1. Introduction

As Indonesia shifts from internal combustion engine (ICE) vehicles to battery-powered electric vehicles (BEVs), maintaining the growth of BEVs is essential to avoid disturbing the country’s power grid balance. Given that the Jawa-Madura-Bali (Jamali) system is Indonesia’s largest electrical system [

1], and these islands host the highest total number of vehicles [

2], it is imperative to simulate the accelerated growth of electric vehicles to evaluate its impact.

The analysis of the Jamali electricity supply involves utilizing data from the National Electricity Company’s RUPTL [

3]. Simulation of the grid’s demand side incorporates various input variables, including the Jamali population, populations of internal combustion engine (ICE) vehicles and electric vehicles (EVs), initial charging time (ICT), the ratio between slow and fast charging, and the charge load curve for each vehicle type. Moreover, scenario variables such as the rate of growth in supply capacity, vehicle population growth, the impact of subsidies on EV attractiveness, ICT, and the fast-charging ratio are also simulated.

After analyzing the data and simulations for one presidential period of 2024-2029 [

4], four key results stand out for analysis: The best-case scenario, which demonstrates the highest EV growth while maintaining the grid’s supply-demand balance; the most likely scenario based on existing literature; the least likely scenario; and the worst-case scenario.

The inputs of this simulation are flexible to accommodate various requirements, and its outputs offer a framework for comprehending the influence of EV growth on the grid’s supply-demand equilibrium from 2024 to 2029. Through an analysis of both the best and worst-case scenario outcomes, the government can formulate regulations and subsidies appropriately.

1.1. Jawa-Madura-Bali Power System (Grid Capacity and Peak Load Demand)

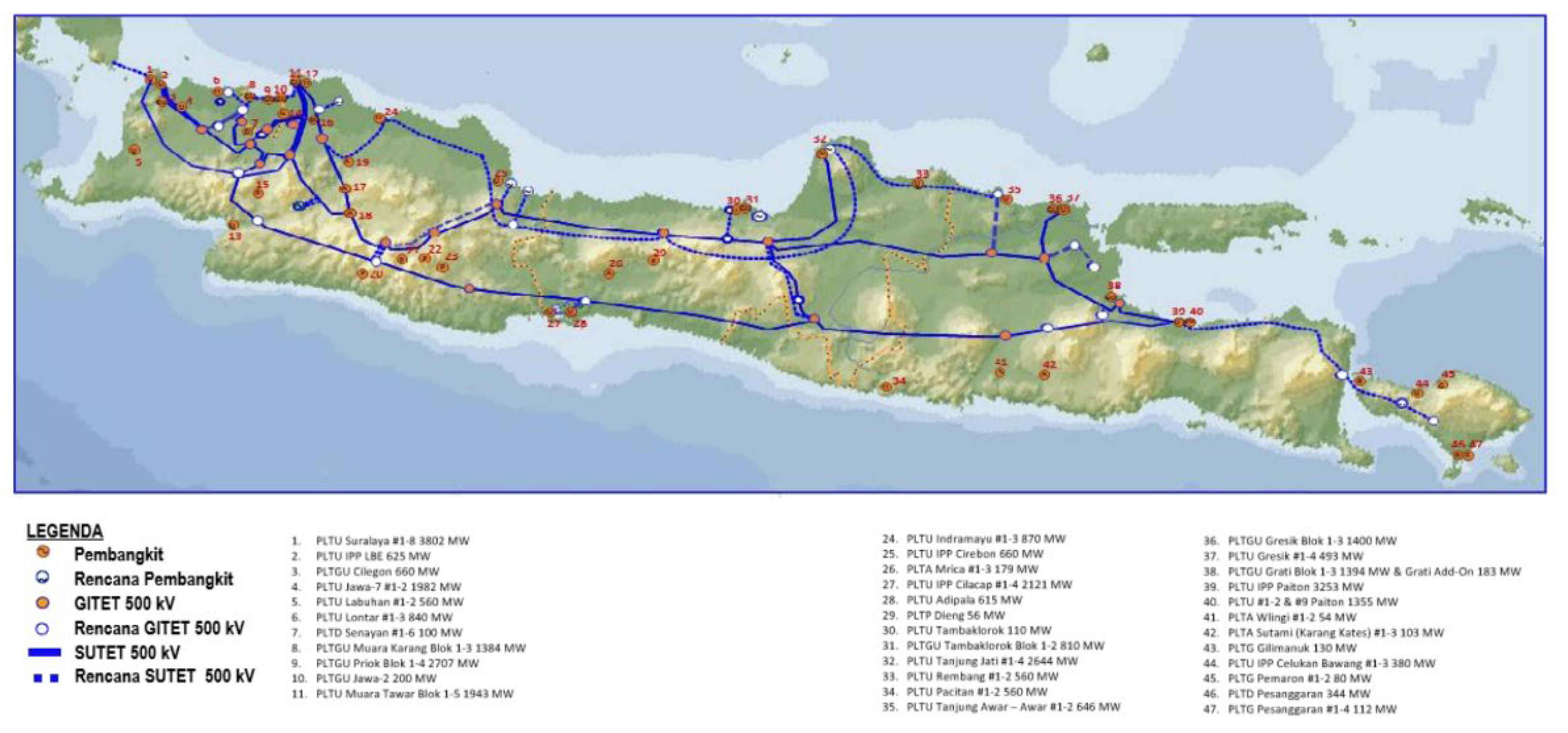

Figure 1.

Jamali Power System [

5].

Figure 1.

Jamali Power System [

5].

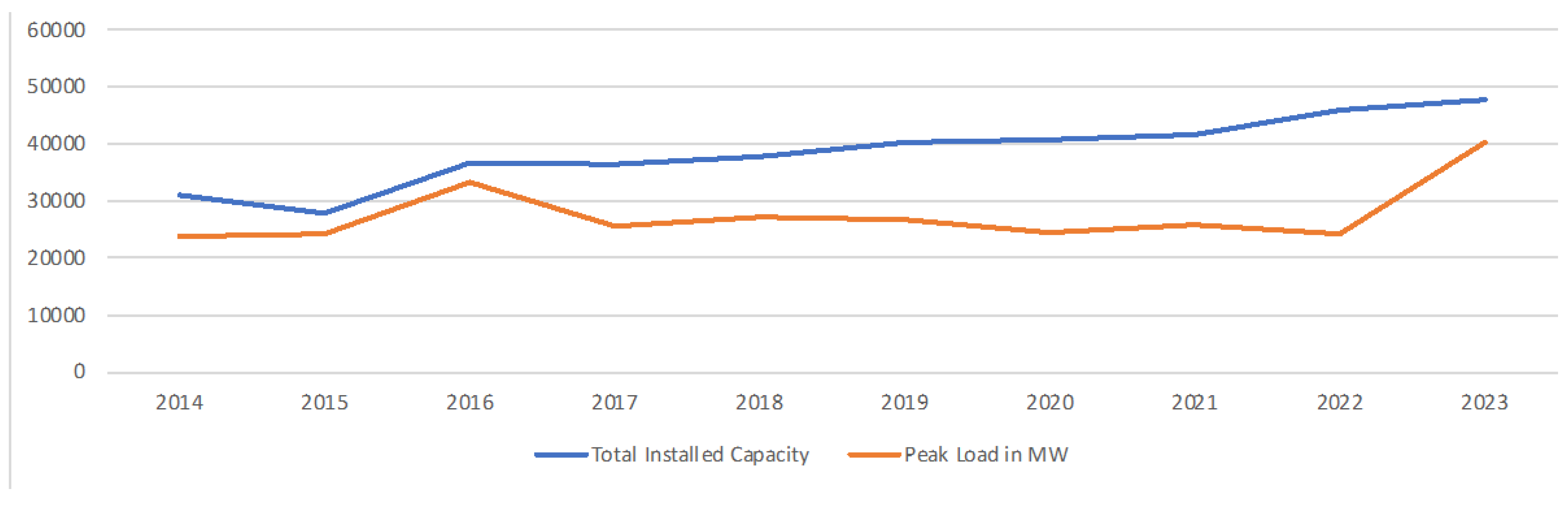

The Jawa Bali grid system plays a vital role in providing power to the islands of Java and Bali in Indonesia, supporting their sizable populations and industrial sectors. With an installed capacity of 47,647 megawatts (MW) in 2023, it ranks among the most substantial electricity grids in Southeast Asia [

1]. During that year, the system faced a peak load of approximately 40,223 MW during peak hours, indicating a relatively narrow margin between capacity and demand [

1].

As of 2022, the population of the combined regions of Java and Bali in Indonesia is estimated to be around 157 million [

6]. The expected population growth for Jawa and Bali regions to 2029 is projected to be significant, driven by factors such as natural population increase (births exceeding deaths) and migration from other parts of Indonesia to these regions. While specific population projections can vary depending on various factors and assumptions, it is estimated that the population of Jawa and Bali regions could surpass 164 million by 2029 (around 0,8% growth [

6]).

However, the region’s rapid economic expansion and urbanization are anticipated to drive an annual peak load increase of about 8% [

1,

7,

8,

9,

10,

11,

12,

13,

14]. To accommodate this growth and ensure a dependable power supply, significant investments are being made in infrastructure and renewable energy sources to bolster the Jawa Bali grid system. The average capacity growth from 2014 to 2023 is 5.37% [

1,

7,

8,

9,

10,

11,

12,

13,

14].

Table 1.

Jamali System Supply and Demand Historical Data. [

1,

7,

8,

9,

10,

11,

12,

13,

14].

Table 1.

Jamali System Supply and Demand Historical Data. [

1,

7,

8,

9,

10,

11,

12,

13,

14].

| Year |

Total Installed Capacity in MW |

Annual Change in % |

Peak Demand Load in MW |

Annual Change in % |

| 2014 |

31,062 |

|

23,908 |

|

| 2015 |

27,867 |

-10.29 |

24,269 |

1.51 |

| 2016 |

36,712 |

31.74 |

33,208 |

36.83 |

| 2017 |

36,517 |

-0.53 |

25,680 |

-22.67 |

| 2018 |

37,721 |

3.30 |

27,097 |

5.52 |

| 2019 |

40,174 |

6.50 |

26,657 |

-1.62 |

| 2020 |

40,685 |

1.27 |

24,420 |

-8.39 |

| 2021 |

41,743 |

2.60 |

25,852 |

5.86 |

| 2022 |

45,835 |

9.80 |

24,228 |

-6.28 |

| 2023 |

47,647 |

3.95 |

40,223 |

66.02 |

| |

Annual Change in average: |

5.37 |

Annual Change in average: |

8.53 |

Figure 2.

Jamali System Capacity and Peak Load Demand 2014-2023. [

1,

7,

8,

9,

10,

11,

12,

13,

14].

Figure 2.

Jamali System Capacity and Peak Load Demand 2014-2023. [

1,

7,

8,

9,

10,

11,

12,

13,

14].

Two key variables of Jamali system important for this simulation are Peak Load and Installed capacity. Peak Load represents the highest load reached by each system within a calendar year. Installed Capacity refers to the capacity of a single generating unit as indicated on the generator nameplate or prime mover, whichever is smaller [

16]. Upon analyzing historical Supply-Demand data from the Jamali system, a notable increase in peak load is observed in 2023. This surge could suggest a rise in demand attributable to the growth of electric vehicles (EVs).

The peak load for the Jawa Bali grid system is usually during the day when demand is highest [

17]. The peak load is driven by various factors, including the time of day, season, and economic activity. It is typically higher during the daytime as commercial and industrial activities are at their peak.

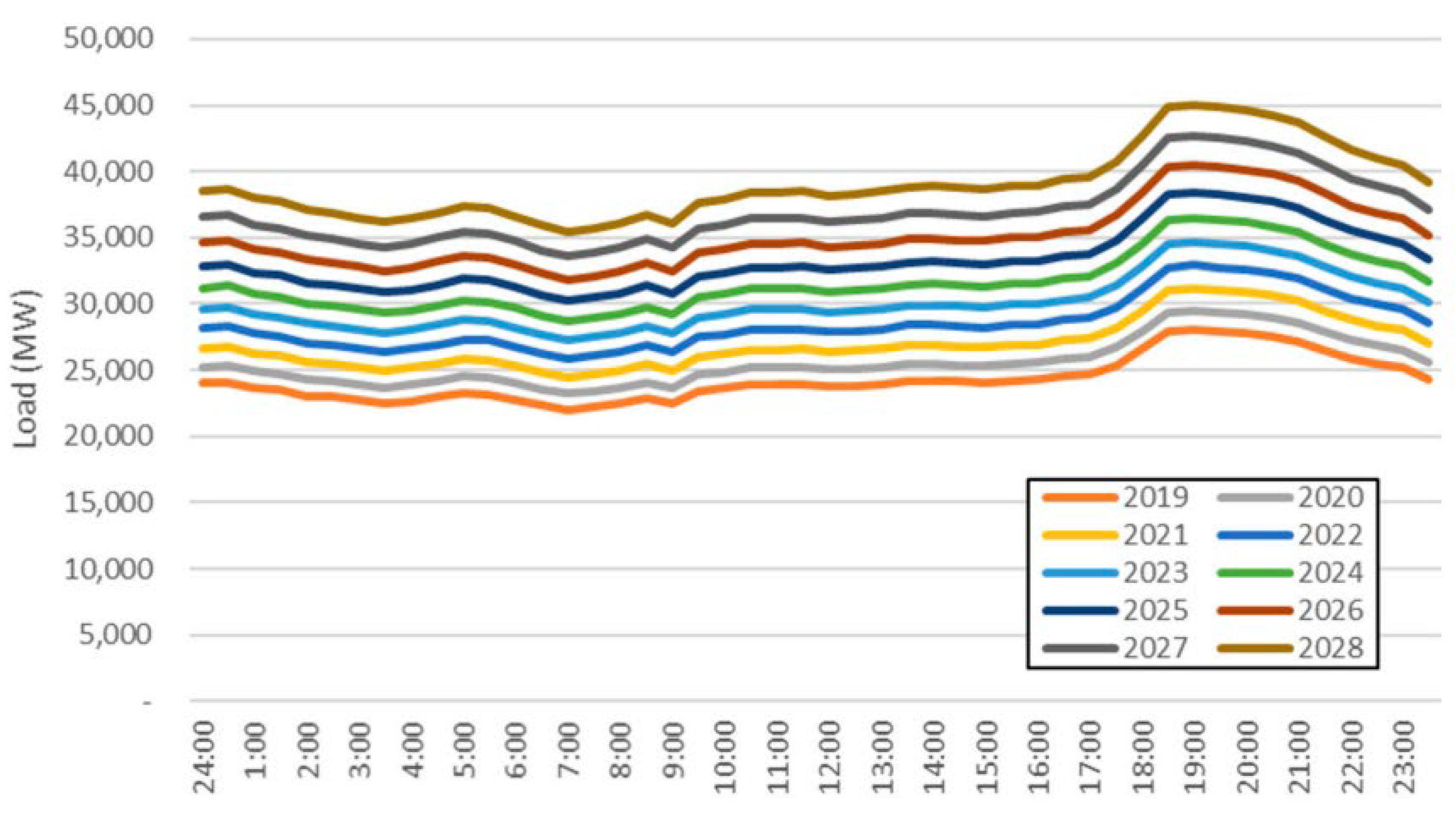

Figure 3.

Jamali Hourly Peak Load. [

17].

Figure 3.

Jamali Hourly Peak Load. [

17].

A crucial aspect of this simulation is the determination of the base peak load, which represents the electricity demand excluding the demand from electric vehicles (EVs). While obtaining this metric can be challenging, it can be estimated through extrapolation of historical data. Since the number of EVs before the introduction of subsidies and regulations in 2023 was minimal, their load demand was insignificant. Therefore, the peak load before that year can be closely regarded as the base peak load.

1.2. Java and Bali’s EV Growth

The electric vehicle (EV) market in Indonesia is poised for significant growth over the next five years, with a range of factors driving this expansion. The government’s supportive policies, including tax incentives and subsidies, are expected to encourage more consumers to switch to EVs [

18]. Additionally, the country’s commitment to reducing carbon emissions and addressing air pollution is likely to drive demand for cleaner transportation options.

In terms of EV preferences, the market in Indonesia is expected to be diverse. While there is a growing interest in luxury EVs, especially among affluent consumers in urban areas, there is also a significant demand for more affordable EVs that cater to daily commuting needs. In 2023, Hyundai sold 7,176 units of the Ioniq 5 and Wuling sold 5,575 units of the Air EV [

19]. They have the highest sales number that year. This dual focus of market preferences is expected to shape the EV market in Indonesia, with manufacturers offering a range of EV models to meet different consumer needs.

Charging infrastructure is a crucial factor in the growth of the EV market and Indonesia is making efforts to expand its charging network. While slow-/home charging is more widely available and convenient for daily use, fast-/public charging stations are also being installed, particularly along major highways and in urban centers, to cater to longer trips and provide more flexibility to EV owners. As the charging infrastructure continues to improve, it is expected to further boost consumer confidence in EVs and drive their adoption in Indonesia. As the beginning of 2024, there are 1.124 public charger made available by PLN [

20]. This does not count public charger made available by landowners or private companies.

1.3. Indonesia’s EV Regulations and Subsidies

Indonesia has been implementing several regulations and incentives to encourage the adoption of electric vehicles (EVs) and address environmental and energy challenges. Some of these regulations include:

Odd-even license plate policy: In major cities like Jakarta, the odd-even license plate policy restricts vehicles based on their license plate numbers on certain days. This measure aims to reduce traffic congestion and air pollution, indirectly encouraging the use of EVs. [

21]

Tax reduction: The government offers tax incentives for EVs, including lower import duties and luxury goods tax exemptions. These incentives make EVs more affordable for consumers and help stimulate the EV market. [

22]

Parking benefits: Some cities provide free or discounted parking for EVs to incentivize their use. This can reduce the overall cost of owning an EV and make them more attractive to consumers. [

23]

Charging infrastructure: The government has been investing in EV charging infrastructure to support the growth of the EV market. This includes installing charging stations in public areas and along highways. [

20]

In terms of subsidies, the Indonesian government has implemented additional programs to expedite this transition. These include a 10% VAT tax deduction for four-wheeler electric vehicles (4wEV), as outlined in Ministry of Finance Regulation number 38 of 2023 [

24], and an IDR 7,000,000 deduction for two-wheeler electric vehicles (2wEV), as specified in Ministry of Industry Regulation number 6 of 2023 [

25].

The political landscape in Indonesia plays a crucial role in influencing the growth of electric vehicles (EVs) in the country. The regulations and subsidies pertaining to EVs until 2029 will be determined by the President elected in 2024, who will serve a single term of five years [

4].

1.4. Current State of the Research Field

Previous research papers have explored various impacts of electric vehicle (EV) growth and proposed solutions. These include the use of Vehicle-to-Grid (V2G) technology [

26], coordinated charging to manage load demand surges [

27], and AI-based demand load prediction utilizing historical data [

28], as well as factors like temperature, traffic [

29], and user behavior data [

30]. Additionally, some simulations have used a normal distribution for initial charging times [

31].

The novelty of this simulation lies in its incorporation of additional growth factors and scenarios as inputs. Focused specifically on the Jawa Bali region, the simulation aims to forecast EV load based on growth projections, considering the region’s distinct EV growth characteristics. The results of this simulation will provide valuable insights for policymakers regarding regulations and subsidies.

2. Materials and Methods

2.1. Data Gathering and Data Analysis

The analysis initiates with the acquisition of data pertaining to the present and anticipated growth of variables impacting both the supply and demand aspects of the grid. This data is imperative for the execution of the simulation.

2.1.1. Power Grid Capacity

Utilizing the National Electricity Company’s data (RUPTL) [

3], an analysis of the Jamali electricity supply can be conducted. The supply side of the grid is simulated by projecting the current capacity and a growth factor based on the RUPTL. The variables concerning the supply side include:

2.1.2. Demand Peak Load

The demand side of the grid contains two main components, which are the base peak load which is excluding electric vehicles load and the EV load itself. A demand simulation model for the EV load was created to calculate the total increase in demand load with a combination of ICE and Electric Vehicle population, initial charging time (ICT), the ratio between slow and fast charging, and the charge load curve of each type of vehicle using the data gathered. The variables related to the demand side and their values are as follows:

Personal Vehicle Population [

32]

Electric Vehicle Population Probability [

33]

2- and 4Wheelers ratio [

32]

Table 2.

Demand side input variables values.

Table 2.

Demand side input variables values.

