1. Introduction

Banks have great potential to support the achievement of sustainable development goals (SDGs) in accordance with their function as financial intermediaries through sustainable lending. In recent years, Indonesia Financial Services Authority (OJK) has issued regulations regarding the implementation of sustainable finance and the implementation of governance for commercial banks, which also includes lending activities. Increased business awareness of environmental and social aspects is a driver of sustainable lending and at the same time a source of funds with incentives and more comfortable investment. However, the average national financing growth for the sustainable business activity category over the last four years (2019-2022) is still 12% [

1], which is below the growth of 40 other countries by 30% [

2]. Stakeholder expectations for sustainable lending are a challenge for banks, especially in the face of various developments in the external environment both at the macroeconomic level and at the industry level including regulatory developments and the potential for greenwashing.

To meet stakeholder expectations and respond to the dynamics of the external environment, state-owned conventional banks, which hold 44.6% of the national loan portfolio, require certain business models and strategies to further drive sustainable loan growth. One approach that can be used is through the value chain concept which is the basis for developing a business model [

3], and at the same time as a material for strategic planning [

4]. The value chain approach is very relevant to lending activities where there are primary and support activities linked to generate margins (financial performance). Given that the output of the generic value chain is just financial performance, it is necessary to adopt the environmental, social and governance (ESG) concept toward sustainable value chain. Sustainable value chains improve the capabilities of companies that cannot be adequately addressed by traditional value chains [

5].

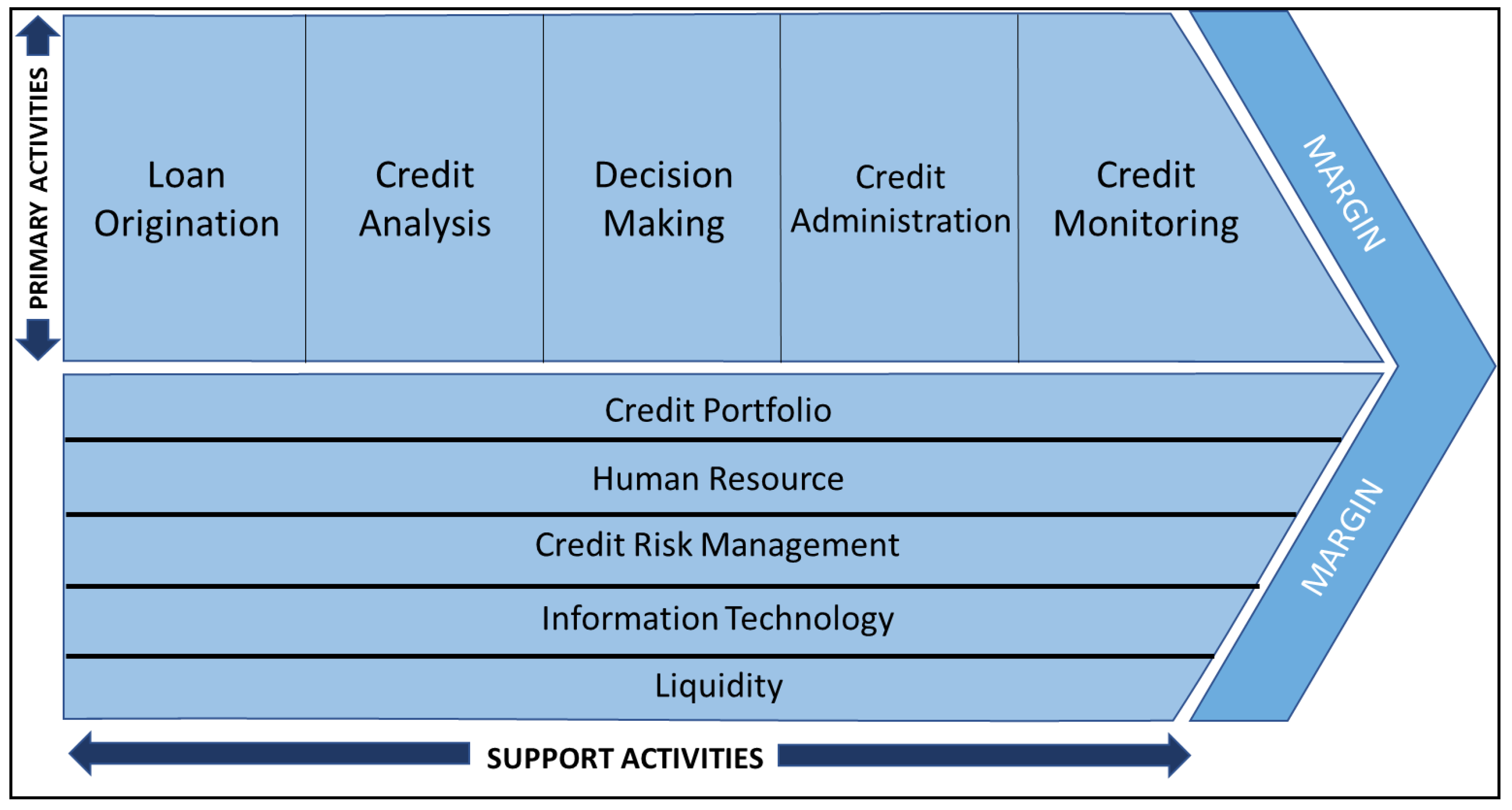

The value chain in lending consists of the primary activities that constitute a series of credit processes from customer data collection, credit analysis and decisions, and administration to credit monitoring [

6]. In addition, there are support activities which are the internal resources of the bank consisting of human resources, risk management, information technology and bank infrastructure [

7,

8]. Meanwhile, output which was originally margin was transformed into economic performance and non-financial performance or ESG performance. There are various research results regarding the effect of ESG performance on financial performance, economic performance and sustainable lending. Research on companies in the USA [

9] and companies in Malaysia and Singapore [

10] show a strong relationship between ESG performance and economic performance. Individually, ESG performance is also related to financial performance, where the governance aspect has a very strong influence compared to other aspects [

11]. Research in the countries of Brazil, Russia, India, China and South Africa (BRICS) revealed that although there was a significant positive relationship between the total ESG score and financial performance, the individual environmental, social and governance scores were not significant [

12]. This condition has the implication that ESG elements have a combined influence on financial performance.

Many elements of the value chain that play a role, and the lack of a unified opinion regarding the influence of ESG performance are the problem formulation in this research. Based on these background and problems, this research aims to identify the conditions of sustainable lending in state owned conventional banks in Indonesia and analyzing the influence of the value chain, economic performance and ESG performance on sustainable lending.

2. Literature Review and Hypothesis Development

2.1. Literature Review

2.1.1. Stakeholder Theory, Triple Bottom Line and ESG

The sustainable business approach is based on the stakeholder theory developed by Freeman [

13]. This theory is a conceptual framework in carrying out strategic management aimed at fulfilling stakeholder interests. This theory states that the success of a company depends on fulfilling the interests of all stakeholders, where the current context includes not only economic interests but also social and environmental ones. Stakeholder theory is used to explain the relationship between the implementation of the ESG concept to economic performance. The research [

9] results show that the entire ESG model has a significant relationship to economic performance. In addition, the findings of this research indicate that social performance and governance significantly influence economic performance in all regression models [

9]. Likewise, [

10] refer to stakeholder theory in research related to the influence of ESG practices on economic performance, the research results explain that ESG performance management is responsible for creating business enthusiasm and an environment that builds company integrity in society and stakeholder trust. Research regarding ongoing performance evaluation in banks is carried out through an approach to stakeholders, consisting of customers, regulators, shareholders, the community, managers and employees [

14].

There are three dimensions related to the concept of business sustainability, namely the economic, social and environmental dimensions [

15] which are the triple bottom line or TBL concept [

16]. The economic dimension is related to the company's capability in generating profits, the social dimension is related to the company's contribution to social aspects such as the welfare of the community around the company and the community that has direct involvement in the company and the environmental dimension is related to the company's involvement in preserving the environment by using resources that can be renewed or recycled (green products). Stauropoulou and Sardianou [

17] measuring sustainable performance in the banking sector with a sustainable index structure following the three-bottom line (TBL) approach. Following up on the concept of TBL, there are several ideas regarding environmental, social and governance or commonly referred to as ESG. The term ESG was first introduced by the United Nations in the article "Who Cares Wins" which explains whether a product has a positive contribution to the environment, social and governance of the organization [

18]. In this concept, in addition to social and environmental aspects as in the TBL concept, there are governance aspects which are an inseparable series. Governance aspects play an important role in value creation by ensuring accountability, compliance, and transparency [

19].

