Submitted:

19 July 2024

Posted:

22 July 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature Review and Research Question

3. Research Methods

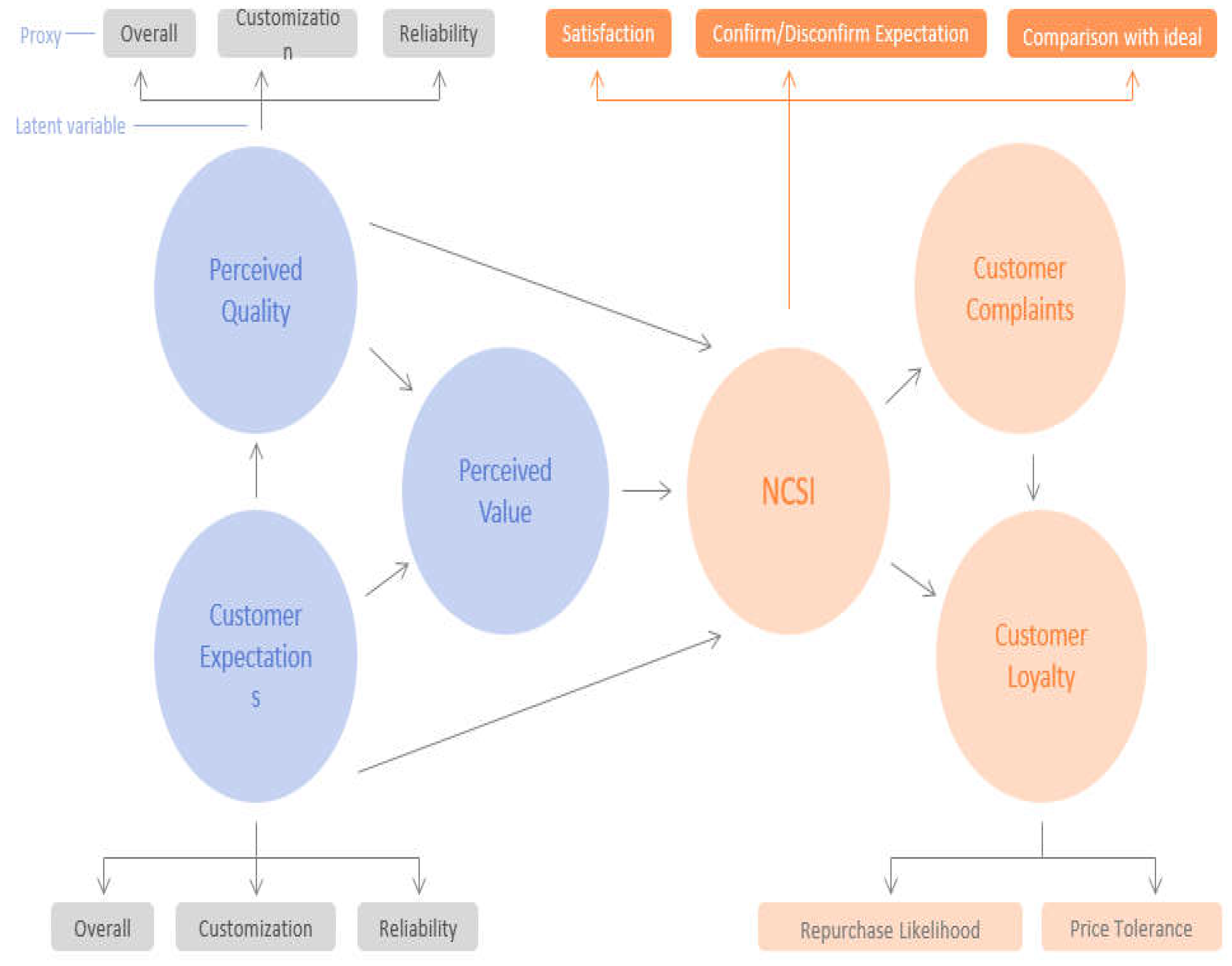

3.1. Customer Satisfaction Index

3.2. Test Models

β7CAPINTENit + β8R&Dit + β9ADVINTENit + Year + Ind + εit

β7CAPINTENit + β8R&Dit + β9ADVINTENit + Year + Ind + εit

4. Results

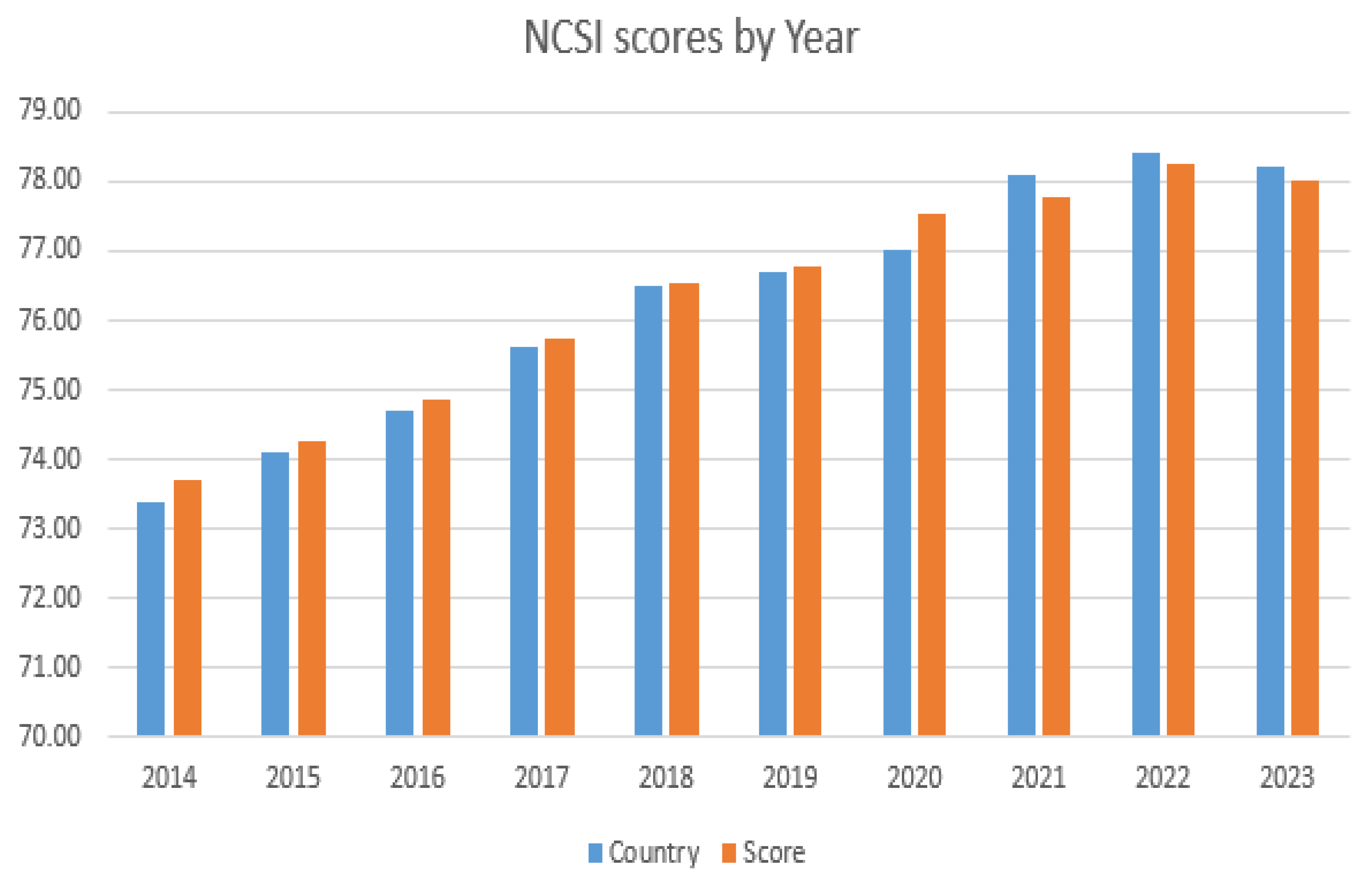

4.1. Descriptive Statistics

4.2. Correlations

4.3. Univariate Tests

4.4. Regression Analysis

4.5. Robustness Check

5. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- How, S.; Lee, C.G. Customer satisfaction and financial performance linear or non-linear relationship: a case study of Marriot International. Curr. Issu. Tourism. 2021, 24, 1184–1189. [Google Scholar] [CrossRef]

- Eachempati, P.; Srivastava, P.R.; Kumar, A.; de Prat, J.M.; Delen, D. Can customer sentiment impact firm value? An integrated text mining approach. Technological Forecasting and Social Change 2022, 174, 121265. [Google Scholar] [CrossRef]

- Alexandre, N. Vertical Integration in Healthcare and Patient Satisfaction: An Exploratory Analysis of Portuguese Reforms. Sustainability 2024, 16, 1078. [Google Scholar] [CrossRef]

- Prados-Peña, M.B.; Crespo-Almendros, E.; Porcu, L. How Online Sales Promotions via Social Networks Affect the Brand Equity of a Heritage Destination. Heritage 2022, 5, 2547–2564. [Google Scholar] [CrossRef]

- Ebrahim, R.S. The role of trust in understanding the impact of social media marketing on brand equity and brand loyalty. Journal of Relationship Marketing 2020, 19, 287–308. [Google Scholar] [CrossRef]

