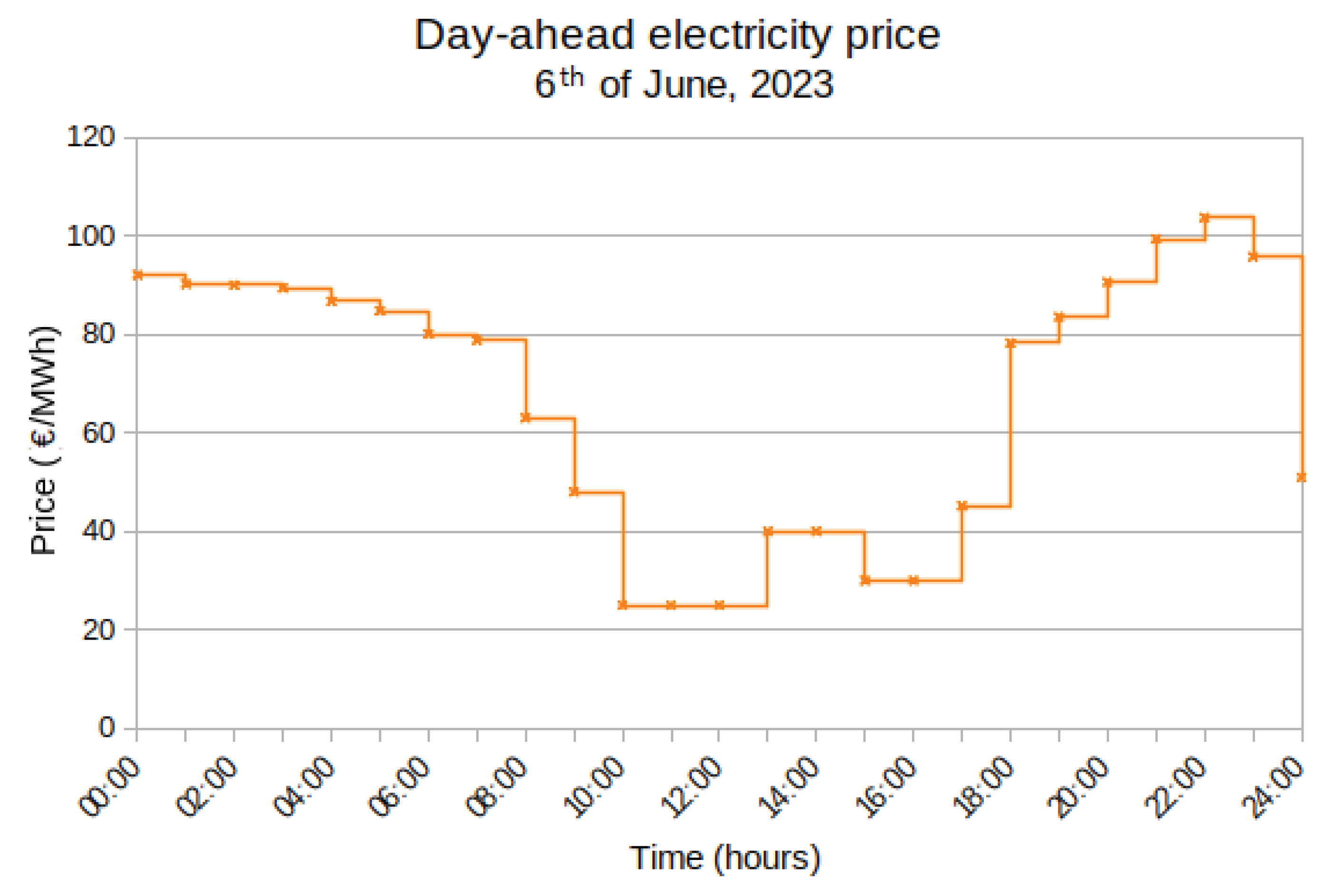

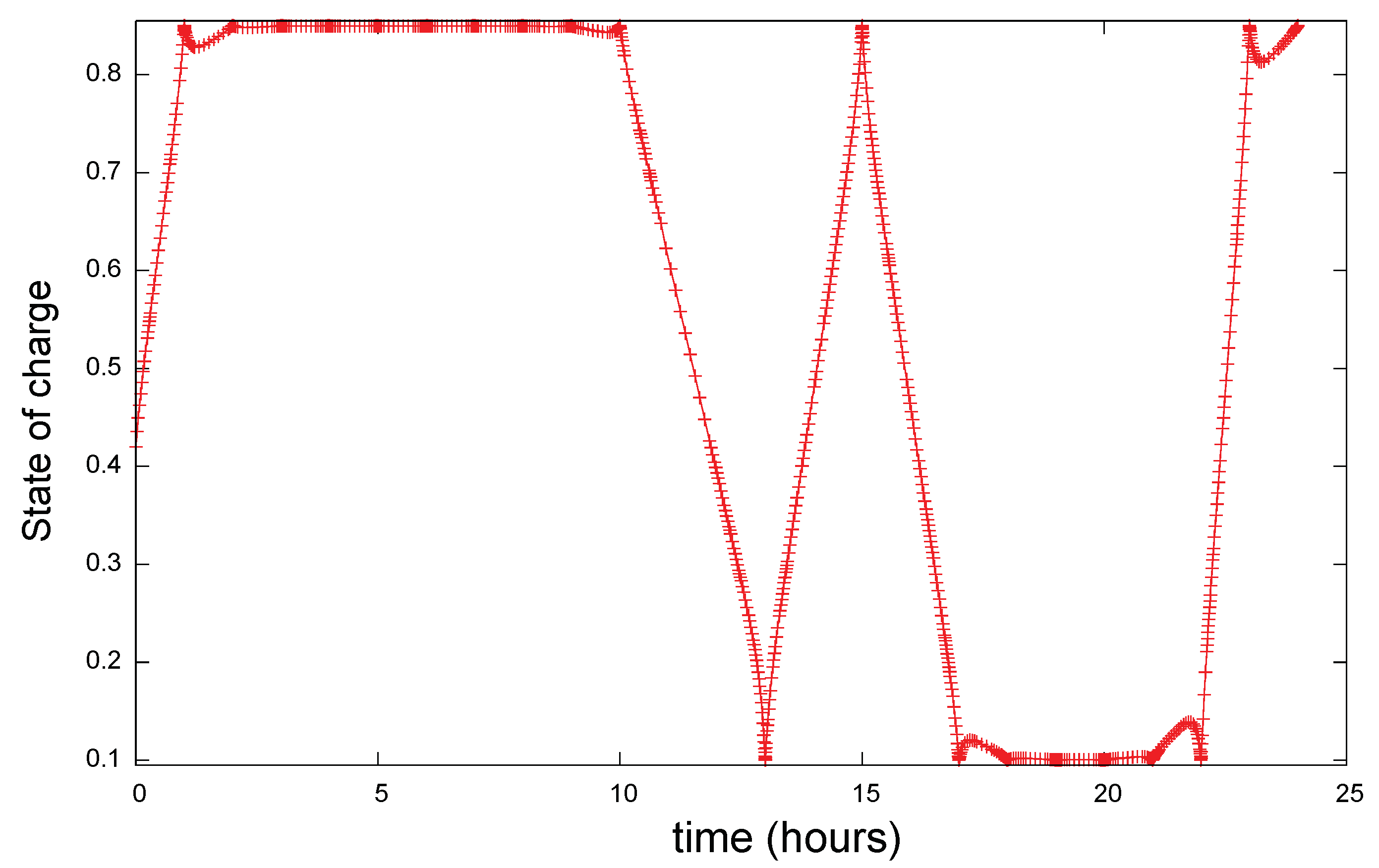

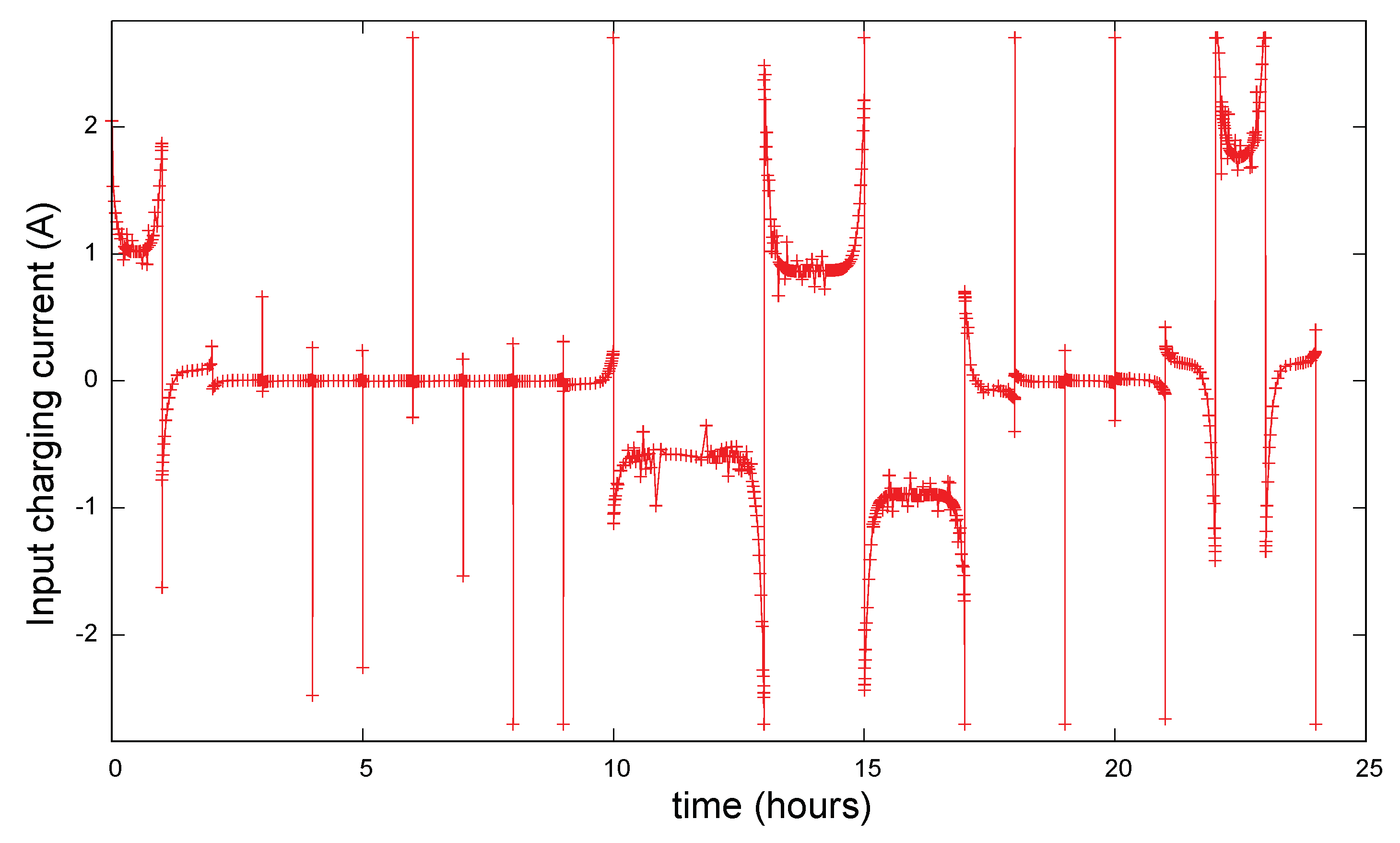

Electricity buyers and sellers in the real world are keenly interested in maximising their profits in the day-ahead electricity market, which spans 24 hours and publishes prices a day before actual buying and selling. In order to comply with the energy trading market rules, the operator who sells energy should commit to selling a certain amount of electricity. These rules greatly depend on the country or the region where they apply, but essentially, the core rules that regulate market participants are remarkably alike.

Before discussing the optimal control problem formulation in detail, two crucial components are defined: the price time series, which determines the electricity price per MWh, and the objective functional, which describes the profits considering the battery’s degradation.

