Submitted:

26 June 2024

Posted:

27 June 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Problem Statement

3. Research Objective

4. Literature Review

4.1. Human Capital Disclosure (HCD) Theoretical Perspective

4.2. Sustainability Reporting

4.3. HCD in Sustainability Reporting

4.4. Classification of HC-Based Sustainability Information

5. Research Method

6. Results

7. Discussion

8. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abeysekera, I. A framework for sustainability reporting. Sus. Account. Manag. Pol. J. 2022, 13, 1386–1409. [Google Scholar] [CrossRef]

- Abdolmohammadi, M.J. Intellectual capital disclosure and market capitalization. J. Intell. Cap. 2005, 6, 397–416. [Google Scholar] [CrossRef]

- Afolabi, H.; Ram, R.; Rimmel, G. Influence and behaviour of the new standard setters in the sustainability reporting arena: implications for the Global Reporting Initiative’s current position. Sus. Account. Manag. Pol. J. 2023, 14, 743–775. [Google Scholar] [CrossRef]

- Alfraih, M.M. (2018). Intellectual capital reporting and its relation to market and financial performance. Int. J. Eth. Sys. 2023, 34, 266–281. [Google Scholar] [CrossRef]

- Ali, I.; Fukofuka, P.T.; Narayan, A.K. Critical reflections on sustainability reporting standard setting. Sus. Account. Manag. Pol. J. 2023, 14, 776–791. [Google Scholar] [CrossRef]

- Alvarez, A. Corporate response to human resource disclosure recommendations. Soc. Resp. J. 2015, 11, 306–323. [Google Scholar] [CrossRef]

- Bananuka, J.; Tauringana, V.; Tumwebaze, Z. Intellectual capital and sustainability reporting practices in Uganda. J. Intell. Cap. 2023, 24, 487–508. [Google Scholar] [CrossRef]

- Cinquini, L.; Passetti, E.; Tenucci, A.; Frey, M. Analyzing intellectual capital information in sustainability reports: some empirical evidence. J. Intell. Cap. 2012, 13, 531–561. [Google Scholar] [CrossRef]

- Confetto, M.G.; Covucci, C. A taxonomy of sustainability topics: a guide to set the corporate sustainability content on the web. The TQM J. 2021, 33, 106–130. [Google Scholar] [CrossRef]

- Di Vaio, A.; Palladino, R.; Hassan, R.; Alvino, F. Human resources disclosure in the EU Directive 2014/95/EU perspective: A systematic literature review. J. Clean. Produ. 2020, 257, 120509. [Google Scholar] [CrossRef]

- Ehnert, I.; Parsa, S.; Roper, I.; Wagner, M.; Muller-Camen, M. Reporting on sustainability and HRM: A comparative study of sustainability reporting practices by the world's largest companies. The Int. J. HRM., 2016, 27, 88–108. [Google Scholar] [CrossRef]

- Farneti, F.; Casonato, F.; Montecalvo, M.; de Villiers, C. The influence of integrated reporting and stakeholder information needs on the disclosure of social information in a state-owned enterprise. Meditari Account. Res. 2019, 27, 556–579. [Google Scholar] [CrossRef]

- Frangieh, G.C.; Yaacoub, H.K. Socially responsible human resource practices: disclosures of the world’s best multinational workplaces. Soc. Responsib. J. 2019, 15, 277–295. [Google Scholar] [CrossRef]

- Gamerschlag, R. Value relevance of human capital information. J. Intell. Cap. 2013, 14, 325–345. [Google Scholar] [CrossRef]

- Grassmann, M.; Fuhrmann, S.; Guenther, T.W. Drivers of the disclosed “connectivity of the capitals”: evidence from integrated reports. Sus. Account. Manag. Pol. J. 2019, 10 877‐908.

- Lajili, K. Human capital disclosure and the contingency view. Pers. Rev. 2022, Vol. ahead-of-print No. ahead-of-print.

