Introduction

Climate change continues to be a problem that is being discussed in various parts of the world. The hottest issue of concern is carbon emissions. Amid the strengthening climate, global carbon emissions from fossil fuels increased rapidly in 2023 to reach a record high. This increase in carbon emissions was reported by the SAINS Global Carbon Project team in the Earth Systematic Science Data Journal on Tuesday (5/12/2023), right during the 28th Global Climate Negotiations in Dubai, United Arab Emirates.

One of the policies in reducing carbon emissions is by agreeing to the Kyoto Protocol and the Paris Agreement. The impact of the Kyoto Protocol agreement requires companies to recognise, measure, record and disclose corporate carbon emissions (Irwhantoko & Basuki 2016). Then to combat climate change, the Paris Agreement sets a goal to limit global warming below 2 degrees centigrade and even better if it is below 1.5 degrees centigrade, compared to pre-industrial levels (Qingxia & Wang 2023). Pollution due to carbon emissions motivates companies to disclose carbon emissions as a form of their responsibility to the environment.

Carbon emissions disclosure is part of sustainability reporting (Alsaifi et al. 2020). Companies are motivated to disclose their carbon emissions for various reasons, including increased stakeholder awareness and environmental awareness, which put new pressure on them to reduce carbon emissions from their operational activities (Emy, Aryani & Bandi 2023). In addition, the disclosure of carbon emissions is very useful for stakeholders in increasing the value of the company (Cong &Freedman, 2011), if the value of a company is good, it will attract investors to invest because they think the company will be much better in the future (Salvatore, 2005), (Berthelot & Robert, 2011), (Chen et al, 2016). However, there are several reasons why most companies do not disclose carbon emissions. Some of them consider that it is too expensive, not mandatory, and the benefits obtained from disclosing carbon emissions may not be worth the benefits obtained (Trinks et.al 2020), (Yu et.al 2022).

I.Gusti Ketut Agung et.al (2020) stated that profitability shows a positive influence on the disclosure of carbon emissions. Other researchers found that there is a negative relationship between profitability and disclosure of carbon emissions Prado-Lorenzo et.al (2009). Meanwhile Desai & Rajesh (2022) stated that leverage is the main determinant of carbon emission disclosure so that it has a positive relationship while according to Wahyuningrum et.al (2024) found that leverage has a negative influence on carbon emission disclosure. This statement is in line with research conducted by Bazhari et.al (2020), in his review investigating the determinants of voluntary reporting found that although company-specific determinants such as company size, leverage, liquidity and profitability are the most widely studied in previous studies, the results found are still inconclusive. This shows a lack of consistency among various researchers Zahra Borghei (2020). This inconsistency can be caused by several factors that still need attention Bazhair et.al (2022).

In contrast to previous research, this study develops research conducted by Bazhair et. al (2022), although several studies have revealed the determinants of carbon emission disclosure in companies but still not fully disclosed, one of the determinants of carbon emission disclosure is media exposure for this study aims to fill this gap with the intention of revisiting the factors that influence carbon emission disclosure with the main focus of exploring the role of media exposure and disclosure practices using a systematic method approach that has been applied by previous research (Zamil et.al 2021), (Khatib et.al 2021), (Khatib et.al 2022).

From this statement, the research questions in this study are as follows:

What is the role of the use of media expose in the disclosure of carbon emissions for companies?

What is the difference between companies that disclose carbon emissions and those that do not?

What factors influence the effectiveness of carbon emission disclosure?

Literature Review

Stakeholder Theory

This theory discusses how to realise a successful business (Akmalia, 2017). Stakeholder theory is a strategic issue relating to the way companies manage their relationships with stakeholders (Khalid & Kouhy, 2017). This theory is also one of the most used theories as a basis for research related to sustainability reporting (Sener, Varoglu and Anil, 2016; Rudytanto and Siregar, 2018).

Stakeholders expect companies to calculate and report on their carbon emissions because carbon management and reports are used to manage and assess business risks and business opportunities associated with climate change (Lash & Wellingtong 2007). Therefore, by disclosing sustainable reports, companies hope to fulfil stakeholder desires to create strong relationships so that the long-term success of the company is achieved (Cahaya et.al 2017).

Legitimacy Theory

Legitimacy theory is widely used to explain environmental disclosure (Syabilla, Wijayanti and Fahria 2021), this expression supports research (O'Donovan 2002) that this theory is used to explain the disclosure of carbon emissions of a company. This theory is a form of motivation for companies to disclose their environment voluntarily, this shows that the company has tried to ensure that its operations are in accordance with the ethics and standards that exist in its environment (Anggraini, SP, and Handayani, S 2021). Legitimacy theory also says that companies disclose environmental information in response to media pressure and as a way to demonstrate to the public the legitimacy of their operations because the media plays an important role in reputation mechanisms, managers and institutions (Cho & Patten, 2007; Dyck & Zingales, 2003).

