Submitted:

14 May 2024

Posted:

14 May 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Materials and Methods

2.1. Materials

2.2. Research Methods

2.2.1. Determination of Some of the Energy Parameters.

2.2.2. Thermogravimetric Analysis and Differential Scanning Calorimetry

2.2.3. Marketing Research of Customer Preferences

3. Results

3.1. Results of Using the Materials and Methods

3.1.1. Results of Determining the Energy Characteristics of the Pellets

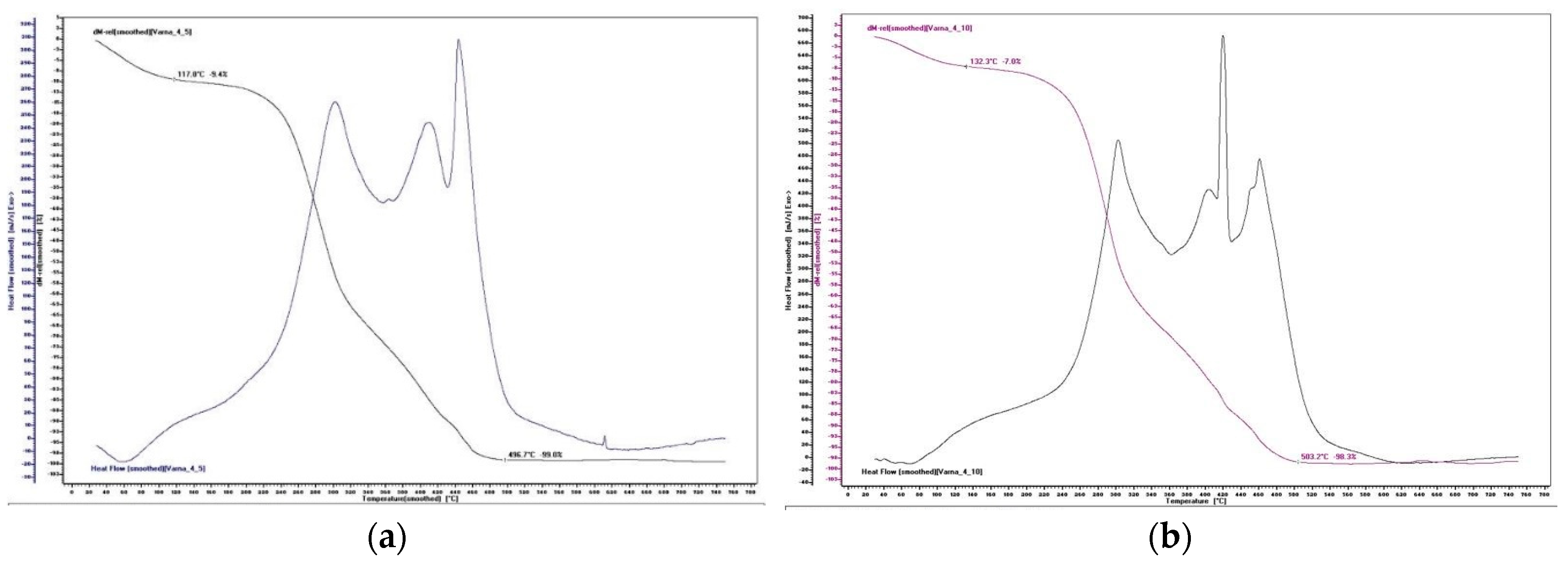

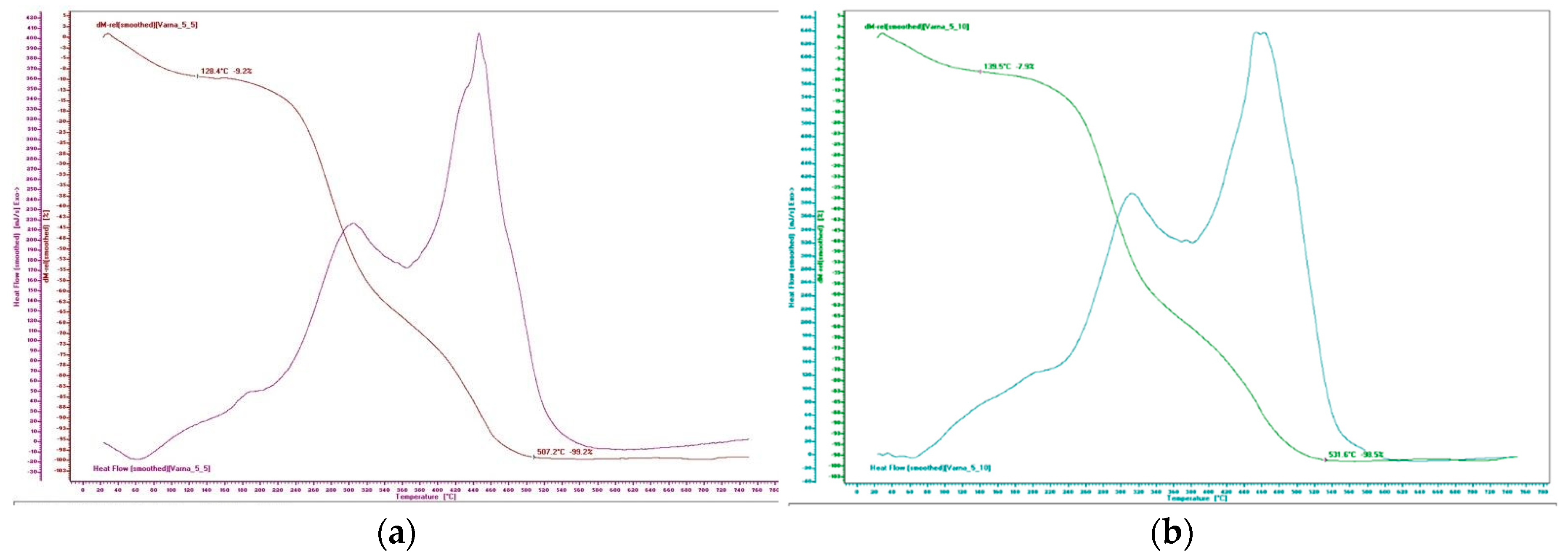

3.1.2. Results of the TG and DSC of the Pellets

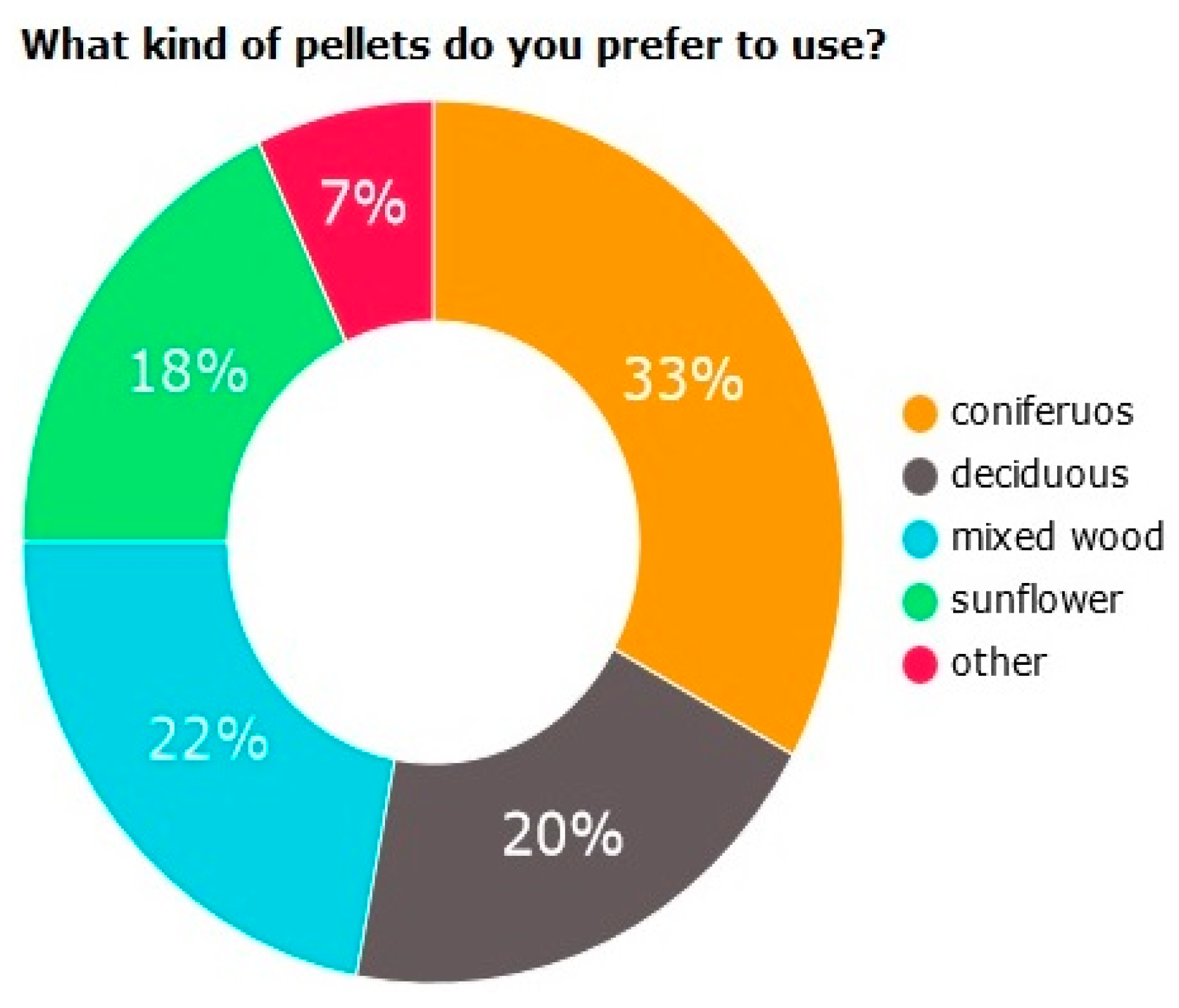

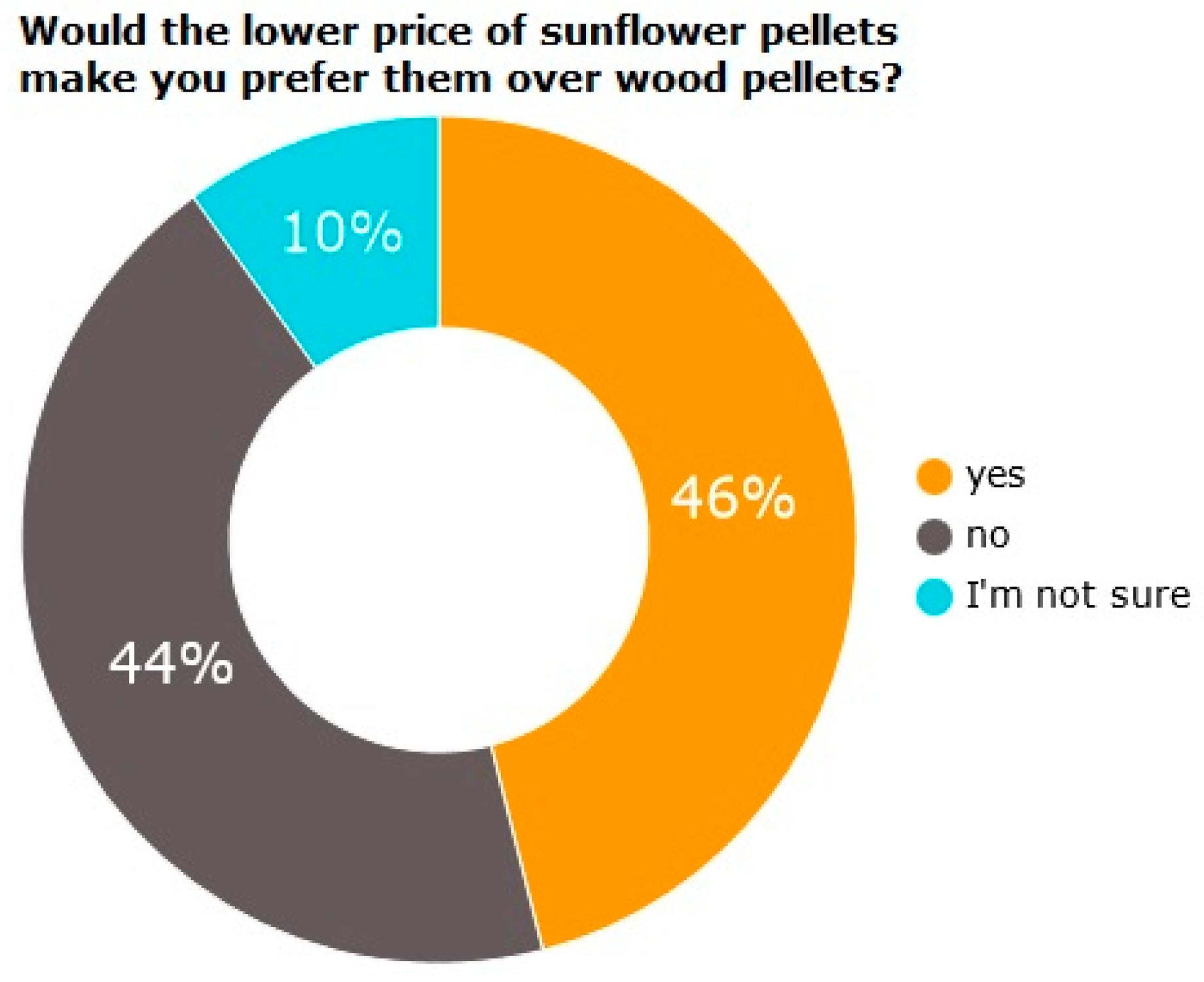

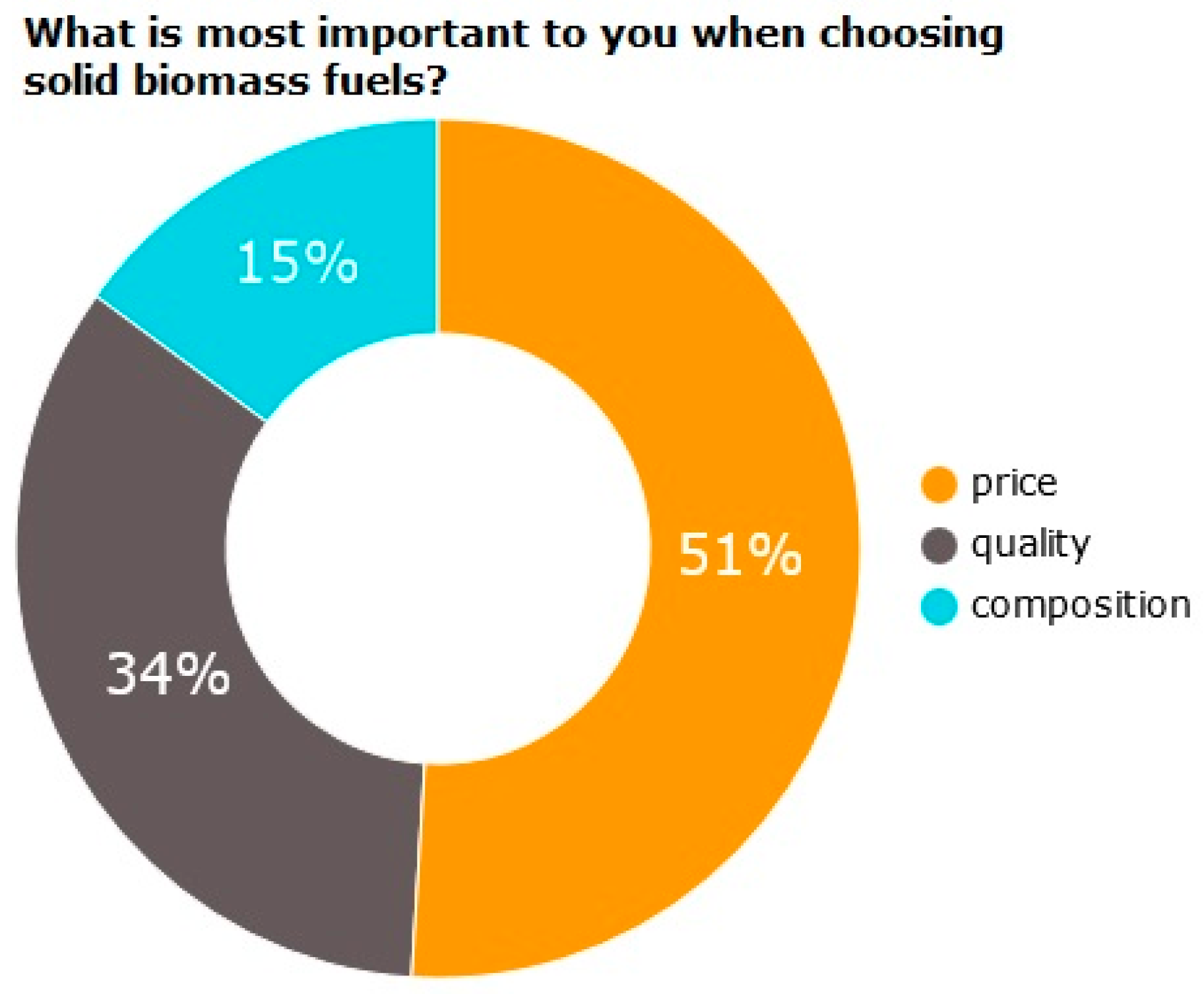

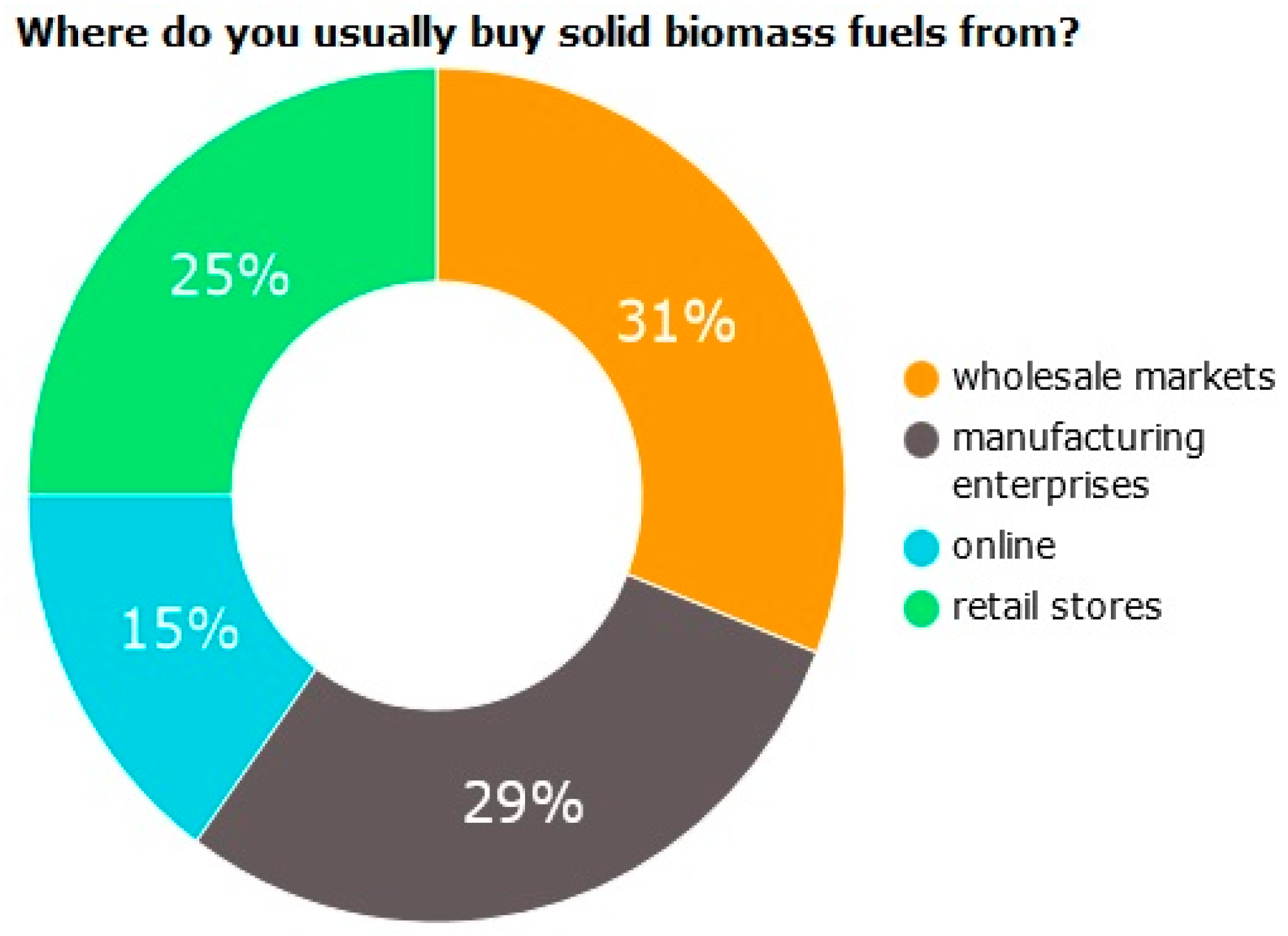

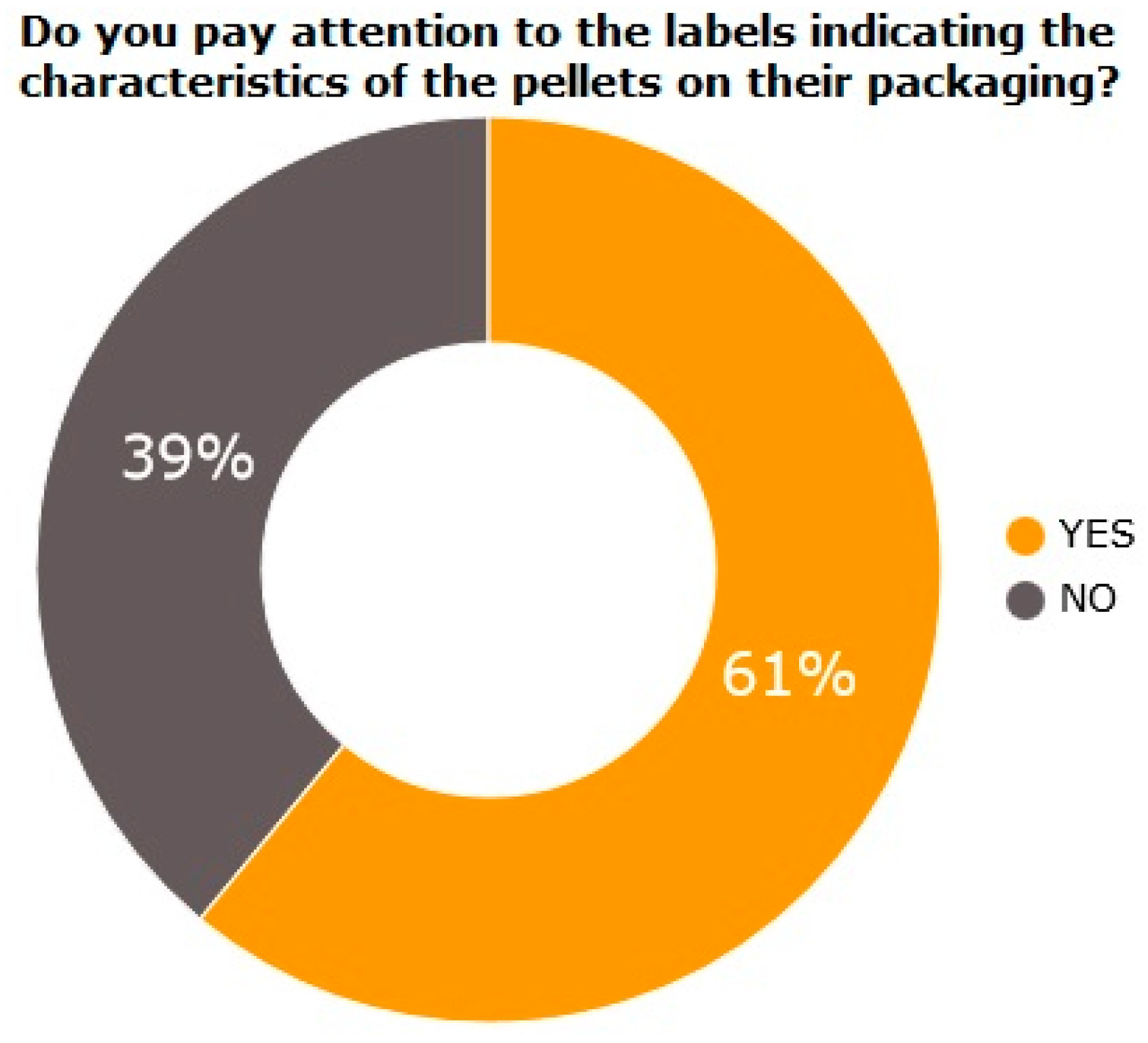

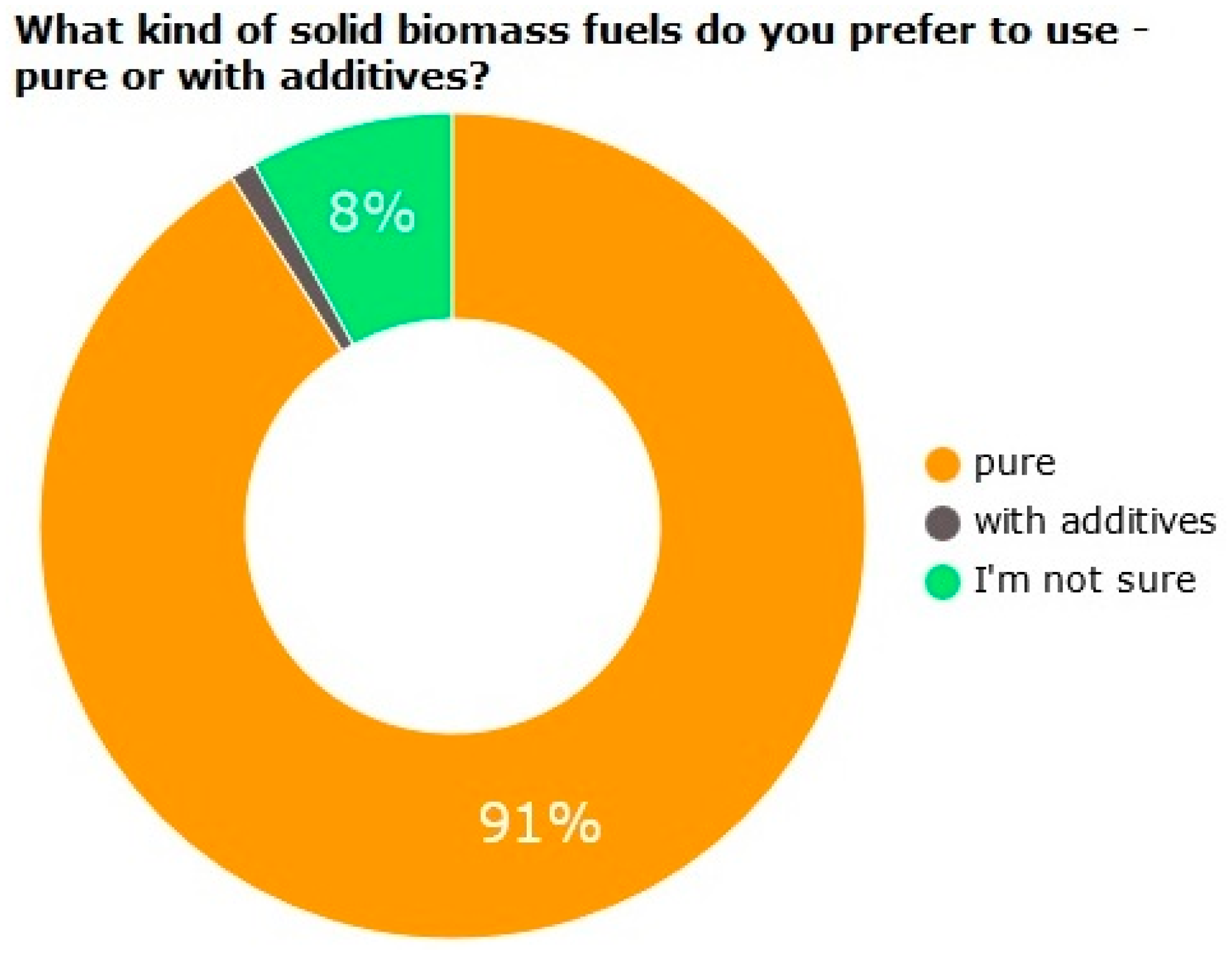

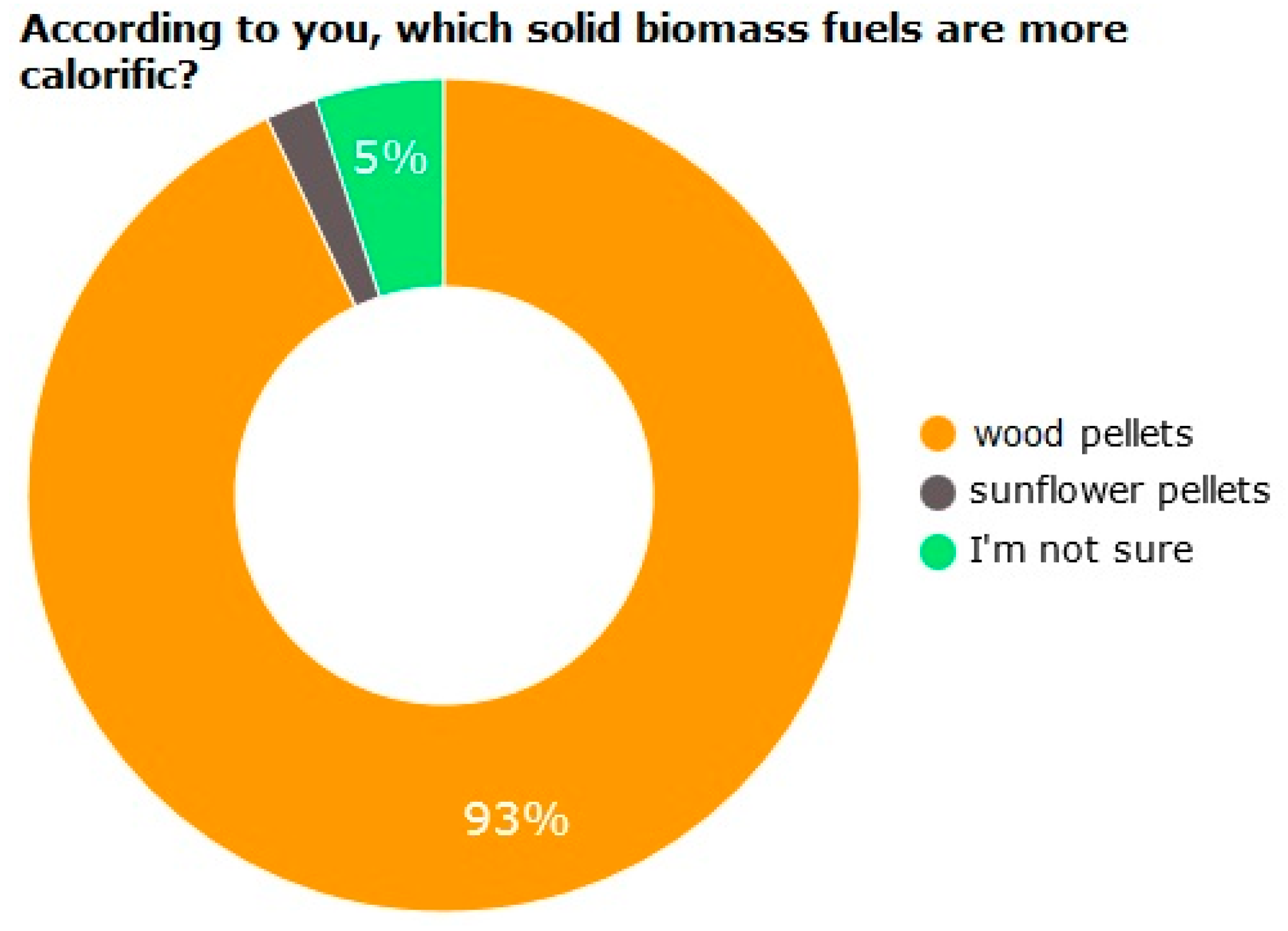

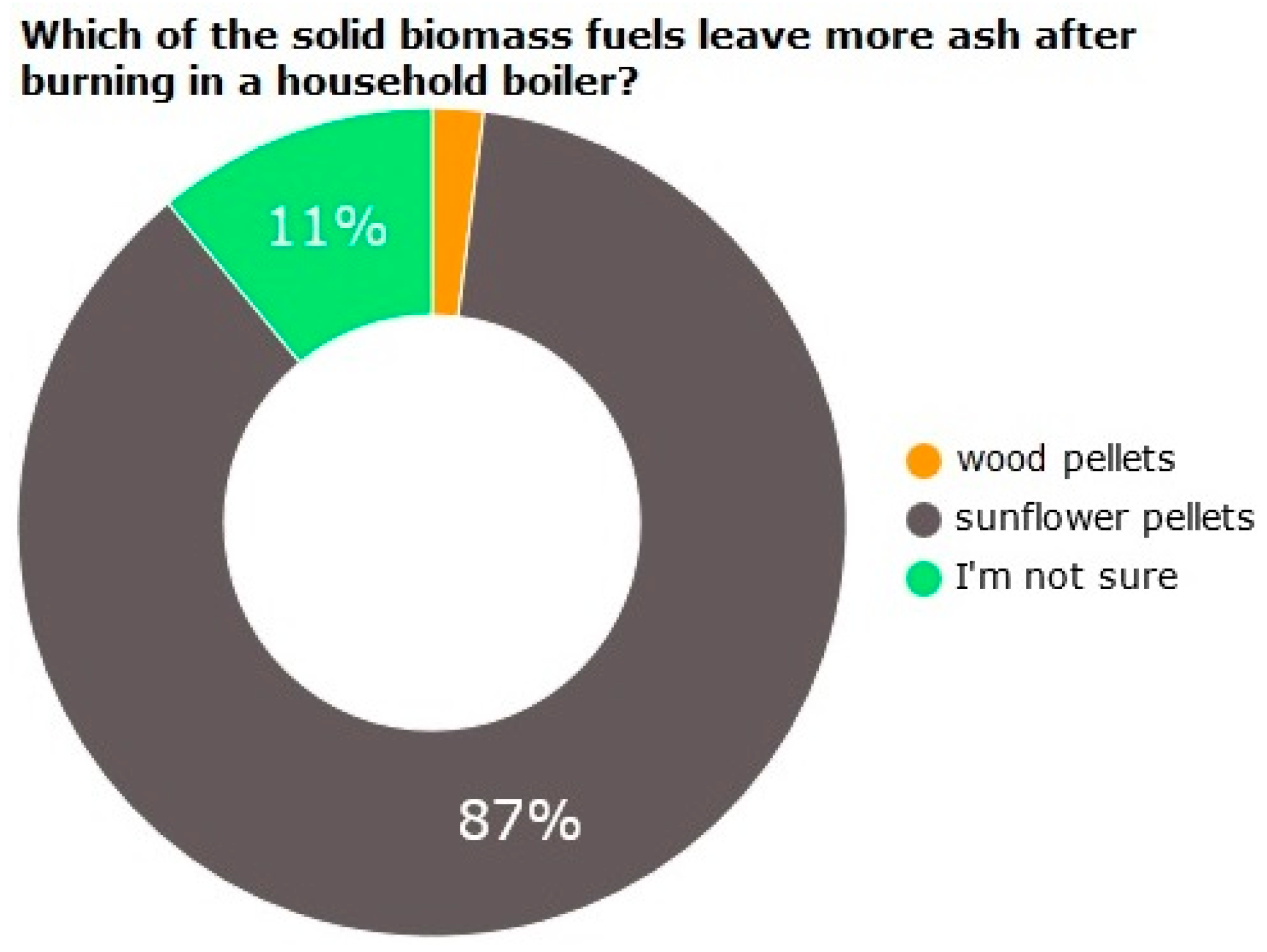

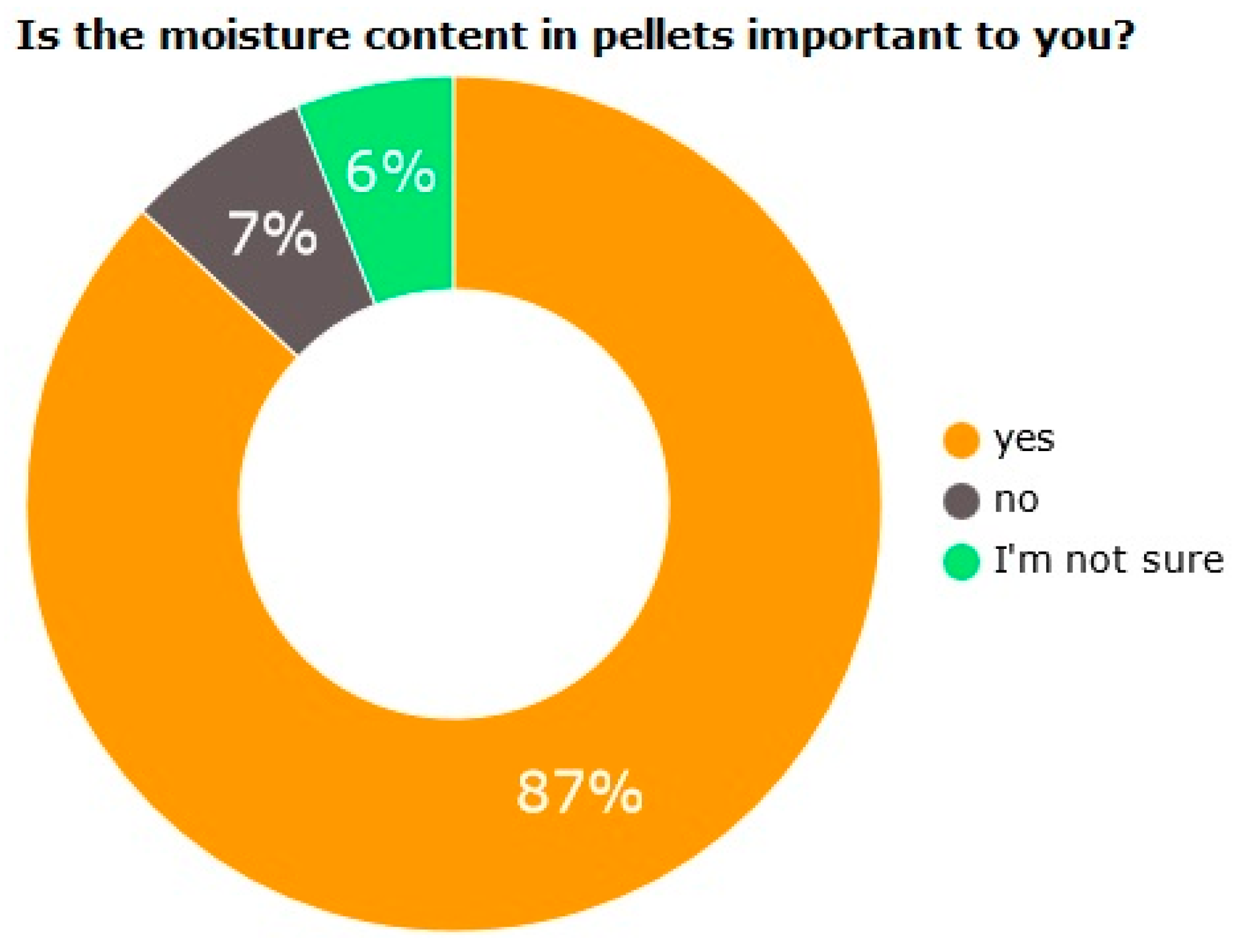

3.2. Results of the Marketing Research of Customer Preferences for Solid Biomass Fuels Usage in Bulgaria

4. Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Nunes, L.J.R. The Rising Threat of Atmospheric CO2: A Review on the Causes, Impacts, and Mitigation Strategies. Environments 2023, 10, 66. [Google Scholar] [CrossRef]

- Strielkowski, W.; Civín, L.; Tarkhanova, E.; Tvaronavičienė, M.; Petrenko, Y. Renewable Energy in the Sustainable Development of Electrical Power Sector: A Review. Energies 2021, 14, 8240. [Google Scholar] [CrossRef]

- Alsarhan, L.M.; Alayyar, A.S.; Alqahtani, N.B.; Khdary, N.H. Circular Carbon Economy (CCE): A Way to Invest CO2 and Protect the Environment, a Review. Sustainability 2021, 13, 11625. [Google Scholar] [CrossRef]

- Mostafaeipour, A.; Bidokhti, A.; Fakhrzad, M.-B.; Sadegheih, A.; Mehrjerdi, Y.Z. A new model for the use of renewable electricity to reduce carbon dioxide emissions. Energy 2021, 238, 121602. [Google Scholar] [CrossRef]

- Voumik, L.C.; Islam, A.; Ray, S.; Yusop, N.Y.M.; Ridzuan, A.R. CO2 Emissions from Renewable and Non-Renewable Electricity Generation Sources in the G7 Countries: Static and Dynamic Panel Assessment. Energies 2023, 16, 1044. [Google Scholar] [CrossRef]

