1. Introduction

The recent increase in the frequency of disasters that happen in densely-populated areas have been catastrophic [

1]. Disasters such as droughts, floods, wildfires and earthquakes have been prominently disruptive and causing many risks [

2]. Observed climate change is already affecting food security through increasing temperatures, changing precipitation patterns and greater frequency of disasters [

3]. According the World Health Organization, there are 828 million people affected by hunger around the world. Although this number is projected to drop over time, 670 million people (8 per cent of the world population) will still be facing hunger in 2030 [

4]. This research contributes to the reduction of the food insecurity while achieving the UN 2

nd Sustainable Development Goal (SDG) of ‘Zero Hunger’ as well as the 15

th SDG of ‘Life on Land’.

Workers in low-income countries are the most affected from climate change. They struggle to find insurance as insurers begin to pull back from risky regions [

5]. Meanwhile, those who are socially vulnerable due to poverty, low education and financial exclusion are exposed to extreme weather disasters [

6]. Insurers, on the other hand, are concerned with quantifying uncertainties and risks. To make this task more cumbersome, the effects of climate change being rapid and disastrous have made insurers’ job become more challenging [

7].

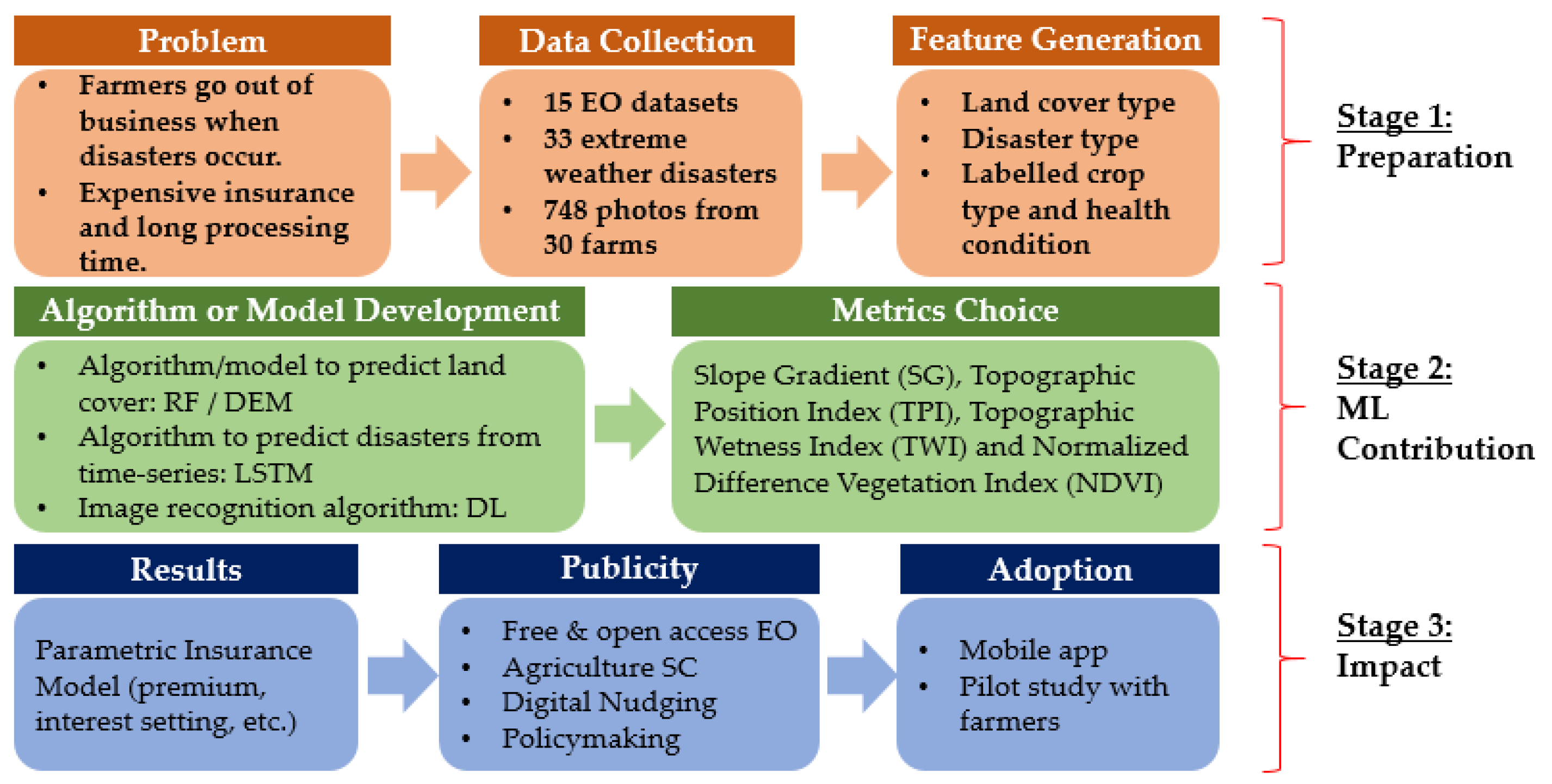

The goal of this research is to develop an insurance system that is affordable to small farm owners, insurers and policy-makers. This can be done via contemporary and archive data from Earth Observation (EO) and Free Open Source Software (FOSS), applying deep learning on mobile phone photos of features at surveyed farms; and geoinformatic data processing involving machine learning. From an insurance sector perspective, the objectives are to: (i) provide insurance access to small-scale farms, allowing them to run a viable business by increasing crop sustainability and resilience to hazards; (ii) allow underwriters to predict risks, thus setting the premium more fairly; (iii) optimize the claim and verify damages using digitally-automated systems. This research will contribute to the theorization of information systems usage for sustainability and community resilience. The below diagram (

Figure 1) explains how this research was conducted. The diagram illustrates a pre-hazard stage starting from a better estimation process of the underlying asset (crop), a better awareness of potential hazards and a historical outlook on previous incidents. The diagram, then, explains how a deep learning model would classify images uploaded by farmers while a parametric insurance model would estimate the damage based on topographic changes on satellite images to issue an automated payout to insured farmers and grant them continuation of their business.

The organization of this manuscript is as follows: the introduction reviews the impacts of extreme weather events on farming and how such risks have been managed. Also, it discusses the provision of insurance for the farming sector. Thereafter, a summary on how the authors collected, processed and analyzed data is explained within the methods section. Next comes the reporting on results followed by a discussion, including recommendations, and conclusions.

1.1. Climate Change, Disasters and Farming

Disasters have resulted in around

$ 200 Billion of economic losses in the period between 1980 and 2014 [

8]. Since then, there has been a constant increase in disasters as well as in number of people living in vulnerable areas [

1]. In 2018, the UK Space Agency predicted that:

“Climate change is expected to result in more frequent and intensive climate-related hazards. It will also reduce the predictability and change the geographic distribution of extreme climatic hazards, such as extreme temperatures, floods and droughts, heat waves, wild fires and storms” [9]. That prediction has largely been verified by numerous extreme weather events – often with records broken – since 2018 [3, 10]. Therefore, many scholars focused their research on reducing the vulnerability in disaster-prone areas by building a resilient climate change ecosystem [

11]. One of the main targets for a resilient extreme weather disasters ecosystem is one with food security [12, 13]. The same can be achieved by decreasing the likelihood of crops failure – e.g. damaged, diseased or destroyed [

14], as well as mitigating the risk of damage to farm infrastructure [

15].

This research contributes to the shifting of the climate risk assessment framework to a sustainable climate-resilient ecosystem. This can be done by (1) predicting when extreme weather disasters occur; and (2) ensuring farmers’ continuation of their course of business thus having sustainable income. This comes in line with the findings of the Intergovernmental Panel on Climate Change (IPCC), which asserted that climate change exacerbates land degradation keeping in mind that ice-free land plays a vital role in human livelihood [

3].

1.2. Disaster Risk Management

A plethora of studies has been examining the implications of disasters on communities. Main aims range on how vulnerable communities should prepare, resist, rebuild and recover after a disaster takes place. The term ‘resilience’ became prominent towards the end of the last century with conceptual frameworks [

16]. Lu and Yang [

17] argued that disasters comes with a social factor, which can be measured using social networks. Accordingly, Wu and Cui [

18] monitored tweets and measured sentiment during Hurricane Sandy.

The suggestion of relying on Information and Communication Technologies to increase resilience especially in under-developed countries was introduced by many researchers followed by the emergence of a sub-discipline known as ‘ICT for Resilience and Sustainable Development (ICT4RS)’. A research by Heeks and Ospina [

19] introduced e-Resilience, a framework that explains the interplay between information systems and humans during disasters. They conducted a survey and reported on the usage of ICT (via mobile phones and internet-connected laptop/tablets) in relation to the respondents’ demographics. Similarly, Longo, Zardo [

11] used ArcGIS software to map land covers and assess their resilience to climate change creating the Ecosystem Service Climate Change Adaptation (ESCCA) framework.

