Submitted:

19 March 2024

Posted:

20 March 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Analysis and Literature Review Results

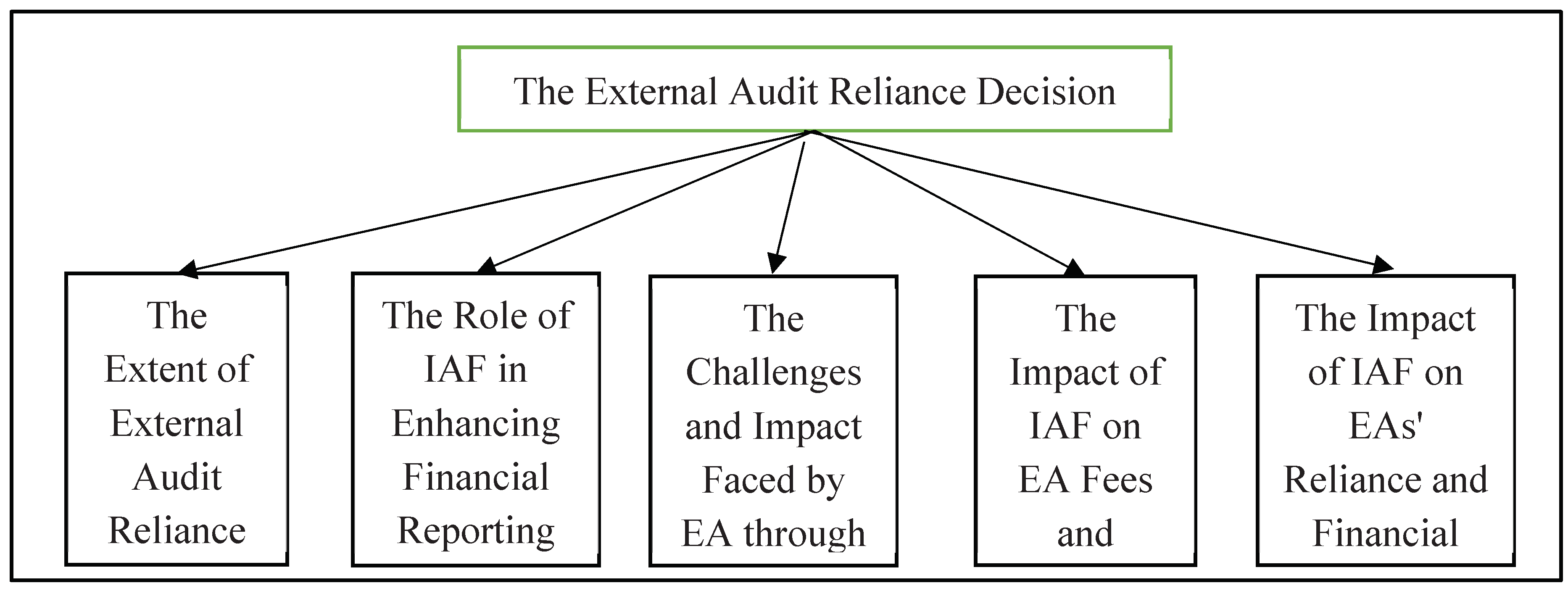

2.1. External Audit Reliance Decision Issues

2.1.1. The Extent of External Audit Reliance

2.1.2. The Role of IAF in Enhancing Financial Reporting Integrity and EA Effectiveness

2.1.3. The Challenges and Impact Faced by EA Through Their Reliance on IAF

2.1.4. The Impact of IAF on EA Fees and Quality

2.1.5. The Impact of IAF on EAs’ Reliance and Financial Statement Quality

3. Discussion

| Section | Key themes | Gaps | Suggestions for future research |

|---|---|---|---|

| 2.1.1 | Factors Influencing External Auditor Reliance. Automated Remediation vs. Human Efforts. Reporting Relationships and Business Risks. Audit Committee Effectiveness. Risk to Objectivity and Professionalism. Regulations and Internal Audit Role. Quality of Internal Audit Task. Impact of Internal Audit on Audit Judgments. Internal Auditing Competence and Objectivity. And, external Auditors’ Struggle with Evidence Integration. |

