1. Introduction

The financial sector is undergoing a profound transformation enabled by advancements in financial technology, shortly fintech. Many have noted that fintech, along with other Industry 4.0 technologies, must be leveraged to enhance environmental sustainability through de-materializing consumption and production, thus ensuring lower use of natural resources [

1,

2,

3].

The rapid technological transformation and digitalisation of financial services resulted in new entrants, fintech banks or neobanks [

4]. Neobanks have emerged as pivotal players in this digital evolution, presenting an alternative to traditional banking models with their innovative business model. These digital, technology-driven financial institutions operate exclusively online, challenging traditional banking models and offering innovative solutions to consumers [

5]. Neobanks have further developed amongst the global COVID-19 pandemic, which changes customers’ behaviour in spending and purchasing, as well as their choices of payment and transfer methods [

1,

6,

7].

As neobanks gain prominence, it becomes imperative to assess their impact on global sustainability, considering the elaborate interplay between environmental, economic, and social dimensions. In this paper, the study of neobanks extends beyond their disruptive effect on traditional banking institutions; we investigate their complex role in shaping sustainability across environmental, economic, and social dimensions.

Neobanks, operating within a digital framework, inherently depart from the physical nature of brick-and-mortar branches of traditional banks. This shift not only aligns with global environmental objectives but also prompts an exploration of the broader sustainability implications associated with their operational model. By leveraging digital platforms, neobanks minimize their environmental footprint, paving the way for a more sustainable financial ecosystem.

Technological innovation stands as a crucial feature of neobanks, with artificial intelligence, machine learning, and blockchain playing integral roles in their operational frameworks. Beyond the immediate improvements in efficiency and risk management, these technologies offer a unique opportunity to address sustainability challenges within the financial sector.

Furthermore, neobanks exhibit a potential to redefine financial inclusivity. Through user-centric interfaces, streamlined processes, and reduced transaction costs, neobanks can extend financial services to historically underserved populations. The absence of physical infrastructure constraints allows neobanks to transcend geographical barriers, thereby contributing to sustainability goals on a global scale. This study aims to dissect the nuanced relationship between neobanks and financial inclusion within the broader context of sustainable development.

Thus, the purpose of this paper is to provide a comprehensive analysis of neobanks’ contributions towards global sustainability. Through extensive literature review, we study the multifaceted landscape of neobanks, analysing their influence on sustainable development on a global scale. Our findings will contribute to better understanding of sustainable impact of neobanks, their technological contributions and social implications. They will help neobanks shape their future sustainable practices to maximize their positive contribution and mitigate potential negative contribution.

This paper is structured as follows. In the first chapter, we present an introduction into the main research problem of our study; the effects of neobanks on sustainability. In second chapter, we describe our methodology. In the third chapter, we present our findings. Fourth chapter concludes this research with discussion.

2. Materials and Methods

To conduct this literature review, a systematic approach was adopted. Academic databases, industry reports, and reputable financial publications were extensively searched to collect relevant literature between January and March 2024. Search was conducted using various combinations of relevant keywords such as "neobanks", “fintech banks” "digital finance", "sustainability", "environmental impact", "social inclusivity", “social responsibility”, “green initiatives”, “green neobanks” and other related terms.

We utilized databases like Google Scholar, Science Direct, Taylor & Francis Online, IEEE Xplore, Scopus, and Web of Science. Our research criteria focused primarily on scientific articles and empirical studies published within the last decade, ensuring the incorporation of contemporary perspectives. Neobanks are relatively new phenomena, and due to that there is a significant research gap in many of their aspects, including their effects on sustainability. Because of that, we also explored other types of articles, databases, and reports from neobanks and other relevant parties. Such research strategy was structured to provide a nuanced understanding of the impact of neobanks on global sustainability.

After data was systematically gathered, it was meticulously analyzed and then synthesized to draw conclusions, identify patterns, and highlight differing perspectives within it. Next, we divided our findings into three main aspects of sustainability: environmental, economic, and social sustainability. Together they provide a comprehensive review of neobanks’ contributions towards sustainability. Our findings not only contribute towards greater understanding of neobanks’ role in global economy and society, but also present a framework for future research in the field of sustainable finance.

3. Results

The last decade has witnessed a transformative shift in the banking sector, marked by the rise of neobanks. Neobanks are digital-only financial institutions that distinguish themselves from traditional banks by operating without physical branches. Instead, they only use technologically advanced digital platforms and mobile applications [

8,

9,

10,

11].

