1. Introduction

Over the past two decades, growing concerns about a deteriorating environment, traffic congestion in cities and unhealthy, sedentary lifestyles have focussed attention all around the world on sustainable transport alternatives such as cycling. Compared to other modes of transport, cycling offers many advantages to individuals and society, including comparatively high speeds, minimal space requirements for paths and cycle parking, reduced pollution, fewer accidents and significant physical benefits. Cycling infrastructure projects are being implemented in many cities around the world to promote more sustainable transport systems [

1].

As a populous country, China experienced rapid growth in bicycle ownership in the 1980s and 1990s and was labelled the “bicycle kingdom” in the 1990s. However, after the mid-1990s, bicycle use declined steadily due to economic growth, increasing urbanisation, the expansion of urban areas and a gradually deteriorating cycling environment [

2,

3]. Since the beginning of the 21st century, the Chinese government has been promoting the new urban development model of a resource-saving and environmentally friendly society, which envisages a significant shift from fossil fuels to renewable energy in order to protect the environment and achieve a harmonious balance between economic growth, population, resources and the environmental sustainability [

4]. In this context, the use of bicycles has been actively promoted. With the trend of the sharing economy, China has once again become a bicycle kingdom, more specifically a “public shared bicycle kingdom” utilising information technology and the Internet.

2. The Platformisation of Cycling

The rise of what is commonly referred to as the “sharing economy”, notably in the transport sector, has been witnessed globally. Venture capital has poured into a variety of smartphone-based mobility services, digital “shared mobility” platforms such as Uber, DiDi Chuxing, Car2Go and Mobike. Integrated “mobility-as-a-service” (MaaS) systems that coordinate multiple individual services into a single portal have become the means to transform everyday urban transport, particularly in cities across North America, Europe and East Asia.

The first

Public Bicycle Sharing Programme (PBSP) in China was launched in 2005 by some tourism companies in Beijing to meet the needs of visitors. A few years later, the first-generation PBSP withdrew from the market due to the inadequate distribution of bicycle stations, lack of safety for cyclists, poor condition of public bicycle equipment, unattractive pricing and the unclear policy direction [

5]. However, since this early unsuccessful experience platform companies have gradually become indispensable in public and private life, and dockless bike-sharing platform systems have emerged in many Chinese cities since 2015; this transformation can be seen as a process of platformisation of cycling.

The concept of platform and the derived concept of platformisation can be found in various fields of study since the turn of the millennium, including network economics, business, media and communication, and software. The term “platformisation” refers to a process in which people and companies increasingly transact products and services via online platforms without relying on offline intermediaries such as physical marketplaces or shopping centres [

6]. Platforms function at the technological level in terms of the implementation and utilisation of technologies; at the social level in terms of communication, relationship and consumption processes; and at the commercial level in terms of companies' profit-making through the commercial exploitation of user data [

7,

8]. The term is also used to refer to the active efforts of platform companies to act as intermediaries for previously non-mediated transactions [

9]. Platformisation of transactions and its economic and infrastructural elements have penetrated, for example, the retail and taxi industries and have influenced the production, distribution and diffusion of products and services in these sectors [

10]. This platformisation of mobility is the result of the convergence of numerous socio-technical and political-economic changes that are manifesting themselves unevenly in the global urban space. The process of platformisation can reshape the way we do business, market structures and forms of production. At the same time, however, it can also raise issues such as data protection, data sovereignty and even monopolistic tendencies [

11].

In this article, we emphasise that platformisation is not just about the technological infrastructure or the economic model, but also about reshaping the cultural practices and governance framework around these digital platforms. By examining the development of bike-sharing in China and analysing the interplay of infrastructural, economic and social factors in the platformisation process, we aim to analyse and clarify the urban governance and regulatory issues raised by the rapid development of dockless bike-sharing in China. We want to show the profound impact of bicycle platformisation on Chinese society in several dimensions (social, economic, political, ecological, anthropological).

3. Historical Framework

In 1868, the inaugural introduction of the bicycle in China occurred in Shanghai, where it was perceived as an exotic Western commodity [

12,

13]. Bicycle use grew rather slowly over the following decades, and bicycles remained an extremely expensive import good for ordinary Chinese citizens largely due to technical barriers. It was not until 1950 that the landscape began to change with the production of the first iconic national bicycle brand,

Flying Pigeon, which was established in Tianjin with the support of the Chinese government [

14,

15]. Despite this development, the 1950s saw bicycles continuing to be perceived as a luxury item, a symbol of a high-quality lifestyle within many Chinese households. However, by this time, China had already doubled its bicycle stock to one million units. The 1970s marked a significant turning point, as bicycles gradually became integral to China’s transportation infrastructure. By the late 1980s, the country boasted over 60 national bicycle manufacturing enterprises and thousands of accessory production facilities [

16,

17]. In Beijing alone, the growth rate of bicycles exceeded 500,000 per year, and it was estimated that the total number of bicycles in China had reached approximately five billion.

During the 1980s and 1990s, the bicycle gradually became the predominant mode of transportation for the Chinese people. The peak in bicycle ownership in urban China was 197 bikes per hundred households in 1996 [

18], and China was characterised as a “Bicycle Kingdom”. However, since the mid-1990s, the Chinese government has thrown its weight behind the automobile industry. This strategic shift coincided with a decline in bicycle usage and an escalation in bicycle exports. Together with the policy of reform and opening up launched under the leadership of Deng Xiaoping at the Third Plenum in 1978 and with the explicit directions of the central government on bicycle transport, bicycle use fell rapidly, the once dominant two-wheelers giving way to cars. The average bicycle ownership in Chinese cities fell from their mid 90s highs to 113 bicycles per hundred households in 2007 [

19]. In Beijing, for example, the modal share of bicycles declined from 41.18% in 1995 to 27.8% in 2007 [

20]. Consequently, the urban landscape transformed dramatically, with the erstwhile “ocean of two wheels” becoming an “ocean of four wheels.” As bicycles ceased to be a fundamental mode of transportation, the low-end bicycle industry entered a long-term downturn. Concurrently, cycling began to be treated as a form of sport, a healthy lifestyle, an entertainment, and riding a bicycle became a nostalgic pursuit for certain generations.

