1. Introduction

New energy industry is an important basis for measuring the level of high-tech development of a country and region, but also a new round of international competition in the strategic high ground, the world's developed countries and regions are the development of new energy as a trend of science and technology, and promote the important initiative of industrial restructuring. At present, the global new energy vehicle industry is accelerating the development of Europe, the United States and Japan are the wisdom of new energy vehicles as a new round of scientific and technological revolution in the pilot industry and the main carrier, to increase support. Against the backdrop of its commitment to achieve carbon peak by 2030 and carbon neutrality by 2060 in response to global climate change, China has taken new energy vehicles as a new breakthrough in the development of high-end industries, and as an important measure to promote the realization of the "dual-carbon" national goal and the construction of a strong advanced manufacturing country. As a new breakthrough in the development of high-end industries, new energy vehicles have been taken as an important hand in promoting the realization of the national goal of "dual-carbon" and the construction of an advanced manufacturing power.

However, regional disruptions in the industrial chain caused by the trade war between the United States and China, global supply and demand uncertainty, natural disasters, social unrest, terrorism, and financial crises have increased the uncertainty of the global political situation. Localized disruptions can be mitigated by support from neighboring regions in the vicinity of the resulting risk of industry chain breakage (Singh, etal., 2023). Especially after the outbreak of the new crown epidemic, regional governments have taken various measures to increase the resilience of healthcare shocks, but the physical isolation and blockade brought about by these measures have had a devastating impact on the logistics industry, especially some automobile manufacturing industries with strong industrial linkages and multinational cooperation, many of which have been embedded in the global automotive industry chain network, and these measures have seriously affected the automotive supply chain chain development (Belhadi, Amine, etal., 2021). In this context, some scholars have called for the need to think about the global value chain, and managers need to increase the thinking in the automotive industry chain supply chain, how to mitigate the risk of similar shocks in the future to protect the healthy development of the automotive industry chain supply chain (Shih, 2020). However, regional disruptions in the industry chain caused by the U.S.-China trade war, global supply and demand uncertainty, natural disasters, social unrest, terrorism, and financial crises have increased the uncertainty of the global political situation. Localized disruptions can be mitigated by support from neighboring regions in the periphery thus posing a risk of industry chain breakage (Singh, etal., 2023). Especially after the outbreak of the new crown epidemic, regional governments have taken various measures to increase the resilience of healthcare shocks, but the physical isolation and blockade brought about by these measures have had a devastating impact on the logistics industry, especially some automobile manufacturing industries with strong industrial linkages and multinational cooperation, many of which have been embedded in the global automotive industry chain network, and these measures have seriously affected the automotive supply chain chain development (Belhadi, Amine, etal., 2021). In this context, some scholars have called for the need to think about the global value chain, and managers need to increase the thinking in the automotive industry chain supply chain, how to mitigate the risk of similar shocks in the future to protect the healthy development of the automotive industry chain supply chain (Shih, 2020).

In this context, this study is based on the concept of industry chain resilience to build a new energy vehicle industry chain resilience comprehensive evaluation index system, to conduct a comprehensive evaluation of the resilience of the new energy vehicle industry chain in the region, through the resilience of the comprehensive evaluation, to help new energy vehicle enterprises and relevant government departments to make up for the industry chain and strengthen the industry chain, to improve the resilience of the industry chain, and to reduce the risk of the industry chain in the face of the changing global political and economic situation.

2. Research Review

In the Yangtze River Delta region's most economically active southern Jiangsu, Changzhou, which had been overshadowed by Suzhou and Wuxi, Jiangsu Province, is taking advantage of new energy to realize a strong rise in the "Suzhou, Wuxi and Changzhou" city belt. 2023 World New Energy Expo Hurun Research Institute released the "2023 Hurun China's new energy industry agglomeration of cities list", which ranked Changzhou fifth in China's new energy industry agglomeration, the only non-provincial capital city Changzhou ranked fifth in China's new energy industry concentration, the only non-provincial capital city. Hurun, Chairman and Chief Research Officer of Hurun Billion, said, "Changzhou not only has the headquartered chain master enterprises such as China Innovation Aviation, Beehive Energy and Trina Solar, but also more than 70% of the chain master enterprises in the domestic segment, such as Ningde Times, Ideal, BYD, Bertrams, and Xingyuan Materials, etc., have set up their manufacturing bases and R&D institutes in Changzhou, such as the largest production base in the Yangtze River Delta for Ningde Times, the largest production base for Ideal Automobile in Changzhou, and the largest production base for Ideal Automobile in Changzhou. For example, the largest production base of Ningde Times in the Yangtze River Delta region is located in Changzhou, and the largest production and manufacturing base of Ideal Automobile in China is also located in Changzhou. At present, Changzhou has formed an industrial ecological closed loop of 'development, storage, delivery, use and research', and the production and sales volume of complete vehicles and power batteries account for half of the entire Jiangsu Province.

Changzhou new energy vehicle industry layout began in 2010, the production of the first new energy vehicles for the Yellow Sea new energy vehicles. 2015 Ideal Automobile in Changzhou to build production base, September 2019 began to put into production; 2019 BYD plant in Changzhou, 2022 BYD Changzhou base began to put into production. Ideal and BYD quickly drive the development of new energy vehicle industry chain in Changzhou, and BAIC Group's new energy heavy trucks are also produced in Changzhou. At the same time, Changzhou City, based on the existing resource endowment and equipment manufacturing industry foundation, comprehensively promotes the development of new energy vehicle industry clusters through the collection of a number of leading projects, and has formed a new energy vehicle industry cluster covering the entire vehicle, body system components, engine and its components, raw materials and equipment, power battery components, chassis System components, electronics and electrical appliances, motor electric control and other relatively complete industrial chain, has become the Yangtze River Delta new energy vehicle plate in the longest industrial chain, involving the most complete areas of one of the regions (as shown in

Table 1). According to

Table 1, Changzhou new energy vehicle industry chain develops the following advantages: First, the core industry chain of new energy vehicle industry chain is relatively complete, the core of new energy vehicle industry is the whole vehicle and power battery, in which BYD, BAIC New Energy, Ideal Automobile and other new energy leading enterprises as well as the new car-making forces lay out their production bases in Changzhou; Changzhou clusters of power batteries and ancillary enterprises covering the upper reaches of the raw materials, functional materials and manufacturing equipment, midstream battery core, electric motor and electric control. Manufacturing equipment, midstream core, module and system, downstream vehicle, recycling, laddering, energy storage, testing and evaluation, expanding the application of 94% of the industry chain, the production capacity of China's first; Second, the core parts and components supporting a complete, charging pile gas permeability enterprises to lead the effect is prominent. Changzhou around the body system field layout of enterprises covering the body, interior and exterior decoration, air conditioning systems, car seats, etc., Star Lights, Deepland Technology, Handley Electronics, Jiangsu Kuangda Group, Star Charge are China's new energy automotive industry chain core enterprises, especially Star Charge is China's largest charging pile service providers and private piles to share the platform for China's more than 60 vehicle enterprises to provide charging pile services.It is these "anchor firms"(De Ruyter et al.,2021) in the new energy vehicle industry chain that continue to attract smaller innovative companies to gather in Changzhou, continuously improving and increasing the new energy vehicle industry chain.

Table 1.

Changzhou New Energy Vehicle Industry Chain Supply Chain Leading Enterprises Mapping.

Table 1.

Changzhou New Energy Vehicle Industry Chain Supply Chain Leading Enterprises Mapping.