| Variable |

Label in Simulation |

Value in 2024 |

| Supply Side |

|

|

| Power Plant Capacity |

PowPlaCap_0 |

50,206,000 kW |

| Base Peak Load |

BasPeaLoa_0 |

28,361,000 kW |

| |

|

|

| Demand Side |

|

|

| Java and Bali Population |

JamPop_0 |

157,820,000 |

| Personal Vehicle Population |

TotVeh_0 |

89,757,134 |

| EV Population Probability |

PerEV_0 |

0.091% |

| 2- and 4Wheelers Ratio |

2w4wRat |

120.04:16.41 |

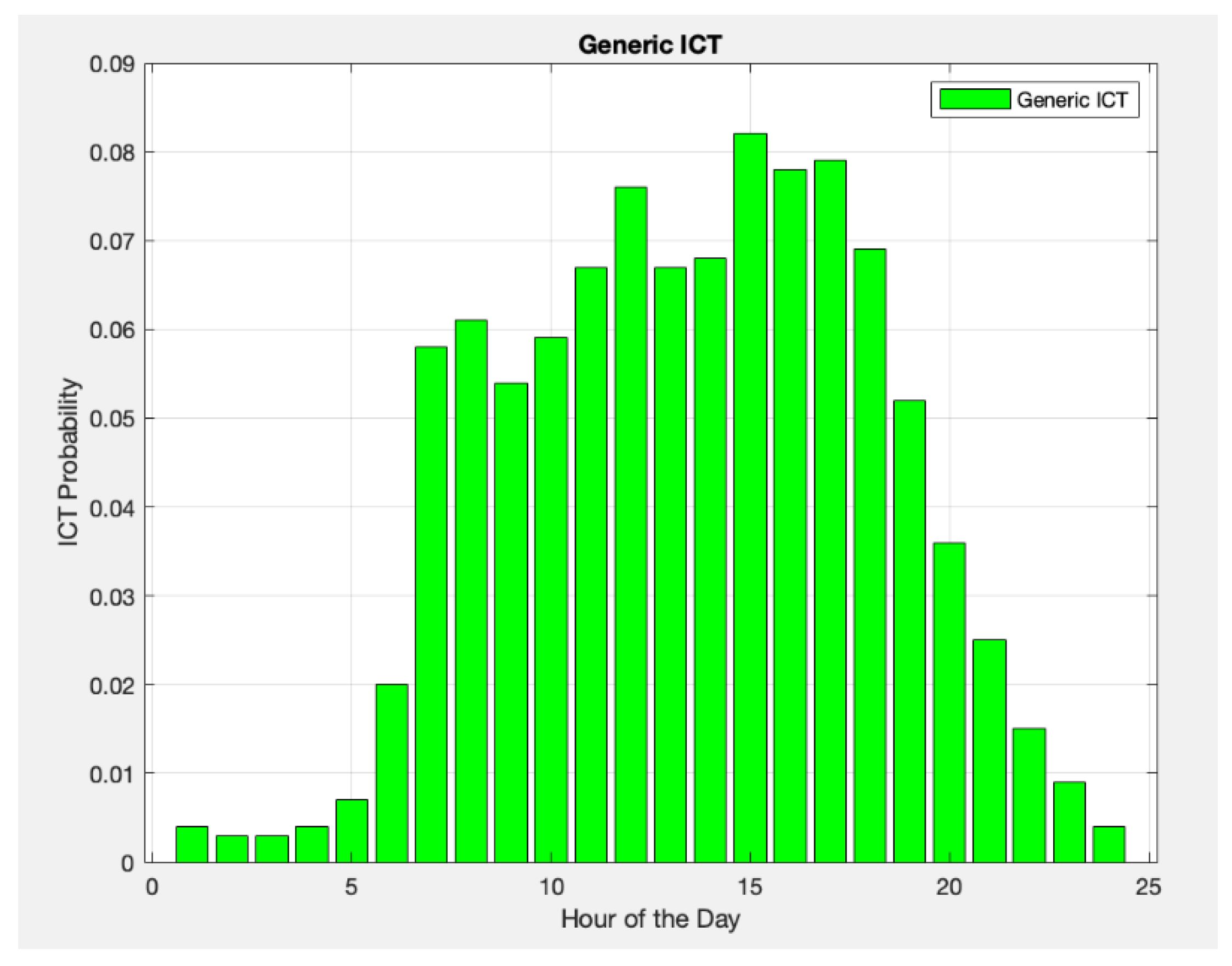

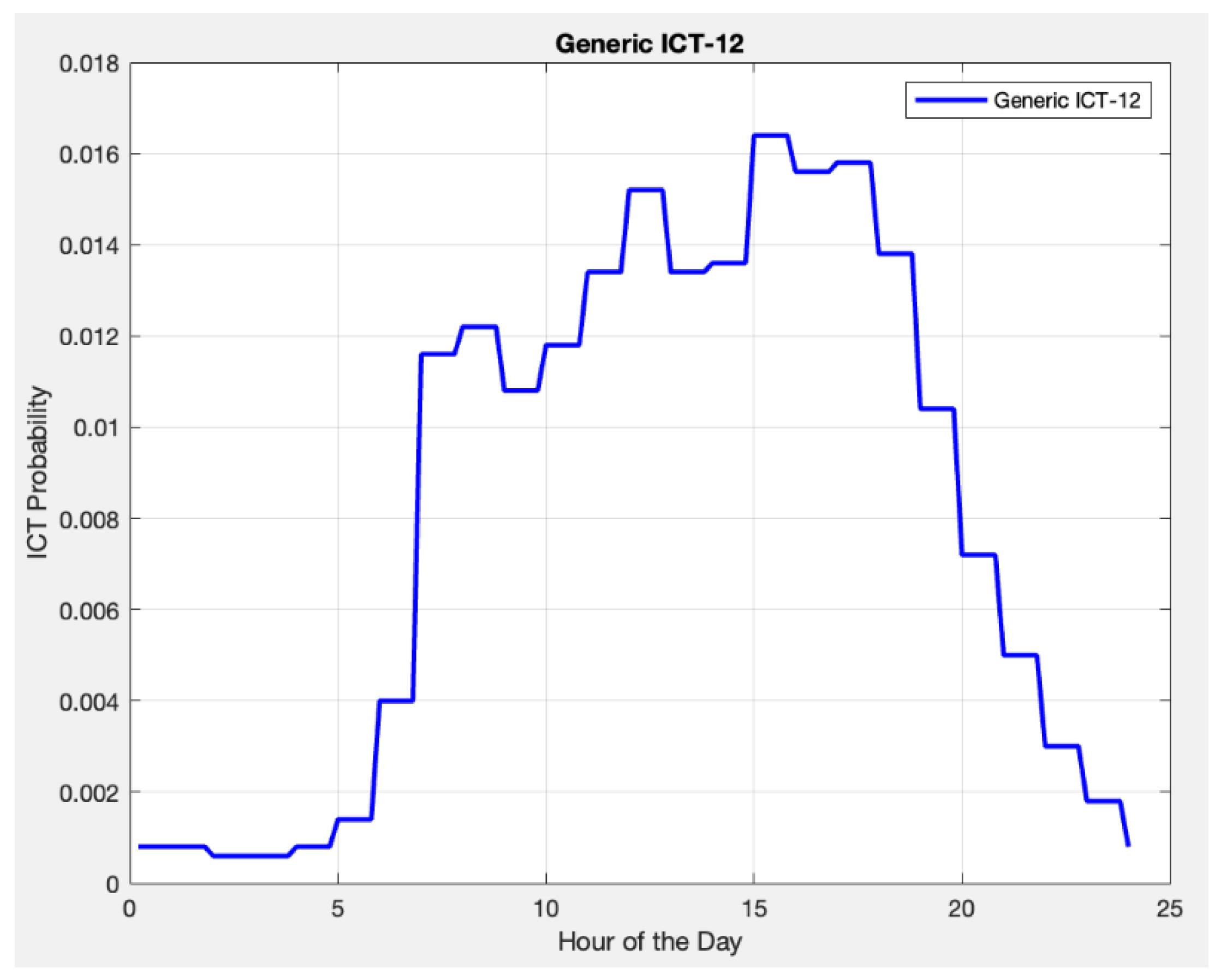

2.1.3. Initial Charging Time

In the simulation of demand load, it is imperative to account for the Initial Charging Time (ICT), denoting the moment when EVs are connected to the grid for daily charging. For most EV users, ICT can be approximated as coinciding with the conclusion of their daily travel. As per the National Household Travel Survey (NHTS) findings, the distribution of end-of-travel times depicted in the graph conforms to a normal distribution [

34]. Subsequently, the data for hourly Initial Charging Times is segmented into intervals of 12 minutes each (5 ICTs per hour, with a resolution of 12 minutes). The probability density function of the graph is presented as follows:

Figure 4.

Generic Initial Charging Time.

Figure 4.

Generic Initial Charging Time.

Figure 5.

ICT with 12 minutes resultion.

Figure 5.

ICT with 12 minutes resultion.

2.1.4. Electric Vehicle’s Specification Details and Charge Curve

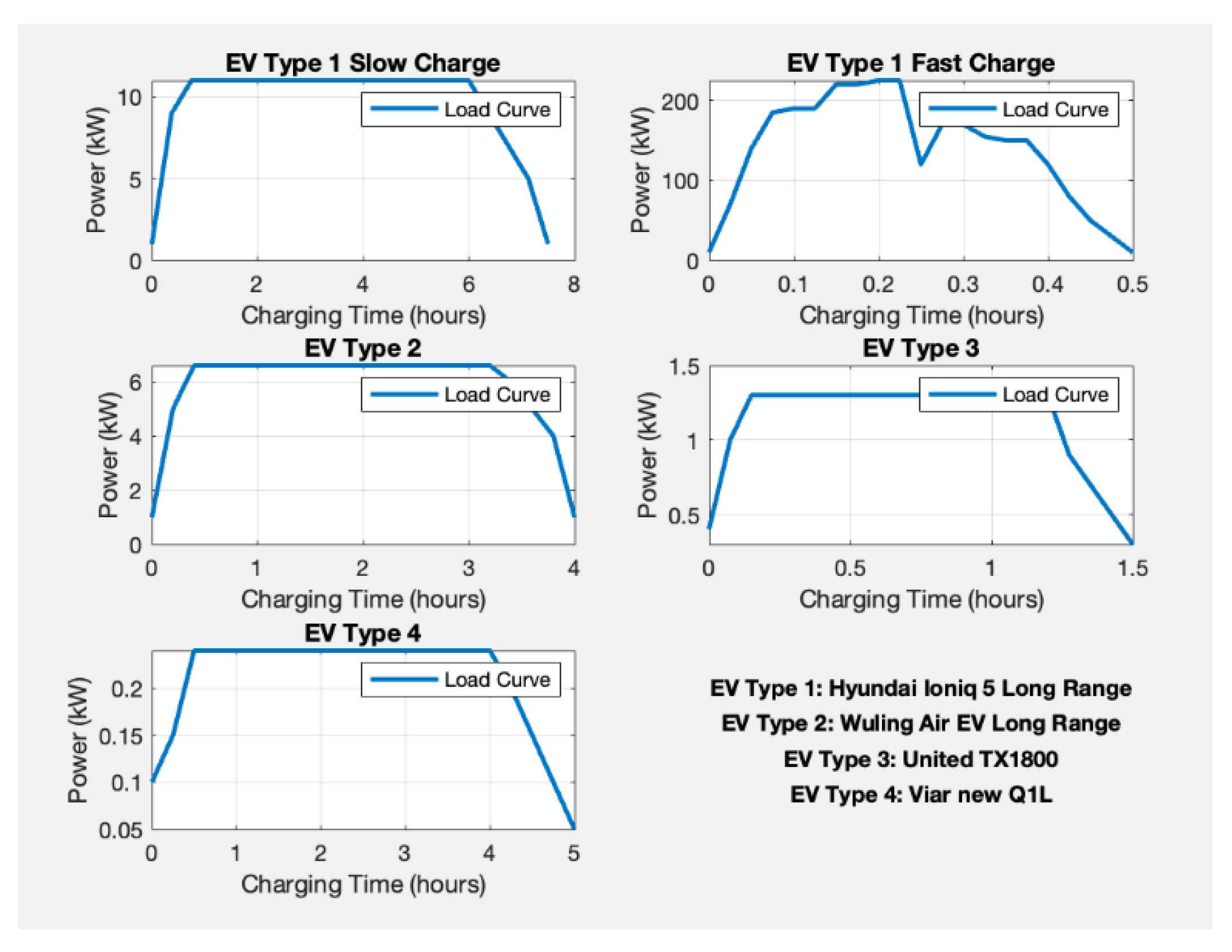

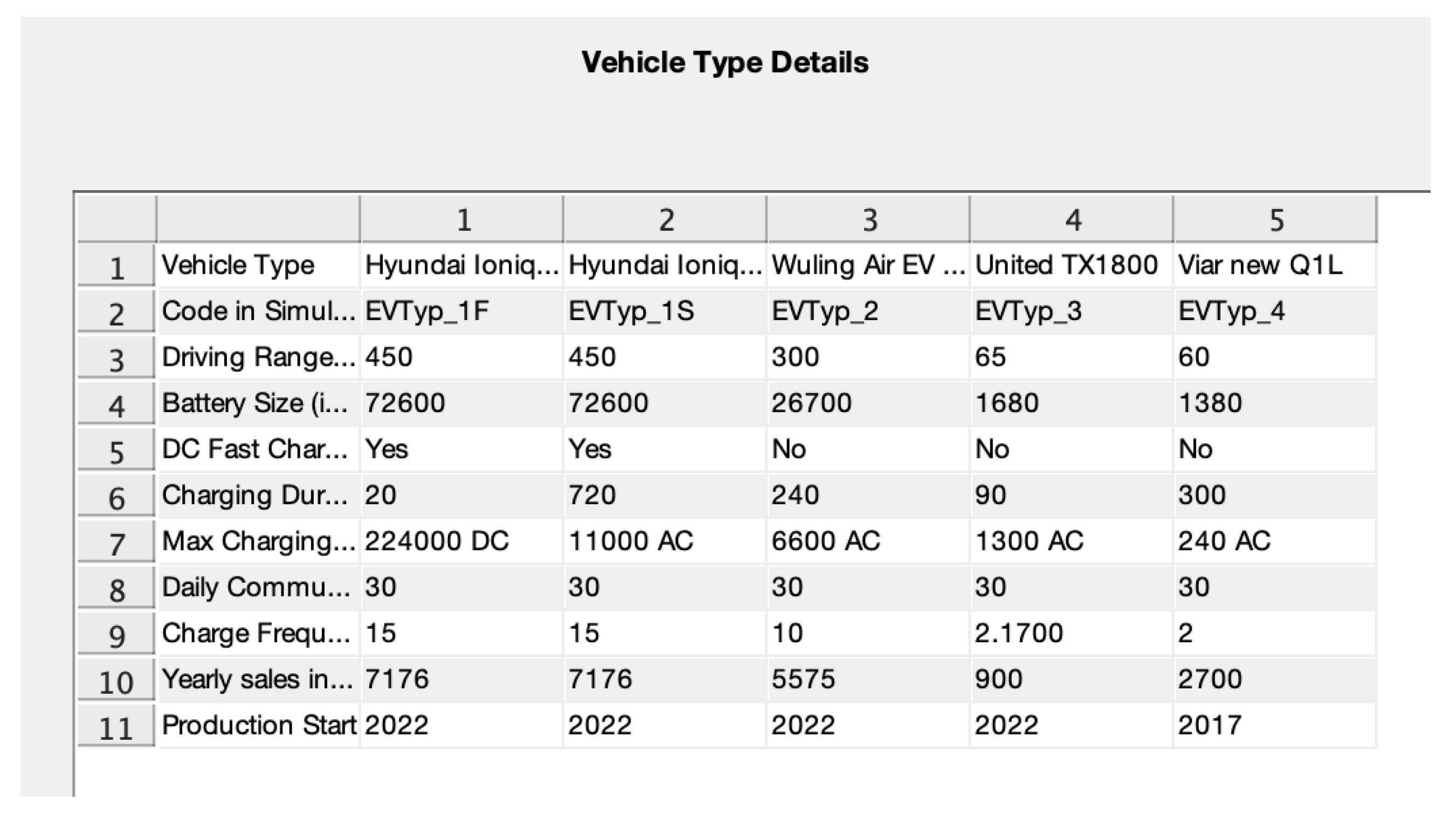

The total load demand will be divided into two categories: two types of four-wheelers EVs (4wEV) and two types of two-wheelers EVs (2wEV). Each category represents both a luxury and a daily-use type of vehicle for both four-wheeled and two-wheeled EVs. The samples are as follows:

2021 Hyundai Ioniq 5 Long Range

2023 Wuling Air EV Long Range

2022 United TX1800

2023 Viar new Q1L, with following specifications:

Table 3.

EV Type Specifications.

Table 3.

EV Type Specifications.

| Vehicle Type |

Hyundai Ioniq 5 Long Range |

Hyundai Ioniq 5 Long Range |

Wuling Air EV Long Range |

United TX1800 |

VIAR new Q1L |

| Label in Simulation |

EVTyp1F |

EVTyp1S |

EVTyp2 |

EVTyp3 |

EVTyp4 |

| Driving Range |

450 km |

450 km |

300 km |

65 km |

60 km |

| Battery Size |

72.6 kWh |

72.6 kWh |

26.7 kWh |

1.68 kWh |

1.38 kWh |

| DC Fast Charging Capability |

Yes |

Yes |

No |

No |

No |

| Charging Duration |

20 mins |

720 mins |

240 mins |

90 mins |

300 mins |

| Max Charging Load |

224 kW DC |

11 kW AC |

6.6 kW AC |

1.3 kW AC |

0.24 kW AC |

| Daily Commute |

30 km |

30 km |

30 km |

30 km |

30 km |

| Charge Frequency |

15 days |

15 days |

10 days |

2.17 days |

2 days |

| Nationwide Yearly Sales in 2023 |

7,176 units |

7,176 units |

5,575 units |

9,00 units |

2,700 units |

| Production Start |

2022 |

2022 |

2022 |

2022 |

2017 |

| |

|

|

|

|

|

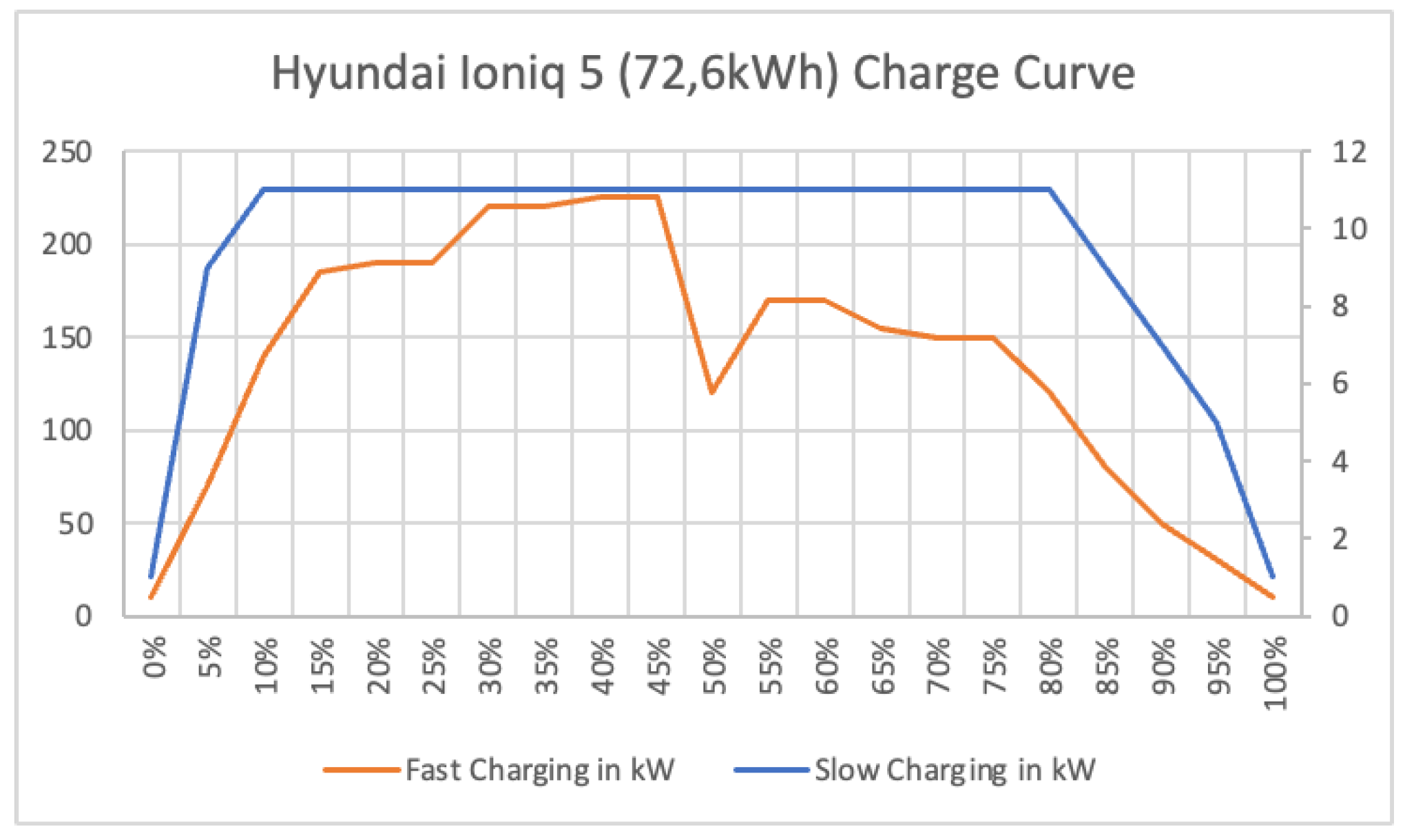

The charging load data for four-wheeled electric vehicles (4wEV) is based on the charge load curve of the 2021 Hyundai Ioniq5, which features a 72.6 kWh battery capacity [

35]. The Hyundai Ioniq is Indonesia’s top-selling 4wEV, with 7,176 units sold in 2023 [

19]. During slow charging mode, the peak load of the Ioniq5 is 7.2 kW, while the peak demand during fast charging mode reaches 225 kW [

35].

The frequency of charging for an electric vehicle (EV) is determined by the total travel distance covered per charge. For example, the IONIQ 5, with a range of 450 kilometers [

35], divided by a norm of 30 kilometers traveled each day [

36], would require charging approximately every 15 days. The graph below illustrates the charge curve of the IONIQ, measured during charging [

37].

Figure 6.

Hyundai Ioniq 5 Long Range Charge Curve.

Figure 6.

Hyundai Ioniq 5 Long Range Charge Curve.

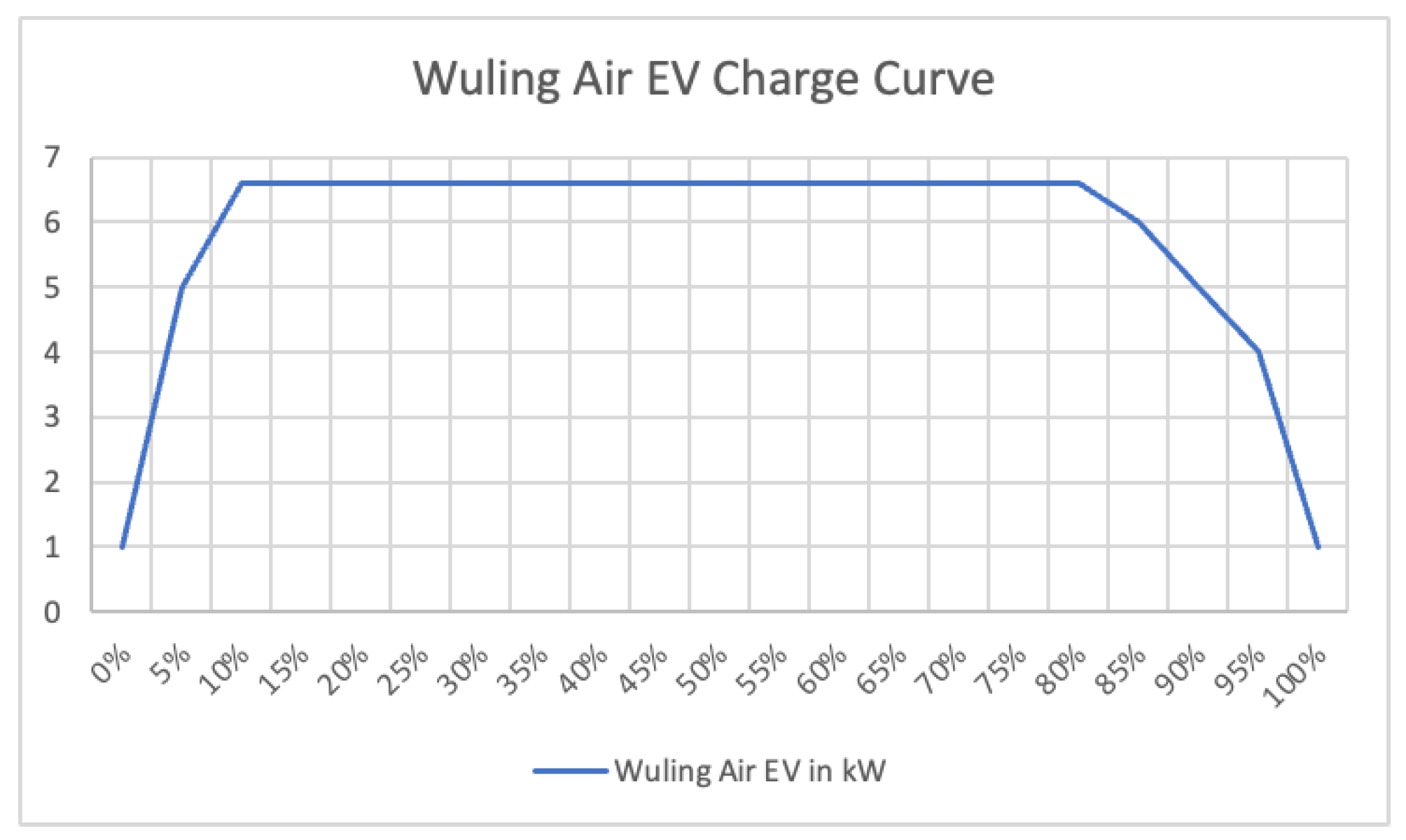

Another source for charging load data for budget four-wheeled electric vehicles (4wEV) was obtained from the Wuling Air EV Long Range model [

38]. The Air EV is the second best-selling 4wEV unit in 2023 [

19]. Unlike the Ioniq5, it does not feature fast charging capability. Based on the average daily commute, the Wuling Air EV Long Range model requires charging approximately every 10 days.

Figure 7.

Wuling Air EV Long Range Charge Curve.

Figure 7.

Wuling Air EV Long Range Charge Curve.