- Nunes, L.J.R. The Rising Threat of Atmospheric CO2: A Review on the Causes, Impacts, and Mitigation Strategies. Environments 2023, 10, 66. [Google Scholar] [CrossRef]

- Cieśliński, R.; Kubiak-Wójcicka, K. Use of the Gas Emission Site Type Method in the Evaluation of the CO2 Emissions in Raised Bogs. Water 2024, 16, 1069. [Google Scholar] [CrossRef]

- Jozay, M.; Zarei, H.; Khorasaninejad, S.; Miri, T. Maximising CO2 Sequestration in the City: The Role of Green Walls in Sustainable Urban Development. Pollutants 2024, 4, 91–116. [Google Scholar] [CrossRef]

- Abakumov, E.; Makarova, M.; Paramonova, N.; Ivakhov, V.; Nizamutdinov, T.; Polyakov, V. Carbon Fluxes from Soils of “Ladoga” Carbon Monitoring Site Leningrad Region, Russia. Atmosphere 2024, 15, 360. [Google Scholar] [CrossRef]

- Bougma, P.-T.C.; Bondé, L.; Yaro, V.S.O.; Gebremichael, A.W.; Ouédraogo, O. Assessing Carbon Emissions from Biomass Burning in Croplands in Burkina Faso, West Africa. Fire 2023, 6, 402. [Google Scholar] [CrossRef]

- Ning, J.; Zhang, C.; Hu, M.; Sun, T. Accounting for Greenhouse Gas Emissions in the Agricultural System of China Based on the Life Cycle Assessment Method. Sustainability 2024, 16, 2594. [Google Scholar] [CrossRef]

