Introduction

The ‘Dublin Principles’ for Integrated Water Resource Management (IWRM) were agreed in 1992 and it was no coincidence that when South Africa’s first democratic government began formulating water policy in 1994, and published the National Water Act in 1998, that the country’s legislation resonated with the principles of IWRM (Allen, 2003). South Africa’s National Water Act (NWA) commences with the idea that “… Water is a scarce and unevenly distributed national resource which occurs in many different forms which are all part of a unitary, inter-dependent cycle and …the need for the integrated management of all aspects of water resources and, where appropriate, the delegation of management functions to a regional or catchment level so as to enable everyone to participate” (RSA, 1998). The NWA replaced South Africa’s Water Act (1956) founded on European water law, and set out to align water allocations with the country’s post-1994 democratic ambition. In support of this ambition, the Department of Water Affairs coined the slogan, “Some for all, forever” to foreground the NWA’s balance between economic efficiency, environmental sustainability and equity.

Whilst principled and internationally acclaimed, the NWA proved difficult to implement and the reallocation of water to unlock the “social and economic value” of water in South Africa is yet to be realised (Schreiner, 2013; Ruiters and Matji, 2015; DWS, 2021). There has been a particular challenge in balancing “equitable and efficient” uses of water in a country that is water scarce, socio-economically unequal and struggling to compete in the global economy (Cullis and van Koppen, 2008; Reuters, 2013; van Koppen and Schreiner, 2014). Underlying the implementation deficit has been the inability to galvanise the water governance configurations that the NWA envisaged would raise the finance necessary for IWRM and new water infrastructure.

As a water scarce, urbanising, upper middle-income country, the ability to supply potable water to people and companies is critical to South Africa’s economy, human health and political stability (Tapela et al., 2015; Bedasso and Obekili, 2016; Fransman and von Fintel, 2024). Various public and private efforts have sought to understand the backlog and propose means of addressing it (Ruiters, 2013; DWS, 2021; DBSA/ WB, 2021). The study that this paper draws on was funded by the DBSA and commissioned under the SA-TIED programme.

1 It adapted the World Bank’s “Beyond the Gap” framework to estimate the 2023-2050 capital and operational investment required if South Africa is to attain its domestic policy goals and comply with SDG6 (DBSA et al., 2023). The study went beyond the conventional approach to investment gap analyses by exploring the implications of internal policy choices (such as commitment to water demand management) and exogenous factors (such as climate change and energy policy) on the investment need. In so doing it exposed trade-offs and revealed the need for new approaches to investment if the obvious benefits of implementing the NWA to achieve SDG6 are to be realised.

The struggle to finance water services at a time of steadily growing water demand and a warming climate is not unique to South Africa (Van Koppen, 2003; Banerjee and Morella, 2011; Onjala and K’Akumu, 2016; Alaerts, 2019; Cirolia, 2020; Van Vliet, 2021; McCoy and Schwartz, 2023). At a time when the availability of water is coming under increasing pressure in many regions of the world, the study juxtaposes the risks that emerge when SDG targets such as universal access to potable water are missed, against the financial and fiscal risks associated when indebted countries invest in universal water access (Markel and Donnenfeld, 2016; Satterthwaite, 2016; Alaerts, 2019; WWF, 2023; CDP, 2023). The discussion section of this paper identifies options and challenges for including private sector investment, and introduces a Monetary Architecture approach that is being explored in South Africa to close the investment gap.

Literature Review

South Africa, like many African countries, has struggled to raise the investment required to extend services to growing and urbanising populations (Onjala and K’Akumu, 2016; Satterthwait, 2016; Neto, 2016; Alaerts, 2019; Van Vliet, 2021; McCoy and Schwartz, 2023). The SDGs are contingent upon African countries escaping the vicious circle of poverty, weak and centralised revenue collection, inadequate investment in infrastructure and services and continued poverty underpinned by a lack of basic services (Lubeck-Schricker et al., 2023). While the rhetoric around the need for improved infrastructure and services in Africa has increased, and is often framed through reference to the SDGs, the financialisation of many public utilities across the continent exposes the provision of basic services to narrow financial metrics relating to debt and return on investment (Ruiters and Matji, 2015; Lameck et al., 2019). The same features that undermine the delivery of services in African countries result in high costs of capital and limited access to the bond market for African countries, rendering many conventional infrastructure finance models difficult to apply (Cartwright, 2022; Haas et al., 2023). Unwittingly, this has created tensions for African utilities forced to choose between pursuing universal access to basic services (and the SDGs) on the one hand, and financial solvency on the other (Budds, & McGranahan, 2003; Satterthwaite, 2016; Ledger and Rampedi, 2018; Lameck et al., 2019).

A wide-ranging review of the global water finance literature suggests that the water-related Sustainable Development Goals (SDGs) will require a 2-4 fold increase in investment in water services ahead of 2045 as demand increases, water catchments are degraded and climate change demands new forms of adaptation (Alaerts, 2019). The rising cost of water service provision increasingly confronts the limits of the traditional international aid and national government funding for water and sanitation services, placing new demands on international financiers looking to retain the productivity of their other water-dependent assets (Alaerts, 2019). Historically, however, publicly owned water utilities were regarded as insufficiently creditworthy and the governance of many municipal water services departments was deemed unreliable, making it difficult for private financiers to unlock the full public good value of water services (McCoy and Schwartz, 2023).

Perversely, in regions most in need of enhanced water services, the institutional capacity to attract and spend investment in water services is weakest, resulting in a growing gap between funding commitments and actual disbursements in regions with the most acute water needs (Alaerts, 2019:12). The gap highlights the need for institutional strengthening and improved governance to absorb the increased flows of finance needed to achieve the SDGs, not to mention context-specific solutions that make sense for the actual public and private actors that need to collaborate via various forms of public-private-community partnerships (Castro, 2007; Neto, 2016; Alaerts, 2019; Swilling, 2015).