Legitimacy helps in the sustainability of the company (Rusmana O, & Purnama 2020). The basis of this theory is that the company will not survive as long as society recognises that the organisation operates based on a value system that is aligned with the value system of the society itself. In short, the company cannot survive if it cannot adjust to the society in which it operates and develop according to the standards that exist in that society (Anggraini, SP, and Handayani, S 2021).

Carbon Emissions Disclosure

Voluntary disclosure theory is the basis for companies in disclosing carbon emission information, this theory explains that companies will voluntarily disclose information if they benefit from the disclosure (Clarkson et.al 2008). Companies with a good environmental track record will be encouraged to publicly disclose their environmental achievements, as a signal to external investors of their concern for the environment. On the other hand, companies with unfavourable environmental profiles, such as high carbon emissions, tend to remain silent (Lee et al., 2023).

Disclosure of carbon emissions also plays a role in reducing information inequality between the company and external stakeholders. Companies disclosing environmental issues can reduce current and future environmental regulatory costs, improve efficiency, and manage operational costs by responding appropriately to environmental issues, which in turn will increase company value (Matsumura et.al 2014). Christi (2015) stated that by disclosing carbon emissions, it can be said that the company has succeeded in realising their concern in overcoming the environmental damage they caused and contributing to environmental sustainability. Companies that disclose carbon emissions will increase their value, this indicates that the disclosure of carbon emissions is the company's effort to legitimise their activities in the eyes of the public (Pratiwi & Sari 2016).