| Large Categories |

Medium Categories |

Small Categories |

Business Directory |

| automotive electronics |

digital instrument |

digital instrumentation |

Continental Holding China Co., Ltd |

| Boshi China Investment Co.,Ltd.* |

| Visteon Automotive Electronics System Co.,Ltd. |

| Shanghai Delco Electronics Instrumentation Co., Ltd. |

| Johnson Controls(China)Investment Co.,Ltd. |

| car stereo |

BOSE ELECTRONICS (SHANGHAI) COMPANY LIMITED |

| Harman International(China)Holdings Co.,Ltd. |

| Dynaudio Shanghai Co., Ltd. |

| Shenzhen Hangsheng Electronics Co.,Ltd. |

| Guangdong Huayang Multi-media Electronics Co., Ltd. |

| safety systems |

Shenzhen Zhongtian Xun Communication Technology Shares Co., Ltd. |

| Tianma MICROELECTRONICS Co., Ltd. |

| Qiming Information Technology Co., Ltd. |

| Quanzhou Minpn Electronic Co., Ltd. |

| Shenzhen Silver Basis Technology Co., Ltd. |

| Vehicles Head-Up Display |

Guangdong Huayang Multi-media Electronics Co., Ltd. |

| Ningbo Joyson Electronic Corp. |

| Zhejiang Crystal-Optech Co., Ltd. |

| E-Lead Electronic Technology (Jiangsu) Co., Ltd. |

| Shenzhen Raythink Technology Co., Ltd. |

| Central Control Integration |

Huizhou Desay SV Automotive Co., Ltd. |

| Huizhou Foryou General Electronics Co., Ltd. |

| Shenzhen Roadrover Technology Co., Ltd. |

| ECARX (Hubei) Technology Co., Ltd. |

| Shenzhen Hangsheng Electronics Corp.,ltd. |

| Automotive Wiring Harness |

wiring harness |

YAZAKI (CHINA) Investment Corporation |

| Aptiv Electric SYSTEMS Co., Ltd. |

| Lear Shanghai Automotive Metals Co., Ltd. |

| Amphenol Assembletech (Xiamen) Co., Ltd.* |

| Leoni Cable (China) Co., Ltd.* |

| vehicle connectors |

YAZAKI (CHINA) Investment Corporation |

| Lear Shanghai Automotive Metals Co., Ltd.ment Co.,Ltd. |

| Aptiv Electric SYSTEMS Co., Ltd. |

| Ningbo Fuerda Smartech Co., Ltd. |

| TYCO Electronics (SHANGHAI) Co., Ltd. |

| vehicle electrical components |

vehicle sensors |

DENSO (CHINA) Investment Co., Ltd. |

| Boshi China Investment Co.,Ltd.* |

| Continental Holding China Co., Ltd |

| Jiangsu Olive Sensors HIGH-TECH Co., Ltd. |

| Sensata TECHNOLOGIES China Co., Ltd.* |

| vehicles switch |

Shanghai Toyo Denso Co., Ltd. |

| Shanghai Yihang Automobile Parts Co., Ltd. |

| Zhejiang Wanchao Electric Co., Ltd. |

| AT&S (CHINA) Company,limited |

| Vehicles electric motors and actuators |

BYD Company Limited* |

| Tuosule Automobile Sales (Beijing) Co., Ltd. |

| Shenzhen Inovance Technology Co., Ltd.* |

| Shanghai Edrive Co., Ltd. |

| Zhongshan BROAD-OCEAN MOTOR Co., Ltd. |

Vehicles

relays |

TYCO Electronics (SHANGHAI) Co., Ltd. |

| Panasonic Corporation of China |

| BAIC Daimos (Cangzhou) Automotive System Co., Ltd. |

| Hongfa Technology Co., Ltd. |

Vehicles

batteries |

Johnson Controls (China) Investment Co., Ltd. |

| Boshi China Investment Co.,Ltd.* |

| Camel Group Co., Ltd. |

| Lithium source power group in China |

| Shenzhen Leoch Power Development Co., Ltd. |

| Vehicles Telematics |

Vehicles Park Assist |

Boshi China Investment Co.,Ltd. |

| Continental Holding China Co., Ltd |

| TUNG THIH ELECTRONIC CO., LTD. |

| Hefei Softec AUTO Electronic JOINT-STOCK Co., Ltd. |

| Vehicles Tire Pressure Monitoring |

Shanghai Baolong Automotive Corporation |

| Shanghai Qunying Machinery Co., Ltd. |

| Shanghai Tonzie Auto Parts Co., Ltd. |

| Continental Holding China Co., Ltd |

| Guangdong Pacific Internet Information Service Co., Ltd. |

| In-Vehicle Infotainment |

Huizhou Desay SV Automotive Co., Ltd. |

| Shenzhen Hangsheng Electronics Corp.,ltd. |

| Jingsu Toppower Automotive Electrionics Co., Ltd. |

| DENSO (CHINA) Investment Co., Ltd. |

| Pioneer China Holding Co., Ltd. |

| Vehicle Cruise Control |

Boshi China Investment Co.,Ltd. |

| Continental Holding China Co., Ltd |

| Aptiv Electric SYSTEMS Co., Ltd. |

| Fluya Auto Parts (Changzhou) Co., Ltd.* |

| Hainachuan Haila Electronics (Jiangsu) Co., Ltd.* |

| Vehicles Intelligent Connectivity |

Vehicle Intelligent Connectivity Sensing System |

In-vehicle Infrared System |

Venninger (Shanghai) Automotive Safety System Co., Ltd. |

| Wuhan Xuanyuan Zhijia Technology Co., Ltd. |

| Hangzhou Hikvision DIGITAL Technology Co., Ltd. |

| Guangzhou SAT Infrared Technology Co., Ltd. |

| Zhejiang Dali Technology Co., Ltd. |

| Millimeter Wave Radar |

Boshi China Investment Co.,Ltd.* |

| Continental Holding China Co., Ltd |

| Hella Shanghai Electronics Co., Ltd. |

| Tianjin Fujitsu TEN Electronic Co., Ltd. |

| DENSO (CHINA) Investment Co., Ltd. |

| In-vehicle Camera |

Boshi China Investment Co.,Ltd.* |

| DENSO (CHINA) Investment Co., Ltd. |

| Valeo Ichikoh (China) Auto Lighting Co., Ltd. |

| Zhejiang Sunny Optics Co., Ltd. |

| Hangzhou Hikvision Electronics Co., Ltd. |

| In-vehicle LiDAR |

Valeo Interior Controls (SHENZHEN) Co., Ltd. |

| Hesai Technology Co., Ltd. |

| Suteng Innovation Technology Co., Ltd. |

| Luminar Technologies, Inc. |

| Huawei TECHNOLOGIES Co., Ltd. |

| Vehicles V2X Communications |

T-box |

Continental Holding China Co., Ltd |

| Boshi China Investment Co.,Ltd. |

| DENSO (CHINA) Investment Co., Ltd. |

| Shenzhen Hamankaton Industrial Co., Ltd. |

| LG Electronics (CHINA) Co., Ltd. |

| Communication Module |

Huawei TECHNOLOGIES Co., Ltd. |

| ZTE Corporation |

| Quectel Wireless Solutions Co., Ltd.* |

| Kuandong (Huzhou) Technology Co., Ltd. |

| Fibocom Wireless Inc. |

| WIFI、In-vehicle Bluetooth |

Cisco China Company, Limited |

| Shenzhen Shengkeweiye Technology Co., Ltd. |

| Jabra (Germany) Technology Co., Limited |

| Shenzhen Soaiy Technology Co., Ltd. |

| Philips Electronic Components (Shanghai) Co., Ltd. |

| Vehicle Actuation Systems |

Vehicle steering system |

KYB Industrial Machinery (Zhengjiang) Ltd. |

| Continental Holding China Co., Ltd |

| Boshi China Investment Co.,Ltd. |

| Nanjing Schaeffler Automation Equipment Co., Ltd. |

| Huayu Automotive Systems Company Limited |

| Vehicle Braking Systems |

Continental Holding China Co., Ltd |

| Boshi China Investment Co.,Ltd. |

| Zf Drivetech (Suzhou) Co., Ltd. |

| Bethel Automotive Safety Systems Co., Ltd. |

| BWI (Shanghai) Co., Ltd. |

| Vehicle Drive Systems |

Continental Holding China Co., Ltd |

| Boshi China Investment Co.,Ltd. |

| DENSO (CHINA) Investment Co., Ltd. |

| Ningbo Wanan Co., Ltd. |

| BYD Company Limited |

| Map Navigation |

Navigation Module |

Shanxi Tianbao Group Co., Ltd. |

| Honeywell International Inc. |

| Chengdu Jiaming Hangdian Technology Co., Ltd. |

| ComNav Technology Ltd. |

| Martin Thought Strong Beidou Navigation Co., Ltd. |

| high definition map |

Beijing Baidu Netcom Science and Technology Co., Ltd. |

| NavInfo Co., Ltd. |

| Amap Software Co., Ltd. |

| EMAPGO Technologies (Beijing) Co., Ltd. |

| Wuhan Kotei BIG DATA Co., Ltd. |

| Decision Making System |

Autonomous Driving System |

Baidu Online Network Technology (Beijing) Co., Ltd. |

| Alibaba(China)Network Technology Co., Ltd. |

| Shenzhen Tencent Computer Systems Company Limited |

| Beijing Pony.Ai Science and Technology Co., Ltd. |

| Guangzhou WeRide Technology Limited Company |

| Domain Controller |

Shanghai Visteon Automotive Electronics System Co., Ltd. |

| Continental Holding China Co., Ltd |

| Boshi China Investment Co.,Ltd. |

| ZF Transmissions Shanghai Co., Ltd. |

| Magna Steyr Automotive Technology (Shanghai) Co., Ltd. |

Electric Vehicle Charging Infrastructure

|

Motor control unit |

Silicon Steel Sheets |

Baowu Special Metallurgy Co., Ltd. |

| Taiyuan Steel (Group) Co., Ltd. |

| Ansteel Group Co., Ltd. |

| Vehicle Motor Controller |

BYD Company Limited* |

| Shenzhen Inovance Technology Co., Ltd.* |

| Tesla Shanghai Co., Ltd. |

| Guangdong United Electronic Fee-Collecting Co., Ltd. |

| XPT (Nanjing) E-powertrain Technology Co., Ltd. |

| Vehicle Inverters |

BYD Company Limited |

| Infineon Technologies (China) Co., Ltd. |

| STMicroelectronics(China)Investment Co.,Ltd. |

| Toshiba Mitsubishi-Electric Industrial Systems(China)Corp. |

| MacMic Science&Technology Co.,Ltd.* |