- Lim, H.J.; Mali, D. A comparative analysis of human capital information opaqueness in South Korea and the UK. J. Intell. Cap. 2022, 23, 1296–1327. [Google Scholar] [CrossRef]

- La Torre, M.; Valentinetti, D.; Dumay, J.; Rea, M.A. Improving corporate disclosure through XBRL: An evidence-based taxonomy structure for integrated reporting. J. Intell. Cap. 2018, 19, 338–366. [Google Scholar] [CrossRef]

- León, R.; Salesa, A. Is sustainability reporting disclosing what is relevant? Assessing materiality accuracy in the Spanish telecommunication industry. Environ. Dev. Sus. 2023, 1–28. [Google Scholar]

- Lueg, R. Constructs for assessing integrated reports—Testing the predictive validity of a taxonomy for organisation size, industry, and performance. Sus. 2022, 14, 7206. [Google Scholar]

- Lueg, K.; Lueg, R. Deconstructing corporate sustainability narratives: A taxonomy for critical assessment of integrated reporting types. Corp. Soc. Resp. Env. Manag. 2021, 28, 1785–1800. [Google Scholar] [CrossRef]

- Maione, G. An energy company's journey toward standardized sustainability reporting: addressing governance challenges. Transf. Govt. Ppl, Proc. Pol 2023, Vol. ahead‐of‐print No. ahead‐of‐print.

- Mariappanadar, S.; Kairouz, A. Influence of human resource capital information disclosure on investors’ share investment intentions: An Australian study. Pers. Rev. 2017, 46, 551–571. [Google Scholar] [CrossRef]

- Marzo, G. The market-to-book value gap and the accounting fallacy. J. Intell. Cap. 2013, 14, 564–581. [Google Scholar] [CrossRef]

- Martikainen, M.; Kinnunen, J.; Miihkinen, A.; Troberg, P. Board’s financial incentives, competence, and firm risk disclosure: Evidence from Finnish index listed companies. J. Appl. Account. Res. 2015, 16, 333–358. [Google Scholar] [CrossRef]

- Martikainen, M.; Miihkinen, A.; Watson, L. Board characteristics and negative disclosure tone. J. Account. Lit. 2023, 45, 100–129. [Google Scholar] [CrossRef]

- Massaro, M.; Dumay, J.; Garlatti, A.; Dal Mas, F. Practitioners’ views on intellectual capital and sustainability: From a performance-based to a worth-based perspective. J. Intell. Cap. 2018, 19, 367–386. [Google Scholar] [CrossRef]

- Moneva, J.J.; Scarpellini, S.; Aranda-Usón, A.; Etxeberria, I.A. Sustainability reporting in view of the European sustainable finance taxonomy: Is the financial sector ready to disclose circular economy? Corp. Soc. Resp. Env. Manag. 2022, 30, 1336–1347. [Google Scholar] [CrossRef]

- Mori Junior, R.; Best, P. GRI G4 content index: Does it improve credibility and change the expectation-performance gap of GRI-assured sustainability reports? Sus. Account. Manag. Pol. J. 2017, 8, 571–594. [Google Scholar] [CrossRef]

- Ngu, S.B.; Amran, A. The impact of sustainable board capital on sustainability reporting. Strat. Dir. 2019, 35, 8–11. [Google Scholar] [CrossRef]

- Nicholson, G.J.; Kiel, G.C. Breakthrough board performance: how to harness your board’s intellectual capital. Corp. Gov. 2004, 4, 5–23. [Google Scholar] [CrossRef]

- Nkundabanyanga, S.K.; Balunywa, W.; Tauringana, V.; Ntayi, J.M. Board role performance in service organisations: the importance of human capital in the context of a developing country. Soc. Resp. J. 2014, 10, 646–673. [Google Scholar] [CrossRef]

- Oliveira, L.; Lima Rodrigues, L.; Craig, R. Intellectual capital reporting in sustainability reports. J. Intell. Cap. 2010, 11, 575–594. [Google Scholar] [CrossRef]