Oliveira [

10] conducted a systematic review of pre- and post-disasters studies and highlighted the importance of building back better in the post-disaster phase in light of the Sendai Framework. The aforementioned framework was published in 2015 by the UN Office for Disaster Risk Reduction aiming to achieve sevent global sustainable targets by 2030. In light with the above, impacts of extreme weather disasters were seen as a threat to food security and agriculture.

Geoinformatics and Farm Risk Management

The global abundance of freely-available digital map data and Earth Observation data with relatively detailed pixels (in the 3m to 300m range), has given scientists the opportunity to integrate many datasets at locations such as farm fields, to detect, map and monitor types of vegetation coverage and hazard zones [

20]. As a result, space agencies started different programs to eliminate food insecurity and protect agriculture productivity. The Global Agriculture Monitoring (GLAM) Project [

12] aimed at monitoring crop conditions using remotely-sensed data [

21]. Similarly, the National Aeronautics and Space Administration (NASA) started the ‘Harvest Africa’ program to monitor crops and issue early warnings in the Sub-Saharan Africa (SSA) region [

22].

Teeuw, Leidig [

23] considered disaster risk management applications of free or low-cost remote sensing data and geospatial analysis software, termed ‘sustainable geoinformatics’ - inspired by that concept, this article presents a low-cost EO-based farm insurance system, the case for which has been clearly stated by the UK Space Agency: “

EO enables accurate mapping of land use and monitoring of changes in crops and the land itself. This data is useful for finance companies that need access to data concerning land used by growers in order to be able to offer them financial products such as insurance or credit. For many small-scale producers in developing countries, these financial products are prohibitively expensive, not designed for their needs, or simply not available at all…” [

9]. The work of Argyriou, Polykretis [

24] focused on using geoinformatics to estimate the impact of rainfall on landslides and, consequently, agricultural activities.

This research examines the feasibility of using applied geoinformatrics for disaster risk management in small farms. This has involved a combination of digital elevation data from satellite remote sensing, daily EO imagery and archive EO data from the past two decades, supported by time-stamped GPS-tagged photos from farmers’ mobile phones and data processing using deep leaning. Of the various studies that focused using geo-informatics/EO and ICT to support agriculture, majority focused on the African continent in different scopes (e.g. West Africa, sub-Saharan Africa, etc.). Additionally, no study has discussed the AI-deep learning model for crop damage detection from an actuarial point of view and how that would affect the underwriting process.

1.3. Provision of Insurance for Small Farmers

Insurance helps maintaining economic stability especially for vulnerable societies [

25]. However, due to its volatility in weather conditions, many insurers stopped covering disasters such as floods [

7]. The impacts of climate change are greater with small-scale farmers because they typically do not have the capacity to cope, due to their limited resources and the cost barrier that they face if they seek farm insurance [

9]. This can be explained by the ‘social identity theory’, which asserts that generations and social classes can impact climate policies [

26].

In agriculture, of the world’s 570 million smallholder farms, 87% are less than 2 Ha in size [

27]. In addition to cost, agriculture insurance remain low in development countries, where many small farms are concentrated, due to institutional and technological constraints [

1] as well as the high cost of loss estimation/verification [

8].

In the Latin American region, only 4 per cent of SMEs working in the farming business have insurance due to lack of governmental support except for Mexico and Brazil [

28]. In addition, premiums were estimated to be around

$ 72 per hectare, which is a significantly-high amount especially for small farm owners. Overall, the insured farmed land was estimated to be 29 million hectares out of a total of 138 million hectares across the continent [

28]. As a result, many smallholder farmers started forming cooperative groups in order to improve productivity and spread risks, as is the case in many farming districts of Colombia, the focus of this research.

Decisions associated with disasters have been characterized with a heuristics nature [

29] instead of being data-driven. Consistently, ‘Parametric Insurance’ uses indices to guide insurance payouts based on pre-defined thresholds in indices [

8]. In other words, its ultimate payment is not based on individual losses, but determined according to a measure (be it an earthquake magnitude or wind speed). In this research, the combination of EO data, GIS and machine learning methods is utilized to identify the right measure(s) per disaster type while arguing that insurance payouts can still be individualized using deep learning technology.

Parametric Insurance

Parametric insurance offer pay outs once a disaster exceeds threshold measured by an index or multiple indices. The adoption of parametric insurance has been challenging and controversial. Figueiredo, Martina [

8] implied that, at the heart of its design, parametric insurance violates risk assessment principles since it issues automated pay outs regardless of actual losses. Nevertheless, parametric insurance has been common when it comes to agricultural products. A framework of how parametric insurance can be used in Africa was developed by Ibarra and Securities [

1]. Subsequently, many studies focused on different aspects of such novel adoption in different developing regions. For example, Figueiredo, Martina [

8] focused on methods to estimate risks by calculating the probability of a flood event happening in Jamaica using a logistic regression model. They based their study on the premise that the target variable has a binary nature: disaster / no disaster. A study by Prokopchuk, Prokopchuk [

30] used temperature, humidity and precipitation to estimate the growth level of grains within Ukraine and linked tha2.1.t to insurance. Inspired by the importance of predictability and the emergence of machine learning, Cesarini, Figueiredo [

31] suggested integrating multiple sources of weather data then applying supervised machine learning (ML) techniques, such as Support Vector Machines and Artificial Neural Networks (ANNs) to classify impacts of drought and floods in the Dominican Republic between 2000 and 2019. The study of Benso, Gesualdo [

25] examined weather indices in Brazil and how those affect soybean farms: they argued that disasters could be interrelated and proposed a multi-hazard risk assessment approach.

During the 2023 United Nations Climate Change Conference, the former secretary of the United States, Hillary Clinton, indicated that she is pioneering new reforms of the insurance industry by working with the Arsht-Rock Foundation Resilience Center to recognize parametric insurance as a form of climate change resilience [

5].

