1. Introduction

Global climate change has become one of the most pressing global challenges in the 21st century, its impact is not only obvious in the natural environment, but also has a profound impact on the global economic system. The unsustainability of greenhouse gas emissions, energy consumption and resource use has driven dramatic changes in the climate system, and has put enormous pressure on all aspects of human society [

1,

2]. In this context,promoting the clean transformation of the supply chain to achieve sustainable, low-carbon and efficient economic models has become an unprecedented opportunity and challenge for the global supply chain. Therefore, most countries and regions in the world have introduced relevant policies to control the carbon emissions of industries that have a greater impact on the environment [

3,

4], such as the power industry [

5,

6,

7].

Compared with another widely used carbon tax policy, the policy of carbon quota and the establishment of carbon trading market, carbon trading directly points to carbon emissions, and the effect of emission reduction is more clear. The introduction and adjustment of the policy almost does not involve complicated administrative processes such as legislation, and the procedure is relatively simple, the adjustment is faster, and the policy is more flexible. In addition, the establishment of carbon trading market makes carbon quota as a market exchangeable product, so that it has the natural attributes of finance, can attract more participation of banks, funds and enterprises, and improve the efficiency of resource allocation. More importantly, as a global market, carbon trading market can better prevent enterprises from moving to countries with loose environmental policies due to carbon tax, resulting in industrial outflow from countries with carbon tax policies [

8].

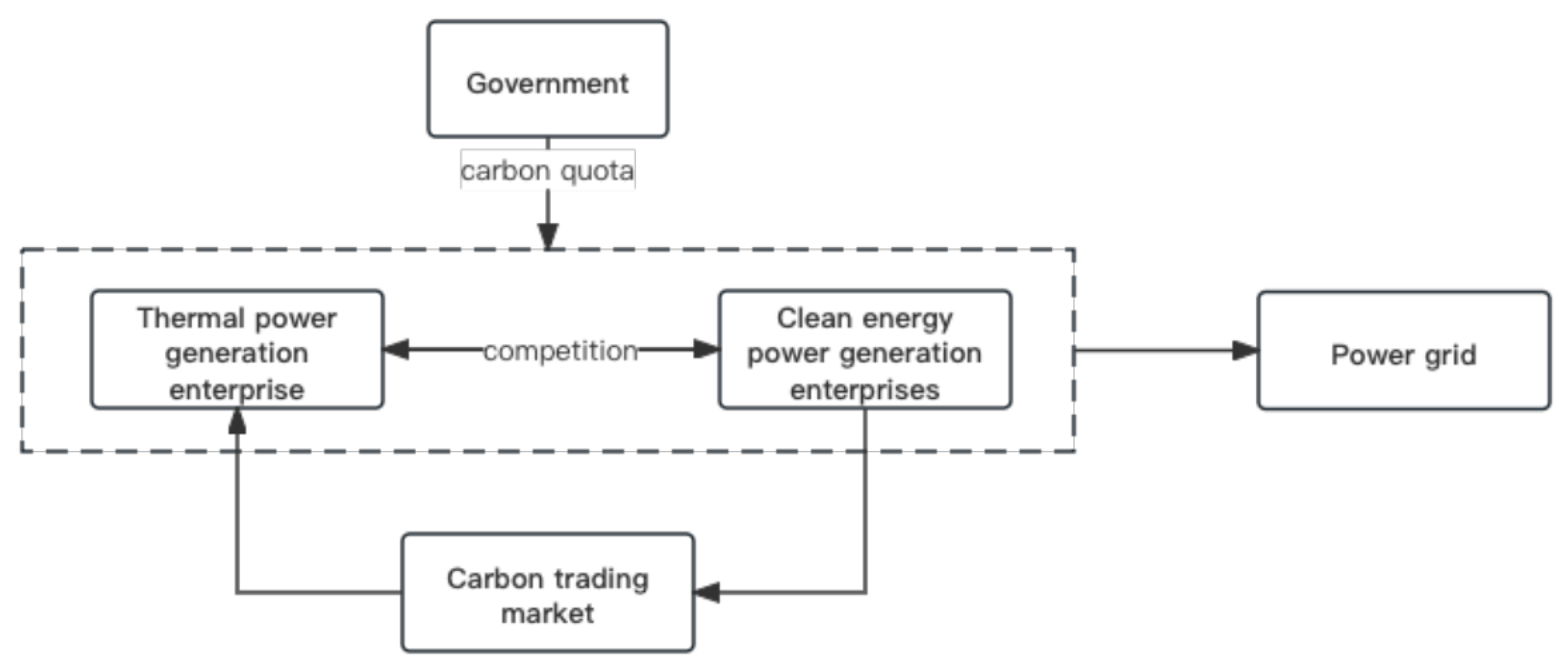

As the power industry is a pillar industry of people’s livelihood, it may be subject to strong government regulation [

9]. In this study, a three-level coordination game model [

10,

11] will be proposed, including a two-level supply chain and government decision-making body composed of thermal power generation enterprises and clean energy power generation enterprises as suppliers and transmission and distribution grids as retailers. In the process of slowing down the demand growth of the electricity market, gradually increasing the competition within the electricity supply chain, gradually promoting the carbon quota policy and establishing and improving the carbon trading market, the optimal carbon quota level of the government and the clean transformation degree of the power supply chain made by the power generation enterprises in the power supply chain are determined. In the competition within the supply chain, due to the rapid development of clean energy power generation and policy support, it will be a leader in determining the level of its technology investment and influencing the decision-making of the government.

The rest of this article is organized as follows. In

Section 2, we reviewed the previous research literature, and based on this, we established a detailed Stackelberg game model in

Section 3 to analyze the impact of the establishment of carbon quota and carbon trading market on the clean transformation of the power supply chain. In section 4, the optimal solution of the power supply chain game is analyzed, and the specific impact of the implementation of carbon quota policy and the change of carbon price in the carbon trading market on the profit of the power supply chain, the level of technological innovation and the progress of the clean transformation of the power supply chain is compared.

Section 5 verifies the validity of the conclusions obtained in

Section 4 through numerical simulation analysis, and summarizes the research findings and conclusions of this paper in section 6, hoping to give some suggestions to power generation enterprises, government agencies and other relevant departments in corporate decision-making and policy formulation. All proofs are given in the appendix.

