1. Introduction

Financial statements offer a comprehensive depiction of the company [

1]. The company’s financial statements are prepared to reflect all activities undertaken by the company. The evaluation of financial statements in achieving the company's targets is an important component, serving as the initial step in determining the company's success strategy. Financial ratios, extracted from financial statements, are key metrics used to evaluate a company's financial health. Ratio analysis is a crucial technique for evaluating a company's financial performance and identifying strengths and weaknesses relative to other companies [

2]. The main objective of a company is to increase profit [

3], so it's important to identify the financial ratios that exert the most significant influence on the company's profit by analyzing financial statements. Subsequently, assessing the attainment of these targets provides insight into the company's performance. The results of the evaluation are followed up by determining strategies to increase the company's profit. Research in financial statement analysis generally revolves around two main issues: augmenting fundamental analysis and detecting market inefficiencies within financial statement data [

4]. Enhancing fundamental analysis is crucial for enhancing profitability forcasts and achieving more accurate company valuation predictions.

From the problems described, several financial ratios that affect profit can be set as company objectives, making the multi-objective goal programming model suitable for application in determining the optimal achievement of targets. It can estimate an organization’s financials to optimally utilize available funds for its improvement goals [

5]. The aim of goal programming is to minimize the degree of deviations from the predefined objectives [

6].

Goal Programming (GP) is a popular method for concurrently addressing multiple objective issues and achieving all objectives [

7]. In its development, the goal programming model can be a model with a priority (preemptive goal programming) and a weighted (weighted goal programming) model. The priority model (preemptive goal programming) sorts all objective functions based on the priority [

8]. Meanwhile, the weighted model (weighted goal programming) assigns weights to each deviation variable based on their relevance of importance [

9].

Siew et al. [

10] has undertaken the optimization of a goal programming approach without weights for managing assets and liabilities in the telecommunications firm Telekom Malaysia Berhad in Malaysia. The study incorporates financial statement parameters focused on maximizing earnings, equities, assets, profits, optimal management elements, and minimizing liabilities. Wijayanti et al. [

11] utilizes goal programming without weights to optimize asset liability management. The five elements of financial statements, namely maximizing assets, minimizing liabilities, maximizing equity, maximizing income, and minimizing financial expenses, are optimized to achieve the company's expected targets. Financial statement analysis is conducted on seven garment companies located in West Java, Indonesia. Tanwar et al. [

12] conducted a study on optimizing assets and liabilities in Indian banks, utilizing a blend of GP models and AHP. The model devised in this research offers advantages to bank managers in their planning and forecasting endeavors. It is crafted in alignment with the practical goals and constraints of the bank, meticulously addressing the challenges confronted by bank officials.

In this study, efforts were made to optimize financial ratios that support company profit by employing a blend of Weighted Goal Programming (WGP) and Analytical Hierarchy Process (AHP). This model aims to see the condition of a company’s financial statements further and optimize financial statements while obtaining maximum profit with minimal risk or expenditure. AHP is employed in determining weights for the goal function that represents the priorities of each financial ratio objective. Goal programming is designed to reduce deviations from the targets of the financial ratios. There has been no research using the WGP model and AHP method to analyze financial statements in non-bank companies, making it a novelty of this research. In study [

12], WGP and AHP are also used to analyze financial statements, but differ in the decision variables, which do not consider the financial statement values in specific time periods. In determining financial ratio parameters in the model, factor analysis is used to select financial ratios that affect the company's profit. Sensitivity analysis is also conducted to assess the model's resilience to data changes.

This paper consists of several chapters. Chapter 2 offers an overview of the literature from prior studies relevant to the current research. Chapter 3 explains the theories utilized in the research. Chapter 4 presents a study case on a company. Chapter 5 provides the results and discussions, categorized into AHP stages, WGP formulation, solution analysis, and sensitivity analysis. The final chapter, Chapter 6, draws conclusions from the conducted research and provides insights for future studies.

2. Related Work

Peykani et al. [

13] introduced a Linear Programming (LP) model that integrates constraints to attain optimal values for parameters within the balance sheet. This model is consistent with the goals of Asset Liability Management (ALM), taking into account constraints related to the system, balance sheet, and regulations. The design of the model emphasizes adherence to the most practical approach with minimal adjustments and seeks to minimize the dimensions or scale of the balance sheet.

Prasad et al. [

14] introduced a weighted goal programming (WGP) model for managing the finances of the healthcare system in Hyderabad. They focused on six financial metrics: liability, equity, income, asset, profit, and the proportion of values in financial statements. The model's weights were determined through percentage normalization and the analytical hierarchy process (AHP). Lam et al. [

15] utilized goal programming to enhance the financial statements of shipping companies, targeting objectives such as asset, liability, equity, earning, profit, and optimum management items.

Khazri et al. [

16] developed a mathematical model to optimize assets and liabilities for an Iranian bank using multiobjective goal programming. Their research took into account the bank's objectives, as well as structural, ideological, and legal constraints to create an ideal planning model. They employed fuzzy hierarchical analysis to define goals, determine priorities, and establish their order of significance.

Alam [

17] has devised and implemented a goal programming methodology to evaluate financial planning, utilizing the annual financial statements of the Saudi Basic Industries Corporation, playing a role in the establishment of a framework for financial planning. Through this research, he outlined specific objectives, including lowering costs, increasing fixed assets, enhancing equity share participation, boosting revenue, raising net profit, and decreasing debt. Hoe et al. [

18] conducted a study aiming to enhance the financial management of publicly listed electronic companies. The goals encompassed the maximization of assets, minimization of liabilities, maximization of equity, profit, and earnings, as well as the optimization of key management aspects, employing a goal programming model.

In Ocal et al.'s study [

19], factor analysis was used on financial data from Turkish construction companies over a five-year period to identify financial indicators that can analyze the industry's financial trends. They identified five independent factors—liquidity, capital structure and profitability, activity efficiency, profit margin and growth, and assets structure—as being responsive to economic changes in the country.A summary of several relevant articles is presented in the following table.

Table 1.

Literature Review.

Table 1.

Literature Review.

| Ref |

Model |

Financial Statement Analysis |

Bank |

AHP |

Factor Analysis |

| [10] |

GP |

✓ |

× |

× |

× |

| [11] |

GP |

✓ |

× |

× |

× |

| [12] |

WGP |

✓ |

✓ |

✓ |

× |

| [13] |

LP |

✓ |

✓ |

× |

× |

| [14] |

WGP |

✓ |

× |

✓ |

× |

| [15] |

GP |

✓ |

× |

× |

× |

| [16] |

WGP |

✓ |

✓ |

✓ |

× |

| [17] |

GP |

✓ |

× |

× |

× |

| [18] |

GP |

✓ |

× |

× |

× |

| [19] |

- |

✓ |

× |

× |

✓ |

| This research |

WGP |

✓ |

× |

✓ |

✓ |

From the literature discussed, GP can be used to analyze financial statements in both banking and non-banking institutions. GP can also be integrated with AHP to determine weights on objective functions.

3. Materials and Methods

3.1. Company Financial Statements

Financial statements serve as a diagnostic tool for assessing financing, investment, and operational activities within a company [

20]. Financial reports are generally prepared in annual periods, but some institutions compile financial reports in monthly, quarterly, or semester periods [

21]. A company owns assets to conduct its business or its economic resources, which include costs due to previous transactions and benefits in the future. Assets can be categorized into various types, including current assets, long-term investments, fixed assets, intangible assets, and other assets. Operating Ratio is an economic sacrifice the company must make in the future. This sacrifice for the future occurs due to commercial activities in the previous period [

22]. Operating ratios are categorized as short-term or long-term on the balance sheet, depending on the length of the contract with the individual or agency with whom the billing is agreed. Long-term agreements can emerge as a balanced result [

23]. Equity is the obligation of a business entity to its owner. Equity is obtained by subtracting the total operating ratio from the total assets. In addition, equity represents the residual interest in the owner’s business [

24]. Revenue is the income earned by a company over a certain period [

25]. Financial expenses (expenses) are economic sacrifices incurred in one accounting period [

26]. Here are the definitions of several financial ratios used in this study.