- Pandit, G. M. First look at the human capital disclosures on Form 10-K. Analyzing the SEC mandate and comparing it to SASB and EU standards. CPA J. 2021, 52. [Google Scholar]

- Pedrini, M. Human capital convergences in intellectual capital and sustainability reports. J. Intell. Cap. 2007, 8, 346–366. [Google Scholar] [CrossRef]

- Perera-Aldama, L. GRI and materiality: discussions and challenges. Sus. Account. Manag. Pol. J. 2023. 14, 884–903. [CrossRef]

- Petcharat, N.; Zaman, M. Sustainability reporting and integrated reporting perspectives of Thai-listed companies. J. Fin. Rep. Account. 2019, 17, 671–694. [Google Scholar] [CrossRef]

- Pigatto, G.; Cinquini, L.; Tenucci, A.; Dumay, J. Disclosing value creation in integrated reports according to the six capitals: a holistic approach for a holistic instrument. Sus. Account. Manag. Pol. J. 2023, 2023. 14, 90–123. [Google Scholar] [CrossRef]

- Pizzi, S.; Principale, S.; de Nuccio, E. Material sustainability information and reporting standards. Exploring the differences between GRI and SASB. Meditari Account. Res. 2022, Vol. ahead-of-print No. ahead-of-print.

- Posadas, S.C.; Tarquinio, L. Assessing the effects of Directive 2014/95/EU on nonfinancial information reporting: Evidence from Italian and Spanish listed companies. Adm. Sci. 2021, 11, 89. [Google Scholar] [CrossRef]

- Raar, J. Reported social and environmental taxonomies: a longer-term glimpse. Manag. Audit. J. 2007, 22 840-860.

- Raimo, N.; Ricciardelli, A.; Rubino, M.; Vitolla, F. Factors affecting human capital disclosure in an integrated reporting perspective. Meas. Bus. Excell. 2020, 24, 575–592. [Google Scholar] [CrossRef]

- Ramona, Z.; Askarany. D. Sustainability reporting and organisational factors. J. Risk Financ. Manag. 2023, 16, 163–1‐18. [Google Scholar]

- Rowbottom, N. Orchestration and consolidation in corporate sustainability reporting. The legacy of the Corporate Reporting Dialogue. Account. Audit. Account. J. 2023, 36, 885–912. [Google Scholar] [CrossRef]

- Saha, R.; Maji, S.G. Board human capital diversity and firm performance: evidence from top listed Indian firms. JIBR. 2022, 14, 382–402. [Google Scholar] [CrossRef]

- Salvi, A.; Raimo, N.; Petruzzella, F.; Vitolla, F. The financial consequences of human capital disclosure as part of integrated reporting. J. Intell. Cap. 2022, 23, 1221–1245. [Google Scholar] [CrossRef]

- Sujatha, R.; Bandaru, R.; Rao, R. Taxonomy construction techniques–issues and challenges. IJCSE. 2011, 2, 661–671. [Google Scholar]

- Sürdü, F.B.; Çalışkan, A.Ö.; Esen, E. Human resource disclosures in corporate annual reports of insurance companies: A case of developing country. Sus. 2020, 12, 1–20. [Google Scholar]

- Tejedo-Romero, F.; Araujo, J.F.F.E. The influence of corporate governance characteristics on human capital disclosure: the moderating role of managerial ownership. J. Intell. Cap. 2022, 23, 342–374. [Google Scholar] [CrossRef]

- Terblanche, W.; De Villiers, C. The influence of integrated reporting and internationalisation on intellectual capital disclosures. J. Intell. Cap. 2019, 20, 40–59. [Google Scholar] [CrossRef]

- Valenti, A.; Horner, S.V. Leveraging board talent for innovation strategy. J. Bus. Strat. 2020, 41, 11–18. [Google Scholar] [CrossRef]

- Van der Zahn, J.L.W.M. Sustainability reporting regime transition and the impact on intellectual capital reporting. J. Appl. Account. Res. 2023, 24, 544–582. [Google Scholar] [CrossRef]