2. Materials and Methods

2.1. The Study Area

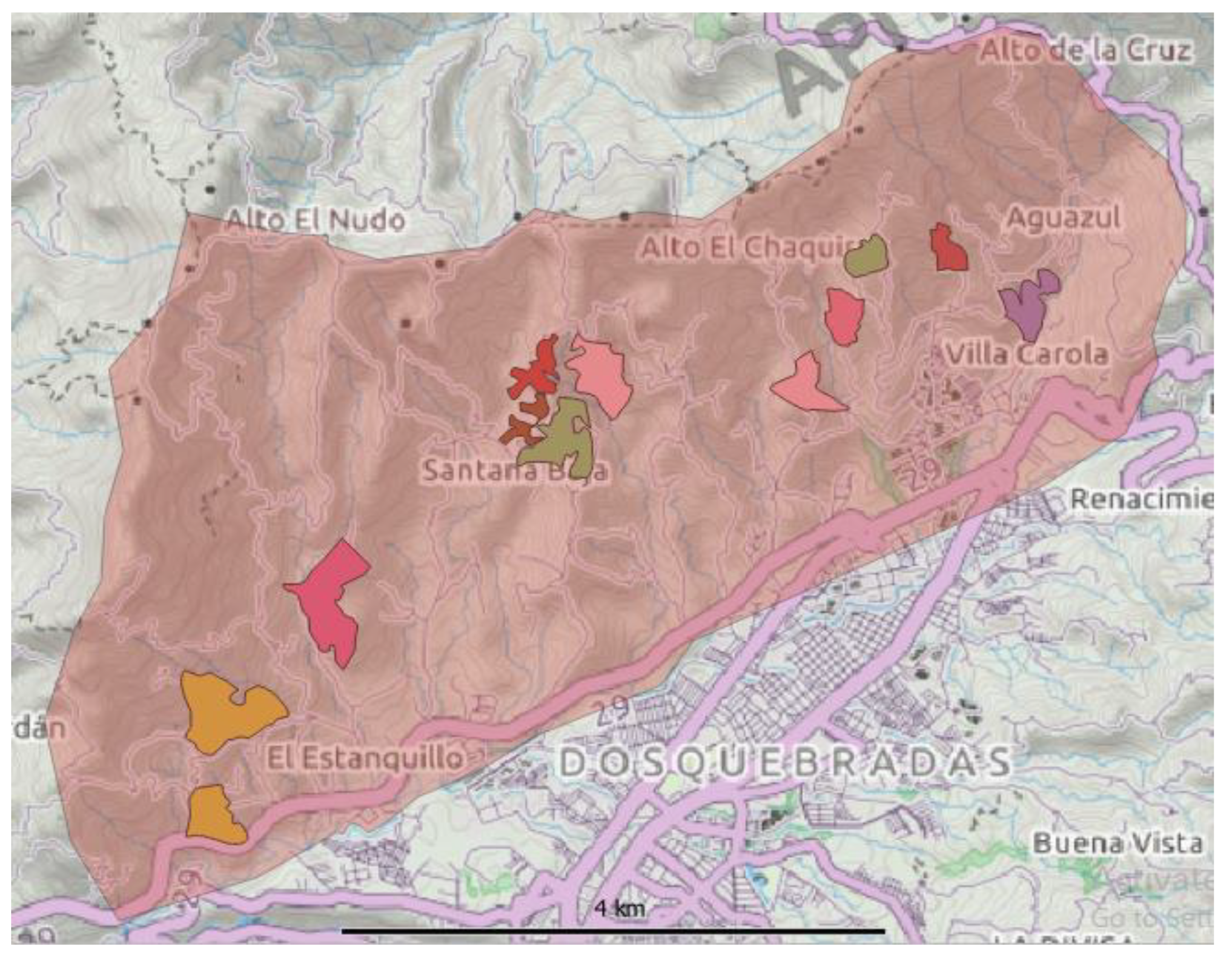

The study areas for this research is the Dosquebradas farming district in Risaralda Department, Colombia (

Figure 2). In addition to the tested areas being known for farming activity, many disasters (notably 29 flood events) occurred between the years 2007 and 2011 [

32].

Farm Locations and Disaster Events

In Dosquebradas, 30 farms were surveyed (

Figure 3) and those were mostly growing coffee with a few fields of avocado. Examination of disaster data in the website of Colombia’s Institute of Hydrology, Meteorology and Environmental Studies (IDEAM) (

http://ideam.gov.co) yielded information about 31 disasters affecting Risaralda Department since 1998, e.g. event dates, areas affected, casualties (see 0). Earthquakes were also included in the database because they often cause landslides, which can severely damage farm infrastructure.

2.2. Data Sources

According to Ibarra and Securities [

1], quality data is essential in building a parametric insurance model. Satellite imagery data varied according to quality and availability. Datasets were used to examine the study area, involving mapping of terrain (geomorphometry), and monitoring of land cover, crop types and weather (temperature and precipitation). After pre-processing the datasets, those were integrated using GIS. The datasets from GEE were used for the time-series analyses of hydro-meteorological indices and the machine learning classification of geomorphometric features to derive landform types and topographies. Finally, GPS-timestamped photos provided via mobile phone apps were used for verification purposes where a deep learning image recognition algorithm was used to identify crop type and health condition.

2.2.1. Earth Observation (EO) Imagery

Satellite data consisting of earth observation imagery provide global datasets on soil, surface and temperature [

7]. In this research, various geoinformatic datasets were used and those are summarized in

Table 1. The farming district was mapped and monitored, for vegetation cover and ground surface temperature, using imagery from the Moderate Resolution Imaging Spectroradiometer (MODIS: 250m pixels), analyzing an archive of MODIS imagery dating back to 2000. Detailed EO-based mapping of farms and individual fields (vegetation cover, crop types, stages of crop growth and photosynthetic activity) was carried out using visible and infra-red imagery from PlanetScope (3.8m pixels) and Sentinel-2 (10m pixels), for which archive imagery extends back to 2015.

2.2.2. Digital Elevation Models (DEMs) and Geomorphometrics

The ALOS PALSAR global DEM (12.5m pixels) produced by the University of Alaska Space Facility was used to carry out geomorphometric analyses of the terrain within the two farming districts. The methodology of Argyriou, Sarris [

33], Argyriou, Teeuw [

34] was used to produce DEM-derived maps of slope steepness, slope aspect, terrain wetness, drainage networks and landform types.

2.2.3. Mobile Phone Photos

Using a customized mobile phone app, time-stamped photos with Global Positioning System (GPS) longitude/latitude coordinates, accurate to +/-5m, were collected in September 2020 within the sampled farms. 748 farm photos were saved on the InsurTech server (

Figure 4) as .kml files. That KML format enabled administrative users to see the locations via Google Earth, thus linking mobile phone photos to insured items on farms, as well as providing locations that could be examined using EO satellite imagery.

2.3. Data Analysis

A research framework was adopted and applied into this research from the study of Wagstaff [

35] given the reliance on ML. The authors followed the aforementioned framework in its three stages: preparation, ML contribution and imapact (

Figure 5). In preparation, the problem was identified and relevant data was collected while generating features and labelling classes. In ML contribution, DEM and RF were used to classify land covers while LSTM was used to learn from extreme weather disasters. Additionally, DL was used to recognize images collected from the mobile app and classify those. Finally, metrics were chosen to indicate the probability of a disaster in a certain location happening. In stage 3, the impact, results were presented in a parametric model form where insurers would adopt a new process and become part of the InsurTech ecosystem. Those results are shared with relevant communities such as policy-makers, tech. developers, agriculture supply chain players and insurers who would benefit from the accessible EO capabilities. This research encouraged the adoption of the new geoinformatic approach in order to sustain a small-scale farming business.

There were three analyses that were performed in this research: (i) terrain analysis of farming districts and individual farms, using DEM-based geomorphometrics; (ii) Time-series analysis of farming districts, monitoring hydrometeorological indices before, during and after historical extreme weather disasters, using long short-term memory (LSTM); (iii) Deep Learning (DL) model to classify mobile phone photos into crop type and health condition.

2.3.1. Terrain: DEM geomorphometrics

A DEM of a given landscape can be analyzed using geomorphometrics to identify key components that will have distinct morphologies, be subject to specific Earth surface processes and thus contain predictable soil and regolith types. A freely-available DEM with near-complete global coverage was used in this research: the 12.5m-pixel ALOS PALSAR DEM. Three geomorphometric features were mapped in the study area:

Slope steepness: Slope Gradient (SG) shows the change occurring in elevation between each pixel of the DEM and its neighbors. Flat surfaces are characterized by low values while a steep relief is indicated by the higher values [

36]. The direction of slope, known as the Slope Aspect, was also mapped because some slopes receive more rainfall as they face towards the dominant direction of winds during the wetter seasons of the year.

Topographic Position Index (TPI), showing landform types: This is a geomorphological measure that classifies landforms into 10 types: canyons and deeply-incised valleys, mid-slope drainage, upland drainage, U-shaped valleys, plains, foot slopes, upper slopes, local ridges, mid-slope ridges, and high ridges [34, 37].

Topographic Wetness Index (TWI): This measure determines the slope of a given field in order to estimate soil moisture and surface saturation of that area. A high TWI value refers to accumulation of moist, surface saturation or alluvial deposits [38, 39]. A low TWI value indicates susceptibility to soil erosion, whereas a high TWI values indicates an area with limited moisture [34, 40, 41].

2.3.2. Vegetation Mapping and Monitoring

Vegetation detection with satellite imagery: Sentinel-2 and PlanetScope imagery were used to discriminate between vegetation and areas of bare soil in the study areas. The production of land cover types through machine learning predictive modelling informed our parametric insurance model and helped in price-setting as detailed later in this paper. This was done using a Random Forest (RF) machine learning classification algorithm [

42]. A high prediction accuracy and high tolerance to outliers and noise are of the main advantages of RFs [

42]. In addition, it estimates correlation between covariates and dependent variables by evaluating the relative importance of covariates [

43]. RF classification was applied to cloud-free Sentinel-2 imagery, based on training samples, to discriminate land cover types.

Normalized Difference Vegetation Index (NDVI): NDVI “is the primary vegetation index for monitoring crop conditions” [

12]. It is widely-used due to its ability to measure photosynthesis activity and, thus, correlate with vegetation density and vitality [44, 45]. NDVI is derived from satellite imagery in the visible and near-infra-red (VNIR) parts of the electromagnetic spectrum. NDVI derived from imagery of the Moderate Resolution Imaging Spectroradiometer (MODIS: 250m pixels) can be used for assessing vegetation dynamics during the past 20 years because archive of MODIS NDVI data extends back to 2000 [

46]. NDVI has been at the center of calculations pertaining food insecurity whenever EO is adopted in order to spot anomalies in growth of crops [

12]. In their study, Bégué, Madec [

12] conducted spatio-temporal analysis of NDVI performance in West Africa. Impacts of extreme weather events, thus, could be evaluated based on NDVI values before, during and after each disaster.