3.2. Formulation of Dynamic Models

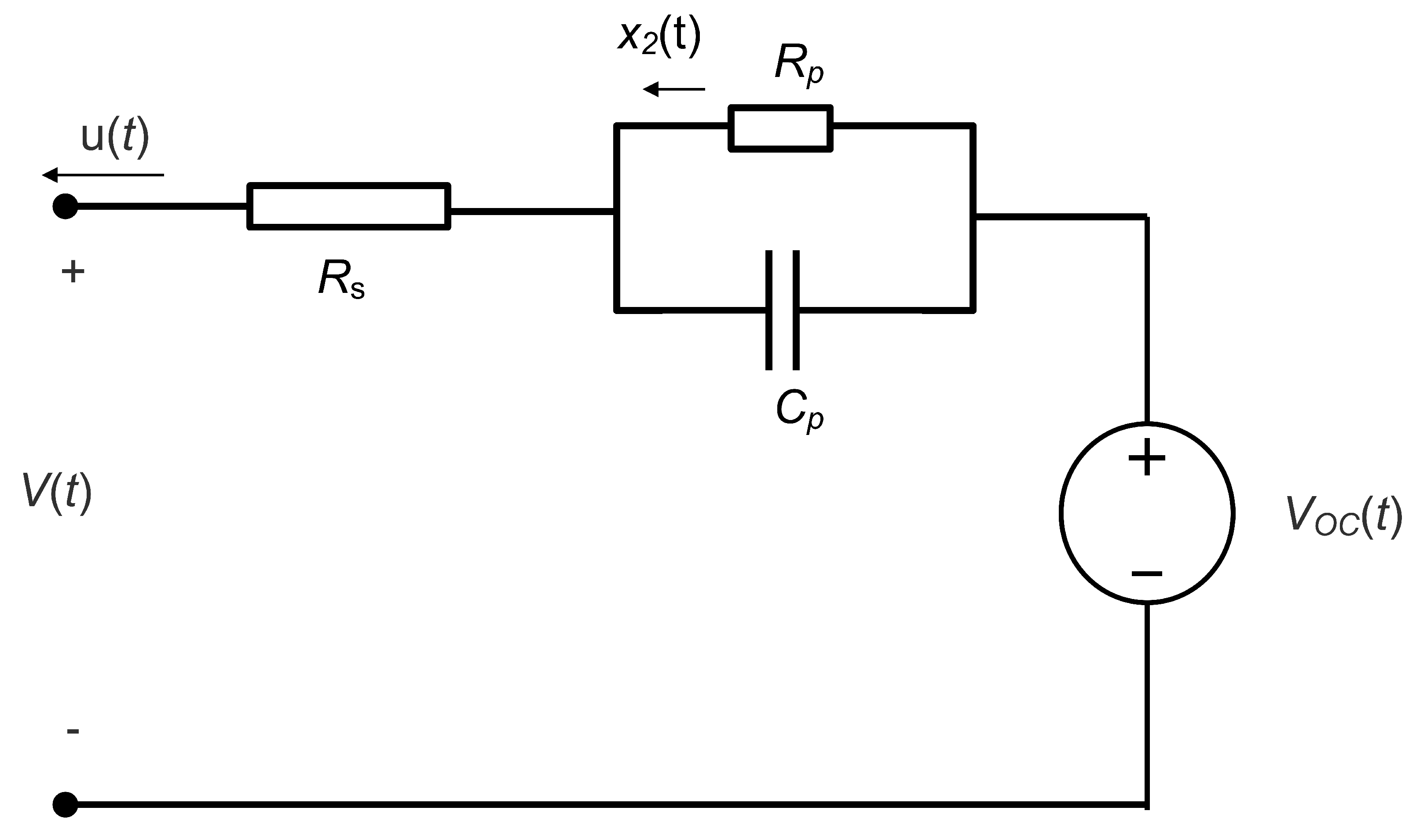

As shown in

Figure 2, an equivalent circuit model was postulated to formulate the empirical model with degradation. The equivalent circuit model does not rely on any thermal model to incorporate temperature effects. Its holistic approach considers these effects embedded in the experimental data. This model achieves enough accuracy to estimate the output voltage, load current and power flow. It also maintains a manageable computational complexity to predict internal degradation.

The state vector used to describe the equivalent circuit model is

where

is the state of charge,

is the current through the resistance

(A),

,

and

are extra states used to determine quantities of interest, as described below. The control variable

u is the current from the battery (A). The convention used in the model implies that

u is positive when the battery is discharging and negative when it is charging.

The model was partially extracted from [

6] and augmented with three new state variables, namely

,

and

, as shown in Equation (

6):

where

C is the nominal battery capacity in Ah,

is the capacity degradation factor of Equation (

5), and

is the voltage across the battery terminals, given in Equation (

7):

where

is function used to estimate the internal voltage,

is a degradation factor given in Equation (

5), and

is the internal battery resistance. The time dependency of the degradation factors

and

is highlighted, as both of them depend of the electric charge

Q passing through the battery, which varies with time.

The state of charge versus

curve for an 18650 Li(NiMnCo)O

2 battery cell data was sourced from reference [

33]. The data were digitalised, and a 7

th-order polynomial was used to fit the curve. Typical values for

, and

are:

=15.80

,

= 8.2

and

= 38

[

34]. The transient behaviour of the lithium-ion cell is characterised by the product of

and

[

35].

States

,

and

are state variables required to estimate the RMS value of the terminal voltage ,

, the mean value of the terminal voltage

, and the total charge going through the battery,

, which is calculated as the integral of

, as follows:

3.3. Empirical Degradation Parameters

The research object of this work is the Sanyo UR18650E lithium-ion battery cell (Sanyo Electric Co., Ltd., Osaka, Japan), which has a cylindrical shape. According to the manufacturer, this cell is rated at

± 0.05 Ah, and its nominal voltage is 3.6 V. The cathode active material consists of Li(NiMnCo)O

2, and the anode material is made of graphite. The grid-connected battery energy storage system modelled in this work is assumed to be composed of 750 UR18650E battery cells, with a total nominal energy storage capacity of 5.67 kWh. The battery cells were assumed to be arranged in a series/parallel configuration. It is important to note that although the cells are assumed to behave identically to simplify the analysis, slight differences in behaviour have been observed even among cells from the same production batch [

36].

The empirical degradation model considers two crucial factors: battery cycling and calendar ageing. The model was extracted from [

30], also using information from [

20]. The model is based on the approach from Liaw et al. [

37] in which a relatively simple equivalent circuit model simulates the battery performance and life cycling using a coupled thermal ageing model. However, all nonlinear parameters in the model were determined through empirical means. In the tests presented in [

20], the authors found two different dependencies during cycling ageing analysis. One related to capacity reduction, or

and one to internal resistance increase,

.

All the experimental data regarding battery capacity fading and resistance degradation used in this work was extracted from reference [

20]. However, all the curve fitting procedures have been revisited, and improvements in the fitting quality have been implemented, as explained below.

