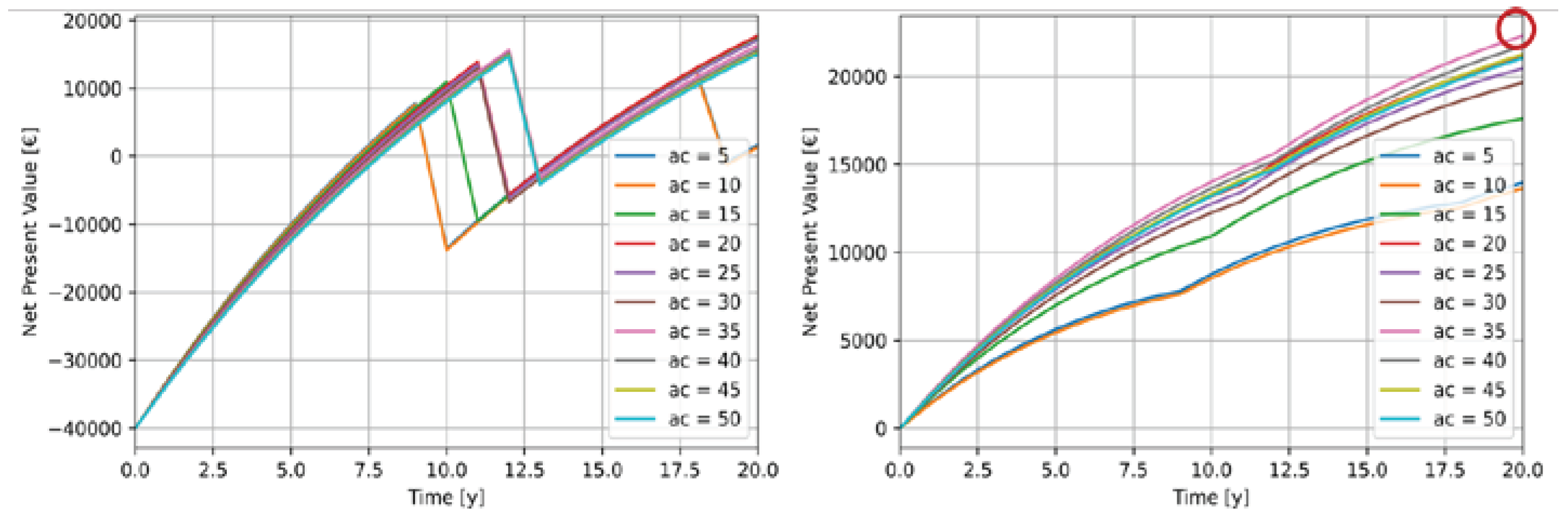

To facilitate the comparison of diverse investments with replacements occurring in different years, a transformation of NPV is employed in this study. Observing the left image in

Figure 3, it proves challenging to discern which Activation Cost (AC) value results in the optimal NPV. Furthermore, the choice is contingent on the specific year for NPV calculation. However, utilizing the image on the right clarifies the most favorable AC value. 6

Figure 3. Net Present Value (NPV) (left) and NPV transformation (right) to compare different Activation Cost (AC).

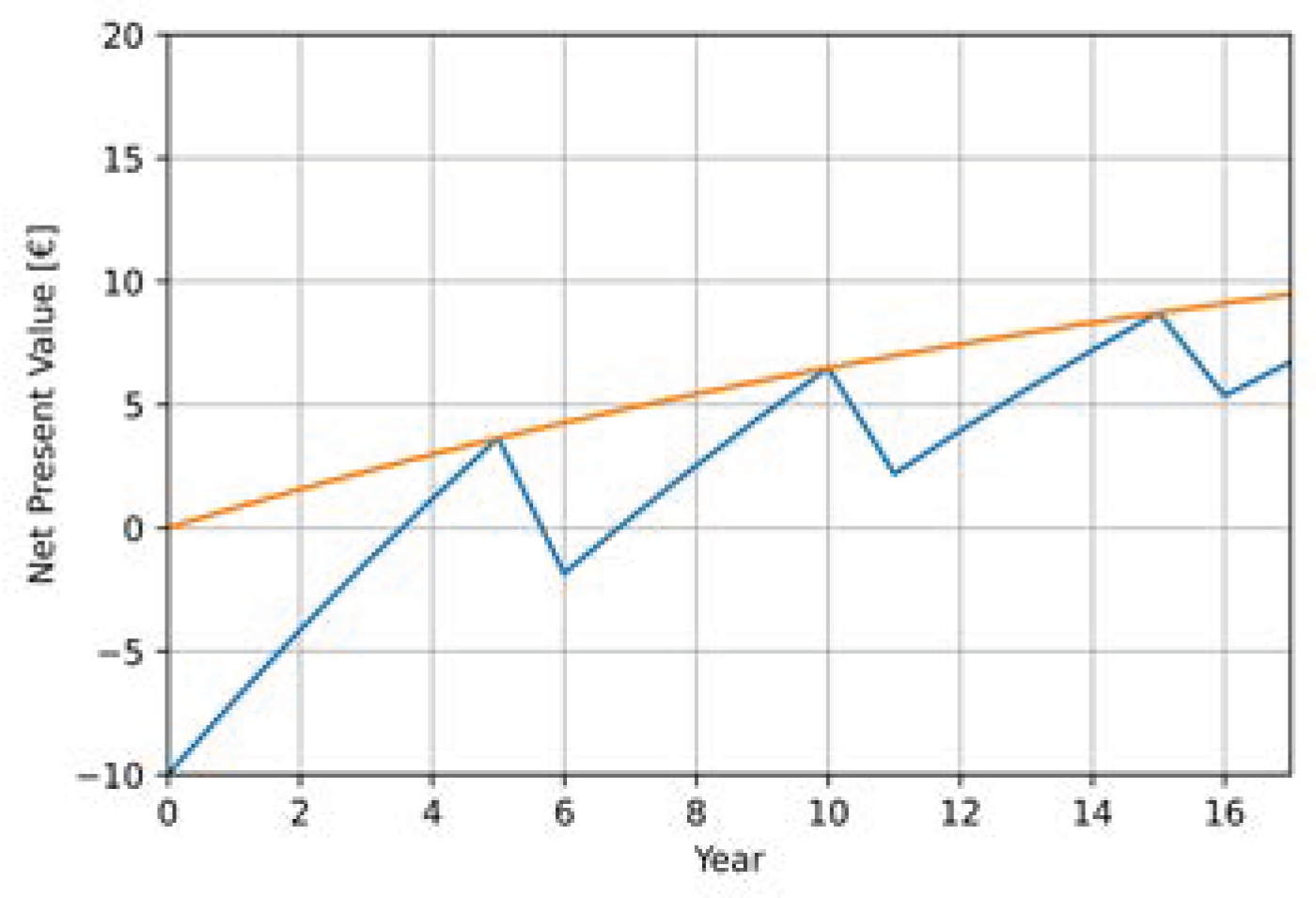

The transformation used for NPV can be explained by observing

Figure 4. The investment presented by the NPV line in blue can be transformed in the equivalent investment of the orange line which does not have discontinuity due to the replacement neither to the initial investment, which is equal to zero. To compute the transformation, it’s essential to consider that both the initial investment cost and the replacement costs are not paid upfront. Instead, they are financed through a loan with a duration equivalent to the battery’s lifespan and a loan interest rate chosen so that the original NPV and the transformed NPV are equal in the years when replacements occur. So, the transformed Cash Flow (CF*) for the transformed NPV must be recalculated to respect such conditions. Equations 7 synthesize how the NPV transformation can be calculated, where LF is the Loan Factor to be considered in the transformed cash flow.

2.5. Simulated Scenarios

This study encompasses the simulation of 36 distinct scenarios aimed at evaluating the impact of four key parameters (

Table 1): Renewable Energy Community (REC) number of customers, energy price, battery cost and the possibility of perform Energy Arbitrage (EA). The first parameter pertains to the REC energy surplus (E

sur) and needs (E

need), which the BESS can harness to derive gains through CSC. The second parameter influences earnings from EA. Battery cost (Cost

bess) has an impact on initial investment and replacement cost, so on NPV. Perform EA influences cash flow.

Within each scenario, a substantial number of simulations are conducted to perform sensitivity analysis on two primary variables (

Table 2): Size

bess and AC. Therefore, for every combination of scenarios, Size

bess values and AC settings, a simulation spanning 20 years is executed. Within this simulation, each hour is an outcome of a MILP optimization process.

Energy Price (EP) is an array comprising 8760 values, corresponding to the number of hours in a year, and is repeated over 20 years. Also, the vectors representing REC energy surplus (Esur) and need (Eneed), which are calculated depending on customer number (CN), have the same dimension. What evolves annually is the available capacity of the BESS, which diminishes due to aging. The procedure for selecting the two EP scenarios and the three CN scenarios (from which Esur and Eneed are dependent) is outlined below.