- Chang, H.J.J.; Jai, T.M.C. Is fast fashion sustainable? The effect of positioning strategies on consumers’ attitudes and purchase intentions. Social Responsibility Journal 2015, 11, 853–867. [Google Scholar] [CrossRef]

- Schivinski, B.; Dabrowski, D. The effect of social media communication on consumer perceptions of brands. Journal of Marketing Communications 2016, 22, 189–214. [Google Scholar] [CrossRef]

- Lili, Z.; Al Mamun, A.; Hayat, N.; Salamah, A.A.; Yang, Q.; Ali, M.H. Celebrity endorsement, brand equity, and green cosmetics purchase intention among Chinese youth. Frontiers in Psychology 2022, 13, 1–15. [Google Scholar]

- Sadyk, D.; Islam, D.M.Z. Brand equity and usage intention powered by value Co-creation: A case of instagram in Kazakhstan. Sustainability 2022, 14, 500. [Google Scholar] [CrossRef]

- Assaf, A.G.; Josiassen, A.; Cvelbar, L.K.; Woo, L. The effects of customer voice on hotel performance. International Journal of Hospitality Management 2015, 44, 77–83. [Google Scholar] [CrossRef]

- Ferreira, D.C.; Vieira, I.; Pedro, M.I.; Caldas, P.; Varela, M. Patient Satisfaction with Healthcare Services and the Techniques Used for its Assessment: A Systematic Literature Review and a Bibliometric Analysis. Healthcare 2023, 11, 639. [Google Scholar] [CrossRef] [PubMed]

- Ittner, C.D.; Larcker, D.F. Are nonfinancial measures leading indicators of financial performance? An analysis of customer satisfaction. Journal of Accounting Research 1998, 36, 1–35. [Google Scholar] [CrossRef]

- Banker, R.; Potter, C.; Srinivasan, D. An empirical investigation of an incentive plan that includes nonfinancial performance measures. The Accounting Review 2000, 75, 65–92. [Google Scholar] [CrossRef]

- Carhart, M. On persistence in mutual fund performance. J. Finance 1997, 52, 57–82. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. Multifactor explanations of asset pricing anomalies. J. Finance 1996, 51, 55–84. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. Forecasting profitability and earnings. The Journal of Business 2000, 73, 161–175. [Google Scholar] [CrossRef]

- Penman, S. Return to fundamentals. J. Accounting, Auditing Finance 1992, 7, 465–483. [Google Scholar] [CrossRef]

- McAlister, L.; Srinivasan, R.; Kim, M.C. Advertising, research and development, and systematic risk of the firm. Journal of Marketing 2007, 71, 35–48. [Google Scholar] [CrossRef]

- Kaplan, R.; Norton, D. The balanced scorecard-measures that drive performance. Harvard Business Review 1992, 70, 71–79. [Google Scholar] [PubMed]

- Kaplan, R.; Norton, D. The Balanced Scorecard: Translating Strategy Into Action.; Harvard Business School Press, Boston, MA, 1996; pp. 1–330.

- Ittner, C.D.; Larcker, D.F.; Rajan, M. The choice of performance measures in annual bonus contracts. Accounting Review 1997, 72, 231–255. [Google Scholar]

- Ittner, C.D.; Larcker, D.F.; Randall, T. Performance implications of strategic performance measurement in financial services firms. Accounting Organizations and Society 2003, 28, 715–741. [Google Scholar] [CrossRef]

- Yang, Y. The value-relevance of nonfinancial information: The biotechnology industry. Advances in Accounting 2008, 23, 287–314. [Google Scholar] [CrossRef]

- Ittner, C.D.; Larcker, D.F.; Taylor, D. Commentary: The stock market’s pricing of customer satisfaction. Marketing Sci. 2009, 28, 826–835. [Google Scholar] [CrossRef]

- Jacobson, R.; Mizik, N. The financial markets and customer satisfaction: Reexaming possible financial market mispricing of customer satisfaction. Marketing Sci. 2009, 28, 810–819. [Google Scholar] [CrossRef]

- Leoni, V.; Moretti, A. Customer satisfaction during COVID-19 phases: the case of the Venetian hospitality system. Current Issues in Tourism 2024, 27, 396–412. [Google Scholar] [CrossRef]

- Das, S.S.; Tiwari, A.K. Understanding international and domestic travel intention of Indian travellers during COVID-19 using a Bayesian approach. Tourism Recreation Research 2020, 46, 228–244. [Google Scholar] [CrossRef]

- Mehta, M.P.; Kumar, G.; Ramkumar, M. Customer expectations in the hotel industry during the COVID-19 pandemic: A global perspective using sentiment analysis. Tourism Recreation Research 2021, 48, 1–18. [Google Scholar] [CrossRef]

- Padma, P.; Ahn, J. Guest satisfaction & dissatisfaction in luxury hotels: An application of big data. International Journal of Hospitality Management 2020, 84, 102318. [Google Scholar]