ROA is a measure indicating a company's capacity to generate earnings, encompassing its entire range of operations [

27].

The Operating Ratio measures operating costs per rupiah of sales; the smaller the ratio, the better the performance [

28].

OIR describes what is commonly referred to as pure profit received for every rupiah from the sales made by a company [

29].

An activity index (efficiency index) gauges a company's capacity to generate income from its overall assets by comparing net revenues to the average total assets [

30].

The current ratio assesses a company's working capital position by comparing total current assets to current liabilities, indicating if current assets significantly exceed short-term debts. [

31].

DAR is employed to assess a company's capability to fulfill its long-term financial commitments [

32].

DER is a financial metric that evaluates the proportion of debt relative to equity [

33].

WCTA is a net assessment comparing a company's current assets to its working capital. WCTA represents the disparity between current assets and current liabilities [

34].

Company Size reflects the magnitude of a company's total assets; the greater the assets, the larger the company's size. The Company Size metric is determined by applying the natural logarithm formula to total assets [

35].

3.2. Factor Analysis

Factor analysis is a statistical method based on the correlation analysis of multiple variables. Its goal is to condense numerous variables into a smaller set of underlying factors that these variables measure. This is achieved by clustering variables that are correlated with one another. The process generally involves four main stages [

19].

Initial Solution: The initial solution involves selecting variables and creating an inter-correlation matrix that includes all of them. This matrix, which is a k×k array (where k denotes the number of variables), contains the correlation coefficients for each pair of variables. When variables have a weak correlation, it's improbable that they share a common factor. Therefore, their correlation is not analyzed further. The Kaiser-Meyer-Olkin (KMO) test and Bartlett’s Test of Sphericity are used to assess the suitability of variables for factor analysis. A KMO value above 0.5 is required for satisfactory analysis. Moreover, Bartlett’s Test of Sphericity should produce a significance value below 0.001, this indicates that the correlation matrix is not an identity matrix.

Extracting factors involves determining the appropriate number of components from the correlation matrix based on the initial solution. Initially, each variable is standardized to have a mean of 0 and a standard deviation of 1. Consequently, a factor necessitates an eigenvalue of at least 1 for extraction.

Rotating the factors is essential to tackle scenarios where one or more variables may load similarly on multiple factors, leading to ambiguity in factor interpretation. Factor rotation enhances the clarity of relationships between variables and factors. Among the various methods, Varimax is the most commonly used.

Naming the factors involves analyzing the factor loadings of each variable to derive results. Subsequently, each factor is assigned an appropriate name based on these factor loadings.

3.3. Analytical Hierachy Process

The AHP is a decision support technique created by Thomas L. Saaty [

36]. This model for decision support dissects complex problems involving multiple factors or criteria into a hierarchical structure. According to [

36], this hierarchy represents a complex problem through a multilevel structure, initiating with the primary goal at the initial level, the hierarchy progresses through factor levels, criteria, sub-criteria, and culminates with the ultimate level containing alternative options.

Analytical Hierarchy Process of the five financial ratios of garment companies to profit, namely the priority weights of the five financial ratios that influence financial profit most. Questionnaire distribution uses pairwise comparisons and expert judgment to obtain prioritization. Priority represents the relative importance of an item. Furthermore, the AHP processes are as follows:

Based on the Saaty base scale [

36], establish the hierarchy for decision-making, ranging from the top-level to the middle-level and low-level in

Table 2.

- 2.

Build a pairwise comparison Criteria matrix; there are assessments required, and feedback is set automatically.

- 3.

Obtain expert judgment (priority weight) based on priority scale calculations.

- 4.

Check for inconsistencies. The Consistency Ratio (CR) is calculated utilizing the Consistency Index.

The value

represents the principal eigen value and

is the size of comparison matrix. The importance of consistency in calculations is also highly emphasized, and evaluated through the Consistency Index (CI) and Consistency Ratio (CR). The RI value (Random Index) is also necessary, typically found in specialized reference tables, such as

Table 3, to compute the Consistency Ratio.

The information gathered from questionnaires was processed using Microsoft Excel. Subsequently, calculations were performed to determine the Consistency Ratio and the relative weight vector of the targets. CR should be less than 0.1 for each pairwise comparison.

3.4. Goal Programming

Goal programming is a decision-making method designed to help decision-makers choose options that most effectively meet their objectives to the highest possible degree [

37]. The fundamental method in Goal Programming involves establishing a target quantified for each goal, formulating an objective function formula for each goal, and then seeking a solution to minimize the deviation between the objective function and each specific goal. Thus, Goal Programming or multi-purpose programming is one of the mathematical models used as a foundation for intricate decision-making to analyze and solve problems that involve many goals so that alternative solutions to optimal problem-solving are obtained [

38].

To deal with problems with several criteria and some alternatives, Saaty, in 1987, presented the AHP [

36]. This method makes it possible to divide and organize problems and sort them hierarchically graphically. Through pairwise comparisons, the hierarchy and influence of fractions are established. They make up the problem and show contrasting value reflections using fundamental scales and quantitative and qualitative criteria. Likewise, AHP can be used to distinguish the consistency of value reflection that contributes to improving decision-making through weighting. WGP is employed to identify the optimal solution, aiming to minimize the total deviations between goals; weighted optimality criteria enable an experimenter to articulate hierarchical preferences across estimable functions using a succinct weighting system [

39]. Decision-making allows you to set a weight for each undesirable deviation for each goal, depending on your preference, so H. P. Ho [

40] presents the formulation for Weight Goal Programming as follows:

where

F is the set of feasible regions, the weights

are assigned to deviation

in their respective objective functions.

is variable

the function

is linear with respect to

,

each is an advantage and disadvantage of achieving the target. The achievement of the deviation variable is defined in

Table 4.

Table 4 demonstrates that achieving the objective of minimizing the negative deviation variable is realized when the deviation variable equals zero, or when the positive deviation variable's value exceeds zero. The goal of the positive deviation variable is achieved if the positive variable of the

th goal equals zero or the negative deviation variable is greater than zero. The goal of adding the positive and negative variables to objective function is accomplished if the negative and positive deviation variables are equal to zero [

14,

17].

The weighting factor assigned to a specific goal serves dual purposes, encompassing both 'normalization' and 'evaluation'. The ‘normalization’ role drives all deviations to a uniform scale according to their degree of closeness, whereas the ‘evaluation’ role reflects the preference structure of decision makers [

40].

