Introduction

In the dynamic landscape of technology companies, the pursuit of optimal performance is paramount, necessitating a comprehensive strategy that meticulously evaluates workforce efficiency and cutting-edge equipment utilization in financial terms. Technology and innovation leaders grapple with the challenge of quantifying effectiveness, a task vital to sustaining a competitive edge. To achieve this, key performance indicators (KPIs) are meticulously defined, tracking metrics such as product development cycle time, time-to-market, and quality assurance (Balakrishnan et.al., 2008). Workforce productivity becomes a focal point, with tools like project management software and performance reviews offering insights into resource allocation and task completion rates (Fometescu and Hategan, 2024). Innovation metrics gauge the success of research and development efforts, assessing the ratio of successful product launches to total projects. Cost-benefit analyses and return on investment calculations scrutinize technology investments, ensuring alignment with long-term goals (Anderson,1995; Ibrahim, 2023). The utilization of cutting-edge equipment is monitored through assessments of downtime, maintenance costs, and energy consumption. Cultivating a culture of continuous improvement and benchmarking against industry standards further refines performance. In this intricate interplay of metrics and assessments, technology companies navigate the path to heightened efficiency and innovation, underlining the symbiotic relationship between workforce, technology, and financial success (Fometescu and Hategan, 2024). With the rapid integration of advanced technologies into their operations, this assessment has gained heightened importance.

Technology leaders wield a distinctive influence on the dual facets of their firms’ financial health – the bottom line and the top line. By adeptly managing operations, they can elevate critical factors including quality, variety, speed, reliability, and dependability. This not only enhances the overall customer experience but also contributes to the generation of augmented revenue streams (Grasso, 2006). Moreover, the efficient orchestration of inventory, workforce, and cutting-edge equipment within the operational framework holds the potential for substantial cost reductions (Barney, 1991). Through strategic deployment of advanced technologies and innovative methodologies, leaders can optimize the efficiency of their workforce, streamline production processes, and minimize downtime. The judicious use of cutting-edge equipment, coupled with astute inventory management, ensures a lean and responsive operational structure (Johnson and Kaplan, 1987; Biondi et.al., 2014). Consequently, technology leaders play a pivotal role in aligning operational excellence with financial objectives (Prahalad, C.K. & Hamel, G 1990). By harmonizing top-line growth with bottom-line efficiencies, they position their firms for sustained success in the ever-evolving landscape of technology-driven industries (Balakrishnan, 2004).

Pertaining specifically to NASDAQ-listed technology companies, the dual impact of operations orchestrated by technology leaders emerges as a key determinant of overall profitability. The intricate interplay between optimizing the bottom line and elevating the top line is especially crucial in this dynamic sector. Technology leaders within NASDAQ-listed firms navigate a landscape where operational efficiency is paramount for sustaining competitiveness and meeting the demands of a rapidly evolving market (Watson, M & Subramaniam, C. 2003, Horobet et.al., 2021). Effective operations management within these technology companies extends beyond traditional paradigms, encompassing factors such as quality, variety, speed, reliability, and dependability (Zanjirdar, et.al., 2014). By enhancing these facets, technology leaders contribute not only to customer satisfaction but also to the creation of diversified revenue streams. In the context of NASDAQ-listed technology companies, where innovation and agility are paramount, the ability to streamline production processes and deploy cutting-edge equipment is integral to maintaining a competitive edge.

Moreover, the astute management of inventory and workforce within operations becomes a linchpin for cost reduction. Technology leaders strategically leverage advanced technologies to optimize workforce efficiency and minimize operational downtime (Banker, et.al., 1995). This judicious use of cutting-edge equipment, coupled with sophisticated inventory management, ensures a lean and responsive operational structure. In the context of NASDAQ-listed technology companies, where market dynamics and investor expectations are particularly high, stakeholders are increasingly seeking tangible methodologies to quantify the financial impact and efficiency of technology-driven operations. This demand for measurable outcomes underscores the need for technology leaders to not only champion innovation but also articulate the concrete financial benefits derived from their operational strategies (Wernerfelt, 1997; Lev and Zarowin, 1999). Clear and transparent communication regarding the financial impact of operational initiatives becomes crucial for maintaining investor confidence and attracting capital in this competitive marketplace. As technology continues to shape the landscape of NASDAQ-listed firms, the ability of technology leaders to navigate and optimize the dual impact of operations remains central to the sustained success and growth of these companies in the global market.

