1. Introduction

Today, project management, as a profession and a growing field of study, is being utilized across various industries, countries, and new application areas, experiencing continuous changes in demand and expectations. This broad applicability and constant change challenge project management researchers to address important topics effectively. Reviewing the literature in project management provides a way to access the required informational resources. This approach not only enhances understanding and identification of weaknesses and deficiencies but also facilitates the development of new discussions and awareness of topics needing research investment (Azizi. 2015). The quality and integration of project management systems play an undeniable role in the success or failure of projects. This is especially critical in project-oriented organizations with large projects. One of the suitable tools to ensure the accuracy and quality of project management activities is the continuous assessment of these activities and the formation of an integrated project management system. In this context, various formal and informal models have been presented over recent years, each with its strengths and weaknesses. An important consideration is the differing characteristics of projects and, consequently, the differences in their management methods across various fields such as construction, information technology, software development, etc., necessitating the design of specific models to evaluate each type of project (Christoph et al., 2021).

Every organization is established to achieve goals set by its stakeholders. To attain superior performance, especially in terms of financial outcomes, it cannot sustain operations without a well-documented plan within an integrated system. This necessitates the implementation of a system capable of planning performance and developing and executing programs through its executive systems, ultimately leading to enhanced financial performance. The issue of performance evaluation has been addressed from various perspectives, but none have provided a comprehensive picture of financial performance assessment and its categorization. It seems that the existence of multiple classifications in the field of performance evaluation creates ambiguity and confusion for users, making it challenging to determine which approach is more suitable (Keshavarz shal. 2019).

Moreover, in today's environment, we encounter organizations involved in construction projects that manage several projects simultaneously, posing serious managerial challenges. Traditional methods no longer suffice to meet their needs and requirements for achieving their goals. The School Renovation Organization, responsible for implementing construction projects for the Ministry of Education, undertakes the construction of hundreds of educational, developmental, and sports facilities annually (Azizi and et al., 2010). However, only a few of these projects are fully completed and handed over to the Ministry of Education on time, while many remain unfinished, requiring funding over several consecutive or even interrupted years to become usable. Therefore, this research begins with the following question:

What impact does an integrated project management system have on the financial performance of the Organization for Renovation, Development, and Equipment of Schools?

2. Theoretical Foundations and Research Background

2.1. Integrated Project Management System

Project management is an organized system and, in a way, the management of resources such that a project is completed with a defined vision, specified quality, determined time frame, and specific cost. In other words, project management involves the application of knowledge, skills, tools, and techniques to activities to meet the needs and expectations of project stakeholders. Project management utilizes two powerful tools: planning and control. Planning and control management are entirely different and require different technical methods, contributing to the advancement of project management science (Nasar et al., 2018).

An integrated project management system is a practical framework aimed at implementing integrated project management processes within project-oriented organizations. This system seeks to establish and maintain an integrated connection between the project-oriented organization and its projects. The integrated project management system has the capability to be developed within project-oriented organizations by the project management office, with the goals of integration, monitoring, control, support, and alignment of projects with the organization's business objectives (Azizi and Yazdani., 2007).

2.2. Financial Performance

Organizational performance refers to how well an organization executes its missions, tasks, and activities, as well as the outcomes of these efforts. Another definition describes organizational performance as the attainment of organizational and social goals or even surpassing those, fulfilling the responsibilities entrusted to the organization. Financial performance is defined by profitability through the return on employed capital. In addition to profitability, revenue growth and increased productivity or asset utilization also signify financial performance (Azizi., 2018).

Financial performance encompasses profitability metrics such as operating profit, return on employed capital, sales growth, cash flow growth, and economic value added. The financial aspect is the most crucial criterion and the ultimate metric that the company generates for its shareholders. It explains the actions taken for them. Essentially, financial performance can be considered to include three key metrics for shareholders:

-

1.

Return on employed capital and cash flow related to short-term results.

-

2.

Reliability of forecasts in accordance with investors' desires to reduce uncertainty.

-

3.

Unexpected changes in performance.

The financial aspect improves administrative and financial practices, human resource processes, and the cost and planning processes for goods, information systems, services, projects, and operations. This aspect indicates that the organization's strategy, applications, and management are aligned with the organization's bottom line. The financial aspect also reflects the strategic options developed in other areas (Davari Farid and et al., 2019).