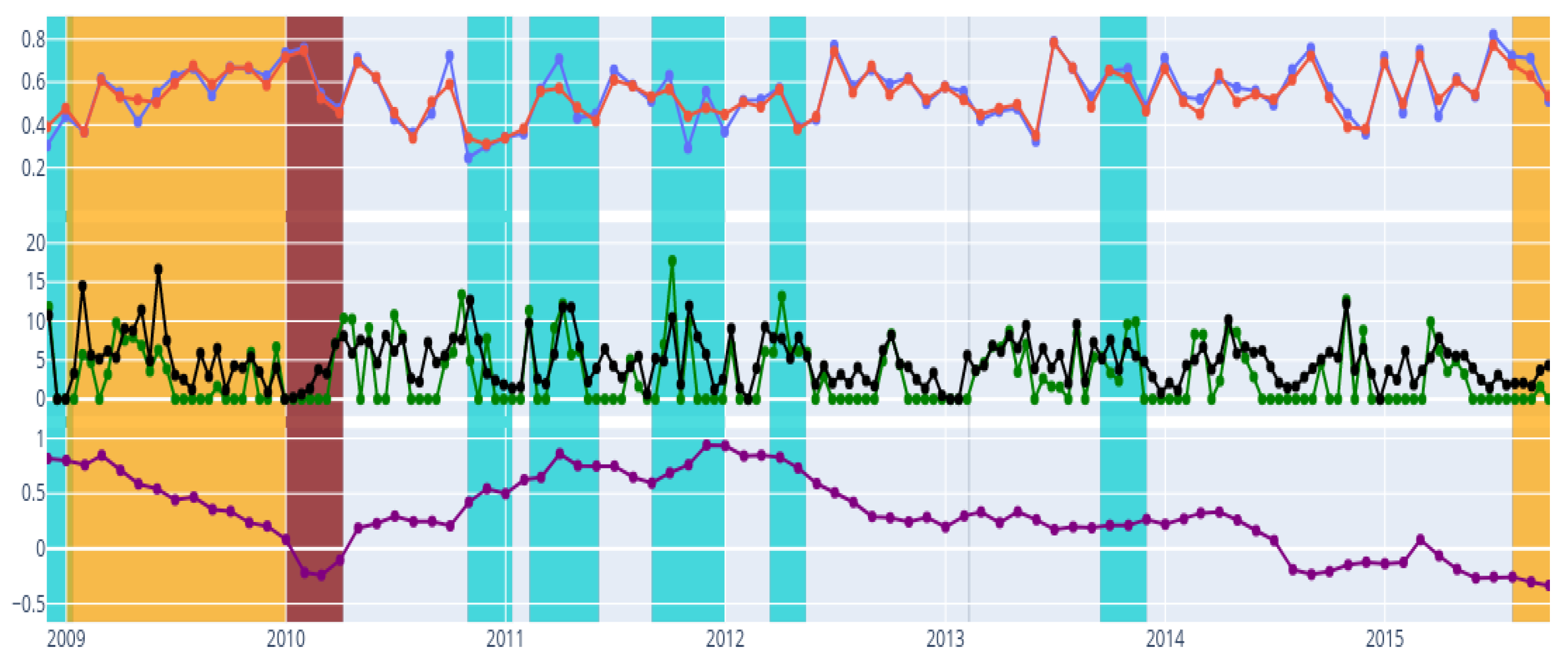

2.3.3. Time-Series Analysis

Datasets were sourced from Google Earth Engine (GEE) to analyze various bioclimatic and hydrometeorological indices for our two study areas, examining data for the past 20 years and focusing on extreme weather events affecting those areas since 2000. Monthly datasets were compiled and analyzed from various climatic data archives: CHIRPS, ERA5 Climate, TerraClimate, PERSIANN Drought Severity Index (PDSI) and the Cloud Classification System-Climate Data Record (CCS-CDR), details of which are provided in

Appendix B. Those hydrometeorological datasets were used to examine periods of extreme weather events, such as intense rainfall and flooding (La Niña), dryness, drought and wildfires (El Niño).

MODIS 16-day rolling mean and medians of NDVI, PERSIANN, CHIRPS precipitation indices and the Palmer Drought Severity Index (PDSI) were plotted on a time-series axis. Also, periods of extreme weather were shaded in colors: blue for floods, light brown for drought and dark red for periods with frequent wildfire (

Figure 6).

2.3.4. Deep Learning (DL)

For geoinformatics to contribute to social resilience and sustainable food security, local knowledge must be incorporated in the implementation of the technology. Therefore, a digital business model was adopted, where insured farmers input their data by uploading timestamped and geo-tagged photos via their mobile phones. Deep learning (DL) models have been utilized as an effective way to detect objects within photos in disaster management. For example, Chaudhuri and Bose [

29] applied convolutional neural networks deep learning model on geo-tagged photos to verify damages in buildings and survivors in the case of earthquakes. Nakalembe and Kerner [

47] argued the plausibility of using deep learning models in lieu of machine learning decision trees and random forests for crop and crop type classifications.

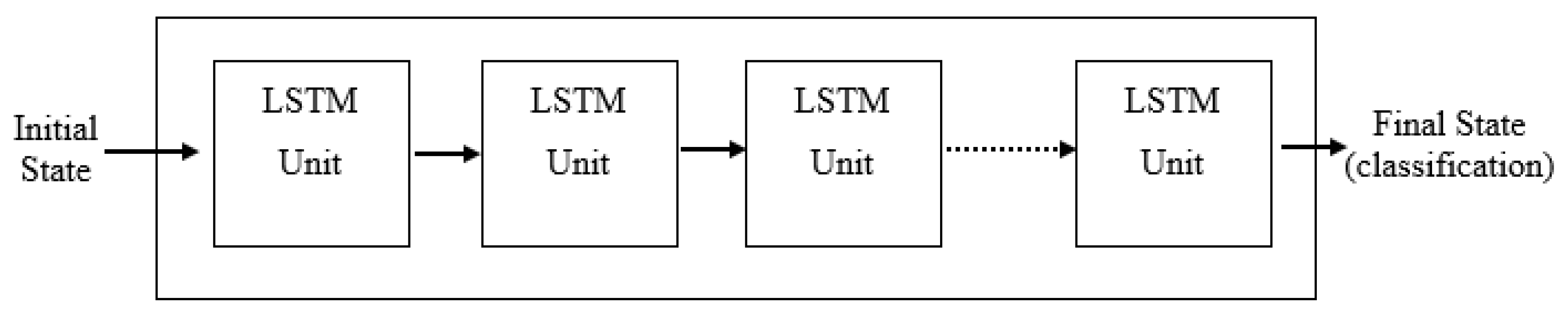

Long Short-Term Memory (LSTM): a sequence learning method has been developed for this research with thousands of time steps via a recurrent neural network known as Long Short-Term Memory (LSTM) model. The batch size and timesteps were used as input features with the output being softmax function used in the output (final) layer [

48]. The model was trained using as many instances of the disaster dataset with a look-back window of day/week/month (n+1) onward. Every time the one-step-ahead feature is predicted, its observed parameters can be used to refine the network state, before moving the time window one step (

Figure 7). This procedure provides an up-to-date network, with updating every time new information is available.

DL was used for image recognition and classification, aiming to detect crop types and verify damage due to disaster events. The DL model is trained to classify labelled crop types. In this research, the focus was on avocados and coffee beans.

To ensure correct pre-processing, hyper-parameters were set at the start of the learning to the shape, size of the crops images. Specifically, rescaling the photos to 28 rows by 28 columns since neural networks work on square shaped images [

29]. The inputs are trained images with their labels as well as a hold out sample (or subset) for testing purposes. Both sequential and activation functions were run on the training datasets to derive initial weights. A forward pass happens when the aforementioned data and parameters were passed to the model.

Mathematical operations (linear algebraic and integral) were performed to assess the correctness of model definitions in predicting the pre-known labels. Thereafter, a backward pass took place where an optimizer aimed at minimizing, using differential operation, the loss value. As mentioned, this was run sequentially until loss was at its minimum value. As a result, weights were set to predict classes of crop type and, sub sequentially, detect crop health condition while the iterative learning process was used to set parameters (

Figure 8).

The DL model used TensorFlow to build and train while relying on high-level classifications in the convolutional neural networks (CNNs) via Keras (

Figure 9). The architecture of CNNs allow networks to learn hierarchies of high level and low level features [

29]. By matching labelled images from the satellite and GPS with personal property photos uploaded by the insured farms, our parametric insurance model would issue automated pay-outs based on real-time predicted risk

3. Results

3.1. Terrain and Infrastructure Risks

The information provided by the detailed, farm-specific, DEM-based geomorphometric risk analysis (

Figure 10), enables the insurer to evaluate the level of risk that any given farm’s infrastructure and crops are exposed to, thereby guiding the setting of premiums for any given farm. For example, in the Dosquebradas district, most farms were found to have relatively minor exposure to flood hazards. However, farm ID # 17 showed a risk of landslides and soil erosion due to steep slopes and topographic wetness in the eastern part of the farm (

Figure 11a), while in western part of the farm there is severe flood risk due to topographic wetness and floodplain locations (

Figure 11b).