|

|

| 2.1.2 | Interplay Between IAFs and External Auditors. Impact of Internal Control Deficiencies. Advocacy for Increased Reliance. Collaboration Dynamics. Reporting Structure Impact. And the impact of IAF Quality Parameters. |

|

|

| 2.1.3 | Decision-making complexity and Professional Judgment. Influential Factors and Interaction Dynamics. Client Demands and Interaction Challenges. Outsourcing and Intrinsic Risk. Trust Dynamics and Information Preference. Collaborative Practices and Regulatory Considerations. Liability Judgments and Nuanced Patterns. Limited Interactions and Strained Dynamics. Globalization, Compliance, and Collaboration. Qualification Assessment and Risk Evaluation. And, cautious Adoption of IAF for Management Training. |

|

|

| 2.1.4 | Duality of IAF Impact. The multifaceted impact of the IAF on EA fees and quality is highlighted, showcasing both positive and negative influences. Internal Audit Department Size and Auditing Dynamics. The size of internal audit departments is identified as a key factor influencing external auditor fees, audit quality, and the likelihood of engaging prestigious audit firms. And, outsourcing IAF functions is linked to high audit quality, prompting auditors to accept lower fees for non-audit services. |

|

|

| 2.1.5 | Significance of EA-IAF Relationship. Challenges in Assessing IAF Reliance. Information Asymmetry and Governance Disclosures. Diverse Effects on Audit Quality. Identity Dynamics and Control Deficiency Evaluations. Role of Collaboration in Reporting Timeliness. |

|

|

4. Materials and Methods

4.1. Design of the Plan

- To assess the extent and nature of external audit reliance on the IAF in organizations.

- To recognize the role of IAF in enhancing financial reporting integrity and EA effectiveness.

- To identify and analyze the challenges and impact faced by EA through their reliance on IAF.

- To evaluate the impact of IAF on EA fees and quality.

- To explore the impact of IAF on EAs’ reliance and financial statement quality.