- Peng, C.; Li, H.; Yang, N.; Lu, M. A Comparison of Greenhouse Gas Emission Patterns in Different Water Levels in Peatlands. Water 2024, 16, 985. [Google Scholar] [CrossRef]

- Mathur, S.; Waswani, H.; Singh, D.; Ranjan, R. Alternative Fuels for Agriculture Sustainability: Carbon Footprint and Economic Feasibility. Agriengineering 2022, 4, 993–1015. [Google Scholar] [CrossRef]

- Rahmanta, M.A.; Aprilana, A. ; Ruly; Cahyo, N. ; Hapsari, T.W.D.; Supriyanto, E. Techno-Economic and Environmental Impact of Biomass Co-Firing with Carbon Capture and Storage in Indonesian Power Plants. Sustainability 2024, 16, 3423. [Google Scholar]

- Holechek, J.L.; Geli, H.M.E.; Sawalhah, M.N.; Valdez, R. A Global Assessment: Can Renewable Energy Replace Fossil Fuels by 2050? Sustainability 2022, 14, 4792. [Google Scholar] [CrossRef]

- Kalak, T. Potential Use of Industrial Biomass Waste as a Sustainable Energy Source in the Future. Energies 2023, 16, 1783. [Google Scholar] [CrossRef]

- Wieruszewski, M.; Górna, A.; Stanula, Z.; Adamowicz, K. Energy Use of Woody Biomass in Poland: Its Resources and Harvesting Form. Energies 2022, 15, 6812. [Google Scholar] [CrossRef]

- Chlebnikovas, A.; Paliulis, D.; Kilikevičius, A.; Selech, J.; Matijošius, J.; Kilikevičienė, K.; Vainorius, D. Possibilities and Generated Emissions of Using Wood and Lignin Biofuel for Heat Production. Energies 2021, 14, 8471. [Google Scholar] [CrossRef]

- Janiszewska, D.; Ossowska, L. The Role of Agricultural Biomass as a Renewable Energy Source in European Union Countries. Energies 2022, 15, 6756. [Google Scholar] [CrossRef]

- Božič, J.T.; Fric, U.; Čikić, A.; Muhič, S. Life Cycle Assessment of Using Firewood and Wood Pellets in Slovenia as Two Primary Wood-Based Heating Systems and Their Environmental Impact. Sustainability 2024, 16, 1687. [Google Scholar] [CrossRef]

- Halkos, G.E.; Aslanidis, P.-S.C. Addressing Multidimensional Energy Poverty Implications on Achieving Sustainable Development. Energies 2023, 16, 3805. [Google Scholar] [CrossRef]

- IEA. Available online: https://www.iea.org/countries/bulgaria (accessed on 21 April 2024).

