1. Introduction

The swift advancements in various technologies, coupled with the evolving nature of financial activities, underscore the growing need for enhanced transparency, security, and efficiency in financial operations [

1]. This is because traditional financial operations often grapple with inefficiencies, susceptibility to fraud, and a lack of immediate transparency [

2]. Moreover, the dynamic landscape of financial technology (fintech) further amplifies the need for innovative solutions. Although blockchain technology is recognized as a promising tool to address these challenges, developing solutions with the appropriate blockchain platform remains an area of ongoing exploration. In the era of fintech, where agility and adaptability are paramount, these systems emerge as pivotal contributors to reshaping financial landscapes. However, seamlessly integrating these blockchain platforms into the financial distribution sector, ensuring compatibility, expandability, and maintaining security, poses a notable challenge [

3,

4].

On the other hand, blockchain technology, recognized for its decentralized, secure, and transparent characteristics, is driving innovation in various domains [

5]. Within this technological realm, public, private, and consortium blockchains each play distinct roles and exert unique impacts. Consortium blockchain systems, particularly distinguished for their decentralized structure and integrated smart contract capabilities, stand out as powerful enablers of transformation [

6]. Moreover, in tandem with this trend, Hyperledger Besu, an open-source client for the Ethereum blockchain, augments current advancements by offering greater flexibility and advanced features [

7]. This synergy between blockchain’s foundational strengths and the enhancements brought forth by Hyperledger Besu contributes to a more dynamic landscape of innovation. The industry’s adoption of blockchain solutions is driven by the inherent advantages of the technology in terms of transparency, and security [

8,

9]. Furthermore, platforms such as Hyperledger provide enterprise-grade solutions for the financial sector, enabling the development of advanced financial applications [

10]. This comprehensive integration of blockchain technology, coupled with specialized platforms, reflects a transformative shift in how industries approach and leverage cutting-edge solutions.

