Introduction

It is widely accepted that entrepreneurship, especially in small- to medium-sized firms (SMEs), is essential for reducing social issues, creating new jobs, reducing poverty, and fostering economic development and growth. The contribution of the small and medium sized enterprises on the actual real Gross Domestic Product (GDP), new employment generation and poverty alleviation is well understood at international level (Chowdhury, 2011). This role is especially so in developing economy because; there are relatively smaller number of large business organizations (Narteh, 2013; Floyd and McManus, 2005), meaning that these economic units are more critical in the promotion of socio-economic development through poverty reduction and income equality. Nevertheless, it would not be correct to say that only Concerned reluctant small and especially micro enterprises, are significant only for less developed countries, because the contribution of these units to gross domestic product in developed high income countries is 50% (Ayyagari et al. , 2007). SMEs are acknowledged worldwide as chief bearers of nascent local entrepreneurs and value creators in the economy. They play a crucial role in eradicating poverty, providing substantial employment opportunities, enhancing technological capabilities, facilitating the diffusion of innovations, and mobilizing capital (Yazdanfar, 2015). SMEs are essential for sustainable development in countries, fostering entrepreneurial talent, innovation, job creation, and economic dynamism, which are vital for sustaining communities (Ng et al., 2016). Research indicates that SMEs are pivotal in driving economic growth, job creation, and social development in many developing countries (Kaira & Rześny-Cieplińska, 2019). Moreover, SMEs are highlighted for their role in sustainable innovation and sustainability practices. Studies emphasize that SMEs integrating social, environmental, and economic sustainability elements are more likely to foster radical innovation and engage extensively with external factors (Nasiri et al., 2021). Additionally, SMEs are seen as significant contributors to economic growth, job creation, innovation, poverty alleviation, technological progress, and competitive advantage (Adeniran & Johnston, 2014).

It is noteworthy that the entrepreneurial activities significantly contribute towards the promotion of fast and harmonized economic growth especially in the SMEs in India. Existing literature also reveals that the SMEs play an important role and the sector accounts for about 90% of the total businesses and 62% of total employment in India (Yadav et al., 2018). These enterprises promote innovation, create employment, and improve exports, which are the key components of economic growth (Binh & Trung, 2019). Studying Indian context, literature review of this research indicates that SMEs play significant role for the economic growth and offering employment opportunities (Verma et al., 2022). Further, as per the Ministry oMicro, Small and Medium Enterprises in India, the SME business accounts for almost 40% of the gross industrial value added in the Indian economy (Mathuku, 2022)Moreover, they admitted that the small and medium enterprises are the key players in realizing a stronger socioeconomic development of the country (Javalgi & Todd, 2011). Hence, developing entrepreneurial skills within SMEs are significant for sustainable innovation and market opportunity scouting which creates profit-making opportunities (Collins & Reutzel, 2017). Furthermore and in addition, the level of entrepreneur ship orientation of SMEs as well as the commitment of management and human capital determines the internationalization experience of the SMEs, thus promoting economic development.

SMEs are significant and it is imperative to understand that the efficiency of enterprises depends greatly on the persons in charge. The following is a research on the paper identifying the importance of entrepreneurial competence in the success of an enterprise (Parmitasari & Rusnawati, 2023). Some of them include entrepreneur intention, which is a personal trait that determines the success of SMEs (Ye & Kulathunga, 2019). Notably, financial knowledge has been identified as a crucial factor in the success of SME owners in the current society, with the subsequent research revealing the role of financial knowledge in the management of corporate risk, minimization of financial barriers, and improvement of firms’ innovativeness and performance (Weerakoon, 2024). Thus, financial knowledge not only enhances sustainability through the attainment of finance but also assists in decision-making and can positively influence SMEs (Weerakoon, 2024; Mohammad et al., 2022; Bongomin et al., 2017). Also, entrepreneurial resilience has emerged into focus as another important individual attribute for becoming entrepreneurs as they are considered responsible for managing difficulties and maintaining stable work-related specifications (Kromidha, 2024, Panjaitan et al., 2022). Resilience is gaining the importance in different fields of the economy and financial transformation contributing to the management of risks because of the changing technology and society (Kromidha, 2024; Manfield & Newey, 2017; Qurniawati & Nurohman, 2021). Existence of resilience capabilities is significant in developing approaches that support firms in preparation for and in handling of unfavorable circumstances with an aim of improving overall performance (Purwidianti & Tubastuvi, 2019). Relationship between financial knowledge, entrepreneurial resilience, and other personal characteristics can be seen in literature regarding SMEs in various settings. For instance in Saudi Arabia, it has been postulated and proved that individual attributes- -financial knowledge is vital sources of enterprise performance (Eniola & Entebang, 2015). Furthermore, studies by different scholars with regard to the impact of financial knowledge of an organization on its overall performance have revealed that there is a positive correlation between financial knowledge and SMEs’ performances in various countries and regions in terms of profitability, productivity, and competitive advantage (Hilal et al., 2020). The Global economy has been affected and has negatively impacted enterprises and especially SMEs (Rahmawati et al., 2022; Conduah & Essiaw, 2022). SMEs failure is a challenge to sustainable development (Zaniarti et al. , 2022) although SMEs are a national treasure for the Indian economy as recognized by (Zaelani et al. , 2022). SMEs in KSA have high failure rates and any government interventions aimed at assisting pandemic affected entrepreneurs have been a thorn in the flesh due to lack of internal knowledge and entrepreneurial skills (Nani et al. , 2022; Ye et al. , 2019). Another source of research in the last decade has stressed that the personality traits such as financial knowledge and skill in entrepreneurship may also be useful for the success of the business ventures (Gunawan et al., 2023).The study revealed that financial knowledge has a significance impact on the financial decision and financial vulnerability of SME in terms of finance accessibility, financial risk taking propensity and financial management (Gunawan et al. 2023, Yanto et al 2022 and Purwidianti and Tubastuvi 2019). Research on topics such as this reveals that financial knowledge is a moderating factor for improving business resilience, particularly in an adverse environment resulting from the COVID-19 pandemic (Widagdo & Sa’diyah, 2023; Zaniarti et al. , 2022; Hirawati et al. , 2021). Also, there is a positive correlation between such financial knowledge dimensions as understanding the management of personal finances, and financial management as a factor that positively influences the business results (Rahmawati et al., 2022; Siswanti et al., 2021; Millen & Stacey, 2022).

Another important fact that dictates organizational performance, particularly in turbulent epochs, is resilience (Ali et al. , 2021; Conduah & Essiaw, 2022). Research has shown that it is easily and period of economic downturns where companies with high resilience excel (Asare-Kyire, 2023). The investigation to SMEs’ performance revealed that entrepreneurial orientation and resilience are crucial for SMEs to be able to identify opportunities in the market changes, which eventually lead to innovation, risk-taking and new opportunities will be identified (Alshebami & Murad, 2022). The moderating role played by entrepreneurial resilience in the relationship between financial knowledge and sustainable performance further highlights the necessity of resilience when it comes to business success (Furman et al., 2020; Hamdana et al., 2021). To improve the sustainability of the organizations’ performance, it is crucial to identify how some individuals’ characteristics such as financial knowledge, entrepreneurial competence, and, more generally, resiliency affect the SMEs (Gunawan et al. , 2023; Ali et al. , 2021; Oktariswan et al. , 2022). These factors allow challenges in the context of opportunities to overcome them, make changes to the financial aspect, and ensure the sustainability of business activity (Oktariswan et al., 2022). Hence, the general understanding of financial management, spirit of entrepreneurship together with the ability to cope with adversities such as the current COVID-19 pandemic is helpful for SMEs to succeed

