1. Introduction

Farming operations take place in uncertain environments, and agricultural activities are risky [

1,

2]. The agricultural industry typically faces risks related to biology, climate, prices, and finances [

3]. Farmers face a wide range of risks, both in terms of the number and variety, [

4] and these have a direct impact on the output and financial success of each agent in the rice production chain [

5]. In agriculture, the terms “risk” and “uncertainty” are used interchangeable [

6]. Risk is the situation in which the decision outcomes and their probabilities of occurrence are known to the decision-maker, and uncertainty is the situation in which such information is not available to the decision-maker [

7]. Risk can also be defined as imperfect knowledge, where the probabilities of possible outcomes are known and uncertainty exists when these probabilities are not known [

8,

9]. Uncertainty refers to incomplete information, whereas risk is the possibility of unpleasant events occurring, such as losses and adversity, which have a negative effect on people [

10].

Almost half of the world’s population consumes rice as a staple grain, making it one of the most significant cereals globally [

11,

12]. It is a substantial source of revenue and a crucial and necessary staple item in the diet of the majority of people in Nigeria [

13]. There has been an increase in paddy rice production in Nigeria with approximately 8.34 million MT produced in 2021 which place the nation as the largest producer in Africa [

14]. Additionally, USDA also reported that rice is the third most produced cereal crop in the world, after maize (1.12 billion MT) and wheat (731.45 million MT). According to [

15], world rice production was 503.27 million MT in 2022 which represents a decrease of 2.29% in rice production around the globe. Given its significance, it has become essential to the Sub-Saharan Africa (SSA) food security plan because it makes up 10.5% of daily caloric intake on average [

16]. Nonetheless, because of the activities involved in the rice value chain, farmers and other value chain participants are exposed to a number of risks and uncertainties. Although rice is a significant food and industrial resource in Nigeria, there is a large disparity between domestic production and consumption, necessitating importation to make up the difference [

17].

According to [

18], Scarcity of resources and lack of funds at the farm level are major barriers to overcoming the ability to adapt to risks, and they have a significant impact on crop productivity. Farmers face a number of difficulties due to of inadequate knowledge about climate change and lack of risk management tools [

19,

20]. Price fluctuation, production risk and market risk are the major risk challenges farmers are subjected [

21]. When prices are too low to satisfy numerous needs, such as paying for debts accrued during production and generating investment for the upcoming planting season, rice farmers are typically more prone to selling their produce after harvest [

4]. According to [

2], farmers have different risk attitudes and perceptions. Risk perception is the assessment of the hazards and the opinions of those who are exposed to the risk [

22]. The intention of individuals toward risk evaluation scenarios about unfavorable or advantageous actions is known as risk attitude [

23]. Farmers in rural areas are typically hesitant to invest the limited resources because they are risk-averse and poor. Since a single crop failure in rice production can constitute a threat, less resources are allocated to real threats. Increased rice productivity in Nigeria is hampered by inadequate understanding of farmers’ attitudes and perceptions of hazards. Therefore, it is crucial for farm planning in production economics and technical innovation to assess the attitude and perception of participants in the rice value chain toward risk [

24].

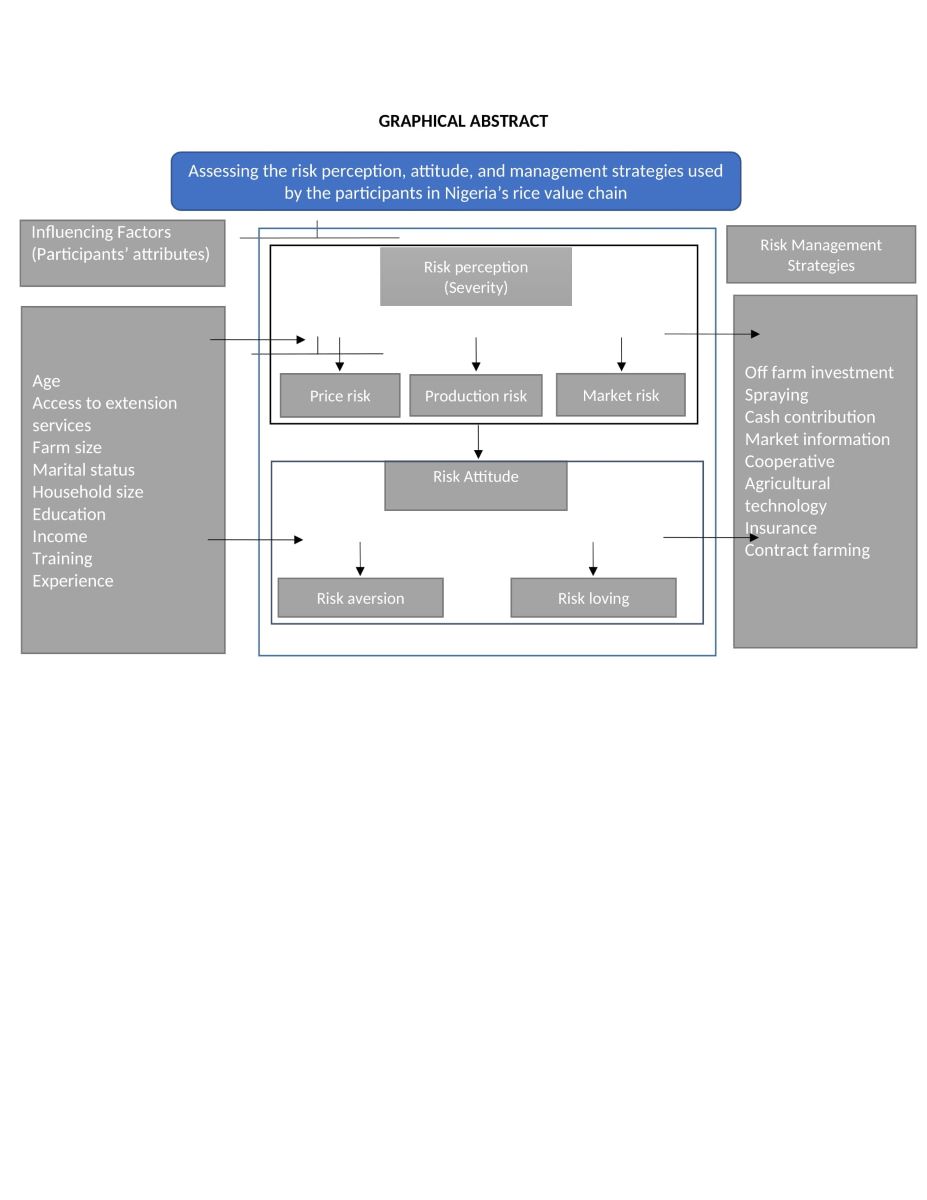

For rice growers to overcome their lack of expertise in risk behaviour, a considerable risk management approach is required [

25]. According to [

26], agricultural losses caused by various risks can be reduced by using advanced risk management techniques, as doing so will enable rice producers to exhibit sophisticated and considerate risk behaviors. This study is crucial since most agricultural predictions and farm planning don’t take farmers’ perceptions of risk and uncertainty in the production process into sufficient account. Studies conducted worldwide evaluated farmers’ attitudes and perceptions of risk [

27,

28,

29]. Therefore, it is uncommon to find information in Nigeria that is unique to the viewpoint of rice value chain risk management. In light of this, the study assessed risk perception and attitudes of participants in the rice value chain by identifying factors influencing these perceptions and attitudes as well as their approach to risk management.

2. Materials and Methods

2.1.1. Description of the Study Area

The study was conducted in Kwara State, north central Nigeria, since it is one of the state’s major rice producers. The state has 16 Local Government Areas with a population estimate of about 2,371,089 (National Population Commission [NPC] 2006) [

30]. The total land area of the State is put at 32,000 square kilometer representing about 6.54% of the total land area of the country (Kwara State Agricultural Development Project [KWADP] 2000) [

31]. The State shares boundaries with Oyo, Osun, Ondo, Niger, Ekiti, Kogi and Kebbi States of Nigeria. The daily temperature ranges between 210°C-330°C with an average rainfall pattern of 14995-15,000mm.There are two main climate seasons, the dry and wet seasons with an intervening cold and dry harmattan period usually experienced from December to January (KWADP, 2000) [

32]. The natural vegetation consists broadly of rain forest, Guinea savannah in the extreme north with a Fadama belt along the River Niger. Kwara vegetation makes it suitable for the cultivation of several cash and food crops. Some of the food crops grown in the state include rice, millet, and sorghum. Kwara State has an estimated figure of 203,833 farm families with the majority being subsistence farmers [

2]. The state is divided into four main agro-ecological zones in consonance with the ecological characteristics, cultural practices and administrative convenience by the Kwara state Agricultural Development project as given below: Zone A: Baruteen & Kaima; Zone B: Edu and Patigi; Zone C: Asa, Ilorin East, Ilorin South, Ilorin West & Moro; Zone D: Ekiti, Ifelodun, Irepodun, Isin, Offa, Oke-Ero & Oyun.