- Srivastava, A.; Kumar, V. Hotel attributes and overall customer satisfaction: What did COVID-19 change? Tourism Management Perspectives 2021, 40, 100867. [Google Scholar] [CrossRef]

- Davras, Ö.; Caber, M. Analysis of hotel services by their symmetric and asymmetric effects on overall customer satisfaction: A comparison of market segments. International Journal of Hospitality Management 2019, 81, 83–93. [Google Scholar] [CrossRef]

- Mittal, V.; Frennea, C. Customer satisfaction: A strategic review and guidelines for managers. MSI fast forward series Marketing Science Institute, Cambridge, MA, 2010, Available at SSRN: https://ssrn.com/abstract=2345469.

- Kumar, V. Introduction: Is customer satisfaction (ir)relevant as a metric? Journal of Marketing 2016, 80, 108–109. [Google Scholar] [CrossRef]

- Anderson, E.W.; Fornell, S.; Mazvancheryl, S.K. Customer satisfaction and shareholder value. Journal of Marketing 2004, 68, 172–185. [Google Scholar] [CrossRef]

- Vitanova, I. Nurturing overconfidence: The relationship between leader power, overconfidence and firm performance. The Leadership Quarterly 2021, 32, 101342. [Google Scholar] [CrossRef]

- Fornell, C.; Mathas, S.; Morgenson III, F.V.; Krishnan, M.S. Customer satisfaction and stock prices: High returns, low risk. J. Marketing 2006, 70, 3–14. [Google Scholar] [CrossRef]

- Tuli, K.R.; Bharadwaj, S.G. Customer satisfaction and stock returns risk. Journal of Marketing 2009, 73, 1–40. [Google Scholar] [CrossRef]

- Amir, E.; Lev, B. Value-relevance of nonfinancial information: The wireless communications industry. J. Acct. Econ. 1996, 22, 3–30. [Google Scholar] [CrossRef]

- Sun, K.; Kim, D. Does customer satisfaction increase firm performance? An application of American Customer Satisfaction Index (ACSI). Int. J. Hospitality Mgmt. 2013, 35, 68–77. [Google Scholar] [CrossRef]

- Agag, G.; Durrani, B.A.; Shehawy, Y.M.; Alharthi, M.; Alamoudi, H.; El-Halaby, S.; Hassanein, A.; Abdelmoety, Z.H. Understanding the link between customer feedback metrics and firm performance. J. Retail Consum Servic. 2023, 73, 1–16. [Google Scholar] [CrossRef]

- Malarvizhi, C.a.N.; Mamun, A.A.; Jayashreem, S.; Naznen, F.; Abir, T. Modelling the significance of social media marketing activities, brand equity and loyalty to predict consumers’ willingness to pay premium price for portable tech gadgets. Heliyon 2022, 8, e10145. [Google Scholar] [CrossRef]

- Chih-Ming, T.; Shih-Peng, H. The Influence of Influencer Marketing on the Consumers’ Desire to Travel in the Post-Pandemic Era: The Mediation Effect of Influencer Fitness of Destination. Sustainability 2023, 15, 1–16. [Google Scholar] [CrossRef]

- Górska-Warsewicz, H. Factors determining city brand equity-A systematic literature review. Sustainability 2020, 12, 7858. [Google Scholar] [CrossRef]

- Wu, C.H.-J. The impact of customer-to-customer interaction and customer homogeneity on customer satisfaction in tourism service-the service encounter prospective. Tourism Management 2007, 28, 1518–1528. [Google Scholar] [CrossRef]

- White, H. A heteroscedasticity-consistent covariance matrix estimator and a direct test for heteroscedasticity. Econometrica 1980, 48, 817–838. [Google Scholar] [CrossRef]

- Gow, I.; Ormazabal, G.; Taylor, D. Correcting for cross-sectional and time-series dependence in accounting research. Accounting Review 2010, 85, 483–512. [Google Scholar] [CrossRef]

- Sullivan, R.; Timmermann, A.; White, H. Data-snooping, technical trading rule performance, and the bootstrap. J. Finance 1999, 54, 1647–1691. [Google Scholar] [CrossRef]

- Greene, W.H. Econometric Analysis, 3rd Edition.; Prentice-Hall: Upper Saddle River, New Jersey, 1997. [Google Scholar]

- Blume, M.E.; Stambaugh, R.F. Biases in computed returns: An application to the size effect. J. Financial Econom 1983, 12, 387–404. [Google Scholar] [CrossRef]

- Brav, A.; Geczy, C.; Gompers, P.A. Is the abnormal return following equity issuances anomalous? J. Financial Econom 2000, 56, 209–249. [Google Scholar] [CrossRef]

