1. Introduction

For over more than four decades, humans have been on a quest to bring more convenience to themselves through constant technological development and improvements. One of the major constraints of this development is exposing ourselves to a naturally exploited world as we are witnessing serious climatic changes and adversities like floods, earthquakes, droughts, forest fires, cyclones, landslides and more. In comparison to the time before industrialization and globalization, the temperature of the earth is expected to rise on an average by 2o Celsius and it will create an irreversible impact on the earth directing it towards even worse climatic issues (IPCC, 2014). The society as a whole is getting impacted although slowly but adversely, because of its own deeds. It has become an urgent need for humans to protect the environment against all the social and environmental issues arising out, owing to which the multiple UN Conferences were held over a period of time with the first one in 1972 and created United Nations Environmental Program (UNEP). It has been realised by the international bodies that environmental exploitation is resulting into serious issues like increasing pollution, depletion of ozone layers, climatic changes, emission of greenhouse gas or carbon dioxide and more (Habib, 2010a; Habib, 2010b). The masses around the world, on realizing the drastic outcomes of natural disturbance, have started ensuring more awareness and planning to take recovery steps and initiatives to make this world a better place to live (IDBT, 2013). In fully understanding the concept of economic development, there has been multiple paradigm shifts over the years (Meier, 2004; Todaro & Smith, 2012). After World War II, nations had started following the path of technological and industrial boost as these were the basis of development with higher Gross Domestic Product (GDP) and per capita Income and ultimately, economic growth. It was in 1960, when economic development was invented as term to lessen unemployment, gender biasness and poverty (Seers, 1969). Later, development was again defined as a means of controlling and bringing down deprivation (Sen, 1999). However, the evolution of the term in between this time gap, introduced the idea of sustainability which was focused on deploying a system that brings development to the present generation without putting the future generation in danger of unfulfilled demands and needs, and referred to this concept as "Sustainable Development" (World Commission on Environment and Development, 1987).

1.1. Sustainability Development

The concept of a sustainable development has emerged as a solution to the ever-degrading situation of the economy at large and making both ends meet. With the application of Sustainable development, an effective model for development is created to reduce the adverse impacts on the climate and emission of greenhouse gases (Panjaitan & Penebar, 2015). The concept of 'sustainability' after years of understanding and propositions was finally named in 1987 by the Brundtland Commission as:

'a development that meets the needs of the present without compromising the ability of future generations to meet their own needs’

Brundtland Commission, 1987

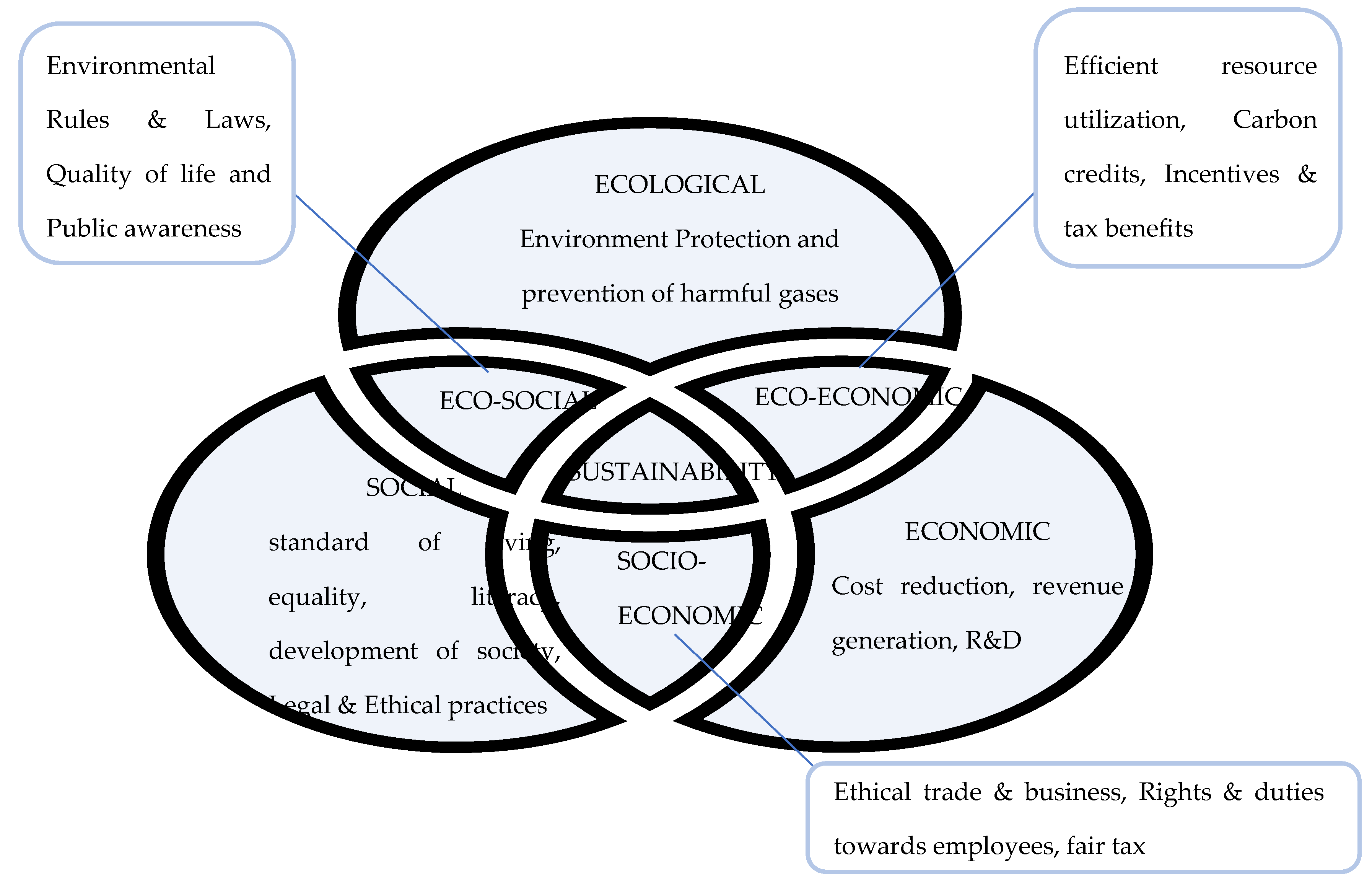

It can better be considered as a concept where efforts are made to provide a better standard of living to humans without compromising on nature and its resources or posing any threats to environment resulting into extinction of species and unfavourable changes in environment due to excessive air and water pollution or deforestation (Benaim & Raftis, 2008; Browning & Rigolon, 2019). Over a period of time, as the concept of sustainable development evolved and became familiar with concerned parties around the world, three dimensions of sustainability resulted as three pillars of sustainable development: Environmental, Social and Economic development (Elkington, 1994; Rogers et al., 2008). For ensuring the overall sustainable development of the planet, a mutual balance between these three pillars is essential. Thus, John Elkington (1994) came with a concept of 'Triple Bottom Line' which is a framework for equilibrium sustainability among the three dimensions. Triple Bottom Line depicts an inter-related and dependent correlation of all the dimensions of sustainability. When present in the global world in a balanced order, it can be referred to a 'Sustainabilized World'.

The industrial sector has a significant role in the technological and economic development with serving the society and protecting environment. These responsibilities are precisely referred to as Economic, Social and Governance (ESG) Goals. The UN Global Compact had introduced a new initiative 'Who Cares Wins" which brought the term 'ESG' into practice in June 2004 with the idea of brimming a correlation between environmental, social and governance factors (Nizam et al., 2019). United Nations Sustainable Stock Exchange has asked the listed companies all around the world to provide their environmental, social and governance (ESG) practices and the influence of the same on their businesses by the year 2030 (Sustainable Stock exchange, 2015). Many studies have been performed on ESG goals which suggest that investments made on the basis of ESG present a better approach towards sustainability that is a step forward than only responsible investments (RI) ( Keefe, 2011; Viederman, 2009). As per the statistics of the year 2016, different nations like Japan and China, USA, UK and India had only 12%, 14%, 20% and 30% of 'green instruments' included in the annual amount of bank loans lending (Arkhipova, 2017). Many studies have expressed the need and benefit of reporting of the ESG practices of business houses as it will bring more transparent disclosures to the existing relationship between the ESG factors and their financial impacts (Adams, 2017). With the adverse impacts on the society and environment, the economic development gets hindered and thus, creates a stumbling block for the overall development of a nation (Luo & Wu, 2016; Raberto et al., 2019). Thus, there is a need for re-configuration of the financial sector to achieve the goals of sustainable development.

Figure 1.