Their bloom in the past decade has been enabled by rapid technology advancements like fintech, increased internet accessibility and a growing demand for convenient, efficient, digitally executed financial services. Such demand has increased significantly during the global pandemic of COVID-19 [

12].

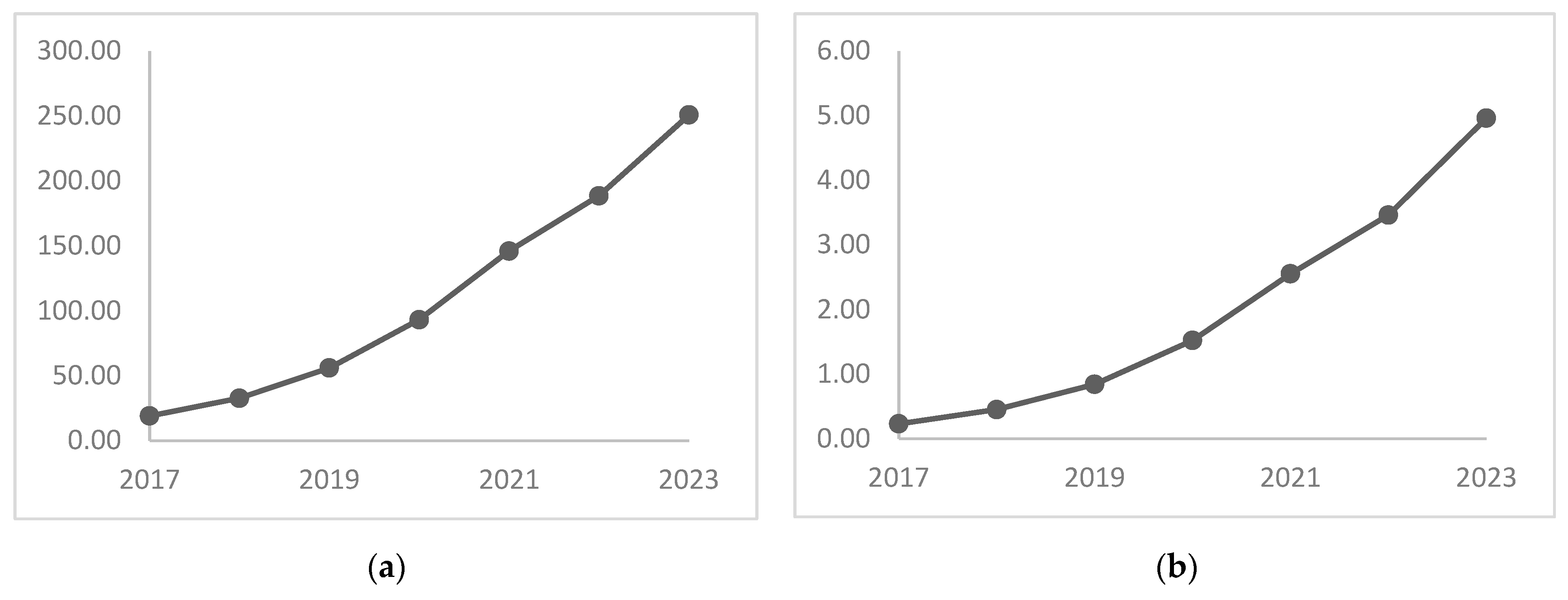

Figure 1 shows the number of neobanking users (in million users) and transaction value of neobanking market (in trillion USD) on a global level from 2017 to 2023. We can see that both continuously increased every year, indicating the growing significance of the neobanking market. Transaction value of the neobanking market reached a little below 5 trillion USD at the end of 2023, while at the end of 2017 it was only 0,23 trillion USD. The number of users globally also grew from approximately 19 million in 2017 to more than 250 million in 2023. This indicates that neobanks are becoming significant players in the financial markets, thus their role in achieving global sustainability must also be considered. Financial institutions like banks and neobanks have a major impact on sustainable development with many direct effects like office buildings for their branches, paper use, waste management and energy consumption. They also impact sustainability via indirect effects like the criteria for financing projects, social inclusion and the development of new products and services [

14,

15].

The United Nations Brundtland Commission has defined sustainability as “meeting the needs of the present without compromising the ability of future generations to meet their own needs”. The framework to do that are the Sustainable Development Goals [

16]. With increasing popularity of neobanks, considering the way they conduct business (without requiring visits to physical branches and paperwork), the question arises as to whether they also contribute towards sustainability in the economy or not.

