1. Introduction

Electric vehicle sales are increasing rapidly starting with COVID-19 in 2020, accelerating the spread in the market. According to the International Energy Agency, global electric vehicle sales in 2022 reached over 26 million units, about more than eleven times the growth from just 2.2 million in 2013 [

1]. After Toyota Motor Corp. introduced the world’s first hybrid passenger car through Prius in 1997, brands that only produce electric vehicles such as Tesla and Lucid have emerged, and traditional automobile OEM brands are also trying to catch the rapidly growing electric vehicle market by introducing various electric vehicle lines. In particular, in China, the world’s largest electric vehicle market, various electric vehicle start-ups such as Xiaopeng, Li Xiang, and Nio have emerged, competing with foreign electric vehicle brands such as Tesla.

Battery, the core of electric vehicles, is one of the important areas for national economy and technological competitiveness as it is included in the government’s national affairs as a future strategic industry [

2]. In particular, as the international political and economic order, such as the U.S.-China trade dispute, has rapidly changed in recent years, there is a growing sense of crisis that the global value chain (GVC) may become unstable. As a result, there is a clear reshoring movement in major countries such as the United States and the EU to foster and strengthen national strategic industries such as semiconductors and batteries in their own countries. In this situation, it is time for Korea to consider policies on how to foster the battery industry.

In particular, demand for battery raw materials has also increased due to inflation and increased supply of electric vehicles after COVID-19, leading to a sharp rise in prices such as lithium and nickel [

3]. According to a White House report, the demand for lithium and graphite is expected to increase by 4,000% by 2040, with China controlling 55% of the world’s rare minerals as of 2020 and 85% of the rare minerals’ re-renewable sector, China’s influence will continue in the future [

4]. Korea also needs several strategies for stable supply and demand for electric vehicle battery production in the future, and in this regard, recycling of waste batteries is attracting new attention.

The global demand for lithium-ion batteries is expected to explode to 4,500 gigawatt hours (GWh) by 2030, and the demand for lithium-ion batteries is expected to grow more than 32% annually from 2015 to 2030. In addition, the demand for batteries used for mobility is overwhelmingly high compared to the demand for batteries used in power storage and home appliances [

5].

Interest in recycling waste batteries after production of electric vehicle batteries is also increasing. Vehicle batteries can be made into new battery packs after mass production of cells and used in electric vehicles, and old battery packs can be discarded or sent to recycling companies to recycle at a limited capacity, or used to produce new batteries after extracting and reprocessing raw materials from waste batteries [

6].

This study aims to analyze patent trends through the collection and analysis of patent data related to waste batteries. Through this, we want to analyze the trend of applications by year, trend of multiple applicants, trend by detailed technology, trend of domestic and foreign patent applications, and IP portfolios of major players, and explore the future direction for finding promising technologies in the waste battery field.

2. Literature Review

Key technologies in recycling waste batteries are secondary battery collection and dismantling technology, lithium salt selective extraction technology, metal salt selective extraction technology, battery condition monitoring, recycling material purification technology, and mixing technology between recycled materials and existing materials. If this is extended to the reuse of waste batteries in electric vehicles, related core technologies include secondary battery diagnostic technologies and equipment, reusable waste battery pack separation methods, optimal operation technologies of reusable batteries, and secondary battery pack manufacturing technologies.

The paper on battery recycling can be summarized into three main topics: the process of battery recycling (dry, wet, etc.) and recycling materials (lithium-ion metal extraction), the economic effects of battery recycling and new techniques.

First, the papers on the approach to the battery recycling process are as follows. Focusing on the recycling process of Li-ion batteries, there is a study that comprehensively organizes cutting-edge technologies for lithium-ion battery recycling, focusing on pretreatment, water supply recycling, and direct regeneration of anode materials [

7]. Next, it is analyzed from the perspective of battery life cycle and integration into the recycling process [

8], and by analyzing the recycling process using a systematic literature review method, it is emphasized that there is a lack of research on lithium-ion battery recycling in the existing literature [

9].

Second, papers on battery recycled materials are as follows. In the application of mineral treatment for battery recycling, mineral treatment processes such as grinding, sieving and self-separation are important to recycle lithium-ion batteries, but these processes should pay attention to the loss and high cost of valuable battery parts [

10]. Metal extraction and pretreatment for recycling metal from spent lithium-ion batteries are a key part of the recycling process of lithium-ion batteries, and although these methods face challenges such as environmental impact and cost, recycling can be carried out using pyrometallurgy and hydrometalurgy technologies [

11]. Finally, from the viewpoint of evaluating the life cycle of battery recycling, recycling different cell chemicals in lithium-ion batteries can significantly reduce environmental impact, and the biggest advantage can be seen in recycling lithium nickel manganese cobalt oxide type batteries due to the recovery of cobalt and nickel [

12].

Third, the papers on the economic effects and new techniques of battery recycling are as follows. With the recent development of battery recycling technology, recycling of spent batteries, including lead-acid and lithium-ion types, focuses on pro-metallic and hydrometal processes, and the future task is high cost and secondary pollution [

13]. Next, in terms of economic and environmental aspects of lithium battery recycling, recycling of lithium-ion batteries has significant economic and environmental advantages, such as reducing chemical pollution and improving the safety of storage facilities [

14]. Finally, bio-technical approaches such as bio leaching using bio-hydrometal technology in lithium-ion battery recycling provide an eco-friendly and cost-effective alternative for recovering metals from spent lithium-ion batteries [

15].

The literature review on battery recycling patent analysis reveals a focus on innovative recycling devices and methods, addressing the challenges in recycling various types of batteries. Key insights include advancements in electrolysis methods for recycling, devices for efficient processing of storage batteries, and trends in recycling technologies identified through patent and paper analysis.