| Vehicles Magnetic Materials |

Hengdian Group DMEGC Magnetics Co.,Ltd |

| Beijing Zhong Ke San Huan High-tech Co.,Ltd. |

| NINGBO YUNSHENG MAGNETIC MATERIALS CO.,LTD. |

| Jinhua Yingluohua Magnetism Industry Co.,Ltd. |

| Yantai Zhenghai Magnetic Material Co.,Ltd. |

| Other parts such as bearings |

C&U Group Shanghai Bearing Co.,Ltd. |

| Tieling Fangxiang Group Electron Technology Co.,Ltd. |

| BH Technology Group Co.,Ltd. |

| Wafangdian Bearing Company Limited |

| Luoyang LYC Bearing Co., Ltd. |

| Vehicles Charging Facilities |

Charging Pile Manufacturing |

Wanbang Star Charging Technology Co., Ltd.* |

| Yishite Energy Storage Technology Co., Ltd. |

| NARI Energy Co., Ltd. |

| Qingdao TGOOD Electric Co., Ltd. |

| Shenzhen Kstar Science & Technology Co., Ltd. |

| Charging Facility Operation |

Wanbang Star Charging Technology Co., Ltd.* |

| Teltel new energy Co., Ltd |

| State Grid Corporation Of China |

| YKC Clean Energy Technologies |

| EV Power Holding Limited |

| Production Equipment |

Stamping Equipment |

Schuler Sales&Service Co.,Ltd. |

| Komatsu Shantui Construction Machinery Co.,Ltd. |

| JIER Machine-Tool Group Co.,Ltd. |

| XIE YI TECH MACHINERY (CHINA) CO.,LTD. |

| Jiangsu Yangli Group Co.,Ltd. |

| Welding Equipment |

Guangzhou Ruisong Technology Co.,Ltd. |

| Guanghzou MINO Automation Co.,Ltd |

| Wuhan Huagong Laser Engineering Co.,Ltd. |

| Han's Laser Technology Industry Group Co.,Ltd. |

| Shanghai Demeike Auto Equipment Manufacturing Co., Ltd. |

| Coating Equipment |

Dürr Paintshop Engineering (Shanghai) Co., Ltd |

| Gearchief Eissmann Changchun Automotive Parts Co.,Ltd. |

| Yangzhou Viburnum Painting Engineering & Technology Co.,Ltd |

| Jiangsu Piaoma Intelligent Equipment Co.,Ltd.* |

| Miracle Automation Engineering Co., Ltd. |

| Vehicle Body Moulds |

Tianjin Motor Dies Co.,Ltd. |

| FAW TOOLING DIE MANUFACTURING CO.,LTD. |

| Anhui CITC & Rayhoo motor dies co,. ltd |

| YANTAI SUPERIOR DIE TECHNOLOGY CO.LTD |

| Lithium-ion Power Equipment |

Wuxi Lead Intelligent Equipment CO.,LTD. |

| Shenzhen Yinghe Technology Co.,Ltd. |

| Zhejiang Hangke Technology Co.,Ltd. |

| Guangdong Lyric Robot Automation Co.,Ltd. |

| Han's Laser Technology Industry Group Co.,Ltd.* |

| Shanghai Putailai New Energy Technology Co.,Ltd. |

| Hymson Laser Technology Group Co.,Ltd.* |

| Shanghai SK Special Machinery Co.,Ltd. |

| United Winners Laser Co.,Ltd.* |

| Funeng Oriental Equipment Technology Co.,Ltd |

| R&D and Testing Organization |

Research and Development Organization |

The National New Energy Vehicle Technology Innovation Center |

| CHINA AUTOMOTIVE TECHNOLOGY AND RESEARCH CENTER CO.,LTD. |

| CATL Future Energy Research Institute |

| CALB Technology Co., Ltd.* |

| Tianmu Lake Institute of Advanced Energy Storage Technologies* |

| Quality Testing Organization |

National Center Of Quality Supervision & Inspection Of Vehicles |

| CATARC Automotive Test Center Co., Ltd* |

| National Quality Inspection and Testing Center of Storage and Power Battery |

| National Quality Inspection and Testing Center of Pneumatic Products |

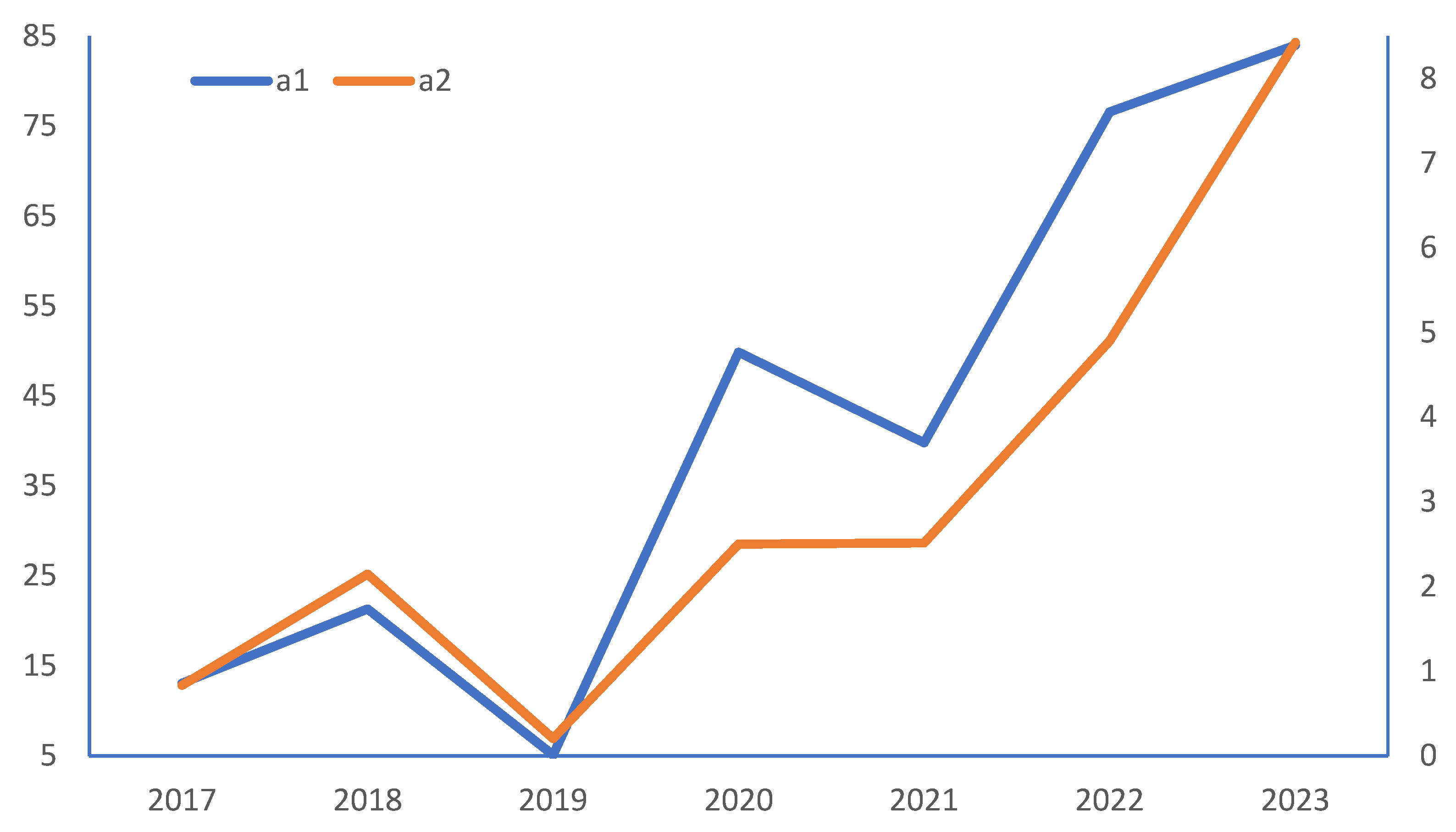

Figure 1 demonstrates the share of Changzhou's new energy vehicle production in Jiangsu Province and China's new energy vehicle production. a1 is the share of Changzhou's new energy vehicle production in Jiangsu Province's new energy vehicle production, and a2 is the share of Changzhou's new energy vehicle production in China's new energy vehicle production. a1 and a2 folds have been soaring since 2019, showing Changzhou's new energy vehicle industry's rapid development.

New energy vehicles and spare parts and power batteries have become the pillars of Changzhou's new energy economic development. During the new crown epidemic, the new energy vehicle industry chain supply chain in Changzhou also faced the production chain supply chain crisis. Based on this, this study tries to adopt resilience to assess the adaptive capacity of the new energy vehicle industry chain supply chain in the face of external risk shocks.

Figure 1.

Changzhou's share of new energy vehicle production in Jiangsu Province and China (%).

Figure 1.

Changzhou's share of new energy vehicle production in Jiangsu Province and China (%).

The term resilience was first used in physics to refer to the ability of a material to absorb energy during plastic deformation and rupture; the better the resilience, the lower the probability that a material will undergo brittle fracture. Scholars have since introduced the concept of resilience into ecology to measure the ability of natural systems to maintain their status quo ante or recover quickly in the face of external shocks such as anthropogenic or natural factors (HollingCS, 1973), and resilience has since evolved in a number of disciplines, with measurements oriented towards coping with multiple, multi-scale disturbances, and with an emphasis on the ability of the system to achieve a dynamic equilibrium that is constantly self-adaptive and self-recovery in the process of change. Reggianietal. introduced resilience into the field of economic research, proposing that resilience can explain the key elements of different regions that perform differently under the influence of external shocks (Reggianietal., 2022), especially after the international financial crisis in 2008, the different recovery performances of different economies in the context of coping with the shocks of the international financial crisis triggered more and more scholars' attention to resilience. Resilience refers to the ability to cope with unexpected disruptions caused by natural disasters or terrorist attacks and quickly return to normal operations (Rice, Caniato, 2003).Martin proposed that resilience is categorized into four dimensions of vulnerability, recoverability, adaptability and innovation, which has been adopted by many scholars, and then this framework is widely used in the economic field to study economic resilience (Martin, 2012).

Industrial chain resilience is both an important component of economic resilience and a part of regional resilience. According to the hierarchical nature of the concept of resilience, industry chain resilience can also be divided into three levels, which is the ability of enterprises in the industry chain to quickly recover and adapt to supply chain disruptions after facing disruptive shocks, and resilient industrial supply chains can anticipate the phenomenon of business disruptions in the industry chain and quickly restore the supply chain to a good state of production and operation, thus generating competitive advantages (Alietal., 2017). In other words, resilient industrial supply chains manage the adaptive capacity of supply chain disruptions through bending, which is conducive to maintaining or increasing the competitive advantage of the industrial chain (Ambulkaretal., 2015).

For firms in the chain, resilience is an important capability for many companies to mitigate traditional risks (Fikseletal.,2015). Resilience focuses on considering unexpected risks as a whole and preventing localized risks from propagating through the system to other elements and components. Protecting the entire system and the behavior and function of that system is extremely important.

Regional economic resilience refers to the ability of a region's economy to withstand shocks in the face of external disruptions, or to move away from the existing growth model and choose a better path. Resilience represents the region's adaptability, innovation, and sustainability (LeeY-H, et.al., 2023). Supply chain resilience is the adaptive capacity of a supply chain to prepare for unforeseen events, respond to disruptions, and recover from them by maintaining continuity of operations at the required level of connectivity and control over structure and function (Ponomarov,Holcomb,2009). Chain resilience is the adaptive capacity of the system to respond to disruptions in a better way and even gain advantage from such events (Brandon-Jonesetal.,2014).

