Submitted:

20 May 2024

Posted:

20 May 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature Review and Theoretical Framework

2.1. Literature Review

2.2. Theoretical Framework

3. Data and Methodology

3.1. Variable Selection and Measurement

3.1.1. Dependent Variable

3.1.2. Independent Variables

3.1.3. Control Variables

3.2. Data Sources and Descriptive Statistics

3.3. Methodology

3.3.1. Construre Regression Modeling of Panel Data

3.3.2. Threshold Regression Modeling of Panel Data

4. Empirical Results

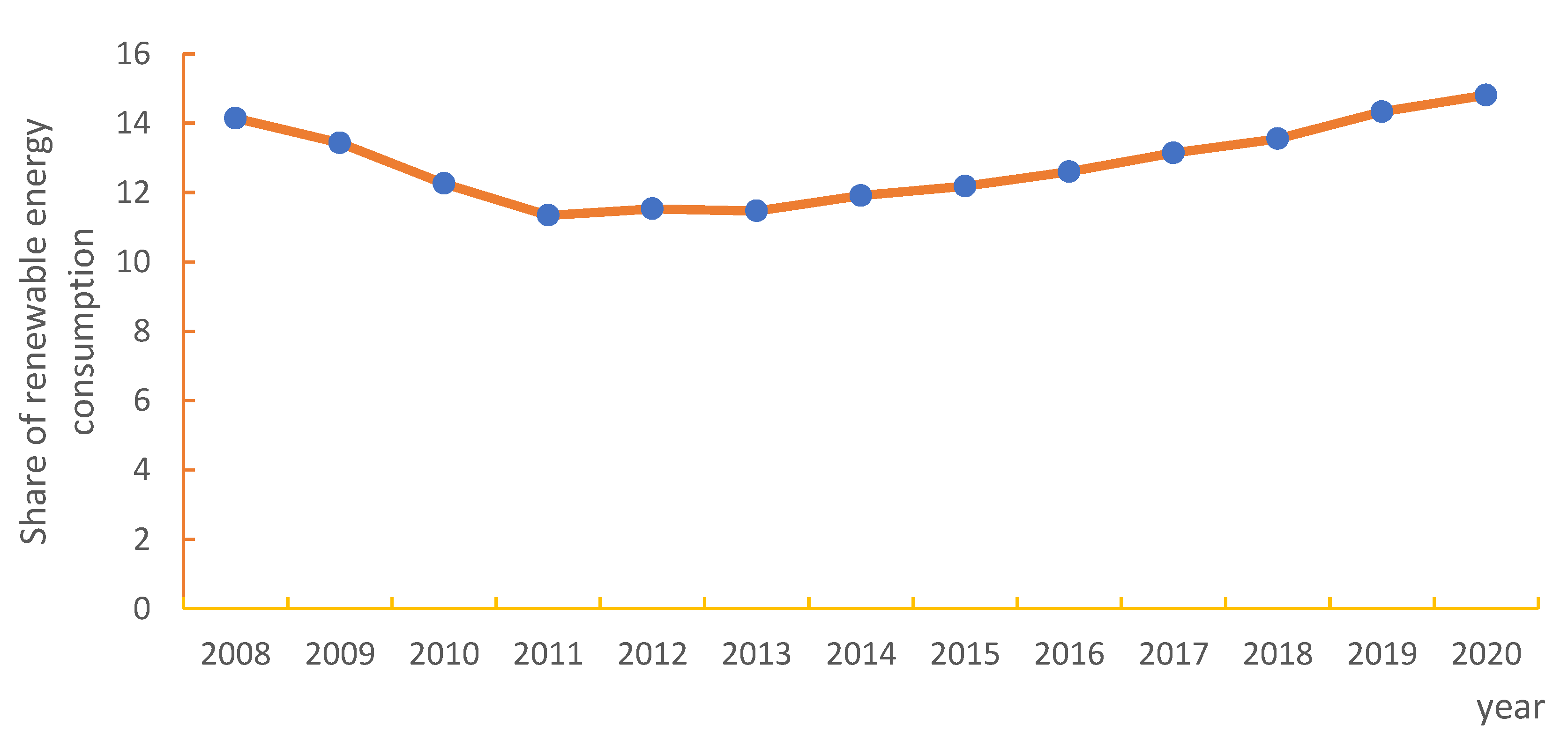

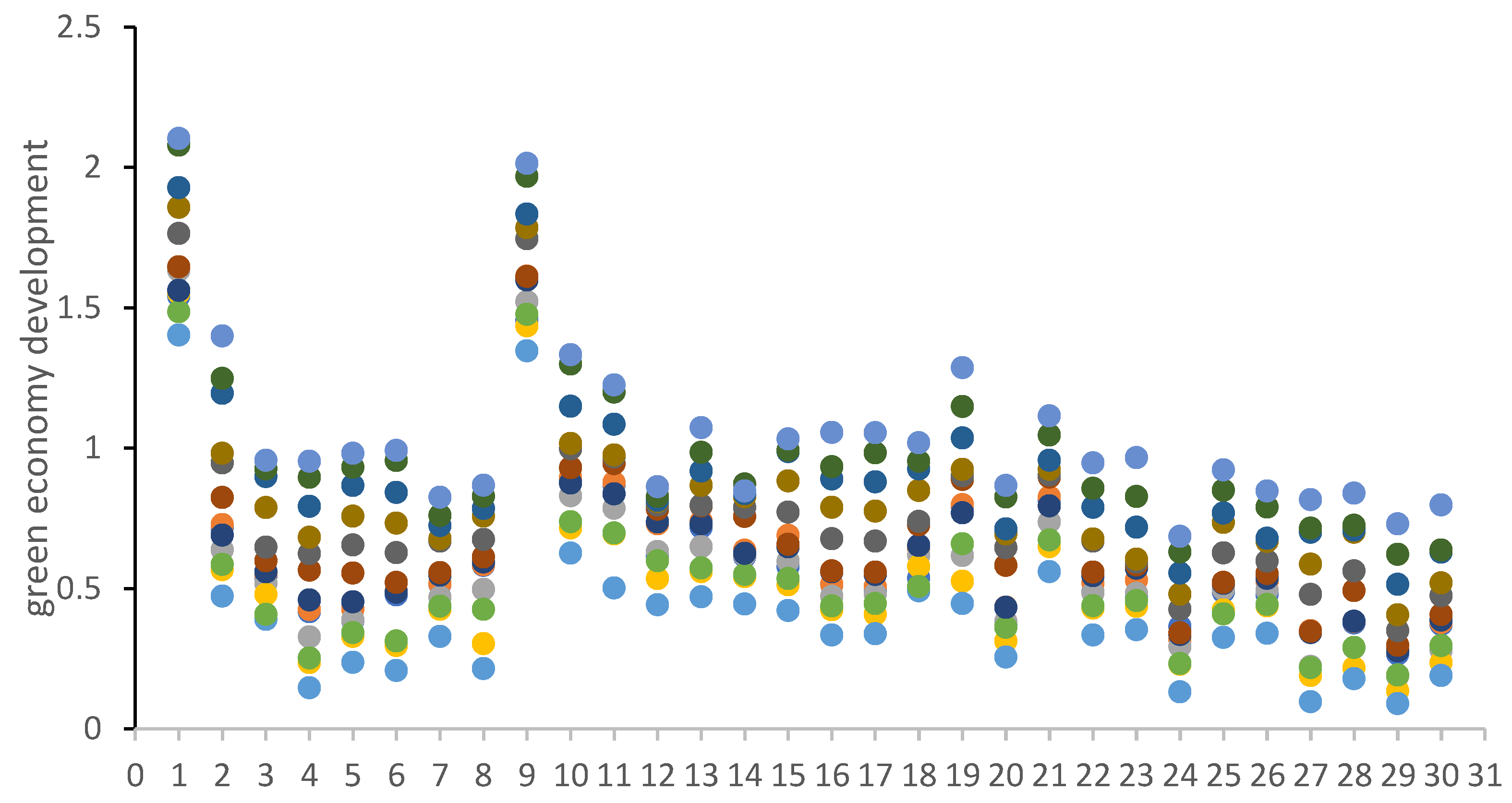

4.1. Trends in the Level of Green Technology Innovation, Renewable Energy Development, and Green Economic Growth

4.2. Panel Unit Root Test

4.3. Panel Cointegration Tests

4.4. Regression Model Selection

4.5. Results of Multiple Linear Regression

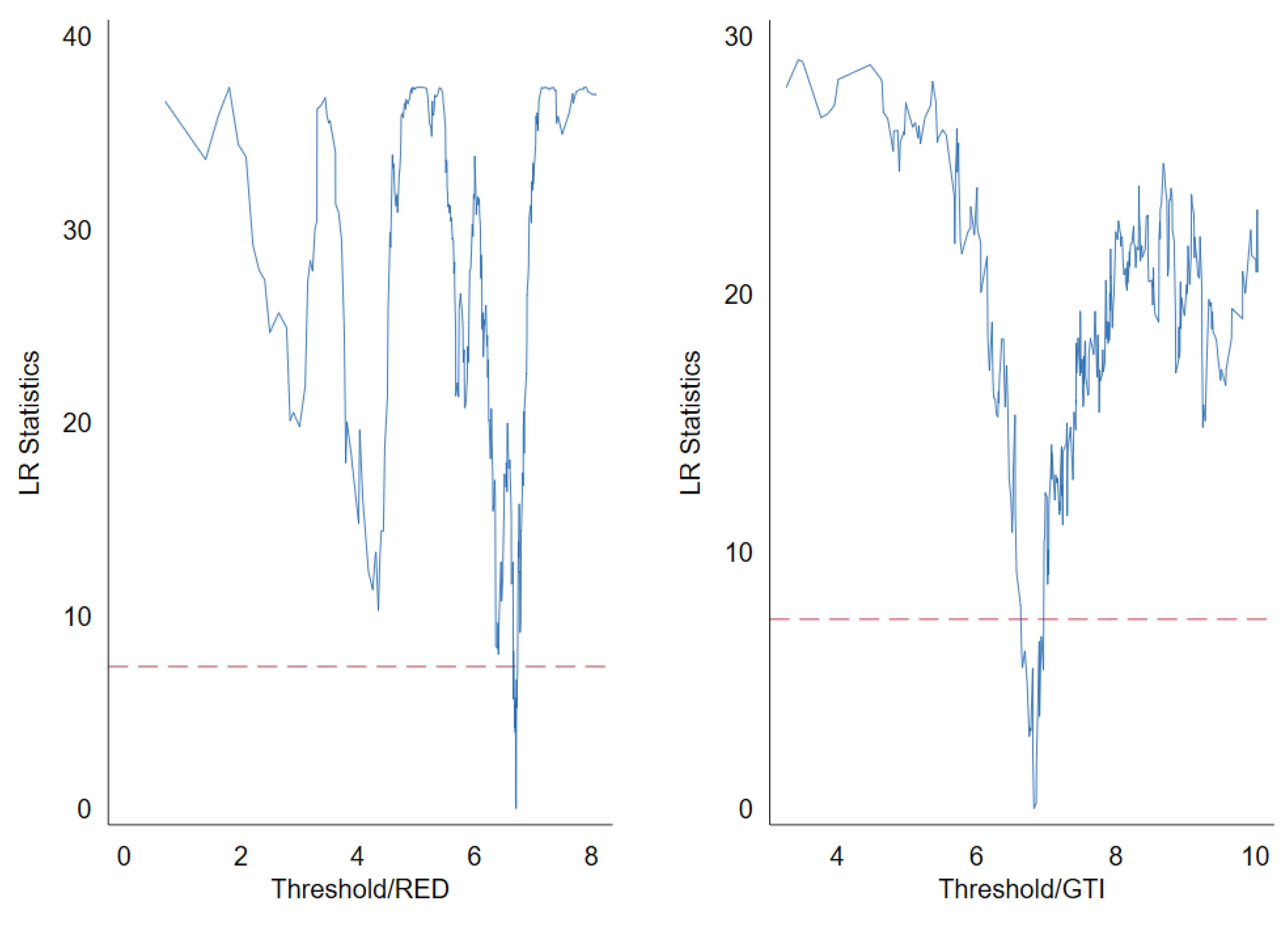

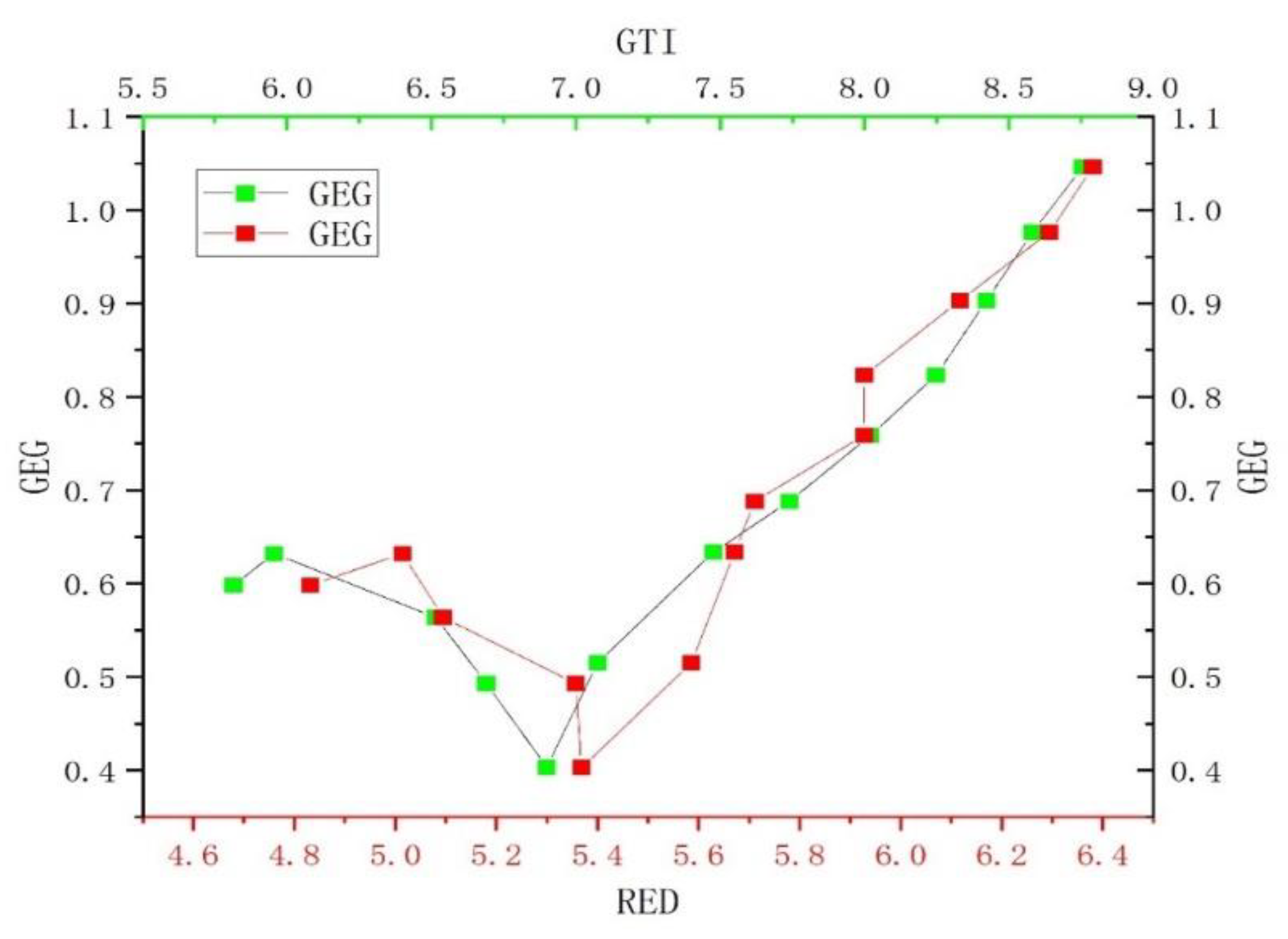

4.6. Panel Threshold Model Analysis

5. Conclusion and Policy Implications

5.1. Conclusions

5.2. Policy Recommendations

- (1)

- To promote the development of a green economy, it is essential to enhance local green development and achieve regional coordination. Local governments should strengthen talent cultivation to provide continuous support for green development. Governments should also optimize the environment for green innovation, integrate resources, and guide policies to improve the