4.2. Defining the Research Questions

4.3. Doing a Literature Search

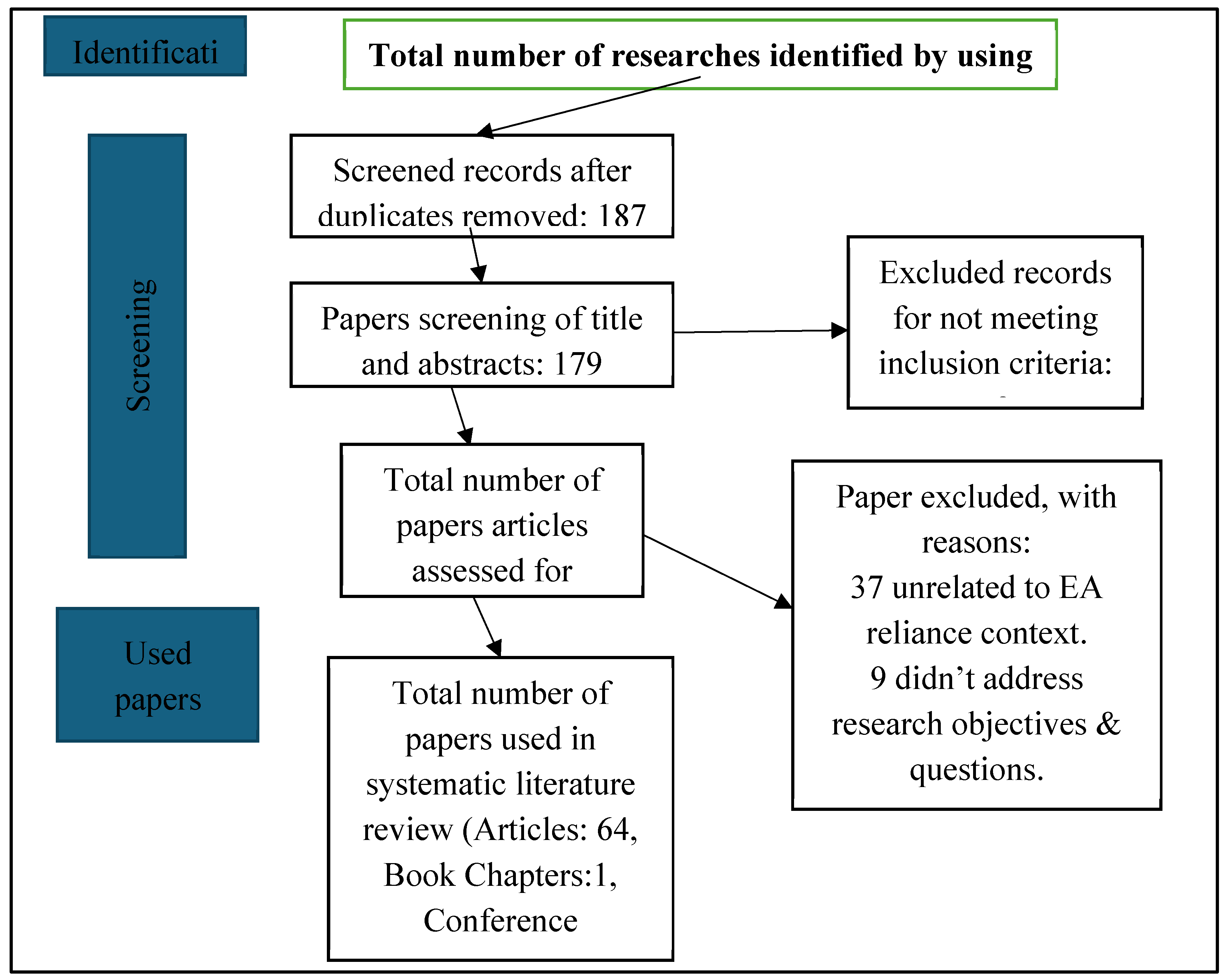

4.4. Using the Criteria of Exclusion and Inclusion

- Research regarding external audit reliance on the IAF.

- Research released in 1984 and 2022.

- Research released in English.

- This research has been reported in one of the most reputable and referenced publications.

4.5. Undertaking the Quality Estimation

- Publications can be found by researching online databases for the terms “external auditing reliance”, “reliance decision”, and “internal audit function”, additionally, duplicate entries were deleted.

- We carefully examined the headlines, abstracts, keywords, and, if needed, the content of the publications to identify those that should be deleted due to irrelevance (Booth et al., 2012).

- Exclusions were made with good justification after eligibility was determined by a full-text evaluation of the papers.

- For a thorough analysis, publications with cross-references were screened, and the ultimate choice of publications to be considered for the systematic review was determined.

4.6. The Diagram of PRISMA

4.7. Details of the Presented Publications

| Source | A number of concerning studies |

|---|---|

| Scopus and Web of Science | 56 |

| Google Scholar | 12 |

| Total publications | 68 |

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Abbott, L.J.; Parker, S.; Peters, G.F. Internal audit assistance and external audit timeliness. Auditing: A Journal of Practice & Theory 2012a, 31, 3–20. [Google Scholar] [CrossRef]

- Abbott, L.J.; Parker, S.; Peters, G.F.; Rama, D.V. Corporate governance, audit quality, and the Sarbanes-Oxley Act: Evidence from internal audit outsourcing. The Accounting Review 2007, 82, 803–835. [Google Scholar] [CrossRef]

- Abbott, L.; Parker, S.; Peters, G.F. Audit fee reductions from internal audit-provided assistance: the incremental impact of internal audit characteristics. Contemporary Accounting Research 2012b, 29, 94–118. [Google Scholar] [CrossRef]

- Abdul Wahab, E.A.; Gist, W.E.; Gul, F.A.; Mat Zain, M. Internal auditing outsourcing, non-audit services, and audit fees. Auditing: A Journal of Practice & Theory 2021, 40, 23–48. [Google Scholar] [CrossRef]

- Agrawal, P.; Tarca, A.; Woodliff, D. External auditors’ evaluation of a management’s expert’s credibility: Evidence from Australia. International Journal of Auditing 2020, 24, 90–109. [Google Scholar] [CrossRef]