The anticipation of heightened sales and increased profitability is closely tied to the efficient operation of firms, with effective cost management playing a pivotal role. One avenue through which firms can exert control over expenses is by incorporating cutting-edge and cost-effective technology into their production systems (Banker et.al.,1989). By leveraging state-of-the-art technology, companies can streamline processes, enhance productivity, and reduce operational costs, ultimately contributing to improved profitability. Another strategic dimension involves the workforce, where a focus on productivity, innovation, and efficient utilization becomes paramount (Foster, G & Gupta, M 1990). Through innovative management practices and the adoption of modern workforce optimization tools, firms can unlock the full potential of their employees. This not only leads to increased output and quality but also ensures that human resources are deployed in the most efficient and effective manner possible. As firms navigate the competitive business landscape, the adoption of innovative technologies and practices becomes a distinguishing factor in achieving sustainable growth. By marrying technological advancements with strategic workforce management, companies position themselves to thrive in a dynamic market, enhance their competitive edge, and realize the anticipated boosts in both sales and profitability.

For technology companies, effective management of selling, general, and administrative expenses (SGA) stand as a critical facet of financial strategy (Nguyen et.al., 2023). In the realm of these companies, where innovation and agility are imperative, SGA expenses can serve as a pivotal cost driver influencing both short and long-term operating earnings. A judicious approach to handling SGA costs is particularly crucial, as technology firms often operate in fast-paced, competitive environments (Gao et.al., 2018). Strategic management of SGA can translate to reduced manufacturing costs, positively impacting the overall cost structure of the company. This is paramount for technology companies seeking higher profitability, especially given the rapid pace of technological advancements and the need to allocate resources efficiently. By optimizing SGA expenditures, technology firms can channel resources toward core business functions, research and development, and the adoption of cutting-edge technologies, fostering innovation and maintaining a competitive edge (Kaplan, R.S and Norton, D.P.,1996) Moreover, a well-managed SGA framework enables these companies to navigate market dynamics effectively, adapt to changing customer demands, and allocate financial resources in a way that supports sustained growth. In essence, the strategic control of SGA expenses in technology companies becomes a linchpin for financial success, ensuring a balance between operational efficiency, innovation, and long-term profitability in a dynamic and evolving industry landscape (Kaplan, R.S and Norton, D.P., 2001).

The efficient management of selling, general, and administrative expenses (SGA) in technology companies is intricately tied to the cost of goods sold (COGS), creating a robust interdependence that demands strategic attention. This dynamic relationship underscores the need for comprehensive cost management strategies that address both SGA expenses and COGS to optimize overall operational efficiency (Chiosea and Daniela., 2023). Technology companies often find indicators of cost efficiency in enhancements to their Information Technology (IT) systems, enabling streamlined processes and improved data-driven decision-making. Operational procedure reorganization is another facet, allowing for the elimination of redundancies and the enhancement of workflow effectiveness. Investments in research and development (R&D) play a crucial role, driving innovation that can lead to the development of more cost-effective products or solutions, thereby influencing both SGA and COGS (Plotnikova 2023). Moreover, improvements in supporting departments, such as marketing and administrative functions, contribute to a leaner operational structure, directly impacting SGA. The synergy of these strategies fosters a cost-efficient environment, aligning with the dynamic nature of the technology industry. As technology companies strive for sustained competitiveness, this comprehensive approach not only enhances their ability to navigate market challenges but also positions them to allocate resources effectively, ensuring a balance between cost containment and investments in innovation for long-term success (Prahalad and Hamel, 1990).