4. Revolution of Public Bicycle Sharing in China

The World’s earliest well-known public bicycle-sharing initiative (

White Bicycle Plan) emerged in its cycling capital, Amsterdam [

21,

22]. Unfortunately, this innovation did not work well at that period. In the following decades, driven by societal changes and technological improvements, bike-sharing systems have sprung up worldwide, from the short-term and long-term checkout-staffed station bicycle rental service to the dockless free-floating bikes. In 2007, the public sharing bicycle model was introduced in major Chinese cities. In 2008, China launched its first bike-sharing program in Hangzhou with 2800 bicycles [

23].

Up until 2010, local governments led the management of docked public sharing bicycles. In 2010, companies specializing in the sharing bicycle industry emerged, but the market was still dominated by docked bicycle schemes. In 2014, with the surge of the sharing economy,

DaiWei and a group of partners co-founded

Ofo, initially conceived to address intra-campus travel needs within universities. Within a year, over 2,000

Ofo bicycles were deployed on the campus of

Peking University, quickly gaining traction in various Beijing universities in the subsequent months. A significant transformation occurred in 2016 when millions of brightly coloured dockless bicycles began to appear on the streets of Chinese cities and gradually replaced the dock-station bicycle-sharing system entirely. Thanks to its low fee, ease of mobile phone accessibility, precise GPS locations, and environmentally friendly concept, bicycle sharing quickly attracted many young users. According to the 2016

China Bike-sharing Market Research Report [

24] published by

Bigdata-Research, by the end of 2016, shared bicycle users increased to 188,640,000, about eight times more than in 2015. By April 2017, over 40 dockless shared-bike startups launched their own smartphone apps, offering access to a vast array of bicycles for minimal fees, sometimes as low as one yuan (about 15 US cents) per hour, with payments facilitated through digital wallets. The integration of GPS technology ensures that these bicycles can be conveniently parked almost anywhere after use. The data published by the

Ministry of Transport of the People’s Republic of China shows that, by the end of 2023, bike-sharing schemes covered 460 cities and registered over 500 million users. According to the

Beijing Municipal Bureau of Transport report, as of November 17, 2023, the total number of rides on shared bikes that year had exceeded 1 billion, setting a new historical record. The daily average number of rides has reached 3.1157 million, a 9.04% increase compared to 2022.

The boom in shared bicycles has had significant influences on Chinese society. Some studies have already emphasised the urban and social regeneration effects caused by the development of various bike-sharing schemes in large, medium and small cities in China [

25,

26,

27,

28,

29,

30,

31,

32,

33,

34]: positive effects include reducing carbon emissions and pollution, linking multiple platforms, promoting urban transport structure, creating jobs, promoting industrial development, accelerating the development of relevant technologies and improving legislation to manage the platforms. There have also been negative effects, though, such as major logistical and administrative headaches for the municipal governments, fierce, capital-financed trade wars and their notorious consequence, the huge bicycle graveyards, and not forgetting the numerous technical issues that have given rise to the phenomenon of “zombie bicycles” and difficulties faced by users in getting refunds.

Shared bicycle schemes have undoubtedly exerted enormous social and economic influences. According to the

Economic and Social Impact of Bike-sharing Report 2017 published by the

China Academy of Information and Communications Technology (CAICT) [

35], bicycle sharing made economic contributions of about 221,300 billion RMB in 2017. This trend has brought a renaissance to Chinese bicycle manufacturers, forcing them to expand their production capacity and hire additional labour to meet the growing demand. China is now the largest bicycle producer, consumer and exporter in the world. By the end of 2019, there were almost 400 million bicycles and 300 million electric bicycles in China. In 2021, bicycle production reached 76.397 million units and the production of electric bicycles was 45.511 million units [

36]. This increase in bicycle production has greatly strengthened China’s traditional bicycle industry and catalysed industrial upgrading and transformation.

The sharing of bicycles continues to drive the industry to improve the research and application capabilities of new technologies such as mobile Internet, NB-IoT locks, geo-fences, satellite tracking and composite materials. To support bike tracking, enable remote locking and unlocking, and provide real-time information to users, bike-sharing systems require robust connectivity and wireless communication infrastructure. The demand for reliable and efficient wireless communication has accelerated the development of technologies such as cellular networks, IoT connectivity, and low-power wide-area networks (LPWANs). Electric bikes (e-bikes) have gained popularity in bike-sharing services and the development of e-bikes has spurred advancements in battery technology, including improvements in battery capacity, charging efficiency, and range. These advancements have broader implications for the electric vehicle industry as a whole.

Bike-sharing services have been exploring sustainable energy solutions to power their operations, including the use of solar-powered charging stations, renewable energy sources for battery charging, and energy-efficient systems. The development and implementation of sustainable energy solutions in bike sharing can drive advancements in renewable energy technologies and promote their wider adoption.

Bike-sharing services rely on mobile applications and software platforms to facilitate user registration, bike reservations, payment processing, and real-time bike availability information. The development of user-friendly and efficient mobile applications has driven advancements in app design, user experience, and seamless integration with various payment systems. For example, users no longer need to download the corresponding application for each bike-sharing brand; instead, all companies develop their “Mini program” on the widely used WeChat app. The bicycle hire fees can be paid via WeChat pay, Alipay, or the account wallet. It was estimated that the bike sharing industry in 2017 allowed the bicycle industry to gain 22,2 billion RMB and expedited the adoption of new technologies, such as NB-IoT smart locks and electronic fences, as well as information consumption through electronic payments, contributing to an additional 23.2 billion RMB, creating employment for 390,000 people.