After the new coronavirus epidemic, there are more studies on the supply chain of the automotive industry chain, but these studies stay more in the qualitative research or case study stage. Studies related to the resilience of the automotive industry chain can be categorized into the following aspects:

Conceptual definition of automotive industry chain supply chain resilience. Automotive industry chain resilience refers to the fact that in today's rapid development of globalization, enterprises in the automotive industry supply chain can prevent the industry chain from breaking and recovering to the original state after facing the impact of internal and external sudden and destructive events, or promote the industry chain or the supply chain to extend to the high value-added, and strengthen the ability of the industry chain supply chain to be autonomous and controllable (Hosseini, 2019; Ali, A., etal. 2017) According to Martin's (2012) application of resilience in economic and social fields, automotive industry chain resilience consists of four forces, coping resistance, adaptive resilience, autonomous control and leading competitiveness. Coping resistance is the focus, the first and foremost, is the premise of the other "three forces". When the industrial chain supply chain is interfered or impacted by internal and external factors, it can cope, resist and not be swallowed up by the interfering impact, which is the first layer of expression of the resilience of the new energy vehicle industrial chain; adaptive resilience is the key, escorting the other "three forces". When the industrial chain faces interference or impact, it can still recover and adapt to the self-regulation ability and recovery ability to promote the adaptability and stability of the industrial chain supply chain, which is the second layer of expression of the resilience of the new energy automotive industry chain; autonomous control and leading competitiveness is the support, which shows the strength of the other "two forces". When the industry chain faces interference or impact, enterprises in the industry chain can anticipate, prejudge and prevent in advance. These "four forces" are an organic whole, interconnected, complementary, mutually reinforcing, indispensable. For example, after the outbreak of the new crown epidemic in 2019, regional governments have adopted corresponding methods of treatment, and these management policies have been introduced due to logistics factors, employee factors, or factors that cause automotive suppliers to be unable to deliver auto parts on time and in quantity, resulting in automotive manufacturers to reduce the production volume or even suspend production.

Measurement of automotive industry chain resilience. Automotive industry chain resilience is a new and important dimension of system performance under uncertainty, consisting of resilience-enhancing features that improve the system's ability to absorb, adapt, and recover itself after a disruption (Hosseini, Barker, 2019; Biringeret.al.,2013). And the industry chain supply chain resilience is divided into four levels of enhanced industry chain supply chain resilience, industry chain supply chain resilience capacity, supply chain industry chain vulnerability and recoverability, and industry chain supply chain resilience, the bottom layer is enhanced industry chain supply chain resilience, which consists of the industry chain manufacturing industry's residual inventory and standby inventory; enhanced industry chain supply chain resilience features constitute the resilience of the industry chain supply chain, including absorption, Adaptation and recovery capacity; the vulnerability and recoverability of the industrial chain supply chain is a function of the recovery capacity, the supply chain with higher recovery capacity needs less work to return to the normal state, and the supply chain with less recovery capacity needs more efforts to return to the normal state; the industrial chain resilience is located in the top level of the structure, and it is a function of the vulnerability and recoverability of the industrial chain.

Influencing factors of automotive industry chain supply chain resilience. The influencing factors of automotive industry chain supply chain resilience are (1) information technology. In the automotive industry, DSC technology is widely used to communicate effectively with the help of data among supply chain entities such as dealers, original equipment manufacturers, suppliers and service providers. The role of digital supply chain technology in automotive supply chain resilience practices to improve the supply chain performance objectives of companies in the automotive industry. A questionnaire survey of practitioners from automotive supply chain entities such as automotive original equipment manufacturers (OEMs), Tier 1 component manufacturers, and leading logistics providers in the emerging markets of Asia-Pacific argues that digital technology moderates supply chain resilience in the automotive industry through digital supply chain technological capabilities, which is conducive to the achievement of industry chain performance objectives.

(2) Localized supply sources. One of the best strategies in the automotive industry to mitigate the risks associated with NCCP is to develop localized sources of supply (AmineBelhadi, et.al., 2021). If sourcing (and processing) is localized in the same region to meet local demand and reduce supply chain integration. As a result, the risk of disruption can be contained within the region because risk events do not spread from one region to another (KochanandNowicki, 2019; Iakovouetal.,, 2014).

(3) Relationships with multinational enterprises. TNCs have the potential to play a key role in situations of natural disasters. Foreign TNCs and local firms in host countries interact through input-output linkages. When natural disasters hit local firms hard, thereby increasing the cost of sourcing local intermediate inputs, most TNCs may leave the host country. However, they are likely to stay if they have close relationships with local suppliers and if the trade costs of importing foreign intermediates are low. (HayatoKato, ToshihiroOkubo, 2022)

3. Building the Comprehensive Evaluation Index System for the Resilience of the New Energy Vehicle Industry Chain

Industrial chain resilience combines the functions of planning and preparing for future crises, and also includes the functions of adapting to changes and disruptions (BarasaE,MbauR,GilsonL., 2018). In addition, the industrial chain is a complex system, and complex systems not only need to observe the characteristics of each part to understand, but also need to observe the results of interactions from the time dimension, and the industrial chain, as the meso level, is the emergent result of various interactive processes of micro enterprises, and is an emergent, process-dependent system result. Based on this, there is a complexity assumption embedded in the resilience of the industrial chain, and complexity is not always clearly defined or developed (FabioB.,etal.,2021). The core feature of the new energy vehicle industry chain is the concentration of R&D in OEMs and Tier 1 supply companies, driven by strong competition and exclusivity strategies.Based on this, this paper tries to use a comprehensive indicator system approach, based on the CSCE principle (completeness, systematicity, executability, interpretability), from the meso perspective of new energy vehicle industry chain supply chain, and constitutes the new energy vehicle industry chain resilience evaluation as a whole by multiple indicators in accordance with the sequential logical progression of the relationship.

Specifically, according to Martin (2012), the new energy vehicle industry chain supply chain resilience is decomposed into four first-level indicators, namely, coping resistance (A1), adaptive resilience (A2), autonomous control (A3), and leading competitiveness (A4), and then further disassembled according to the key factors of the first-level indicators, and then ultimately obtained the new energy vehicle industry chain supply chain resilience comprehensive evaluation index system.

Table 2.

Comprehensive evaluation index system of new energy vehicle industry chain resilience.

Table 2.

Comprehensive evaluation index system of new energy vehicle industry chain resilience.

| Level 1 |

Level 2 |

Level 3 |

Explanation of indicators |

| resistance(A1) |

Industrial scale(B1) |

Value added of new energy vehicle industry(C1) |

Annual value added of all enterprises in the new energy vehicle industry chain |

| Growth rate of Value added of new energy vehicle industry(C2) |

Growth rate of annual value added of all enterprises in the new energy vehicle industry chain |

| New Energy Vehicle Industry Coverage(C3) |

Coverage of new energy vehicle industry chain enterprises |

| Employment scale of new energy vehicle industry(C4) |

Total employment in new energy vehicle industry chain enterprises |

| Industrialbenefits(B2) |

Total Profit of EaDS in new energy vehicle industry(C5) |

Total Annual Profit of EaDS in New Energy Vehicle Industry Chain |

| Total tax payment of EaDS in new energy vehicle industry(C6) |

Total annual tax payment of EaDS of new energy vehicle industry chain |

Adaptive

resilience(A2) |

market position(B3) |

Number of EaDS in new energy vehicle industry(C7) |

Number of EaDS in new energy vehicle industry |

| Total assets of new energy vehicle industry(C8) |

Total assets of new energy vehicle industry chain |

| Industry Revenue of new energy vehicle industry(C9) |

Industry Revenue of new energy vehicle industry chain enterprises |

| Human Capital(B4) |

Number of employees with bachelor's degree or above(C10) |

Number of employees with bachelor's degree or above of new energy vehicle industry chain enterprises |

| Expenditures on education and training of EaDS(C11) |

Total annual education and training expenditures of EaDS of new energy vehicle industry chain |

Industrial

Contribution(B5) |

Contribution ratio of total assets of EaDS(C12) |

Contribution ratio of total assets of EaDS of new energy vehicle industry chain |

| Rate of increase in business investment in fixed assets(C13) |

Annual fixed asset investment addition rate of enterprises in the new energy vehicle industry chain |

| Profitability Coverage of EaDS(C14) |

Percentage of Profit of Enterprises Above Scale in New Energy Vehicle Industry Chain |

Renew

alorresumption(A3) |

Technology Absorption Capacity(B6) |

Number of High-tech enterprises(C15) |

Number of high-tech enterprises in the new energy vehicle industry chain |

| Total actual utilization of foreign capital by industry(C16) |

Total Actual Utilized Foreign Capital of New Energy Vehicle Industry Chain Enterprises |

| Number of foreign-invested industrial enterprises (C17) |

Number of foreign-invested industrial enterprises in the new energy vehicle industry chain |