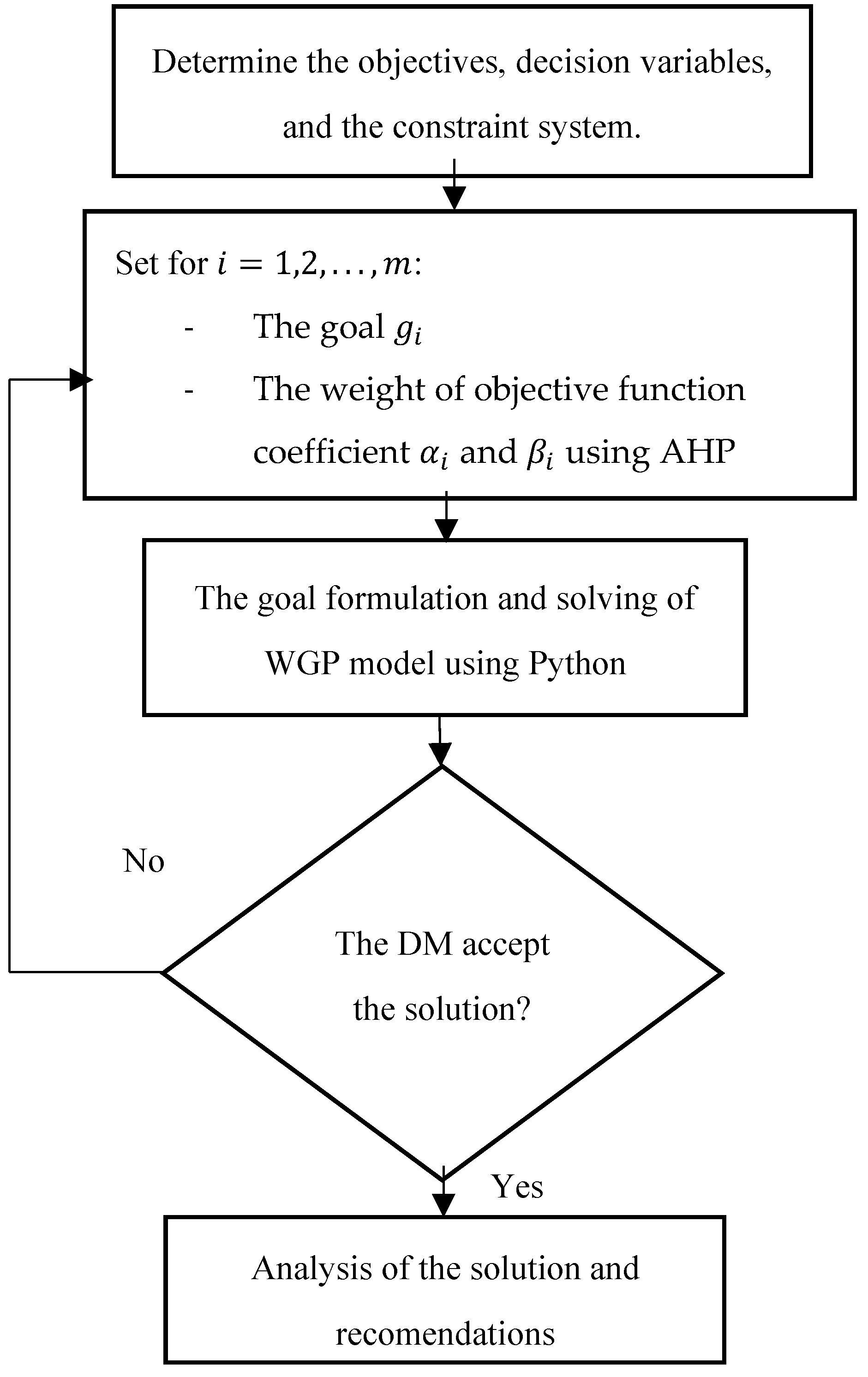

Figure 1 presents the steps for formulating the Goal Programming problem, beginning with determining the decision variables, the objective function, the objective function with top priority, the weighting, the achievement function, and completing the Goal Programming model [

38]. The WGP algorithm consists of 5 stages, which are presented in the following flowchart.

3.5. Sensitivity Analysis

Sensitivity analysis generally examines how variations in a model's input data influence its output data [

41]. Inputs, commonly termed as "factors" in sensitivity analysis, encompass model parameters, forcing variables, boundary and initial conditions, structural configuration choices, assumptions, and constraints. Outputs consist of functions derived from model responses, varying across spatial and temporal domains, encompassing objective functions such as production or cost functions in cost-benefit analysis, or error functions in model calibration.

Sensitivity analysis primarily focuses on assessing how variations in constraints and other model parameters impact the optimal solution. It serves several key purposes in systems analysis and modeling [

42]: (a) in scientific exploration, sensitivity analysis is employed to investigate causal connections and understand the impact of different processes, hypotheses, parameters, scales, and their interactions on a system, b) dimensionality reduction aims to identify insignificant factors within a system that may be redundant and can be addressed or eliminated in subsequent analyses, (c) data worth assessment is used to pinpoint the processes, parameters, and scales primarily influencing a system, identifying areas where acquiring new data can most effectively reduce targeted uncertainty, and (d) decision support involves evaluating the sensitivity of expected outcomes to various decision options, constraints, assumptions, and uncertainties.