Previously, in Korea, patent was conducted to analyze patent trends on waste battery recycling. Keywords were battery, electronic cell, patent, recycling, and 2,490 cases were selected from 1971 to 2000 for H01M-006/52 and H01M-010/54 among IPC classifications, and 871 of them were analyzed through filtering [

16].

And also there is multi-countries analysis of used battery recycling [

17]. The paper analyzes patents and published papers on recycling technologies for used batteries, focusing on the years, countries, companies, and technologies involved. The paper analyzed patents and published papers on recycling technologies for used batteries from 1972 to 2011, focusing on the open patents of USA (US), European Union (EU), Japan (JP), Korea (KR), and SCI journal articles. The trends of the patents and journal articles were analyzed based on the years, countries, companies, and technologies involved. However, in this paper, there is no analysis for China patents and papers of battery recycling. And it also missed 2012 to 2023 period battery recycling patent analysis due to its published year.

Overseas, there is a study that analyzed 90,000 battery patents from 2000 to 2019 [

18]. In addition, there is a study that analyzed technologies and trends for recycling lithium-ion batteries [

19]. And also, there is a patent analysis study that reviews patent applications filed by major Japanese battery manufacturers provides insights into technology development in the Japanese battery industry, which could be relevant for understanding the trends in patenting in the battery recycling sector [

20].

Even though there are many academic articles about battery recycling, it is hard to find articles that are about battery recycling patent analysis because most of articles focused on material technology [

21,

22,

23] or overall system and process of battery recycling [

24,

25,

26,

27].

Based on the information available, the battery technology patent race is intensifying among South Korea, China, and USA, with significant developments and strategic moves observed in each country [

28]. South Korea and China are particularly competitive in the arena of battery patents, with South Korean companies like LG Energy Solution and Samsung SDI leading in terms of both quantity and quality of patents, especially in areas such as electrode materials, cell processes, and packaging. China, while having the largest market share through companies like CATL, focuses more on lithium-phosphate-iron (LFP) cathode materials and silicon anode materials.

And also, the current trends in battery recycling in the United States are marked by significant developments and investments, driven by the growing demand for electric vehicles (EVs) and the associated need for efficient battery recycling. The U.S. currently employs mainly two methods for battery recycling – hydrometallurgical and pyrometallurgical [

29,

30]. The hydrometallurgical process involves using an acid-rich solution to extract battery materials, while the pyrometallurgical method uses simpler pretreatments like crushing or shredding. Companies like Redwood Materials and Li-Cycle are scaling up their operations, focusing on innovative recycling processes that recover crucial metals like cobalt, nickel, and lithium from used batteries and manufacturing scrap.

As such, the market and technology for battery recycling in Korea, China, and the United States are fully expanding. However, it is not easy to find a paper that analyzes in-depth battery recycling patents in Korea, China, and the United States. Therefore, through this paper, we will analyze battery recycling patents in the three countries, how to increase battery cycle efficiency through battery recycling, and analyze the differences between each country through patent trends in the three countries.

3. Patent Analysis

In relation to secondary batteries, we will collect data on Korea, China, and United States patents, etc. for batteries, secondary, electrorod, lithium, ION, anod, cathod, waste, cycle, etc., and analyze patent trends.

Through quantitative analysis, multiple technology trends were analyzed based on the effective population searched in the waste battery technology field, setting future technology development directions, future development areas, patent portfolio analysis of major players, and market analysis were performed. In quantitative analysis, it is possible to grasp the recent market status of the technology field from various angles through the analysis of the following items, and detailed technology classification is also performed for more detailed technology classification is also performed. Through this, we intend to extract major patents and explore the direction of discovering promising technologies in the future.

A patent analysis was conducted based on patent applications for battery recycling [Yo2W30/84_All] in three countries: Korea, China, and the United States. This data was searched and conducted at Wintelips (wintelips.com) and Energy patent house (energypatenthouse.com) that are for gathering patent data.