2. Literature Reviews

2.1. Background of this Study

SMEs are an important constituent of the Indian economy since they contribute a significant amount towards employment as well as towards the country’s GDP. Presenting the statistics of the Confederation of Indian Industry (CII), it has been identified that SMEs contribute around 30% towards the Indian GDP (Das & Das, 2023). Further, the exports of SMEs in Indian contribute approximately 17% of the GDP as at 2014 as noted by (Deshmukh and Thampi, 2014). Indonesian Ministry of Cooperatives and Small and Medium Enterprises has stated that SMEs account for 61. 07% to the GDP (Parlyna, 2023). Furthermore, SMEs in India contribute around 40% to the GDP (Iqbal et al., 2018). These figures highlight the substantial impact that SMEs have on the Indian economy. From the point of view of employment generation, SMEs have played a major role. These Asian MSMEs, including Indian MSMEs, contribute to about 70% of employment creation while India’s MSMEs come out strengthened by accounting for about 90% of the industrial enterprises and contributing 40% towards manufacturing value addition (Sharma et al., 2021). The SMEs sector in India accounts for 17 % of the GDP and for 45 % of the total industrial value addition (Deshmukh & Thampi, 2014). Also, in Malaysia, SMEs played an important role of contributing 38% to be 39% of the GDP while the total export is 48%. , increased from 3% to 4% of employment in 2019 (Hussain et al., 2022). The above statistics prove how crucial SMEs appear in employment creation and nurturing the economy. From the point of view of employment generation, SMEs have played a major role. These Asian MSMEs, including Indian MSMEs, contribute to about 70% of employment creation while India’s MSMEs come out strengthened by accounting for about 90% of the industrial enterprises and contributing 40% towards manufacturing value addition (Sharma et al., 2021). The SMEs sector in India accounts for 17 % of the GDP and for 45 % of the total industrial value addition (Deshmukh & Thampi, 2014). Also, in Malaysia, SMEs played an important role of contributing 38. 9% of the GDP while the total export is 48%. Increased from 3% to 4% of employment in 2019 (Hussain et al., 2022). The above statistics prove how crucial SMEs appear in employment creation and nurturing the economy. Moreover, in total, SMEs are great for economic growth, industrial production, and employment in India and other countries. This has put emphasis into the outstanding role that they both play in contributing to GDP as well as the employment sector. It is for this reason that policymakers and stakeholders require to continue giving their backing to SMEs in order to optimally develop this segment’s potential for spurring on economic growth and prosperity. The outbreak of COVID-19 pandemic disease has affected Small and Medium Enterprises (SMEs) in India. Furthermore, literatures that have looked into the pandemic impact on SMEs in countries such as Switzerland, Malaysia, Nigeria, Indonesia and Europe revealed that these businesses had been greatly affected with revenue losses of more than 50%, reduction in performance, loss of customer patronage and disruption in product supply chain as stated by (Nicolas et al., 2023; Rashid et al., 2022; AP et al., 2022; Hs et al., 20230. The COVID-19 shock targeted various kinds of manufacturing SMEs (Juergensen et al., 2020). The material crisis put a focus on that a lot of local companies faced the existential risks, making it obvious that the effective management of the respective businesses during crises and the support from the public authorities for the disasters’ outcomes would be required (Rahman et al., 2022; Nicolas et al., 2023). Referring specifically to India, SMEs had to use suitable strategies in responding to the crisis (Yeon et al., 2022). The pandemic increased the awareness of digital marketing and e-commerce for SMEs’ survival (Sudarmiatin et al., 2023). SMEs that adopted technology and e-commerce before the pandemic were better prepared to face the challenges brought on by the global crisis. Research by Khalil et al. (2022) conducted across six developing countries demonstrated that digital technology played a crucial role in helping SMEs survive the pandemic, enhancing their resilience and ensuring their continuity. Similarly, Ranatunga et al. (2022) highlighted that ICT adoption significantly contributed to the resilience of small businesses during the COVID-19 crisis, without requiring substantial investments or extensive adjustments.

2.2. Theoretical Background

The RBV (resource-based view) theory is anchored in the concept of using valuable, rare, unique and inimitable resources when creating a better source of competitiveness (Mashavira et al. 2022; Luo et al. 2022). This conception has been further developed in the recent literature by paying closer attention to the extant literature focusing on the knowledge-resource and more particularly to the SMEs’ concentrate on enhancing sustainable performance (Fatoki & Asah, 2011). The paper has given an understanding of the financial knowledge as the capability that with the aid of the entrepreneurial capability help in the procurement and management of the right combination of the resources which provide the increased worth of the proposition and the sustainable competitive edge (Mashavira et al. , 2022; Bilal et al. , 2017). According to Atiase et al. (2023), firm performance particularly within the SMEs, is concealed by principal activities and managerial skills which are either in a state of deficiency or are relatively dormant which contribute towards the failures of SMEs. Theatrical and empirical evidence shows that antecedent human resources such as managerial skills and finances and entrepreneurial skills are a critical factor in the overall acquisition of those resources and the capacity of the SMEs to apply those resources right and optimally for the enhancement of their competitiveness and performance (Luo et al. , 2022; Mashavira et al. , 2022). Research scholars present a picture of how managerial competencies to influence business growth in SMEs drawing from an understanding that it mediates the relationship between the financial strategies on one hand and business growth, on the other (Namagembe, 2023; Bilal et al. , 2017). Moreover, as the literature also postulates, due to the fact that the fundamental processes of the managerial training and development enable the managers to apply exactly the necessary competencies in the organizational setting in order to achieve the organizational objectives and hence, improve the overall organizational performance, the latter is also considered to play a major role within the improvement of the contending general manager effectiveness in SMEs. When it comes to funding and sustainable operations coupled with superior performance in small businesses, matter like financial knowledge, the entrepreneurial skill, and the business resilience have very critical roles to play. It is therefore be to the SMEs’ advantage if they have adequate stock of these knowledge resources as it contributes to the organizations sustainability (Ye & Kulathunga, 2019). A firm’s competitive advantage according to the RBV theory therefore depends on its tangible as well as intangible resources; and financial knowledge falls under the latter. Research has it that the knowledge, awareness and the financial attitude of the owners of the business organizations play a key role to the performance of their firms by promoting financial education as indicated in the following arguments (Eniola & Entebang, 2017). In addition, business resilience plays the role of moderator that allows individuals to overcome adversity and contribute to sustainable performance soon (Purnomo, 2019). Small and medium-sized enterprises can optimize their sustainability by implementing the sustainable business model that helps to survive at the moments of crises, such as the COVID-19 pandemic, and promote the community’s sustainability (DiBella et al., 2022). Furthermore, the influence of innovativeness as the moderator between the key success factors and the SME performance has been analyzed by Ng et al. (2019) where the role of the transformational leadership and the competencies of the entrepreneur and technical competence are stressed. In addition, the study has examined the moderating effect of government support on adaptability that enhances SME business resilience, where the features of information technology capability have been employed (Choong et al., 2023). Studies have pointed out that, by combining the RBV theory and the triple bottom line evolution of the concept of innovation has been obtained as a major mediator variable between entrepreneurial skill and sustainable performance in manufacturing SMEs (Koliby et al., 2022).

2.3. Sustainable Functioning

Enterprise sustainability includes the ethical factors of income distribution, working environment and conditions and human rights which also defines the expanded concept of sustainability that came to the fore with the Brundtland report in 1987. United Nations World Commission on Environment and Development (UNWCED) in 1987’s report titled “Our common future” coined the concept of sustainable development which highlighted development for the present generation without eradicated the capability of the future generations for similar development. The topic of sustainability is crucial to identifying and establishing such strategies for organizing a business’s activities to achieve sustainable value for stakeholder in terms of multiple performance parameters in the short and long term, taking into account the limitations of nature and society. Basically, sustainability can thus be defined as the achievement of economic success, environmental conservation as well as social justice (Hummels & Argyrou, 2021). Explaining sustainability as development that meets humanity’s current needs without depleting the world’s resources and threatening future generations’ ability to do the same has been central in sustainability discourse since the release of the Brundtland Report (Roche, 2018). As has been seen before, this concept has been backed up by other frameworks or policies that succeeded this guideline such as the 17 Sustainable Development Goals or the SDG 2015 (Membrillo-Hernández et al., 2021).

The Brundtland report helped stressed on sustainable development and thus many a sector was affected including tourism where there has been appreciable research on sustainable tourism since 1987 (Ruhanen et al. , 2015). Further, the ecological concept of agriculture became popular especially after the Brundtland Report, thus, establishing the fact that the report has ramifications in multiple disciplines (Velten et al., 2015). The concept of TBL management was launched in 1994, and it also stresses the consideration of social, environmental, and economic effects in sustainable practices (Edralin & Pastrana, 2020).