In the same period, the bike sharing helped city dwellers save travel costs of 119.6 billion RMB, saving 1% of the national amount of gasoline produced and 10% of the national air pollution cost. Cycling, as a green mode of transportation, can effectively reduce carbon emissions. According to reports [

37], one

MeituanBike and e-bike sharing can reduce carbon emissions respectively by 213.70 kg and 558.05 kg over the whole life cycle, which includes the production, in-service and recycling phases.

By 2022, the number of shared bicycles equipped with Chinese domestically developed BeiDou-based navigation satellite positioning chips has reached 5 million in over 450 cities on the mainland; in addition to positioning and navigation, the chips will help users and bike companies monitor user speeds, battery conditions, and criminal acts on the bikes.

Dockless sharing bicycles contribute greatly to promoting the urban transportation structure. In China, 67.5% of commutes are less than five kilometers [

38], which means that shared bikes and e-bikes can meet most Chinese commuting needs. In first-tier cities like Beijing, Shanghai, and Shenzhen, bike sharing perfectly solves the “first/last mile” problem as a kind of extension of train and bus services to and from commuters’ homes [

39]. Users can easily access bike stations near public transportation hubs, such as bus stops or subway stations. This connectivity enhances the accessibility of public transportation and encourages more people to use it for their daily commute.

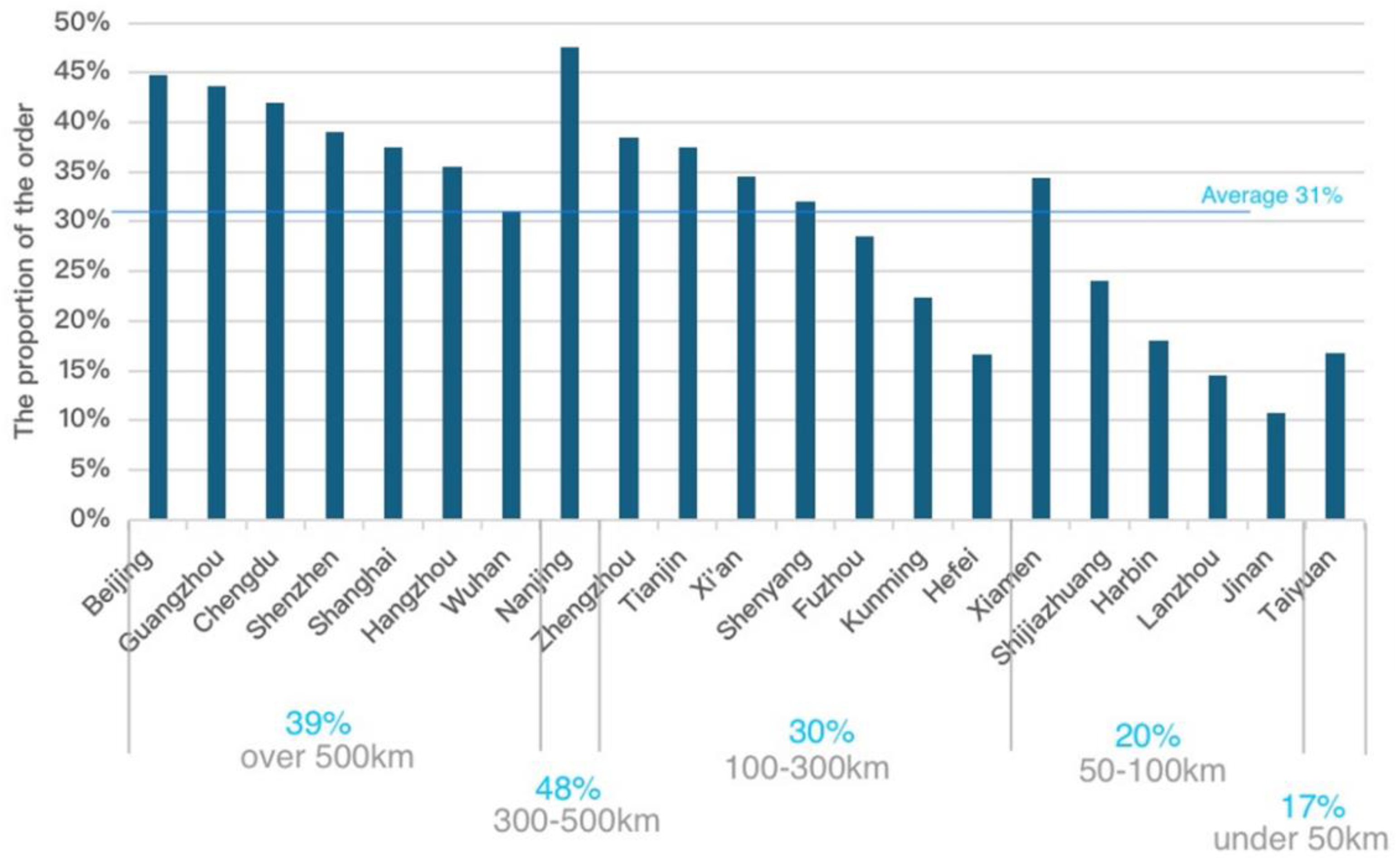

Figure 1 shows the proportion of bicycle sharing around the urban rail transit during morning and evening rush hours [

40] and its relationship to the length of the urban and suburban rail transit in major Chinese cities. The data measures the intensity and proximity of commuting mode use of “urban rail transit + bike sharing” in each city, which is an important reference point for evaluating the contribution of bike sharing to rail transport use. The data shows that the average share of bike sharing orders around urban rail transit during morning and evening rush hours is 31%; in the cities with more than 500 km of urban rail transit, the figures reach 39%, which means that the “urban rail transit + bike sharing” travel mode is more widely adopted by bike sharing users.