- Peco-Torres, F.; Polo-Peña, A.I.; Frías Jamilena, D.M. Antecedents and consequences of strategic online-reputation management: Moderating effect of online tools. Journal of Hospitality and Tourism Technology 2023, 14, 384–400. [Google Scholar] [CrossRef]

- Andaleeb, S.S.; Conway, C. Customer satisfaction in the restaurant industry: an examination of the transaction-specific model. Journal of Services Marketing 2009, 20, 311. [Google Scholar] [CrossRef]

- Arora, R.; Singer, J. Customer satisfaction and value as drivers of business success for fine dining restaurants. Services Marketing Quarterly 2006, 28, 89–102. [Google Scholar] [CrossRef]

| Variable | N | Mean | STD | 1% | Median | 99% |

|---|---|---|---|---|---|---|

| Score | 324 | 0.76451 | 0.02369 | 0.70000 | 0.77000 | 0.84000 |

| Country | 324 | 0.76381 | 0.01642 | 0.73400 | 0.76700 | 0.78400 |

| TOBIN | 324 | 1.17966 | 0.85951 | 0.43802 | 0.94900 | 5.65086 |

| MB | 324 | 1.26571 | 1.33063 | 0.22502 | 0.90910 | 7.31504 |

| BETA | 324 | 0.76531 | 0.40568 | 0.00894 | 0.73159 | 1.82184 |

| ROE | 324 | 0.03490 | 0.14198 | -0.65438 | 0.05056 | 0.24486 |

| ROA | 324 | 0.02628 | 0.05142 | -0.12927 | 0.02590 | 0.16431 |

| PROFIT | 324 | 0.02078 | 1.02091 | -1.22569 | 0.03906 | 0.62720 |

| SIZE | 324 | 29.17952 | 1.42394 | 26.46180 | 29.16761 | 31.62234 |

| LEV | 324 | 0.42785 | 0.17577 | 0.09449 | 0.43221 | 0.79877 |

| LIQ | 324 | 1.45725 | 2.20639 | 0.22152 | 1.01867 | 4.85774 |

| CAPINTEN | 324 | 4.33694 | 21.17959 | 0.58704 | 1.49981 | 35.51815 |

| R&D | 324 | 0.00871 | 0.04393 | 0.00000 | 0.00000 | 0.23277 |

| ADVINTEN | 324 | 0.02343 | 0.02479 | 0.00000 | 0.01329 | 0.09704 |

| Variable | [1] | [2] | [3] | [4] | [5] | [6] | [7] | [8] | [9] | [10] | [11] | [12] | [13] | [14] |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| [1]Score | 1 | 0.6320 | -0.0561 | -0.0851 | -0.1343 | 0.0612 | 0.0742 | 0.0142 | 0.1331 | -0.1440 | 0.0055 | -0.1165 | -0.0675 | 0.0582 |

| <.0001 | 0.3142 | 0.1262 | 0.0158 | 0.2720 | 0.1830 | 0.7988 | 0.0165 | 0.0094 | 0.9218 | 0.0361 | 0.2258 | 0.2963 | ||

| [2]Country | 1 | -0.2153 | -0.2389 | -0.0381 | -0.0484 | -0.0539 | -0.0596 | 0.0606 | -0.0250 | 0.0992 | -0.0636 | -0.0954 | -0.1010 | |

| <.0001 | <.0001 | 0.4950 | 0.3855 | 0.3338 | 0.2850 | 0.2766 | 0.6546 | 0.0745 | 0.2540 | 0.0865 | 0.0694 | |||

| [3]TOBIN | 1 | 0.9640 | 0.0536 | 0.1929 | 0.3956 | -0.0328 | -0.2130 | -0.1877 | -0.0107 | 0.0591 | 0.0547 | 0.3084 | ||

| <.0001 | 0.3370 | 0.0005 | <.0001 | 0.5562 | 0.0001 | 0.0007 | 0.8473 | 0.2891 | 0.3267 | <.0001 | ||||

| [4]MB | 1 | 0.0460 | 0.1137 | 0.3336 | -0.0491 | -0.2666 | -0.1185 | -0.0134 | 0.0559 | 0.0443 | 0.2994 | |||

| 0.4100 | 0.0408 | <.0001 | 0.3780 | <.0001 | 0.0330 | 0.8105 | 0.3160 | 0.4272 | <.0001 | |||||

| [5]BETA | 1 | -0.1313 | -0.1206 | 0.0252 | 0.2533 | 0.1904 | 0.0035 | 0.1200 | -0.0021 | -0.3632 | ||||

| 0.0183 | 0.0302 | 0.6525 | <.0001 | 0.0006 | 0.9505 | 0.0312 | 0.9694 | <.0001 | ||||||