- AICPA. Statement on Auditing Standards No, 65: The auditors’ consideration of the internal audit function in an audit of financial statements; AICPA: New York, NY, 1991. [Google Scholar]

- Albawwat, I.E. External auditors’ reliance on the internal audit functions and audit fees. Global Business and Economics Review 2022, 26, 436–456. [Google Scholar] [CrossRef]

- Alktani, S.; Ghareeb, A. Evaluation of the Quality of the Internal Auditing Position in the Public Sector in Saudi Arabia: An Applied Study. Global Review of Accounting and Finance 2014, 5, 93–106. [Google Scholar] [CrossRef]

- Alqudah, H.M.; Amran, N.A.; Hassan, H. Factors affecting the internal auditors’ effectiveness in the Jordanian public sector: The moderating effect of task complexity. EuroMed Journal of Business 2019, 14, 251–273. [Google Scholar] [CrossRef]

- Al-Twaijry AA, M.; Brierley, J.A.; Gwilliam, D.R. An examination of the relationship between internal and external audit in the Saudi Arabian corporate sector. Managerial Auditing Journal 2004, 19, 929–944. [Google Scholar] [CrossRef]

- Alzeban, A.; Gwilliam, D. Factors affecting the internal audit effectiveness: A survey of the Saudi public sector. Journal of International Accounting, Auditing and Taxation 2014, 23, 74–86. [Google Scholar] [CrossRef]

- Archambeault, D.S.; DeZoort, F.T.; Holt, T.P. The need for an internal auditor report to external stakeholders to improve governance transparency. Accounting Horizons 2008, 22, 375–388. [Google Scholar] [CrossRef]

- Arel, B.; Jennings, M.M.; Pany, K.; Reckers, P.M. Auditor liability: A comparison of judge and juror verdicts. Journal of Accounting and Public Policy 2013, 31, 516–532. [Google Scholar] [CrossRef]

- Argento, D.; Umans, T.; Håkansson, P.; Johansson, A. Reliance on the internal auditors’ work: experiences of Swedish external auditors. Journal of Management Control 2018, 29, 295–325. [Google Scholar] [CrossRef]

- Axén, L. Exploring the association between the content of internal audit disclosures and external audit fees: Evidence from Sweden. International Journal of Auditing 2018, 22, pp. 285–297. [Google Scholar] [CrossRef]

- Azzam, M.J.; Alrabba, H.M.; AlQudah, A.M.; Mansur HM, A. A study on the relationship between internal and external audits on financial reporting quality. Management Science Letters 2020, 10, 937–942. [Google Scholar] [CrossRef]

- Baatwah, S.R.; Al-Ebel, A.M.; Amrah, M.R. Is the type of outsourced internal audit function provider associated with audit efficiency? Empirical evidence from Oman. International Journal of Auditing 2019, 23, 424–443. [Google Scholar] [CrossRef]

- Bame-Aldred, Charles and Brandon, Duane M. and Messier Jr, William F. and Rittenberg, Larry and Stefaniak, Chad M. (2013). A Summary of Research on External Auditor Reliance on the Internal Audit Function. Auditing: A Journal of Practice and Theory, Forthcoming, Northeastern U. D’Amore-McKim School of Business Research Paper No. 2013-11, 32(SUPPL.1), pp. 251–286.

- Bedard, J.C.; Graham, L. Detection and severity classifications of Sarbanes-Oxley Section 404 internal control deficiencies. The Accounting Review 2011, 86, 825–855. [Google Scholar] [CrossRef]

- Bellucci, M.; Cesa Bianchi, D.; Manetti, G. Blockchain in accounting practice and research: systematic literature review. Meditari Accountancy Research 2022, 30, 121–146. [Google Scholar] [CrossRef]

- Bierstaker, J.; Chen, L.; Christ, M.H.; Ege, M.; Mintchik, N. Obtaining assurance for financial statement audits and control audits when aspects of the financial reporting process are outsourced. Auditing: A Journal of Practice & Theory 2013, 32 (Suppl. 1), 209–250. [Google Scholar] [CrossRef]

- Booth, A.; Papaioannou, D.; Sutton, A. Systematic Approaches to a Successful Literature Review; Sage: London, 2012. [Google Scholar]