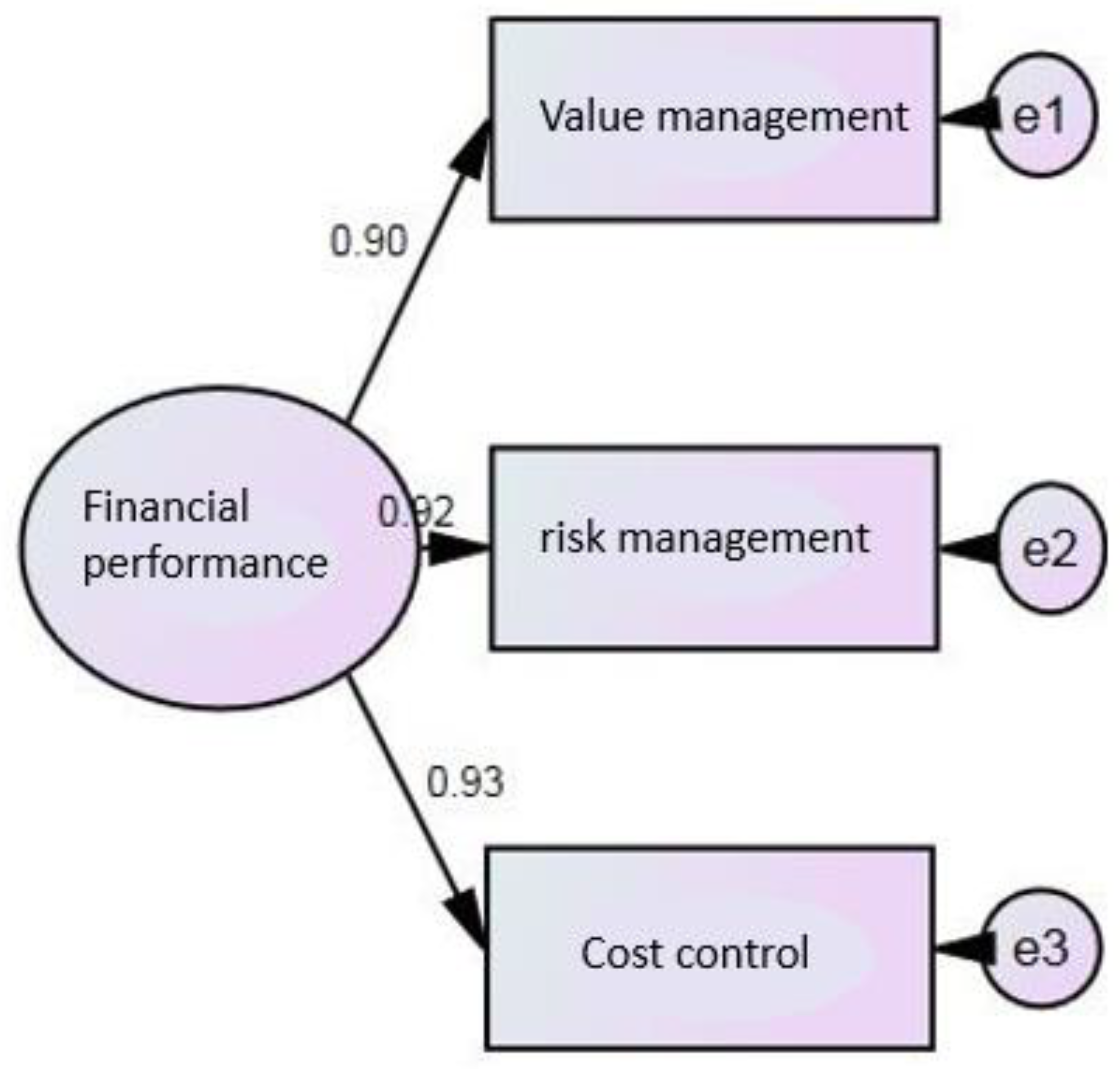

Financial performance has three dimensions: value management, risk management, and cost management (Azizi et al., 2015):

2.2.1. Value Management

In the era of communications and information, the knowledge-based economy emphasizes the importance of values, their development, and overall value management. These values help establish and maintain standards that can guide individuals toward actions beneficial to the organization. When organizational standards or values are widely adopted among members, organizational efficiency, productivity, and success increase (Hassan Alali, 2022). Value-based management provides a general framework through which managers can define, implement, and enforce value strategies within organizations. It equips information owners with tools to monitor and coordinate managerial actions. A key feature of value management is value-based indicators (Habibi and et al, 2018).

2.2.2. Risk Management

The goal of risk management is to manage uncertainty. It includes activities such as identifying, assessing, monitoring, and mitigating the impact of risks on a business. A proper risk management program with suitable risk management strategies can minimize costly and stressful problems, reducing claims and insurance premiums.

2.2.3. Cost Management

Project cost management involves the processes required to ensure that a project is completed within the approved budget (Falahati and et al, 2019).

2.3. Previous Research in This Field

Some notable studies in this area include:

Hashami et al. (2021), in their study titled "The Impact of Business Intelligence System Acceptance on Financial Performance of Organizations," concluded that financial performance does not directly improve through the acceptance of business intelligence systems. Instead, acceptance of the system enhances internal processes, customer relations, and organizational learning, which indirectly leads to improved financial performance. Practically, this research enhances executives' understanding of how business intelligence systems impact organizational performance. The acceptance of such systems results in tangible financial benefits through improved process performance, customer satisfaction, and learning. Thus, financial performance is the ultimate benefit of using this system.

Sorkhani Ganji et al. (2021), in their study titled "The Impact of Management Accounting Systems on the Development of Intellectual Capital Components and Financial Performance with Emphasis on Business Intelligence in Iran's Capital Market," found that in recent years, substantial efforts have been made to implement management accounting systems to enhance intellectual capital and financial performance. The use of business intelligence and business analytics to support decision-making and increase profitability has expanded globally. Therefore, business intelligence affects the relationship between management accounting systems, intellectual capital components, and financial performance. Management accounting systems are related to the development of intellectual capital components and financial performance, and business intelligence influences these relationships. To improve intellectual capital and performance, it is recommended that managers integrate management accounting systems and business intelligence.