2. Literature Review

2.1. Carbon Quota Policy

As early as the last century, the marketlization of carbon emission rights has entered the academic field of vision [

12].Nowadays,countries have introduced relevant policies to limit carbon emissions,this prompted relevant enterprises to start to formulate new development strategies according to policy changes, and promoted the progress of relevant research [

13,

14]. At present, carbon quota [

15,

16,

17,

18] and carbon tax [

19,

20,

21] policy are the most widely used carbon emission reduction policy means that do not increase government financial expenditure.The effects of the two are different in different aspects, but both have limitations that may not achieve the expected emission reduction effect and will have an impact on enterprises’ willingness to invest in low-carbon production technologies [

22,

23].

The impact of policies such as carbon quotas on the production of enterprises has also received widespread attention [

24,

25,

26].Previous studies have shown that the implementation of carbon trading will increase the price of electricity and promote the proportion of renewable energy generation, helping the power sector to reduce emissions [

27].At the same time, the implementation of carbon policies will promote the low-carbon transformation of the industry and improve the level of industrial sustainability [

28,

29],and this is often accompanied by an increase in the level of relevant technology [

30].

2.2. Supply Chain Modeling and Analysis

In the study of supply chain sustainability, some scholars are committed to establishing an optimization model for integrating renewable energy into the power supply chain to better analyze and plan the supply chain [

31].Environmental indicators such as carbon emissions are an important reference for exploring supply chain sustainability [

32]. The use of game theory for model building has always been an important research direction in this field, therefore, Vasnani et al. (2018) [

33]discussed the current trends and applications of game theory in supply chain management, emphasized the relevance of game theory in the decision-making process, and emphasized the integration of game theory with different supply chain structures, decisions, and status quo.Because carbon quota policy needs carbon trading market as the basis to function, the change of carbon price will affect the effectiveness of carbon quota policy.Through the analysis of relevant models, different enterprises have different sensitivity and intensity of response to relevant policies [

34,

35].

Since the main source of power generation is fossil energy and clean energy, the duopoly model is more suitable as a tool to analyze the change of power supply chain [

36,

37]. Although carbon tax is not the main content of this study, the supply chain model based on carbon tax policy in relevant literature is also worth referring to.The incentive effect of carbon dioxide emission tax policy on sustainable pricing and production policy is studied in some articles [

38].Zheng et al.studied the impact of the emission allocation scheme in the early stage of a cap-and-trade system in a duopoly market, and analyses the corporate and social effects of the different schemes [

39].In addition, by establishing the system dynamics model of clean energy market, the influence of carbon quota price on the emission reduction effect and cost-effectiveness of clean energy market can also be studied [

40].

3. Model Establishment and Analysis

3.1. Initial State of the Power Generation Enterprise

Under the duopoly market environment, we established a two-level supply chain [

41] consisting of thermal power generation enterprises and clean energy power generation enterprises as suppliers ,power grids as retailers, and considers the regulatory role of the government in the implementation of carbon quota policy [

42,

43].Among them, the unit power generation of thermal power generation enterprise(

t) is

a, the unit power generation of clean energy power generation enterprise(

n) is

b, respectively.Considering that the pricing rule of China’s electricity market is the conventional on-grid price, both of them supply the generated electricity to the power grid at the price

P (this paper assumes that all the electricity generated by the power generation enterprise can be sold to the power grid).At the same time, in order to improve power generation efficiency and assume social responsibilities including reducing greenhouse gas emissions, power generation enterprises will carry out technological innovation investment at the level of

, and the cost coefficient of technological innovation investment is

.Under a certain level of investment, power generation enterprises will increase production commensurate with the level of investment.Based on the reality that China’s economy has turned to high-quality development and power demand has shifted from high-speed increase to stable and rising, the market will not be able to fully absorb the increase in power generation, that is, there is a market competition level

within the power supply chain.Therefore, when a company expanding its market scale, it will partially reduce the market share of its competitors, which is regarded in this paper as a reduction in the output of its competitors, that is, competition will cause a decrease in the output of the two power generation enterprises.

Figure 1 shows the relationship between decision makers.

3.2. Carbon Emission Cost

In the carbon trading market, carbon price k is the floating price in the market, and there is no fixed price.When the carbon quota obtained by the thermal power generation enterprise is , the carbon quota required for its production is ).Under the current policy, clean energy power generation enterprises assume that the carbon emission of power generation is 0 in reality, but the government still issues corresponding carbon quotas for their operation. When the carbon quota level is obtained, that can be traded can be sold in the carbon trading market and converted into corporate profits.

In this model, carbon quota will be allocated to the two types of power generation enterprises at the total level of a+b. According to the status of carbon trading market, carbon quota in thermal power generation enterprises will reduce carbon purchases, and carbon quota in clean energy power generation enterprises will increase their carbon credits that can be traded in the carbon trading market.Accordingly, the carbon trading income and costs borne by enterprises of the two power generation modes are as follows:

3.3. Decision-Making of Power Generation Enterprises

The profit functions for the power generation enterprises are:

3.4. Government Decisions - Total Environmental Costs

The problem facing the government is to set the optimal implementation level of the carbon quota policy to achieve the minimum carbon emission cost (maximum carbon emission benefit) of the power supply chain, so as to reduce the negative impact of the power supply chain on climate issues and promote the clean transformation of the power supply chain.In this paper, the total cost of carbon emissions in the electricity supply chain is .

3.5. Market share

In order to better represent the degree of clean transformation of the power supply chain during the implementation of the carbon quota policy, we will establish a simple market share function to represent the market share of clean energy power generation enterprises in the power supply chain, and evaluate the effectiveness of the carbon quota policy on this basis. Market share function of clean energy power generation enterprises:

4. Optimal Decisions

Since this paper mainly examines the impact of internal supply chain competition and carbon quota policy on the power supply chain, in order to simplify the calculation without losing universality, the assumption is, , a=1-b, =

4.1. Optimal Decision of Power Generation Enterprise

Due to the support for the development of clean energy caused by climate change and other reasons, as well as the maturity of clean energy power generation technology, clean energy power generation is being popularized at a very high speed. Therefore, in the Stackelberg game model of this paper, clean energy power generation enterprises are assumed to be game leaders. The technological innovation investment level is determined according to the technological innovation investment decision made by thermal power generation enterprises.

Theorem 1.

When the government implements the carbon quota policy, the profit, output and technological innovation level of power generation enterprises are:

Proposition 1. By analyzing Theorem 1, we can get three important inferences:

- 1.

- 2.

When the level of competition β increases, will decline.The increased level of β will help increase when . Conversely, will decline.

- 3.

When will decrease with the increase of β. Conversely, will increase.