Altogether, definition given by the Brundtland Report has acted as starting point for setting basic principles for sustainable development in different fields, mobilizing them towards more responsible activities that may contribute to the satisfaction of current requirements without compromising the future generations’ opportunities to meet their needs and to protect the environment. Sustainability performance refer to the triple bottom line which is social, economic, and environmental and thus it gives a clear indication of the organization’s performance based on stakeholder’s needs by embracing good Corporate Governance standards. Khan et al. (2016) have defined the term ‘sustainability performance’ as a firm’s environmental and social initiatives, its ability to retain employees, its investment to society and the balance that the firm is able to achieve among economics, environment and social factors. This definition makes it crucial for sustainability to be included across different forms of a firm’s operations in order to enhance value delivery and ensure satisfaction among stakeholders. In additional studies by Eccles et al. (2014), it emerges that business with high sustainability scores have well-developed procedures for stakeholder interaction and have a long-term outlook for their activities, as well as providing proportionally more non-financial information. That is why meaningful work and commitment to sustainability can be effective to enhance organizational work effectiveness and productivity.

2.4. Financial Knowledge

Increasing awareness among the Indian entrepreneurs is useful in raising their knowledge of financial management for improving competence. Data has revealed strong evidence that financial knowledge positively influences both entrepreneurial engagement and success. It is also significant for the entrepreneurial intention, to be able to detect the require financial sources for financing the entrepreneurial ventures (Alshebami and Marri, 2022). In addition, available literature revealed that youth entrepreneurs’ financial knowledge level plays a positive role towards enhancing their total entrepreneurship skills (Wise, 2012). West African University students should undergo financial knowledge training in order to create awareness of entrepreneurs concerning the key types of funding they can source from other players in the creative industries; as well as fostering a favorable entrepreneurial environment (Purnomo, 2019). Moreover, there is a positive relationship between attaining financial knowledge and increasing young entrepreneurial capabilities, thereby promoting the SME firm performance (Eniola & Entebang, 2015). Therefore, the literature review is indicative of how integrated financial knowledge influences the proficiency of Indian entrepreneurs. Building and developing the financial knowledge infrastructure empowers entrepreneurs with better knowledge and skills in handling money and facilitates their access to finance, leading to overall improvement of the performance of entrepreneurs.

H1 : Financial knowledge has a significant positive effect on entrepreneurial proficiency among Indian entrepreneurs.

H2 : Financial knowledge has a significant positive effect on business resilience among the Indian entrepreneurs.

2.5. Entrepreneurial Proficiency

The theory of entrepreneurial proficiency has several characteristics that lay down features that affect success in relation to entrepreneurship. Various authors have stressed the role of human capital, entrepreneurial competencies, attitude, confidence, and creativity in attaining the goal of enterprise performance. Thus, Unger et al. (2011) stressed antecedents of human capital suggesting that skills, educational background, business experience, and personal motivation are critical for small business performance (Unger et al., 2011). Moreover, entrepreneurial competence, specifically the complexity of these indicators, such as target time, intents, engagements, and risk-taking, proved to influence business performance and entrepreneurial motivation, according to Destiana et al. (2023). Furthermore, Destiana et al. (2023) also revealed that a good mental attitude and entrepreneurial skills as well as knowledge creates a competitive advantage in the competitive business environment especially Micro, Small and Medium Enterprises. Moreover, as it is explained entrepreneurial optimism is regarded as a characteristic that enhances the achievement of business success in the market (Ma, 2024). This kind of optimism along with the quality of strong entrepreneurial operating experience, as postulated by (Manafe et al., 2023), means that there is possibility of enhanced business performance. Manafe et al. (2023) also, defined how crisis-related entrepreneurial actions can act as stressor protectant resources for well-being that is linked to business and personal success (Eib & Bernhard-Oettel, 2023). Therefore, it is possible to state that human capital, entrepreneurial competence, attitude, self-efficiency, innovation and optimism constitute an integral part of the factors that define and impact the entrepreneurial efficiency and success. Fostering such aspects entails a constructive influence on entrepreneurs’ results and ensures recognizable longevity within the economic environment.

H3 : Entrepreneurial proficiency has a significant positive effect on business resilience among Indian entrepreneurs.

H4 : Entrepreneurial proficiency has a significant positive effect on enterprise sustainable functioning among SMEs in India.

2.6. Business Resilience

This paper seeks to define and describe the concept of entrepreneurship resilience with the view of enabling one to counter the odds that he or she encounters. It comprises the success factor skills of overcoming adversity, working well under pressure, getting up after failure, learning, elastic, and mood regulation skills (Fatoki, 2018). It is not only important at the individual level of the entrepreneur but it also has profound influence at the organizational level because organizational resilience helps organizations to bounce back from the adverse situations and crises (Bullough et al., 2014). Previous studies prove an understanding of the link between entrepreneurial resilience and sustainable improvement while stressing its positive consequences for sustainable results (Bullough et al., 2014). Therefore, the concept of business resilience is crucial in SMEs’ survival and other general community structures (Bullough et al., 2014). Self-management is one of the most crucial interpersonal skills that define an entrepreneur as a business-person hence helping him or her work towards sustainability even in situations of uncertainties (Fatoki, 2018). Literature review has clearly suggested that the effect of resilience on entrepreneurial success is both direct and positive, as far as the impact it has on both, self and organizational performance is concerned (Bullough et al., 2014). Moreover, this paper establishes that one of the theories that support this fact is the entrepreneurial resilience which encompasses factors that can lead to the success of businesses especially during the difficult periods in the life of the business, including the periods of crises disasters among others (Panjaitan et al., 2022). Resilience is essential for entrepreneurship as it enables the creation of value and development of of sustainable ventures, as precisely stated by (Panjaitan et al., 2022). Moreover, business resilience has been associated with boosting the course of entrepreneurial intentions whereby there is a direct positive influence on the success of entrepreneurship (Keqiang et al., 2023). Therefore, it can be deduced that business resilience plays a significant role in influencing the prospects of entrepreneurial ventures. It equip the managers to manage challenges, overcome adversities, and respond to dynamic environment contributing to sustainability of the businesses and economic clusters.

H5: Business resilience has a significant positive effect on enterprise sustainable functioning among SMEs in India.

2.7. Mediating Role of Business Resilience

Business resilience is one of the significant sources of competitiveness of SMEs as it moderates the processes of knowledge resources transformation into the resources of competitive advantage and sustainable outcome (Branicki et al., 2017). However, though skills such as financial knowledge and entrepreneurial competency are vital, the mastery of the knowledge of how to acquire or develop these resources, protect them, maintain, and use them, most of the time is not easy (Bullough et al. , 2014). Studious literature supports the fact that this construct called ‘entrepreneurial resilience’ acts as a mediator between entrepreneurial grit and career success and between competency and superior performance entitled. Apart from that, firm-specific capabilities build up other resources such as strategic resilience; this is because there is the possibility of mediating between entrepreneurial resilience and the improvement in the performance of the firm (Ogbumgbada, 2023). In the context of SMEs, knowledge resources and adversities can be best described by the entrepreneurial resilience which defines the individuals and organizations’ ability to gain knowledge, face adversities and accomplish the sustainable performance (Branicki et al., 2017). It operates as a means through which people can cope with and rapidly manage stress in a way that enhances exceptional performance (Bullough et al., 2014). The evidence indicates that SMEs can ensure sustainability through the mediators with particular emphasis put in the outlook that entrepreneurial resilience serves as a primary enabler to allow an individual to overcome challenges and foster sustainability (Shafie & Isa, 2023). In conclusion, the entrepreneurial resilience is a significant mediator that enables SMEs manage the knowledge resources and overcome the challenges in an effort to attain sustainable performance. Therefore, building resilience may help empower people and organizations’ learning and survival capabilities in the context of the small and medium enterprise environment.