2.1.2. Research Design

A multistage random sampling technique was employed to select 260 study samples that include 200 rice farming households and 60 rice processors. The list of rice-producing local government areas and communities was obtained from the Kwara State Ministry of Agriculture. In the first stage, five major rice-producing LGAs namely Patigi, Edu, Moro, Asa, and Ifelodun were purposively selected because they are predominantly rice-producing areas. In the second stage, 5 rice-growing communities were randomly selected in each of the five LGAs. In the third stage, eight rice farming households were randomly selected from each of the communities to make a total sample of 200 respondents. However, a snowballing approach was used in identifying 60 rice processors in the selected communities; 12 processors were selected from each of the 5 communities making a total sample of 60.

2.1.3. Data Collection

Primary data was obtained through a well-structured questionnaire administered to the respondents by the researcher and his team of trained enumerators. The interviews were conducted in the local language of the respondents. Information were collected on all the relevant questions to the study (socioeconomic characteristics, risk perception, risk attitude, and risk management). A pretest of the questionnaire was done, and a few amendments were made to the questionnaire to get more appropriate information and enhance the reliability of the data.

2.2. Theoretical Framework

There exist various approaches to measure farmers risk attitudes [

33]. [

34] categorized these methods into direct and indirect methods. They observed that the direct method has significant problems because the subjects’ levels of tolerance or intolerance for gambling and the fact that probability concepts are far from instinctively clear and takes time. They proposed the use of indirect method where risk was introduced into an economic model decision making as a safety-first rule. [

35] categorized the approaches of measuring risk attitude into different groups’ namely economic anthropology, econometrics, farm risk programming, sectoral risk programming, expected utility and safety-first theory. [

36] reported that the most commonly used utility functions when assessing risk preferences are the negative exponential, power, expo-power and cubic functions with each starting with the assumption that an economic agent’s utility function has a positive slope over the entire range of payoffs.

[

37] measured risk attitude through eliciting Certainty Equivalents (CEs) and the experimental method as gambling with real payoffs. [

38] explained that there several approaches for measuring farmers’ risk attitude which include the von Neumann-Morgenstern (N-M) model, Equally Likely Certainty Equivalent (ELCE) method, a modified version of the N-M model, and the Equally Likely but risky outcome method. Hence, we adopted the interview method of the direct approach with the ELCE, using a Purely Hypothetical Risky model (explained in

Section 2.3.2). The farmers and processors are categorized into three groups. Risk-preferring (those willing to take risks or the expected outcome is preferred over certain), risk neutral (indifferent to certain and uncertain outcomes, but has the same expected income), and risk-averse (those who give preference to certain income over income that is uncertain). It is assumed that the selection of expected or sure outcomes is based on utility. Farmers choose options which give them more utility i.e., farmers maximize utility. Utility, in this study is a function of wealth, but we use it as a function of income [

9].

The individual wants to maximize utility with respect to income.

The convex utility function is positive and shows that more is preferred over less. Similarly, risk aversion is a concave utility function that exhibits a decline in marginal utility as the payoff increases. Risk neutral has a linear utility function [

9]. According to [

40], decision makers compare the expected utility in risky and uncertain prospects. [

41] stated rather than accepting another option with a modest and certain reward, individuals are more hesitant to accept choices with uncertain payoffs. Farmers will attempt to maximize utility while observing constraints:

Y represents income and c is consumption. The utility function shows the nature of farmers’ attitude on the risk preference or risk averse. Furthermore, this will lead to risk aversion which is the main attitudinal concept in the expected utility theory [

42]. A decision-maker’s utility function will shape their risk preferences [

39]. When an individual has a utility function with a positive slope, it shows a greater payoff is always preferred to a lesser one.

2.3. Analytical Framework

2.3.1. Risk Perception

Based on the potential sources of risk, the actors’ perceptions of risk were divided into categories. Using a five-point Likert scale, the respondents’ responses to questions were used to gauge their sense of danger. The farmers and processors were presented with a variety of statements on the hazards connected to their agricultural activities, and they had to agree or disagree with each one while checking the relevant scale or number category according to their perception. There were five descriptive categories used, such as extremely important = 5, important = 4, not sure = 3, not important = 2, and not very important = 1. The farmers’ perceptions of risk related to financial, production, and environmental sources were examined using the weighted scores of each item and their corresponding means, as shown in [

26,

43]. The frequencies of responses for the farmers’ risk perceptions were multiplied by the scores on the Likert scale.

2.3.2. Risk Attitude

The ELCE was used to investigate how farmers reacted to risk. To do this, a series of risky occurrences had their certainty equivalents (CE) determined, and the results were compared to utility values [

36].

Risks rise in direct proportion to monetary value. Following [

26], the expected utility (EU) for the two end point scenarios was first determined, considering a low income of N50,000 (

$63.13)

1 and a high income of N100,000 (

$126.26). When asked to identify the value of certain outcomes, the farmers and processors became uninterested in selecting riskier outcomes with a total household income range from N0 to N100,000. If a respondent selected a risky result with an income of N40,000 (

$50.51), they were required to specify the precise risky outcomes with total incomes ranging from 0 to N40,000 and related prospects.

The CEs were therefore created and evaluated against utility values. The CE was obtained using this method and matched with utility values for the other income distributions. For instance, when asked to specify their exact findings, respondents were asked to identify their total annual income, which is equally likely to range between N100,000 and N40,000. While the highest income N100,000 was matched to the utility value 1, the lowest result N0 was matched to the utility value 0. Furthermore, the utility value 0 was attached to the lower outcome 0 and 1 with the higher outcome N80,000. The value of 0.5 was chosen to the cases where the respondent was asked to choose between N0 and 100,000. The utility value for N 40,000 is expressed as follows:

A cubic utility function was employed to evaluate the utility of all the respondents after the different CE of the individual respondent was obtained and compared with their utility values. The utility function equation is stated as follows:

The cubic utility functions were related with various risk attitudes; risk perception, risk aversion, and risk preference [

44]. Generally, the shape of utility function on a normal scale will change into an absolute risk aversion, which can be employed in quantitatively in estimating risk aversions [

39,

45]. The arithmetic form of absolute risk aversion is as follows:

where;

U’ and U’‘ represents the 1st and 2nd derivatives

W = wealth, respectively, and

ra (w) = the coefficient(s) of absolute risk aversion.

The risk aversion and risk preference characteristics of the respondents are represented by the positive and negative coefficients for absolute risk aversion, respectively, according to [

42]. If the respondents are risk-averse, the outcome will be 0. If not, the respondents’ risk aversion will be equal to 1 and 0.

2.3.3. Determinants of the Risk Attitude and Risk Perception

The logit model was employed to determine the factors influencing the attitudes of farmers and processors toward risk perception. Following [

46], the binary logit model was adopted because the dependent variables of this study had binary outcome. The model was used in examining effect of socioeconomic characteristics on the actors’ risk perceptions and attitude. The logistic model is expressed as follows:

where;

Y* represents the risk attitude and risk perception,

β is the vector of unknown parameters that are estimated,

X represents the vector of explanatory variables which affects outcome variables and

Ɛ is the error term.

It is illustrated as follows:

where Y

ij represents the binary outcome. Y* = 0 if Y* is less than 0, and Y* =1 when Y* is greater than 0 as described below.

Risk perception and risk attitudes of farmers and processors toward various forms of risks were the dependent variable in the study. The independent variables modelled were farm characteristics including, age, marital status, income, occupation, household size, household head, access to extension services, experience and farm size.

3. Results and Discussion

3.1. Demography, Risk Perception and Attitude of Farmers and Processors

The descriptive statistics of the farmers’ and processors’ socio-economic and demographic influencing their risk attitudes and risk perceptions is presented in

Table 1.

From the results presented in

Table 1, the average age of the farmers and processors in the study area is 40 years. Farmer had an average of fourteen years of farming experience growing rice, compared to an average of twelve years for processors. The average number of family members among farmers and processors was 11, with the majority of farmers (75%) having a limited or smaller farm size (about 2 hectares). Furthermore, about 71% of the farmers and about 70% of the processors exhibit a risk-averse behaviour, which means they are unwilling to take any kind of risk.

The results also show that about 31% of farmers perceive production risk to be the least important risk, while 63% of rice farmers believe price risk to be the most critical risk. Similarly, about 59% of rice farmers value market risk highly. The situation relates to the current state of rice cultivation in Nigeria. Higher input costs make it difficult for poor and economically disadvantaged farmers to secure the necessary funding for rice cultivation. Again, because of fluctuations in input or output markets and climate variability, farmers cannot be certain that their turnover will cover their production costs, even if they are effective in managing their financing. The result further showed that, while 42% of rice producers prioritize pricing risk, 62% of processors view production risk as the most important risk. Of all the risks, 38% of farmers consider biological risk to be the least serious.

3.1.2. Risk Perception of the Farmers and Processors

The distribution of the farmers’ and processors’ risk perception is presented in

Table 2. Three risk types were considered, namely, production, market and price risks.