Industrial

Investment Environment(B7) |

Industry exports and imports(C18) |

Import and export value of new energy vehicle industry chain enterprises |

| Industry Intra-city Transaction Volume(C19) |

Total amount of new energy vehicle industry chain enterprises' transactions Intra-city |

| Dependence of new energy vehicle industry on foreign trade(C20) |

Percentage of foreign trade in intermediate products of new energy vehicle industry chain |

| financial services(B8) |

Loan balance of financial institutions at year-end(C21) |

Loan balance of financial institutions at year-end in the new energy vehicle industry chain |

| Market Capitalization of Listed Enterprises of Industry(C22) |

Total Market Capitalization of Listed Enterprises of the new energy vehicle industry chain |

| re-orientation(A4) |

scientific and technological innovation investment(B9) |

Number of industrial professionals and technicians(C23) |

Number of industrial professionals and technicians of the new energy vehicle industry chain |

| Number of new projects approved in the industry(C24) |

Number of new projects approved in the new energy vehicle industry chain |

| Industry R&D Investment Intensity(C25) |

R&D Investment Intensity in new energy vehicle industry chain |

scientific and technological innovation

Output(B10) |

Industrial Patent Grants(C26) |

Number of Patent Grants in new energy vehicle industry chain |

| Average growth rate of output value of industrial high-tech enterprises(C27) |

Average growth rate of output value of high-tech enterprises in new energy vehicle industry chain |

| energy consumption per unit GDP(C28) |

energy consumption per unit GDP of new energy vehicle industry chain |

| Sales of new industrial products(C29) |

Total Sales of new products of new energy vehicle industry chain |

Coping resistance focuses on the industry chain's resistance to external perturbations, as well as the speed and degree of its recovery, where it just returns to the equilibrium state or path before the shock. Coping resistance (A1) is measured by industrial scale (B1) and industrial efficiency (B2), which defines the industrial scale and efficiency of the new energy vehicle industry chain, and calculates the resilience of the new energy vehicle industry chain by comparing the scale and efficiency. Among them, the larger the industrial scale of the industry chain, the stronger the ability to resist external changes, and the greater the resilience of the industry chain (LeeY-H, et.al., 2023;), the general use of industrial value added, industrial value added growth rate, industrial coverage, industrial employment scale to measure the industrial scale; the greater the profitability of the enterprises in the industry chain, the greater the sustainable competitive advantage, and the greater the industry chain resilience. (PuG.,et.al.,2023), industrial efficiency is generally measured by corporate profits (Yusufet.al.,2014), corporate tax payments.

Adaptive resilience (A2) is the ability of a chain system to maintain its core performance in the face of external shocks by adapting its structure, function and organization to accommodate changes in order to bounce forward. Adaptive capacity is characterized by tolerating the certainty of progress and developing a framework suitable for adapting to new conditions and goals (Jainet.al.,2017). If the supply chain has the capacity to adapt to things easily, it can return to its original or enhanced state after a disruption. Adaptive resilience is more influential than coping with resistance because it is more sustainable and effective in the context of uncertainty that the future may bring (Walkeretal, 2014). Adaptive resilience consists of three dimensions: market position, human capital and industry contribution. Market position is associated with both the financial capability of firms in the supply chain (Pettitet.al.,2010) and an increase in market share (Yusufet.al.,2014), and the stronger the market position, the more helpful it is in maintaining the relationship with the customer after an unforeseen event (RobertaPereira2014; Fikselet.al. 2015). Market position is measured using the number of enterprises above scale in the new energy vehicle industry chain, the total amount of assets in the industry chain, and the business revenue of enterprises in the industry chain.Human capital is a key factor in increasing chain resilience (ShelaV,et.al.,, 2023).Human capital consists of two aspects: first, the ability of employees to analyze, monitor and control key supply chain points through the analysis of massive amounts of information (Tukamuhabwaetal.,2017; Blackhurstetal.,2005); and second. Human capital contributes to chain resilience through employees' existing learning capabilities and ongoing training, which facilitates flexibility, competence, and work-based emotional well-being.

Renewal (A3),the degree of renewal or recovery of the regional growth path prior to the shock, emphasizing the magnitude of the perturbation that the system can withstand before it enters a new state or equilibrium (i.e., a change in form, function, or location).The main factors affecting renewal are technology absorptive capacity and high-level productive services, and the relationship between the two and renewal is positive. Technology absorptive capacity is the comprehensive ability of the industrial chain to carry out technological learning, cooperation and transformation, the stronger the technology absorptive capacity, the more conducive to the advantages of technological spillovers and re-innovation, which is conducive to improving the resilience of the industrial chain (Chatzistamoulou et al., 2022;Palekiene O et.al.,2015). High levels of services through near-neighborhood or short-distance intermediate products, as well as high-quality financial services help to improve industry chain resilience (Liu et al. 2021; Lee et al. 2021;Palekiene O et.al.,2015).

Re-orientation (A4), real resilience firms in the chain are constantly innovating, innovating products and markets and staying ahead of competitors is an important part of increasing the resilience of the chain (DindarianK, 2023).Technological innovation is the core element of modern economic growth and an important source of enhancing the resilience of the new energy automobile industry chain (Palekiene O et.al.,2015). The inputs and outputs of technological innovation directly measure the leading competitiveness of the industry chain, and a strong innovation system is a major factor in the resilience of the industry chain (Palekiene O et.al.,2015).

4. Weights Measurement of New Energy Vehicle Industry Chain Resilience Evaluation Index System

Considering the internal complexity of the resilience of the new energy vehicle industry chain and the outside uncertainty, this study adopts the entropy method to determine the weights of the index system. In information theory, entropy is a measure of uncertainty. The larger the amount of information, the smaller the uncertainty and the smaller the entropy; the smaller the amount of information, the larger the uncertainty and the larger the entropy. According to the characteristics of entropy, you can calculate the entropy value to judge the randomness of an event and the degree of disorder, you can also use the entropy value to judge the degree of dispersion of a certain indicator, the greater the degree of dispersion of the indicator, the greater the impact of the indicator on the comprehensive evaluation (weight), and the smaller the value of its entropy. The specific steps of measurement are:

Step 1: Data standardization. Standardize the data of each indicator.

Step 2: Find the information entropy of each indicator. According to the definition of information entropy in information theory, the information entropy of a set of data and Where if , then .

Step 3: Determine the weight of each indicator. According to the formula of information entropy, the information entropy of each indicator is calculated as . The weight of each indicator is calculated by information entropy as .

Organize the relevant data of Changzhou new energy vehicle industry chain from 2020 to 2022, and use the entropy value method to measure the weight results as

Table 3.

Table 3.

Changzhou new energy vehicle industry chain resilience index weights.

Table 3.

Changzhou new energy vehicle industry chain resilience index weights.

| Level1 |

weights |

Level2 |

weights |

Level3 |

weights |

| resistance(A1) |

33.53 |

Industrial scale(B1) |

22.35 |

Value added of new energy vehicle industry(C1) |

8.66 |

| Growth rate of Value added of new energy vehicle industry(C2) |

6.14 |

| New Energy Vehicle Industry Coverage(C3) |

4.43 |

| Employment scale of new energy vehicle industry(C4) |

3.12 |

| Industrialbenefits(B2) |

11.18 |

Total Profit of EaDS in new energy vehicle industry(C5) |

7.45 |

| Total tax payment of EaDS in new energy vehicle industry(C6) |

3.73 |

Adaptive

resilience(A2) |

28.66 |

market position(B3) |

9.17 |

Number of EaDS in new energy vehicle industry(C7) |

4.5 |

| Total assets of new energy vehicle industry(C8) |

1.81 |

| Industry Revenue of new energy vehicle industry(C9) |

2.86 |

| Human Capital(B4) |

3.52 |

Number of employees with bachelor's degree or above(C10) |

1.76 |

| Expenditures on education and training of EaDS(C11) |

1.76 |

Industrial

Contribution(B5) |

15.97 |

Contribution ratio of total assets of EaDS(C12) |

5.33 |

| Rate of increase in business investment in fixed assets(C13) |

2.26 |

| Profitability Coverage of EaDS(C14) |

8.38 |

Renewal

or resumption(A3) |

13.97 |

Technology Absorption Capacity(B6) |

7.48 |

Number of High-tech enterprises(C15) |

4.03 |

| Total actual utilization of foreign capital by industry(C16) |

1.23 |

| Number of foreign-invested industrial enterprises (C17) |

2.22 |

Industrial

Investment Environment(B7) |

2.88 |

Industry exports and imports(C18) |

0.96 |

| Industry Intra-city Transaction Volume(C19) |

0.41 |

| Dependence of new energy vehicle industry on foreign trade(C20) |

1.51 |

| financial services(B8) |

6.46 |

Loan balance of financial institutions at year-end(C21) |

1.1 |

| Market Capitalization of Listed Enterprises of Industry(C22) |

2.51 |

| re-orientation(A4) |

24.15 |

scientific and technological innovation investment(B9) |

8.05 |

Number of industrial professionals and technicians(C23) |

3.95 |

| Number of new projects approved in the industry(C24) |

2.51 |

| Industry R&D Investment Intensity(C25) |

1.59 |

scientific and technological innovation

Output(B10) |

16.1 |

Industrial Patent Grants(C26) |

2.02 |

| Average growth rate of output value of industrial high-tech enterprises(C27) |

6.18 |

| energy consumption per unit GDP(C28) |

3.07 |

| Sales of new industrial products(C29) |

4.83 |

5. Changzhou New Energy Vehicle Industry Chain Supply Chain Resilience Evaluation

Changzhou new energy vehicle industry chain supply chain data were used to make a comprehensive measurement of the supply chain resilience of new energy vehicle industry chain in Changzhou from 2020 to 2022, and the results are shown in

Table 4. Changzhou new energy vehicle industry chain supply chain resilience soared during the study period, with an average annual growth rate of 53%.

Table 4.

Resilience score of Changzhou new energy vehicle industry chain(2020-2022).

Table 4.