3. Methods

This quantitative study employed a cross-sectional design and collected data from small entrepreneurs in India to assess financial knowledge, entrepreneurial skills, resilience, and the sustainable functioning of SMEs. Data collection was carried out through an offline questionnaire administered from January to May 2024. The study utilized a 5-point Likert scale to gather responses from participants for its four key concepts. Sample questions were included to assess respondents' financial knowledge and entrepreneurial skills. Additionally, test questions were incorporated to evaluate business resilience and sustainable functioning. The study did not include any control variables, as no age-specific, firm-specific, or industry-specific relationships were hypothesized. The focus was solely on the dependent and independent variables under investigation.

3.1. Sample Size

According to Krejcie and Morgan, (1970), a researcher can conduct data analysis using 275 samples from a population of 1500 units (Chuan and Penyelidikan, 2006).

3.2. Measurement Tool

The research instrument consisted of indicators from the other research works formulated to meet the context of the study. As part of the initial stage of this research instrument, data was gathered on aspects such as the business sector, number of years in operation, and other related aspects as capture below table. In the second part, employing the usage of subjective parameters, the respondents’ evaluation of their own financial situation, skills, ability to sustain their employees and the firm’s sustainable functioning were analysed. Rewrite. The indicators used to measure financial knowledge were adopted from (Ai Nety et al., 2022; Hussain et al., 2018; Bongomin et al., 2017; Gusman et al., 2021). As for Entrepreneurial proficiency, the questions were adopted from (Alshebami and Seraj, 2021; Mamun et al., 2018; Bareiss et al., 2005; López-Núñez et al., 2022b), while items that measured Business Resilience were adopted from (Bak et al., 2023; Fatoki, 2018; Choong et al., 2023). Finally, enterprise sustainable functioning items were adopted from (Fazal et al., 2019; Mamun et al., 2018; Malesios et al., 2018). A five-point Likert scale (1 = ‘strongly disagree’, 5 = ‘strongly agree’) was used for all of the variables of the study.

3.3. Data Analysis Method

In order to conduct the analysis of the present study, PLS-SEM with the help of Smart PLS was applied. The results of this analysis are stated following the guidelines provided in the literature for PLS modelling (Hair et al., 2019; Sarstedt et al., 2022).

4. Results

4.1. Demographic Analysis

Data was collected from 275 small business entrepreneurs of India out of which 77. 32 percent were males and 22. 54 percent of participants were females (see

Table 1). The largest proportion of responders was people from 21 to 30 years old (45. 81%) and from 31 to 40 years old (30. 90%). As for the education levels, it is evident that most 35. This was closely followed by the Graduation (27 %), which one percent more than the respondents who alleged to have an Ordinary level education. Regarding the experience of the business, a major part of the respondents, which is 138, have been in business for 6-10 years while 95 respondents have been in business for 1- 5 years. Lastly, based on the business area, the majority of the respondents claimed to be involved in the business of the service sector (31.63 %, whereas17.09 % belonged to the wholesale/retail trade and 9.81% manufacturing sector and other 28.38

4.2. Validity and Reliability

Table contains descriptive measures as well as reliability and validity tests results. Reliability test carried out within this study through Cronbach’s alpha results greater than 0.817 for all the variable. According to the researcher, all instruments were reliable (Hair et al., 2019 explains that for inter-observer agreement of 0. 817, all instruments were reliable. In order to check the internal consistency reliability of the measuring instrument, the composite reliability values for all the constructs have also been presented in

Table 2 which also reveals that all the values have exceeded 0. 8, which proves reliability (Hair et al., 2019; Sarstedt et al., 2022).

Where, Entrepreneurial proficiency (EP), Financial knowledge (FK), Sustainable Functioning (SF), Business Resilience (BR)

Confirming convergent validity, AVE values of all items in

Table 2 are found to be higher than 0.50. Furthermore, as observed in

Table 3, the AVE for each item in Fornell–Larcker criterion exceeds the construct’s highest squared correlation with another construct, confirming discriminant validity.

4.3. Path Analysis

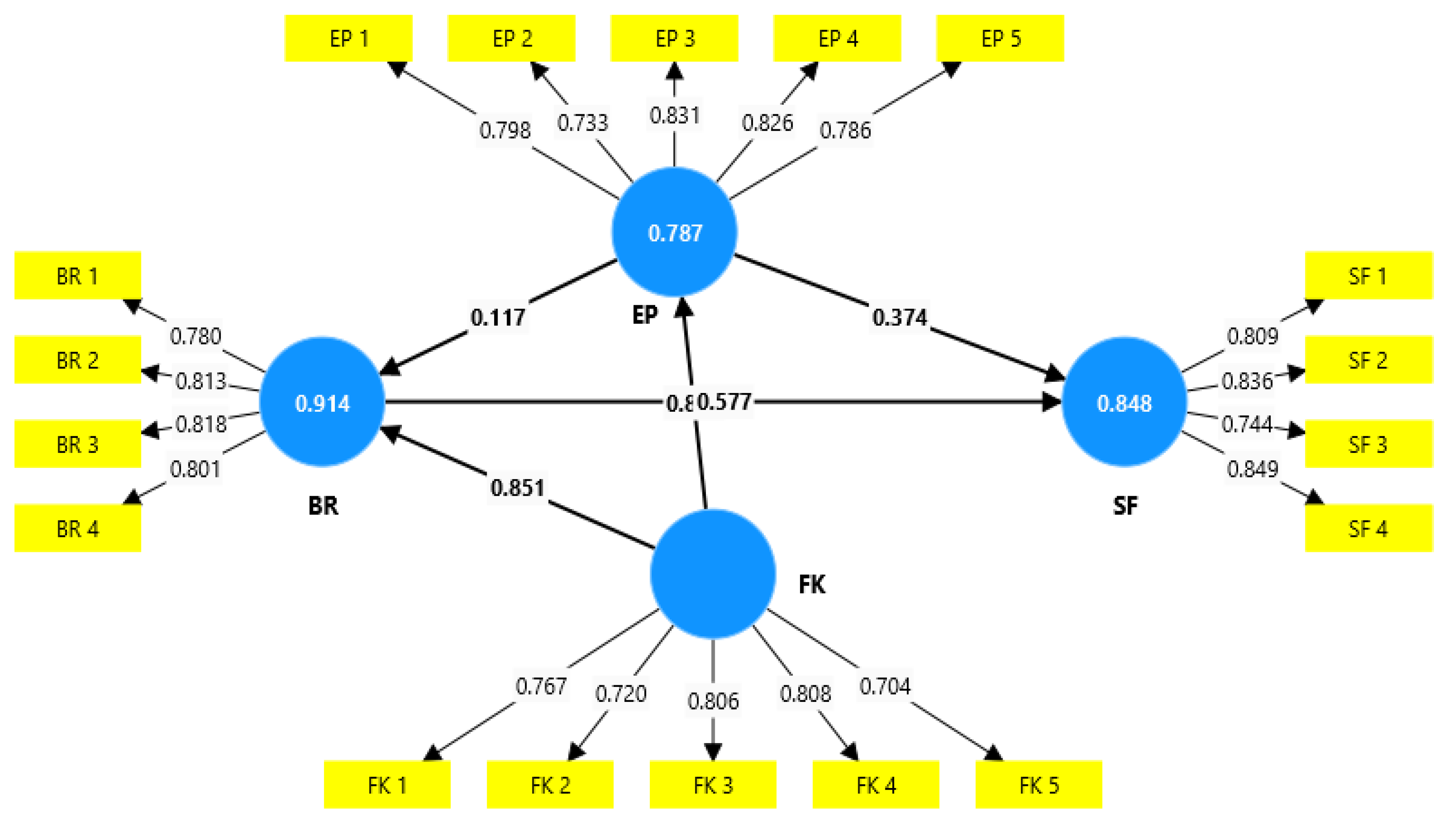

In

Figure 1, the path analysis is depicted. According to the coefficients (

Table 4), financial knowledge among Indian entrepreneurs had a significantly positive impact on their entrepreneurial proficiency. The coefficient value for financial knowledge on entrepreneurial proficiency (Hypothesis H1) was 0.015 with a p-value of 0.000 (at 5% significance). In addition, the t-value of 6.024 indicates that 6.024 percent of the variation in entrepreneurial proficiency may be explained by financial understanding. Financial knowledge was found to have a significant and positive impact on business resilience, as evidenced by the positive (0.05) coefficient value for financial knowledge (Hypothesis H2) and a p-value of 0.000. The t-value of 4.968 indicates that 4.968% of the variance in business resilience may be explained by financial expertise. Entrepreneurial proficiency, on the other hand, had a positive coefficient of 0.047 and a p-value of 0.013 (Hypothesis H3), indicating that competence positively impacted business resilience. The t-value of 2.486 suggests that 2.486 percent of the variation in business resilience might be explained by entrepreneurial competency.