- Zaid, M.A.A.; Issa, A. A roadmap for triggering the convergence of global ESG disclosure standards: lessons from the IFRS foundation and stakeholder engagement. Corp. Gov 2023, Vol. ahead‐of‐print No. ahead‐of‐print.

| GRI No. | Human capital metrics and people-related information | Linked HCD Codes | |

|---|---|---|---|

| BHCD | EHCD | ||

| 102-7 | Total number of employees based on business operations. | N/A | EHCD-1 |

| 102-8 | Total of employees per employment contract type, gender, geographic location and fulltime employees perform a significant portion of activities. | N/A | EHCD-2 |

| 102-16 | Regular training provided to the board members and employees on values, principles, standards, and norms of behaviour. | BHCD-3 | EHCD-3 |

| 102-17 | Communication and training provided to employees regarding ethics. | N/A | EHCD-4 |

| 102-18 | Structuring of the board and related committees, and roles are allocated for decision-making on ESG. | BHCD-5 | N/A |

| 102-19 | Delegation of authority for ESG topics from the board to senior executives and other employees. | BHCD-6 | N/A |

| 102-20 | Appointment of the executive team members to perform the ESG roles. | BHCD-7 | N/A |

| 102-21 | Board stakeholder consultation on ESG matters. | BHCD-8 | N/A |

| 102-22 | Structuring of the board and related committees in respect of gender independence, tenure, other commitments, ESG competencies. | BHCD-9 | N/A |

| 102-23 | Role of the chairperson of the board and distinction of whether he / she functions within the organisation. | BHCD-10 | N/A |

| 102-24 | Selection process and criteria for the appointment of the board and its committees, diversity consideration, independence ESG expertise. | BHCD-11 | N/A |

| 102-25 | Board responsibility regarding conflicts of interest and measures for employees to consider. | BHCD-12 | EHCD-12 |

| 102-26 | Board and executive leadership responsibility in developing, approving, and updating the strategic direction, and goals related to ESG. | BHCD-13 | N/A |

| 102-27 | Measures taken to develop and enhance the board’s collective knowledge of ESG. | BHCD-14 | N/A |

| 102-28 | Board’s performance evaluation processes in respect of ESG and actions in response of the feedback. | BHCD-15 | N/A |

| 102-29 | Board’s role in identifying and managing ESG material impacts, risks and opportunities, and if there are stakeholder consultation processes on these issues. | BHCD-16 | N/A |

| 102-30 | Board’s role in reviewing the effectiveness of the organisation’s risk management processes for ESG. | BHCD-17 | N/A |

| 102-31 | Frequency of the board engaging on the review of ESG matters and their impacts, risks, and opportunities. | BHCD-18 | N/A |

| 102-32 | Review and approval of sustainability report by the appropriate committees ensuring that ESG material topics are covered. | BHCD-19 | N/A |

| 102-33 | Communication process regarding critical concerns to the board. | BHCD-20 | EHCD-20 |

| 102-35 | Remuneration policies for the board and senior executives in terms of fixed pay and variable pay criteria for achieving the ESG. | BHCD-21 | N/A |

| 102-36 | Consultative processes in determining remuneration. | BHCD-22 | N/A |

| 102-37 | Stakeholder engagement on determining remuneration as well as voting procedures regarding the remuneration policies and proposals. | BHCD-23 | EHCD-23 |

| 102-38 | Ratio of the annual total compensation for the organisation’s employees. | N/A | EHCD-24 |

| 102-39 | Ratio of the % increase in annual total compensation for the organisation’s employees. | N/A | EHCD-25 |

| 102-40 | A list of stakeholder groups including employees and trade unions engaged by the organisation. | N/A | EHCD-26 |

| 102-41 | % of total employees covered by collective the bargaining agreements. | N/A | EHCD-27 |

| 102-42 | The basis for identifying and selecting stakeholders such as trade unions engaged by the organisation. | BHCD-28 | EHCD-28 |

| 102-43 | Stakeholder engagement approach specifically with the trade union, including frequency of engagement. | BHCD-29 | N/A |