Resilience score of Changzhou new energy vehicle industry chain(2020-2022).

| Year |

2020 |

2021 |

2022 |

| score |

18.23 |

27.95 |

42.68 |

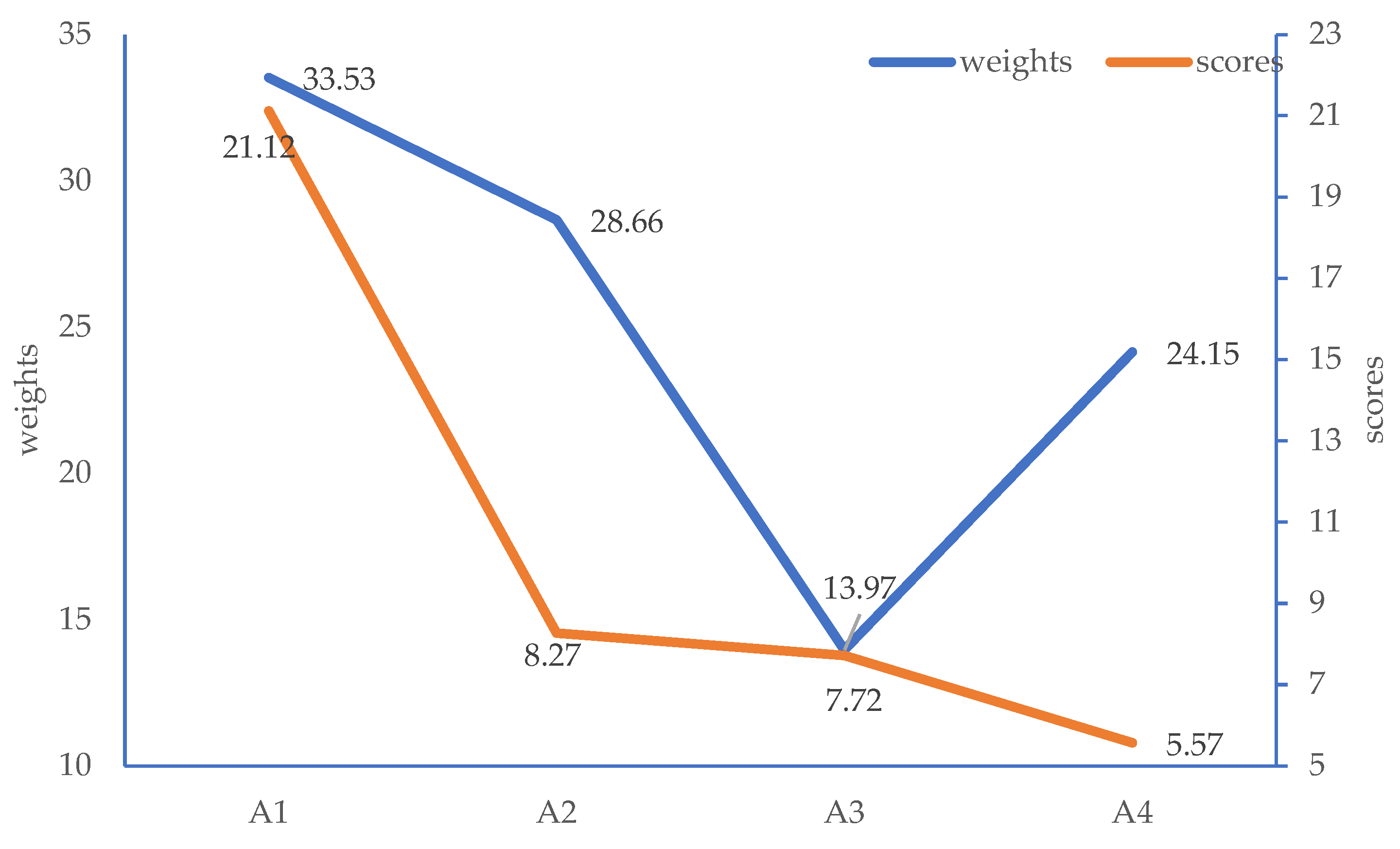

Divided into the weights and scores of the resilience comprehensive evaluation index system, the weights and scores of the first-level indexes of the resilience comprehensive evaluation show that the indexes that are closest to the ideal state are the coping resistance and the autonomy control.

Figure 2.

Comparison of the weights and scores of the first-level indicators of the resilience of the new energy vehicle industry chain.

Figure 2.

Comparison of the weights and scores of the first-level indicators of the resilience of the new energy vehicle industry chain.

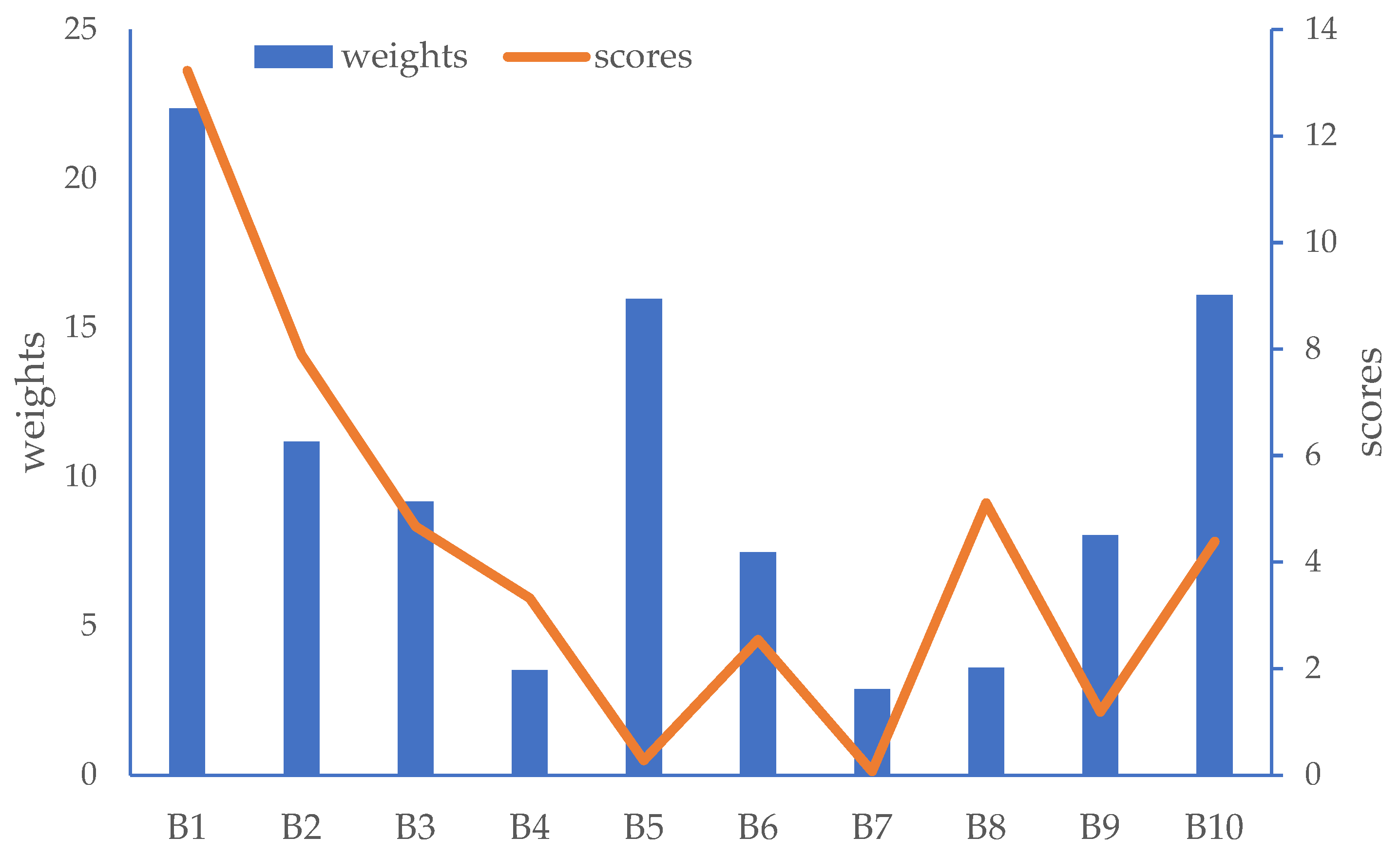

Figure 3.

Comparison of the weights and scores of the second-level indicators of the resilience of the new energy vehicle industry chain.

Figure 3.

Comparison of the weights and scores of the second-level indicators of the resilience of the new energy vehicle industry chain.