capabilities of green technologies, thereby improving resource efficiency and achieving energy transition. We should formulate customized and distinct green development policies to showcase the unique strengths and characteristics of various regions. Advanced regions, such as Guangdong and Jiangsu, can lead by providing technical support and promoting collaboration for green development in other areas. For example, Guangdong Province has become one of the leading regions in China's green economy by encouraging clean energy development and promoting the environmental protection industry. It can share its experiences and technologies with other regions, helping to improve their green development. Ultimately, we can advance local green development and promote harmonious and enduring growth of the environmentally friendly economy by strengthening talent cultivation, optimizing the innovation environment, implementing differentiated policies, and promoting regional cooperation.

- (2)

- To enhance green technology innovation and renewable energy development, as well as to foster the growth of green finance and optimize industrial structure adjustments. First, governments should fund green technology and renewable energy research. It can achieve this by establishing green technology innovation hubs, providing R&D funding, and encouraging enterprises, research institutions, and universities to increase their research and innovative efforts regarding renewable energy and green technology. Second, governments should establish a robust green finance system, providing a range of financial services and solutions to aid in the advancement of renewable energy and green technology. For example, governments can incentivize financial firms to issue green bonds to attract capital into the green economy sector and enhance green finance regulation to ensure that green financial products are credible and transparent. Lastly, it is necessary to optimize industrial structure by imposing strict environmental standards on high-pollution industries and promoting the growth of eco-friendly sectors. Furthermore, it is critical to adjust government intervention methods to reduce reliance on traditional industries and ensure rational resource allocation.

- (3)

- To augment the green technology development research and enhance utilizing renewable energy, it is recommended to establish a specialized institution tasked with monitoring the advancements in green technology innovation and renewable energy development. This body would also evaluate their impacts on green economic growth, ensuring alignment with sustainability goals. We can quickly adjust and optimize relevant policies to fully capitalize on their potential to stimulate economic growth once we determine that the development level in a particular area is approaching or has exceeded a certain threshold.