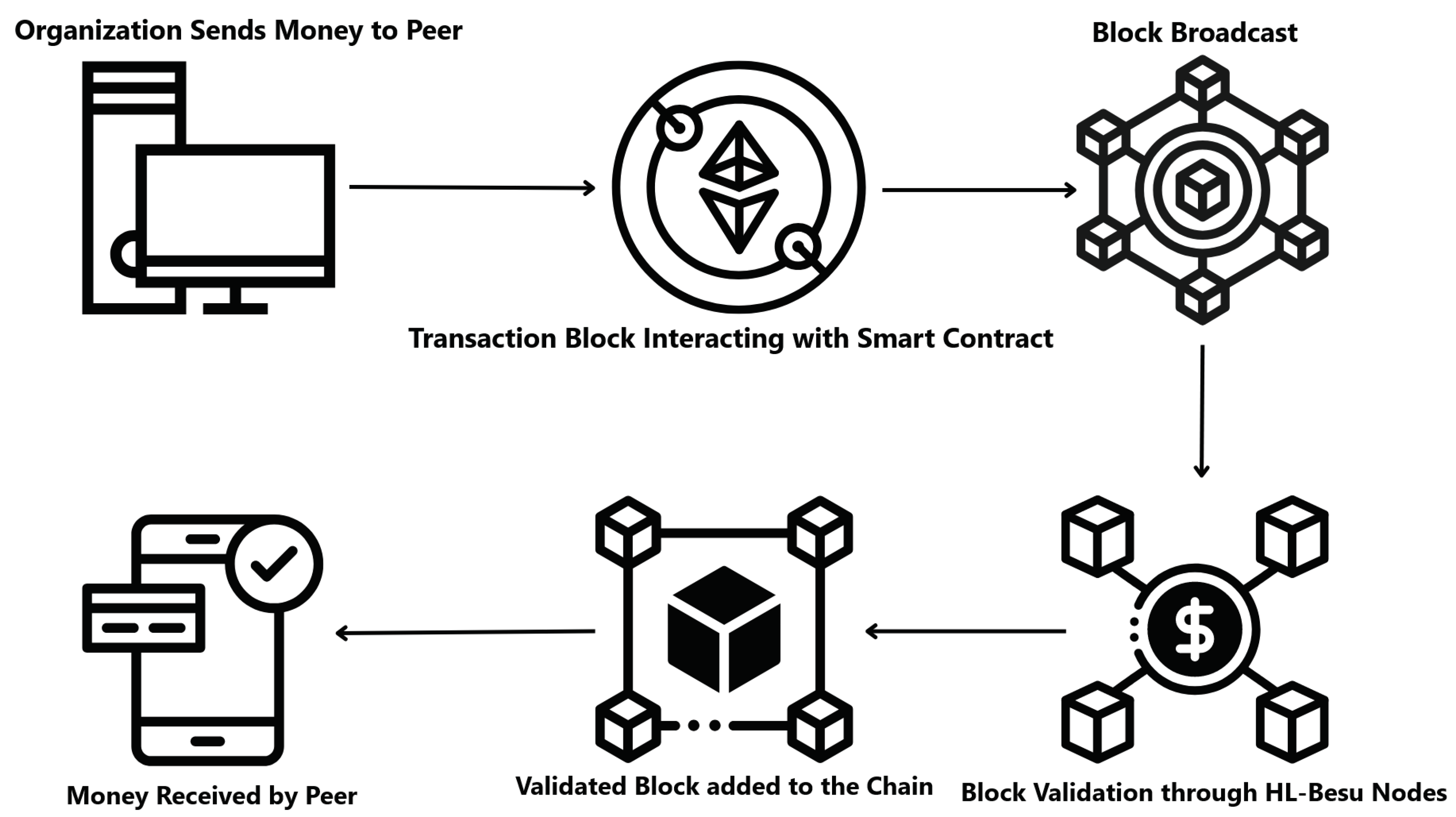

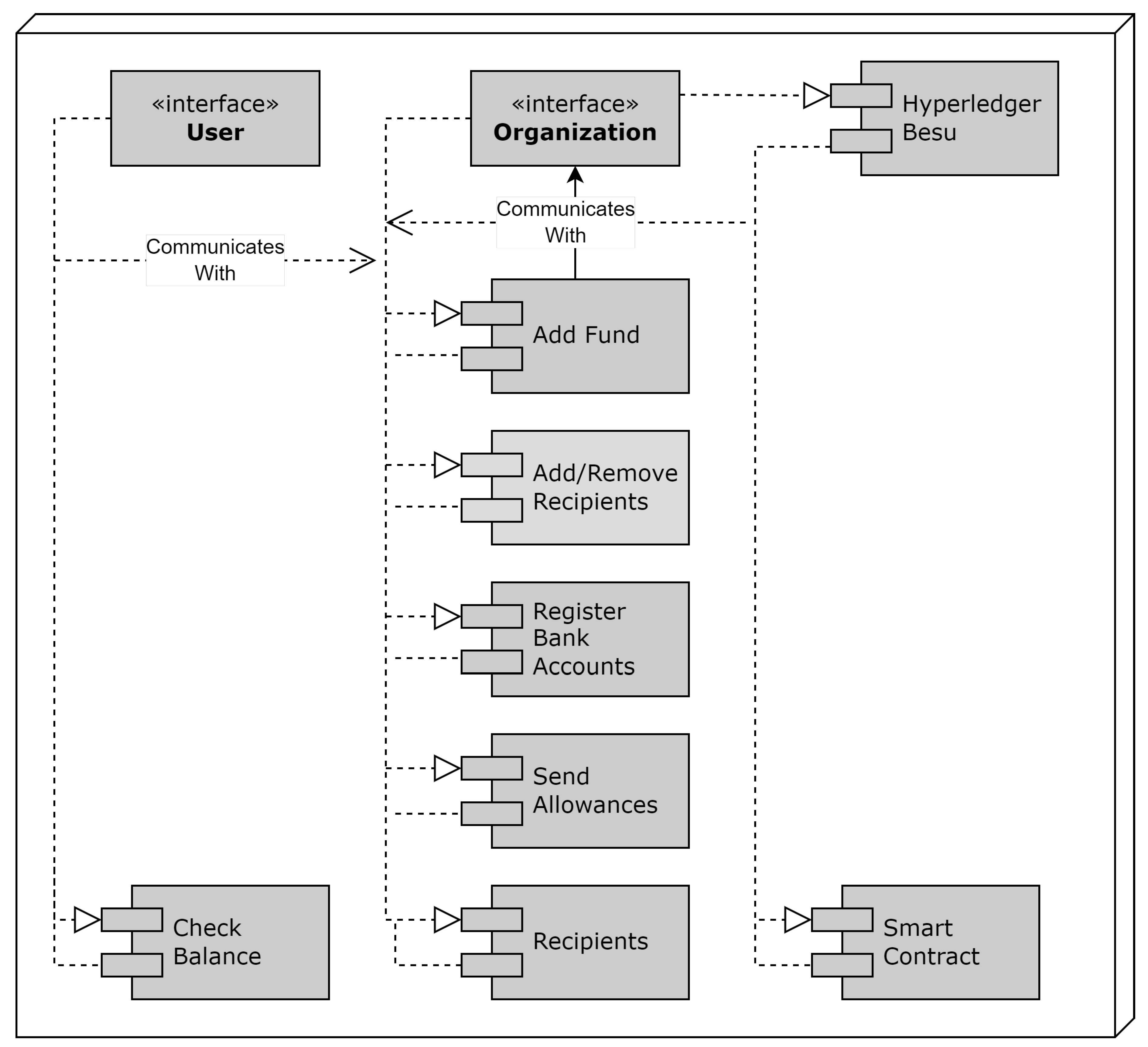

This research investigates the intricate architecture and functional capacities of integrating platforms like Hyperledger Besu [

11,

12], with a particular focus on addressing challenges inherent in traditional financial distribution systems [

13]. The proposed financial distribution platform utilizes a consortium blockchain, combining its interoperability, scalability, and controlled access features with the robust functionalities of Hyperledger Besu. The incorporation of embedded smart contracts is expected to enhance procedural automation, reducing the need for manual intervention and minimizing the likelihood of human errors.

The architecture of the proposed blockchain-based system emphasizes adaptability and robustness while effectively addressing persistent issues in the financial distribution industry. This integration streamlines processes, facilitating advancements in the delivery of financial services and establishing the proposed system as an efficient solution. The research also aims to elucidate the distinct features of Hyperledger Besu, with a specific focus on its potential in financial distribution amid the growing discourse on the various applications of blockchain technology. The primary significance of this study lies in its comprehensive analysis of smart contract generation and its seamless incorporation into a private Hyperledger Besu environment. The study highlights the significant impact of smart contracts on streamlining operations, minimizing human involvement, and mitigating common issues like inefficiencies, susceptibility to fraud, and limited real-time visibility.