Entrepreneurial proficiency had a significantly favorable effect on sustainable functioning among Indian SMEs, as evidenced by the path coefficient value for entrepreneurial proficiency on enterprise sustainable functioning (Hypothesis H4), which was 0.055 with a p-value of 0.000. The t-value of 8.001 suggests that 8.01% of the variance in firm sustainability may be explained by entrepreneurial proficiency. Moreover, business resilience had a significantly favorable impact on sustainable performance among Indian SMEs, as indicated by the path coefficient value for business resilience on enterprise sustainable functioning (Hypothesis 5) of 0.054 with a p-value of 0.000.The t-value of 10.716 indicates that 10.716 percent of the variance in company sustainability might be explained by business resilience.

4.4. Mediating Effects

The indirect effect coefficients, t-values and p-values are shown in

Table 5. As observed, entrepreneurial proficiency had a significantly (p-value < 0.05) positive and indirect effect on sustainable functioning among Indian SMEs (at 5% significance), thus confirming the significant mediating effect of business resilience on the correlation between proficiency and sustainable performance (Hypothesis H

M1).

In addition,

Table 5 reveals that financial knowledge had a significant indirect effect on sustainable functioning, which suggests that business resilience mediated the effect of financial knowledge on sustainable functioning among Indian SMEs (Hypothesis H

M2) among the respondents.

5. Discussion

Recent study on financial knowledge in SMEs has shown that the field is still in its infancy and so needs more empirical focus. Furthermore, there is also a dearth of study on resilience in the literature on entrepreneurship. Researchers have been urging more research on the role that knowledge resources and character attributes play in enabling sustainability across small and medium-sized enterprises (SMEs) as a successful strategy for revitalizing entrepreneurial activities after the pandemic. Therefore, the impact of financial knowledge and entrepreneurial proficiency on the success of sustainable enterprises has been investigated in this study. Concurrently, we have looked into how business Resilience influences the connection between proficiency and financial knowledge and long-term company success.

The results indicate that financial knowledge significantly enhances entrepreneurial proficiency, confirming Hypothesis H1. This finding supports a recent study (Ai Nety et al., 2022), which shows that a solid understanding of financial concepts, products, institutions, and money management improves business decision-making. This, in turn, fosters the development of essential capabilities for crisis survival and long-term business sustainability. Moreover, the results demonstrate that financial knowledge significantly boosts business resilience, confirming Hypothesis H2.This research supports the existing literature (Eniola & Entebang, 2015; Bullough et al., 2014; Panjaitan et al., 2022) by demonstrating that sound financial knowledge and skills help entrepreneurs overcome obstacles and setbacks, ultimately enabling their businesses to withstand a crisis. Additionally, it was found that business resilience is significantly positively impacted by entrepreneurial proficiency, confirming Hypothesis H3. Consistent with earlier research (Khan et al., 2016; Eccles et al., 2014; Manafe et al., 2023), this result indicates that resilient behaviour among entrepreneurs is significantly influenced by specific skills and talents. It also reveals that entrepreneurial proficiency significantly enhances the sustainable functioning of Indian SMEs, supporting Hypothesis H4. According to the literature currently under publication ((Panjaitan et al., 2022; Keqiang et al., 2023; Eccles et al., 2014), this emphasizes the importance of appropriate proficiency for the long-term viability of SMEs in India. Ultimately, it is discovered that business resilience significantly improves sustainability functioning of entrepreneurs, supporting Hypothesis H5.Consistent with previous studies (Panjaitan et al., 2022; Eccles et al., 2014), the findings underscore the necessity for SMEs to develop resilience to swiftly overcome challenges, thereby minimizing fragile technical and societal dynamics and achieving sustainability. Concerning the mediating roles, the findings support Hypothesis HM1, demonstrating that business resilience strongly mediates the impact of entrepreneurial proficiency on the sustainable performance of Indian SMEs.

This conclusion suggests that resilient behavior contributes to organizational sustainability, with adequate competencies supporting resilience, consistent with prior research (Branicki et al., 2017; Shafie & Isa, 2023). According to Hypothesis HM2, the mediation test provides further evidence supporting the notion that business resilience mediates the relationship between sustainability and financial knowledge. This indicates that business resilience enables small and medium-sized enterprises (SMEs) to cultivate, maintain, and leverage financial knowledge, thereby enhancing their sustainable performance.

6. Implications and Conclusions

We found that recent research has not provided much literature regarding the connection of proficiency and resilience as well as outcomes and on the mediating effects of the research’s focal construct business Resilience.

In addition, higher capability concerning disconfirming events with regard to entrepreneurship. Thus, in the post-pandemic world, the philosophy of learning can be said to be most of the time valid. First of all, the present literature has proven that the analysis of the antecedents of knowledge-resource and person-characteristics in enhancing sustainability. For this reason, they should be considered as one of the possible forms of recourse to the stimulation of the entrepreneurial processes among SMEs.

Therefore, to address the marked need for research encroachment on the content area and present a multifaceted distinction of the diverse important variables that can influence the recovery process. Specific observations on the use of COVID-19 crisis on the performance of the SMEs and hypothesis prescripts and know-how about sustainable enterprise performance and money.

Simultaneously, the objective of this research was to examine the moderating effect of business Resilience on cognitive and financial knowledge with firms’ sustainable financial growth and success.The implications that arise from the findings suggest that financial literacy statistically influences entrepreneurial proficiency and resilience. Thus, entrepreneurial proficiency was found to have a strong positive correlation with the dependent variable. Regarding the research focus, the proposed study aims at examining the research issue of Indian SMEs’ entrepreneurial resilience and sustainable functioning. Last, the cross-sectional analysis showed that business resilience statistically exerted a positive influence on the aspects of sustainability performance in regard to the sample of the study. Despite, the results from the analysis using PLS-SEM enabled the confirmation of the mediating role.

The following is the research question: significance of business Resilience in the moderating role on the relationship between the entrepreneurial proficiency, financial knowledge, and sustainable functioning of SMEs. Overall, the findings suggest that includes tangible resources and valuables such as financial knowledge and proficiency of the firm only fostering by an organization improves and develops various assets, for instance, the entrepreneurial resilience and which if promoted therefore helps to achieve sustainable functioning among these business entities.Thus, taking into account all the analysis and the discussion the following conclusions can be made to aim at further development of the contemporary entrepreneurship literature. Lastly, contribution wise, theoretically, the study contributes as an input to the generation of new knowledge in the area of the study because the research establishes factually the relationship between financial literacy, entrepreneurial competency resilience, and sustainable performance. Nevertheless, this study takes the RBV to the next level in terms of examining the moderation role of knowledge based assets; namely financial literacy and firm peculiar competency or entrepreneurial competence in the attainment of enduring gains through a resource-based lens. Therefore, it can be asserted that managers’ quality is linked to failure and success of business firms. Finally, therefore, this paper proposes a new approach of getting to sustainment, which has given attributes as its foundation knowledge and capabilities. Concerning the relevance of proficiency, ability to cope with pressures, and the ability to manage one’s finances as to the nature of performance, firms should ensure that employees gain perfect amount of such traits, knowledge, and capabilities. As our research results have empirically supported our hypothesis and indeed indicated that resilience originates from proficiency and financial understanding; the groups of entrepreneurs and managers might enhance their coping potential through the process of acquiring entrepreneurial competency and financial knowledge as antecedents of the organizational success and thus respondents’ views are tested against these propositions. This could be deemed feasible via pertinent workshops/training from specialists in the subject matter. It would also be reasonable for policymakers and managers to subsidize financial knowledge as our findings. This also shows that financial knowledge has better explanatory power than other variable or factors. For limitations some of which were presented in this study include, the framework that was used in this study could not capture all aspects. This paper identifies several factors of sustainable SME performance.