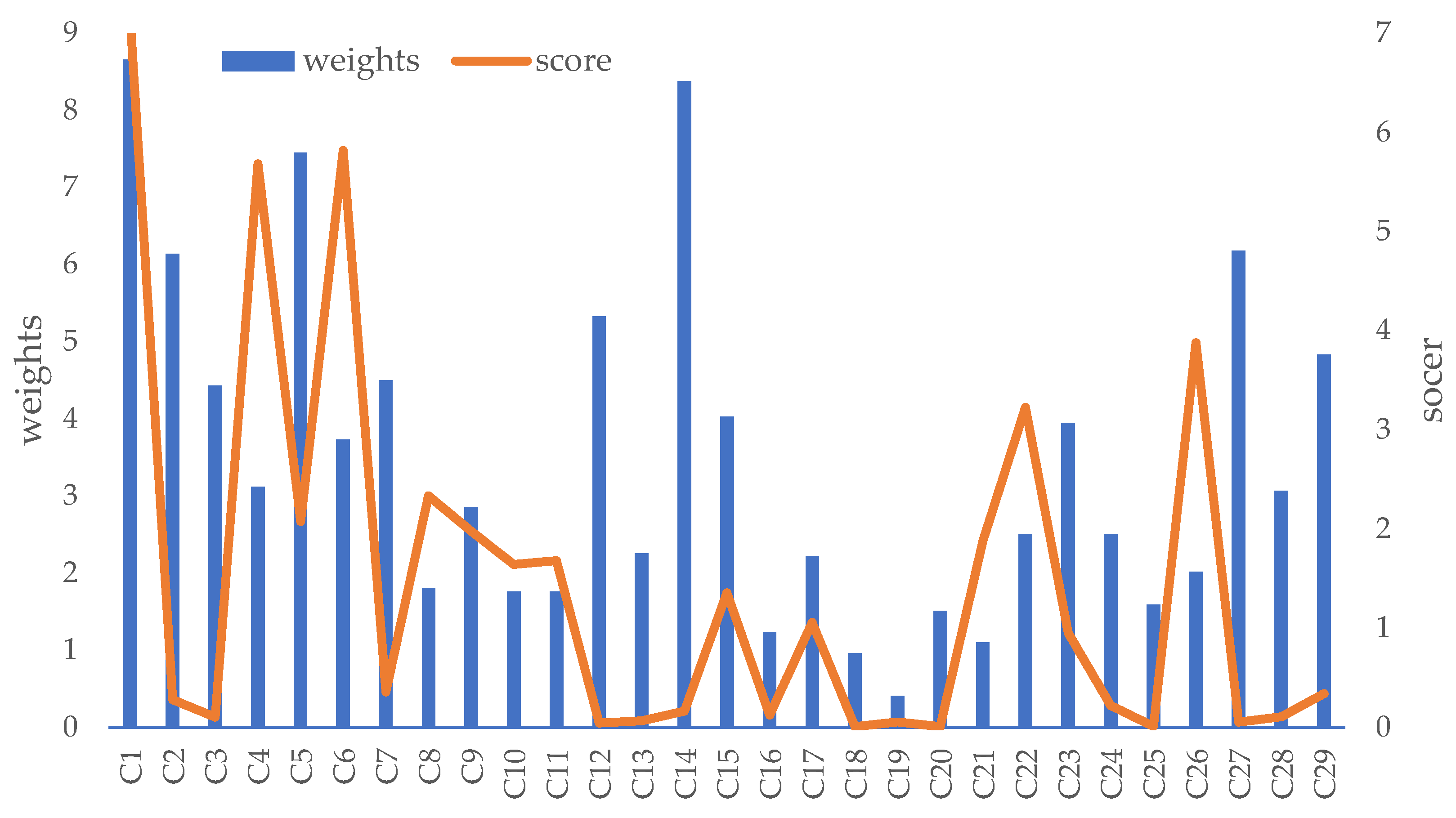

Figure 4.

Comparison of the weights and scores of the third-level indicators of the resilience of the new energy vehicle industry chain.

Figure 4.

Comparison of the weights and scores of the third-level indicators of the resilience of the new energy vehicle industry chain.

Among the secondary indicators, the human capital indicator, whose actual score is approximately equal to the weighted score, is the best performer among all secondary indicators. Indicators with large differences include economic scale, industrial contribution and scientific and technological innovation output.

Among the three-level indicators, the actual scores of industrial employment scale, total tax paid by the enterprises on a regular basis, total industrial assets, industrial year-end loan balance of financial institutions, market value of listed enterprises at the end of the year in the industry, and the number of patents granted by the industry are higher than the weighted scores, which indicates that it is better to be in an ideal state. However, the indicators of growth rate of industrial added value, industrial coverage, total profit of state-owned enterprises, number of state-owned enterprises, contribution rate of total assets of state-owned enterprises, profitability of state-owned enterprises, number of patented technicians in industry, number of newly approved projects in industry, growth rate of industrial high-tech industrial output, energy consumption of 10,000 yuan of GDP in industry, and sales of new products in industry need to be further improved and developed.

6. Discussion

According to the existing research related to the resilience of the industrial chain chain, most of the measurements of the resilience of the industrial chain from the theory or a single indicator (A, Amine Belhadi, et al., 2020; Stevenson and Spring, 2007). Therefore, we construct a comprehensive evaluation index system of new energy vehicle industry chain resilience to analyze the resilience of the new energy vehicle industry chain in Changzhou based on Martin's (2012) resilience-related research.

Our first achievement is to construct a comprehensive evaluation index system for the resilience of the new energy vehicle industry chain, which consists of four first-level index components, namely, coping resistance, adaptive resilience, autonomous control, and leading competitiveness, and the relationship of the four in resilience is sequentially progressive. In addition to contributing to the extensive literature on the comprehensive indicator evaluation system, we extend the behavior of the new energy vehicle industry chain and the enterprises in the industry chain. The researcher of Jiangsu Institute of Strategic Studies and the related personnel of the Automobile Industry Section of Changzhou Industry and Information Bureau affirmed the scientificity and effectiveness of the index system, which can indeed quantify the resilience of the new energy vehicle industry chain.

Another important contribution to the existing research is to evaluate the resilience of the new energy vehicle industry chain in Changzhou. Changzhou city has been vigorously developing a new energy economy since the implementation of "development, storage, delivery and use" as a closed-loop development, and new energy vehicles are the main development industry of "use". 2019-2022 new energy vehicle industry chain resilience composite score is consistent with the trend of new energy vehicle production changes. The trend is consistent. According to the data released by Changzhou City Statistics, the results of this study on the new energy vehicle industry chain resilience of Changzhou City are in line with the development of the new energy vehicle industry chain in Changzhou. First, in 2019, new energy vehicles were included in the seven high-tech industries of Changzhou City, and in January 2021, Changzhou City Bureau of Statistics began to include the new energy vehicle industry in the scope of government information published on economic operation, and in August 2021, it began to publish the contribution rate of the new energy vehicle industry to the growth of the total value of industrial output above the scale, and in November 2022, the new energy vehicle industry had already become the first new energy industry contributing rate. industry category, the annual measurement results of the resilience of new energy vehicle industry chain are basically consistent with the development of new energy vehicle industry in Changzhou.

Secondly, in order to further increase the resilience of the new energy vehicle industry chain, Changzhou City has drafted and enacted a series of measures to develop the new energy vehicle industry since 2023, such as Changzhou New Energy Industry Promotion Regulations (Draft), Changzhou New Energy Industry Development Plan, Changzhou Science and Technology Innovation Promotion Regulations, Changzhou Accelerating the Construction of new energy vehicle Parts and Components Industry Ecological Work Program, and so on, which puts forward a series of measures to develop the new energy vehicle industry, including the compilation and The implementation of "new energy vehicles new energy vehicles and automotive core components and other industry-specific planning" new projects to the new energy vehicle industry chain tilt development, "government agencies, institutions, in principle, new and renewed official vehicles all use of new energy vehicles" through the Government The government will expand the sales market of new energy vehicles through government purchase, "coordinate the overall development of the new energy industry chain, promote leading enterprises to dock with advantageous parts and components enterprises, and lead the industry chain and upstream and downstream enterprises of the supply chain to collaborate in the development of the industry chain" and "support the steady expansion of the scale of the new energy vehicle industry, continuously improve the production capacity of the entire intelligent vehicle, and actively build a new energy vehicle industry. Production capacity, and actively build new energy vehicle field vehicle well-known brands and ecological dominant enterprises, and promote the construction of new energy vehicle industry highland" aims to guide the new energy vehicle continuous technological innovation to realize the new energy vehicle industry chain on the size of the enterprise bigger and stronger, so as to increase the value-added of the industry to do the industry coverage, and to improve the resilience of the new energy vehicle industry chain supply chain. At the same time, in January 2024, Jiangsu Provincial People's Government issued the "Opinions on Supporting the High-Quality Development of Changzhou's New Energy Industry" to support Changzhou's high-quality promotion of new energy vehicle industry chain innovation and upgrading development, and to reduce the weak links in the resilience of the supply chain of the new energy vehicle industry chain in Changzhou. Thirdly, there is a certain time interval from investment to production in the new energy vehicle industry, for example: the Ideal Automobile Changzhou production base was invested in 2015 and put into production in 2019, and the BYD Changzhou production base was invested in 2019 and put into production in 2022, so the current resilience indicator of the lower science and technology innovation output score is that the innovation inputs in 2022 and before have not yet formed outputs, and the indicator in the January to November in 2023 the data for the original value indicator through show a leap forward.

In the context of public health events represented by the new coronavirus and the development of global economic regionalization, the society pays more attention to the regional industrial chain and the development of the resilience of the regional industrial chain, which will all contribute to the research and development of the regional industrial chain spurt. From a broad perspective, the resilience of new energy vehicle industry chain is affected by coping resistance, adaptive resilience, autonomous control and leading competitiveness. From a deeper perspective, from the perspective of new energy vehicle industry chain development, coping resistance is the first step to increase industry chain resilience, followed by adaptive resilience and autonomous control, and ultimately the industry chain has leading competitiveness, and the stronger the resilience of the regional industry chain of new energy vehicles, the more conducive to the high-quality development of the regional economy. Therefore, under the premise of not violating national policies and regulations, countries around the world should actively improve the resilience of the industry chain of segmented industrial manufacturing.

7. Conclusions

This article is based on the basic concept of resilience, combines the complexity of the new energy vehicle industry chain to construct a comprehensive evaluation index system for the resilience of the supply chain of the new energy vehicle industry chain in Changzhou, and quantifies the resilience of the supply chain of the new energy and automobile industry chain by using the relevant data of the enterprises in the supply chain of the new energy vehicle industry chain in Changzhou.

The comprehensive evaluation index system of new energy vehicle industry chain resilience includes 4 first-level indicators, 10 second-level indicators and 29 third-level indicators, including coping resistance, adaptive resilience, autonomous control and leading competitiveness. Using Changzhou new energy vehicle industry chain related data for evaluation, the results show that: Changzhou new energy vehicle industry chain supply chain resilience is being strengthened, but there is still a distance from the ideal resilience. It is necessary to combine its own development advantages, gather innovative kinetic energy, take new energy vehicle and power battery industry as the important grips, make up the short boards of the industry chain, meanwhile, support excellence and strength, focus on the power battery industry cluster, and accelerate the construction of independent and controllable industry system, in order to build a domestic innovation highland in the field of new energy vehicle.