The ESG concept refers to a material dimension that is outside the financial division that is a challenge for companies to achieve optimal company performance [

20]. ESG aspects can be described individually through their respective indicators. Indica-tors commonly used as an element of environmental aspects are energy conversion efficiency, biodiversity and land use, waste and toxic emissions, clean technology, while for the social aspect using elements of treatment to stakeholders, product safety, privacy and data security [

21,

22]. The similar indicators are presented by Devalle et al. [

23] by observing the environmental aspects of the use of resources emission and environ-mental innovation, while the social aspects consist of elements of community enhancement and product responsibility. Governance indicators consist of elements of board of director structure and commitment to implementing governance principles.

2.1.2. Value Chain Concept and Resource Based View

Approach to internal resources in lending using the value chain concept [

24] which presents systematically the economic activities of a company and its interactions to develop competitive advantage. The primary activities in the value chain concept are activities that are directly related to product creation, sales, distribution, maintenance and service activities [

24]. While supporting activities are activities that support operational activities in a company as a whole consisting of procurement, technology development, human resource management and company infrastructure [

24]. This concept was originally developed for industrial activities in general, but can be adopted into other business activities such as banking [

7]. With regard to this, the application in lending activities needs to be adjusted by referring to some relevant literature. The process of providing lending consists of several activities, namely loan origination, credit analysis, credit approval, credit documentation, loan disbursement and credit administration, handling non-performing loans [

25]. This is in line with the asset financing process [

26], which consists of origination, assessment, supervision and collection. Meanwhile, according to Shong and Chung [

27], the loan origination process activities consist of accepting loan applications, credit analysis, credit structuring and loan agreements, disbursement and administration, loan review and resolution. Scannella [

6] used a value chain framework in developing a loan origination scheme consisting of several stages of the credit process, namely customer application, data collection process, credit analysis and decision making, which are the primary activities. The lending operation process model with the value chain framework developed by Hubbard et al. [

28], showed relatively similar main activities [

6].

In research on competencies in commercial banks [

7], on smart sourcing in the banking environment [

8], and on digital transformation of bank services [

29] each using the value chain concept to determine the effect of activity variables on competence or on smart sourcing or on respond to disruption. Indicators of supporting activities are adjusted by including risk management activities as a substitute for procurement activities, in addition to human resources, information technology and bank infrastructure. This is because the role of risk management in the banking environment is very important in supporting prudent bank activities. Other adjustments to support activities in lending are related to the bank's function as a financial intermediary. According to the financial intermediation theory of banking, the two main activities of banks, namely fund-raising and lending activities, form an uninterrupted cycle of business activities [

30]. The funds raised are liquidity that will be channeled into lending activities in the form of lending products and portfolios. Loan growth and deposit are significant determinants of bank’s liquidity [

31]. On the other hand, money supply is strongly related to credit creation [

32]. The application of the value chain concept in banking activities that have been adapted to lending activities includes primary activities and support activities as presented in

Figure 1.

In anticipation of increasing competition and to maintain business continuity, banks choose resources that can be relied upon to be a competitive advantage according to their capabilities in the value chain both from primary activities and support activities in accordance with the resource-based view of the firm [

33]. The three concepts of resource-based view of the firm are firm resources, competitive advantage and sustainable competitive advantage [

34]. This approach is done by initiating certain activities with a concept that is difficult to imitate so that it becomes a sustainable competitive advantage. The strength of the company's internal factors is related to its capabilities in managing resources and transforming them to anticipate opportunities and challenges [

35]. Capabilities are often developed from functional areas or by a combination of physical resources, human resources and technological resources at the corporate level [

36].

2.1.3. Sustainable Lending

Sustainable lending has been going on for quite some time, but there is no standardized definition that has been agreed upon. Sustainable lending is a lending activity that is consistent with the objectives of sustainable finance, namely financing sustainable environment ally sound economic activities [

37]. Accenture [

38] describes sustainable lending as an investment activity that considers social, environmental, and governance aspects that play an important role in decision making. This definition is in line with The Luxembourg Banker's Association [

39], according to the statement of sustainable investment, sustainable lending that is oriented towards Environmental, Social, and Governance (ESG) factors needs to be considered as part of the credit process and decision. Helaba [

40] describes the sustainable lending framework as the implementation of lending activities that have a positive impact on the environment, social, and contribute to corporate responsible governance (ESG). Meanwhile, according to Calderon and Chong [

41] sustainable lending is a bank's decision to provide loans only to companies that pay attention to environmental and social aspects in their business activities. Apart from the consideration of ESG aspects, economic aspects also have a significant role in supporting sustainable lending activities. Economic sustainability involves all topics related to intergenerational and intragenerational economic considerations [

42]. Economic sustainability refers to activities that support long-term economic growth without negatively impacting the social, environmental and social culture of the community. In addition, economic sustainability not only includes sustainable financing opportunities, but also the reorientation of the financial sector on sustainability issues especially through sustainable finance projects that are currently in progress [

43]. Based on definitions and framework above, in this research, sustainable lending is a bank activity that supports the provision of credit with an environmental, social and governance perspective while still achieving economic value.

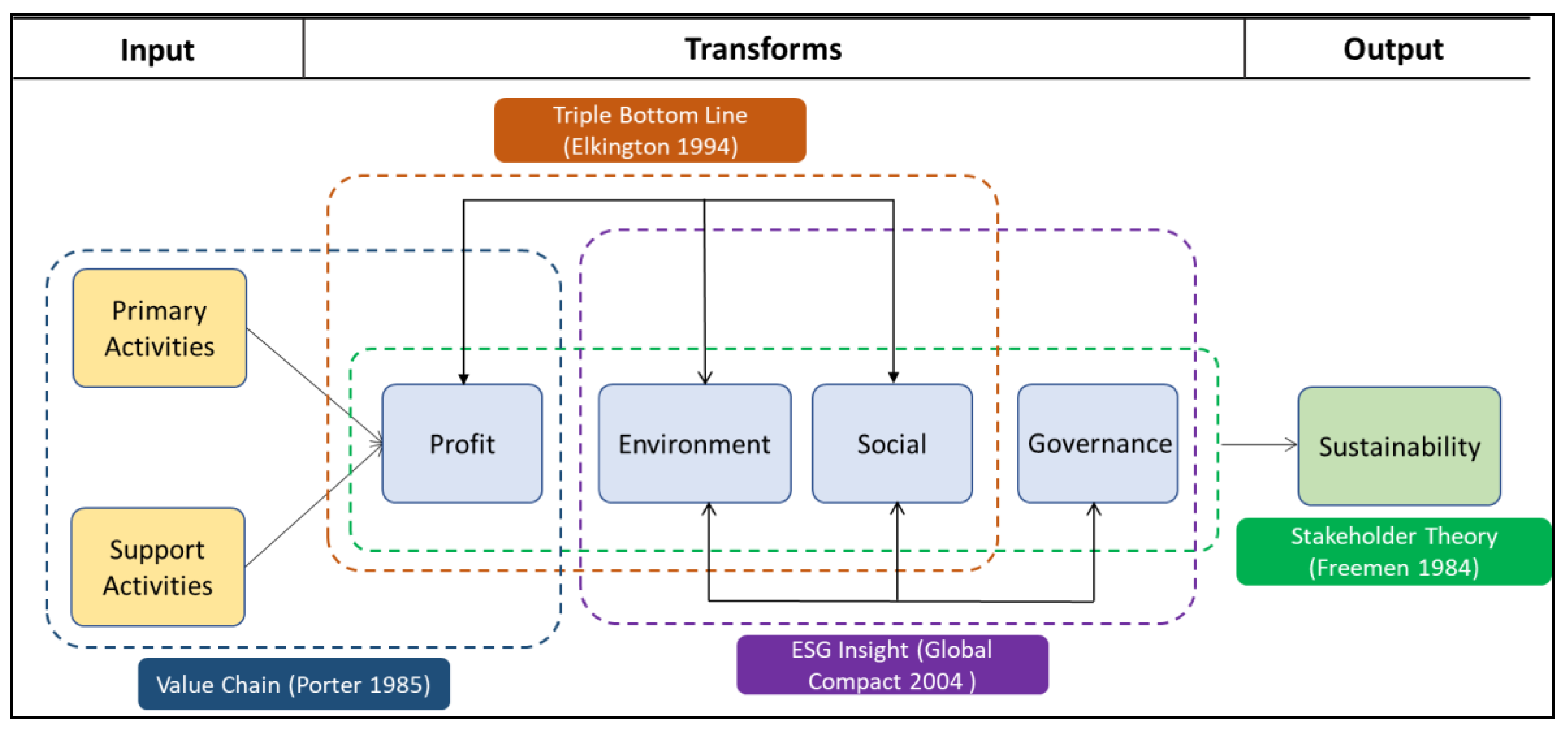

Value chain analysis is very widely used for financial performance, but there is still relatively little attention for sustainable performance that takes into account environmental and social factors. Therefore, value chain variants need to be expanded by combining them with the three pillars of sustainability, economic, environmental and social [

44]. The sustainable value chain (SVC) is an extension of the original concept of the value chain developed by Porter [

24]. Wu et al. [

5] argue the SVC model improves firm capabilities that cannot be adequately addressed by the traditional value chain. Sustainable value chains align and link identified resources over selected generic strategies with environmental management, social responsibility and economic well-being to ensure sustainable development [

45].

