Submitted:

20 June 2024

Posted:

24 June 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Theoretical Foundations and Litrature Review

2.1. Theoretical Foundations

2.2. Litrature Review

3. Methodology

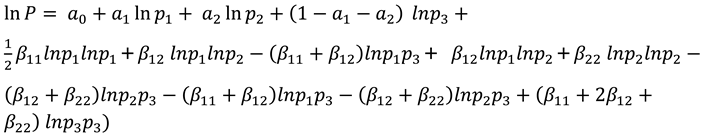

3.1. Almost Ideal Demand System (AIDS)

4. Discussion

- Banknotes and cash registers

- Visual deposits

- Term deposits

4.1. Model Estimation

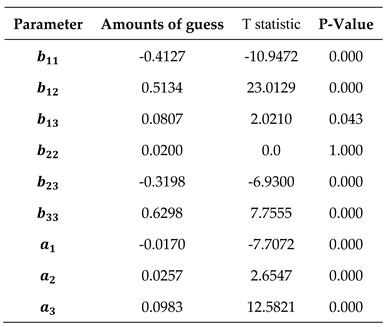

4.1.1. Model Estimation Using AIDS Model

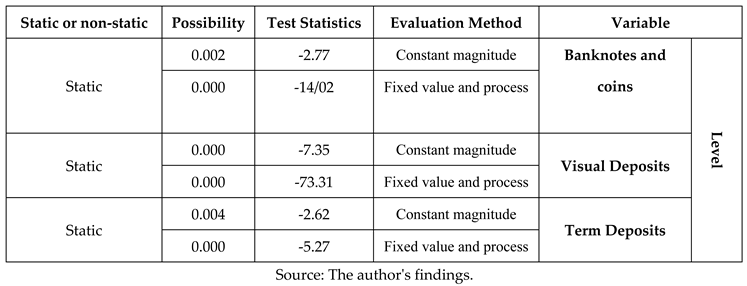

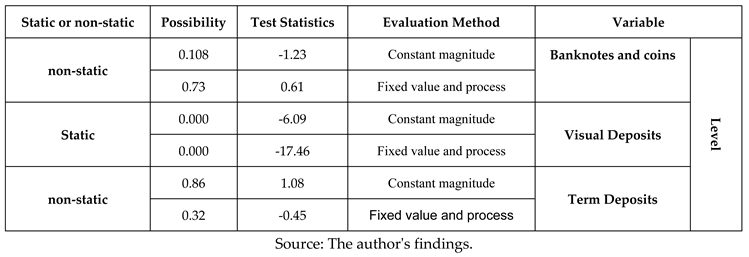

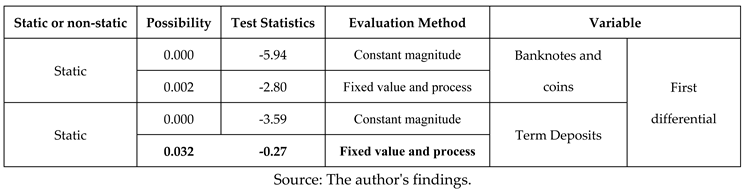

4.1.2. Results of Reliability Tests

5. Results

References

- Al-Imran, R.; Nasrollah, F.; Al-Imran, S.A. Investigating the Effect of the Economic Stability Index on Money Demand in Iran. J. Appl. Econ. 2010, 1, 71–98. [Google Scholar]

- Atta-Mensah, J. The Demand for Money in a Stochastic Environment. Bank of Canada Working Paper No. 2004.7. 2004. [CrossRef]

- Azizi, J. , Esmaeilpoor, F. and Taleghani, M. (2010). Effect of the Quality Costing System on Implementation and Execution of Optimum Total Quality Management. International journal of Business and Management (CANADA). Vol.5.No.8. [CrossRef]

- Azizi, J.; Aref Eshghi, T. The Role of Information and Communication Technology (ICT) in Iranian Olive Industrial Cluster. J. Agric. Sci. 2011, 3, 228–232. [Google Scholar] [CrossRef]

- Azizi, J. Evaluation of the Efficiency of the Agricultural Bank Branches by Using Data Envelopment Analysis and the Determination of a consolidated index: The Case Study MAZANDARAN Province. Iran. J. Agric. Econ. 2015, 9, 63–76. [Google Scholar]

- Azizi, J.; Torkamani, J. Estimation Of Demand Function For Different Types Of Meat In Iran: Application Of Cointegration. EQTESAD-E KESHAVARZI VA TOWSE'E https://www.sid.ir/en/Journal/ViewPaper.aspx?ID=22226. 2001, 9, 217–238. [Google Scholar]

- Azizi, J. , and Yazdani, S. (2007). Investigation stability income of export date of Iran.