The majority of farmers (93%) and processors (85%), according to the results, faced production risk. Similarly, the majority of farmers and processors cited market and pricing risk as their top concern.

3.2. Risk Attitude of the Farmers and Processors

Equally Likely Certainty Equivalent (ELCE) method was used to estimate the farmers and processors’ risk aversion coefficient. Certainty equivalents (CE) were derived for a sequence of risky outcomes and were matched with the utility values. This was subsequently used to group farmers into risk averters and risk-takers as presented in

Table 3.

Due to the lack of zero risk coefficients, which is a sign of risk neutrality, the result had the attitudes of both the farmers and the processors divided into two classes that were mutually exclusive (risk averse and risk preferring (favourable). The majority of the farmers (71%) had positive absolute risk aversion coefficients according to the results, making them risk averse. The minority (29%) had negative absolute risk aversion Arrow-Pratt coefficients which makes them risk preferring.

Similar findings were found with the processors, with the majority (70%) of them being grouped as risk-averse. The findings support the widespread belief in the agricultural community that smallholder farmers are mostly risk averse, and it is consistent with previous findings from the work of [

47] and [

48].

3.2.1. Determinants of Risk Attitude and Risk Perception of Rice Farmers

The effects of the exogenous variables on the risk attitudes and risk perception of the farmers were investigated using logistic regression model and the result is presented in

Table 4. Values from the diagnostic statistic (likelihood ratio, LR chi, and the pseudo R

2) show the goodness of fit of the model. The marginal effects explain how much the risk aversion level of the farmers’ changes if the exogenous variable changes by a unit.

From the results of the logistic model presented in

Table 4, it was found that the farmer’s risk aversion has a direct connection with age, experience, farm size, and extension contact because of the positive and significant coefficients. This implies that a unit increase in farmers’ age will lead to an increase of 0.008 in their level of risk aversion. The coefficient of extension service was positive and statistically significant at 5% which means that an increase in extension contact will cause a rise of 0.089 in the farmer’s risk aversion level. Moreover, as the farmers experience level increases by one unit, the rice farmers tend to increase in their risk aversion level by 0.008. For an increase in farm size, there is an increase of 0.068 in the farmers’ risk aversion level.

The results also show that farmers risk attitudes are positively and significantly influenced by age, access to training, farm size, and farming experience. The age coefficient was positively related to the farmers’ risk attitudes at 1% significant level of probability, indicating that older farmers are more risk averse than younger farmers. This implies that younger farmers are more interested in challenging risks than older farmers which could be attributed to the fact that younger farmers are likely to be more innovative and energetic than older farmers. This is consistent with the findings of [

33] and [

49]. In a similar vein, farmers with more years of farming experience tend to be more risk-averse than farmers with less farming experience. This finding conflicts with that of [

10] that reported that farmers’ risk aversion was negatively correlated with their farming experience. Similarly, access to extension services and farm size were found to be statistically significant, suggesting that farmers who have greater access to information and have larger farms likely to be risk averse. Also, a negative coefficient but significant experience is consistent with the findings of [

50] that reported that experienced farmers recognize price risk as the main risk to rice producers which may be attributed to their poor financial condition.

Additionally, the results indicate that age has a positive but non-significant impact on market risk, while it has a significant positive impact (at the 1% level of significance) on output and pricing risks. Older farmers take into consideration the risk of fluctuations in input-output prices, while young farmers who are inexperienced with using pesticides, controlling pests, and other agricultural techniques face a significant production risk [

51]. The outcome additionally demonstrates that more seasoned rice farmers rank market risk as the most significant risk, whereas less seasoned farmers rank production risk higher.

The result further demonstrates that more experienced rice farmers prioritize market risk as the most important risk, whereas less experienced farmers prioritize production risk higher Furthermore, household income is statistically significant for both prices and production risks and exhibits a positive association with all risk perceptions. This suggests that in order to increase their profits, farmers who earn more money take on more production risk.

Education was negatively correlated with production risk, indicating that farmers with higher levels of education did not view pest and disease risk as a significant concern for their crop. This may occur from knowledgeable, educated farmers placing a higher value on other risks than production risk. The majority of rice farmers view market risk as a significant issue, as evidenced by the positive and high formal education coefficient for market risk.

The result further indicates that farmers’ perceptions of market and production risk are highly influenced by the size of their farms. Compared to farmers with relatively smaller farms, farmers with larger farms view production and market risks as a challenge. This result aligns with the findings by [

51] and [

50]. However, even though the result is not significant, farmers who own large farms perceive that price is a key risk factor.

The results also indicate a positive correlation between risk preference and high family sizes, which may be explained by labor availability giving farmers the confidence to take on more risk. Furthermore, the results of [

50], which revealed that seasoned farmers identify price risk as the main risk to rice producers and may be related to their precarious financial situation, are consistent with a negative coefficient but significant experience.

The results also indicate a positive relationship between large family size and risk preference, which may be explained by labour availability giving farmers the confidence to take on more risk. This validates the findings of [

51] who stated that farmers with large household were more risk seeking than farmers with smaller households but contradicts those of [

46] who found no significant relationship between household sizes with risk aversion of farmers.

3.2.2. Determinants of Risk Attitude and Perception of Rice Processors

The logistic regression and marginal effects results for the risk attitude of processors is presented in

Table 5.

The result shows that formal education, experience, and extension contacts were all statistically significant. The results of the marginal effects (ME) showed that formal education, extension contact and experience all had a proportional relationship with processors risk aversion status. This is an indication that a unit change in the variable of interest translate to an increase or decrease in the risk aversion level by the coefficient value of the variable.

On the response scale, it was observed that education has an inverse relationship with the risk aversion level of the processors. This implies that if the education of the processors increases by one unit, the risk aversion level of the processor tends to decrease by 0.015 units. The coefficient of extension service is negative and statistically significant at 1%. This implies that the risk aversion level of the processors tends to decrease by 0.122 units as the extension contacts increases by one unit. On the response scale for experience, the marginal effect is negative and significant at 1%. This means as the experience of the processors increases by one unit, there is a decrease of 0.012 units in their risk aversion level.

The logistic regression model result of factors affecting rice processors’ risk attitudes and perception are presented in

Table 5. Age has a positive and non-significant coefficient which suggests that younger processors are more risk loving than older processors. This is similar to the findings of [

52]. The coefficient of processing experience is positive and statistically significant this means rice processors with more experience are less risk averse compared to processors with lesser experience. This could be that experienced processors have a good knowledge of risk management strategies and this is consistent with the findings about the farmers’ attitude toward risk. This suggests that the years of experience had not led to a decrease in risk aversion. This result is in line with the results of [

6,

53], but in contrast with the findings [

54,

55].

Similarly, educated processors exhibited more risk-averse behaviour since a higher level of education or knowledge would enhance the perception of various risks associated with farming by the family head or other decision-maker. So, it may influence decisions made at the farm level and strategies employed to manage a number of risks. Education plays a big part in this since it helps a decision maker see things more clearly, which makes it important. This is consistent with the findings of [

56,

57]. Also, when compared to processors who lack training, those who have access to training are more risk-averse. The possible reason may be the information level difference.

The processors with higher income were found to be less risk averse than the processors with lesser income. This could be as a result more income which can escalate processor risk bearing capacity, so they can try to adopt new technology and become willing to take the risk of doing better and finally attitude of farmer towards risk changes. The results also supported the findings of [

55] and [

56]. Findings on household size show a positive coefficient. This implies that processors with large household size are less averse to risk than those with fewer household sizes. This is in line with the findings of [

56].

The results presented in

Table 5 shows that production risk, market risk, and price risk were the three main concerns that were covered. The only factor that statistically significantly affects how the processors perceive production risk is age, education, and family size. This is consistent with the findings of [

57,

58]. According to rice processors’ perceptions of market risk, major factors include income, age, household headship, marital status, and experience. Market risk is a risk that older, more seasoned rice processors value more than younger, less seasoned processors. The same is true of income, suggesting that processors with higher incomes perceive market risk more highly than those with lower incomes. This is in line with the research findings of [

51]. Age, household head, and income coefficients are statistically significant and positive for price risk. Older processors who are the head of the household value price risk over production and market risk. Corresponding to this, more experienced rice processors give greater importance on price risk than inexperienced and younger rice processors. Also, processors with higher incomes perceive price risk as being higher than those with lower incomes.

3.3. Rice Farmers’ Perception of the Sources of Risk

The unpredictability nature of the outcome of production with certainty emanates from various sources. Rice farmers’ perception of the sources of risk is presented in

Table 6.

Pests and illnesses were ranked as the top risk factor by the majority of farmers and were the most prevalent risk factor among others. This finding is in line with the findings of [

58] and [

59], who reported that rice pest and disease stood out as the major risk affecting the farmers. The findings demonstrate why disease control raises farmers’ output costs and why farmers rated disease incidence so highly. According to the findings, farmers identified drought, price volatility, and a lack of input as the second, third, and fourth most significant risk factors, respectively as also reported by the findings of [

58] agree with this. Similarly, [

60] reported that adverse weather (drought or excessive rainfall) is a significant risk that influences farmers’ production, resulting in crop failures and variations in crop yield. The farmers have identified two main sources of risk as market failures and infrastructural challenges which they said have impact on their profitability. This is in line with the findings of [

61].