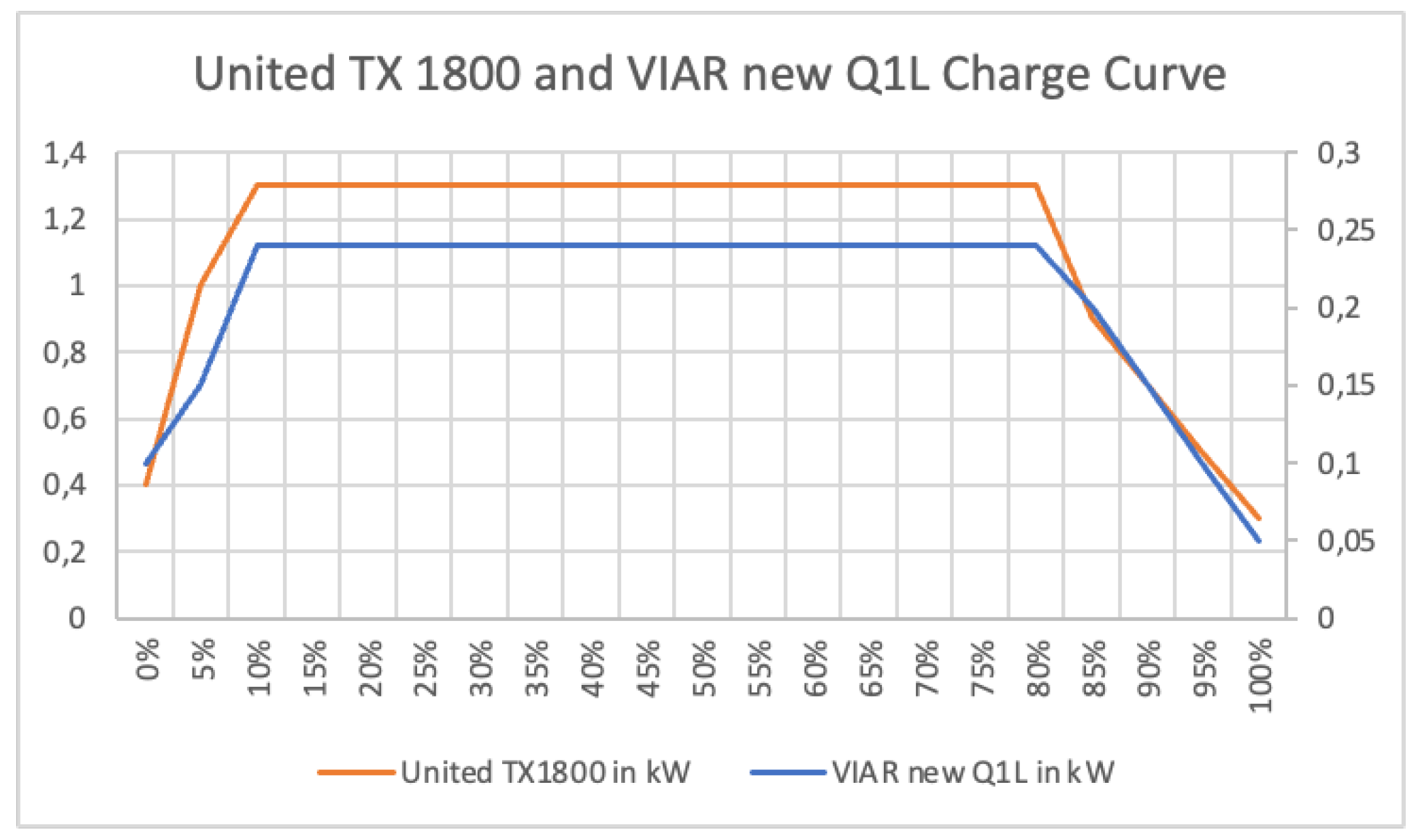

The total load from two-wheeled electric vehicles (2wEV) is calculated using charge load data obtained from the United TX1800 [

39] and the budget-oriented VIAR new Q1L electric motorcycle, which was a pioneer of 2wEV in Indonesia in 2017 [

40]. The United TX1800 has a 1300W charge peak [

39], while the VIAR new Q1L has a 0.24 kW peak [

40]. Daily distance traveled and initial charging time (ICT) are similar to the 4wEV load simulation. Generally, 2wEVs in Indonesia do not feature fast charging capabilities.

Figure 8.

United TX 1800 and VIAR new Q1L Charge Curve.

Figure 8.

United TX 1800 and VIAR new Q1L Charge Curve.

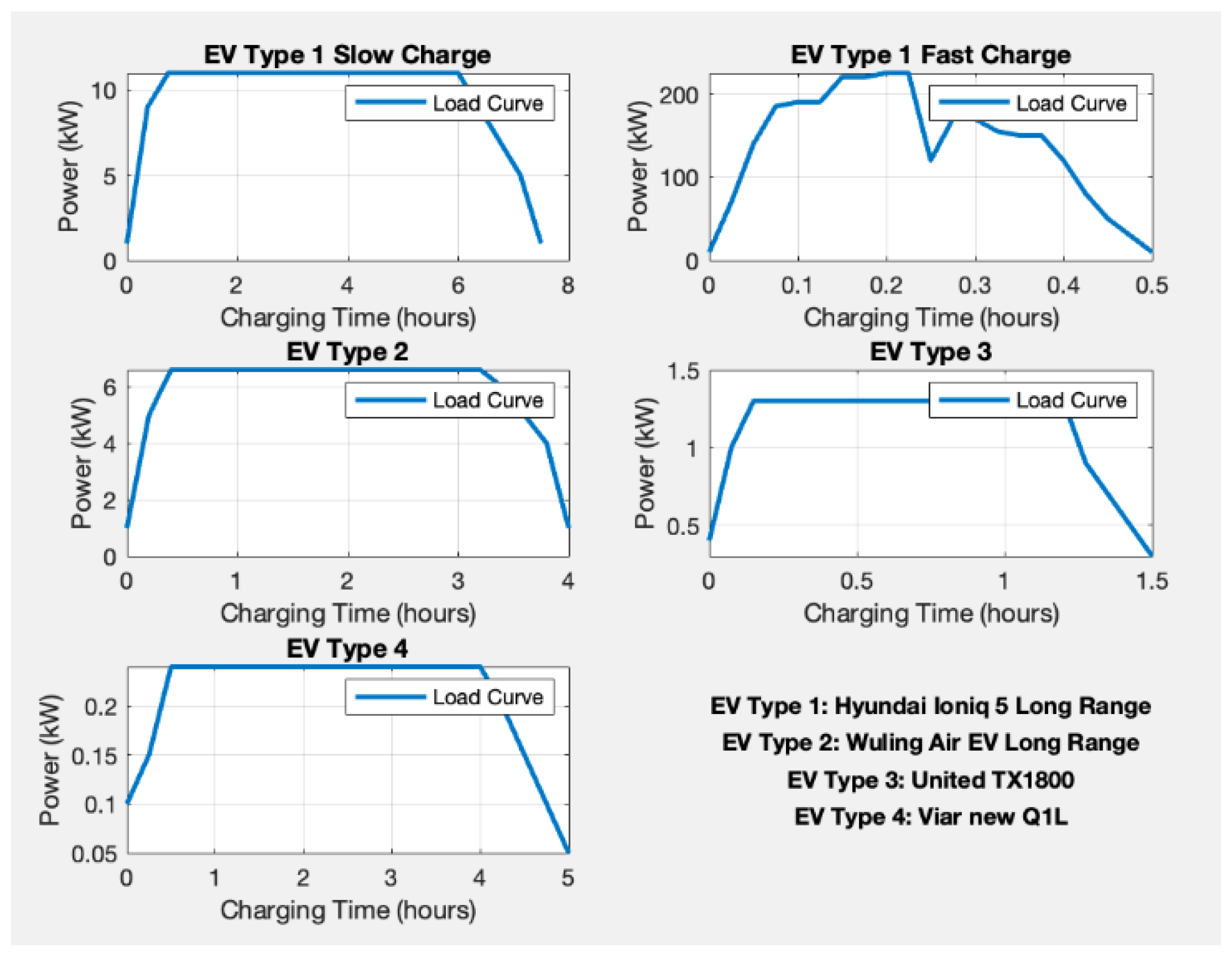

These charge curves are utilized as inputs in the demand simulation. The total additional electricity demand from EVs is determined by the combination of the number and type of vehicles, ICT, and the fast/slow charging curve of each vehicle. The charge curves from each EV type used in the simulation are shown below:

Figure 9.

EV Charge Curves.

Figure 9.

EV Charge Curves.

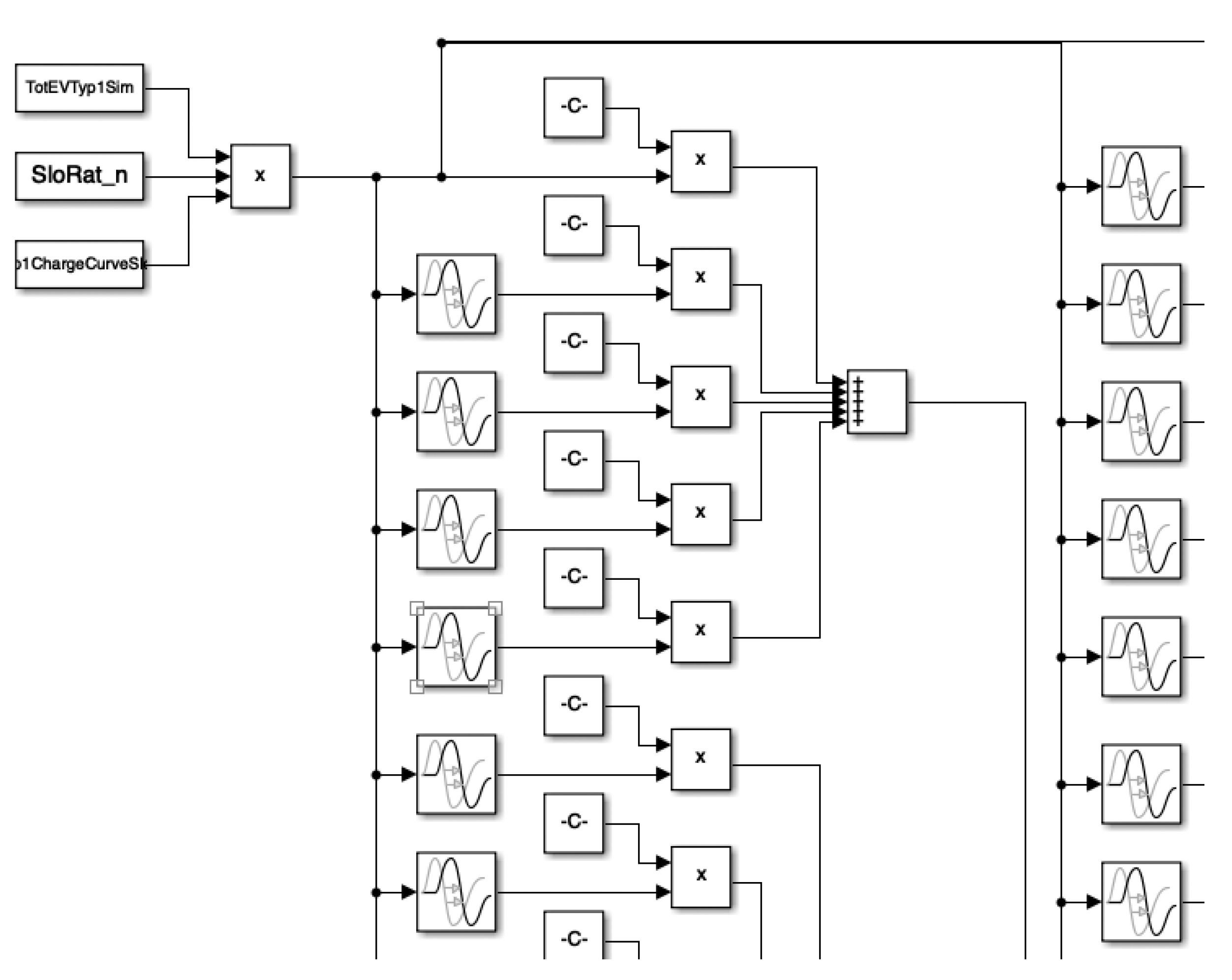

2.2. Supply-Demand Simulation

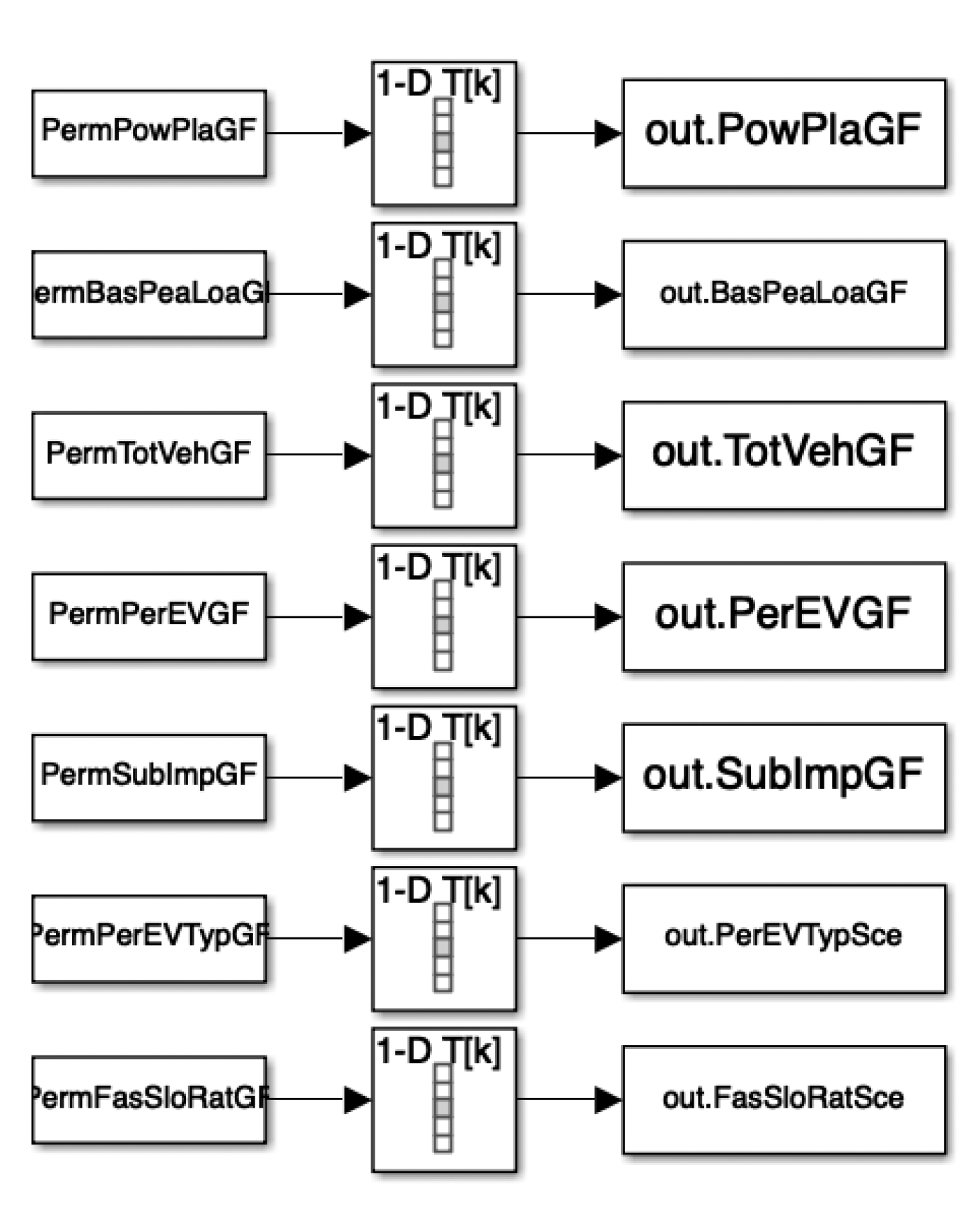

The collected data will be used as inputs in MATLAB and simulated in Simulink. The power plant capacity is used as the supply capacity in the simulation. The current capacity and its projected growth factor were obtained from the RUPTL PLN.

The base peak load, which excludes EV load, is also simulated using its current value and growth factor.

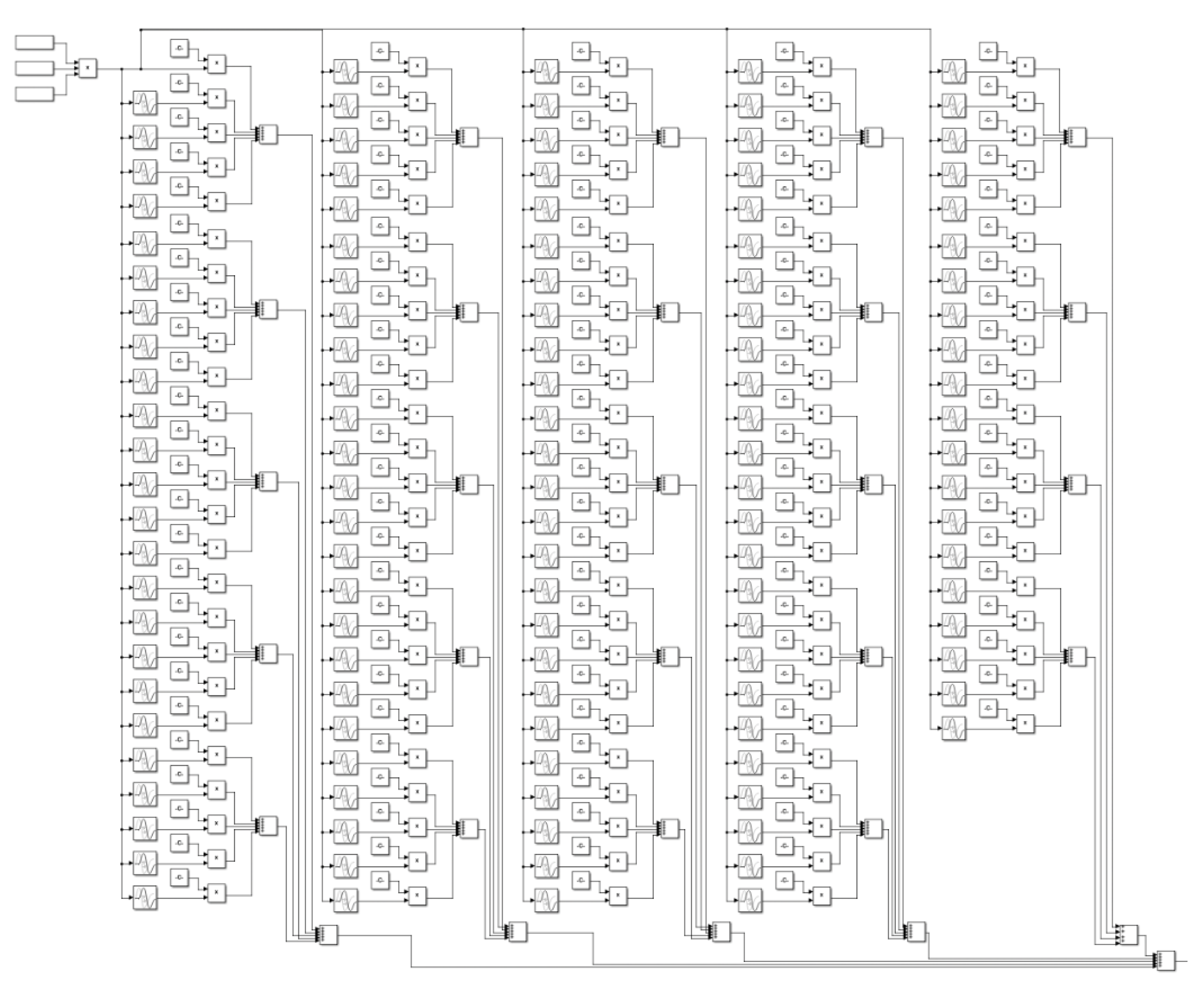

The demand load was calculated based on the Jamali population and its ratio to vehicle ownership. A certain percentage of these vehicles are EVs. The growth factor of EVs is influenced by their attractiveness and the impact of EV subsidies.

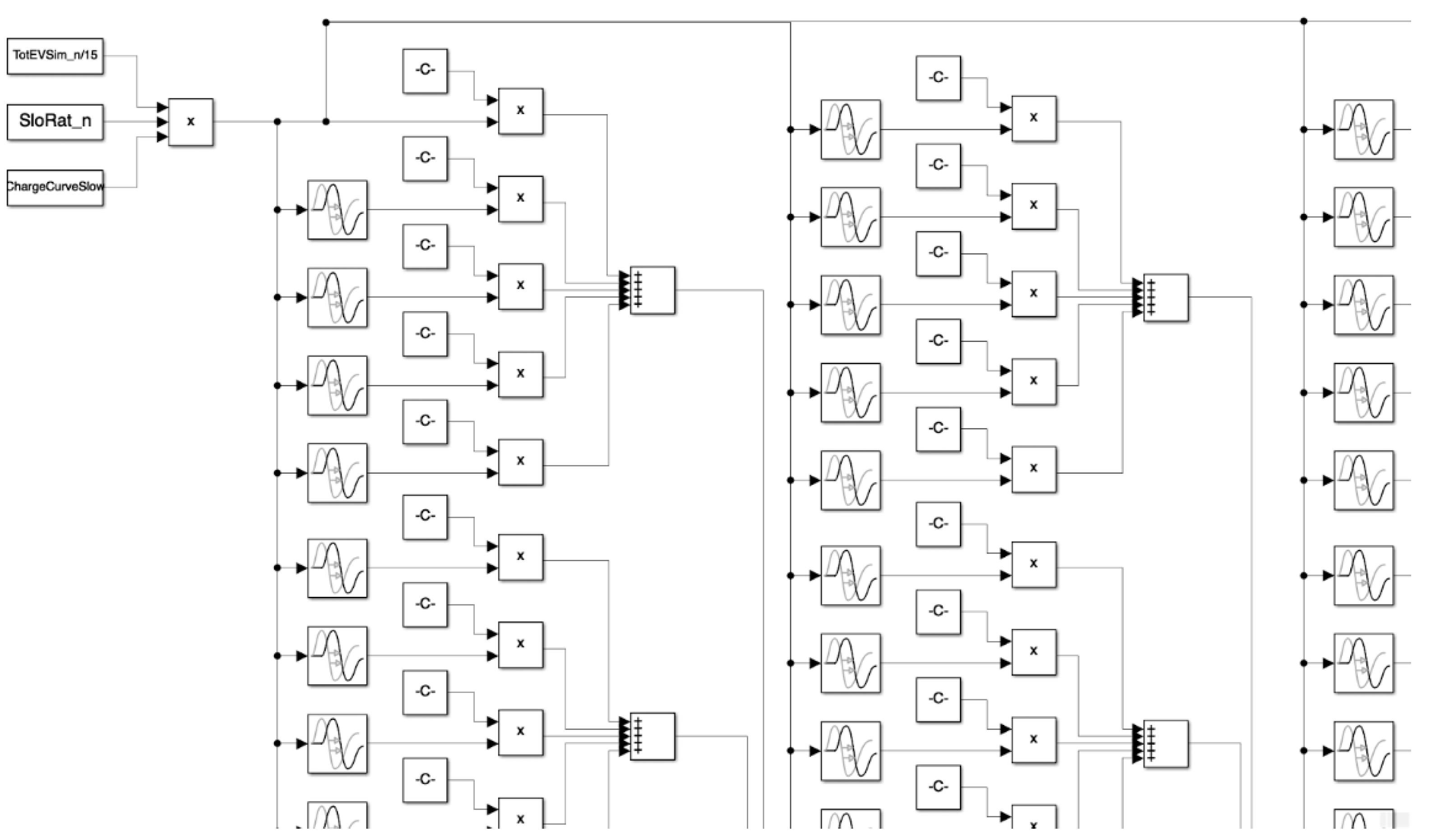

The demand simulation then progresses in Simulink. The simulations are conducted individually for each type of EV: including EVTyp_1F, EVTyp_1S, EVTyp2, EVTyp3, and EVTyp4.

Figure 10.

Simulink Model for EV Load Demand Simulation.

Figure 10.

Simulink Model for EV Load Demand Simulation.

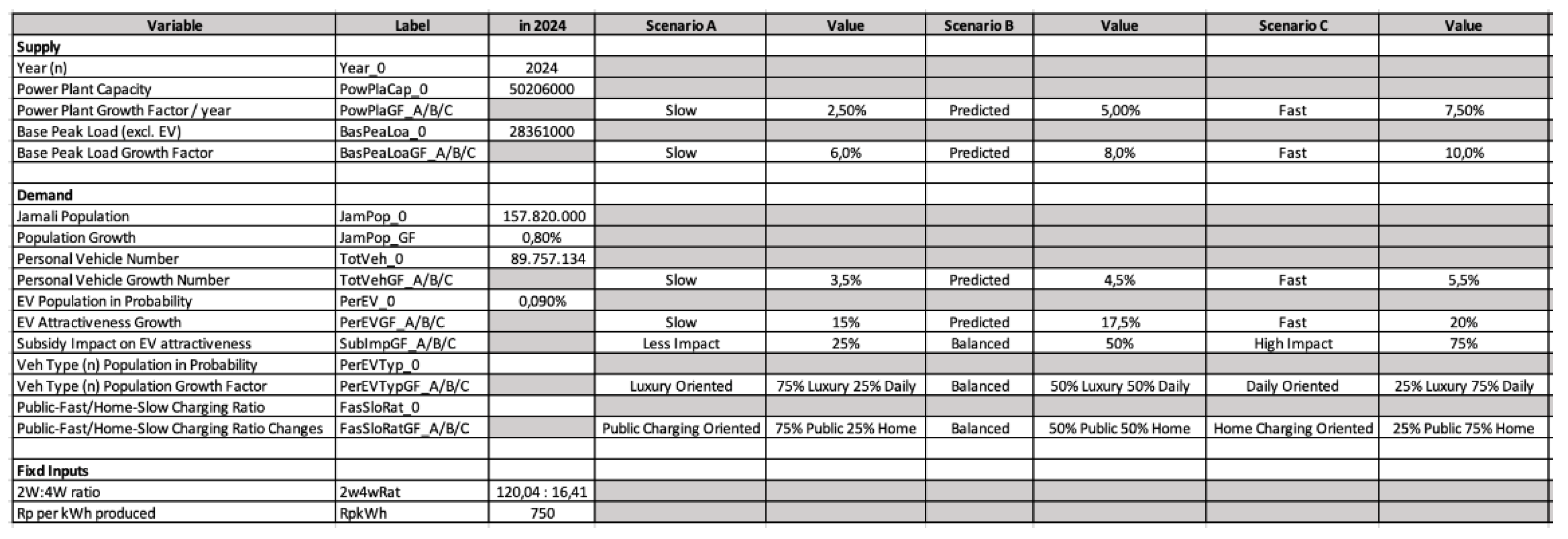

2.3. Scenario Permutations

In addition to the supply-demand simulations for the period 2024-2029, various scenarios are to be simulated. Each scenario involves variations in the growth speed of each supply-demand simulation’s input variable. These variations in growth factors include:

Table 4.