Proposition 1 reveals that when the government intervenes in the power supply chain through carbon quota policy, the power generation enterprises will not take the current market competition environment as the basis for their decision-making to determine their technological innovation input, but mainly make strategic decisions based on government policies. Moreover, clean energy power generation enterprises will always invest in technological innovation, and with the allocation of carbon quotas to them, their technological innovation investment level will also increase, showing the advantages of carbon quota policy in promoting technological innovation in the field of clean energy power generation.

However, the implementation of carbon quota policy will reduce the enthusiasm of technological innovation investment of thermal power generation enterprises in a specific environment, and even cause technological retrogression of thermal power generation enterprises, which will not be conducive to the technological update of the power supply chain.

At the same time, in the process of implementing carbon quota policy, the change of competition level within the supply chain will also affect the output and profit indicators of the power supply chain. (2) It is found that after the implementation of carbon quota policy, competition will lead to a continuous decline in power generation of thermal power generation enterprises, which means that thermal power generation enterprises will lose competitiveness in the competition within the supply chain after the implementation of carbon quota policy. For clean energy power generation enterprises, competition will also damage their competitiveness under certain circumstances. (3) We find that although the power generation of thermal power generation enterprises under the carbon quota policy will decrease with the intensification of competition, their profits will not necessarily be affected. When the carbon quota reaches a certain level, its profits and clean energy power generation enterprises will rise at the same time, but the power generation of clean energy power generation enterprises will also rise at the same time.

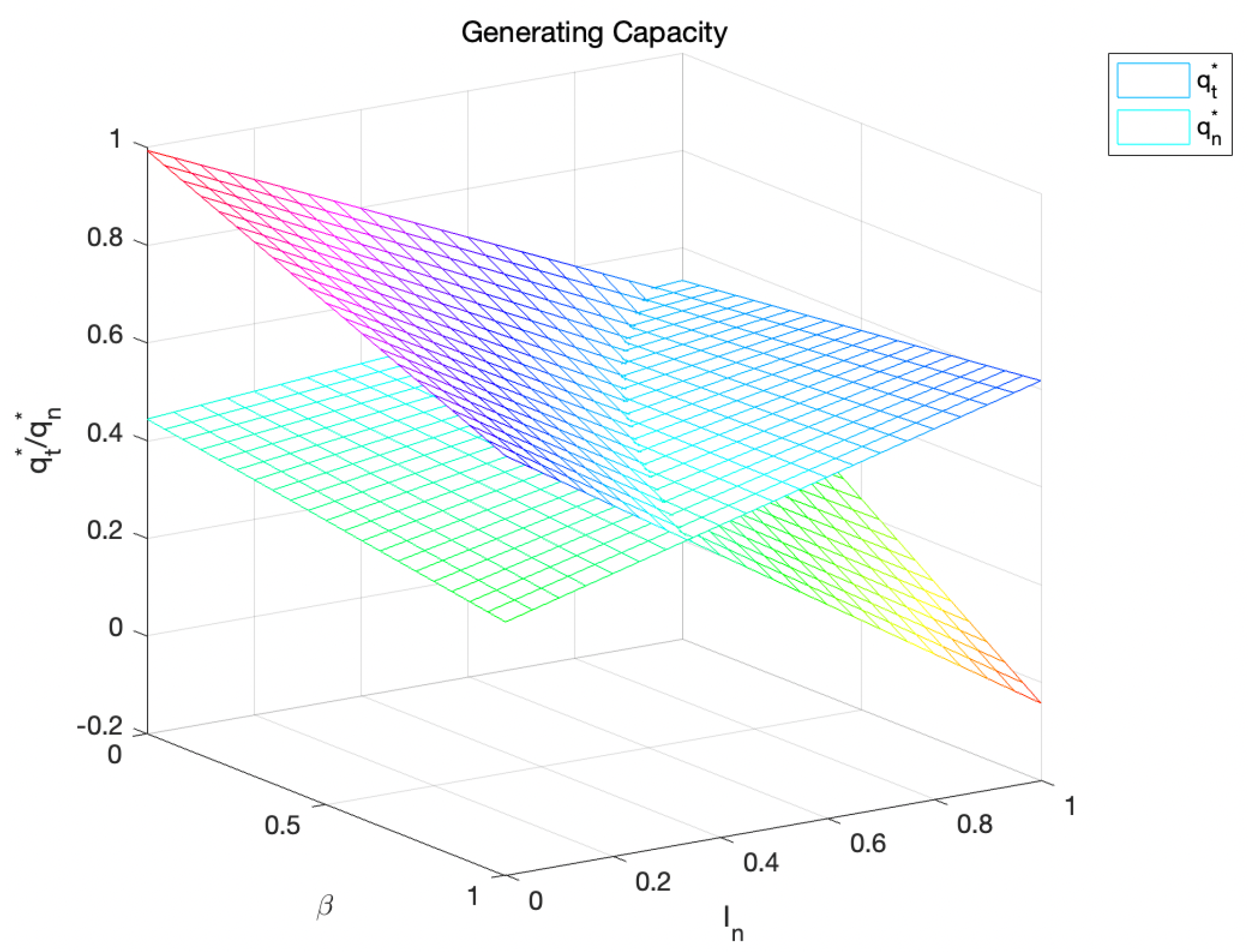

Figure 2.

Generating Capacity.

Figure 2.

Generating Capacity.

4.2. Environmental Cost

The function of electric power environmental cost in supply chain game is:

Theorem 2. The environmental cost will have a maximum value under the parameter conditions assumed in this paper.When the maximum value is achieved,,. The overall environmental cost of the power supply chain does not only depend on the allocation of carbon allowances, but is affected by the level of internal competition.

Theorem2 suggests that the implementation of carbon quota policy and the level of competition within the power supply chain have dual effects on the environmental cost of the power supply chain, but they do not necessarily contribute to the control of the environmental cost of the power supply chain.

On the other hand, we find that the environmental cost of the power supply chain is not necessarily positive, that is, when the carbon quota policy is implemented in the power supply chain, the environmental cost brought by the carbon emission of the thermal power generation enterprise is less than the environmental benefit brought by the carbon emission saving of the clean energy power generation enterprise. This provides some basis for the realization of the international environmental protection vision of "reaching the peak of carbon and carbon neutrality".

At the same time, Theorem2 suggests that when the government is playing games with enterprises in the power supply chain to reduce the environmental cost of the industry and promote the transformation of the power supply chain, it should focus on the internal competition of the power supply chain when formulating carbon quota policies.

4.3. Market Share of Clean Energy Power Generation Enterprises

Theorem 3.