Based on the value chain approach combined with the application of the triple bottom line concept and ESG insights to fulfill the interests of stakeholders, a conceptual framework of a sustainable value chain for sustainable lending was developed, which is presented in

Figure 2.

2.2. Hypotheses Development

2.2.1. The Relationship between Value Chain and Economic Performance

The results of various studies show that an increase in the total credit portfolio will lead to a potential increase in Non-Performing Loan (NPL) [

46,

47] and a decrease in financial performance [

48] , however, if credit portfolio management is carried out well it will encourage increased profitability [

49], otherwise it will have a negative effect on -facing the bank's financial performance [

50]. Overly aggressive credit provision will actually be the main factor causing the downfall of a bank if this is not in line with efforts to maintain its quality through monitoring [

51]. The role of human resources and the readiness of organizations to adopt innovation in the banking sector will strengthen company performance achievements [

52]. The main source of risk apart from credit policy is low analytical skills [

53]. Another important factor is digital technology which significantly supports the bank's profitability in the long-term [

54]. From the review of the primary activities (credit analysis) and support activities (credit portfolio, human resources, credit risk management, digital technology) included in the value chain concept, it shows its relationship with financial performance. Based on this, the hypothesis is formulated as follows:

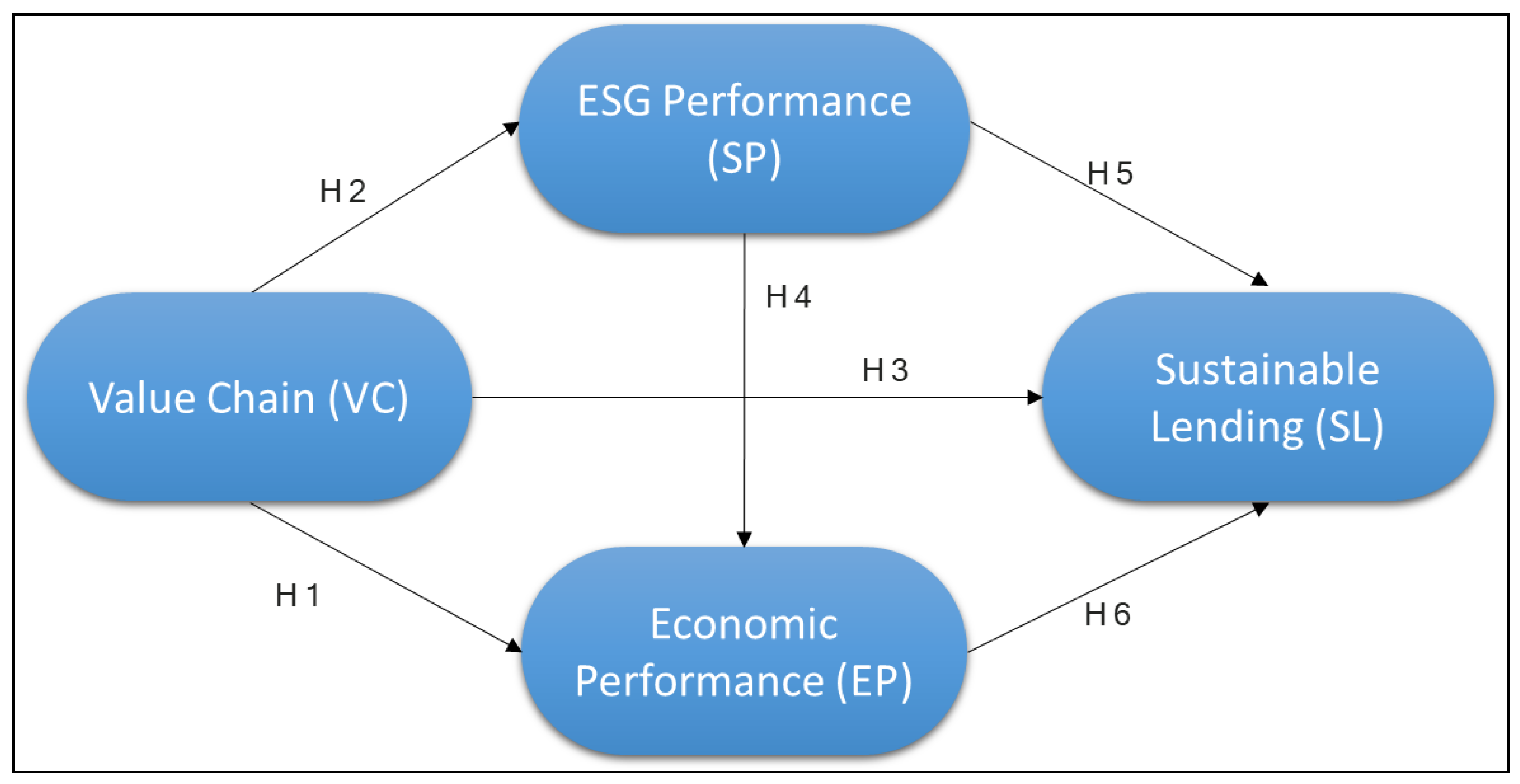

Hypothesis 1 (H1). The value chain in commercial lending has a positive effect on economic performance.

2.2.2. Relationship between Value Chain and ESG Performance

Research by Khatun et al. [

55]related to ESG regarding the implementation of green finance policies by commercial banks in Bangladesh towards sustainable growth, private and foreign banks are faster in adopting green banking practices than government-owned banks. This is different from Indonesia where out of eight banks as first movers in sustainable finance, three state-owned banks are dominant in lending to sustainable business activities [

56]. Like economic performance, the credit portfolio also has a relationship with ESG performance, namely the ESG score [

57]. This is in line with the research of Huy and Loan [

58] which shows risk management has a positive impact on green credit. The availability of green financial products has a positive effect on green banking performance [

59]. In addition to the availability of green products, other factors that encourage the distribution of green loans are the promotion of green education [

59] and the quality of human resources [

58]. Other research also reveals that digital technology transformation can improve efficiency and encourage improved ESG performance [

60]. Primary activities such as credit analysis of ESG affect the credit rating. This is associated with creditworthiness evaluation of borrowers, where ESG factors are considered as related to cash flow [

23]. A review of the primary activities (credit analysis) and support activities (credit policy and credit score as part of credit risk management, credit portfolio and credit product, human resources, digital technology, funding liquidity) shows their relationship with ESG performance. Based on this, the hypothesis is formulated as follows:

Hypothesis 2 (H2). Value chain in commercial lending has a positive and significant effect on ESG performance.

2.2.3. Value Chain Relationship with Sustainable Lending

Gelhard and Delft's research [

61] describes the concept of the value chain model and its effect on sustainable financial performance. The value chain enables companies to deliver sustainable products and services in a timely manner, address changing customer needs, shorten lead times, and reduce inventory costs. The results of the study revealed strategic flexibility and value chain flexibility as distinct yet interrelated capabilities in the pursuit of superior sustainability performance. An important part of the lending value chain related to sustainability is liquidity, in which funding liquidity has a positive effect on sustainable bank lending [

37]. Several organizations in the financial sector have established various principles as benchmarks for sustainability measurement. The Global Alliance for Banking on Values [

62] defined six principles of value-based banking, while the Indonesian Financial Services Authority (OJK) [

63] defined eight principles of sustainable finance. From the two organization's principles, the triple bottom line, transparency, responsible investment and inclusiveness are directly relevant to sustainable lending. However, there has been no research that combines the value chain concept with the principles of sustainable finance published by the GABV and OJK.