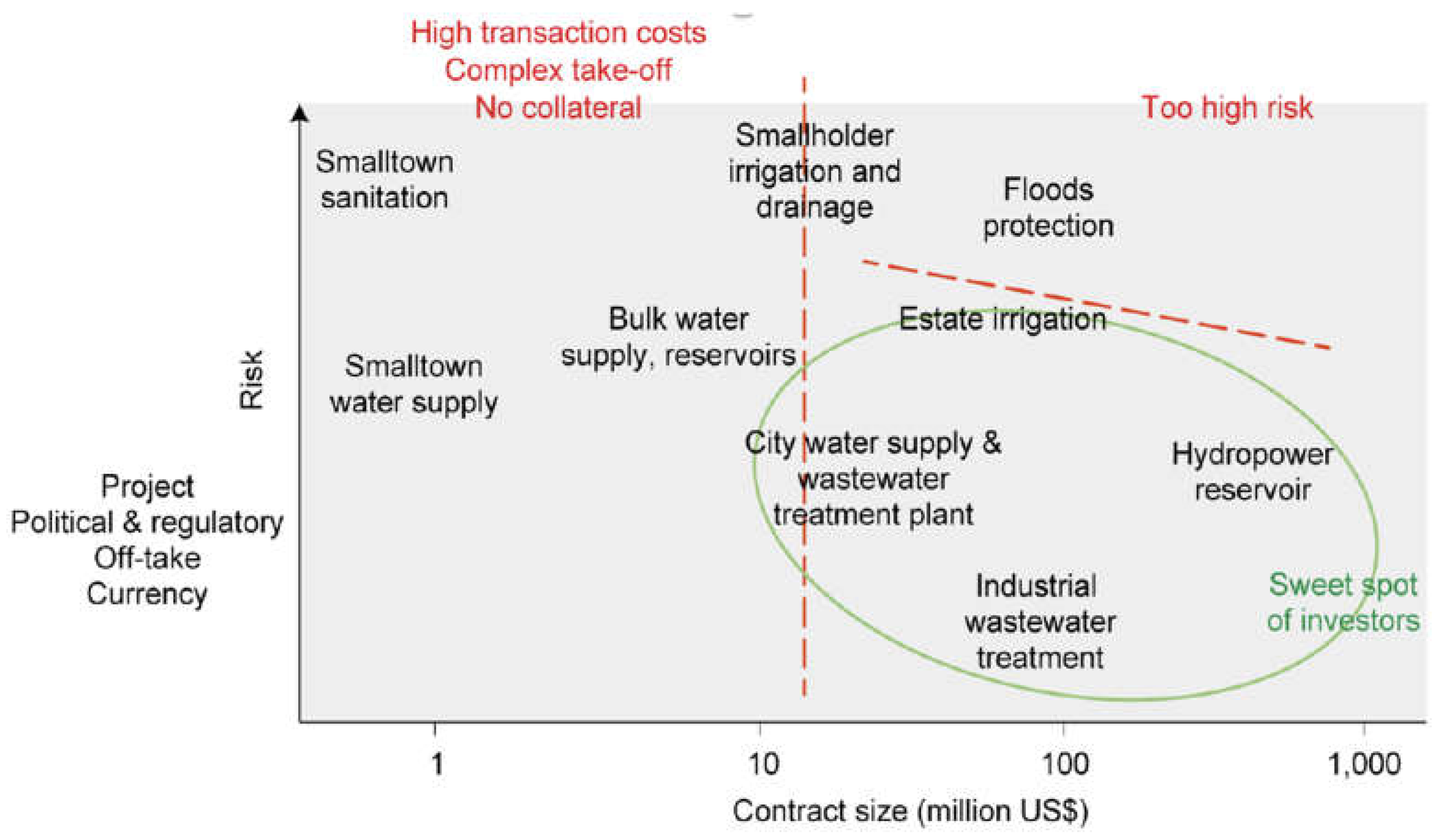

The finance sector has begun exploring new ways to address the challenge. The emphasis has been on blended finance solutions, bringing in Development Finance Institutions and creating specialist funds (e.g., the Philippine Water Revolving Fund and the Kenya Pooled Water Fund) while maximising the potential of local capital markets to reduce foreign exchange risk (Haas et al., 2023). The tendency of private financiers has been to seek out large, low-risk projects (see

Figure 1). On their own these discrete projects do not ensure a sustainable water system or universal access to safe and reliable water services. On the contrary, the value of privately funded water assets depends on a range of actors and systemic interventions many of which are are unattractive to private financiers on account of their size, ability to generate financial returns and complexity: climate adaptation measures (e.g., flood buffers), healthy water catchments, bulk water supply, small-holder irrigation, water treatment plants, small-town water services and revenue collections systems. There is, however, no escaping the consequences of a lack of funding for water and sanitation services. As Alaerts predicts, at some point the interests of the private financial sector and water sector converge as the negative consequences of under-investment in water services and climate pressures take their toll on all actors, including financiers (Alaerts, 2019).

In South Africa access to water and sanitation services is fundamental to human dignity, livelihood opportunities and economic growth (NDP, 2011). Various studies have highlighted the links between investment in the water sector and socio-economic progress: the benefits of economic growth and social stability that arise from improved water quality exceed the cost of investing in water treatment plants by a factor of six or seven in the Breede River Catchment (Cullis et al., 2018); a 17% “increase in water scarcity” would result in a 0.34% decrease in South Africa’s gross domestic product by 2030 (Briand et al. 2021); a R7.5bn augmentation of South Africa’s Western Cape Water Supply System would add 7% in GDP to the region’s economy, 195 000 jobs and improvements to the Balance of Payments between 2020 and 2035 (Pegasys, 2022).

Building on the country’s Constitution, South Africa’s NWA (36 of 1998) recognised water as both a human right and a systemic economic, social and environmental good. The Act requires that every South African has “sufficient water” (Constitution of the Republic of South Africa, 1996, 27(1)b), which the Water Services Act (1997) interpreted as access to 25 litres per person per day or 6 kilolitres per household per month dispensed from a tap not further than 200 metres from their dwelling (RSA, 2007). Famously, the Act also requires a critical minimum amount of water—the “ecological reserve”—to be left in rivers and streams to retain the functionality of these ecological assets and their role in the national water system. The policy was aware that unlocking the systemic benefits of easy access to adequate potable water

2 and healthy aquatic ecosystems was not something that could be achieved by traditional project finance. In keeping with the Dublin Principles’ notion of water as a public good, the NWA nationalised South Africa’s water resource and mandated the government, specifically the DWS, with the financial responsibility for water infrastructure and water services. South Africa’s National Development Plan envisaged spending 10% of the country’s GDP on service delivery infrastructure, but when last reported this number stood at 5.8% and was falling (NPC, 2011; National Treasury, 2020). The NWA does provide for a series of user charges to cover operational funding and augment the fiscal transfers from DWS for bulk water infrastructure. These include:

A water resource management charge paid by all water users (including non-irrigated forest and sugarcane enterprises) except hydropower companies and used in the management of water catchments.

A water resource infrastructure charge (sometimes called the Capital Unit Charge) paid by all users except non-irrigated forest and sugarcane enterprises and used in the financing and replacing of water infrastructure.

A water discharge mitigation charge, levied on polluters (chemical or temperature) of freshwater resources.

A Water Research Commission charge, paid by all users and applied in support of water related research.

Crucially, while the National DWS was deemed responsible for funding in the NWA of 1998, the responsibility for providing services and raising tariffs was given to 19 ‘to-be-established’ Catchment Management Agencies (CMAs). As of 2024, only two CMAs had been registered with most water catchments remaining dependent on regional offices of the DWS and the irrigation boards that formed part of South Africa’s water governance prior to the National Water Act. In the absence of CMAs the raising of tariffs from agricultural and forestry users, who still account for 70% of water consumed in South Africa, and the levying of penalties on polluters, has proven difficult. Households and businesses in South Africa purchase water from local or district municipalities designated as Water Services Authorities (WSAs). The WSAs either purchase treated water from water boards, or purchase raw water from DWS and treat it themselves (Pegasys, 2022). In general, what South African water users pay for water does not reflect the scarcity of the resource in the country, let alone the cost of securing and supplying water or treating waste water (Ruiters and Matji, 2015; Cartwright, 2021). As a result, both capital and operations in South Africa’s water sector remain heavily reliant on fiscal transfers from National Government to Local Governments in the form of four Conditional Grants and “Equitable Share” (Cartwright, 2021; DBSA/WB, 2022).

Despite governance and pricing problems, South Africa’s first water policy as a democratic country was initially successful in extending access to potable water, particularly in urban areas. The proportion of households with access to reticulated water increased between 1994 and 2010 from 59% to 93%, and with sanitation from 43% to 73% (DWS, 2011; Schreiner, 2013). Corresponding census data report that the number of people with access to reticulated potable water continued to improve from 84.4% in 2002 to 88.7% in 2021. The same data show access to sanitation improved from 61.7% to 84.1% over the two decades to 2021 (StatsSA, Aug 2022), and a number of municipalities increased their offering of free basic water from 6 kilolitres per household per month to 9 kilolitres.

The successful extension of water services was accompanied by an under-investment in other aspects of the water sector. The full cost of universal access to potable water and sanitation in South Africa includes the capital and maintenance cost of “access infrastructure” (taps and toilets), “distribution infrastructure” (inter-basin transfers and pipes for bulk water), “water treatment infrastructure”, “water storage” (dams, reservoirs), “investment in water catchments” and the “operating systems” (salaries, software and communication) required to make the water system workable (Muller, 2021).

3 South Africa has not been able to mobilise the entirety of investment required and a number of South Africa’s water catchments and water infrastructure have been in a state of decline. The DWS’s Blue and Green Drop reports, released in 2023, indicated that of the 958 water supply systems across South Africa, 29% were in a “critical” state of disrepair—up from 18% in 2014 (DWS, 2023). The number of water supply systems reporting “poor or bad” microbiological water quality in 2022 was reported as 46%, up from 5% in 2014 (DWS, 2023). In Limpopo, Mpumalanga and the North West Province, the percentage of households without access to water increased between 2011 and 2021, under pressure from population growth, urbanisation and the failure of local and provincial governments that were unable to maintain their existing bulk infrastructure. “Non-revenue water” comprising leakages, illegal connections and non-payments, provides a particularly prescient indicator of the state of water infrastructure and governance capacity; in South Africa “non-revenue water” increased from 37% of all water in 2014 to 47% in 2023 and water related service delivery protests increased in concert (Tapela et al., 2015; DWS, 2023).