Therefore, this paper introduces a financial distribution system based on a consortium blockchain. The partially decentralized nature of consortium blockchains, catering to organizations’ preference for keeping sensitive data private, plays a pivotal role in the proposed system’s architecture. Within this system, the proposed smart contract serves a dual role as both a transactional tool and a specialized solution designed to improve transactional procedures. Its multifaceted capabilities include ensuring data accuracy, facilitating swift execution, and ensuring adherence to regulatory requirements within the dynamic financial distribution landscape. Rigorous testing and empirical analysis utilizing the Hyperledger Besu platform reveal that the proposed system’s performance surpasses traditional blockchain frameworks. The results unequivocally demonstrate its proficiency in handling high-frequency financial transactions with minimal computational burden.

The subsequent sections of this article are organized as follows:

Section 2 provides a discussion of existing blockchain-based systems, outlining their advantages and disadvantages.

Section 3 outlines the architecture of the proposed system. The development and implementation of the proposed system, alongside a discussion of the envisioned smart contracts, are presented in

Section 4. The performance evaluation of the proposed system is detailed in

Section 5, and the paper concludes in

Section 6.

2. Existing Systems

The potential of blockchain technology has not yet been completely recognized, and its implementation across numerous industries is still in its early stages [

20]. Studies highlight how blockchain technology may greatly improve operations and provide transparent, reliable systems. This is especially helpful for senior citizens who need critical services [

21]. Blockchain technology is known to provide better security and privacy, more efficiency, and lower prices in the service industry [

4]. Self-executing contracts with embedded code, or "smart contracts," are emphasized for their ability to streamline authorization procedures and guarantee data integrity [

7].

Challenges for blockchain-based service platforms include regulatory compliance, interoperability, and user adoption [

10]. Notwithstanding these obstacles, additional research into the full potential and constraints of blockchain technology is imperative given its wide range of possible applications in the service industry [

22]. To increase trading efficiency and security, an emphasis is focused on creating a decentralized stock market platform using consortium blockchain [

1]. The underlying problems with traditional stock exchanges, namely their high costs, lack of transparency, and vulnerability to fraud, are suggested to be resolved by this platform.

Enhanced security is the main benefit of consortia blockchain use in stock exchanges. It lowers the possibility of market manipulation by making it easier to create smart contracts for crucial trading procedures like clearing and settlement and by offering a decentralized ledger with transparent transaction records [

1]. It is advised to conduct more research to examine this platform’s scalability and potential effects on the larger financial industry.

The HonestChain solution uses consortium blockchain to enable secure data sharing amongst health information systems in the healthcare industry [

24]. Experiments and simulations show that this method improves data security and privacy while meeting regulatory requirements. HonestChain is a decentralized permission system that combines attribute-based encryption and access management to optimize security and efficiency in the sharing of healthcare data. A consortium blockchain method tackles security concerns, trust issues, and limited storage capacity for vehicular ad-hoc networks (VANETs) [

25]. Improvements in capacity, data sharing, and storage security are shown, but problems still exist because of the dynamic nature of VANETs and the constrained resources of vehicles.

To solve high transaction costs and insufficient transparency in cross-border transactions, a consortium blockchain system is recommended [

10]. Despite drawbacks including a small number of network users and technological limitations, an examination conducted in Shenzhen demonstrates that this system outperforms conventional approaches in terms of transaction speed, security, and cost-effectiveness. The scalability of consortium blockchain technology, its interaction with current systems, and its wider sectoral implications need more research [

12]. Future studies will concentrate on enhancing the technology’s ability to manage higher volumes and integrating it with other systems while looking at new applications across a range of industries.

The authors [

34] suggest Mudrachain, a blockchain-based system intended to improve efficiency in financial institutions’ current check clearance procedures. This study makes a significant contribution to the current discussion over blockchain’s revolutionary potential for banking and finance. Although it greatly enhances this discussion, it does not adequately address the difficulties related to the general application of blockchain technology. Mudrachains’s success and efficacy depend on this board’s adoption. A thorough examination of workable plans for this adoption could strengthen the case even further.

Logistics may benefit from consortium blockchain, which combines elements of private and public blockchains [

12]. It provides a decentralized, transparent, and secure platform to address logistics concerns. Through the use of a hierarchical consensus method, the T2L system improves supply chain transaction security and product traceability. Case studies demonstrate T2L’s efficiency, affordability, and transparency in comparison to conventional systems; however, more investigation is required into its viability and scalability [

12].

Ensuring secure data sharing and personalized services is essential for intelligent transportation systems [

26]. A transparent and safe platform for sharing services and data is provided by the consortium blockchain system that is being suggested. To improve the efficiency and customization of transportation services, digital identities, and smart contracts both enable data sharing [

26]. To promote a decentralized network for safe data exchange and service customization, a case study illustrates consortium blockchain’s capacity to offer secure data sharing and customizable services.

A consortium blockchain system is suggested for smart homes to safeguard data privacy [

21]. This system uses smart contracts to manage data sharing and homomorphic encryption to secure data. It also integrates aspects of both public and private blockchains. This technique safeguards the confidentiality and integrity of data by enabling computations on encrypted data without the necessity for decryption. According to recent studies, the consortium blockchain is known for creating a decentralized network of reliable companies, which lowers the danger of data breaches and illegal access.