The innovation of this paper lies in: the first time to build a comprehensive index system to evaluate the supply chain resilience of new energy vehicle industry chain, and evaluate and describe the industry chain resilience from the four dimensions of coping resistance, adaptive resilience, autonomous control and leading competitiveness in order of progression, so that the scientific issue of new energy vehicle industry chain resilience is more concrete and visible; secondly, to measure the resilience of new energy vehicle industry chain resilience in Changzhou City, Jiangsu Province, which helps to carry out the research of regional industry chain resilience; and secondly, to estimate the resilience of new energy vehicle industry chain in Changzhou City, Jiangsu Province. Secondly, the measurement of supply chain resilience of new energy vehicle industry chain in Changzhou City, Jiangsu Province is helpful for the research of regional industry chain supply chain resilience.

Based on the above conclusions, there are certain research deficiencies in this study, and in the future, we can consider expanding and deepening the following aspects: first, expanding the research area, expanding the regional research object of the resilience of the new energy vehicle industry chain supply chain to Jiangsu Province and even China; second, identifying the resilience of the new energy vehicle industry chain evaluation interval, summarizing the resilience to the strong resilience, the general resilience and the weak resilience, and thus putting forward targeted industrial development proposals.

Author Contributions

Conceptualization, methodology, formal analysis, M.Z.; writing—original draft preparation, M.Z.; writing—review and editing, X.L. and Y.S.. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Social Science Fund of Jiangsu University of Technology(Grant No.KYY21511) and the fund of "New Energy Capital" (Changzhou) Development Research(Grant No. KYY23502).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

Not applicable.

References

- A, Amine Belhadi; et al. Manufacturing and service supply chain resilience to the COVID-19 outbreak: Lessons learned from the automobile and airline industries.Technological Forecasting and Social Change,2020,163:1-19. [CrossRef]

- Agusti M, Galan J L, Acedo F J. Saving for the bad times: Slack resources during an economic downturn. Journal of Business Strategy, 2022, 43(1): 56-64. [CrossRef]

- Ali, A., Mahfouz, A. and Arisha, A., Analysing supply chain resilience: Integrating the constructs in a concept mapping framework via a systematic literature review, Supply Chain Management an International Journal, 2017, 22(1):16–39. [CrossRef]

- Ambulkar, S., Blackhurst, J. and Grawe, S., Firm's resilience to supply chain disruptions: Scale development and empirical examination, Journal of Operations Management, 2015,Vol. 33–34 No.1:111–122. [CrossRef]

- Amine Belhadi,et.al.,Manufacturing and service supply chain resilience to the COVID-19 outbreak: Lessons learned from the automobile and airline industries,Technological Forecasting and Social Change,2021,Volume 163, February:1-19. [CrossRef]

- Balakrishnan, A. S., and Usha Ramanathan. The role of digital technologies in supply chain resilience for emerging markets’ automotive sector.Supply Chain Management.2021,26(6): 654-671. [CrossRef]

- Barasa E, Mbau R, Gilson L. What is resilience and how can it be nurtured? A systematic review of empirical literature on organizational resilience. International journal of health policy and management, 2018, 7(6): 491. [CrossRef]

- Bento F, Garotti L, Mercado M P. Organizational resilience in the oil and gas industry: A scocial review. Safety science, 2021, 133: 105036. [CrossRef]

- Blackhurst, J., Craighead, C.W., Elkins, D., Handfield, R.B.. An empirically derived agenda of critical research issues for managing supply-chain disruptions. Int J Production Research,2005, 43 (19), 4067–4081. [CrossRef]

- Brandon-Jones E, Squire B, Autry CW, Petersen KJ. A contingent resource-based perspective of supply chain resilience and robustness. J Supply Chain Manag,2014, 50(3):55–73. [CrossRef]

- Chatzistamoulou N, Kounetas K, Tsekouras K.Technological hierarchies and learning: Spillovers, complexity, relatedness, and the moderating role of absorptive capacity. Technol Forecast Soc Change,2022,183:121925. [CrossRef]

- Dindarian K. How Recognizable Is the Black Swan?//Embracing the Black Swan: How Resilient Organizations Survive and Thrive in the face of Geopolitical and Macroeconomic Risks. Cham: Springer International Publishing, 2023: 155-157.Fiksel J, Croxton KL, Pettit TJ.From risk to resilience: Learning to deal with disruption. MIT Sloan Manag Rev,2015,56(2):78–86. [CrossRef]

- Ghadafi M. Razak, Linda C. Hendry & Mark Stevenson.Supply chain traceability: A review of the benefits and its relationship with supply chain resilience,Production Planning & Control, 2023,34:11, 1114-1134. [CrossRef]

- Glickman TS, White SC.Security, visibility and resilience: The keys to mitigating supply chain vulnerabilities. Int J Logist Manag,2006, 2(2):107–119. [CrossRef]

- Hayato Kato,Toshihiro Okubo,The Resilience of FDI to Natural Disasters Through Industrial Linkages,Environmental and Resource Economics,2022, 82:177–225. [CrossRef]

- Holling, Crawford S. Resilience and stability of ecological systems. Annual review of ecology and systematics 4.1,1973: 1-23. [CrossRef]

- Seyedmohsen Hosseini, Dmitry Ivanov,Bayesian networks for supply chain risk, resilience and ripple effect analysis: A literature review,Expert Systems with Applications,Volume 161,2020,113649. [CrossRef]

- Iakovou, E., Vlachos, D., Keramydas, C., Partsch, D. Dual sourcing for mitigating humanitarian supply chain disruptions. Journal of Humanitarian Logistics and Supply Chain Management,2014,4 (2), 245–264. [CrossRef]

- Ivanov D, Dolgui A. Viability of intertwined supply networks: Extending the supply chain resilience angles towards survivability. A position paper motivated by COVID-19 outbreak. International journal of production research, 2020, 58(10): 2904-2915. [CrossRef]

- Kamalahmadi, Masoud, Mansoor Shekarian, and Mahour Mellat Parast. The impact of flexibility and redundancy on improving supply chain resilience to disruptions.International Journal of Production Research,2022, 60(6): 1992-2020. [CrossRef]

- Kochan, C.G., Nowicki, D.R..Supply chain resilience: A systematic literature review and typological framework. Int J Physical Distribution Logistics Management,2019,48 (8), 842–865. [CrossRef]

- Lee, JD., Lee, K., Meissner, D. et al. Local capacity, innovative entrepreneurial places and global connections: An overview. J Technol Transf,2021, 46:563–573. [CrossRef]

- Lee, Y.-H.; Kao, L.-L.; Liu, W.-H.; Pai, J.-T. A Study on the Economic Resilience of Industrial Parks. Sustainability.2023, 15, 2462. [CrossRef]

- Martin, Ron. Regional economic resilience, hysteresis and recessionary shocks.Journal of economic geography.2012,12(1): 1-32. [CrossRef]

- Liu X, Zhang X, Li S.Measure of China’s macroeconomic resilience: A systemic risk perspective. Soc Sci China.2021, 1(12–32):204.

- Palekiene O, Simanaviciene Z, Bruneckiene J.The application of resilience concept in the regional development context. Procedia-Social and Behavioral Sciences.2015, 213: 179–184. [CrossRef]

- Pettit TJ, Fiksel J, Croxton KL.Ensuring supply chain resilience:development of a conceptual framework. J Bus Logist.2010, 31(1):1–2. [CrossRef]

- Ponomarov SY, Holcomb MC.Understanding the concept of supply chain resilience. Int J Logist Manag.2009,20(1):124–143. [CrossRef]

- Pu G, Li S, Bai J. Effect of supply chain resilience on firm’s sustainable competitive advantage: A dynamic capability perspective. Environmental Science and Pollution Research, 2023, 30(2): 4881-4898. [CrossRef]

- Reggiani, Aura, Thomas De Graaff, and Peter Nijkamp. Resilience: An evolutionary approach to spatial economic systems.Networks and Spatial Economics.2002,2: 211-229. [CrossRef]

- Rice JB, Caniato F. Building a secure and resilient supply net-work. Supply Chain Manag Rev.2003,7(5):22–30.

- Roberta Pereira C, Christopher M, Lago Da Silva A.Achieving supply chain resilience: The role of procurement. Supply Chain Manag: Int J.2014,19(5/6):626–642. [CrossRef]

- Shela V, Ramayah T, Noor Hazlina A. Human capital and organisational resilience in the context of manufacturing: A systematic literature review. Journal of Intellectual Capital, 2023, 24(2): 535-559. [CrossRef]

- Shih, Willy. Is it time to rethink globalized supply chains?. MIT Sloan Management Review.2020, 61(4): 1-3. [CrossRef]

- Singh, Jagroop, Abu Bakar Abdul Hamid, and Jose Arturo Garza-Reyes. Supply chain resilience strategies and their impact on sustainability: An investigation from the automobile sector.Supply Chain Management: An International Journal ahead-of-print,2023. [CrossRef]

- Stevenson, M. and Spring, M., Flexibility from a supply chain perspective: Definition and review,International Journal of Operations and Production Management, 2007,27(7): 685-713. [CrossRef]

- Sytch, Maxim, Yong Kim, and Scott Page.Supplier-Selection Practices for Robust Global Supply Chain Networks: A Simulation Of The Global Auto Industry.California Management Review.2022, 64(2): 119-142. [CrossRef]

- Tang CS.Robust strategies for mitigating supply chain disruptions. Int J Logist: Res Appl,2006, 9(1):33–45. [CrossRef]

- Tukamuhabwa, B., Stevenson, M., Busby, J.. Supply chain resilience in a developing country context: A case study on the interconnectedness of threats, strategies and outcomes. Supply Chain Management: An Int J,2017,22 (6), 486–505. [CrossRef]

- Walker B, Nilakant V, Baird R.Promoting Organisational Resilience through Sustaining Engagement in a Disruptive Environment: What are the implications for HRM? Research Forum. 2014:1-20.

- Yusuf YY, Gunasekaran A, Musa A, Dauda M, El-Berishy NM, Cang S.A relational study of supply chain agility, competitiveness and business performance in the oil and gas industry. Int J Prod Econ.2014,147:531–543. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).