Input variation’s value.

Table 4.

Input variation’s value.

| Variable |

Label in Simulation |

Scenario A |

Value |

Scenario B |

Value |

Scenario C |

Value |

| Supply-Side |

|

|

|

|

|

|

|

| Power Plant Capacity Growth |

PowPlaGF |

Slow |

2.5% |

Predicted |

5% |

Fast |

7.5% |

| Base Peak Load Demand Growth |

BasPeaLoaGF |

Slow |

6% |

Predicted |

8% |

Fast |

10% |

| |

|

|

|

|

|

|

|

| Demand-Side |

|

|

|

|

|

|

|

| Personal Vehicle Population Growth |

TotVehGF |

Slow |

3.5% |

Predicted |

4.5% |

Fast |

5.5% |

| EV Attractiveness Growth |

PerEVGF |

Slow |

15% |

Predicted |

17.5% |

Fast |

20% |

| Subsidy Impact on EV Attractiveness |

SubImpGF |

Less Impact |

25% |

Balanced |

50% |

High Impact |

75% |

| Vehicle Type Preferences |

PerEVTypGF |

Luxury Oriented |

Luxury 75%

Daily 25% |

Balanced |

Luxury 50%

Daily 50% |

Daily Oriented |

Luxury 25%

Daily 75% |

| Home-/Public Charging Preferences |

FasSloRatGF |

Public Charging Oriented |

Public 75%

Home 25% |

Balanced |

Public 50%

Home 50% |

Home Charging Oriented |

Public 25%

Home 75% |

In combinatorial mathematics, a permutation refers to the different ways of selecting and arranging objects. It represents an arrangement of objects in a specific order. When repetition is allowed and the order matters, the number of possible permutations of r elements taken from a set of n elements is given by (n

r) [

46].

Since combination’s repetition is allowed, each of the 7 variable inputs can be filled with any of the 3 growth factor speed variation, giving us 2187 possible scenarios.

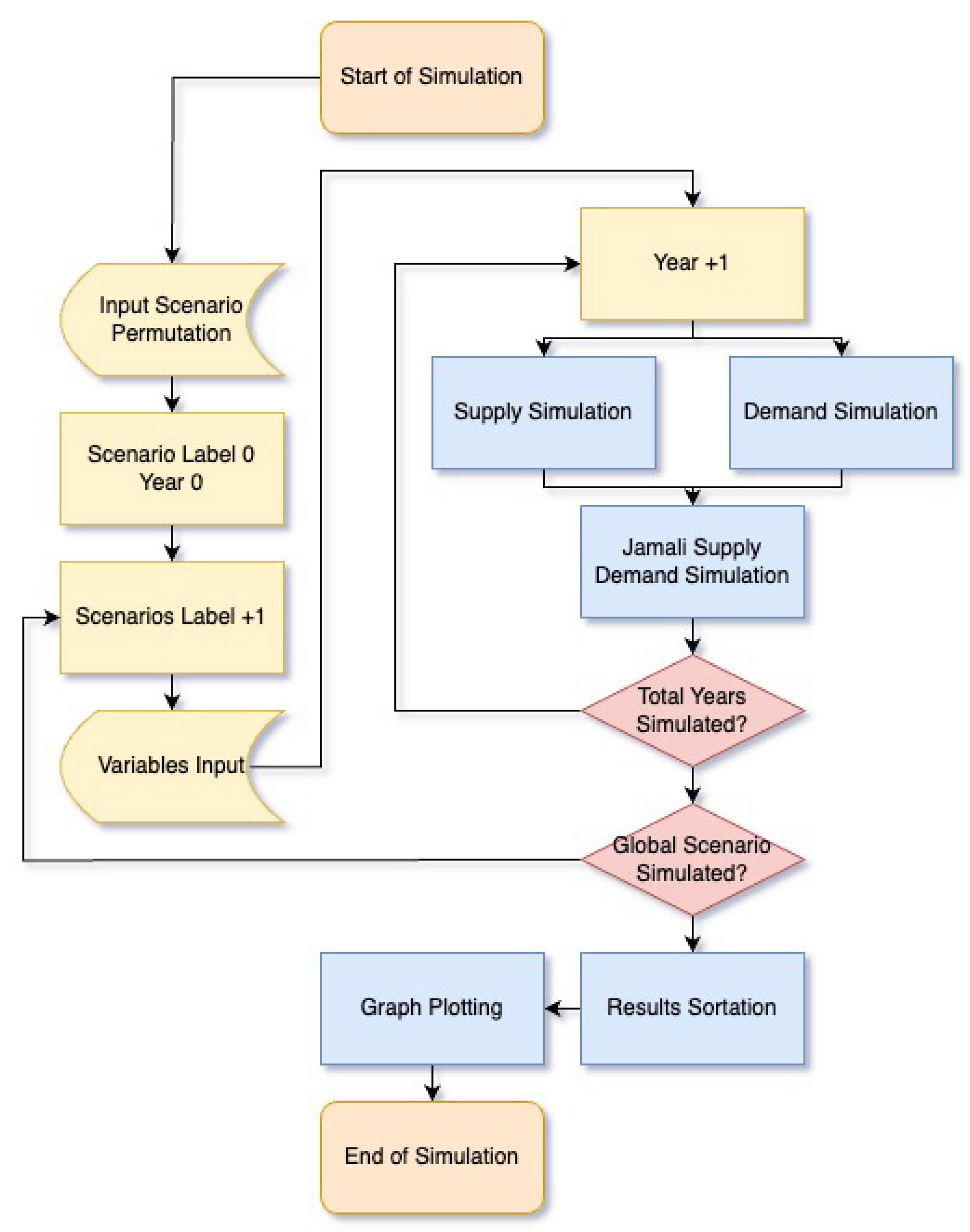

2.4. Global Simulations

The global simulation begins with the permutation of input scenarios. Each permutation provides values for the variables. With 3 possibilities for each of the 7 different variables, this results in 2187 scenarios. Based on the values of each scenario, the supply and demand simulations commence. Each supply-demand simulation runs for five years, covering the period from 2024 to 2029.

Figure 11.

Simulation’s Flowchart.

Figure 11.

Simulation’s Flowchart.

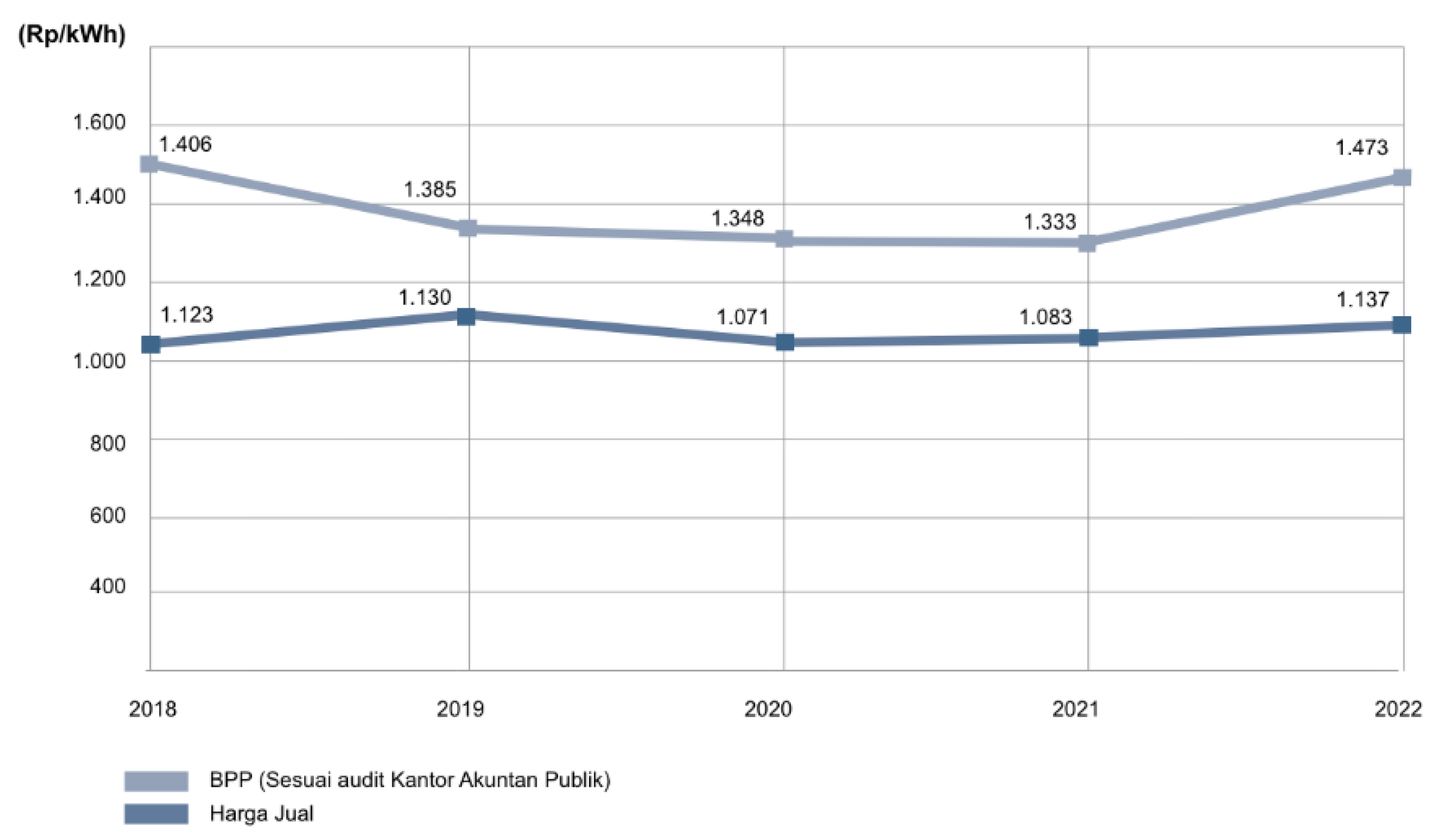

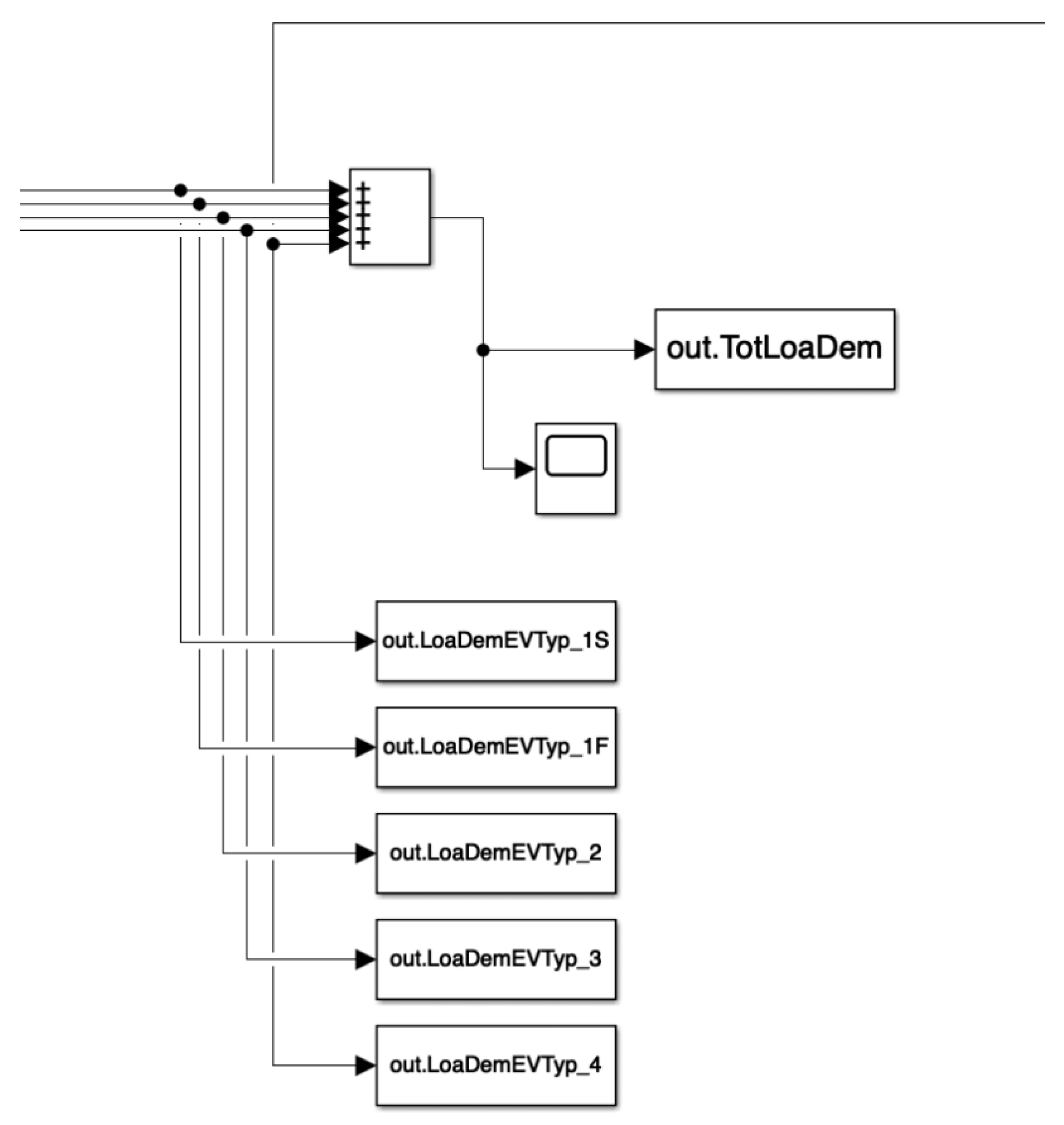

The three main outputs for each scenario are the end EV percentage by 2029, cost allocation for the additional yearly electricity supply, and cost allocation for the yearly EV subsidies. The total cost allocation for the additional yearly electricity supply was simulated by considering the deficit in power plant capacity by the end of 2029. The supply cost per kilowatt-hour (kWh) of Rp1,108/kWh was derived from BPP PLN. [

47]

Figure 12.

Supply Cost per kWh (BPP PLN) 2018-2022 [

47].

Figure 12.

Supply Cost per kWh (BPP PLN) 2018-2022 [

47].

On the contrary, the cost allocation for the yearly EV subsidies was determined by considering the surplus of the power plant capacity. To achieve a balance in the grid’s supply and demand, a specific number of EVs must be added to offset the supply. These include a 10% VAT tax deduction each 4wEV [

24] and an IDR 7,000,000 deduction for each 2wEV [

25].

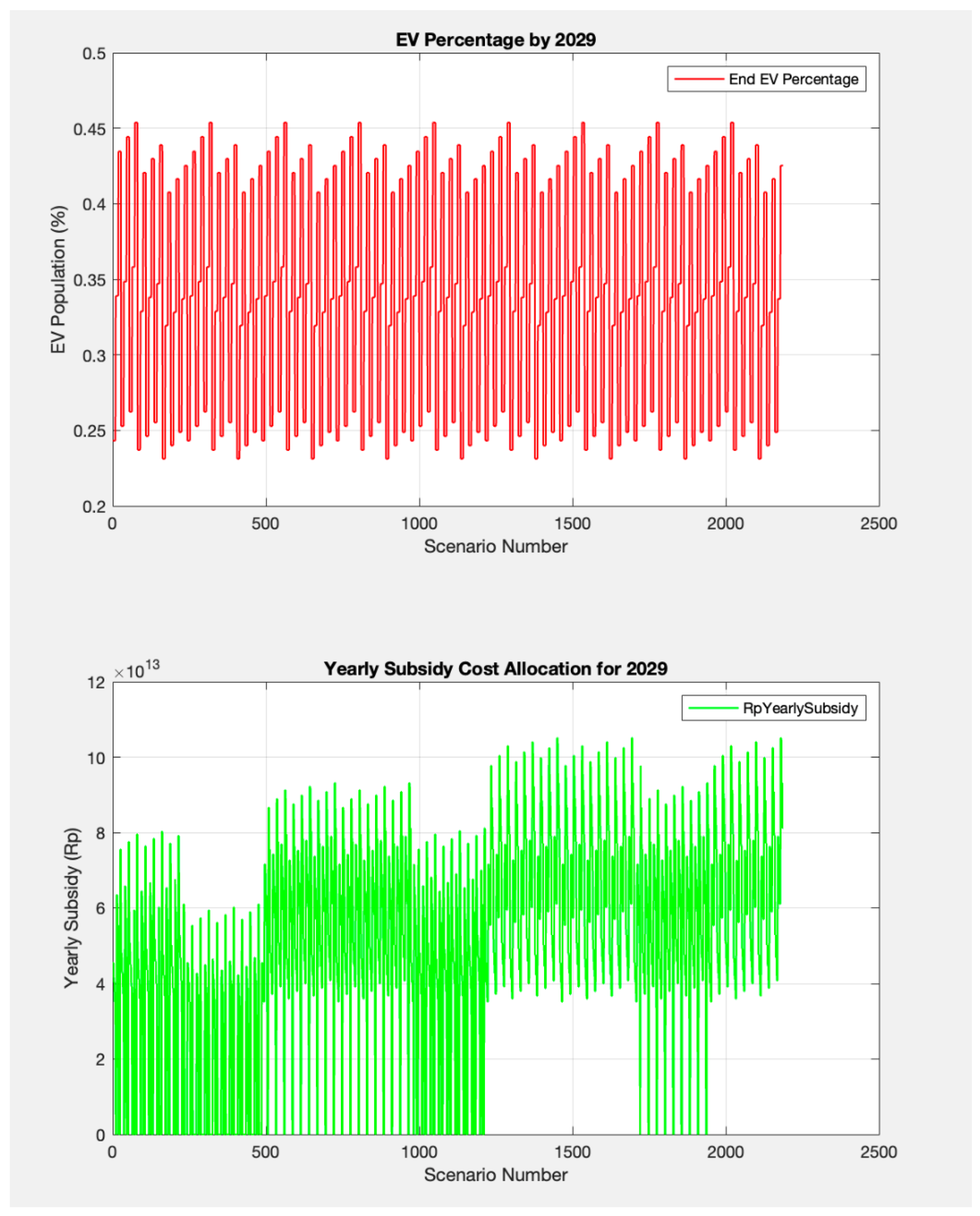

The outputs from each of the 2187 scenarios are sorted based on three criteria. Given that EV growth is the primary goal of the government, the initial sorting criterion for the best scenarios is the highest EV percentage result in 2029. Subsequently, the scenarios are sorted by the minimum yearly cost allocation. Conversely, to identify the worst possible scenario, the simulation sorts by the least EV percentage with the highest yearly cost allocation.

Table 5.

Output’s Priority Order.

Table 5.

Output’s Priority Order.

| Output’s Objective |

Priority Order |

| High EV Growth |

1st

|

| and |

| Low-Cost Allocation for Supply |

2nd

|

| Low-Cost Allocation for Subsidy |

The second sortation criterion (cost allocation for the additional yearly electricity supply and cost allocation for the yearly EV subsidies) will offset each other depending on the power plant capacity deficit by the year 2029. Apart from presenting the best and worst possible outputs given the scenarios available, the simulation should be able to execute the inputted scenarios.

3. Results

After simulating the scenarios, four results are worth considering: the scenario with the best outputs, the scenario with the worst outputs, and the most and least probable scenarios based on the information and predictions formed during the literature review.

Table 6.

Scenario Outputs.

Table 6.

Scenario Outputs.