A study of the Sustainable Development Goals (SDGs) and open innovation from FinTech enterprises has found that lending, financial infrastructure and personal finance exhibit discourse correlated to innovation, and on a smaller scale, correlated with SDGs [

17].

Industry 4.0 technologies like fintech are defined as “indisputable change agents for sustainability” [

1]. Through surveying bank customers in Malaysia, this research has proved that fintech significantly and positively influences sustainability. Fintech was found to be a driver of financial inclusion and have significant contribution towards sustainability in Malaysia.

Another study examined the usage of digital financial services and its social effect in the Ugandan market [

18]. Through analysis of survey responses from 400 users of digital financial services, the authors have found the adoption of these services to be significantly impacted by the need for access to financial products and services from the unbanked population. These services have been found to positively impact sustainable development goals of gender equality (SDG5), decent work and economic growth (SDG8) and reducing inequalities (SDG10) through increasing financial inclusion.

Similarly, the effect of digital financial services, originating from fintech, on achieving the SDGs was analysed through field data from rural area in Zambia [

19]. It was found that savings via these services helps households with low income to smoother their consumption, lower vulnerability to shocks through risk diversification and invest by saving, which can significantly contribute towards achieving the SDGs.

It was also investigated how fintech supports sustainable development [

15] and found that fintechs provide services to previously underbanked and unbanked parts of population, indicating its contribution towards higher financial inclusion. In previously mentioned study it was also found that fintech contributes towards financial inclusion through serving unbanked and underbanked consumers, such as low-income households and minority groups [

1]. It enables accessible, affordable and convenient financing, which then helps increase economic opportunities for these parts of population [

1,

20,

21].

Fintech services have also been found to lower overall costs, increase the quality of financial services, increase employment rates and lower the poverty rate through lower transaction costs and providing financial access through microfinance and crowdfunding [

1,

2,

22]. Technology within financial services can also significantly contribute to improving consumers' digital literacy and skills. Additionally, FinTech services have the potential to lower energy consumption, such as fuel usage, and bolster environmental protection by reducing carbon emissions [

1,

22,

23,

24]. Another research also found that fintechs may play a significant role in transitioning towards sustainable finance through its microfinance and crowdfunding options [

2].

In general, it was proven that customer identity verification mechanism, IT systems, security controls, business continuity plan in exceptional circumstances and liquidity management mechanism contribute towards sustainability of neobanks [

25]. Similarly, another study examined factors that affect sustainability of neobanks and their development [

26]. Through literature review, it was found that economic, regulatory, and technological environment, along with dynamic customer demand determine the sustainability of neobanks.

In a study of green initiatives from banks on a global level [

27], the term “Green Banking” was determined for banks globally investing in green strategies as a part of wider plan for sustainable development. They note the green finance movement to be relatively recent, but growing fast, and warn that in higher demand for green financial products can be expected. Furthermore, they study five examples of banks, often called green (neo)banks, that have implemented green initiatives in significant extent. All of these examples are neobanks; Starling, Treecard, Aspiration, bunq and Tomorrow. This already indicates the significant progress neobanks have made in active contributing towards the greener development, compared to traditional banks. For a long time, green banking has been widely encouraged amongst banks in order to stimulate sustainability through environmentally friendly projects and investments [

28,

29].

Furthermore, we have also dived into practical examples of sustainable practices in neobanks.

Table 1 summarises our findings.

Table 1 shows that various neobanks already conduct many measures aimed at increasing global sustainability. Most commonly those include sustainable investment, heightened transparency, prioritizing of sustainable goals, and increasing awareness of one’s environment footprint. Additionally, some of them offer innovative additional measures that can help attract more consumers towards the green initiative, like planting a tree every time a certain amount is spent, carbon footprint calculator and wooden or recycled plastic credit and debit cards.

Despite various positive findings regarding their advantages and contributions towards global sustainability, neobanks are not without challenges and possible disadvantages.

For instance, a study examined the ethical aspect of fintech adoption and potential negative implications [

36]. The authors warn on issues like customer privacy and data breaches, while highlighting the importance of establishing digital ethics in fintech and thus, neobanks.

Neobanks, as well as other fintech entities, are possibly associated with high degree of cyber-related risks, potential loss of privacy, compromised data security, heightened financial losses from frauds and scams, uncertain legal status, absence of regulations, and concerns about operational effectiveness among fintech providers. These risks predominantly arise from the misuse and exploitation of data, which has become increasingly accessible in the digital domain [

1,

37,

38].