Khandan et al. (2022), in their study titled "The Impact of Integrated Management on the Performance of Construction Project Management," concluded that integrated management has a positive and significant impact on the performance of construction project management. Additionally, the type of project also influences project management performance. Consequently, the proposed project management performance framework can be used by project managers in the construction industry to design and implement effective strategies.

Hasan Al Ali et al. (2022), in their study titled "The Impact of Project Management Systems on Organizational Performance from a Technological Perspective in the United Arab Emirates," concluded that there are significant relationships between integrated project management systems and technological orientation, project management systems and organizational performance, and technological orientation and organizational performance. The study also demonstrated a significant partial mediating effect of technological orientation between project management systems and performance. It concluded that companies can enhance performance by incorporating technological tools and that components of project management systems are crucial factors supporting performance. Thus, the study encourages corporate management to pursue technology to improve performance in today's competitive and digital age.

Damascene et al. (2022), in their study titled "The Impact of Project Management Information Systems on Project Performance in Rwanda," found that project management information systems have a significant impact on project performance.

Barbosa et al. (2020), in their study titled "Configuring Project Management Practices to Enhance Performance of Innovative Open R&D Projects," concluded that configuring project management systems can positively impact organizational performance through research and development and the use of innovative open technologies.

3. Conceptual Model and Research Hypotheses

The main hypothesis of the current research is as follows:

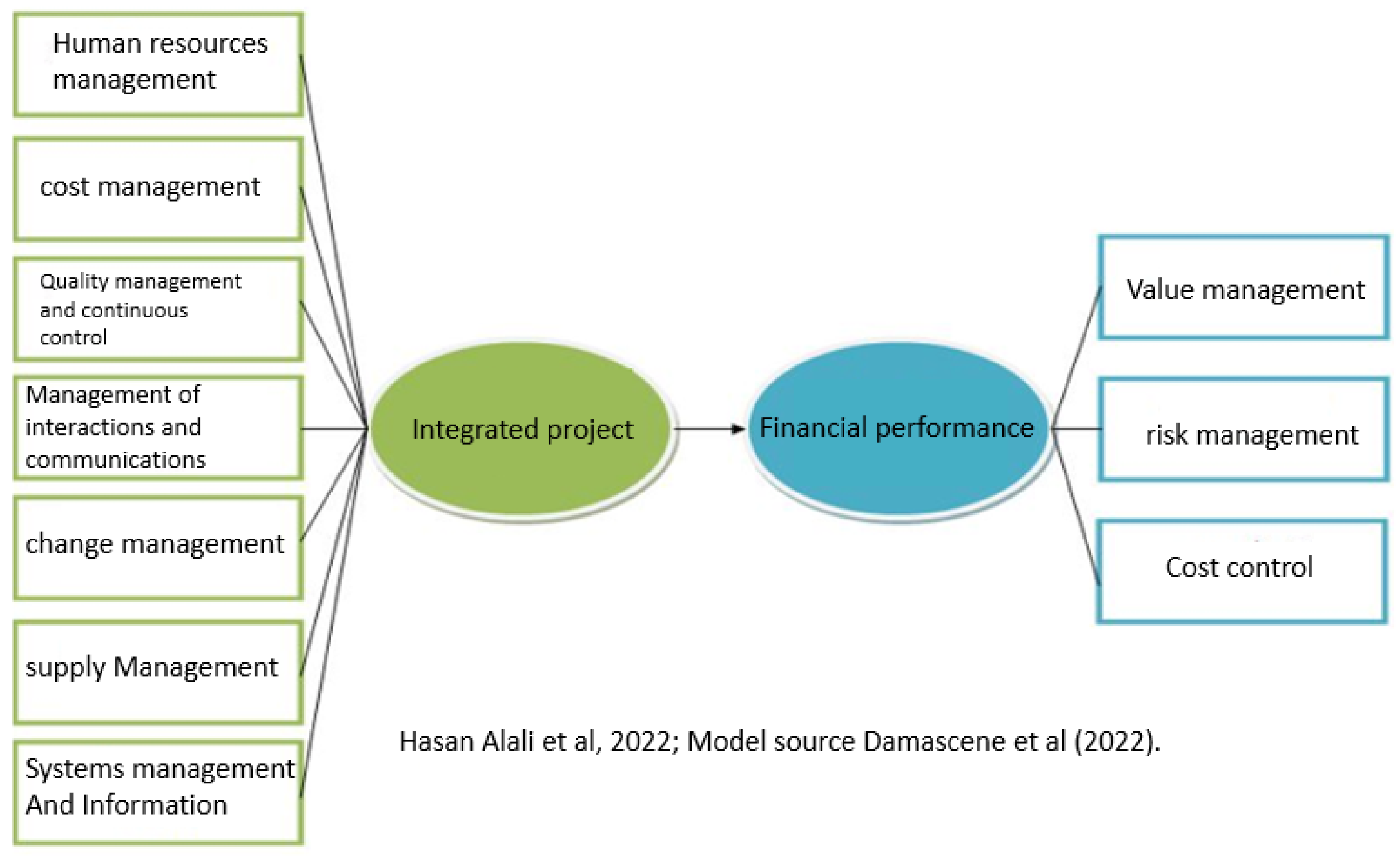

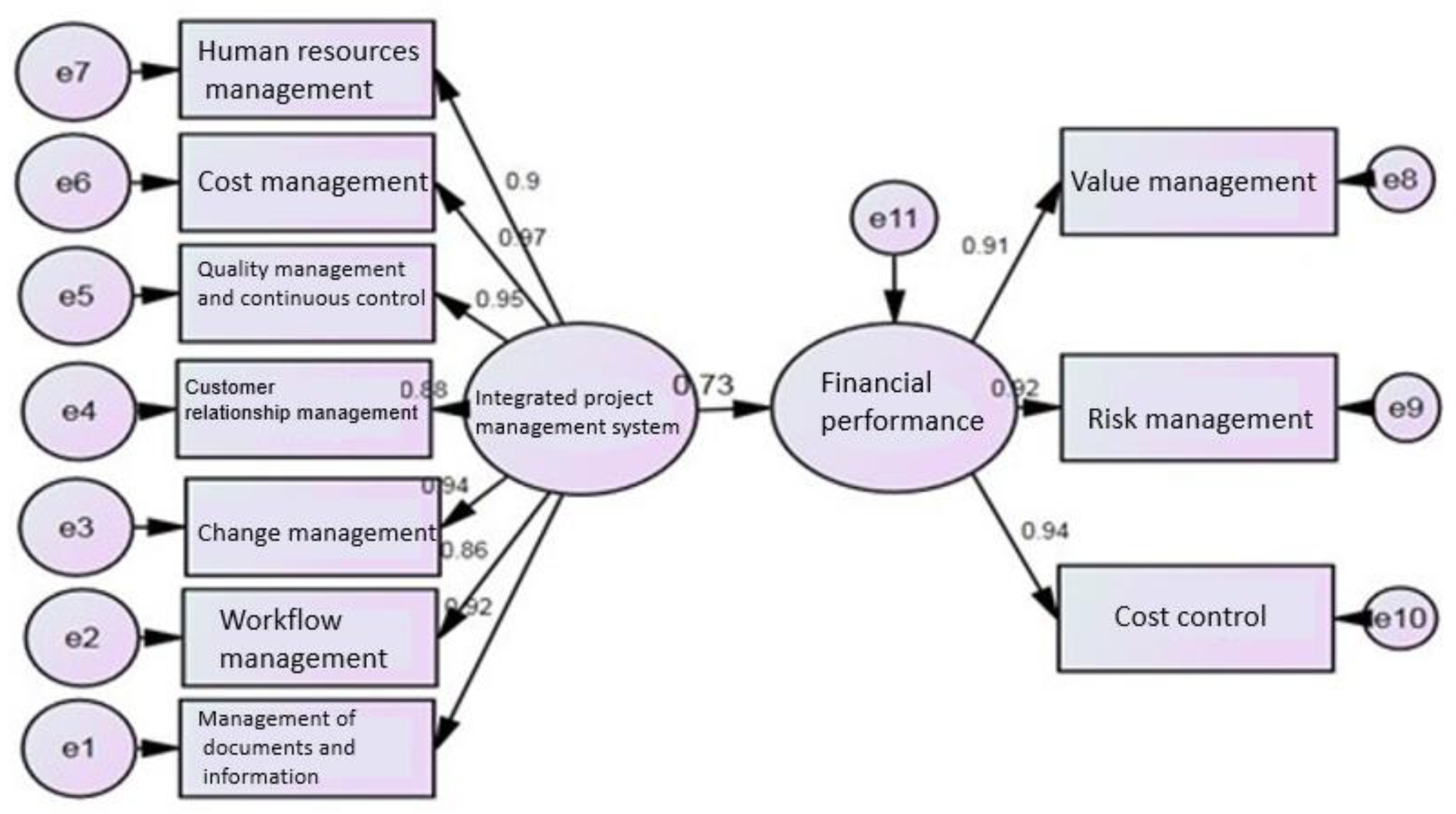

An integrated project management system has a positive and significant impact on the financial performance of the Organization for Renovation, Development, and Equipment of Schools. The conceptual model of the current research can be illustrated as shown in Figure.

Figure 1.

Conceptual Model of the Research.

Figure 1.

Conceptual Model of the Research.

4. Materials and Methods

This applied research was conducted using a descriptive-correlational method. The statistical population included 2,700 employees of the Organization for Renovation, Development, and Equipment of Schools. Using sample size determination methods, a sample of 340 employees was selected through simple random sampling.

To collect data, we utilized a combination of two questionnaires: a standardized financial performance questionnaire for public organizations with 21 questions, and a researcher-developed integrated project management system questionnaire (with the assistance of experts from the Organization for Renovation, Development, and Equipment of Schools) containing 130 questions. The reliability of the questionnaires was determined using Cronbach's alpha, which was 0.86 for financial performance, 0.88 for the integrated project management system, and 0.91 for the overall questionnaire. Construct validity was assessed through interviews and consultations with management experts, as well as construct validity using exploratory factor analysis and Varimax rotation (orthogonal) with principal component methods. The factor loadings for each question were above 0.5, which is acceptable. Content validity was calculated using the Lawshe coefficient (CVR), with all factors scoring above 0.49. To confirm face validity, respondents were asked to highlight any ambiguities in the questions, and no ambiguities were reported, indicating that the data collection tools in this study have face validity. Descriptive statistics and inferential statistical tests, including Pearson correlation and multiple regression, were used to analyze the data.