Triple Bottom Line Framework Source: Created based on Elkington, 1994; Porter & Van der Linde, 1995; OECD, 2000; Dréo, 2006; Brooks 2013.

Figure 1.

Triple Bottom Line Framework Source: Created based on Elkington, 1994; Porter & Van der Linde, 1995; OECD, 2000; Dréo, 2006; Brooks 2013.

The practice of introducing ecological initiatives in businesses tend to be the de-growth initiatives which have become necessary in present time to transform the society in reaction to the increasing issues of ecological imbalances, environment degradation, depletion of resources, debt crisis and capitalization problems (Agyeman et al., 2003). However, critics believe that it is only an attempt to bring the economy and environment together and bringing a reconciliation between generating growth through capital formation without environmental degradation and resource depletion (Brand, 2012; Jackson & Victor, 2011).

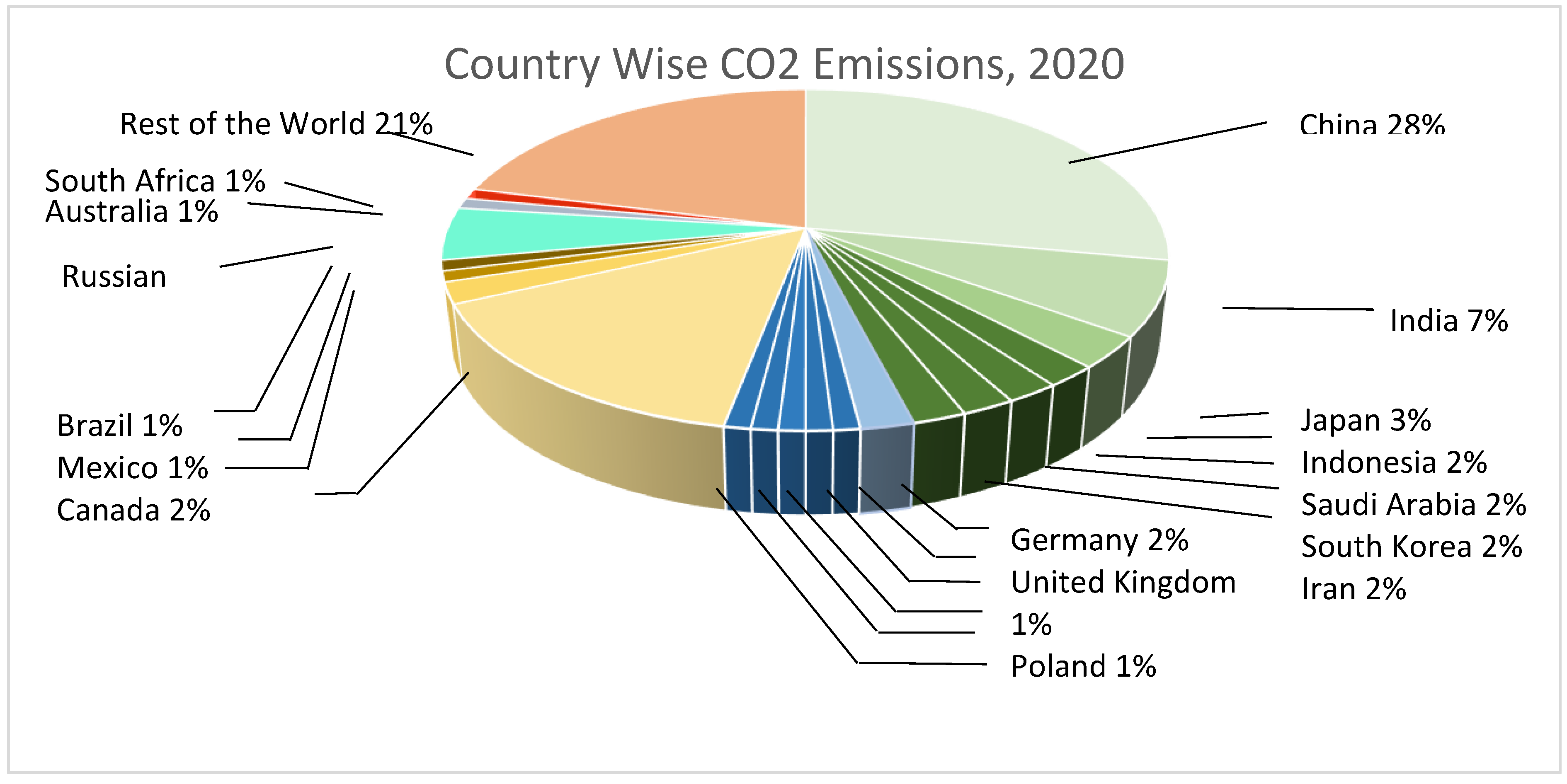

Figure 2.

Country Wise CO2 Emissions, 2020 Source: 2020 Union of Concerned Scientists Data: Earth Systems Science Data 11, 1783-1838, 2019.

Figure 2.

Country Wise CO2 Emissions, 2020 Source: 2020 Union of Concerned Scientists Data: Earth Systems Science Data 11, 1783-1838, 2019.

1.2. Sustainable Finance

“Sustainable finance can be referred as any of the financial institution’s practices supporting and facilitating sustainable development”.

~ (UNEPFI 2015)

Academic research has witnessed a surge in interest and popularity with respect to the field of Sustainable Finance (Carolina Rezende De Carvalho Ferrei et al., 2016; Cunha et al., 2021; Fatemi & Fooladi, 2013; Migliorelli, 2021; Thistlethwaite, 2014). Numerous scholarly investigations have defined the concept of Sustainable Finance within the existing body of academic literature. For instance, Sustainable finance is defined as finance that contributes to sustainable development across three interrelated dimensions: Economic, Environmental, and Social dimension (Ryszawska, 2016). According to (Migliorelli, 2021) Sustainable Finance can be defined as a form of financial support that is directed towards sectors or activities that actively contribute to the attainment of one or more of the key sustainability dimensions. Based on (Ozili, 2021) the concept of Sustainable Finance comprises the integration of Environmental, Social, and Governance (ESG) factors into investment decision-making within the field of finance. (Sommer 2020), defines sustainable finance can be defined as the process of mobilising and allocating capital in order to facilitate the transition towards a more sustainable economy.

Sustainable finance is a correlation of ESG factors; environment, Social and Governance to have a long-term agenda to integrate the performances of financial agendas with the performance of social and environmental agendas (Keefe, 2011; Soppe, 2009). Contrary the general social welfare idea of 'social impact investment', it is strategic in nature with the objective of funding projects that not only bring profits but also provide value to society (Bayandina & Voronin, 2015).