Based on the value chain review of economic performance and ESG performance above, it shows its support for sustainable lending.

Hypothesis 3 (H3). Value chain has a positive and significant effect on sustainable lending.

2.2.4. The Relationship between ESG Performance and Economic Performance

There are various research results regarding the relationship of ESG performance or non-financial performance to economic performance and company financial performance. Cek and Eyupoglu's research [

9] describes a strong relationship between ESG performance and economic performance and individually shows the real influence of social and governance aspects. ESG performance has a positive impact on financial performance, where governance aspects have a very strong influence compared to other aspects [

11], there is a significant influence of social and governance aspects on credit ratings [

23]. Research by Farida et al. [

64] in Indonesia shows that the people business credit program product is an entry point to the micro-enterprise’s households’ segment of the bank. Yilmaz's research [

12] on BRICS countries revealed that although there is a positive significant relationship between the total ESG score and financial performance, the individual environmental, social and governance scores are not significant. Based on the description above, it shows the relationship between ESG performance and financial performance, so the hypothesis is prepared as follows:

Hypothesis 4 (H4). ESG performance in commercial lending has a positive and significant effect on economic performance.

2.2.5. Relationship between ESG Performance and Sustainable Lending

ESG is relevant to have a positive effect as a competitive advantage in the context of sustainable business. There is a broader influence suggested by Zhao et al. [

65], where good ESG performance not only improves financial performance, but also has a significant impact on investors, company management, decision makers and regulators which are stakeholders. One of the key attractions in green investment is the company's green brand [

66]. As one element of ESG, green credit can promote green sustainable development by Bao and He [

67]. Another element of ESG, corporate social performance has relationship with financial product safety [

68]. In addition, there is an increase in loan volume with total value of household asset through access to extension services. The third element of ESG, sound corporate governance structure enhances the loan quality and bank stability [

69]. There are eight relevant corporate governances in that research and using principle component analysis.

However, the increase in ESG financing needs to be aware of the potential for greenwashing by borrower, namely exposing or claiming the application of green banking in their product or services excessively without a clear basis [

70]. Therefore, to minimize the occurrence of green washing, it is done by increasing transparency through the disclosure of financial and non-financial reports of the company's green policy and its achievements [

71]. Based on the description above, there is a relationship between ESG performance in aggregate and individually (environmental, social and governance) with sustainable lending, so the following hypothesis is arranged:

Hypothesis 5 (H5). ESG performance has a positive and significant effect on sustainable lending.

2.2.6. The Relationship between Economic Performance and Sustainable Lending

Lending growth coupled with increased profitability can reduce problem loans because banks are able to improve lending risk management through training [

72]. Research by Lee and Rosenkranz [

73] regarding the relationship between economic performance and sustainable lending in Asian countries shows that bank-specific factors such as rapid lending growth and excessive lending provision contribute to the occurrence of NPLs. OJK determines that apart from financial aspects, there are environmentally friendly products and the involvement of local parties [

74] as economic performance that influences sustainable finance. This includes distributing financing with environmentally friendly products such as green energy, sustainable plantations or green property. Besides financial factors there are client loyalty and shareholder loyalty factors [

9]. These two factors play a role in sustainable business activities. In the framework of sustainable finance, several principles were developed by institutions abroad such as the Global Alliance for Banking on Values (GABV) [

62] and domestically [

63]. Both the OJK and GABV principles contain economic principles, which means that economic factors are related to sustainable financing. Based on this explanation, a hypothesis is formulated as follows:

Hypothesis 6 (H6). Economic performance has a positive and significant effect on sustainable lending.

Based on hypothesis 1 and hypothesis 6, there is an indirect relationship between the value chain concept and sustainable lending through economic performance, which gives birth to the following hypothesis:

Hypothesis 7 (H7). Value chain through economic performance has a positive and significant effect on sustainable lending.

Based on hypothesis 2 and hypothesis 5, there is an indirect relationship between the value chain concept and sustainable lending through ESG performance, which gives birth to the following hypothesis:

Hypothesis 8 (H8). Value chain through ESG performance has a positive and significant impact on sustainable lending.

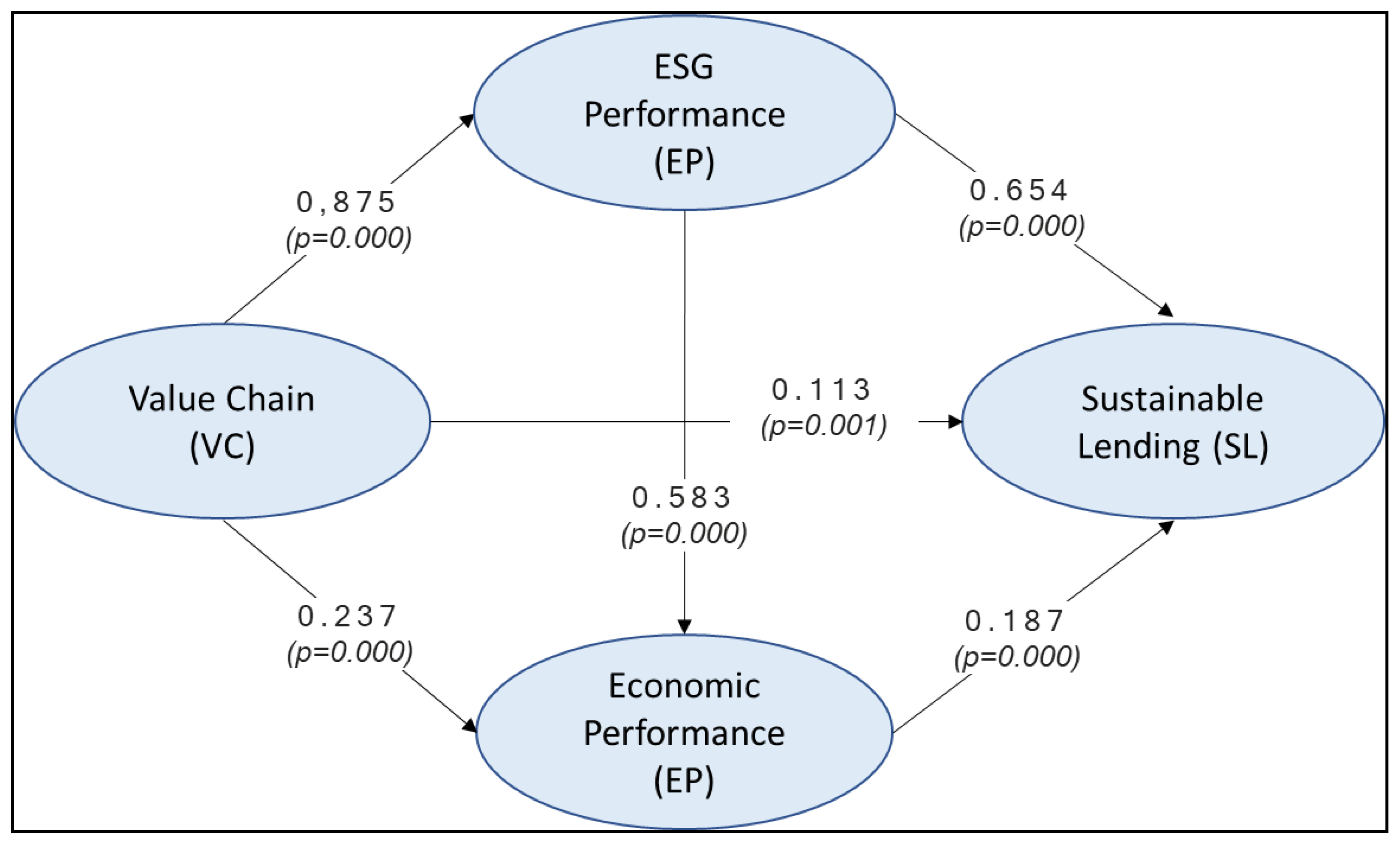

2.3. Conceptual Framework of the Study

Based on the sustainable lending hypothesis above, a research conceptual model was prepared in

Figure 3.