3.2. Indices and Predictions: Climate and Vegetation over Time

The behavior of the PERSIANN Drought Severity Index (PDSI) demonstrated a constant trend in normal time and varied during extreme weather events. The most obvious downward trend was associated with wildfires, where PDSI demonstrated a sharp decline. Both of drought (El Niño) and flood (La Niña) disasters recorded moderate incline in PDSI. As a result, relying on PDSI solely to differentiate between the two types of extreme weather comes with limitations.

On the other hand, the behavior of MODIS NDVI exhibited a constant trend during normal disaster-free times. During floods, NDVI remained constant with less volatility. When it comes to drought, an upward trend is demonstrated. Conversely, NDVI sustained a sharp decline in the times of wildfire.

3.2. Deep Learning and Mobile Phone Photos of Crops

The aim of using DL is two create 2-tier layers by classifying crops into: (1) coffee beans (class I) vs. avocados (class II); and (2) healthy crops vs. unhealthy (or damaged) crops. Our binary classification algorithm resulted in an overall 0.8743 accuracy. The table below (

Table 2) shows the performance of the model based on 748 collected from 30 farms in the Dosquebradas study area.

4. Discussion

4.1. Parametric Insurance Model

A parametric insurance model has been developed that incorporates crop type, crop value/yield, historic claims-loss data and satellite remote sensing data, as well as, photos of the crops at the time of buying the policy. To estimate the crop yield, underwriters can use tools like such as The Global Agriculture Monitoring (GLAM) decision support system, to quantitatively-forecast crop yields or they can rely on historical production numbers and selling prices. This model also considers geomorphometrics and historical trends of hydrometeorological indices for risk assessment of the underlying asset (i.e. insured farm and crops). On the one hand, geomorphometrics indicates the likelihood of flooding, erosion, and land slides. On the other hand, historical extreme weather disasters can be studied in terms of types, recency, frequency and monetary claims. This would help with setting acceptable ranges for the two indices included (i.e. NDVI and PDSI) for the farm to be insured at a low risk of damage to the crops and surrounding infrastructure.

The design of a parametric model should assist in determining outputs to be used in underwriting an insurance policy. Those outputs are:

Actuarial rate tables - premiums, reserves, cash values and dividends.

Interest rates

Loading rates, expense charges, and policy fees

Date bands and face amount bands

Premium calculation rules

Billing and collection rules

Underwriting rules

The aforementioned outputs will be unbiased and set more fairly since those are based on indices captured from EO, Geomorphometry and topography. Additionally, for underwriting, both policy and premium setting would change automatically as the first notification of loss (FNOL) is issued. Having a dynamic model is advantageous and can be achieved through Information and Communication Technology for Resilience (ICT4R), a term that has been studied in research in depth [

49]. For example, the Topographic Witness Index (TWI) is a static index that only varies with slope steepness and topographic position of a specific farmland. Some adjustments are applied to it during dry and wet seasons, but it remains largely static. Nevertheless, real-time TWI and soil moisture can be monitored with micro-sensors that are placed around farm fields’ boundaries.

4.1.1. Insurance Claim Verification

Claim verification process is a tedious task that can take long time to be processed. Relying on machine learning and deep learning models help automating such a process while cutting time and costs. Also, the ability of the system operators to freely-download and analyze globally-available EO satellite imagery overcomes site access limitations in developing countries. Furthermore, when analyzing data-driven claims, the opportunity of prescriptive analytics emerges when insurers, re-insurers, creditors and governmental agencies at to minimize damage of agricultural products. The following sub-sections consider the impact this research can have on the society.

4.1.2. Automated Decision Making

Having an automated hazard detection would recommend to farmers the next best course of action, through what is known as ‘digital nudging’ [

50]. For example, recommending drip irrigation for areas that the 20-year NDVA records indicate are prone to drought.

4.2. Impact

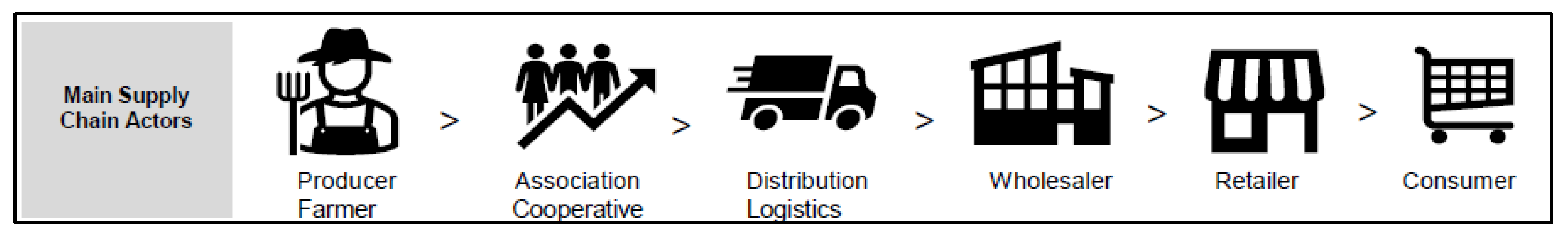

This research has direct impact on the risk transfer within the agricultural supply chain. Additionally, it has a wider impact to the society with fairer and inclusive effects.

4.2.1. Applications of EO for Finance and Insurance Services

It has been argued by Longo, Zardo [

11] that despite having knowledge of climate change adaptation frameworks, this knowledge needs to be integrated in practice. Therefore, the focus in this research was on the farmers-insurers relationship in practical terms. Additionally, the findings can be generalized and risk can be distributed by extending it across agricultural supply chains. Actors in such supply chains can benefit from predicting extreme weather disasters and automated decisions in agriculture. In the below figure (

Figure 12), some of those actors can be seen. In addition, insurance credit can be allowed using the parametric insurance model for re-insurers. In summary, authors demonstrated how banks and agricultural fund managers can apply EO models and techniques to evaluate and estimate the projected return on their financial investment in commodities.

4.2.2. Moral Hazard and Information Asymmetry

When using parameters to gauge risks, both parties, insurance provider and insured farmer, would have access to similar information about parameters leading to elimination of information asymmetry. Similarly, moral hazards (mainly represented by fraudulent claims) are significantly reduced since the widespread availability of indices provided by 3

rd party weather agencies [

25].

4.2.3. Digital Divide and Data Poverty

Digital divide looks into the gap between those with ready access to digital services through information and communication technologies (ICT) and those who are without such access. The aforementioned gap is caused by geographical, economic, educational, attitudinal, generational or even physical factors [

51]. It was argued that extreme weather disasters affect people unequally by harming those who are most digitally-excluded [52, 53].

Marginal communities are yet to be represented by datasets due to limited access to ICT items [

52]. Additionally, data generated from limited devices and services are of low quality and can have negative effects due to its unreliability [

54]. The proposal to use EO-satellite imagery to serve areas that suffer from digital divide eliminates the data injustice dilemma and contributes to a digital inclusivity.

Additionally, this research contributed to digital inclusivity by datifying [

55] the Colombian farming community. The level of community intelligence, determined by ICT access, determines its resilience and ability to generate reliable information [

29].

4.2.4. Sustainability

In this research, the authors were able to improve sustainability by assisting communities in hedging the risk of hunger while offering a low-cost insurance plan. This paper outlines how the insurance ecosystem may use the affordable EO publicly available data and FOSS to apply DL for image classification as well as ML for mapping terrain and estimating extreme weather disasters risks. Not only this new process is affordable for insurers and farmers, but also it is relatively rapid and accurate. Specifically, an alert is raised automatically as soon as an indicator (or a parameter) exceeds or drops below a pre-determined acceptable range driving up the likelihood of an extreme weather disaster. This automated decision is also complemented with an image recognition algorithm that uses deep learning to verify the crop type and its condition as soon as a farmer submits a claim. Finally, ML algorithm such as RF is used to capture changes in topography and approve loss claims.

In summary, the findings of this paper contribute to the farming business continuity and to a rapid recovery of farmers’ livelihoods – thus boosting sustainable development and improving quality of life.