After the implementation of carbon quota policy, the optimal market share of clean energy power generation enterprises in the power supply chain is:

Proposition 2. When ,the level of competition will decrease MS in (, ), promote in when , the level of competition will increase by MS in , decrease MS in .When will constantly improve the power supply chain market share. In the above conclusions, .

Proposition2 shows that the change of competition level will affect the implementation effect of carbon quota policy,and the initial market state of the power supply chain before the implementation of carbon quotas (the initial market share of renewable energy power generation enterprises) also affects the effect of policy implementation. When the market share of renewable energy power generation enterprises is larger than that of thermal power generation enterprises, the same level of policy and competition may cause completely opposite effects. It shows that the change of competition level will affect the implementation effect of carbon quota policy.

Meanwhile, the initial market state of the power supply chain before the implementation of carbon quotas (the initial market share of renewable energy power generation enterprises) also affects the effect of policy implementation. When the market share of renewable energy power generation enterprises is larger than that of thermal power generation enterprises, the same level of policy and competition may cause completely opposite effects.

5. Numerical Analysis

In the numerical comparison simulation process of decentralized decision making and centralized decision making, the parameter values used in the simulation process of decentralized decision making model will still be used.According to the current market share statistics of thermal power generation and clean energy power generation in China, assume that a=0.7, b=0.3, In order to ensure that point can exist in the process of numerical simulation ( is assumed in this paper), assume P=0.6, .

5.1. Changes in Power Generation of Power Generation Enterprises

Figure 2 clearly shows the process of the change of competition level on the output of clean energy power generation enterprises from negative to positive under the influence of carbon quota policy. It can be found that the implementation of carbon quota policy has sustained restrictions on thermal power generation enterprises under the competition level.And the higher the competition level, the greater the reduction rate of power generation under the carbon quota policy.At the same time, when ,the increase in the level of competition has had a positive effect for clean energy power generation enterprises to increase their power generation.On the contrary, when ,the increase in the level of competition has reduced the power generation of clean energy power generation enterprises.

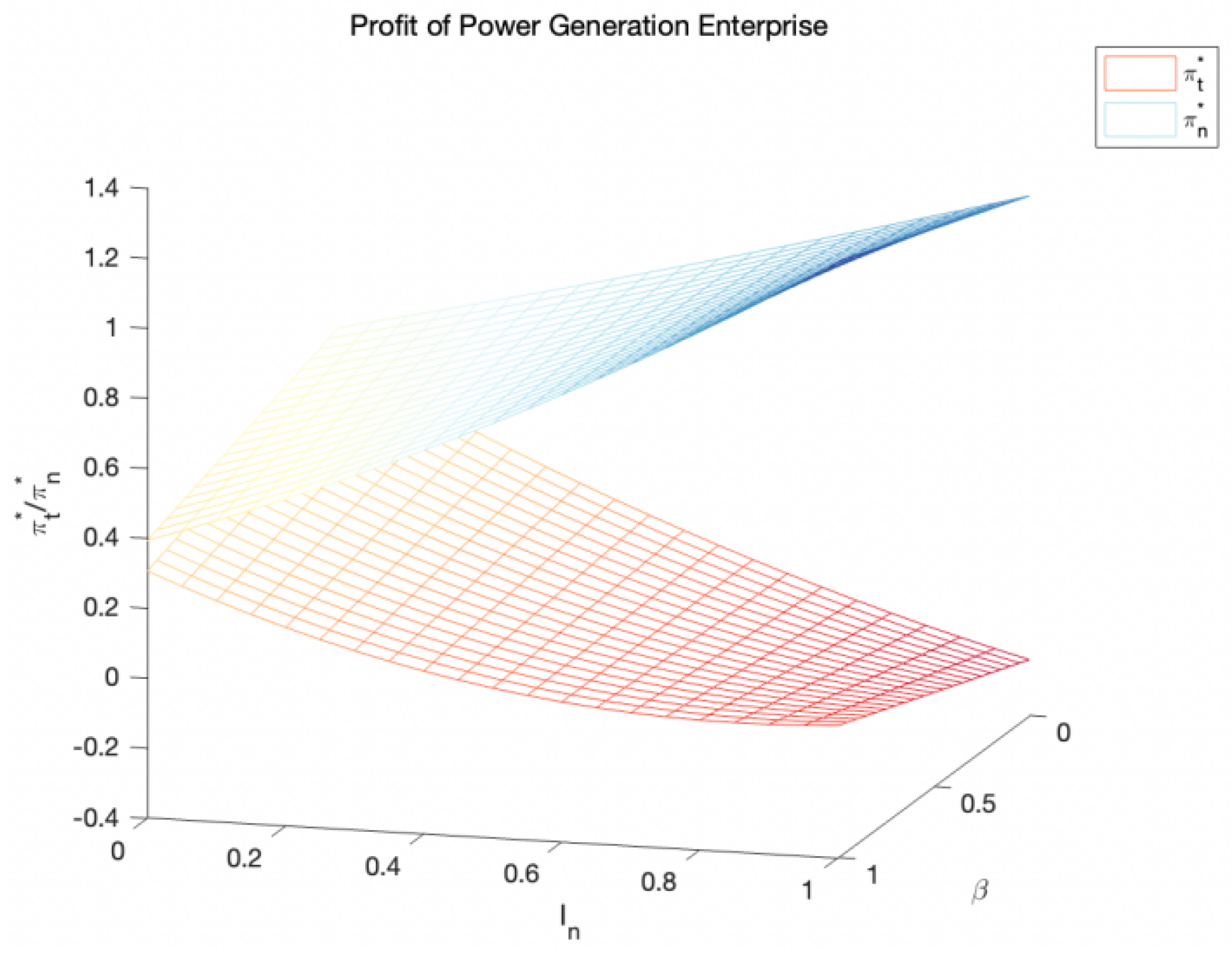

5.2. Changes in the Profits of Power Generation Enterprises

Figure 3 reveals that the change of competition level will always increase the profits of clean energy power generation enterprises under the influence of carbon quota policy, but when the competition level is high, carbon quota policy will have a greater impact on the profits of clean energy power generation enterprises.When ,the improvement of the competition level has contributed a positive impact on the improvement of the optimal profit level of various power generation enterprises, but when , the improvement of the competition level will not be conducive to the higher profits of power generation enterprises.

Figure 3.

Profit of Power Generation Enterprise.

Figure 3.

Profit of Power Generation Enterprise.