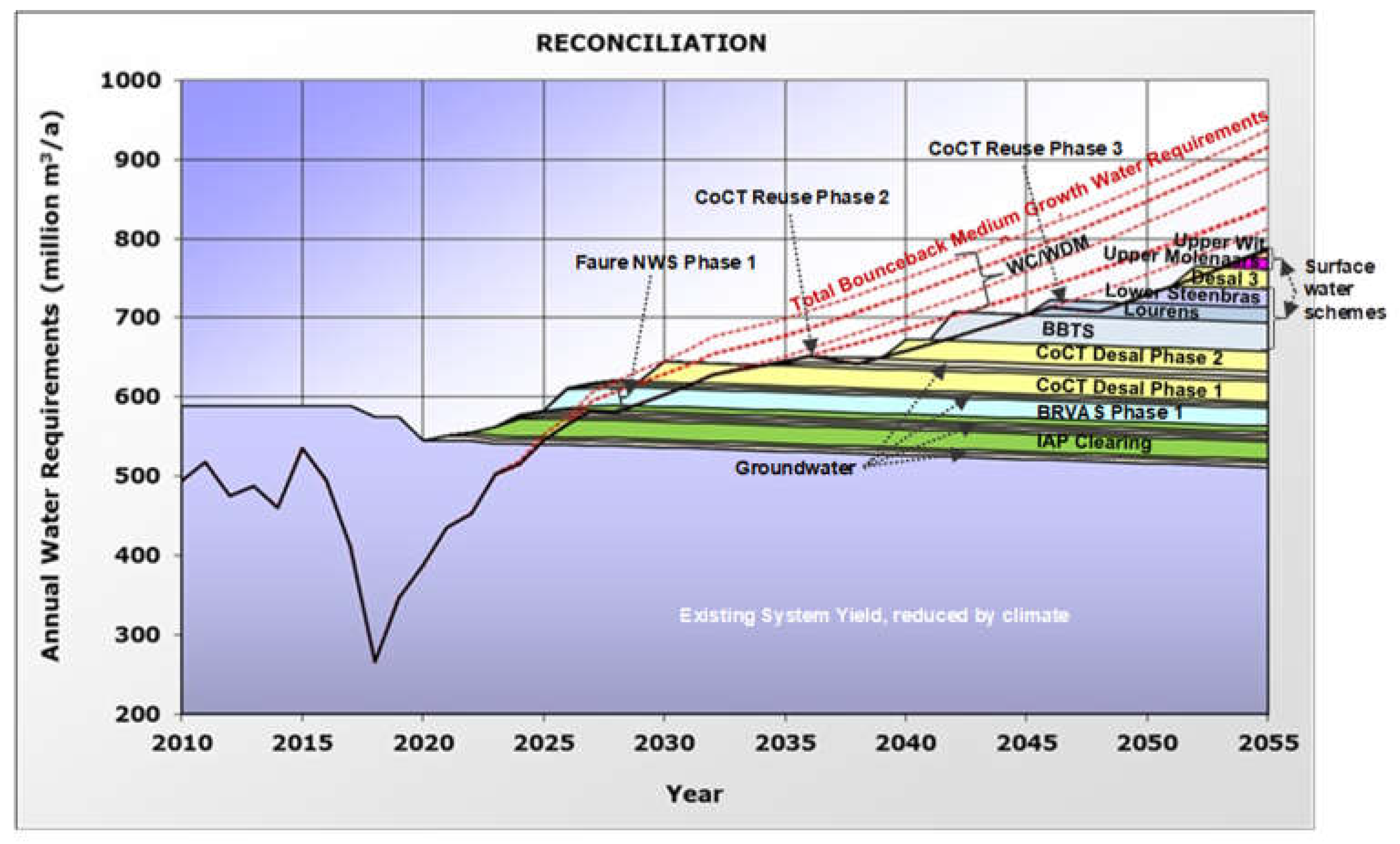

Catchments in South Africa are required to produce “reconciliation studies” that anticipate future demand and cost bulk infrastructure options required to meet this demand (see

Figure 1) (DWS, 2023). These can be used to produce estimates of the investment required to arrest the decline and fulfil the policy goals of the NWA. In 2011, the backlog was estimated at R600 billion (Ruiters, 2013), in 2019 a hastily compiled “Water and Sanitation Master Plan” estimated the need for R900 billion over 10 years (as opposed to the budgeted R565 billion) to attain the “Goals set out in the National Development Plan (NDP), the Sustainable Development Goals (SDGs) (in particular SDG6: Ensure Water and Sanitation For All) as well as the African Union Agenda 2063” (DWS, 2019). A study by the DBSA and World Bank estimated the funding requirement for compliance with SDG6 to be between R110bn and R147bn (2021 Rands) per annum in the 10 years prior to 2030 (a gap of R43bn to R47bn per annum) (DBSA/WB, 2021).

The SA-TIED study was an extension of this analysis. Unlike the Reconciliation Studies, the ‘Beyond the Gap’ analyses included the full cost of attaining South Africa’s policy goals and SDG6, including the catchment stewardship that is easily overlooked, maintenance costs and the water services infrastructure that typically falls to local governments to finance. By identifying the investment need the study provided a critical first step in identifying the levels of investment that will be required to realise the benefits of universal access to safe drinking water and sanitation. While not the specific task of the research, the logical question emerging from this work is how to unlock the public and private investments to achieve South Africa’s water targets and SDG6.

Methodology

The adapted ‘Beyond the Gap’ framework that was applied in this study, comprised four steps (Rozenberg and Fay 2019):

Identify objectives: With support from DWS, the Water Research Commission (WRC), and a broader Water Sector Working Group, the SDG objectives were interpreted through the lens of South Africa’s national water policy and associated targets. Six sector objectives were applied in the model: universal access to safe and reliable water and hygiene services based on the SDGs and South African policy (DWS’s National Water and Sanitation Master Plan goal of 175 litres per capita per day); affordable and financially sustainable water services, which was interpreted in the model to imply lowest life-cycle cost and a financing arrangement that equitably distributes liability for the cost; reduced demand on freshwater resources through the adoption of efficiency measures; increased catchment and water infrastructure resilience, particularly in the context of climate change and more intense rainfall events; reducing the environmental impact of service delivery through attention to greenhouse gas emissions and resource efficiency—in South Africa, the ‘wastewater treatment and discharge’ category accounts for 4.5 MtCO2e per annum, 0.9% of national emissions (Department of Fisheries, Forestry and the Environment 2023); aligning with SDG 6.4, the model assumed a 15% improvement in water use efficiency by 2030, as outlined in the National Development Plan (RSA, 2011).

Identify policy choices: The policy choices that influence the investment required to achieve the described ‘objectives’ was selected with help from the project steering committee (comprised of DBSA, SA-TIED, the PCC, and NPC). The options included (i) attainment of SDG 6.1 and 6.2 on every property, or, alternatively, in line with DWS precedents allowing for these water services to be shared by up to five properties in some instances; (ii) different water service technology options: “conventional” (standpipe taps and flush toilets), “low cost” (ventilated pit latrines) or “alternative” (waterless and biodigesting toilets) technologies (iii) different degrees of “water conservation and demand management”; (iv) timing—whether the objectives were achieved by 2030 as imagined by the SDGs or by 2040; (v) the extent of invasive alien plant clearing and its impact on run-off in major catchments; (vi) the size of the water allocation to South Africa’s agricultural sector, ranging from an increase of 15%, and increase of 6% or a reduction of 15% on 2020 levels; (vii) a respective 15% improvement and 15% decline in operational efficiencies at bulk water supplies and inter-basin transfers by 2030, that the model then assumed would be maintained until 2050.

Identify exogenous factors: Attention was given to “exogenous factors” that are unrelated to water policy but which influence the quantum of required investment to attain the ‘objectives’ identified in the first step. The extent of anthropogenic warming and its impact in South Africa, and the choice of South Africa’s implemented energy sector strategy, were respectively identified as significant on the quantum of required investment. Climate scenarios were based on CSIR’s Greenbook (Cullis et al., 2019) and included: a wet scenario based on the 90th percentile under Representative Concentration on Pathway (RCP) 8.5 by 2050; a median scenario based on the 50th percentile under RCP 8.5 by 2050; and a dry scenario based on the 10th percentile under RCP 8.5 by 2050. Energy policy choices related to the early retirement, or not, of South Africa’s five oldest coal-fired power stations and the associated reduction in water demand from these stations was modelled as an additional “exogenous factor”. The extent of socio-economic progress was considered, but excluded as an exogenous factor on the basis of a previous study that had found socio-economic progress to be of limited influence on the cost of realising water sector objectives (DBSA/WB, 2021).

iv) Estimate investment requirements for achieving objectives: By combining exogenous factors with policy choices, a set of future scenarios was established. Considering all combinations of exogenous factors and policy choices 11,664 water demand futures were possible.