| 102-44 | Employee-related issues, concerns raised through stakeholder engagement with the trade union. | N/A | EHCD-30 |

| 103-2 | The total number of employee grievances, the number of grievances that were addressed (or reviewed) and resolved during the reporting period. | N/A | EHCD-31 |

| 201-1 | Direct economic value generated and distributed (EVG&D) in terms of employee wages and benefits. | N/A | EHCD 32 |

| 201-3 | Defined benefit plan, liabilities and how these are met, and the estimated value of those liabilities. Pension contributions and employee participation. | BHCD-33 | EHCD-33 |

| 202-1 | Relevant ratio of the entry level wage by gender at significant locations of operation to the minimum wage. | N/A | EHCD-34 |

| 202-2 | Appointment of senior management from the local community. | BHCD-35 | N/A |

| 205-2 | Communication of anti-corruption policies and procedures to the board members by region, and employees per category and region. | BHCD-36 | EHCD-36 |

| Training of anti-corruption policies and procedures to the board members by region, and employees per category and region. | BHCD-37 | EHCD-37 | |

| 206-1 | Number of legal actions pending or completed regarding anti-competitive behaviour and violations of anti-trust by the board, executive and employees. | BHCD-38 | EHCD-38 |

| The role of board and executive leadership team in formally reviewing and approving the tax strategy, and the frequency of this review. | BHCD-39 | N/A | |

| 207-2 | Accountability of the board and executive leadership team on tax strategy and measures taken about unethical or unlawful behaviour. | BHCD-40 | EHCD-40 |

| 207-4 | Tax calculation for employees based on remuneration and taxes withheld and paid on behalf of employees. | BHCD-41 | EHCD-41 |

| 401-1 | Sourcing and rate of recruitment of new number and rate of new employee age group, gender, and region. | N/A | EHCD-42 |

| Total number and rate of employee turnover by age group, gender and region. | N/A | EHCD-43 | |

| 401-2 | Benefits which are standard for full-time employees but are not provided to temporary or part-time employees, by significant locations of operation. | N/A | EHCD-44 |

| 401-3 | Total number of employees that were entitled to parental leave, by gender, leave provision by gender, leave returnees by gender | N/A | EHCD-45 |

| 402-1 | Weeks’ notice provided to employees and their representatives in respect of organisation restructuring. | N/A | EHCD-46 |

| Specific provisions of notice period in the collective agreements following the consultation and negotiation process. | N/A | EHCD-47 | |

| 403-1 | Implementation of the occupational health and safety system including the scope of workers covered. | BHCD-48 | EHCD-48 |

| 403-2 | Processes used to identify work-related hazards and assess risks on a routine and non-routine basis. | BHCD-49 | EHCD-49 |

| 403-3 | A description of the occupational health services’ functions that contribute to the identification and elimination of hazards and minimization of risks. | BHCD-50 | EHCD-50 |

| 403-4 | Processes for worker participation and consultation in the on occupational health and safety management system. | BHCD-51 | EHCD-51 |

| 403-5 | Occupational health and safety training provided to workers, including training on specific work-related hazards, hazardous activities / situations. | N/A | EHCD-52 |

| 403-6 | Workers’ access to non-occupational medical and healthcare services, and the scope of access provided. | N/A | EHCD-53 |

| 403-8 | Number and % of all employees and workers who are not employees but covered by the health and safety management system. | N/A | EHCD-54 |

| 403-9 | Work-related injuries including fatalities and hours worked. | N/A | EHCD-55 |

| 403-10 | Work-related ill heath including fatalities. | N/A | EHCD-56 |

| 404-1 | Average hours of training that the organisation’s employees by gender and employee category. | N/A | EHCD-57 |

| 404-2 | Type and scope of programmes implemented, and assistance provided to upgrade employee skills and facilitate continued employability. | N/A | EHCD-58 |

| 404-3 | Percentage of total employees by gender and by employee category who received a regular performance and career development review. | N/A | EHCD-59 |