Furthermore, we find that when the carbon price level is higher than the electricity price, when the government implements the carbon quota policy, the profits of thermal power generation enterprises will be very low, and will continue to decrease when the carbon quota is allocated to clean energy power generation enterprises, but when the carbon quota of clean energy power generation enterprises is increased, their profit decline rate will slow down, and the profit growth of clean energy power generation enterprises will also slow down.At the same time, we find that when the carbon price level is higher than the electricity price, when the government implements the carbon quota policy, the profits of thermal power generation enterprises will be very low, and will continue to decrease when the carbon quota is allocated to clean energy power generation enterprises, but when the carbon quota of clean energy power generation enterprises is increased, their profit decline rate will slow down, and the profit growth of clean energy power generation enterprises will also slow down.

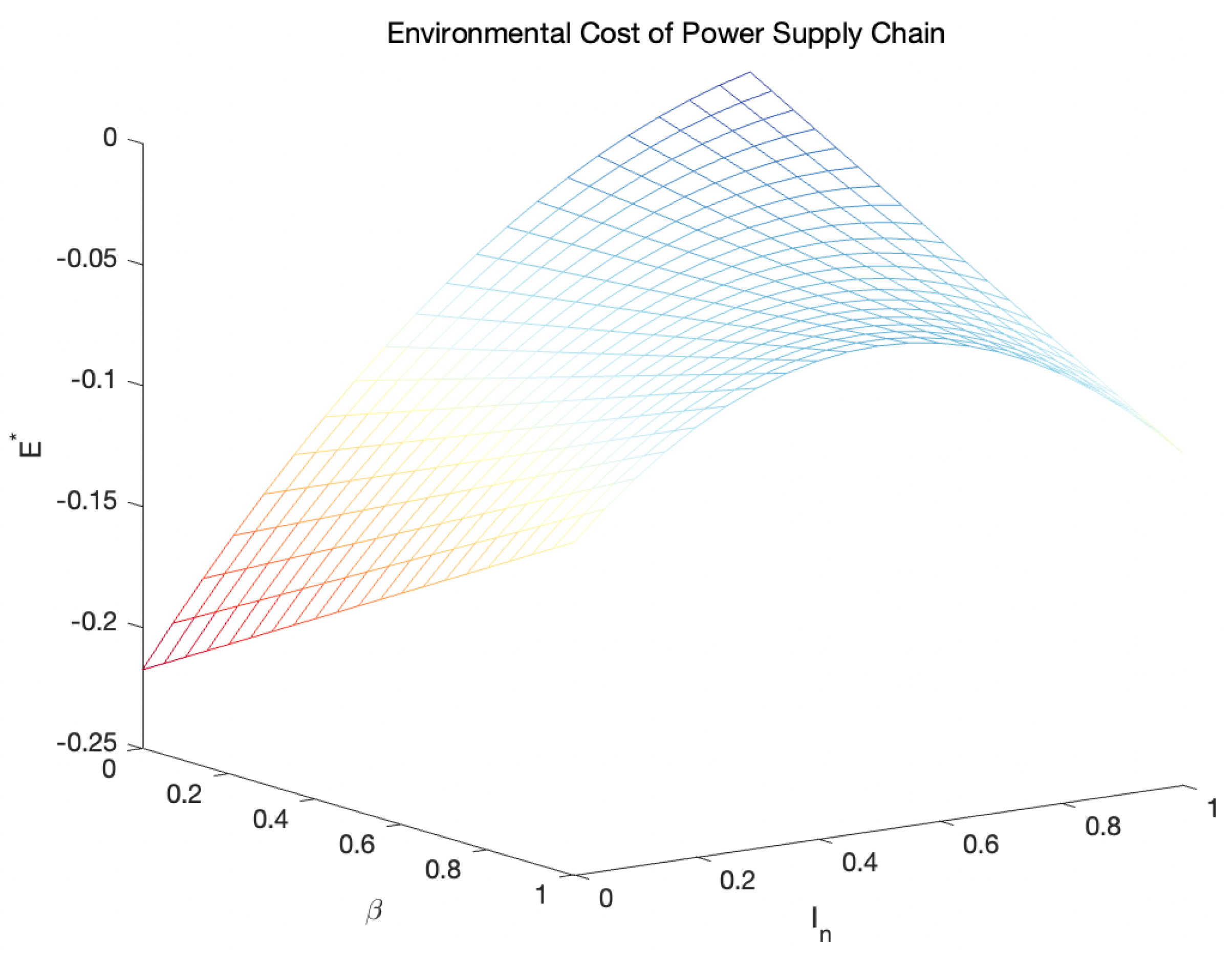

5.3. Environmental Cost

Figure 4 indicates that when the government makes decisions related to carbon quota policy, the level of competition within the power supply chain will affect the effect of policy implementation. We find that when the level of competition within the supply chain is low, the implementation of carbon quota policy may only slow down the added value of environmental cost caused by the increase of output of thermal power generation enterprises, and can only slow down its growth trend. When the level of competition increases, the effect of carbon quota policies will be more obvious, and there will be opportunities to contain and reverse the increase in environmental costs within their feasible areas.

Figure 4.

Environmental Cost of Power Supply Chain.

Figure 4.

Environmental Cost of Power Supply Chain.