Capital and operating costs (

Table 1) of achieving the identified objectives under each water demand future was forecast using two Microsoft Excel models. The first involved a Water Services Model that calculated demand for potable water and the cost of providing the water distribution infrastructure, taps and toilets to meet this demand for urban formal, urban informal, rural formal, and rural informal communities respectively between 2023 to 2050. The second, involved a Water Resources Model that captured the cost of securing additional water, in order to meet demand in each of South Africa’s seven major water systems. The Water Resources Model selected the most suitable “augmentation option” from a predetermined sequence of 157 options (see

Figure 1 for example), to close the gap between aggregate demand and supply up to 2050. Crucially, the Water Resources Model determined when demand in the respective systems would exceed supply, signalling the timing of new investment in water resources. The model drew a distinction between the cost of securing potable and non-potable water yield.

Both models had to rely on assumptions when estimating the cost of securing and dispensing water in the future. Where existing water infrastructure costs were available, Statistics South Africa’s Contract Price Adjustment Formula (CPAF) was used to inflate these costs. There were, however, no cost precedents for some of the new technologies, including some renewable energy technologies. In these instances, the costs referenced in literature (most frequently the literature released by Gates Foundation) were applied in the model. Costs for the clearing of invasive alien plants (IAPs) were obtained from a study by Blignaut et al. (2007) and compared with more recent estimates for the Greater Cape Town Water Fund (The Nature Conservancy 2019) and from data on general clearing costs provided by World Wildlife Fund (WWF) and South African National Biodiversity Institute (SANBI). The study went to some lengths to caution against assumed accuracy of future water supply costs, and operating costs in particular, noting the existing under-spend on operating costs and the unpredictability of future electricity costs as sources of uncertainty.

In all cost estimates, 2022 Rands were used as the unit of currency. No adjustments were made for currency fluctuations and no discount rate was applied to future costs.

Figure 2.

Example of a DWS reconciliation study. Source: DBSA 2023.

Figure 2.

Example of a DWS reconciliation study. Source: DBSA 2023.

- iv.

Estimate the funding gap: The final step of the ‘Beyond the Gap’ framework involves calculating the difference between existing flows of investment and the required investment, to report the funding gap for both capital and operating expenditure, under the different scenarios of future water demand.

Findings

Given the number of possible water futures generated by different combinations of the policy and exogenous factors, it was important to report the model results relative to a baseline scenario. The chosen baseline comprised no major policy interventions, median climate change impacts, current energy supply mix with the same water allocations to these energy options, achieving SDGs and NDP goals by 2030 through conventional technologies only, maintenance of existing levels of IAP clearing, a continuation of existing allocations to agriculture and existing levels of efficiency in the integrated bulk supply system.

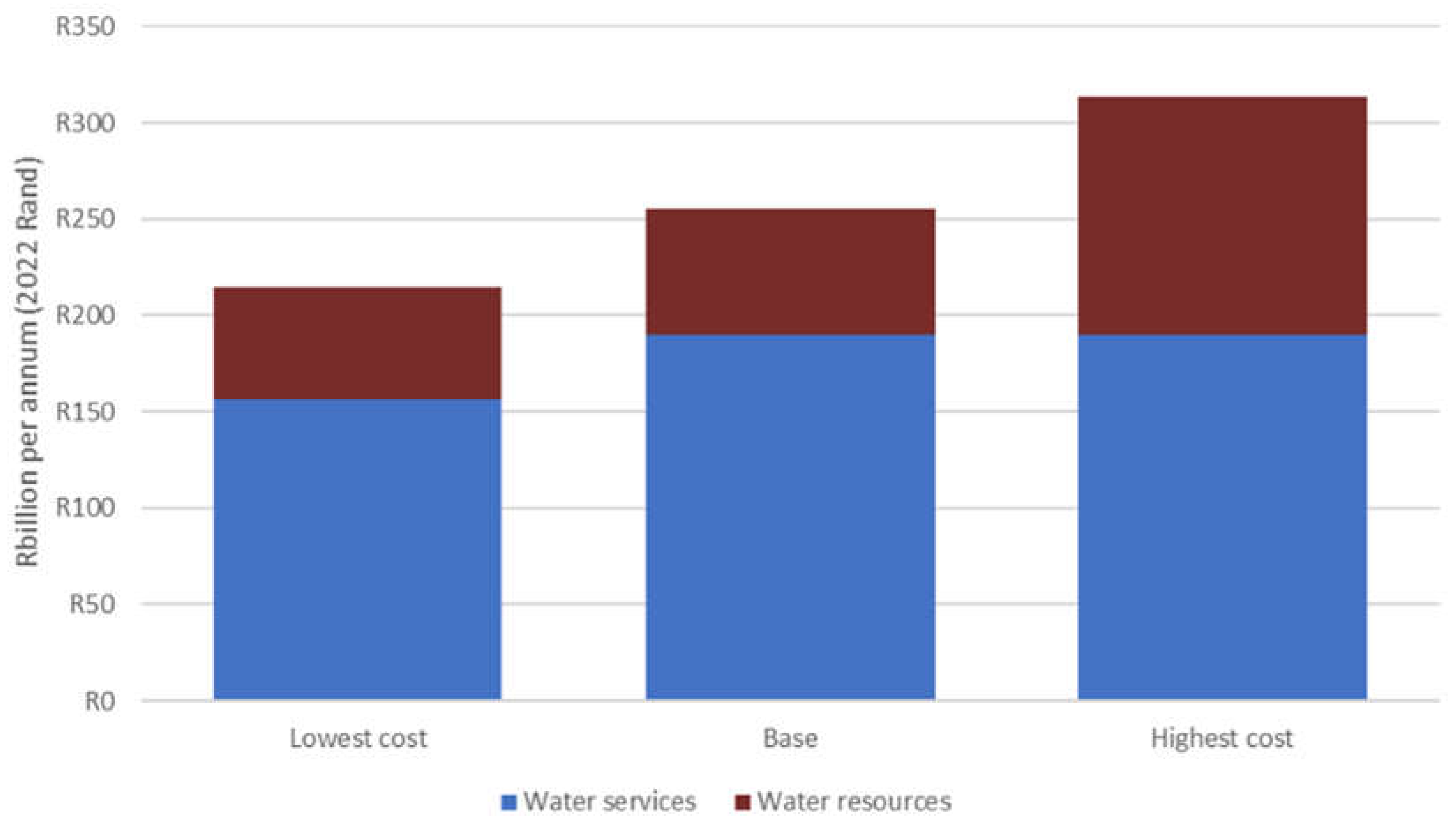

Model estimates suggest that the baseline scenario required R256 billion

4 in combined operating and capital expenditure, annually between 2023 and 2050 to achieve water sector objectives (SDG 6.1, 6.2 and 6.4). This represents a R91 billion annual increase—the funding gap—on the estimated existing allocations to the South African water sector, a 55% increase in investment per year assuming all the budgeted investment is made. The total investment requirement to meet the policy objectives by 2030 and sustain this level of service to 2050 is estimated at R7.16 trillion.

By adjusting different exogenous and policy assumptions it was possible to appraise the sensitivity of the total investment need to other parameters. The study found that the annual investment requirement could be reduced to R214 billion per annum (capital and operating expenditure) under a combination of a wet climate, an energy transition away from coal, sharing of some water taps between (up to) five houses, aggressive water conservation and demand management, increased clearing of IAPs, reduced allocations to agriculture, and improved bulk water system efficiencies. The funding gap between required and existing expenditure under this scenario is similarly reduced to R49 billion per annum or 30% more than is currently invested.

Under a combination of dry climate, no energy transition, conventional technologies, no management of IAPs, increased allocations to agriculture, and a decline in system efficiencies, achieving the SDGs would require an investment of R314 billion (2022 Rands) on average, per annum. This represents a funding gap of R149 billion per annum or an increase of investment and expenditure of 90% relative to estimated existing allocations.

The difference between the “highest cost” and “lowest cost” scenarios was 46% in total, but comprised of a 21% difference for water services infrastructure and a 115% difference for water resources infrastructure. The wide range of costs produced by the Water Resources Model reflects the range of options for securing additional water yield. The difference points to the significant savings for bulk water infrastructure that could be realised by effective water and energy policies. Without these policies, the water sector is required to activate some very expensive water augmentation options.