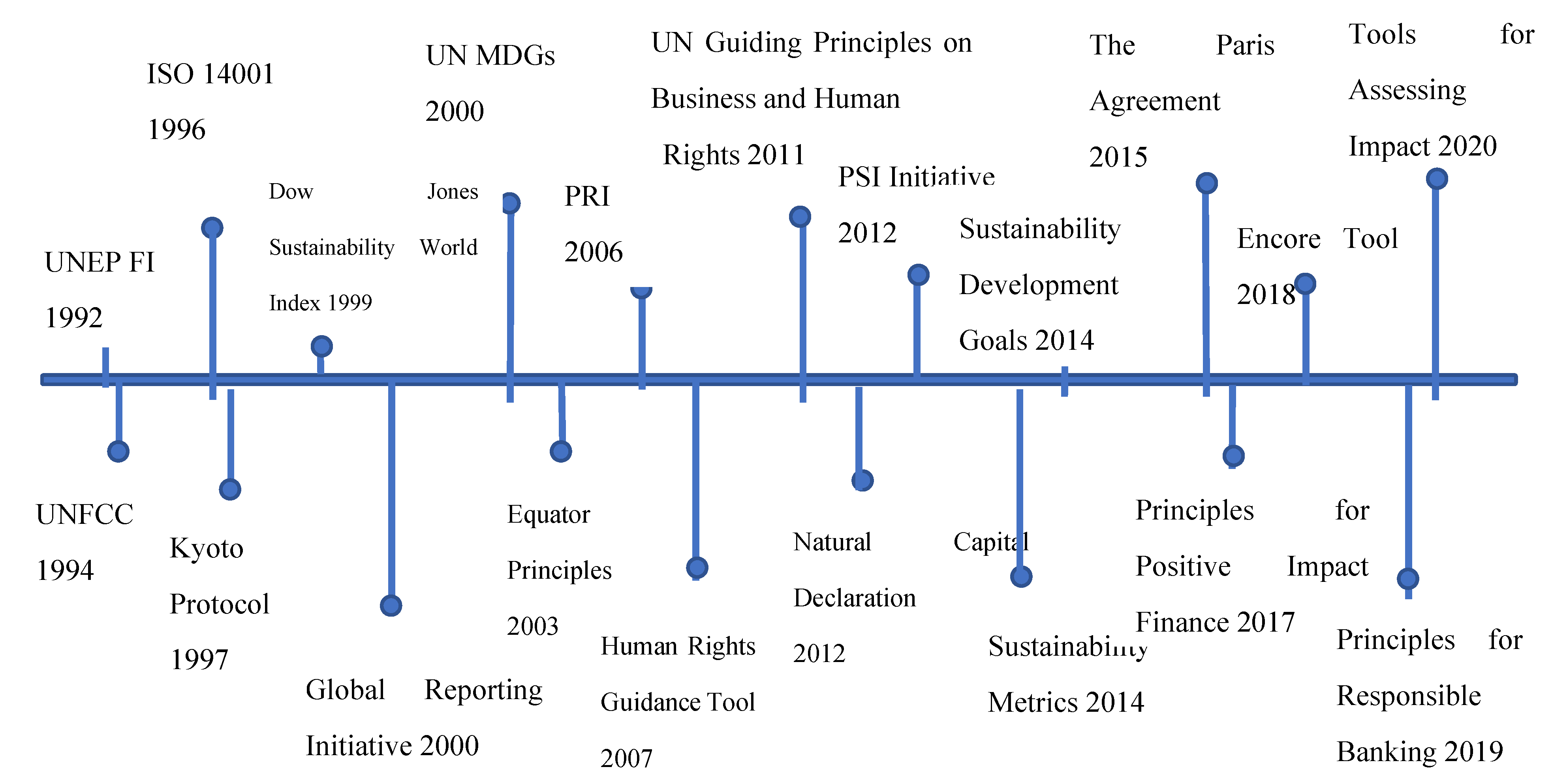

Figure 3.

Initiatives formulated globally over the years Source: Author's Creation.

Figure 3.

Initiatives formulated globally over the years Source: Author's Creation.

1.3. Current Scenario of Green Financing in the Global World

Human beings have infected their own world by making investments into carbon intensive products and practises. The subsequent impact of such practises has been disturbing and are expected to go worse in future, if reverse technique is not adopted. It is expected that with the current ongoing pace of the use of fossil fuels and release of greenhouse gases, the death count would be 45 to 53 million every year for the time period of 2010 to the year 2030. It is true that there cannot be a clear and definite measure of the harmful impacts of carbon practises, however, in the monetary terms, it has been found that these practices can bring the global gross domestic product GDP to fell at a rate of 1.7% to 3.2% every year from 2010 to 2020, as estimated to be the worst hit on the nations which are least developed and where a higher number of people are under the poverty line (cefc, 2016). The foremost reason for the deteriorating position is the excessive emission of greenhouse gases into the environment and every nation to a less or more extent is responsible for it.

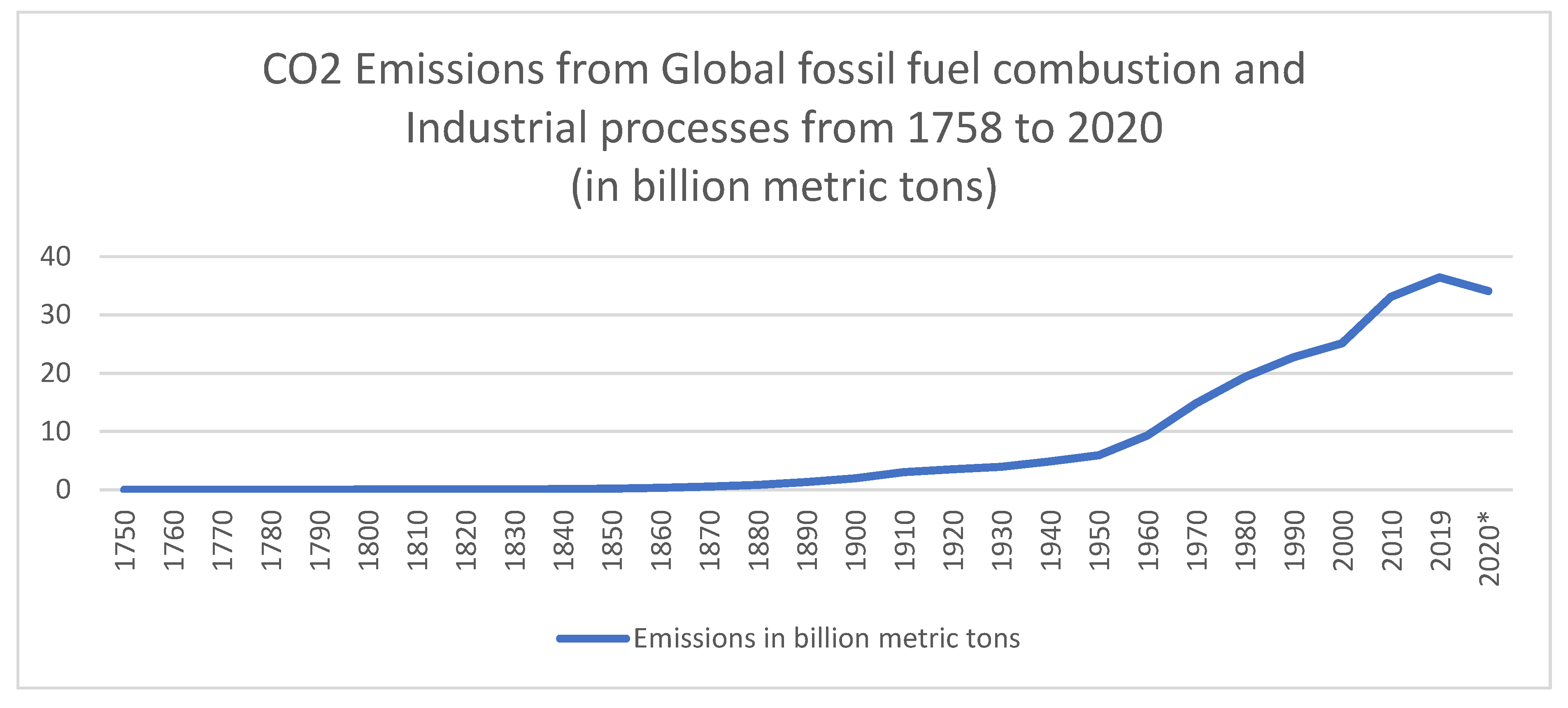

Figure 4.

CO2 Emissions from Global fossil fuel combustion and Industrial processes from 1758 to 2020 (in billion metric tons) Source: Statista, 2021.

Figure 4.

CO2 Emissions from Global fossil fuel combustion and Industrial processes from 1758 to 2020 (in billion metric tons) Source: Statista, 2021.

The above graph clearly states the uncontrolling and ever increasing level of carbon emissions. It is an alarming situation for governments and international bodies to take action against this threatening situation. Sustainable development goals (SDGs) are the most adopted targets for the nations around the world to obtain and acquire sustainability in their nations. It is not easy to prove that precisely obtain calculative figures of nations on SDGs as varied considerations have been made by the nations according to their approach in achieving these goals (IPCC, 2014).

Table 1.

Indian banks and financial Institutions as signatories of International Standards.

Table 1.

Indian banks and financial Institutions as signatories of International Standards.

| Name of Bank |

International and National Standards adopted |

| YES Bank |

|

| Insurance Institute of India |

|

Indus Environmental Services Pvt. Ltd. Equicap Asia Management Private Limited SBI Funds Management Private Limited ECube Investment Advisors Malabar Investments 3one4 Capital Advisors LLP UTI Asset Management Company Ltd. True North |

|

| Indian Banking Association |

|

| Small Industries Development Bank of India (SIDBI) |

|

2. Literature Review and Development of Hypothesis

Biswas, N. (2011), clarified that green banking as combining operational and technology efficiencies in the marketplace. The author has also presented the status of India with concerned to green practices adopted by the banking sector. The author suggested in his paper that banks should go green and play a proactive role to take sustainable and environmental aspects into their account as lending principle. The author also states that there is a lack of awareness regarding equator principles in India in which 62 global signatories of banks and financial institutions are the members where Indian banks yet to commit these principles. While concluding the author states that there is a huge ignorance of banks and financial institutions towards the green banking initiatives at international level.