3. Methodology

3.1. Sample and Data Collection

This research was conducted at conventional state-owned banks in Indonesia, namely a group of banks that have core capital greater than 70 trillion rupiah (IDR) and are state-owned enterprises, in June-November 2023, consisting of three banks which is headquartered in Jakarta. The three banks have similar processes and credit products and are the first movers on sustainable banking in Indonesia. The research data used primary data, obtained through a survey conducted with a questionnaire instrument with a purposive sampling approach. The questionnaire was distributed on-line to respondents who came from credit managers in the credit unit and 414 responses were received. Secondary data was obtained from sustainability reports and annual reports of the three banks and reports or publication data from the Financial Services Authority.

The characteristics of credit managers can be seen through descriptive analysis of respondents in

Table 1. The majority of respondents consisted of 64% men and 36% women aged 26-35 years (54.11%) and 36-45 years (29.71%). Most respondents had a bachelor's degree (77.05%) and a master's degree (21.98%) with 6-10 years of work experience (36.23%) followed by 11-15 years (24.40%) and 1-5 years (23.67%). The number of male officials is generally greater than that of females. Other characteristics of credit managers shown through respondents are 63.04% from business units and 29.5% from risk units, consisting of 63.29% wholesale segment (35.75% corporate and 27.54% commercial) and 29.23% retail segment (22.71% SME and 6.52% micro). The respondents' understanding of ESG loans is shown through their experience in managing ESG loans where 42.51% of respondents have ever managed and/or are currently managing loans and 73.19% of respondents stated that they have read the bank's sustainability report and 42.51% have participated in socialization to increase their understanding of ESG and 36.23% have attended workshops/seminars on ESG.

Based on the description above shows that in general, credit managers at the three state-owned banks that are the object of research have an understanding of ESG factors, especially sustainability loans. This is shown by only 11.11% of respondents who have never participated in training activities that increase their understanding of ESG and sustainability linked-loan (SLL). Respondents generally also have an understanding of the ESG sustainability of the banking institutions concerned. It can be seen from 73.11% of respondents who read the annual sustainability report of the banking institution concerned. From this aspect, especially from human resources in these banking institutions, it can be concluded that human resource management in the three state-owned banks is capable of synergizing ESG aspects, especially sustainability loans disbursed by these banks.

3.2. Research Instruments

The variables used are latent variables consisting of value chain (VC) , economic performance (EP) , ESG performance (SP), and sustainable lending (SL). VC has two dimensions, namely primary activities (PA) and support activities (SA). EP has four dimensions, namely financial performance (FP), green credit financing (GF), credit financing through social impact cooperation (CS), and credit financing based on ESG scores (CE). SP has three dimensions, namely environmental oriented (EO), social oriented (SO), governance oriented (GO). SL has five dimensions, namely the principle of responsible investment (PRI), the principle of social and environmental risk management (PSE), the principle of green washing awareness (PGA), the principle of governance (PG) and the principle of inclusion (PI). Measurement of indicators for observed variables uses a Likert scale. The Likert scale consists of five points ranging from one (strongly disagree) to five (strongly agree) in assessing the dimensions of sustainable lending of state-owned banks in Indonesia (

Table 2).

3.3. Data Analysis Method

The conceptual model was developed from the value chain framework concept of the factors that play a role in lending distribution, followed by analysis of the data collected using structural equation modeling (SEM). The analysis was carried out to determine the relationship between the value chain (support activities and primary activities of the credit process) with economic performance and ESG performance which influence the sustainable lending of state-owned banks in Indonesia. Evaluation of the measurement model was carried out to test the validity of indicators measured via loading factor (valid when loading factor>0.5) and reliability measured via Cronbach's Alpha and composite reliability (>0.6) and average variance extracted (AVE>0.5). Meanwhile, the structural model evaluation looks at the significance of the influence using p-value (p<0.05; for a significance level of 5%).

4. Analysis and Result

4.1. Factors That Play a Role in Sustainable Lending

Based on the results of the analysis of the description of sustainable lending in three state-owned conventional banks, it is known that the credit distribution pattern consists of various credit process activities and internal resources and does not yet describe a sustainable business model. However, the three banks have distributed credit in the category of sustainable business activities, which over the last 5 years has grown an average of 10.1% every year. Credit managers have an understanding of providing sustainable credit where 89% of credit managers have participated in ESG training, 73% have read bank sustainability reports, 60% have 6-15 years of experience and 43% directly manage ESG credit.

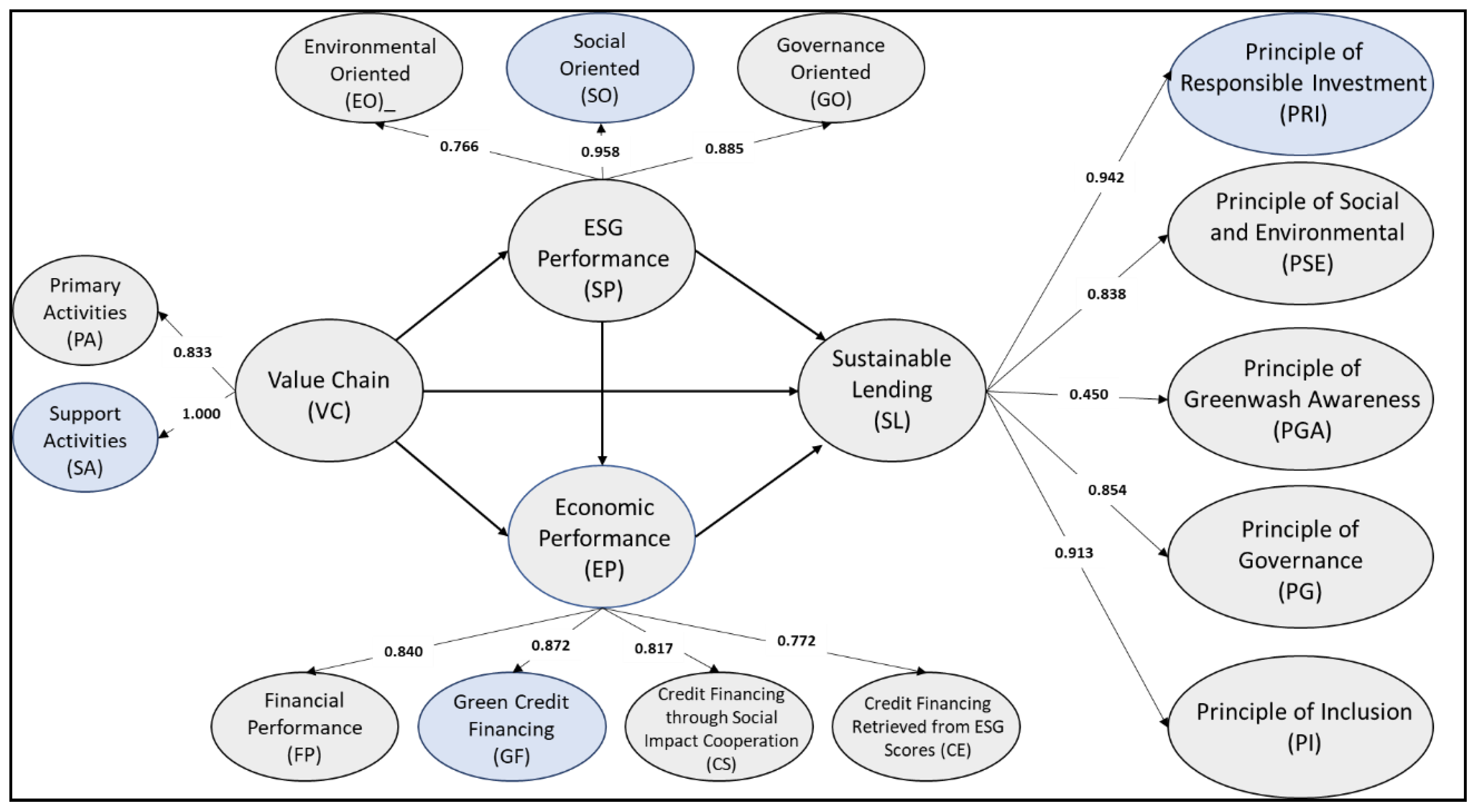

Evaluation of the measurement model was carried out to test the validity of indicators measured through loading factors and reliability measured through Cronbach's Alpha (CA) and composite reliability (CR) as well as average variance extracted (AVE) on the dimensions. Based on the results of the measurement model analysis, it shows that all loading factor values for each indicator are above the threshold of 0.5, as well as CA and CR values above 0.6 and AVE above 0.5. So it is concluded that all indicators have good construct validity and reliability.