3.4. Rice processors Perception of the Sources of Risk

Rice processors perception of risk sources is presented in

Table 7.

From

Table 7, it can be seen that rice processors perceive price fluctuation as the most important source of risk. According to [

62], the growth of small-scale agricultural activities is fully dependent on the stability of the prices of the products they produce. Similarly, [

63] reported there are variations in rice production are caused by unstable input prices. As a result, production changes lag behind changes in pricing, which leads to an imbalance between yield and price.

The majority of rice processors considered the lack of modern technology and poor storage facilities to be a very significant risk. This is consistent with the research findings of [

64] which reported that rice processors use old processing equipment and have limited access to other necessary facilities, such as paddy and milled rice grading facilities, and adequate storage and transport facilities, which has an impact on the processing quality of rice. Additional risk factors were household head illness (63.3%), labor (56.7%), infrastructural problems (28.3%), and high processing cost (21.7%), in descending order of importance.

3.5. Risk Management Strategies Adopted by Rice Farmers

The various strategies employed by the rice farmers to mitigate risks in the study area are presented in

Table 8.

Off-farm investment was ranked top because it is regarded as a key risk management strategy. This is in line with the research of [

65], which revealed that farmers favored crop variety as a risk management strategy. Because farmers viewed pests and diseases as a significant source of risk, it is not surprising that pest and disease control was ranked second. Hence, reducing the prevalence of pests and illnesses could help reduce the risk involved and enhance rice output. This supports the findings of [

66,

67] who found that illnesses and pests pose significant hazards to rice growers. In addition, cash contributions came in third as a risk management strategy used to lessen risk. Training came in fourth place and was listed as an important aspect in risk management. If the farmers received education and training, it would help them to raise their level of awareness and give them a greater understanding of the risks they face. It is interesting that the majority of rice farmers employ a variety of risk management techniques. Financial buffer (33%) and cooperative societies (30%), which are placed 11th and 12th, respectively, are other risk management strategies that are thought to be very significant. Selling assets was shown to be a less significant aspect in risk management as 43% of rice farmers placed it 13th.

3.8. Risk Management Strategies Adopted by Rice Processors

The strategies identified by the processors as management tools used to mitigate the sources of risk are presented in

Table 9.

From

Table 9, cash contribution was ranked first which as the major management strategy employed by processors in managing risk the risk. Market information was ranked second as management strategy adopted to help mitigate risk by the rice processors. About 60% of the farmers stated that diversification is an important factor in risk mitigation. According to [

46], investment in off farm activities as an important risk management strategy for agricultural production. Borrowing and crop insurance are considered as important strategy by the processors and they are both ranked 5th. This is understandable because insurance is one of the prerequisites to assessing a loan as reported by [

68]. Other important risk management strategies reported in order of ascension are training (33%) and price control (25%) which are ranked 10th and 11th respectively. Like rice farmers, processors also reported selling of assets as a less important factor in managing risks as 38.3% of the rice processors ranked it 12th.

4. Conclusions and Policy Implications

The study evaluated the risk attitude, risk perception and management strategies of randomly selected 200 rice farmers and 60 rice processors in Kwara State, Nigeria. Risk aversion and risk preference were the two primary categories of risk attitude identified among the actors in the rice value chain. According to the findings of this study, majority of farmers and processors are risk averse. Also, both farmers and processors consider price risk, market risk, and production risk as major sources of risk. From the result of the logistic analysis, it can be concluded that age, access to extension services, farm size, household size, education, income, and experience have a statistically significant effect on the farmers and processors risk attitudes and perceptions. This implies that these factors are important to consider while developing risk management policies at the farm level.

The findings have practical implications for improving farm risk management by targeting risk attitude and perception through various interventions. Furthermore, this research findings may be useful for policymakers, producers, and farm management consultants providing risk management services. Policymakers can gain insight into farmers’ reactions to policy changes, as well as how they combine and prioritize risk management strategies. Our findings will help farm management consultants tailor their advice and risk management services to farmers’ socioeconomic characteristics and decision-making processes.

Farmers’ access to adequate and effective basic educational opportunities must be improved. The government must strengthen the existing education system by providing the necessary resources required in managing risks. Furthermore, it is recommended that policies and strategies should place a greater emphasis on strengthening agricultural extension service provision by providing incentives, training, increasing educational levels, and assigning non-overlapping and harmonious responsibilities to extension agents as this would help provide timely information to farmers so that they better manage various risks.

Appendix A

Table A1.

Absolute risk aversion coefficient of the farmers.

Table A1.

Absolute risk aversion coefficient of the farmers.