| Simulation Result |

Scenario Label |

Scenario Permutation |

EV Percentage in 2029 |

Cost Allocation on Supply |

Cost Allocation on Subsidy |

| Best Scenario |

1776 |

3213313 |

45.38% |

Rp492,218,007,498 |

Rp0 |

| Worst Scenario |

163 |

1131111 |

23.12% |

Rp0 |

Rp47,556,001,136,600 |

| Most Probable |

378 |

1222333 |

42.98% |

Rp970,330,692,972 |

Rp0 |

| Least Probable |

1459 |

3111111 |

24.32% |

Rp0 |

Rp45,475,187,899,827 |

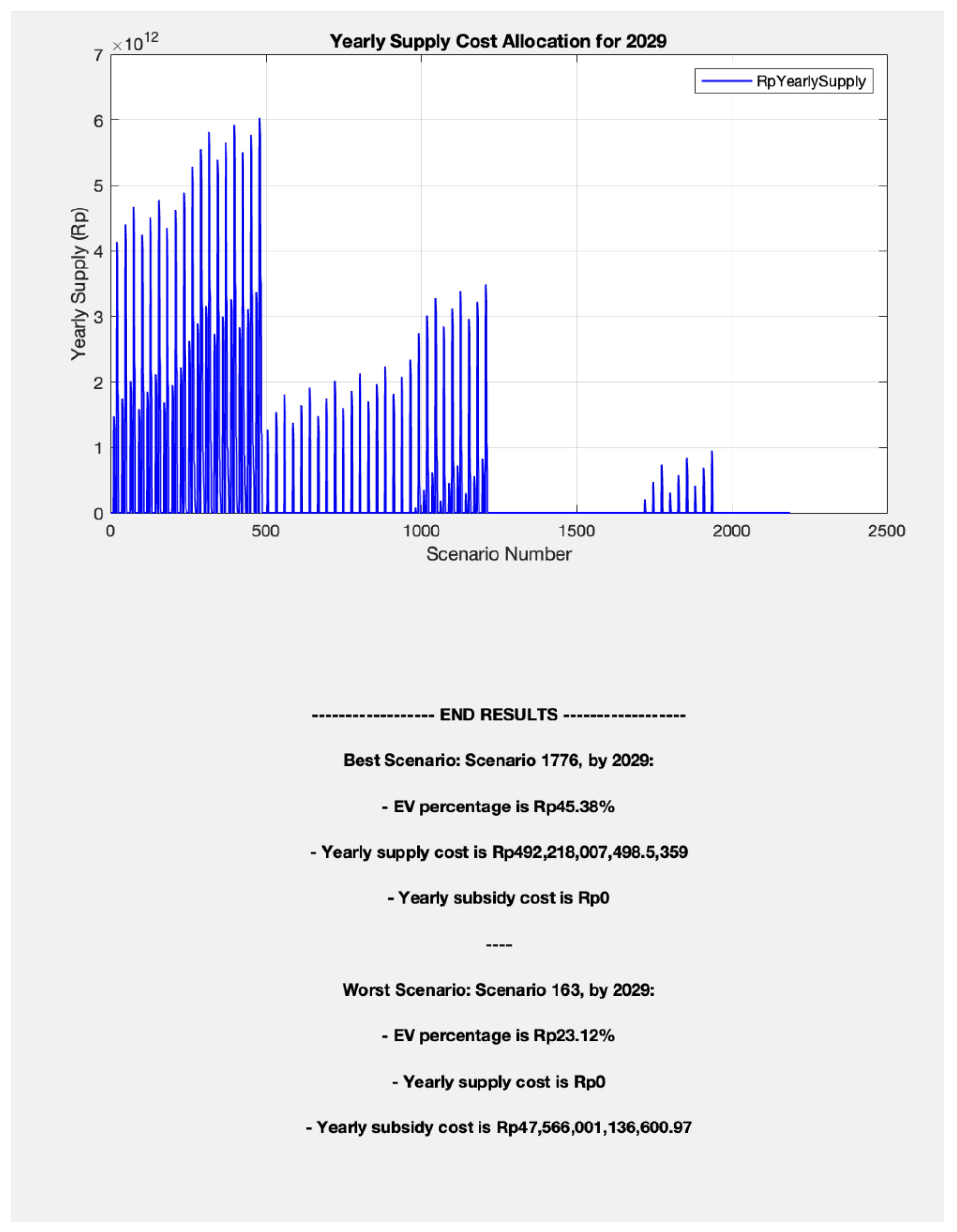

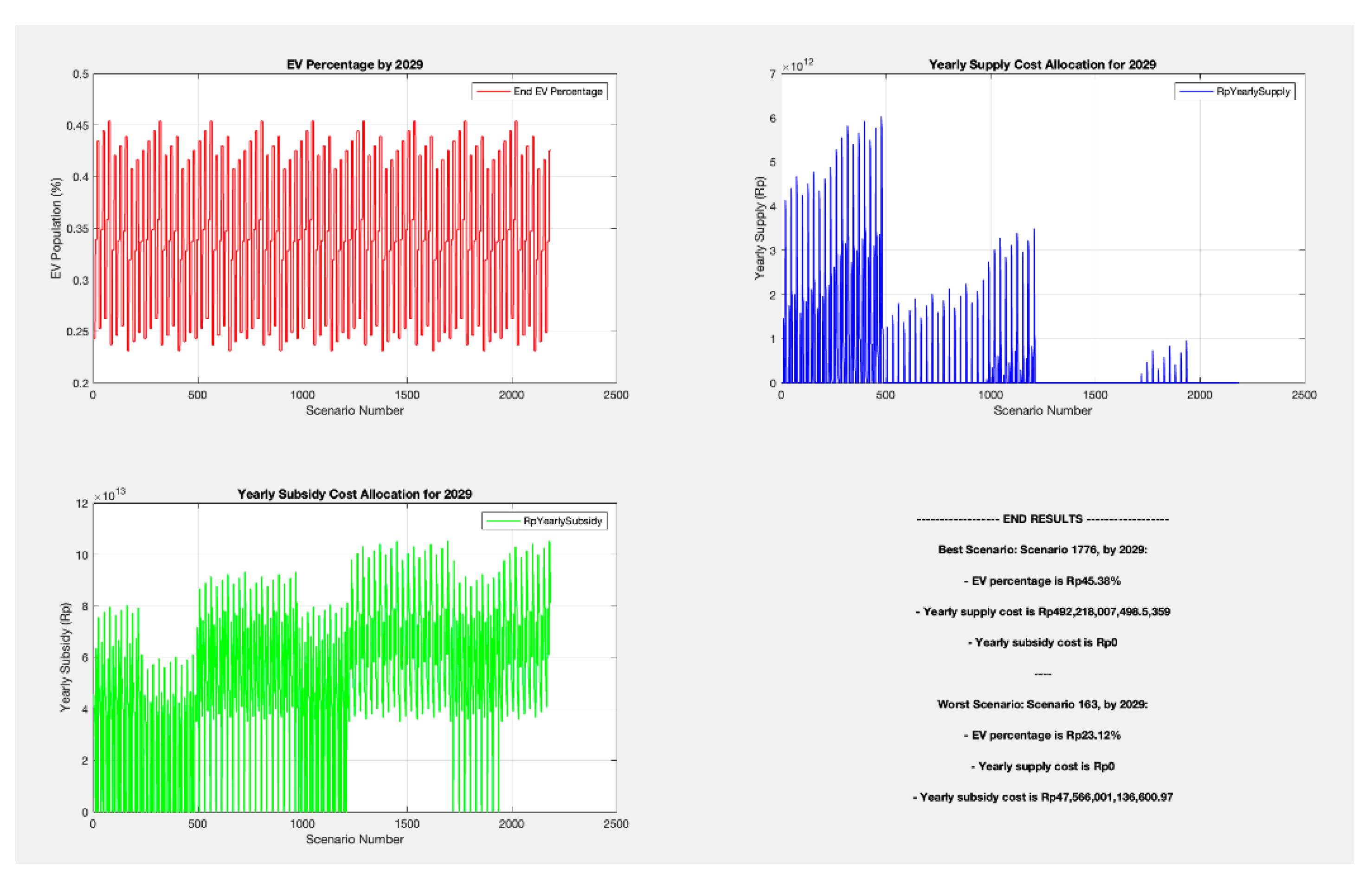

The output graph of the global simulation is displayed below, featuring three graphs with the scenario number on the x-axis. These graphs illustrate the three outputs: EV Percentage in 2029, Mandatory Cost Allocation on Supply in 2029, and Cost Allocation on Subsidy in 2029.

Figure 13.

Global Simulations Output 1.

Figure 13.

Global Simulations Output 1.

Figure 13.

Global Simulations Output 2.

Figure 13.

Global Simulations Output 2.

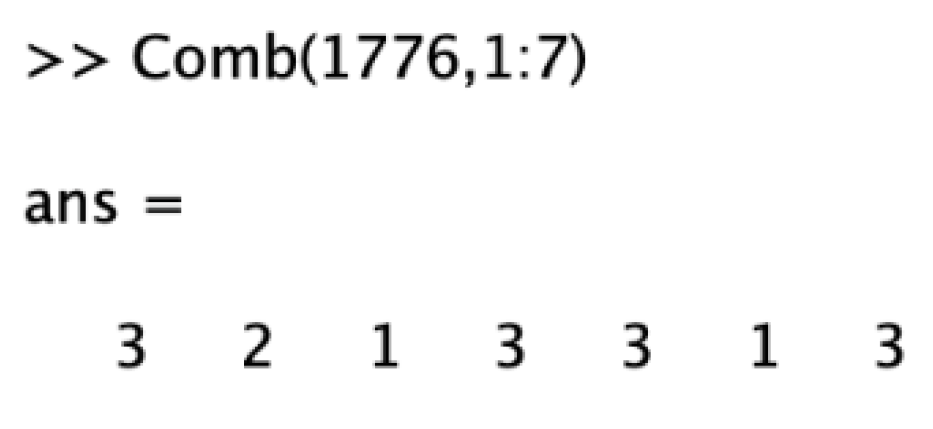

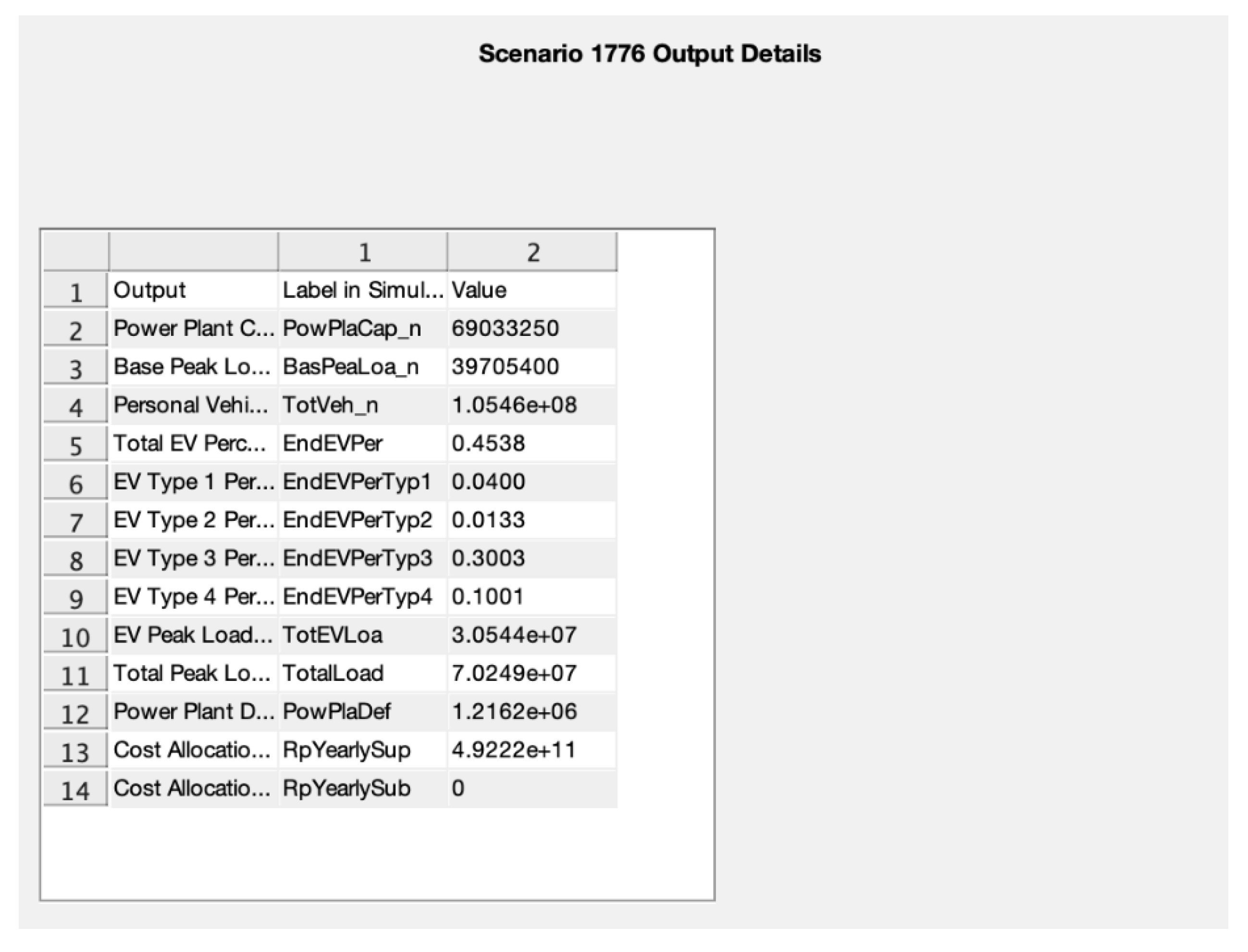

3.1. Best Case Scenario

Based on the output simulation of 2187 scenarios for 2024-2029, the best-case scenario achieves the highest EV growth without disturbing the grid’s supply and demand balance. In the global scenario, all results were sorted, and the scenario with the highest EV percentage by 2029 was selected. Subsequently, all scenarios with the best EV percentage were sorted based on the lowest cost allocation for supply adjustment or subsidy allocation. This resulted in scenario label 1776. The output for this scenario permutation was 3213313, which translates to the following variable inputs (highlighted in blue):

Figure 14.

Best Scenario Input Permutation.

Figure 14.

Best Scenario Input Permutation.

Table 7.

Best Scenario Inputs.

Table 7.

Best Scenario Inputs.

| Power Plant Capacity Growth |

Base Peak Load Demand Growth |

Personal Vehicle Population Growth |

EV Attractiveness Growth |

Subsidy Impact on EV Attractiveness |

Vehicle Type Preferences |

Home-/Public Charging Preferences |

| Slow Growth |

Slow Growth |

Slow Growth |

Slow Growth |

Less Impact |

Luxury Oriented |

Public Charging Oriented |

| Predicted Growth |

Predicted Growth |

Predicted Growth |

Predicted Growth |

Balanced |

Balanced |

Balanced |

| Fast Growth |

Fast Growth |

Fast Growth |

Fast Growth |

High Impact |

Daily Oriented |

Home Charging Oriented |

This scenario resulted in supply and demand details below:

Table 8.

Best Scenario Outputs.

Table 8.

Best Scenario Outputs.

| Output |

Label in Simulation |

Value |

Units |

| Power Plan Capacity |

PowPlaCap |

69,033,250 |

kW |

| Base Peak Load Demand |

BasPeaLoa |

39,705,400 |

kW |

| Personal Vehicle Population |

TotVeh_n |

105,460,000 |

units |

| Total EV Percentage |

EndEVPer |

45.38 |

% |

| EV Type 1 Percentage |

EndEVPerTyp1 |

4 |

% |

| EV Type 2 Percentage |

EndEVPerTyp2 |

1.3 |

% |

| EV Type 3 Percentage |

EndEVPerTyp3 |

30 |

% |

| EV Type 4 Percentage |

EndEVPerTyp4 |

10 |

% |

| EV Peak Load Demand |

TotEVLoa |

30,544,000 |

kW |

| Total Peak Load Demand |

TotalLoad |

70,249,000 |

kW |

| Plant Capacity Surplus/Deficit |

PowPlaDef |

121,620 |

kW |

| Cost Allocation for Supply |

RpYearlySup |

492,218,007,498 |

Rupiah |

| Cost Allocation for Subsidy |

RpYearlySub |

0 |

Rupiah |

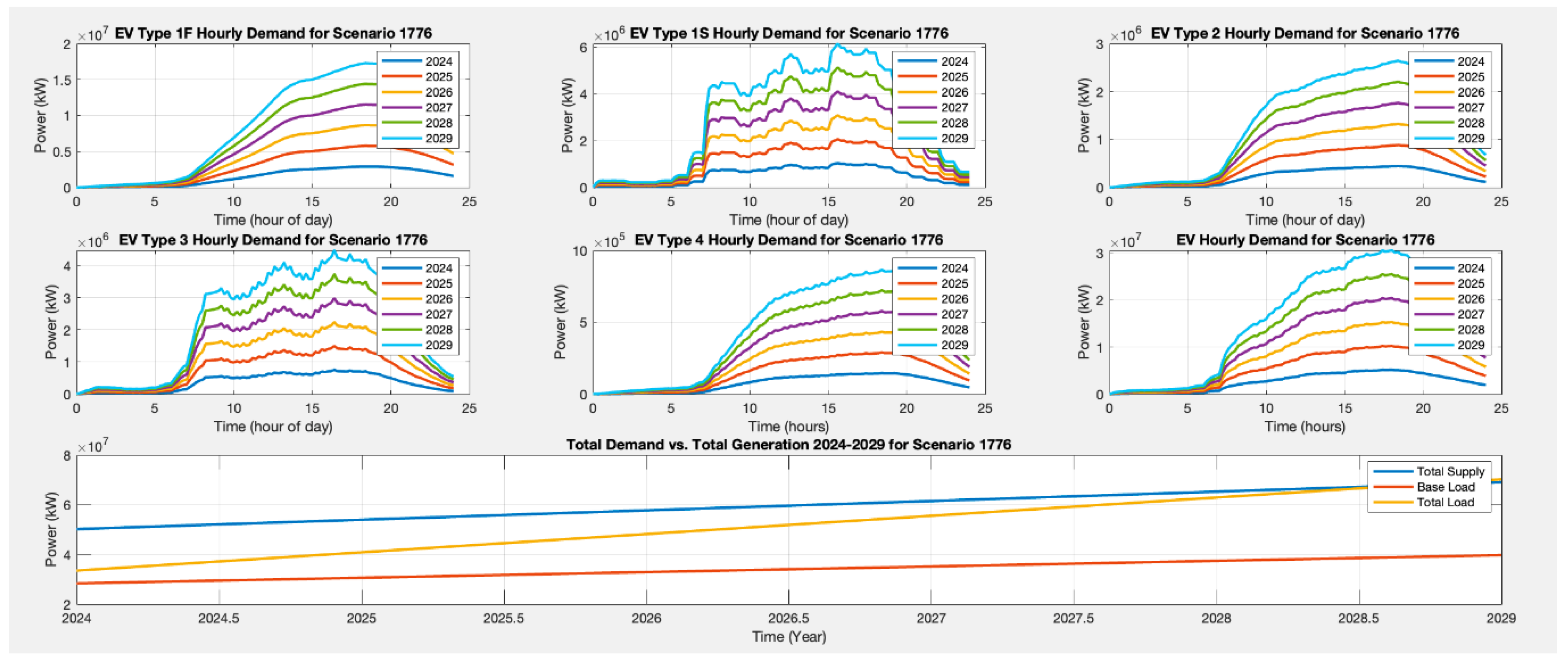

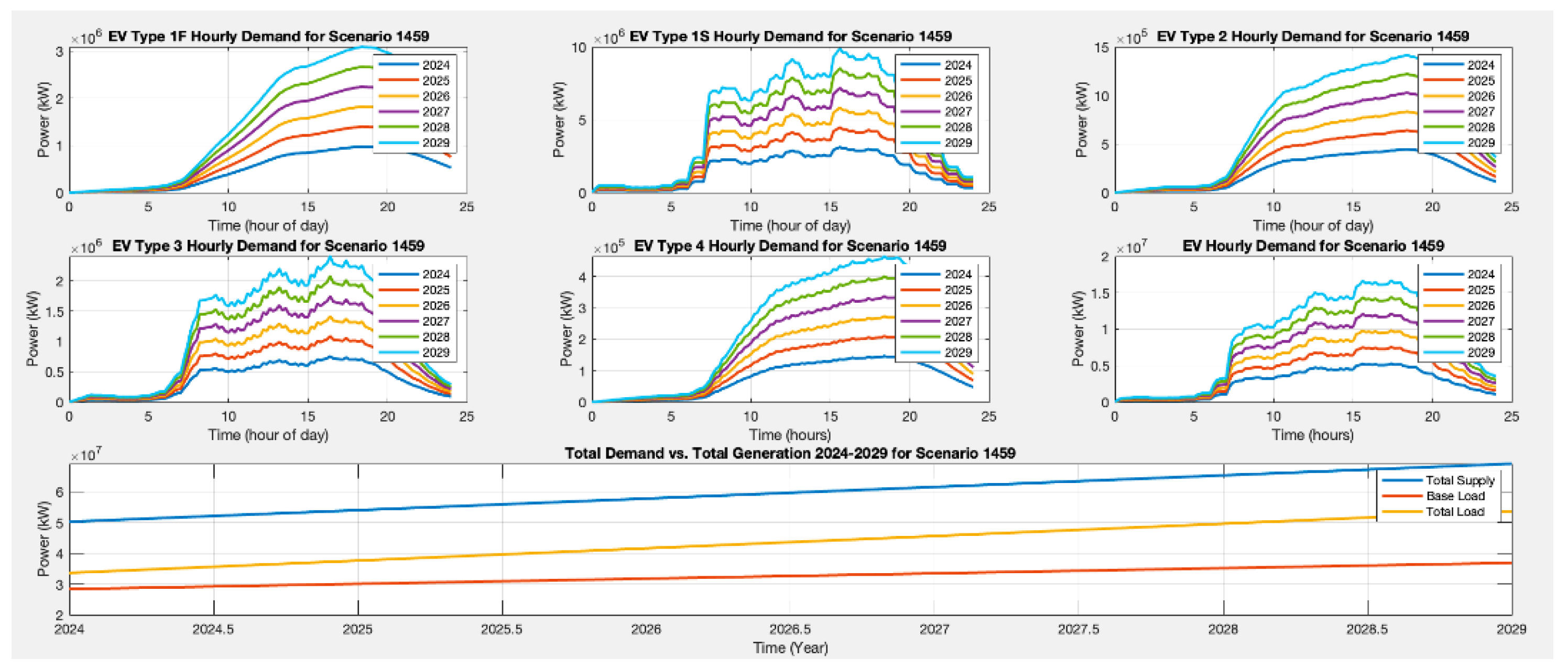

The hourly Demand for each EV type and the total power plant surplus/deficit are shown below:

Figure 15.

Best Scenario Output Graphs.

Figure 15.

Best Scenario Output Graphs.

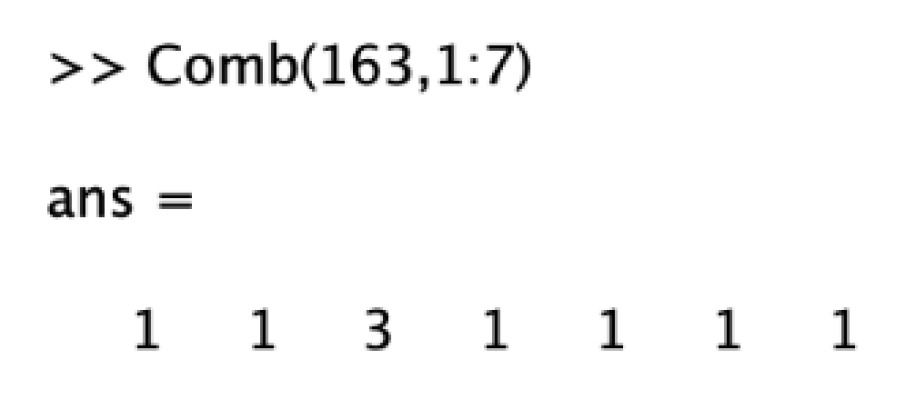

3.2. Worst Case Scenario

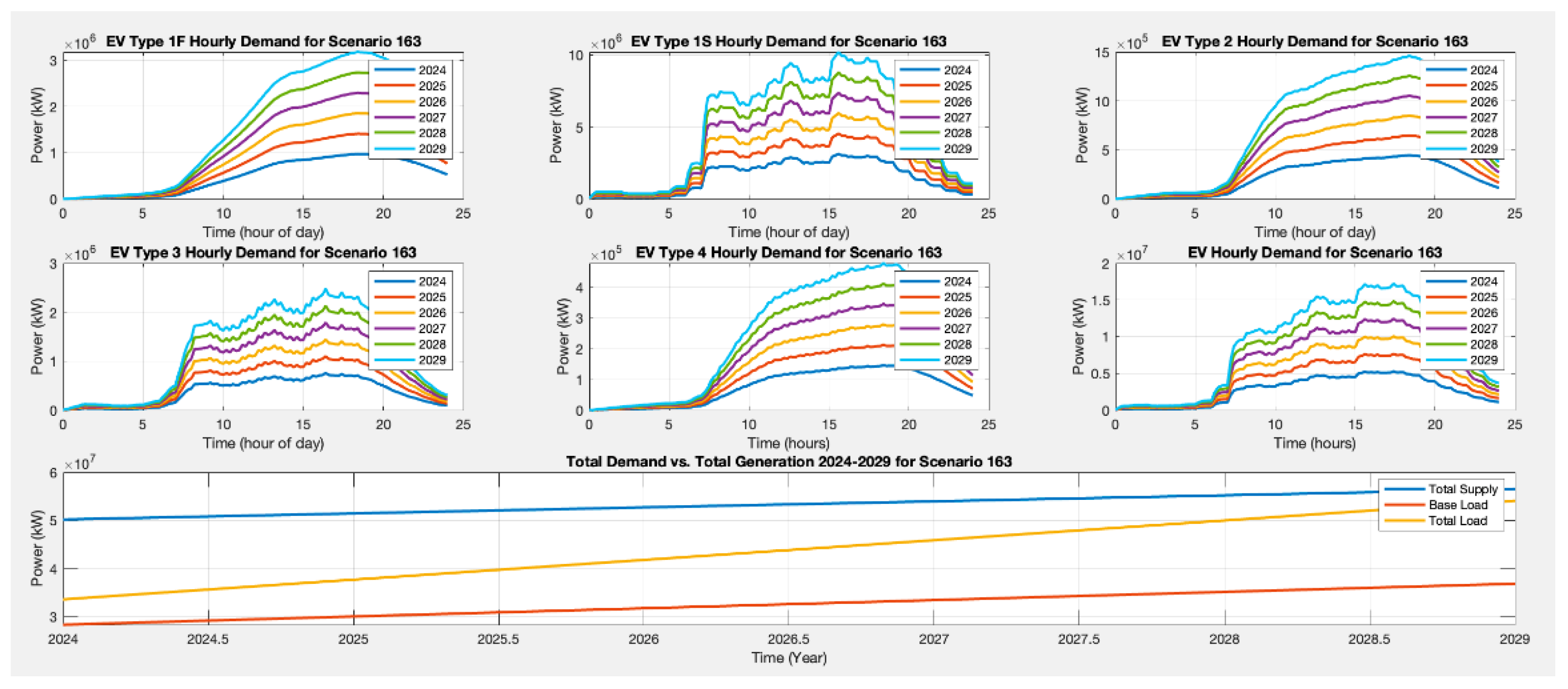

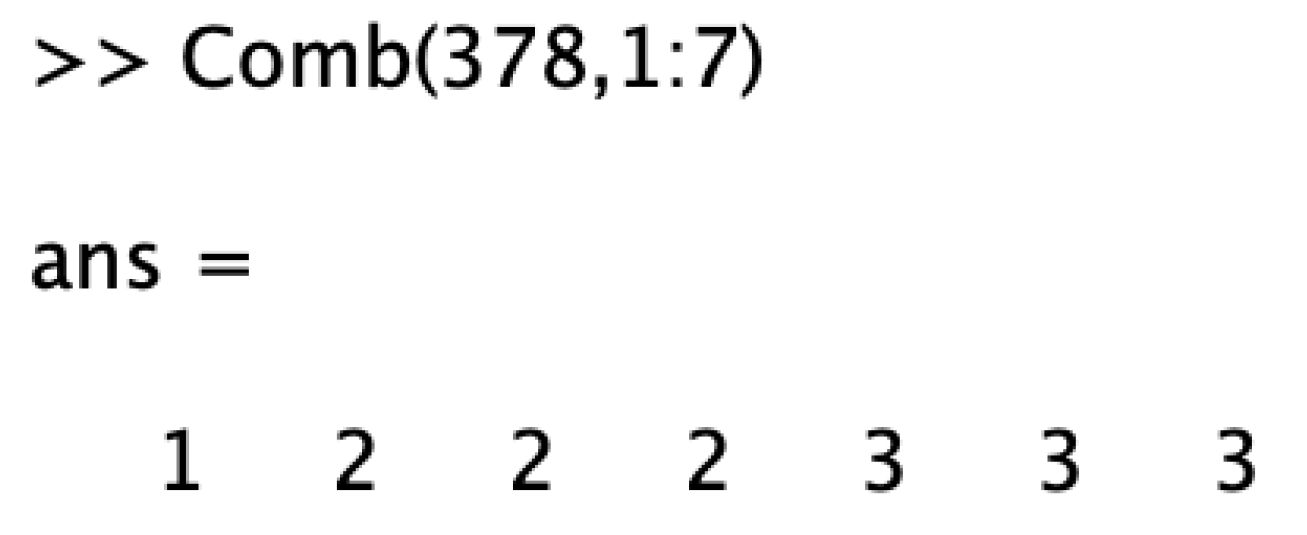

Based on the output simulation of 2187 scenarios for 2024-2029, the worst-case scenario was selected by sorting the scenarios with the least EV percentage in 2029. These scenarios were then re-sorted based on the highest cost allocation for supply adjustment or subsidy allocation. The worst-performing scenario was labeled 163. Its scenario permutation was 1131111 with the following input details (highlighted in blue):

Figure 16.