Research Methodology

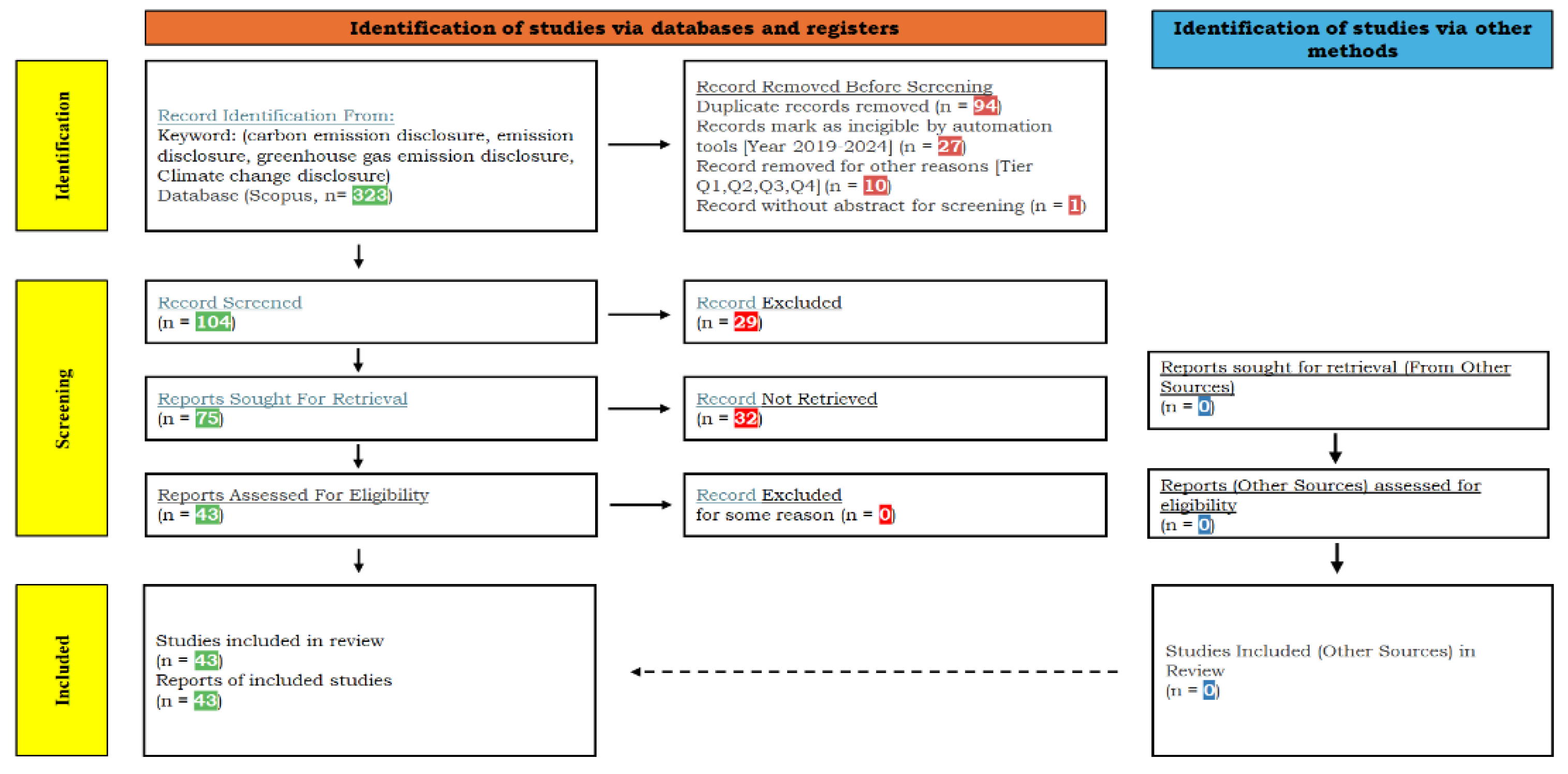

This study conducted a systematic review of the literature related to carbon emissions disclosure using the Systematic Literature Review approach. SLR is an approach tool used to identify, evaluate and interpret all existing and relevant literature related to the research to be studied (Kitchenham, 2007). SLR is a rule-based methodology, to synthesise research findings in a comprehensive, transparent and reproducible manner (Snyder, 2019); (Tsalavoutas et al., 2020).

The research design in this study used the PRISMA model to select and identify eligible articles (Benvenuto, 2023).The initial stage of identifying relevant articles for the topic under study, the researcher selected the scopus database using the Watase-Uake application with the keywords "carbon emission disclosure", "emission disclosure", "greenhouse gas emission disclosure", and "Climate change disclosure".A total of 236 articles obtained from the data set were included in the review if they met all the research criteria as follows:

Second, after the initial screening process left 104 articles for further screening by reading titles, abstracts, and looking at keywords relevant to the topic under study. Of the 104 articles, 29 articles did not pass the screening process because they did not meet the research inclusion criteria, leaving 75 articles. Of the 75 articles selected, 32 articles have been excluded due to limited access to certain data sources, so that the final result is 43 articles that are suitable for the topic and then examined by reading them in full for extraction review. Paul et.al (2021) state that there are at least 40 articles for SLR, if it exceeds 40 then immediately extracting and classifying articles is better than busy looking for articles that have been obtained.PRISMA process carried out can be seen in

Figure 1.

Table 1.

Literature inclusion criteria.

Table 1.

Literature inclusion criteria.

| Criteria |

Inclusion |

| Index |

Scopus |

| Time Period |

2015-2024 |

| Document Type |

Article |

| Language |

English |

Results and Discussion

Carbon Emissions Disclosure Using Media Expose

From a total of 43 articles relevant to the research topic, 5 articles were found to specifically address the media aspect. Despite their limited number, these articles are still used for consideration in this study to provide a broader perspective.

Based on

Table 2. It was found that the role of media exposure in the disclosure of carbon emissions varies, in research (Ulupui et al., 2020; Wahyuningrum et al., 2024) which said that media exposure significantly and positively affects the disclosure of carbon emissions and companies that get media coverage tend to disclose their carbon emissions more widely. In research (Bewley & Li, 2000; Rupley et al., 2012), researchers found that traditional media (newspapers) is a driving factor or for companies to increase their disclosure of environmental information.

In contrast to research (Abdullah et al. 2020) found that media expose is not able to encourage the disclosure agenda in terms of environmental issues, this means that the media is not effective in encouraging information related to carbon emissions. Likewise, research (Chen et al., 2023) found that the higher the online media on the company, the worse the quality of the company's environmental information. The reason is because large companies are not always better than small companies in disclosing their carbon use. Other findings also say there are 500 global companies still unwilling to disclose their carbon emissions (Luo, L et.al 2013). Another reason is because there are differences in online and traditional media, media coverage is more negatively biased and mixed with less good information, causing the public to lack trust so that it is difficult to form public opinion, then it is estimated that media agenda setting is less effective (Chen et al., 2023).

In general, there are differences in research findings regarding the influence of the media on corporate carbon emissions disclosure. Some show a negative impact, where the media is unable to encourage transparency, while others show a positive impact, where the media can motivate companies to disclose carbon emissions information more comprehensively, either due to compliance or awareness of the importance of transparency.

When companies or organisations disclose their carbon emissions, it can affect their image in the eyes of the public. The media often covers information on carbon emissions and climate change mitigation efforts, so transparent disclosure of carbon emissions and efforts to reduce emissions can influence public perception of the company or organisation. In addition, with increasing awareness of environmental issues, the media also tends to pay more attention to companies that are active in managing their carbon emissions.