It’s noteworthy that higher selling, general, and administrative (SGA) expenses can, at times, be a strategic investment rather than a mere financial burden for technology companies. This is particularly true when these expenses are directed towards acquiring intangible assets or initiatives that contribute to future operational efficiency and profitability (Riahi and Khoufi, 2016). For instance, investments in research and development (R&D), employee training, or cutting-edge technology infrastructure may fall under SGA expenditures but can yield significant long-term benefits. When management deliberately increases SGA expenses with a focus on acquiring intangible assets, they may be positioning the company for improved manufacturing processes, enhanced product quality, or the development of innovative solutions. These strategic investments in intangibles, while reflecting as higher current SGA expenses, can pave the way for future reductions in the cost of goods sold (COGS). The synergistic effect of these investments can ultimately lead to increased operational efficiency, reduced manufacturing costs, and improved competitiveness in the market. In such cases, higher SGA expenses can be viewed as a positive indicator of a firm’s performance, signalling its commitment to innovation and future profitability. Investors and stakeholders, when evaluating financial reports, may interpret these higher SGA expenditures as a strategic move rather than an immediate financial strain. The focus shifts from short-term cost containment to long-term value creation, acknowledging that the upfront investment in intangible assets may yield substantial returns in terms of product differentiation, market share, and sustained profitability over time. Therefore, in the context of strategic planning and forward-looking initiatives, higher SGA expenses can be indicative of a company’s proactive approach to ensuring its relevance and success in the ever-evolving landscape of the technology industry.

Conversely, when inefficient firms experience higher unintended selling, general, and administrative (SGA) expenses, it often signals a situation where costs are spiralling out of control, posing a potential threat to future profitability. This scenario is indicative of operational inefficiencies, mismanagement, or a lack of cost control measures within the organization. Unintended increases in SGA expenses may stem from issues such as inefficient processes, redundant operations, or inadequate resource allocation. To gain a comprehensive understanding of the long-term impact on operating and financial efficiency, it is crucial to conduct a thorough examination of the company’s financial data and annual statements. Metrics derived from these documents offer valuable insights into the health of the firm (Zhang, 2013). Key efficiency indicators include the ratio of SGA expenses to revenue, trends in operating income, and comparisons with industry benchmarks. High and escalating SGA expenses, when not aligned with tangible investments in innovation or strategic initiatives, may erode profit margins and hinder a company’s ability to compete effectively (Ewert and Wagenhofer, 2005). Investors and analysts closely scrutinize these metrics to assess the firm’s ability to manage costs, generate sustainable profits, and maintain competitiveness in the market. Inefficient firms may face challenges in adapting to market dynamics, which can further exacerbate the negative impact of elevated SGA expenses. Therefore, a proactive approach to identifying and addressing inefficiencies is essential for preserving and enhancing future profitability. This might involve process optimization, restructuring, or a reassessment of resource allocation strategies (Tsolas, 2021). By leveraging financial metrics and conducting a comprehensive analysis, stakeholders can gauge the effectiveness of a firm’s cost management practices and its resilience in the face of evolving market conditions.

Technology-based companies listed on NASDAQ represent a diverse and dynamic sector within the stock market. Comprising a wide range of firms involved in software development, hardware manufacturing, telecommunications, and various innovative technologies, these companies are known for their cutting-edge solutions and contributions to the digital landscape. Notable industry giants such as Apple, Microsoft, and Amazon are among the prominent players listed on NASDAQ. The sector is characterized by rapid innovation, intense competition, and a focus on disruptive technologies, including artificial intelligence, cloud computing, and cybersecurity. Investors often turn to NASDAQ for exposure to high-growth tech stocks, seeking opportunities to capitalize on the continual evolution of the digital economy. The performance of technology stocks on NASDAQ is closely watched as a barometer of the industry’s overall health and its impact on global markets.