This is why it is hence advised that other pertinent variables should be incorporated in future studies. The detailed guidelines include such introductions of some changes in the further development of the parameters of the research model as serving to enhance the predictive characteristics of the model in the further stages of research. In parallel with this, such measures as failing to take necessary precautions was also ignored. That is why the small and medium scaled enterprises are selected to be the subjects of this investigation, which are located in the India only. To improve generalizability, other research frameworks that are possible can be where other organizations are included in the sample or the study can be done in a multiple country or multiple culture scenario. As we incorporated the use of offline survey, then it is recommendable that we provided our conclusions are evaluated cautiously. To enhance the objective of the country’s SMEs population by addressing the lack of companies in the following areas, it is also possible to describe the reasons for the sectorial distribution of the variable, the further researcher can use the technique of a stratified random sampling while focusing on the differences in the demographic parameters, if the size of the dataset is sufficient for the further analysis in this respect.

References

- Chowdhury, S. R. (2011). Impact of global crisis on small and medium enterprises. Global Business Review, 12(3), 377-399. [CrossRef]

- Narteh, B. (2013). SME bank selection and patronage behaviour in the Ghanaian banking industry. Management Research Review, 36(11), 1061-1080. [CrossRef]

- Floyd, D. and McManus, J. (2005). The role of SMEs in improving the competitive position of the European Union. European Business Review, 17(2), 144-150. [CrossRef]

- Ayyagari, M., Beck, T., & Demirgüç-Kunt, A. (2007). Small and medium enterprises across the globe. Small Business Economics, 29(4), 415-434. [CrossRef]

- Yazdanfar, D. (2015). Firm-level determinants of job creation by SMEs: Swedish empirical evidence. Journal of Small Business and Enterprise Development, 22(4), 666-679. [CrossRef]

- Ng, H., Kee, D., & Ramayah, T. (2016). The role of transformational leadership, entrepreneurial competence and technical competence on enterprise success of owner-managed SMEs. Journal of General Management, 42(1), 23-43. [CrossRef]

- Kaira, Z. and Rześny-Cieplińska, J. (2019). Innovation strategies in SME’s economic growth and job creation in economy. WSB Journal of Business and Finance, 53(1), 167-173. [CrossRef]

- Nasiri, M., Saunila, M., Rantala, T., & Ukko, J. (2021). Sustainable innovation among small businesses: the role of digital orientation, the external environment, and company characteristics. Sustainable Development, 30(4), 703-712. [CrossRef]

- Adeniran, T. and Johnston, K. (2014). Ict utilisation within experienced South African small and medium enterprises. The Electronic Journal of Information Systems in Developing Countries, 64(1), 1-24. [CrossRef]

- Yadav, V., Sharma, M., & Singh, S. (2018). Intelligent evaluation of suppliers using extent fuzzy topsis method. Benchmarking an International Journal, 25(1), 259-279. [CrossRef]

- Binh, D. and Trung, N. (2019). Research on the application of e-commerce to small and medium enterprises (SMEs): the case of India. Business and Economic Research, 9(3), 102. [CrossRef]

- Verma, S., Shome, S., & Patel, A. (2022). Exploring the effects of firm-specific factors on financing preferences of listed SMEs in India. Business Perspectives and Research, 12(1), 149-163. [CrossRef]

- Mathuku, P. (2022). Effect of entrepreneurial skills on organizational performance of small and medium enterprises in Nakuru city-Kenya. International Journal of Economics and Business Administration, X(Issue 3), 156-173. [CrossRef]

- Javalgi, R. and Todd, P. (2011). Entrepreneurial orientation, management commitment, and human capital: the internationalization of SMEs in India. Journal of Business Research, 64(9), 1004-1010. [CrossRef]

- Collins, J. and Reutzel, C. (2017). The role of top managers in determining investment in innovation: the case of small and medium-sized enterprises in India. International Small Business Journal Researching Entrepreneurship, 35(5), 618-638. [CrossRef]

- Parmitasari, R. (2023). Sustainability and performance of small and medium business: the role of financial literature. International Journal of Professional Business Review, 8(5), e01048. [CrossRef]

- Ye, J. and Kulathunga, K. (2019). How does financial knowledge promote sustainability in SMEs? A developing country perspective. Sustainability, 11(10), 2990. [CrossRef]

- Weerakoon, W. (2024). Financial knowledge on digital banking and financial performance among small and medium- sized enterprises in sri lanka. AFR, 2(01). [CrossRef]

- Mustafa, N., Jaffar, R., Fadhil, N., Shaharuddin, S., & Taliyang, S. (2022). The antecedents of financial knowledge and the impact on SMEs’ performance: a conceptual paper. International Journal of Academic Research in Business and Social Sciences, 12(12). [CrossRef]

- Bongomin, G., Ntayi, J., Munene, J., & Malinga, C. (2017). The relationship between access to finance and growth of SMEs in developing economies. Review of International Business and Strategy, 27(4), 520-538. [CrossRef]

- Kromidha, E. (2024). Developing entrepreneurial resilience from uncertainty as usual: a learning theory approach on readiness, response and opportunity. International Journal of Entrepreneurial Behaviour & Research, 30(4), 1001-1022. [CrossRef]

- Panjaitan, R., Hasan, M., & Vilkana, R. (2022). Sophisticated technology innovation capability: entrepreneurial resilience on disaster -resilient MSMEs. Serbian Journal of Management, 17(2), 375-388. [CrossRef]

- Manfield, R. and Newey, L. (2017). Resilience as an entrepreneurial capability: integrating insights from a cross-disciplinary comparison. International Journal of Entrepreneurial Behaviour & Research, 24(7), 1155-1180. [CrossRef]

- Qurniawati, R. and Nurohman, Y. (2021). Performance and sustainability of halal food SMEs. Journal of Finance and Islamic Banking, 4(1). [CrossRef]

- Purwidianti, W. and Tubastuvi, N. (2019). The effect of financial knowledge and financial experience on sme financial behavior in indonesia. Jurnal Dinamika Manajemen, 10(1), 40-45. [CrossRef]

- Eniola, A. and Entebang, H. (2015). Financial knowledge and sme firm performance. International Journal of Research Studies in Management, 5(1). [CrossRef]

- Hilal, B., Rahim, N., & Iranmanesh, M. (2020). The conceptual framework of SMEs financial success in sultanate of oman. Journal of Governance and Integrity, 3(2). [CrossRef]

- Rahmawati, C., Rubiyatno, R., & Sutadi, T. (2022). Efforts to increase coffee store business income through financial literature during the covid-19 pandemic. Semanggi Jurnal Pengabdian Kepada Masyarakat, 1(02), 74-83. [CrossRef]

- Conduah, A. and Essiaw, M. (2022). Resilience and entrepreneurship: a systematic review. F1000research, 11, 348. [CrossRef]

- Zaniarti, S., Veronica, S., & Arsytania, R. (2022). The effect of financial knowledge on the sustainability of micro, small, and medium, enterprises with access to finance as a mediating variable. The International Journal of Management Science and Business Administration, 9(1), 17-31. [CrossRef]

- Zaelani, R., Sujana, H., & Zaky, M. (2022). The influence of Islamic financial knowledge, innovation and the government on the sustainability of MSMEs in Sukabumi city. Kne Social Sciences. [CrossRef]

- Nani, Y. and Marhaeni, A. (2022). Determinant analysis of financial literature of MSME: study case at kediri, bali, indonesia. European Journal of Business Management and Research, 7(5), 4-8. [CrossRef]

- Gunawan, A. and Pulungan, D. (2023). Improving MSME performance through financial knowledge, financial technology, and financial inclusion. International Journal of Applied Economics Finance and Accounting, 15(1), 39-52. [CrossRef]

- Yanto, H., Baroroh, N., Hajawiyah, A., & Rahim, N. (2022). The roles of entrepreneurial skills, financial knowledge, and digital knowledge in maintaining mSMEs during the covid-19 pandemic. Asian Economic and Financial Review, 12(7), 504-517. [CrossRef]

- Purwidianti, W. and Tubastuvi, N. (2019). The effect of financial knowledge and financial experience on SME financial behavior in Indonesia. Jurnal Dinamika Manajemen, 10(1), 40-45. [CrossRef]