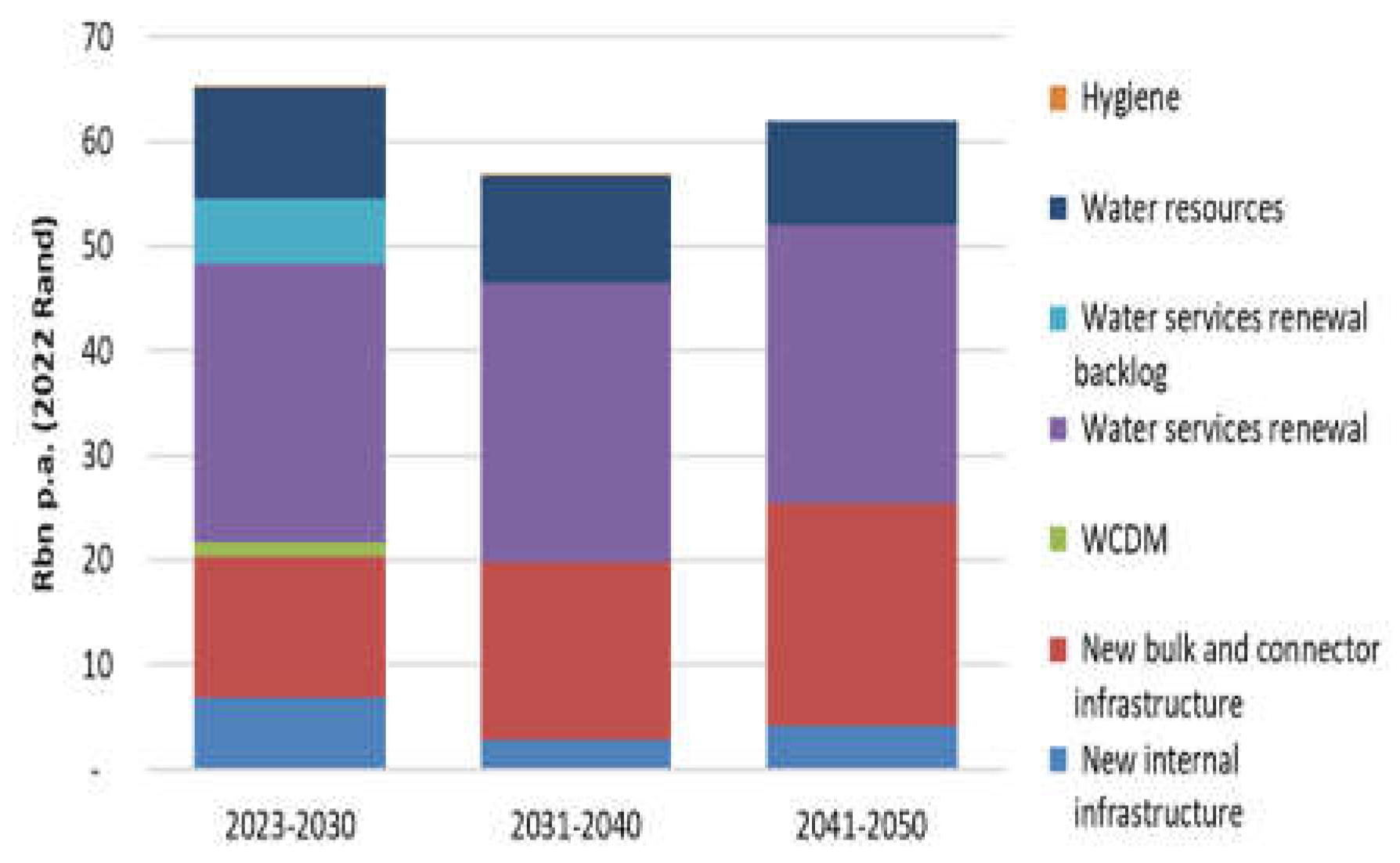

The inclusion of both capital and operating expenditure and water supply and water distribution and treatment, accounts for the generally higher estimates of investment need relative to previous studies, including the National Water and Sanitation Plan (NWSMP) estimate of R899 billion between 2018–2028 for capital expenditure only. The inclusion of all costs is, however, considered a more accurate reflection of the cost of attaining NDP and related water policy goals and SDG6. The magnitude of annual operating costs is shown to be 3 to 4 times larger than capital costs (

Figure 3), and ignoring operating costs is one of the causes of infrastructure decay and backlogs. It is noteworthy that any policy choice that results in high near-term demand, such as an immediate increase in the allocation to agriculture, drastically increases the investment need by requiring near term investments in water supply and the associated operating costs.

The cost of water conservation and demand management and capacity building is relatively small in the model, but yields systemic benefits to the sector and is capable of improving efficiency and effectiveness of a wide range of other parameters. It is this feature that renders investment in water conservation and demand side management particularly cost effective in the model. Similarly, investments in sectoral coordination and ‘capacity building’ are modelled as unlocking readily available water savings and service delivery gains by aligning the provincial responsibility for housing delivery and bulk water supply with the local government responsibility for human settlement planning and water reticulation. This effectively ‘costs’ the capacity deficit referred to by Alaerts (2019) as a constraint on increased investment.

The model results point to the importance of timing in infrastructure investment and maintenance. Given the extent of South Africa’s water assets (nearly R1 trillion) it is no surprise that delays in maintaining and replacing this infrastructure, result in higher investment needs. South Africa has learned the hard lesson since 1998 that delays in infrastructure maintenance and extensions result in reduced operational efficiency and a greater long term capital replacement need. Similarly, the temptation in South Africa to push the achievement of the water access and sanitation goals beyond 2030 to ‘buy time’, is revealed as making no difference to the cost of achieving these goals, as the need and cost amplifies with delays.

Figure 4.

Disaggregated operating expenditure requirement associated with the baseline scenario. (Source: DBSA et al. 2023).

Figure 4.

Disaggregated operating expenditure requirement associated with the baseline scenario. (Source: DBSA et al. 2023).

Figure 5.

Disaggregated capital expenditure requirement associated with the baseline scenario. (Source: DBSA et al. 2023).

Figure 5.

Disaggregated capital expenditure requirement associated with the baseline scenario. (Source: DBSA et al. 2023).

Discussion

In nationalising South Africa’s water resource in 1998, the NWA mandated the government of South Africa, and specifically the Minister of the DWS, with responsibilities for funding the country’s life-giving and critical economic water resource. The NWA was intended to unlock the full public good value of integrated water resource management and universal access to water and sanitation services, and the Act created water tariff instruments through which to raise the required funding. In practice, it has proven a difficult mandate to honour. Activating the tariffs instruments and charging users the full cost of sustainable water and sanitation would have required the institutional capacity and political economy to apply significantly higher water prices.

Understanding the full extent of the outstanding investment need, R75 billion—R149 billion per annum, represents a critical step towards unlocking the multiple benefits that would arise if the country implemented its water policies. Infrastructure investment models have a track-record of either under-reporting actual investment costs or reporting very large numbers based on an ‘ideal world’ scenario that has very little chance of being funded (Andersen et al., 2016; Flyvbjerg and Gardner, 2023). This assessment mitigated those risks by assessing the gap between existing and required investment, and by including the influence of policy choices and exogenous factors. While the estimated investment gap is large, the study reveals how it can be increased or decreased by a variety of decisions and actors.

The approach serves to achieve a number of important outcomes: it locates infrastructure finance in the policy world rather than as a discrete science; it challenges policy officials and financiers to consider the impact of their decisions on the amount of investment required; it foregrounds the role of macro-economic policies in achieving the SDGs and by implication NDP goals (Eriksson et al., 2019) and it translates the impact of climate change into the availability of a critical resource and the need for investment (Hallegatte and Mach, 2016). It also highlights the importance of paying for renewal of existing infrastructure in order to prevent a reduction in the efficiency of the operation of existing systems (such as the bulk systems) that are threatened by a lack of funding and technical capacity both within national entities (such as DWS to manage the bulk systems) and municipalities (to maintain the water and sanitation infrastructure).

The study exposes an awkward tension between the risks of not attaining a critical SDG for South Africa on the one hand, and the risks of fiscal precarity and spiralling debt if too much money is spent to achieve the SDGs or this money is not well managed (Archer and Dodman, 2017; Battiston,2017). This is an under-acknowledged tension in the normative SDG literature. Financiers, in particular, tend to discount the risks that are incubated when development outcomes are not achieved (Satterthwaite and Dodman, 2013; Satterthwaite, 2016; Monnin, 2018; Krogstrup and Oman, 2019).