On the one hand, if companies successfully disclose their efforts to reduce carbon emissions and commit to sustainable business practices, they can improve their image in the eyes of the public. Companies can gain appreciation from consumers, investors, and the general public for their transparency and commitment to environmental issues. However, on the other hand, if carbon emissions disclosure reveals that the company has high levels of emissions and has not made adequate efforts to reduce them, this can have a negative impact. The company may face pressure from the public, environmental activists and regulators. It may also affect the company's brand image and consumer and investor confidence, which may impact the company's financial performance.

Media coverage makes it easier for stakeholders to obtain information about the company's environmental conditions and performance, including its carbon emissions. This allows stakeholders to respond to this information Florecia and Handoko (2021). This phenomenon supports legitimacy theory, companies disclose environmental information in response to media pressure and as an effort to demonstrate the legitimacy of their operations to the public. The media plays an important role in reputation building mechanisms, both for managers and institutions (Cho & Patten, 2007; Dyck & Zingales 2003).

Disclosure of environmental information, including carbon emissions, is a tool for companies to manage public perception and maintain their reputation. The media acts as an intermediary that conveys information from companies to stakeholders, as well as a channel for public pressure on companies regarding their environmental performance.

Carbon Emissions Disclosure for Companies

Based on the results in

Table 3, carbon emissions disclosure tends to have some positive differences compared to companies that do not disclose their carbon emissions. Companies that disclose their carbon emissions tend to have higher stock levels, strong internal controls, good quality financial statements, the company is also said to be successful in complying with existing policies, increasing company value, most importantly, it can address climate change risks which can increase investor interest so that the company can gain the trust of stakeholders. This disclosure can also protect low-carbon investments, reduce risk premiums, and increase transparency and accountability which can be useful for corporate sustainability (Alsaifi et al., 2020; Bilal et al., 2022; Bui et al., 2020; Downar et al., 2021), 2020; Bilal et al., 2022; Bui et al., 2020; Downar et al., 2021; Kim et al., 2021; Kılıç & Kuzey, 2019; H. Lee & Lee, 2022; J. Lee et al., 2023; Liu et al., 2023; Lu et al., 2021; Palea & Drogo, 2020; Perera et al., 2023; Tan et al., 2020).

This statement supports the theory of voluntary disclosure which states that companies will voluntarily disclose information if they benefit from the disclosure (Clarkson et.al 2008). The results of the study are also supported by (Matsumura et.al 2014) which reveals that companies that disclose environmental issues can reduce current and future environmental regulatory costs, improve efficiency, and manage operational costs by responding appropriately to environmental issues, which in turn will increase company value.

Meanwh ile, companies that do not disclose their carbon emissions have the opposite characteristics to companies that do disclose their carbon emissions. Companies that do not disclose carbon emissions tend to have lower financial statement quality, less effective risk management, experience reputational risk, potential regulation and lost business opportunities (Bingler et al., 2024; Kılıç & Kuzey, 2019; J. Lee et al., 2023; Palea & Drogo, 2020; Saha et al., 2021). Companies consider that the disclosure of carbon emissions is not very important, the reason is that the company is already at a high level of PROFER so it is not interested in attracting stakeholder attention (Ulupui et al., 2020) companies are also more focused on financial performance and profitability than the environment (Alsaifi et al., 2020; Bilal et al., 2022; Lu et al., 2021), with the actions of companies that do not disclose their carbon emissions companies can lose stakeholder confidence and have failed to comply with existing policies (Downar et al., 2021).

This result is in accordance with the statement (J. Lee et al., 2023), he stated that companies that have an unfavourable environmental profile such as high carbon emissions, tend to choose not to disclose environmental information voluntarily. This happens because companies with poor performance may tend to feel that the legitimacy of their operations is threatened. Disclosing negative information about carbon emissions or other environmental aspects can jeopardise the company's reputation and trigger negative reactions from stakeholders. To protect their legitimacy, companies with a poor environmental profile will try to hide or limit the disclosure of negative information. They tend to choose silence or only disclose the minimum information possible.

Companies that disclose carbon emission information can signal that the company is responsible and transparent which can improve the company's reputation and attract investors (Eunsoo et.al 2021). Companies that disclose carbon have better financial statement quality, which is reflected in conservative earnings management (Bilal et.al 2022). However, several factors also determine the company's disclosure of carbon emissions, such as the type of industry. The more intensive the company produces carbon emissions, the greater their efforts in publishing carbon emission disclosures. Companies that are not intensive in producing carbon emissions only disclose some carbon emission disclosure items.