5. Discassion

The study sample primarily consisted of male employees with an average age of 41-50 years, holding bachelor's degrees and having 11-15 years of experience.

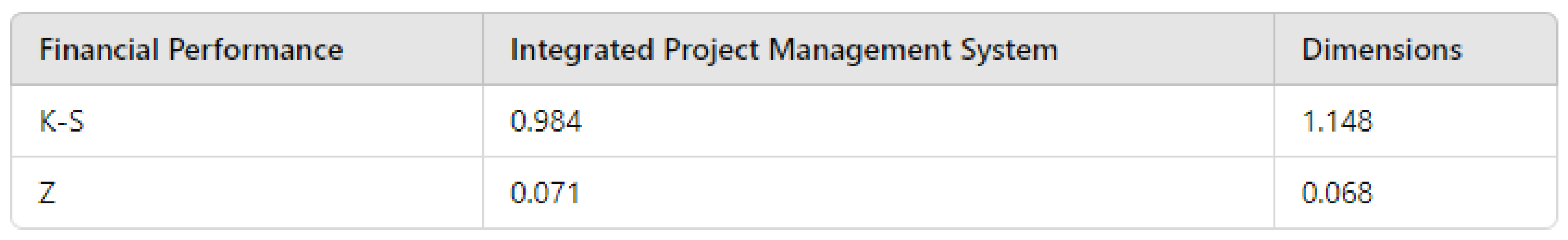

To test for normality of the data, the Kolmogorov-Smirnov (K-S) test was used, and the results are presented in

Table 1.

Table 1.

K-S Test Coefficients.

Table 1.

K-S Test Coefficients.

Since the sig value is greater than 0.05 and the z value is less than 1.96, the data are considered normal. Therefore, the conditions for normality of the variables under study for estimating unknown parameters are reliable.

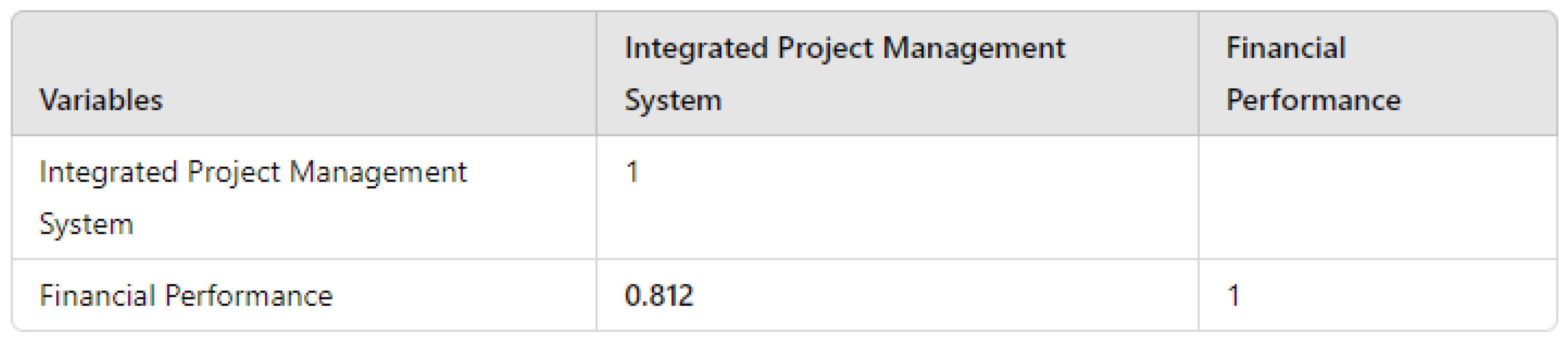

To examine the relationship between the research variables, Pearson correlation was used, and the results are shown in

Table 2.

Table 2.

Covariance Matrix of Research Variables (n = 340).

Table 2.

Covariance Matrix of Research Variables (n = 340).

The criterion for confirming correlation in the covariance matrix, based on the Pearson correlation coefficient at a 95% significance level, is obtaining a sig value less than 0.05 (one star) and at a 99% significance level, obtaining a sig value less than 0.01 (two stars). According to the table above, the correlation between the dimensions of the research is confirmed at the 99% significance level.