New financing approaches will have to be found if the suite of benefits associated with realising the NWA vision and SDG6 are to be unlocked (Alaerts, 2019). These approaches will need to balance fiscal stability against the “financially systemic” risk of not achieving SDG6 (Schoenmaker and Tilburg, 2016); both the failure to deliver on water policy objectives and the rapid allocation of capital to achieve these objectives hold the risk of macro-economic and political instability in South Africa.

Reallocating water from agricultural to higher-paying household and business users, and increasing tariffs across all users, could reduce the funding gap to just 18%, but these options have proven difficult to apply amid concerns around food prices and rural economies (Cartwright, 2021). The most significant investment savings result from reducing the extent of “non-revenue water”, investments in IAP clearing, water conservation and demand management, capacity building and more efficient integration of different water schemes. Some of these options would create the type of work that would put money in water-users’ hands, thereby increasing their ability to pay for water. There is further scope to reinterpret the definition of universal access to water. A hallmark Constitutional Court (South Africa’s apex court) ruling in 2009 prescribed that it was up to local governments in South Africa to determine free basic water allowance based on their available water and budgets (Mazibuko et al. vs City of Johannesburg, 8 October, 2009). The court required water utilities to only, “Take reasonable legislative and other measures to seek the progressive realisation of the right” while ensuring their own financial viability (ConCourt, 2009). The same ruling found the installation of pre-paid water metres not to violate individual’s rights, pointing to possible revenue enhancement steps (ConCourt, 2009).

The study aggregates investment needs across seven South African water systems rather than providing back-log estimates for specific systems. In practice, funding arrangements differ across catchments, and the aggregation of the investment gap conceals places where this gap might be low or even narrowing. The City of Cape Town, acting as a WSA for example, applied an aggressive step tariff during its Day Zero drought (2016-2018) to assist in the financing of drought mitigation measures (Kaiser, 2024). Cape Town’s approach reveals the potential to mobilise water infrastructure investment from sources beyond DWS, including from affluent households and by leveraging the local government’s balance sheet to raise bond finance. Where failing water infrastructure assets and rolling water shortages or floods are recognised as everyone’s liabilities (as was the case during the Day Zero Drought 2016-2018, or in the wake of the KZN floods of 2021), households begin investing in water storage tanks, farms installed multiple small dams and reservoirs, and investing in groundwater extraction or grey water re-use become attractive. In the wake of the KZN flood damage in 2022, the need to invest in more stable water catchments, capable of retaining water in grasslands, wetlands and soils and reducing flood damage, suddenly became apparent to all asset owners. In this context, it is possible to raise finance for both water resource and water services infrastructure from a multiplicity of sources. Where this investment can create jobs, such as has been demonstrated by various ecological infrastructure options, or through the proliferation of grey water recycling for example, it supports the type of poverty alleviation that could enhance the capacity to raise finance through water tariffs (Blignaut, et al., 2008; Maia, et al., 2011; Olsen et al., 2021). South Africa has been preoccupied with economic growth policies to create jobs, but could balance this with water sector investment that creates the type of jobs that support economic growth.

Understanding SDG6 in the context of IWRM creates the possibility of securing water sector investment from multiple actors, including departments responsible for the natural environment, mining, energy and health. This would be a departure from the South African tendency to burden single government ministries with the responsibility to resolving complex and multi-faceted problems, some of which are beyond the influence of the responsible department, and align with Neto’s Integrated Urban Water Policy Approach (Neto, 2016). It would require the DWS to oversee, but not necessarily implement, a suite of complementary measures capable of contributing to the closing of the funding gap. These include a better understanding of ability and willingness to pay for water access and water security across sectors and a closing of the gap between the cost of water supply and water tariffs; improved budget spend and revenue collection by municipalities, water boards and irrigation schemes; tighter co-operation with the Department of Forestry, Fisheries and the Environment Affairs and with conservation NGOs and land users to enhance catchment integrity, the storage of water in catchments and to slow the rate of soil erosion and deposition in the country’s dams, leak detection and repair; mediated water pressure to reduce pipe damage and leaks, improved on-site water storage including the installation of gutters and water storage tanks on all government built houses, agricultural incentives to enhance soil organic carbon that retains and soil moisture and buffers farmers against the impact of drought; building of trust around the value of water metres in leak detection and the progressive installation of water metres that are vandalism and theft proof (Kaiser, 2024).

The effective blending of public and private financial flows to support the attainment of the NDP water goals and SDG6, would not only unlock the multiple significant benefits of universal access to water services, but serve as a critical exemplar of how to achieve other NDP goals and SDGs that are currently at risk of under-investment. Recognising the potential presents the immediate dilemma of how best to mobilise the required funding and investment. A Keynesian ‘spend-tax-borrow’ approach requires National Treasury as the lead coordinator of a significant increase in national debt based on the assumption that the result would be a higher growth rate and therefore revenues to service the debt. A monetary policy approach involving ‘quantitative easing’ would require South Africa’s Reserve Bank to increase money supply to the financial system on the assumption that this will lower the cost of capital and catalyse co-investments and growth. Both macro-economic policy options are constrained by South Africa’s debt levels, inflationary pressures, low growth rates and inadequate ability to spend money quickly and impactfully in the water sector. They also lack political support from key decision makers in South Africa’s governing party, who tend to favour austerity.

Private sector involvement could be via privatisation or blended finance, both of which are already in evidence in South Africa, albeit in a limited way. Some Water Service Authorities are now run by private sector operators in an effective privatisation (e.g., Queenstown, Stutterheim, Nelspruit). Blended finance has untapped potential and the Development Bank of Southern Africa (DBSA) has established the Infrastructure Fund as a vehicle for blending grants from the national fiscus with private sector funding provided mainly by the pension funds (DBSA, 2022). The Infrastructure Fund works with the newly created National Water Resources Infrastructure Agency (established by the DWS) to coordinate blended finance solutions in the water sector. These institutional innovations offer important potential, but need to be complemented by an enabling financing paradigm if they are to unlock private sector financial flows for universal access to safe and reliable water services.

Recognising the need for significant increases in investment and an enabling financial paradigm to achieve the goals of the NDP and the relevant SDGs in South Africa, the National Planning Commission (NPC)’s Finance Task Team together with the DBSA, has commissioned a Monetary Architecture study of South Africa financial ecosystem, with the hope of reconciling water and finance sector interests (Alaerts, 2019; Murau and Guter-Sandau, 2023). The Monetary Architecture approach depicts the credit-based financial system that evolved globally after the dropping of the Gold Standard in 1971 as a web of interlocking balance sheets, in particular the balance sheets of Central Banks, Commercial Banks, Non-Banking Financial Institutions and the multi-level fiscal ecosystem. Within this system, everyone’s liability is someone else’s asset, and vice versa, and mapping these relationships can identify shared opportunities, liabilities and incentives to invest (Murau and Guter-Sandau, 2020).

5 Understanding the financial ecosystem in this way, renders it possible to identify financial “elasticity spaces” where reconfigurations of balance sheets could unlock novel financial flows (Murau and Guter-Sandau, 2023). In the Eurozone, for example, the so-called ‘Off-Balance Sheet Fiscal Agencies’ (OBFAs) were able to re-align balance sheets to ensure financial flows that Banks and fiscal authorities were prohibited from funding (Murau and Guter-Sandau, 2023).

The DBSA’s newly created Infrastructure Fund seeks to emulate this outcome. More specifically, the Infrastructure Fund intends to reconfigure the relationships between the balance sheets of the water boards and WSAs, DFIs and pension funds to close the water sector investment gap. In South Africa private pension funds and the Government Employees Pension Fund collectively manage over half of all savings in the country, roughly R5 trillion. The value of these funds exceeds GDP, but less than 10% currently gets invested in infrastructure and the real economy, and a growing proportion (as much as 45%) is invested outside of the country (Moleko & Ikhide, 2017; Pillay & Fedderke, 2022). As Alaerts suggests, however, at some stage pension funds have an incentive to invest in a functional and sustainable water sector in order to protect the value of their other assets and to ensure a world into which it is possible to retire comfortably (Alaerts, 2019. The potential to mobilise private investment to address systemic challenges has been demonstrated by South Africa’s energy sector, where the combination of unreliable grid-supplied electricity and favourable relative prices has seen R70-80 billion of private finance invested in 5.4 GW of rooftop solar (Swilling, 2023). This was enabled by banks pro-actively reconfiguring the relationships between the balance sheets of banks, households and businesses to unlock financial flows that resulted in a whole new set of assets with positive environmental impacts.