- Brandon, D.M. External auditor evaluations of outsourced internal auditors. Auditing 2010, 29, 159–173. [Google Scholar] [CrossRef]

- Brazel, J.F.; Jones, K.L.; Prawitt, D.F. Auditors’ reactions to inconsistencies between financial and nonfinancial measures: The interactive effects of fraud risk assessment and a decision prompt. Behavioral Research in Accounting 2014, 26, 131–156. [Google Scholar] [CrossRef]

- Breger, D.; Edmonds, M.; Ortegren, M. Internal audit standard compliance, potentially competing duties, and external auditors’ reliance decision. Journal of Corporate Accounting & Finance 2020, 31, 112–124. [Google Scholar] [CrossRef]

- Brody, R.G. External auditor’s willingness to rely on the work of internal auditors: The influence of work style and barriers to cooperation. Advances in Accounting. 28 2012, 11–21. [Google Scholar] [CrossRef]

- Carcello, J.V.; Eulerich, M.; Masli, A.; Wood, D.A. The value to management of using the internal audit function as a management training ground. Accounting Horizons 2018, 32, 121–140. [Google Scholar] [CrossRef]

- Chen, L.H.; Chung, H.H.; Peters, G.F.; Wynn, J.P. Does Incentive-based Compensation for Chief Internal Auditors Impact Objectivity? An External Audit Risk Perspective. Auditing: A Journal of Practice & Theory 2017, 36, 21–43. [Google Scholar] [CrossRef]

- Christ, M.H.; Eulerich, M.; Krane, R.; Wood, D.A. New Frontiers for Internal Audit Research. Accounting Perspectives 2021, 20. [Google Scholar] [CrossRef]

- Christ, M. H.; Masli, A.; Sharp, N. Y.; Wood, D. A. Using the internal audit function as a management training ground: Is the monitoring effectiveness of internal auditors compromised. SSRN Electronic Journal, Working Paper. University of Georgia. 2012. [Google Scholar] [CrossRef]

- Čular, M.; Slapničar, S.; Vuko, T. The Effect of Internal Auditors’ Engagement in Risk Management Consulting on External Auditors’ Reliance Decision. European Accounting Review 2020, 29, 999–1020. [Google Scholar] [CrossRef]

- Denyer, D.; Tranfield, D. Producing a systematic review, The Sage Handbook of Organizational Research Methods; Sage Publications: London, 2009; pp. 671–689. [Google Scholar]

- Desai, N.; Gerard, G.J.; Tripathy, A. Internal audit sourcing arrangements and reliance by external auditors. Audit. J. Pract. Theory. 30 2011, 149–171. [Google Scholar] [CrossRef]

- Desai, R.; Desai, V.; Libby, T.; Srivastava, R.P. External Auditor’s Evaluation of the Internal Audit Function: An Empirical Investigation. International Journal of Accounting Information Systems 2017, 24, 1–14. [Google Scholar] [CrossRef]

- Desai, V.; Roberts, R.W.; Srivastava, R. An analytical model for external auditor evaluation of the internal audit function using belief functions. Contemporary Accounting Research 2010, 27, 537–575. [Google Scholar] [CrossRef]

- Duska, R. The Good Auditor—Skeptic or wealth accumulator? Ethical lessons learned from the Arthur Andersen debacle. Journal of Business Ethics 2005, 57, 17–29. [Google Scholar] [CrossRef]

- Dzikrullah, A.D.; Harymawan, I.; Ratri, M.C. Internal audit functions and audit outcomes: Evidence from Indonesia. Cogent Business & Management 2020, 7, 1750331. [Google Scholar] [CrossRef]

- Farkas, M. J.; Hirsch, R. M. The Effect of Frequency and Automation of Internal Control Testing on External Auditor Reliance on the Internal Audit Function. Journal of Information Systems 2016, 30, 21–40. [Google Scholar] [CrossRef]

- Felix Jr, W.L.; Gramling, A.A.; Maletta, M.J. The influence of non-audit service revenues and client pressure on external auditors’ decisions to rely on internal audit. Contemporary Accounting Research 2005, 22, 31–53. [Google Scholar] [CrossRef]