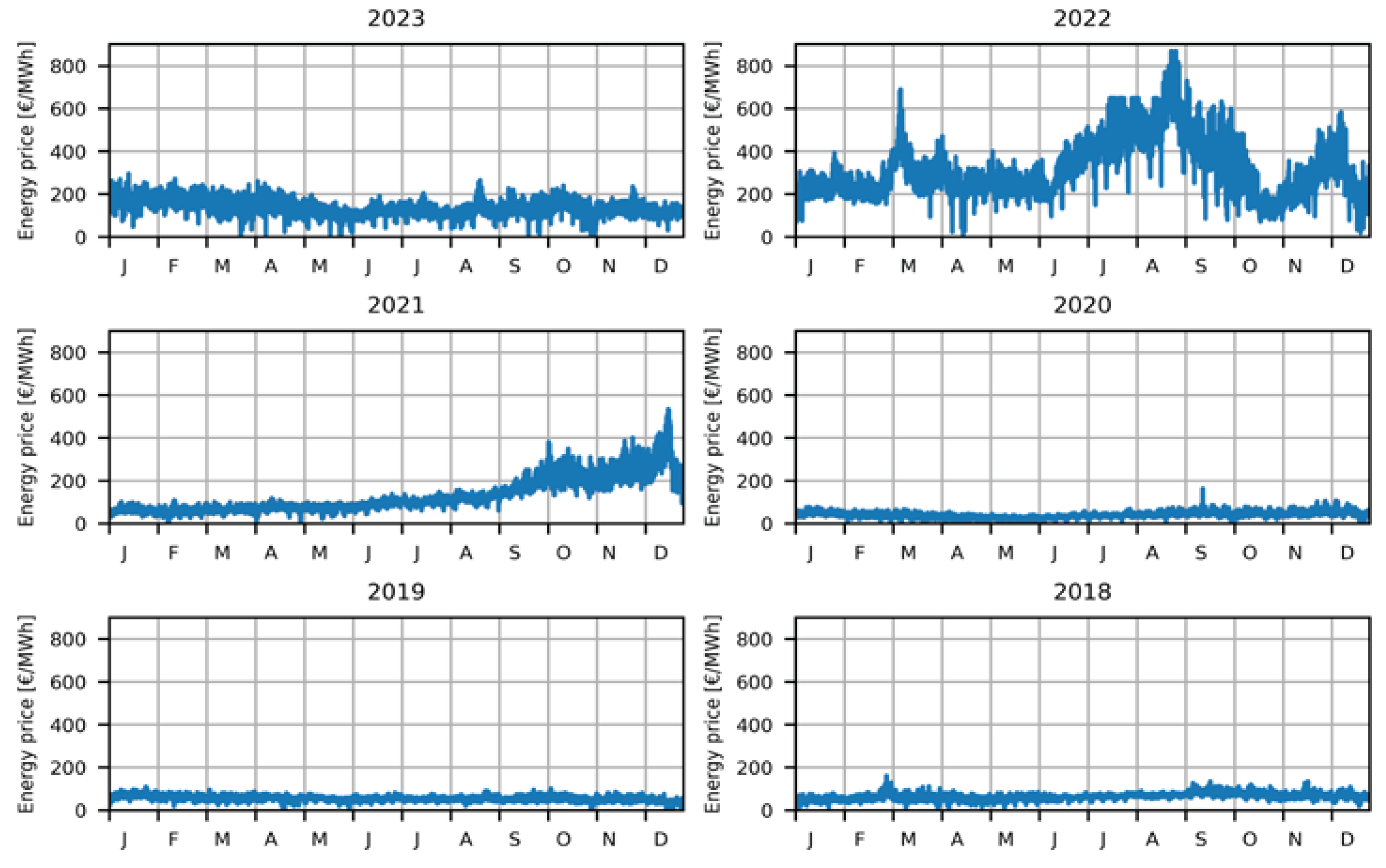

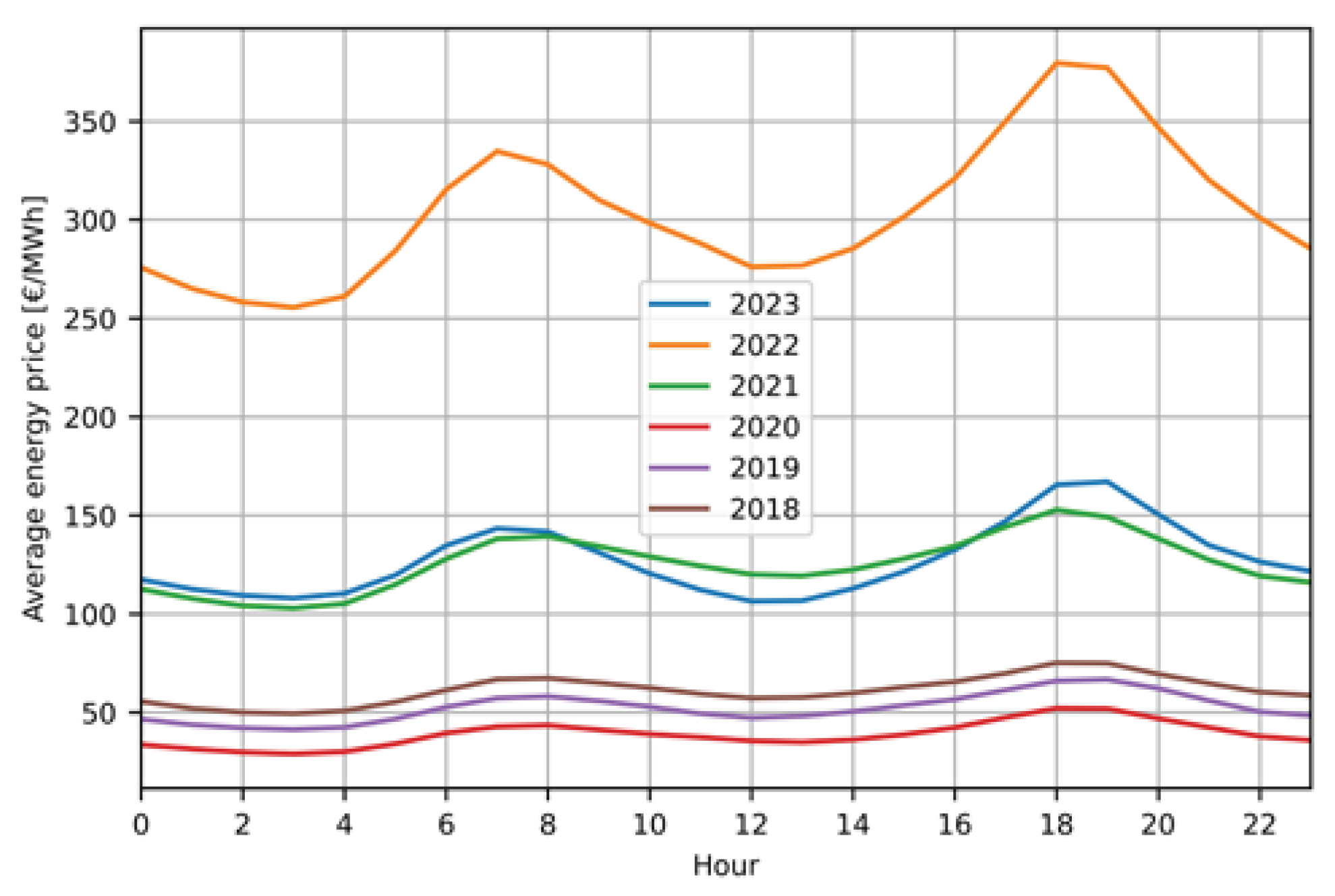

Considering the information about Energy Price (EP) in the Italian electricity market reported in

Figure 5 and

Figure 6 [

46], two different scenarios are selected. As a low-price scenario the EP of 2020 is chosen as the worst-case scenario, and as a high-price scenario, 2023 prices are considered. The years 2021 and 2022 were excluded due to their excessive anomalies and randomness.

Dataset used for photovoltaic production download from PVgis [

50] are also from 2020 and 2023. This correspondence ensured that the price trends remained consistent with the fluctuations in production. The input parameters for PVgis included the geographical coordinates of Florence, a tilt angle of 30°, an azimuth angle of 0°, and losses of 14%.

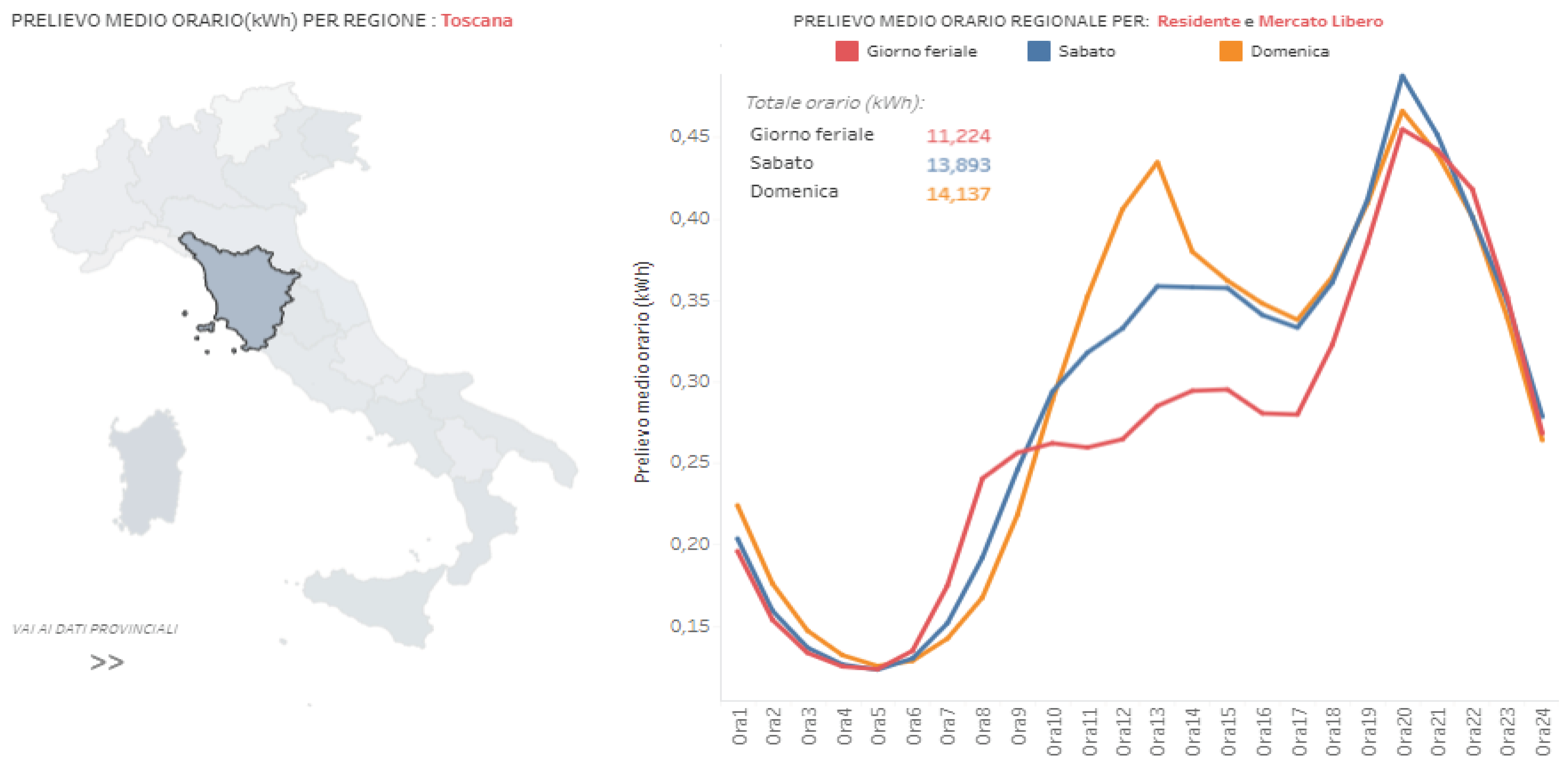

To calculate the Esur and Eneed of the REC, in addition to the photovoltaic production series, the aggregated consumption series of all community customers is required.

A load series representing a 3kWp typical residential consumers from Tuscany is generated by utilizing average hourly profiles provided by the Italian regulatory authority [

51] (

Figure 7). These profiles are differentiated based on the month and the type of day. The resulting load series is subsequently scaled by the number of customers within the considered REC, aggregating the total consumption pattern.