| 405-1 | Diversity statistics of individuals board and employees per category in terms of gender; age group, other indicators of diversity | BHCD-60 | EHCD-60 |

| 405-2 | Ratio of the basic salary and remuneration of women to men for each employee category, by significant locations of operation. | N/A | EHCD-61 |

| 406-1 | Total number of incidents of discrimination and remediation plans being implemented. | N/A | EHCD-62 |

| 407-1 | Operations and suppliers in which workers’ rights to exercise freedom of association or collective bargaining may be violated or at significant risk. | N/A | EHCD-63 |

| 408-1 | Risk for incidents of child labour, young workers exposed to hazardous work. | N/A | EHCD-64 |

| 409-1 | Risk for incidents of forced or compulsory labour. | N/A | EHCD-65 |

| 410-1 | Percentage of security personnel who have received formal training in the organisation’s human rights policies or specific procedures. | N/A | EHCD-66 |

| 411-1 | Total number of identified incidents of violations involving the rights of indigenous peoples where workers performed the organisation’s activities | N/A | EHCD-67 |

| 412-2 | Training on human rights policies or procedures concerning aspects of human rights that are relevant to operations. | N/A | EHCD 68 |

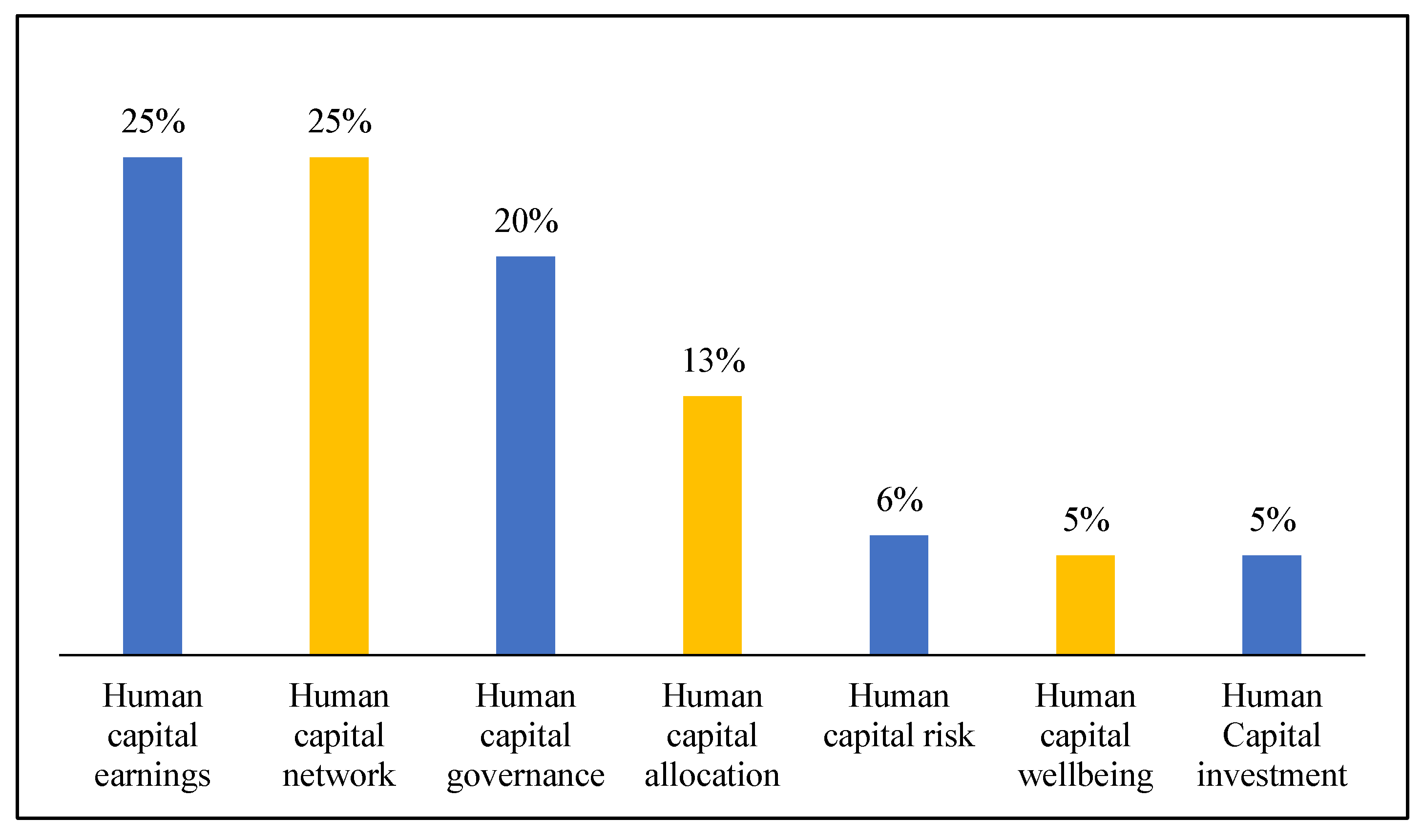

| Themes and definitions | Sub-themes |

|---|---|

| Human capital allocation (HCA): Information regarding the methods and initiatives taken to attract and source talent into the organisation. |

|

| Human capital wellbeing (HCW): Information regarding the programmes and initiatives to secure the health and safety of employees. |

|

| Human capital investment (HCI): Information regarding the financial and non-financial resources utilised to optimise people’s skills for improving performance. |

|