Our study is thus aimed at competitive analysis of top 25 technology companies listed on NASDAQ who are the leaders and represent cutting edge technology growth in the industry. Objective of our study is to identify relationships and patterns among selected financial metrics to assess the operational efficiency of NASDAQ-listed technology companies between 2011 to 2023. Financial metrics used in the study include following variables: revenue, cost of goods sold, operating expenses, research, and development expenses, selling and general administrative expenses, and operating income. Our study uses cointegration and Granger causality tests which brings a quantitative lens to the analysis, providing nuanced insights into the long-term relationships and causative factors influencing operational efficiency. Additionally, the sector-specific approach recognizes the unique challenges faced by technology firms, such as disruptive innovation cycles and global supply chain dynamics. Therefore, this study not only addresses immediate concerns for investors and stakeholders but also contributes valuable knowledge to the broader discourse on technology’s role in the contemporary economic landscape.

Data Collection and Methodology

Bloomberg provides access to reliable real time and historical data for publicly traded companies. Bloomberg data was used as a source for our study. A total of 103 companies data pertaining to the metrics was downloaded from 2008 to Quarter 3, 2021. Upon screening the data for sufficiency, it was observed that, only 47 companies had complete data with respect to all the metrics from year 2011 to 2021. Among these companies, 25 technology related companies were considered as shown in

Table 1(Appendix). Thus, the data downloaded consisted of the income statement and balance sheets from September, 2011 to September, 2021 for each quarter of top 25 technology companies by market capitalization which are listed in NASDAQ. Quarterly data for sales, cost of goods sold (COGS), operating expenses (OExp), research and development expenses (RD), selling and general administrative expenses (SGA) and operating income (OInc) for all the 25 technology companies were collected using Bloomberg as the source. The choice of these efficiency indicators included variables that suggest effectiveness of managerial control on costs and its impact on the operating profitability of the technology companies. For example, higher SGA expense can suggest lack of management control on costs with adverse effect on future profitability. However, contrary explanation could be the potential to create intangible assets through SGA expenditure. There may also be ‘cost stickiness’ of SGA expenses as indicated by Anderson et.al., 2007.

We reviewed the autocorrelation that was present in the time series before making any analysis and eliminated the same. Phillips-Perron unit root test was considered to understand the existence of stationarity in each time series. For each time series we considered the lag length depending on the condition of minimizing the Akaike Information Criteria (AIC) values for the indicators which were considered among the technology companies. Thus, the lag length was considered and selected by minimizing the AIC over different choices of the lag length. The values of AIC are formulated by computing the value of the equation

Where, T refers to number of observations with K depicting is the number of regressors, and the residual sum of squares is indicated by RSS.

Our research adopts Johansen’s cointegration methodology (methodology developed by Johansen (1988) as an alternative and robust framework to delve into equilibrium price adjustments and ascertain long-run relationships within the context of technology companies. As articulated by Engle and Granger (1987), the presence of cointegration among a system of variables suggests that their economic forces interconnect, tethering these variables in a long-run equilibrium relationship. In essence, the application of Johansen’s cointegration methodology serves as a powerful analytical tool to explore and understand the intricate dynamics among operating efficiency indicators within technology companies (Awad and Fahema (2013)). This methodology goes beyond mere correlation by providing insights into the underlying economic forces that drive long-term relationships among these variables. By employing this approach, the study aims to uncover the level of integration among key operational metrics, shedding light on the interconnectedness and equilibrium aspects that define the operational efficiency landscape in the technology sector. We choose this method over various choices as it enables testing for the presence of more than one cointegrating vector (Johansen 1988, 1991, 1994; Johansen and Julius, 1990,1991). The method by Johansen is preferable and has many advantages. To name a few, in the context of our paper is that, identification of the number of cointegrating vectors was possible. The inferences drawn are based on the number of significant eigenvalues. We also find that, according to Banerjee (1999), the alternative cointegration tests was found to have low power in comparison to Johansen’s test. To check for stationarity arising from a linear combination of variables, the following AR representation for a vector VTS made up of ‘n’ variables is used,