References

- Abakah, E.J.A.; Nasreen, S.; Tiwari, A.K.; Lee, C.-C. US leveraged loan and debt markets: Implications for optimal portfolio and hedging. International Review of Financial Analysis 2023, 87, 102514. [Google Scholar] [CrossRef]

- Ali, E.B.; Anufriev, V.P.; Amfo, B. Green economy implementation in Ghana as a road map for a sustainable development drive: A review. Scientific African 2021, 12, e00756. [Google Scholar] [CrossRef]

- An, W. The Meaning, Mechanism and Practice of Green Finance. Economic Latitude and Longitude 2008, 5, 156–158. [Google Scholar]

- Anser, M.K.; Iqbal, W.; Ahmad, U.S.; Fatima, A.; Chaudhry, I.S. Environmental efficiency and the role of energy innovation in emissions reduction. Environmental Science and Pollution Research 2020, 27, 29451–29463. [Google Scholar] [CrossRef] [PubMed]

- Banker, R.D.; Charnes, A.; Cooper, W.W. Some models for estimating technical and scale inefficiencies in data envelopment analysis. Management Science 1984, 30, 1078–1092. [Google Scholar] [CrossRef]

- Bayer, P.; Dolan, L.; Urpelainen, J. Global patterns of renewable energy innovation, 1990–2009. Energy for Sustainable Development 2013, 17, 288–295. [Google Scholar] [CrossRef]

- Bhatnagar, S.; Sharma, D. Evolution of green finance and its enablers: A bibliometric analysis. Renewable and Sustainable Energy Reviews 2022, 162, 112405. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. European Journal of Operational Research 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Chemmanur, T.J.; Fulghieri, P. Entrepreneurial finance and innovation: An introduction and agenda for future research. The Review of Financial Studies 2014, 27, 1–19. [Google Scholar] [CrossRef]

- Chen, C.; Pinar, M.; Stengos, T. Renewable energy consumption and economic growth nexus: Evidence from a threshold model. Energy Policy 2020, 139, 111295. [Google Scholar] [CrossRef]

- Chen, W.; Lei, Y. The impacts of renewable energy and technological innovation on environment-energy-growth nexus: New evidence from a panel quantile regression. Renewable Energy 2018, 123, 1–14. [Google Scholar] [CrossRef]

- Chien, F.; Kamran, H.W.; Albashar, G.; Iqbal, W. Dynamic planning, conversion, and management strategy of different renewable energy sources: a sustainable solution for severe energy crises in emerging economies. International Journal of Hydrogen Energy 2021, 46, 7745–7758. [Google Scholar] [CrossRef]

- Cooper, W.W.; Seiford, L.M.; Tone, K. Data envelopment analysis: a comprehensive text with models, applications, references and DEA-solver software (Vol. 2). Springer: 2007.

- Dai, L.; Xiong, Y. Does the green finance development and renewable energy affect the economic recovery in Asian economies. Renewable Energy 2023, 216, 118922. [Google Scholar] [CrossRef]

- Dang, V.A.; Kim, M.; Shin, Y. Asymmetric capital structure adjustments: New evidence from dynamic panel threshold models. Journal of Empirical Finance 2012, 19, 465–482. [Google Scholar] [CrossRef]

- Dong, F.; Li, Y.; Gao, Y.; Zhu, J.; Qin, C.; Zhang, X. Energy transition and carbon neutrality: Exploring the non-linear impact of renewable energy development on carbon emission efficiency in developed countries. Resources, Conservation and Recycling 2022, 177, 106002. [Google Scholar] [CrossRef]

- Doraszelski, U.; Jaumandreu, J. R&D and productivity: Estimating endogenous productivity. Review of Economic Studies 2013, 80, 1338–1383. [Google Scholar]

- Du, J.; Shen, Z.; Song, M.; Vardanyan, M. The role of green financing in facilitating renewable energy transition in China: Perspectives from energy governance, environmental regulation, and market reforms. Energy Economics 2023, 120, 106595. [Google Scholar] [CrossRef]

- Du, K.; Cheng, Y.; Yao, X. Environmental regulation, green technology innovation, and industrial structure upgrading: The road to the green transformation of Chinese cities. Energy Economics 2021, 98, 105247. [Google Scholar] [CrossRef]

- Egli, F.; Steffen, B.; Schmidt, T.S. A dynamic analysis of financing conditions for renewable energy technologies. Nature Energy 2018, 3, 1084–1092. [Google Scholar] [CrossRef]

- Ekins, P. Economic growth and environmental sustainability: the prospects for green growth. Routledge: 2002.

- Energy, R. Renewable Energy and Climate Change; International Renewable Energy Agency: United Arab Emirates, 2015. [Google Scholar]

- Fabozzi, F.J.; Focardi, S.; Ponta, L.; Rivoire, M.; Mazza, D. The economic theory of qualitative green growth. Structural Change and Economic Dynamics 2022, 61, 242–254. [Google Scholar] [CrossRef]

- Fang, W.; Liu, Z.; Putra, A.R. S. Role of research and development in green economic growth through renewable energy development: empirical evidence from South Asia. Renewable Energy 2022, 194, 1142–1152. [Google Scholar] [CrossRef]

- Fang, Y.; Shao, Z. Whether green finance can effectively moderate the green technology innovation effect of heterogeneous environmental regulation. International Journal of Environmental Research and Public Health 2022, 19, 3646. [Google Scholar] [CrossRef]

- Goulder, L.H.; Schneider, S.H. Induced technological change and the attractiveness of CO2 abatement policies. Resource and Energy Economics 1999, 21, 211–253. [Google Scholar] [CrossRef]

- Gu, S.; Xie, M.; Zhang, X. Green Development: New Concepts and New Measures. Environmental Protection 2016, 12, 13–15. [Google Scholar]

- Gullberg, A.T.; Ohlhorst, D.; Schreurs, M. Towards a low carbon energy future–Renewable energy cooperation between Germany and Norway. Renewable Energy 2014, 68, 216–222. [Google Scholar] [CrossRef]

- Hansen, B.E. Inference when a nuisance parameter is not identified under the null hypothesis. Econometrica: Journal of the Econometric Society, 1996; 413–430. [Google Scholar]

- He, J.; Iqbal, W.; Su, F. Nexus between renewable energy investment, green finance, and sustainable development: Role of industrial structure and technical innovations. Renewable Energy 2023, 210, 715–724. [Google Scholar] [CrossRef]

- He, L.; Zhang, L.; Zhong, Z.; Wang, D.; Wang, F. Green credit, renewable energy investment and green economy development: Empirical analysis based on 150 listed companies of China. Journal of Cleaner Production 2019, 208, 363–372. [Google Scholar] [CrossRef]

- Heal, G. (2010). Reflections—the economics of renewable energy in the United States. Review of Environmental Economics and Policy.