4.2.5. Policy Making

Policymakers can make use of geoinformatics and satellite imagery data for social good. This is consistent with the framework proposed by Oktari, Munadi [

56], who concluded that ICT artefacts are the primary driver for sustainability and policies. This research unlocks many opportunities for farmers, insurers and credit associations in many ways. Specifically, when suggesting that insured individuals (in this research, farmers) contribute to the claim verification process, this creates social recognition and, thus, contributes to institutional trust and a sustainable pro-environmental attitude towards climate change policies [

26]. In return, InsurTech mobile application can make recommendations such as building a glasshouse or a installing a new irrigation system that is suitable for the soil of a specific area, which is known as ‘digital nudging’ [

50] and farmers would respond to that positively. Similarly, credit/financing societies can provide loans to ensure continuation of the supply of crops in that area based on an InsurTech recommendation system. Meanwhile, more variables and data can benefit better risk modelling, such as the growth cycles of different crops being used to better estimate losses.

4.3. Limitations

There has been a few challenges with technology and data.

4.3.1. Technological Challenges

In technology, when exporting interactive maps using GEE API, those expired after a few days due to authentication issues with GEE. Since the use for research purposes, the authors could not request that the maps work permanently. Instead, maps were reproduced by running the Python code.

Additionally, cloud coverage hindered the use of optical satellite imagery (e.g. Sentinel-2 and PlanetScope), which prevented the investigation of photosynthetic activity in crops. On the other hand, radar satellite imagery (e.g. Sentinel-1), which is able to penetrate cloud cover and detect land surface features and crop types, did not perform in areas with steep slopes. Consequently, both radar and optical satellite imagery had to be included in the damage verification component of the insurance ecosystem.

4.3.2. Data Challenges

Collecting farm data presented a challenge, which affected the deep learning model. Specifically, photos were collected during the period of COVID-19 and many restrictions were in place for our collaborators to navigate in Colombia in March – April 2020. As a result, mobile photos dataset was relatively small (748 photos).

On the other hand, when labelling the photos, an imbalanced dataset was produced leading to better classification of coffee beans in comparison with avocados. This was because of the imbalance between the two classes in dataset. This has affected the accuracy of the DL model (currently at a moderate 0.85 classification accuracy). Nevertheless, there is a huge potential for improvement with the app deployment and more regions signing up onto it).

4.4. Recommendations

One of the recommendations is to extend the estimation from crops to other structural damages caused to farmers (e.g. access roads, bridges, processing facilities). Additionally, the recommendation of [

29] to integrate resources with DL systems was indicated earlier. Insurance companies can benefit from automated verification of extreme weather disasters and correct triggering of claims - thus issuing a pay-out to the insured farmer with less administrative costs. This can be done by ongoing monitoring of EO-derived indices such as NDVI. Finally, the use of mobile phone photos (time-stamped and GPS-located) can identify the crop, inform its condition and save verification costs on the insurers.

4.5. Future Agenda

4.5.1. Wider Coverage

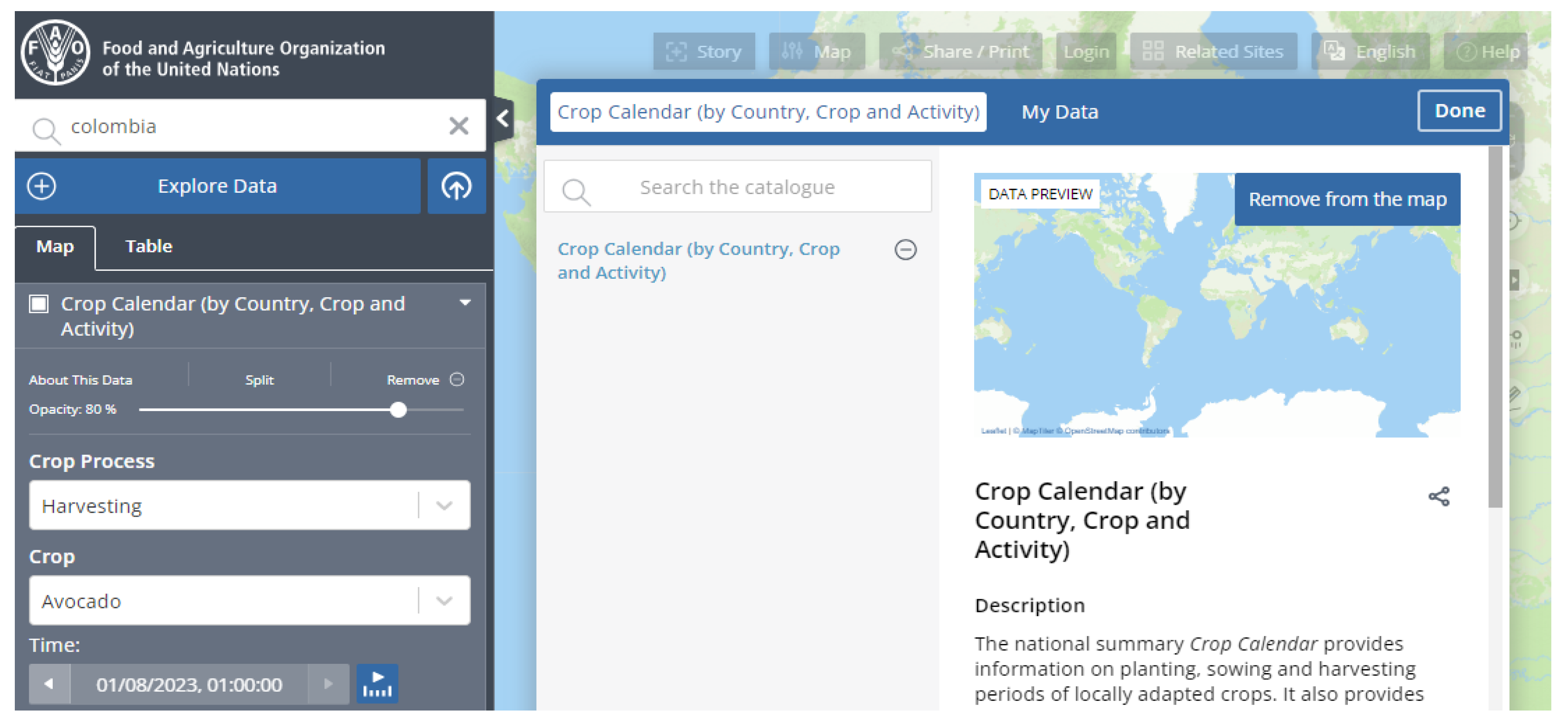

In terms of the underlying asset (crop), the value of crop insured can be better estimated by adding the level of growth (of the crop) at the time of the disaster. This means that a farmer with damaged crops at the sowing season would not have lost the value of a whole season of the insured crop. This is because such farmer can restart the season immediately as soon as a small payout is approved by the insurer to compensate the value of the seeds. Conversely, when a disaster happens during the harvesting season (toward the end of the season), a significant loss can be expected. This is because the whole season would have been written off. The Food and Agriculture Organization (FAO) provides an interactive tool (

Figure 13) known as the ‘Crop Calendar (by Country, Crop and Activity)’.

FAO also summarizes the output of the tool by issuing a timeline of crops calendars per country. The aforementioned factor (growth level) can feed into the insurance model to increase transparency and information symmetry.

Researchers in the future could determine whether insuring a specific product in a specific location is viable and, subsequently, determine the level of risk associated with it, thus, setting fair insurance premiums by integrating such tools in their actuarial insurance model.

4.5.2. Multiple Data Sources

It has been argued that disasters are hard to verify unless first responders and victims/affected people contribute to the disaster data [

57]. This can be done by integrating different data sources. In data science and information systems, one of the main features is data integration. In this research, EO was used for post-disaster damage verification, along with photographic evidence from client farmer phones. However, other sources can also be used such as scrapping texts from national disasters agencies and analyzing such texts. This would detect any paradigm shift in the semantics describing weather indices [

58]. Additionally, exchanges on social media platforms have been effective when communicating emergency situations specifically when a shared vision and language is present [

17].

5. Conclusions

This research has examined the terrain where farms are located to understand their exposure to extreme weather events based on geomorphological measures (e.g. slope steepness, topographic wetness) derived from a globally-available free satellite imagery and a satellite-derived DEM. As a result, estimating the damage that extreme weather disasters caused was possible in terms of crop damages and the likelihood at a given site of geohazards such as flooding, landslides and soil erosion. When it comes to insurance and crop damage verification, faster decisions resulted from utilizing a DL image recognition algorithm.

Key features of this insurance system are its low operational cost and rapid damage verification, relative to conventional approaches to farm insurance. It is an affordable form of insurance for small-scale farmers, with the rapid verification and payment of claims enabling policy-holders to potentially recover more quickly from disasters.