Where,

VTS is found to be at most I(1), Q

it represent the seasonal dummies (i.e., a vector of non-stochastic variables) and c is constant. It needs to be noted that, it would not be necessary that all variables that make up VTS can be I(1). In order to find cointegration in the system, we need only two variables in the process to be I(1). However, if only two time series are examined (bivariate representation) then both have to be I(1). Thus, if error-correction term is appended, then:

The equation is basically a vector representation of equation (1) with the seasonal dummies added. In the equation, we find all long-run information to be contained in the levels terms,

VTS t-k and short-run information is contained in the differences

. The equation (2) would have the same degree of integration on both sides only if 0=

(the series are not cointegrated).

, is (0), which infers cointegration. In order to test for cointegration, the validity of

H1(r), shown below, is tested as:

Where, b is found to be matrix of cointegrating vectors with g representing a matrix of error correction coefficients. The hypothesis H

1(

r) is found to imply that the process

is stationary, and the

VTSt is nonstationary along with

VTSt found to be stationary in nature (Johansen, 1991). The results obtained using the Johansen method yields the Trace and the λ

max statistics which enables in determination of the number of cointegrating vectors.

Johansen Tests for Cointegration Rank for Systems (Efficiency Indicators for all Technology companies)

The results for systems (consisting of various efficiency indicators of technology companies) using Johansen’s method are presented in

Table 2,

Table 3,

Table 4,

Table 5,

Table 6,

Table 7 and

Table 8.

Table 2 provides a brief summary of cointegration test results for Adobe Inc. The Trace statistics, critical values and p-values are reported. These are found to be basically likelihood ratio tests with the null hypothesis being L

T+1 = L

T+2=……= L

P = 0, indicating that the system has

p-r unit roots, where

r is the number of cointegrating vectors. Using the sequential approach the rank were determined starting with the hypothesis of

p unit roots. If this is rejected, then the next hypotheses L

2 = L

3 = …..= L

p =0 is tested and so on. For each system there can be at most n-1 cointegrating vectors (or common factors) that bind the assets in the system (n being the number of time series in the system). For example, between sales and efficiency indicators and cost of goods sold and other indicators for oil price and equity indices, there can be at most I(2-1) common factor. For Adobe Inc. cointegration between sales and operating efficiency indicators display one cointegrating vector for the all the variables i.e., COGS, OExp, RD, SGA and OInc. Similarly, in

Table 6, cointegration between COGS and other efficiency indicators provides similar results. In a system shown in

Table 2, which includes all variables there are two cointegrating vectors suggesting that there are two factors that binds these variables in the long run.

If we consider all the companies, as shown in

Table 3 to

Table 8, firstly considering the cointegration between sales and operating efficiency being mainly COGS indicator displays one cointegrating vector for the all the companies except for Analog Devices Inc., ASML Holding NV, Cisco Systems, Electronic Arts Inc, Intuit Inc, IDEXX Laboratories, Inc., KLA Corporation and Skyworks Solutions Inc. Similarly, in

Table 6,7 and 8, cointegration between COGS and other efficiency indicators provides similar results.

Secondly, if we consider cointegration between sales and operating expenses, we find the presence of one and two cointegrating vector for most of the companies except for Intuit Inc, IDEXX Laboratories, Inc., KLA Corporation, NVIDIA Corp, Skyworks Solutions Inc, Texas Instruments Inc, Verisk Analytics, Inc., VeriSign, Inc. Similarly, in

Table 6,

Table 7 and

Table 8, cointegration between COGS and other operating expenses provides similar results.