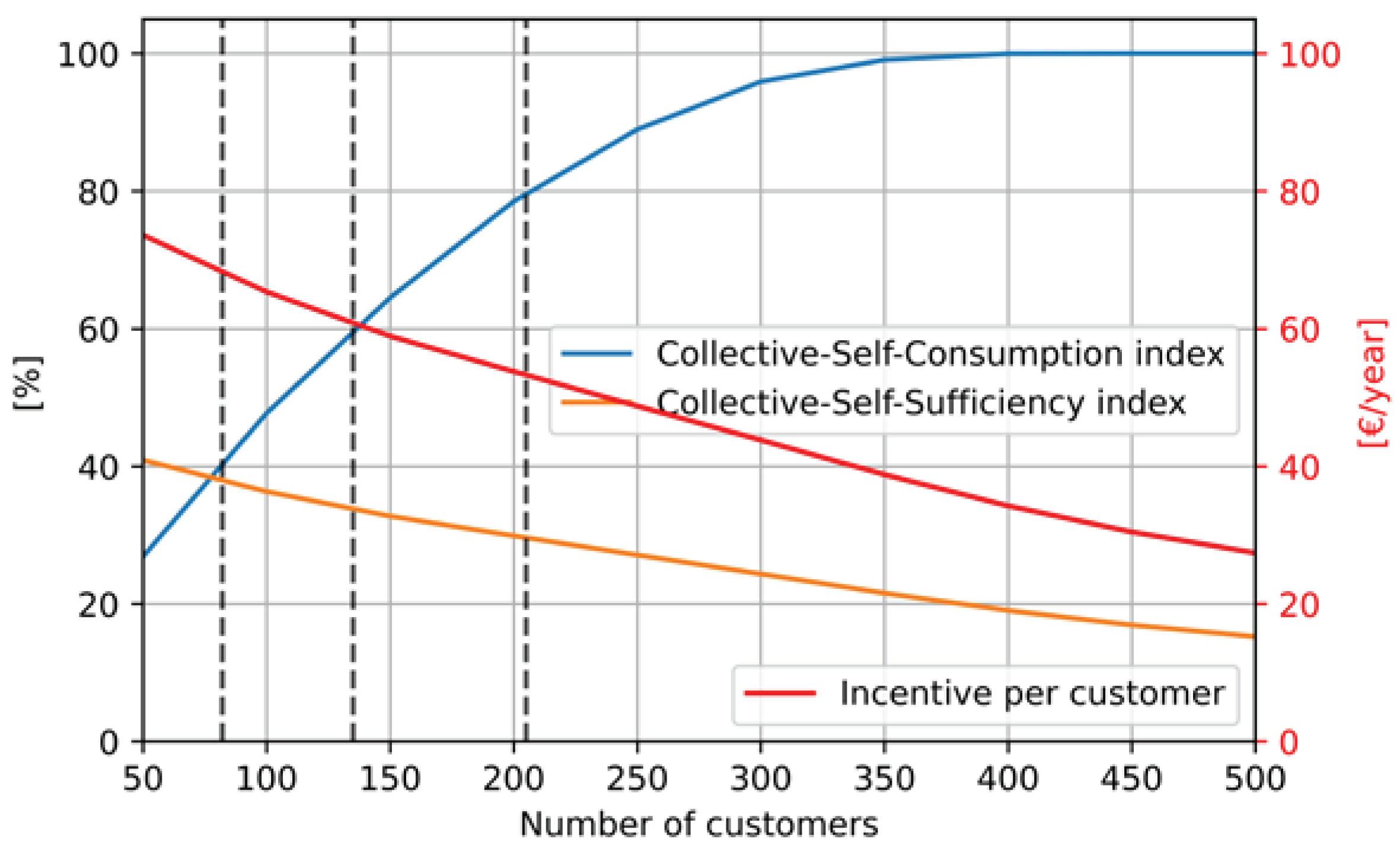

Using the open-source multi-energy simulation software "MESSpy" [

52,

53], a sensitivity analysis was conducted on varying the number of customers within the REC (

Figure 8). Based on this analysis, three scenarios were selected (

Table 3) to be simulated with the BESS, representing collective self-consumption indices of 40%, 60%, and 80%.

The collective self-consumption (CSC) index is defined as the ratio of collective self-consumption to the total electricity production from photovoltaic sources, while the collective self-sufficiency (CSS) index is the ratio of collective self-consumption to the total energy demand of the customers. These two indexes are representative to the REC independence from the national grid.

Figure 8 not only identifies three potential scenarios but also elucidates why evaluating a battery within future RECs is sensible:

As the number of customers increases, the CSC rises, while the CSS diminishes. Moreover, the incentive per customer decreases. In practical terms, with more users, the metaphorical "pie" must be divided into more portions, leading to smaller individual slices. This observation highlights the impracticality of considering RECs with excessively high CSC levels, suggesting that surplus energy (Esur) will persist in future RECs. This raises the question of who will harness this surplus if not through grid-connectet community batteries. Thus, the graph underscores that RECs will consistently have surplus energy, justifying the evaluation of introducing a BESS to harness and capitalize on this surplus.

3. Results

The outcomes are delineated across three segments. Firstly, elucidating the impact of Battery Energy Storage System (BESS) on Renewable Energy Community (REC) energy balances. Secondly, delineating the significance of the activation cost (AC) parameter concerning battery degradation and Net Present Value (NPV). Lastly, conducting economic optimization of battery sizing within each scenario and appraising potential investments performing Energy Arbitrage (EA) or dedicating the BESS only to Collective-Self-Consumption (CSC).

3.1. Energy Balances

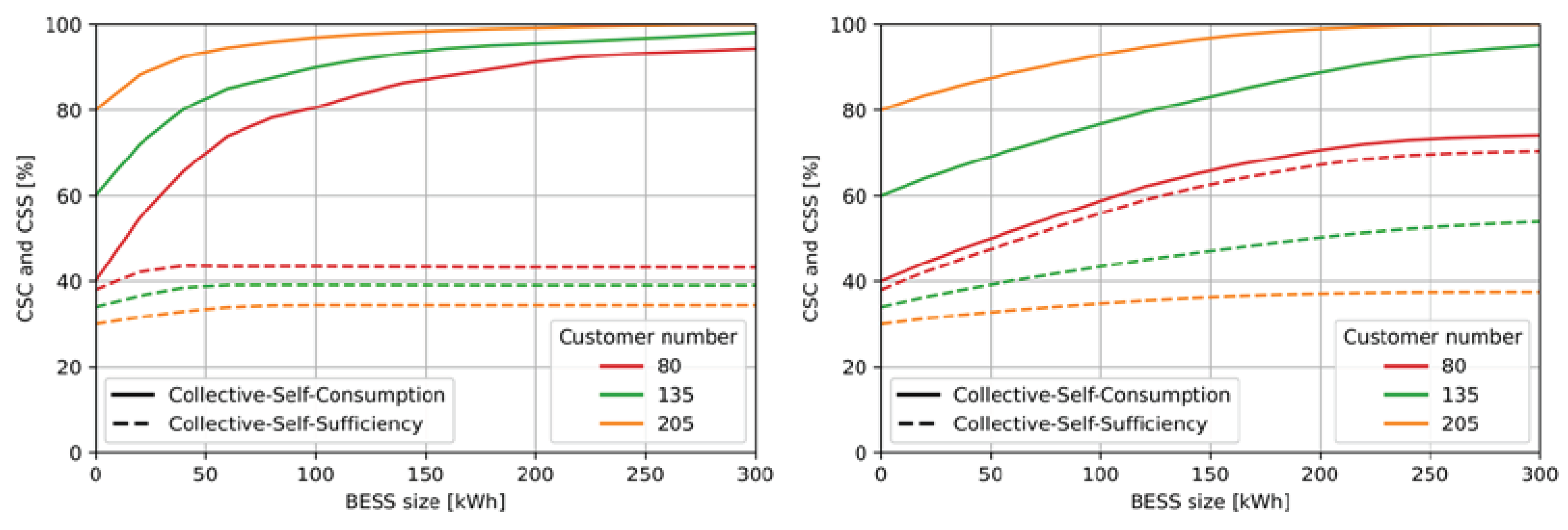

Upon integrating a BESS into a REC, its grid independence increases. The collective self-consumption (CSC) and collective self-sufficiency (CSS) indices, reflecting REC autonomy from the grid, increase with larger battery sizes (

Figure 9).

However, the degree of increase varies with the performance of EA: the augmentation of CSS is constrained by regulations pertaining to access to incentives via the battery. Notably, while withdrawing energy during surplus periods is incentivized, injection during times of need lacks similar encouragement. Consequently, injections may not necessarily occur during these energy needs, which could otherwise enhance CSS, but rather during periods of elevated pricing.

Conversely, in the absence of EA, the battery is limited to utilizing surplus energy from the REC and injecting it when required, thereby aligning the enhancement of CSC and CSS in this scenario.