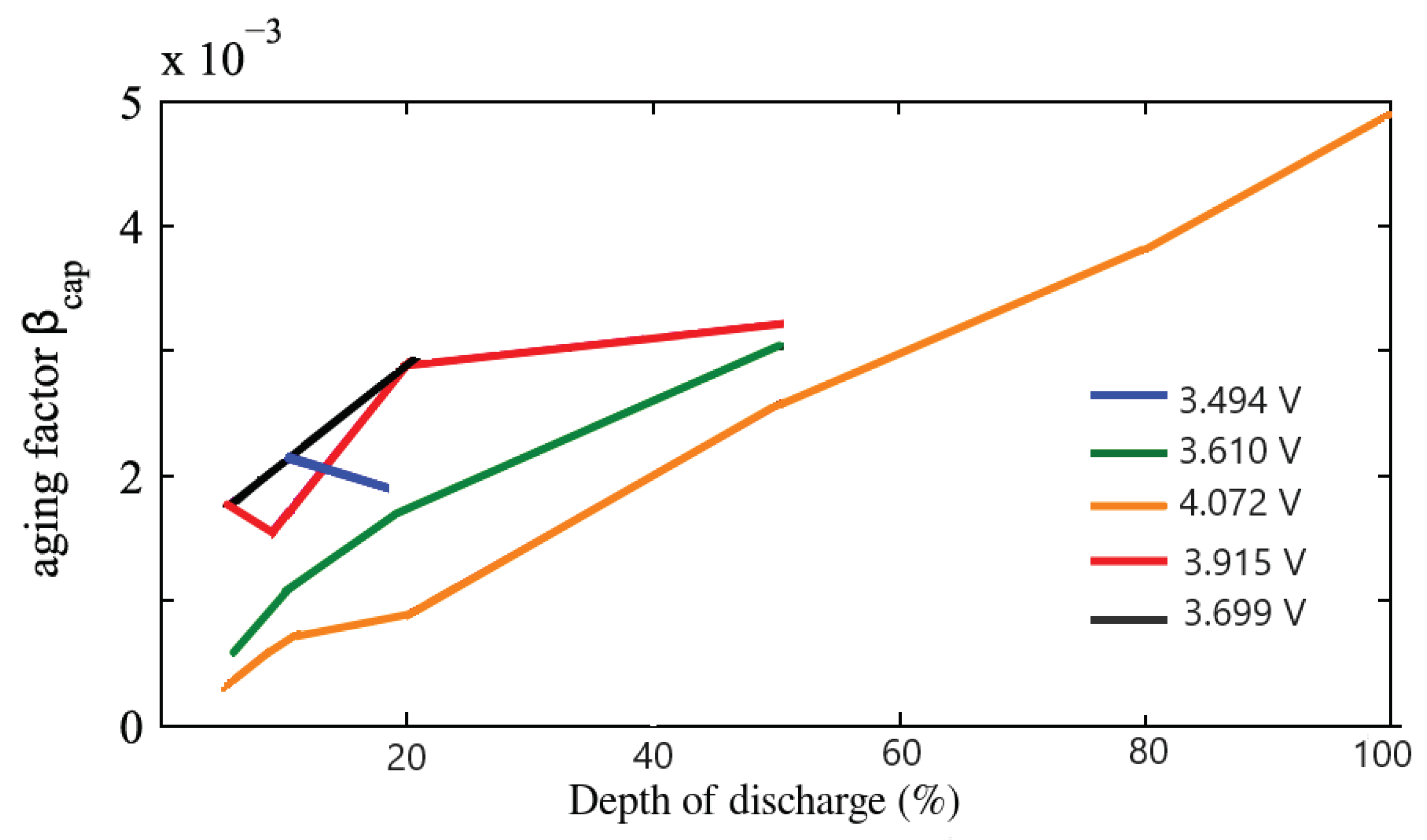

To begin with, we examined the reduction of battery capacity due to battery cycling. The relationship between the capacity reduction during battery cycling and the charge that passes through the battery is determined by Equation (

1). On the other hand, the increase of resistance during battery cycling and the charge passing through the battery is determined by Equation (