| [6]ROE | 1 | 0.8182 | 0.3837 | 0.0164 | -0.2537 | 0.0052 | -0.0553 | -0.0031 | 0.1296 | |||||

| <.0001 | <.0001 | 0.7689 | <.0001 | 0.9257 | 0.3207 | 0.9557 | 0.0196 | |||||||

| [7]ROA | 1 | 0.5496 | -0.0648 | -0.3158 | 0.0143 | -0.0858 | -0.0186 | 0.1675 | ||||||

| <.0001 | 0.2445 | <.0001 | 0.7971 | 0.1231 | 0.7394 | 0.0025 | ||||||||

| [8]PROFIT | 1 | 0.0297 | -0.0525 | -0.0502 | 0.1395 | 0.0327 | 0.0302 | |||||||

| 0.5942 | 0.3459 | 0.3674 | 0.0119 | 0.5580 | 0.5887 | |||||||||

| [9]SIZE | 1 | 0.3434 | -0.0184 | -0.1738 | -0.1311 | -0.3360 | ||||||||

| <.0001 | 0.7412 | 0.0017 | 0.0182 | <.0001 | ||||||||||

| [10]LEV | 1 | -0.3698 | -0.0788 | -0.1179 | -0.2446 | |||||||||

| <.0001 | 0.1569 | 0.0339 | <.0001 | |||||||||||

| [11]LIQ | 1 | -0.0406 | -0.0407 | 0.0895 | ||||||||||

| 0.4665 | 0.4650 | 0.1078 | ||||||||||||

| [12]CAPINTEN | 1 | 0.0554 | -0.1042 | |||||||||||

| 0.3205 | 0.0610 | |||||||||||||

| [13]R&D | 1 | 0.0289 | ||||||||||||

| 0.6039 | ||||||||||||||

| [14]ADVINTEN | 1 |

| Post=0 | Post=1 | Diff | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Variable | N | Mean | STD | Median | N | Mean | STD | Median | t-value | Pr > |t| |

| [1]Score | 188 | 0.7540 | 0.0234 | 0.7600 | 136 | 0.7790 | 0.0149 | 0.7800 | -10.93 | <.0001 |

| [2]Country | 188 | 75.2638 | 1.2054 | 75.6000 | 136 | 77.9250 | 0.5469 | 78.1500 | -24.01 | <.0001 |

| [3]TOBIN | 188 | 1.3048 | 0.9925 | 0.9894 | 136 | 1.0066 | 0.5926 | 0.8889 | 3.12 | 0.0020 |

| [4]MB | 188 | 1.4766 | 1.5636 | 0.9795 | 136 | 0.9742 | 0.8379 | 0.7830 | 3.41 | 0.0007 |

| [5]BETA | 188 | 0.7540 | 0.4309 | 0.7076 | 136 | 0.7809 | 0.3692 | 0.7662 | -0.59 | 0.5576 |

| [6]ROE | 188 | 0.0419 | 0.1050 | 0.0467 | 136 | 0.0252 | 0.1811 | 0.0519 | 1.04 | 0.2975 |

| [7]ROA | 188 | 0.0291 | 0.0448 | 0.0255 | 136 | 0.0224 | 0.0594 | 0.0267 | 1.16 | 0.2470 |

| [8]PROFIT | 188 | 0.0754 | 0.4006 | 0.0381 | 136 | -0.0547 | 1.5038 | 0.0412 | 1.13 | 0.2585 |

| [9]SIZE | 188 | 29.1097 | 1.4370 | 29.1280 | 136 | 29.2761 | 1.4053 | 29.2573 | -1.04 | 0.3000 |

| [10]LEV | 188 | 0.4261 | 0.1692 | 0.4280 | 136 | 0.4302 | 0.1850 | 0.4424 | -0.21 | 0.8359 |

| [11]LIQ | 188 | 1.3103 | 1.0928 | 0.9381 | 136 | 1.6603 | 3.1499 | 1.0489 | -1.41 | 0.1591 |

| [12]CAPINTEN | 188 | 4.9047 | 27.3046 | 1.3781 | 136 | 3.5521 | 6.2828 | 1.5583 | 0.57 | 0.5713 |

| [13]R&D | 188 | 0.0115 | 0.0546 | 0.0000 | 136 | 0.0049 | 0.0214 | 0.0000 | -0.69 | 0.4897 |

| [14]ADVINTEN | 188 | 0.0253 | 0.0259 | 0.0134 | 136 | 0.0209 | 0.0231 | 0.0126 | 1.56 | 0.1191 |

| DV= | TOBIN | DV= | MB | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Column1 | Column2 | Column3 | Column4 | |||||||||

| Variable | Coeff | t-value | Pr > |t| | Coeff | t-value | Pr > |t| | Coeff | t-value | Pr > |t| | Coeff | t-value | Pr > |t| |