- Huang, Y.; Chen, C.; Lei, L.; Zhang, Y. Impacts of green finance on green innovation: A spatial and nonlinear perspective. Journal of Cleaner Production 2022, 365, 132548. [Google Scholar] [CrossRef]

- Inglesi-Lotz, R.; Dogan, E. The role of renewable versus non-renewable energy to the level of CO2 emissions a panel analysis of sub-Saharan Africa’s Βig 10 electricity generators. Renewable Energy 2018, 123, 36–43. [Google Scholar] [CrossRef]

- Irandoust, M. The renewable energy-growth nexus with carbon emissions and technological innovation: Evidence from the Nordic countries. Ecological Indicators 2016, 69, 118–125. [Google Scholar] [CrossRef]

- Jerzmanowski, M. Total factor productivity differences: Appropriate technology vs. efficiency. European Economic Review 2007, 51, 2080–2110. [Google Scholar] [CrossRef]

- Ji, Q.; Zhang, D. How much does financial development contribute to renewable energy growth and upgrading of energy structure in China? Energy Policy 2019, 128, 114–124. [Google Scholar] [CrossRef]

- Jiakui, C.; Abbas, J.; Najam, H.; Liu, J.; Abbas, J. Green technological innovation, green finance, and financial development and their role in green total factor productivity: Empirical insights from China. Journal of Cleaner Production 2023, 382, 135131. [Google Scholar] [CrossRef]

- Jin, W. Can technological innovation help China take on its climate responsibility? An intertemporal general equilibrium analysis. Energy Policy 2012, 49, 629–641. [Google Scholar] [CrossRef]

- Kennet, M.; Heinemann, V. Green Economics: setting the scene. Aims, context, and philosophical underpinning of the distinctive new solutions offered by Green Economics. International Journal of Green Economics 2006, 1, 68–102. [Google Scholar] [CrossRef]

- Khan, K.; Su, C.W.; Rehman, A.U.; Ullah, R. Is technological innovation a driver of renewable energy? Technology in Society 2022, 70, 102044. [Google Scholar] [CrossRef]

- Kim, D.-H.; Lin, S.-C.; Chen, T.-C. Financial structure, firm size and industry growth. International Review of Economics & Finance 2016, 41, 23–39. [Google Scholar]

- Kim, S.E.; Kim, H.; Chae, Y. A new approach to measuring green growth: Application to the OECD and Korea. Futures 2014, 63, 37–48. [Google Scholar] [CrossRef]

- Lee, C.-C.; Lee, C.-C. How does green finance affect green total factor productivity? Evidence from China. Energy Economics 2022, 107, 105863. [Google Scholar] [CrossRef]

- Lee, C.-C.; Wang, F.; Chang, Y.-F. Does green finance promote renewable energy? Evidence from China. Resources Policy 2023, 82, 103439. [Google Scholar] [CrossRef]

- Lee, C.-C.; Zhang, J.; Hou, S. The impact of regional renewable energy development on environmental sustainability in China. Resources Policy 2023, 80, 103245. [Google Scholar] [CrossRef]

- Lee, C.W.; Zhong, J. Top down strategy for renewable energy investment: Conceptual framework and implementation. Renewable Energy 2014, 68, 761–773. [Google Scholar] [CrossRef]

- Li, C.; Umair, M. Does green finance development goals affects renewable energy in China. Renewable Energy 2023, 203, 898–905. [Google Scholar] [CrossRef]

- Li, K.; Lin, B. Economic growth model, structural transformation, and green productivity in China. Applied Energy 2017, 187, 489–500. [Google Scholar] [CrossRef]

- Li, X. Regional green economic growth: measurement, decomposition and driving factors - Empirical data from Japan. Journal of Hebei University of Economics and Trade 2019, 40, 24–34. [Google Scholar]

- Li, X.; Song, Y.; Yao, Z.; Xiao, R. Forecasting China’s CO 2 emissions for energy consumption based on cointegration approach. Discrete Dynamics in Nature and Society 2018, 2018. [Google Scholar]

- Li, Y.; Pan, W. Drivers of green transformation and upgrading of resource-based industries. Technical Economy 2016, 35, 65–69. [Google Scholar]

- Li, Z.; Luan, R.; Lin, B. The trend and factors affecting renewable energy distribution and disparity across countries. Energy 2022, 254, 124265. [Google Scholar] [CrossRef]

- Liddle, B. Impact of population, age structure, and urbanization on carbon emissions/energy consumption: evidence from macro-level, cross-country analyses. Population and Environment 2014, 35, 286–304. [Google Scholar] [CrossRef]

- Lin, B.; Bai, R. Nexus between green finance development and green technological innovation: A potential way to achieve the renewable energy transition. Renewable Energy 2023, 218, 119295. [Google Scholar]

- Lin, B.; Zhou, Y. Measuring the green economic growth in China: Influencing factors and policy perspectives. Energy 2022, 241, 122518. [Google Scholar] [CrossRef]

- Lin, B.; Zhu, J. The role of renewable energy technological innovation on climate change: Empirical evidence from China. Science of the Total Environment 2019, 659, 1505–1512. [Google Scholar] [CrossRef] [PubMed]

- Liu, R.; Wang, D.; Zhang, L.; Zhang, L. Can green financial development promote regional ecological efficiency? A case study of China. Natural Hazards 2019, 95, 325–341. [Google Scholar] [CrossRef]

- Liu, Z.; Xu, J.; Wei, Y.; Hatab, A.A.; Lan, J. Nexus between green financing, renewable energy generation, and energy efficiency: empirical insights through DEA technique. Environmental Science and Pollution Research 2021, 1–14. [Google Scholar] [CrossRef]

- Luo, X.; Jin, Y. Research on Green Development Efficiency of Resource-based Cities under Transformation and Upgrading--Taking the Central Region as an Example. Journal of Southwest Jiaotong University: Social Science Edition 2017, 18, 77–83. [Google Scholar]

- Luo, Y.; Long, X.; Wu, C.; Zhang, J. Decoupling CO2 emissions from economic growth in the agricultural sector across 30 Chinese provinces from 1997 to 2014. Journal of Cleaner Production 2017, 159, 220–228. [Google Scholar] [CrossRef]

- Luukkanen, J.; Kaivo-Oja, J.; Vähäkari, N.; O’Mahony, T.; Korkeakoski, M.; Panula-Ontto, J.; Phonhalath, K.; Nanthavong, K.; Reincke, K.; Vehmas, J. Green economic development in Lao PDR: A sustainability window analysis of Green Growth Productivity and the Efficiency Gap. Journal of Cleaner Production 2019, 211, 818–829. [Google Scholar] [CrossRef]

- Ma, H.; Dong, S. Impact of different types of environmental regulation on carbon emission efficiency. Beijing Institute of Technology 2020, 22, 1–10. [Google Scholar]