3). The experimental data set to estimate the parameter

was digitally extracted from Figure 11 of reference [

20]. The data points are shown in

Table 1. The data showed that

is strongly dependent on both the average battery voltage (

) and the depth of discharge

as shown in

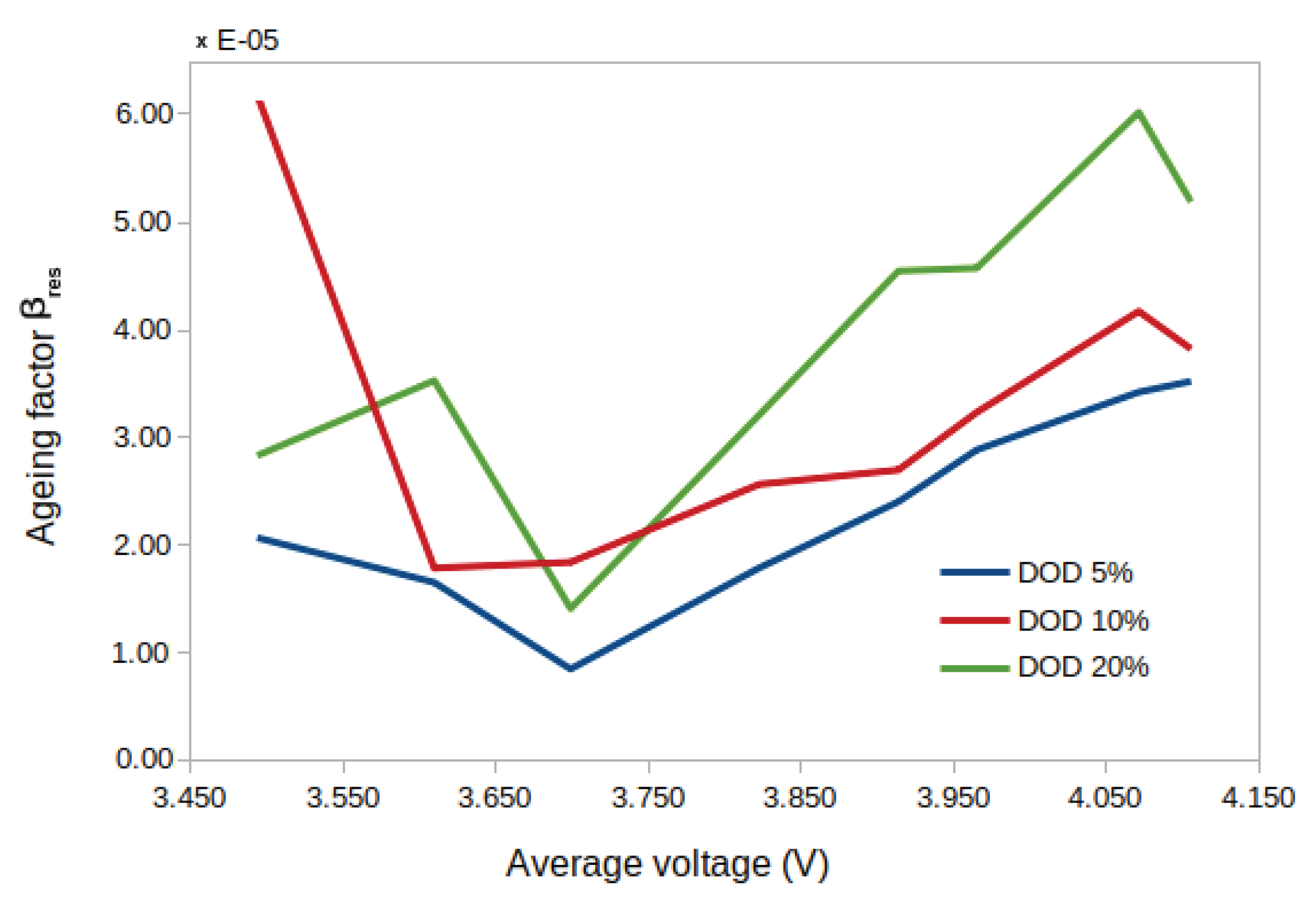

Figure 3.

In reference [

20], the author proposed a method for effectively linking the parameters

and

with the voltage and depth of discharge. They suggested a linear function combined with a quadratic function. While this approach is reasonably accurate, we chose to use a different methodology. We opted for the bilinear interpolation function, a feature provided by PSOPT, optimal control solver used in this work [

38]. We sampled the data based on voltage and depth of discharge, and the data points are presented in

Table 1.

Second, we consider degradation in the capacity via calendar ageing. Here, the battery capacity varies with time, particularly with

, according to the Equation (

3). The calendar ageing data showed that

and

strongly depend on the average battery voltage and the cell temperature

T. Therefore, they can be approximated using a single two-variable interpolation function to fit both dependencies simultaneously.