| Human capital network (HCN): Companies’ engagement with internal, and external stakeholders through its employees. |

|

| Human capital governance (HCG): Information regarding the organisations’ structure, key roles, and processes to improve corporate governance. |

|

| Human capital risk (HCR): Information regarding the organisations’ events or occurrences negatively affecting employees, and the employees’ unethical behaviour negatively affecting the organisation. |

|

| Human capital earnings (HCE): Information regarding paid remuneration, benefits and incentives to employees and the board. |

|

| Emergent HC sustainability disclosure themes | HCD disclosure codes linked to the GRI Standards | |||||

|---|---|---|---|---|---|---|

| Human capital allocation (HCA) | EHCD-1 | EHCD-2 | EHCD-4 | BHCD-7 | BHCD-35 | EHCD-42 |

| EHCD-43 | EHCD-45 | EHCD-46 | BHCD-60 | EHC-60 | ||

| Human capital wellbeing (HCW) | EHCD-48 | EHCD-49 | EHCD-50 | EHCD-53 | EHCD-54 | |

| Human capital investment (HCI) | EHCD-3 | BHCD-3 | BHCD-14 | BHCD-37 | EHCD-37 | EHCD-52 |

| EHCD-57 | EHCD-58 | EHCD-59 | EHCD-66 | EHCD-68 | ||

| Human capital network (HCN) | BHCD-8 | BHCD-20 | EHCD-20 | BHCD-22 | BHCD-23 | EHCD-23 |

| EHCD-26 | EHCD-27 | EHCD-28 | EHCD-29 | EHCD-30 | BHCD-36 | |

| EHCD-36 | EHCD-47 | BHCD-51 | EHCD-51 | |||

| Human capital governance (HCG) | BHCD-5 | BHCD-6 | BHCD-9 | BHCD-10 | BHCD-11 | BHCD-12 |

| BHCD-13 | BHCD-15 | BHCD-16 | BHCD-17 | BHCD-18 | BHCD-19 | |

| BHCD-39 | BHCD-40 | BHCD-48 | BHCD-49 | BHCD-50 | ||

| Human capital risk (HCR) | EHCD-31 | BHCD-38 | EHCD-38 | EHCD-40 | EHCD-55 | EHCD-56 |

| EHCD-62 | EHCD-63 | EHCD-64 | EHCD-65 | EHCD-67 | ||

| Human capital earnings (HCE) | BHCD-21 | EHCD-24 | EHCD-25 | EHCD-32 | EHCD-33 | BHCD-33 |

| EHCD-34 | EHCD-41 | EHCD-44 | EHCD-61 | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).