- Mensah, C.N.; Long, X.; Dauda, L.; Boamah, K.B.; Salman, M.; Appiah-Twum, F.; Tachie, A.K. Technological innovation and green growth in the Organization for Economic Cooperation and Development economies. Journal of Cleaner Production 2019, 240, 118204. [Google Scholar] [CrossRef]

- Meo, M.S.; Abd Karim, M.Z. The role of green finance in reducing CO2 emissions: An empirical analysis. Borsa Istanbul Review 2022, 22, 169–178. [Google Scholar]

- Mohsin, M.; Taghizadeh-Hesary, F.; Iqbal, N.; Saydaliev, H.B. The role of technological progress and renewable energy deployment in green economic growth. Renewable Energy 2022, 190, 777–787. [Google Scholar] [CrossRef]

- Murphy, B. Outline of the People’s Republic of China 14th Five-Year Plan for National Economic and Social Development and Long-Range Objectives for 2035. Descripción Del 14o Plan Quinquenal de La República Popular China Para El Desarrollo Económico y Social Nacional y Los Objetivos a Largo Plazo Para 2021, 2035, 102. [Google Scholar]

- Nicolli, F.; Vona, F. Energy market liberalization and renewable energy policies in OECD countries. Energy Policy 2019, 128, 853–867. [Google Scholar] [CrossRef]

- Odugbesan, J.A.; Rjoub, H.; Ifediora, C.U.; Iloka, C.B. Do financial regulations matters for sustainable green economy: evidence from Turkey. Environmental Science and Pollution Research 2021, 28, 56642–56657. [Google Scholar] [CrossRef] [PubMed]

- Ohlan, R. The impact of population density, energy consumption, economic growth and trade openness on CO2 emissions in India. Natural Hazards 2015, 79, 1409–1428. [Google Scholar] [CrossRef]

- Pece, A.M.; Simona, O.E. O.; Salisteanu, F. Innovation and economic growth: An empirical analysis for CEE countries. Procedia Economics and Finance 2015, 26, 461–467. [Google Scholar] [CrossRef]

- Popp, D.; Hascic, I.; Medhi, N. Technology and the diffusion of renewable energy. Energy Economics 2011, 33, 648–662. [Google Scholar] [CrossRef]

- Qi, X.; Guo, Y.; Guo, P.; Yao, X.; Liu, X. Do subsidies and R&D investment boost energy transition performance? Evidence from Chinese renewable energy firms. Energy Policy 2022, 164, 112909. [Google Scholar]

- Qian, Y.; Liu, J.; Forrest, J.Y.-L. Impact of financial agglomeration on regional green economic growth: evidence from China. Journal of Environmental Planning and Management 2022, 65, 1611–1636. [Google Scholar] [CrossRef]

- Rao, F.; Tang, Y.M.; Chau, K.Y.; Iqbal, W.; Abbas, M. Assessment of energy poverty and key influencing factors in N11 countries. Sustainable Production and Consumption 2022, 30, 1–15. [Google Scholar] [CrossRef]

- Robaina, M.; Madaleno, M. Resources: Eco-efficiency, sustainability, and innovation in tourism. The Future of Tourism: Innovation and Sustainability, 2019; 19–41. [Google Scholar]

- Ruan, F.; Yan, L.; Wang, D. The complexity of the resource-based cities in China on creating sustainable development. Cities 2020, 97, 102571. [Google Scholar] [CrossRef]

- Saba, C.S.; Djemo, C.R. T.; Eita, J.H.; Ngepah, N. Towards environmental sustainability path in Africa: The critical role of ICT, renewable energy sources, agriculturalization, industrialization, and institutional quality. Energy Reports 2023, 10, 4025–4050. [Google Scholar] [CrossRef]

- Sadorsky, P. The effect of urbanization on CO2 emissions in emerging economies. Energy Economics 2014, 41, 147–153. [Google Scholar] [CrossRef]

- Sawhney, A.; Kahn, M.E. Understanding cross-national trends in high-tech renewable power equipment exports to the United States. Energy Policy 2012, 46, 308–318. [Google Scholar] [CrossRef]

- Shahbaz, M.; Raghutla, C.; Song, M.; Zameer, H.; Jiao, Z. Public-private partnerships investment in energy as new determinant of CO2 emissions: the role of technological innovations in China. Energy Economics 2020, 86, 104664. [Google Scholar] [CrossRef]

- Shang, Y. The impact of Yangtze River Delta low-carbon technology innovation cooperation on green economic growth. China’s Population, Resources and Environment, 2023; 135–145. [Google Scholar]

- Shi, B.; Shen, K. rong. Total Factor Energy Efficiency in China under Market Segregation: An Empirical Analysis Based on the Super-Efficient DEA Approach. World Economy 2008, 9, 49–59. [Google Scholar]

- Solow, R.M. A contribution to the theory of economic growth. The Quarterly Journal of Economics 1956, 70, 65–94. [Google Scholar] [CrossRef]

- Song, M.; Wang, S. Can employment structure promote environment-biased technical progress? Technological Forecasting and Social Change 2016, 112, 285–292. [Google Scholar] [CrossRef]

- Song, M.; Zhao, X.; Shang, Y.; Chen, B. Realization of green transition based on the anti-driving mechanism: an analysis of environmental regulation from the perspective of resource dependence in China. Science of the Total Environment 2020, 698, 134317. [Google Scholar] [CrossRef]

- Su, Y.; Fan, Q. Renewable energy technology innovation, industrial structure upgrading and green development from the perspective of China’s provinces. Technological Forecasting and Social Change 2022, 180, 121727. [Google Scholar] [CrossRef]

- Tan, J.; Su, X.; Wang, R. The impact of natural resource dependence and green finance on green economic growth in the context of COP26. Resources Policy 2023, 81, 103351. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of efficiency in data envelopment analysis. European Journal of Operational Research 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Villa, L.S. Invention, inventive learning, and innovative capacity. Behavioral Science 1990, 35, 290–310. [Google Scholar] [CrossRef]

- Wan, Y.; Sheng, N. Clarifying the relationship among green investment, clean energy consumption, carbon emissions, and economic growth: a provincial panel analysis of China. Environmental Science and Pollution Research 2022, 1–15. [Google Scholar] [CrossRef] [PubMed]

- Wan, Y.; Sheng, N.; Wei, X.; Su, H. Study on the spatial spillover effect and path mechanism of green finance development on China’s energy structure transformation. Journal of Cleaner Production 2023, 137820. [Google Scholar] [CrossRef]