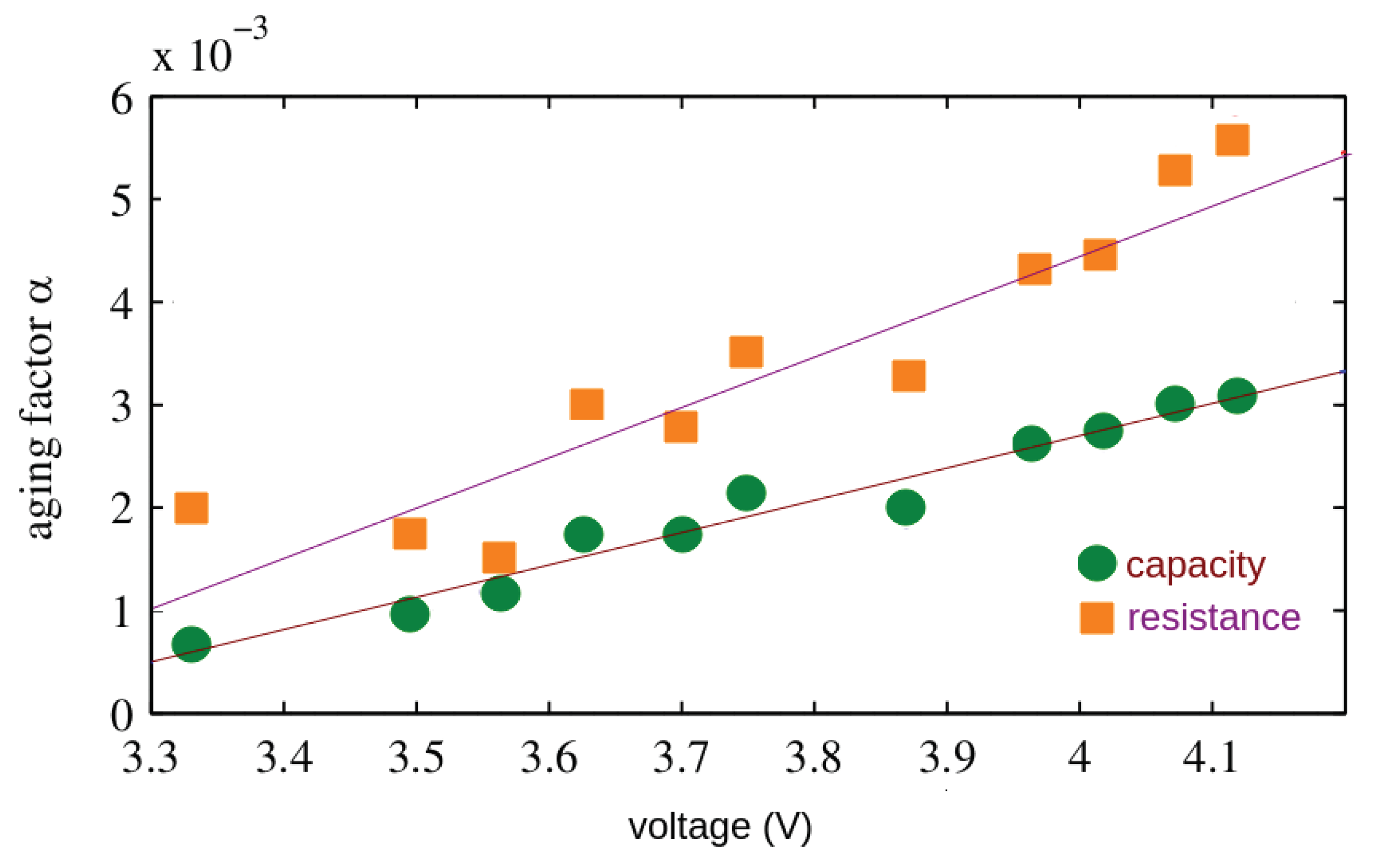

It can intuitively be observed from the graphs that

is linearly dependent on the voltage and follows the Arrhenius formula for temperature dependency according to the following equations:

where the variables

,

T and

R are the activation energy, temperature in Kelvin and the universal gas constant, respectively. The parameter

is a combination of both results as shown in Equation (

13):

Equation (12) can be transformed into a linear function using the natural logarithm function, as shown in Equation (

14)