Another study conducted by Nielsen's (2011), identifies that Global Online Environment and Sustainability Survey which indicate that a significant proportion of the Indian population expressed concerns regarding air and water pollution. Specifically, 90 percent of the surveyed individuals expressed concern towards these forms of pollution. Additionally, 80 percent of the respondents acknowledged the significance of climate change as an environmental issue (Nielsen, 2011). The previous findings are further supported by a more contemporary study conducted on a sample of 1270 Indian consumers, which revealed that 85 percent of the participants expressed a sense of assurance regarding the superior environmental impact of green products (TNS Global, 2014). Accordingly, there exists empirical data indicating that corporate stakeholders are increasingly being held accountable for their involvement in sustainable business practises (Shrivastava, 1993).

Bryson et al., (2016), identifies the key factors to predict consumer intention to use green banking services in India. A questionnaire was designed by the researcher and hypothesis were formulated and tested. Furthermore, the data was collected on which Confirmatory Factor Analysis (CFA) and Kaiser-Mayer–Olkin (KMO) was performed. The research findings carry significant consequences for banks in India. This study has successfully discovered multiple aspects that contribute to the formation of individuals intentions to utilise green banking services. Attitude toward green banking, collectivism, environmental concern, perceived consumer effectiveness, perceived consumer integrity are the main antecedents playing significant role in consumer intention to use green banking services in India.

Olivier et al., (2017), examined the perspectives of stakeholders, particularly those involved in Socially Responsible Investment (SRI) practices, regarding the importance of sustainability reports that follow to the Global Reporting Initiative (GRI) framework. The present study is grounded upon a comprehensive analysis of 33 semi-structured interviews conducted with a diverse range of stakeholders and subject matter experts within the Canadian context, specifically focusing on the domain of Socially Responsible Investing (SRI). The present study's findings bear practical implications for both auditors and users of reports. Auditors are advised to diligently verify the implementation of Global Reporting Initiative (GRI) principles. Similarly, users of these reports are encouraged to cross-reference the information contained within GRI reports with other sources, including those provided by external stakeholders such as non-governmental organisations (NGOs). This cross-referencing process serves as a means to evaluate the sustainability performance of the entities under consideration.

Tran et al., (2020), explicates that the collective duty for ensuring the sustainable management of the global economy now rests with all stakeholders, including consumers, corporations, governments, and financial institutions. The completion of this work has become a necessity for these individuals. Moreover, this study aims to investigate the function of intermediaries in promoting sustainability. Typically, green initiatives necessitate a significant financial commitment. In addition to the necessity of meeting capital requirements and addressing limited awareness, there exists a demand for further action.

Kaur, S. and Lohani, K. (2022), explained the importance of green finance and why do we need it. The author suggested that India needs to be climate conscious to control the adverse impacts of it. Moreover author gave many suggestions to frame the green policies in India. In order to explore the green finance in India the author also highlights the COP26 (Conference of Parties) meet which was held in Glasgow 2021. Furthermore the present study mentioned that India needs an investment which is estimated around 10 trillion dollars to achieve the zero carbon economy by 2070. The purpose of the present study is to shed light on the current state of green financing in India, as well as its future prospects, by focusing on the actions undertaken by the government in this respect and the path forward.

Hart & Ahuja (1996), examined how emission reduction affects company finances using an accounting-based approach. Multiple linear regressions were used to examine how emission decrease affected ROS, ROA, and ROE. Emission reduction and control variables like R&D intensity, capital intensity, and leverage are included in the study. This empirical study only covers manufacturing and mining. As various industries, including chemicals and transportation, contribute to rising emissions, this study has limited data. Only two industries may not represent the sample data needed, raising questions regarding the conclusions' validity.

Pathak & Tewari (2017), examines the sustainability reporting practises of the top 60 banks, comprising 20 each from Indian, European, and International banks. The objective is to investigate the emphasis placed on non-economic disclosures and assess using theoretical frameworks from accounting disclosure theories such as Institutional and Stakeholder theory. Content analysis was done and the findings suggest that banks prioritise sectors that address the fundamental and immediate requirements of the business ecosystem, such as energy, agriculture, and renewable resources like wind and water. All of these developments have a recognizable social impact.

Another study by Kodra and Partalidou (2017) examines green investment and firm financial and environmental performance. Company capitalisation, size, and book-to-market value ratio are used to measure financial performance. Environmentally responsible companies may increase their average profit, according to research. The research suggests the business's financial efficiency will increase. The essay focuses environmentally efficient industries including banking, technology equipment, software, and IT. It also lists fossil fuel energy, chemistry, natural resources, and utility services as environmentally inefficient.

Ari & Koc (2018), investigated whether public investment causes sovereign debt, including external and domestic debt, in the context of public-debt sustainability restrictions. The study examines the four countries with the greatest GDP—the US, China, Japan, and Germany—from 2000 to 2015. This study provides a quantitative examination of empirical data. The main goal is to support the claim that sovereign debt burdens public infrastructure finance, especially when it exceeds present criteria, as suggested in this study and supported by previous research. Through this process, our research yields insights that help us make suggestions for mobilising domestic resources and creating new financial structures. These steps are essential for sustainable development within sustainable public debt limits. This study concludes that using financially unsustainable methods to implement a sustainable development initiative invariably yields unsustainable economic results.

According to Cunha et al. (2021), the literature on Sustainable Finance and Investment (SFI) is fragmented, making it difficult to define the area and separate it from conventional finance and investment. Researchers identified and consolidated the core SFI (Sustainable Finance and Investment) components using a systematic literature assessment of 166 papers. Additionally, researchers identified the most important areas for further study. This approach defines SFI (Sustainable Finance and Investment), identifies important stakeholders, and discusses their characteristics, strategies, and results. The authors also provide a framework for understanding SFI (Sustainable Finance and Investment) and a research agenda. The agenda organises SFI (Sustainable Finance and Investment) key research questions and suggests methods to address them. The research shows that SFI (Sustainable Finance and Investment) actors have collaborated to improve social and environmental results through their financial and investment efforts. However, the field's main challenges are the SFI concept's inadequate theoretical development, the current focus on short-term financial perspectives, and the lack of empirical evidence on SFI's social and environmental impacts.

According to Sahoo, P. and Nayak, B.P.'s (2007), Financial Sector play significant role in incorporating environmental and ecological concerns into their lending principles. Doing so would compel industries to make mandated investments in environmental management, the use of suitable technologies, and management systems. To address the existing progress, which overuses the natural environment for economic gain, has given rise to a new paradigm of development called sustainable development. Regarding the environmental aspects of their customers and products, banks in India need to exercise extra caution. The author concluded by saying that none of the Indian banks had accepted the equator concepts. The banks and other financial institutions in India have not yet taken many initiatives to take Sustainable Finance into consideration, despite the fact that banks play a significant role in the economy.

Ameer, R., & Othman, R. (2012), conducted a research on top 100 Sustainable global corporations in 2008 that were chosen from a universe of 3,000 firms from developed and emerging markets for this study. The results shown that the companies who pay attention to the set of obligations, referred to as superior sustainable practices, have better financial performance than those that do not engage themselves in sustainable practices. Furthermore, results suggest that sustainable organizations financial performance has improved and remained stable over time.

Schoenmaker (2018), defines that the United Nations has developed the Sustainable Development Goals (SDGs) for transition towards a sustainable and inclusive economy. Sustainable development is a broader concept encompassing three interconnected dimensions: economic, social, and environmental. The present paper commences by conducting a comprehensive review of the prevailing environmental and social challenges that are currently being encountered by society. The study also discussed, what are the reasons for the finance sector to actively contribute to the advancement of sustainable development? The primary objective of the financial system is to efficiently allocate capital to its most productive utilisation. Financial institutions have begun to proactively exclude companies with unsustainable practises from their portfolios, a risk-based approach that we have categorised as Sustainable Finance 1.0 and 2.0 within our newly developed framework. Leading organisations are currently demonstrating a growing commitment to allocating resources towards sustainable enterprises and initiatives, with the aim of generating enduring benefits for the broader society. This approach, often referred to as Sustainable Finance 3.0, reflects a strategic shift towards prioritising long-term value creation.

Aras et al., (2018), the primary objective of this research paper is to explore into the realm of multidimensional corporate sustainability procedures, with a specific focus on Turkish banks. The aim is to develop a comprehensive corporate sustainability performance evaluation model that fits the unique context of these financial institutions. By conducting a thorough investigation, this study seeks to contribute to the existing body of knowledge on sustainable business practises and provide valuable insights for the Turkish banking sector. The utilisation of Content Analysis and TOPSIS methods is observed in the examination of 12 sustainability reports published by four Turkish deposit banks between 2012 and 2014. Various methodologies are utilised to evaluate the diverse facets of economic, environmental, and social governance, in addition to the financial aspects of corporate sustainability. The analysis of the dimensional base performance scores indicates that there are variations in the performance scores across different banks for each year. Furthermore, it is worth noting that instead of solely focusing on achieving the highest score in individual dimensions, enhancing performance across all dimensions significantly contributes to the overall score and ranking of the bank.