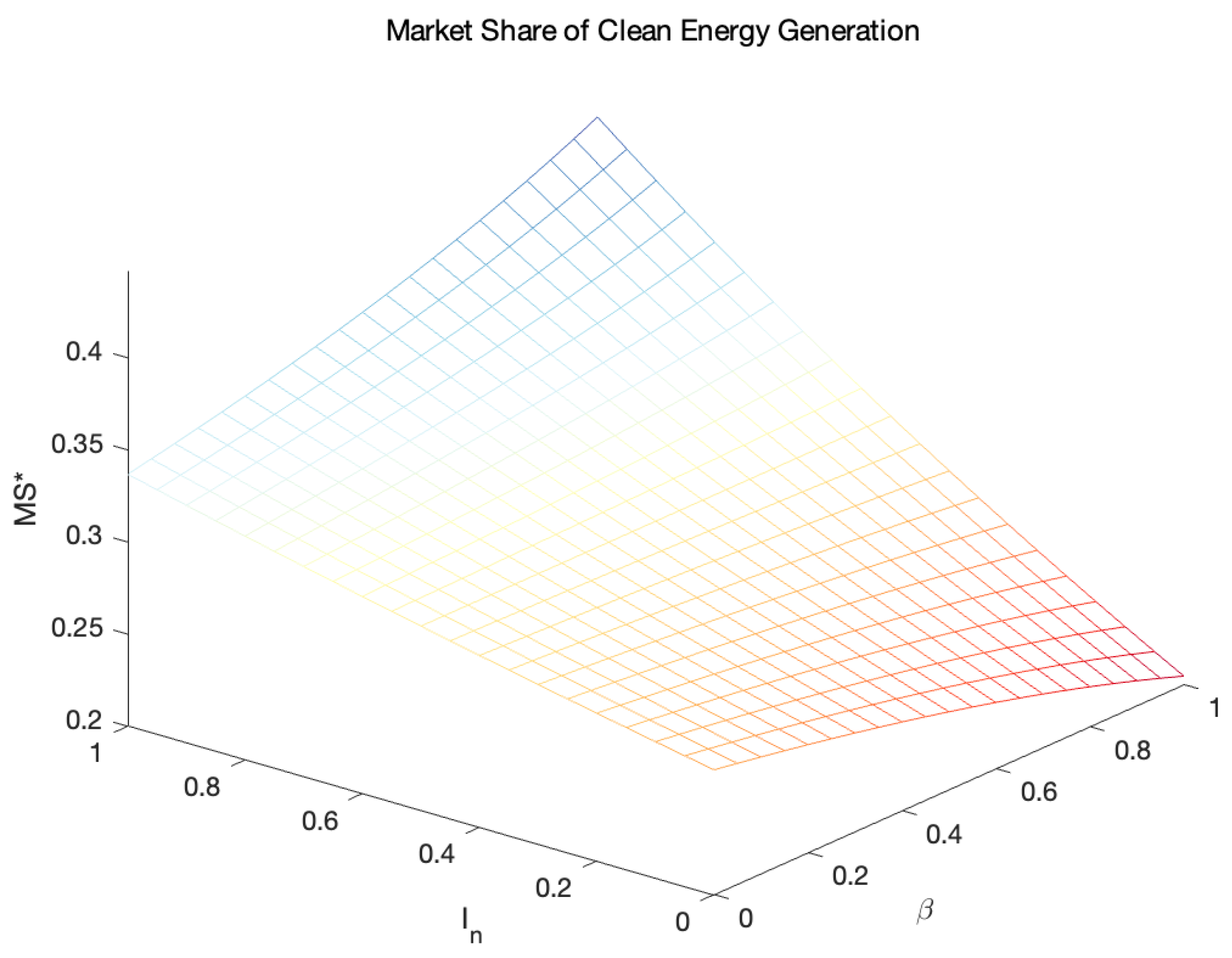

5.4. Market Share

Figure 5 simulates the situation in which the market share of the initial thermal power generation enterprise is higher than that of the clean energy power generation enterprise in the hypothesis in this paper, and it can be found that the improvement of competition level promotes the clean transformation of the power supply chain.

Figure 5.

Market Share of Clean Energy Generation.

Figure 5.

Market Share of Clean Energy Generation.

When the carbon quota of clean energy power generation enterprises is low, its market share growth rate is also low in the competitive environment, which is consistent with the analysis results in Proposition2 (In the hypothesis made in this section, when the carbon quota is approaching 0, the transformation caused by competition is also less obvious).

6. Conclusion

As more and more national and regional governments pay attention to climate change, various governments have introduced different carbon quota policies and promoted the establishment of carbon trading markets to promote the clean transformation of power supply chain and limit carbon emissions of thermal power generation enterprises. In this study, we combined the change of competition level within the power supply chain under the change of economic environment to study the impact of carbon quota policy on the technological innovation level, output and profit of two types of power generation enterprises in the power supply chain. The environmental cost of the electricity supply chain is also studied by capturing the interaction between the government and the electricity supply chain enterprises (the government as the leader of the Stackelberg model). Specifically, we integrate carbon quota policy and changes in competition level within the supply chain into a duopoly model consisting of thermal power generation enterprises and clean energy power generation enterprises, and study the government’s carbon quota policy decision and the firm’s response to the relevant policy under certain conditions of changes in relevant parameters.

The results show that under certain circumstances, the effect of carbon quota policy will be affected by the level of competition within the power supply chain and the correlation between the purchase price and carbon price from the current transmission and distribution grid. When the carbon quota is higher than a certain critical value, thermal power generation enterprises will stop innovation, and even produce technical level retrogression, while clean energy power generation enterprises will always invest in technological innovation after the implementation of carbon quota policy. At the same time, when the carbon quota is below a certain level, the competition will make the two kinds of power generation enterprises make decisions to reduce their power generation, which challenges the power generation enterprises to maintain the stability of energy supply, and at this level, the profits of power generation enterprises will also decrease, which has a negative impact on the operation of enterprises. When the carbon quota is higher than this level, the clean energy power generation enterprises will increase their output to take up the reduced output of the thermal power generation enterprises, and the profits of both types of power generation enterprises will be increased, which will be more conducive to the stability of the power supply chain.

In the study of the environmental cost of the electricity supply chain and the market share of clean energy power generation enterprises concerned by the government, we found that the effect of the carbon quota policy made by the government is affected by the level of competition within the supply chain, and there are local maximum and minimum values, but nonlinear or single extreme values. This implies the uncertainty and duality of the effect of carbon quota policy, which is not necessarily conducive to controlling the environmental cost of the supply chain, and puts forward higher requirements for the scientific nature of government policy formulation. In the study on the market share of clean energy power generation enterprises affected by carbon quota policy, we also found that changes in competition level will have uncertain effects on the clean transformation of supply chain guided by carbon quota policy. When the market share of clean energy power generation enterprises is at a specific level, the change of competition level will not be conducive to the clean transformation of the supply chain, and in the opposite premise, competition will be beneficial to the clean transformation of the supply chain.

In the future, the main research directions will be as follows. First of all, this paper studies the static carbon quota policy. Since the government’s decision is adjusted according to the current situation of the power supply chain, the dynamic game model can be considered to study the direction of the government’s policy in the dynamic change of the power supply chain in the future. Second, because the market-oriented reform of the electric power industry has not been completed, the premise of government pricing is still used in this study, and the change of electricity price is not considered. Future studies should pay attention to the current situation of the electric power industry and make dynamic adjustments to electricity price and carbon price. Third, this study did not consider the relevant requirements for the stability of the power supply chain. As an important energy source for national production and life, the stability of electricity is very important for economic and social stability, so it is possible to add constraints to ensure the stability of power supply. Finally, we study the influence of supply chain game and carbon quota policy through analytical modeling. In the future, empirical analysis can be carried out to determine the reliability of the conclusion and improve and optimize the model in this paper.