The experimental data set to estimate the parameter

and

for the linear case was digitally extracted from Figure 8 in reference [

20] and is shown in

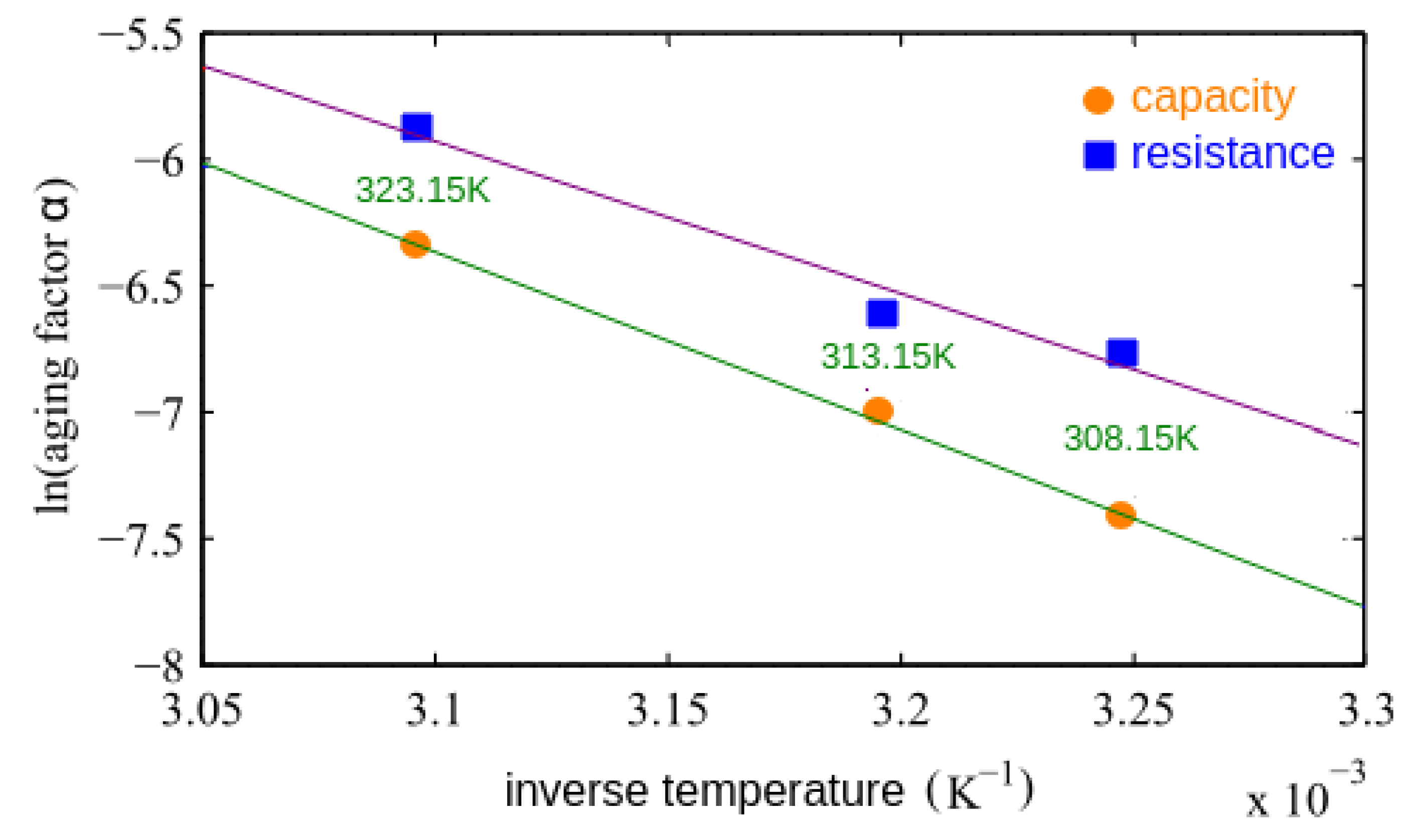

Figure 4.

Employing linear regression (the brown line in the figure) has yielded the subsequent linear approximation:

Similarly, the experimental data set to estimate the parameter

and

for the exponential case was digitally extracted from Figure 9 in reference [

20] and is plotted in natural logarithm scale in

Figure 5.

For the temperature dependency, using the data points shown in

Figure 5 to produce a linear interpolation (green line), and employing linear regression has yielded the subsequent linear approximation:

and finally, the parameter

is given in Equation (

17):

Equations (

15) and (

17) cannot be combined into a single equation, as suggested in Equation (

13), because the two fitting functions,

and

, do not match precisely for all the experimental data. Therefore, we will use the technique proposed in reference [

20]. The approach is to average

and

at the temperature of

, where the two experimental curves intersect. The resulting value is named

and it is used for scaling both fitting functions is a single one. Then apply this scale factor to the final

equation.

From

Figure 4,

at

T=

is 0.0016368, and from

Figure 5,

is 0.0001746702. Hence, the scale factor applied to

is given in Equation (

18):

Applying the scale factor to

and

:

The resulting scale factor that needs to be applied to the fitting function

is given in Equation (

21):

By combining equations (

15) and (

17) with (22), the final expression for

is given in equation (

23):

The estimation of the total capacity lost considering cycling ageing and calendar ageing is the superposition of the

as shown in Equation (

1) and

as shown in Equation (

3).

A similar procedure was applied to find the values for degradation in the resistance,

. The experimental data set to estimate the parameter

was digitally extracted from Figure 12 (

b) of reference [

20]. We used a bilinear interpolation function, which is provided in the optimal control solver, PSOPT. The data was sampled for different values of voltage and depth of discharge. The data points are shown in

Table 2.

The data showed that

is strongly dependent on both the average battery voltage (

) and the depth of discharge

as shown in

Figure 6.

To obtain

, we followed the same steps as before, with

being defined in Equation (

18). The data points are shown in

Figure 4 and

Figure 5. Equation (

24) provides the expression for

:

The estimation of the total resistance increase considering battery cycling and calendar ageing is the superposition of the

as shown in Equation (

2) and

as shown in Equation (

4).