The question also arises regarding their operational costs, especially energy consumption. Neobanks are banks that operate exclusively digitally and thus, require strong and complex technological infrastructure. We can assume their operational costs are lower compared to traditional banks, which must also maintain a network of physical branches and ATMs, but are they low enough to be considered a positive improvement from sustainable point of view? Further research is needed to better understand the impact of their operational costs. The rapid technological evolution and digital nature of neobanks have also raised concerns about electronic waste generation. The disposal and recycling of outdated devices and servers are areas where sustainability practices need ongoing attention.

Based on the findings of this literature review and previous research conducted by authors on this topic [

5,

8,

10,

12,

37,

39], in

Table 2 we further divide contributions of neobanks towards sustainability into three main pillars: contributions towards environmental sustainability, economic sustainability, and social sustainability.

Neobanks, like any other financial institution or business, can have both positive and negative impacts on environmental, economic, and social sustainability. Neobanks leverage cutting-edge technologies such as artificial intelligence (AI), machine learning, and blockchain to enhance operational efficiency. This results in more accessible and favourable financial services, which in many ways positively contributes towards environmental, economic, and social sustainability on a global scale. Operating in a digital atmosphere unbound by physical constraints like logistics, neobanks have the capability to reach global markets and also provide financial services to remote areas. This global reach opens up new economic opportunities for individuals and businesses, fostering economic sustainability on an international scale.

Even though so far, significantly less negative contributions have been found than positive, we must also consider those a priority. Data privacy and cybercrime risks have already realised in some neobanks like N26 [

37]. Appropriate regulation and dynamic supervision are essential for sufficient mitigation of these risks and other possible negative effects of neobanks on global sustainability.

4. Discussion

The objective of this study was to synthesise the existing knowledge of the impact of neobanks on global sustainability, specifically in environmental, economic, and social dimensions. Neobanking market is rapidly growing, and their impact on global sustainability requires further research.

Through comprehensive literature review, our study aimed to provide in-depth understanding of the environmental, economic, and social implications of neobanks for global stability. Our findings help to inform future research directions, guide policymaking, and contribute to the ongoing transition a more sustainable, inclusive global financial ecosystem and sustainable finance in the digital age.

We have found many current and positive contributions of neobanks towards sustainability. A notable impact of neobanks on environmental sustainability is their reducement of paper use and logistics impact of banking services. In terms of economic sustainability, they contribute significantly towards higher financial inclusion, as well as towards more innovative and competitive financial markets. From the social sustainability’s point of view, they importantly contribute to higher social inclusion of marginalized groups and increasement of financial literacy. However, we also note of new and increasing risks they bear, such as cybercrime and data privacy, as well as potential high electronic waste and energy consumption.

Based on our findings, we can conclude that neobanks pose an important tool for achieving sustainability in the global financial system. In the future, we think they could contribute even more. While some neobanks already use renewable energy sources, future advancements in this area could solve the potential dilemma of neobanks’ energy consumption and help develop more sustainable data storage solutions for all neobanks, should this be needed.

Concerning economic sustainability, we think neobanks will continue to contribute towards higher financial inclusion with their accessibility and affordability. Also, towards more innovative and competitive financial markets with innovative banking products and services. Additionally, we think implementation of responsible lending practices will be even wider spread amongst neobanks.

As to social sustainability, we think they will continue with existing practices: improving financial literacy and social inclusion. We think they will expand their community engagement, particularly engagement with user communities, as it appears to be a successful business strategy so far.

In conclusion, the relationship between neobanks and sustainability is complex and dynamic. Neobanks have made significant strides in contributing to environmental, economic, and social sustainability, but challenges and opportunities persist. Regulatory frameworks must evolve to accommodate the dynamic nature of neobanks while upholding principles of fairness and inclusivity. Further research in this field, especially in terms of regulation and supervision, is crucial for risk mitigation, refining sustainable business strategies and maximizing the positive contributions of neobanks towards sustainability.

Author Contributions

Conceptualization, Ž.J.O., T.J. and A.A.; methodology, Ž.J.O.; software, A.A.; validation, T.J. and Ž.J.O.; formal analysis, A.A.; investigation, A.A.; resources, A.A.; data curation, A.A.; writing—original draft preparation, A.A.; writing—review and editing, Ž.J.O.; visualization, Ž.J.O. and T.J.; supervision, Ž.J.O.; project administration, A.A. and Ž.J.O.; funding acquisition: Ž.J.O. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Slovenian Research and Innovation Agency (ARIS), grant number P5-0027.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- R. Abdul-Rahim, S. A. Bohari, A. Aman, and Z. Awang, “Benefit–Risk Perceptions of FinTech Adoption for Sustainability from Bank Consumers’ Perspective: The Moderating Role of Fear of COVID-19,” Sustain., vol. 14, no. 14, 2022.