Key Factors Affecting the Effectiveness of Carbon Emissions Disclosure

Based on

Table 4 above the findings that have been mentioned, there are several factors that affect the disclosure of carbon emissions by companies, it can be seen that the most dominant or frequently mentioned factors are:

Pressure from various stakeholders, such as investors, regulators, communities and non-governmental organisations, is also a dominant factor supporting organisations to disclose their carbon emissions information. Companies tend to respond to this pressure to maintain their legitimacy and reputation. As awareness of climate change increases, stakeholders are increasingly demanding transparent and tangible efforts to curb carbon emissions (Kumarasiri J, 2017), this statement is in line with (Lash & Wellingtong 2007) that stakeholders expect companies to report their emissions due to carbon management and such reports are used to manage and assess business risks and business opportunities associated with climate change. Carbon information disclosure can be explained as a response to concerns and pressures from stakeholders, Roberts, R. W. (1992). If the company is unable to fulfil the wishes of stakeholders regarding carbon performance, the company risks being rejected, causing the company's share price to fall and ultimately impacting the company's valuation Shen Huayu et.al (2020).

- 2.

Corporate Governance

Corporate governance factors are often associated with carbon emissions disclosure. Several aspects of governance such as board structure, institutional ownership, and executive characteristics are considered to have a significant influence on the company's decision to disclose information related to carbon emissions. These results are in line with the results by research (Karim et al., 2021) found that there is a significant positive relationship between internal corporate governance and carbon emissions disclosure. This suggests that good corporate governance is a key factor that can increase the level of disclosure of carbon emissions. Other findings also suggest that strong internal governance can strengthen the relationship between corporate capital expenditure and carbon emissions disclosure (Datt et al., 2022; Downar et al., 2021; Garzón-Jiménez & Zorio-Grima, 2021; Gonenc & Krasnikova, 2022; Karim et al, 2021; Kılıç & Kuzey, 2019; J. Lee, 2022; J. Lee et al., 2021; N. Li et al., 2021; P. Li et al., 2023; Linares-Rodríguez et al., 2022; Park et al., 2023; Tan et al., 2020; Ulupui et al., 2020). Strong corporate governance, with clear policies and procedures related to carbon emissions disclosure, can ensure that disclosures are consistent and of high quality, and support effective mitigation actions.

- 3.

Company Characteristics

Company characteristics such as size, industry sector, carbon emissions intensity, ownership structure, and institutional environment are also often mentioned as factors that influence carbon emissions disclosure. Companies with certain characteristics may be more inclined or less attentive in their disclosure of carbon emissions information. Choi et.al (2013) argue, businesses in sectors that produce a lot of carbon emissions such as transportation, materials, energy, and utilities, have a higher level of voluntary disclosure of carbon emissions. Meanwhile, research by Azaria and Achyani (2015) states that company size affects how much information is disclosed in the company's annual report. The larger the size of a company, the more visible its operational activities and its contribution to the environment. Certain parties can use this to emphasise the company to pay more attention to environmental issues Cahya B.T (2017).

Conclusions

Based on the research results presented, it can be concluded that the role of the media in encouraging disclosure of corporate carbon emissions information is still diverse and inconsistent. Some studies show that the media can positively encourage disclosure of carbon emissions, but others show that the media is not effective in encouraging transparency on environmental issues. The reporting of carbon emissions by companies will have an impact on their image in the eyes of the public. Transparent disclosures that demonstrate climate change mitigation efforts can enhance a company's reputation, whereas high emissions disclosures can lower its image and stakeholder trust.

Legitimacy theory explains that companies disclose environmental information, including carbon emissions, as an effort to gain legitimacy and maintain their reputation in the eyes of the public. For future research, further studies need to be conducted on other factors, apart from the media, that can encourage voluntary disclosure of carbon emissions by companies. In addition, future research could explore more deeply the company's strategy in managing image and reputation through disclosure of carbon emissions information, as well as conduct a comparative analysis between the effectiveness of traditional media and online media in encouraging transparency of corporate environmental information.

The results also show a significant difference between companies that disclose carbon emissions and those that do not. Companies that disclose carbon emissions tend to have several advantages, such as higher stock levels, strong internal controls, good quality financial statements, and success in complying with existing policies. These disclosures can also protect low-carbon investments, reduce risk premiums, and increase transparency and accountability that are useful for corporate sustainability.

On the other hand, companies that do not disclose carbon emissions have the opposite characteristics, such as lower financial statement quality, less effective risk management, and face reputational risk, potential regulation, and lost business opportunities. Companies tend to consider carbon emissions disclosure as less important because they are already at a high level of profitability, so they are not interested in attracting stakeholder attention. This statement is consistent with legitimacy theory, where companies with poor environmental profiles choose not to disclose negative information in order to protect the legitimacy of their operations. Future research needs to further explore other factors that may support companies to disclose information related to carbon emissions, in addition to the benefits received by companies. Analyse the effectiveness of various mechanisms and incentives that can encourage corporate transparency and accountability in disclosing carbon emissions. As well as further research on company strategies in managing reputation and legitimacy through disclosure of environmental information.