| Intercept | 4.041 | 3.50 | 0.0005 | 0.589 | 0.40 | 0.6900 | 8.101 | 4.08 | <.0001 | 2.201 | 0.92 | 0.3594 |

| SCORE | -0.583 | -0.50 | 0.6208 | 4.311 | 2.37 | 0.0185 | -1.131 | -0.58 | 0.5606 | 7.267 | 2.53 | 0.0120 |

| POST | 4.986 | 1.96 | 0.0504 | 8.129 | 1.88 | 0.0609 | ||||||

| SCORE*POST | -6.811 | -2.08 | 0.0384 | -11.149 | -2.00 | 0.0464 | ||||||

| SIZE | -0.095 | -2.84 | 0.0048 | -0.102 | -2.92 | 0.0037 | -0.234 | -4.43 | <.0001 | -0.248 | -4.45 | <.0001 |

| LEV | -0.072 | -0.25 | 0.8002 | 0.065 | 0.22 | 0.8259 | 0.674 | 1.38 | 0.1691 | 0.914 | 1.80 | 0.0733 |

| LIQ | -0.025 | -1.55 | 0.1221 | -0.017 | -1.23 | 0.2212 | -0.016 | -0.71 | 0.4790 | -0.003 | -0.14 | 0.8889 |

| CAPINTEN | 0.003 | 2.76 | 0.0061 | 0.003 | 2.78 | 0.0057 | 0.003 | 2.29 | 0.0228 | 0.004 | 2.33 | 0.0203 |

| R&D | 35.752 | 3.57 | 0.0004 | 36.989 | 3.57 | 0.0004 | 51.820 | 3.39 | 0.0008 | 53.941 | 3.40 | 0.0008 |

| ADVINTEN | 6.153 | 2.68 | 0.0078 | 5.327 | 2.36 | 0.0190 | 8.783 | 2.40 | 0.0168 | 7.338 | 2.05 | 0.0410 |

| YEAR | YES | YES | YES | YES | ||||||||

| IND | YES | YES | YES | YES | ||||||||

| N | 324 | 324 | 324 | 324 | ||||||||

| Adj-R2 | 0.2347 | 0.2528 | 0.2188 | 0.2426 |

| DV= | TOBIN | DV= | MB | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Column1 | Column2 | Column3 | Column4 | |||||||||

| Variable | Coeff | t-value | Pr > |t| | Coeff | t-value | Pr > |t| | Coeff | t-value | Pr > |t| | Coeff | t-value | Pr > |t| |

| Intercept | 4.190 | 4.31 | <.0001 | 4.078 | 4.19 | <.0001 | 8.318 | 5.27 | <.0001 | 8.125 | 5.17 | <.0001 |

| CONADJ | 4.247 | 2.85 | 0.0046 | 5.713 | 3.08 | 0.0022 | 7.657 | 3.02 | 0.0027 | 10.185 | 3.28 | 0.0012 |

| POST | -0.204 | -2.93 | 0.0036 | -0.360 | -3.46 | 0.0006 | ||||||

| CON*POST | -6.187 | -2.49 | 0.0131 | -10.691 | -2.46 | 0.0146 | ||||||

| SIZE | -0.119 | -3.32 | 0.001 | -0.111 | -3.13 | 0.0019 | -0.277 | -4.70 | <.0001 | -0.265 | -4.55 | <.0001 |

| LEV | 0.139 | 0.46 | 0.6452 | 0.135 | 0.45 | 0.6527 | 1.058 | 1.96 | 0.051 | 1.050 | 1.98 | 0.0490 |

| LIQ | -0.015 | -1.11 | 0.2691 | -0.013 | -1.03 | 0.3058 | 0.002 | 0.13 | 0.8976 | 0.006 | 0.36 | 0.7159 |

| CAPINTEN | 0.003 | 2.94 | 0.0036 | 0.003 | 2.76 | 0.0061 | 0.004 | 2.52 | 0.0123 | 0.004 | 2.32 | 0.0213 |

| R&D | 37.310 | 3.57 | 0.0004 | 37.086 | 3.50 | 0.0005 | 54.666 | 3.39 | 0.0008 | 54.259 | 3.32 | 0.0010 |

| ADVINTEN | 5.150 | 2.29 | 0.0224 | 4.731 | 2.14 | 0.0329 | 6.966 | 1.99 | 0.0474 | 6.231 | 1.8 | 0.0723 |

| YEAR | Yes | Yes | Yes | Yes | ||||||||

| IND | Yes | Yes | Yes | Yes | ||||||||

| N | 324 | 324 | 324 | 324 | ||||||||

| Adj-R2 | 0.2470 | 0.2623 | 0.2355 | 0.2564 |

| DV= | TOBIN | DV= | MB | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Column1 | Column2 | Column3 | Column4 | |||||||||