Moreover, more than 10% of orders are placed between 10 pm and 2 am, when train and bus services are suspended [

42]. In second, third, fourth, and lower-tier cities, the proportion of daily users is more than 30%; in fourth and lower-tier cities, it is 37.1%. For example, in Changsha, Kunming, and Yinchuan, 41% of

MeituanBike users use an e-bike more than twice a day. Data released in January 2017 on user distribution indicates that the majority of dockless bicycle usage (65.9%) is attributed to commuters utilising them as an adjunct to their regular transport, 57.1% for intra-city short-distance travel, and 38.7% for travel within college and university campuses. During the rush hours in many big cities, scores, even hundreds of shared bicycles are packed along the sidewalks outside most major transit hubs. In many big cities, bike-rental companies deploy fleets of trucks to redistribute bicycles throughout urban areas back to subway stations, executing several rounds of transfers within a single day. This innovative integration of Internet-based services with traditional transportation, named “Internet + transportation” and “bicycle + railway”, has significantly augmented and enhanced the urban public transportation network.

Table 1 shows the average journey time spent by active users in large Chinese cities for each shared bike journey. This shows that the shared bike is used as a connection between the railway station and the individual destination.

5. Rainbow War. Capital-Funded War in the Sharing Bicycle Industry

Since the start-up company

Ofo entered the market and achieved great success, competitors have quickly followed. According to statistics reported by the China

Academy of Information and Communications Technology [

44], in 2016, there were more than 30 brands on the market, covering cities from Beijing, Shanghai, and Shenzhen to the first and second-tier cities in China. In 2016, more than 30 investors invested capital in 11 sharing bike companies, and the industry's total funding exceeded RMB 3 billion in the second half of the year. Between 2016 and 2017, bike sharing companies secured a total of nearly

$5 billion in financing, of which

Mobike received about

$1.2 billion,

Ofo raised

$1.45 billion, and even newcomer

HelloBike, wholly owned by

Alibaba, raised

$350 million. With each brand sporting a brightly coloured logo—the yellow

Ofo bikes, the orange of

Mobike, green

Didibikes, and the blue of

Xiaomingbike,—the bicycle sharing industry had entered a so called “

Rainbow War”, heavily backed by capital investors.

The Media Consulting Survey data shows that in 2017, the number of shared bike users was 209 million, and the market size was 10.28 billion RMB. 2017 is not only the peak of the development of the industry but also a year of wild capital investment: In 2017, there were 23 million shared bikes across the country, operated by more than 77 companies. After 2017, the industry began to enter the precipitation period, following the market law of survival of the fittest. The rampant capital expansion and ultra-low-price competition brought every bike rental company into this capital-financed war. The industry’s rapid growth far outstripped immediate demand and became increasingly competitive and financially unsustainable for some companies, leading to difficulties in maintaining and managing their fleets. Competitors clenched their teeth and struggled to achieve profitability. The intense competition, high operating costs, and difficulties in managing fleets have led to financial losses and, in some cases, the disappearance of companies. Many bicycles were abandoned, damaged, or left unused. After the peak of the industry boom, millions of illegally parked bikes and an oversupply of bicycles piled up in open spaces of suburbs, becoming “bike graveyards” or “bike dumping grounds”.

The main “orange and yellow” fight for market dominance between Ofo and Mobike raged from 2016 to 2017, and it still impacts the whole industry today. In 2016, the Ofo company deployed over 800,000 iconic yellow bicycles across more than 30 Chinese cities, taking up 51.2% of the market share; its competitor, Mobike, launched 500,000 orange bicycles, capturing 40.1% of the market share. These two frontrunners in the market raised and invested hundreds of millions competing to build the biggest bicycle fleets and collect the most user deposits.

In 2018, after the bike sharing bubbleburst, many bicycle manufacturing enterprises suffered significantly due to the sharp reduction of orders and the debts from shared bicycle companies in crisis. Shanghai Phoenix admitted that the income in 2018 declined 46.68% compared to 2017, which included over 60,000,000 RMB of debts from Ofo. According to the China Bicycle Association data, the total production of shared bicycles in 2018 was 5,000,000, accounting for only a quarter of the previous year.

In March 2018, several firms began offering services without requiring a deposit. However, the China Consumers’ Association has received numerous complaints about deposit refund difficulties from many bicycle sharing platforms, especially those who would go bankrupt. By 2024, at least 16,000,000 users are still waiting for the deposit refund from the already vanished Ofo yellow bicycles. By the end of 2023, the Mobike users were finally able to get their deposit of 299 RMB back (about 40 euros), after six years of waiting. Yet despite the turbulence and aftermath of the bicycle wars, shared bicycle schemes have remained alive and become increasingly stable through governmental management.

6. Management Headaches Caused by Millions of Shared Bicycles

Between 2016 and 2017, with the support of capital, bike sharing start-ups competed to increase investments, and the total quantities of shared bikes proliferated, quickly exceeding the carrying capacity in cities. A number of causes led to hundreds of millions of bikes becoming "urban garbage" within just two years of the bike sharing boom. Chief among these reasons were unsuccessful cost management, an immature business paradigm, pernicious low-price competition, and disordered administration at the initial stage. By February 2018, over 20 of the 77 shared bicycle companies had stopped operations due to financial problems, resulting in millions of bikes abandoned on the streets—whether usable or “zombie bikes” from collapsed companies. During this period of high-speed development, namely from 2016 to 2018, operations and maintenance management was not followed up in a timely manner. As a result, a series of problems such as indiscriminate parking, obstruction of pedestrian routes and occupation of public spaces became more and more prominent, resulting in a variety of urban management problems. The sudden increase in the number of bicycles on the streets gave rise to concerns about road safety. These problems had decreased significantly by 2024.