The third research result that has been presented, concluded that there are several main factors that influence the disclosure of carbon emissions information by companies, including, Pressure from various stakeholders, such as investors, regulators, communities, and non-governmental organisations, is the dominant factor that continues to support companies to disclose brand carbon emissions. Companies tend to respond to this pressure to maintain their legitimacy and reputation in the eyes of the public. As awareness of climate change increases, stakeholders increasingly demand transparency and tangible efforts to control carbon emissions. Second, corporate governance, such as board structure, institutional ownership, and executive characteristics, are also considered to have a positive influence on companies' decisions to disclose information related to carbon emissions. Strong governance can strengthen the link between various corporate initiatives and the level of quality carbon emissions disclosure. Third, firm characteristics, such as size, industry sector, carbon emissions intensity, ownership structure, and institutional environment, are also frequently mentioned as determinants of carbon emissions disclosure. Companies with certain characteristics tend to be more or less active in disclosing their carbon emissions information. Overall, the results show that stakeholder pressure, good corporate governance, as well as the unique characteristics of each company may also be factors that influence companies' voluntary disclosure of carbon emissions information.

Recommendations and Limitations

This research is far from perfect, this research is still in a small scope, due to the limitations of researchers, the data used is only open access only, the research conducted also only raises media expose and carbon emission disclosure factors, it is recommended for future research to use a broad scope, other factors that can affect carbon emission disclosure also still need to be explored further such as audit, or ownership and there is no evidence that reveals that less disclosed information means the quality of reporting is lace. future researchers can take these recommendations.

Author Contributions

Writing – original draft, S.S; Methodology, G.T.P; Writing – review and editing, Mediaty and G.T.P.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare that there is no conflict of interest.

References

- Akmalia, N. (2017). Pengaruh Stakeholders Power, Ukuran Perusahaan, Kinerja Lingkungan dan Exposure Media Terhadap Pengungkapan Lingkungan (Studi Empiris Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia Tahun 2013-2015). [CrossRef]

- Alsaifi, K., Elnahass, M., & Salama, A. (2020). Carbon disclosure and financial performance: UK environmental policy. Business Strategy and the Environment, 29(2), 711-726.

- Anggraini, S. P., & Handayani, S. (2021). Pengaruh Tekanan Stakeholders, Sertifikasi ISO 14001, Protabilitas dan Leverage Terhadap Pengungngkapan Emisi Karbon. JIKEM: Jurnal Ilmu Komputer, Ekonomi dan Manajemen, 1(1), 153-168.

- Azaria, A& Achyani, F. (2015). Faktor-Faktor yang Mempengaruhi Tingkat Keluasan Pengungkapan Informasi Dalam Laporan Tahunan. Prosiding: Menakar Masa Depan Profesi Memasuki MEA 2015 Menuju Era Crypto Economic. Universitas Muhammadiyah Surakarta.Surakarta.

- Bazhair, A. H., Khatib, S. F., & Al Amosh, H. (2022). Taking stock of carbon disclosure research while looking to the future: A systematic literature review. Sustainability, 14(20), 13475.

- Benvenuto, M., Aufiero, C., dan Viola, C. 2023. A Systematic Literature Review on the Determinants of Sustainability Reporting Systems. Heliyon 9 (2023) e14893.

- Berthelot, S., & Robert, A.-M. (2011). Climate Change Disclosures: An Examination of Canadian Oil and Gas Firms. Issues In Social And Environmental Accounting, 5(2), 106.

- Bewley, K., & Li, Y. (2000). Disclosure of environmental information by Canadian manufacturing companies: A voluntary disclosure perspective. Advances in Environmental Accounting and Management, 1, 201–226.

- Borghei, Z. (2021). Carbon disclosure: A systematic literature review. Accounting & Finance, 61(4), 5255-5280.

- Borghei, Z., Leung, P., & Guthrie, J. (2018). Voluntary greenhouse gas emission disclosure impacts on accounting-based performance: Australian evidence. Australasian journal of environmental management, 25(3), 321-338.

- Brereton, P., Kitchenham, B. A., Budgen, D., Turner, M., & Khalil, M. (2007). Lessons from applying the systematic literature review process within the software engineering domain. Journal of systems and software, 80(4), 571-583.