4. Case Study

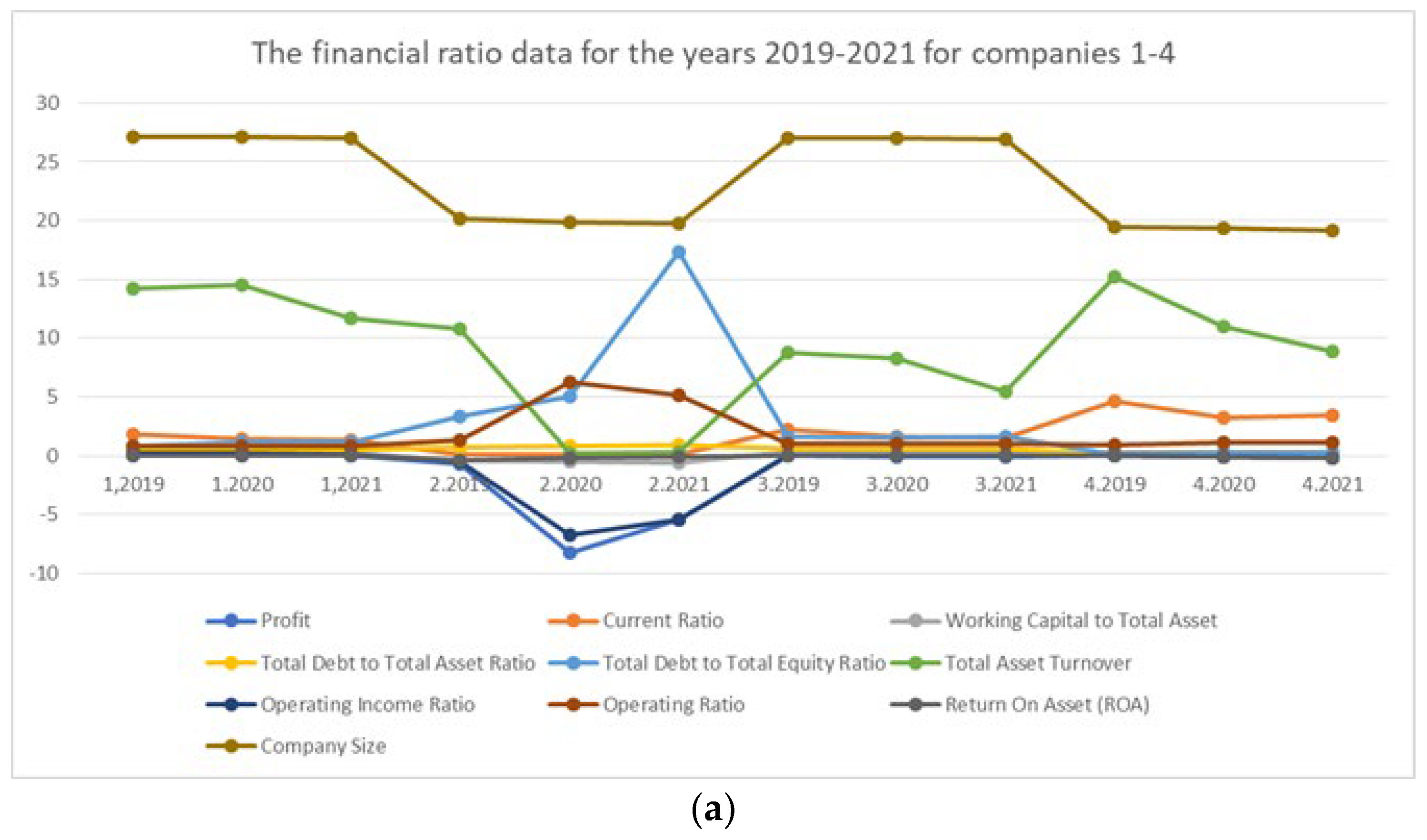

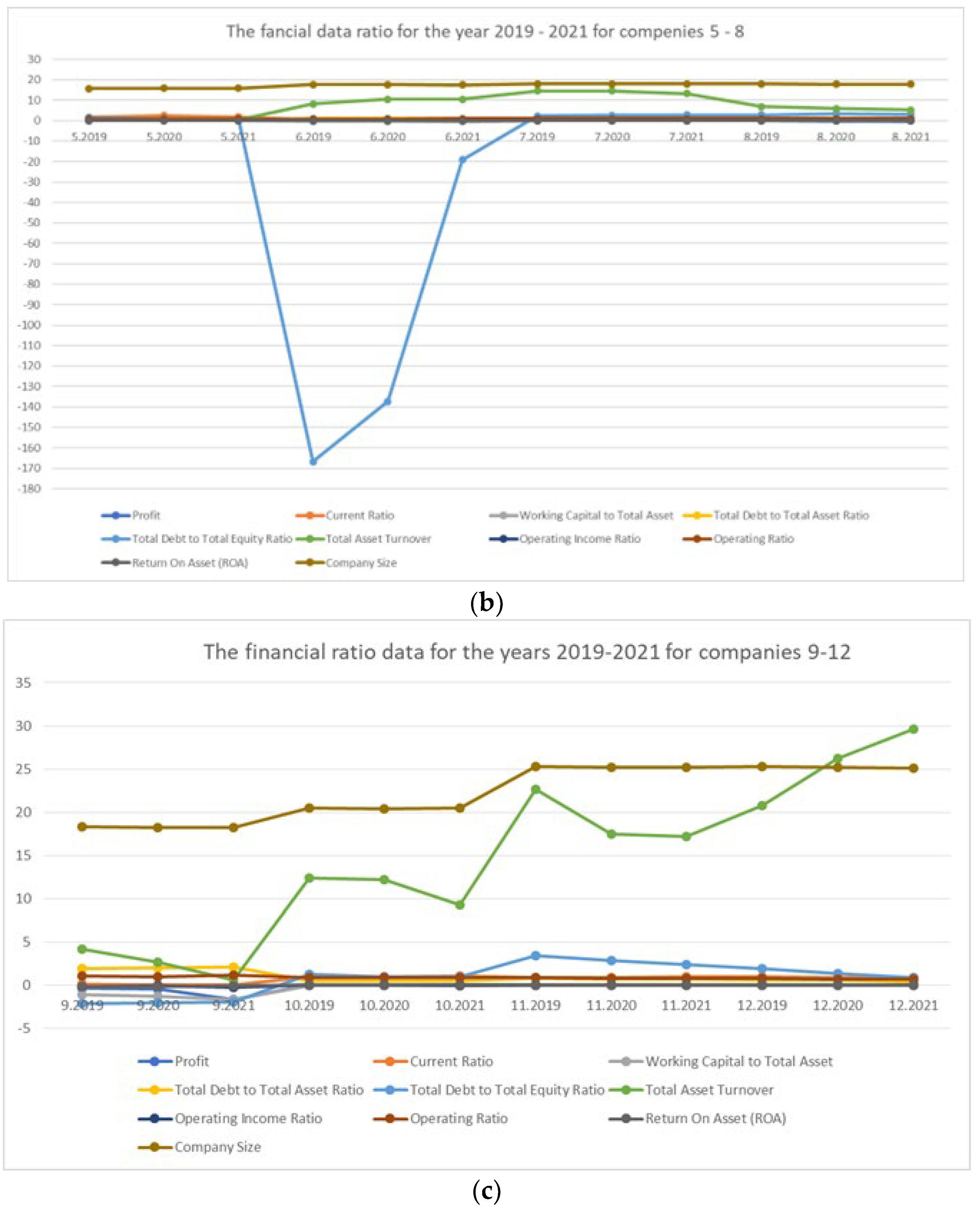

Data utilized in this study was gathered and subjected to selection for use in the analysis process. The research utilized secondary data obtained from the official website of the Indonesia Stock Exchange. The selection of companies followed a purposive sampling method, focusing on garment companies located in the West Java region with comprehensive financial records spanning from 2019 to 2021. Based on these criteria, financial statements from 12 garment companies in the West Java region for the years 2019-2021 were obtained. The financial ratios used in this study are Total Asset Turnover, Current Ratio, Working Capital to Total Assets, Debt to Assets Ratio, Debt to Equity Ratio, Company Size, Return on Assets, Operating Ratio, Operating Income Ratio.

Figure 1 below presents the data from 12 garment companies.

Factor analysis on financial ratios that impact the company's profit was used to analyze the data. The following are the results of the factor analysis.

4.1. Initial Solution

Data feasibility testing and variable correlation are assessed through the KMO (Kaiser-Meyer-Olkin) test and Bartlett's test before commencing factor analysis. The outcomes of these tests are presented in

Table 5.

Table 5 shows that the KMO value for this research data is 0.522, which is greater than 0.05. Additionally, Bartlett's test shows a value of 372.284, which is greater than 36 (df), and the significance value (0.0001) is less than the significance level (0.05). Based on these results, factor analysis is deemed appropriate for analyzing the data in the form of a correlation matrix.

In the anti-image matrix values, the results of the MSA (Measure of Sampling Adequacy) test are shown in

Table 6 as follows.

Anti-image matrices are valuable tools for identifying and selecting variables appropriate for inclusion in factor analysis. In the Anti-image Correlation section,

Table 5 includes the letter code (a), which signifies the Measure of Sampling Adequacy (MSA). It is noted that all variables meet the MSA value, thus these variables can be continued for factor analysis.

4.2. Extraction Factor

The Eigen values determine the number of principal factors extracted. The count of eigenvalues exceeding one indicates the quantity of principal factors incorporated.

Table 6 presents the eigenvalues and the percentage of total and cumulative variance of each variable completely using the Principal Component Method.