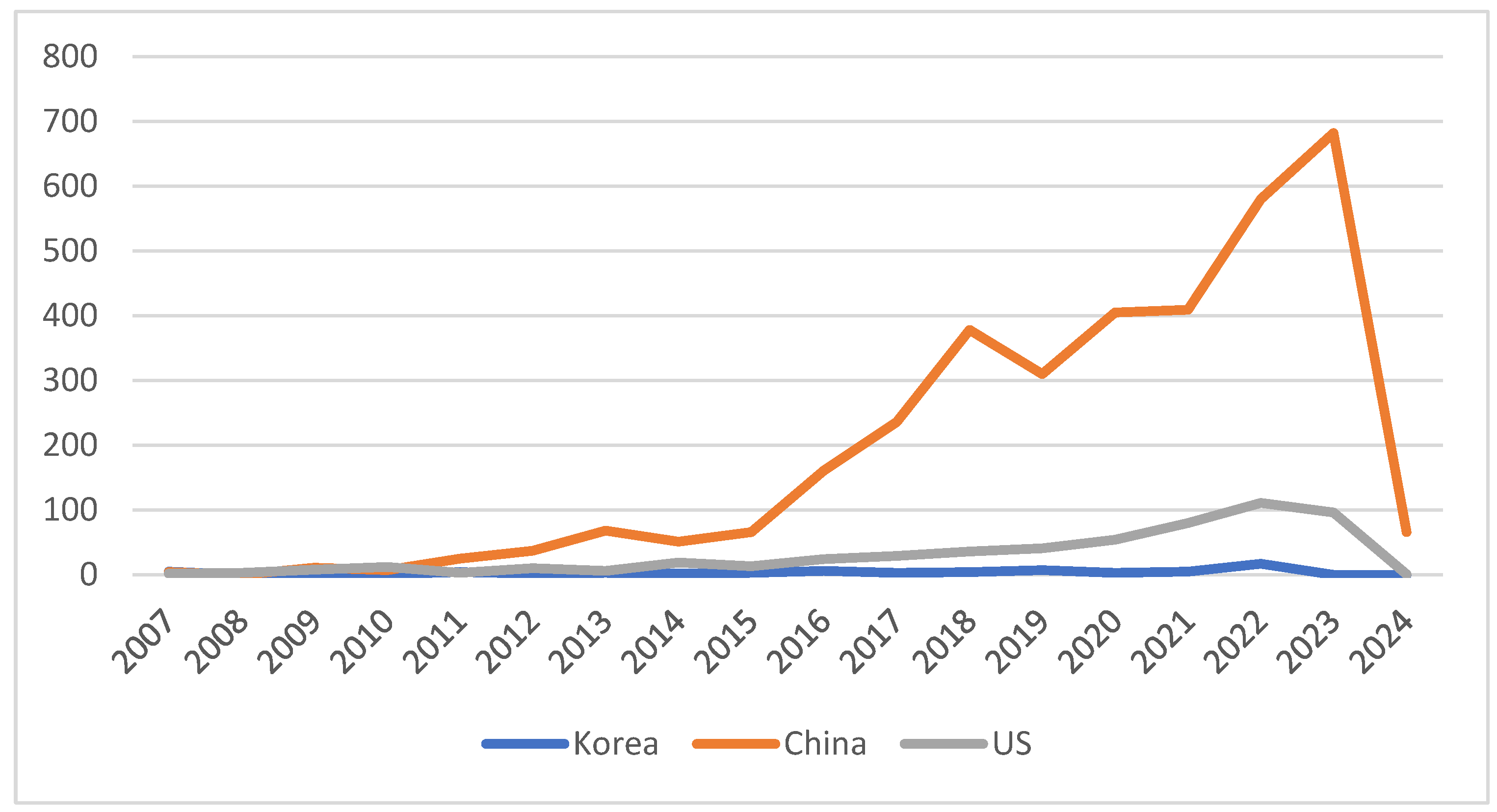

Figure 1 shows the annual status of battery recycling patent applications in Korea, China, and the United States during 2007 to 2024. Korea showed modest and consistent patent activity with a notable increase in 2022. China demonstrated a significant and consistent rise in patent filings over the years, peaking in 2023 before a sharp drop in 2024. And US showed a steady increase in patent filings, peaking in 2022, followed by a decline in subsequent years.

Table 1 shows a comparison of different companies regarding their intellectual property (IP) holdings, specifically patents, in the context of battery recycling technology. It looks like the table is organized by country, with companies from Korea, China, and United States. These are a kind of snapshot of the patent landscape among key players in the battery recycling technology, which is useful for understanding the competitive environment and innovation trends.

Table 2 presents data on patents related to battery recycling, specifically organized by country (Korea, China and United States) and the keywords associated with the patents. The analysis reveals a strong emphasis on battery recycling technologies (H01M-010) across various countries and companies, indicating a global trend towards improving battery recycling processes. Companies in Korea and China also show significant interest in metal extraction and material preparation processes, while those in the United States focus on intelligent control systems and data management in recycling. For

Table 2’s IPC(International Patent code) contents, you could find these codes from WIPO(World Intellectual Property Organization) [

31].

In the United States, the keyword H01M-010 shows consistent activity over the years, indicating ongoing research and patent filings in battery recycling technologies. Keywords C22B-003 and C22B-007 also exhibit significant activity, reflecting the importance of metal recovery in the recycling process. The keywords B01J-035, B02C-003, and B02C-004 display variability in trends, with some years showing higher activity related to chemical processes and material crushing. Additionally, G06Q-010 and G05D-001 have noticeable activity in recent years, highlighting the integration of smart technologies in recycling operations.

In Korea, H01M-010 shows a steady increase in activity, reflecting a growing focus on battery recycling technologies. Keywords C22B-003 and C22B-007 show some activity, indicating efforts in metal recovery from recycled materials. The keywords B01J-035 and B09B-003 exhibit variable trends, suggesting an interest in chemical processes and waste disposal technologies. B02C-003 and B02C-004 are less prominent but still present, indicating activities related to material crushing and preparation.

In China, the keyword H01M-010 shows significant and increasing activity, demonstrating a strong focus on battery recycling. Keywords C22B-003 and C22B-007 show high activity, highlighting extensive efforts in metal recovery. The keywords B01J-035, B09B-003, B02C-003, and B02C-004 exhibit substantial activity, indicating a broad approach to recycling involving chemical processes and material crushing. Additionally, H01M-004 has a notable presence, suggesting innovations in primary cell technologies.

All three countries show strong and consistent activity in battery recycling (H01M-010), with China leading in the number of patents. Significant efforts in metal recovery (C22B-003, C22B-007) are observed in the US and China, with Korea also contributing. Chemical processes and material crushing show variable but present trends in all three countries, indicating ongoing research in optimizing recycling processes. Smart technologies (G06Q-010, G05D-001) have a more recent focus, particularly in the US, reflecting the integration of data processing and control systems in recycling.

Table 3 describes that the analysis reveals varying levels of patent activity and impact across the three countries. CPP stands for “Citations Per Patent” and represents the average number of times a patent is cited by other patents or publications. It is a metric used to assess the impact and influence of a company’s or institution’s patents on further research and technological development. CPP is calculated by dividing the total number of citations by the total number of patents.