The behaviours of some users, such as riding on sidewalks or disregarding traffic rules, have led to conflicts with pedestrians and other vehicles, increasing the risk of accidents. In some cases, excessive bicycles have cluttered the urban landscape. Abandoned or improperly parked bicycles can create an eyesore, detracting from the city’s aesthetic appeal and even blocking traffic. Shared bike schemes can be plagued by vandalism and theft. Bikes have been damaged or had parts removed for personal use or resale. Some people even destroy the QR codes and electronic locks to take public bicycles into private use, securing them with their own bike locks. One of the shared bicycle maintenance tasks is now to cut these private locks, and some enthusiastic and angry students have even organised dozens of volunteers to do the same. A HelloBike maintenance worker in Xi’an revealed that he has cut over 30,000 personal locks during his three-year maintenance work. This has resulted in significant financial losses for the companies.

Many cities took measures to control the number of bikes operating in the market. On 19 May 2022, for example, the Guangzhou Municipal Transportation Bureau launched a new round of tenders for operations. The tender reduced the number of bicycles by 150,000 compared to the previous tender and controlled the operation of sharing bikes in the entire city of Guangzhou in the order of 400,000. “Random parking” has always been a common problem in the management of shared bicycles across the country. In recent years, the Hangzhou Urban Management Bureau has been exploring the possibility of data-enabled bicycle management. In March 2023, the Hangzhou Public Slow Traffic Management Platform was built and started trial operation. The platform can monitor the number of bicycles, rental status, and overall regional distribution of various sharing bike companies in real-time and carry out network management of the operation of shared bicycles in the city. Currently, there are three shared bicycle operators in Hangzhou: MeituanBike, HelloBike, and Didi Bike. The three companies have released about 250,000 bikes in Hangzhou, and each bicycle has its unique ID. Querying the ID on the platform can show the current location of the bike, its rental status, historical order information and so on. From 2018 to 2019, majorfirst-tier cities have launched large-scale shared bicycle clean-up activities. In Hangzhou, for example, after three large-scale clean-ups, the number of sharing bikes in the city fell from 88,270,000 at the beginning of 2018 to 390,000 in the last quarter of 2018.

7. Governmental management and regulations of public bicycle sharing in China

The shared bicycle industry in China has acquired significant attention and support from the government, particularly in its initial stages. In December 2015, President Xi Jinping articulated the government’s commitment to bolster the sharing economy and innovations fueled by the Internet. This commitment was rapidly followed by practical measures. For example, within a month of Mobike’s introduction in Guangzhou in 2016, the local authorities established 39 designated parking zones for shared bicycles throughout the city. Similarly, the Shanghai government not only allocated specific parking areas to facilitate this new transport option but also set up signs to guide citizens in using the Mobike service effectively. Institutional reinforcement was further demonstrated in May 2017 with the establishment of the Sharing Bicycle Committee under the aegis of the China Bicycle Association, underscoring the industry’s strategic significance for transforming urban mobility in the era of the sharing economy.

After some problems arose with the company competition and urban traffic management, the government published a series of regulations to control the whole industry. From July to September 2017, twelve cities, including Hangzhou, Guangzhou, and Beijing, announced the suspension of any new shared bicycle launch. In August 2017, China’s Ministry of Transportation, together with ten other departments, jointly issued new rules requiring urban officials and enterprises to regulate bike parking, standardise services, and guarantee the safety of users’ deposits. In January 2018, the China Academy of Information and Communications Technology released a “bike-sharing supervision platform” to help relevant government departments monitor the number and operation of shared bikes in real-time in various administrative areas. On this platform, government staff can see all the operational data of shared bikes in real-time, including the number of vehicles, health status, cycling rate, number of rides, active vehicle curve, turnover rate, and so on. Based on the above data, the platform can also demarcate electronic fences, set up recommended and no-parking areas, and regulate bicycle parking. In addition to the web version, there is also a mobile app that officials can use when out on duty. In 2020, the Beijing government enhanced investigation and punishment on irregularities related to shared bikes, such as incomplete operation data connections, lack of broken bicycle maintenance staff, and disorganised parking by riders.

In June 2021, The State Administration for Market Regulation held a meeting with major domestic brand operators on June 3rd to discuss shared consumption and pricing, making it a landmark event in the development of China’s sharing economy. In December 2021, the Beijing government launched a shared bicycle “hundred-day renovation” activity to limit the total number of shared bikes in urban areas of Beijing to 800,000 units and enhance the utilisation rate (with MeituanBike at most 400,000, HelloBike at 210,000 and Didi Bike at 190,000 units in the central downtown).

At the same time, electronic commerce law advanced. Since 2017, Many bike-sharing users have found that their deposits cannot be refunded, many bike-sharing platforms cannot be contacted via customer service, or the companies have shut down. This phenomenon soon spread to dozens of bike-sharing platforms. The new Electronic Commerce Law, enacted on 1st 2019, set out specific e-commerce deposit refund rules. In November 2019, the Beijing Market Supervision and Administration Bureau published regulations for prepaid internet rental bicycles. The regulations demand that the deposit or pre-payment of any public shared bicycle service cannot be more than 100 RMB; simultaneously, the user deposit collected by the operating enterprise shall not be misappropriated for investment or other loan purposes. In January 2022, to regulate bike-sharing internet platforms’ compliance with the law, the Beijing Municipal Commission of Transport issued evaluation standards for a credit system targeting bike-sharing companies.

8. Differences in Local Policy on Shared E-Scooters

Shared bikes have their limitations, such as slow travelling speeds and, but they are particularly unsuitable in cities which are mainly characterised by mountainous and hilly terrain. E-scooter sharing addresses some of the shortcomings of the bicycle and has become very popular in many Chinese cities. According to the China Major Cities Bike/Electric Scooter Riding Report 2023, published by the China Academy of Urban Planning and Design, the average distance for a shared bike journey is 1.5 kilometres, while for a shared e-scooter it is 2.3 kilometres. Prices for bike sharing usually start at 1.5 yuan, while prices for e-scooters start at 2-2.5 yuan. Although e-scooter sharing is welcomed by many users, its development faces many challenges.