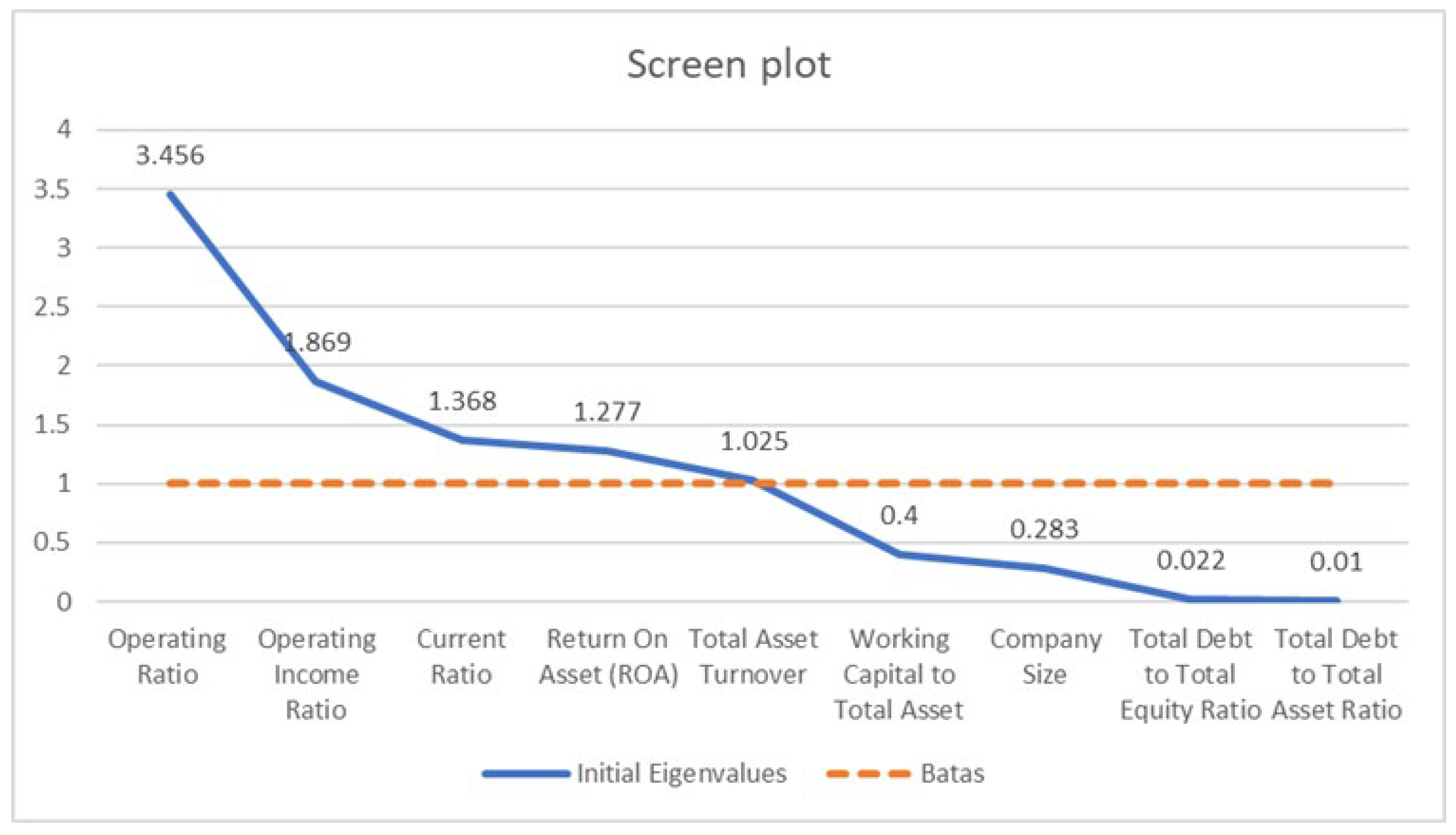

Table 7 shows five extracted factors with eigenvalues greater than one. Sequentially, these factors have eigenvalues of 3.456; 1.869; 1.368; 1.277; and 1.025. For the total variance in percentage, the variance for factor 1 is 38.397%, for factor 2 is 20.770%, and for factor 3 is 15.196%. The percentage variance is obtained by multiplying the ratio of the eigenvalue of each factor by the total original variables and then by 100%. Based on the cumulative percentage variance, the five extracted factors explain a variance of 38.397% + 20.770% + 15.196% + 9.744% + 8.061% = 92.168%. This cumulative variance exceeds the minimum threshold of 60%, ensuring that these five factors are considered representative of the six original variables.

The number of principal factors is also determined by the pattern of eigenvalue decline shown in a screen plot. The screen plot is presented in

Figure 3.

The number of new factors corresponds to the factors with eigenvalues of one or higher. In

Figure 3, there is a sharp decline in the eigenvalue after the first component. Subsequently, the second and third components show a gradual decline but remain above one. After the third component, the eigenvalue falls below one. Therefore, the first three factors are deemed sufficient to represent the nine original variables.

After the extracted factors are obtained, the communalities are determined, which differ from the variance explained by the extracted factors. The communalities of the six analyzed variables, in descending order, are detailed in

Table 8.

Table 8 shows the communalities of the nine analyzed variables in descending order. The variable with the highest communality value is "Profit Operating Ratio" with a value of 0.924, meaning that about 92.4% of the variance in the first variable can be explained by the formed factors. Similarly, this applies to the variables with the second, third, and subsequent highest communalities. The larger the communality value of a variable, the stronger its relationship with the formed factors.

4.3. Rotation Factor

Factor loadings can be seen from the correlation values between each factor and variable. Factor loadings provide information about which variables are significantly correlated with a particular factor.

Table 9 shows the factor loadings as follows.

Table 9 explains the unrotated factor loadings. While the relationships between factors and individual variables are evident, there are overlapping factors that are difficult to identify and interpret. If the loading of the first component is at least 0.5 (≥ 0.5), the variable is considered a member of the formed factor. However, if the loading is less than 0.5 (< 0.5), the variable is not a member of that factor.

If a measurement variable has loadings of ≥ 0.5 across multiple factors, a factor rotation using the varimax method should be performed to ensure that no variable has a loading of ≥ 0.5 on two or more factors. The rotated factor loadings can be shown in

Table 10.

From

Table 10 above, it can be seen that the Current Ratio with a weight of 0.867 falls into Factor 1, while the WCTA, DAR, OIR, and ROA fall into Factor 2. The DER, TATO, OR, and CS fall into Factor 3.

After identifying the variables that form based on their significant weight values within the same factor, the final step is factor interpretation. A total of 9 statement variables were reduced using factor analysis into 3 main factors. Each factor is named according to the variables that comprise it. Each factor consists of 2 to 4 variables.

Considering the results of factor analysis, only the variables Total Asset Turn Over, Current Ratio, Return On Assets, Operating Ratio, Operating Income Ratio have an effect on Company Profits. So, these financial ratios are used in formulating weighted goal programming. In the application of WGP model, financial report from a firm included in the Indonesia Stock Exchange, was utilized for the years 2019 to 2021, then the value of Return on Assets (ROA), Operating Ratio (OR), Operating Income Ratio (OIR), Total Asset Turnover (TATO), and Current Ratio (CR) are calculated as in

Table 11.

5. Results and Discussion

5.1. Analytical Hierarchy Process

Analytical Hierarchy Process of the five financial ratios of garment companies to profit, namely the priority weights of the five financial ratios that influence financial profit most. Questionnaire distribution uses pairwise comparisons and expert judgment to obtain prioritization. Priority represents the relative importance of an item.

Table 12 represents the Criteria Matrix, which illustrates the relative relationships between different criteria within the context of the conducted analysis. The values in the table depict the correlations between these criteria. These values indicate the extent to which a criterion correlates with other criteria. The values within the matrix cells represent multiplier factors that connect the intersecting criteria.

Table 13 presents the weights assigned to different goals or criteria, indicating their relative importance in decision-making. Each goal represents a distinct aspect relevant to the decision at hand. Meanwhile, the weight contains decimal values ranging from 0 to 1, indicating the assigned weights for each goal. These weights reflect the proportionate significance of each goal about the overall decision. Higher weight values indicate greater importance. These weights provide a quantitative measure of the relative importance of each goal, aiding decision-makers in prioritizing and evaluating different criteria effectively.