- Glover, S.M.; Prawitt, D.F.; Wood, D.A. Internal audit sourcing arrangement and the external auditor’s reliance decision. Contemporary Accounting Research 2008, 25, 193–213. [Google Scholar] [CrossRef]

- Gramling, A.A.; Maletta, M.J.; Schneider, A.; Church, B.K. The role of the internal audit function in corporate governance: A synthesis of the extant internal auditing literature and directions for future research. Journal of Accounting Literature 2004, 23, 194. [Google Scholar]

- Gray, J.; Hunton, J.E. External auditors’ reliance on the internal audit function: The role of second-order belief attribution. Unpublished working paper discussed at Bentley University 2011, 1–49. [Google Scholar]

- Hay, D. Further evidence from meta-analysis of audit fee research. International Journal of Auditing 2013, 17, 162–176. [Google Scholar] [CrossRef]

- International Federation of Accountants (IFAC). ISA 610 (revised). Using the Work of the Internal Audit Function and Internal Auditors to Provide Direct Assistance. 2013. [Google Scholar]

- Ismael, H.R.; Roberts, C. Factors affecting the voluntary use of internal audit: evidence from the UK. Managerial Auditing Journal 2018, 33, 288–317. [Google Scholar] [CrossRef]

- Jacky, Y.; Sulaiman, N.A. Factors Affecting the Use of Data Analytics in External Auditing. Management & Accounting Review 2022, 21. [Google Scholar]

- Jesson, J.; Matheson, L.; Lacey, F.M. Doing your literature review: Traditional and systematic techniques, FIRST EDITION; SAGE Publications Ltd., 2011; pp. 1–192. ISBN 9781446242391. [Google Scholar]

- Kamil, O.A.; Ahmed, E.A. Extent of Adoption of External Auditor on Internal Control in Bank Auditing. International Journal of Innovation, Creativity and Change 2020, 10, 612–624. [Google Scholar]

- Kaplan, S.; Schultz, J. The role of internal audit in sensitive communications.Altamonte Springs, FL: The Institute of Internal Auditors Research Foundation. 2006. [Google Scholar]

- Kok, M.; Maroun, W. Not all experts are equal in the eyes of the International Auditing and Assurance Standards Board: On the application of ISA510 and ISA620 by South African registered auditors. South African Journal of Economic and Management Sciences 2021, 24, 1–13. [Google Scholar] [CrossRef]

- Lee, H.Y.; Park, H.Y. Characteristics of the internal audit and external audit hours: evidence from S. Korea. Managerial Auditing Journal 2016, 31, 629–654. [Google Scholar] [CrossRef]

- Lin, S.; Pizzini, M.; Vargus, M.; Bardhan, I.R. The role of the internal audit function in the disclosure of material weaknesses. The Accounting Review 2011, 86, 287–323. [Google Scholar] [CrossRef]

- Lowe, D.J.; Geiger, M.A.; Pany, K. The effects of internal audit outsourcing on perceived external auditor independence. Auditing: A Journal of Practice & Theory 1999, 18, 7–26. [Google Scholar] [CrossRef]

- Malaescu, I.; Sutton, S. G. The reliance of external auditors on internal audit’s use of continuous audit. Journal of Information Systems 2015, 29, 95–114. [Google Scholar] [CrossRef]

- Margheim, L. L. Further evidence of external auditors’ reliance on internal auditors. Journal of Accounting Research 1986, 24, 194–205. [Google Scholar] [CrossRef]

- Massaro, M.; Dumay, J.; Guthrie, J. On the shoulders of giants: undertaking a structured literature review in accounting. Accounting, Auditing and Accountability Journal 2016, 29, 767–801. [Google Scholar] [CrossRef]

- Mat Zain, M.; Zaman, M.; Mohamed, Z. The effect of internal audit function quality and internal audit contribution to external audit on audit fees. International journal of auditing 2015, 19, 134–147. [Google Scholar] [CrossRef]

- Messier Jr, W.F.; Schneider, A. A hierarchical approach to the external auditor’s evaluation of the internal auditing function. Contemporary Accounting Research 1988, 4, 337–353. [Google Scholar] [CrossRef]