In testing the contribution of dimensions to variables, it is measured through loading factors which represent contribution and by p-value as a significance test. Analysis of the measurement model for testing the significance of the contribution of dimensions to latent variables shows that all dimensions in each latent variable significantly contribute as represented by a loading factor above 0.7 and a p-value below 5%. There are 14 dimensions from 4 variables that play a role, namely primary activities (PA), support activities (SA), financial performance (FP), green credit financing (GF), credit financing through social impact cooperation (CS), credit financing retrieved from ESG scores (CE), environmental oriented (EO), social oriented (SO), governance oriented (GO), the principle of responsible investment (PRI), the principle of social and environmental risk management (PSE), the principle of green washing awareness (PGA) , the principle of governance (PG) and the principle of inclusion (PI).

In the VC variable, the SA dimension has a greater contribution compared to PA. The SA dimension of credit distribution is the bank's strategic factors in providing credit to debtors, while the PA dimension is the bank's operational activities in the credit process to debtors. In accordance with the resource-based view [

33], resources that can be utilized to achieve competitive advantage come from infrastructure, capital and human resources. In the EP variable, the GF dimension has the largest contribution. This financing trend is in line with the indicators studied [

22]. As for the SP variable, the SO dimension provides the largest contribution compared to the other 2 dimensions, GO and EO. This result is in accordance with the research of Cek and Eyupoglu [

9] and is in line with the trend of disbursement of ESG linked-loans which is much larger than green loans [

2]. The social aspect includes product responsibility and system reliability which play a role in protecting the interests of debtors and also includes respect for human rights in the form of equality [

22]. Responsible products, reliable systems, easy access are highly expected by debtors to maintain comfortable transactions. However, the results of this study are different from the findings of Taliento et al. [

21] who do not look at the impact of individual ESG performance on economic performance. In the SL variable, the largest contribution comes from PRI. This is in accordance with stakeholder’s theory which explains the fulfillment of stakeholder’s interests so that the organization lasts [

13]. Fulfilling interests is not only limited to economics but also takes into account environmental, social and governance responsibilities.

Figure 4 presents the result of structural equation model analysis and the impact of the relationships between factors and constructs.

4.2. The Influence of Value Chain, Economic Performance and ESG Performance on Sustainable Lending

In the evaluation of the structural model which tests the significance of the influence of exogenous variables on endogenous variables, it is divided into 2 categories, namely direct influence

and indirect

influence. Indirect influence or indirect effect is the influence of a variable that is mediated by other variables. Research hypothesis testing is presented in

Table 3.

Based on the hypothesis testing shown in

Table 3 above, the p-value obtained for each hypothesis path is smaller than the 5% real level so it can be concluded that the path relationship or influence between variables is significant. VC has the largest positive effect on SP, followed by EP and SL, which means that the better the VC, the better the SP, EP and SL. The research results of Rahat and Nguyen [

57] confirm previous findings which show that value chain supporting activities in the form of credit portfolios, and human resources, information technology, risk management and financial capacity influence ESG performance [

58]. Likewise, the influence of value chain supporting activities on economic performance is in line with the research results of Jiang et al. [

37] where a higher capital ratio has a positive effect on credit growth and profitability, credit risk management has a positive effect on company value [

75]. Meanwhile, the influence of VC on SL comes from funding liquidity [

37].

Another result is that SP has a positive effect on EP and SL. The influence of SP on EP is in line with the results of research by Menicucci and Paolucci [

22] which shows that reducing emissions and waste has a positive effect on operational and financial performance, research by Gutiérrez-Ponce and Wibowo [

76] where social aspects have a positive effect on ROA and ROE. Meanwhile, the positive influence of SP on SL is in line with the results of research by Pyka and Nocoń [

77] which shows that ESG risks increase bank involvement in implementing sustainable finance and research by Bao and He [

67] shows that green credit encourages sustainable development as well as research by Salim et al. [

68] who found that corporate social performance has a positive relationship with financial product security. EP also has a positive effect on SL, although not as much as the effect of SP. This is in accordance with Yilmaz's research [

12] regarding the relationship between corporate sustainability and financial performance through net profit margin and operating profit margin.

Testing the indirect effect of

the value chain on sustainable lending shows that all of them have a positive effect. The indirect influence of the value chain on sustainable lending is mediated by ESG performance with an influence size of 0.572, while that is mediated by economic performance with a much smaller value (0.044).

Figure 5 shows the result of structural equation model analysis of this research and reveals the impact of the relationships between constructs.

5. Discussion and Implications

The purpose of this study is to identify the condition of sustainable lending in state-owned commercial banks and analyzed the influence of value chain, economic performance and ESG performance on sustainable lending. The results of this study showed that the value chain (VC), ESG (environmental, social and governance) performance (PS) and economic performance (EP) have a direct and positive influences on sustainable lending (SL), where ESG performance (SP) has the largest influence. For each aspect, social orientation (SO) contributes the largest to sustainable lending. In addition, testing the direct effect of the value chain on sustainable lending shows that all of these have a positive effect. The indirect effect of the value chain (VC) on sustainable lending (SL) mediated by ESG performance (SP) has a larger effect than that mediated by economic performance (EP).

5.1. Theoretical Implication

There are several significant implications related to the research results on theory, where from the value chain (VC) approach a method can be developed in measuring the role of factors that affect sustainable lending in commercial banks. In this case, it is done by introducing the generic value chain performance which was originally limited to margins into economic performance (EP) and ESG performance (SP). In addition, adjustments to the dimensions in the EP variable in the form of financing on the basis of ESG score (CE) and dimensions in the Sustainable Lending (SL) variable in the form of greenwashing awareness principles (PGA) (which have not been found in previous literature), show a significant contribution to sustainable lending. Likewise, the adjustment of two indicators of the support activities (SA) dimension of the value chain variable in the form of credit portfolio and liquidity to add to the existing elements in the previous literature (risk management, human resources and technology development) makes AP one of the dimensions that make a major contribution to the value chain.

5.2. Managerial Implication

The managerial implications of this research are divided into managerial implications for banks and for regulators. Considering that the results show ESG (environmental, social and governance) performance (SP) and economic performance (EP) have a direct and positive effect on sustainable lending (SL), there are managerial implications for banks including: 1) Development of bank products with a social perspective (for example credit products to support young entrepreneurs, migrant workers, infrastructure projects in rural areas) and green perspective (such as credit products for conservation projects); 2) Development of ESG loan products such as sustainability linked-loans or ESG-linked loans (ESG-oriented products are provided according to the quality of the debtor's ESG rating). Managerial implications for regulators include: 1) Expanding the scope of sustainable loan, not only depend on the intended use of funds for social lending or green lending categories, but also by opening a new ESG linked-loan category; 2) Adjusting the credit risk profile in assessing the bank's health level by adding social risk parameters as indicators of sustainability.

6. Conclusions and Future Research

The research results show that internal bank factors play a role in sustainable lending, reflected in the results of the analysis of significant dimensional contributions to four variables, consisting of 14 dimensions, namely primary activities, support activities, financial performance, environmentally friendly lending financing, credit financing through social impact collaboration, and credit financing based on ESG scores, environmental oriented, social oriented, governance oriented, responsible investment principles, social and environmental risk management principles, green washing awareness principles, governance principles and inclusive principles. The indicators with the largest loading factor representing each dimension are Credit Risk Management, Low Emission and Waste Project Financing, Product Responsibility and Responsible Investment Principles. Directly, three determinants of sustainability, which are the value chain (VC), economic performance (EP) and ESG performance (SP) have a positive influence, with the greatest influence by SP followed by EP and VC. Indirectly, the value chain (VC) through economic performance (EP) and ESG performance (SP), has a positive effect, and the biggest influence is mediated by SP above EP. Value chain, ESG performance and economic performance can explain sustainable lending very well. Therefore, the value chain, ESG performance and economic performance can be used as a basis for developing sustainable business models.

For further research, the following things need to be considered and followed up: 1) Expanding research data collection to include private banks, and sharia or Islamic banks, so that they can represent the population of the banking industry in Indonesia; 2) Future research can be expanded by utilizing respondent data from different fields experts to evaluate the significant challenges of sustainable lending in Indonesia.