The insurance ecosystem presented here assists sustainable development in two main ways:

(i) by the use of affordable EO data and FOSS (sustainable geoinformatics), resulting in low-cost insurance, affordable to small-hold farmers;

(ii) via relatively rapid processing & verification of damage loss claims – i.e. with payouts potentially within days, rather than months – facilitating business continuity and enabling rapid recovery of farmer livelihoods.

Author Contributions

Conceptualization: [R.T, A.A, D.O, A.W]; Methodology: [R.T, A.A]; Writing: [A.A.R]; data collection: [D.O & M.F]; data analysis and modelling: [A.A.R, M.F]; mobile app development: [D.O]; Review and edit: [A.A.R, R.T, A.A].

Funding

This research was funded by Space Research and Innovation Network for Technology (SPRINT), grant number OC2020DCYg/OW131379Z7.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data is publicly available through the links provided in the manuscript and

Appendix B.

Acknowledgments

The authors acknowledge the assistance received from staff, who attended our brainstorming meetings, from the University of Portsmouth. Special thanks to Dr. Ivan Jordanov, Dr. Mathias Leidig, Dr. Malcolm Whitworth & Dr. Risto Talas.

Conflicts of Interest

The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript; or in the decision to publish the results.

Appendix A: Natural Hazards in Dosquebradas Colombia 1998-2020 (compiled from IDEAM online database)

| |

Disaster |

Start Date |

End Date |

| 1 |

Drought |

1998-01-01 |

1999-01-01 |

| 2 |

Flood |

1999-01-10 |

1999-05-19 |

| 3 |

Earthquake |

1999-01-25 |

1999-01-26 |

| 4 |

Flood |

1999-10-28 |

1999-12-31 |

| 5 |

Flood |

2000-05-18 |

2000-05-24 |

| 6 |

Wildfire |

2001-08-01 |

2001-09-01 |

| 7 |

Drought |

2002-01-01 |

2003-01-01 |

| 8 |

Flood |

2002-04-24 |

2002-04-29 |

| 9 |

Flood |

2003-08-01 |

2003-12-01 |

| 10 |

Flood |

2004-01-01 |

2004-06-28 |

| 11 |

Drought |

2004-01-01 |

2005-01-01 |

| 12 |

Flood |

2005-04-12 |

2005-05-07 |

| 13 |

Flood |

2005-09-15 |

2005-11-17 |

| 14 |

Flood |

2006-01-01 |

2006-04-27 |

| 15 |

Drought |

2006-01-01 |

2007-01-01 |

| 16 |

Flood |

2007-10-20 |

2007-10-26 |

| 17 |

Flood |

2008-01-01 |

2008-05-19 |

| 18 |

Flood |

2008-11-16 |

2009-01-12 |

| 19 |

Drought |

2009-01-01 |

2010-01-01 |

| 20 |

Wildfire |

2010-01-01 |

2010-04-06 |

| 21 |

Flood |

2010-10-30 |

2011-01-12 |

| 22 |

Flood |

2011-02-10 |

2011-06-05 |

| 23 |

Flood |

2011-09-01 |

2011-12-31 |

| 24 |

Flood |

2012-03-15 |

2012-05-14 |

| 25 |

Earthquake |

2013-02-09 |

2013-02-09 |

| 26 |

Flood |

2013-09-15 |

2013-12-01 |

| 27 |

Drought |

2015-08-01 |

2016-02-01 |

| 28 |

Storm |

2016-09-20 |

2016-09-23 |

| 29 |

Flood |

2017-03-17 |

2017-05-16 |

| 30 |

Flood |

2017-12-01 |

2018-01-07 |

| 31 |

Drought |

2018-01-01 |

2020-01-01 |

| 32 |

Flood |

2019-02-20 |

2019-02-26 |

| 33 |

Flood |

2020-06-10 |

2020-07-10 |

Appendix B Datasets analyzed in Google Earth Engine

References

- Ibarra, H. and I.L. Securities, Parametric insurance: general market trends and perspectives for the African insurance sector. Insurance Linked Securities. Partnerre New Solutions Inc, 2010.

- Tim, Y.; University of New South Wales; Leidner, D. E.; University of Virginia Digital Resilience: A Conceptual Framework for Information Systems Research. J. Assoc. Inf. Syst. 2023, 24, 1184–1198. [Google Scholar] [CrossRef]

- Shukla, P.R. , et al., IPCC, 2019: Climate Change and Land: an IPCC special report on climate change, desertification, land degradation, sustainable land management, food security, and greenhouse gas fluxes in terrestrial ecosystems. 2019.

- WHO. Global hunger numbers rose to as many as 828 million in 2021. 2022; Available from: https://www.who.int/news/item/06-07-2022-un-report--global-hunger-numbers-rose-to-as-many-as-828-million-in-2021.

- Reuters. Hilary Clinton at COP28 climate talks calls for insurance reform. 2023; Available from: https://www.marketscreener.com/news/latest/Hillary-Clinton-at-COP28-climate-talks-calls-for-insurance-reform-45490148/.

- Sigit, A.; Koyama, M.; Harada, M. Flood Risk Assessment Focusing on Exposed Social Characteristics in Central Java, Indonesia. Sustainability 2023, 15, 16856. [Google Scholar] [CrossRef]

- Medium. Issue 96: Insurance. Future 2023; Available from: https://medium.com/@planetsnapshots/issue-96-insurance-1caa45991937.

- Figueiredo, R.; Martina, M.L.; Stephenson, D.B.; Youngman, B.D. A Probabilistic Paradigm for the Parametric Insurance of Natural Hazards. Risk Anal. 2018, 38, 2400–2414. [Google Scholar] [CrossRef] [PubMed]

- UKSA, Space for Agriculture in Developing Countries. 2018, UK Space Agency International Partnerships Programme.

- Oliveira, M. , WHAT IS THE ROLE OF INFORMATION AND COMMUNICATION TECHNOLOGIES (ICT) IN BUILDING RESILIENCE ASPECTS IN CASE OF DISASTER? 2023.

- Longo, A.; Zardo, L.; Maragno, D.; Musco, F.; Burkhard, B. Let’s Do It for Real: Making the Ecosystem Service Concept Operational in Regional Planning for Climate Change Adaptation. Sustainability 2024, 16, 483. [Google Scholar] [CrossRef]

- Begue, A.; Madec, S.; Lemettais, L.; Leroux, L.; Interdonato, R.; Becker-Rescheff, I.; Barker, B.; Justice, C.; Kerdiles, H.; Meroni, M. How Well Do EO-Based Food Security Warning Systems for Food Security Agree? Comparison of NDVI-Based Vegetation Anomaly Maps in West Africa. IEEE J. Sel. Top. Appl. Earth Obs. Remote. Sens. 2023, 16, 1641–1653. [Google Scholar] [CrossRef]

- Yin-Long, X., Z. Yun-Cheng, and Z. Pan-Mao, Advances in scientific understanding on climate change and food security from IPCC special report SRCCL. Advances in Climate Change Research, 2020. 16(1): p. 37.

- Challinor, A.J.; Simelton, E.S.; Fraser, E.D.G.; Hemming, D.; Collins, M. Increased crop failure due to climate change: assessing adaptation options using models and socio-economic data for wheat in China. Environ. Res. Lett. 2010, 5. [Google Scholar] [CrossRef]

- Rozaki, Z.; Wijaya, O.; Rahmawati, N.; Rahayu, L. Farmers’ Disaster Mitigation Strategies in Indonesia. Rev. Agric. Sci. 2021, 9, 178–194. [Google Scholar] [CrossRef] [PubMed]

- Tobin, G.A. , Sustainability and community resilience: the holy grail of hazards planning? Global Environmental Change Part B: Environmental Hazards, 1999. 1(1): p. 13-25.