In particular, the authors [

21] support a homomorphic consortium blockchain to improve data privacy in smart home systems. Conventional data privacy techniques are considered insufficient for smart homes, requiring a more comprehensive and adaptable strategy. To preserve the effectiveness and security of smart home systems, data privacy is to be protected by the proposed homomorphic consortium blockchain. Integrating homomorphic encryption into a consortium blockchain framework offers a practical method for safeguarding the privacy of sensitive data. Assessments validate its efficacy in preserving the confidentiality and integrity of data [

21].

The study [

11], which addresses mobile device security, lists obstacles to malware detection, including the absence of a centralized authority and the dynamic nature of malware. The suggestion is for a consortium blockchain as a safe, transparent, and decentralized malware detection system. Tests and simulations show that this technology lowers the expenses associated with traditional approaches while improving mobile malware identification and prevention. To facilitate collaborative malware detection and prevention, the authors [

11] propose a unique consortium blockchain network that uses a consensus approach to store and distribute detection findings across numerous devices.

The authors [

22] also look at efficiency and safety in the production of coal mines, and they suggest a consortium blockchain as a way to address issues with data management, such as accountability and transparency. A decentralized, transparent, and secure framework for managing data is provided by the blockchain, where digital identities guarantee participant authenticity and smart contracts automate the production process [

22]. A consortium blockchain system for safe and adaptable access to medical data is suggested for the healthcare industry [

23]. By addressing the industry’s susceptibility to security threats, this technology preserves regulatory compliance while guaranteeing the privacy and accuracy of medical data. It has a dynamic permission function for ongoing data protection, limits access to medical data to authorized entities, and keeps an unchangeable log of all access attempts [

23].

[

24] examines data accountability and provenance tracing, emphasizing the advantages of consortium blockchain technologies in terms of automating these procedures and guaranteeing data integrity. The proposed architecture offers a decentralized, transparent, and secure alternative for data management, with implications for the government, banking, and healthcare industries that need to monitor data provenance and accountability [

24]. In addition, the authors [

24] discuss the difficulties associated with data management in smart grids and suggest a consortium blockchain as a decentralized, transparent, and safe platform. Authorized stakeholders can access a secure ledger that stores a variety of data sources that are integrated into the smart grid in this manner [

24].

Akropolis, a worldwide pension scheme powered by blockchain, is unveiled in [

8]. Evaluations of this system indicate advances in pension management and address issues of efficiency, transparency, and pension fund management. It provides a decentralized pension management system that makes safe access and effective fund management possible [

8]. For Vehicle-to-Grid (V2G) networks, attribute-based signatures and consortium blockchains are suggested as ways to protect privacy [

22]. A distributed, transparent, and secure architecture for protecting data privacy is ensured by this combination. With signatures that encode user properties for safe access and transactions, smart contracts and attribute-based signatures simplify procedures and preserve data integrity [

22].

An analysis of Hawk, a smart contract privacy mechanism, can be found in [

25]. It combines homomorphic encryption, multiparty processing, and zero-knowledge proofs to provide low latency and higher throughput than current blockchain models. Hawk protects participant and data privacy while guaranteeing safe smart contract execution [

25]. In the research paper [

26], a novel peer-to-peer blockchain-based system for file storing and sharing is introduced. With a file indexing technique for effective file retrieval and smart contracts for data transfer governance, this system tackles the problems of large-scale operations and security in file storage and sharing [

26].

The authors in paper [

21] discuss the use of consortium blockchain in smart grid systems, overcoming issues with consensus brought on by blockchain’s decentralized structure. To improve system efficiency and take participant reliability into account, a hierarchical trust-based consensus mechanism is suggested. Traditional consensus algorithms like PoW and PoS have problems with scalability, latency, and fault tolerance that can be resolved with this method [

21].

The literature review highlights the growing significance of consortium blockchain in industries such as finance, healthcare, and logistics. It tackles important topics like data security and transparency whilst being distinct. These studies demonstrate blockchain technology’s potential to revolutionize several industries and more importantly, financial distribution industries which can thrive on increased transparency and traceability that is enabled by blockchain. Thus the proposed system looks promising since it accommodates smart contracts and utilizes a private network that comes with increased security.