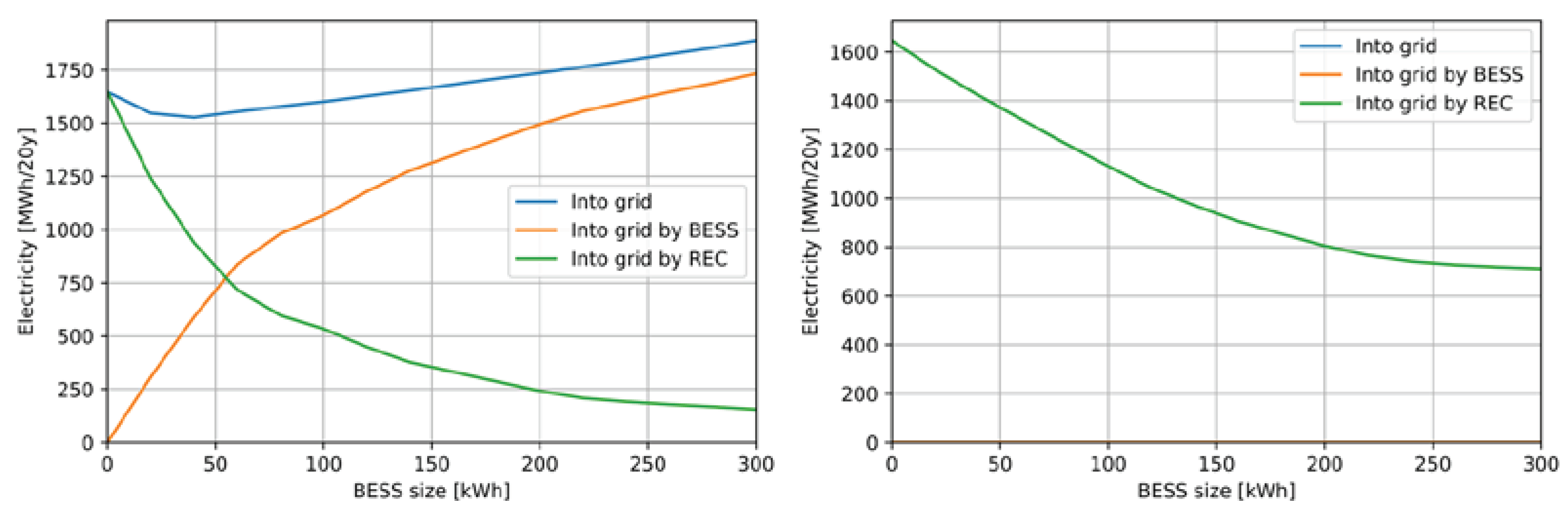

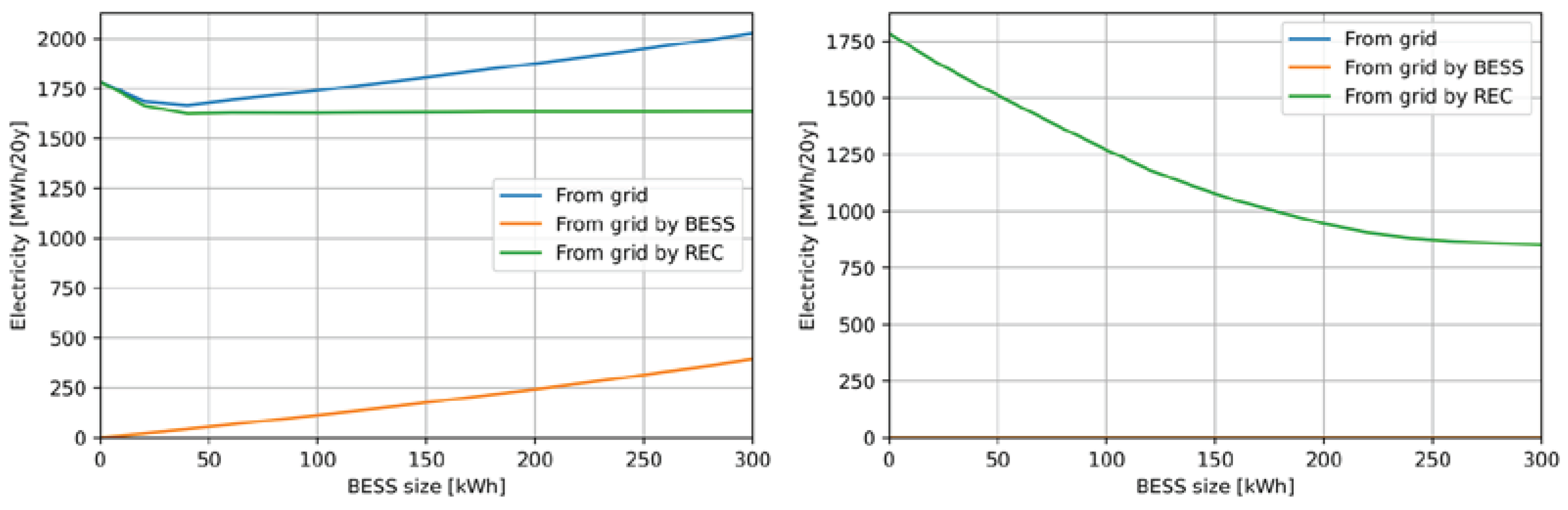

Figure 10 and

Figure 11 underscore a key revelation from this study. Performing the REC’s reliance on the grid, considering the BESS as part of the REC, paradoxically rises instead of declining. Over a 20-year span, both the energy fed into and withdrawn from the grid increase due to the battery’s independent EA activities, notwithstanding decreases in energy exchange within the REC. To address this, the approach advocated in the right-hand graphs restricts the battery to charge solely from the REC surplus and discharge solely to meet community needs. This strategy of non-EA reduces overall energy fed into and withdrawn from the grid, thus mitigating REC energy dependence.

3.2. Activation Cost and Energy Arbitrage

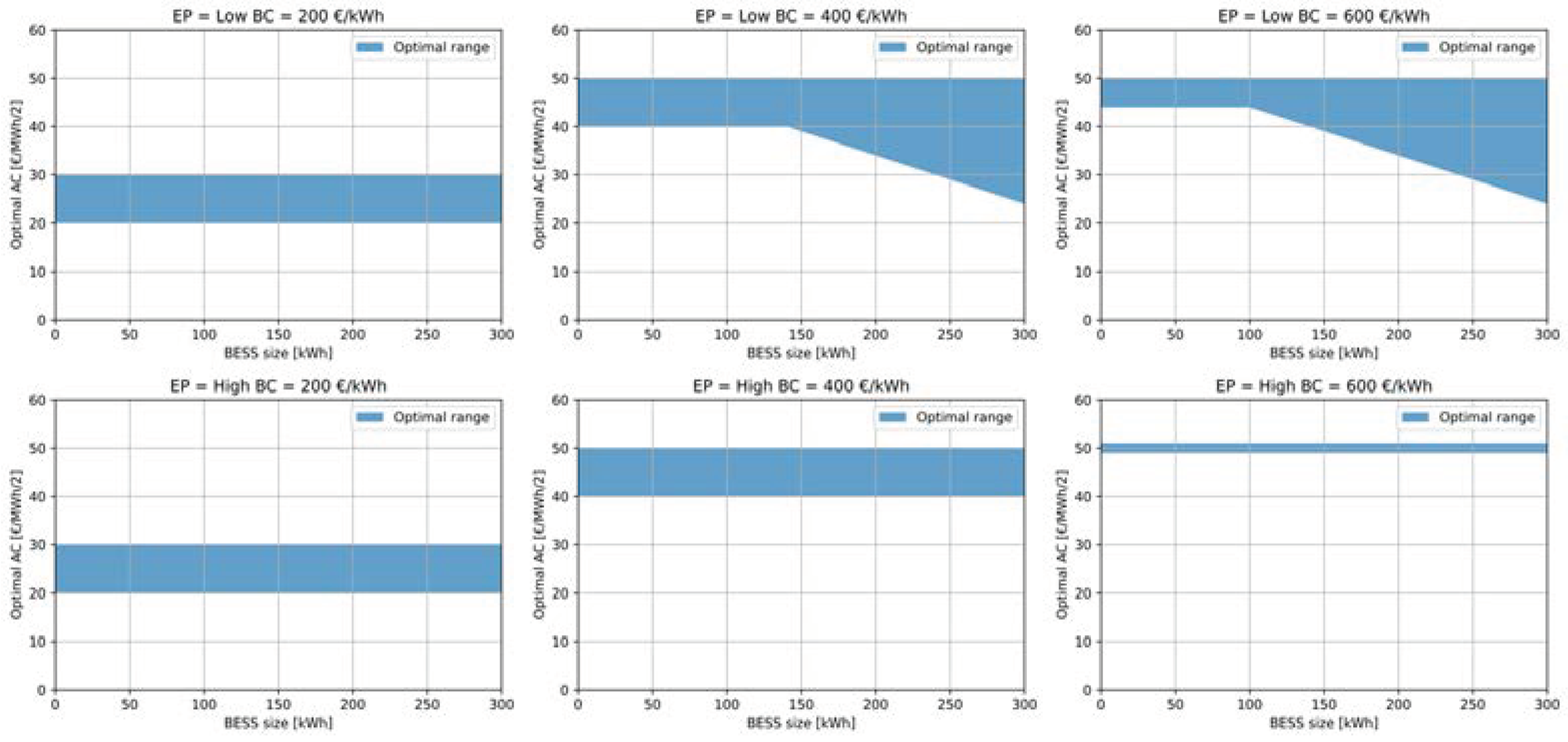

Adjusting the Activation Cost (AC) parameter across various levels results in the computation of diverse optimal BESS schedules. Over a 20-year analysis period, these variations in AC values significantly impact cash flows and BESS lifetimes, consequently influencing the Net Present Value (NPV), which is highly dependent on AC. Simulations encompassing each scenario and BESS size have been conducted with AC values ranging from 5 to 60.

Figure 12 provides a summary of the optimal AC values, maximizing the NPV transformation (NPV*) over 20 years. These simulations focus on scenarios performing EA. Since AC does not influence the gain from CSC (see

Figure 2a), there is no point in studying its effects in scenarios without EA.

Results are presented with confidence intervals, wherein NPV* values differ by less than 1% of the NPV* value.

The battery cost, equivalent to the replacement cost at the end of its life, emerges as the most influential parameter. For BESS cost around 200 €/kWh, it is advisable to set AC values between 20 and 30 to enhance EA profits, albeit at the expense of accelerating battery consumption with numerous cycles. Conversely, for higher costs, optimal values shift towards 50, indicating fewer cycles but highly profitable ones, ensuring prolonged battery longevity. The graph also illustrates that battery size and energy price does not significantly influence AC selection.

Summing up, the importance of optimizing battery scheduling considering the expected replacement cost emerges. One way to do this is proposed in this study by optimizing the AC parameter entered as a penalty of the objective function.

3.3. Economic Feasibility

This The findings presented in this concluding paragraph exclusively pertain to configurations with optimal Activation Cost (AC) values.