- Widagdo, B. and Sa'diyah, C. (2023). Business sustainability: functions of financial behavior, technology, and knowledge. Problems and Perspectives in Management, 21(1), 120-130. [CrossRef]

- Hirawati, H., Sijabat, Y., & Giovanni, A. (2021). Financial knowledge, risk tolerance, and financial management of micro-enterprise actors. Society, 9(1), 174-186. [CrossRef]

- Siswanti, S., Ridjal, S., & Sumail, L. (2021). Does intellectual capital of “capital” matter? Investigation of small business revenue. Jurnal Inovasi Ekonomi, 6(03), 87-92. [CrossRef]

- Oktariswan, D., Manurung, A., Ulupui, I., & Buchdadi, A. (2022). Concept model research of financial psychology to sme business sustainability. Interdisciplinary Social Studies, 1(8), 1031-1053. [CrossRef]

- Das, A. and Das, M. (2023). Productivity improvement using different lean approaches in small and medium enterprises (SMEs). Management Science Letters, 13(1), 51-64. [CrossRef]

- Deshmukh, P. and Thampi, G. (2014). Empirical analysis of factors influencing erp implementation in Indian SMEs. [CrossRef]

- Parlyna, R. (2023). Enterpreneurial orientation and sme’s performance in dki jakarta province: the role of religiousity as a moderator. GIC, 1, 228-236. [CrossRef]

- Iqbal, Q., Ahmad, N., & Ahmad, B. (2018). Enhancing sustainable performance through job characteristics via workplace spirituality. Journal of Science and Technology Policy Management, 12(3), 463-490. [CrossRef]

- Hussain, W., Nordin, E., Majid, R., Razali, F., Mustafah, N., Mahdir, I., & A’lima, M. (2022). Strategies and supports to malaysian SMEs (mSMEs) facing covid 19: road to sustainability. International Journal of Academic Research in Business and Social Sciences, 12(11). [CrossRef]

- Nicolas, C., Brender, N., & Maradan, D. (2023). How did swiss small and medium enterprises weather the covid-19 pandemic? evidence from survey data. Journal of Risk and Financial Management, 16(2), 104. [CrossRef]

- Rashid, M., Yusoff, N., & Kamarudin, K. (2022). The impact of covid-19 pandemic towards the resilience of small medium enterprises (SMEs) in Malaysia. Iop Conference Series Earth and Environmental Science, 1082(1), 012001. [CrossRef]

- AP, I., Odiri, V., JS, O., & Akpoyibo, G. (2022). Impact of covid-19 on small and medium scale enterprises performance: evidence from nigeria. International Journal of Management and Sustainability, 11(2), 81-91. [CrossRef]

- Hs, S., Ariani, N., & Syafitri, F. (2023). SMEs performance risk management in Indonesia: the impact of the covid-19 pandemic crisis. International Journal of Social Science and Human Research, 06(05). [CrossRef]

- Juergensen, J., Guimón, J., & Narula, R. (2020). European SMEs amidst the covid-19 crisis: assessing impact and policy responses. Journal of Industrial and Business Economics, 47(3), 499-510. [CrossRef]

- Rahman, M., Fattah, F., Bag, S., & Gani, M. (2022). Survival strategies of SMEs amidst the covid-19 pandemic: application of sem and fsqca. Journal of Business and Industrial Marketing, 37(10), 1990-2009. [CrossRef]

- Yeon, G., Hong, P., Elangovan, N., & M., D. (2022). Implementing strategic responses in the covid-19 market crisis: a study of small and medium enterprises (SMEs) in india. Journal of Indian Business Research, 14(3), 319-338. [CrossRef]

- Sudarmiatin, S., Wang, L., & Hidayati, N. (2023). The implementation of digital marketing in sme's: opportunities and challenges during the covid-19 pandemic. Indonesian Journal of Business and Entrepreneurship. [CrossRef]

- Khalil, A., Abdelli, M., & Mogaji, E. (2022). Do digital technologies influence the relationship between the covid-19 crisis and SMEs’ resilience in developing countries? Journal of Open Innovation Technology Market and Complexity, 8(2), 100. [CrossRef]

- Ranatunga, R., Jayasekara, M., & Priyanath, H. (2022). Impact of ict usage and dynamic capabilities on the business resilience of SMEs during the covid-19 pandemic: a case of Galle district. Journal of Management Matters, 9(2), 63-95. [CrossRef]

- Mashavira, N., Guvuriro, S., & Chipunza, C. (2022). Driving SMEs’ performance in south africa: investigating the role of performance appraisal practices and managerial competencies. Journal of Risk and Financial Management, 15(7), 283. [CrossRef]

- Luo, D., Shahbaz, M., Qureshi, M., Anis, M., Mahboob, F., Kazouz, H., & Mei, J. (2022). How maritime logistic SMEs lead and gain competitive advantage by applying information technology?. Frontiers in Psychology, 13. [CrossRef]

- Bak, O., Shaw, S., Colicchia, C., & Kumar, V. (2023). A systematic literature review of supply chain resilience in small–medium enterprises (SMEs): a call for further research. IEEE Transactions on Engineering Management, 70(1), 328-341. [CrossRef]

- Fatoki, O. and Asah, F. (2011). The impact of firm and entrepreneurial characteristics on access to debt finance by SMEs in king williams’ town, south africa. International Journal of Business and Management, 6(8). [CrossRef]

- Choong, Y. O., Seow, A. N., Low, M. P., Ismail, N. H., Choong, C., & Seah, C. S. (2023). Delving the impact of adaptability and government support in small-and medium-sized enterprises business resilience: the mediating role of information technology capability. Journal of Contingencies and Crisis Management, 31(4), 928-940. [CrossRef]

- Bilal, A., Naveed, M., & Anwar, F. (2017). Linking distinctive management competencies to SMEs’ growth decisions. Studies in Economics and Finance, 34(3), 302-330. [CrossRef]

- Atiase, V., Wang, Y., & Mahmood, S. (2023). Does managerial training increase SMEs managers' effectiveness? A capability development approach. International Journal of Entrepreneurial Behaviour & Research, 29(8), 1807-1836. [CrossRef]

- Namagembe, S. (2023). Small and medium enterprise agro-processing firms supply chain performance: the role of owner-manager’s managerial competencies, information sharing and information quality. Modern Supply Chain Research and Applications, 5(4), 265-288. [CrossRef]

- Ye, J. and Kulathunga, K. (2019). How does financial knowledge promote sustainability in SMEs? A developing country perspective. Sustainability, 11(10), 2990. [CrossRef]

- Eniola, A. and Entebang, H. (2017). SME managers and financial knowledge. Global Business Review, 18(3), 559-576. [CrossRef]

- Purnomo, B. (2019). Artistic orientation, financial knowledge and entrepreneurial performance. Journal of Enterprising Communities People and Places in the Global Economy, 13(1/2), 105-128. [CrossRef]

- DiBella, J., Forrest, N., Burch, S., Rao-Williams, J., Ninomiya, S., Hermelingmeier, V., & Chisholm, K. (2022). Exploring the potential of SMEs to build individual, organizational, and community resilience through sustainability-oriented business practices. Business Strategy and the Environment, 32(1), 721-735. [CrossRef]

- Choong, Y., Seow, A., Low, M., Ismail, N., Choong, C., & Seah, C. (2023). Delving the impact of adaptability and government support in small-and medium-sized enterprises business resilience: the mediating role of information technology capability. Journal of Contingencies and Crisis Management, 31(4), 928-940. [CrossRef]

- Koliby, I., Abdullah, H., & Suki, N. (2022). Linking entrepreneurial competencies, innovation and sustainable performance of manufacturing smes. Asia-Pacific Journal of Business Administration, 16(1), 21-40. [CrossRef]

- Hummels, H. and Argyrou, A. (2021). Planetary demands: redefining sustainable development and sustainable entrepreneurship. Journal of Cleaner Production, 278, 123804. [CrossRef]

- Roche, S. (2018). The contribution of lifelong learning to development – personal and communal. International Review of Education, 64(1), 1-7. [CrossRef]