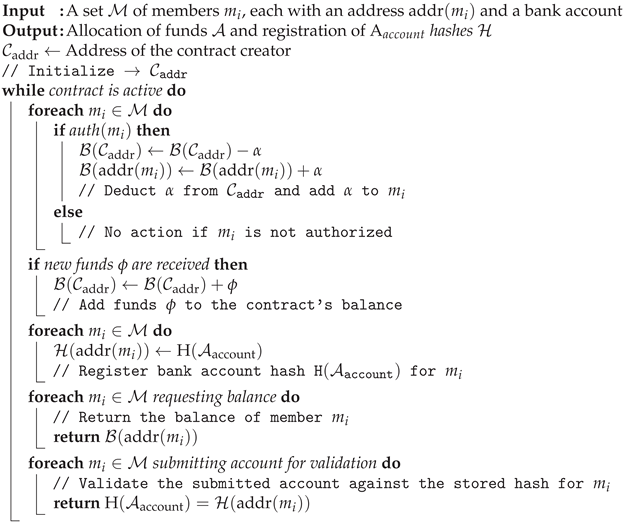

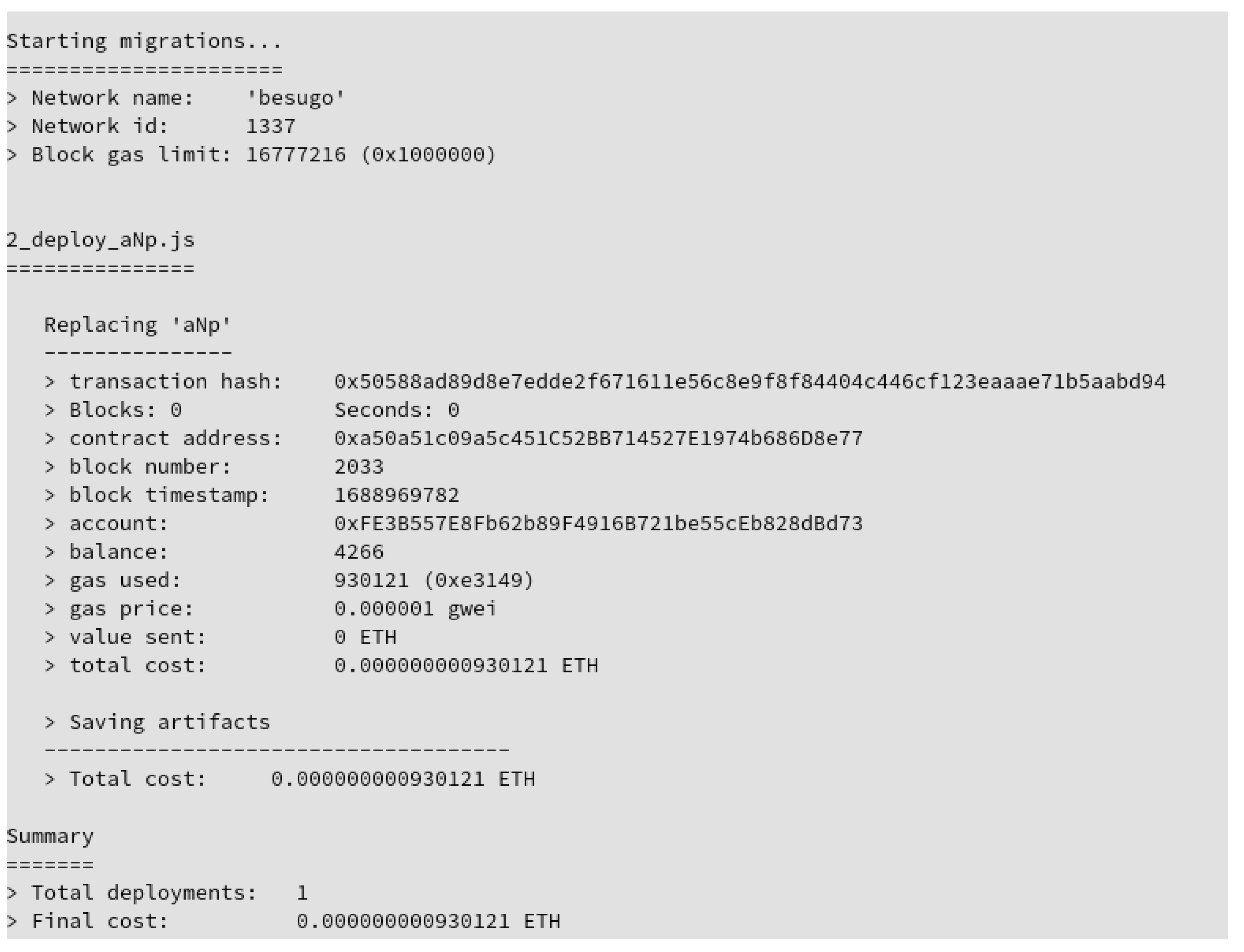

5. Performance Evaluation

The performance evaluation of the proposed system focuses on assessing the efficiency and responsiveness of a smart contract deployed on a custom network via the Hyperledger Besu platform. Conducted on a robust system with an AMD RYZEN 5600X processor and 16GB DDR4 RAM, the test, executed on the Fedora Workstation using the Caliper tool, measures throughput, latency, and resource usage. This evaluation aims to comprehend the system’s performance and reliability under diverse transaction loads.

5.1. Benchmark Configurations & Metric

The benchmarking setup for the proposed system’s smart contract, using Hyperledger Caliper, targets three specific functions: addRecipient, sendAllowance, and registerBankAccount. Each function undergoes five runs of transaction tests, ranging from 50 to 500 transactions in increments of 50. Employing a fixed-rate control for each transaction level, mirroring the transaction number for transactions per second (tps), the tests utilize specific JavaScript modules for each function with consistent arguments: initialMoney set at 10,000 and moneyToTransfer at 100.

The Hyperledger Caliper Framework provides parameters and their respective data based on the set benchmark configuration. The observed metrics from the test benchmark framework include:

-

Throughput (TPS): TPS, refers to the number of transactions a blockchain network can process per second. It’s a key metric for gauging the scalability and efficiency of the system (TPS = Total Number of Transactions / Total Time in Seconds).

In blockchain, high throughput is desirable, especially for public chains, to accommodate large numbers of users and applications. However, achieving high TPS often requires trade-offs with decentralization and security.