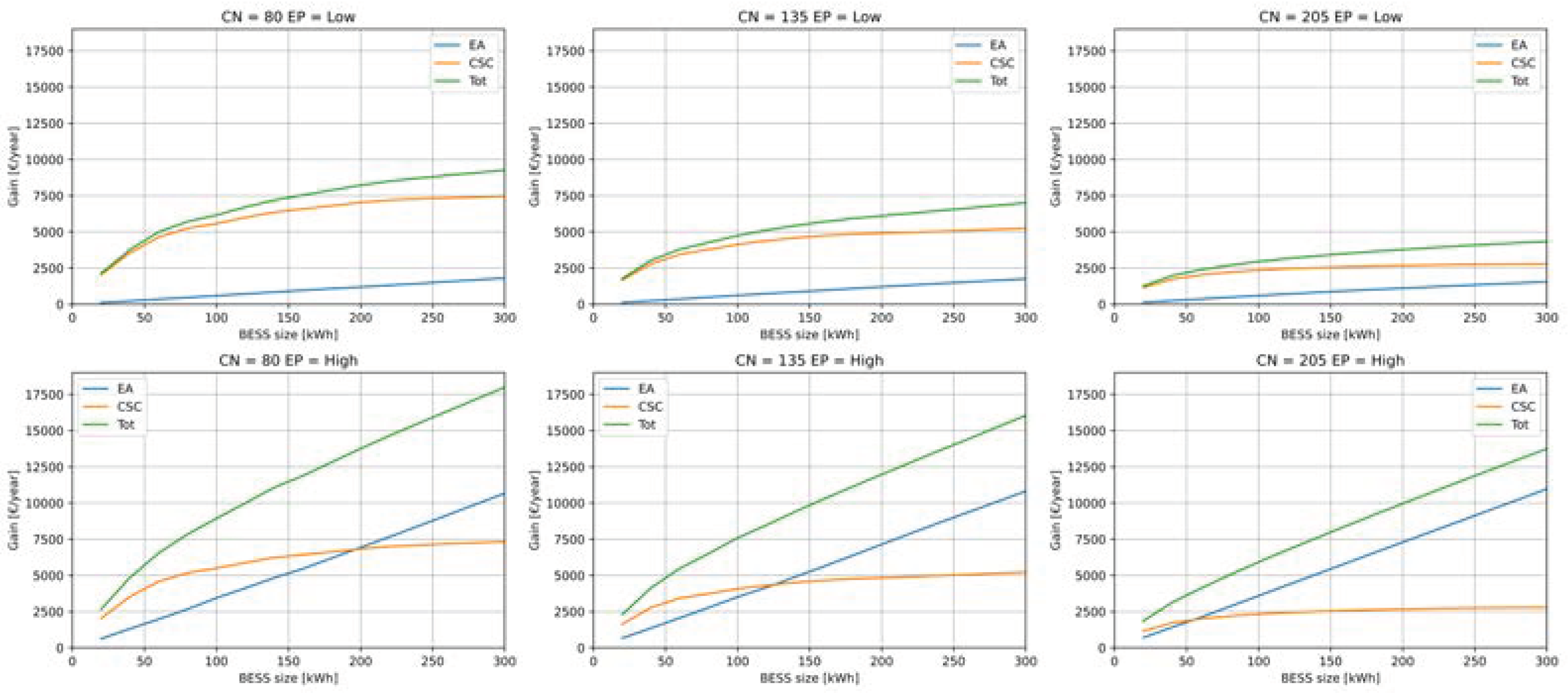

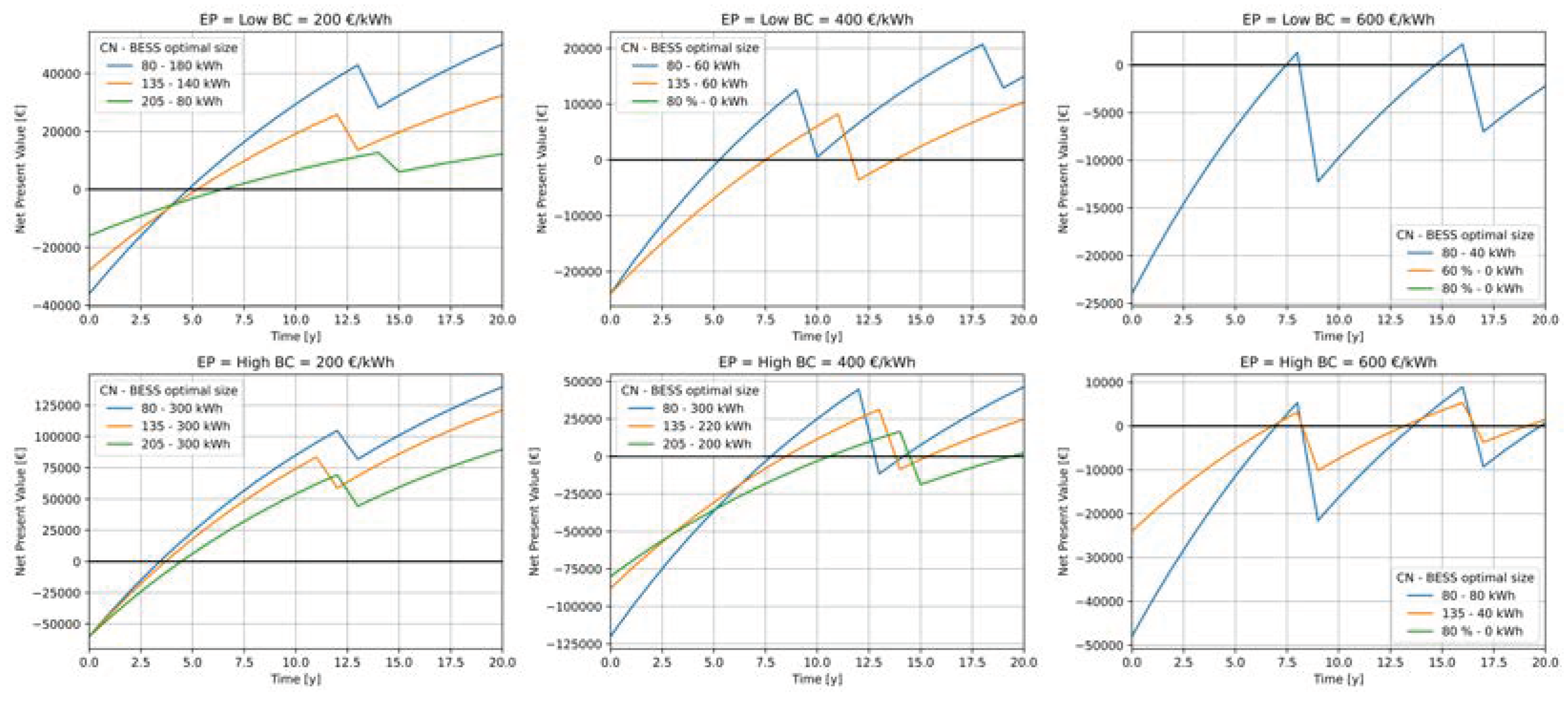

Figure 13 and

Figure 14 delineate the respective contributions of the two principal cash flows, Energy Arbitrage (EA) and Collective Self-Consumption (CSC), to the investment’s returns.

The analysis reveals that in scenarios featuring EA (

Figure 13) and characterized by low energy prices, the gain derived from CSC significantly surpasses that of EA, exceeding it by approximately fivefold. Consequently, investments in such scenarios are primarily driven by REC incentives and are contingent upon the evolution of customer numbers over time. In other words, it is crucial to match the BESS to a REC with lot of energy surplus. However, with high energy prices, the profit from EA may indeed outstrip that from CSC.

In scenarios without EA performing, the EA gain is only due to the buying and selling of energy at times of surplus and need in the REC, and not to an actual EA that exploits electricity market price fluctuations. In these cases (

Figure 14) the total cash flow experiences a decline by several thousand euros per year (see y-axis scale), chiefly due to reduced EA profits but also owing to lower CSC levels. However, if energy prices are high EA continues to make an important contribution of about one third of the total cash flow.

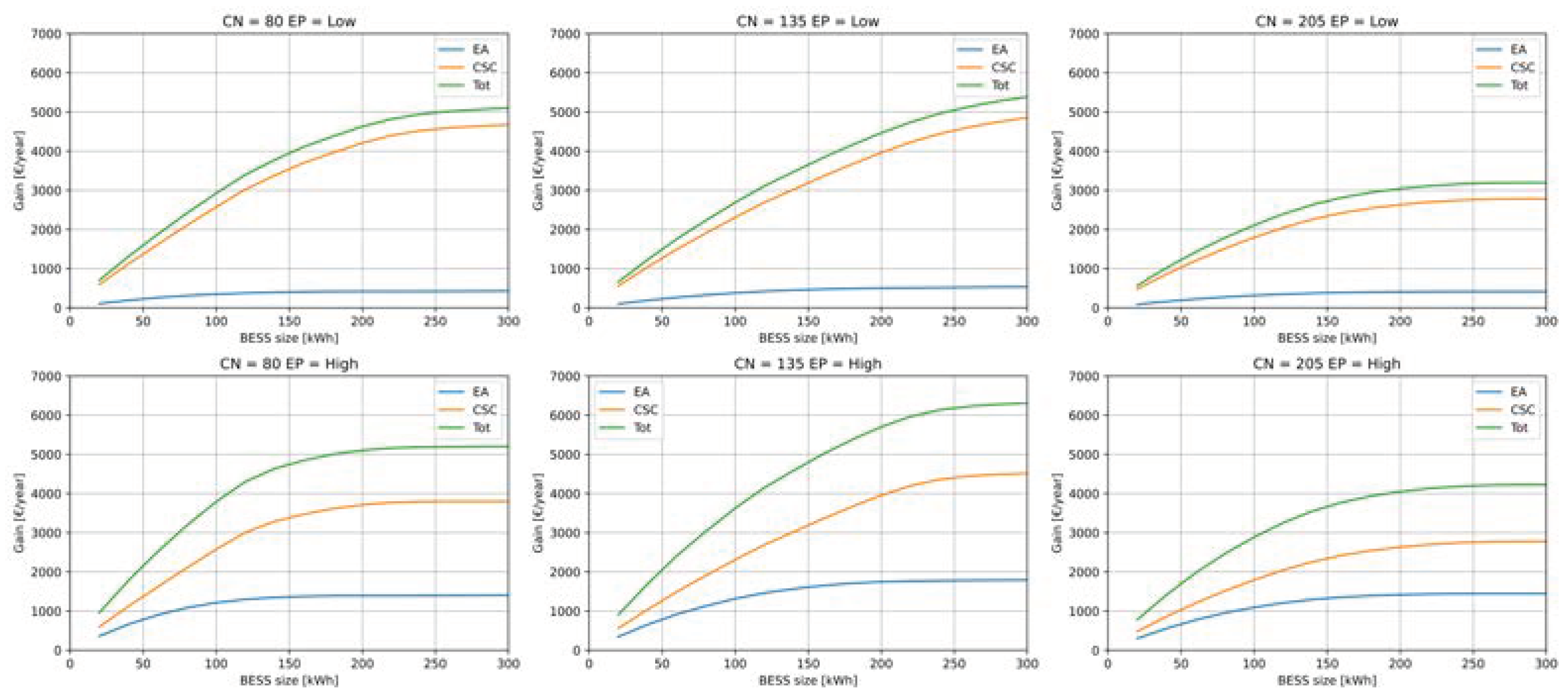

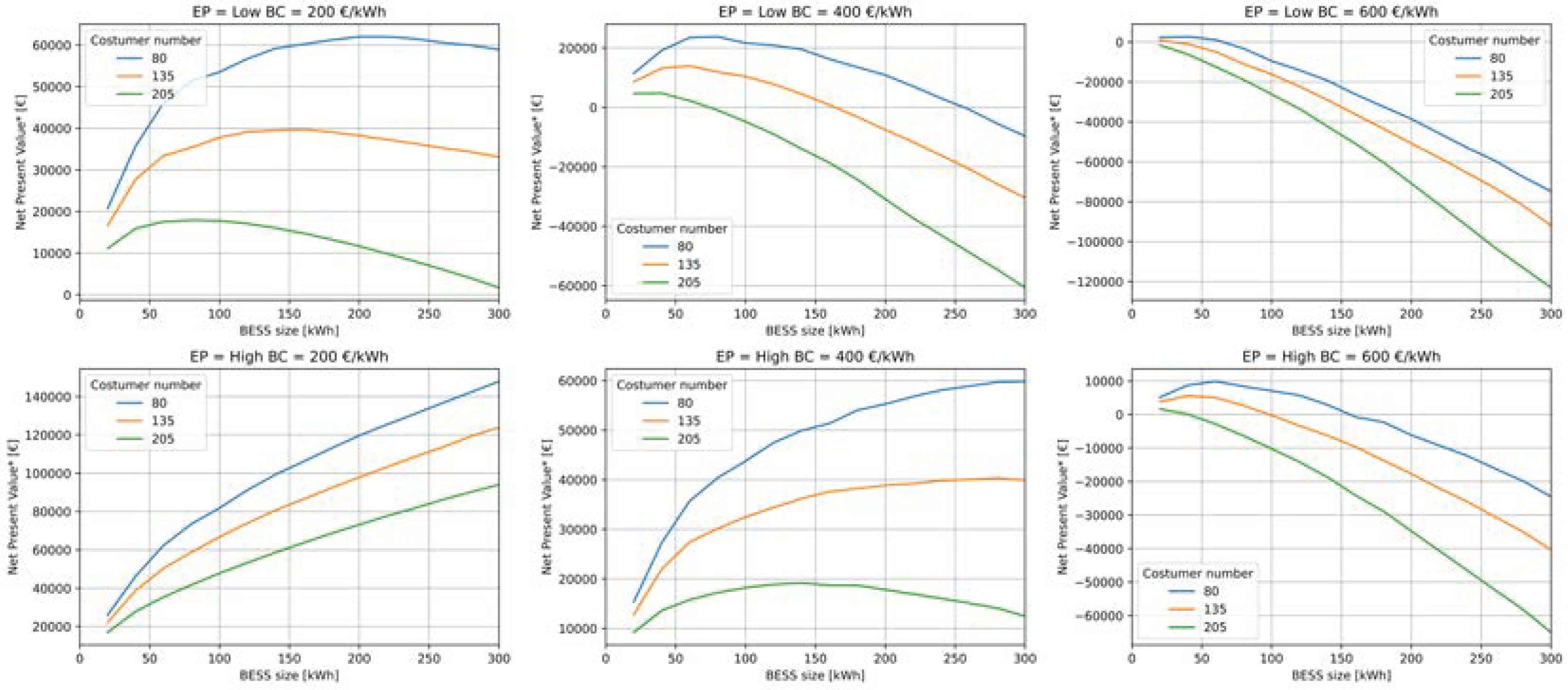

Figure 15 and

Figure 16 depict the transformed Net Present Value (NPV*) as it relates to BESS size, offering insights into optimal BESS sizes for each scenario of

Table 1.