Worst Scenario Input Permutation.

Figure 16.

Worst Scenario Input Permutation.

Table 9.

Worst Scenario Inputs.

Table 9.

Worst Scenario Inputs.

| Power Plant Capacity Growth |

Base Peak Load Demand Growth |

Personal Vehicle Population Growth |

EV Attractiveness Growth |

Subsidy Impact on EV Attractiveness |

Vehicle Type Preferences |

Home-/Public Charging Preferences |

| Slow Growth |

Slow Growth |

Slow Growth |

Slow Growth |

Less Impact |

Luxury Oriented |

Public Charging Oriented |

| Predicted Growth |

Predicted Growth |

Predicted Growth |

Predicted Growth |

Balanced |

Balanced |

Balanced |

| Fast Growth |

Fast Growth |

Fast Growth |

Fast Growth |

High Impact |

Daily Oriented |

Home Charging Oriented |

This scenario resulted in supply and demand details below:

Table 10.

Worst Scenario Outputs.

Table 10.

Worst Scenario Outputs.

| Output |

Label in Simulation |

Value |

Units |

| Power Plan Capacity |

PowPlaCap |

56,481,750 |

kW |

| Base Peak Load Demand |

BasPeaLoa |

36,869,300 |

kW |

| Personal Vehicle Population |

TotVeh_n |

114,440,000 |

units |

| Total EV Percentage |

EndEVPer |

23.12 |

% |

| EV Type 1 Percentage |

EndEVPerTyp1 |

2 |

% |

| EV Type 2 Percentage |

EndEVPerTyp2 |

0.6 |

% |

| EV Type 3 Percentage |

EndEVPerTyp3 |

15 |

% |

| EV Type 4 Percentage |

EndEVPerTyp4 |

5 |

% |

| EV Peak Load Demand |

TotEVLoa |

17,222,000 |

kW |

| Total Peak Load Demand |

TotalLoad |

54,092,000 |

kW |

| Plant Capacity Surplus/Deficit |

PowPlaDef |

-2,390,100 |

kW |

| Cost Allocation for Supply |

RpYearlySup |

0 |

Rupiah |

| Cost Allocation for Subsidy |

RpYearlySub |

47,556,001,136,600 |

Rupiah |

The hourly Demand for each EV type and the total power plant surplus/deficit are shown below:

Figure 17.

Worst Scenario Output Graphs.

Figure 17.

Worst Scenario Output Graphs.

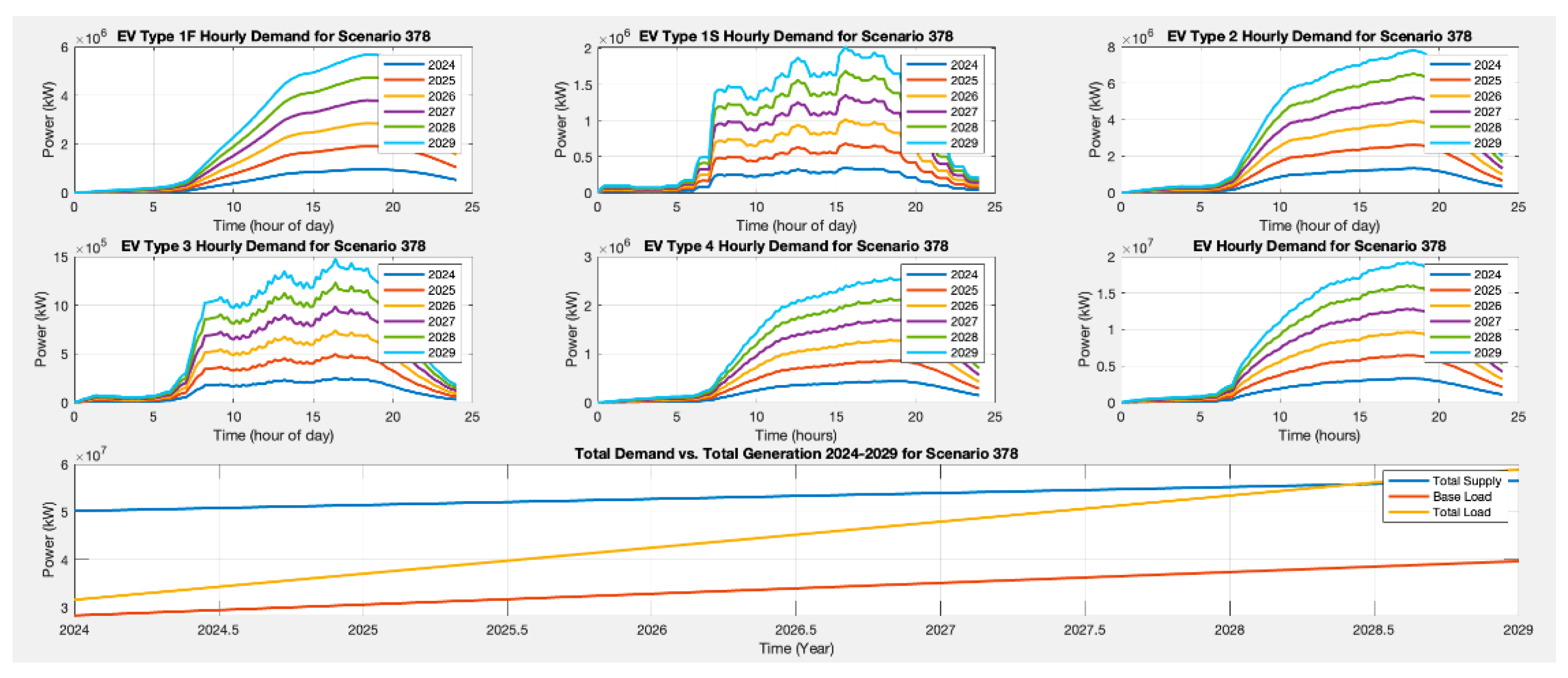

3.3. Most Probable Scenario

Another simulation result worth analyzing is the most probable scenario. This scenario was determined based on information collected during literature research. The growth of power plant capacity is expected to be slow due to PLN’s current oversupply issue [

48]. Normal predictions are made for base peak load demand, personal vehicle population, and EV attractiveness growth [

49]. According to a survey conducted by Indonesia Cerah in January 2024, subsidies are expected to have a high impact on EV attractiveness in Indonesia [

50]. In the last year, there has been a strong preference for budget daily cars, reflecting the direction of the Indonesian market [

51]. Home charging is strongly preferred over public charging [

52].

Table 11.

Most Probable Scenario Inputs.

Table 11.

Most Probable Scenario Inputs.

| Power Plant Capacity Growth |

Base Peak Load Demand Growth |

Personal Vehicle Population Growth |

EV Attractiveness Growth |

Subsidy Impact on EV Attractiveness |

Vehicle Type Preferences |

Home-/Public Charging Preferences |

| Slow Growth |

Slow Growth |

Slow Growth |

Slow Growth |

Less Impact |

Luxury Oriented |

Public Charging Oriented |

| Predicted Growth |

Predicted Growth |

Predicted Growth |

Predicted Growth |

Balanced |

Balanced |

Balanced |

| Fast Growth |

Fast Growth |

Fast Growth |

Fast Growth |

High Impact |

Daily Oriented |

Home Charging Oriented |

The scenario permutation of 1222333 (highlighted in blue) translates to Scenario label 378. This scenario resulted in a 42.98% EV percentage in 2029. In that year, there is a power plant capacity deficit of 2,397 MW. To achieve supply-demand balance, a cost allocation of Rp970,330,692,972 needs to be prepared.

Figure 18.

Most Probable Scenario Input Permutation.

Figure 18.

Most Probable Scenario Input Permutation.

Table 12.

Most Probable Scenario Outputs.

Table 12.

Most Probable Scenario Outputs.

| Output |

Label in Simulation |

Value |

Units |

| Power Plan Capacity |

PowPlaCap |

56,481,750 |

kW |

| Base Peak Load Demand |

BasPeaLoa |

39,705,400 |

kW |

| Personal Vehicle Population |

TotVeh_n |

109,950,000 |

units |

| Total EV Percentage |

EndEVPer |

42.98 |

% |

| EV Type 1 Percentage |

EndEVPerTyp1 |

1.3 |

% |

| EV Type 2 Percentage |

EndEVPerTyp2 |

3.8 |

% |

| EV Type 3 Percentage |

EndEVPerTyp3 |

9.5 |

% |

| EV Type 4 Percentage |

EndEVPerTyp4 |

28.4 |

% |

| EV Peak Load Demand |

TotEVLoa |

19,174,000 |

kW |

| Total Peak Load Demand |

TotalLoad |

58,879,000 |

kW |

| Plant Capacity Surplus/Deficit |

PowPlaDef |

2,397,600 |

kW |

| Cost Allocation for Supply |

RpYearlySup |

970,330,692,972 |

Rupiah |

| Cost Allocation for Subsidy |

RpYearlySub |

0 |

Rupiah |

The hourly Demand for each EV type and the total power plant surplus/deficit are shown below:

Figure 19.

Most Probable Scenario Output Graphs.

Figure 19.

Most Probable Scenario Output Graphs.

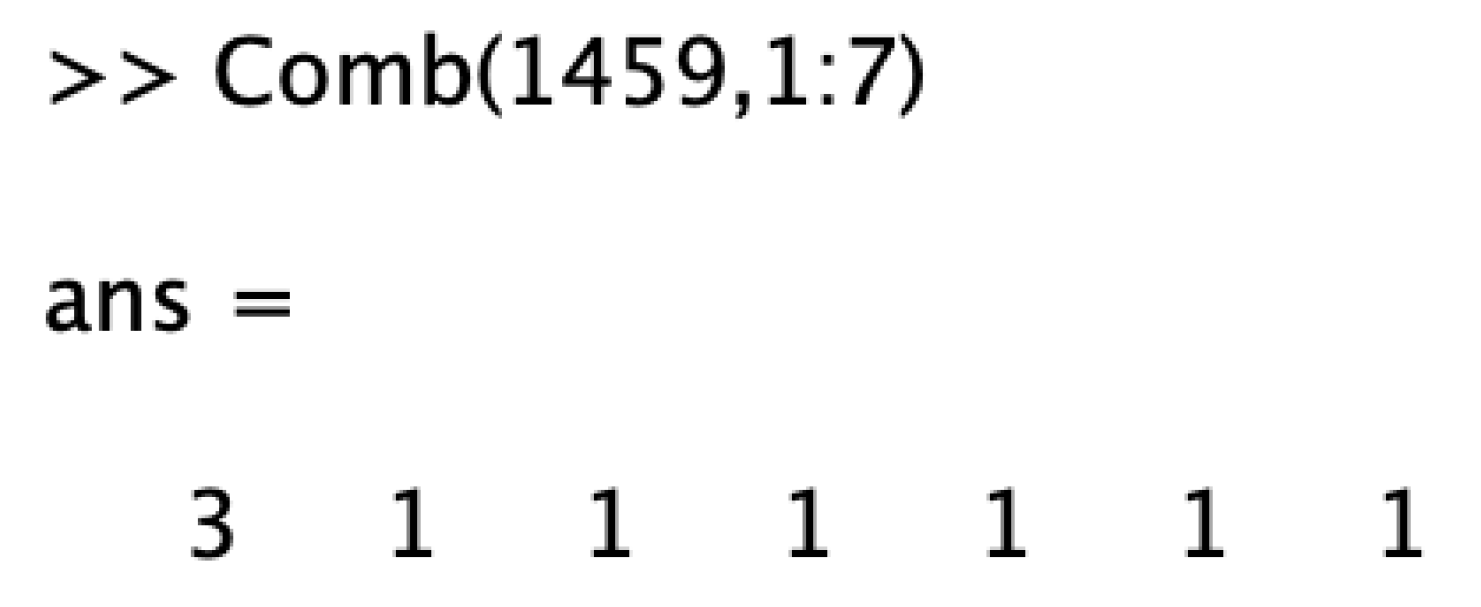

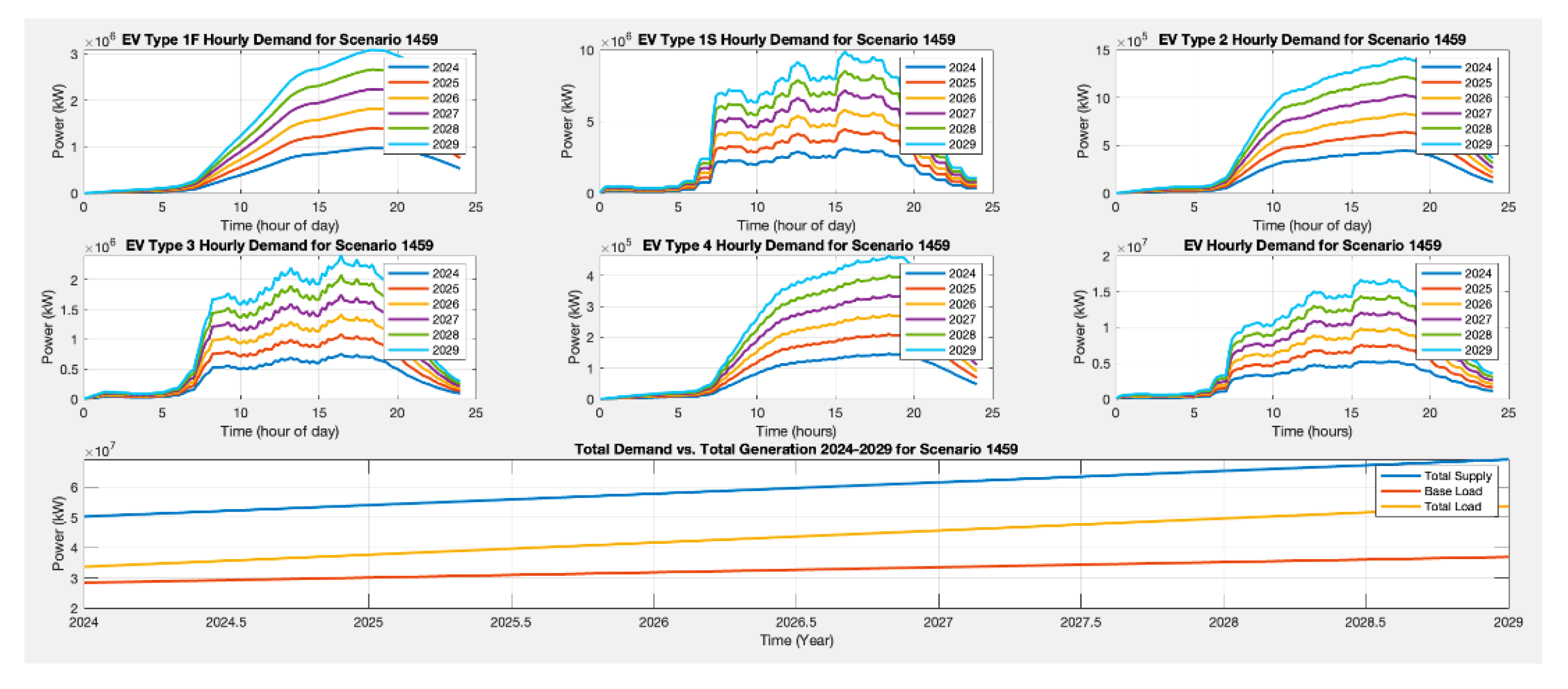

3.4. Least Probable Scenario

On the other hand, the least probable scenario, based on the literature review, features inputs that are the opposite of the most probable scenario. The inputs for scenario 1621 of 3111111 (highlighted in blue) are shown in the table below:

Table 13.

Least Scenario Inputs.

Table 13.

Least Scenario Inputs.

| Power Plant Capacity Growth |

Base Peak Load Demand Growth |

Personal Vehicle Population Growth |

EV Attractiveness Growth |

Subsidy Impact on EV Attractiveness |

Vehicle Type Preferences |

Home-/Public Charging Preferences |

| Slow Growth |

Slow Growth |

Slow Growth |

Slow Growth |

Less Impact |

Luxury Oriented |

Public Charging Oriented |

| Predicted Growth |

Predicted Growth |

Predicted Growth |

Predicted Growth |

Balanced |

Balanced |

Balanced |

| Fast Growth |

Fast Growth |

Fast Growth |

Fast Growth |

High Impact |

Daily Oriented |

Home Charging Oriented |

Figure 20.

Least Probable Scenario Input Permutation.

Figure 20.

Least Probable Scenario Input Permutation.

This scenario resulted in supply and demand details below:

Table 14.

Least Probable Scenario Outputs.

Table 14.

Least Probable Scenario Outputs.

| Output |

Label in Simulation |

Value |

Units |

| Power Plan Capacity |

PowPlaCap |

69,033,250 |

kW |

| Base Peak Load Demand |

BasPeaLoa |

36,869,300 |

kW |

| Personal Vehicle Population |

TotVeh_n |

105,460,000 |

units |

| Total EV Percentage |

EndEVPer |

24.32 |

% |

| EV Type 1 Percentage |

EndEVPerTyp1 |

2.1 |

% |

| EV Type 2 Percentage |

EndEVPerTyp2 |

0.7 |

% |

| EV Type 3 Percentage |

EndEVPerTyp3 |

16 |

% |

| EV Type 4 Percentage |

EndEVPerTyp4 |

5.3 |

% |

| EV Peak Load Demand |

TotEVLoa |

16,696,000 |

kW |

| Total Peak Load Demand |

TotalLoad |

53,566,000 |

kW |

| Plant Capacity Surplus/Deficit |

PowPlaDef |

-15,467,600 |

kW |

| Cost Allocation for Supply |

RpYearlySup |

0 |

Rupiah |

| Cost Allocation for Subsidy |

RpYearlySub |

45,475,187,899,827 |

Rupiah |

The hourly Demand for each EV type and the total power plant surplus/deficit are shown below:

Figure 21.

Least Scenario Output Graphs.

Figure 21.

Least Scenario Output Graphs.

4. Discussion and Conclusions

These simulation outputs should serve as predictive guidelines to forecast and take action to maintain the balance of supply and demand in Jamali’s power grid, considering the growth of electric vehicles and the impact of subsidies.

Based on the best scenario, the key to achieving a high EV percentage by 2029 with the lowest possible cost allocation is to have slow and controlled EV population growth while maximizing the subsidy impact on EV attractiveness and promoting home charging. Interestingly, the most probable scenario based on literature research closely approaches the best possible outcome. Having sufficient supply capacity and controlling the pace of slow and steady EV growth would lead to a higher EV percentage by 2029 with approximately half the yearly cost allocation between these two scenarios.

The worst scenario illustrates the adverse effects of rapid and unmanaged electric vehicle (EV) growth, coupled with low subsidy impact and a strong preference for public charging. This scenario results in a notably low EV percentage by 2029 and a high-cost allocation for subsidies. It serves as a cautionary example, highlighting the importance of strategic planning and policy implementation to steer EV adoption toward sustainable and balanced growth.

Due to constraints in data availability and simulation capability, variables such as dynamic population growth factors, dynamic peak load curves on weekends, and dynamic initial charging times (ICT) were not included in this simulation. These variables could be incorporated in future improvements to enhance the accuracy of the model. Improving the simulation’s inputs and considering additional variables should greatly increase its accuracy.

Author Contributions

Conceptualization, J.T. and R.D.; methodology, J.T. and R.D.; software, J.T.; validation, J.T. and R.D.; formal analysis, J.T. and R.D.; investigation, J.T. and R.D.; resources, J.T. and R.D.; data curation, J.T.; writing—original draft preparation, J.T.; writing—review and editing, J.T.; visualization, J.T.; supervision, R.D.; project administration, R.D.; funding acquisition, R.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Dissertation Research Grant for International Publication (Hibah Riset PUTI UI) no. NKB-339/UN2.RST/HKP.05.00/2022.

Data Availability Statement

We encourage all authors of articles published in MDPI journals to share their research data. In this section, please provide details regarding where data supporting reported results can be found, including links to publicly archived datasets analyzed or generated during the study. Where no new data were created, or where data is unavailable due to privacy or ethical restrictions, a statement is still required. Suggested Data Availability Statements are available in section “MDPI Research Data Policies” at

https://www.mdpi.com/ethics.

Acknowledgments

The authors would like to express their gratitude and appreciation to the Research and Development Department of the University of Indonesia (Risbang UI) for financing this study through the Dissertation Research Grant for International Publication (Hibah Riset PUTI UI) no. NKB-339/UN2.RST/HKP.05.00/2022.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A – Simulation Input Excel Data

Figure A1.

Screen capture of the initial input excel data.

Figure A1.

Screen capture of the initial input excel data.

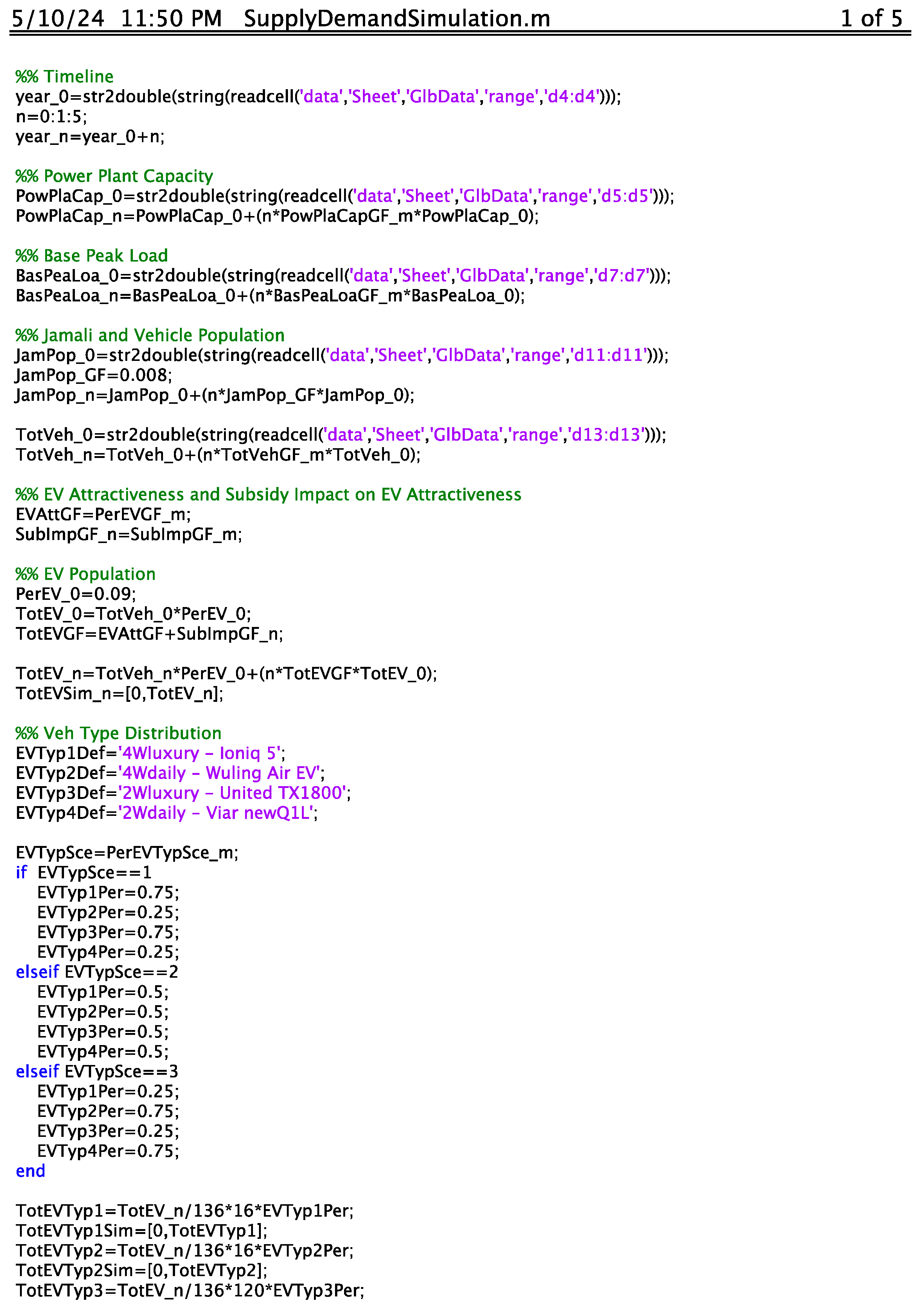

Appendix B – MATLAB Scripts (Supply Demand Simulation)

Figure B1.