After obtaining the weight values, a consistency check is performed on the opinions of experts by calculating the maximum eigenvalue (λmax), which is 5. Subsequently, the Consistency Index is calculated using the following formula:

After that, the Consistency Ratio was calculated using the following formula:

The calculation found that the Consistency Ratio (CR) value was 0 or 0% (<10%). This means that the subjective evaluation of experts on the priority of the fifth financial ratio is consistent, then the weight values obtained in

Table 13 can be included in the next WGP model.

5.2. Goal Programming Formulation

The data is compiled as a Weighted Goal Programming model used in determining the order of priority goals in the Company’s Asset Liability Management (ALM), consisting of the following variables:

is the value of the financial statements in 2019

is the value of the financial statements in 2020

is the value of the financial statements in 2021

is the negative deviation value from the i-th goal or target

is the positive deviation value from the i-th goal or target

The first constraint function is the goal constraint function, which calculates the values of the financial ratios used in this study. The determination of the value of the financial ratios is obtained from the calculation of financial ratios from the company’s financial statements in the period 2019-2021. The financial statement data fluctuates, so the results of the calculation of financial ratios are taken on average from the data for the year concerned. The target values of each financial ratio are determined through benchmarking with 12 other garment companies over three years, which is determined as the righthand side (RHS) constant in the constraint function.

The formulation of the objective constraint function relates to the financial statement elements used: OIR, OR, ROA, TATO, and CR, which is formulated as:

- 2.

Formulation of minimizing goal constraint Operating Ratio:

- 3.

Formulation of maximizing goal constraint Operating Income Ratio:

- 4.

Formulation of maximizing goal constraint Total Asset Turnover:

- 5.

Formulation of minimizing goal constraint Current Asset:

The constraint (12) is to maximize the Return on Assets, and the deviation below the target is minimized. Thus, the negative deviation must be zero . The constraint (13) aims to minimize the Operating Ratio, and the deviation above the target is minimized. Thus, the positive deviation must be zero . The constraint (14) is to maximize Operating Income Ratio, and the deviation below the target is minimized. Thus, the negative deviation must be zero . The constraint (15) is to maximize Total Asset Turnover, and the deviation below the target is minimized. Thus, the negative deviation must be zero . The constraint (16) is to maximize Current Ratio, and the deviation below the target is minimized. Thus, the negative deviation must be zero .

Because

, then the initial model of the objective function is

The non-negative constraint is

Model goal programming to optimize financial ratios consists of the objective function in equation (17), constraint functions (12), (13), (14), (15), dan (16), as well as non-negativity constraints (18).

5.3. Computational Method Written in the Python Programming Language

The Python algorithm utilized to solve the WGP model is presented as follows:

|

First Algorithm: Addressing the Weigh Goal Programming |

| Begin |

|

| Step 1: |

Specify the problem with the "LpMinimize" syntax and define the variables using the "LpVariable" syntax. |

| Step 2: |

Import the required library (Pulp) to initialize the model. |

| Step 3: |

Define the decision variables. |

| Step 4: |

Create the optimization model. |

| Step 5: |

Set the objective function to minimize the weighted sum of the deviation variables and add the constraints. |

| Step 6: |

Solve the optimization problem. |

| Step 7: |

Display the outcomes using the syntax below: |

| |

For each i ∈ 3 do |

| |

Print |

| |

For each i ∈ 10 do |

| |

Print |

| |

End For |

| |

End For |

| End |

|

Besides the algorithm for solving the WGP model, Python is also used in sensitivity analysis. The Python algorithm for sensitivity analysis is as follows.

|

Second Algorithm: Sensitivity Analysis for Weigh Goal Programming |

| Begin |

|

| Step 1: |

Conduct sensitivity analysis for the optimization issue. |

| Step 2: |

Determine the sensitivity of the objective function coefficients and right-hand side constants. |

| Step 3: |

Identify the range of values for which the current solution remains optimal. |

| Step 4: |

Print sensitivity analysis results. |

| Step 5: |

Display the outcomes using the syntax below: |

| |

For each constraint i ∈ 3 do |

| |

Print

|

| |

For each constraint right-hand side constant j ∈ 10 do |

| |

Print |

| |

End For |

| |

End For |

| End |

|

5.4. Numerical Simulation

The Weight Goal Programming model that has been formulated is solved using Lingo software. The results obtained from the WGP model optimization indicate that the optimal solution of objective function is 1.494. The value of the objective function indicates the presence of deviation from the optimized financial ratio. The values of decision variables in the WGP model are

and otherwise is zero. The optimal solution shows that the financial statement value in the 3rd year is 4.450, which supports the achievement of the financial ratio target. The deviation variables value of the goal constraints for each financial ratio are presented in

Table 14 and

Figure 2.

Table 13 and

Figure 4 shows that efforts to achieve all objectives through the constituent elements at the same time obtain the optimal solution combination, namely

The target of maximizing the Return on Asset was not achieved because there was a negative deviation value from the total number of the Company’s Return on Asset, i.e. .

The target of minimizing the Operating Ratio was not achieved because there was a positive deviation value from the total number of the Company’s Operating Ratio, i.e. .

The target of maximizing Operating Income Ratio was not achieved because there was a negative deviation value from the Company’s total Operating Income Ratio, i.e. .

The target of maximizing Total Asset Turnover was achieved because there was no negative deviation from the total amount of the Company’s Total Asset Turn Over i.e. .

The target of maximizing Current Ratio was not achieved because there was a negative deviation value from the total number of the Company’s Current Ratio, i.e., .

The goal achievement can be seen in the following table:

Based on the completed WGP model, the objective function that minimizes Z is obtained: 1.494. Out of the five established objectives, only Total Asset Turnover have been achieved by the WGP model. However, there is three objectives that have not been achieved, namely the objective of maximizing the Return on Asset, minimizing Operating Ratio, maximizing the Operating Income Ratio, and maximizing the Current Ratio. Goal achievement is indicated by the Goal Values that the company can achieved based on the WGP model's ideal solution.

In the case of maximizing the goal of Total Asset Turnover, the negative deviation variable has a value of zero, indicating that the objective constraint of this model is equal to or greater than the established Goal Value. The obtained Total Asset Turnover remains at IDR 76.657 billion due to .

For the objectives of maximizing Return on Assets, Operating Income Ratio, and Current Ratio, the values of the negative deviation variables are 0.002, 0.435, and 7.058, respectively and the positive deviation variable of the Operating Ratio is 1.457. These values indicate that the achieved targets are not met because they deviate below the established targets by IDR 0.002 billion for Return on Assets, IDR 0.435 billion for the Operating Income Ratio, IDR 7.058 billion for the Current Ratio, and deviate above the target by IDR 1.457 billion for the Operating Ratio.

5.5. Sensitivity Analysis

In this paper, sensitivity analysis is employed to assess the model's robustness when subjected to alterations in the data. Sensitivity analysis is conducted on the weight values of the coefficients in the objective function and the target values on the right-hand side. For the coefficients of the objective function, the allowable range of weights to maintain the optimal solution obtained is presented in

Table 16.

Based on

Table 16, the coefficients of the objective function show that the negative deviation of ROA can vary within the range of 0.004 – 0.397, the positive deviation of OR variable can increase by 0.098 and decrease by 0.015, the negative coefficient of OIR can increase by 0.269 and cannot decrease, the negative deviation coefficient of TATO can increase indefinitely and decrease up to 0.149, the negative deviation coefficient of CR can increase by 0.012 and decrease by 0.057, and other variables with objective function coefficients of 0 can increase indefinitely except for

and

can decrease with varying values.

In the sensitivity analysis for the right-hand side target values, the allowable range of changes is presented in

Table 17. The right-hand side values can increase indefinitely except for the constraints OR and TATO, which can increase by 1.457 and 1.096, respectively. The OR constraint can decrease indefinitely, while the constraints for ROA, OIR, TATO, and CR can decrease by 0.002, 0.435, 30.292, and 7.058, respectively.