The Infrastructure Fund’s ambition and the Monetary Architecture approach is relevant for both the South African context and the global pursuit of the SDGs. Alaerts’ suggestion that private financiers eventually face an incentive to invest in public good outcomes, is prescient and is reflected in the DBSA’s formation of the Infrastructure Fund (Alaerts, 2019). What South Africa’s fiscal and finance leadership recognise, however, is that the potential behind this convergence of interests could be limited unless complemented by novel financial paradigms such as that suggested by the Monetary Architecture approach.

Conclusion

South Africa boasts an internationally acclaimed water policy, but as with many countries is exposed to increasing demand for water, warming climates and degrading catchments, all of which make it more expensive to ensure IWRM and universal access to water services. Under South Africa’s National Water Act, these cost pressures accrue to public water entities mandated with responsibility for water resource management, new bulk infrastructure and distribution and treatment. While the country’s water policy makes it possible for public entities to pass these costs on to water users, charging users for the full cost of water services has proven impossible.

The empirical study of South Africa’s water sector commissioned by an influential partnership of public sector institutions (NPC, PCC, DBSA and NT) demonstrates that under a business-as-usual scenario (conventional water and energy technologies, existing allocations to agriculture, median climate change projections for rainfall and continuation of existing operational efficiencies) there is a R91 billion per annum gap (2023-2050) between current and required levels of investment. A transition away from coal, sharing of some water taps, aggressive water conservation and demand management, increased clearing of IAPs, reduced allocations to agriculture, and improved bulk water system efficiencies could reduce this gap to R75 billion per annum, and aggressive water tariff hikes could further reduce the deficit to R43 billion per annum. A suite of inappropriate technology choices and policy decisions with regards to energy, delayed maintenance, operational inefficiency and increased water allocations to agriculture would increase the funding gap to R149 billion per annum.

The ‘Beyond the Gap’ framework looks at capital and operating expenditure, and answers the question ‘how much investment is needed’; a question that is applicable to the pursuit of SDGs in many countries. In South Africa, where IWRM is intended to serve a broad range of socio-economic and environmental outcomes, but where water reallocations and the raising of tariffs has proven more difficult than anticipated, even the favourable “Beyond the Gap” scenarios leave a significant shortfall on the pursuit of SDG 6 and national water objectives. This deficit exposes the country to a suite of social, economic and environmental risks, all of which are “financially systemic” and difficult to insulate against (Schoenmaker and Tilburg, 2016). It poses the question of ‘who will invest’ to close the gap and avoid systemic risks, given the limits of government funding and the prevalence of conservative fiscal and monetary policies. In addressing this challenge, it is important to go beyond vague references to blended finance, local currency markets, capacity building and a more prominent role for intermediaries. The creation of a bespoke Infrastructure Fund designed to blend finance, in concert with the Monetary Architecture approach referenced above offers a way of mapping the architecture of financial ecosystems in order to determine where there is an appropriate set of ‘elasticity spaces’ for sourcing new financial flows by reconfiguring inter-balance sheet relationships without requiring fundamental shifts in monetary and fiscal policy. Future research will reveal whether the Monetary Architecture approach can help in assessing how infrastructure financing can be generated in order to protect people, pension funds, financiers and fiscal resources from the risks associated with not delivering on the goal of universal access to safe and reliable water and sanitation, and the SDGs more broadly.

References

- Admati, A. (2017) A Skeptical View of Financialized Corporate Governance, Journal of Economic Perspectives 31(3):131–50. [CrossRef]

- Alaerts, G.J. (2019) Financing for Water - Water for Financing: A Global Review of Policy and Practice. Sustainability, 11:821. [CrossRef]

- Allen, T. (2003) IWRM-IWRAM: A new sanctioned discourse? (SOAS Water Issues Study Group Occasional Paper 50). School of Oriental and African Studies London: University of London.

- Andersen, B; Samset, K; Welde, W (2016) Low estimates – high stakes: underestimation of costs at the front-end of projects. International Journal of Managing Projects in Business, 9 (1) (2016), pp. 171-193. [CrossRef]

- Arezki, R., F. Samama, J. Stiglitz, P. Bolton, and S. Peters (2016) “From Global Savings Glut to Financing Infrastructure: The Advent of Investment Platforms,” IMF Working Paper No. 16/18, Washington, DC.

- Banerjee, S.G. and Morella, E. (2011) Africa’s Water and Sanitation Infrastructure: Access, Affordability, and Alternatives. Background Paper No. 60864, Africa Infrastructure Country Diagnostic (AICD) World Bank, Washington DC. [CrossRef]

- Bank of England (2019) “Enhancing banks’ and insurers’ approaches to managing the financial risks from climate change,” Supervisory Statement SS3/19, April.

- Battiston, S., A. Mandel, I. Monasterolo, F. Schütze, and G. Visentin, (2017) A climate stress-test of the financial system, Nature Climate Change 7: 283–288. [CrossRef]

- Bedasso, B. E., & Obikili, N. (2016). A Dream Deferred: The Microfoundations of Direct Political Action in Pre- and Post-democratisation South Africa. The Journal of Development Studies, 52(1), 130–146. [CrossRef]

- Briand, A., Reynaud, A., Viroleau, F., Markantonis, V., and Branciforti, G. (2021). Assessing The Macroeconomic Effects Of Water Scarcity In South Africa Using A Water-CGE Model. [CrossRef]

- Budds, J., & McGranahan, G. (2003). Are the debates on water privatization missing the point? Experiences from Africa, Asia and Latin America. Environment and Urbanization, 15(2), 87-114. [CrossRef]

- Cartwright, A (2021) Roadmap for Mobilising Investment in Ecological Infrastructure for Water Security in Two South African Catchments, Report for SANBI, EI4WS Project.

- Cartwright, A (2022) Repositioning Finance Within Africa’s Sustainable Energy Transition. https://www.africancentreforcities.net/electricity-infrastructure-repositioning-finance-within-africas-sustainable-energy-transition/.

- Castro, J.E. (2007) Water Governance in the Twentieth-First Century. Ambiente & Sociedade, X(2):97-118. [CrossRef]

- CDP (2023) Riding the wave: how the private sector is seizing opportunities to accelerate progress on water security. https://cdn.cdp.net/cdp-production/cms/reports/documents/000/006/925/original/CDP_Water_Global_Report_2022_Web.pdf?1679328280.

- Cullis, J. and Phillips, M. (2019). Green Book. Surface Water Supply. Water supply climate risk narrative for South Africa. Pretoria: Aurecon & CSIR. Available at: https://pta-gis-2-web1.csir.co.za/portal/apps/GBCascade/index.html?appid=74fc5a7337f34460b7a09242d0770229.

- Cullis, J., Rossouw, N., du Toit, G., Petrie, D., Wolfaardt, G., de Clercq, W.

- Horn, A. (2018) Economic risks due to declining water quality in the Breede River catchment. Water SA, vol.44, n.3, pp.464-473. ISSN 1816-7950. [CrossRef]

- Cullis, J., & van Koppen, B. (2008) Applying the gini coefficient to measure the distribution of water use and benefits of water use in South Africa’s provinces. Unpublished report Pretoria: Department of Water Affairs and Forestry and International Water Management Institute.

- Development Bank of Southern Africa (DBSA) and World Bank (2022) Beyond the Gap: Water Sector Report. Available at: Beyond the Gap Scenarios for South Africa’s Water and Sanitation Sector (dbsa.org).

- Department of Water and Sanitation (DWS) (2018). National Water and Sanitation Master Plan (NWSMP). Pretoria: DWS. https://www.dws.gov.za/National%20Water%20and%20Sanitation%20Master%20Plan/Documents/Volume%201%20(Printed%20version%20).pdf.

- Department of Water and Sanitation (DWS) (2021) National Water and Sanitation Master Plan. https://www.dws.gov.za/National%20Water%20and%20Sanitation%20Master%20Plan/.

- DWS (2007).

- Development Bank of Southern Africa (DBSA) (2022) Infrastructure Fund: Application Guideline No. 2 of 2022. 251022 IF Application Guideline_0.pdf (dbsa.org).

- DBSA, PCC, NPC and SA-TIED (2023) South Africa’s water sector investment requirements to 2050.

- Flyvbjerg, B. and Gardner, D. (2023) How big things get done. Crown Currency. ISBN: 978-0593239513.