Supply-demand simulation script page 1 of 5.

Figure B1.

Supply-demand simulation script page 1 of 5.

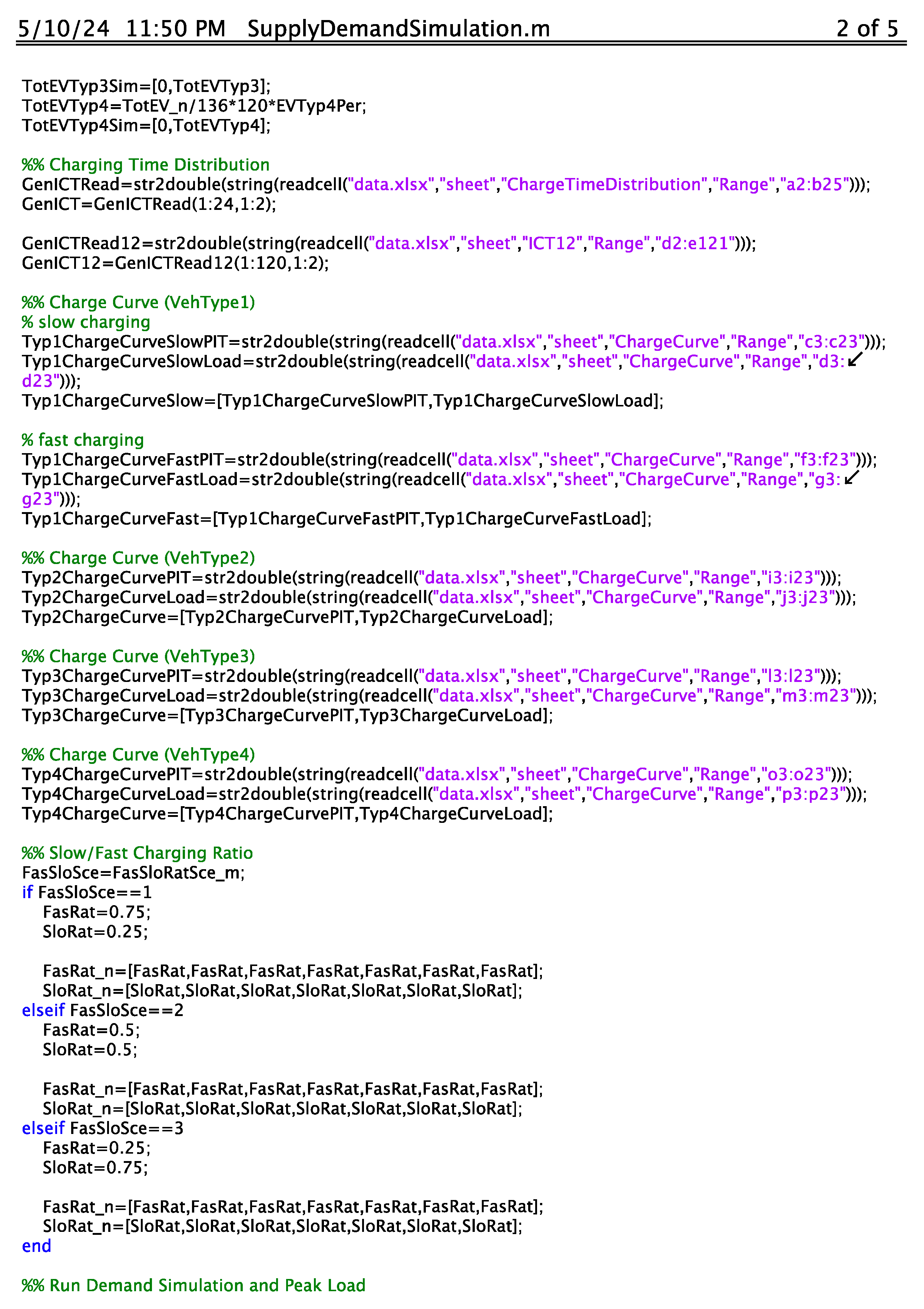

Figure B2.

Supply-demand simulation script page 2 of 5.

Figure B2.

Supply-demand simulation script page 2 of 5.

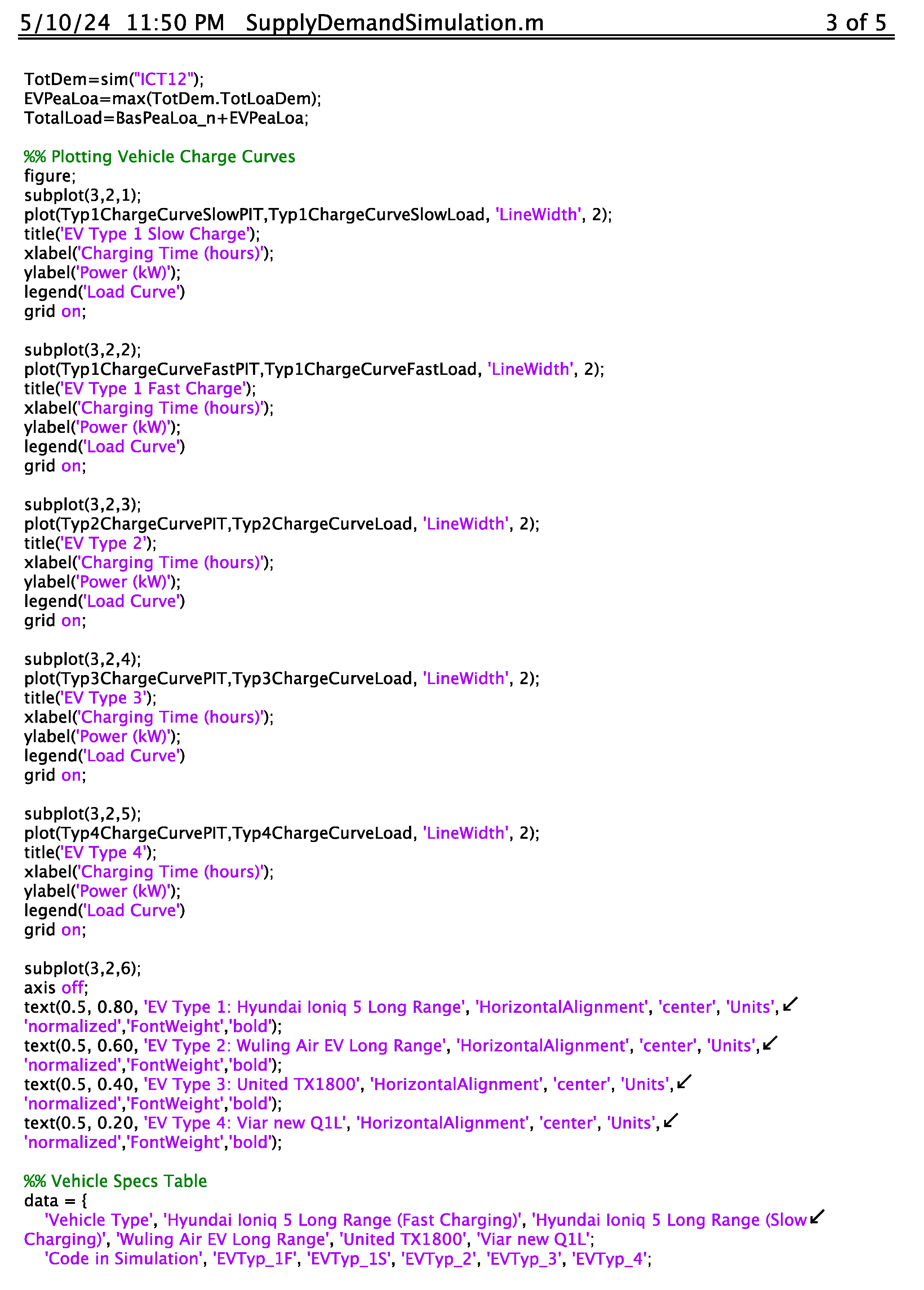

Figure B3.

Supply-demand simulation script page 3 of 5.

Figure B3.

Supply-demand simulation script page 3 of 5.

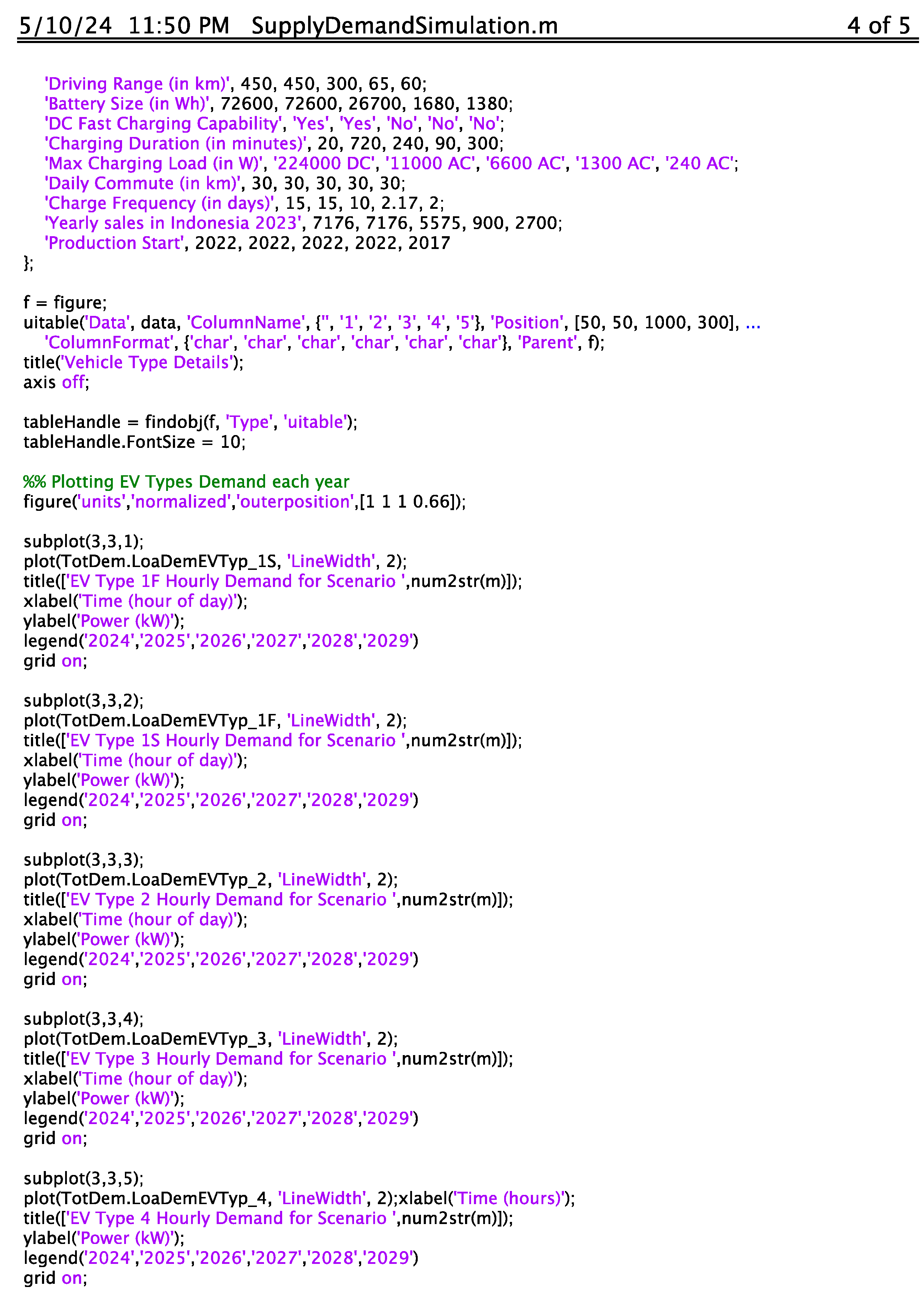

Figure B4.

Supply-demand simulation script page 4 of 5.

Figure B4.

Supply-demand simulation script page 4 of 5.

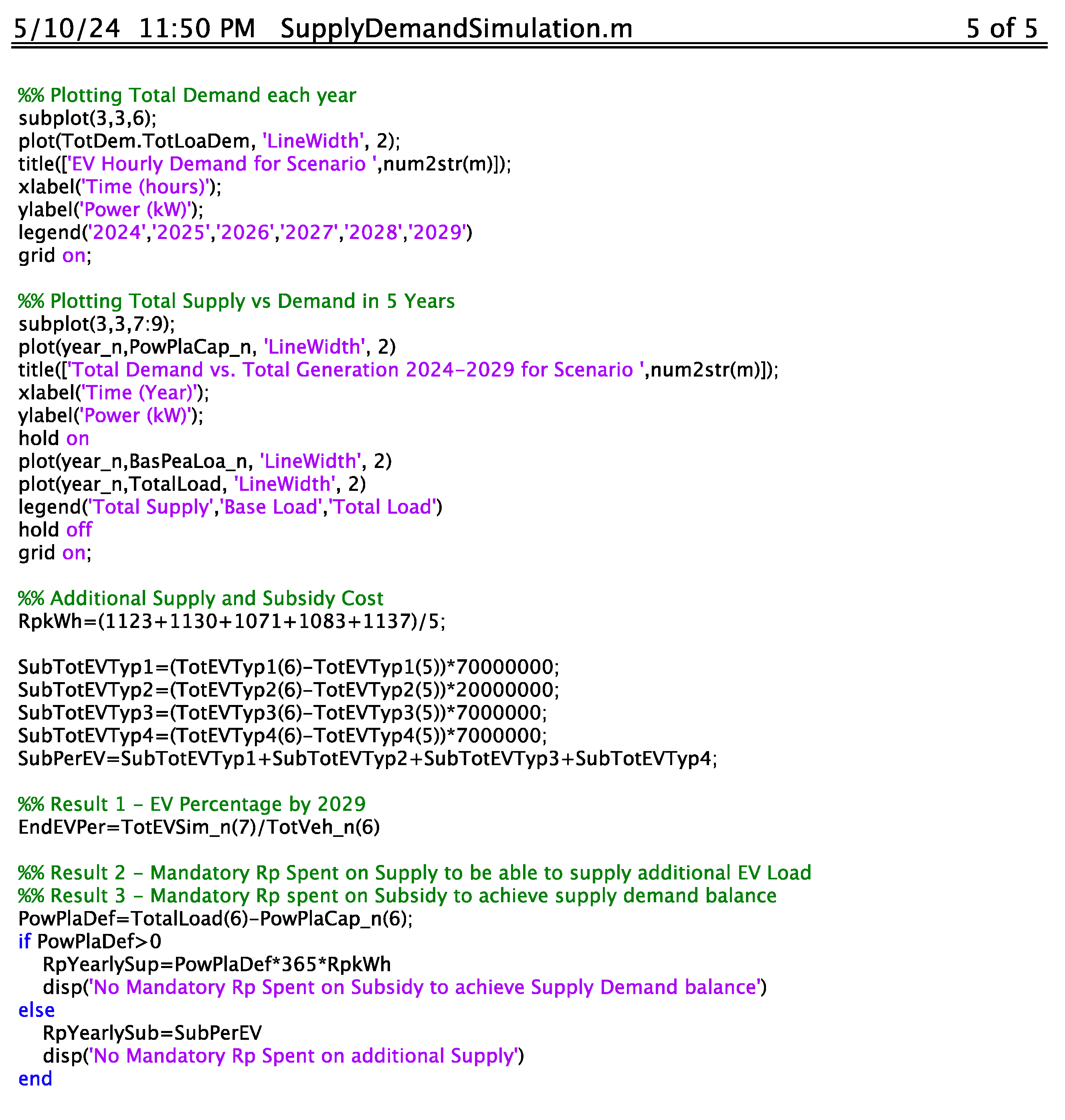

Figure B5.

Supply-demand simulation script page 4 of 5.

Figure B5.

Supply-demand simulation script page 4 of 5.

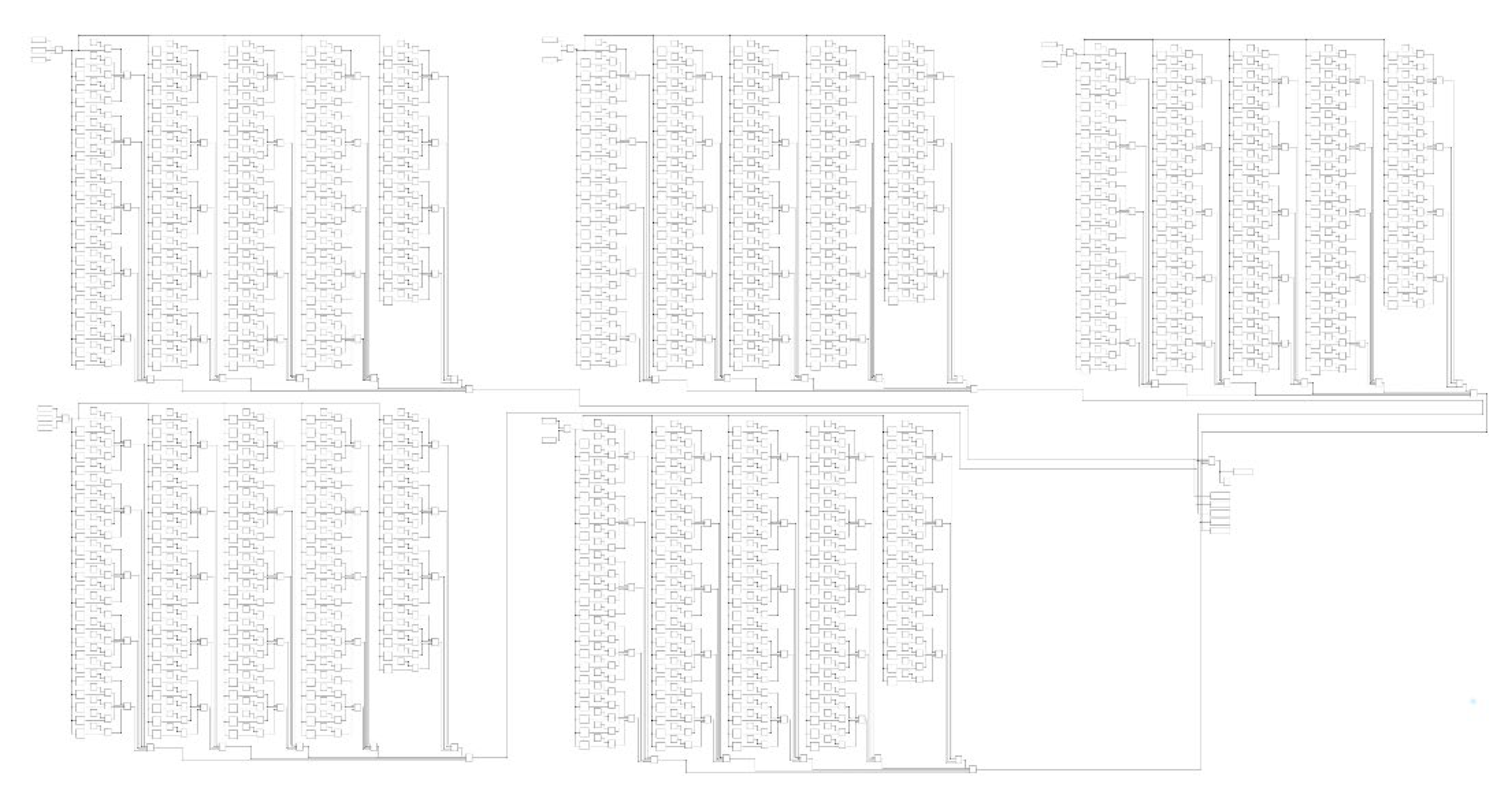

Appendix C – MATLAB Scripts (Global Simulation)

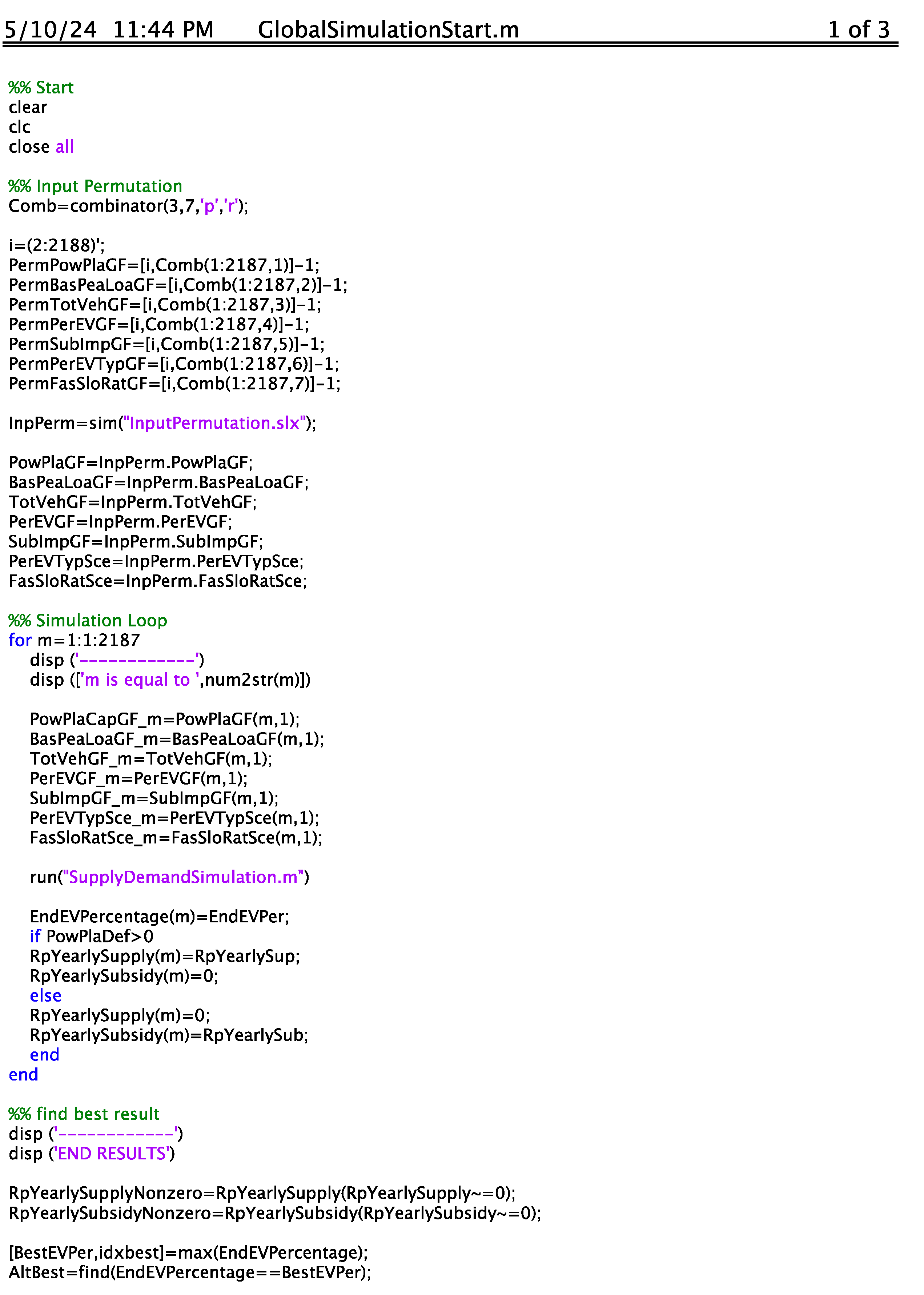

Figure C1.