A high CPP indicates that the patents are frequently cited, suggesting that the technology is innovative and significantly contributes to the field. Conversely, a low CPP implies that the patents are less frequently cited, which could mean they are less influential, newer, or not yet widely recognized. For example, if a company has filed 10 patents and these patents have been cited 50 times, the CPP would be 5. Thus, CPP serves as a vital indicator of the qualitative impact of patents.

China leads in the number of patents, particularly in battery recycling and metal recovery, though the citation impact (CPP) varies significantly among players. Korea shows a growing focus on battery recycling, with some companies demonstrating high CPPs indicating influential patents. The United States exhibits strong activity in both the number and impact of patents, particularly in smart technologies and data processing related to recycling operations.

In Korea, Umicore has a moderate number of patents (9) with a relatively low citation count (6), resulting in a CPP of 0.7. Recycle Cooperation stands out with a higher CPP of 2.8 from 10 patents and 28 citations, indicating that their patents are well-regarded and frequently referenced. BASF SE shows similar characteristics to Umicore with 7 patents and a CPP of 0.7. RD Solution, with 5 patents and a CPP of 0.4, shows lower impact, while ED Engineering, despite having only 3 patents, has a high CPP of 2.7, suggesting highly regarded contributions.

In China, Anhui Nandu Huabo New Material Technology leads with 34 patents but has a low CPP of 0.4 from 15 citations, indicating extensive patenting activity with limited citation impact. Anhui Lvwo Recycling Energy Technology and Guizhou Zhongwei Resources Recycling Industry Development have similar profiles, with moderate patent activity and low CPPs of 0.4 and 0.3, respectively. Guangdong Haozhi Technology has the lowest CPP of 0.1 with 8 patents and 1 citation. However, Changsha Research Institute of Mining and Metallurgy stands out with a high CPP of 4.5 from 19 patents and 85 citations, indicating highly influential patents.

In the United States, Strong Force VCN shows substantial patent activity with 61 patents and a high CPP of 3.6 from 220 citations, indicating influential patents. Grst International Limited has 9 patents but no citations, resulting in a CPP of 0. Guangdong Brunp Recycling Technology has 29 patents and a balanced CPP of 1.0 from 30 citations. Hunan Brunp Recycling Technology has a moderate number of patents (27) with a low CPP of 0.4 from 7 citations. Worcester Polytechnic Institute exhibits the highest CPP of 6.9 with 17 patents and 118 citations, highlighting their significant contributions to recycling technologies.

Table 4 in the document provides PII, TS, and PFS information by players in Korea, China, and United States. The Patent Impact Index (PII) is a measure that compares the average number of citations per patent of a specific entity to the average number of citations per patent of all entities in a given dataset. It is calculated as follows:

A higher PII indicates that an entity’s patents are cited more frequently compared to the average, suggesting a greater impact or influence in the field.

Technology Strength (TS) quantifies the overall impact of an entity’s patent portfolio. It is calculated as the product of the number of patents and the average number of citations per patent (CPP):

A higher TS indicates a stronger technological position, reflecting both the quantity and the quality (impact) of the patents.

Patent Family Size (PFS) indicates the average number of countries in which a patent is filed within the same patent family. It is calculated as follows:

A larger PFS suggests that the patents have wider geographical coverage, which can imply broader market protection and greater potential for commercialization.

In Korea, Umicore has a moderate patent count with a low Patent Impact Index (PII) of 0.34, reflecting less impact compared to the average, and a Technology Strength (TS) of 6.0, with an average Patent Family Size (PFS) of 2.22. Recycle Cooperation, however, shows significant impact with a high PII of 1.41, a TS of 28.0, and a broad geographic coverage indicated by a PFS of 3.00. BASF SE has a low PII of 0.36 and a TS of 5.0, indicating moderate technology strength, with a PFS of 2.14. RD Solution has minimal impact with a PII of 0.20 and low technology strength (TS of 2.0), with a PFS of 2.00. ED Engineering shows strong impact with a high PII of 1.34, a TS of 8.0, and good geographic coverage (PFS of 2.67).

In China, Anhui Nandu Huabo New Material Technology and Anhui Lvwo Recycling Energy Technology both have a low PII of 0.22, indicating limited impact, with TS values of 15.0 and 7.0, and narrow geographic coverage with PFS values of 1.32 and 1.56, respectively. Guizhou Zhongwei Resources Recycling Industry Development also has a minimal impact with a PII of 0.18 and low TS of 6.0, with a PFS of 1.29. Guangdong Haozhi Technology has very limited impact with a PII of 0.06, minimal TS of 1.0, and narrow geographic coverage (PFS of 1.25). In contrast, Changsha Research Institute of Mining and Metallurgy has significant impact with a high PII of 2.25, strong TS of 85.0, and good geographic coverage indicated by a PFS of 3.16.

In the United States, Strong Force VCN shows significant impact with a high PII of 1.82, very strong technology strength (TS of 220.0), and broad geographic coverage (PFS of 2.46). Grst International Limited has no impact, as indicated by a PII of 0.00, no technology strength (TS of 0.0), and narrow geographic coverage (PFS of 1.00). Guangdong Brunp Recycling Technology shows moderate impact with a PII of 0.52, a TS of 30.0, and narrow geographic coverage (PFS of 1.72). Hunan Brunp Recycling Technology has limited impact with a low PII of 0.13, low technology strength (TS of 7.0), and narrow geographic coverage (PFS of 1.00). Worcester Polytechnic Institute, on the other hand, has significant impact with a high PII of 3.50, very strong technology strength (TS of 118.0), and broad geographic coverage (PFS of 3.53).