-

Latency(s): Latency is the time taken from when a transaction is submitted until it’s added to the blockchain. It’s a measure of how quickly the network can confirm and commit transactions (Latency = Timestamp of Block Confirmation - Timestamp of Transaction Submission).

Low latency is crucial for applications that require real-time or near-real-time settlements. However, like TPS, there’s often a trade-off between low latency, security, and decentralization in blockchain networks.

5.2. Performance Analysis

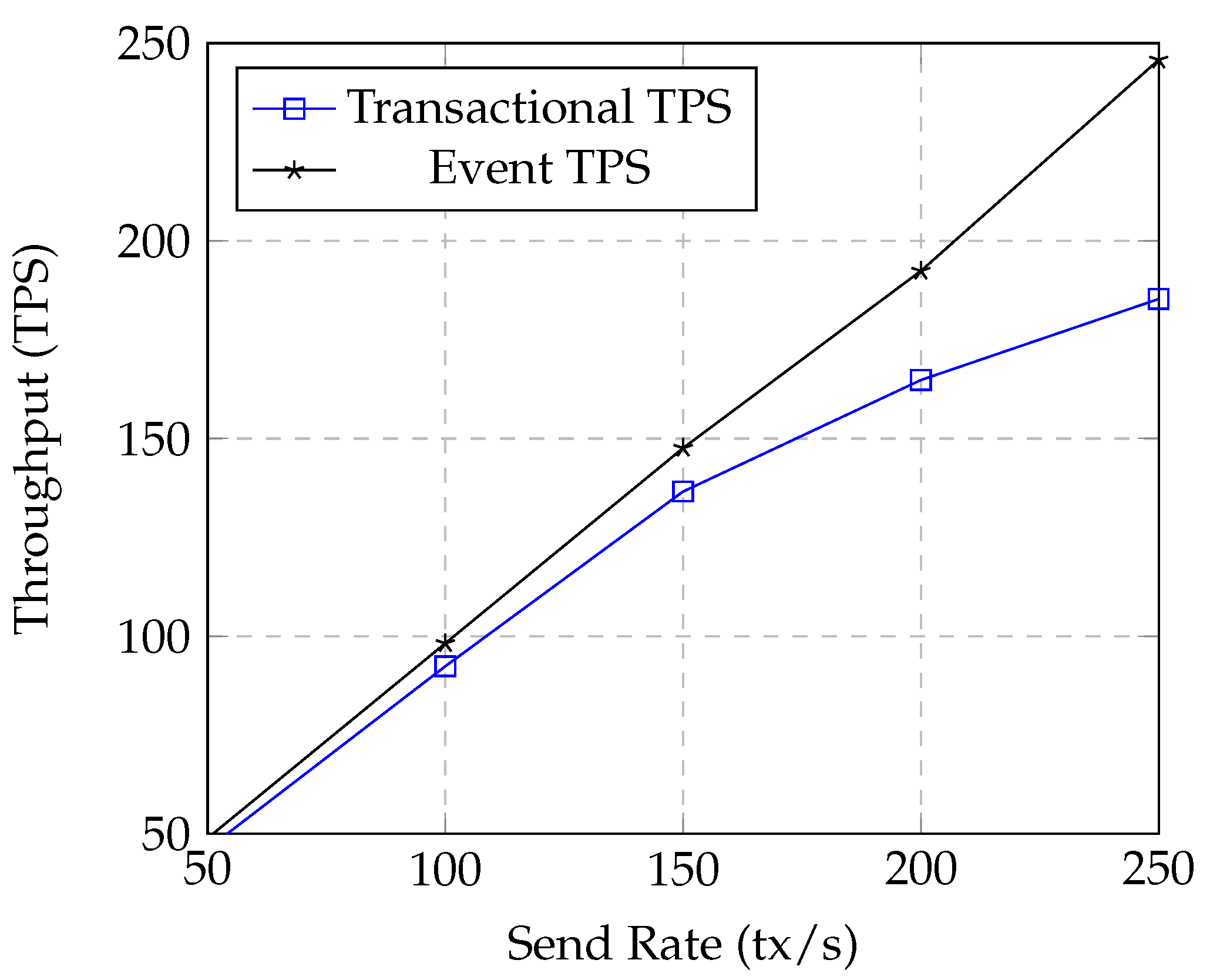

The performance of various function components of the smart contract for the proposed system is illustrated in

Figure 4. These functions are categorized into two groups: Transactional and Event where the figure highlights the throughput of these TPSs concerning varying send rates within a 4-Validator configuration.

The initial send rate is set at 50 and gradually increased to 250 for this analysis. It is observed that both Transactional TPS and Event TPS are similar at low rates. However, the curves diverge with increasing send rates. Transactional TPS shows an initial steep ascent followed by a plateau, suggesting a saturation point or system constraint. In contrast, Event TPS exhibits a more consistent and almost linear growth, indicating adaptability to higher send rates until it also plateaus. These nuanced differences in trajectories underscore distinct capacities and optimization levels between the two systems.