- Messier Jr, W.F.; Reynolds, J.K.; Simon, C.A.; Wood, D.A. The effect of using the internal audit function as a management training ground on the external auditor’s reliance decision. The accounting review 2011, 86, 2131–2154. [Google Scholar] [CrossRef]

- Mihret, D.G. How Can We Explain Internal Auditing? The Inadequacy of Agency Theory and A Labor Process Alternative. Critical Perspectives on Accounting 2014, 25, 771–782. [Google Scholar] [CrossRef]

- Morrill, C.; Morrill, J. Internal auditors and the external audit: A transaction cost perspective. Managerial Auditing Journal 2003, 18, 490–504. [Google Scholar] [CrossRef]

- Mubako, G.; Muzorewa, S.C. Interaction between internal and external auditors—insights from a developing country. Meditari Accountancy Research 2019, 27, 840–861. [Google Scholar] [CrossRef]

- Munro, L.; Stewart, J. External auditors’ reliance on internal auditing: further evidence. Managerial Auditing Journal 2011, 26, 464–481. [Google Scholar] [CrossRef]

- Mustapha, M.; Lee, Y.K. Sourcing arrangement of internal audit services: does it matter to the external auditors. International Journal of Business Continuity and Risk Management 2020, 10, 99–111. [Google Scholar] [CrossRef]

- Noh, M.; Park, H.; Cho, M. The effect of the dependence on the work of other auditors on error in analysts’ earnings forecasts. International Journal of Accounting and Information Management 2017, 25, 110–136. [Google Scholar] [CrossRef]

- Oussii, A.A.; Boulila Taktak, N. Audit report timeliness: Does internal audit function coordination with external auditors’ matter? Empirical evidence from Tunisia. EuroMed Journal of Business 2018, 13, 60–74. [Google Scholar] [CrossRef]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E.; et al. The PRISMA 2020 statement: an updated guideline for reporting systematic reviews. BMJ 2021, 372, 1–9. [Google Scholar] [CrossRef]

- Pahlevan-Sharif, S.; Mura, P.; Wijesinghe, S.N. A systematic review of systematic reviews in tourism. Journal of Hospitality and Tourism Management 2019, 39, 158–165. [Google Scholar] [CrossRef]

- Petherbridge, J.; Messier, W.F. The impact of PCAOB regulatory actions and engagement risk on auditors’ internal audit reliance decisions. Journal of Accounting and Public Policy 2015, 35, 3–18. [Google Scholar] [CrossRef]

- Pike, B.J.; Chui, L.; Martin, K.A.; Olvera, R.M. External Auditor’s Involvement in the Internal Audit Function’s Work Plan and Subsequent Reliance Before and After A Negative Audit Discovery. Auditing: A Journal of Practice & Theory 2016, 35, 159–173. [Google Scholar] [CrossRef]

- Pizzini, M.; Lin, S.; Ziegenfuss, D.E. The Impact of Internal Audit Function Quality and Contribution on Audit Delay. Auditing: A Journal of Practice and Theory 2015, 34, 25–58. [Google Scholar] [CrossRef]

- Prawitt, D.F.; Sharp, N.Y.; Wood, D.A. Reconciling archival and experimental research: Does internal audit contribution affect the external audit fee? Behavioral Research in Accounting 2011, 23, 187–206. [Google Scholar] [CrossRef]

- Prawitt, D.F.; Smith, J.L.; Wood, D.A. Internal audit quality and earnings management. The Accounting Review 2009, 84, 1255–1280. [Google Scholar] [CrossRef]

- Public Company Accounting Oversight Board (PCAOB). An audit of internal control over financial reporting that is integrated with an audit of financial statements. PCAOB Release No. 2007–005, Washington, DC. 2007. [Google Scholar]

- Public Company Accounting Oversight Board (PCAOB). AS 2605: Consideration of the Internal Audit Function. PCAOB Alert No. 11, Washington, DC. 2013. [Google Scholar]

- Quick, R.; Henrizi, P. Experimental evidence on external auditor reliance on the internal audit. Review of Managerial Science 2019, 13, 1143–1176. [Google Scholar] [CrossRef]