Global simulation script page 1 of 3.

Figure C1.

Global simulation script page 1 of 3.

Figure C2.

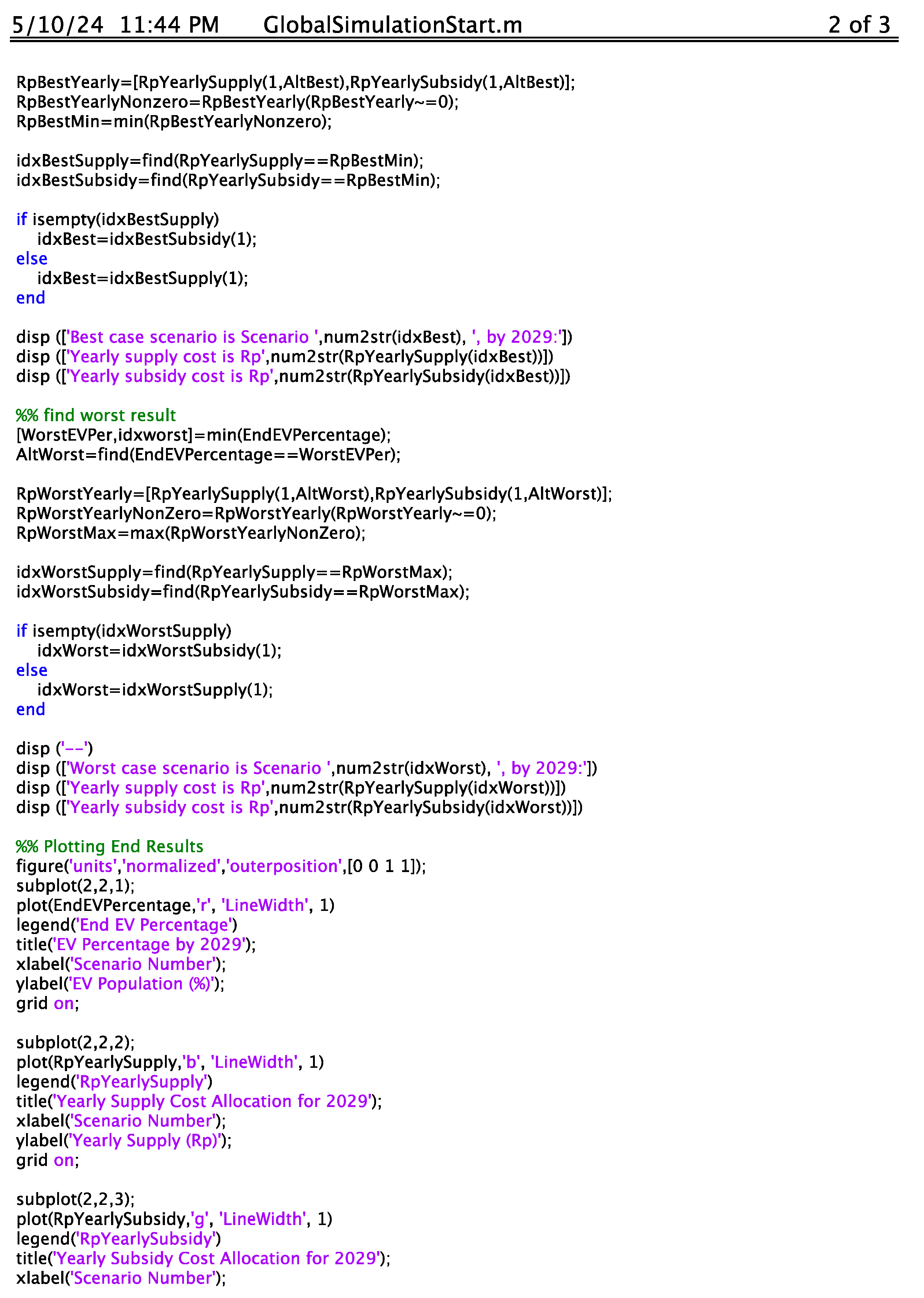

Global simulation script page 2 of 3.

Figure C2.

Global simulation script page 2 of 3.

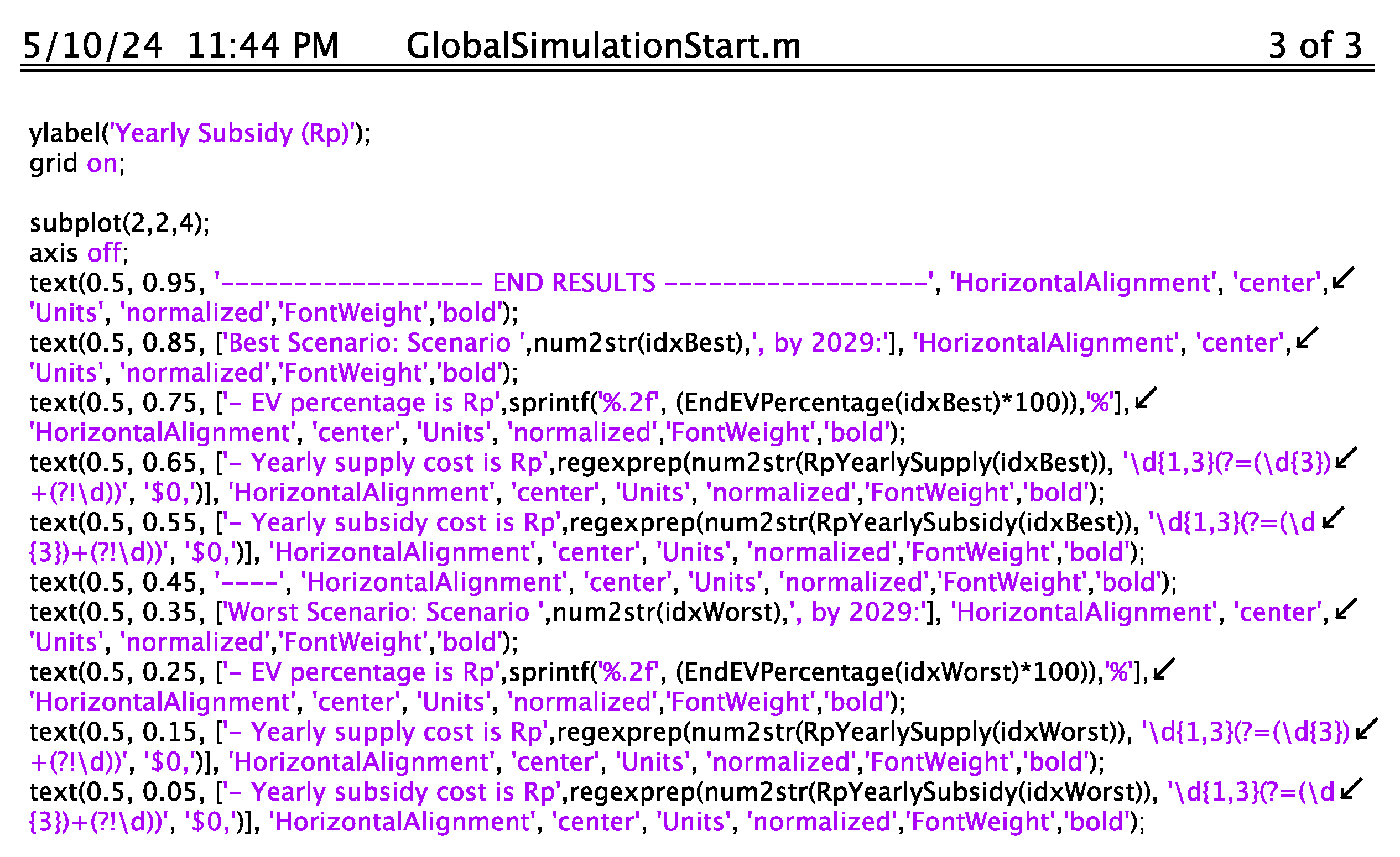

Figure C3.

Global simulation script page 3 of 3.

Figure C3.

Global simulation script page 3 of 3.

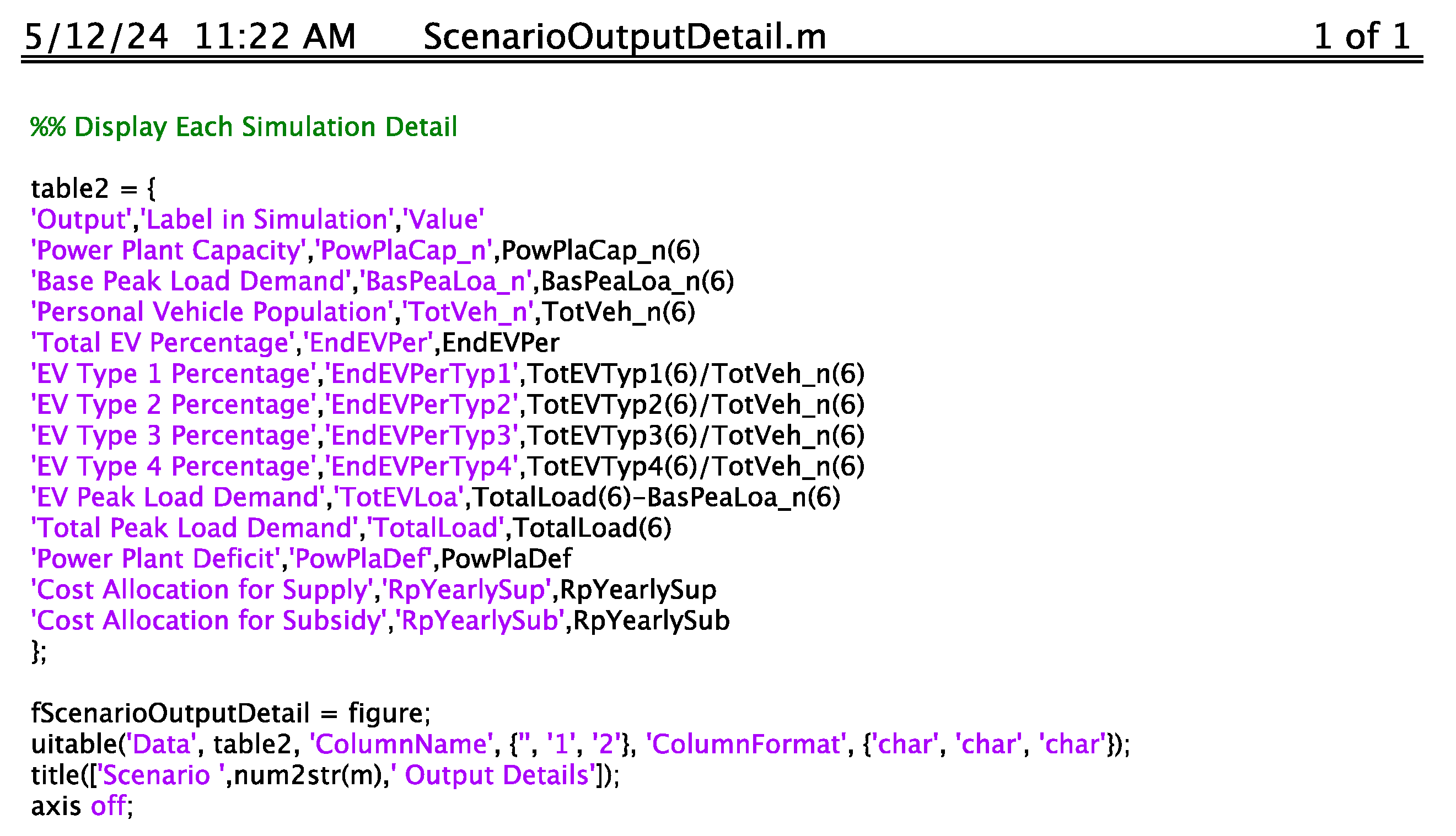

Appendix D – MATLAB Script (Scenario Output Details)

Figure D1.

Scenario Output Details Script.

Figure D1.

Scenario Output Details Script.

Appendix E – Simulink Model (Supply Demand Simulation)

Figure E1.

Simulink Model for Demand Simulation 1.

Figure E1.

Simulink Model for Demand Simulation 1.

Figure E2.

Simulink Model for Demand Simulation 2.

Figure E2.

Simulink Model for Demand Simulation 2.

Figure E3.

Simulink Model for Demand Simulation 3.

Figure E3.

Simulink Model for Demand Simulation 3.

Figure E4.

Simulink Model for Demand Simulation 4.

Figure E4.

Simulink Model for Demand Simulation 4.

Appendix F – Simulink Model (Input Permutation)

Figure F1.

Simulink Model Input Permutation.

Figure F1.

Simulink Model Input Permutation.

Appendix G – Results Data and Graphs

Figure G1.

EV Charge Curves.

Figure G1.

EV Charge Curves.

Figure G2.

EV Type Specifications.

Figure G2.

EV Type Specifications.

Figure G3.

Scenario Output Graphs.

Figure G3.

Scenario Output Graphs.

Figure G4.

Scenario Output Details.

Figure G4.

Scenario Output Details.

Figure G5.

Global Simulation Output Graphs.

Figure G5.

Global Simulation Output Graphs.

References

- PT. PLN (Persero). Statistik PLN 2023; PT. PLN (Persero): Jakarta, Indonesia, 2024; pp. 1.

- Badan Pusat Statistik: Jumlah Kendaraan Bermotor Menurut Provinsi dan Jenis Kendaraan (unit), 2022. Available online: https://www.bps.go.id/id/statistics-table/3/VjJ3NGRGa3dkRk5MTlU1bVNFOTVVbmQyVURSTVFUMDkjMw==/jumlah-kendaraan-bermotor-menurut-provinsi-dan-jenis-kendaraan--unit---2022.html?year=2022 (accessed on 8 May 2024).

- PT. PLN (Persero). Rencana Usaha Penyediaan Tenaga Listrik (RUPTL) 2021-2030; PT. PLN (Persero): Jakarta, Indonesia, 2021; p. V-4, V-15. [Google Scholar]

- Indonesia, Pemerintah Pusat. Undang-undang (UU) Nomor 42 Tahun 2008 tentang Pemilihan Umum Presiden dan Wakil Presiden; Pemerintah Pusat: Jakarta, Indonesia, 2008; p. 5. [Google Scholar]

- PT. PLN (Persero). Rencana Usaha Penyediaan Tenaga Listrik (RUPTL) 2021-2030; PT. PLN (Persero): Jakarta, Indonesia, 2021; p. IV-2. [Google Scholar]

- Direktorat Jenderal Kependudukan dan Catatan Sipil. Laporan Tahun 2022, Indonesia, 2022.

- PT. PLN (Persero). Statistik PLN 2014; PT. PLN (Persero): Jakarta, Indonesia. 2015.

- PT. PLN (Persero). Statistik PLN 2015; PT. PLN (Persero): Jakarta, Indonesia. 2016.

- PT. PLN (Persero). Statistik PLN 2016; PT. PLN (Persero): Jakarta, Indonesia. 2017.

- PT. PLN (Persero). Statistik PLN 2017; PT. PLN (Persero): Jakarta, Indonesia. 2018.

- PT. PLN (Persero). Statistik PLN 2018; PT. PLN (Persero): Jakarta, Indonesia. 2019.

- PT. PLN (Persero). Statistik PLN 2019; PT. PLN (Persero): Jakarta, Indonesia. 2020.

- PT. PLN (Persero). Statistik PLN 2020; PT. PLN (Persero): Jakarta, Indonesia. 2021.

- PT. PLN (Persero). Statistik PLN 2021; PT. PLN (Persero): Jakarta, Indonesia. 2022.

- PT. PLN (Persero). Statistik PLN 2022; PT. PLN (Persero): Jakarta, Indonesia. 2023.

- PT. PLN (Persero). Statistik PLN 2022; PT. PLN (Persero): Jakarta, Indonesia, 2023; p. 3. [Google Scholar]

- H.B.T.; D.F.H. The Challenges and Opportunities of Renewable Energy Source (RES) Penetration in Indonesia: Case Study of Java-Bali Power System. MDPI energies 2020, pp. 11.

- Indonesia, Pemerintah Pusat. Peraturan Presiden (Perpres) Nomor 79 Tahun 2023 tentang Perubahan atas Peraturan Presiden Nomor 55 Tahun 2019 tentang Percepatan Program Kendaraan Bermotor Listrik Berbasis Baterai (Battery Electric Vehicle) untuk Transportasi Listrik; Pemerintah Pusat; Jakarta, Indonesia, 2023.

- The Association of Indonesia Automotive Industries, Indonesian Automotive Industry Data 2023; GAIKINDO; Indonesia, 2024.

- PT. PLN: Press Release No. 047.PR/STH.00.01/II/2024. Available online: https://web.pln.co.id/cms/media/siaran-pers/2024/02/lebih-dari-1-100-spklu-tersedia-pln-siap-layani-mobilitas-ev-di-hari-h-pemilu-2024/ (accessed on 5 May 2024).

- Indonesia, Pemerintah Daerah Khusus Ibukota Jakarta. Peraturan Gubernur (PERGUB) Provinsi Daerah Khusus Ibukota Jakarta Nomor 88 Tahun 2019 tentang Perubahan atas Peraturan Gubernur Nomor 155 Tahun 2018 tentang Pembatasan Lalu Lintas dengan Sistem Ganjil Genap, 2019.

- Indonesia, Kementrian Keuangan. Peraturan Menteri Keuangan Nomor 10 Tahun 2024 tentang Perubahan Atas Peraturan Menteri Keuangan Nomor 26/PMK.010/2022 tentang Penetapan Sistem Klasifikasi Barang Dan Pembebanan Tarif Bea Masuk Atas Barang Impor, 2024.

- Kementrian Perdagangan Republik Indonesia. Surat Edaran Nomor 03 Tahun 2023 tentang Penyediaan Stasiun Pengisian Kendaraan Listrik Umum dan Pemberian Tempat Parkir Prioritas Untuk Kendaraan Bermotor Listrik Berbasis Baterai (Battery Electrical Vehicle) di Pusat Perbelanjaan; Indonesia, 2023.

- Indonesia, Kementrian Keuangan. Peraturan Menteri Keuangan Nomor 38 Tahun 2023 tentang Pajak Pertambahan Nilai atas Penyerahan Kendaraan Bermotor Listrik Berbasis Baterai Roda Empat Tertentu dan Kendaraan Bermotor Listrik Berbasis Baterai Bus Tertentu yang Ditanggung Pemerintah Tahun Anggaran 2023; Jakarta, 2023.

- Indonesia, Kementrian Perindustrian. Peraturan Menteri Perindustrian Nomor 6 Tahun 2023 tentang Pedoman Pemberian Bantuan Pemerintah untuk Pembelian Kendaraan Bermotor Listrik Berbasis Baterai Roda Dua; Jakarta, 2023.

- M.U; N.M.H. The effect of vehicle-to-grid integration on power grid stability: A review. IOP Conference Series: Earth and Environmental Science 2023. [CrossRef]

- D. L; Y.L. An Application Designed for Guiding the Coordinated Charging of Electric Vehicles. MDPI sustainability 2023. [Google Scholar] [CrossRef]

- M.Z; N.F.A. Reinforcement Learning-Enabled Electric Vehicle Load Forecasting for Grid Energy Management. MDPI mathematics 2023. [CrossRef]

- J. F.; X.C. Electric Vehicle Charging Load Prediction Model Considering Traffic Conditions and Temperature. MDPI processes 2023. [Google Scholar] [CrossRef]

- W. K.; W.S. Comparison of electric vehicle load forecasting across different spatial levels with incorporated uncertainty estimation. Elsevier Energy 2023. [CrossRef]

- P.J.; Y.S. Predicting and Managing EV Charging Demand on Electrical Grids: A Simulation-Based Approach. MDPI energies 2023. [CrossRef]

- Badan Pusat Statistik: Perkembangan Jumlah Kendaraan Bermotor Menurut Jenis (Unit), 2021-2022. Availaible online: https://www.bps.go.id/id/statistics-table/2/NTcjMg==/perkembangan-jumlah-kendaraan-bermotor-menurut-jenis--unit-.html (accessed on 6 April 2024).

- Kementrian Perhubungan. Populasi Kendaraan Listrik di Indonesia berdasarkan Registrasi Uji Tipe; Jakarta, 2023.

- H.J.W; B.W. Charging Load Forecasting of Electric Vehicle Based on Charging Frequency. IOP Conference Series: Earth and Environmental Science 2019.

- Hyundai Ioniq Specification. Available online: https://www.hyundai.com/id/id/find-a-car/ioniq5/specification (accessed on 1 April 2024).

- W.A.K; S. The Commuting Pattern Analysis Of Commuters From Depok City West Java. Jurnal UNJ 2020, pp. 4.

- Inside EV: Hyundai Ioniq 5 Amazes: Real Fast Charging Session Data Analyzed. Available online: https://insideevs.com/news/503522/hyundai-ioniq5-fast-charging-analysis/ (accessed on 3 April 2024).

- Wuling Air Specification. Available online: https://wuling.id/id/air-ev?product_id=18 (accessed on 5 April 2024).

- United TX1800 Specification. Available online: https://unitedmotor.co.id/product/tx1800/ (accessed on 5 April 2024).

- Viar new Q1L Specification. Available online: https://viarmotor.com/subsidi-motor-listrik-viar-new-q1/ (accessed on 5 April 2024).

- Badan Pusat Statistik: Jumlah Kendaraan Bermotor Menurut Provinsi dan Jenis Kendaraan (unit), 2019. Available online: https://www.bps.go.id/id/statistics-table/3/VjJ3NGRGa3dkRk5MTlU1bVNFOTVVbmQyVURSTVFUMDkjMw==/jumlah-kendaraan-bermotor-menurut-provinsi-dan-jenis-kendaraan--unit---2019.html?year=2019 (accessed on 5 May 2024).

- Badan Pusat Statistik: Jumlah Kendaraan Bermotor Menurut Provinsi dan Jenis Kendaraan (unit), 2020. Available online: https://www.bps.go.id/id/statistics-table/3/VjJ3NGRGa3dkRk5MTlU1bVNFOTVVbmQyVURSTVFUMDkjMw==/jumlah-kendaraan-bermotor-menurut-provinsi-dan-jenis-kendaraan--unit---2020.html?year=2020 (accessed on 5 May 2024).

- Badan Pusat Statistik: Jumlah Kendaraan Bermotor Menurut Provinsi dan Jenis Kendaraan (unit), 2020. Available online: https://www.bps.go.id/id/statistics-table/3/VjJ3NGRGa3dkRk5MTlU1bVNFOTVVbmQyVURSTVFUMDkjMw==/jumlah-kendaraan-bermotor-menurut-provinsi-dan-jenis-kendaraan--unit---2021.html?year=2021 (accessed on 5 May 2024).

- I.S.; I.G.A.A. Private car ownership in Indonesia: Affecting factors and policy strategies. Elsevier TRIP, 2023.

- Bloomberg Newsletter: Electric Vehicle Market Looks Headed for 22% Growth This Year. Available online: https://www.bloomberg.com/news/newsletters/2024-01-09/electric-vehicle-market-looks-headed-for-22-growth-this-year (accessed on 1 May 2024).

- U.J. Introduction to Mathematical Probability; McGraw-Hill, New York, 1937.

- PT. PLN (Persero). Statistik PLN 2021; PT. PLN (Persero): Jakarta, Indonesia, 2022, pp. 77.

- E.H.; P.A. Indonesia Wants to Go Greener, but PLN Is Stuck With Excess Capacity From Coal-Fired Power Plants; IEEFA, 2021, pp. 2,4.

- G.W.J.: The 2010 – 2035 Indonesian Population Projection; UNFPA, Indonesia.

- Indonesia Cerah. Survey Kebijakan Transisi Energi Berkeadilan; 2024.

- VERO. The Road to Southeast Asia; 2023.

- IESR. Indonesia Electric Vehicle Outlook 2023; IESR, Indonesia, 2023; pp. 27.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).