Zheng et. al., (2021), conducted an investigation into the development of Green Finance (GF) within the banking sector of Bangladesh, with a specific focus on the primary credit banks (PCBs). The researchers found that the level of awareness, beliefs, and knowledge pertaining to the key aspects of GF, including its social, economic, and environmental dimensions, as well as the sources of green financing, were deemed satisfactory among PCB bankers. These findings suggest that the successful implementation of GF in Bangladesh has the potential to support the nation's long-term economic growth. The investigation further explained the paramount significance of the "economic dimension" in driving GF, with the "social" and "environmental" dimensions afterwards follow in order of importance.

Migliorelli (2021), argues that a sustainable society and climate-neutral economy require intellectual integration. Effective regulation, technical advances, scientific investigation, and consumption changes have been highlighted as the main drivers of the transformation for years. The study also notes that variety in sustainable finance may hinder conceptual thinking. This heterogeneity creates dangers that could damage the emerging market's legitimacy. The concerns include green and sustainable washing, when companies pretend to be environmentally benign. Rebranding money flows without generating environmental advantages is another concern. Disorderly capital spread adjustments between industries are also a concern. The author suggests that sustainable finance should openly address the continuing dialogue about major sustainability dimensions and the sectors or activities that truly contribute to them.

Reporting on sustainability, the triple-bottom-line, corporate social responsibility, and social responsibility are all terms that mean the same thing (Roca and Searcy, 2012: 103). Sustainability Performance of Banks is a major dimension of environment protection around the world, in which the banking system plays a major role. Balanced information on financial/economic, social/ethical, and environmental performance is included in sustainability reports. Because financial institutions are responsible for directing global capital flows, shaping international policies, and maintaining macroeconomic stability, they have the potential to have far-reaching effects on the environment, human rights, and social justice, whether these effects are positive or negative. As a result, the actions taken by the financial system to promote sustainable development affect and guide all other sectors. Financial institutions are commonly acknowledged to have a high potential for impacting environmental and social sustainability (Öner Kaya, 2010: 79).

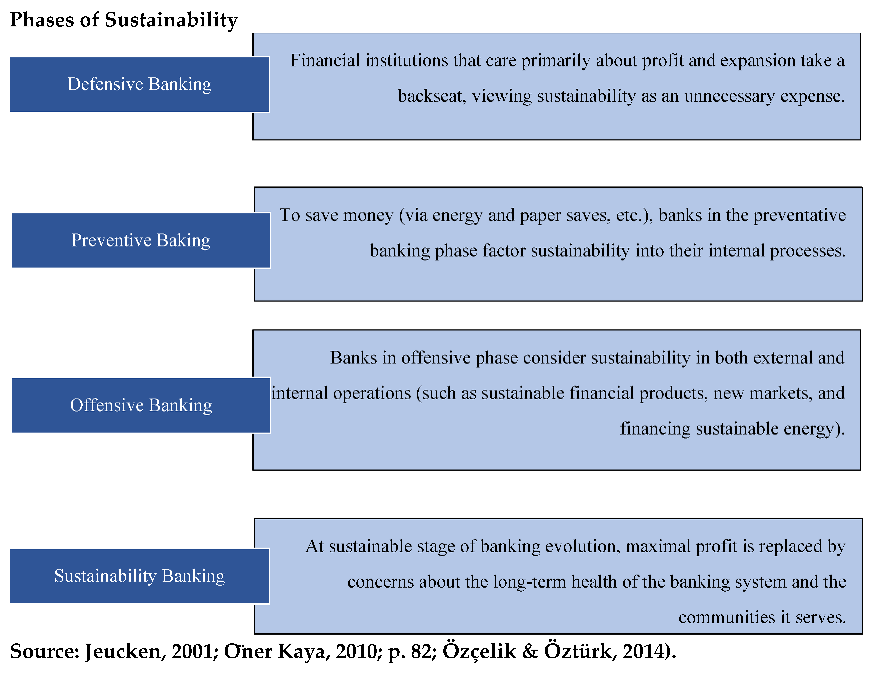

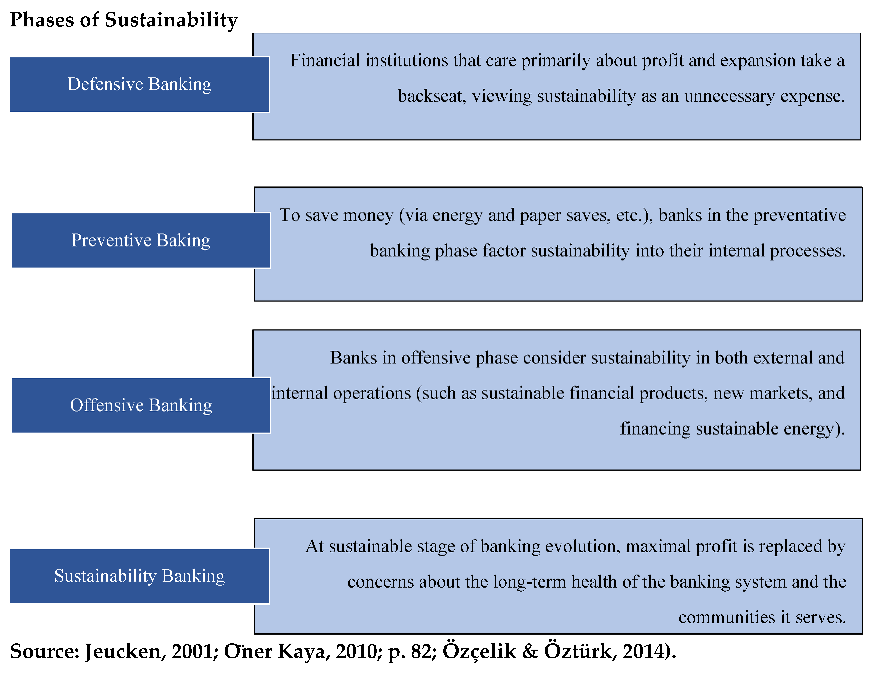

Banking can be divided into 4 stages for the ultimate achievement of sustainability. These 4 phases are:

The phases are elaborated in the figure 5.1 below:

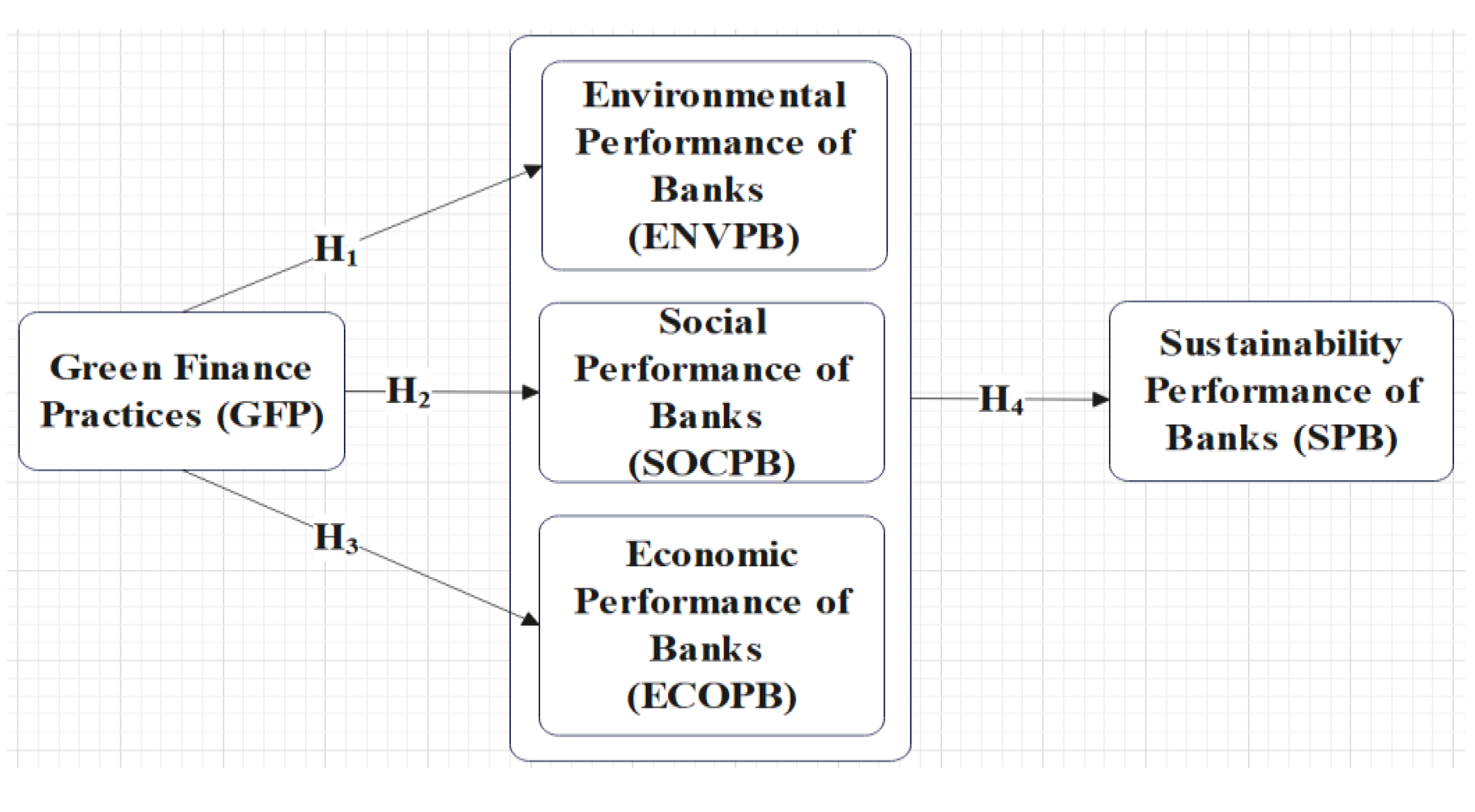

Sustainability Performance of Banks can be measured through 3 parameters: Environmental Performance of Banks, Social Performance Banks and Economic Performance of Banks (Elkington, 1994; Rogers et al., 2008). Although some researchers have considered other parameters along with these three parameters like; Financial Performance etc. (Hassan et al., 2015; Ongore & Kusa, 2013). However, as claimed by many researchers, many banks use the above stated 3 parameters as the most appropriate ones for sustainability reporting. Environment, Social and Economic Performance together form the sustainability performance of banks (Zheng et al., 2021).

Based on these prior studies, the following hypothesis is proposed for empirical testing.

H1: There is positive and significant impact of Green Financing Practices on Environment Performance of Banks

H2: There is positive and significant impact of Green Financing Practices on Social Performance of Banks

H3: There is positive and significant impact of Green Financing Practices on Economic Performance of Banks

H4: There is positive and significant impact of Green Financing Practices on Sustainability Performance of Banks

Statement of Purpose

The research has been undertaken with the major purpose of determining the antecedents of green financing practices in the banking sector for sustainable development. In context to this, the study aims to evaluate the factors that affect green financing in the banking sector. Knowing the reasons or the factors affecting, the study further makes an attempt to understand the impact of green financing practices on the performance of the banks. As evident from the literature, there is a lack of literature between green financing practices and performance of banks. Finally, the study proposes to make an in-depth exploration of the difference in the performance of public and private sector banks in adoption of green financing by the banking sector. Thus, this study makes an overall study of the aspects of green financing to explore the concerning issues in green financing in order to support the growth of green practices in banking sector in Punjab.

Sample Selection And Data Sources

The collection is based on two major types of data, that is, primary data and secondary data (Eriksson and Paul, 1997). Primary data is the collection of data at 'first hand' directly from the source of response. It is raw data that does not have any structure for a meaningful interpretation, applied in case of descriptive, exploratory and causal research (Hair et al., 2008). Secondary data, on the other hand, is collected from an already existing source which can be any organization, body or agency. The data is originally collected from other studies and can be used for a research study for any other purpose. For the analysis of the present research, primary data in quantitative manner has been used in accordance with the requirement set for the objectives. For data collection, structured questionnaire has been prepared with inclusion of dichotomous data type and 5-point Likert scale. The responses recorded through Likert scale were indicated with 1 as strongly disagree and 5 is indicated as strongly agree (Likert, 1932). The data has been collected through multistage sampling method. First, Judgmental Sampling has been used to define the banks from which data will be collected. On the basis of the Green Credit Directive, 2016 of the RBI, the study has selected 5 public sector banks and 5 private sector banks based on the asset value of the banks. The study undertakes only 10 public and private banks. After selecting the banks, the study has applied quota sampling technique. Under the quota sampling technique, the study has divided all the branches in Punjab on the basis of region. The study, then, selected the branches randomly from the list of branches in every region. Again, in the branches, the data has been collected from the employees of the bank through judgement sampling. The employees engaged in credit lending as per their job role were selected for filling the questionnaire. The whole population is divided into 3 sections. Punjab can be divided into 3 regions ie. Majha, Malwa and Doaba. The number of branches of banks from different districts have been considered and almost equal data has been collected from all the regions. Further, in the region, the data is collected through convenience sampling as it is collected from the branches visited through the districts. It is found that there are 390 branches of Axis Bank, 217 branches of Bank of Baroda, 165 branches of Bank of India, 309 branches of Canara Bank, 1210 branches of Punjab National Bank, 602 branches of HDFC Bank, 285 branches of ICICI Bank, 125 branches of IndusInd Bank, 135 branches of Kotak Mahindra Bank, 1200 branches of SBI Bank in Punjab (Prokerela.com). There is scarce literature available on the related topic of the study in India and thus, the dimensions of the study are derived from the literature of the studies performed globally.

A small survey was conducted before the collection of the whole data for pre-testing the reliability and validity of the questionnaire. The pilot study was performed on a data set of 130 collected from the respondents. The reliability values and Cronbach alpha values were found to test the reliability of the research questionnaire. A total of 23 statements have been included in the study for the purpose of analysis, based on the review of existing studies. All 23 items were undertaken for the analysis of the study. First, the reliability analysis for all the statements has been done through IBM SPSS Version 26. The reliability of these 23 statements was found to be 0.883 which is higher than the acceptable limit of 0.7 and more (Kline, 1999). Based on this reliability value, the dataset was found to be feasible to conduct the further analysis. The reliability analysis of all the 23 items as obtained from the software is provided as below:

Table 2.

Reliability Statistics.

Table 2.

Reliability Statistics.

| Cronbach's Alpha |

No. of Items |

| 0.883 |

23 |

Table 3.

Scale Statistics.

Table 3.

Scale Statistics.

| Mean |

Variance |

Std. Deviation |

N of Items |

| 112.0422 |

281.359 |

16.77377 |

23 |

The scale statistics measured for the dataset after the deletion of the items which were not feasible for the study, are reported as stated in the above table. It shows that the Mean value is found to be 112.0422. The Variance for the dataset is 281.359 while the Standard Deviation is 16.77377.

The reliability analysis of all the items individually has been measured and shown in table 3.4, provided below:

Table 4.

Reliability Analysis.

Table 4.

Reliability Analysis.

| Item-Total Statistics |

Scale Mean |

Scale Variance |

Corrected Item - Total Correlation |

Cronbach's Alpha |

| Employee incentive programs are conducted frequently in the bank for environmental suggestions. |

109.3052 |

260.984 |

0.465 |

0.879 |

| My bank promotes environmental oriented enterprises through special grants. |

109.5785 |

253.316 |

0.608 |

0.875 |

| My bank promotes environmental oriented enterprises through loans. |

109.2631 |

261.388 |

0.509 |

0.878 |

| My bank promotes environmental oriented enterprises through guidance. |

109.1032 |

258.829 |

0.549 |

0.877 |

| I believe my bank is donating its part profits to green growth organizations. |

109.1817 |

256.955 |

0.564 |

0.876 |

| Bank offers donations to credit cardholders participating in green activities |

109.5785 |

257.799 |

0.534 |

0.877 |

| Bank offers discounts to credit cardholders participating in green activities |

109.1977 |

259.128 |

0.543 |

0.877 |

| Bank offers mileage accruals to credit cardholders participating in green activities |

109.1613 |

257.355 |

0.572 |

0.876 |

| I believe my bank offers insurances at discounted fee to the customers involving in eco-friendly activities |

109.3052 |

260.044 |

0.525 |

0.877 |

| My bank provides increased investments into fire burnt brick manufacturing firms which can withstand high temperatures, making them sustainable |

109.1788 |

260.493 |

0.526 |

0.878 |

| The investment in green brick manufacturing businesses to build green infrastructure is increasing in the bank |

109.1788 |

257.326 |

0.562 |

0.877 |

| In the bank, more financing is being provided for projects enhancing green establishments/ buildings |

109.2791 |

256.947 |

0.607 |

0.876 |

| Extending loans to green marketing and other green practices has increased in my bank |