- EEA. Available online: https://eea.innovationnorway.com/article/bulgaria:-green-biomass-energy (accessed on 22 April 2024).

- Butler, J.W.; Skrivan, W.; Lotfi, S. Identification of Optimal Binders for Torrefied Biomass Pellets. Energies 2023, 16, 3390. [Google Scholar] [CrossRef]

- Saletnik, B.; Saletnik, A.; Zaguła, G.; Bajcar, M.; Puchalski, C. The Use of Wood Pellets in the Production of High Quality Biocarbon Materials. Materials 2022, 15, 4404. [Google Scholar] [CrossRef] [PubMed]

- Ilari, A.; Pedretti, E.F.; De Francesco, C.; Duca, D. Pellet Production from Residual Biomass of Greenery Maintenance in a Small-Scale Company to Improve Sustainability. Resources 2021, 10, 122. [Google Scholar] [CrossRef]

- Hassan, M.; Usman, N.; Hussain, M.; Yousaf, A.; Khattak, M.A.; Yousaf, S.; Mishr, R.S.; Ahmad, S.; Rehman, F.; Rashedi, A. Environmental and Socio-Economic Assessment of Biomass Pellets Biofuel in Hazara Division, Pakistan. Sustainability 2023, 15, 12089. [Google Scholar] [CrossRef]

- Kogabayev, T.; Põder, A.; Barth, H.; Värnik, R. Prospects for Wood Pellet Production in Kazakhstan: A Case Study on Business Model Adjustment. Energies 2023, 16, 5838. [Google Scholar] [CrossRef]

- Bochniak, A.; Stoma, M. Estimating the Optimal Location for the Storage of Pellet Surplus. Energies 2021, 14, 6657. [Google Scholar] [CrossRef]

- Bosona, T.; Gebresenbet, G. Evaluating Logistics Performances of Agricultural Prunings for Energy Production: A Logistics Audit Analysis Approach. Logistics 2018, 2, 19. [Google Scholar] [CrossRef]

- Kline, K.L.; Dale, V.H.; Rose, E.; Tonn, B. Effects of Production of Woody Pellets in the Southeastern United States on the Sustainable Development Goals. Sustainability 2021, 13, 821. [Google Scholar] [CrossRef]

- Milewska, B.; Milewski, D. Implications of Increasing Fuel Costs for Supply Chain Strategy. Energies 2022, 15, 6934. [Google Scholar] [CrossRef]

- Ter-Mikaelian, M.T.; Chen, J.; Desjardins, S.M.; Colombo, S.J. Can Wood Pellets from Canada’s Boreal Forest Reduce Net Greenhouse Gas Emissions from Energy Generation in the UK? Forests 2023, 14, 1090. [Google Scholar] [CrossRef]

- Giannini, V.; Maucieri, C.; Vamerali, T.; Zanin, G.; Schiavon, S.; Pettenella, D.M.; Bona, S.; Borin, M. Sunflower: From Cortuso’s Description (1585) to Current Agronomy, Uses and Perspectives. Agriculture 2022, 12, 1978. [Google Scholar] [CrossRef]

- Puttha, R.; Venkatachalam, K.; Hanpakdeesakul, S.; Wongsa, J.; Parametthanuwat, T.; Srean, P.; Pakeechai, K.; Charoenphun, N. Exploring the Potential of Sunflowers: Agronomy, Applications, and Opportunities within Bio-Circular-Green Economy. Horticulturae 2023, 9, 1079. [Google Scholar] [CrossRef]

- Nakonechna, K.; Ilko, V.; Berčíková, M.; Vietoris, V.; Panovská, Z.; Doležal, M. Nutritional, Utility, and Sensory Quality and Safety of Sunflower Oil on the Central European Market. Agriculture 2024, 14, 536. [Google Scholar] [CrossRef]

- Mabuza, L.M.; Mchunu, N.P.; Crampton, B.G.; Swanevelder, D.Z.H. Accelerated Breeding for Helianthus annuus (Sunflower) through Doubled Haploidy: An Insight on Past and Future Prospects in the Era of Genome Editing. Plants 2023, 12, 485. [Google Scholar] [CrossRef]

- Puttha, R.; Venkatachalam, K.; Hanpakdeesakul, S.; Wongsa, J.; Parametthanuwat, T.; Srean, P.; Pakeechai, K.; Charoenphun, N. Exploring the Potential of Sunflowers: Agronomy, Applications, and Opportunities within Bio-Circular-Green Economy. Horticulturae 2023, 9, 1079. [Google Scholar] [CrossRef]

- Havrysh, V.; Kalinichenko, A.; Pysarenko, P.; Samojlik, M. Sunflower Residues-Based Biorefinery: Circular Economy Indicators. Processes 2023, 11, 630. [Google Scholar] [CrossRef]

- Stoicea, P.; Chiurciu, I.A.; Soare, E.; Iorga, A.M.; Dinu, T.A.; Tudor, V.C.; Gîdea, M.; David, L. Impact of Reducing Fertilizers and Pesticides on Sunflower Production in Romania versus EU Countries. Sustainability 2022, 14, 8334. [Google Scholar] [CrossRef]

- Božič, J.T.; Fric, U.; Čikić, A.; Muhič, S. Life Cycle Assessment of Using Firewood and Wood Pellets in Slovenia as Two Primary Wood-Based Heating Systems and Their Environmental Impact. Sustainability 2024, 16, 1687. [Google Scholar] [CrossRef]

- Matula, T.; Labaj, J.; Vadasz, P.; Plešingerová, B.; Smalcerz, A.; Blacha, L. Application of Sunflower Husk Pellet as a Reducer in Metallurgical Processes. Materials 2023, 16, 6790. [Google Scholar] [CrossRef]

- Turzyński, T.; Kluska, J.; Ochnio, M.; Kardaś, D. Comparative Analysis of Pelletized and Unpelletized Sunflower Husks Combustion Process in a Batch-Type Reactor. Materials 2021, 14, 2484. [Google Scholar] [CrossRef] [PubMed]

- Reyes, F.; Vasquez, Y.; Gramsch, E.; Oyola, P.; Rappenglück, B.; Rubio, M.A. Photooxidation of Emissions from Firewood and Pellet Combustion Using a Photochemical Chamber. Atmosphere 2019, 10, 575. [Google Scholar] [CrossRef]

- Mašán, V.; Burg, P.; Souček, J.; Slaný, V.; Vaštík, L. Energy Potential of Urban Green Waste and the Possibility of Its Pelletization. Sustainability 2023, 15, 16489. [Google Scholar] [CrossRef]

- Jasinskas, A.; Kleiza, V.; Streikus, D.; Domeika, R.; Vaiciukevičius, E.; Gramauskas, G.; Valentin, M.T. Assessment of Quality Indicators of Pressed Biofuel Produced from Coarse Herbaceous Plants and Determination of the Influence of Moisture on the Properties of Pellets. Sustainability 2022, 14, 1068. [Google Scholar] [CrossRef]

- Petlickaitė, R.; Jasinskas, A.; Domeika, R.; Pedišius, N.; Lemanas, E.; Praspaliauskas, M.; Kukharets, S. Evaluation of the Processing of Multi-Crop Plants into Pelletized Biofuel and Its Use for Energy Conversion. Processes 2023, 11, 421. [Google Scholar] [CrossRef]

- Rupasinghe, R.L.; Perera, P.; Bandara, R.; Amarasekera, H.; Vlosky, R. Insights into Properties of Biomass Energy Pellets Made from Mixtures of Woody and Non-Woody Biomass: A Meta-Analysis. Energies 2023, 17, 54. [Google Scholar] [CrossRef]

- Kamperidou, V. Quality Analysis of Commercially Available Wood Pellets and Correlations between Pellets Characteristics. Energies 2022, 15, 2865. [Google Scholar] [CrossRef]

- BDS. Available online: https://bds-bg.org/bg/project/show/bds:proj:101406 (accessed on 25 April 2024).

- BDS. Available online: https://bds-bg.org/bg/project/show/bds:proj:119539 (accessed on 25 April 2024).

- BDS. Available online: https://bds-bg.org/bg/project/show/bds:proj:100349 (accessed on 25 April 2024).

- BDS. Available online: https://bds-bg.org/bg/project/show/bds:proj:99910 (accessed on 25 April 2024).