6. Conclusion

Financial statements can illustrate the financial condition of a company through its financial ratios. Factor analysis is conducted to identify the factors that have the most significant impact on profit. In this study, a case study conducted on a garment company for the years 2019-2020 found that Return on Assets, Operating Ratio, Operating Income Ratio, Total Asset Turnover, and Current Ratio are the factors most affecting profit. These five ratios are used to build the WGP model. Optimization of the WGP model, developed through the determination of weights using the AHP method, can yield an optimal solution by minimizing deviations from the specified target financial ratios. The results obtained indicate that the company has met the target for the TATO financial ratio, but the other four ratios have not yet reached the target. The financial statement value obtained in 2021 is 4.450, and otherwise is zero, which supports the achievement of the financial ratio target. The recommended range of weights and target financial ratios for maintaining the optimal solution (company performance) are demonstrated by performing a sensitivity analysis. The research findings revealed that the Return on Assets, which measures a company’s efficiency in generating profit from its assets, has not yet met the anticipated target. This suggests that the company should enhance its utilization of assets to generate more revenue. Companies have the opportunity to boost their ROA by increasing their profit margin through strategies such as product differentiation or by improving asset turnover using a cost leadership strategy [

43]. This research also found that the goal of minimizing the operating ratio has not been achieved. The operating ratio can be reduced by decreasing operational costs relative to sales. By improving cost efficiency, it is also possible to increase the sales level, thereby boosting gross profit by reducing the cost of goods sold [

44]. The research findings also revealed that the Operating Income Ratio, which assesses a company's capacity to generate operational income from its sales, has not reached the expected target. The Operating Income Ratio can be improved by maximizing sales to generate operating profit and by reducing operational costs related to sales [

44]. Furthermore, the research findings have shown that the Current Ratio, which assesses a company's working capital position, has not reached the expected target. Improving the Current Ratio involves increasing current assets such as cash, inventories, trade receivables, and VAT receivables. Concurrently, reducing short-term debts is essential to decrease the company's liabilities [

45]. In the broader context, while the GP model has ensured the fulfillment of all priority objectives, this analysis underscores areas that require rectification to achieve a more optimal financial performance. Mitigating operational costs and enhancing asset efficiency will be crucial in attaining this objective. Therefore, the company is recommended to undertake a comprehensive review of its cost structure and asset management strategies to address these critical findings and achieve enhanced financial outcomes. The limitation of this research is the inability to address uncertain parameters such as financial ratios that may change due to uncertain interest rate fluctuations. For future research, considerations in assuming several uncertain parameters such as the value of financial ratios can better reflect reality. Therefore, combining WGP with other methods such as robust optimization can be considered to address uncertainty in financial ratios.

Author Contributions

Conceptualization, H.W. and S.S.; methodology, H.W.; software, H.W.; validation, S.S. and D.C.; formal analysis, H.W.; investigation, S.S.; data curation, S.S.; writing—original draft preparation, H.W.; writing—review and editing, A.S.; visualization, A.S.; supervision, S.S.; project administration, D.C.; funding acquisition, S.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Indonesian Ministry of Education, Culture, Research, And Technology grant number 2064/UN6.3.1/PT.00/2022.

Acknowledgments

The authors would like to thank the Indonesian Ministry of Education, Culture, Research, and Technology. Research and Community this research was funded by the Indonesian Ministry of Education, Culture, Research, and Technology for a Doctor Disertation Research Project in 2022 entitled “Model Optimisasi Asset-Liability Management menggunakan Robust Goal Programming”.

Conflicts of Interest

The authors declare no conflict of interest.

References

- U. V. Pelekh, N. V. Khocha, and H. V. Holovchak, “Financial statements as a management tool,” Management Science Letters, vol. 10, no. 1, pp. 197–208, 2020. [CrossRef]

- A. Dalessandro, “Effective Strategies for Assets and Liabilities Management,” pp. 1–19, 2013. [CrossRef]

- N. Bărbută-Misu, M. Madaleno, and V. Ilie, “sustainability Analysis of Risk Factors A ff ecting Firms ’ Financial Performance — Support for Managerial Decision-Making,” Sustainability, vol. 11, no. 18, pp. 1–19, 2019. [CrossRef]

- T. L. Yohn, “Research on the use of financial statement information for forecasting profitability,” Accounting & Finance Research, vol. 60, no. 3, pp. 3163–3181, 2018. [CrossRef]

- K. V. Lakshmi, G. A. Harish Babu, and K. N. Uday Kumar, “Application of goal programming model for optimization of financial planning: Case study of a distribution company,” Palestine Journal of Mathematics, vol. 10, no. Special Issue 1, pp. 144–150, 2021.

- A. Hussain and H. Kim, “Goal-Programming-Based Multi-Objective Optimization in O ff -Grid Microgrids,” Sustainability, vol. 12, no. 8119, pp. 1–18, 2020. [CrossRef]

- Alarjani and, T. Alam, “Lexicographic Goal Programming Model for Bank’s Performance Management,” Journal of Applied Mathematics, vol. 2021, 2021. [CrossRef]

- Hasbiyati, R. Desri, and M. D. H. Gamal, “Pre-Emptive Goal Programming Method for Optimizing Production Planning,” BAREKENG: Jurnal Ilmu Matematika dan Terapan, vol. 17, no. 1, pp. 0065–0074, 2023. [CrossRef]

- S. Banik and D. Bhattacharya, “Weighted Goal Programming Approach for Solving Multi-Objective De Novo Programming Problems,” International Journal of Engineering Research in Computer Science and Engineering (IJERCSE), vol. 5, no. 2, pp. 2394–2320, 2018.

- L. W. Siew, L. W. Hoe, and L. P. Fun, “Optimizing the Asset and Liability Management of Telecommunication Company using Goal Programming Model,” Journal of Electronic & Information Systems, vol. 2, no. 2, pp. 24–29, 2020. [CrossRef]

- H. Wijayanti, S. Supian, D. Chaerani, and A. Shuib, “Optimization of Asset Liability Management on Textile and Garment Companies using Goal Programming Model,” in Proceedings of the 8th International Conference on the Applications of Science and Mathematics, 2023, pp. 15–24.

- Tanwar, A. K. Vaish, and N. V. M. Rao, “Mathematical Modeling of Management in Banks Using Goal Programming and Ahp,” Indian Journal of Finance and Banking, vol. 4, no. 4, pp. 1–19, 2020. [CrossRef]

- P. Peykani, M. Sargolzaei, M. H. Botshekan, C. Oprean-Stan, and A. Takaloo, “Optimization of Asset and Liability Management of Banks with Minimum Possible Changes,” Mathematics, vol. 11, no. 12, p. 2761, Jun. 2023. [CrossRef]

- A. V. S. Prasad and Y. R. Reddy, “Comparison of two weighted goal programming models for financial management of a health care system,” vol. 3, no. 2, pp. 363–369, 2018.

- W. S. Lam, W. H. Lam, and P. F. Lee, “Decision Analysis on the Financial Management of Shipping Companies using Goal Programming Model,” 2021.