- Cahaya, F. R., Porter, S. A., Tower, G., & Brown, A. (2017). Coercive Pressures on Occupational Health and Safety Disclosures. Journal of Accounting in Emerging Economies, 7(3), 318–336. [CrossRef]

- Cahya, B. T. (2017). Relevansi carbon emission disclosure dan karakteristik perusahaan pada perusahaan yang terdaftar di Jakarta Islamic Index. Jurnal Ekonomi & Keuangan Islam, 73-80.

- Chen, H., Fang, X., Xiang, E., Ji, X., & An, M. (2023). Do online media and investor attention affect corporate environmental information disclosure? Evidence from Chinese listed companies. International Review of Economics & Finance, 86, 1022-1040.

- Cho, C. H., & Patten, D. M. (2007). The role of environmental disclosures as tools of legitimacy: A research note. Accounting, organizations and society, 32(7-8), 639-647.

- Choi, B. B., Lee, D., & Psaros, J. (2013). An analysis of Australian company carbon emission disclosures. Pacific Accounting Review, 25(1), 58-79.

- Christi, B. U. (2015). Profitabilitas, Leverage, Ukuran Perusahaan, Sertifikasi ISO 14001, dan Pengungkapan Emisi Karbon (Studi Empiris pada Perusahaan yang Mengungkapan Sustainability Report dan terdaftar di BEI pada tahun 2015-2017).

- Clarkson, P. M., Li, Y., Richardson, G. D., & Vasvari, F. P. (2008). Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Accounting, organizations and society, 33(4-5), 303-327.

- Cong, Y., & Freedman, M. (2011). Corporate governance and environmental performance and disclosures. Advances in Accounting, 27(2), 223-232. Desai, R. (2022). Determinants of corporate carbon disclosure: A step towards sustainability reporting. Borsa Istanbul Review, 22(5), 886-896.

- Ding, J., Lu, Z., & Yu, C. H. (2022). Environmental information disclosure and firms’ green innovation: Evidence from China. International Review of Economics & Finance, 81, 147-159.

- Dyck, A., & Zingales, L. (2002). The corporate governance role of the media.

- Färe, R., Grosskopf, S., & Tyteca, D. (1996). An activity analysis model of the environmental performance of firms—application to fossil-fuel-fired electric utilities. Ecological economics, 18(2), 161-175.

- Florencia, V., & Handoko, J. (2021). Uji pengaruh profitabilitas, leverage, media exposure terhadap pengungkapan emisi karbon dengan pemoderasi. Jurnal Riset Akuntansi dan Keuangan Vol, 9(3).

- Freedman, M., & Jaggi, B. (2005). Global warming, commitment to the Kyoto protocol, and accounting disclosures by the largest global public firms from polluting industries. The International Journal of Accounting, 40(3), 215-232.

- Gerged, A. M., Beddewela, E., & Cowton, C. J. (2021). Is corporate environmental disclosure associated with firm value? A multicountry study of Gulf Cooperation Council firms. Business Strategy and the Environment, 30(1), 185-203.

- Giannarakis, G., Andronikidis, A., & Sariannidis, N. (2020). Determinants of environmental disclosure: investigating new and conventional corporate governance characteristics. Annals of Operations Research, 294(1), 87-105.

- Irwhantoko, I., dan B. Basuki. 2016. Carbon Emission Disclosure: Studi pada Perusahaan Manufaktur Indonesia. Jurnal Akuntansi Dan Keuangan, 18(2), 92–104.

- Jaggi, B., Allini, A., Macchioni, R., & Zagaria, C. (2017). The factors motivating voluntary disclosure of carbon information: Evidence based on Italian listed companies. Organization & Environment, 31(2), 178–202.

- Khalid, T. B., & Kouhy, R. (2017). The Impact of National Contextual Factors on Corporate Social and Environmental Disclosure (CSED): The Perceptions of Jordanian Stakeholder. Search.Proquest.Com, i, 556–578.

- Khatib, S. F., Abdullah, D. F., Elamer, A., & Hazaea, S. A. (2022). The development of corporate governance literature in Malaysia: A systematic literature review and research agenda. Corporate Governance: The International Journal of Business in Society, 22(5), 1026-1053.

- Khatib, S. F., Abdullah, D. F., Elamer, A., Yahaya, I. S., & Owusu, A. (2023). Global trends in board diversity research: A bibliometric view. Meditari Accountancy Research, 31(2), 441-469.

- Kumarasiri, J. Tekanan pemangku kepentingan terhadap emisi karbon: Strategi dan penggunaan akuntansi manajemen. Australia J. Lingkungan. Kelola. 2017 , 24 , 339–354.

- Lash, J. and Wellington, F. 2007. ”Competitive advantage on a warmingplanet.”Harvard Business Review, Vol. 85, No. 3, pp. 94-102.

- Luo, L., Tang, Q., & Lan, Y. C. (2013). Comparison of propensity for carbon disclosure between developing and developed countries: A resource constraint perspective. Accounting Research Journal, 26(1), 6-34.