- Civitarese, V.; Acampora, A.; Sperandio, G.; Bassotti, B.; Latterini, F.; Picchio, R. A Comparison of the Qualitative Characteristics of Pellets Made from Different Types of Raw Materials. Forests 2023, 14, 2025. [Google Scholar] [CrossRef]

- Jia, G. Combustion Characteristics and Kinetic Analysis of Biomass Pellet Fuel Using Thermogravimetric Analysis. Processes 2021, 9, 868. [Google Scholar] [CrossRef]

- Silva, J.; Teixeira, S.; Teixeira, J. A Review of Biomass Thermal Analysis, Kinetics and Product Distribution for Combustion Modeling: From the Micro to Macro Perspective. Energies 2023, 16, 6705. [Google Scholar] [CrossRef]

- Dong, L.; Huang, X.; Ren, J.; Deng, L.; Da, Y. Thermogravimetric Assessment and Differential Thermal Analysis of Blended Fuels of Coal, Biomass and Oil Sludge. Appl. Sci. 2023, 13, 11058. [Google Scholar] [CrossRef]

- Linseis. Available online: https://www.linseis.com/en/products/simultaneous-thermal-analyzer-tga-dsc/sta-pt-1600 (accessed on 28 April 2024).

- Szymajda, A.; Łaska, G. The Effect of Moisture and Ash on the Calorific Value of Cow Dung Biomass. Proceedings 2019, 16, 4. [Google Scholar] [CrossRef]

- Zafar, U.; Sarwar, A.; Safdar, M.; Sabir, R.M.; Majeed, M.D.; Raza, A. Development and Characterization of Biomass Pellets Using Yard Waste. Eng. Proc. 2023, 56, 323. [Google Scholar] [CrossRef]

- Almusafir, R.; Smith, J.D. Thermal Decomposition and Kinetic Parameters of Three Biomass Feedstocks for the Performance of the Gasification Process Using a Thermogravimetric Analyzer. Energies 2024, 17, 396. [Google Scholar] [CrossRef]

- Fraga, L.G.; Silva, J.; Teixeira, S.; Soares, D.; Ferreira, M.; Teixeira, J. Influence of Operating Conditions on the Thermal Behavior and Kinetics of Pine Wood Particles Using Thermogravimetric Analysis. Energies 2020, 13, 2756. [Google Scholar] [CrossRef]

- Wilczkowska), E.M.I. (.; Nietrzeba, U.; Pietras, M.; Marciniak, A.; Głuski, G.; Hupka, J.; Szymajda, M.; Kamiński, J.; Szerewicz, C.; Goździk, A.; et al. Possible Options for Utilization of EU Biomass Waste: Pyrolysis Char, Calorific Value and Ash Content. Materials 2024, 17, 226. [Google Scholar] [CrossRef]

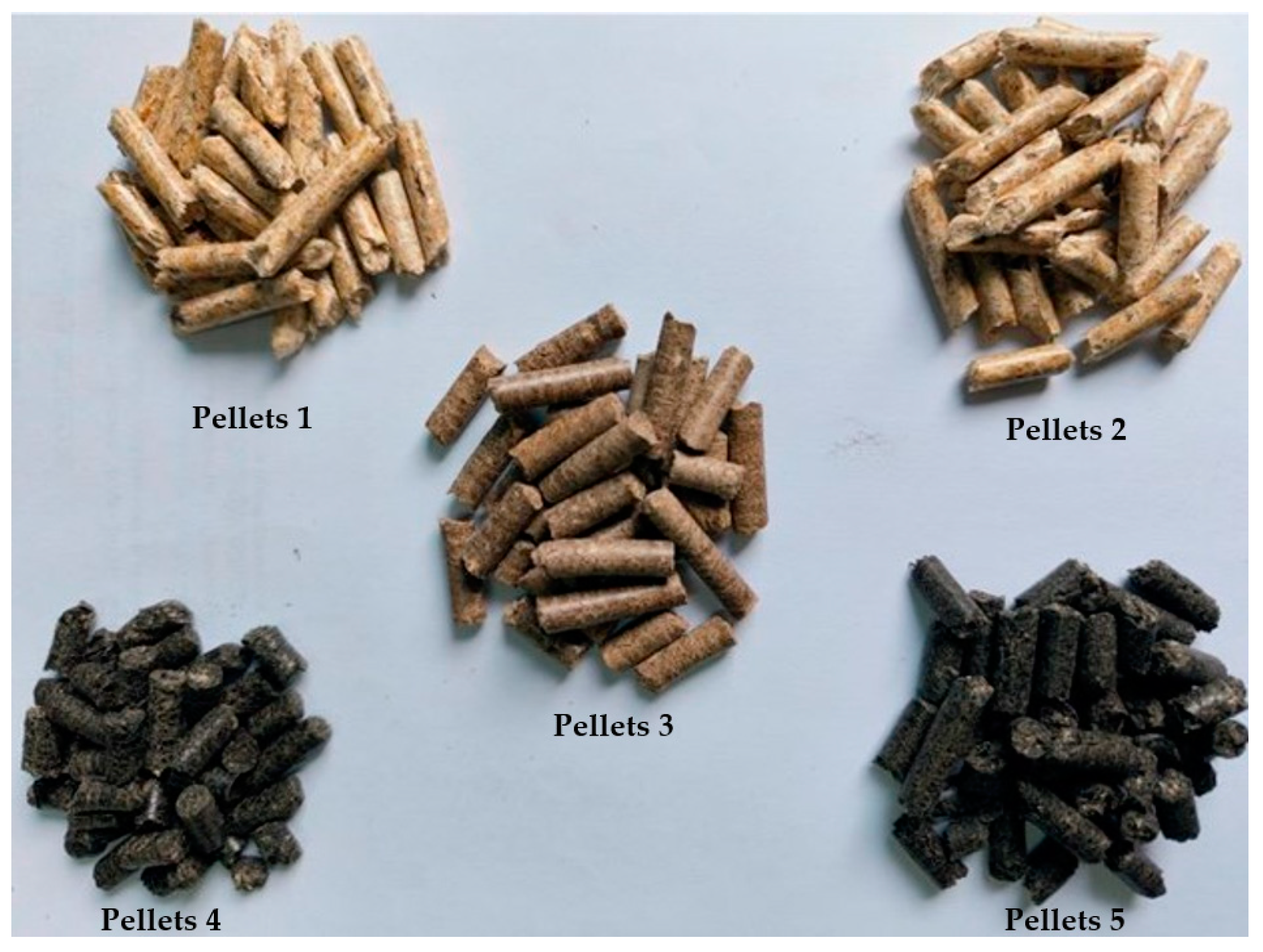

| Samples | Pellets 1 | Pellets 2 | Pellets 3 | Pellets 4 | Pellets 5 |

|---|---|---|---|---|---|

| type | wood | wood | wood and sunflower | sunflower | sunflower |

| material | CW+DW | CW+DW | CW+SH | SH | SH |

| Indicator | Units | Pellets 1 | Pellets 2 | Pellets 3 | Pellets 4 | Pellets 5 |

|---|---|---|---|---|---|---|

| Total moisture content | % | 7,47±0,20 | 7,14±0,20 | 7,07±0,20 | 7,82±0,20 | 7,42±0,20 |