- Lu, Y.; Yang, D. Information exchange in virtual communities under extreme disaster conditions. Decis. Support Syst. 2011, 50, 529–538. [Google Scholar] [CrossRef]

- Wu, D.; Cui, Y. Disaster early warning and damage assessment analysis using social media data and geo-location information. Decis. Support Syst. 2018, 111, 48–59. [Google Scholar] [CrossRef]

- Heeks, R.; Ospina, A.V. Conceptualising the link between information systems and resilience: A developing country field study. Inf. Syst. J. 2018, 29, 70–96. [Google Scholar] [CrossRef]

- Li, G.; Zhao, J.; Murray, V.; Song, C.; Zhang, L. Gap analysis on open data interconnectivity for disaster risk research. Geo-spatial Inf. Sci. 2019, 22, 45–58. [Google Scholar] [CrossRef]

- Becker-Reshef, I.; Justice, C.; Sullivan, M.; Vermote, E.; Tucker, C.; Anyamba, A.; Small, J.; Pak, E.; Masuoka, E.; Schmaltz, J.; et al. Monitoring Global Croplands with Coarse Resolution Earth Observations: The Global Agriculture Monitoring (GLAM) Project. Remote Sens. 2010, 2, 1589–1609. [Google Scholar] [CrossRef]

- Nakalembe, C.; Justice, C.; Kerner, H.; Justice, C.; Becker-Reshef, I. Sowing Seeds of Food Security in Africa. Eos 2021, 102. [Google Scholar] [CrossRef]

- Teeuw, R.M.; Leidig, M.; Saunders, C.; Morris, N. Free or low-cost geoinformatics for disaster management: Uses and availability issues. Environ. Hazards 2013, 12, 112–131. [Google Scholar] [CrossRef]

- Argyriou, A.V.; Polykretis, C.; Teeuw, R.M.; Papadopoulos, N. Geoinformatic Analysis of Rainfall-Triggered Landslides in Crete (Greece) Based on Spatial Detection and Hazard Mapping. Sustainability 2022, 14, 3956. [Google Scholar] [CrossRef]

- Benso, M.R.; Gesualdo, G.C.; Silva, R.F.; Silva, G.J.; Rápalo, L.M.C.; Navarro, F.A.R.; Marques, P.A.A.; Marengo, J.A.; Mendiondo, E.M. Review article: Design and evaluation of weather index insurance for multi-hazard resilience and food insecurity. Nat. Hazards Earth Syst. Sci. 2023, 23, 1335–1354. [Google Scholar] [CrossRef]

- Jütersonke, S.; Groß, M. The Effect of Social Recognition on Support for Climate Change Mitigation Measures. Sustainability 2023, 15, 16486. [Google Scholar] [CrossRef]

- Lowder, S.K.; Skoet, J.; Raney, T. The Number, Size, and Distribution of Farms, Smallholder Farms, and Family Farms Worldwide. World Dev. 2016, 87, 16–29. [Google Scholar] [CrossRef]

- Iturrioz, R. and D. Arias, Agricultural insurance in Latin America: Developing the market. 2010: World Bank.

- Chaudhuri, N.; Bose, I. Exploring the role of deep neural networks for post-disaster decision support. Decis. Support Syst. 2020, 130, 113234. [Google Scholar] [CrossRef]

- Prokopchuk, O.; Prokopchuk, I.; Mentel, G.; Bilan, Y. Parametric Insurance as Innovative Development Factor of the Agricultural Sector of Economy. Agris on-line Pap. Econ. Informatics 2020, 12, 69–86. [Google Scholar] [CrossRef]

- Cesarini, L.; Figueiredo, R.; Monteleone, B.; Martina, M.L.V. The potential of machine learning for weather index insurance. Nat. Hazards Earth Syst. Sci. 2021, 21, 2379–2405. [Google Scholar] [CrossRef]

- Quiñones, M. , et al., Un enfoque ecosistémico para el análisis de una serie densa de tiempo de imágenes de radar Alos PALSAR, para el mapeo de zonas inundadas en el territorio continental colombiano. Biota Colombiana, 2016. 17: p. 63-85.

- Argyriou, A.V.; Sarris, A.; Teeuw, R.M. Using geoinformatics and geomorphometrics to quantify the geodiversity of Crete, Greece. Int. J. Appl. Earth Obs. Geoinformation 2016, 51, 47–59. [Google Scholar] [CrossRef]

- Argyriou, A.V.; Teeuw, R.M.; Rust, D.; Sarris, A. GIS multi-criteria decision analysis for assessment and mapping of neotectonic landscape deformation: A case study from Crete. Geomorphology 2016, 253, 262–274. [Google Scholar] [CrossRef]

- Wagstaff, K. , Machine learning that matters. arXiv preprint. arXiv:1206.4656, 2012.

- Reuter, H. and A. Nelson, Geomorphometry in ESRI packages. Developments in soil science, 2009. 33: p. 269-291.

- Tagil, S.; Jenness, J. GIS-Based Automated Landform Classification and Topographic, Landcover and Geologic Attributes of Landforms Around the Yazoren Polje, Turkey. J. Appl. Sci. 2008, 8, 910–921. [Google Scholar] [CrossRef]

- Beven, K.J. and M.J. Kirkby, A physically based, variable contributing area model of basin hydrology/Un modèle à base physique de zone d'appel variable de l'hydrologie du bassin versant. Hydrological sciences journal, 1979. 24(1): p. 43-69.

- Sørensen, R.; Zinko, U.; Seibert, J. On the calculation of the topographic wetness index: evaluation of different methods based on field observations. Hydrol. Earth Syst. Sci. 2006, 10, 101–112. [Google Scholar] [CrossRef]

- Hjerdt, K.N.; McDonnell, J.J.; Seibert, J.; Rodhe, A. A new topographic index to quantify downslope controls on local drainage. Water Resour. Res. 2004, 40. [Google Scholar] [CrossRef]

- Migoń, P.; Kasprzak, M.; Traczyk, A. How high-resolution DEM based on airborne LiDAR helped to reinterpret landforms – examples from the Sudetes, SW Poland. Landf. Anal. 2013, 22, 89–101. [Google Scholar] [CrossRef]

- Breiman, L. , Random forests. Machine learning, 2001. 45: p. 5-32.

- Kubosova, K.; Brabec, K.; Jarkovsky, J.; Syrovatka, V. Selection of indicative taxa for river habitats: a case study on benthic macroinvertebrates using indicator species analysis and the random forest methods. Hydrobiologia 2010, 651, 101–114. [Google Scholar] [CrossRef]

- Justice, C.; Townshend, J.; Vermote, E.; Masuoka, E.; Wolfe, R.; Saleous, N.; Roy, D.; Morisette, J. An overview of MODIS Land data processing and product status. Remote. Sens. Environ. 2002, 83, 3–15. [Google Scholar] [CrossRef]

- Tucker, C.J. Red and photographic infrared linear combinations for monitoring vegetation. Remote Sens. Environ. 1979, 8, 127–150. [Google Scholar] [CrossRef]

- Kern, A.; Marjanović, H.; Barcza, Z. Spring vegetation green-up dynamics in Central Europe based on 20-year long MODIS NDVI data. Agric. For. Meteorol. 2020, 287, 107969. [Google Scholar] [CrossRef]

- Nakalembe, C.; Kerner, H. Considerations for AI-EO for agriculture in Sub-Saharan Africa. Environ. Res. Lett. 2023, 18, 041002. [Google Scholar] [CrossRef]

- Chollet, F. , Keras documentation. keras. io, 2015. 33.

- Bertschek, I.; Polder, M.; Schulte, P. ICT and resilience in times of crisis: evidence from cross-country micro moments data. Econ. Innov. New Technol. 2019, 28, 759–774. [Google Scholar] [CrossRef]

- Jesse, M.; Jannach, D. Digital nudging with recommender systems: Survey and future directions. Comput. Hum. Behav. Rep. 2021, 3, 100052. [Google Scholar] [CrossRef]

- Cullen, R. Addressing the digital divide. Online Inf. Rev. 2001, 25, 311–320. [Google Scholar] [CrossRef]

- Masiero, S. and P. Nielsen, Resilient ICT4D: building and sustaining our community in pandemic times. arXiv preprint. arXiv:2108.09712, 2021.

- Leidig, M.; Teeuw, R.M.; Gibson, A.D. Data poverty: A global evaluation for 2009 to 2013 - implications for sustainable development and disaster risk reduction. Int. J. Appl. Earth Obs. Geoinformation 2016, 50, 1–9. [Google Scholar] [CrossRef]

- Pan, S.L.; Zhang, S. From fighting COVID-19 pandemic to tackling sustainable development goals: An opportunity for responsible information systems research. Int. J. Inf. Manag. 2020, 55, 102196–102196. [Google Scholar] [CrossRef]

- Taylor, L. What is data justice? The case for connecting digital rights and freedoms globally. Big Data Soc. 2017, 4, 2053951717736335. [Google Scholar] [CrossRef]

- Oktari, R.S.; Munadi, K.; Idroes, R.; Sofyan, H. Knowledge management practices in disaster management: Systematic review. Int. J. Disaster Risk Reduct. 2020, 51, 101881. [Google Scholar] [CrossRef]

- Hertzum, M. How do journalists seek information from sources? A systematic review. Inf. Process. Manag. 2022, 59, 103087. [Google Scholar] [CrossRef]

- Abd Rabuh, A., M. El-Masri, and K. Al-Yafi, A Text Analytics Approach to Evaluate Paradigm Shifts in Information Systems Research.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).