| Farmer Number |

Absolute risk

aversion

coefficient |

Farmer Number |

Absolute risk

aversion

coefficient |

Farmer Number |

Absolute risk

aversion

coefficient |

| 1 |

-0.00003615 |

36 |

-0.00000959 |

71 |

0.00001604 |

| 2 |

-0.00005389 |

37 |

0.0001198 |

72 |

0.00005554 |

| 3 |

0.00001558 |

38 |

0.00000959 |

73 |

0.000009769 |

| 4 |

0.00001561 |

39 |

0.000004813 |

74 |

0.000009769 |

| 5 |

0.000003184 |

40 |

7.041E-07 |

75 |

0.000009769 |

| 6 |

0.000003184 |

41 |

0.000004813 |

76 |

0.000009769 |

| 7 |

0.00005956 |

42 |

9.171E-07 |

77 |

-0.00000959 |

| 8 |

0.00001668 |

43 |

-0.00000959 |

78 |

0.000009769 |

| 9 |

0.00001668 |

44 |

0.00000977 |

79 |

0.00001704 |

| 10 |

0.00000277 |

45 |

0.00001041 |

80 |

0.000009769 |

| 11 |

0.000003379 |

46 |

0.000005042 |

81 |

0.00001608 |

| 12 |

0.00000277 |

47 |

9.171E-07 |

82 |

0.00001608 |

| 13 |

0.000003184 |

48 |

0.00001075 |

83 |

-0.000001245 |

| 14 |

0.00004254 |

49 |

9.171E-07 |

84 |

9.171E-07 |

| 15 |

0.00001069 |

50 |

0.000008466 |

85 |

0.00001014 |

| 16 |

0.000007467 |

51 |

-0.00002514 |

86 |

-0.000001124 |

| 17 |

0.000003891 |

52 |

-0.00000959 |

87 |

0.00001608 |

| 18 |

0.0001 |

53 |

-0.00000959 |

88 |

9.171E-07 |

| 19 |

0.0001485 |

54 |

0.00001091 |

89 |

0.00001608 |

| 20 |

0.0001485 |

55 |

0.00001055 |

90 |

-0.00000959 |

| 21 |

0.0001 |

56 |

0.00001112 |

91 |

0.0000524 |

| 22 |

0.00001113 |

57 |

0.00000977 |

92 |

0.00001608 |

| 23 |

0.0000568 |

58 |

-0.00000959 |

93 |

-0.00002514 |

| 24 |

-0.000001245 |

59 |

0.000001608 |

94 |

-0.00000959 |

| 25 |

0.00000977 |

60 |

-0.000001245 |

95 |

-0.00000959 |

| 26 |

0.00000977 |

61 |

0.00005554 |

96 |

0.000009769 |

| 27 |

-0.00000959 |

62 |

0.00000977 |

97 |

0.000009769 |

| 28 |

-0.00000959 |

63 |

-0.00000959 |

98 |

-0.00000959 |

| 29 |

-0.00002409 |

64 |

0.00001608 |

99 |

-0.000009525 |

| 30 |

9.171E-07 |

65 |

0.000009769 |

100 |

9.171E-07 |

| 31 |

0.000004746 |

66 |

0.00001608 |

101 |

-0.000009575 |

| 32 |

9.171E-07 |

67 |

-0.00000959 |

102 |

-0.00000959 |

| 33 |

-0.00000959 |

68 |

0.00005554 |

103 |

0.000009229 |

| 34 |

9.171E-07 |

69 |

0.000009715 |

104 |

0.000009769 |

| 35 |

-0.00000959 |

70 |

-0.00000959 |

105 |

-0.00000959 |

| 106 |

9.171E-07 |

141 |

-0.00005389 |

176 |

9.171E-07 |

| 107 |

-0.00000959 |

142 |

0.00001608 |

177 |

-0.00000959 |

| 108 |

0.000009769 |

143 |

-0.00000959 |

178 |

-0.00000959 |

| 109 |

0.000009769 |

144 |

0.00005554 |

179 |

-0.00000959 |

| 110 |

-0.000009575 |

145 |

0.000009715 |

180 |

0.000001608 |

| 111 |

0.000009731 |

146 |

-0.00000959 |

181 |

-0.000001245 |

| 112 |

0.00000277 |

147 |

0.00005554 |

182 |

0.00005554 |

| 113 |

0.000009769 |

148 |

0.000009769 |

183 |

0.00000977 |

| 114 |

0.000008466 |

149 |

0.000009769 |

184 |

-0.00000959 |

| 115 |

-0.00002514 |

150 |

0.000009769 |

185 |

0.00001608 |

| 116 |

-0.00000959 |

151 |

0.000009769 |

186 |

0.000009769 |

| 117 |

-0.00000959 |

152 |

0.0001198 |

187 |

0.00001608 |

| 118 |

0.000003184 |

153 |

0.00000959 |

188 |

-0.00000959 |

| 119 |

0.00001558 |

154 |

0.000004813 |

189 |

0.00005956 |

| 120 |

0.00001014 |

155 |

7.041E-07 |

190 |

0.00001668 |

| 121 |

0.000004746 |

156 |

0.000004813 |

191 |

0.00001668 |

| 122 |

-0.00002514 |

157 |

-0.00000959 |

192 |

0.00000277 |

| 123 |

-0.00000959 |

158 |

-0.00000959 |

193 |

0.000003379 |

| 124 |

-0.00000959 |

159 |

0.00001608 |

194 |

0.00000277 |

| 125 |

0.000001608 |

160 |

0.000009769 |

195 |

0.000003184 |

| 126 |

0.000009229 |

161 |

0.00001608 |

196 |

-0.000009575 |

| 127 |

0.00001604 |

162 |

0.00001561 |

197 |

-0.00000959 |

| 128 |

0.00005554 |

163 |

0.000003184 |

198 |

0.000009229 |

| 129 |

0.000009715 |

164 |

0.000003184 |

199 |

0.000009769 |

| 130 |

-0.00000959 |

165 |

0.00005956 |

200 |

-0.00000959 |

| 131 |

-0.00000959 |

166 |

0.00001668 |

|

|

| 132 |

0.00001558 |

167 |

0.00001668 |

|

|

| 133 |

0.00001561 |

168 |

0.00000277 |

|

|

| 134 |

-0.00000959 |

169 |

0.000003379 |

|

|

| 135 |

0.00001075 |

170 |

-0.00000959 |

|

|

| 136 |

9.171E-07 |

171 |

0.00001091 |

|

|

| 137 |

0.000008466 |

172 |

0.000003184 |

|

|

| 138 |

0.000009769 |

173 |

0.00001558 |

|

|

| 139 |

-0.00000959 |

174 |

0.00001014 |

|

|

| 140 |

-0.00003615 |

175 |

0.000004746 |

|

|

Table A2.

Absolute risk aversion coefficient of the processors.

Table A2.

Absolute risk aversion coefficient of the processors.

| Processor Number |

Absolute risk aversion coefficient |

Processor Number |

Absolute risk aversion coefficient |

| 1 |

0.000003184 |

31 |

0.00000277 |

| 2 |

0.00001069 |

32 |

-0.00005389 |

| 3 |

-0.000001245 |

33 |

0.00001075 |

| 4 |

0.00000977 |

34 |

0.000003184 |

| 5 |

-0.00000959 |

35 |

0.000001608 |

| 6 |

0.00005554 |

36 |

-0.000001245 |

| 7 |

0.00000977 |

37 |

0.000007467 |

| 8 |

-0.00005389 |

38 |

-0.00000959 |

| 9 |

0.0001 |

39 |

0.000009769 |

| 10 |

0.00000277 |

40 |

-0.00002409 |

| 11 |

-0.00000959 |

41 |

0.000004813 |

| 12 |

-0.00003615 |

42 |

0.00004254 |

| 13 |

0.0001485 |

43 |

-0.00000959 |

| 14 |

-0.00000959 |

44 |

0.00001014 |

| 15 |

0.000005042 |

45 |

0.00001041 |

| 16 |

0.000003891 |

46 |

0.00005554 |

| 17 |

0.000008466 |

47 |

9.171E-07 |

| 18 |

-0.00002514 |

48 |

0.00001075 |

| 19 |

-0.00000959 |

49 |

0.000009769 |

| 20 |

0.000001608 |

50 |

0.000009769 |

| 21 |

0.00001608 |

51 |

0.00001668 |

| 22 |

-0.000001245 |

52 |

0.00001668 |

| 23 |

-0.00003615 |

53 |

0.00005554 |

| 24 |

-0.00000959 |

54 |

0.000009769 |

| 25 |

9.171E-07 |

55 |

0.000009769 |

| 26 |

0.00001014 |

56 |

0.00001608 |

| 27 |

-0.00003615 |

57 |

0.000009769 |

| 28 |

-0.000001245 |

58 |

7.041E-07 |

| 29 |

0.000001608 |

59 |

0.00001608 |

| 30 |

0.000009229 |

60 |

0.000009769 |

| 1 |

$1 was equivalent of N793 at the time of this study. |

References

- Akcaoz, H.; Ozkan, B. Determining risk sources and strategies among farmers of contrasting risk awareness: A case study for Cukurova region of Turkey. J. Arid. Environ. 2005, 62, 661–675. [Google Scholar] [CrossRef]

- Ayinde, O.E. Risk analysis in innovation system: a case study of production of vitamin A cassava variety among farmers in Oyo state, Nigeria. J. Agric. Fac. Gaziosmanpaşa Univ. (JAFAG) 2017, 34, 261–268. [Google Scholar]

- Zulfiqar, F.; Ullah, R.; Abid, M.; Hussain, A. Cotton production under risk: a simultaneous adoption of risk coping tools. Nat. Hazards 2016, 84, 959–974. [Google Scholar] [CrossRef]

- Mgale, Y.J.; Yunxian, Y. Price risk perceptions and adoption of management strategies by smallholder rice farmers in Mbeya region, Tanzania. Cogent Food Agric. 2021, 7, 1919370. [Google Scholar] [CrossRef]

- Pochara, F. Commodities Exchange: Options for Addressing Price Risk and Price Volatility in Rice. 2012. [Google Scholar]

- Adnan, K.M.M.; Ying, L.; Sarker, S.A.; Hafeez, M.; Razzaq, A.; Raza, M.H. Adoption of Contract Farming and Precautionary Savings to Manage the Catastrophic Risk of Maize Farming: Evidence from Bangladesh. Sustainability 2018, 11, 29. [Google Scholar] [CrossRef]

- Hamsa, K.; Bellundagi, V. Review on Decision-making under Risk and Uncertainty in Agriculture. Econ. Aff. 2017, 62, 447–453. [Google Scholar] [CrossRef]

- Aina, O., & Omonona, B. Nigeria agricultural insurance scheme (NAIS): Prospect, achievement and problems. Global Advanced Research Journal of Agricultural Science, 2012, 1(5), 097-103.

- Hardaker, J., Huirne, R., Anderson, J., & Lien, G. (2004). Coping with risk in agriculture. CABI. CABI, Wallingford.

- Hardaker, J., Lien, G., Anderson, J., & Huirne, R. (2015). Introduction to risk in agriculture. In Coping with risk in agriculture: applied decision analysis (pp. 1-15). CABI Wallingford UK.

- Okoruwa, V.O. (2006). Technical efficiency differentials in rice production technologies in Nigeria.

- Patria, D.G.; Sutrisno, A.; Sukamto, S.; Lin, J. Process optimization in the development of porang glucomannan (Amorphophallus mulleri B.) incorporated into the restructured rice using a pasta extruder: physicochemical properties, cooking characteristics, and an estimated glycemic index. Food Sci. Technol. 2022, 42, e03021. [Google Scholar] [CrossRef]

- Obalola, T. O., Likita, T., Aboaba, K. O., & Olabode, E. J. (2020). Drivers of Cassava and rice consumption in Nigeria: A vector error correction model approach. Agro-Economist, 7(1), 1-11.

- United State Department of Agriculture (2024). World agricultural production. Foreign agricultural services, Circular Series WAP 2-24 February 2024.

- Food and Agriculture Organization (2022). Cereal supply and demand brief.

- Bello, L.O.; Baiyegunhi, L.J.S.; Danso-Abbeam, G. Productivity impact of improved rice varieties' adoption: case of smallholder rice farmers in Nigeria. Econ. Innov. New Technol. 2021, 30, 750–766. [Google Scholar] [CrossRef]

- Abid, M.; Scheffran, J.; Schneider, U.A.; Ashfaq, M. Farmers' perceptions of and adaptation strategies to climate change and their determinants: the case of Punjab province, Pakistan. Earth Syst. Dyn. 2015, 6, 225–243. [Google Scholar] [CrossRef]

- Kukal, M.S.; Irmak, S. Climate-driven crop yield and yield variability and climate change impacts on the U.S. great plains agricultural production. Sci. Rep. 2018, 8, 3450. [Google Scholar] [CrossRef]

- Ngailo, J., Mwakasendo, J., Kisandu, D., & Tippe, D. (2016). Rice farming in the Southern Highlands of Tanzania: management practices, socio-economic roles and production constraints. Eur. J. Res. Soc. Sci, 4.