109.1468 |

256.661 |

0.611 |

0.876 |

| Green practices significantly reduce energy consumption in our bank. |

107.8765 |

275.41 |

0.172 |

0.884 |

| Green practices significantly reduce carbon emission in our bank. |

107.8881 |

273.75 |

0.216 |

0.883 |

| My bank is improving knowledge and understanding of staff on environmental protection, energy saving, etc. |

107.8837 |

275 |

0.17 |

0.884 |

| Green practices have positive effect on the image of our bank. |

108.016 |

272.54 |

0.232 |

0.883 |

| Green practices of bank result in better relationship between community and stake holders. |

108.0131 |

272.147 |

0.24 |

0.883 |

| Green practices result in increased compliance with applicable social laws and regulations. |

108.0174 |

270.981 |

0.279 |

0.882 |

| Green practices significantly improve revenue of our bank. |

107.9084 |

275.487 |

0.171 |

0.884 |

| Green practices significantly improve market share of our bank. |

108.0814 |

274.5 |

0.187 |

0.884 |

| Green practices highly decrease operational expenditure of our bank. |

107.9927 |

274.022 |

0.215 |

0.883 |

| Green practices improve resource management efficiency in our bank. |

107.9913 |

274.044 |

0.193 |

0.884 |

For further analysis, Exploratory Factor Analysis (EFA) was conducted. Items with factor loadings greater than 0.6 were considered. However, on applying exploratory factor analysis, few of the factors were not having required factor loading and not forming any factors and thus, were deleted. After deleting the inappropriate items from the data, 23 items were found acceptable. For the first variable related to green financing practices, 13 items were retained. While for the sustainability performance of banks, 10 items were accepted. The reliability analysis for these items was again performed through SPSS. The reliability for the 23 items was found to be 0.883. The reliability of the scale was found to be feasible which is higher than 0.7 acceptable level. Based on the reliability analysis, it can be stated that the data is suitable for conducting the further analysis.

Universe Of The Study And Sample Design

The questionnaire is framed and distributed among the employees of banks and responses were collected. The study is focused on the banking sector of Punjab. The study considers both public sector and private sector banks. The population of the study are the employees working at all levels of banks in Punjab. The data was collected from a total of 688 respondents.

For the collection of primary data, 5 banks from each category (public and private banks) have been undertaken. The banks have been selected on the basis of asset value of the banks. The top five private banks selected, based on asset value include: HDFC Bank, ICICI Bank, Axis Bank, Kotak Mahindra and IndusInd Bank. The top five public banks selected, based on asset value include: SBI Bank, Bank of Baroda, Punjab National Bank (PNB), Canara Bank and Bank of India. To accomplish the objectives of the study, the data has been collected from the employees of the banks of Punjab around all the three regions. These three regions of Punjab include: Majha, Malwa and Doaba. Though a total of 900 questionnaires were distributed, 688 responses were retained for the study with a response rate of 76.44%.

3. Research Question and Theoretical Framework of the Study

Figure 5.

Theoretical Framework: Green Finance Assessment Model of Banks (Source: Author’s Creation).

Figure 5.

Theoretical Framework: Green Finance Assessment Model of Banks (Source: Author’s Creation).

According to the main research questions and hypothesis, the structured questionnaire was formulated and circulated among the employees of the banking sector in Punjab. We describe the following factors and determinants of various constructs through analysis in the following section.

Green Financing Practices (GFP)

The very first factor measured from the factor analysis technique as shown in the table 2.1, has been named as 'Green Financing Practices'. The very first dimension comprises of thirteen items which are related to the green financing practices which can be adopted by banking sector in relation to their external clients, either individuals or business, and in the internal working and external managerial environment of the organization. Out of the total 45 items under the construct, 32 items were deleted and only 13 items were retained.

Table 5.

Determinants of Green Financing Practices Identified.

Table 5.

Determinants of Green Financing Practices Identified.

| Determinants Identified |

|---|

| Employee Incentive Programmes |

| Grants to environmental oriented enterprises |

| Loans to environmental oriented enterprises |

| Guidance to environmental oriented enterprises |

| Donating part profits to green growth organizations |

| Donations to credit cardholders with green activities |

| Discounts to credit cardholders with green activities |

| Mileage Accruals to credit cardholders with green activities |

| Offering insurance products at discounted fee |

| Financing for fire burnt brick manufacturing firms withstanding high temperatures, making them sustainable |

| Financing for green brick manufacturing businesses |

| Financing for green establishments/ buildings |

| Financing for green marketing and other green practices |

Environment Performance of Banks

Environmental Performance in the banking sector is the second dimension measured by factor analysis. The dimension is named as 'Environment Performance of Banks'. A total of 3 items were undertaken for measuring the construct. All the 3 items were accepted and none were rejected.

The determinants identified for environment performance of banks is as follows:

Table 6.

Determinants of Environment Performance of Banks Identified.

Table 6.

Determinants of Environment Performance of Banks Identified.

| Determinant Identified |

|---|

| Energy Consumption in Banks |

| Carbon Emissions in Banks |

| Knowledge and Understanding of Staff |

Social Performance of Banks

Social Performance in the banking sector is the third dimension measured by factor analysis. The factor is named as 'Social Performance of Banks'. For measuring this construct, a total of 3 items were undertaken. All the 3 items measured an acceptable factor loading and none of these were rejected.

The determinants identified for social performance of banks are as follows:

Table 7.

Determinants of Social Performance of Banks Identified.

Table 7.

Determinants of Social Performance of Banks Identified.

| Determinant Identified |

|---|

| Positive Effect on Bank Image |

| Better Relationship between community and stakeholders |

| Increased compliance with applicable social laws and regulations. |

Economic Performance of Banks

Economic Performance in the banking sector is the fourth dimension measured by factor analysis. The dimension is named as 'Economic Performance of Banks'. For measuring this dimension, the study undertook 4 items. As per the factor loading of these items, all the items were found in the range of acceptable limits and thus, all four items were accepted and none were rejected.

The determinants identified for economic performance of banks are as follows:

Table 8.

Determinants of Economic Performance of Banks Identified.

Table 8.

Determinants of Economic Performance of Banks Identified.

| Determinant Identified |

|---|

| Improve Revenue of Bank |

| Improve Market Share of Bank |

| Decrease Operational Expenditure of Bank |

| Improve Resource Management Efficiency of Bank |

The Kaiser-Meyer-Olkin and Barlett's Test

The Kaiser-Meyer-Olkin (KMO) is a statistical technique which is used to measure the appropriateness of the sample size taken for the study and also, to ensure that the sample size is appropriate to apply exploratory factor analysis (EFA) (Kaiser, 1974). For the present study, the Kaiser-Meyer-Olkin (KMO) value is measured to be 0.908 which is satisfactory. Any value of KMO greater than 0.8 is considered to be good. Further, the significance level is checked which is used to describe the relationship between the variables (Schuessler, 1971). The significance level is measured to be 0.000 which shows a strong relationship between the various variables undertaken for applying EFA. The results derived from SPSS for Kaiser-Meyer-Olkin (KMO) and Barlett's Sphericity Test are shown in the

Table 3.5 below. It can be stated from the results derived that the values of Barlett's Test of Sphericity and KMO are found to be appropriate and fit to apply factor analysis further (Hair et al., 2015; Kaiser, 1974; Sharma, 2015).

Table 9.

Kaiser-Meyer-Olkin (KMO) and Barlett's Test.

Table 9.

Kaiser-Meyer-Olkin (KMO) and Barlett's Test.

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy |

.908 |

| Barlett's Test of Sphericity |

Approx. Chi-Square |

9474.466 |

| df |

528 |

| Sig. |

.000 |

Table 10.

Factor Naming, Variance Explained and Eigenvalue.

Table 10.