Firstly, the development of e-scooter sharing varies greatly from city to city, with different attitudes towards its management and policy discrepancies. The main problem is the varying potential impacts of e-scooter sharing on local traffic regulations, as assessed by local authorities. The administration of first-tier cities is the strictest. In central areas, the use of e-scooters is generally prohibited, and in cities such as Guangzhou, private e-scooters are even banned on certain roads. In 2017, Shanghai issued the Guidelines for the Standardised Development of Sharing Bicycles in Shanghai. It pointed out the significant impact of outdoor charging and parking on battery safety and deciding not to develop e-scooters for sharing in Shanghai. In Beijing and Guangzhou, although no explicit bans were issued, companies were discouraged from launching and asked to recall the e-scooters. In second-tier cities, some allow their use while others ban them. Kunming allows use throughout the urban area, and cities such as Changsha and Wuhan also allow the shared e-scooters. In October 2023, Lanzhou officially opened up to e-scooter sharing and trialled regulated development through pilot programmes. In Taizhou, Zhejiang Province, e-scooters disappeared overnight and only returned after regulated management by the local government. Zhengzhou, Xi’an and other cities explicitly prohibit electric bicycle sharing schemes. Taiyuan initially saw a sharp increase in the use of e-scooters, but in 2021 the Taiyuan City Transportation Bureau cracked down on illegally used vehicles, causing them to “disappear overnight”. To date, the operation of shared e-scooters is not permitted in Taiyuan. In cities where their use is permitted, it is often restricted to certain areas: Chengdu and Hangzhou allow their use outside the major urban areas. In contrast, there are generally no restrictions in third, fourth and fifth-tier cities. In Shandong province, for example, cities such as Heze, Binzhou, Liaocheng and Dezhou have introduced shared e-scooters, but they do not exist in Jinan, the provincial capital. Therefore, small and medium-sized cities are the main application areas for e-scooter sharing.

The development of e-scooter sharing in some cities is arguably now out of control. Companies have often deployed too many e-scooters to rapidly expand their business, leading to widespread problems with disorganised parking that has affected urban aesthetics and traffic regulations. However, many cities already have experience with bike sharing and have learned important lessons. Transport authorities are able to set quotas for the use of e-scooters, organise public tenders, select operating companies and then regularly evaluate the quality of service and adjust the deployment quotas based on the evaluation results. Not all problems can be eliminated though, and due to the access systems, some cities have also encountered issues with artificially created barriers. The National Development and Reform Commission (NDRC) published a report in 2023 on typical cases where the negative lists for market access were violated, including several cases where shared e-scooter schemes operated.

Some local governments have indirectly set the conditions for market access through leasing and procurement methods, setting exclusive rights to operate shared e-scooters, demanding mandatory service fees, and raising the thresholds for market access. These practices, which violate the requirements of the fair competition system, have shown a nationwide trend and require urgent attention.

Finally, the safety aspects in the initial phase are also a significant disadvantage in the development of public hire e-scooters. To save costs, some brands used lead-acid batteries in the early years, which were not durable and posed a significant safety risk. In addition, there are no uniform standards for e-scooters and quality varies; some vehicles travel too fast, contributing to traffic accidents. According to the traffic police, there was a high and increasing number of deaths caused by e-scooter traffic accidents in Shanghai between 2015 and 2016. In 2015, there were 158 accidents involving e-scooters, resulting in 96 fatalities, and in 2016, there were 108 accidents resulting in 95 fatalities. E-scooter sharing is considered one of the main causes of accidents, with a fatality rate of 88%. For this reason, Shanghai stopped the development of e-scooter sharing in 2017.

Table 2.

Comparison of Shared Bicycles and Shared E-Scooters in Major Chinese Cities, 2023 [

45].

Table 2.

Comparison of Shared Bicycles and Shared E-Scooters in Major Chinese Cities, 2023 [

45].

| |

Shared bicycles |

Shared e-scooter |

| Geographical distribution |

Cities at all levels |

Prohibiting placement in the first-tier cities, the second-tier cities and smaller cities are the main market |

| Popularity rate |

High penetration rate |

Low penetration rate |

| Average cycling distance |

2-2.5 km |

>3 km |

| Cycling time period |

Morning and evening peak |

Morning and evening peak; number of night cycling users in southern cities is much higher than in northern cities |

| Development stage |

Stability stage |

Expansion stage |

5. Conclusions

This article has looked at the development of bicycle use in the People’s Republic of China and traced four phases: the first phase from 1949 to the late 1970s, when the bicycle was seen almost as an exotic pastime for wealthy Western bourgeois; a second phase from the late 1970s to the 1990s, when the Chinese Communist Party accepted the introduction of bicycles into Chinese society and began mass production (The kingdom of bicycles); a third phase from the 1990s to 2010-2015, when the bicycle disappeared from the urban context and was replaced by the car; finally, a fourth phase from 2016 until today, in which bicycle use is undergoing a revival and bicycle sharing systems are spreading in all major Chinese cities (The “new” kingdom of bicycles). We then focused on this last phase by analysing the development of different public bike sharing systems in China and the transition from traditional models to the modern phenomenon of platform-based bike sharing. The platformisation of cycling, driven by the sharing economy and technological advances, has significantly changed various aspects of Chinese society. The emergence of dockless bike-sharing platforms was a major turning point in the mid-2010s. The integration of information technology and the internet facilitated the rapid growth of the sharing economy, transforming China into a “public bike-sharing kingdom”. The convenience, affordability and environmental benefits of sharing bikes caused the number of users to skyrocket, reaching more than 500 million by the end of 2023.

The positive impact of sharing bikes on Chinese society can be seen in economic contributions, industrial development, technological innovation and environmental sustainability. The growth of the shared bike industry has catalysed advances in connectivity, wireless communication, battery technology and renewable energy. In addition, the integration of bike sharing into public transport has solved the “first/last mile” problem in major cities and improved the accessibility of urban transport.

Our contribution has also addressed the challenges and complexities that arose from the “Rainbow War”—a capital-funded competition between large bike-sharing companies. The intense competition led to financial losses, oversupply and ultimately the closure of several companies. “Bike graveyards” or “bike dumping grounds” came to symbolise the consequences: millions of abandoned bicycles littering the cities.