In scenarios performing EA (

Figure 15), a BESS cost of 600 €/kWh renders BESS installation economically unviable, while 400 €/kWh proves attractive, especially in scenarios with high energy prices. Larger BESS sire is recommended for setups with substantial surplus, while scenarios with low energy prices favor smaller BESS units. A cost of 200 €/kWh strikes a balance, rendering BESS integration cost-efficient across various scenarios.

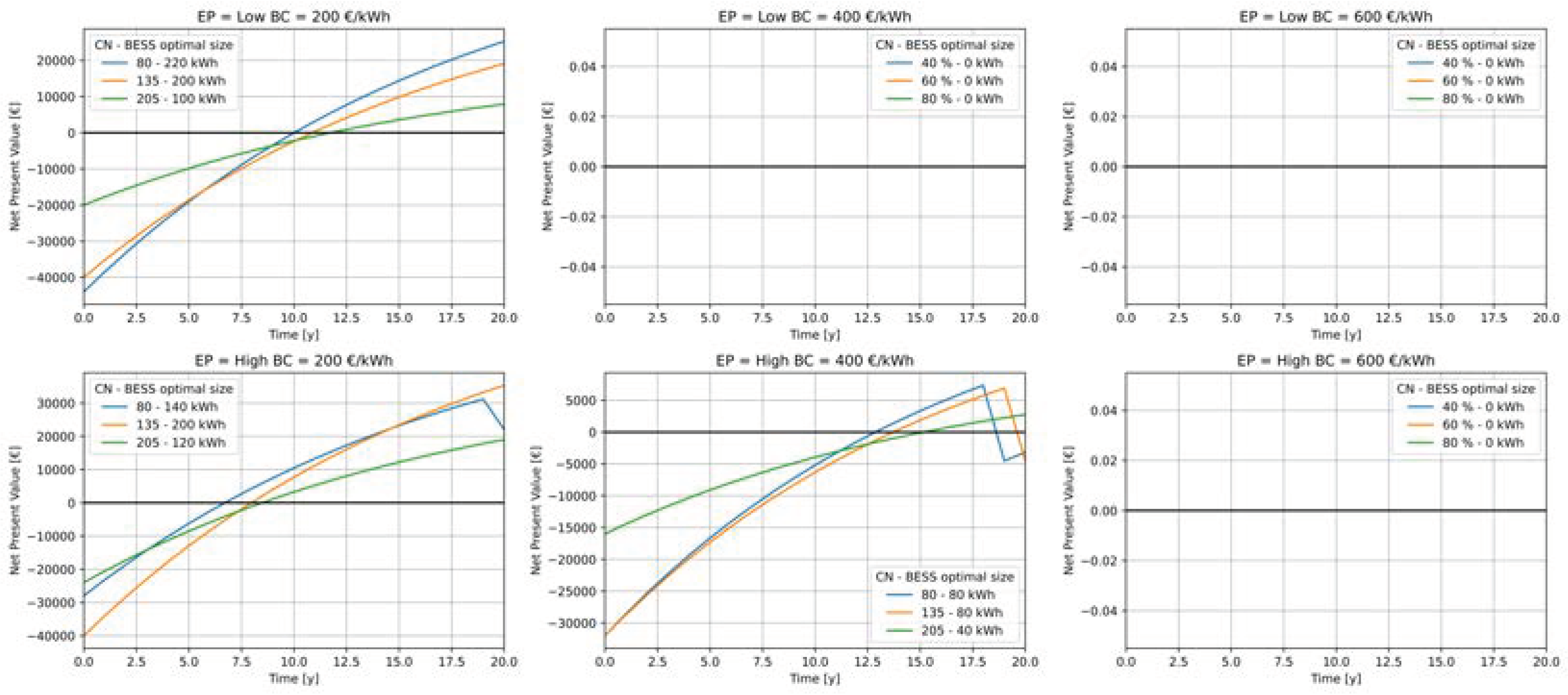

Not performing EA (

Figure 16) diminishes battery investment attractiveness. At 400 €/kWh, only smaller batteries are feasible, while 200 €/kWh remains appealing, even if the NPV* values achieved are lower than in the case with EA.

An intriguing observation arises regarding the impact of the customer number on battery investment. In EA scenarios, it becomes apparent that as the number of customers decreases (and REC surplus consequently increases), the NPV* of the investment rises. This trend stems from the augmented income attributed to the withdrawn by the BESS of the REC surplus energy, that becomes CSC. However, in instances where EA is not implemented, this assertion holds only partially true. This is because for the BESS to be able to utilize such surplus, there must also exist REC energy need to justify its re-injection later. Consequently, it is implied that batteries should be matched to REC converging towards an equilibrium point between surplus and need, thereby optimizing both Collective Self-Consumption (CSC) and Collective Self-Sufficiency (CSS), i.e., with neither too many nor too few customers (

Figure 16 bottom left).

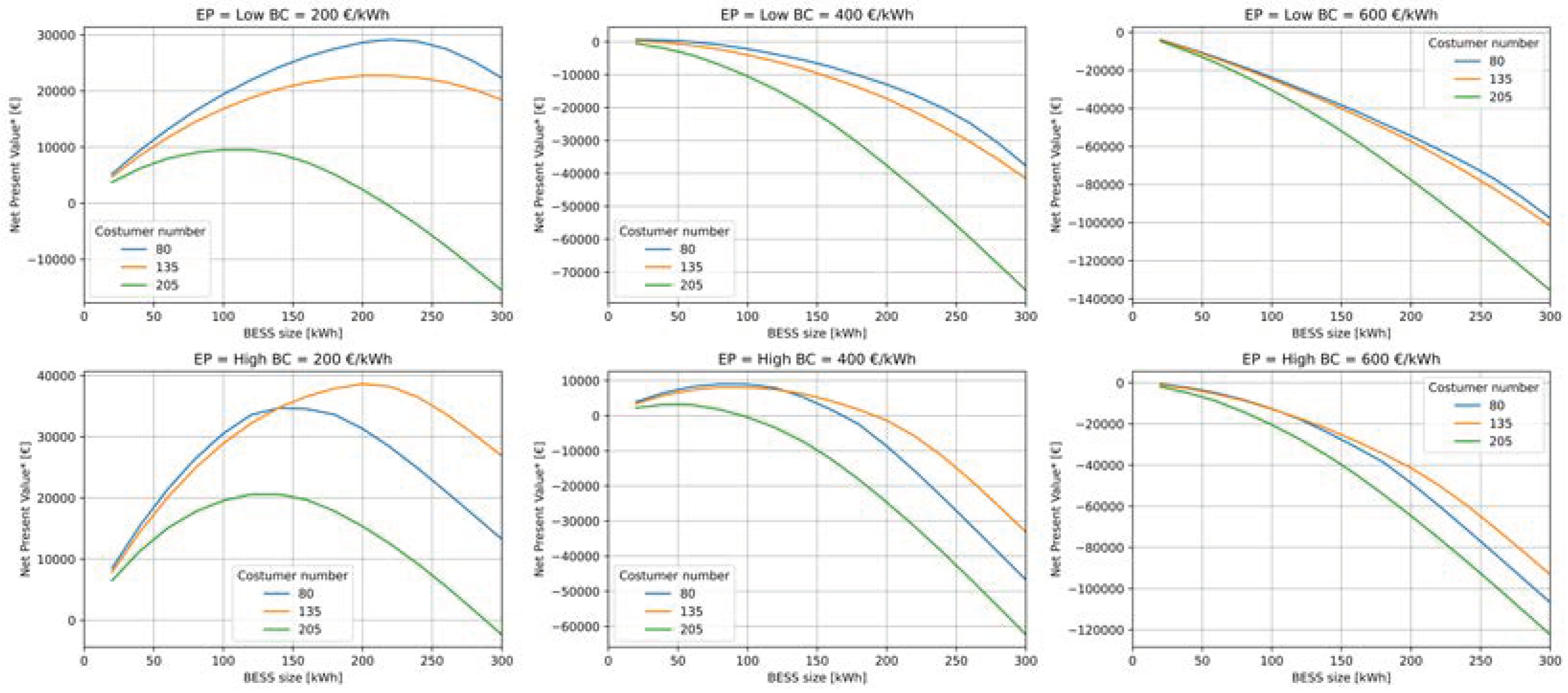

Figure 17 and

Figure 18 provide further clarity by illustrating the progression of NPV, focusing on the original NPV rather than the transformed version, and considering the optimal BESS size solution for each scenario. These curves offer a comprehensive perspective on investments, encompassing NPV, payback time, and battery lifetime.

In scenarios performing EA (

Figure 17), a BESS cost of 200 €/kWh presents compelling investments, ensuring a 5-year payback period in low-price scenarios and even shorter periods in high-price scenarios. A cost of 400 €/kWh also allows for investments with payback times of less than 10 years, albeit with more significant impacts from energy prices and customer number. However, 600 €/kWh is evidently excessive.

Without EA (

Figure 18), investments become less attractive, with payback periods extending by approximately 5 years and optimal battery sizes decreasing alongside NPV. Here, the battery cost must be around 200 €/kWh or less for attractiveness.

Battery lifetimes exhibit steps due to replacement costs. Without EA, batteries can last about 20 years or longer, while performing EA, lifetimes vary between 7 and 13 years. Despite reduced lifetimes, the increase in cash flow, payback time, and NPV over 20 years compensates, rendering the investment more attractive overall.

4. Discussion

In a residential Renewable Energy Community (REC) powered by 100 kWp of photovoltaic systems, a comprehensive techno-economic analysis was conducted to evaluate the energy and economic impact of introducing a grid connected Battery Energy Storage System (BESS). The analysis encompassed various scenarios considering community customers number, electricity market prices, battery cost, size and the decision to engage in energy arbitrage (EA). The Italian market and regulation are taken as a reference.

Two primary revenue sources were examined: the raise in collective self-consumption (CSC) incentives due to BESS withdrawal of REC surplus energy, and EA, involving participation in the day-ahead and intra-day electricity market to buy energy when prices are low and sell it at higher rates.