Figure 2 shows a scatter plot and this provides a clear picture of patent influence (CPP) and geographic coverage (PFS) across key players in Korea, China, and the United States. Players like Worcester Polytechnic Institute, Changsha Research Institute of Mining and Metallurgy, and Recycle Cooperation are leaders in terms of influential patents with wide geographic coverage. Conversely, some players in China and the US exhibit lower influence and narrower coverage, highlighting areas for potential improvement or strategic focus.

Korea exhibits a diverse range of patent influences across its key players, with a general trend towards moderate to high influence and decent geographic coverage. Notably, Recycle Cooperation and ED Engineering stand out for their exceptional Citations Per Patent (CPP) and broad Patent Family Size (PFS). Recycle Cooperation, with a CPP of 2.8 and a PFS of 3, demonstrates substantial influence in the field, indicating that their patents are both highly impactful and widely recognized across different regions. Similarly, ED Engineering, with a CPP of 2.7 and a PFS of 2.67, shows a strong patent influence and good geographic reach, underscoring their significant contributions to battery recycling technologies. Other players like Umicore and BASF SE maintain a steady presence with moderate CPP values of 0.7, reflecting a consistent, if not outstanding, impact in the field. RD Solution, with a lower CPP of 0.4 and a PFS of 2, indicates less influential patents, suggesting room for growth in both impact and reach.

In China, the range of patent influences varies widely among the key players. The standout performer is Changsha Research Institute of Mining and Metallurgy, which boasts a remarkable CPP of 4.5 and a PFS of 3.16. This indicates that their patents are highly influential and enjoy extensive geographic coverage, making significant contributions to the industry. On the other end of the spectrum, companies like Guangdong Haozhi Technology exhibit a very low CPP of 0.1 and a narrow PFS of 1.25, reflecting minimal impact and limited geographic reach. Other Chinese players, such as Anhui Nandu Huabo New Material Technology and Anhui Lvwo Recycling Energy Technology, maintain low CPP values of 0.4 with varying geographic coverage, indicating that while they have a presence in the market, their patents are less influential. Guizhou Zhongwei Resources Recycling Industry Development, with the lowest CPP of 0.3, further underscores the disparity in influence among Chinese companies, highlighting a broad spectrum from highly influential to minimally impactful patents.

The United States features a wide range of patent influences, from very high to virtually nonexistent. Worcester Polytechnic Institute is the leader, with an impressive CPP of 6.9 and a PFS of 3.53, indicating exceptional influence and extensive geographic coverage. This demonstrates that their patents are not only highly impactful but also widely recognized and adopted across different regions. Strong Force VCN also shows a strong presence with a CPP of 3.6 and a PFS of 2.46, reflecting significant influence and good geographic reach. In contrast, Grst International Limited exhibits no patent citations, resulting in a CPP of 0 and a PFS of 1, indicating that their patents have no discernible impact or geographic reach. Guangdong Brunp Recycling Technology and Hunan Brunp Recycling Technology fall in the middle, with CPP values of 1.0 and 0.4 respectively, and varying PFS, showing moderate influence and geographic coverage. This wide range illustrates the diversity in patent influence among U.S. players, from leading innovators to those with minimal impact.

Overall, Korea, China, and the United States each display distinct characteristics in their patent influences and geographic coverages. Korea’s key players generally exhibit moderate to high influence with decent coverage, with standout performers like Recycle Cooperation and ED Engineering. China’s landscape is more varied, with Changsha Research Institute of Mining and Metallurgy leading in influence, while other players lag significantly. The United States presents a broad spectrum, with Worcester Polytechnic Institute achieving exceptional influence and others like Grst International showing no impact, reflecting a diverse range of patent efficacy and reach.

4. Discussion

These are the challenges and strategies for policy makers in order to promote battery recycling technology and related industry.

Korea faces the challenge of maintaining consistent innovation across all its players. While companies like Recycle Cooperation and ED Engineering exhibit high CPP, others like Umicore and RD Solution show moderate to low CPP, highlighting the need for more impactful R&D efforts. To address this, fostering collaboration between industry and academia, increasing R&D investments, and implementing innovation-friendly policies are crucial. Additionally, expanding the geographic coverage of patents is essential, as companies like RD Solution have room for improvement in international patent family size. Encouraging global patent filings and partnerships with international entities can help Korean companies enhance their market influence.

China’s primary challenge is increasing the patent influence of many of its companies. Firms like Guangdong Haozhi Technology and Guizhou Zhongwei Resources Recycling Industry Development have low CPP, indicating less impactful patents. Improving patent quality through better R&D practices and focusing on innovative technologies can help increase their influence. Moreover, there is a significant disparity in patent influence among Chinese companies, with Changsha Research Institute of Mining and Metallurgy leading significantly. Bridging this gap by supporting smaller or less advanced companies through subsidies, tax incentives, and access to advanced research facilities is essential. Enhancing international presence is also crucial, as some companies have limited international patent coverage. Facilitating international patent applications and collaborations can help strengthen their global presence.

The United States exhibits a wide range of patent influences, from highly impactful (Worcester Polytechnic Institute) to minimal or none (Grst International Limited). Ensuring high patent quality across all players by strengthening review processes and providing support for companies with lower CPP can help maintain high standards. Addressing variability in geographic coverage is also important, as some companies have limited reach. Encouraging broader geographic patent filings and international collaborations can help expand U.S. companies’ influence globally. Additionally, fostering innovation in lagging sectors through targeted support and incentives can stimulate innovation and increase overall patent influence.