- Wang, R.; Mirza, N.; Vasbieva, D.G.; Abbas, Q.; Xiong, D. The nexus of carbon emissions, financial development, renewable energy consumption, and technological innovation: what should be the priorities in light of COP 21 Agreements? Journal of Environmental Management 2020, 271, 111027. [Google Scholar] [CrossRef] [PubMed]

- Wei, Z.; Yuguo, J.; Jiaping, W. Greenization of venture capital and green innovation of Chinese entity industry. Ecological Indicators 2015, 51, 31–41. [Google Scholar] [CrossRef]

- Xiao, Z.; Tan, R.; Jianbang Shi. A study of the impact of environmental regulation on regional green innovation efficiency - a quasi-natural experiment based on the ‘carbon credit’ pilot. Engineering Management Technology Frontier 2022, 41, 63–69. [Google Scholar]

- Xie, F.; Liu, C.; Chen, H.; Wang, N. Threshold effects of new energy consumption transformation on economic growth. Sustainability 2018, 10, 4124. [Google Scholar] [CrossRef]

- Xie, F.; Liu, Y.; Guan, F.; Wang, N. The role of technological progress and renewable energy deployment in green economic growth. Environmental Sciences Europe 2020, 32, 1–15. [Google Scholar]

- Xu, J.; She, S.; Gao, P.; Sun, Y. Role of green finance in resource efficiency and green economic growth. Resources Policy 2023, 81, 103349. [Google Scholar] [CrossRef]

- Yu, B.; Fan, C. Green finance, technological innovation and high-quality economic development. Nanjing Social Sciences 2022, 9, 31–43. [Google Scholar]

- Yu, C.-H.; Wu, X.; Zhang, D.; Chen, S.; Zhao, J. Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 2021, 153, 112255. [Google Scholar] [CrossRef]

- Yu, S.; Hu, X.; Li, L.; Chen, H. Does the development of renewable energy promote carbon reduction? Evidence from Chinese provinces. Journal of Environmental Management 2020, 268, 110634. [Google Scholar] [CrossRef]

- Zhan, Z.; Wang, R.; Liu, Y. The Impact of Fintech and Green Finance Synergy on Industrial Structure Upgrading - Based on the perspective of heterogeneous environmental regulation. 2023, 152–162.

- Zhang, D.; Mohsin, M.; Taghizadeh-Hesary, F. Does green finance counteract the climate change mitigation: asymmetric effect of renewable energy investment and R&D. Energy Economics 2022, 113, 106183. [Google Scholar]

- Zhang, H.; Geng, C.; Wei, J. Coordinated development between green finance and environmental performance in China: The spatial-temporal difference and driving factors. Journal of Cleaner Production 2022, 346, 131150. [Google Scholar] [CrossRef]

- Zhang, K.Q.; Chen, H.H.; Tang, L.Z.; Qiao, S. Green finance, innovation and the energy-environment-climate nexus. Frontiers in Environmental Science 2022, 10, 879681. [Google Scholar] [CrossRef]

- Zhao, J.; Shahbaz, M.; Dong, K. How does energy poverty eradication promote green growth in China? The role of technological innovation. Technological Forecasting and Social Change 2022, 175, 121384. [Google Scholar] [CrossRef]

- Zhao, X.; Mahendru, M.; Ma, X.; Rao, A.; Shang, Y. Impacts of environmental regulations on green economic growth in China: New guidelines regarding renewable energy and energy efficiency. Renewable Energy 2022, 187, 728–742. [Google Scholar] [CrossRef]

- Zhao, X.; Mahendru, M.; Ma, X.; Rao, A.; Shang, Y. Impacts of environmental regulations on green economic growth in China: New guidelines regarding renewable energy and energy efficiency. Renewable Energy 2022, 187, 728–742. [Google Scholar] [CrossRef]

- Zheng, H.; Song, M.; Shen, Z. The evolution of renewable energy and its impact on carbon reduction in China. Energy 2021, 237, 121639. [Google Scholar] [CrossRef]

- Zhong, W.; Jiang, F.; Wan, X. The empirical study on the impact of industrial structure changes on the carbon intensity in China. Audit & Economy Research 2015, 6, 88–96. [Google Scholar]

- Zhou, G.; Zhu, J.; Luo, S. The impact of fintech innovation on green growth in China: Mediating effect of green finance. Ecological Economics 2022, 193, 107308. [Google Scholar] [CrossRef]

- Zhou, X.; Tang, X.; Zhang, R. Impact of green finance on economic development and environmental quality: a study based on provincial panel data from China. Environmental Science and Pollution Research 2020, 27, 19915–19932. [Google Scholar] [CrossRef]

- Zhu, Y.; Taylor, D.; Wang, Z. The role of renewable energy in reducing residential fossil energy-related CO2 emissions: evidence from rural China. Journal of Cleaner Production 2022, 366, 132891. [Google Scholar] [CrossRef]

| Indicators | Category | Specific indicators | Indicator Measurement | Reference | Unit |

| inputs | Factor inputs | Labor | Number of employees in each province at the end of the year | Tan et al. (2023) | 10,000 people |

| Capital | Physical capital stock per province (perpetual inventory method) | Ma & Dong (2020) | 100 million yuan | ||

| Land | Land area per provincial administrative area | X. Zhao et al. (2022a) | km² | ||

| Energy | Energy consumption per province (mainly refers to coke, coal, and natural gas) | Tan et al. (2023) | 10,000 tons of standard coal | ||

| outputs | Desired outputs (Economic benefit) |

Economic Development Level | GDP total | Shang (2023) | 100 million yuan |

| Undesired output (Environmental impact) |

Environmental Pollution Level | Industrial waste gas emissions | Xiao et al. (2022) | 100 million cu.m | |

| Industrial wastewater emissions | 104 tons | ||||

| Industrial general solid waste emissions | 104 tons |

| Overall indicator | sub-indicator | Indicators measurement | Reference |

| Green Finance Development Index | Green credit | The ratio of interest expenditure within the total industry for six high energy-consuming sectors | B. Yu & Fan (2022) |

| Green securities | The ratio of the market value of the six energy-intensive industries to the overall market value of A-shares | Wan et al. (2023) | |

| Green Insurance | The ratio of agricultural insurance income to the gross agricultural output value | Lee et al. (2023) | |

| Green investment | The investment-to-gross Domestic Product (GDP) ratio for environmental pollution prevention. | Tan et al. (2023) | |

| Environmental support | The ratio of government spending on environmental protection to total government spending | Zhan et al. (2023) |