| Variable | Coeff | t-value | Pr > |t| | Coeff | t-value | Pr > |t| | Coeff | t-value | Pr > |t| | Coeff | t-value | Pr > |t| |

| Intercept | 4.087 | 3.37 | 0.0009 | 0.705 | 0.47 | 0.6358 | 8.151 | 3.89 | 0.0001 | 2.383 | 0.98 | 0.3296 |

| SCORE | -0.441 | -0.36 | 0.7221 | 4.408 | 2.41 | 0.0165 | -0.979 | -0.48 | 0.6311 | 7.297 | 2.52 | 0.0124 |

| POST | 4.526 | 1.67 | 0.0970 | 7.621 | 1.58 | 0.1142 | ||||||

| SCORE*POST | -6.265 | -1.78 | 0.0759 | -10.562 | -1.70 | 0.0897 | ||||||

| SIZE | -0.101 | -2.87 | 0.0045 | -0.110 | -3.02 | 0.0028 | -0.241 | -4.28 | <.0001 | -0.256 | -4.36 | <.0001 |

| LEV | -0.004 | -0.01 | 0.9881 | 0.160 | 0.53 | 0.5988 | 0.718 | 1.38 | 0.1698 | 1.000 | 1.86 | 0.0641 |

| LIQ | -0.020 | -1.54 | 0.1253 | -0.010 | -1.02 | 0.3089 | -0.011 | -0.56 | 0.5729 | 0.005 | 0.30 | 0.7647 |

| CAPINTEN | 0.003 | 2.83 | 0.0051 | 0.003 | 2.87 | 0.0044 | 0.003 | 2.27 | 0.0238 | 0.004 | 2.35 | 0.0193 |

| R&D | 33.669 | 3.32 | 0.0010 | 34.944 | 3.32 | 0.0010 | 49.584 | 3.13 | 0.0020 | 51.758 | 3.14 | 0.0018 |

| ADVINTEN | 6.508 | 2.60 | 0.0099 | 5.622 | 2.28 | 0.0233 | 9.427 | 2.37 | 0.0184 | 7.910 | 2.03 | 0.0434 |

| YEAR | YES | YES | YES | YES | ||||||||

| IND | YES | YES | YES | YES | ||||||||

| N | 290 | 290 | 290 | 290 | ||||||||

| Adj-R2 | 0.2295 | 0.2153 | 0.2521 | 0.2428 |

| DV= | TOBIN | DV= | MB | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Column1 | Column2 | Column3 | Column4 | |||||||||

| Variable | Coeff | t-value | Pr > |t| | Coeff | t-value | Pr > |t| | Coeff | t-value | Pr > |t| | Coeff | t-value | Pr > |t| |

| Intercept | 4.399 | 4.27 | <.0001 | 4.226 | 4.12 | <.0001 | 8.565 | 5.07 | <.0001 | 8.263 | 4.96 | <.0001 |

| CONADJ | 4.973 | 3.10 | 0.0021 | 5.829 | 3.17 | 0.0017 | 8.733 | 3.14 | 0.0019 | 10.229 | 3.28 | 0.0012 |

| POST | -0.242 | -3.80 | 0.0002 | -0.419 | -4.31 | <.0001 | ||||||

| CON*POST | -6.842 | -2.37 | 0.0183 | -11.930 | -2.35 | 0.0195 | ||||||

| SIZE | -0.127 | -3.36 | 0.0009 | -0.118 | -3.14 | 0.0019 | -0.287 | -4.55 | <.0001 | -0.271 | -4.39 | <.0001 |

| LEV | 0.247 | 0.78 | 0.4367 | 0.226 | 0.72 | 0.4704 | 1.169 | 2.01 | 0.0449 | 1.132 | 2.00 | 0.0464 |

| LIQ | -0.008 | -0.82 | 0.4102 | -0.006 | -0.70 | 0.4826 | 0.010 | 0.64 | 0.5228 | 0.012 | 0.89 | 0.3721 |

| CAPINTEN | 0.003 | 2.98 | 0.0031 | 0.003 | 2.82 | 0.0051 | 0.004 | 2.49 | 0.0133 | 0.004 | 2.32 | 0.0212 |

| R&D | 35.426 | 3.32 | 0.0010 | 34.996 | 3.26 | 0.0012 | 52.766 | 3.13 | 0.0019 | 52.024 | 3.08 | 0.0023 |

| ADVINTEN | 5.309 | 2.18 | 0.0303 | 5.014 | 2.08 | 0.0381 | 7.297 | 1.92 | 0.0558 | 6.784 | 1.80 | 0.0724 |

| YEAR | YES | YES | YES | YES | ||||||||

| IND | YES | YES | YES | YES | ||||||||

| N | 290 | 290 | 290 | 290 | ||||||||

| Adj-R2 | 0.2470 | 0.2640 | 0.2370 | 0.2587 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).