- Matsumura, E. M., Prakash, R., & Vera-Munoz, S. C. (2014). Firm-value effects of carbon emissions and carbon disclosures. The accounting review, 89(2), 695-724.

- Nursulistyo, E. D., Aryani, Y. A., & Bandi, B. (2023). The Disclosure of Carbon Emission in Indonesia: A Systematic Literature Review. Jurnal Dinamika Akuntansi dan Bisnis, 10(1), 1-18.

- O’Donovan, G. 2002. Environmental Disclosures in the Annual Report: Extending the Applicability and Predictive Power of Legitimacy Theory. Accounting, Auditing and Accountability Journal 15(3): pp. 344 – 371.

- Paul, J., Lim, W. M., O’Cass, A., Hao, A. W., & Bresciani, S. (2021). Scientific procedures and rationales for systematic literature reviews (SPAR-4-SLR). International Journal of Consumer Studies, 45(4), O1-O16.

- Prado-Lorenzo, J. M., Rodríguez-Domínguez, L., Gallego-Álvarez, I., & García-Sánchez, I. M. (2009). Factors influencing the disclosure of greenhouse gas emissions in companies world-wide. Management Decision, 47(7), 1133-1157.

- Pratiwi, P. C., & Sari, V. F. (2016). Pengaruh Tipe Industri , Media Exposure Dan Profitabilitas Terhadap Carbon Emission Disclosure. Jurnal WRA, 4(2), 829–844.

- Roberts, R. W. (1992). Determinants of corporate social responsibility disclosure: An application of stakeholder theory. Accounting, organizations and society, 17(6), 595-612.

- Rudyanto, A., & Siregar, S. V. (2018). The effect of stakeholder pressure and corporate governance on the quality of sustainability report International Journal of Ethics and Systems Article information : Internasional Journal of Ethics and Systems, 34(2), 233–249. [CrossRef]

- Rupley, K. H., Brown, D., & Marshall, R. S. (2012). Governance, media and the quality of environmental disclosure. Journal of Accounting and Public Policy, 31(6), 610–640.

- Rusmana, O., & Purnaman, S. M. N. (2020). Pengaruh pengungkapan emisi karbon dan kinerja lingkungan terhadap nilai perusahaan. Jurnal Ekonomi, Bisnis, Dan Akuntansi, 22(1), 42-52.

- Şener, İ., Varoğlu, A., & Anıl, A. (2016). Sustainability Reports Disclosures : Who are the Most Salient Stakeholders ?, 235, 84–92. [CrossRef]

- Shen, H., Zheng, S., Adams, J., & Jaggi, B. (2020). The effect stakeholders have on voluntary carbon disclosure within Chinese business organizations. Carbon Management, 11(5), 455-472.

- Snyder, H. (2019). Literature review as a research methodology: An overview and guidelines. Journal of business research, 104, 333-339.

- Syabilla, D., Wijayanti, A., & Fahria, R. (2021). Pengaruh investasi hijau dan keragaman dewan direksi terhadap pengungkapan emisi karbon. Konferensi Riset Nasional Ekonomi Manajemen Dan Akuntansi, 2(1), 1171-1186.

- Trinks, A., Mulder, M., & Scholtens, B. (2020). An efficiency perspective on carbon emissions and financial performance. Ecological Economics, 175, 106632.

- Tsalavoutas, I., Tsoligkas, F., & Evans, L. (2020). Compliance with IFRS mandatory disclosure requirements: a structured literature review. Journal of International Accounting, Auditing and Taxation, 40, 100338.

- ULUPUI, I. Gusti Ketut Agung, et al. Carbon Emission Disclosure, Media Exposure, Environmental Performance, Characteristics of Companies: Evidence from Non Fincancial Sectors in Indonesia. 2020.

- Wahyuningrum, I. F. S., Ihlashul’amal, M., Utami, S., Djajadikerta, H. G., & Sriningsih, S. (2024). Determinants of carbon emission disclosure and the moderating role of environmental performance. Cogent Business & Management, 11(1), 2300518.

- Wang, J., Song, L., & Yao, S. (2013). The determinants of corporate social responsibility disclosure: Evidence from China. Journal of Applied Business Research, 29(6), 1833.

- Wang, Q. (2023). Financial effects of carbon risk and carbon disclosure: A review. Accounting & Finance, 63(4), 4175-4219.

- Zamil, I. A., Ramakrishnan, S., Jamal, N. M., Hatif, M. A., & Khatib, S. F. (2023). Drivers of corporate voluntary disclosure: a systematic review. Journal of Financial Reporting and Accounting, 21(2), 232-267.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).