- Obalola, T. O., Aboaba, K. O., Agboola, B. O., AMEH, E. P., & ABUBAKAR, B. B. (2021). Effect Of Information System on Risk Attitudes Of Rural Farmers In Goronyo Irrigation Scheme, Goronyo Local Government Area, Sokoto State, Nigeria. Scientific Papers: Management, Economic Engineering in Agriculture & Rural Development, 21(1).

- Seck, P.A.; Tollens, E.; Wopereis, M.C.; Diagne, A.; Bamba, I. Rising trends and variability of rice prices: Threats and opportunities for sub-Saharan Africa. Food Policy 2010, 35, 403–411. [Google Scholar] [CrossRef]

- Gattig, A.; Hendrickx, L. Judgmental Discounting and Environmental Risk Perception: Dimensional Similarities, Domain Differences, and Implications for Sustainability. J. Soc. Issues 2007, 63, 21–39. [Google Scholar] [CrossRef]

- Ayinde, K., Ayinde, O. E., Muchie, M., Omotesho, O., & Adewumi, M. O. (2012). Multi-Risk model of small-scale agricultural enterprenuers in Central Part of Nigeria.

- Flaten, O.; Lien, G.; Koesling, M.; Valle, P.; Ebbesvik, M. Comparing risk perceptions and risk management in organic and conventional dairy farming: empirical results from Norway. Livest. Prod. Sci. 2005, 95, 11–25. [Google Scholar] [CrossRef]

- Lucas, M.; Pabuayon, I. University of the Philippines Los Baños Risk Perceptions, Attitudes, and Influential Factors of Rainfed Lowland Rice Farmers in Ilocos Norte, Philippines. Asian J. Agric. Dev. 2011, 8, 61–77. [Google Scholar] [CrossRef]

- Islam, D.I.; Rahman, A.; Sarker, N.I.; Sarker, S.R.; Jianchao, L. Factors Influencing Rice Farmers’ Risk Attitudes and Perceptions in Bangladesh amid Environmental and Climatic Issues. Pol. J. Environ. Stud. 2020, 30, 177–187. [Google Scholar] [CrossRef] [PubMed]

- Duong, T.T.; Brewer, T.; Luck, J.; Zander, K. A Global Review of Farmers’ Perceptions of Agricultural Risks and Risk Management Strategies. Agriculture 2019, 9, 10. [Google Scholar] [CrossRef]

- Sulewski, P.; Kłoczko-Gajewska, A. Farmers’ risk perception, risk aversion and strategies to cope with production risk: an empirical study from Poland. Stud. Agric. Econ. 2014, 116, 140–147. [Google Scholar] [CrossRef]

- van Winsen, F.; de Mey, Y.; Lauwers, L.; Van Passel, S.; Vancauteren, M.; Wauters, E. Determinants of risk behaviour: effects of perceived risks and risk attitude on farmer’s adoption of risk management strategies. J. Risk Res. 2014, 19, 56–78. [Google Scholar] [CrossRef]

- NPC (2006): State Population, National Population Commission Nigeria. http://www.population.gov.ng/index.php?option=com_content&view=article&id=89. Retrieved 22nd of July, 2012.

- Kwara State Agricultural Development Project, KWADP, (2000): Agronomic Survey Report, Kwara State, Nigeria.

- Ayinde, O. E., Adenuga, A. H., Omotesho, K. F., & Oke, A. O. (2012). Comparative analysis of root and tuber expansion programme In Kwara State, Nigeria. Journal of Agriculture and Social Research (JASR), 12(2), 19-28.

- Dadzie, S.K.N.; Acquah, H.D.-G. Attitudes Toward Risk and Coping Responses: The Case of Food Crop Farmers at Agona Duakwa in Agona East District of Ghana. Int. J. Agric. For. 2012, 2, 29–37. [Google Scholar] [CrossRef]

- Moscardi, E., & De Janvry, A. (1977). Attitudes toward risk among peasants: an econometric approach. American Journal of Agricultural Economics, 59(4), 710-716.

- Dillon, J.L.; Scandizzo, P.L. Risk Attitudes of Subsistence Farmers in Northeast Brazil: A Sampling Approach. Am. J. Agric. Econ. 1978, 60, 425–435. [Google Scholar] [CrossRef]

- Binici, T., Koc, A., Zulauf, C. R., & Bayaner, A. (2003). Risk attitudes of farmers in terms of risk aversion: A case study of lower Seyhan plain farmers in Adana province, Turkey. Turkish Journal of Agriculture and Forestry, 27(5), 305-312.

- Binswanger, H.P. Attitudes Toward Risk: Experimental Measurement in Rural India. Am. J. Agric. Econ. 1980, 62, 395–407. [Google Scholar] [CrossRef]

- Anderson, J. R., Dillon, J. L., & Hardaker, J. B. (1985). Farmers and risk.

- Olarinde, L., Manyong, V. M., & Akintola, J. (2007). Attitudes towards risk among maize farmers in the dry savanna zone of Nigeria: some prospective policies for improving food production. African Journal of Agricultural Research.

- Von Neumann, J.; Morgenstern, O. 1944: Theory of Games and Economic Behavior; Princeton University Press: Princeton, NJ, USA, 1944.

- Levy, H.; Levy, A. Arrow-Pratt Measures of Risk Aversion: The Multivariate Case. Int. Econ. Rev. 1991, 32, 891. [Google Scholar] [CrossRef]

- Musser, W. N., & Patrick, G. F. (2002). How much does risk really matter to farmers? In A comprehensive assessment of the role of risk in US agriculture (pp. 537-556). Springer.

- Obalola, O.T.; Ayinde, O.E. Risk and risk management strategies of smallholder onion farmers in Sokoto state, Nigeria. Acta Agric. Slov. 2018, 111, 559–566. [Google Scholar] [CrossRef]

- Oppong, S. (2021). From risk perception to accident: An empirical test of the risk chain process model. Sigurnost, 63(2), 125-142.

- Pratt, J.W. (1978). Risk aversion in the small and in the large. In Uncertainty in economics (pp. 59-79). Elsevier.

- Ullah, R.; Jourdain, D.; Shivakoti, G.P.; Dhakal, S. Managing catastrophic risks in agriculture: Simultaneous adoption of diversification and precautionary savings. Int. J. Disaster Risk Reduct. 2015, 12, 268–277. [Google Scholar] [CrossRef]

- Aydogdu, M.H.; Yenigün, K. Farmers’ Risk Perception towards Climate Change: A Case of the GAP-Şanlıurfa Region, Turkey. Sustainability 2016, 8, 806. [Google Scholar] [CrossRef]

- Korir, L.K. (2011). Risk management among agricultural households and the role of off-farm investments in Uasin Gishu County, Kenya.

- Adnan, K.M.M.; Sarker, S.A.; Tama, R.A.Z.; Shan, T.B.; Datta, T.; Monshi, M.H.; Hossain, S.; Akhi, K. Catastrophic risk perceptions and the analysis of risk attitudes of Maize farming in Bangladesh. J. Agric. Food Res. 2023, 11. [Google Scholar] [CrossRef]

- Akhtar, S.; Li, G.-C.; Nazir, A.; Razzaq, A.; Ullah, R.; Faisal, M.; Naseer, M.A.U.R.; Raza, M.H. Maize production under risk: The simultaneous adoption of off-farm income diversification and agricultural credit to manage risk. J. Integr. Agric. 2019, 18, 460–470. [Google Scholar] [CrossRef]

- Ahmad, D., Afzal, M., & Rauf, A. (2019). Analysis of wheat farmers’ risk perceptions and attitudes: evidence from Punjab, Pakistan. Natural Hazards, 95(3), 845-861.

- Rehima, M., Belay, K., Dawit, A., & Rashid, S. (2013). Factors affecting farmers’ crops diversification: Evidence from SNNPR, Ethiopia. International Journal of Agricultural Sciences, 3(6), 558-565.

- Fahad, S.; Wang, J.; Khan, A.A.; Ullah, A.; Ali, U.; Hossain, M.S.; Khan, S.U.; Huong, N.T.L.; Yang, X.; Hu, G.-Y.; et al. Evaluation of farmers' attitude and perception toward production risk: Lessons from Khyber Pakhtunkhwa Province, Pakistan. Hum. Ecol. Risk Assessment: Int. J. 2018, 24, 1710–1722. [Google Scholar] [CrossRef]

- e Saqib, S.; Ahmad, M.M.; Panezai, S.; Ali, U. Factors influencing farmers' adoption of agricultural credit as a risk management strategy: The case of Pakistan. Int. J. Disaster Risk Reduct. 2016, 17, 67–76. [Google Scholar] [CrossRef]

- Yusuf, S. A., Ashagidigbi, W. M., & Bwala, D. P. (2015). Poverty and risk attitude of farmers in North-Central, Nigeria. Journal of environmental and agricultural sciences, 3, 1-7.