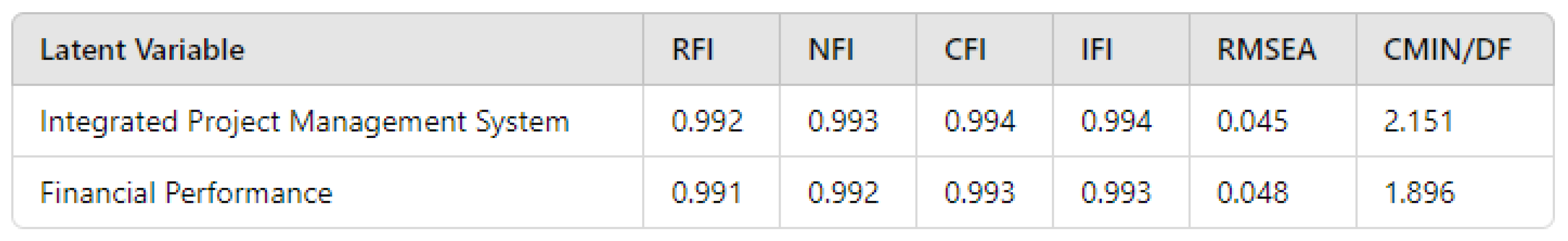

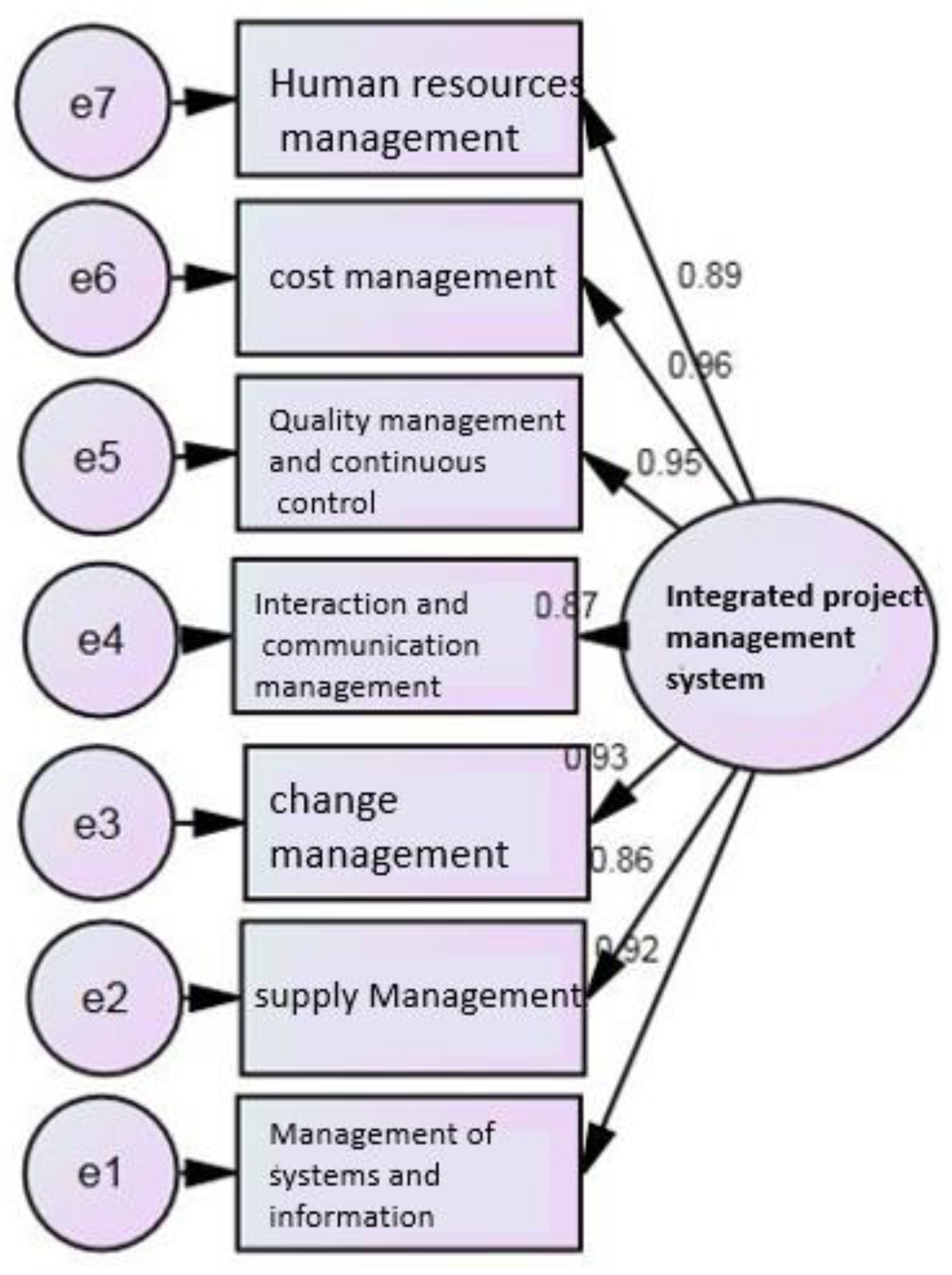

5.1. Estimation and Testing of Measurement Models (Confirmatory Factor Analysis Models)

After collecting the data to determine how well the measurement indicators (observed variables) can assess the latent variables, all observed variables related to the latent variables were individually tested. The overall fit indices for the measurement models (confirmatory factor analysis) were measured using Amos18 software for the latent variables of the integrated project management system and financial performance. The results are shown in

Figure 2 and

Figure 3, and

Table 3.

Table 3.

Fit Indices for Latent Variables.

Table 3.

Fit Indices for Latent Variables.