- Azizi, J.; Vahabi Sorood, M.; Mohammadinejad, A. Influential Elements Influencing How Consumers Behave when Purchasing Organic Farm Products. Preprints 2024, 2024060611. [Google Scholar] [CrossRef]

- Bafandeh Imandoost, Sadegh, and Ghasemi, Hessameddin (2011), "Investigating the Factors Affecting Iran's Money Demand Using Bayesian Averaging Approach," Financial Monetary Economics, No. 1, pp. 37–57.

- Branson, William (1994). Macroeconomics (translated by Morteza Emadzadeh), Tehran, Islamic Azad University Scientific Publishing Center.

- Baumol, W.J. The transaction demand for cash: an inventory theoretic approach. Q. J. Econ. 1952, 545–556. [Google Scholar] [CrossRef]

- Dehmardeh, N.; Izadi, H.R. A Study of the Demand Function of Money in Iran. Q. J. Econ. Stud. 2009, 9, 153–169. [Google Scholar]

- Farzin-Vash, A.; Samadi Boroujeni, R. Measuring the Welfare Cost of Inflation in Iran. Eghtesadi J. 2012, 12, 7–18. [Google Scholar]

- Fallahi, M.A.; Neghdari, E. Investigating the Factors Affecting Money Demand in Iran's Economy with an Emphasis on Exchange Rate (Application of the ARDL Model). J. Knowl. Dev. 2005, 147–166. [Google Scholar]

- Falahati, S.; Azizi, J. Role of Rural Markets in Rural People’s Economic Prosperity in Guilan Province of Iran. Village Dev. 2019, 22, 125–139. [Google Scholar] [CrossRef]

- Fridman, M. The Demand for Money, Some Theoretical and Empirical Results. J. Political Econ. Univ. Chic. Press 1959, 67, 185–191. [Google Scholar] [CrossRef]

- Jabbari, Afsaneh and Azizi, Jafar, Analysis of the Demand for Dairy: The application of the NBR model (June 2, 2024). Available at SSRN: https://ssrn.com/abstract=4851510. [CrossRef]

- Keynes, J. M. (1936). The general theory of interest, employment, and money.

- Khalili Araghi, Mansour, Abbasnejad, Hossein, and Goudarzi Farahani, Yazdan (2013). "Estimating the Money Demand Function in Iran Using Error Correction and Correlation Models," Journal of Monetary and Financial Economics (formerly Knowledge and Development), New Period, Vol. 20, No. 5, pp. 1–26.

- Lin, K.-P.; Oh, J.S. Stability of the U.S. Short-Run Money Demand Function, 1959–81. J. Financ. 2012, 39, 1383–1396. [Google Scholar]

- Kumar, Saten, Webber, Don J., and Fargher, Scott (2010), “Money demand stability: A case study of Nigeria," MPRA Paper 26074, University Library of Munich, Germany, pp. 1–28.

- Lee, C.-C.; Chang, C.P. The Demand for Money in China: A Reassessment Using the Bounds Testing Approach. J. Econ. Forecast. 2102, 74–94. [Google Scholar]

- Lungu, M.; et al. Money demand function for Malawi: implications for monetary policy conduct. Banks Bank Syst. 2012, 7, 50–63. [Google Scholar]

- Marshall, A. (1923). Money, credit, and commerce.

- Pedroni, P. Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf Bull Econ Stat 1999, 61, 653–670. [Google Scholar] [CrossRef]

- Singh, P.; Pandey, M.K. Is Long-Run Demand for Money Stable in India? An Application of the Gregory-Hansen Model," the IUP. J. Appl. Econ. 2012, 6, 59–69. [Google Scholar]

- Snowden, Brian (2004). A New Guide to Macroeconomics (Translated by Ali Souri, Mansour Khalili Iraqi), Brothers.

- Tobin, J. The interest-elasticity of transactions demands cash. Rev. Econ. Stat. 1956, 241–247. [Google Scholar] [CrossRef]

- World Bank (2023), “World Development Indicators 2023”. worldbank.org.

- Zara-Nejad, M.; Anvari, E. Estimation of the Hedonic Price Function of Housing in Ahvaz City Using Mixed Data Methods. Q. J. Econ. Res. 2006, 8, 138–168. [Google Scholar]

|

|

|

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).