- R. Moro-Visconti, S. C. Rambaud, and J. L. Pascual, “Sustainability in FinTechs: An explanation through business model scalability and market valuation,” Sustain., vol. 12, no. 24, pp. 1–24, 2020. [CrossRef]

- J. Oláh, N. Aburumman, J. Popp, M. A. Khan, H. Haddad, and N. Kitukutha, “Impact of industry 4.0 on environmental sustainability,” Sustain., vol. 12, no. 11, 2020. [CrossRef]

- S. Nagy, L. Molnár, and A. Papp, “Customer Adoption of Neobank Services from a Technology Acceptance Perspective – Evidence from Hungary,” Decis. Mak. Appl. Manag. Eng., vol. 7, no. 1, pp. 187–208. 2024. [CrossRef]

- A. Amon, S. Bobek, T. Jagrič, and S. Sternad Zabukovšek, “Analiza digitalne transformacije poslovnih modelov bank z modelom Canvas,” Bančni Vestn., vol. 72, no. 1/2, pp. 19–26, 2023, [Online]. Available: https://bv.zbs-giz.si/bancni-vestnik/e-arhiv/2023-1-2/analiza-digitalne-transformacije-poslovnih-modelov-bank-z-modelom-canvas.

- C. Prentice, J. Chen, and B. Stantic, “Timed intervention in COVID-19 and panic buying,” J. Retail. Consum. Serv., vol. 57, 2020. [CrossRef]

- S. Laato, A. K. M. N. Islam, A. Farooq, and A. Dhir, “Unusual purchasing behavior during the early stages of the COVID-19 pandemic: The stimulus-organism-response approach,” J. Retail. Consum. Serv., vol. 57, 2020. [CrossRef]

- A. Amon and T. Jagrič, “BLOCKCHAIN TECHNOLOGY IN BANKING AS A TOOL TOWARDS THE SDGS,” Strength. Resil. by Sustain. Econ. Bus. - Towar. SDGs, no. FEB International Scientific Conference 2023, 2023.

- T. Bradford, “Neobanks: Banks by Any Other Name?,” Fed. Reserv. Bank Kansas City, vol. 12, p. 2020, 2020, [Online]. Available: https://www.kansascityfed.org/Payments Systems Research Briefings/documents/7600/psrb20bradford0812.pdf.

- T. Jagrič, D. Fister, A. Amon, and V. Jagrič, “Neobanks - eagles or pigeons of banking ecosystems?,” Bančni Vestn., vol. 70, no. 11, pp. 50–57, 2021, [Online]. Available: https://bv.zbs-giz.si/bancni-vestnik/clankidokument/clanek/2021/11/neobanks---eagles-or-pigeons-of-banking-ecosystems.pdf.

- Z. Temelkov, “Overview of Neobanks Model and Its Implications for Traditional Banking,” pp. 156–165, 2020. [CrossRef]

- T. Jagrič and A. Amon, “Key factors of neobanking’s occurrence,” J. Innov. Bus. Manag., 2023. [CrossRef]

- Statista, “Neobanking,” The Neobanking Market, 2024. https://www.statista.com/outlook/dmo/fintech/neobanking/worldwide.

- M. Jeucken, Sustainable Finance and Banking. Sustainable Finance and Banking, 2010.

- D. Varga, “Fintech: Supporting Sustainable Development By Disrupting Finance,” Budapest Manag. Rev., vol. 8, no. 11, pp. 231–249, 2018.

- United Nations, “Sustainability,” 2024. https://www.un.org/en/academic-impact/sustainability.