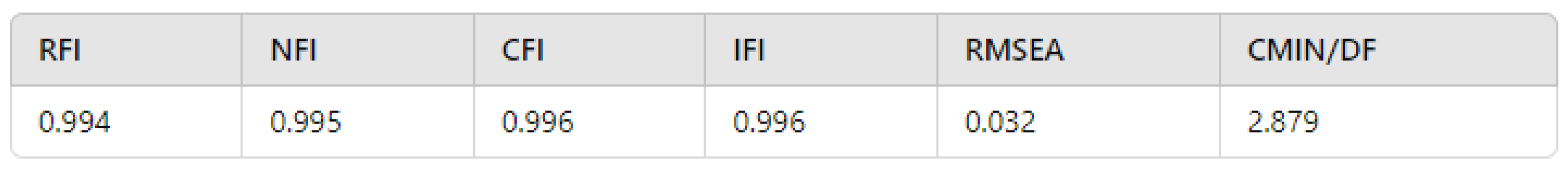

For the above indices, a model is considered to have good fit for path analysis if the RFI, NFI, IFI, and CFI indices are between 0 and 1, with values closer to 1 indicating a better fit. The RMSEA index should be below 0.10 to be acceptable, and the acceptable value for the CMIN/DF index is between 1 and 5.

Therefore, the model for the latent variables demonstrates a good fit. Structural equations and Amos18 software have been used to test the research hypothesis, and the results are presented in

Table 4 and Chart 4:

Table 4.

Statistic Results.

Table 4.

Statistic Results.

Based on the information above, it can be concluded that the model has an excellent fit. Considering the results of the model analysis, the hypothesis was tested, and the results are presented in

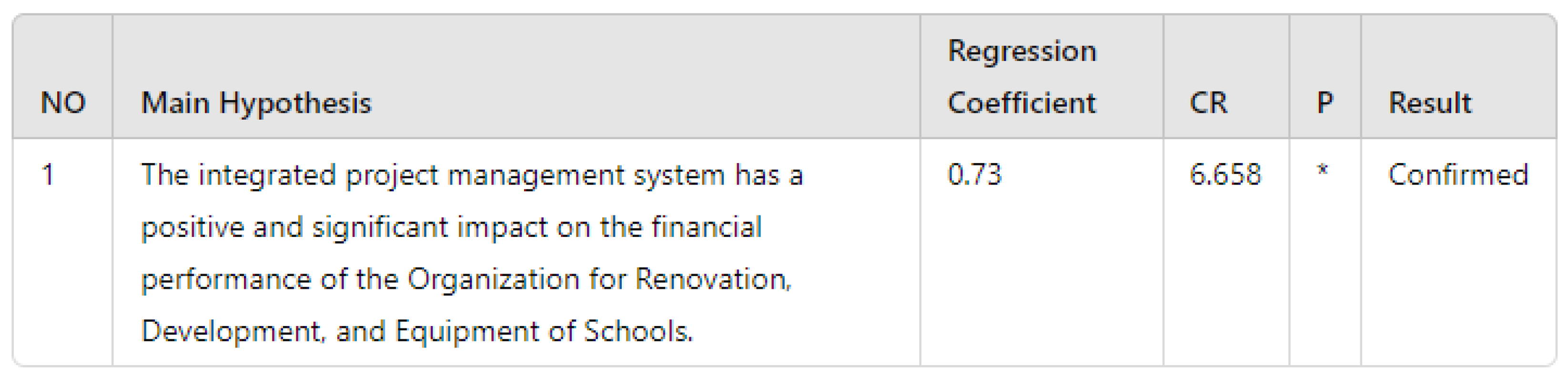

Table 5:

Table 5.

Hypothesis Test.

Table 5.

Hypothesis Test.

To test the significance of the hypothesis, two specific indices were used: the Critical Ratio (CR) and P value. According to a significance level of 0.05, the Critical Ratio should be greater than 1.96. According to the above table, in the research hypothesis, the CR value is more than 1.96, and at the same time, the P value is less than 0.05, so the research hypothesis is confirmed.

6. Conclusion

This study aimed to answer the question: "What impact does the integrated project management system have on the financial performance of the Organization for Renovation, Development, and Equipment of Schools?" For this purpose, we analyzed the collected data using Amos18 software and obtained the following results:

According to

Table 5, our hypothesis was confirmed, meaning the answer to the above question is positive. Now, let's analyze the obtained values. Our main hypothesis was related to the impact of the integrated project management system on financial performance, which was confirmed with a regression coefficient of 0.73. This means that employing the integrated project management system improves financial performance.

Regarding the dimensions of financial performance, the most significant factors, in order, were cost control, risk management, and value management, with factor loadings of 0.93, 0.92, and 0.90, respectively. The first key factor explaining financial performance in the current research was determined to be cost control. Project cost management includes the processes required to ensure that the project is completed within the approved budget, which involves the following components:

- -

Resource Planning: Determining the resources (people, equipment, materials) and the quantity of each needed to complete the project activities.

- -

Cost Estimation: Preparing an estimate of the costs required for the necessary resources to complete the project activities.

- -

Cost Budgeting: Allocating the overall estimated cost to individual work activities.

- -

Cost Control: Managing changes to the project budget.

These processes interact with each other and with processes from other knowledge areas. Each process may involve the efforts of one or more individuals or groups, depending on the project's needs. Typically, each process occurs at least once in every project phase. Project cost management primarily concerns the costs of the resources required to complete the project activities. However, it should also consider the impact of project decisions on the cost of using the project's product. For instance, limiting the number of design reviews might reduce the project cost but increase the client's operational costs. This broader view of project cost management is often referred to as life-cycle costing. Life-cycle costing, along with value engineering techniques, is used to reduce costs and time, improve quality and performance, and optimize decision-making.

In conclusion, since the integrated project management system has a significant positive impact on financial performance, it is recommended that:

- -

The finance department: should consider project resource planning, cost estimation, project cost budgeting, and cost control in contracts and organizational activities to establish baseline programs.