- Zeweld, W.; Van Huylenbroeck, G.; Tesfay, G.; Speelman, S. Impacts of socio-psychological factors on smallholder farmers’ risk attitudes: empirical evidence and implications. Agrekon 2019, 58, 253–279. [Google Scholar] [CrossRef]

- Akhtar, S.; Gu-cheng, L.; Ullah, R.; Nazir, A.; Amjed, M.; Haseeb, M.; Iqbal, N.; Faisal, M. Factors influencing hybrid maize farmers' risk attitudes and their perceptions in Punjab Province, Pakistan. J. Integr. Agric. 2018, 17, 1454–1462. [Google Scholar] [CrossRef]

- Abdulrahman, A., & Abdullahi, A. (2020). Risk situations and poverty management strategies among rice farmers inNiger state, Nigeria. Journal of sustainable development in Africa, 22(4), 61-73.

- Nguyen, K.T.; Ho, C.H.P.; Trinh, D.C. Risks and risk responses of rice farmers in the Mekong Delta, Vietnam. Lett. Spat. Resour. Sci. 2021, 15, 129–144. [Google Scholar] [CrossRef]

- Ayinde, O., Omotesho, O., & Adewumi, M. (2008). Risk attitudes and management strategies of small-scale crop producer in Kwara State, Nigeria: A ranking approach. African Journal of Business Management, 2(12), 217.

- Sibanda, S., & Workneh, T. S. (2020). Potential causes of postharvest losses, low-cost cooling technology for fresh produce farmers in Sub-Sahara Africa. African Journal of Agricultural Research, 16(5), 553-566.

- Huka, H., Ruoja, C., & Mchopa, A. (2014). Price fluctuation of agricultural products and its impact on small scale farmers development: Case analysis from Kilimanjaro Tanzania. European Journal of Business and Management, 6(36), 155-160.

- Xie, H.; Wang, B. An Empirical Analysis of the Impact of Agricultural Product Price Fluctuations on China’s Grain Yield. Sustainability 2017, 9, 906. [Google Scholar] [CrossRef]

- Alemu, D., Isinika, A., Odame, H., & Thompson, J. (2021). The Role of Small-Scale Processors in Supporting Agricultural Commercialisation Among Smallholder Rice Farmers in East Africa: Lessons from Ethiopia and Tanzania.

- Ellis, E. (2017). Factors affecting risk management strategies to climate change effects in Ghana. International Journal of Food and Agricultural Economics (IJFAEC), 5(1128-2018-073), 1-17.

- Pasaribu, S.M. (2010). Developing rice farm insurance in Indonesia. Agriculture and Agricultural Science Procedia, 1, 33-41.

- Ajala, A.S.; Gana, A. Analysis of Challenges Facing Rice Processing in Nigeria. J. Food Process. 2015, 2015, 1–6. [Google Scholar] [CrossRef]

- Balana, B.B.; Oyeyemi, M.A. Agricultural credit constraints in smallholder farming in developing countries: Evidence from Nigeria. World Dev. Sustain. 2022, 1. [Google Scholar] [CrossRef]

Table 1.

Descriptive analysis of the variables used in the model.

Table 1.

Descriptive analysis of the variables used in the model.

| |

|

Farmers |

Processors |

| Variables |

Description |

Mean |

Standard deviation |

Mean |

Standard deviation |

| Independent variables |

|

|

| Households socio-economic characteristics |

|

|

| Age |

Continuous |

39.710 |

9.07844 |

40.1500 |

8.37637 |

| Experience (years) |

Continuous |

13.6550 |

7.68121 |

12.0167 |

6.89016 |

| Household size |

Continuous |

10.8350 |

4.73072 |

11.3167 |

4.42064 |

| Income |

Continuous |

468916.6667 |

170037.64207 |

201758.3 |

84618.1 |

| Farm size |

Dummy takes the value 1 if small (farm size: <6 acres as small, 6-10

acres as medium, and >10 acres as large) and 0 otherwise |

2.0250 |

0.74993 |

|

| Access to extension services |

Dummy takes the value 1 if there is high frequency and 0 otherwise |

1.5050 |

0.50123 |

1.5000 |

0.50422 |

| Risk perceptions |

| Production risk |

Dummy takes the value 1 if production risk value>5 and 0 otherwise |

1.3050 |

0.46156 |

1.6167 |

0.49030 |

| Market risk |

Dummy takes the value 1 if market risk value>5 and 0 otherwise |

1.5900 |

0.49307 |

1.3833 |

0.49030 |

| Price risk |

Dummy takes the value 1 if price risk value>5 and 0 otherwise |

1.6300 |

0.48402 |

1.4167 |

0.49717 |

| Risk attitude |

Dummy takes the value 1 if risk averse and 0 otherwise |

0.7100 |

0.45490 |

0.7000 |

0.46212 |

Table 2.

Distribution of the risk perception of the farmers and processors.

Table 2.

Distribution of the risk perception of the farmers and processors.

| Perception |

Farmers (n=200) |

Processors (n=60) |

| |

|

|

| |

Frequency |

Percentage |

Frequency |

Percentage |

| Production |

| Yes |

186 |

93.0 |

51 |

85.0 |

| No |

14 |

7.0 |

9 |

15.0 |

| Market |

| Yes |

131 |

65.5 |

46 |

76.7 |

| No |

69 |

34.5 |

14 |

23.3 |

| Price |

| Yes |

172 |

86.0 |

43 |

71.7 |

| No |

28 |

14.0 |

17 |

28.3 |

Table 3.

Distribution of the risk attitude of the farmers.

Table 3.

Distribution of the risk attitude of the farmers.

| Risk Attitude |

Farmers (n=200) |

Processors (n=60) |

| |

Frequency |

Percentage |

Frequency |

Percentage |

| Risk averse |

142 |

71.0 |

42 |

70.0 |

| Risk preference |

58 |

29.0 |

18 |

30.0 |

| Total |

200 |

100 |

60 |

100 |

Table 4.

Parameter estimates of the logistic regression model of factors affecting farmers’ risk attitudes and perceptions.

Table 4.

Parameter estimates of the logistic regression model of factors affecting farmers’ risk attitudes and perceptions.

| Explanatory Variables |

Risk Attitude |

Marginal effect |

Risk Perception |

| Production risk |

Market risk |

Price risk |

| Age |

0.909***

(0.042) |

0.019**

(0.008) |

0.083***

(0.022) |

-0.007

(0.038) |

0.025***

(0.008) |

| Household size |

1.017

(0.072) |

0.003

(0.013) |

0.064

(0.062) |

-0.098*

(0.060) |

0.041**

(0.020) |

| Formal education |

0.898

(0.110) |

0.020

(0.023) |

-0.076

(0.113) |

0.061**

(0.025) |

0.005

(0.107) |

| Income |

1.000

(1.35e-06) |

0.000

(0.000) |

0.000***

(0.001) |

0.000

(0.000) |

0.000**

(0.000) |

| Extension service |

0.238***

(0.119) |

0.269***

(0.089) |

0.224*

(0.125) |

0.293

(0.426) |

0.221

(0.594) |

| Farm Size |

1.887*

(0.704) |

0.119*

(0.068) |

0.565*

(0.325) |

-0.211*

(0.118) |

0.432

(0.437) |

| Household head |

1.266

(0.986) |

0.049

(0.145) |

0.815

(0.757) |

0.612

(0.687) |

-0.065

(0.693) |

| Occupation |

0.807

(0.180) |

0.040***

(0.041) |

-0.169

(0.223) |

-0.237

(0.201) |

-0.061

(0.208) |

| Experience |

1.111**

(0.051) |

0.020**

(0.008) |

-0.001

(0.043) |

0.014

(0.039) |

-0.088**

(0.041) |

| Log Likelihood |

-62.29 |

|

-130.61 |

151.91 |

148.63 |

| LR test chi2 |

20.30 |

19.23 |

10.39 |

11.13 |

| Pseudo-R |

0.027 |

0.208 |

0.112 |

0.120 |

| Prob > chi2 |

0.140 |

0.148 |

0.083 |

0.089 |

| Number of observations |

200 |

200 |

200 |

200 |

Table 5.

Parameter estimation of the logistic model of factors affecting processors’ risk attitudes and perceptions.

Table 5.

Parameter estimation of the logistic model of factors affecting processors’ risk attitudes and perceptions.

| Explanatory Variables |

Risk Attitude |

Marginal Effect |

Risk Perception |

| Production risk |

Market risk |

Price risk |

| Age |

1.158

(0.136) |

0.021

(0.015) |

-0.017***

(0.005) |

1.176*

(0.090) |

0.231**

(0.102) |

| Household head |

0.872

(0.902) |

-0.020

(0.152) |

0.955

(0.802) |

-1.336*

(0.821) |

2.011**

(0.898) |

| Household size |

0.777

(0.146) |

-0.037

(0.026) |

0.348**

(0.170) |

-0.104

(0.150) |

-0.123

(0.171) |

| Formal education |

0.210*

(0.187) |

-0.229*

(0.122) |

-1.174*

(0.688) |

0.033

(0.668) |

-0.396

(0.706) |

| Experience |

0.794**

(0.077) |

0.034***

(0.012) |

0.076

(0.067) |

-0.043**

(0.067) |

-0.084

(0.072) |

| Income |

0.100

(0.000) |

-2.44e-08

(0.000) |

0.5e-03**

(0.2e-03) |

0.000*

(0.000) |

0.000**

(0.000) |

| Extension contact |

0.069***

(0.065) |

-0.393***

(0.122) |

-0.563

(0.652) |

-0.807

(0.667) |

-0.651

(0.694) |

| Log Likelihood |

-24.81 |

|

66.40 |

66.28 |

61.97 |

| LR test chi2 |

23.68 |

13.48 |

15.33 |

19.54 |

| Pseudo-R |

0.009 |

0.274 |

0.302 |

0.374 |

| Prob > chi2 |

0.323 |

0.201 |

0.224 |

0.278 |

| Number of observations |

60 |

|

60 |

60 |

60 |

Table 6.