- J. N. Franco-Riquelme and L. Rubalcaba, “Innovation and sdgs through social media analysis: Messages from fintech firms,” J. Open Innov. Technol. Mark. Complex., vol. 7, no. 3, 2021. [CrossRef]

- T. J. Museba, E. Ranganai, and G. Gianfrate, “Customer perception of adoption and use of digital financial services and mobile money services in Uganda,” J. Enterprising Communities, vol. 15, no. 2, pp. 177–203, 2021. [CrossRef]

- S. Chikalipah, “The pyrrhic victory of FinTech and its implications for achieving the Sustainable Development Goals: evidence from fieldwork in rural Zambia,” World J. Sci. Technol. Sustain. Dev., vol. 17, no. 4, pp. 329–340, 2020. [CrossRef]

- P. K. Senyo and E. L. C. Osabutey, “Unearthing antecedents to financial inclusion through FinTech innovations,” Technovation, vol. 98, 2020. [CrossRef]

- UNSGSA, “Annual Report to The Secretary-General: Financial Inclusion: Technology, Innovation, Progress,” New York, 2018. [Online]. Available: https://www.unsgsa.org/sites/default/files/resources-files/2020-09/_AR_2018_web.pdf. (accessed on 04.03.2024).

- E. Ziemba, “The contribution of ICT adoption to sustainability: households’ perspective,” Inf. Technol. People, vol. 32, no. 3, pp. 731–753, 2019. [CrossRef]

- X. Deng, Z. Huang, and X. Cheng, “FinTech and sustainable development: Evidence from China based on P2P data,” Sustain., vol. 11, no. 22, 2019. [CrossRef]

- R. Dubey et al., “Can big data and predictive analytics improve social and environmental sustainability?,” Technol. Forecast. Soc. Change, vol. 144, pp. 534–545, 2019. [CrossRef]

- B. Almasri and D. Sunoco, “Toward Sustainability : Digital Banking,” Reseacrh, no. September, 2023.

- Z. Temelkov, “Factors affecting neobanks sustainability and development,” J. Econ., vol. 7, no. 1, pp. 1–10, 2022. [CrossRef]

- J. Rakshitha and R. Chaya, “Driving Sustainability: Exploring Global Green Banking Initiatives for a Greener Future,” J. Dev. Res., 2023. [CrossRef]

- E. Monis and R. Pai, “Literature Review of Neo Banking: an Acceptability and Compatibility Study,” EPRA Int. J. Res. Dev., vol. 8, no. 12, pp. 326–333, 2023.

- P. Sahoo and B. P. Nayak, “Green Banking in India,” Indian Econ. J., vol. 55, no. 3, pp. 82–98, 2007. [CrossRef]

- Monzo, “Our approach to the environment,” 2024. https://monzo.com/protecting-the-environment/.(accessed on 04.03.2024).

- Monzo, “Our Business Practices,” 2024. https://monzo.com/our-business-practices/.(accessed on 04.03.2024).

- Helios, “helios,” 2024. https://www.helios.do/. (accessed on 04.03.2024).

- R. Dillet, “Green-Got is a neobank for climate-conscious customers,” TechCrunch, 2023. https://techcrunch.com/2023/05/04/green-got-is-a-neobank-for-climate-conscious-customers/?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAJHI3h3y9qRCDb2MOHMGCPypcQExQp3eszd9ABC2oqwrEBzLJZIrWMJwLYQSe_2qpMPsxzpgBH7da09kJ9lL. (accessed on 21.03.2024).

- P. Allen, “French neobank Green-Got lands €5 million to fuel the future of sustainable banking,” EU-Startups, 2023. https://www.eu-startups.com/2023/05/french-neobank-green-got-lands-e5-million-to-fuel-the-future-of-sustainable-banking/. (accessed on 04.03.2024).

- M. Paul, “Meet Helios, the sustainable neobank from Paris which has roped in €9 million to limit global warming,” tech eu, 2022. https://tech.eu/2022/04/25/meet-helios-the-sustainable-neobank-from-paris-which-has-roped-in-eur9-million-for-greener-world/.(accessed on 04.03.2024).

- R. A. Prastyanti, R. Rezi, and I. Rahayu, “Ethical Fintech is a New Way of Banking,” Kontigensi J. Ilm. Manaj., vol. 11, no. 1, pp. 255–260, 2023. [CrossRef]

- A. Amon and T. Jagrič, “Challenges and opportunities of a neobanking phenomenon : a case study of N26,” in Challenges of the financial institutions in the digital and green transformation of economic ecosystem, Harlow: Pearson, 2022, pp. 49–67.

- H. Stewart and J. Jürjens, “Data security and consumer trust in FinTech innovation in Germany,” Inf. Comput. Secur., vol. 26, no. 1, pp. 109–128, 2018. [CrossRef]

- A. Amon and Ž. Oplotnik, “Sustainable finance in the digital age: a review of the neobanking phenomenon,” 2024.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).