Author Contributions

Conceptualization, B.G. and G.S.;methodology, B.G. and G.S.; software, G.S.;writing—original draft preparation, G.S.; writing—review and editing, B.G.; visualization, G.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Acknowledgments

The author would like to thank the anonymous commenters for their suggestions and constructive comments.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Appendix A.1. Proof of Theorem 1

Since the two power generation enterprises are competitive, we will use the solution step of decentralized decision making to solve the problem.

In decentralized decision-making, the profits of the two power generation enterprises are determined by the level of investment in technological innovation. Since renewable energy power generation enterprises are the leaders, the first order partial derivation of the profits of thermal power generation enterprises and technological innovation level is:.Its second partial derivative is:.It can be determined that there is an optimal level of technical investment in thermal power generation enterprises ,when ,.

Bringing

in the output function of renewable energy power generation enterprises, we can see that after the thermal power generation enterprises make investment decisions, the output of renewable energy power generation enterprises is:

Plug in the profit function:

Find the first and second partial derivatives of

with respect to

respectively:

;

.It can be determined that there is an optimal level of technical investment in renewable energy power generation enterprises

.By plugging x and y into the output function and the profit function, we can obtain:

Appendix A.2. Proof of Theorem 2

First, calculate the first and second partial derivatives of

with respect to

,

:

According to the hypothesis in this paper, it can be found that ,,,that is, the Hessian matrix of the function is negative definite, is a concave function in the feasible domain assumed in this paper, and there is a maximum value.

If we set the first partial derivative of this function to zero, we can find:

It can be found that when the maximum value is obtained, changes with the change of competition level , while changes according to the change of , that is, both and are only affected by the initial competition level .

Appendix A.3. Proof of Theorem 3

Since Theorem 3 is derived from the conclusion in Theorem 1, it can be derived from Theorem 1.

Appendix B

Appendix B.1. Proof of Propositions 1

(1)Due to the carbon quota assumed in this paper , in Theorem 1 is a formula composed of positive numbers,We can know that .In Theorem 1,,when ,,;conversely,.

(2)Take the partial derivative of

and

with respect to

, we get:

As this paper assumes , we can see that the increased level of competition will hurt .When ,the first partial derivative of with respect to is always greater than 0, the competition level will increase , and vice versa will damage .

(3)The partial derivative of with respect to , respectively, can be obtained:;.

Since ,when , is less than 0, and vice versa is greater than 0.Meanwhile,as , can be simplified to discuss the positive and negative properties of .When ,<0,vice versa,greater than 0.

Appendix B.2. Proof of Propositions 2

Taking the first partial derivative of

yields:

Since its denominator is always greater than 0, we will only need to analyze:

When , the quadratic coefficient of the quadratic function is greater than 0; ,he quadratic coefficient of the quadratic function is less than 0.To solve the quadratic function, obtain(When ,this quadratic function has a unique solution,but at this time .According to the hypothesis in this paper, the function will have two different solutions in the feasible domain.)Therefore,when , will decrease;, will increase.When , will increase;, will increase.

References

- Allen, M. R.; Frame, D. J.; Huntingford, C.; Jones, C. D.; Meinshausen, N. Warming caused by cumulative carbon emissions towards the trillionth tonne. Nature 2009, 458, 1163–1166. [Google Scholar] [CrossRef] [PubMed]

- Zhang, M.; Liu, X.; Wang, W.; Zhou, M. Decomposition analysis of CO2 emissions from electricity generation in China. Energy Policy 2013, 52, 159–165. [Google Scholar] [CrossRef]

- Cao, K.; Xu, X.; Wu, Q.; et al. Optimal production and carbon emission reduction level under cap-and-trade and low carbon subsidy policies. Journal of Cleaner Production 2017, 167, 505–513. [Google Scholar] [CrossRef]

- Sinayi, M.; Rasti-Barzoki, M. A game theoretic approach for pricing, greening, and social welfare policies in a supply chain with government intervention. Journal of Cleaner Production 2018, 196, 1443–1458. [Google Scholar] [CrossRef]

- Bernow, S.; Dougherty, W.; Duckworth, M.; Brower, M. An integrated approach to climate policy in the us electric power sector. Energy Policy 1998, 26, 375–393. [Google Scholar] [CrossRef]

- Aslani, A.; Mohaghar, A. Business structure in renewable energy industry: Key areas. Renewable and Sustainable Energy Reviews 2013, 27, 569–575. [Google Scholar] [CrossRef]

- Xu, B.; Lin, B. Assessing the development of China’s new energy industry. Energy Economics 2018, 70, 116–131. [Google Scholar] [CrossRef]

- Gerbelova, H.; Amorim, F.; Pina, A.; Melo, M.; Ioakimidis, C.; Ferrao, P. Potential of CO2(carbon dioxide) taxes as a policy measure towards low-carbon Portuguese electricity sector by 2050. Energy 2014, 69, 113–119. [Google Scholar] [CrossRef]

- Liu, J. China’s renewable energy law and policy: A critical review. Renewable and Sustainable Energy Reviews 2019, 99, 212–219. [Google Scholar] [CrossRef]

- Fareeduddin, M.; Hassan, A.; Syed, M. N.; Selim, S. Z. The impact of carbon policies on closed-loop supply chain network design. Procedia CIRP 2015, 26, 335–340. [Google Scholar] [CrossRef]

- Wang, Z.; Wang, C. How carbon offsetting scheme impacts the duopoly output in production and abatement: analysis in the context of carbon cap-and-trade. Journal of Cleaner Production 2015, 103, 715–723. [Google Scholar] [CrossRef]

- Rose, A.; Stevens, B. The efficiency and equality of marketable permits for CO2 emission. Resource & Energy Economics 1993, 15, 117–146. [Google Scholar] [CrossRef]

- Zhou, P.; Wen, W. Carbon-constrained firm decisions: from business strategies to operations modeling. European Journal of Operational Research 2020, 281, 1–15. [Google Scholar] [CrossRef]

- Narassimhan, E.; Gallagher, K. S.; Koester, S.; Alejo, J. R. Carbon pricing in practice: a review of existing emissions trading systems. Climate Policy 2018, 18, 967–991. [Google Scholar] [CrossRef]

- Wang, L.; Liu, C.; Yang, X. Research on Carbon Emission Reduction Effect of China’s Carbon Trading Pilot. .Advances in Social Sciences Research Journal 2020, 7, 240–250. [Google Scholar] [CrossRef]

- Wang, B.J.; Zhao, J.L.; Wei, Y.X. Carbon emission quota allocating on coal and electric power enterprises under carbon trading pilot in China: Mathematical formulation and solution technique. Journal of Cleaner Production 2019, 239, 118104. [Google Scholar] [CrossRef]