A 20-year simulation is executed for each scenario, incorporating battery aging based on charge-discharge cycles and their depth. BESS hourly energy balances are determined via a rolling-horizon 24-hours-looking-ahead scheduling, optimized with Mixed-integer linear Programming. The objective function is composed with the gains from CSC, EA, and an activation cost to prevent ageing.

A modified Net Present Value transformation is also proposed to effectively compare investments with varying replacement times.

The analysis of energy balances underscores the importance of a shared battery for boosting collective self-consumption and collective-self-sufficiency. However, scenarios performing EA showed an increase in both total energy feed and withdrawn from the national grid compared to scenarios without a battery.

The section on activation costs highlights the parameter’s relevance in performing EA. The importance of optimizing battery scheduling considering the expected replacement cost emerges.

Economic results emphasize the optimal battery size for each scenario and the investment cost-effectiveness. Dedicating the battery solely to CSC requires that the price does not exceed 200 €/kWh. On the other hand, performing EA allows for a viable investment also with a cost around 400 €/kWh and halves the payback time. Moreover, the primary gain is derived in any case from incentives for CSC, illustrating the market’s dependence on incentives. EA, especially in scenarios with other energy prices, represents an important boost to the cash flow.

An interesting finding is that the most suitable REC for BESS introduction is one with an intermediate number of customers, i.e., a balanced surplus and need levels, but this is true only if EA is not performed. Otherwise, a match with a low number of customers or a high surplus is preferable.

Regarding battery aging, it was demonstrated that a BESS used solely for CSC can last about 20 years, instead its lifespan is halved performing EA. Nevertheless, the increase in cash flow, payback time, and NPV compensates for this reduction, making the investment more attractive overall.

A comparison between energy and economic optimality highlights a mismatch, indicating the need for further reductions in battery prices, greater market incentives and a review of regulation about the role of grid connected BESS inside REC.

Future studies could explore the potential of BESS in REC beyond CSC and EA considering additional revenue sources such as ancillary services. Additionally, battery management strategies should incorporate real-time control for dispatching, addressing forecast errors in production, consumption, and energy prices. Grid constraints should also be considered to make the analysis complete.

Author Contributions

Mattia Pasqui: Term, Conceptualization, Methodology, Software, Validation, Formal analysis, Investigation, Data Curation, Writing – Original Draft, Visualization. Lorenzo Becchi: Term, Conceptualization, Methodology, Validation, Formal Analysis, Writing - Review & Editing. Marco Bindi: Term, Conceptualization, Methodology, Validation, Formal Analysis, Writing - Review & Editing. Matteo Intravaia: Term, Conceptualization, Methodology, Validation, Formal Analysis, Writing - Review & Editing. Francesco Grasso: Resources, Writing - Review & Editing, Supervision, Funding acquisition. Gianluigi Fioriti: Writing - Review & Editing, Supervision. Carlo Carcasci: Resources, Writing - Review & Editing, Supervision, Project administration, Funding acquisition.

Funding

“This research received no external funding”.

Institutional Review Board Statement

“Not applicable”.

Informed Consent Statement

“Not applicable”.

Data Availability Statement

All the codes used are public available on GitHub [

53,

54]. Production data are downloaded from PVgis [

50] and load profiles from ARERA [

51].

Conflicts of Interest

“The authors declare no conflicts of interest.”

References

- European Commission, “Clean energy for all Europeans package.” Accessed: Feb. 26, 2024. [Online]. Available online: https://energy.ec.europa.eu/topics/energy-strategy/clean-energy-all-europeans-package_en.

- European Commission, “The European Green Deal.” Accessed: Feb. 26, 2024. [Online]. Available online: https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal_en.

- European Parliament, Directive (EU) 2019/944 on Common Rules for the Internal Market for Electricity. 2019. [Online]. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32019L0944.

- European Parliament, Directive (EU) 2018/2001 on the promotion of the use of energy from renewable sources. 2018. [Online]. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32018L2001&from=EN.

- Presidenza del Consiglio dei Ministri, DECRETO LEGISLATIVO 8 novembre 2021, n. 210. 2022. [Online]. Available online: https://www.gazzettaufficiale.it/eli/id/2021/12/11/21G00233/sg.

- Presidenza del Consiglio dei Ministri, DECRETO LEGISLATIVO 8 novembre 2021, n. 199. 2022. [Online]. Available online: https://www.gazzettaufficiale.it/eli/id/2021/11/30/21G00214/sg.

- MASE, Decreto CER. 2024. [Online]. Available online: https://www.mase.gov.it/comunicati/energia-mase-pubblicato-decreto-cer.

- ARERA, TIAD. 2022. [Online]. Available online: https://www.arera.it/atti-e-provvedimenti/dettaglio/22/727-22.

- GSE, Regole operative CER. [Online]. Available online: https://www.gse.it/media/comunicati/comunita-energetiche-rinnovabili-il-mase-approva-le-regole-operative.

- ARERA, TIDE Testo Integrato Dispacciamento Elettrico. 2022. [Online]. Available online: https://www.arera.it/atti-e-provvedimenti/dettaglio/19/322-19.

- RES, L’accumulo elettrochimico di energia Nuove regole, nuove opportunità. [Online]. Available online: https://www.rse-web.it/prodotti_editoriali/libro-bianco-sistemi-di-accumulo/.

- Sale, H.; Morch, A.; Buonanno, A.; Caliano, M.; Di Somma, M.; Papadimitriou, C. Development of Energy Communities in Europe. In Proceedings of the 2022 18th International Conference on the European Energy Market (EEM), Ljubljana, Slovenia, 13–15 September 2022. [Google Scholar] [CrossRef]

- de São José, D.; Faria, P.; Vale, Z. Smart energy community: A systematic review with metanalysis. Energy Strat. Rev. 2021, 36, 100678. [Google Scholar] [CrossRef]

- Fioriti, D.; Poli, D.; Frangioni, A. A bi-level formulation to help aggregators size Energy Communities: A proposal for virtual and physical Closed Distribution Systems. In Proceedings of the 2021 IEEE International Conference on Environment and Electrical Engineering and 2021 IEEE Industrial and Commercial Power Systems Europe (EEEIC/I&CPS Europe), Bari, Italy, 7–10 September 2021. [Google Scholar] [CrossRef]

- Gui, E.M.; MacGill, I. Typology of future clean energy communities: An exploratory structure, opportunities, and challenges. Energy Res. Soc. Sci. 2018, 35, 94–107. [Google Scholar] [CrossRef]

- Cielo, A.; Margiaria, P.; Lazzeroni, P.; Mariuzzo, I.; Repetto, M. Renewable Energy Communities business models under the 2020 Italian regulation. J. Clean. Prod. 2021, 316, 128217. [Google Scholar] [CrossRef]

- Olivero, S.; Ghiani, E.; Rosetti, G.L. The first Italian Renewable Energy Community of Magliano Alpi. In Proceedings of the 2021 IEEE 15th International Conference on Compatibility, Power Electronics and Power Engineering (CPE-POWERENG), Florence, Italy, 14–16 July 2021; pp. 1–6. [Google Scholar] [CrossRef]

- Casalicchio, V.; Manzolini, G.; Prina, M.G.; Moser, D. From investment optimization to fair benefit distribution in renewable energy community modelling. Appl. Energy 2022, 310, 118447. [Google Scholar] [CrossRef]

- Felice, A.; Rakocevic, L.; Peeters, L.; Messagie, M.; Coosemans, T.; Camargo, L.R. An assessment of operational economic benefits of renewable energy communities in Belgium. J. Phys. Conf. Ser. 2021, 2042, 012033. [Google Scholar] [CrossRef]

- Felice, A.; Rakocevic, L.; Peeters, L.; Messagie, M.; Coosemans, T.; Camargo, L.R. Renewable energy communities: Do they have a business case in Flanders? Appl. Energy 2022, 322, 119419. [Google Scholar] [CrossRef]

- Barchi, G.; Pierro, M.; Secchi, M.; Moser, D. Residential Renewable Energy Community: A Techno-Economic Analysis of the Italian Approach. In Proceedings of the 2023 IEEE International Conference on Environment and Electrical Engineering and 2023 IEEE Industrial and Commercial Power Systems Europe (EEEIC/I&CPS Europe), Madrid, Spain, 6–9 June 2023; pp. 1–6. [Google Scholar] [CrossRef]

- Li, N.; Hakvoort, R.A.; Lukszo, Z. Cost allocation in integrated community energy systems—A review. Renew. Sustain. Energy Rev. 2021, 144, 111001. [Google Scholar] [CrossRef]

- Ghaemi, S.; Anvari-Moghaddam, A. Local energy communities with strategic behavior of multi-energy players for peer-to-peer trading: A techno-economic assessment. Sustain. Energy Grids Networks 2023, 34, 101059. [Google Scholar] [CrossRef]

- Lilliu, F.; Recupero, D.R.; Vinyals, M.; Denysiuk, R. Incentive mechanisms for the secure integration of renewable energy in local communities: A game-theoretic approach. Sustain. Energy Grids Networks 2023, 36, 101166. [Google Scholar] [CrossRef]

- Grasso, F.; Lozito, G.M.; Fulginei, F.R.; Talluri, G. Pareto optimization Strategy for Clustering of PV Prosumers in a Renewable Energy Community. In Proceedings of the 2022 IEEE 21st Mediterranean Electrotechnical Conference (MELECON), Palermo, Italy, 14–16 June 2022; pp. 703–708. [Google Scholar] [CrossRef]

- Ascione, F.; Bianco, N.; Mauro, G.M.; Napolitano, D.F.; Vanoli, G.P. Comprehensive analysis to drive the energy retrofit of a neighborhood by optimizing the solar energy exploitation – An Italian case study. J. Clean. Prod. 2021, 314, 127998. [Google Scholar] [CrossRef]

- Mihailova, D.; Schubert, I.; Burger, P.; Fritz, M.M. Exploring modes of sustainable value co-creation in renewable energy communities. J. Clean. Prod. 2021, 330, 129917. [Google Scholar] [CrossRef]

- Barabino, E.; Fioriti, D.; Guerrazzi, E.; Mariuzzo, I.; Poli, D.; Raugi, M.; Razaei, E.; Schito, E.; Thomopulos, D. Energy Communities: A review on trends, energy system modelling, business models, and optimisation objectives. Sustain. Energy Grids Networks 2023, 36, 101187. [Google Scholar] [CrossRef]

- Minuto, F.D.; Lazzeroni, P.; Borchiellini, R.; Olivero, S.; Bottaccioli, L.; Lanzini, A. Modeling technology retrofit scenarios for the conversion of condominium into an energy community: An Italian case study. J. Clean. Prod. 2020, 282, 124536. [Google Scholar] [CrossRef]

- Secchi, M.; Barchi, G.; Macii, D.; Moser, D.; Petri, D. Multi-objective battery sizing optimisation for renewable energy communities with distribution-level constraints: A prosumer-driven perspective. Appl. Energy 2021, 297, 117171. [Google Scholar] [CrossRef]