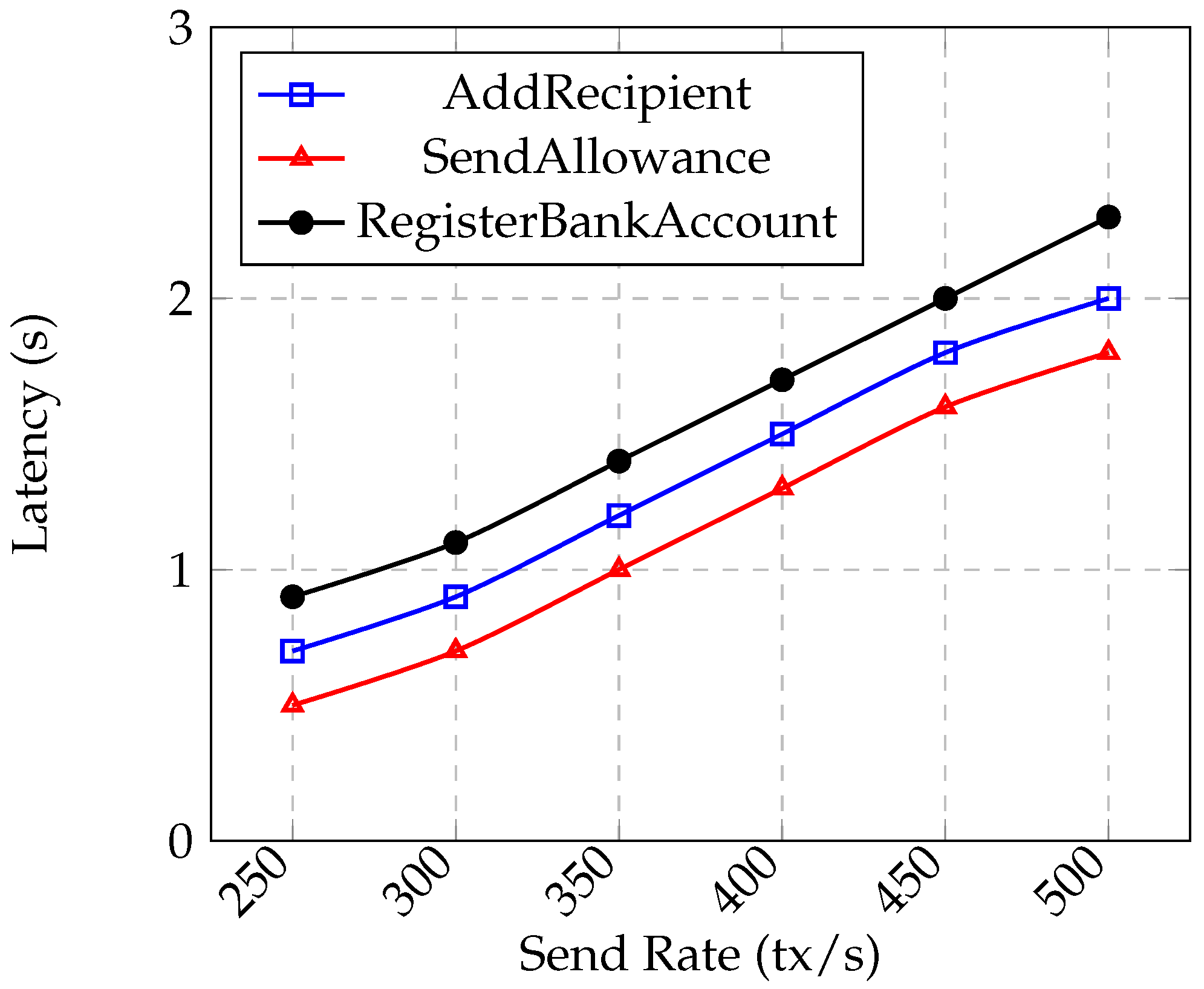

Figure 5, depicts the performance dynamics of three distinct smart contract functions—AddRecipient, SendAllowance, and RegisterBankAccount—within a 4-Validator environment. Hence, the figure highlights the performance of these functions in terms of latency. To evaluate the performance of these functions, relatively higher send rates are considered. Thus, the initial rate is set at 250 and gradually increased to 500 for this purpose. The graph provides a comprehensive exploration of the intricate equilibrium within the system. Notably, RegisterBankAccount consistently displays heightened latency, hinting at its computationally intensive nature or the possibility of encountering execution bottlenecks. Upon observation, SendAllowance emerges as the most optimized for higher throughputs, while RegisterBankAccount lags in terms of efficiency. Moreover, the escalating latency beyond the optimal point for all functions underscores the critical importance of avoiding network overload, emphasizing the intricate relationship between throughput and latency.

The transmit rate and latency rate have a proportional relationship, as seen in

Figure 5. AddRecipient, SendAllowance, and RegisterBankAccount all exhibit a noticeable increase in latency as the transmit rate increases from 250 to 500 transactions per second (tx/s). This Pattern indicates a system that scales in terms of handling load but at the same time has decreased processing efficiency. The rise in latency is not just a result of increased demand; rather, it is a reflection of the inefficiencies in the underlying system’s ability to handle concurrent transactions. It becomes clear that there is a fundamental trade-off between throughput and latency in distributed system design. Although the system shows excellent throughput scalability, it does so at the cost of higher latency. This occurrence highlights a common problem in distributed systems architecture; throughput optimization frequently leads to compromised latency and vice versa.