- -

The research and development unit: should study the latest articles and utilize the experiences of other organizations, formally communicate changes to the project manager, informally and directly communicate changes to the team, implement changes in the project approach to control change, manage data structure controls, physical and functional controls, a defined and documented change control process for changes in scope, identify environmental changes, track environmental changes, formally approve environmental changes, and update project plans with corrective actions.

- -

Human resources management: should strive to improve a healthy reward system, effective hiring and selection processes, an efficient recruitment system to attract effective employees, job-person fit, an effective training and development system, a healthy performance evaluation system, a fair payment system, retirement planning, a safe work environment, and healthcare systems.

References

- Azizi, J. (2018). Measuring Effective Factors on Rice Farmers Participation Level for taking part in Farmer Field School Education. Journal of Agricultural Economics Research. 10(39): 117-130. https://jae.marvdasht.iau.ir/article_2883.html?lang=en.

- Azizi, J. and Yazdani, S. (2007). Investigation stability income of export date of Iran. Iranian Journal of Agricultural Science. 13(2):2-19.

- Azizi, J. (2015). Evaluation of the Efficiency of the Agricultural Bank Branches by Using Data Envelopment Analysis and the Determination of a consolidated index: The Case Study Mazandaran Province. Iranian Journal of Agricultural Economics. No.1. Vol.9. Pages: 63-76. https://www.sid.ir/en/Journal/ViewPaper.aspx?ID=600891.

- Azizi, J., Kavoosi-Kalashami, M., and Allahyari, M.S. (2015). Behaviour analysis of basic inputs prices in Iran's livestock subsector. The Journal of Animal & Plant Sciences, 25(3): 860-868. https://www.thejaps.org.pk/docs/v-25-03/34.pdf.

- Azizi, J., Taleghani, M., Esmaeilpoor, F., Goodarsvand, M. (2010). Effect of the Quality Costing System on Implementation and Execution of Optimum Total Quality Management. International Journal of Business and Management. 5(8):19-26. [CrossRef]

- Barbosa, A. Salerno, M. Nascimento, P. (2020). Configurations of project management practices to enhance the performance of open innovation R&D projects, International Journal of Project Management. [CrossRef]

- Christoph, A. J. & Konrad, S. (2021). Project Complexity as an Influence Factor on the Balance of Costs and Benefits in Project Management Maturity Modeling, Procedia - Social and Behavioral Sciences, 119, 162–171.

- Damascene, M. Gamariel, N. Placide, M. (2022). Influence of Project Management Information Systems on the Performance of Projects in Rwanda; A Case of Ruhengeri Referral Hospital Projects, Musanze District. International Journal of Applied Sciences: Current and Future Research Trends (IJASCFRT), Volume 13, No 1, pp 167-172.

- Davari Farid, R., Azizi, J., Allahyari, M. S., Damalas, C. A., & Sadeghpour, H. (2019). Marketing mix for the promotion of biological control among small-scale paddy farmers. International Journal of Pest Management, 65(1), 59–65. [CrossRef]

- Habibi, Y., Azizi, J., and Keshavarz Shal, F. (2018). Role of insurance in broiler farms risk management (a case of Rudbar County). International Journal of Agricultural Management and Development. 8(3): 321-328. https://journals.iau.ir/article_527240_ae18528fa2f0d9440c5a6c88acc0a66c.pdf.

- Hashemi, H., Alborzi, M., & Rajab Zadeh Ghatari, A. (2021). Evaluating the Impact of Business Intelligence Acceptability on Improving Organizational Financial Performance. Iranian Journal of Information Management, 7(1), 179-200. [CrossRef]

- Hassan AlAli, A. Salleh Hudin, N. (2022). Effect of Technological Orientation on Project Management Process and Infrastructure Performance of RTA in UAE, Journal of International Business and Management (JIBM). [CrossRef]

- Keshavarz Shal, F., Azizi, J., and Niknejad, M. (2019). The Role of Rural Production Cooperatives in Sustainable Social and Economic Development of Rural Communities of Guilan Province. CO - OPERATION AND AGRICULTURE (TAAVON), 8(30 ), 97-124. SID. https://sid.ir/paper/377797/en.

- Khandan M, Ebrahimi A, Hamta A, Koohpaei A. The Association of Leadership Style and Coronavirus Anxiety with Safety Behavior among Workers of the Sanitary Products Industry in Qom Province, Iran: A Structural Equation Modeling Analysis. J Occup Health Epidemiol 2022; 11 (4) :291-301. http://johe.rums.ac.ir/article-1-589-en.html.

- Falahati, S., & Azizi, J. (2019). Role of Rural Markets in Rural People’s Economic Prosperity in Guilan Province of Iran. Village and Development, 22(2), 125-139. [CrossRef]

- Nassar, N.; AbouRizk, S. (2018). Practical Application for Integrated Performance Measurement of Construction Projects. J. Manag. Eng, 30, 04014027.

- 18. Sarkhani Ganji, H. R., Najafi-Moghadam, A., & Sarraf, F. (2022). The impact of management accounting systems on development of intellectual capital dimensions by emphasis on business intelligence in Iran capital market. International Journal of Finance & Managerial Accounting, 7(26), 133-143. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).