- Fransman, T., and von Fintel, M. (2024). Voting and protest tendencies associated with changes in service delivery. Dev. South. Afr. 41, 71–90. [CrossRef]

- Haas, A., Cartwright, A., Garang, A., and Songwe, V. (2023) From Millions to Billion. Financing the Development of African Cities. https://www.afdb.org/en/documents/millions-billions-financing-development-african-cities.

- Hadley, S., Mustapha, S., Colenbrander, S., Miller, M. and Quevedo, A. (2022) Country platforms for climate action: something borrowed, something new? ODI Emerging analysis. London: ODI (www.odi.org/en/publications/country-platforms-forclimate-action-something-borrowed-something-new/).

- Hallegatte, S. and K.J. Mach, 2016: Make climate-change assessments more relevant. Nature, 534(7609), 613-615, 34. [CrossRef]

- Kaiser, G. (2024) Parched - the Cape Town Drought Story. Presentation from the book at the Smart Water Networks Forum https://youtu.be/ZKYfRJfvBwA.

- Krogstrup, S and Oman, W. (2021) Macroeconomic and Financial Policies for Climate Change Mitigation: A Review of the Literature. IMF Working Paper; Monetary and Capital Markets Department.

- Lameck W, Kinemo S, Mwakasangula E, Masue O, Lyatonga I, and Anasel M, (2019) Relationship Between National and Local Government in Tanzania. Report prepared for Tanzania Urbanisation Laboratory (TULab).

- Ledger, T. and Rampedi, M. (2019) Mind the gap. Section 139 Interventions in Theory and in Practice. A PARI Report. Public Affairs Research Institute 26 Rhodes Avenue, Parktown West, Johannesburg, South Africa.

- Lubeck-Schricker, M., Patil-Deshmukh, A., Murthy, S. L., Chaubey, M. D., Boomkar, B., Shaikh, N., Shitole, T., Eliasziw, M., & Subbaraman, R. (2023). Divided infrastructure: legal exclusion and water inequality in an urban slum in Mumbai, India. Environment and Urbanization, 35(1): 178-198. [CrossRef]

- Markle, A and Donnenfeld, Z (2016) Refreshing Africa’s future: Prospects for achieving universal WASH access by 2030, African Futures Brief no 17, ISS, 28 June 2016. https://issafrica. s3.amazonaws.com/site/uploads/AF17. Pdf.

- McCoy, W and Schwartz, K (2023) The water finance gap and the multiple interpretations of ‘bankability’. Journal of Water, Sanitation, Hygiene for Development, 13 (1): 19–29. [CrossRef]

-

https://doi.org/10.2166/washdev.2022.201.

- Moleko, N. & Ikhide, A. (2017) Pension Funds Evolution, Reforms and Trends in South Africa. International Journal of Economics and Finance Studies, 9(2):134-151.

- Monnin, P., (2018) “Central banks should reflect climate risks in monetary policy operations,” SUERF Policy Note, Issue No 41.

- Muller, M. (2007). Adapting to climate change: water management for urban resilience. Environment and Urbanization, 19(1): 99-113. [CrossRef]

- Murau, S. 2020. A macro-financial model of the Eurozone architecture embedded in the global Offshore US-Dollar System. GEGI Study July 2020. Boston, MA: Global Development Policy Center, Global Economic Governance Initiative (GEGI), Boston University.

- Murau, S.and Guter-Sandau, A (2023) Monetary Architecture and the Green Transition. Economy and Space, Economy and Space, pp.1-20. [CrossRef]

- Neto, S. (2016) Water governance in an urban age. Utilities Policy, 43:32-41. [CrossRef]

- Nganyanyuka, K., Martinez, J., Lungo, J., & Georgiadou, Y. (2018). If citizens protest, do water providers listen? Water woes in a Tanzanian town. Environment and Urbanization, 30(2), 613-630. [CrossRef]

- Republic of South Africa (RSA) (1996) Constitution of South Africa Act (no. 108). Statutes of the South Africa Constitutional Law. Cape Town: Office of the President.

- Republic of South Africa (RSA) (1997) Water Services Act. Act 108 of 1997. Government Gazette No. 18522 Cape Town: Office of the President.

- Republic of South Africa (RSA) (1998) National Water Act. Government Gazette Vol.398. 26 August 1998 Cape Town: Office of the President.

- Republic of South Africa. National Planning Commission. (2011). Chapter 6: An integrated and inclusive rural economy. In: National development plan: Our future make it work. 2030 Vision. Pretoria: National Planning Commission, The Presidency.

- Reuters, C. and Matji, M (2015) Water institutions and governance models for the funding, financing and management of water infrastructure in South Africa. Water SA vol.41 n.5 Pretoria Oct. 2015.

- Rozenberg, J. and Fay, M. (2019). Beyond the Gap: How Countries Can Afford the Infrastructure They Need while Protecting the Planet. Sustainable Infrastructure Series. February 2019. Available at: https://elibrary.worldbank.org/doi/abs/10.1596/978-1-4648-1363-4.

- Ruiters, C. (2013) Funding models for financing water infrastructure in South Africa: Framework and critical analysis of alternatives. Water SA [online], vol.39, n.2, pp.313-326. [CrossRef]

- Satterthwaite, D. and Dodman, D. (2013), “Towards resilience and transformation for cities within a finite planet”, Environment and Urbanization Vol 25, no 2, pages 291–298. 18. [CrossRef]

- Schreiner, B. (2013) Viewpoint - Why has the South African National Water Act been so difficult to implement? Water Alternatives, 6(2): 239-245.

- Pillay, N. & Fedderke, J. (2022) Characteristics of the South African Retirement Fund Industry. Pretoria: South African Reserve Bank, South African Reserve Bank Working Paper Series WP/22/17.

- Swilling, M. Towards Sustainable Urban Infrastructures for the Urban Anthropocene. (2015) In: Allen, A., Lampis, A. & Swilling, M. (eds.) Untamed Urbanism. London and New York: Routledge.

- Swilling, M. (2023) Massive bottom-up response to the power crisis sees spike in private energy generation. Daily Maverick, 22 August 2023.

- Tapela, B; Ntwana B and Sibanda, D (2015) Social Protests and Water Service Delivery in South Africa WRC Report No. TT 631/15 ISBN 978-1-4312-0672-8.

- Van den Berg, C and Danilenko, A. (2017) Performance of Water Utilities in Africa. World Bank, Washington, DC. http://hdl.handle.net/10986/26186.

- van Koppen, B., and Schreiner, B. (2014). Moving beyond integrated water resource management: developmental water management in South Africa. Int. J. Water Resour. Dev. 30, 543–558. [CrossRef]

- van Vliet, M. T. H., Jones, E. R., Flörke, M., Franssen, W. H. P., Hanasaki, N., Wada, Y., et al. (2021). Global water scarcity including surface water quality and expansions of clean water technologies. Environ. Res. Lett. 16. [CrossRef]

- Worldwide Fund for Nature (2023) Freshwater Fact Sheet https://files.worldwildlife.org/wwfcmsprod/files/Publication/file/7h59qthco9_WWF_Freshwater_Factsheet_Sep23.1.pdf?_ga=2.66472878.1486079689.1713205885-1628315992.1713205885.

| 1 |

SA-TIED refers to the Southern Africa - Towards Inclusive Economic Development programme, co-convened by the National Treasury and the United Nations University - World Institute for Development Economics Research ( https://sa-tied.wider.unu.edu/about). The study was commissioned through a research partnership between South Africa’s National Planning Commission (NPC), Presidential Climate Commission (PCC), Development Bank of Southern Africa (DBSA), and the National Treasury. DBSA provided all the funding for the research project. Mark Swilling is a Commissioner on the NPC and Coordinator of the NPC’s Infrastructure Task Team, and until September 2023 he was Chair of the Board of the DBSA. In his capacity as ‘academic lead’ of SA-TIED’s Workstream on the Water-Energy-Food nexus, Swilling co-authored the terms of reference for the study undertaken by the PDG/ Zutari Team. Together with Georgina Ryan (also a co-author) from National Treasury, he was also a member of the multi-stakeholder Steering Committee that provided strategic guidance for the research. James Cullis and Kim were members of the PDG/Zutari team. |

| 2 |

Not least of which is the liberating of children and women’s time that have traditionally been spent in collecting water from rivers and streams. |

| 3 |

Helgard Muller was Chief Director: water services at the (then) Department of Water Affairs |

| 4 |

All results were reported in nominal 2022 Rands, without the application of a discount rate or adjustments for inflation. |

| 5 |

Murau and Guter-Sandai showed this in their published study of the Eurozone’s globally embedded financial ecosystem. |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).