Author Contributions

Conceptualization, K.A.A.M; methodology, K.A.A.M.; software, K.A.A.M.; formal analysis, K.A.A.M.; resources, K.A.A.M. and H.S.; data curation, K.A.A.M.; writing—original draft preparation, K.A.A.M.; writing—review and editing, K.A.A.M, H.S. I.F. and D.B.H.; visualization, K.A.A.M.; supervision, K.A.A.M, H.S. I.F. and D.B.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Data is not publicly available, though the data may be made available on request from the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Financial Services Authority of the Republic of Indonesia (OJK) Laporan Profil Industri Perbankan - Triwulan I 2022; Jakarta, 2022.

- Kim, S.; Kumar, N.; Lee, J.; Oh, J. ESG Lending; 2022.

- Strakova, J.; Simberova, I.; Partlova, P.; Vachal, J.; Zich, R. The Value Chain as the Basis of Business Model Design. Journal of Competitiveness 2021, 13, 135–151. [Google Scholar] [CrossRef]

- Hergert, M.; Morris, D. Accounting Data for Value Chain Analysis. Strategic Management Journal 1989, 10, 175–188. [Google Scholar] [CrossRef]

- Wu, K.J.; Tseng, M.L.; Yang, W.H.; Ali, M.H.; Chen, X. Re-Shaping Sustainable Value Chain Model under Post Pandemic Disruptions: A Fast Fashion Supply Chain Analysis. Int J Prod Econ 2023, 255, 108704. [Google Scholar] [CrossRef]

- Scannella, E. What Drives the Disintegration of the Loan Origination Value Chain in the Banking Business. Business Process Management Journal 2015, 21, 288–311. [Google Scholar] [CrossRef]

- Lamarque, E. Identifying Key Activities in Banking Firms: A Competence-Based Analysis. Advances in Applied Business Strategy 2004, 7. [Google Scholar] [CrossRef]

- Lammers, M.; Loehndorf, N.; Weitzel, T. Strategic Sourcing in Banking - A Framework. ECIS 2004. [Google Scholar]

- Cek, K.; Eyupoglu, S. Does Environmental, Social and Governance Performance Influence Economic Performance? Journal of Business Economics and Management 2020, 21, 1165–1184. [Google Scholar] [CrossRef]

- Tarmuji, I.; Maelah, R.; Tarmuji, N.H. The Impact of Environmental, Social and Governance Practices (ESG) on Economic Performance: Evidence from ESG Score. International Journal of Trade, Economics and Finance 2016, 7, 67–74. [Google Scholar] [CrossRef]

- Velte, P. Does ESG Performance Have an Impact on Financial Performance? Evidence from Germany. Journal of Global Responsibility 2017, 80, 169–178. [Google Scholar] [CrossRef]

- Yilmaz, I. Sustainability and Financial Performance Relationship: International Evidence. World Journal of Entrepreneurship, Management and Sustainable Development 2021, 17, 537–549. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management; Cambridge University Press: London, 2010; ISBN 9780521151740. [Google Scholar] [CrossRef]

- Rebai, S.; Azaiez, M.N.; Saidane, D. Sustainable Performance Evaluation of Banks Using a Multi-Attribute Utility Model: An Application to French Banks. Procedia Economics and Finance 2012, 2, 363–372. [Google Scholar] [CrossRef]

- Slaper, T.; Hall, T. The Triple Bottom Line : What Is It and How Does It Work? Indiana University Kelley School of Business 2011. [Google Scholar]

- Elkington, J. Towards the Sustainable Corporation: Win-Win-Win Business Strategies for Sustainable Development. Calif Manage Rev 1994, 36, 90–100. [Google Scholar] [CrossRef]

- Stauropoulou, A.; Sardianou, E. Understanding and Measuring Sustainability Performance in the Banking Sector. In Proceedings of the IOP Conference Series: Earth and Environmental Science; 2019; Volume 362. [Google Scholar] [CrossRef]

- Financial Sector Initiative Who Cares Wins: Connecting Financial Markets to a Changing World; Switzerland, 2004.

- Miralles-Quirós, M.M.; Miralles-Quirós, J.L.; Redondo-Hernández, J. The Impact of Environmental, Social, and Governance Performance on Stock Prices: Evidence from the Banking Industry. Corp Soc Responsib Environ Manag 2019, 26, 1446–1456. [Google Scholar] [CrossRef]

- Bassen, A.; Kovács, A.M. Environmental, Social and Governance Key Performance Indicators from a Capital Market Perspective. Zeitschrift für Wirtschafts- und Unternehmensethik 2008, 9, 182–192. [Google Scholar] [CrossRef]

- Taliento, M.; Favino, C.; Netti, A. Impact of Environmental, Social, and Governance Information on Economic Performance: Evidence of a Corporate “sustainability Advantage” from Europe. Sustainability (Switzerland) 2019, 11, 1738. [Google Scholar] [CrossRef]

- Menicucci, E.; Paolucci, G. ESG Dimensions and Bank Performance: An Empirical Investigation in Italy. Corporate Governance (Bingley) 2023, 23, 563–586. [Google Scholar] [CrossRef]

- Devalle, A.; Fiandrino, S.; Cantino, V. The Linkage between ESG Performance and Credit Ratings: A Firm-Level Perspective Analysis. International Journal of Business and Management 2017, 12, 53. [Google Scholar] [CrossRef]

- Porter, M.E. Competitive Advantage: Creating and Sustaining Superior Performance; Free Press, 1985; ISBN 9781416595847. [Google Scholar]

- Colquitt, J. Credit Risk Management: How to Avoid Lending Disasters and Maximize Earnings; McGraw Hill LLC, 2007; ISBN 9780071510530. [Google Scholar]

- Van Greuning, H.; Brajovic Bratanovic, S. Analyzing Banking Risk (Fourth Edition): A Framework for Assessing Corporate Governance and Risk Management; World Bank: Washington, DC, 2020; ISBN 978-1-4648-1446-4. [Google Scholar]

- Wei-Shong, L.P.; Albert Kuo-Chung, M. The Internal Performance Measures of Bank Lending: A Value-added Approach. Benchmarking: An International Journal 2006, 13, 272–289. [Google Scholar] [CrossRef]

- Hubbard, G.; Rice, J.; Galvin, P. Strategic Management; Pearson Australia, 2014; ISBN 9781486012428. [Google Scholar]

- Naimi-Sadigh, A.; Asgari, T.; Rabiei, M. Digital Transformation in the Value Chain Disruption of Banking Services. Journal of the Knowledge Economy 2022, 13, 1212–1242. [Google Scholar] [CrossRef]

- Werner, R.A. A Lost Century in Economics: Three Theories of Banking and the Conclusive Evidence. International Review of Financial Analysis 2016, 46, 361–379. [Google Scholar] [CrossRef]

- Assfaw, A.M. Firm-Specific and Macroeconomic Determinants of Banks Liquidity: Empirical Investigation from Ethiopian Private Commercial Banks. journal of accounting finance and auditing studies (JAFAS) 2019, 5, 123–145. [Google Scholar] [CrossRef]

- Yang, L.; Liping, Z. Credit Creation. China Finance and Economic Review 2014, 3, 3–22. [Google Scholar]

- Wernerfelt, B. A Resource-Based View of the Firm. Strategic Management Journal 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J Manage 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Teece, D.J. Business Models and Dynamic Capabilities. Long Range Plann 2018, 51, 40–49. [Google Scholar] [CrossRef]

- Amit, R.; Schoemaker, P.J.H. Strategic Assets and Organizational Rent. Strategic Management Journal 1993, 14, 33–46. [Google Scholar] [CrossRef]

- Jiang, H.; Xu, S.; Cui, J.; Subhani, G. The Impact of Bank Capital, Liquidity and Funding Liquidity on Sustainable Bank Lending: Evidence from MENA Region. Econ Anal Policy 2023, 79, 713–726. [Google Scholar] [CrossRef]

-

Accenture Sustainable Lending : An Action Plan for Banks; Dublin, 2021.

-

The Luxembourg Banker’s Association Sustainable Lending from The Bank’s Perspective; Luxembourg, LUX, 2022.

-

Helaba Making an Impact–Together, Annual Report 2022; Germany, DE, 2023.

- Calderon, F.; Chong, L.C. Dilemma of Sustainable Lending. Journal of Sustainable Finance and Investment 2014, 4, 192–209. [Google Scholar] [CrossRef]

- Gleißner, W.; Günther, T.; Walkshäusl, C. Financial Sustainability: Measurement and Empirical Evidence. Journal of Business Economics 2022, 92, 467–516. [Google Scholar] [CrossRef]

- European Commission Economic Sustainability in the CAP. Available online: https://agriculture.ec.europa.eu/sustainability/economic-sustainability/cap-measures_en (accessed on 16 April 2024).