To address these challenges, promoting enhanced collaboration between academia, industry, and government can lead to more innovative and impactful patents. Increasing R&D investments by both governments and private sectors is crucial to boost innovation. Encouraging companies to file patents internationally can enhance their global presence and market influence. Implementing supportive policies, such as tax incentives, subsidies for R&D, and easier access to patenting processes, can further help overcome these challenges. By addressing these key challenges, Korea, China, and the United States can strengthen their positions in the global patent landscape and drive further innovation in the battery recycling sector.

And also, there many alternative approaches for battery recycling. There are many patents for battery recycling. However, beside of China, the overall market of battery recycling is not that open yet because now electric vehicle market is fast growing. So, we need to find the way of getting more efficiency for battery performance by using new technologies. Beside of waste battery recycling, there are many ways to make better battery performance using many deep technologies. For example, we could use software and hardware technologies in field of battery efficiency so that we could expect to get better performance and longer life span of battery. There are 4 Korean start-ups for doing this.

First of all, Voltwin is a company that provides digital twin-based battery diagnosis and monitoring solutions. It aims to solve the real-world problems that arise when using batteries by combining digital twin technology and deep learning technology in the virtual world. It aims to develop a solution that can be applied to the entire battery life cycle, which operates from the battery design stage and needs to be recycled as a waste battery. In particular, through the battery state and life prediction service for BoT (Battery of Things), it is possible to diagnose and monitor the battery of personal mobility or electric vehicles on mobile, and it is easy to measure the rating of battery recycling by accurately measuring the battery state.

Secondly, Betterial is a startup that is attracting attention after five years of founding by challenging the field of CNT conductive materials. In particular, it shows unrivaled technology in the field of single-walled CNTs for Batterial cathode materials. Single-walled CNTs that use water as a solvent are more difficult to disperse than multi-walled CNTs for anode materials that use organic solvents that are relatively advantageous for dispersion, so specific companies are monopolizing the market. The dispersion technology can be seen as a combination of material analysis technology based on experience and understanding of CNTs, solvents, and dispersants and the know-how of mechanical device technology to form an entry barrier. As Betterreal shows performance indicators that are comparable to its competitors in the evaluation of global companies related to single-walled CNTs, it is almost the only Korean start-ups to create an entry barrier. In particular, LG Energy Solution built its own battery manufacturing line, centering on personnel with experience in battery development for many years, and is receiving favorable reviews for manufacturing a CNT conductive material dispersion that shows the effect of improving the performance of actual customers’ batteries by having the ability to self-test the battery performance of the mass-produced CNT conductive material. The company started supplying materials for mass production to small battery companies in the fourth quarter of 2023 and is also conducting a step-by-step evaluation to deliver materials to cell makers.

Thirdly, Solivis is a solid electrolyte development startup. It recently received an investment of 4 million U.S. dollars by attracting investment for the Series A. Solaris is a startup that is developing technology to mass-produce solid electrolytes for all-solid-state batteries, which are drawing attention as secondary batteries for electric vehicles. The company was founded by Shin Dong-wook, a professor of new material engineering at Hanyang University who is considered a master of all-solid-state batteries. It has technological prowess such as technology to mass-produce sulfide-based solid electrolytes, mass-produce and refine raw materials, and 75 patents related to Korea and abroad. Solaris’ technology is mass-producing technology. Solaris has secured production technology that applies a wet synthesis method that can mass-produce homogeneous solid electrolytes and a process variable control mechanism that can reduce process costs and increase productivity. After receiving investment, Solaris plans to supply samples to global secondary battery companies and major automobile manufacturers. It is also preparing for mass production by starting construction of a pilot production line plant.

Fourthly, founded in 2017, Libest is a company that develops lithium-ion batteries and flexible batteries. In the early days of its establishment, Libest focused on flexible lithium-ion batteries. In this case, safety and energy efficiency are important tasks because it must be used for a long time in direct contact with the human body. Focusing on these two, flame-retardant and floating batteries and next-generation batteries along with flexible lithium-ion batteries have become Rivest’s main business models. In the case of flexible lithium-ion batteries, technological maturity has already entered the stage of mass production. At the recently completed Daejeon plant, 2.5 products will be manufactured per minute. Marketing is also underway with related industries such as metaverse, AR, VR, and smart wearable devices, centering on the North American market. Flame-retardant and floating lithium-ion batteries are battery technologies that do not burn or freeze. In general, Libest has caught all battery characteristics that satisfy only one of flame retardancy and immobility. By applying flame retardant and floating technology to the separator and electrolyte, the materials used for the existing cathode and anode can be used while being used as they are. Compared to existing flame-retardant and floating batteries, the temperature range that can be covered is also wide. Therefore, there is no need to change the production process. Currently, it is being applied to electric two-wheeled vehicles, EVs, and ESS fields along with patent applications. The next-generation battery applying Libest’s technology is a battery technology that can maximize energy density and significantly reduce raw material costs and is currently in the development stage. Good results are being achieved through active technology development, and the plan is to increase technological maturity as quickly as possible.