In addition, the management of millions of shared bicycles has posed a major challenge for cities. Problems such as indiscriminate parking, road safety issues, vandalism and theft required regulatory intervention. The government responded by introducing regulations, setting up committees and developing technological solutions to monitor and manage the shared bike ecosystem.

In the final section, we have analysed the differences in local policies regarding e-scooter sharing. While e-scooters removed some limitations of conventional bicycles, their development has faced challenges such as different regulations, uncontrolled proliferation and safety concerns. This emphasises the need for comprehensive and consistent regulations to effectively manage the dynamic landscape of shared modes of transport.

Overall, the study provides a detailed account of the transformation of bicycle use in China and highlights the diverse impacts of platform-based bike sharing on various facets of Chinese society. The development of different bike sharing systems in China is a unique and crucial case to interpret the current situation of bike sharing and imagine future scenarios. Contrary to a dominant and unitary way of thinking that arises from the experience of Northern European countries [

46], the massive and widespread experimentation of different bike sharing systems in China reveals not only potentials and aspects of sustainability, innovation and urban and social regeneration, but also some hidden shadows in small-scale contexts such as those of Northern Europe, but which have emerged in a pluralistic and diversified context such as that of a “national subcontinent” like China.

Five challenges emerge from this experience for urban sociologists and other researchers interested in analysing these social issues: first, bike sharing and urban management; second, bike sharing and the travel habits of residents; third, bike sharing and health; fourth, bike sharing and the environment; and fifth, bike sharing and lifestyle.

Author Contributions

Conceptualization, G.F. and Y.T.; methodology, G.F. and P.D.; validation, G.F., P.D. and M.P.; formal analysis, G.F. and Y.T.; investigation, G.F. and Y.T.; data curation, G.F., Y.T. and P.D.; writing—original draft preparation, G.F. writing—review and editing, G.F., P.D. and M.P.; visualization, G.F. and Y.T.; supervision, G.F., P.D. and M.P. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Gössling, S.; Choi, A.S. Transport transitions in Copenhagen: Comparing the cost of cars and bicycles. Ecological economics 2015, 113, 106–113. [Google Scholar] [CrossRef]

- Zhang, H.; Shaheen, S.A.; Chen, X. Bicycle evolution in China: From the 1900s to the present. International Journal of Sustainable Transportation 2014, 8, 317–335. [Google Scholar] [CrossRef]

- Xu, T. History of bicycles in modern China; Shanghai People’s Publishing House, 2015. [Google Scholar]

- Li, C.; Wang, M. Green and low-carbon-oriented urban redevelopment: the transformation of urban governance in China. In Handbook on Local Governance in China; Edward Elgar Publishing, 2023; pp. 260–271. [Google Scholar] [CrossRef]

- Liu, Z.; Jia, X.; Cheng, W. Solving the last mile problem: Ensure the success of public bicycle system in Beijing. Procedia-social and behavioral sciences 2012, 43, 73–78. [Google Scholar] [CrossRef]

- Van Dijck, J.; Poell, T.; De Waal, M. The platform society: Public values in a connective world; Oxford University Press, 2018. [Google Scholar]

- Tirino, M. Mediatization and Platformization of Cycling Cultures: Actors, Practices, Processes. Eracle. Journal of Sport and Social Sciences 2022, 5, 5–32. [Google Scholar] [CrossRef]

- Paulussen, S.; Harder, R.A.; Johnson, M. Facebook and news journalism. In The Routledge Companion to Digital Journalism Studies; Franklin, B., Eldridge, S.A., Eds.; Routledge: New York-London, 2017; pp. 427–435. [Google Scholar]

- Tiwana, A.; Benn, K.; Ashley, A.B. Platform Evolution: Coevolution of Platform Architecture, Governance, and Environmental Dynamics. Information Systems Research 2010, 21, 675–687. [Google Scholar] [CrossRef]

- Nieborg, D.B.; Poell, T. The platformization of cultural production: Theorizing the contingent cultural commodity. New Media and Society 2018, 20, 4275–4292. [Google Scholar] [CrossRef]

- Poell, T.; Nieborg, D.; van Dijck, J. Platformisation. Internet Policy Review 2019, 8. [Google Scholar] [CrossRef]

- Zhang, H.; Shaheen, S.A.; Chen, X. Bicycle evolution in China: From the 1900s to the present. International Journal of Sustainable Transportation 2014, 8, 317–335. [Google Scholar] [CrossRef]

- Xu, T. History of bicycles in modern China; Shanghai People’s Publishing House, 2015. [Google Scholar]

- Zhang, H.; Shaheen, S.A.; Chen, X. Bicycle evolution in China: From the 1900s to the present. International Journal of Sustainable Transportation 2014, 8, 317–335. [Google Scholar] [CrossRef]

- Xu, T. History of bicycles in modern China; Shanghai People’s Publishing House, 2015. [Google Scholar]

- Zhang, H.; Shaheen, S.A.; Chen, X. Bicycle evolution in China: From the 1900s to the present. International Journal of Sustainable Transportation 2014, 8, 317–335. [Google Scholar] [CrossRef]

- Xu, T. History of bicycles in modern China; Shanghai People’s Publishing House, 2015. [Google Scholar]

- National Bureau of Statistics. China Statistic Yearbook (1989–2009); China Statistical Press: Beijing, China, 2010; Available online: https://www.chinayearbooks.com/china-statistical-yearbook.html (accessed on 4 April 2024).

- National Bureau of Statistics. China Statistic Yearbook (1989–2009); China Statistical Press: Beijing, China, 2010; Available online: https://www.chinayearbooks.com/china-statistical-yearbook.html (accessed on 4 April 2024).

- Source: China Statistic Yearbook (1981-2009) National Bureau of Statistics of China. Available online: https://www.chinayearbooks.com/china-statistical-yearbook.html (accessed on 4 April 2024).