- Weckesser, T.; Dominković, D.F.; Blomgren, E.M.; Schledorn, A.; Madsen, H. Renewable Energy Communities: Optimal sizing and distribution grid impact of photo-voltaics and battery storage. Appl. Energy 2021, 301, 117408. [Google Scholar] [CrossRef]

- Dimovski, A.; Moncecchi, M.; Merlo, M. Impact of energy communities on the distribution network: An Italian case study. Sustain. Energy Grids Networks 2023, 35, 101148. [Google Scholar] [CrossRef]

- Talluri, G.; Lozito, G.M.; Grasso, F.; Garcia, C.I.; Luchetta, A. Optimal Battery Energy Storage System Scheduling within Renewable Energy Communities. Energies 2021, 14, 8480. [Google Scholar] [CrossRef]

- Oh, E. Fair Virtual Energy Storage System Operation for Smart Energy Communities. Sustainability 2022, 14, 9413. [Google Scholar] [CrossRef]

- Pasqui, M.; Felice, A.; Messagie, M.; Coosemans, T.; Bastianello, T.T.; Baldi, D.; Lubello, P.; Carcasci, C. A new smart batteries management for Renewable Energy Communities. Sustain. Energy Grids Networks 2023, 34, 101043. [Google Scholar] [CrossRef]

- Pasqui, M.; Vaccaro, G.; Lubello, P.; Milazzo, A.; Carcasci, C. Heat pumps and thermal energy storages centralised management in a Renewable Energy Community. Int. J. Sustain. Energy Plan. Manag. 2023, 38, 65–82. [Google Scholar] [CrossRef]

- Terlouw, T.; AlSkaif, T.; Bauer, C.; van Sark, W. Multi-objective optimization of energy arbitrage in community energy storage systems using different battery technologies. Appl. Energy 2019, 239, 356–372. [Google Scholar] [CrossRef]

- Gu, B.; Mao, C.; Wang, D.; Liu, B.; Fan, H.; Fang, R.; Sang, Z. A data-driven stochastic energy sharing optimization and implementation for community energy storage and PV prosumers. Sustain. Energy Grids Networks 2023, 34, 101051. [Google Scholar] [CrossRef]

- Gährs, S.; Knoefel, J. Stakeholder demands and regulatory framework for community energy storage with a focus on Germany. Energy Policy 2020, 144, 111678. [Google Scholar] [CrossRef]

- Namor, E.; Sossan, F.; Cherkaoui, R.; Paolone, M. Control of Battery Storage Systems for the Simultaneous Provision of Multiple Services. IEEE Trans. Smart Grid 2018, 10, 2799–2808. [Google Scholar] [CrossRef]

- Gupta, R.; Zecchino, A.; Yi, J.-H.; Paolone, M. Reliable Dispatch of Active Distribution Networks via a Two-Layer Grid-Aware Model Predictive Control: Theory and Experimental Validation. IEEE Open Access J. Power Energy 2022, 9, 465–478. [Google Scholar] [CrossRef]

- Nick, M.; Cherkaoui, R.; Paolone, M. Optimal Allocation of Dispersed Energy Storage Systems in Active Distribution Networks for Energy Balance and Grid Support. IEEE Trans. Power Syst. 2014, 29, 2300–2310. [Google Scholar] [CrossRef]

- Jaffal, H.; Guanetti, L.; Rancilio, G.; Spiller, M.; Bovera, F.; Merlo, M. Electricity Market Services. 2024; pp. 1–25.

- Rancilio, G.; Bovera, F.; Merlo, M. Revenue Stacking for BESS: Fast Frequency Regulation and Balancing Market Participation in Italy. Int. Trans. Electr. Energy Syst. 2022, 2022, 1–18. [Google Scholar] [CrossRef]

- Lipu, M.H.; Ansari, S.; Miah, S.; Hasan, K.; Meraj, S.T.; Faisal, M.; Jamal, T.; Ali, S.H.; Hussain, A.; Muttaqi, K.M.; et al. A review of controllers and optimizations based scheduling operation for battery energy storage system towards decarbonization in microgrid: Challenges and future directions. J. Clean. Prod. 2022, 360, 132188. [Google Scholar] [CrossRef]

- GME, “GME - Gestore dei Mercati Energetici SpA.” [Online]. Available online: https://www.mercatoelettrico.org/it/.

- Rancilio, G.; Lucas, A.; Kotsakis, E.; Fulli, G.; Merlo, M.; Delfanti, M.; Masera, M. Modeling a Large-Scale Battery Energy Storage System for Power Grid Application Analysis. Energies 2019, 12, 3312. [Google Scholar] [CrossRef]

- E Alam, M.J.; Saha, T.K. Cycle-life degradation assessment of Battery Energy Storage Systems caused by solar PV variability. In Proceedings of the 2016 IEEE Power and Energy Society General Meeting (PESGM), Boston, MA, USA, 17–21 July 2016; pp. 1–5. [Google Scholar]

- Lubello, P.; Papi, F.; Bianchini, A.; Carcasci, C. Considerations on the impact of battery ageing estimation in the optimal sizing of solar home battery systems. J. Clean. Prod. 2021, 329, 129753. [Google Scholar] [CrossRef]

- E. Commission, “PVGIS Photovoltaic Geographical Information System.” [Online]. Available online: https://joint-research-centre.ec.europa.eu/pvgis-photovoltaic-geographical-information-system_en.

- ARERA, “Analisi dei consumi dei clienti domestici.” Accessed: Feb. 27, 2024. [Online]. Available online: https://www.arera.it/dati-e-statistiche/dettaglio/analisi-dei-consumi-dei-clienti-domestici.

- Bottecchia, L.; Lubello, P.; Zambelli, P.; Carcasci, C.; Kranzl, L. The Potential of Simulating Energy Systems: The Multi Energy Systems Simulator Model. Energies 2021, 14, 5724. [Google Scholar] [CrossRef]

- M. Pasqui, P. Lubello, A. Mati, A. Ademollo, C.Carcasci, “MESSpy: Multi-Energy System Simulator - Python version.” GitHub. [Online]. Available online: https://github.com/pielube/MESSpy.

- M.Pasqui, “Comunity-battery-CSC-EA,” GitHub. [Online]. Available online: https://github.com/PasquinoFI/Comunity-battery-CSC-EA.

Figure 1.

Case study definition.

Figure 1.

Case study definition.

Figure 2.

Effects of Activation Cost (AC) on Collective-Self-Consumption (CSC) and Energy Arbitrage (EA) cash flow (

Figure 2 2a), on Net Present Value (NPV,

Figure 2 2b), and on number of cycles per year (

Figure 2 2c).

Figure 2.

Effects of Activation Cost (AC) on Collective-Self-Consumption (CSC) and Energy Arbitrage (EA) cash flow (

Figure 2 2a), on Net Present Value (NPV,

Figure 2 2b), and on number of cycles per year (

Figure 2 2c).

Figure 3.

Net Present Value (NPV) (left) and NPV transformation (right) to compare different Activation Cost (AC).

Figure 3.

Net Present Value (NPV) (left) and NPV transformation (right) to compare different Activation Cost (AC).

Figure 4.

Net Present Value (NPV) (blue line) and NPV transformation (orange line).

Figure 4.

Net Present Value (NPV) (blue line) and NPV transformation (orange line).

Figure 5.

Hourly energy price in the Italian electricity market from 2018 to 2023.

Figure 5.

Hourly energy price in the Italian electricity market from 2018 to 2023.

Figure 6.

Average hourly energy price in Italian market from 2018 to 2023.

Figure 6.

Average hourly energy price in Italian market from 2018 to 2023.

Figure 7.

Average load profiles in January for a 3kW residential customer in Tuscany.

Figure 7.

Average load profiles in January for a 3kW residential customer in Tuscany.

Figure 8.

100 kWp REC key parameters varying customer number.

Figure 8.

100 kWp REC key parameters varying customer number.

Figure 9.

CSC+EA (left) vs CSC (right): collective-self-consumption index and collective-self-sufficiency index for varying battery size and customer number.

Figure 9.

CSC+EA (left) vs CSC (right): collective-self-consumption index and collective-self-sufficiency index for varying battery size and customer number.

Figure 10.

CSC+EA (left) vs CSC (right): energy fed into the grid by varying BESS size.

Figure 10.

CSC+EA (left) vs CSC (right): energy fed into the grid by varying BESS size.

Figure 11.

CSC+EA (left) vs CSC (right): energy withdrawn from the gird by varying BESS size.

Figure 11.

CSC+EA (left) vs CSC (right): energy withdrawn from the gird by varying BESS size.

Figure 12.

CSC+EA: optimal Activation Cost (AC) values for varying Energy Price (EP), battery cost (BC) and battery size.

Figure 12.

CSC+EA: optimal Activation Cost (AC) values for varying Energy Price (EP), battery cost (BC) and battery size.

Figure 13.

CSC+EA: cash flow for varying Customer Number (CN), Energy Price (EP) and BESS size.

Figure 13.

CSC+EA: cash flow for varying Customer Number (CN), Energy Price (EP) and BESS size.

Figure 14.

CSC: cash flow for varying Customer Number (CN), Energy Price (EP) and BESS size.

Figure 14.

CSC: cash flow for varying Customer Number (CN), Energy Price (EP) and BESS size.

Figure 15.

CSC+EA: NPV* varying Energy Price (EP), BESS cost (BC), customer number and BESS size.

Figure 15.

CSC+EA: NPV* varying Energy Price (EP), BESS cost (BC), customer number and BESS size.

Figure 16.

CSC: NPV* varying Energy Price (EP), BESS cost (BC), customer number and BESS size.

Figure 16.

CSC: NPV* varying Energy Price (EP), BESS cost (BC), customer number and BESS size.

Figure 17.

CSC+EA: optimal investments assessment for varying Energy Price (EP), BESS cost (BC) and Customer Number (CN).

Figure 17.

CSC+EA: optimal investments assessment for varying Energy Price (EP), BESS cost (BC) and Customer Number (CN).

Figure 18.

CSC: optimal investments assessment for varying Energy Price (EP), BESS cost (BC) and Customer Number (CN).

Figure 18.

CSC: optimal investments assessment for varying Energy Price (EP), BESS cost (BC) and Customer Number (CN).

Table 1.

Simulated scenarios.

Table 1.

Simulated scenarios.

| Parameter |

Scenarios |

| Customer number (CN) |

80, 135, 205 residential customers |

| Energy Price (EP) |

Low and high prices (2020 and 2023) |

| Battery cost (Costbess) |

200, 400, 600 €/kWh |

| Energy Arbitrage (EA) |

CSC+EA vs CSC |

Table 2.

Sensitivity analysis.

Table 2.

Sensitivity analysis.

| Variable |

Range |

| Battery size (Sizebess) |

20 to 300 kWh |

| Activation Cost (AC) |

5 to 60 €/MWh |

Table 3.

Three scenarios selected for customer number.

Table 3.

Three scenarios selected for customer number.

| Customer number [CN] |

CSC

[%] |

CSS

[%] |

Esur [MWh/year] |

Eneed

[MWh/year] |

| 80 |

40 |

38 |

82 |

89 |

| 135 |

60 |

34 |

55 |

160 |

| 205 |

80 |

30 |

27 |

258 |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).