Sources of risk to the rice farmers.

Table 6.

Sources of risk to the rice farmers.

| Variables |

VI |

I |

NS |

NI |

NVI |

WS |

MS |

Rank |

| Pest and Diseases |

127

(63.5) |

68

(34.0) |

1

(0.5) |

1

(0.5) |

3

(1.5) |

915 |

4.575 |

1st

|

| Price fluctuation |

71

(35.5) |

124

(62.0) |

4

(2.0) |

1

(0.5) |

0

(0.00) |

865 |

4.325 |

2nd |

| Drought |

80

(40.0) |

104

(52.0) |

50

(7.5) |

1

(0.5) |

0

(0.00) |

863 |

4.315 |

3rd |

| Lack of input |

56

(28.0) |

132

(66.0) |

12

(6.0) |

0

(0.00) |

0

(0.00) |

844 |

4.220 |

4th

|

| Change in policy |

89

(42.5) |

70

(35.0) |

16

(8.0) |

20

(10.0) |

5

(2.5) |

818 |

4.090 |

5th

|

| Excessive Rainfall |

31

(15.5) |

134

(67.0) |

31

(15.5) |

4

(2.0) |

0

(0.00) |

792 |

3.960 |

6th

|

| Household head illness |

106

(53.0) |

29

(14.5) |

22

(11.0) |

36

(18.0) |

7

(3.5) |

791 |

3.955 |

7th

|

| Infrastructural bottleneck |

77

(38.5) |

77

(38.5) |

14

(7.0) |

23

(11.5) |

9

(4.5) |

790 |

3.950 |

8th

|

| High post-harvest losses |

70

(35.0) |

82

(41.0) |

19

(9.5) |

7

(3.5) |

22

(11.0) |

771 |

3.855 |

9th

|

| High cost of production |

51

(25.5) |

103

(51.5) |

20

(10.0) |

12

(6.0) |

14

(7.0) |

765 |

3.825 |

10th |

| Market failure |

45

(22.5) |

84

(42.0) |

61

(30.5) |

9

(4.5) |

1

(0.5) |

763 |

3.815 |

11th

|

| Insufficient family labour |

70

(35.0) |

41

(20.5) |

26

(13.0) |

37

(18.5) |

26

(13.0) |

692 |

3.460 |

12th

|

Table 7.

Risk sources associated to rice processors in the study area.

Table 7.

Risk sources associated to rice processors in the study area.

| Variables |

VI |

I |

NS |

NI |

NVI |

WS |

MS |

Rank |

| Price fluctuation |

35

(58.3) |

25

(41.7) |

0

(0.00) |

0

(0.00) |

0

(0.00) |

275 |

4.5833 |

1st

|

| Technology adoption |

35

(58.3) |

24

(40.0) |

1

(1.7) |

0

(0.00) |

0

(0.00) |

274 |

4.5667 |

2nd

|

| Poor Storage facilities |

32

(53.3) |

23

(38.3) |

4

(6.7) |

1

(1.7) |

0

(0.00) |

266

|

4.333

|

3rd

|

| Household head illness |

12

(20.0) |

38

(63.3) |

9

(13.3) |

1

(1.7) |

1

(1.7) |

242 |

4.033 |

4th

|

| Labour |

7

(11.7) |

34

(56.7) |

10

(16.7) |

7

(11.7) |

2

(3.3) |

217 |

3.6167 |

5th

|

| Infrastructural bottleneck |

4

(6.7) |

17

(28.3) |

19

(31.7) |

18

(30.0) |

2

(3.3) |

183 |

3.05 |

6th

|

| High cost of processing |

7

(11.7) |

13

(21.7) |

7

(11.7) |

10

(16.7) |

23

(38.3) |

151 |

2.5167 |

7th

|

Table 8.

Risk management strategies employed by the farmers.

Table 8.

Risk management strategies employed by the farmers.

| Variables |

VI |

I |

NS |

NI |

NVI |

WS |

MS |

Rank |

| Off-Farm investment |

144

(72.0) |

53

(26.5) |

3

(1.5) |

0

(0.00) |

0

(0.00) |

941 |

4.705 |

1st |

| Spraying for diseases & pests |

125

(62.5) |

73

(36.5) |

0

(0.00) |

2

(1.0) |

0

(0.00) |

921 |

4.605 |

2nd |

| Cash contribution |

109

(54.5) |

91

(45.5) |

0

(0.00) |

0

(0.00) |

0

(0.00) |

909 |

4.545 |

3rd |

| Training |

85

(42.5) |

112

(56.0) |

3

(1.5) |

0

(0.00) |

0

(0.00) |

882 |

4.410 |

4th |

| Market information |

78

(39.0) |

116

(58.0) |

6

(3.0) |

0

(0.00) |

0

(0.00) |

872 |

4.360 |

5th |

| Price contract |

112

(56.0) |

49

(24.5) |

26

(13.0) |

13

(6.5) |

0

(0.00) |

860 |

4.300 |

6th |

| Crop insurance |

119

(59.5) |

36

(18.0) |

29

(14.5) |

15

(7.5) |

0

(0.00) |

857 |

4.285 |

7th |

| Post-harvest |

81

(40.5) |

72

(36.0) |

38

(19.0) |

8

(4.0) |

1

(0.5) |

824 |

4.120 |

8th |

| Borrowing |

77

(38.5) |

77

(38.5) |

30

(15.0) |

14

(7.0) |

2

(1.0) |

813 |

4.065 |

9th |

| Contract |

66

(33.0) |

88

(44.0) |

29

(14.5) |

14

(7.0) |

3

(1.5) |

800 |

4.000 |

10th |

| Financial buffer |

66

(33.0) |

85

(42.5) |

27

(13.5) |

17

(8.5) |

5

(2.5) |

790 |

3.950 |

11th |

| Cooperative |

60

(30.0) |

49

(24.5) |

56

(28.0) |

35

(17.5) |

0

(0.00) |

734 |

3.670 |

12th |

| Selling assets |

18

(9.0) |

19

(9.5) |

64

(32.0) |

85

(42.5) |

14

(7.0) |

542 |

2.710 |

13th |

Table 9.

Risk management strategies employed by the processors.

Table 9.

Risk management strategies employed by the processors.

| Variables |

VI |

I |

NS |

NI |

NVI |

WS |

MS |

Rank |

| Cash contribution |

37

(61.7) |

23

(38.3) |

0

(0.00) |

0

(0.00) |

0

(0.00) |

277 |

4.617 |

1st

|

| Market information |

31

(51.7) |

23

(38.3) |

6

(10.0) |

0

(0.00) |

0

(0.00) |

265 |

4.417 |

2nd

|

| Investment in off farm |

36

(60.0) |

17

(28.3) |

1

(1.7) |

6

(10.0) |

0

(0.00) |

263 |

4.383 |

3rd |

| Cooperative |

23

(20.7) |

27

(24.3) |

5

(4.5) |

5

(4.5) |

0

(0.00) |

248 |

4.133 |

4th |

| Borrowing |

19

(31.7) |

28

(46.7) |

10

(16.7) |

2

(3.3) |

1

(1.7) |

242 |

4.033 |

5th |

| Crop insurance |

25

(41.7) |

20

(33.3) |

7

(11.7) |

8

(13.3) |

0

(0.00) |

242 |

4.033 |

5th |

| Technology adoption |

19

(31.7) |

28

(46.7) |

6

(10.0) |

7

(11.7) |

0

(0.00) |

239 |

4.120 |

7th |

| Financial buffer |

21

(35.0) |

21

(35.0) |

11

(18.3) |

11

(18.3) |

2

(3.3) |

235 |

3.917 |

8th |

| Contract |

15

(25.0) |

27

(45.0) |

14

(23.3) |

3

(5.0) |

1

(1.7) |

232 |

3.867 |

9th |

| Training |

18

(30.0) |

26

(43.3) |

3

(5.0) |

13

(21.7) |

0

(0.00) |

229 |

3.817 |

10th |

| Price control |

21

(35.0) |

15

(25.0) |

11

(18.3) |

11

(18.3) |

2

(3.3) |

222 |

3.700 |

11th |

| Selling Assets |

9

(15.0) |

10

(16.7) |

16

(26.7) |

23

(38.3) |

2

(3.3) |

181 |

3.670 |

12th

|

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).