Fifthly, CGI is a company founded with the aim of joint research and development and mass production with global electric vehicle and electronic device manufacturing customers. CGI’s core customers are companies that produce electric vehicles and electronic devices that absolutely require heat emission management and the entire finished product manufacturing industry with electronic components. The features of CGI core technology include large-area and ultra-thin Vapor Chamber (Qread), thermal ground plane (TGP) specialized in high heat and high heat products with reverse orientation, and system design and analysis technology of Vapor Chamber Embedded Heat Release Device (HCCS). CGI is a medium design and first plate welding manufacturing technology that transfers heat with very low thermal resistance through the evaporation and condensation process of fluid inside the structure, and has a related patent. In addition, heat conduction can be implemented by applying a dedicated fluid to more than 5,000 W/mK and can be applied without restrictions to the location of the heat source. In addition, for the first time in the world, it succeeded in slimming and weight reduction of finished products by realizing the thickness of ultra-thin flakes (0.3t or less). TGP technology is evaluated as a new technology that can implement new heat transfer characteristics in the medical and military equipment sectors, which are paying attention to high-heat spreading technology, which is limited by conventional heat spreading technology that increases heat resistance in high-temperature flow conditions through special porous material surface treatment inside the structure. Unlike conventional fluid vaporization, this new technology is a heat transfer technology using fluid boiling, and it is possible to design a simple structure without wicks inside the vaper chamber, which enables breakthrough weight reduction and cost reduction. In addition, this technology is specialized in high-heating products (70W/cm2 or more) and is characterized by the implementation of cooling high-heating products that cannot be implemented with existing vaper chambers. Currently, it is jointly developing a solution with a domestic military equipment company to manage high heat generation of laser sources of laser guns and laser weapons, and plans to deliver prototypes in 2024 and continue to mass production.

Lastly, founded in March 2021, Amass developed innovative and diverse ICT-based solutions that can be used in the automobile industry, and achieved three patent registrations and five patent applications. Based on automobile manufacturer-based data and its solutions using AI, it is carrying out business with the aim of digitizing and automating the automobile insurance and resource circulation market. Amass’ automobile parts recycling solution is a solution that provides opportunities for commercialization, inventory management, and sales of high-quality automobile parts that have not been recycled due to the difficulty of checking the parts information included in the vehicle when handling total loss vehicles and waste vehicles at automobile insurers and junkyards, and are discarded or neglected, through confirmation of vehicle information and parts information using manufacturer-based data and AI. All parts information of the vehicle (part list, part number, part name, part compatibility, part price) can be checked. It is characterized by checking all parts list of the vehicle by entering the vehicle identification number alone, selecting and removing only non-goods, computerizing and automatically uploading sales information, enabling efficient commercialization, inventory management, and distribution. Ames also developed an automation solution for auto insurance compensation. The disadvantage of the existing method of damage assessment is that it takes a lot of time because it is carried out by manually checking the parts of the repair statement that are directly charged by humans. In addition, it is difficult to avoid conflicts over the scope, method, and price appropriateness of repairs as it is in a specialized field. Amass’ automation solution for auto insurance compensation developed to solve this problem is a verification system that utilizes the manufacturer-based data of the vehicle. Because it is automatically verified, a quick, accurate, and convenient damage assessment is possible. Through this verification step, it is easy to determine whether the repair cost is appropriately set, which improves the loss ratio and reduces costs as well as prevents insurance fraud. In addition, the burden of work can be reduced by digitizing and automating the auto insurance compensation business process.

5. Conclusions

This study conducted a comprehensive global patent analysis on battery recycling technologies, focusing on secondary batteries across Korea, China, and the United States. The findings reveal significant differences in patent activities and technological focuses among these countries. Korea exhibits a mix of moderate to high patent influence with decent geographic coverage, with standout companies like Recycle Cooperation and ED Engineering. China shows a wide range of patent influences, with Changsha Research Institute of Mining and Metallurgy leading significantly, while other companies lag. The United States displays a broad spectrum of patent influences, from highly impactful patents by Worcester Polytechnic Institute to minimal influence from companies like Grst International Limited. Addressing the identified challenges—such as maintaining consistent innovation in Korea, increasing patent influence and reducing disparity among companies in China, and ensuring high patent quality in the United States—can significantly enhance the global competitiveness of these nations in battery recycling technologies.

Moreover, several additional analyses could further strengthen this study. Economic impact assessments of patent activities could reveal cost savings from recycling and the economic benefits of enhanced technologies. Environmental impact assessments could evaluate the reductions in resource extraction and waste generation. Developing a technological roadmap could identify future trends and emerging technologies in battery recycling, guiding strategic planning and investment decisions. Conducting detailed case studies of leading companies would provide deeper insights into their strategies and contributions. Additionally, examining national policies and their impact on battery recycling technologies could offer recommendations for policy improvements. Finally, analyzing market trends and forecasting future demand for battery recycling technologies, considering the rapid growth of the electric vehicle market, would provide valuable insights into the industry’s future directions.

Author Contributions

Lee, Chae-Hoon has only author contribution in all aspects about this research article including conceptualization, methodology, data gathering and curation, data analysis, investigation, writing – original draft, review and editing, visualization, project administration.

Funding

This research received no external funding.

Data Availability Statement

The Original contributions presented in this study are included in the article, further inquiries can be directly reached to the corresponding author.

Acknowledgments

This study starts from EVS37 oral poster presentation in Seoul, South Korea (Apr. 25th, 2024). Special thanks to EVS37 program that makes me have an opportunity to submit research paper to this WEVJ special issue.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- IEA. Global EV Outlook 2023. April 2023. Available online: https://www.iea.org/reports/global-ev-outlook-2023 (accessed on 16 May 2024).

- Korea Policy Briefing. 110 Key National Tasks of The Yoon Suk-Yeol Administration (in Korean). May 2022. Available online: https://www.korea.kr/archive/expDocView.do?docId=39973 (accessed on 8 October 2023).

- Yahoo Finance. Lithium Prices Hit Record High: 3 Stocks to Buy. September 2022. Available online: https://finance.yahoo.com/news/lithium-prices-hit-record-high-131601067.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAGFReAEBt8D-oFP0nzwc4Lu02K4rftpBL5FPuV4eU-zG-NZIlypvKbX6oiwjo81-Fop9yN-8671_QQyPiU_QvI2BIh2z_R3bjj1rUDB5VkvlVICS9xMFkGv1c_RB5qJtAFaLCbJ_VSc3EkC66d96veefcJfTjSchESfsX3_FZJAX (accessed on 16 May 2024).