Factor Naming, Variance Explained and Eigenvalue.

| Sr. No. |

Factor Name (Variance Explained) |

Cronbach Alpha |

Eigenvalue |

Loadings |

Items |

| F1 |

Green Financing Practices (19.828) |

0.918 |

7.734 |

0.818 |

My bank promotes environmental oriented enterprises through special grants. |

| 0.750 |

Bank offers donations to credit cardholders participating in green activities |

| 0.728 |

In the bank, more financing is being provided for projects enhancing green establishments/ buildings |

| 0.717 |

Bank offers discounts to credit cardholders participating in green activities |

| 0.715 |

The investment in green brick manufacturing businesses to build green infrastructure is increasing in the bank |

| 0.691 |

I believe my bank is donating its part profits to green growth organizations. |

| 0.689 |

Bank offers mileage accruals to credit cardholders participating in green activities. |

| 0.686 |

My bank promotes environmental oriented enterprises through guidance. |

| 0.676 |

Extending loans to green marketing and other green practices has increased in my bank. |

| 0.665 |

Employee incentive programs are conducted frequently in the bank for environmental suggestions. |

| 0.665 |

I believe my bank offers insurances at discounted fee to the customers involving in eco-friendly activities. |

| 0.659 |

My bank promotes environmental oriented enterprises through loans. |

| 0.651 |

My bank provides increased investments into fire burnt brick manufacturing firms which can withstand high temperatures, making them sustainable. |

| F2 |

Environment Performance of Banks (28.565) |

0.777 |

4.005 |

0.828 |

Green practices significantly reduce carbon emission in our bank. |

| 0.819 |

Green practices significantly reduce energy consumption in our bank. |

| 0.808 |

My bank is improving knowledge and understanding of staff on environmental protection, energy saving, etc. |

| F3 |

Social Performance of Banks (35.316) |

0.736 |

2.357 |

0.814 |

Green practices result in increased compliance with applicable social laws and regulations. |

| 0.792 |

Green practices of bank result in better relationship between community and stake holders. |

| 0.768 |

Green practices have positive effect on the image of our bank. |

| F4 |

Economic Performance of Banks (41.682) |

0.740 |

2.111 |

0.784 |

Green practices significantly improve market share of our bank. |

| 0.777 |

Green practices highly decrease operational expenditure of our bank. |

| 0.727 |

Green practices improve resource management efficiency in our bank. |

| 0.671 |

Green practices significantly improve revenue of our bank. |

5. Testing the Hypothesis & Findings of the Study

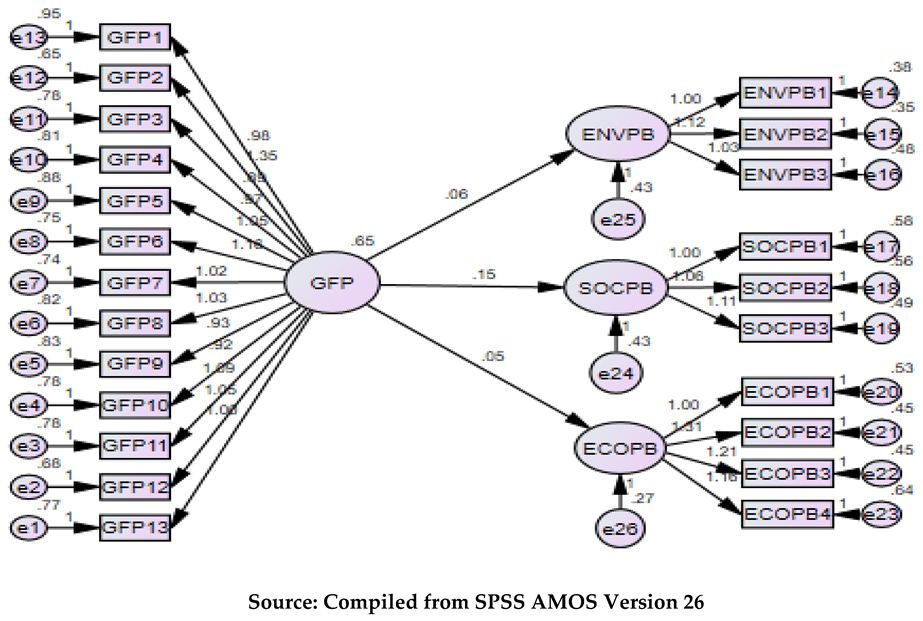

H1: 'There is positive and significant impact of Green Financing Practices on Environment Performance of Banks'

| Dependent Variable |

Independent Variable |

Estimate |

S.E. |

C.R. |

p-Value |

| Environment Performance of Banks (ENVPB) |

Green Financing Practices (GFP) |

0.064 |

0.037 |

1.758 |

0.079 |

| Source: Compiled from SPSS Amos Version 26 Output. |

The bias in the model's estimated associations between variables is quantified by the standard error (S.E.). Very little bias is present in the model, as indicated by the S.E. value of 0.064. Critical Ratio (CR), measured as a z-score at a 5% significance level, is found to be 1.758, which is unsatisfactory because it is less than the threshold value of 1.96. Finally, the p-value is crucial in determining whether or not to accept the model's hypothesis. The likelihood that the hypothesis is correct is given by the p-value. Any p-value less than 0.05 is regarded to be statistically significant. The p-value in this model is 0.079, indicating an insignificant impact. Therefore, the analysis above leads us to reject the hypothesis (p-value 0.079, t-value 1.758, 0.079). This implies that "Green Financing Practices have an insignificant impact on the Environment Performance of Banks."

H2: 'There is positive and significant impact of Green Financing Practices on Social Performance of Banks'

| Dependent Variable |

Independent Variable |

Estimate |

S.E. |

C.R. |

p-Value |

| Social Performance of Banks (SOCPB) |

Green Financing Practices (GFP) |

0.154 |

0.039 |

3.921 |

*** |

| Source: Compiled from SPSS Amos Version 26 Output. |

S.E. is calculated to be 0.039, which indicates minimal bias in the model. The z-score, or critical ratio at the 5% level of significance is 3.921, which is better than the required minimum of 1.96. The p-value is crucial in deciding whether to accept or reject the model's hypothesis. Statistical significance is assumed when the p-value is less than 0.05. The p-value calculated using SPSS AMOS Version 26 is ***, as indicated in the table above. High statistical significance is shown by the present model's p-value being less than 0.001. Based on this analysis, we can conclude that the stated hypothesis is true (p-value <0.001, t-value 3.921, β 0.186). Thus, it can be concluded that "Green Financing Practices have a significant impact on the Social Performance of Banks."

H3: 'There is positive and significant impact of Green Financing Practices on Economic Performance of Banks'

| Dependent Variable |

Independent Variable |

Estimate |

S.E. |

C.R. |

p-Value |

| Economic Performance of Banks (ECOPB) |

Green Financing Practices (GFP) |

0.053 |

0.030 |

1.790 |

0.073 |

| Source: Compiled from SPSS Amos Version 26 Output. |

We find that the S.E. is as little as 0.053, indicating a very low level of biasness in the model. Additionally, the z-value of 1.790 at the 5% level of significance for critical ratio (CR) is less than the threshold value of 1.96, thus, unacceptable. The p-value is what determines whether or not the model's hypothesis is accepted. The p-value obtained using SPSS AMOS version 26 is 0.073 as indicated in the table above. As an example, in SEM, a p-value should be less than 0.05 for the impact to be significant. There is low statistical significance in the current model, with a p-value of more than 0.05. From this, we deduce that the hypothesis should be rejected (p-value 0.073, t-value 1.790, 0.083). This signifies that "Green Financing Practices have an insignificant impact on the Economic Performance of Banks."

The results of the above stated hypotheses imply that the impact of Green Financing practices is insignificant on Sustainability Performance of Banks. It is because out of the 3 parameters to assess sustainability, there a significant impact on the social performance only and no significant impact is found on the environment and economic performance of banks.

H4: 'There is positive and significant impact of Green Financing Practices on Sustainability Performance of Banks'

| Dependent Variable |

Independent Variable |

Estimate |

S.E. |

C.R. |

p-Value |

| Sustainability Performance of Banks (SPB) |

Green Financing Practices (GFP) |

0.081 |

0.024 |

3.420 |

*** |

| Source: Compiled from SPSS Amos Version 26 Output. |

.

The standard error (S.E.) is the measure to estimate the biasness present among the relationships of different variables in the model. The value of S.E. is found to be as low as 0.024 which depicts a very low level of biasness in the model. Further, the critical ratio (CR) which is the z-value at 5% significance level is observed as 3.420 which is higher than 1.96 and thus, is acceptable. Finally, the acceptance or rejection of the hypothesis of the model is highly based upon the p-value. The p-value states the probability to which the hypothesis is true. For the p-value, any value obtained which is < 0.05 is considered to be significant. As shown in the table above, the p-value found through SPSS AMOS Version 26 is ***. In SEM, the p-value can be depicted through *, ** and ***, where * depicts a p-value less than 0.05, ** depicts the p-value as less than 0.01 and *** depicts p-value less than 0.001. In the current model, the p-value is found to be less than 0.001, which clearly states that there is a high level of significance. Thus, it can be concluded from the above analysis that the hypothesis is accepted (p-value <0.001, t-value 3.420, β 0.216). This means that 'There is significant impact of Green Financing Practices on the Sustainability Performance of the Banks. The stated results obtained concur in correspondence to the studies of some authors (Zheng et al., 2021; Ren & Yuan, 2018).