5.3. Performance Comparison

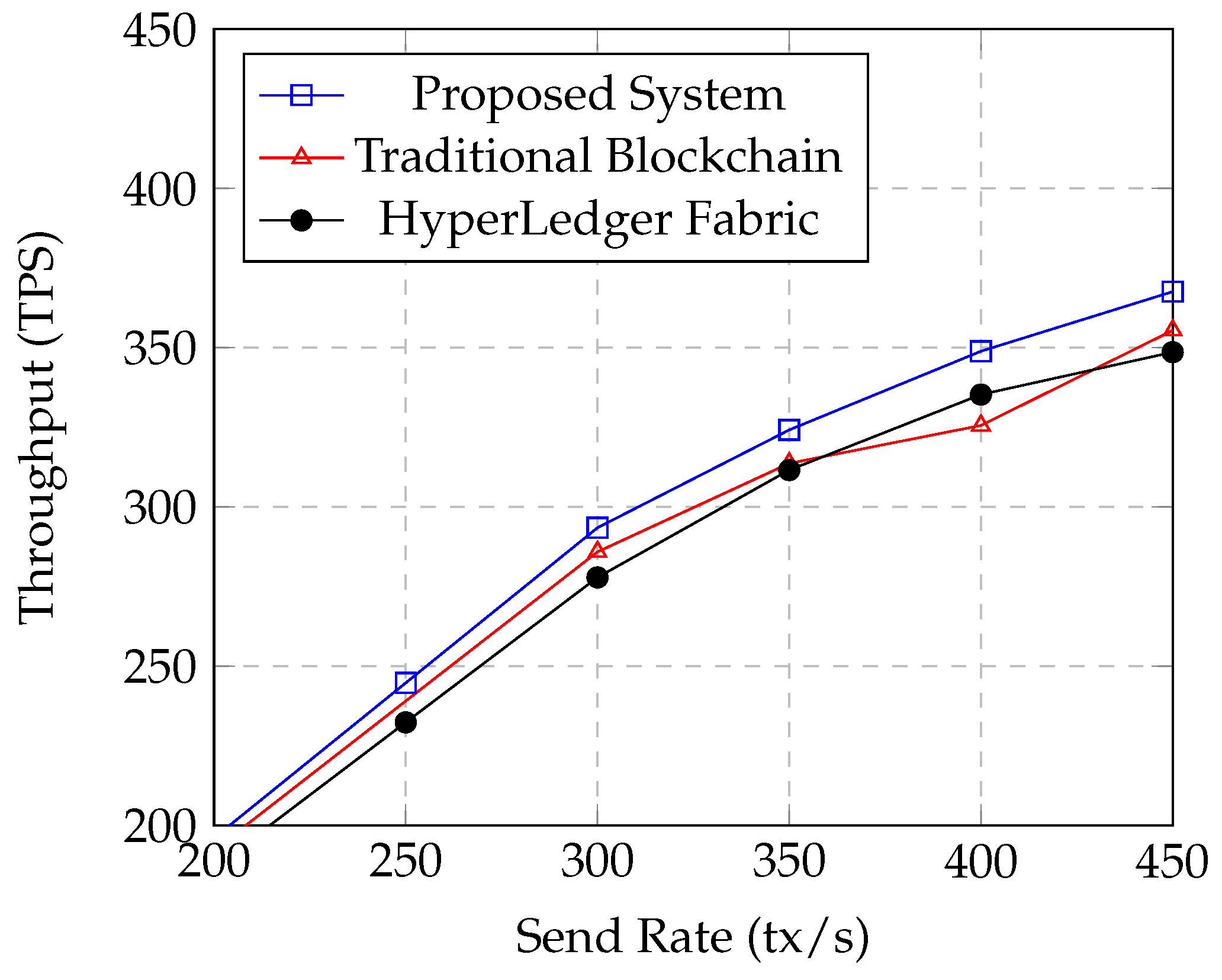

In this section, we evaluate and compare the overall efficiency of the proposed system, with throughput serving as the primary performance metric. The results are juxtaposed against two benchmark systems: Traditional Blockchain and Hyperledger Fabric. The selection of these systems is strategic—Hyperledger Fabric represents a contemporary benchmark, while Traditional Blockchain serves as a representation of legacy systems. This comparative analysis discerns the strengths of the proposed system, shedding light on its potential and prospective contributions to the industry.

Therefore,

Figure 6 presents the throughput performances of these three systems. The initial rate is set at 200 and progressively increased to 450 for this analysis. Examining a range of transmission rates, the graph distinctly underscores the advantages of the proposed system over its conventional counterparts. Graph [

Figure 6] showcases the enhanced efficiency and scalability of the proposed solution. The system maintains significant throughput performance, even with an increase in the transmission rate. This trend is particularly noticeable at higher send rates, where the proposed system exhibits a less pronounced decline in throughput growth. This suggests a heightened emphasis on efficiency and scalability in the system’s architecture, potentially leveraging improved consensus techniques, sophisticated algorithms, or more effective data structures.

In contrast, despite demonstrating excellent performance, conventional blockchain systems like Hyperledger Fabric fall short of the proposed system’s efficiency, especially when dealing with larger transaction volumes. This variation points to possible bottlenecks or inherent inefficiencies in conventional blockchain layouts that could impede performance under high loads. Even well-established blockchain networks can face scalability issues, as indicated by Hyperledger Fabric’s performance trajectory, which roughly aligns with those of other systems.

Considering the performance of the proposed system, the implementation of creative solutions or optimizations beyond the constraints of traditional blockchain architectures becomes imperative. Progress in these areas is crucial not only to increase transaction throughput but also to address more general scalability issues that have long been a focus of blockchain systems and their development.