- S. Khazri, A. Dehghan, and A. Aslizadeh, “Design and optimization of the asset and liability model based on the multiple-objective decision-making view,” Industrial Engineering and Management Systems, vol. 17, no. 2, pp. 311–317, 2018. [CrossRef]

- T. Alam, “Modeling and Analyzing a Multi-Objective Financial Planning Model Using Goal Programming,” Applied System Innovation, vol. 5, no. 6, p. 128, 2022. [CrossRef]

- W. Hoe, L. W. Siew, and L. P. Fun, “Optimizing the financial management of electronic companies using goal programming model,” Journal of Physics: Conference Series, vol. 2070, no. 1, 2021. [CrossRef]

- M. Emin Öcal, E. L. Oral, E. Erdis, and G. Vural, “Industry financial ratios-application of factor analysis in Turkish construction industry,” Building and Environment, vol. 42, no. 1, pp. 385–392, 2007. [CrossRef]

- P. Hasanaj and B. Kuqi, “Analysis of Financial Statements,” Humanities and Social Science Research, vol. 2, no. 2, p. p17, 2019. [CrossRef]

- S. C. Mashkour, “Analysis Of Prof. Dr. Saoud Chayed Mashkour Alamry Muthanna University First Edition,” Analysis of Financial Statements, no. January, pp. 1–208, 2020, [Online]. Available: https://www.researchgate.net/publication/338385318_ANALYSIS_OF_FINANCIAL_STATEMENTS.

- Q. Xu, G. Fernando, K. Tam, and W. Zhang, “Financial report readability and audit fees: a simultaneous equation approach,” Managerial Auditing Journal, vol. 35, no. 3, pp. 345–372, 2020. [CrossRef]

- A. Roy, S. M. Gilbert, and G. Lai, “The Implications of Strategic Inventory for Short-Term vs. Long-Term Supply Contracts in Nonexclusive Reselling Environments,” Manufacturing and Service Operations Management, vol. 24, no. 5, pp. 2629–2647, 2022. [CrossRef]

- S. Otaka, “Rethinking the Concept of Equity in Accounting: Origin and Attribution of Business Profit,” Accounting, Economics and Law: A Convivium, pp. 777–795, 2020. [CrossRef]

- A. K. K. R. Jayathilaka, “Operating Profit and Net Profit : Measurements of Profitability,” Open Access Library Journal, vol. 7, pp. 1–11, 2020. [CrossRef]

- A. Z. Karagul, “Financial and Technical Analysis of Insurance Sector with Goal Programming Model,” Sigma Journal of Engineering and Natural Sciences, vol. 36, no. 2, pp. 1–23, 2018.

- Husna and, I. Satria, “Effects of Return on Asset, Debt To Asset Ratio, Current Ratio, Firm Size, and Dividend Payout Ratio on Firm Value,” International Journal of Economics and Financial Issues, vol. 9, no. 5, pp. 50–54, 2019. [CrossRef]

- M. Abdulkareem, A. Chakrawal, and K. M. Rathod, “An Analytical study of Profitability and Operating Ratio analysis of selected Chemical Companies in India,” International Journal of Scientific and Management Research, vol. 4, no. 8, pp. 59–68, 2021. [CrossRef]

- Choiriyah, F. Fatimah, S. Agustina, and U. Ulfa, “The Effect Of Return On Assets, Return On Equity, Net Profit Margin, Earning Per Share, And Operating Profit Margin On Stock Prices Of Banking Companies In Indonesia Stock Exchange,” International Journal of Finance Research, vol. 1, no. 2, pp. 103–123, 2021. [CrossRef]

- E. Nasution, L. P. Putri, and S. Dungga, “The Effect of Debt to Equity Ratio and Total Asset Turnover on Return on Equity in Automotive Companies and Components in Indonesia,” in 3rd International Conference on Accounting, Management and Economics 2018 (ICAME 2018) The, 2019, vol. 92, no. Icame 2018, pp. 182–188. [CrossRef]

- Ciptawan and B., O. Frandjaja, “The Impact Of Current Ratio And Gross Profit Margin Towards Financial Distress In Technology Sector Companies Listed In Indonesia Stock Exchange For Period 2016-2020,” Journal of Industrial Engineering & Management Research, vol. 3, no. 1, pp. 197–214, 2022. [CrossRef]

- P. Lumbantobing, L. Sulivyo, D. N. Sukmayuda, and A. D. Riski, “The Effect of Debt to Asset Ratio and Debt to Equity Ratio on Return on Assets in Hotel, Restaurant, and Tourism Sub Sectors Listed on Indonesia Stock Exchange for the 2014-2018 Period,” International Journal of Multicultural and Multireligious Understanding, vol. 7, no. 9, p. 176, 2020. [CrossRef]

- E. Harinurdin, “The Influence of Financial Ratio and Company Reputation on Company Stock Prices Financial Sector,” MDPI proceedings, vol. 83, no. 47, p. 12, 2022. [CrossRef]

- A. Aidi, T. W. Setiawan, and A. Junaidi, “Analysis of Financial Health Level Using the Z-Score ( Altman ) Method in Transportation Companies Listed on the Indonesia Stock Exchange for the 2019-2021 Period,” vol. 3, no. 4, pp. 461–473, 2022.

- Azaro, L. Djajanto, and P. A. Sari, “The Influence of Financial Ratios and Firm Size on Firm Value (An Empirical Study on Manufacturing Companies Sector Consumers Goods Industry Listed in Indonesian Stock Exchange in 2013–2017),” vol. 136, no. Ambec 2019, pp. 142–147, 2020. [CrossRef]

- Y. Kara, “Measuring the Sustainability of Cities in Turkey with the Analytic Hierarchy Process,” Open Journal of Social Sciences, vol. 07, no. 04, pp. 322–334, 2019. [CrossRef]

- Goh, “Optimizing Accounting Decision Making Using Goal Programming,” Journal of Corporate Accounting and Finance, vol. 30, no. 1, pp. 161–168, 2019. [CrossRef]

- H. Omrani, M. Valipour, and A. Emrouznejad, “Using Weighted Goal Programming Model for Planning Regional Sustainable Development to Optimal Workforce Allocation: An Application for Provinces of Iran,” Social Indicators Research, vol. 141, no. 3, pp. 1007–1035, 2019. [CrossRef]

- Allen-Moyer and, J. Stallrich, “Incorporating Minimum Variances into Weighted Optimality Criteria,” American Statistician, vol. 76, no. 3, pp. 262–269, 2022. [CrossRef]

- H. P. Ho, “The supplier selection problem of a manufacturing company using the weighted multi-choice goal programming and MINMAX multi-choice goal programming,” Applied Mathematical Modelling, vol. 75, pp. 819–836, 2019. [CrossRef]

- J. Schulte and V. Nissen, “Sensitivity analysis of combinatorial optimization problems using evolutionary bilevel optimization and data mining,” Annals of Mathematics and Artificial Intelligence, no. 91, pp. 309–328, 2023. [CrossRef]

- S. Razavi et al., “The Future of Sensitivity Analysis : An essential discipline for systems modeling and policy support,” Environmental Modelling and Software, vol. 137, no. 104954, 2021. [CrossRef]

- H. D. Yi, S. Park, and J. Kim, “The effects of business strategy and inventory on the relationship between sales manipulation and future profitability,” Sustainability (Switzerland), vol. 11, no. 8, pp. 1–18, 2019. [CrossRef]

- A. Fajar, “Comparative Analysis of Financial Statements PT. Indofood Sukses Makmur Tbk,” International Journal of Multicultural and Multireligious Understanding, vol. 8, no. 3, pp. 244–253, 2021. [CrossRef]

- Dianti and, H. Putri, “Financial Ratio Analysis To Assess The Company’s Financial Performance On Cv. Fortuna Motorindo Diponegoro Branch Surabaya City,” Journal of Economy, Accounting and mManagement Science, vol. 2, no. 2, pp. 114–122, 2021, [Online]. Available: http://wastu.unmerbaya.ac.id/index.php/wastu/index.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).