| Ash content (in dry condition) |

% | 0,79±0,21 | 0,72±0,21 | 0,74±0,21 | 2,57±0,21 | 2,67±0,21 |

| Ash content (in operational condition) |

% | 0,73±0,21 | 0,70±0,21 | 0,69±0,21 | 2,37±0,21 | 2,47±0,21 |

| Calorific value (higher, in dry condition) |

kJ/kg | 19,57±1,8 | 19,96±1,8 | 19,42±1,8 | 21,37±1,8 | 21,07±1,8 |

| Calorific value higher, in operational condition |

kJ/kg | 18,11±1,8 | 18,53±1,8 | 18,05±1,8 | 19,70±1,8 | 19,51±1,8 |

| Calorific value (lower, in dry condition) |

kJ/kg | 18,31±1,8 | 18,69±1,8 | 18,16±1,8 | 20,14±1,8 | 19,85±1,8 |

| Calorific value lower, in operational condition |

kJ/kg | 16,77±1,8 | 17,19±1,8 | 16,71±1,8 | 18,39±1,8 | 18,20±1,8 |

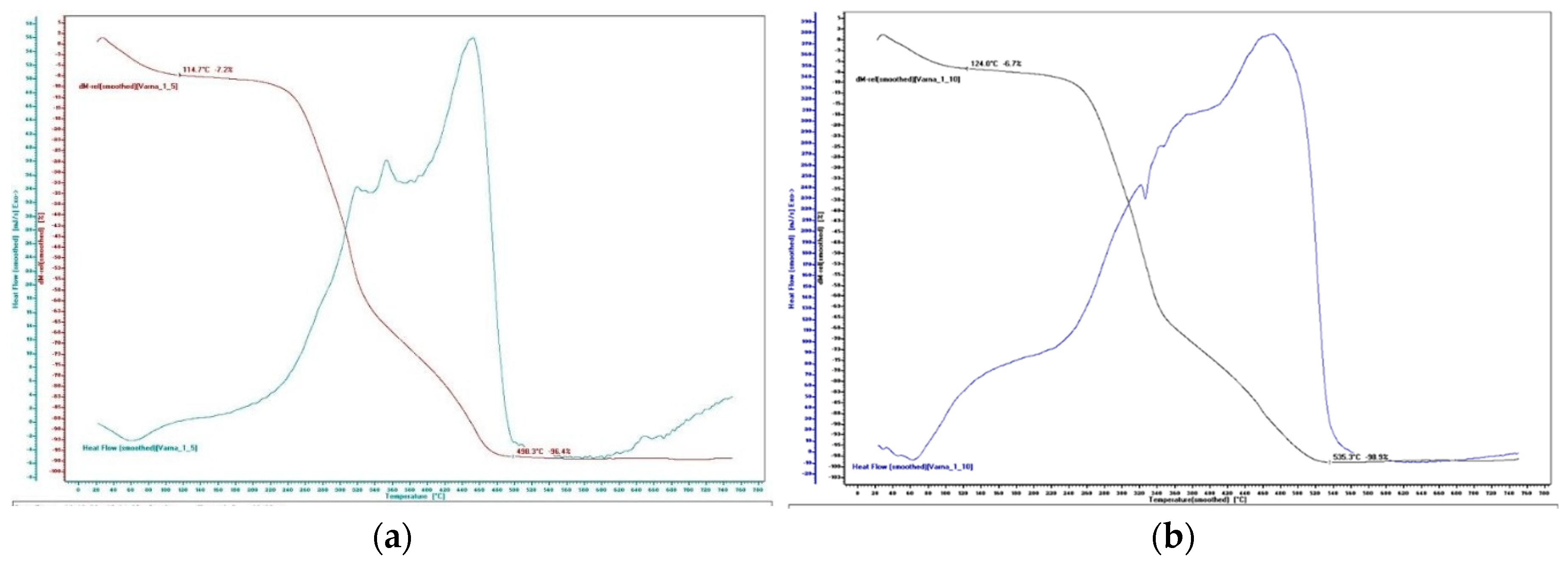

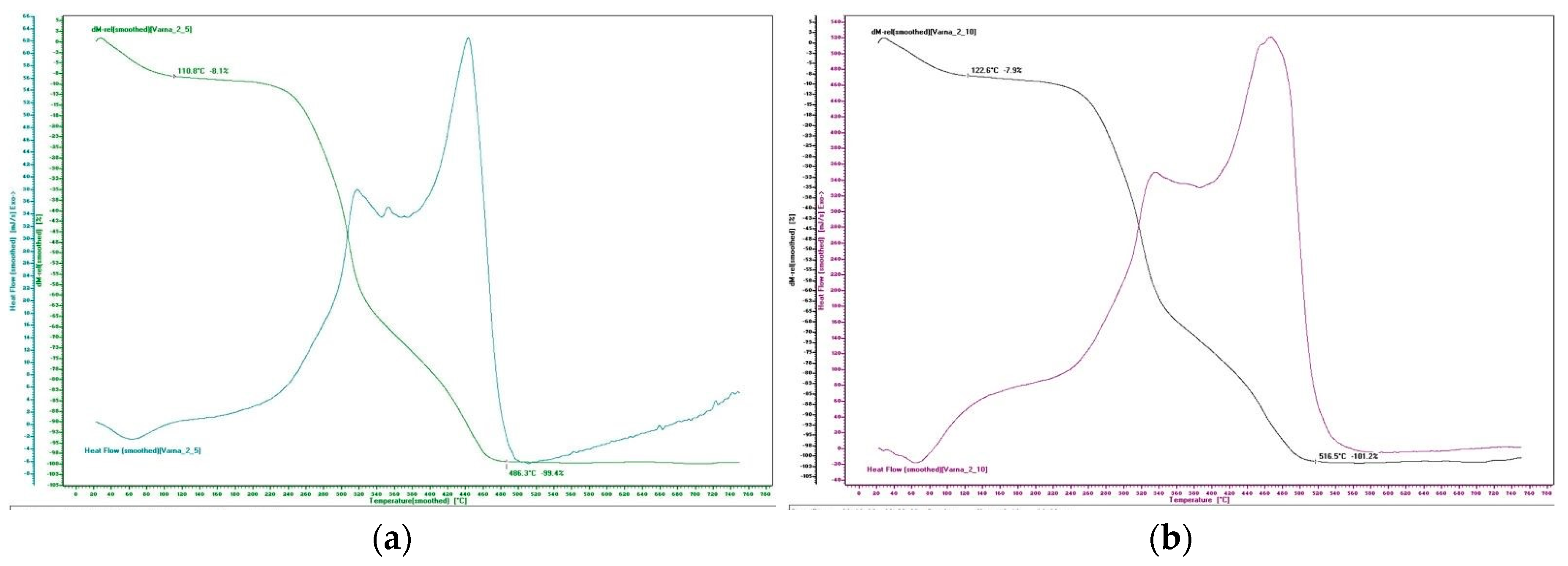

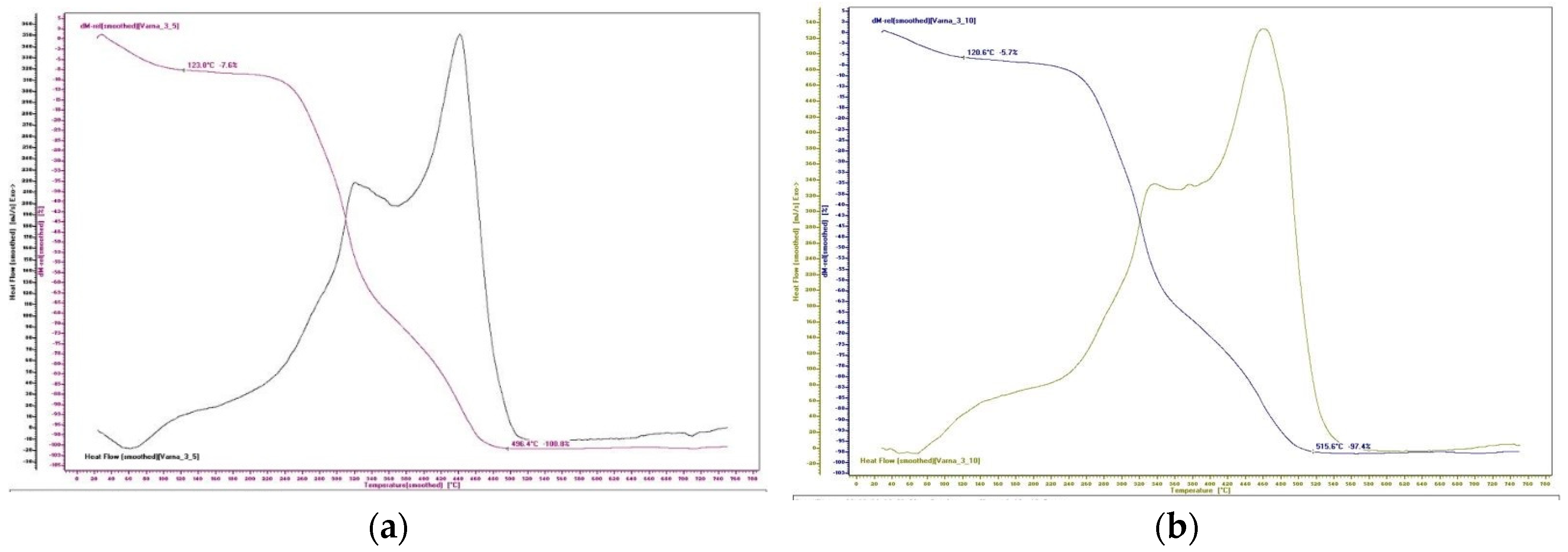

| Exothermic peaks observed | ||

|---|---|---|

| 5℃/min | 10℃/min | |

| Pellets 1 | 320℃, 360℃ and 460℃ | 330℃, 350℃, 380℃ and 480℃ |

| Pellets 2 | 320℃ and 460℃ | 340℃ and 480℃ |

| Pellets 3 | 320℃, 360℃ and 460℃ | 340℃, 380℃ and 480℃ |

| Pellets 4 | 310℃, 420℃ and 460℃ | 310℃, 420℃ and 470℃ |

| Pellets 5 | 310℃ and 460℃ | 320℃ and 480℃ |

| Temperature range, ℃ | |||

|---|---|---|---|

| Stage 1 | Stage 2 | Stage 3 | |

| Pellets 1 | 20-115*/ 20-125** | 115-460* / 125-480** | 460-750* / 480-750** |

| Pellets 2 | 20-111* / 20-123** | 111-460* / 123-480** | 450-750* / 480-750** |

| Pellets 3 | 20-123* / 20-121** | 123-460* / 121-470** | 460-750* / 470-750** |

| Pellets 4 | 20-117* / 20-132** | 117-460* / 132-470** | 460-750* / 470-750** |

| Pellets 5 | 20-129* / 20-140** | 129-460* / 140-480** | 460-750* / 480-750** |

| Losses from the total mass, % | |||

|---|---|---|---|

| Stage 1 | Stage 2 | Stage 3 | |

| Pellets 1 | 7,2* / 7** | 95* / 94** | 1,4* / 4,9** |

| Pellets 2 | 8,1* / 7,9** | 93* / 92** | 6,4* / 8,2** |

| Pellets 3 | 7,6* / 5,7** | 90* / 84** | 10* / 13,4** |

| Pellets 4 | 9,4* / 7** | 89* / 90** | 10* / 8,3** |

| Pellets 5 | 9,2* / 7,9** | 85* / 92** | 14,2*/ 6,5** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).