- Fearne, A.; Garcia Martinez, M.; Dent, B. Dimensions of Sustainable Value Chains: Implications for Value Chain Analysis. Supply Chain Management: An International Journal 2012, 17, 575–581. [Google Scholar] [CrossRef]

- Sultan, A. Saurabh Achieving Sustainable Development through Value Chain. International Journal of Managing Value and Supply Chains 2013, 4, 39–46. [Google Scholar] [CrossRef]

- Makkasau, R.; Martaputri, W.; Abdullah, T.M.K. Analysis of Factors That Influence the Potential of Non-Performing Loan. Journal of Critical Reviews 2020, 7. [Google Scholar]

- Tushaj, A.; Sinaj, V. Non–Performing Loans⇔ Effect on the Loans⇔ Shrinkage in Albanian Banking Sector. Advances in Science, Technology and Engineering Systems 2021, 6, 961–967. [Google Scholar] [CrossRef]

- Wang, C.; Cheng, Z.; Yue, X.G.; McAleer, M. Risk Management of COVID-19 by Universities in China. Journal of Risk and Financial Management 2020, 13. [Google Scholar] [CrossRef]

- Bhat, M.A.; Tariq, S.; Ahmed, I. Scrutinize the Effectiveness of Loan Portfolio Management: Challenges and Remedial. Studies in Indian Place Names 2020, 40. [Google Scholar]

- Muriithi, J.G.; MunyuaWaweru, K.; Muturi, W.M. Effect of Credit Risk on Financial Performance of Commercial Banks Kenya. IOSR Journal of Economics and Finance 2016, 7, 72–83. [Google Scholar] [CrossRef]

- Widyatini, I.R. The Effect of Risk Taking Behavior Performed by The Economic Agents Toward The Risk of the Bankruptcy of Banks. Review of Integrative Business and Economics Research 2017, 6. [Google Scholar]

- Salampasis, D.G.; Mention, A.L.; Torkkeli, M. Human Resources Management and Open Innovation Adoption in the Banking Sector: A Conceptual Model. International Journal of Business Excellence 2015, 8, 433. [Google Scholar] [CrossRef]

- Alalade, S.A.; Binuyo, B.O.; Oguntodu, J.A. Managing Credit Risk to Optimize Banks’ Profitability: A Survey of Selected Banks in Lagos State, Nigeria. Research Journal of Finance and Accounting 2014, 5. [Google Scholar]

- Shanti, R.; Siregar, H.; Zulbainarni, N. Tony Role of Digital Transformation on Digital Business Model Banks. Sustainability 2023, 15, 16293. [Google Scholar] [CrossRef]

- Khatun, M.N.; Sarker, M.N.I.; Mitra, S. Green Banking and Sustainable Development in Bangladesh. Sustainability and climate change 2021, 14. [Google Scholar] [CrossRef]

- Financial Services Authority of the Republic of Indonesia (OJK) Sustainable Finance Roadmap Phase II (2021 - 2025); Jakarta, ID, 2021;

- Rahat, B.; Nguyen, P. Does ESG Performance Impact Credit Portfolios? Evidence from Lending to Mineral Resource Firms in Emerging Markets. Resources Policy 2023, 85, 104052. [Google Scholar] [CrossRef]

- Huy, N.Q.; Loan, N.T. Factors Affecting Green Credit Development at Commercial Banks in Vietnam. 2022. [CrossRef]

- Lapinskienė, G.; Danilevičienė, I. Assessment of Green Banking Performance. Sustainability 2023, 15, 14769. [Google Scholar] [CrossRef]

- Zhu, Y.; Jin, S. How Does the Digital Transformation of Banks Improve Efficiency and Environmental, Social, and Governance Performance? Systems 2023, 11, 328. [Google Scholar] [CrossRef]

- Gelhard, C.; von Delft, S. The Role of Strategic and Value Chain Flexibility in Achieving Sustainability Performance: An Empirical Analysis Using Conventional and Consistent PLS. In Proceedings of the 2nd International Symposium on Partial Least Squares Path Modeling: The conference for PLS Users; University of Twente; p. 2015. [CrossRef]

- Global Alliance for Banking on Values Strong and Straightforward: The Business Case for Sustainable Banking; Amsterdam, NL, 2012.

- Financial Services Authority of the Republic of Indonesia (OJK) Penerapan Keuangan Berkelanjutan Bagi Lembaga Jasa Keuangan, Emiten, Dan Perusahaan Publik; Indonesia, 2017.

- Farida, F.; Siregar, H.; Nuryartono, N.; Intan KP, E. Micro Enterprises’ Access to People Business Credit Program in Indonesia: Credit Rationed or Non-Credit Rationed? International Journal of Economic Perspectives 2015, 9. [Google Scholar]

- Zhao, C.; Guo, Y.; Yuan, J.; Wu, M.; Li, D.; Zhou, Y.; Kang, J. ESG and Corporate Financial Performance: Empirical Evidence from China’s Listed Power Generation Companies. Sustainability (Switzerland) 2018, 10, 2607. [Google Scholar] [CrossRef]

- Pimonenko, T.; Bilan, Y.; Horák, J.; Starchenko, L.; Gajda, W. Green Brand of Companies and Greenwashing under Sustainable Development Goals. Sustainability (Switzerland) 2020, 12, 1679. [Google Scholar] [CrossRef]

- Bao, J.; He, M. Does Green Credit Promote Green Sustainable Development in Regional Economies?—Empirical Evidence from 280 Cities in China. PLoS ONE 2022, 17, e0277569. [Google Scholar] [CrossRef]

- Salim, K.; Disli, M.; Ng, A.; Dewandaru, G.; Nkoba, M.A. The Impact of Sustainable Banking Practices on Bank Stability. Renewable and Sustainable Energy Reviews 2023, 178, 113249. [Google Scholar] [CrossRef]

- Adegboye, F.B.; Osabohien, R.; Olokoyo, F.O.; Matthew, O.A. Foreign Direct Investment, Globalisation Challenges and Economic Development: An African Sub-Regional Analysis. International Journal of Trade and Global Markets 2020, 13, 414. [Google Scholar] [CrossRef]

- Galletta, S.; Mazzù, S.; Naciti, V.; Paltrinieri, A. A PRISMA Systematic Review of Greenwashing in the Banking Industry: A Call for Action. Res Int Bus Finance 2024, 69. [Google Scholar] [CrossRef]

- Xu, W.; Li, M.; Xu, S. Unveiling the “Veil” of Information Disclosure: Sustainability Reporting “Greenwashing” and “Shared Value”. PLoS ONE 2023, 18, e0279904. [Google Scholar] [CrossRef] [PubMed]

- Rachman, R.A.; Kadarusman, Y.B.; Anggriono, K.; Setiadi, R. Bank-Specific Factors Affecting Non-Performing Loans in Developing Countries: Case Study of Indonesia. Journal of Asian Finance, Economics and Business 2018, 5, 35–42. [Google Scholar] [CrossRef]

- Rosenkranz, P.; Lee, J. Nonperforming Loans in Asia: Determinants and Macrofinancial Linkages. SSRN Electronic Journal 2019. [Google Scholar] [CrossRef]

- Financial Services Authority of the Republic of Indonesia (OJK) Lampiran Ke II Tentang Penerapan Keuangan Berkelanjutan Bagi Lembaga Jasa Keuangan, Emiten, Dan Perusahaan Publik; Indonesia, 2017.

- Olalere, O.E.; Sem Kes, M.; Aminul Islam, M.; Rahman, S. The Effect of Financial Innovation and Bank Competition on Firm Value: A Comparative Study of Malaysian and Nigerian Banks. Journal of Asian Finance 2021, 8. [Google Scholar] [CrossRef]

- Gutiérrez-Ponce, H.; Wibowo, S.A. Do Sustainability Activities Affect the Financial Performance of Banks? The Case of Indonesian Banks. Sustainability (Switzerland) 2023, 15, 6892. [Google Scholar] [CrossRef]

- Pyka, I.; Nocoń, A. Green Lending Policy from the Perspective of a Holistic Approach to Bank Risk. Ruch Prawniczy, Ekonomiczny i Socjologiczny 2023, 85, 71–99. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).