| Variable | Symbol | Measurement | Source |

| Green Economic Growth | GEG | by the super-efficient SBM | CSY, PSY, CESY |

| Technology Innovation | TI | green invention patents | CNIPA |

| Renewable Development | RED | renewable energy power generation | CEPY |

| Green Finance | GF | construct a comprehensive index of green finance | CSY,CISY,CESY, PSY, CASY |

| Economic Development Level | PGDP | regional gross domestic product per capita | PSY |

| Population Density | PD | the density of the population per square kilometer | PSY |

| Government Intervention | GOV | government fiscal expenditure/GDP | PSY |

| Industrial Structure | IS | The ratio of the tertiary sector's output value to Gross Domestic Product (GDP) | CSY |

| Variables | N | Mean | Standard deviation | Min. | Max. |

| GEG | 390 | 0.695 | 0.358 | 0.0890 | 2.102 |

| RED | 390 | 5.584 | 1.495 | 0 | 8.339 |

| GTI | 390 | 7.466 | 1.479 | 2.565 | 10.72 |

| GF | 390 | 0.0660 | 0.0243 | 0.0271 | 0.172 |

| IS | 390 | 1.125 | 0.647 | 0.494 | 5.297 |

| GOV | 390 | 0.251 | 0.105 | 0.106 | 0.758 |

| PD | 390 | 5.470 | 1.289 | 2.053 | 8.275 |

| PGDP | 390 | 1.277 | 0.811 | 0.476 | 4.934 |

| Variable | LLC test | IPS test | HT test | stability |

| GEG | -7.813*** | -3.640*** | -3.640*** | stable |

| RED | -7.890*** | -3.000*** | -2.300*** | stable |

| GTI | -3.227*** | -1.200 | -1.760** | stable |

| GF | -3.764*** | -3.911*** | -3.334*** | stable |

| IS | -2.650*** | -2.430*** | -7.282*** | stable |

| PGDP | -4.283*** | -2.865*** | -2.638*** | stable |

| PD | -5.354*** | 1.395 | -2.865*** | stable |

| GOV | -7.041*** | -4.823*** | -4.823*** | stable |

| Method | Test statistics | statistic | p-value |

| Westerlund test | Variance ratio | 11.287*** | 0.000 |

| Pedroni test | Modified Phillips–Perron t | 10.370*** | 0.000 |

| Phillips–Perron t | -0.794 | 0.213 | |

| Augmented Dickey-Fuller t | -2.226** | 0.013 | |

| Kao test | Modified Dickey-Fuller t | -2.523*** | 0.006 |

| Dickey-Fuller t | -4.304*** | 0.000 | |

| Augmented Dickey-Fuller t | -5.787*** | 0.000 | |

| Unadjusted modified Dickey-Fuller t | -3.044*** | 0.001 | |

| Unadjusted Dickey-Fuller t | -4.545*** | 0.000 |

| Test Summary | statistical value | Prob. |

| F test | 46.49 | 0.0000 |

| LM test | 1726.64 | 0.0000 |

| Hausman test | 189.01 | 0.0000 |

| (1) | (2) | (3) | |||

| Variables | Ols | RE | FE | ||

| RED | 0.038*** | 0.034** | 0.104*** | ||

| (0.021) | (0.018) | (0.019) | |||

| GTI | 0.100*** | 0.131*** | 0.131*** | ||

| (0.011) | (0.013) | (0.015) | |||

| GF | 0.574 | 1.430** | 1.398** | ||

| (0.482) | (0.611) | (0.611) | |||

| PGDP | 0.263*** | 0.243*** | 0.102* | ||

| (0.018) | (0.033) | (0.054) | |||

| PD | 0.054*** | 0.013 | -1.132*** | ||

| (0.016) | (0.029) | (0.232) | |||

| GOV | 0.868*** | 0.050 | -0.935*** | ||

| (0.161) | (0.209) | (0.231) | |||

| IS | -0.037** | -0.033** | -0.043*** | ||

| (0.015) | (0.016) | (0.015) | |||

| Constant | -0.923*** | -0.960*** | 5.383*** | ||

| (0.142) | (0.202) | (1.224) | |||

| Observations | 390 | 390 | 390 | ||

| R-squared | 0.725 | 0.559 | 0.631 | ||

| Hausman test | Prob > chi2 = 0.0000 |

| (1) | (2) | ||

| Variables | Eq. (3) | Eq. (4) | |

| RED | 0.097*** | 0.089*** | |

| (0.020) | (0.019) | ||

| GTI | 0.138*** | 0.150*** | |

| (0.015) | (0.015) | ||

| GF | 1.438*** | 1.005* | |

| (0.638) | (0.597) | ||

| GF*RED | 0.232** | ||

| (0.057) | |||

| GF*GTI | 0.455*** | ||

| (0.057) | |||

| GOV | -0.975*** | -1.049*** | |

| (0.234) | (0.229) | ||

| IS | -0.040*** | -0.0399*** | |

| (0.015) | (0.0147) | ||

| PGDP | 0.082 | 0.138*** | |

| (0.053) | (0.0527) | ||

| PD | -1.144*** | -1.357*** | |

| (0.232) | (0.230) | ||

| Constant | 5.462*** | 6.557*** | |

| (1.219) | (1.208) | ||

| Observations | 390 | 390 | |

| R-squared | 0.636 | 0.653 |

| Threshold variable |

Threshold number |

F-statistics | p-Value | Threshold value |

Confidence Intervals(95%) |

| RED | Single | 38.17 | 0.021 | 6.700 | [6.675, 6.708] |

| GTI | Single | 29.74 | 0.051 | 6.816 | [6.713, 6.849] |

| Model (5) | Model (6) | ||

| Variables | Threshold variable: RED | Threshold variable: GTI | |

| GTI | 0.083*** | ||

| (0.060) | |||

| GF | 0.098 | 0.220 | |

| (0.174) | (0.186) | ||

| PGDP | 0.032*** | 0.046*** | |

| (0.006) | (0.006) | ||

| IS | -0.367** | -0.314*** | |

| (0.068) | (0.073) | ||

| GOV | -0.828*** | -0.771*** | |

| (0.211) | (0.228) | ||

| PD | -1.529*** | -0.813*** | |

| (0.211) | (0.223) | ||

| RED·1{RED≤6.405} | 0.104*** | ||

| (0.019) | |||

| RED·1 {RED>6.405} | 0.126*** | ||

| (0.020) | |||

| RED·1{GTI≤11.59} | 0.127*** | ||

| (0.017) | |||

| RED·1{GTI>11.59} | 0.147*** (0.016) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).