- Pucher, J.; Buehler, R. Making Cycling Irresistible: Lessons from The Netherlands, Denmark and Germany. Transport Reviews 2008, 28, 495–528. [Google Scholar] [CrossRef]

- Pucher, J.; Buehler, R. City Cycling; MIT Press: Massachusetts, 2012. [Google Scholar]

- Shaheen, S.; Zhang, H.; Martin, E.; Guzman, S. Hangzhou public bicycle: understanding early adoption and behavioral response to bikesharing in Hangzhou, China. Transportation Research Record 2011, 2247, 34–41. Available online: https://escholarship.org/uc/item/31510910 (accessed on 4 April 2024). [CrossRef]

- Bigdata-Center Research. China Bike-sharing Market Research Report, 2016. Available online: http://www.bigdata-research.cn/content/201702/383.html (accessed on 4 April 2024).

- Hua, M.; Chen, X.; Zheng, S.; Cheng, L.; Chen, J. Estimating the parking demand of free-floating bike sharing: A journey-data-based study of Nanjing, China. Journal of Cleaner Production 2020, 244, 118764. [Google Scholar] [CrossRef]

- Jiang, Q.; Ou, S.-J.; Wei, W. Why Shared Bikes of Free-Floating Systems Were Parked Out of Order? A Preliminary Study based on Factor Analysis. Sustainability 2019, 11, 3287. [Google Scholar] [CrossRef]

- Li, X.; Zhang, Y.; Du, M.; Yang, J. Social Factors Influencing the Choice of Bicycle: Difference Analysis among Private Bike, Public Bike Sharing and Free-Floating Bike Sharing in Kunming, China. KSCE Journal of Civil Engineering 2019, 23. [Google Scholar] [CrossRef]

- Wang, J.; Huang, J.; Dunford, M. Rethinking the Utility of Public Bicycles: The Development and Challenges of Station-Less Bike Sharing in China. Sustainability 2019, 11, 1539. [Google Scholar] [CrossRef]

- Xu, H.; Yuan, M.; Li, J. Exploring the relationship between cycling motivation, leisure benefits and well-being. International review for spatial planning and sustainable development 2019, 7, 157–171. [Google Scholar] [CrossRef] [PubMed]

- Guo, Y.; Zhou, J.; Wu, Y.; Li, Z. Identifying the factors affecting bike-sharing usage and degree of satisfaction in Ningbo, China. Plos One 2017, 12, e0185100. [Google Scholar] [CrossRef] [PubMed]

- Li, X.; Zhang, Y.; Sun, L.; Liu, Q. Free-Floating Bike Sharing in Jiangsu: Users’ Behaviors and Influencing Factors. Energies 2018, 11, 1664. [Google Scholar] [CrossRef]

- Ma, L.; Zhang, X.; Ding, X.; Wang, G. Bike sharing and users’ subjective well-being: An empirical study in China. Transportation Research Part A: Policy and Practice 2018, 118, 14–24. [Google Scholar] [CrossRef]

- Zhang, L.; Zhang, J.; Duan, Z.; Bryde, D. Sustainable bike-sharing systems: Characteristics and commonalities across cases in urban China. Journal of Cleaner Production 2015, 97, 124–133. [Google Scholar] [CrossRef]

- Shaheen, S.; Zhang, H.; Martin, E.; Guzman, S. Hangzhou public bicycle: understanding early adoption and behavioral response to bike sharing in Hangzhou, China. Transportation Research Record 2011, 2247, 34–41. [Google Scholar] [CrossRef]

- China Academy of Information and Communications Technology (CAICT). Economic and Social Impact of Bike-Sharing Report, 2017. Available online: https://www.caict.ac.cn (accessed on 4 April 2024).

- Chinese Cycling Association. Available online: http://cycling.sport.org.cn/ (accessed on 4 April 2024).

- The Environmental Development Center of the Ministry of Ecology and Environment and China Environmental United Certification Center. Lifecycle pollution and carbon reduction from bike and e-bike sharing, 2022. Available online: https://www.cdmfund.org/31603.html (accessed on 4 April 2024).

-

Report on Commuting Monitoring of Major Cities in China, 2021. Available online: https://finance.sina.cn/tech/2021-07-30/detail-ikqciyzk8417843.d.html?fromtech=1&from=wap (accessed on 4 April 2024).

- Liu, Z.; Jia, X.; Cheng, W. Solving the last mile problem: Ensure the success of public bicycle system in Beijing. Procedia-social and behavioral sciences 2012, 43, 73–78. [Google Scholar] [CrossRef]

- The proportion of orders for bike sharing around the urban rail transit in the morning and evening rush hours refers to the ratio of orders within 100 metres of the urban rail transit station to all orders in the entire operating area in the morning and evening rush hours of each day.

-

Annual report on shared bikes and e-scooters in major Chinese cities, CAUPD, 2023. https://mp.weixin.qq.com/s/fLDNu3wg6Htg3RdIsBtybA.

-

Better Life with Low-carbon Travel. A Report on the Social Value of Shared e-bikes, 2021. Available online: https://www.digitalelite.cn/h-nd-1638.html (accessed on 4 April 2024).

-

Annual report on bike sharing and e-scooter sharing in major Chinese cities, CAUPD, 2023. https://mp.weixin.qq.com/s/fLDNu3wg6Htg.

- China Academy of Information and Communications Technology. China’s Bike-Sharing Industry Development Report, 2018.

- Institute of Transportation, China Institute of Regulator. Annual report on sharing bikes and sharing e-scooters in major Chinese cities, CAUPD, 2023. https://mp.weixin.qq.com/s/fLDNu3wg6Htg3RdIsBtybA.

- Bieliński, T.; Ważna, A. New Generation of Bike-Sharing Systems in China: Lessons for European Cities. Journal of Management and Financial Sciences 2019, 33, 25–42. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).