- Qi, C.; Choi, Y. A study on the CO2 marginal abatement cost of coal-fueled power plants: is the current price of China pilot carbon emission trading market rational? Carbon Management 2020, 11, 1–12. [Google Scholar] [CrossRef]

- Chen, P.; Dagestani, A.A. Urban planning policy and clean energy development Harmony- evidence from smart city pilot policy in China. Renewable Energy 2023, 210, 251–257. [Google Scholar] [CrossRef]

- Wesseh, P.K.; Lin, B.Q.; Atsagli, P. Carbon taxes, industrial production, welfare and the environment. Energy 2017, 123, 305–313. [Google Scholar] [CrossRef]

- Bristow, A. L.; Wardman, M.; Zanni, A. M.; Chintakayala, P. K. Public acceptability of personal carbon trading and carbon tax. Ecological Economics 2010, 69, 1824–1837. [Google Scholar] [CrossRef]

- Wu, W.; Ren, Y.; Shi, L. Comparison of Renewable Energy Policy Based on Electricity Supply Chain Benefit. China Population, Resources and Environment 2013, 23, 44–48. [Google Scholar]

- Dou, X.; Li, Y.; Wang, B.; Xue, C. Power supply chain incentive mechanism based on overall profit. Electric Power Automation Equipment 2010, 30, 58–62. [Google Scholar]

- Zeng, S.; Jiang, C.; Ma, C.; Su, B. Investment efficiency of the new energy industry in China. Energy Economics 2018, 70, 536–544. [Google Scholar] [CrossRef]

- Chen, W.; Zhao, H. Integrated impact of the carbon quota constraints on enterprises within supply chain: direct cost and indirect cost. Renewable and Sustainable Energy Reviews 2018, 92, 774–783. [Google Scholar] [CrossRef]

- Sun, J.; Li, G.; Wang, Z. Optimizing China’s energy consumption structure under energy and carbon constraints. Structural Change and Economic Dynamics 2018, 47, 57–72. [Google Scholar] [CrossRef]

- Xia, C.; Wang, Z.; Xia, Y. The drivers of China’s national and regional energy consumption structure under environmental regulation. Journal of Cleaner Production 2021, 285, 124913. [Google Scholar] [CrossRef]

- Cong, R.G.; Wei, Y.M. Potential impact of (CET) carbon emissions trading on China’s power sector: A perspective from different allowance allocation options. Energy 2010, 35, 3921–3931. [Google Scholar] [CrossRef]

- Shen, B.; Yang, X.; Xu, Y.; Ge, W.; Liu, G.; Su, X.; Zhao, S.; Dagestani, A.A.; Ran, Q. Can carbon emission trading pilot policy drive industrial structure low carbon restructuring: new evidence from China. Environmental Science and Pollution Research 2023, 30, 41553–41569. [Google Scholar] [CrossRef] [PubMed]

- Apergis, N.; Payne, J.E. Renewable and non-renewable electricity consumption–growth nexus: Evidence from emerging market economies. Applied Energy 2011, 10, 5226–5230. [Google Scholar] [CrossRef]

- Frondel, M.; Ritter, N.; Schmidt, C.M.; Vance, C. Economic impacts from the promotion of renewable energy technologies: The German experience. Energy Policy 2010, 38, 4048–4056. [Google Scholar] [CrossRef]

- Al-Nory, M. T. Optimal decision guidance for the electricity supply chain integration with renewable energy: aligning smart cities research with sustainable development goals. IEEE Access 2019, 10, 142–149. [Google Scholar] [CrossRef]

- Barari, S.; Agarwal, G.; Zhang, W. J. C.; Mahanty, B.; Tiwari, M. K. A decision framework for the analysis of green supply chain contracts: an evolutionary game approach. Expert Systems with Applications 2012, 39, 2965–2976. [Google Scholar] [CrossRef]

- Vasnani, N. N.; Chua, F. L. S.; Ocampo, L. A.; Pacio, L. B. M. Game theory in supply chain management: current trends and applications. International Journal of Applied Decision Sciences 2018, 12, 56. [Google Scholar] [CrossRef]

- Huang, C.; Du, S.; Wang, B.; Tang, W. Accelerate or hinder it? Manufacturer transformation under competition and carbon emission trading. International Journal of Production Research 2023, 61, 6230–6250. [Google Scholar] [CrossRef]

- Xia, T.; Wang, Y.; Lv, L.; Shen, L.; Cheng, T. C. E. Financing decisions of low-carbon supply Chain under Chain-to-Chain competition. International Journal of Production Research 2023, 61, 6153–6176. [Google Scholar] [CrossRef]

- Jian, M.; He, H.; Ma, C.; Wu, Y.; Yang, H. Reducing greenhouse gas emissions: a duopoly market pricing competition and cooperation under the carbon emissions cap. Environmental Science and Pollution Research 2019, 26, 16847–16854. [Google Scholar] [CrossRef] [PubMed]

- Zhao, L.; Zhang, J. Analysis of a duopoly game with heterogeneous players participating in carbon emission trading. Nonlinear Analysis Modelling and Control 2014, 19, 118–131. [Google Scholar] [CrossRef]

- Chen, X.; Hao, G. Sustainable pricing and production policies for two competing firms with carbon emissions tax. International Journal of Production Research 2014, 53, 6408–6420. [Google Scholar] [CrossRef]

- Zheng, Y.; Zhou, W.; Chen, X.; Huang, W. The effect of emission permit allocation in an early-stage cap-and-trade for a duopoly market. International Journal of Production Research 2021, 59, 909–925. [Google Scholar] [CrossRef]

- Zhao, X.G.; Chen, H.; Hu, S. et al. The impact of carbon quota allocation and low-carbon technology innovation on carbon market effectiveness: a system dynamics analysis. Environmental Science and Pollution Research 2023, 30, 96424–96440. [Google Scholar] [CrossRef]

- Poddar, S.; Banerjee(Chatterjee), T.; Banerjee, S. Taxation on duopoly e-commerce platforms and their search environments. Business & Economics 2023, 3, 140. [Google Scholar]

- Belleflamme, P.; Toulemonde, E. Tax incidence on competing two-sided platforms. Journal of Public Economic Theory 2018, 20, 9–21. [Google Scholar] [CrossRef]

- Giri, B.C.; Mondal, C.; Maiti, T. Analysing a closed-loop supply chain with selling price, warranty period and green sensitive consumer demand under revenue sharing contract. Journal of Cleaner Production 2018, 190, 822–837. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).