- Rabóczki, M. B. “Internal audit functions and corporate governance: Evidence from Hungary”. Society and Economy 2018, 40, 289–314. [Google Scholar] [CrossRef]

- Roussy, M. , & Perron, A., New Perspectives in Internal Audit Research: A Structured Literature Review. Accounting Perspectives 2018, 17, 345–385. [Google Scholar] [CrossRef]

- Saidin, S.Z. Does Reliance on Internal Auditor’s Work Reduced the External Audit Cost and External Audit Work? Procedia - Social and Behavioral Sciences 2014, 164, 641–646. [Google Scholar] [CrossRef]

- Schneider, A. Modeling external auditors’ evaluations of internal auditing. Journal of Accounting Research 1984, 657–678. [Google Scholar] [CrossRef]

- Schneider, A. The reliance of external auditors on the internal audit function. Journal of Accounting Research 1985, 23, 911–919. [Google Scholar] [CrossRef]

- Schneider, A. Analysis of professional standards and research findings to develop decision aids for reliance on internal auditing. Research in Accounting Regulation. 22 2010, 96–106. [Google Scholar] [CrossRef]

- Soh, D.; Martinov-Bennie, N. Internal auditors’ perceptions of their role in environmental, social, and governance assurance and consulting. Managerial Auditing Journal 2015, 30, 80–111. [Google Scholar] [CrossRef]

- Speklé, R. F.; van Elten, H. J.; Kruis, A. M. Sourcing of internal auditing: An empirical study. Management Accounting Research 2007, 18, 102–124. [Google Scholar] [CrossRef]

- Stefaniak, C.M.; Cornell, R.M. Social identification and differences in external and internal auditor objectivity. Current issues in auditing 2011, 5, 9–14. [Google Scholar] [CrossRef]

- Stefaniak, C.M.; Houston, R.W.; Cornell, R.M. The effects of employer and client identification on internal and external auditors’ evaluations of internal control deficiencies. Auditing: A Journal of Practice & Theory 2012, 31, 39–56. [Google Scholar] [CrossRef]

- Suh, I.; Masli, A.; Sweeney, J.T. Do Management Training Grounds Reduce Internal Auditor Objectivity and External Auditor Reliance? The Influence of Family Firms. Journal of Business Ethics 2020, 173, 205–227. [Google Scholar] [CrossRef]

- Suwaidan, M.S.; Qasim, A. External auditors’ reliance on internal auditors and its impact on audit fees: An empirical investigation. Managerial Auditing Journal 2010, 25, 509–525. [Google Scholar] [CrossRef]

- Swanger, S. L.; Chewning, E. G., Jr. The effect of internal audit outsourcing on financial analysts’ perceptions of external auditor independence. Auditing A Journal of Practice & Theory 2001, 20, 115–129. [Google Scholar] [CrossRef]

- Tagesson, T.; Eriksson, O. What do auditors do? Obviously, they do not scrutinize the accounting and reporting. Financial Accounting & Management 2011, 27, 272–285. [Google Scholar] [CrossRef]

- Tuluk, F. Collateral Misrepresentation, External Auditing, and Optimal Supervisory Policy. Open Economies Review 2021, 32, 975–1016. [Google Scholar] [CrossRef]

- Weisner, M.; Sutton, S. When the World isn’t always Flat: The Impact of Psychological Distance on auditors’ Reliance on Specialists. International Journal of Accounting Information Systems 2015, 16, 23–41. [Google Scholar] [CrossRef]

| No. | Procedure | Papers regarding “External Auditing Reliance and IAF” published between 1984 and 2022 |

|---|---|---|

| 1. | Searching criteria with “keywords” | External auditing reliance, reliance decision, internal audit function. |

| 2. | Choose databases and conduct searches | Google Scholar, Scopus, and Web of Science. |

| 3. | Selected documents | English-language publications, in trustworthy sources, and included big data analysis and financial auditing. |

| 4. | Combine resources | Evaluation of the listed publications thoughtfully. |

| 5. | Advertise review outcomes | Results are based on the compilation of information or the most recent evidence from the results of multiple independent studies, which can help with practices based on proof. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).