If we consider cointegration between sales and Research and Development, we find the presence of one and two cointegrating vector for most of the companies except for ASML Holding NV, Intel Corporation, Intuit Inc, IDEXX Laboratories, Inc., NVIDIA Corp, Skyworks Solutions Inc, Texas Instruments Inc. Similarly, in

Table 6,

Table 7 and

Table 8, cointegration between COGS and research and development provides similar results. If we consider cointegration between sales and SGA, we find the presence of one and two cointegrating vector for most of the companies except for ASML Holding NV, Broadcom Inc, Fortinet Inc, Alphabet Inc, Intel Corporation, IDEXX Laboratories, Inc., KLA Corporation, NVIDIA Corp, Skyworks Solutions Inc, Texas Instruments Inc, Verisk Analytics, Inc., VeriSign, Inc.. Similarly, in

Table 6,

Table 7 and

Table 8, cointegration between COGS and SGA provides similar results. Finally, when we consider cointegration between sales and operating income (OInc), we find the presence of one and two cointegrating vector for most of the companies except for Analog Devices Inc., Cisco Systems, Fortinet Inc, Intuit Inc, NVIDIA Corp, Skyworks Solutions Inc, Texas Instruments Inc. Similarly, in

Table 6,

Table 7 and

Table 8, cointegration between COGS and OInc provides similar results.

Based on

Table 9,

Table 10 and

Table 11, Granger Causality tests results are summarized in

Table 1a and

Table 1b. Clearly we observe the two-way and one-way causality flows from sales to other operating indicators and vice versa. Notable is that for few companies such as Activision Blizzard, Inc., Cisco Systems, Dexcom Inc, Electronic Arts Inc, Alphabet Inc, Intel Corporation, Microsoft Corp, Netflix Inc, bivariate causality exist between sales and other variables like cost of goods sold, operating expenses and research and development costs. Significant univariate causality is most often found to exist from operating variables to sales and not vice versa for majority of the companies. It is noteworthy to observe that significance is much stronger with SGA expenses having a larger impact on the sales of Technology companies both in the short and long-term. Similar results were obtained when Granger Causality tests are run between COGS and other efficiency indicators. Results are even more significant as COGS Granger cause RD and SGA expenses. This implies that efficient management of COGS is more important, and if these expense are managed well it could provide greater flexibility to technology companies to bring about superior operating performance. For example, if companies deliberately increase SGA and RD expenses it would lead to higher future operating profitability.

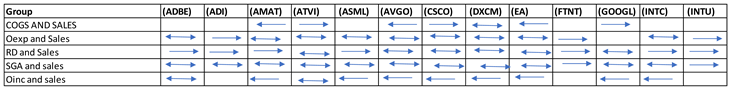

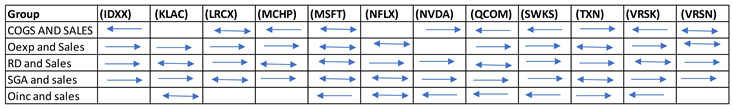

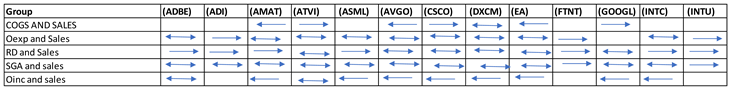

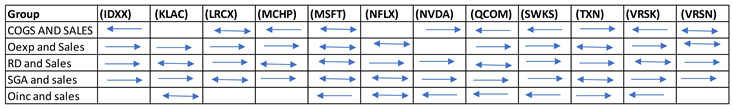

Table 1.

(a): Pictorial representation of causal relationship between Sales versus Operating Efficiency indicators for all the first 13 companies (Adobe Inc. to Intuit Inc) considered in the study. (b): Pictorial representation of causal relationship between Sales versus Operating Efficiency indicators for all the remaining companies (IDEXX Laboratories, Inc. to VeriSign, Inc.) considered in the study

Table 1.

(a): Pictorial representation of causal relationship between Sales versus Operating Efficiency indicators for all the first 13 companies (Adobe Inc. to Intuit Inc) considered in the study. (b): Pictorial representation of causal relationship between Sales versus Operating Efficiency indicators for all the remaining companies (IDEXX Laboratories, Inc. to VeriSign, Inc.) considered in the study

| (a) |

|

| (b) |

|