- White House. Building Resilient Supply Chains, Revitalizing American Manufacturing, and Fostering Broad-based Growth. June 2021. Available online: https://www.bis.doc.gov/index.php/documents/technology-evaluation/2958-100-day-supply-chain-review-report/file (accessed on 16 May 2024).

- McKinsey. Power spike: How battery makers can respond to surging demand from EVs. October 2022. Available online: https://www.mckinsey.com/capabilities/operations/our-insights/power-spike-how-battery-makers-can-respond-to-surging-demand-from-evs (accessed on 8 October 2023).

- McKinsey. Second-life EV batteries: The newest value pool in energy storage. April 2019. Available online: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/second-life-ev-batteries-the-newest-value-pool-in-energy-storage (accessed on 8 October 2023).

- Wang et.Al.. Recent progress on the recycling technology of Li-ion batteries. Journal of Energy Chemistry 2021, 55, 391-419.

- M.Frank et.Al.. Identification and Mitigation of Predominant Challenges in the Utilization of Aged Traction Batteries within Stationary Second-Life Scenarios. Energies 2024, 17(5), 988.

- P.K.Das et.Al.. Life cycle assessment of electric vehicles: a systematic review of literature. Environmental Science and Pollution Research 2023, 31, 73-89.

- S.Al-Thyabat et.Al.. Adaptation of minerals processing operations for lithium-ion (LiBs) and nickel metal hydride (NiMH) batteries recycling: Critical review. Minerals Engineering 2013, 45, 4-17.

- X.Zheng et.Al.. A Mini-Review on Metal Recycling from Spent Lithium-Ion Batteries. Engineering 2018, 4, 361-370.

- M.Mohr et.Al.. Toward a cell-chemistry specific life cycle assessment of lithium-ion battery recycling processes. Journal of Industrial Ecology 2020, 24, 1310-1322.

- N.Jun-Min. Advances on the recycling and reusing of spent batteries. Chinese Journal of Power Sources 2005.

- G.Filomeno & S.Feraco. Economic, Technical and Environmental Aspects of Recycling Lithium Batteries: A Literature Review. Global Journals of Research in Engineering 2020, 20, 1-8.

- J.J.Roy et.Al.. A review on the recycling of spent lithium-ion batteries (LIBs) by the bioleaching approach. Chemosphere 2021, 282.

- T.W.Kang et.Al.. Analysis of Patents on the Recycling Technologies for Waste Batteries. Journal of Korean Industry of Resources Recycling 2005, 14, 44-59.

- S.M.Shin et.Al.. Trend on the Recycling Technologies for Spent Batteries by the Patent and Paper Analysis. Journal of the Korean Institute of Resources Recycling 2012, 21, 16-25.

- P.Metzger et.Al.. Battery innovation and the Circular Economy: What are patents revealing? Renewable Energy 2023, 516-532.

- Z.J.Baum et.Al.. Lithum-Ion Battery Recycling-Overview of Techniques and Trends. ACS Energy Letters 2022, 7, 560-907.

- T.Ouchi et.Al.. Reviews on the Japanese Patent Applications Regarding Nickel/Metal Hydride Batteries. Batteries 2016, 2.

- Prazanova et.Al.. Pre-Recycling Material Analysis of NMC Lithium-Ion Battery Cells from Electric Vehicles. Crystals 2023, 13, 1-14.

- K.Tanong et.Al.. Metal Recycling Technologies for Battery Waste. Recent Patents on Engineering 2014, 8, 13-23.

- R.Sommerville et.Al.. A qualitative assessment of lithium-ion battery recycling processes. Resources, Conservation and Recycling 2021, 165.

- D.Deshwal et.Al.. Economic Analysis of Lithium-Ion Battery Recycling in India. Wireless Personal Communications, 2022, 124, 3263-3286.

- J.Dewulf et.Al.. Recycling rechargeable lithium-ion batteries: Critical analysis of natural resource savings. Resources, Conservation and Recycling 2010, 54, 229-234.

- L.Gaines et.Al.. Life-Cycle Analysis for Lithium-Ion Battery Production and Recycling. 90th Annual Meeting of the Transportation Research Board presentation article 2010.

- X.Song et.Al.. Estimation of Waste Battery Generation and Analysis of the Waste Battery Recycling System in China. Journal of Industrial Ecology 2017, 21, 57-69.

- BusinessKorea. Korea, China, Japan Heat up Race for Battery Patents (in Korean). July 2023. Available online: https://www.businesskorea.co.kr/news/articleView.html?idxno=118779 (accessed on 21 January 2024).

- Fastmarkets. US dives into lithium battery recycling: 2023 preview. January 2023. Available online: https://www.fastmarkets.com/insights/us-dives-into-lithium-battery-recycling/ (accessed on 21 January 2024).

- MIT Technology Review. Battery recycling: 10 Breakthrough Technologies 2023. January 2023. Available online: https://www.technologyreview.com/2023/01/09/1064886/battery-recycling-10-breakthrough-technologies-2023/ (accessed on 21 January 2024).

- WIPO. International Patent Classification: IPC Publication. January 2024. Available online: https://ipcpub.wipo.int/?notion=scheme&version=20240101&symbol=none&menulang=en&lang=en&viewmode=f&fipcpc=no&showdeleted=yes&indexes=no&headings=yes¬es=yes&direction=o2n&initial=A&cwid=none&tree=no&searchmode=smart (accessed on 22 January 2024).

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).