- Membrillo-Hernández, J., Lara-Prieto, V., & Caratozzolo, P. (2021). Sustainability: a public policy, a concept, or a competence? Efforts on the implementation of sustainability as a transversal competence throughout higher education programs. Sustainability, 13(24), 13989. [CrossRef]

- Ruhanen, L., Weiler, B., Moyle, B., & McLennan, C. (2015). Trends and patterns in sustainable tourism research: a 25-year bibliometric analysis. Journal of Sustainable Tourism, 23(4), 517-535. [CrossRef]

- Velten, S., Leventon, J., Jager, N., & Newig, J. (2015). What is sustainable agriculture? a systematic review. Sustainability, 7(6), 7833-7865. [CrossRef]

- Fazal, S. A., Mamun, A. A., Wahab, S. A., & Mohiuddin, M. (2019). Social and Environmental Sustainability, Host Country Characteristics, and the Mediating Effect of Improved Working Practices: Evidence from Multinational Corporations in Malaysia. Journal of Asia-Pacific Business, 20(2), 102–124. [CrossRef]

- Edralin, D. and Pastrana, R. (2020). Nexus between sustainable business practices and the quest for peace. Bedan Research Journal, 5(1), 1-58. [CrossRef]

- Malesios, C., Dey, P. K., & Abdelaziz, F. B. (2018). Supply chain sustainability performance measurement of small and medium sized enterprises using structural equation modeling. Annals of Operations Research, 294(1-2), 623-653. [CrossRef]

- Khan, M., Serafeim, G., & Yoon, A. (2016). Corporate sustainability: first evidence on materiality. The Accounting Review, 91(6), 1697-1724. [CrossRef]

- Alshebami, A. and Marri, S. (2022). The impact of financial knowledge on entrepreneurial intention: the mediating role of saving behavior. Frontiers in Psychology, 13. [CrossRef]

- Ai Nety Sumidartini, Suryanto, Nenden kostini, & Herwan Abdul Muhyi. (2022). DOES FINANCIAL KNOWLEDGE AFFECT THE RESILIENCE OF SMALL BUSINESSES IN TRADITIONAL MARKETS? PalArch’s Journal of Archaeology of Egypt / Egyptology, 19(2), 252-262. Retrieved from https://archives.palarch.nl/index.php/jae/article/view/11018.

- Hussain, J., Salia, S., & Karim, A. H. (2018). Is knowledge that powerful? financial knowledge and access to finance. Journal of Small Business and Enterprise Development, 25(6), 985-1003. [CrossRef]

- Bongomin, G. O. C., Ntayi, J. M., Munene, J. C., & Malinga, C. A. (2017). The relationship between access to finance and growth of SMEs in developing economies. Review of International Business and Strategy, 27(4), 520-538. [CrossRef]

- Wise, S. (2013). The impact of financial knowledge on new venture survival. International Journal of Business and Management, 8(23). [CrossRef]

- Purnomo, B. (2019). Artistic orientation, financial knowledge and entrepreneurial performance. Journal of Enterprising Communities People and Places in the Global Economy, 13(1/2), 105-128. [CrossRef]

- Gusman, N., Soekarno, S., & Mirzanti, I. R. (2021). The impact of founder’s financial behavior traits and knowledge on SMEs performance: empirical evidence from SMEs in indonesia. Jurnal Keuangan Dan Perbankan, 25(3), 671-687. [CrossRef]

- Eniola, A. and Entebang, H. (2015). Financial knowledge and SME firm performance. International Journal of Research Studies in Management, 5(1). [CrossRef]

- Unger, J., Rauch, A., Fresé, M., & Rosenbusch, N. (2011). Human capital and entrepreneurial success: a meta-analytical review. Journal of Business Venturing, 26(3), 341-358. [CrossRef]

- Mamun, A. A., Ibrahim, M. D., Yusoff, M. N. H. B., & Fazal, S. A. (2018). Entrepreneurial Leadership, Performance, and Sustainability of Micro-Enterprises in Malaysia. Sustainability, 10(5), 1591. [CrossRef]

- Destiana, D., Yandes, J., Santosa, A., & Fadillah, S. (2023). The effect of entrepreneurial competence on business success through entrepreneurial motivation as an intervening variable. Jurnal Manajemen, 14(1), 99. [CrossRef]

- López-Núñez, M. I., Rubio-Valdehita, S., Armuña, C., & Pérez-Urria, E. (2022). ENTREComp Questionnaire: A Self-Assessment Tool for Entrepreneurship Competencies. Sustainability, 14(5), 2983. [CrossRef]

- Bareiss, R., Porter, B.W., & Murray, K.S. (2005). Supporting Start-to-Finish Development of Knowledge Bases. Machine Learning, 4, 259-283.

- Alshebami, A. S., Seraj, A. H. A. (2021). The Antecedents of Saving Behavior and Entrepreneurial Intention of Saudi Arabia University Students.Educational Sciences: Theory and Practice, 21(2), 67 – 84. [CrossRef]

- Ma, H. (2024). Unpacking the optimistic mindset of business students towards entrepreneurship. Plos One, 19(2), e0297868. [CrossRef]

- Manafe, M., Ohara, M., Gadzali, S., Harahap, M., & Ausat, A. (2023). Exploring the relationship between entrepreneurial mindsets and business success: implications for entrepreneurship education. Journal on Education, 5(4), 12540-12547. [CrossRef]

- Eib, C. and Bernhard-Oettel, C. (2023). Entrepreneurial action and eudaimonic well-being in a crisis: insights from entrepreneurs in sweden during the covid-19 pandemic. Economic and Industrial Democracy, 45(2), 335-362. [CrossRef]

- Bullough, A., Renko, M., & Myatt, T. (2014). Danger zone entrepreneurs: the importance of resilience and self–efficacy for entrepreneurial intentions. Entrepreneurship Theory and Practice, 38(3), 473-499. [CrossRef]

- Panjaitan, R., Hasan, M., & Vilkana, R. (2022). Sophisticated technology innovation capability: entrepreneurial resilience on disaster -resilient msmes. Serbian Journal of Management, 17(2), 375-388. [CrossRef]

- Keqiang, W., Zhao, X., Wang, X., Chen, X., Hung, T., Wang, Z., & Lee, S. (2023). The impact of entrepreneurial resilience on the entrepreneurial intention of return migrants: an empirical study based on survey data from multiple provinces in china. Sage Open, 13(2). [CrossRef]

- Branicki, L., Sullivan-Taylor, B., & Livschitz, S. (2017). How entrepreneurial resilience generates resilient smes. International Journal of Entrepreneurial Behaviour & Research, 24(7), 1244-1263. [CrossRef]

- Ogbumgbada, O. (2023). Entrepreneurial resilience and growth of small and medium enterprises in Port Harcourt. [CrossRef]

- Shafie, D. and Isa, S. (2023). Impact of entrepreneurial leadership, entrepreneurial self-efficacy, basic psychological needs satisfaction, and training effectiveness on entrepreneur resilience in Malaysian SMEs. International Journal of Academic Research in Business and Social Sciences, 13(3). [CrossRef]

- Krejcie, R. V., & Morgan, D. W. (1970). Determining Sample Size for Research Activities. Educational and Psychological Measurement, 30(3), 607-610. [CrossRef]

- Chuan, C. L., & Penyelidikan, J. (2006). Sample Size Estimation Using Krejcie and Morgan and Cohen Statistical Power Analysis: A Comparison. Jurnal Penyelidikan IPBL, 7, 78-86.

- Hair, J.F., Risher, J.J., Sarstedt, M. and Ringle, C.M. (2019), "When to use and how to report the results of PLS-SEM", European Business Review, Vol. 31 No. 1, pp. 2-24. [CrossRef]

- Sarstedt, M., Ringle, C.M., Hair, J.F. (2022). Partial Least Squares Structural Equation Modeling. In: Homburg, C., Klarmann, M., Vomberg, A. (eds) Handbook of Market Research. Springer, Cham. [CrossRef]

- Chin, W. W. (2009). Bootstrap cross-validation indices for PLS path model assessment. In Handbook of partial least squares: Concepts, methods and applications (pp. 83-97). Berlin, Heidelberg: Springer Berlin Heidelberg.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).